Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23.1 - SOCKET MOBILE, INC. | k10ex23_1.htm |

| EX-31 - EXHIBIT 31.2 - SOCKET MOBILE, INC. | k10ex31_2.htm |

| EX-32 - EXHIBIT 32.1 - SOCKET MOBILE, INC. | k10ex32_1.htm |

| EX-31 - EXHIBIT 31.1 - SOCKET MOBILE, INC. | k10ex31_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| (X) | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

( ) TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _______ to _______.

Commission file number 1-13810

SOCKET MOBILE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 94-3155066 | |

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

39700 Eureka Drive, Newark, CA 94560

(Address of principal executive offices including zip code)

(510) 933-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Name of Exchange on Which Registered | |

| Common Stock, $0.001 Par Value per Share | OTCQB |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [ ] NO [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ X ] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

As of June 30, 2015, the aggregate market value of the registrant’s Common Stock ($0.001 par value) held by non-affiliates of the registrant was $11,305,978 based on the closing sale price as reported on the Over the Counter Marketplace system.

Number of shares of Common Stock ($0.001 par value) outstanding as of March 18, 2016: 5,659,903 shares

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13, and 14 of Part III are incorporated by reference from the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held on May 11, 2016. Such Proxy Statement will be filed within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements forecasting our future financial condition and results, our future operating activities, market acceptance of our products, expectations for general market growth of mobile computing devices, growth in demand for our data capture products, expansion of the markets that we serve, expansion of the distribution channels for our products, and the timing of the introduction and availability of new products, as well as other forecasts discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Words such as “may,” “will,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements are based on current expectations, estimates, and projections about our industry, management’s beliefs, and assumptions made by management. These forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results and outcomes may differ materially from what is expressed or forecasted in any such forward looking statements. Factors that could cause actual results and outcomes to differ materially include, but are not limited to: weakness in the world economy generally and in the markets we serve in particular; the risk of delays in the availability of our products due to technological, market or financial factors including the availability of product components and necessary working capital; our ability to successfully develop, introduce and market future products; our ability to effectively manage and contain our operating costs; the availability of third-party hardware and software that our products are intended to work with; product delays associated with new model introductions and product changeovers by the makers of products that our products are intended to work with; continued growth in demand for barcode scanners; market acceptance of emerging standards such as RFID/Near Field Communications and of our related data capture products; the ability of our strategic relationships to benefit our business as expected; our ability to enter into additional distribution relationships; or other factors described in this Form 10-K including “Item 1A. Risk Factors” and recent Form 8-K and Form 10-Q reports filed with the Securities and Exchange Commission. We assume no obligation to update such forward-looking statements or to update the reasons why actual results could differ materially from those anticipated in such forward-looking statements.

You should read the following discussion in conjunction with the financial statements and notes included elsewhere in this report, and other information contained in other reports and documents filed from time to time with the Securities and Exchange Commission.

The Company

We are a leading producer of data capture products for the worldwide business mobility markets. Our products are incorporated into mobile applications used in mobile point of sale (mPOS), hospitality, asset management, commercial services, healthcare and other mobile business markets. Our primary products are cordless barcode scanners that connect over Bluetooth and work with applications running on smartphones, mobile computers and tablets using operating systems from Apple® (iOS), Google™ (Android™) and Microsoft® (Windows®/Windows Mobile™). We offer an easy-to-use software developer kit (SDK) to mobile application developers to enable the use of our products with their applications. Our products become an ingredient of the application solution and our products are marketed by the application developer or their resellers as part of that solution. Our registered developer program for data capture applications has grown from 700 developers at the beginning of 2015 to more than 1,400 developers at the beginning of 2016.

| 1 |

We offer barcode scanning products for both 1D (imager and laser) and 2D barcode scanning in standard and durable cases. Our 7 Series barcode scanners are lightweight and ergonomically designed for easy handling as a stand-alone cordless barcode scanner. Our 7 Series standard cases come in 5 vivid colors. Our 7 Series durable barcode scanners are designed for use in environments needing a more durable barcode scanner. In the first half of 2016 we are upgrading our durable barcode scanning line by introducing our D700 series durable barcode scanners in linear imaging, laser and 2D models. Using the same ergonomic form factor, the barcode scanners have an IP54 durability rating and improved durability features. Our 8 Series cordless barcode scanners in linear imaging and 2D models are designed to be attachable to smartphones for one-handed barcode scanning and can also be used in handheld mode. They attach to smartphones with an easily detachable clip. In the first half of 2016, we are introducing a case, “DuraCase”, designed to keep the smartphone and barcode scanner together and enabling both devices to be charged simultaneously.

Many smartphones and tablets now offer Near Field Communications (“NFC”), and RFID technology along with digital wallet applications for loyalty cards, identification cards, payment cards, coupons, event tickets and others which leverage the exchange of electronic “tokens”. These tokens can be exchanged through another NFC enabled device. We are incorporating an NFC reader/writer into the base of a retail accessory stand that today enables customers to scan barcoded documents. The NFC reader/writer may also be used as a stand-alone base. In addition, we are developing a handheld NFC reader/writer for the similar purposes. We will work with our registered developers during 2016 and beyond to encourage them to include Near Field Communications capabilities in their mobile applications.

Our Software Developer Kit (“SDK”) supports all of our barcode scanners with a single installation, making it easy for a developer to integrate our data collection capabilities while giving the customer the ability to select the products that work best for them. We also support using the built-in camera in a customer’s smartphone or tablet for lower volume data collection requirements. When a developer builds in our SDK, a customer can edit and direct the placement in their application of collected data while also receiving feedback that the collection of data was successfully completed.

Cordless barcode scanning represented 85 percent of our revenue in 2015, up from 79 percent in 2014. We also offer a handheld mobile computer first introduced in 2007 running Windows Embedded 6.5 operating system from Microsoft. Handheld computer and legacy product revenue represented 13 percent of our revenue in 2015 and 18 percent of our revenue in 2014. Handheld computer revenue has been in decline as developers move their applications to smartphones and tablets. We have announced that we will discontinue our handheld computer product line during 2016. Service revenue represented 2 percent of our revenue in 2015 and 3 percent in 2014.

| 2 |

We design our own products and test product components obtained from third party contract manufacturers. We perform final product assembly, test, package, and distribute our products at and from our Newark, California facility. We offer our products worldwide through two-tier distribution enabling customers to purchase from a large number of on-line resellers around the world including application developers who resell their own products along with our data collection products. We believe growth in mobile applications and the mobile workforce are resulting from technical advances in mobile technologies, cost reductions in mobile devices and the growing adoption by businesses of mobile applications, building a growing demand for our products. Our data capture products address the growing need for speed and accuracy by today’s mobile workers and by the systems supporting those workers, thereby enhancing their productivity and allowing them to exploit time sensitive opportunities and improve customer satisfaction.

Products

Cordless barcode scanners

We offer a family of cordless barcode scanning products that connect over Bluetooth with smartphones, tablets and mobile computers running operating systems from Apple (iOS), Google (Android), and Microsoft (Windows/Windows Mobile). Our cordless barcode scanners include two dimensional (2D) and linear (1D laser and 1D imager) barcode scanners in both colorful standard cases and durable cases. Our series 7 standard models in 5 vivid colors are lightweight and ergonomically designed for extended use as handheld barcode scanners. Our D700 series durable models being introduced in the first half of 2016 have an IP54 rating for use in wet, dusty or harsher environments. Our series 8 models are designed to be attached to a smartphone or similar handheld device with a clip to enable one-handed barcode scanning, but can be used as a stand-alone barcode scanner. We also offer a robust combination sleeve and charging station to attach as a single unit our Series 8 model barcode scanners to an iPod or similar device for one-handed barcode scanning in environments where the devices are intended to stay together. Extended warranty programs are available for all of our barcode scanning products.

NFC data capture products

Near Field Communications (NFC), an RFID radio technology, is being widely deployed in smartphones to enable the electronic transfer of loyalty cards, identification cards, payment cards, coupons, event tickets and electronic tokens on smartphones and similar devices, often in combination with Beacon technology that identifies for the smartphone the electronic information accepted by a merchant or vendor and helps present such information for identification, event entry, coupon application or payment. We are developing products that our registered developers can use within their applications to accept information either by barcode scan or by an electronic transfer of data over NFC/RFID. The NFC/RFID products are expected to commence shipping late in 2016.

Handheld Computers

We offer a family of SoMo® (“Socket® Mobile”) handheld computer products with antimicrobial cases running the Windows Embedded Handheld System 6.5 operating system. Handheld computer accessories include plug-in 1D and 2D barcode scanners, charging cradles, durable cases, and plug-in radio frequency identification (RFID) readers with NFC (near field communications). Our handheld computers are designed with wireless LAN (802.11 b/g/n) and Bluetooth connectivity for use with applications that do not require phones. Our newest family of handheld computers, the SoMo Model 655, commenced sales in June 2012, replacing the SoMo650 introduced in 2007. Due to the technical obsolescence of key components, we have announced end of life for this product family and are expected to exhaust supplies during 2016.

| 3 |

Service

Our products are warranted for one year and we offer SocketCare extended warranty programs for up to five years including repair or replacement due to accidental breakage. We will also repair or replace products that are beyond their warranty period.

Registered Developers and Developer Support Programs

Data Capture Software Developer Kit (SDK). We offer a data capture software developer kit to registered software application developers. Our data capture SDK enables developers to easily integrate Socket’s data capture software into their applications. The software and SDK are being enhanced to add NFC/RFID data capture to current barcode scanning capabilities and enable data capture with either technology with a single SDK. When integrated, the application owns the data capture barcode scanner or NFC/RFID reader and controls its behavior. The underlying software works with smartphones, tablets and mobile computers using operating systems from Apple (iOS), Google (Android), and Microsoft (Windows and Windows Mobile).

Registered developers and developer support. Registered developers consist of third party application providers and developers developing in-house solutions for businesses. We have more than 1,400 registered developers with a growing number of mobile applications deployed. The primary market segments being addressed by our registered developers are mobile point of sale (mPOS), hospitality, asset management, commercial services and healthcare along with applications addressing other mobile business markets. We support our registered developers with periodic software updates and assistance and solicit their feedback in considering future product improvements and direction.

General

Total employee headcount on December 31, 2015 was 50. We subcontract the manufacturing of all of our product components to independent third-party contract manufacturers located in the United States, Mexico, Taiwan and Singapore that have the equipment, know-how and capacity to manufacture products to our specifications. We assemble, test and distribute our products from our facilities in Newark, California. Our products are sold through a worldwide network of distributors and on-line resellers, application developers, and value added resellers.

We were founded in March 1992 as Socket Communications, Inc. and reincorporated in Delaware in 1995 prior to our initial public offering in June 1995. We have financed our operations since inception primarily from the sale of equity capital or convertible debt and a receivables-based revolving line of credit with our bank. We began doing business as Socket Mobile, Inc. in January 2007 to better reflect our market focus on the mobile business market and changed our legal name to Socket Mobile, Inc. in April 2008. Our common stock trades on the OTCQB Market under the symbol “SCKT”. Our principal executive offices are located at 39700 Eureka Drive, Newark, CA 94560, and our phone number is (510) 933-3000. Our Internet home page is located at http://www.socketmobile.com; however, the information on, or that can be accessed through, our home page is not part of this Annual Report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to such reports are available free of charge on or through our Internet home page as soon as reasonably practical after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

| 4 |

Marketing Strategy and Dynamics

Capitalize on Strategic Relationships. We actively support software application developers to integrate our products into their applications through our registered developer program. We provide an easy to use software developer kit (SDK) and training and technical support to our registered developers. We support the marketing activities of our registered developers in promoting the applications that include our products. Once our barcode scanning products are integrated into a developer’s application, our products become part of the application solution and are part of the developer’s marketing program for that application. We stay current on operating system updates provided by Apple, Google and Microsoft to support new products running the latest versions of their operating systems on smartphones, tablets and mobile computers while providing backward compatibility. We spend extensive engineering time and resources to ensure that our cordless barcode scanning products are compatible with a wide variety of the most popular smartphones, tablets and mobile computers running a variety of operating systems. We adhere to standards of a number of standards setting bodies whose technologies are used in our products including Bluetooth (both handheld computers and cordless barcode scanners) and wireless LAN (handheld computers).

Markets. Our growth in 2015 and 2014 was driven by sales of barcode scanners integrated into retail mobile point of sale applications for use with Apple tablets. Many developers of mobile point of sale applications have been funded by venture capital organizations enabling their rapid development and growth. Other mobile markets being addressed by registered developers include hospitality, asset management, commercial services, and healthcare. We expect all of these markets to increase the availability and use of mobile applications and the demand for mobile barcode scanners.

Expand and improve our product offerings. We offer a wide range of products that enable application developers and their customers to design their mobile systems to meet their specific requirements, and we encourage our distributors to support the full range of our products. The goal is for customers to view Socket as a primary source for their mobile barcode scanning needs. Within our family of barcode scanning products, we offer durable and standard cases (the latter in multiple colors), linear imaging and laser barcode scanning, 2D barcode scanning, and two form factors: an ergonomically designed handheld cordless barcode scanner (our model 7 series) and a smartphone attachable barcode scanner (our model 8 series) to enable one-handed barcode scanning. Both series 7 and series 8 products connect cordlessly over Bluetooth and may be used as handheld barcode scanners. We design our products to comply with the regulations of the many worldwide agencies that regulate the safety, performance and use of electronic products.

Price our products competitively and available worldwide. We have designed our products to be priced competitively although we are subject to changes in component pricing by our suppliers. We update our products from time to time and work with our vendors to achieve reductions in component pricing. We distribute our products through a worldwide distribution network that places products into geographic regions to shorten purchasing times and provides a credit shield to us. Our largest distributors are Ingram Micro®, ScanSource® and BlueStar, and they support a worldwide network of on-line resellers including Amazon®.com, CDW® and Barcodes, Inc.

| 5 |

Build a Strong Brand Name. We believe that our products make a difference in the daily work life of mobile workers and the people they serve. We are building a brand image focused on business mobility. This image closely associates us with business mobility solutions and to reflect this image, we began doing business as Socket Mobile, Inc. in January 2007 and changed our legal name to Socket Mobile, Inc. in April 2008. We stress with customers the design of our products for the markets they address, emphasizing quality and standards-based connectivity. Mobility requires products that are compact and designed to be handled while mobile, with low power consumption to extend time between charges, and easy to use. We strive to offer high performance products in a wide range of competitive prices. Through our developer support program, we work closely with application developers who are developing productivity enhancing applications for the mobile workforce. Our overall company brand identity and positioning goal is to be a leading provider of easy-to-deploy business mobility data capture systems to the business mobility market.

Competition and Competitive Risks

The overall market for mobile handheld computing solutions is both complex and competitive. Our barcode scanning hardware products compete with similar hardware products in all of our markets in the United States, Europe and Asia and we differentiate our products with our software developer kit and our underlying data capture software designed to work with smartphones, tablets and other mobile computers running the Apple, Android and Windows operating systems. Our longtime focus on creating innovative mobile solutions for the mobile workforce has resulted in good brand name recognition and reputation. We believe that our brand name identifies our products as durable, dependable, small form factor, low power and easy to use, all features designed for a mobile worker while mobile, and the breadth of our product offerings, including the extensive features of our software and software developer kit will continue to differentiate us relative to our competitors.

Cordless Barcode Scanning. We offer a full range of handheld cordless barcode scanners connecting to smartphones, tablets and other computing devices over Bluetooth. Our Software Developer Kit (SDK) enables registered third party application developers to integrate the features of our Data Capture software into their applications and helps differentiate our products. We face competition from products similar to our cordless hand scanners from Koamtec, Code Corporation, and Opticon (Japan). Barcodes may also be scanned using the built-in camera in smartphones or tablets with applications like Scandit or Manatee Works. However, scanning using the built-in camera is typically slower and more awkward especially as the pixel count gets larger. Users may choose a barcode scanner that connects directly to an Apple tablet, iPhone or computer such as offered by Infinite Peripherals and Honeywell. Users also may choose more rugged barcode scanners as an alternative, some of which are integrated into computing devices from manufacturers such as Datalogic, Honeywell®, and Zebra Technologies. Many of these devices are not Apple certified. Many connect to Apple devices over Bluetooth in keyboard emulation mode, and do not offer extensive tools for software developers such as our software developer kit (SDK) to integrate features of our sophisticated data collection scanning software into data capture applications.

Near Field Communications (NFC) and Radio Frequency Identification (RFID). We are developing the use of NFC/RFID technology with NFC/RFID reader/writers to enable the transfer of electronic tokens to and from smartphones, tablets and mobile applications that are supported by our software developer kit. Use of electronic tokens includes loyalty cards, identification cards, payment cards, coupons, and event tickets. Distribution of electronic tokens by organizations to customers is becoming more widespread, and organizations need the ability to accept these tokens electronically from their customers. For retail organizations, we are adding NFC reader/writer technology to the base of our presentation stand which will support data collection either by scanning a barcode including one displayed on an electronic screen or by electronically accepting the transfer of an NFC token. We are also developing a stand-alone RFID handheld reader/writer that communicates over Bluetooth. NFC today is primarily being used to facilitate payment transactions through organizations such as Square, Clover, Revel Systems, Poynt, Verifone and Ingenico using Apple Pay, Android Pay and Samsung Pay. Other developers are able to facilitate payments within their mobile applications using software tools supplied by Apple, Google, PayPal and Visa. If a registered developer adds the use of our NFC/RFID products to their application, their customers will be able to broaden their use of NFC/RFID beyond payments to issue and accept loyalty cards, identification cards, coupons and event tickets.

| 6 |

Proprietary Technology and Intellectual Property

We have been granted 33 U.S. patents and 10 design patents and have other patent applications under review. We have registered trademarks with the U.S. Patent and Trademark Office for the mark “Socket”, our logo, the terms “Go-WiFi” and “Battery Friendly” and have trademark applications pending for the marks “DuraScan” and “SocketScan”.

We have developed a number of technological building blocks that enhance our ability to design new hardware and software products, to offer products which run on multiple software and hardware platforms, and to manufacture and package products efficiently.

We own and control the design of our barcode scanners, enabling us to modify its features or software to meet specific customer requirements.

Building on our expertise in embedded radio-dependent firmware, within our Bluetooth cordless products are software and firmware that include a wide variety of functions to enable efficient radio control and overall systems functionality. For cordless barcode scanning this includes our patented Error Proof Protocol, which is designed to ensure that scanned data is correctly received by the mobile computing device and allows for real-time validation of data and error notification to the user. We have developed data capture software that allows our products to communicate with applications on smartphones and tablets running operating systems from Apple (iOS), Google (Android), and Microsoft (Windows and Windows Mobile).

We have developed a number of software programs that provide unique functions and features for our data collection products. For example, our data collection software enables all of our barcode scanning products to scan a variety of barcodes and to route the data to many different types of data files on a number of operating systems used in mobile devices. Our Bluetooth software used in conjunction with our Bluetooth hardware provides a completely functional Bluetooth solution enabling connections and data transfers between Bluetooth-enabled devices.

We rely on a combination of patent, copyright, trademark and trade secret laws, and confidentiality procedures to protect our proprietary rights. As part of our confidentiality procedures, we generally enter into non-disclosure agreements with our employees, distributors and strategic partners, and limit access to our software, documentation and other proprietary information. Despite these precautions, it may be possible for a third-party to copy or otherwise obtain and use our products or technology without authorization, or to develop similar technology independently. In addition, we may not be able to effectively protect our intellectual property rights in certain foreign countries. From time to time we receive communications from third parties asserting that our products infringe, or may infringe, their proprietary rights. In connection with any such claims, litigation could be brought against us that could result in significant additional expense or compel us to discontinue or redesign some of our products.

| 7 |

Personnel

Our future success will depend in significant part upon the continued service of certain of our key technical and senior management personnel, and our continuing ability to attract, assimilate and retain highly qualified technical, managerial and sales and marketing personnel. Our total employee headcount as of December 31, 2015 was 50. Our employees are not represented by a union, and we consider our employee relationships to be good. As of December 31, 2015, we had 15 persons in sales, marketing and customer service, 9 persons in development engineering, 8 persons in finance and administration, and 18 persons in operations.

We have a history of operating losses and may not maintain ongoing profitability.

Except for fiscal years 2015, 2014 and 2004, we incurred significant operating losses in each financial period since our inception. To maintain ongoing profitability, we must accomplish numerous objectives, including continued growth in our business, ongoing support to registered developers whose applications support the use of our data collection products, and the development of successful new products. We cannot foresee with any certainty whether we will be able to achieve these objectives in the future. Accordingly, we may not generate sufficient net revenue or manage our expenses sufficiently to maintain ongoing profitability. If we cannot maintain ongoing profitability, we will not be able to support our operations from positive cash flows, and we would use our existing cash to support operating losses. If we are unable to secure the necessary capital to replace that cash, we may need to suspend some or all of our current operations.

We may require additional capital in the future, but that capital may not be available on reasonable terms, if at all, or on terms that would not cause substantial dilution to inventors’ stock holdings.

We may need to raise capital to fund our growth or operating losses in future periods. Our forecasts are highly dependent on factors beyond our control, including market acceptance of our products and delays in deployments by businesses of applications that use our data capture products. Even if we maintain profitable operating levels, we may need to raise capital to provide sufficient working capital to fund our growth. If capital requirements vary materially from those currently planned, we may require additional capital sooner than expected. There can be no assurance that such capital will be available in sufficient amounts or on terms acceptable to us, if at all.

| 8 |

If application developers are not successful in their efforts to develop, market and sell their applications into which our software and products are incorporated, we may not achieve our sales projections.

We are dependent upon application developers to integrate our scanning and software products into their applications designed for mobile workers using smartphones, tablets and mobile computers, and to successfully market and sell those application products and solutions into the marketplace. We focus on serving the needs of application developers as sales of our data capture products are application driven. However, these developers may take considerable time to complete development of their applications, may experience delays in their development timelines, may develop competing applications, may be unsuccessful in marketing and selling their application products and solutions to customers, or may experience delays in customer deployments and implementations, which would adversely affect our ability to achieve our revenue projections.

Global economic conditions may have a negative impact on our business and financial condition in ways that we currently cannot predict, and may further limit our ability to raise additional funds.

Global economic conditions may have an impact on our business and our financial condition. We may face significant challenges if global economic growth slows down and conditions in the financial markets worsen. In particular, should these conditions cause our revenues to be materially less than forecast, we may find it necessary to initiate reductions in our expenses and defer product development programs. In addition, our ability to access the capital markets and raise funds required for our operations may be severely restricted at a time when we would like, or need, to do so, which could have an adverse effect on our ability to meet our current and future funding requirements and on our flexibility to react to changing economic and business conditions.

Our quarterly operating results may fluctuate in future periods, which could cause our stock price to decline.

We expect to experience quarterly fluctuations in operating results in the future. We generally ship orders as received, and as a result we may have little backlog. Quarterly revenues and operating results therefore depend on the volume and timing of orders received during the quarter, which are difficult to forecast. Historically, we have often recognized a substantial portion of our revenue in the last month of the quarter. This subjects us to the risk that even modest delays in orders or in the manufacture of products relating to orders received, may adversely affect our quarterly operating results. Our operating results may also fluctuate due to factors such as:

| • | the demand for our products; |

| • | the size and timing of customer orders; |

| • | unanticipated delays or problems in our introduction of new products and product enhancements; |

| • | the introduction of new products and product enhancements by our competitors; |

| • | the timing of the introduction and deployments of new applications that work with our products; |

| • | changes in the revenues attributable to royalties and engineering development services; |

| • | product mix; |

| • | timing of software enhancements; |

| • | changes in the level of operating expenses; |

| • | competitive conditions in the industry including competitive pressures resulting in lower average selling prices; |

| • | timing of distributors’ shipments to their customers; |

| • | delays in supplies of key components used in the manufacturing of our products, and |

| • | general economic conditions and conditions specific to our customers’ industries. |

| 9 |

Because we base our staffing and other operating expenses on anticipated revenues, unanticipated declines or delays in the receipt of orders can cause significant variations in operating results from quarter to quarter. As a result of any of the foregoing factors, or a combination, our results of operations in any given quarter may be below the expectations of public market analysts or investors, in which case the market price of our common stock would be adversely affected.

In order to maintain the availability of our bank lines of credit we must remain in compliance with the covenants as specified under the terms of the credit agreements and the bank may exercise discretion in making advances to us.

Our credit agreements with our bank requires us to maintain cash and qualified receivables that are at least 1.75 times amounts borrowed and outstanding under the credit agreements. The agreements contain customary representations, warranties, covenants and events of default that limit our ability to incur additional liens or indebtedness, make distributions to our stockholders and make investments. The events of default entitle our bank to accelerate our obligations and require repayment of our outstanding indebtedness thereunder. These events of default include a breach of our payment obligations or covenants, a material impairment in our financial condition or ability to repay any indebtedness to our bank and the commencement of dissolution or insolvency proceedings. The agreement may be terminated by us or by our bank at any time. Upon such termination, our bank would no longer make advances under the credit agreement and outstanding advances would be repaid as receivables are collected. All advances are at our bank’s discretion and our bank is not obligated to make advances. Our bank has been granted a first priority security interest in all of our assets, including our intellectual property.

Goodwill comprises a significant portion of our assets and may be subject to impairment write-downs in future periods which would substantially increase our losses, make it more difficult to achieve profitability, and could cause our stock price to decline.

We review our goodwill for impairment at least annually as of September 30th, and more often if factors suggest potential impairment. Many factors are considered in evaluating goodwill including our market capitalization, comparable companies within our industry, our estimates of our future performance, and discounted cash flow analysis. Many of these factors are highly subjective and may be negatively impacted by our financial results and market conditions in the future. We may incur goodwill impairment charges in the future and any future write-downs of our goodwill would adversely affect our operating results, make it more difficult to maintain profitability, and as a result the market price of our common stock could be adversely affected.

| 10 |

We may be unable to manufacture our products because we are dependent on a limited number of qualified suppliers for our components.

Several of our component parts are produced by one or a limited number of suppliers. Shortages or delays could occur in these essential components due to an interruption of supply or increased demand in the industry. Suppliers may choose to restrict credit terms or require advance payment causing delays in the procurement of essential materials. If we are unable to procure certain component parts, we could be required to reduce our operations while we seek alternative sources for these components, which could have a material adverse effect on our financial results. To the extent that we acquire extra inventory stocks to protect against possible shortages, we would be exposed to additional risks associated with holding inventory, such as obsolescence, excess quantities, or loss.

If we fail to develop and introduce new products rapidly and successfully, we will not be able to compete effectively, and our ability to generate sufficient revenues will be negatively affected.

The market for our products is prone to rapidly changing technology, evolving industry standards and short product life cycles. If we are unsuccessful at developing and introducing new products and services on a timely basis that include the latest technologies conform to the newest standards and that are appealing to end users, we will not be able to compete effectively, and our ability to generate significant revenues will be seriously harmed.

The development of new products and services can be very difficult and requires high levels of innovation. The development process is also lengthy and costly. Short product life cycles for smartphones and tablets expose our products to the risk of obsolescence and require frequent new product upgrades and introductions. We will be unable to introduce new products and services into the market on a timely basis and compete successfully, if we fail to:

| • | invest significant resources in research and development, sales and marketing, and customer support; |

| • | identify emerging trends, demands and standards in the field of mobile computing products; |

| • | enhance our products by adding additional features; |

| • | maintain superior or competitive performance in our products; and |

| • | anticipate our end users’ needs and technological trends accurately. |

We cannot be sure that we will have sufficient resources to make adequate investments in research and development or that we will be able to identify trends or make the technological advances necessary to be competitive.

A significant portion of our revenue currently comes from a limited number of distributors, and any decrease in revenue from these distributors could harm our business.

A significant portion of our revenue comes from a limited number of distributors. In fiscal years 2015 and 2014, Ingram Micro Inc., ScanSource, Inc., and BlueStar, Inc. together represented approximately 69% and 67%, respectively, of our worldwide revenues. We expect that a significant portion of our revenue will continue to depend on sales to a limited number of distributors. We do not have long-term commitments from our distributors to carry our products, and any of our distributors may from quarter to quarter comprise a significant concentration of our revenues. Any could choose to stop selling some or all of our products at any time, and each of these companies also carries our competitors’ products. If we lose our relationship with any of our significant distributors, we would experience disruption and delays in marketing our products.

| 11 |

We may not be able to collect revenues from customers who experience financial difficulties.

Our accounts receivable are derived primarily from distributors. We perform ongoing credit evaluations of our customers’ financial conditions but generally require no collateral from our customers. Reserves are maintained for potential credit losses, and such losses have historically been within such reserves. However, many of our customers may be thinly capitalized and may be prone to failure in adverse market conditions. Although our collection history has been good, from time to time a customer may not pay us because of financial difficulty, bankruptcy or liquidation. If global financial conditions have an impact on our customers’ ability to pay us in a timely manner, and consequently, we may experience increased difficulty in collecting our accounts receivable, and we may have to increase our reserves in anticipation of increased uncollectible accounts.

We could face increased competition in the future, which would adversely affect our financial performance.

The market in which we operate is very competitive. Our future financial performance is contingent on a number of unpredictable factors, including that:

| • | some of our competitors have greater financial, marketing, and technical resources than we do; |

| • | we periodically face intense price competition, particularly when our competitors have excess inventories and discount their prices to clear their inventories; and |

| • | certain manufacturers of tablets and mobile phones offer products with built-in functions, such as Bluetooth wireless technology or barcode scanning, that compete with our products. |

Increased competition could result in price reductions, fewer customer orders, reduced margins, and loss of market share. Our failure to compete successfully against current or future competitors could harm our business, operating results and financial condition.

If we do not correctly anticipate demand for our products, our operating results will suffer.

The demand for our products depends on many factors and is difficult to forecast as we introduce and support more products, and as competition in the markets for our products intensifies. If demand is lower than forecasted levels, we could have excess production resulting in higher inventories of finished products and components, which could lead to write-downs or write-offs of some or all of the excess inventories, and reductions in our cash balances. Lower than forecasted demand could also result in excess manufacturing capacity at our third-party manufacturers and in our failure to meet minimum purchase commitments, each of which may lower our operating results.

| 12 |

If demand increases beyond forecasted levels, we would have to rapidly increase production at our third-party manufacturers. We depend on suppliers to provide additional volumes of components, and suppliers might not be able to increase production rapidly enough to meet unexpected demand. Even if we were able to procure enough components, our third-party manufacturers might not be able to produce enough of our devices to meet our customer demand. In addition, rapid increases in production levels to meet unanticipated demand could result in higher costs for manufacturing and supply of components and other expenses. These higher costs could lower our profit margins. Further, if production is increased rapidly, manufacturing yields could decline, which may also lower operating results.

We rely primarily on distributors and resellers to sell our products, and our sales would suffer if any of these third-parties stops selling our products effectively.

Because we sell our products primarily through distributors and resellers, we are subject to risks associated with channel distribution, such as risks related to their inventory levels and support for our products. Our distribution channels may build up inventories in anticipation of growth in their sales. If such growth in their sales does not occur as anticipated, the inventory build-up could contribute to higher levels of product returns. The lack of sales by any one significant participant in our distribution channels could result in excess inventories and adversely affect our operating results and working capital liquidity.

Our agreements with distributors and resellers are generally nonexclusive and may be terminated on short notice by them without cause. Our distributors and resellers are not within our control, are not obligated to purchase products from us, and may offer competitive lines of products simultaneously. Sales growth is contingent in part on our ability to enter into additional distribution relationships and expand our sales channels. We cannot predict whether we will be successful in establishing new distribution relationships, expanding our sales channels or maintaining our existing relationships. A failure to enter into new distribution relationships or to expand our sales channels could adversely impact our ability to grow our sales.

We allow our distribution channels to return a portion of their inventory to us for full credit against other purchases. In addition, in the event we reduce our prices, we credit our distributors for the difference between the purchase price of products remaining in their inventory and our reduced price for such products. Actual returns and price protection may adversely affect future operating results and working capital liquidity by reducing our accounts receivable and increasing our inventory balances, particularly since we seek to continually introduce new and enhanced products and are likely to face increasing price competition.

We depend on alliances and other business relationships with third-parties, and a disruption in these relationships would hinder our ability to develop and sell our products.

We depend on strategic alliances and business relationships with leading participants in various segments of the mobile applications market to help us develop and market our products. Our strategic partners may revoke their commitment to our products or services at any time in the future or may develop their own competitive products or services. Accordingly, our strategic relationships may not result in sustained business alliances, successful product or service offerings, or the generation of significant revenues. Failure of one or more of such alliances could result in delay or termination of product development projects, failure to win new customers, or loss of confidence by current or potential customers.

| 13 |

We have devoted significant research and development resources to design products to work with a number of operating systems used in mobile devices including Apple (iOS), Google (Android), and Microsoft (Windows/Windows Mobile). Such design activities have diverted financial and personnel resources from other development projects. These design activities are not undertaken pursuant to any agreement under which Apple, Google or Microsoft is obligated to collaborate or to support the products produced from such collaboration. Consequently, these organizations may terminate their collaborations with us for a variety of reasons, including our failure to meet agreed-upon standards or for reasons beyond our control, such as changing market conditions, increased competition, discontinued product lines, and product obsolescence.

Our intellectual property and proprietary rights may be insufficient to protect our competitive position.

Our business depends on our ability to protect our intellectual property. We rely primarily on patent, copyright, trademark, trade secret laws, and other restrictions on disclosure to protect our proprietary technologies. We cannot be sure that these measures will provide meaningful protection for our proprietary technologies and processes. We cannot be sure that any patent issued to us will be sufficient to protect our technology. The failure of any patents to provide protection to our technology would make it easier for our competitors to offer similar products. In connection with our participation in the development of various industry standards, we may be required to license certain of our patents to other parties, including our competitors that develop products based upon the adopted standards.

We also generally enter into confidentiality agreements with our employees, distributors, and strategic partners, and generally control access to our documentation and other proprietary information. Despite these precautions, it may be possible for a third-party to copy or otherwise obtain and use our products, services, or technology without authorization, develop similar technology independently, or design around our patents.

Effective copyright, trademark, and trade secret protection may be unavailable or limited in certain foreign countries.

We may become subject to claims of intellectual property rights infringement, which could result in substantial liability.

In the course of operating our business, we may receive claims of intellectual property infringement or otherwise become aware of potentially relevant patents or other intellectual property rights held by other parties. Many of our competitors have large intellectual property portfolios, including patents that may cover technologies that are relevant to our business. In addition, many smaller companies, universities, and individuals have obtained or applied for patents in areas of technology that may relate to our business. The industry is moving towards aggressive assertion, licensing, and litigation of patents and other intellectual property rights.

If we are unable to obtain and maintain licenses on favorable terms for intellectual property rights required for the manufacture, sale, and use of our products, particularly those products which must comply with industry standard protocols and specifications to be commercially viable, our results of operations or financial condition could be adversely impacted.

| 14 |

In addition to disputes relating to the validity or alleged infringement of other parties’ rights, we may become involved in disputes relating to our assertion of our own intellectual property rights. Whether we are defending the assertion of intellectual property rights against us or asserting our intellectual property rights against others, intellectual property litigation can be complex, costly, protracted, and highly disruptive to business operations by diverting the attention and energies of management and key technical personnel. Plaintiffs in intellectual property cases often seek injunctive relief, and the measures of damages in intellectual property litigation are complex and often subjective or uncertain. Thus, any adverse determinations in this type of litigation could subject us to significant liabilities and costs.

New industry standards may require us to redesign our products, which could substantially increase our operating expenses.

Standards for the form and functionality of our products are established by standards committees. These independent committees establish standards, which evolve and change over time, for different categories of our products. We must continue to identify and ensure compliance with evolving industry standards so that our products are interoperable and we remain competitive. Unanticipated changes in industry standards could render our products incompatible with products developed by major hardware manufacturers and software developers. Should any major changes, even if anticipated, occur, we would be required to invest significant time and resources to redesign our products to ensure compliance with relevant standards. If our products are not in compliance with prevailing industry standards for a significant period of time, we would miss opportunities to sell our products for use with new hardware components from mobile computer manufacturers and OEMs, thus affecting our business.

Undetected flaws and defects in our products may disrupt product sales and result in expensive and time-consuming remedial action.

Our hardware and software products may contain undetected flaws, which may not be discovered until customers have used the products. From time to time, we may temporarily suspend or delay shipments or divert development resources from other projects to correct a particular product deficiency. Efforts to identify and correct errors and make design changes may be expensive and time consuming. Failure to discover product deficiencies in the future could delay product introductions or shipments, require us to recall previously shipped products to make design modifications, or cause unfavorable publicity, any of which could adversely affect our business and operating results.

The loss of one or more of our senior personnel could harm our existing business.

A number of our officers and senior managers have been employed for more than twenty years by us, including our President, Chief Financial Officer, Vice President of Operations and Vice President of Engineering/Chief Technical Officer. Our future success will depend upon the continued service of key officers and senior managers. Competition for officers and senior managers is intense, and there can be no assurance that we will be able to retain our existing senior personnel. The loss of one or more of our officers or key senior managers could adversely affect our ability to compete.

| 15 |

The expensing of options will continue to reduce our operating results such that we may find it necessary to change our business practices to attract and retain employees.

Historically, we have used stock options as a key component of our employee compensation packages. We believe that stock options provide an incentive to our employees to maximize long-term stockholder value and, through the use of vesting, encourage valued employees to remain with us. The expensing of employee stock options adversely affects our net income and earnings per share, will continue to adversely affect future quarters, and will make profitability harder to achieve. In addition, we may decide in response to the effects of expensing stock options on our operating results to reduce the number of stock options granted to employees or to grant options to fewer employees. This could adversely affect our ability to retain existing employees and attract qualified candidates, and also could increase the cash compensation we would have to pay to them.

If we are unable to attract and retain highly skilled sales and marketing and product development personnel, our ability to develop and market new products and product enhancements will be adversely affected.

We believe our ability to achieve increased revenues and to develop successful new products and product enhancements will depend in part upon our ability to attract and retain highly skilled sales and marketing and product development personnel. Our products involve a number of new and evolving technologies, and we frequently need to apply these technologies to the unique requirements of mobile products. Our personnel must be familiar with both the technologies we support and the unique requirements of the products to which our products connect. Competition for such personnel is intense, and we may not be able to attract and retain such key personnel. In addition, our ability to hire and retain such key personnel will depend upon our ability to raise capital or achieve increased revenue levels to fund the costs associated with such key personnel. Failure to attract and retain such key personnel will adversely affect our ability to develop and market new products and product enhancements.

Our operating results could be harmed by economic, political, regulatory and other risks associated with export sales.

Export sales (sales to customers outside the United States) accounted for approximately 22% and 25% of our revenue in fiscal years 2015 and 2014, respectively. Accordingly, our operating results are subject to the risks inherent in export sales, including:

| • | longer payment cycles; |

| • | unexpected changes in regulatory requirements, import and export restrictions and tariffs; |

| • | difficulties in managing foreign operations; |

| • | the burdens of complying with a variety of foreign laws; |

| • | greater difficulty or delay in accounts receivable collection; |

| • | potentially adverse tax consequences; and |

| • | political and economic instability. |

Our export sales are primarily denominated in Euros for our sales to European distributors. Accordingly, an increase in the value of the United States dollar relative to Euros could make our products more expensive and therefore potentially less competitive in European market. Declines in the value of the Euro relative to the United States dollar may result in foreign currency losses relating to collection of Euro denominated receivables if left unhedged.

| 16 |

Our operations are vulnerable to interruption by fire, earthquake, power loss, telecommunications failure, and other events beyond our control.

Our corporate headquarters is located near an earthquake fault. The potential impact of a major earthquake on our facilities, infrastructure, and overall business is unknown. Additionally, we may experience electrical power blackouts or natural disasters that could interrupt our business. Should a disaster be widespread, such as a major earthquake, or result in the loss of key personnel, we may not be able to implement our disaster recovery plan in a timely manner. Any losses or damages incurred by us as a result of these events could have a material adverse effect on our business.

Failure to maintain effective internal controls could have a material adverse effect on our business, operating results and stock price.

We have evaluated and will continue to evaluate our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act, which requires an annual management assessment of the design and effectiveness of our internal control over financial reporting. If we fail to maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our stock could drop significantly.

The sale of a substantial number of shares of our common stock could cause the market price of our common stock to decline.

Sales of a substantial number of shares of our common stock in the public market could adversely affect the market price for our common stock. The market price of our common stock could also decline if one or more of our significant stockholders decided for any reason to sell substantial amounts of our common stock in the public market.

As of March 18, 2016, we had 5,659,903 shares of common stock outstanding. Substantially all of these shares are freely tradable in the public market, either without restriction or subject, in some cases, only to S-3 prospectus delivery requirements and, in other cases, only to manner of sale, volume, and notice requirements of Rule 144 under the Securities Act.

As of March 18, 2016, we had 2,170,439 shares of common stock subject to outstanding options under our stock option plans, and 159,034 shares of common stock were available for future issuance under the plans. We have registered the shares of common stock subject to outstanding options and reserved for issuance under our stock option plans. Accordingly, the shares of common stock underlying vested options will be eligible for resale in the public market as soon as the options are exercised.

| 17 |

As of March 18, 2016, we had 169,335 shares of common stock subject to outstanding warrants issued in our 2009 private placement and in connection with a convertible note financing in November 2010. We have registered the resale of all shares of common stock subject to the warrants. Accordingly, the shares of common stock underlying these warrants will be eligible for resale in the public market as soon as the warrants are exercised, subject only to S-3 prospectus delivery requirements.

As of March 18, 2016, we had $752,625 in subordinated convertible notes payable. Up to 417,218 shares of common stock could be issued for conversion of the notes plus all accrued interest thru December 31, 2015.

Volatility in the trading price of our Common Stock could negatively impact the price of our Common Stock.

During the period from January 1, 2015 through March 18, 2016, our common stock price fluctuated between a high of $3.25 and a low of $1.82. On July 30, 2012, our common stock was delisted from the NASDAQ market and began trading on the Over-the-Counter Marketplace due to our equity balances falling below the minimum threshold required for continued NASDAQ listing. We have experienced low trading volumes in our stock, and thus relatively small purchases and sales can have a significant effect on our stock price. The trading price of our common stock could be subject to wide fluctuations in response to many factors, some of which are beyond our control, including general economic conditions and the outlook of securities analysts and investors on our industry. In addition, the stock markets in general, and the markets for high technology stocks in particular, have experienced high volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

Item 1B. Unresolved Staff Comments

None.

We lease a 37,100 square foot office facility in Newark, California under a lease expiring in June 2022. This facility houses our headquarters and manufacturing operations, and is used by all segments of the Company. We believe that our current facilities are sufficient and adequate to meet our needs for the foreseeable future.

We are currently not a party to any material legal proceedings.

Item 4. Mine Safety Disclosures

Not applicable.

| 18 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock

The Company’s common stock is traded on the OTCQB Marketplace under the symbol “SCKT.”

The quarterly high and low sales prices of our common stock, as reported on the OTCQB Marketplace through March 18, 2016 and for the last two fiscal years are as shown below:

Common Stock | ||||||||||

Quarter Ended | High | Low | ||||||||

| 2014 | ||||||||||

| March 31, 2014 | $ | 1.14 | $ | 0.70 | ||||||

| June 30, 2014 | $ | 1.91 | $ | 0.85 | ||||||

| September 30, 2014 | $ | 2.74 | $ | 1.40 | ||||||

| December 31, 2014 | $ | 2.75 | $ | 1.95 | ||||||

| 2015 | ||||||||||

| March 31, 2015 | $ | 3.19 | $ | 1.95 | ||||||

| June 30, 2015 | $ | 2.35 | $ | 1.85 | ||||||

| September 30, 2015 | $ | 2.49 | $ | 2.09 | ||||||

| December 31, 2015 | $ | 2.49 | $ | 2.25 | ||||||

| 2016 | ||||||||||

| March 31, 2016 (through March 18, 2016) | $ | 3.25 | $ | 1.82 | ||||||

On March 18, 2016, the closing sales price for our common stock as reported on the OTCQB Marketplace was $3.20. We had approximately 3,100 beneficial stockholders of record as of March 18, 2016. We have not paid dividends on our common stock, and we currently intend to retain future earnings for use in our business and do not anticipate paying dividends in the foreseeable future.

The information required by this item regarding equity compensation plans is incorporated by reference to the information set forth in Item 12 of this Annual Report on Form 10-K.

| 19 |

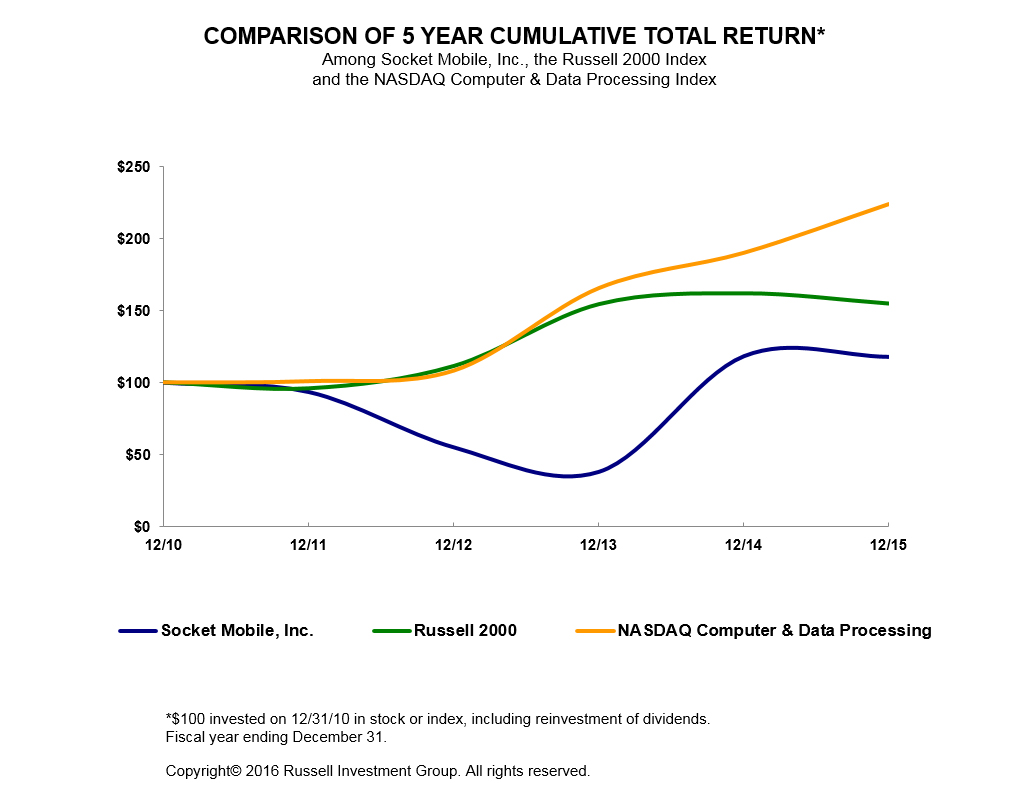

Performance Graph

The performance graph shown below shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that section, and shall not be deemed to be incorporated by reference into any filing of Socket Mobile, Inc. under the Securities Act of 1933, as amended, or the Exchange Act. The performance graph below shows a five-year comparison of cumulative total stockholder return, calculated on a dividend reinvestment basis and based on a $100 investment, from December 31, 2010 through December 31, 2015 comparing the return on the Company's common stock with the Russell 2000 Index and the NASDAQ Computer & Data Processing Index. No dividends have been declared or paid on the common stock during such period. Historical stock price performance is not necessarily indicative of future stock price performance.

| 20 |

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the financial statements and the notes thereto in Item 8, “Financial Statements and Supplementary Data.”

| Years Ended December 31, | ||||||||||||||||||||

| (Amounts in thousands except per share) | 2011 | (a) | 2012 | 2013 | 2014 | 2015 | ||||||||||||||

| Income Statement Data: | ||||||||||||||||||||

| Revenues | $ | 17,511 | $ | 13,565 | $ | 15,661 | $ | 17,021 | $ | 18,400 | ||||||||||

| Gross profit | $ | 7,250 | $ | 5,047 | $ | 6,303 | $ | 7,413 | $ | 8,935 | ||||||||||

| Operating expenses | $ | 8,524 | $ | 8,056 | $ | 6,426 | $ | 6,482 | $ | 6,806 | ||||||||||

| Net income (loss) | $ | (2,422 | ) | $ | (3,298 | ) | $ | (620 | ) | $ | 432 | $ | 1,817 | |||||||

Net income (loss) per share: Basic | $ | (0.56 | ) | $ | (0.68 | ) | $ | (0.13 | ) | $ | 0.09 | $ | 0.33 | |||||||

| Diluted | $ | (0.56 | ) | $ | (0.68 | ) | $ | (0.13 | ) | $ | 0.08 | $ | 0.30 | |||||||

| Weighted average shares outstanding: | ||||||||||||||||||||

| Basic | 4,360 | 4,854 | 4,865 | 5,006 | 5,555 | |||||||||||||||

| Diluted | 4,360 | 4,854 | 4,865 | 5,251 | 5,975 | |||||||||||||||

| At December 31, | ||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 957 | $ | 391 | $ | 606 | $ | 633 | $ | 938 | ||||||||||

| Total assets | $ | 10,397 | $ | 7,921 | $ | 8,102 | $ | 8,370 | $ | 9,688 | ||||||||||

| Bank line of credit | $ | 1,110 | $ | 811 | $ | 764 | $ | 816 | $ | — | ||||||||||

| Related party convertible notes payable | $ | — | $ | 750 | $ | 778 | $ | 753 | $ | 753 | ||||||||||

| Short term notes payable | $ | — | $ | 95 | $ | 650 | $ | 600 | $ | 500 | ||||||||||

| Capital leases and deferred rent - long term portion | $ | 184 | $ | 227 | $ | 265 | $ | 276 | $ | 305 | ||||||||||

| Total stockholders’ equity | $ | 3,126 | $ | 469 | $ | 133 | $ | 1,029 | $ | 3,343 | ||||||||||

| (a) | In the year ended December 31, 2011, the net loss includes non-cash charges to interest expense of approximately $1,050,000 related to the Company’s senior convertible note issued in November 2010. The note was subsequently called by the Company in August 2011, and the note holder completed full conversion of the note to common stock by September 2011. |

| 21 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity and Capital Resources

For 2015, we generated $18.4 million in revenue, an increase of 8% compared to revenue of $17.0 million for 2014. Net income for 2015 was $1.8 million compared to net income of $0.4 million in 2014. Except for fiscal years 2015, 2014 and 2004, we incurred significant operating losses in each financial period since our inception. As of December 31, 2015, we have an accumulated deficit of $58.9 million. At December 31, 2015, our cash balance was $0.9 million and we had a borrowing capacity of approximately $1.6 million on our bank lines of credit. Our balance sheet at December 31, 2015 had a current ratio (current assets divided by current liabilities) of 0.86 to 1.0, and a working capital deficit of $0.7 million (current assets less current liabilities). Historically we have financed our operations through convertible debt, the sale of equity securities, equipment financing, and revolving bank lines of credit.

We have taken actions to control our expenses, improve our efficiencies and maintain profitability. We have the ability to further reduce expenses if necessary. Steps taken included limited growth of headcount to manage payroll costs, the introduction of new products, and continued close support of our distributors and registered developers whose applications support the use of our data capture products. We believe we will be able to further improve our liquidity and secure additional sources of financing by managing our working capital balances, use of our bank lines of credit, and raising additional capital as needed including the issuance of additional equity securities. However, there can be no assurance that additional capital will be available on acceptable terms, if at all, and any such terms may be dilutive to existing stockholders. Our bank lines of credit may be terminated at our or the bank’s discretion. If we cannot maintain profitability, we will not be able to support our operations from positive cash flows, and would use our existing cash to support operating losses. If we are unable to secure the necessary capital for our business, we may need to suspend some or all of the current operations.

To maintain revenue growth and profitability, we anticipate requirements for cash will include funding of higher receivable and inventory balances, and increased expenses, including an increase of costs relating to new employees to support our growth and increases in salaries, benefits, and related support costs for employees.

Critical Accounting Policies

Our significant accounting policies are described in Note 1 to our financial statements for the years ended December 31, 2015 and 2014. The application of these policies requires us to make estimates and judgments that affect the reported amount of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We base our estimates on a combination of historical experience and reasonable judgment applied to other facts. Actual results may differ from these estimates, and such differences may be material to the financial statements. In addition, the use of different assumptions or judgments may result in different estimates. We believe our critical accounting policies that are subject to these estimates are: Revenue Recognition and Accounts Receivable Reserves, Inventory Valuation, Stock Based-Compensation, and Valuation of Goodwill and Other Intangible Assets.

| 22 |

Revenue Recognition and Accounts Receivable Reserves

We defer revenue recognition on products sold to distributors until our distributors sell the products to their customers, because our distributors generally have limited rights to return products to us for stock rotation, stock reduction, or replacement of defective product. The amount of deferred revenue net of related cost of revenue is classified as deferred income on shipments to distributors on our balance sheet. We use inventory reports received from our distributors at the end of each reporting period to determine the extent of inventory at the distributor, and thus, the amount of income to defer. Stock rotation and stock reduction from our distributors generally results in a balance sheet adjustment to our deferred income and does not impact our revenue or cost of revenue.

We generally recognize revenues on sales to customers other than distributors upon shipment provided that persuasive evidence of a sales arrangement exists, the price is fixed and determinable, title has transferred, collection of resulting receivables is reasonably assured, there are no customer acceptance requirements, and there are no remaining significant obligations. Most of our customers other than distributors do not have rights of return except under warranty.

We also earn revenue from an extended warranty service program offered on select products. Revenues from the extended warranty service program are recognized ratably over the life of the extended warranty contract. The amount of unrecognized warranty service revenue is classified as deferred service revenue and presented on our balance sheet in its short and long-term components. We also earn revenue from services performed in connection with consulting arrangements. For those contracts that include contract milestones or acceptance criteria we recognize revenue as such milestones are achieved or as such acceptance occurs. In some instances the acceptance criteria in the contract requires acceptance after all services are complete and all other elements have been delivered, in which case revenue recognition is deferred until those requirements are met.

We estimate the amount of uncollectible receivables at the end of each reporting period based on the aging of the receivable balance, historical trends, and communications with our customers. If actual bad debts are significantly different from our estimates our operating results will be affected.

Inventory Valuation

Our inventories primarily consist of component parts used to assemble our products after we receive orders from our customers. We purchase or have manufactured the component parts required by our engineering bill of materials. The timing and quantity of our purchases are based on order forecasts, the lead time requirements of our vendors, and on economic order quantities. At the end of each reporting period, we compare our inventory on hand to our forecasted requirements for the next nine-month period, and write off the cost of any inventory that is surplus, less any amounts that we believe we can recover from disposal of goods that we specifically believe will be saleable past a nine-month horizon. Our sales forecasts are based upon historical trends, communications from customers, and marketing data regarding market trends and dynamics. Surplus or obsolete inventory can also be created by changes to our engineering bill of materials. Charges for the amounts we record as surplus or obsolete inventory are included in cost of revenue.

Stock-Based Compensation