Attached files

| file | filename |

|---|---|

| EX-3.2 - EXHIBIT 3.2 - STRATUS PROPERTIES INC | q415exhibit32.htm |

| EX-21.1 - EXHIBIT 21.1 - STRATUS PROPERTIES INC | q415exhibit211.htm |

| EX-24.1 - EXHIBIT 24.1 - STRATUS PROPERTIES INC | q415exhibit241.htm |

| EX-10.9 - EXHIBIT 10.9 - STRATUS PROPERTIES INC | q415exhibit109.htm |

| EX-23.1 - EXHIBIT 23.1 - STRATUS PROPERTIES INC | q415exhibit231.htm |

| EX-10.10 - EXHIBIT 10.10 - STRATUS PROPERTIES INC | q415exhibit1010.htm |

| EX-10.11 - EXHIBIT 10.11 - STRATUS PROPERTIES INC | q415exhibit1011.htm |

| EX-31.2 - EXHIBIT 31.2 - STRATUS PROPERTIES INC | q415exhibit312.htm |

| EX-24.2 - EXHIBIT 24.2 - STRATUS PROPERTIES INC | q415exhibit242.htm |

| EX-32.2 - EXHIBIT 32.2 - STRATUS PROPERTIES INC | q415exhibit322.htm |

| EX-32.1 - EXHIBIT 32.1 - STRATUS PROPERTIES INC | q415exhibit321.htm |

| EX-31.1 - EXHIBIT 31.1 - STRATUS PROPERTIES INC | q415exhibit311.htm |

UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

Washington, D.C. 20549 | ||

FORM 10-K | ||

(Mark One) | ||

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the fiscal year ended December 31, 2015 | ||

OR | ||

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||

For the transition period from | to | |

Commission File Number: 000-19989 | ||

Stratus Properties Inc.

(Exact name of registrant as specified in its charter)

Delaware | 72-1211572 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

212 Lavaca St., Suite 300 | |

Austin, Texas | 78701 |

(Address of principal executive offices) | (Zip Code) |

(512) 478-5788 | |

(Registrant's telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.01 per share | The NASDAQ Stock Market | |

Preferred Stock Purchase Rights | The NASDAQ Stock Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. o Large accelerated filer þ Accelerated filer o Non-accelerated filer o Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes þ No

The aggregate market value of common stock held by non-affiliates of the registrant was approximately $109.9 million on February 29, 2016, and approximately $68.6 million on June 30, 2015.

Common stock issued and outstanding was 8,067,356 shares on February 29, 2016, and 8,061,106 shares on June 30, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our proxy statement for our 2016 annual meeting of stockholders are incorporated by reference into Part III (Items 10, 11, 12, 13 and 14) of this report.

STRATUS PROPERTIES INC. | |

TABLE OF CONTENTS | |

Page | |

PART I

Items 1. and 2. Business and Properties

Except as otherwise described herein or the context otherwise requires, all references to “Stratus,” “we,” “us” and “our” in this Form 10-K refer to Stratus Properties Inc. and all entities owned or controlled by Stratus Properties Inc. All of our periodic reports filed with or furnished to the United States (U.S.) Securities and Exchange Commission (SEC) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are available, free of charge, through our website, www.stratusproperties.com, or by submitting a written request via mail to Stratus Investor Relations, 212 Lavaca St., Suite 300, Austin, Texas, 78701. These reports and amendments are available through our website or by request as soon as reasonably practicable after we electronically file or furnish such material with or to the SEC.

All references to “Notes” herein refer to the Notes to Consolidated Financial Statements located in Part II, Item 8. of this Form 10-K.

Overview

We are a diversified real estate company engaged primarily in the acquisition, entitlement, development, management, operation and sale of commercial, hotel, entertainment, and multi- and single-family residential real estate properties, primarily located in the Austin, Texas area, but including projects in certain other select markets in Texas.

We generate revenues from sales of developed properties, from our hotel and entertainment operations and from rental income from our commercial properties. Developed property sales can include an individual tract of land that has been developed and permitted for residential use, a developed lot with a home already built on it or condominium units at the W Austin Hotel & Residences. We may sell properties under development, undeveloped properties or commercial properties, if opportunities arise that we believe will maximize overall asset values as part of our business plan. See Note 11 for further discussion of our operating segments.

Our principal executive offices are located in Austin, Texas, and our company was incorporated under the laws of the state of Delaware on March 11, 1992. Stratus Properties Inc. was formed to hold, operate and develop the domestic real estate and oil and gas properties of our former parent company. We sold all of our oil and gas properties during the 1990s and have since focused solely on our real estate properties. Our overall strategy has been to enhance the value of our properties by securing and maintaining development entitlements and developing and building real estate projects on these properties for sale or investment. We have also pursued opportunities for new projects that offer the possibility of acceptable returns and risks. See "Business Strategy and Related Risks" in Part II, Items 7. and 7A. for further discussion.

Operations

A description of our operating segments follows.

Hotel. The W Austin Hotel includes 251 luxury rooms and suites, a full service spa, gym, rooftop pool and 9,750 square feet of meeting space. We have an agreement with Starwood Hotels & Resorts Worldwide, Inc. (Starwood) for the management of hotel operations at our W Austin Hotel & Residences. Revenue per available room for the W Austin Hotel, which is calculated by dividing total room revenue by the average total rooms available during the year, was $279 for 2015, $291 for 2014, and $260 for 2013.

Revenue from our hotel segment accounted for 51 percent of our total revenue for 2015, 45 percent for 2014 and 31 percent for 2013.

Entertainment. The entertainment space at the W Austin Hotel & Residences is occupied by Austin City Limits Live at the Moody Theater (ACL Live) and includes a live music and entertainment venue and production studio with a maximum capacity of approximately 3,000 people. In addition to hosting concerts and private events, ACL Live is the home of Austin City Limits, a television program showcasing popular music legends. ACL Live hosted 210 events in 2015 with an estimated attendance of 245,000, 207 events in 2014 with an estimated attendance of

1

231,200 and 186 events in 2013 with an estimated attendance of 217,100. As of February 29, 2016, ACL Live has events booked through May 2017.

Our entertainment business also includes events hosted at other venues through our joint ventures (see "Properties - Unconsolidated Affiliates" below and Note 6).

Revenue from our entertainment segment accounted for 24 percent of our total revenue for 2015, 20 percent for 2014 and 12 percent for 2013.

Real Estate Operations. The number of developed lots/units, acreage under development and undeveloped acreage as of December 31, 2015, that comprise our real estate operations are presented in the following table.

A developed lot or unit is an individual tract of land or residential unit that has been developed and permitted for residential use. Acreage under development includes real estate for which infrastructure work over the entire property has been completed, is currently being completed or is able to be completed and for which necessary permits have been obtained. The undeveloped acreage shown in the table below is presented according to anticipated uses for multi- and single-family lots and commercial development based upon our understanding of the properties’ existing entitlements. However, because of the nature and cost of the approval and development process and uncertainty regarding market demand for a particular use, there is no assurance that the undeveloped acreage will ever be developed. Undeveloped acreage includes real estate that can be sold “as is” (i.e., no infrastructure or development work has begun on such property).

Acreage | ||||||||||||||||||||||||||

Under Development | Undeveloped | |||||||||||||||||||||||||

Developed Lots/Units | Multi- family | Commercial | Total | Single Family | Multi- family | Commercial | Total | Total Acreage | ||||||||||||||||||

Austin: | ||||||||||||||||||||||||||

Barton Creek | 68 | 18 | — | 18 | 512 | 308 | 398 | 1,218 | 1,236 | |||||||||||||||||

Circle C | 31 | — | — | — | — | 36 | 216 | 252 | 252 | |||||||||||||||||

Lantana | — | — | — | — | — | — | 56 | 56 | 56 | |||||||||||||||||

W Austin Residences | 2 | — | — | — | — | — | — | — | — | |||||||||||||||||

The Oaks at Lakeway | — | — | 87 | 87 | — | — | — | — | 87 | |||||||||||||||||

Magnolia | — | — | — | — | — | — | 124 | 124 | 124 | |||||||||||||||||

West Killeen Market | — | — | — | — | — | — | 9 | 9 | 9 | |||||||||||||||||

San Antonio: | ||||||||||||||||||||||||||

Camino Real | — | — | — | — | — | — | 2 | 2 | 2 | |||||||||||||||||

Total | 101 | 18 | 87 | 105 | 512 | 344 | 805 | 1,661 | 1,766 | |||||||||||||||||

Revenue from our real estate operations segment accounted for 18 percent of our total revenue for 2015, 28 percent for 2014 and 53 percent for 2013.

The following table summarizes the estimated development potential, including 236 multi-family lots and 52,349 square feet of commercial space currently under development, of our acreage as of December 31, 2015:

Single Family | Multi-family | Commercial | ||||||

(lots) | (units) | (gross square feet) | ||||||

Barton Creek | 156 | 2,050 | 1,604,081 | |||||

Lantana | — | — | 485,000 | |||||

Circle C | — | 296 | 692,857 | |||||

Magnolia | — | — | 351,000 | |||||

West Kileen Market | — | — | 44,000 | |||||

Flores Street | — | 6 | — | |||||

Total | 156 | 2,352 | 3,176,938 | |||||

Commercial Leasing. Our principal commercial leasing holdings at December 31, 2015, consisted of (1) 38,316 square feet of office space, including 9,000 square feet occupied by our corporate office, and 18,327 square feet of retail space at the W Austin Hotel & Residences and (2) a 22,366-square-foot retail complex and a 3,085-square-foot bank building representing the first phase of Barton Creek Village and (3) 231,436 square feet of planned commercial space for The Oaks at Lakeway, a HEB Grocery Company, L.P. (HEB) anchored retail project, of which

2

179,087 square feet was open at December 31, 2015. During 2015, we completed the sales of Parkside Village, a retail project consisting of 90,184 square feet, and 5700 Slaughter, a retail project consisting of two retail buildings totaling 21,248 square feet in the aggregate and a 4,450 square-foot bank building on an existing ground lease, both located in the Circle C community. See Note 12 for further discussion.

Revenue from our commercial leasing segment accounted for 7 percent of our total revenue for 2015 and 2014 and 4 percent for 2013.

For further information about our operating segments see “Results of Operations” in Part II, Items 7. and 7A. See Note 11 for a summary of our revenues, operating income and total assets by operating segment.

Properties

Our Austin-area properties include the following:

The W Austin Hotel & Residences

In December 2006, we acquired a two-acre city block in downtown Austin for $15.1 million to develop a multi-use project. In 2008, we entered into a joint venture with Canyon-Johnson Urban Fund II, L.P. (Canyon-Johnson) for the development of the W Austin Hotel & Residences. On September 28, 2015, we completed the purchase of Canyon-Johnson's approximate 58 percent interest in the joint venture that owned the W Austin Hotel & Residences. See Note 2 for further discussion.

The W Austin Hotel & Residences contains a 251-room luxury hotel, 159 residential condominium units, 38,316 square feet of leasable office space, including 9,000 square feet occupied by our corporate office, 18,327 square feet of retail space and entertainment space occupied by Austin City Limits Live at the Moody Theater (ACL Live) which includes a live music and entertainment venue and production studio. In December 2010, the hotel at the W Austin Hotel & Residences opened, and in January 2011, we began closing on sales of condominium units. We sold 32 condominium units during 2013 and 7 condominium units during 2014. There were no sales during 2015 and as of December 31, 2015, only two condominium units remained unsold. The two unsold units are being marketed.

Barton Creek

Calera. Calera is a residential subdivision with plat approval for 155 lots. The initial 16-acre phase of the Calera subdivision included 16 courtyard homes at Calera Court, the last of which were sold in 2012.

The second phase of Calera, Calera Drive, consisted of 53 single-family lots, many of which adjoin the Fazio Canyons Golf Course. During 2013, we sold the remaining six Calera Drive lots.

Construction of the final phase of Calera, known as Verano Drive, was completed in July 2008 and included 71 single-family lots. During 2014, we sold the remaining nine Verano Drive lots.

Mirador Estate. The Mirador subdivision consisted of 34 estate lots, with each lot averaging approximately 3.5 acres in size. During 2013, we sold the final Mirador lot.

Amarra Drive. Amarra Drive Phase I, which was the initial phase of the Amarra Drive subdivision, was completed in 2007 and included six lots with sizes ranging from approximately one to four acres. During 2013, we sold the remaining two Phase I lots.

In 2008, we developed Amarra Drive Phase II, which consisted of 35 lots on 51 acres. During 2014, we sold 16 Phase II lots. We did not sell any Phase II lots in 2015, and as of December 31, 2015, 14 Phase II lots remain unsold. During early 2016, we sold one Phase II lot.

In first-quarter 2015, we completed the development of Amarra Drive Phase III, which consists of 64 lots on 166 acres. During 2015, we sold ten Phase III lots and as of December 31, 2015, 54 Phase III lots remained unsold. As of February 29, 2016, one Phase III lot was under contract.

The Amarra Villas, the last phase of the Amarra Drive subdivision, is a 20-unit townhome development. We completed site work in late 2015 and construction began in early 2016.

3

The Santal (formerly Tecoma). The Santal multi-family project is a garden-style apartment complex consisting of 236 units. Construction commenced in January 2015 and pre-leasing began in November 2015. The first units were completed in January 2016, and the project is expected to be completed in June 2016.

Barton Creek Village. The first phase of Barton Creek Village consists of a 22,366-square-foot retail complex and a 3,085-square-foot bank building. As of December 31, 2015, occupancy was 100 percent for the retail complex and the bank building was leased through January 2023.

Circle C Community

Effective August 2002, the City of Austin (the City) granted final approval of a development agreement (the Circle C settlement), which firmly established all essential municipal development regulations applicable to our Circle C properties until 2032. The City also provided us $15.0 million of cash incentives in connection with the future development of our Circle C and other Austin-area properties. These incentives, which are in the form of credit bank capacity, can be used for City fees and for reimbursement of certain infrastructure costs. Annually, we may elect to sell up to $1.5 million of the incentives to other developers for their use in paying City fees related to their projects as long as the projects are within the desired development zone, as defined within the Circle C settlement. As of December 31, 2015, we have permanently used $11.7 million of the $15.0 million of cash incentives provided by the City, including cumulative sales of $5.1 million to other developers. We also have $1.4 million in credit bank capacity in use as temporary fiscal deposits. At December 31, 2015, available credit bank capacity was $1.9 million.

We are developing the Circle C community based on the entitlements secured in our Circle C settlement with the City. Our Circle C settlement, as amended in 2004, permits development of 1.16 million square feet of commercial space, 504 multi-family units and 830 single-family residential lots. Meridian is an 800-lot residential development at the Circle C community. Development of the final phase of Meridian, which consisted of 57 one-acre lots, was completed in first-quarter 2014. We sold 7 Meridian lots during 2014, 19 Meridian lots during 2015, and as of December 31, 2015, 31 Meridian lots remained unsold. As of February 29, 2016, ten Meridian lots were under contract.

On July 2, 2015, we completed the sales of our Austin-area Parkside Village and 5700 Slaughter commercial properties, both located in the Circle C community. The Parkside Village retail project, which we owned in a joint venture with LCHM Holdings, LLC, consisted of 90,184 leasable square feet and was sold for $32.5 million. The project included a 33,650-square-foot full-service movie theater and restaurant, a 13,890-square-foot medical clinic and five other retail buildings, including a 14,926-square-foot building, a 10,175-square-foot building, a 8,043-square-foot building, a 4,500-square-foot building and a stand-alone 5,000-square-foot building. The 5700 Slaughter retail project, which we wholly owned, consisted of 25,698 leasable square feet and was sold for $12.5 million. See Note 12 for further discussion.

During 2013, we sold entitlements for 20,000 square feet of office space in Circle C for $1.2 million. As of December 31, 2015, our Circle C community had remaining entitlements for 692,857 square feet of commercial space and 296 multi-family units.

Lantana

Lantana is a partially developed, mixed-use real-estate development project. During 2013, we sold a 16-acre tract with entitlements for approximately 70,000 square feet of office space for $2.1 million. As of December 31, 2015, we had remaining entitlements for approximately 485,000 square feet of office and retail use on 56 acres. Regional utility and road infrastructure is in place with capacity to serve Lantana at full build-out as permitted under our existing entitlements.

The Oaks at Lakeway

In 2013, we acquired 87 acres in the greater Austin area to develop The Oaks at Lakeway project, a HEB anchored retail project planned for 231,436 square feet of commercial space. As of December 31, 2015, leases for 78 percent of the space, including the HEB store lease, have been executed and leasing for the remaining space is under way. The HEB store opened in October 2015, and leases for 45,492 square feet of additional space commenced in November 2015. Construction of the remainder of the project is ongoing.

4

Our other Texas properties and development projects include:

Magnolia

In 2014, we acquired 124 acres in the greater Houston area to develop the Magnolia project, a HEB-anchored retail project planned for 351,000 square feet of commercial space. Planning and infrastructure work by the city of Magnolia and road expansion by the Texas Department of Transportation are in progress and construction is expected to be completed in 2017.

West Killeen Market

In 2015, we acquired approximately 21 acres in Killeen, Texas, to develop the West Killeen Market project, a HEB-anchored retail project planned for 44,000 square feet of commercial space and three pad sites adjacent to a 90,000 square-foot HEB grocery store. Construction is expected to begin in third-quarter 2016, and the HEB store is expected to open in March 2017.

Unconsolidated Affiliates

Crestview Station. In 2005, we formed a joint venture with Trammell Crow Central Texas Development, Inc. to acquire an approximate 74-acre tract at the intersection of Airport Boulevard and Lamar Boulevard in Austin, Texas, for $7.7 million. The property, known as Crestview Station (the Crestview Station Joint Venture) is a single-family, multi-family, retail and office development, located on the site of a commuter rail line. As of December 31, 2015, the Crestview Station Joint Venture has sold all of its properties except for one commercial site. We account for our 50 percent interest in the Crestview Station Joint Venture under the equity method.

Stump Fluff. In April 2013, we formed a joint venture, Stump Fluff LLC (Stump Fluff), with Transmission Entertainment, LLC (Transmission) to own, operate, manage and sell live music and entertainment promotion, booking, production, merchandising, venue services and other related products and services. As of December 31, 2015, Stratus' capital contributions to Stump Fluff totaled $1.5 million. Stratus will contribute additional capital to Stump Fluff as necessary to fund its working capital needs. Stratus and Transmission each have a 50 percent voting interest in Stump Fluff. After Stratus is repaid its original capital contributions and a preferred return (10 percent annually) on those contributions, Stratus will receive 33 percent of any distributions from Stump Fluff. We account for our investment in Stump Fluff under the equity method.

Guapo Enterprises. In May 2013, Stratus and Austin Pachanga Partners, LLC (Pachanga Partners) formed a joint venture, Guapo Enterprises LLC (Guapo) to own, operate, manage and sell the products and services of the Pachanga music festival business. As of December 31, 2015, Stratus' capital contributions to Guapo totaled $0.3 million. Stratus will contribute additional capital to Guapo as necessary to fund its working capital needs. Stratus and Pachanga Partners each have a 50 percent voting interest in Guapo. After Stratus is repaid its original capital contributions and a preferred return (10 percent annually) on those contributions, Stratus will receive 33 percent of any distributions from Guapo. We account for our investment in Guapo under the equity method.

See Note 6 for further discussion of our unconsolidated affiliates.

Competition

We operate in highly competitive industries, namely the real estate development, hotel, entertainment and commercial leasing industries. In the real estate development industry, we compete with numerous public and private developers of varying sizes, ranging from local to national in scope. As a result, we may be competing for investment opportunities, financing and potential buyers with developers that may possess greater financial, marketing or other resources than we have. Our prospective customers generally have a variety of choices of new and existing homes and homesites when considering a purchase. We attempt to differentiate our properties primarily on the basis of community design, quality, uniqueness, amenities, location and developer reputation.

In the hotel industry, competition is generally based on quality and consistency of rooms, restaurant and meeting facilities and services, attractiveness of location, price and other factors. Management believes that we compete favorably in these areas. Our W Austin Hotel competes with other hotels and resorts in our geographic market, including facilities owned locally and facilities owned by national and international chains.

5

In the entertainment industry, we compete with other venues in Austin, Texas, and venues in other markets for artists likely to perform in the Austin, Texas region. Consequently, touring artists have several alternatives to our venue in scheduling tours. Some of our competitors in venue management have a greater number of venues in certain markets and may have greater financial resources in those markets. We differentiate our entertainment businesses by providing a quality live music experience and promoting our entertainment space through KLRU's broadcast of Austin City Limits.

The commercial leasing industry is highly fragmented among individuals, partnerships and public and private entities, with no dominant single entity or person. Although we may compete against large sophisticated owners and operators, owners and operators of any size can provide effective competition for prospective tenants. We compete for tenants primarily on the basis of property location, rent charged, and the design and condition of improvements.

See Part I, Item 1A. "Risk Factors" for further discussion.

Discontinued Operations

In 2012, we sold 7500 Rialto, an office building in Lantana. In connection with the sale, we recognized a gain of $5.1 million and deferred a gain of $5.0 million because of a guaranty provided to the lender in connection with the buyer's assumption of the loan related to 7500 Rialto. The guaranty was released in January 2015, and we recognized the deferred gain totaling $5.0 million ($3.2 million to net income attributable to common stock) in first-quarter 2015.

Credit Facility and Other Financing Arrangements

Obtaining and maintaining adequate financing is a critical component of our business. For information about our credit facility and other financing arrangements, see “Capital Resources and Liquidity - Credit Facility and Other Financing Arrangements” in Part II, Items 7. and 7A. and Note 7.

Regulation and Environmental Matters

Our real estate investments are subject to extensive local, city, county and state rules and regulations regarding permitting, zoning, subdivision, utilities and water quality as well as federal rules and regulations regarding air and water quality and protection of endangered species and their habitats. Such regulation has delayed and may continue to delay development of our properties and may result in higher development and administrative costs. See Part I, Item 1A. "Risk Factors" for further discussion.

We have made, and will continue to make, expenditures for the protection of the environment with respect to our real estate development activities. Emphasis on environmental matters will result in additional costs in the future. Based on an analysis of our operations in relation to current and presently anticipated environmental requirements, we currently do not anticipate that these costs will have a material adverse effect on our future operations or financial condition.

Employees

At December 31, 2015, we had a total of 114 employees, 39 of which were full-time employees, located at our Austin, Texas headquarters. We believe we have a good relationship with our employees, none of whom are represented by a union. Since January 1, 1996, certain services necessary for our business and operations, including certain administrative, financial reporting and other services, have been performed by FM Services Company (FM Services) pursuant to a services agreement. FM Services is a wholly owned subsidiary of Freeport-McMoRan Inc. Either party may terminate the services agreement at any time upon 60 days notice or earlier upon mutual written agreement.

6

Item 1A. Risk Factors

This report contains "forward-looking statements" within the meaning of U.S. federal securities laws. Forward-looking statements are all statements other than statements of historical facts, such as statements regarding the implementation and potential results of our five-year plan, projections or expectations related to operational and financial performance or liquidity, reimbursements for infrastructure costs, financing and regulatory matters, development plans and sales of properties, commercial leasing activities, timeframes for development, construction and completion of our projects, capital expenditures, liquidity and capital resources and other plans and objectives of management for future operations and activities. We undertake no obligation to update any forward-looking statements. We caution readers that forward-looking statements are not guarantees of future performance and our actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause our actual results to differ materially from those anticipated in the forward-looking statements include the following:

Risks Relating to our Business and Industries

We need significant amounts of cash to service our debt. If we are unable to generate sufficient cash to service our debt, our liquidity, financial condition and results of operations could be negatively affected.

Our business strategy requires us to rely on cash flow from operations and our debt agreements as our primary sources of funding for our liquidity needs. As of December 31, 2015, our outstanding debt totaled $263.1 million and our cash and cash equivalents totaled $17.0 million. Our level of indebtedness could have significant consequences. For example, it could:

• | Increase our vulnerability to adverse changes in economic and industry conditions; |

• | Require us to dedicate a substantial portion of our cash flow from operations and proceeds from asset sales to pay or provide for our indebtedness, thus reducing the availability of cash flows to fund working capital, capital expenditures, acquisitions, investments and other general corporate purposes; |

• | Limit our flexibility to plan for, or react to, changes in our business and the market in which we operate; |

• | Place us at a competitive disadvantage to our competitors that have less debt; and |

• | Limit our ability to borrow money to fund our working capital, capital expenditures, debt service requirements and other financing needs. |

As of December 31, 2015, we had approximately $28.8 million of debt scheduled to become due during 2016. In January 2016, we refinanced the debt secured by the W Austin Hotel & Residences, which reduced our 2016 debt maturities to $13.7 million. Refer to Note 13 for further discussion. Historically, much of our debt has been renewed or refinanced in the ordinary course of business. Current economic conditions in our areas of operations could deteriorate, which may impact our ability to refinance our debt and obtain renewals or replacement of credit enhancement devices on favorable terms or at all. As a result, in the future we may not be able to obtain sufficient external sources of liquidity on attractive terms, if at all, or otherwise renew, extend or refinance a significant portion of our outstanding debt scheduled to become due in the near future. In addition, there can be no assurance that we will maintain cash reserves and generate sufficient cash flow from operations in an amount sufficient to enable us to service our debt or to fund our other liquidity needs. Any of these occurrences may have a material adverse effect on our liquidity, financial condition and results of operations. For example, our inability to extend, repay or refinance our debt when it becomes due, including upon a default or acceleration event, could force us to sell properties on unfavorable terms or ultimately result in foreclosure on properties pledged as collateral, which could result in a loss of our investment and harm our reputation.

The terms of the agreements governing our indebtedness include restrictive covenants and require that certain financial ratios be maintained. For example, the minimum stockholders' equity covenant contained in several of our debt agreements requires us to maintain total stockholders’ equity of no less than $110.0 million. At December 31, 2015, our total stockholders’ equity was $136.6 million and, as a result, we were in compliance with this covenant. Failure to comply with any of these covenants could result in a default that may, if not cured, accelerate the payment under our debt obligations which would likely have a material adverse effect on our liquidity, financial condition and results of operations. Our ability to comply with our covenants will depend upon our future economic

7

performance. These covenants may adversely affect our ability to finance our future operations or capital needs or to engage in other business activities that may be desirable or advantageous to us.

In order to maintain compliance with the covenants in our debt agreements and carry out our business plan, we may need to raise additional capital through equity transactions or obtain waivers or modifications of covenants from our lenders. Such additional funding may not be available on acceptable terms, if at all, when needed. We also may need to incur additional indebtedness in the future in the ordinary course of business to fund our development projects and our operations. There can be no assurance that such additional financing would be available when needed or, if available, offered on acceptable terms. If new debt is added to current debt levels, the risks described above could intensify.

We are periodically rated by nationally recognized credit rating agencies. Any downgrades in our credit rating could impact our ability to borrow by increasing borrowing costs as well as limiting our access to capital. In addition, a downgrade could require us to post cash collateral and/or letters of credit, which would adversely affect our cash flow and liquidity.

Additionally, a significant amount of our outstanding debt bears interest at variable rates. See “Disclosures About Market Risks” in Part II, Items 7. and 7A. for more information.

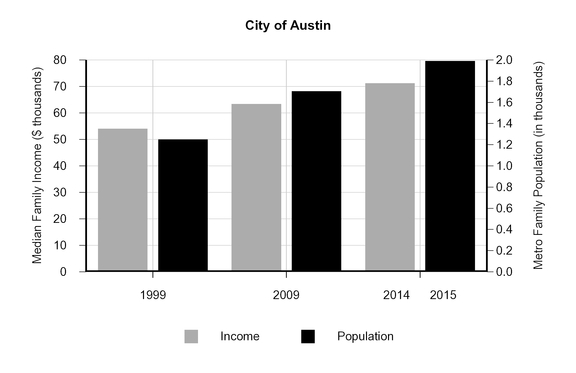

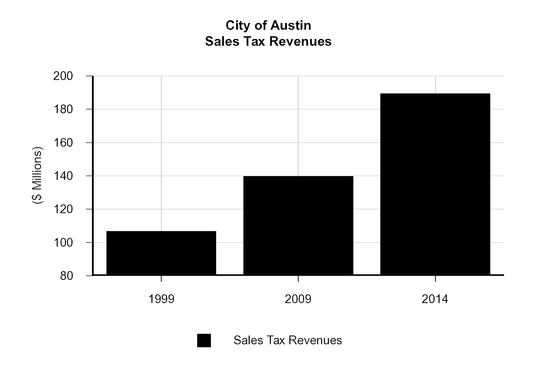

We are vulnerable to concentration risks because our operations are almost exclusive to the Austin, Texas market.

Our real estate operations are primarily, and our hotel and entertainment venue operations are entirely, located in Austin, Texas. Because of our geographic concentration and limited number of projects, our operations are more vulnerable to local economic downturns and adverse project-specific risks than those of larger, more diversified companies. The performance of the Austin economy greatly affects our sales and consequently the underlying values of our properties. Our geographic concentration may create increased vulnerability during regional economic downturns, which can significantly affect our financial condition and results of operations. See "Overview - Real Estate Market Conditions" in Part II, Items 7. and 7A. for more information.

The success of our business is significantly related to general economic conditions and, accordingly, our business could be harmed by any slowdown or deterioration in the economy.

Periods of economic weakness or recession; significantly rising interest rates; declining employment levels; declining demand for real estate; declining real estate values; conditions which negatively shape public perception of travel, including travel-related accidents, the financial condition of the airline, automotive and other transportation-related industries; or the public perception that any of these events or conditions may occur or be present, may negatively affect our business. These economic conditions can result in a general decline in acquisition, disposition and leasing activity, demand for hotel rooms and related lodging services, a general decline in the value of real estate and in rents, which in turn reduces revenue derived from property sales and leases and hotel operations as well as revenues associated with development activities. These conditions also can lead to a decline in property sales prices as well as a decline in funds invested in existing commercial real estate and related assets and properties planned for development. In addition, during periods of economic slowdown and recession, many consumers have historically reduced their discretionary spending, and our entertainment businesses depend on discretionary consumer and corporate spending. A reduction in consumer spending historically is accompanied by a decrease in attendance at live entertainment, sporting and leisure events, which may result in reductions in ticket sales, sponsorship opportunities and our ability to generate revenue with our entertainment businesses.

During an economic downturn, investment capital is usually constrained and it may take longer for us to dispose of real estate investments. As a result, the value of our real estate investments may be reduced and we could realize losses or diminished profitability. If economic and market conditions decline, our business performance and profitability could deteriorate. If this were to occur, we could fail to comply with certain financial covenants in our debt agreements, which would force us to seek amendments with our lenders. No assurance can be given that we would be able to obtain any necessary waivers or amendments on satisfactory terms, if at all.

8

Our business and the market price of our common stock could be negatively affected as a result of the actions of activist shareholders.

Carl E. Berg has delivered notice to us that he plans to nominate two director candidates for election to our board of directors at our 2016 annual meeting of stockholders. In addition, Mr. Berg has submitted a stockholder proposal to be included in our proxy statement requesting that our board of directors immediately engage a nationally-recognized investment banking firm to explore a prompt sale, merger or other business combination. Our business, operating results or financial condition could be harmed by this potential proxy contest because, among other things:

• | Responding to the proxy contest is costly and time-consuming, is a significant distraction for our board of directors, management and employees, and diverts the attention of our board of directors and senior management from the pursuit of our business strategy, which could adversely affect our results of operations and financial condition; |

• | Perceived uncertainties as to our future direction, our ability to execute on our strategy, or changes to the composition of our board of directors or senior management team, including our chief executive officer, may lead to the perception of a change in the direction of our business, instability or lack of continuity which may be exploited by our competitors, and may result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners; |

• | The expenses for legal and advisory fees and administrative and associated costs incurred in connection with responding to proxy contests and any related litigation may be substantial; and |

• | We may choose to initiate, or may become subject to, litigation as a result of the proxy contest or matters arising from the proxy contest, which would serve as a further distraction to our board of directors, management and employees and would require us to incur significant additional costs. |

In addition, the market price of our common stock could be subject to significant fluctuation or otherwise be adversely affected by the uncertainties described above or the outcome of the proxy contest.

Changes in weather conditions or natural disasters could adversely affect our business, financial condition and results of operations.

Our performance may be adversely affected by weather conditions. For our real estate operations, adverse weather may delay development or damage property, resulting in substantial repair or replacement costs to the extent not covered by insurance, a reduction in property values, or a loss of revenue, each of which could have a material adverse effect on our business, financial condition and results of operations. Our competitors may be affected differently by such changes in weather conditions or natural disasters depending on the location of their supplies or operations. Adverse weather conditions also may affect our live music events. Due to weather conditions, we may be required to reschedule an event to another available day, which would increase our costs for the event and could negatively affect the attendance at the event, as well as concession and merchandise sales, which could adversely affect our financial condition and results of operations.

Our insurance coverage on our properties may be inadequate to cover any losses we may incur.

We maintain insurance on our properties, including property, liability, fire and extended coverage. However, there are certain types of losses, generally of a catastrophic nature, such as hurricanes and floods or acts of war or terrorism that may be uninsurable or not economical to insure. We use our discretion when determining amounts, coverage limits and deductibles for insurance. These terms are determined based on retaining an acceptable level of risk at a reasonable cost. This may result in insurance coverage that in the event of a substantial loss would not be sufficient to pay the full current market value or current replacement cost of our lost investment. Inflation, changes in building codes and ordinances, environmental considerations and other factors also may make it unfeasible to use insurance proceeds to replace a building or other facility after it has been damaged or destroyed. Under such circumstances, the insurance proceeds we receive may be inadequate to restore our economic position in a property. In addition, we may become liable for injuries and accidents occurring during the construction process that are underinsured.

9

Risks Relating to Real Estate Operations

The real estate business is highly competitive and many of our competitors are larger and financially stronger than we are.

The real estate business is highly competitive. We compete with a large number of companies and individuals that have significantly greater financial, sales, marketing and other resources than we have. Our competitors include local developers who are committed primarily to particular markets and also national developers who acquire properties throughout the U.S. A downturn in the real estate industry could significantly increase competition among developers. Increased competition could cause us to increase our selling incentives and/or reduce our prices. An oversupply of real estate properties available for sale or lease, as well as the potential significant discounting of prices by some of our competitors, may adversely affect our results of operations.

Our results of operations, cash flows and financial condition are greatly affected by the performance of the real estate industry.

Revenue from our real estate operations segment accounted for 18 percent of our total revenue for the fiscal year ended December 31, 2015. The U.S. real estate industry is highly cyclical and is affected by changes in global, national and local economic conditions and events such as general employment and income levels, availability of financing, interest rates, consumer confidence and overbuilding of or decrease in demand for residential and commercial real estate. Our real estate activities are subject to numerous factors beyond our control, including local real estate market conditions (both where our properties are located and in areas where our potential customers reside), substantial existing and potential competition, general national, regional and local economic conditions, fluctuations in interest rates and mortgage availability, changes in demographic conditions and changes in government regulations or requirements. Any of the foregoing factors could result in a reduction or cancellation of sales and/or lower gross margins for sales. Lower than expected sales could have a material adverse effect on the level of our profits and the timing and amounts of our cash flows.

Real estate investments often cannot easily be converted into cash and market values may be adversely affected by these economic circumstances, market fundamentals, and competitive and demographic conditions. Because of the effect these factors have on real estate values, it is difficult to predict the level of future sales or sales prices that will be realized for individual assets.

Our operations are subject to an intensive regulatory approval process and opposition from environmental groups, either or both of which could cause delays and increase the costs of our development efforts or preclude such developments entirely.

Before we can develop a property, we must obtain a variety of approvals from local and state governments with respect to such matters as zoning and other land use issues, and subdivision, site planning and environmental issues under applicable regulations. Some of these approvals are discretionary. Because government agencies and special interest groups have in the past expressed concerns about our development plans in or near Austin, our ability to develop these properties and realize future income from our properties could be delayed, reduced, prevented or made more expensive.

Several special interest groups have in the past opposed our plans in the Austin area and have taken various actions to partially or completely restrict development in some areas, including areas where some of our most valuable properties are located. We have actively opposed these actions. However, because of the regulatory environment that has existed in the Austin area and the opposition of these special interest groups, there can be no assurance that an unfavorable ruling would not have a significant long-term adverse effect on the overall value of our property holdings.

Our operations are subject to environmental regulation, which can change at any time and could increase our costs.

Real estate development is subject to state and federal environmental regulations and to possible interruption or termination because of environmental considerations, including, without limitation, air and water quality and protection of endangered species and their habitats.

10

Certain of the Barton Creek and Lantana properties include nesting territories for the Golden-cheeked Warbler, a federally listed endangered species. In 1995, we received a permit from the U.S. Wildlife Service pursuant to the Endangered Species Act, which to date has allowed the development of the Barton Creek and Lantana properties free of restrictions under the Endangered Species Act related to the maintenance of habitat for the Golden-cheeked Warbler.

Additionally, in April 1997, the U.S. Department of Interior listed the Barton Springs Salamander as an endangered species after a federal court overturned a March 1997 decision by the Department of Interior not to list the Barton Springs Salamander based on a conservation agreement between the State of Texas and federal agencies. The listing of the Barton Springs Salamander has not affected, nor do we anticipate it will affect, our Barton Creek and Lantana properties for several reasons, including the results of technical studies and the U.S. Fish and Wildlife Service 10(a) permit obtained by us in 1995. The development permitted by the 2002 Circle C settlement with the City has been reviewed and approved by the U.S. Fish and Wildlife Service and, as a result, we also do not anticipate that the 1997 listing of the Barton Springs Salamander will affect our Circle C properties.

In January 2013, the U.S. Department of the Interior announced that it had conducted an economic assessment of the potential designation of critical habitat for four species of Central Texas salamanders. Although this potential designation of habitat has not affected, nor do we anticipate that it will affect, our Barton Creek, Lantana or Circle C properties for several reasons, including prior studies and approvals, and our existing U.S. Fish and Wildlife Service 10(a) permit obtained in 1995, future endangered species listings or habitat designations could impact development of our properties.

We are making, and will continue to make, expenditures with respect to our real estate development for the protection of the environment. Emphasis on environmental matters will result in additional costs in the future. New environmental regulations or changes in existing regulations or their enforcement may be enacted and such new regulations or changes may require significant expenditures by us. The recent trend toward stricter standards in environmental legislation and regulations is likely to continue and could have a material adverse effect on our operating costs.

Risks Relating to Hotel Operations

We are subject to the business, financial and operating risks common to the hotel industry, any of which could reduce our revenues.

Revenue from our hotel segment accounted for 51 percent of our total revenue for the fiscal year ended December 31, 2015. Business, financial and operating risks common to the hotel industry include:

• | Changes in desirability of geographic regions and geographic concentration of our operations and customers; |

• | Decreases in the demand for hotel rooms and related lodging services, including a reduction in business travel as a result of alternatives to in-person meetings (including virtual meetings hosted online or over private teleconferencing networks) or due to general economic conditions; |

• | Decreased corporate or governmental travel-related budgets and spending, as well as cancellations, deferrals or renegotiations of group business such as industry conventions; |

• | Negative public perception of corporate travel-related activities; |

• | The effect of internet intermediaries and other new industry entrants on pricing and our increasing reliance on technology; |

• | The costs and administrative burdens associated with complying with applicable laws and regulations in the U.S., including health, safety and environmental laws, rules and regulations and other governmental and regulatory action; |

• | Changes in operating costs including, but not limited to, energy, water, labor costs (including the effect of labor shortages and unionization), food costs, workers’ compensation and health-care related costs, insurance and unanticipated costs such as acts of nature and their consequences; and |

11

• | Cyclical over-building in the hotel industry. |

External perception of the W Austin Hotel could negatively affect our results of operations.

Starwood manages hotel operations at the W Austin Hotel. Our ability to attract and retain guests depends, in part, upon the external perceptions of Starwood and the quality of the W Austin Hotel and its services and we have to spend money periodically to keep the properties well maintained, modernized and refurbished. The reputation of the W Austin Hotel may be negatively affected if Starwood fails to act responsibly or comply with regulatory requirements in a number of areas, such as safety and security, sustainability, responsible tourism, environmental management, human rights and support for the local communities where Starwood manages and/or owns properties. The considerable increase in the use of social media over recent years has greatly expanded the potential scope and scale, and increased the rapidity of the dissemination of negative publicity that could be generated by any adverse incident or failure on the part of hotel operators. An adverse incident involving associates or guests and any media coverage resulting therefrom may cause a loss of consumer confidence in the Starwood brand which could negatively affect our results of operations. Additionally, the Starwood brand could be adversely affected by the late 2015 announcement of Marriott International, Inc.'s plans to acquire Starwood.

Our revenues, profits or market share could be harmed if we are unable to compete effectively in the hotel industry in Austin.

The hotel industry in Austin is highly competitive. The W Austin Hotel competes for customers with other hotel and resort properties in Austin, ranging from national and international hotel brands to independent, local and regional hotel operators. We compete based on a number of factors, primarily including quality and consistency of rooms, restaurant and meeting facilities and services, attractiveness of location and price. Some of our competitors may have substantially greater marketing and financial resources than we do, and if we are unable to successfully compete in these areas, our operating results could be adversely affected.

Historically, the Austin market has had a limited number of high-end hotel accommodations. However, hotel capacity is being expanded by other hotel operators in Austin, including several properties in close proximity to the W Austin Hotel & Residences. As new rooms come on-line, increased competition could lead to an excess supply of hotel rooms in the Austin market, thereby causing Starwood to increase promotional incentives for hotel guests and/or reduce rates. Increased competition in the Austin market from new hotels or hotels that have recently undergone substantial renovation could have an adverse effect on occupancy, average daily rate and room revenue per available room.

Additionally, some of our hotel rooms are booked through third-party internet travel intermediaries as well as lesser-known online travel service providers. In addition, travelers can book stays on websites that facilitate the short-term rental of homes and apartments from owners, thereby providing an alternative to hotel rooms. Increased internet bookings could have an adverse effect on occupancy, average daily rate and room revenue per available room.

Risks Relating to Entertainment Businesses

We face intense competition in the live music industry, and we may not be able to maintain or increase our current revenue, which could adversely affect our business, financial condition and results of operations.

Revenue from our entertainment businesses accounted for 24 percent of our total revenue for the fiscal year ended December 31, 2015. Our entertainment businesses compete in a highly competitive industry, and we may not be able to maintain or increase our current revenue as a result of such competition. The live music industry competes with other forms of entertainment for consumers’ discretionary spending and within this industry we compete with other venues to book artists. Our competitors compete with us for key employees who have relationships with popular music artists and that have a history of being able to book such artists for concerts and tours. These competitors may engage in more extensive development efforts, undertake more far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to existing and potential artists. Our competitors may develop services, advertising options or music venues that are equal or superior to those we provide or that achieve greater market acceptance and brand recognition than we achieve. It is possible that new competitors may emerge and rapidly acquire significant market share.

12

Other variables related to our entertainment businesses that could adversely affect our financial performance by, among other things, leading to decreases in overall revenue, the number of sponsors, event attendance, ticket prices and fees or profit margins include:

• | An increased level of competition for advertising dollars, which may lead to lower sponsorships as we attempt to retain advertisers or which may cause us to lose advertisers to our competitors offering better programs that we are unable or unwilling to match; |

• | Unfavorable fluctuations in operating costs, which we may be unwilling or unable to pass through to our customers via ticket prices; |

• | Competitors’ offerings that may include more favorable terms than we do in order to obtain events for the venues they operate; |

• | Technological changes and innovations that we are unable to adopt or are late in adopting that offer more attractive entertainment alternatives than we or other live entertainment providers currently offer, which may lead to a reduction in attendance at live events, a loss of ticket sales or lower ticket fees; |

• | Other entertainment options available to our audiences that we do not offer; |

• | General economic conditions which could cause our consumers to reduce discretionary spending; |

• | Unfavorable changes in labor conditions which may require us to spend more to retain and attract key employees; |

• | Interruptions in our ticketing systems and infrastructures and data loss or other breaches of our network security; and |

• | Changes in consumer preferences. |

Additionally, our entertainment operations are seasonal. The results of operations from our entertainment segment vary from quarter to quarter and year over year, and the financial performance in certain quarters or years may not be indicative of, or comparable to, our financial performance in subsequent quarters or years.

Personal injuries and accidents may occur in connection with our live music events, which could subject us to personal injury or other claims and increase our expenses, as well as reduce attendance at our live music events, causing a decrease in our revenue.

There are inherent risks involved with producing live music events. As a result, personal injuries and accidents have, and may, occur from time to time, which could subject us to claims and liabilities for personal injuries. Incidents in connection with our live music events at the Moody Theater or festival sites that we rent through our joint ventures could also result in claims or reduce attendance at our events, which could cause a decrease in our revenue or reduce our operating income. We maintain insurance policies that provide coverage for personal injuries sustained by persons at our venues or events or accidents in the ordinary course of business, and there can be no assurance that such insurance will be adequate at all times and in all circumstances.

Risks Relating to Commercial Leasing

Unfavorable changes in market and economic conditions could negatively affect occupancy or rental rates, which could negatively affect our financial condition and results of operations.

Another decline in the real estate market and economic conditions could significantly affect rental rates. Occupancy and rental rates in our market, in turn, could significantly affect our profitability and our ability to satisfy our financial obligations. The risks that could affect conditions in our market include the following:

• | Local conditions, such as oversupply of office space, a decline in the demand for office space or increased competition from other available office buildings; |

• | The inability or unwillingness of tenants to pay their current rent or rent increases; and |

13

• | Declines in market rental rates. |

Additionally, tenants at our retail properties face continual competition in attracting customers from various on-line and other competitors. Our competitors and those of our tenants could have a material adverse effect on our ability to lease space in our retail properties and on the rents we can charge or the concessions we can grant. Further, as new technologies emerge, the relationship among customers, retailers, and shopping centers are evolving on a rapid basis. If we are unable to adapt to such new technologies and relationships on a timely basis, our financial performance will be adversely impacted.

We cannot predict with certainty whether any of these conditions will occur or whether, and to what extent, they will have an adverse effect on our operations.

Risks Relating to Ownership of Shares of Our Common Stock

Our common stock is thinly traded; therefore, our stock price may fluctuate more than the stock market as a whole.

As a result of the thin trading market for shares of our common stock, our stock price may fluctuate significantly more than the stock market as a whole or the stock prices of similar companies. Without a larger public float, shares of our common stock will be less liquid than the shares of common stock of companies with broader public ownership, and as a result, the trading prices for shares of our common stock may be more volatile. Among other things, trading of a relatively small volume of shares of our common stock may have a greater effect on the trading price than would be the case if our public float were larger.

Item 1B. Unresolved Staff Comments

None.

Item 3. Legal Proceedings

We are from time to time involved in legal proceedings that arise in the ordinary course of our business. We do not believe, based on currently available information, that the outcome of any legal proceeding will have a material adverse effect on our financial condition or results of operations. We maintain liability insurance to cover some, but not all, potential liabilities normally incident to the ordinary course of our business as well as other insurance coverage customary in our business, with such coverage limits as management deems prudent.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of the Registrant

Certain information as of February 29, 2016, regarding our executive officers is set forth in the following table and accompanying text. Each of our executive officers serves at the discretion of our board of directors.

Name | Age | Position or Office | ||

William H. Armstrong III | 51 | Chairman of the Board, President and Chief Executive Officer | ||

Erin D. Pickens | 54 | Senior Vice President and Chief Financial Officer | ||

Mr. Armstrong has been employed by us since our inception in 1992. Mr. Armstrong has served as President since August 1996, Chief Executive Officer since May 1998 and Chairman of the Board since August 1998.

Ms. Pickens has served as our Senior Vice President since May 2009 and as our Chief Financial Officer since June 2009. Ms. Pickens previously served as Executive Vice President and Chief Financial Officer of Tarragon Corporation from November 1998 until April 2009, and as Vice President and Chief Accounting Officer from September 1996 until November 1998 and Accounting Manager from June 1995 until August 1996 for Tarragon and its predecessors. Tarragon Corporation filed for voluntary reorganization under Chapter 11 of the U.S. Bankruptcy Code on January 12, 2009, and emerged from bankruptcy on July 6, 2010.

14

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Performance Graph

The following graph compares the change in the cumulative total stockholder return on our common stock from December 31, 2010, through December 31, 2015, with the cumulative total return of (a) the Standard & Poor's (S&P) 500 Stock Index, (b) the Dow Jones U.S. Real Estate Index and (c) the below custom peer group of real estate related companies:

Alexander & Baldwin, Inc. (ALEX)

Consolidated-Tomoka Land Co. (CTO)

Forestar Group Inc. (FOR)

The Howard Hughes Corporation (HHC)

Maui Land & Pineapple Company, Inc. (MLP)

The St. Joe Company (JOE)

Tejon Ranch Co. (TRC)

This comparison assumes $100 invested on December 31, 2010, in (a) our common stock, (b) the S&P 500 Stock Index, (c) the Dow Jones U.S. Real Estate Index and (d) the custom peer group.

The total returns shown assume that dividends are reinvested. The stock price performance shown below is not necessarily indicative of future price performance.

Comparison of Cumulative Total Return

Stratus Properties Inc., S&P 500 Stock Index,

Dow Jones U.S. Real Estate Index and Custom Peer Group

December 31, | |||||||||||||||||||||||

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||||

Stratus Properties Inc. | $ | 100 | $ | 86 | $ | 94 | $ | 188 | $ | 152 | $ | 224 | |||||||||||

S&P 500 Stock Index | 100 | 102 | 118 | 157 | 178 | 181 | |||||||||||||||||

Dow Jones U.S. Real Estate Index | 100 | 106 | 126 | 128 | 163 | 167 | |||||||||||||||||

Custom Peer Group | 100 | 77 | 114 | 149 | 149 | 131 | |||||||||||||||||

15

Common Stock

Our common stock trades on The Nasdaq Stock Market (NASDAQ) under the symbol "STRS". The following table sets forth, for the periods indicated, the range of high and low sales prices of our common stock, as reported by NASDAQ.

2015 | 2014 | ||||||||||||||

High | Low | High | Low | ||||||||||||

First Quarter | $ | 13.95 | $ | 11.01 | $ | 17.93 | $ | 16.35 | |||||||

Second Quarter | 15.11 | 12.56 | 17.55 | 15.53 | |||||||||||

Third Quarter | 16.50 | 13.60 | 16.50 | 13.75 | |||||||||||

Fourth Quarter | 20.98 | 14.91 | 14.74 | 13.25 | |||||||||||

As of February 29, 2016, there were 400 holders of record of our common stock. We have not in the past paid, and do not anticipate in the future paying, cash dividends on shares of our common stock. The declaration of dividends is at the discretion of our board of directors; however, our ability to pay dividends is restricted by the terms of our credit facility. See Part III, Item 12. for information on our equity compensation plans.

Unregistered Sales of Equity Securities

None.

Issuer Purchases of Equity Securities

The following table sets forth information with respect to shares of our common stock that we repurchased under the board-approved open market share purchase program during the three-month period ended December 31, 2015.

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programsa | Maximum Number of Shares That May Yet Be Purchased Under the Plans or Programsa | |||||||||

October 1 to 31, 2015 | — | $ | — | — | 991,695 | ||||||||

November 1 to 30, 2015 | — | — | — | 991,695 | |||||||||

December 1 to 31, 2015 | — | — | — | 991,695 | |||||||||

Total | — | $ | — | — | 991,695 | ||||||||

a. | In November 2013, the board of directors approved an increase in our open-market share purchase program, initially authorized in 2001, for up to 1.7 million shares of our common stock. The program does not have an expiration date. |

Stratus' loan agreements with Comerica Bank and Diversified Real Asset Income Fund require lender approval of any common stock repurchases.

16

Item 6. Selected Financial Data

The selected consolidated financial data shown below is derived from our audited consolidated financial statements. These historical results are not necessarily indicative of results that you can expect for any future period. You should read this data in conjunction with Items 7. and 7A. "Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk" and Item 8. "Financial Statements and Supplementary Data".

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

(In Thousands, Except Per Share Amounts) | ||||||||||||||||||||

Years Ended December 31: | ||||||||||||||||||||

Revenues | $ | 80,871 | $ | 94,111 | $ | 127,710 | $ | 115,737 | $ | 137,036 | ||||||||||

Operating income | 25,732 | a,b | 10,364 | c,d | 14,151 | b,d | 2,781 | 1,681 | ||||||||||||

Equity in unconsolidated affiliates' (loss)income | (1,299 | ) | 1,112 | (76 | ) | (29 | ) | (337 | ) | |||||||||||

Income (loss) from continuing operations, net of taxes | 14,377 | a,b | 18,157 | c,d,e | 5,894 | b,d | (9,118 | ) | (5,424 | ) | ||||||||||

Income from discontinued operations, net of taxes | 3,218 | f | — | — | 4,805 | f | 191 | f | ||||||||||||

Net income (loss) | 17,595 | a,b | 18,157 | c,d,e | 5,894 | b,d | (4,313 | ) | (5,233 | ) | ||||||||||

Net income (loss) attributable to common stock | 12,177 | a,b | 13,403 | c,d,e | 2,585 | b,d | (1,586 | ) | (10,388 | ) | ||||||||||

Basic net income (loss) per share: | ||||||||||||||||||||

Continuing operations | $ | 1.11 | $ | 1.67 | $ | 0.32 | $ | (0.80 | ) | $ | (1.41 | ) | ||||||||

Discontinued operations | 0.40 | — | — | 0.60 | 0.02 | |||||||||||||||

Basic net income (loss) per share | $ | 1.51 | $ | 1.67 | $ | 0.32 | $ | (0.20 | ) | $ | (1.39 | ) | ||||||||

Diluted net income (loss) per share: | ||||||||||||||||||||

Continuing operations | $ | 1.11 | a,b | $ | 1.66 | c,d,e | $ | 0.32 | b,d | $ | (0.80 | ) | $ | (1.41 | ) | |||||

Discontinued operations | 0.40 | f | — | — | 0.60 | f | 0.02 | f | ||||||||||||

Diluted net income (loss) per share | $ | 1.51 | a,b | $ | 1.66 | c,d,e | $ | 0.32 | b,d | $ | (0.20 | ) | $ | (1.39 | ) | |||||

Average shares outstanding: | ||||||||||||||||||||

Basic | 8,058 | 8,037 | 8,077 | 7,966 | 7,482 | |||||||||||||||

Diluted | 8,091 | 8,078 | 8,111 | 7,966 | 7,482 | |||||||||||||||

At December 31: | ||||||||||||||||||||

Real estate held for sale | $ | 25,944 | $ | 12,245 | $ | 18,133 | $ | 60,244 | $ | 74,003 | ||||||||||

Real estate held for investment, net | 186,626 | 178,065 | 182,530 | 189,331 | 185,221 | |||||||||||||||

Real estate under development | 139,171 | 123,921 | 76,891 | 31,596 | 54,956 | |||||||||||||||

Land available for development | 23,397 | 21,368 | 21,404 | 49,569 | 60,936 | |||||||||||||||

Total assets | 432,627 | 402,687 | 346,943 | 379,128 | 421,605 | |||||||||||||||

Debt | 263,114 | 196,477 | 151,332 | 137,035 | 158,451 | |||||||||||||||

Stockholders' equity | 136,599 | 136,443 | 123,621 | 121,687 | 118,189 | |||||||||||||||

Noncontrolling interests in subsidiaries | 75 | 38,643 | 45,695 | 87,208 | 99,493 | |||||||||||||||

a. | Includes a total gain of $20.7 million ($10.8 million to net income attributable to common stock or $1.34 per share) associated with the sales of Parkside Village and 5700 Slaughter (see Note 12 for further discussion). |

b. | Includes a pre-tax gain of $0.6 million ($0.08 per share) in 2015 associated with the sale of a tract of undeveloped land and $2.1 million ($0.26 per share) in 2013 associated with undeveloped land sales. |

c. | Includes a gain of $1.5 million ($0.19 per share) associated with a litigation settlement. Also includes lease termination charges of $0.3 million ($0.04 per share) recorded by the commercial leasing segment. |

d. | Includes income of $0.6 million ($0.07 per share) in 2014 and $1.8 million ($0.22 per share) in 2013, related to insurance settlements and $0.4 million ($0.05 per share) in 2014 and $1.1 million ($0.13 per share) in 2013, for the recovery of building repair costs. |

e. | Includes a credit to provision for income taxes of $12.1 million, $1.50 per share, for the reversal of valuation allowances on deferred tax assets. |

f. | Includes the results of 7500 Rialto Boulevard, which was sold in February 2012, including a gain on the sale of $5.1 million ($0.65 per share) in 2012 and a deferred gain of $5.0 million ($3.2 million attributable to common stock or $0.40 per share) in 2015. |

17

Items 7. and 7A. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk

OVERVIEW

In Management’s Discussion and Analysis of Financial Condition and Results of Operations, “we,” “us,” “our” and "Stratus" refer to Stratus Properties Inc. and all entities owned or controlled by Stratus Properties Inc. You should read the following discussion in conjunction with our consolidated financial statements and the related discussion of “Business and Properties” and “Risk Factors” included elsewhere in this Form 10-K. The results of operations reported and summarized below are not necessarily indicative of future operating results, and future results could differ materially from those anticipated in forward-looking statements (refer to "Cautionary Statement" for further discussion). All subsequent references to “Notes” refer to Notes to Consolidated Financial Statements located in Part II, Item 8. “Financial Statements and Supplementary Data.”

We are a diversified real estate company engaged primarily in the acquisition, entitlement, development, management, operation and sale of commercial, hotel, entertainment, and multi- and single-family residential real estate properties, primarily located in the Austin area, but including projects in certain other select markets in Texas. We generate revenues from sales of developed properties, from our hotel and entertainment operations and from rental income from our commercial properties. Developed property sales can include an individual tract of land that has been developed and permitted for residential use, a developed lot with a home already built on it or condominium units at the W Austin Hotel & Residences. We may sell properties under development, undeveloped properties or commercial properties, if opportunities arise that we believe will maximize overall asset values as part of our business plan. See "Business Strategy and Related Risks" below. See Note 11 for further discussion of our operating segments and "Business Strategy and Related Risks" for a discussion of our business strategy.

The principal holdings in our Real Estate Operations segment are in southwest Austin, Texas. The number of developed lots/units, acreage under development and undeveloped acreage as of December 31, 2015, that comprise our real estate operations are presented in the following table.

Acreage | ||||||||||||||||||||||||||

Under Development | Undeveloped | |||||||||||||||||||||||||

Developed Lots/Units | Multi-Family | Commercial | Total | Single Family | Multi- family | Commercial | Total | Total Acreage | ||||||||||||||||||

Austin: | ||||||||||||||||||||||||||

Barton Creek | 68 | 18 | — | 18 | 512 | 308 | 398 | 1,218 | 1,236 | |||||||||||||||||

Circle C | 31 | — | — | — | — | 36 | 216 | 252 | 252 | |||||||||||||||||

Lantana | — | — | — | — | — | — | 56 | 56 | 56 | |||||||||||||||||

W Austin Residences | 2 | — | — | — | — | — | — | — | — | |||||||||||||||||

The Oaks at Lakeway | — | — | 87 | 87 | — | — | — | — | 87 | |||||||||||||||||

Magnolia | — | — | — | — | — | — | 124 | 124 | 124 | |||||||||||||||||

West Killeen Market | — | — | — | — | — | — | 9 | 9 | 9 | |||||||||||||||||

San Antonio: | ||||||||||||||||||||||||||

Camino Real | — | — | — | — | — | — | 2 | 2 | 2 | |||||||||||||||||

Total | 101 | 18 | 87 | 105 | 512 | 344 | 805 | 1,661 | 1,766 | |||||||||||||||||

Our residential holdings at December 31, 2015, included developed lots at Barton Creek and the Circle C community, and condominium units at the W Austin Hotel & Residences. See "Development Activities - Residential" for further discussion. Our commercial leasing holdings at December 31, 2015, consisted of the office and retail space at the W Austin Hotel & Residences, the first phase of Barton Creek Village and The Oaks at Lakeway. See "Development Activities - Commercial" for further discussion.

The W Austin Hotel & Residences is located on a two-acre city block in downtown Austin and contains a 251-room luxury hotel, 159 residential condominium units (of which the remaining two unsold units were being marketed as of December 31, 2015), and office, retail and entertainment space. The hotel is managed by Starwood Hotels & Resorts Worldwide, Inc. The entertainment space, occupied by Austin City Limits Live at the Moody Theater (ACL Live), includes a live music and entertainment venue and production studio.

18

In 2015, we purchased the noncontrolling interest in the CJUF II Stratus Block 21, LLC joint venture (the Block 21 Joint Venture) which owned the W Austin Hotel & Residences and we now own 100 percent of the entity (see "Business Strategy and Related Risks" below).