Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UCP, Inc. | ucpq42015results.htm |

| EX-99.1 - EXHIBIT 99.1 - UCP, Inc. | a12312015ucppressrelease.htm |

4Q15 Earnings Presentation March 14 , 2016

U Forward-Looking Statements We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, beliefs, expectations or intentions, financial condition, liquidity, results of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “project,” “goal,” “potential,” “predict,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward- looking statements. Statements regarding the following subjects, among others, may be forward-looking: economic changes, either nationally or in the markets in which we operate, including declines in employment, volatility of mortgage interest rates and inflation; downturns in the homebuilding industry, either nationally or in the markets in which we operate; continued volatility and uncertainty in the credit markets and broader financial markets; our business operations; changes in our business and investment strategy; availability of land to acquire and our ability to acquire such land on favorable terms or at all; availability, terms and deployment of capital; disruptions in the availability of mortgage financing or increases in the number of foreclosures in our markets; shortages of or increased prices for labor, land or raw materials used in housing construction; delays or restrictions in land development or home construction or reduced consumer demand resulting from adverse weather and geological conditions or other events outside our control; the cost and availability of insurance and surety bonds; changes in, or the failure or inability to comply with, governmental laws and regulations; the timing of receipt of regulatory approvals and the opening of communities; the degree and nature of our competition; our leverage and debt service obligations; our future operating expenses, which may increase disproportionately to our revenue; our ability to achieve operational efficiencies with future revenue growth; our relationship, and actual and potential conflicts of interest, with PICO Holdings Inc.; and availability of qualified personnel and our ability to retain our key personnel. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Forward-looking statements are not predictions of future events. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

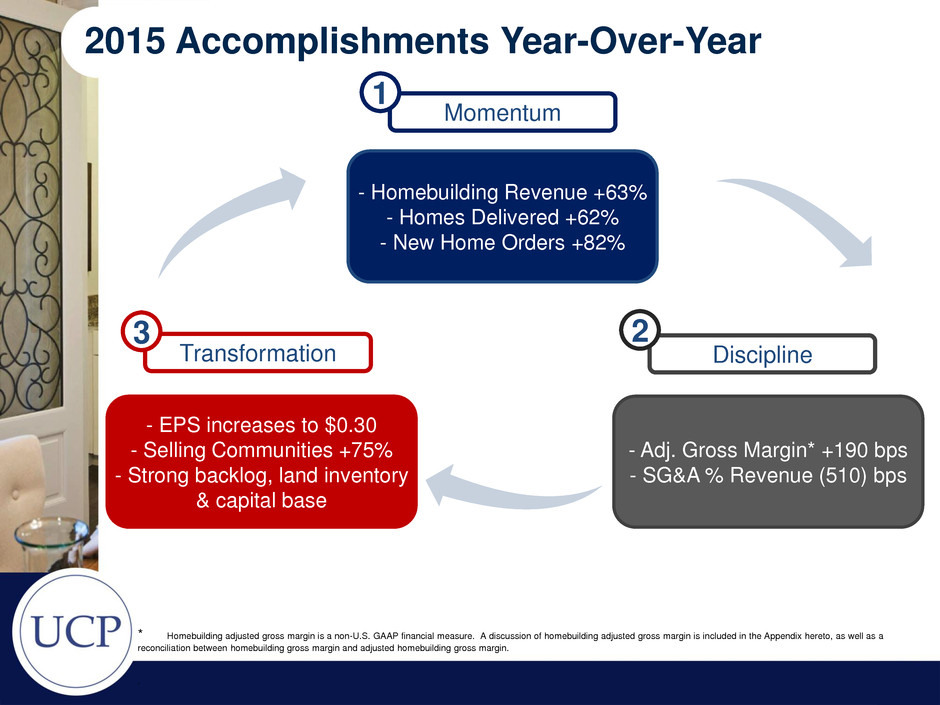

U 2015 Accomplishments Year-Over-Year - Adj. Gross Margin* +190 bps - SG&A % Revenue (510) bps - EPS increases to $0.30 - Selling Communities +75% - Strong backlog, land inventory & capital base Momentum 1 Discipline 2 Transformation 3 - Homebuilding Revenue +63% - Homes Delivered +62% - New Home Orders +82% * Homebuilding adjusted gross margin is a non-U.S. GAAP financial measure. A discussion of homebuilding adjusted gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin. .

U Central Valley 20% SF Bay Area 25% Pacific Northwest 13% Southern CA 9% Southeast [PERCENT AGE] Q4 2015 Homebuilding Revenue Dynamics Homebuilding Revenue Homes Delivered Average Selling Price Mix of Homes Delivered by Region Homes Delivered $360k $370k 4 $343 $399 ASP ($000) 4Q 2014 4Q 2015 $45 $89 Homebuilding Revenue ($M) 4Q 2014 4Q 2015131 223 Homes Delivered 4Q 2014 4Q 2015

U 17.3% 19.0% 22.5% 20.9% 4Q FY 2014 2015 Gross Margin Expansion 5 Highlights Adj. Homebuilding Gross Margin* Adj. Consolidated Gross Margin* Larger, more efficient platform 4Q15 adjusted homebuilding gross margin up 390 basis points year-over-year Higher sequential gross margins in the 2H15 vs 1H15 Focus on increasing mix of traditional dirt sales vs spec and cost saving initiatives paying off 17.3% 18.4% 21.2% 20.3% 4Q FY 2014 2015 * Homebuilding adjusted gross margin is a non-U.S. GAAP financial measure. A discussion of homebuilding adjusted gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin. .

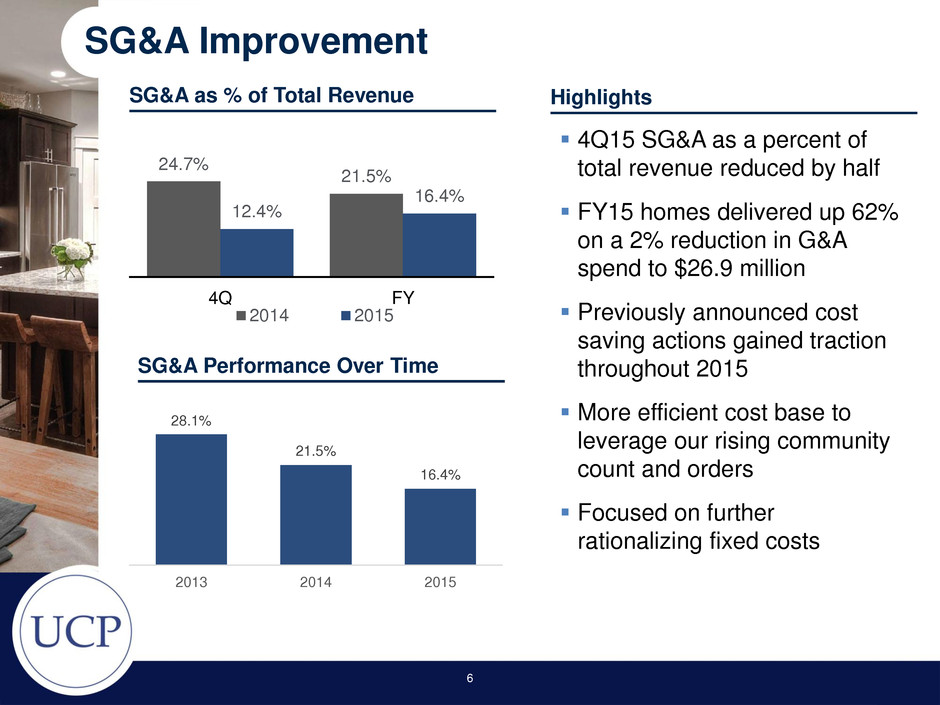

U SG&A Improvement 6 SG&A as % of Total Revenue SG&A Performance Over Time 24.7% 21.5% 12.4% 16.4% 4Q FY 2014 2015 28.1% 21.5% 16.4% 2013 2014 2015 Highlights 4Q15 SG&A as a percent of total revenue reduced by half FY15 homes delivered up 62% on a 2% reduction in G&A spend to $26.9 million Previously announced cost saving actions gained traction throughout 2015 More efficient cost base to leverage our rising community count and orders Focused on further rationalizing fixed costs

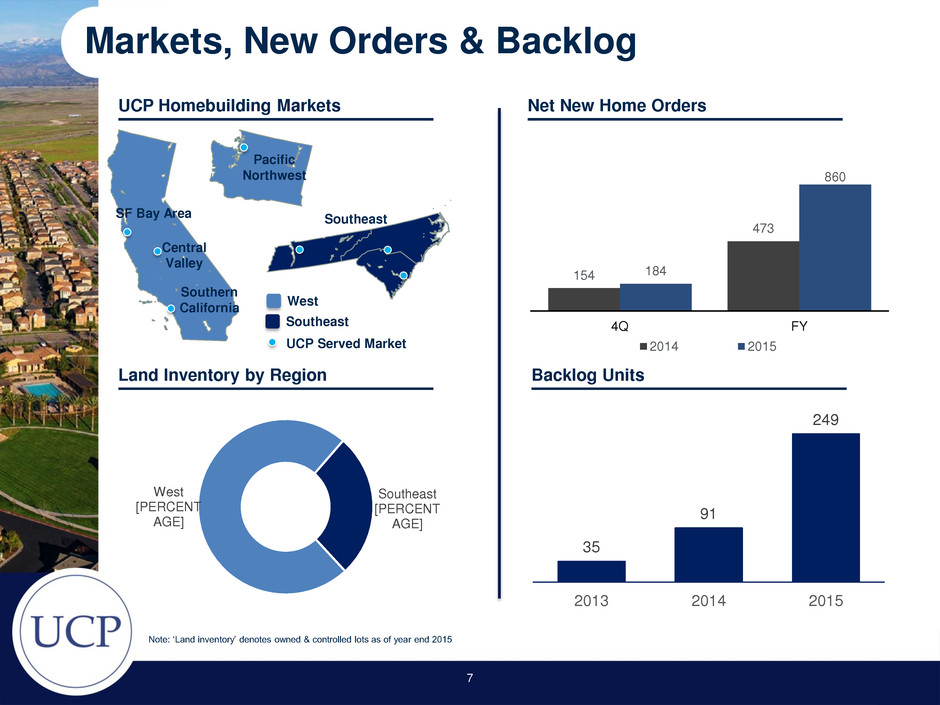

U 35 91 249 2013 2014 2015 Markets, New Orders & Backlog UCP Homebuilding Markets Net New Home Orders Land Inventory by Region $360k $370k 7 Backlog Units Southeast Southern California Central Valley SF Bay Area Pacific Northwest 154 473 184 860 4Q FY 2014 2015 UCP Served Market Note: ‘Land inventory’ denotes owned & controlled lots as of year end 2015 Southeast [PERCENT AGE] West [PERCENT AGE] Southeast West

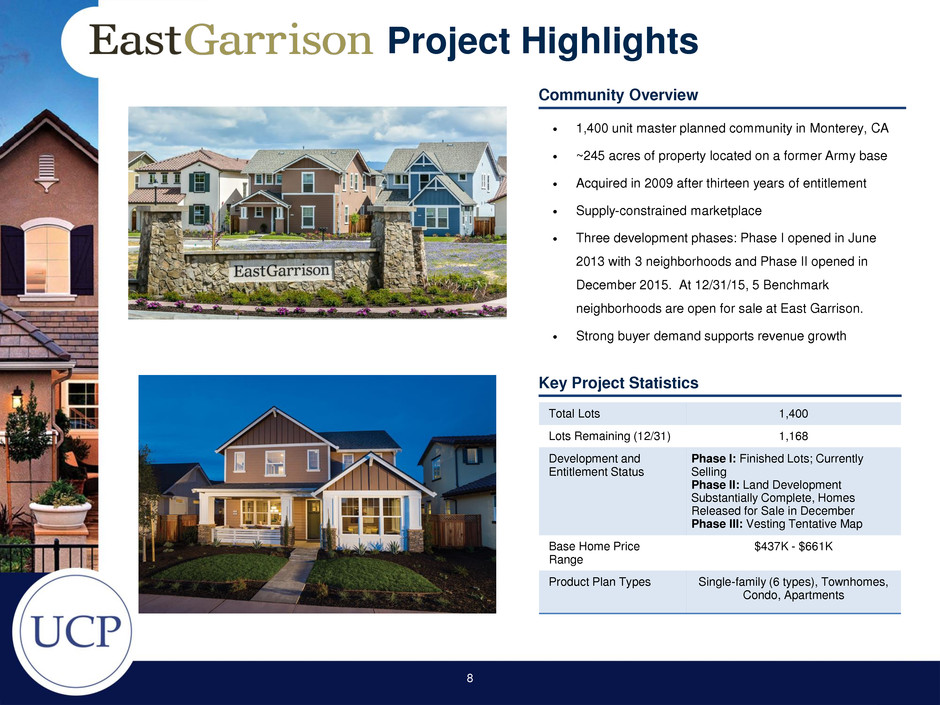

U Project Highlights Community Overview Key Project Statistics 1,400 unit master planned community in Monterey, CA ~245 acres of property located on a former Army base Acquired in 2009 after thirteen years of entitlement Supply-constrained marketplace Three development phases: Phase I opened in June 2013 with 3 neighborhoods and Phase II opened in December 2015. At 12/31/15, 5 Benchmark neighborhoods are open for sale at East Garrison. Strong buyer demand supports revenue growth Total Lots 1,400 Lots Remaining (12/31) 1,168 Development and Entitlement Status Phase I: Finished Lots; Currently Selling Phase II: Land Development Substantially Complete, Homes Released for Sale in December Phase III: Vesting Tentative Map Base Home Price Range $437K - $661K Product Plan Types Single-family (6 types), Townhomes, Condo, Apartments 8

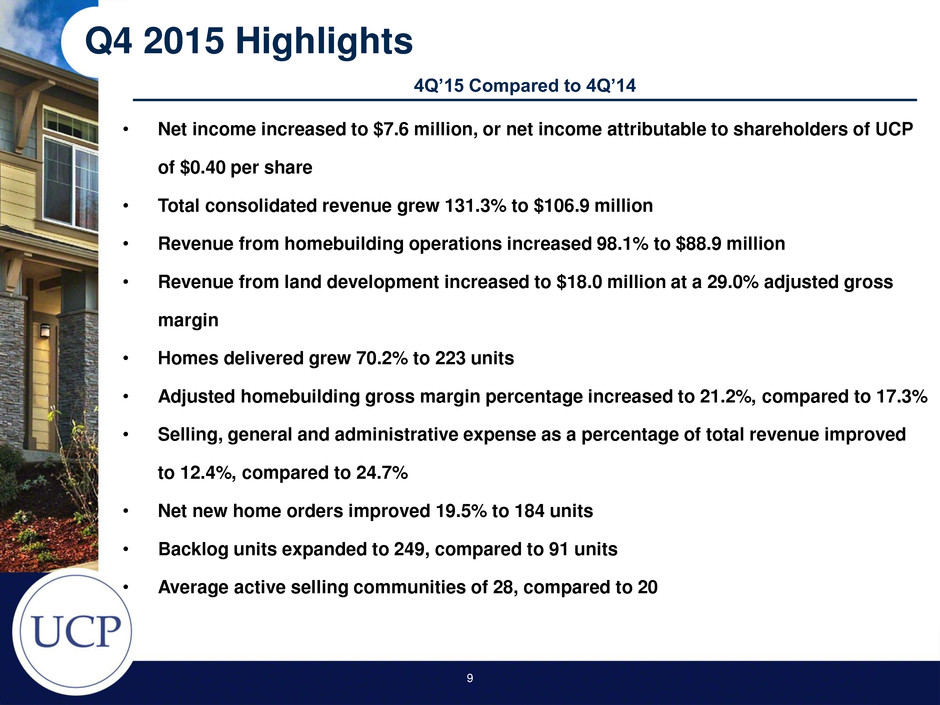

Q4 2015 Highlights • Net income increased to $7.6 million, or net income attributable to shareholders of UCP of $0.40 per share • Total consolidated revenue grew 131.3% to $106.9 million • Revenue from homebuilding operations increased 98.1% to $88.9 million • Revenue from land development increased to $18.0 million at a 29.0% adjusted gross margin • Homes delivered grew 70.2% to 223 units • Adjusted homebuilding gross margin percentage increased to 21.2%, compared to 17.3% • Selling, general and administrative expense as a percentage of total revenue improved to 12.4%, compared to 24.7% • Net new home orders improved 19.5% to 184 units • Backlog units expanded to 249, compared to 91 units • Average active selling communities of 28, compared to 20 4Q’15 Compared to 4Q’14 9

Net income increased to $5.8 million, or net income attributable to shareholders of UCP of $0.30 per share Total consolidated revenue grew 45.8% to $278.8 million Revenue from homebuilding operations grew 62.5% to $252.6 million Homes delivered improved 62.3% to 701 units New home orders improved 81.8% to 860 units Adjusted homebuilding gross margin percentage increased to 20.3%, compared to 18.4% General and administrative expense reduced by 1.9%, or approximately $500,000, to $26.9 million FY 2015 Highlights FY 2015 Compared to FY 2014 10

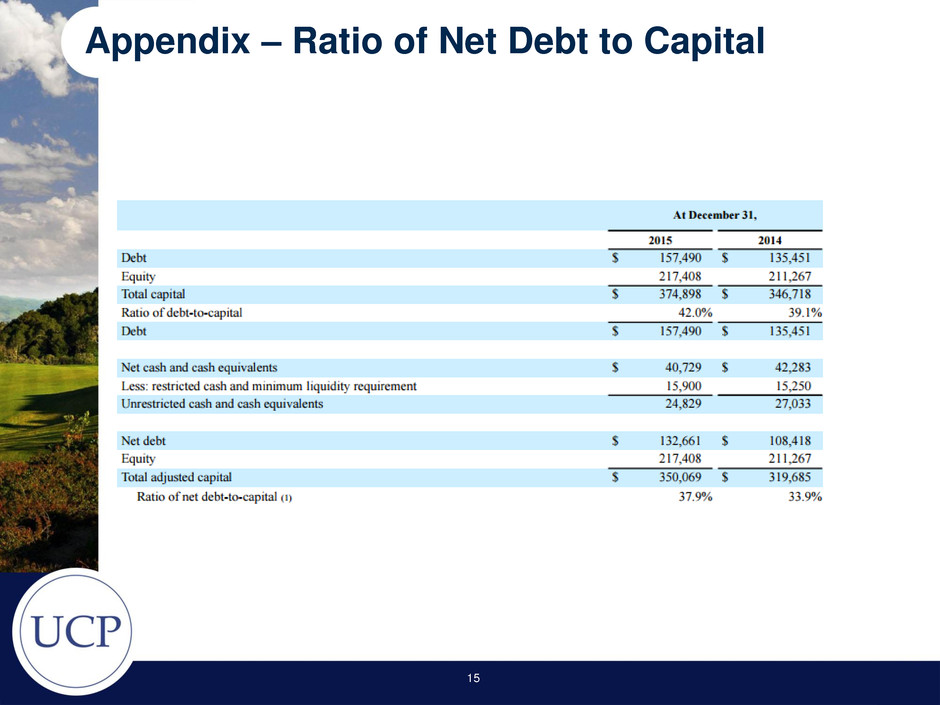

U ($ millions) 12/31/15 12/31/14 Debt $157.5 $135.5 Equity 217.4 211.3 Total Capital 374.9 346.7 Cash Available for Debt Repayment $24.8 $27.0 Net Debt 132.7 108.4 Net Capital 350.1 319.7 Ratio of Net Debt-to-Capital 37.9% 33.9% Net Debt-to- Capital Ratio Balance Sheet Strength 11 Solid capital position and leverage metrics to execute growth objectives * The ratio of net-debt-to-capital is a non-U.S. GAAP financial measure. A discussion of net-debt-to-capital is included in the Appendix hereto, as well as a reconciliation between net-debt-to- capital and debt-to-capital. .

U $92.7 $191.2 $278.8 2013 2014 2015 Homebuilding Land Other Strong Track Record of Growth 2015 represented another high growth year with all around positive performance Growing Business with Disciplined Focus $360k $370k 12 Strong growth track record 2015 deliveries of 701 homes, up from 196 homes in 2013 Invested significant time, capital and energy to build a platform for sustained success Better positioned to generate additional value growing base Scalable corporate infrastructure largely built out to support growth +46% YoY Revenue Increase

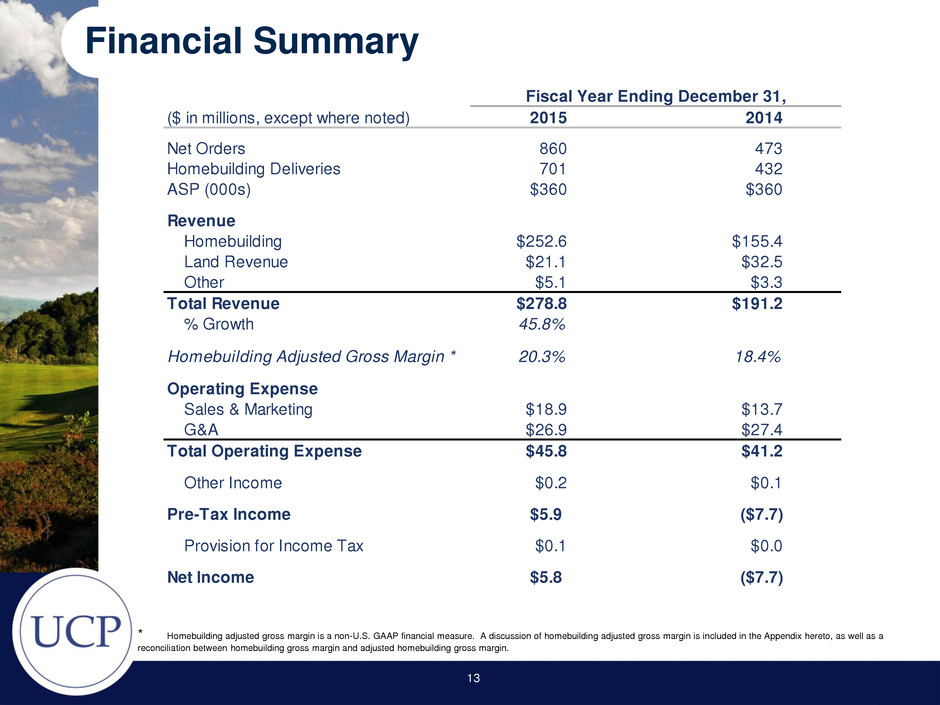

U Financial Summary 13 * Homebuilding adjusted gross margin is a non-U.S. GAAP financial measure. A discussion of homebuilding adjusted gross margin is included in the Appendix hereto, as well as a reconciliation between homebuilding gross margin and adjusted homebuilding gross margin. . Fiscal Year Ending December 31, ($ in millions, except where noted) 2015 2014 Net Orders 860 473 Homebuilding Deliveries 701 432 ASP (000s) $360 $360 Revenue Homebuilding $252.6 $155.4 Land Revenue $21.1 $32.5 Other $5.1 $3.3 Total Revenue $278.8 $191.2 % Growth 45.8% Homebuilding Adjusted Gross Margin * 20.3% 18.4% Operating Expense Sales & Marketing $18.9 $13.7 G&A $26.9 $27.4 Total Operating Expense $45.8 $41.2 Other Income $0.2 $0.1 Pre-Tax Income $5.9 ($7.7) Provision for Income Tax $0.1 $0.0 Net Income $5.8 ($7.7)

U Appendix – Adj. Gross Margin Reconciliation 14 (1) Homebuilding adjusted gross margin percentage is a non-U.S. GAAP financial measure. Adjusted gross margin is defined as gross margin plus capitalized interest, impairment and abandonment charges. We use adjusted gross margin information as a supplemental measure when evaluating our operating performance. We believe this information is meaningful, because it isolates the impact that leverage and non-cash impairment and abandonment charges have on gross margin. However, because adjusted gross margin information excludes interest expense and impairment and abandonment charges, all of which have real economic effects and could materially impact our results, the utility of adjusted gross margin information as a measure of our operating performance is limited. In addition, other companies may not calculate gross margin information in the same manner that we do. Accordingly, adjusted gross margin information should be considered only as a supplement to gross margin information as a measure of our performance. The table above provides a reconciliation of adjusted gross margin numbers to the most comparable U.S. GAAP financial measure. .

U Appendix – Ratio of Net Debt to Capital 15