Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - UCP, Inc. | ex322_03x31x17-pirrello.htm |

| EX-32.1 - EXHIBIT 32.1 - UCP, Inc. | ex321_03x31x17-bogue.htm |

| EX-31.2 - EXHIBIT 31.2 - UCP, Inc. | ex312_03x31x17-pirrello.htm |

| EX-31.1 - EXHIBIT 31.1 - UCP, Inc. | ex311_03x31x17-bogue.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 10-Q

SQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017

OR

£TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-36001

UCP, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation) | 90-0978085 (IRS Employer Identification No.) |

99 Almaden Blvd., Suite 400, San Jose, CA 95113

(Address of principal executive offices, including Zip Code)

(408) 207-9499

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes S No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | £ | Accelerated filer | S | ||

Non-accelerated filer | £ | Smaller reporting company | £ | ||

(Do not check if a smaller reporting company) | Emerging growth company | S | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes S No £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No S

On May 3, 2017, the registrant had 7,958,314 shares of Class A common stock, par value $0.01 per share outstanding and 100 shares of Class B common stock, par value $0.01 per share outstanding.

UCP, INC.

FORM 10-Q

TABLE OF CONTENTS

Page No. | ||

PART I - FINANCIAL INFORMATION | ||

PART II - OTHER INFORMATION | ||

2

UCP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except shares and per share data)

March 31, 2017 | December 31, 2016 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 34,270 | $ | 40,931 | |||

Restricted cash | 1,547 | 1,547 | |||||

Total cash, cash equivalents and restricted cash | 35,817 | 42,478 | |||||

Real estate inventories | 389,379 | 373,207 | |||||

Fixed assets, net | 855 | 883 | |||||

Intangible assets, net | 82 | 101 | |||||

Receivables | 3,677 | 5,628 | |||||

Deferred tax assets, net | 5,227 | 5,482 | |||||

Other assets | 7,081 | 6,327 | |||||

Total assets | $ | 442,118 | $ | 434,106 | |||

Liabilities and equity | |||||||

Accounts payable | $ | 16,533 | $ | 18,435 | |||

Accrued liabilities | 30,998 | 25,342 | |||||

Customer deposits | 4,526 | 2,449 | |||||

Notes payable, net | 87,001 | 86,658 | |||||

Senior notes, net | 74,550 | 74,336 | |||||

Total liabilities | 213,608 | 207,220 | |||||

Commitments and contingencies (Note 11) | |||||||

Equity | |||||||

Preferred stock, par value $0.01 per share, 50,000,000 authorized, no shares issued and outstanding as of March 31, 2017; no shares issued and outstanding as of December 31, 2016 | — | — | |||||

Class A common stock, $0.01 par value; 500,000,000 authorized, 8,104,660 issued and 7,958,314 outstanding as of March 31, 2017; 8,042,834 issued and 7,896,488 outstanding as of December 31, 2016 | 81 | 80 | |||||

Class B common stock, $0.01 par value; 1,000,000 authorized, 100 issued and outstanding as of March 31, 2017; 100 issued and outstanding as of December 31, 2016 | — | — | |||||

Additional paid-in capital | 97,532 | 97,123 | |||||

Treasury stock at cost; 146,346 shares as of March 31, 2017; 146,346 as of December 31, 2016 | (1,250 | ) | (1,250 | ) | |||

Accumulated earnings | 5,821 | 4,675 | |||||

Total UCP, Inc. stockholders’ equity | 102,184 | 100,628 | |||||

Noncontrolling interest | 126,326 | 126,258 | |||||

Total equity | 228,510 | 226,886 | |||||

Total liabilities and equity | $ | 442,118 | $ | 434,106 | |||

See accompanying notes to condensed consolidated financial statements.

3

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME OR LOSS

(Unaudited)

(In thousands, except shares and per share data)

Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

REVENUE: | |||||||

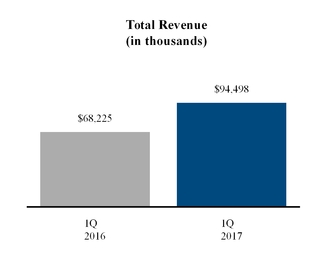

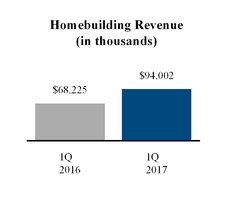

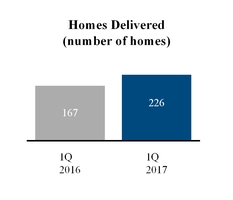

Homebuilding | $ | 94,002 | $ | 68,225 | |||

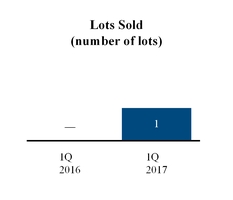

Land development | 496 | — | |||||

Total revenue: | 94,498 | 68,225 | |||||

COSTS AND EXPENSES: | |||||||

Cost of sales - homebuilding | 76,653 | 56,206 | |||||

Cost of sales - land development | 475 | 461 | |||||

Impairment on real estate | 102 | — | |||||

Total cost of sales | 77,230 | 56,667 | |||||

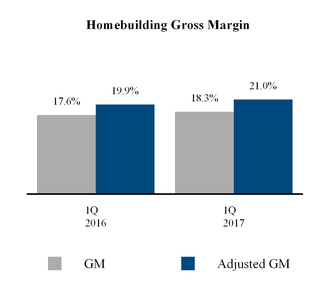

Gross margin - homebuilding | 17,349 | 12,019 | |||||

Gross margin - land development | 21 | (461 | ) | ||||

Gross margin - impairment on real estate | (102 | ) | — | ||||

Total gross margin | 17,268 | 11,558 | |||||

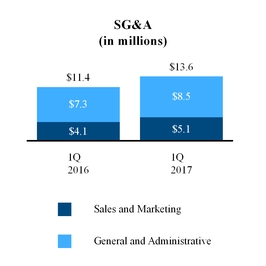

Sales and marketing | 5,149 | 4,076 | |||||

General and administrative | 8,502 | 7,275 | |||||

Total expenses | 13,651 | 11,351 | |||||

Income from operations | 3,617 | 207 | |||||

Other income, net | 460 | 28 | |||||

Net income before income taxes | $ | 4,077 | $ | 235 | |||

Provision for income taxes | (621 | ) | (5 | ) | |||

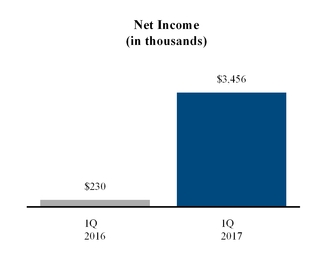

Net income | $ | 3,456 | $ | 230 | |||

Net income attributable to noncontrolling interest | $ | 2,310 | $ | 134 | |||

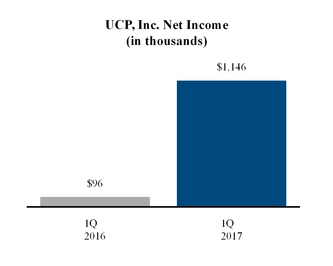

Net income attributable to UCP, Inc. | 1,146 | 96 | |||||

Other comprehensive income, net of tax | — | — | |||||

Comprehensive income | $ | 3,456 | $ | 230 | |||

Comprehensive income attributable to noncontrolling interest | $ | 2,310 | $ | 134 | |||

Comprehensive income attributable to UCP, Inc. | $ | 1,146 | $ | 96 | |||

Earnings per share of Class A common stock: | |||||||

Basic | $ | 0.14 | $ | 0.01 | |||

Diluted | $ | 0.14 | $ | 0.01 | |||

Weighted average shares of Class A common stock: | |||||||

Basic | 7,950,723 | 8,021,747 | |||||

Diluted | 8,102,962 | 8,022,601 | |||||

See accompanying notes to condensed consolidated financial statements.

4

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands, except number of shares)

UCP, Inc. Shareholders’ Equity | |||||||||||||||||||||||||||||||||

Shares of common stock outstanding | Common stock | Additional paid-in capital | Treasury stock | Accumulated deficit | Noncontrolling interest | Total equity | |||||||||||||||||||||||||||

Class A | Class B | Class A | Class B | ||||||||||||||||||||||||||||||

Balance as of December 31, 2015 | 8,014,434 | 100 | $ | 80 | $ | — | $ | 94,683 | $ | — | $ | (4,563 | ) | $ | 127,208 | $ | 217,408 | ||||||||||||||||

Class A - Issuance of common stock for RSUs, net of withholding taxes paid for vested RSUs | 11,157 | (20 | ) | (25 | ) | (45 | ) | ||||||||||||||||||||||||||

Stock-based compensation expense | 80 | 105 | 185 | ||||||||||||||||||||||||||||||

Net income | 96 | 134 | 230 | ||||||||||||||||||||||||||||||

Balance as of March 31, 2016 | 8,025,591 | 100 | $ | 80 | $ | — | $ | 94,743 | $ | — | $ | (4,467 | ) | $ | 127,422 | $ | 217,778 | ||||||||||||||||

Balance as of December 31, 2016 | 7,896,488 | 100 | $ | 80 | $ | — | $ | 97,123 | $ | (1,250 | ) | $ | 4,675 | $ | 126,258 | $ | 226,886 | ||||||||||||||||

Class A - Issuance of common stock for RSUs, net of withholding taxes paid for vested RSUs | 61,826 | 1 | (122 | ) | (158 | ) | (279 | ) | |||||||||||||||||||||||||

Re-allocation from stock issuances | 411 | (411 | ) | — | |||||||||||||||||||||||||||||

Stock-based compensation expense | 181 | 236 | 417 | ||||||||||||||||||||||||||||||

Excess income tax benefit from stock based awards | (61 | ) | (61 | ) | |||||||||||||||||||||||||||||

Distribution to noncontrolling interest | (1,909 | ) | (1,909 | ) | |||||||||||||||||||||||||||||

Net income | 1,146 | 2,310 | 3,456 | ||||||||||||||||||||||||||||||

Balance as of March 31, 2017 | 7,958,314 | 100 | $ | 81 | $ | — | $ | 97,532 | $ | (1,250 | ) | $ | 5,821 | $ | 126,326 | $ | 228,510 | ||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

5

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended March 31, | |||||||

(In thousands) | 2017 | 2016 | |||||

Operating activities | |||||||

Net income | $ | 3,456 | $ | 230 | |||

Adjustments to reconcile net income to net cash used in operating activities: | |||||||

Stock-based compensation | 417 | 185 | |||||

Excess income tax benefit from stock based awards | (61 | ) | — | ||||

Abandonment charges | 102 | 419 | |||||

Impairment on real estate inventories | 102 | — | |||||

Depreciation and amortization | 143 | 156 | |||||

Fair value adjustment of contingent consideration | — | 8 | |||||

Deferred income taxes, net | 255 | — | |||||

Changes in operating assets and liabilities: | |||||||

Real estate inventories | (15,348 | ) | (10,839 | ) | |||

Receivables | 1,951 | (71 | ) | ||||

Other assets | (740 | ) | 1,104 | ||||

Accounts payable | (1,902 | ) | (2,697 | ) | |||

Accrued liabilities | 5,229 | (1,230 | ) | ||||

Customer deposits | 2,077 | 454 | |||||

Income taxes payable | 427 | (64 | ) | ||||

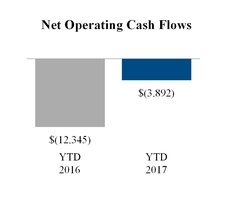

Net cash used in operating activities | (3,892 | ) | (12,345 | ) | |||

Investing activities | |||||||

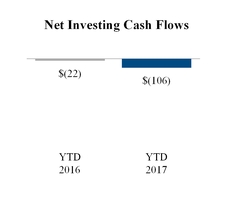

Purchases of fixed assets | (106 | ) | (22 | ) | |||

Net cash used in investing activities | (106 | ) | (22 | ) | |||

Financing activities | |||||||

Distribution to noncontrolling interest | (1,909 | ) | — | ||||

Proceeds from notes payable | 39,771 | 35,476 | |||||

Repayment of notes payable | (39,375 | ) | (33,112 | ) | |||

Debt issuance costs | (871 | ) | (12 | ) | |||

Withholding taxes paid for vested RSUs | (279 | ) | (45 | ) | |||

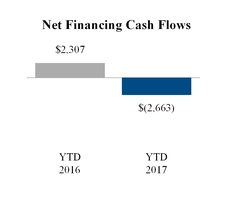

Net cash (used in) provided by financing activities | (2,663 | ) | 2,307 | ||||

Net decrease in cash, cash equivalents and restricted cash | (6,661 | ) | (10,060 | ) | |||

Cash, cash equivalents and restricted cash – beginning of period | 42,478 | 40,729 | |||||

Cash, cash equivalents and restricted cash – end of period | $ | 35,817 | $ | 30,669 | |||

Non-cash investing and financing activity | |||||||

Exercise of land purchase options acquired with acquisition of business | $ | 10 | $ | 6 | |||

Issuance of Class A common stock for vested restricted stock units | $ | 1,007 | $ | 113 | |||

Supplemental cash flow information | |||||||

Income taxes paid | $ | — | $ | 70 | |||

See accompanying notes to condensed consolidated financial statements.

6

UCP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. ORGANIZATION, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

As used in this report, unless the context otherwise requires or indicates, references to “the Company,” “we,” “our” and “UCP” refer to UCP, Inc. and its consolidated subsidiaries, including UCP, LLC.

Business Description and Organizational Structure of the Company

The Company is a homebuilder and land developer with expertise in residential land acquisition, development and entitlement, as well as home design, construction and sales. The Company’s homebuilding and land development operations are each segmented into two geographic regions, West and Southeast. We operate in the states of California, Washington, North Carolina, South Carolina and Tennessee.

The Company’s operations began in 2004 and principally focused on acquiring land, entitling and developing it for residential construction, and selling residential lots to third-party homebuilders. In 2010, the Company formed Benchmark Communities, LLC, its wholly-owned homebuilding subsidiary, to design, construct and sell high quality single-family homes. On April 10, 2017, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Company has agreed to merge with a wholly-owned subsidiary of Century Communities, Inc. (together with its subsidiaries and unless the context otherwise requires, “Century”). In the merger, each outstanding share of the Company’s Class A common stock, par value $0.01 per share (“Class A common stock”), will be converted into the right to receive $5.32 in cash and 0.2309 of a newly issued share of Century common stock, par value $0.01 per share (“Century Common Stock”). The transaction is expected to close by the end of the third quarter of 2017, subject to customary closing conditions, including the adoption of the Merger Agreement by the Company’s stockholders at a special meeting. See Note 13, “Subsequent Event” to the accompanying unaudited condensed consolidated financial statements for a further discussion of the merger.

The Company is a holding company, whose principal asset is its interest in UCP, LLC, the subsidiary through which it directly and indirectly conducts its business. As of March 31, 2017, the Company held a 43.3% economic interest in UCP, LLC and PICO Holdings, Inc. (“PICO”), a NASDAQ-listed, diversified holding company, held the remaining 56.7% economic interest in UCP, LLC.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany accounts have been eliminated in consolidation.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. These financial statements should be read in conjunction with the Company's audited financial statements for the year ended December 31, 2016, which are included in the Company’s Annual Report on Form 10-K that was filed with the Securities and Exchange Commission (“SEC”) on March 3, 2017. The accompanying unaudited condensed consolidated financial statements include all adjustments (consisting of normal recurring adjustments) necessary for the fair presentation of the Company’s results for the interim periods presented. These consolidated and segment results are not necessarily indicative of the Company’s future performance.

As an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, the Company has taken advantage of certain temporary exemptions from various reporting requirements, including reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements. The Company could be an emerging growth company until the last day of the fiscal year following the fifth anniversary of the July 23, 2013 completion of its initial public offering, although a variety of circumstances can cause it to lose this status earlier.

Use of Estimates in Preparation of Financial Statements

The preparation of condensed consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the disclosure and reported amounts of assets and liabilities reported at the date of the financial

7

statements and the reported amounts of revenues and expenses for each reporting period. The significant estimates made in the preparation of the Company’s accompanying unaudited condensed consolidated financial statements relate to the assessment of real estate impairments, valuation of assets and liabilities acquired, cost capitalization, accrued obligations, warranty reserves, income taxes and contingent liabilities. While management believes that the carrying value of such assets and liabilities are appropriate as of March 31, 2017 and December 31, 2016, it is reasonably possible that actual results could differ from the estimates upon which the carrying values were based.

Related Party Transactions

Agreements Related to our Initial Public Offering

As of March 31, 2017, PICO holds an economic and voting interest in our Company equal to approximately 56.7%. The Company is party to certain agreements with PICO, including an Exchange Agreement (pursuant to which PICO has the right to cause the Company to exchange PICO’s interests in UCP, LLC for shares of the Company’s Class A common stock on a one-for-one basis, subject to equitable adjustments for stock splits, stock dividends, reclassifications and repurchases by UCP of Class A common stock), an Investor Rights Agreement (pursuant to which PICO has certain rights, including the right to select two individuals for nomination for election to the Company’s board of directors (the “Board”) for as long as PICO owns at least a 25% voting interest in the Company), a Tax Receivable Agreement (pursuant to which PICO is entitled to 85% of any cash savings in U.S. federal, state and local income tax that the Company actually realizes as a result of any increase in tax basis caused by PICO’s exchange of UCP, LLC interests for shares of the Company’s Class A common stock) and a Registration Rights Agreement, with respect to the shares of Class A common stock that PICO may receive in exchanges made pursuant to the Exchange Agreement. In connection with the pending merger transaction with Century, each of the Company, UCP, LLC and PICO has agreed to terminate the Exchange Agreement, the Tax Receivable Agreement and the Registration Rights Agreement (without any payments from, or any cost or expense to, any such party) subject to and contingent upon the completion of the proposed merger with Century.

Voting Agreement

Concurrently with the execution and delivery of the Merger Agreement, on April 10, 2017, Century, a wholly-owned subsidiary of Century, PICO, the Company and UCP, LLC entered into a voting support and transfer restriction agreement (the “Voting Agreement”). Pursuant to the terms of the Voting Agreement, PICO agreed, among other things, to vote all outstanding shares of Class A common stock and Class B common stock, par value $0.01 per share, of the Company currently held or thereafter acquired by PICO (the “PICO Shares”) in favor of the adoption of the Merger Agreement and against any proposal by third parties to acquire the Company, and to take certain other actions in furtherance of the transactions contemplated by the Merger Agreement, including the Exchange (as defined below), in each case subject to the limitations set forth in the Voting Agreement. Among other such limitations, PICO’s obligation to vote in favor of the adoption of the Merger Agreement will be reduced to such number of PICO Shares as is equal to 28% of the aggregate outstanding voting power of the Company if the Board changes its recommendation in respect of an Intervening Event (as defined in the Merger Agreement), and the Voting Agreement automatically terminates if the Merger Agreement is terminated (including if the Company terminates the Merger Agreement to accept a Superior Company Proposal, as defined in the Merger Agreement).

The foregoing description of the Voting Agreement is only a summary, does not purport to be complete and is qualified in its entirety by reference to the full text of the Voting Agreement, which is filed as an exhibit to our Current Report on Form 8-K filed with the SEC on April 11, 2017.

Agreement to Exchange

Concurrently with the execution and delivery of the Merger Agreement, on April 10, 2017, the Company, UCP, LLC and PICO entered into an agreement to exchange (the “Agreement to Exchange”), pursuant to which PICO exercised its right under the Exchange Agreement to effect the exchange of all of its Series A Units of UCP, LLC for shares of Class A common stock (the “Exchange”). Under the Agreement to Exchange, the Exchange will occur immediately prior to, and remain subject to the consummation immediately thereafter of, the merger.

The foregoing description of the Agreement to Exchange is only a summary, does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement to Exchange, which is filed as an exhibit to our Current Report on Form 8-K filed with the SEC on April 11, 2017.

2017 Agreement with PICO. On February 6, 2017, PICO submitted a written notice of its nomination of Eric H. Speron (a current Class I director) and Keith M. Locker for election to our Board at the 2017 Annual Meeting of Stockholders and various governance related proposals to be voted upon at such meeting (the “PICO Notice”). On March 29, 2017, we entered into an agreement with PICO (the “2017 Agreement with PICO”) with respect to, among other things, the matters set forth in the

8

PICO Notice. Pursuant to this agreement, we have agreed to, among other things, (i) expand our Board from six to seven directors immediately prior to the 2017 Annual Meeting of Stockholders and nominate Messrs. Locker and Speron and Kathleen R. Wade (a Current Class I director) to be elected at the 2017 Annual Meeting of Stockholders to serve as directors with a term expiring at our 2020 Annual Meeting of Stockholders; and (ii) submit, recommend and solicit proxies in favor of governance proposals at the 2017 Annual Meeting of Stockholders. The governance proposals address the declassification of our Board, the calling of special meetings of stockholders, stockholder action by written consent, removal of directors and amendments to our bylaws. PICO has agreed to, among other things, vote all common stock held by it in favor of each of the Board’s director nominees at the 2017 Annual Meeting of Stockholders and in favor of each governance proposal and to withdraw the PICO Notice. The foregoing description of the 2017 Agreement with PICO is only a summary, does not purport to be complete and is qualified in its entirety by reference to the full text of the 2017 Agreement with PICO, which is filed as an exhibit to our Current Report on Form 8-K filed with the SEC on March 30, 2017. The Board has determined to await the result of the special meeting of stockholders at which stockholders will be asked to adopt the Merger Agreement. If the Merger Agreement is adopted and the transaction with Century is thereafter consummated, there will be no need to hold an annual meeting of stockholders during 2017. Alternatively, if the Merger Agreement is not approved and the transaction with Century is not consummated, the Board intends to convene an annual meeting of stockholders during 2017 at which the above-described governance matters, among other items, will be presented to stockholders for consideration.

Segment Reporting

The Company has segmented its operating activities into two operating segments, West and Southeast, and two reportable segments, Homebuilding and Land development. Each reportable segment includes real estate with similar economic characteristics, including similar historical and expected long-term gross margin percentages, product types, geography, production processes and methods of distribution.

Cash and Cash Equivalents and Restricted Cash

Cash and cash equivalents include highly liquid instruments purchased with original maturities of three months or less. The Company has approximately $15.1 million of cash held in money market accounts on its condensed consolidated balance sheets as of March 31, 2017 and December 31, 2016.

Cash items that are restricted as to withdrawal or usage include deposits of $1.5 million as of March 31, 2017 and December 31, 2016, related to a construction loan, credit card agreements, contractor’s license and a letter of credit.

As part of the Company’s adoption of Accounting Standards Update 2016-18 (“ASU 2016-18”), Statement of Cash Flows - Restricted Cash, restricted cash is included as a component of cash, cash equivalents and restricted cash in the accompanying unaudited condensed consolidated statements of cash flows. ASU 2016-18 requires that the statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents on a retrospective basis. The adoption did not have a material impact on the Company’s unaudited condensed consolidated statements of cash flows during the three months ended March 31, 2017. For the three months ended March 31, 2016, the beginning and ending balances for cash, cash equivalents and restricted cash increased by approximately $0.9 million.

Capitalization of Interest

The Company capitalizes interest to real estate inventories during the period that real estate is undergoing development. Interest capitalized as a cost of real estate inventories is included in cost of sales-homebuilding or cost of sales-land development as related homes or real estate are delivered.

Advertising Expenses

The Company expenses advertising costs as incurred. Advertising expenses for the three months ended March 31, 2017 and 2016 were $0.2 million and $0.4 million, respectively.

Real Estate Inventories and Cost of Sales

The Company capitalizes pre-acquisition costs, the purchase price of real estate, development costs and other allocated costs, including interest, during development and home construction. Pre-acquisition costs, including non-refundable land deposits, are expensed to cost of sales when the Company determines continuation of the related project is not probable. Applicable costs incurred after development or construction is substantially complete are charged to sales and marketing or general and administrative (“G&A”) expenses, as appropriate.

9

Land, development and other common costs are typically allocated to real estate inventories based on the number of homes to be constructed. Direct home construction costs are recorded using the specific identification method. Cost of sales-homebuilding includes the construction costs of each home and all applicable land acquisition, real estate development, capitalized interest and related allocated common costs. Changes to estimated total development costs subsequent to initial home closings in a community are allocated to remaining homes in the community. Cost of sales-land development includes land acquisition and development costs, capitalized interest, impairment charges, abandonment charges for projects that are no longer economically viable, and real estate taxes.

Real estate inventories are stated at cost, unless the carrying amount is determined not to be recoverable, in which case real estate inventories are written down to fair value.

All real estate inventories are classified as held until the Company commits to a plan to sell the real estate, the real estate can be sold in its present condition, the real estate is being actively marketed for sale and it is probable that the real estate will be sold within twelve months. Homes completed or under construction are included in real estate inventories in the accompanying unaudited condensed consolidated balance sheets at the lower of cost or net realizable value.

Impairment and Abandonment of Real Estate Inventories

The Company evaluates real estate inventories for impairment when conditions exist suggesting that the carrying amount of real estate inventories is not fully recoverable and may exceed its fair value. Indicators of impairment include, but are not limited to, significant decreases in local housing market values, decreases in the selling prices of comparable homes, significant decreases in gross margins and sales absorption rates, costs in excess of budget, and actual or projected cash flow losses. The Company prepares and analyzes cash flows at the lowest level for which there are identifiable cash flows that are independent of the cash flows of other groups of assets.

When estimating future cash flows of its real estate assets, the Company makes various assumptions, including: (i) expected sales prices and sales incentives (based on, among other things, an estimate of the number of homes available in the market, pricing and incentives, and potential sales price adjustments based on market and economic trends); (ii) expected sales pace and cancellation rates (based on local housing market conditions, competition and historical trends); (iii) costs incurred to date and expected to be incurred (including, but not limited to, land and land development costs, home construction costs, indirect construction costs, and selling and marketing costs); (iv) alternative product offerings that may be offered that could have an impact on sales pace, sales price and/or building costs; and (v) alternative uses for the property.

If events or circumstances indicate that the carrying amount of real estate inventories may be impaired, such impairment will be measured based upon the difference between the carrying amount and the fair value of such asset(s) determined using the estimated future discounted cash flows, excluding interest charges, generated from the use and ultimate disposition of such asset(s). Such losses, if any, are reported within cost of sales for the period.

We estimate the fair value of each impaired community by determining the present value of the estimated future cash flows at a discount rate commensurate with the risk of the respective community. In determining the fair value of land held for sale, management considers, among other things, prices for land in recent comparable sale transactions, market analysis studies, which include the estimated price a willing buyer would pay for the land, and recent bona fide offers received from third parties.

During the three months ended March 31, 2017, approximately $0.1 million of impairment losses were recorded with respect to the Company’s real estate inventories at its Glenmoor community, located in Myrtle Beach, South Carolina (“Glenmoor”). As of March 31, 2017, a model home in the Glenmoor project suffered damages due to a fire resulting in approximately $0.1 million in impairment loss. See Note 8, “Fair Value Disclosures--Non-Financial Instruments Carried at Fair Value--Non-Recurring Estimated Fair Value of Real Estate Inventories” to the accompanying unaudited condensed consolidated financial statements for a further discussion of the impairment of the real estate asset.

No such real estate impairment losses were recorded for the three months ended March 31, 2016.

Abandonment charges during the three months ended March 31, 2017 and 2016 were $0.1 million and $0.4 million, respectively. Abandonment charges are included in cost of sales in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss for the period in which they were recorded. These charges were related to the Company electing not to proceed with one or more land acquisitions after the incurrence of costs during due diligence.

10

Intangible Assets

Intangible assets with determinable useful lives are amortized on a straight-line basis over the estimated remaining useful lives (ranging from six months to five years), added to the value of land when an intangible option is used to purchase the related land, or expensed in the period when the option is cancelled. Acquired intangible assets with contractual terms are generally amortized over their respective contractual lives. When certain events or changes in operating conditions occur, an impairment assessment is performed for the intangible assets.

Fixed Assets, Net

Fixed assets are carried at cost, net of accumulated depreciation. Depreciation is computed using the straight-line method over the estimated remaining useful lives of the assets. Computer software and hardware are depreciated over three to five years, office furniture and fixtures are depreciated over five years, vehicles are depreciated over five years and leasehold improvements are depreciated over the shorter of their useful life or lease term and range from one to five years. Maintenance and repairs are charged to expense as incurred, while significant improvements are capitalized. Depreciation expense is included in G&A expenses in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss.

Receivables

The detail of receivables is set forth below (in thousands):

March 31, 2017 | December 31, 2016 | ||||||

Warranty insurance receivables | $ | 1,118 | $ | 1,118 | |||

Manufacturer rebates | 554 | 454 | |||||

Reimbursement for land development work | 1,760 | 4,016 | |||||

Other receivables | 245 | 40 | |||||

Total | $ | 3,677 | $ | 5,628 | |||

As of March 31, 2017 and December 31, 2016, the Company had no allowance for doubtful accounts recorded.

Other Assets

The detail of other assets is set forth below (in thousands):

March 31, 2017 | December 31, 2016 | ||||||

Customer deposits in escrow | $ | 4,475 | $ | 2,394 | |||

Prepaid expenses | 942 | 1,098 | |||||

Other deposits and prepaid interest | 1,595 | 1,345 | |||||

Funds held in escrow | — | 1,490 | |||||

Other assets | 69 | — | |||||

Total | $ | 7,081 | $ | 6,327 | |||

Homebuilding, Land Development Sales and Other Revenues Profit Recognition

In accordance with applicable guidance under Accounting Standards Codification (“ASC”) Topic 360 - Property, Plant, and Equipment, revenue from home sales and other real estate sales is recorded and any profit is recognized when the respective sales are closed. Sales are closed when all conditions of escrow are met, title passes to the buyer, appropriate consideration is received and collection of associated receivables, if any, is reasonably assured and the Company has no continuing involvement with the sold asset. The Company does not offer financing to any buyers. Sales price incentives are accounted for as a reduction of revenues when the sale is recorded. If the earnings process is not complete, the sale and any related profits are deferred for recognition in future periods. Any profit recorded is based on the calculation of cost of sales, which is dependent on an allocation of costs.

11

Stock-Based Compensation

Stock-based compensation expense is measured at the grant date based on the fair value of the award and is recognized as expense over the period during which the awards vest in accordance with applicable guidance under ASC Topic 718 - Compensation - Stock Compensation. See Note 9, “Equity--Stock-Based Compensation” to the unaudited condensed consolidated financial statements for further discussion on stock-based compensation.

As part of the Company’s adoption of Accounting Standards Update 2016-09 (“ASU 2016-09”), Compensation - Stock Compensation (Topic 718), the classification for the excess income tax benefit from stock based awards is presented as an operating activity on the accompanying unaudited condensed consolidated statements of cash flows. ASU 2016-09 provides clarification for certain share-based payment transactions and the classification of such transactions on the statement of cash flows and requires all amendments within ASU 2016-09 to be adopted in the same period. The adoption did not have a material impact on the Company’s unaudited condensed consolidated statements of cash flows during the three months ended March 31, 2017 and 2016.

Stock Repurchase Program

Our Board authorized the Stock Repurchase Program on June 6, 2016, to repurchase up to $5.0 million of the Company’s Class A common stock between June 7, 2016 and June 1, 2018. Treasury stock represents shares repurchased under the Stock Repurchase Program, which are reflected as a reduction in Stockholders’ Equity in accordance with ASC Topic 505-30 - Equity - Treasury Stock. The number of shares repurchased is based on the settlement date and factored into our weighted average calculation for earnings per share (“EPS”). See Note 9, “Equity--Stock Repurchase Program” to the unaudited condensed consolidated financial statements for additional information regarding the Stock Repurchase Program.

Warranty Reserves

Estimated future direct warranty costs are accrued and charged to cost of sales-homebuilding in the period in which the related homebuilding revenue is recognized. Amounts accrued are based upon estimates of the amount the Company expects to pay for warranty work. The Company assesses the adequacy of its warranty reserves on a quarterly basis and adjusts the amounts recorded, if necessary, in the period in which the change in estimate occurs. Annually, or more frequently as needed, the Company engages a third-party actuary to assist in the analysis of warranty reserves based on historical data and industry trends for our communities. Warranty reserves are included in accrued liabilities in the accompanying unaudited condensed consolidated balance sheets.

Changes in warranty reserves are detailed in the table set forth below (in thousands):

Three months ended March 31, | |||||||

2017 | 2016 | ||||||

Warranty reserves, beginning of period | $ | 5,642 | $ | 2,852 | |||

Warranty reserves accrued | 659 | 471 | |||||

Warranty expenditures | (175 | ) | (106 | ) | |||

Warranty reserves, end of period | $ | 6,126 | $ | 3,217 | |||

Consolidation of Variable Interest Entities

The Company enters into purchase and option agreements for the purchase of real estate as part of the normal course of business. These purchase and option agreements enable the Company to acquire real estate at one or more future dates at pre-determined prices. The Company believes these acquisition structures reduce its financial risk associated with real estate acquisitions and holdings and allow the Company to better manage its cash position and return metrics.

In accordance with ASC Topic 810, "Consolidation," the Company assesses each purchase agreement to acquire real estate from an entity to determine if a variable interest entity ("VIE") may be created. Although the Company may not have legal title to the underlying land, if the Company determines that it is the primary beneficiary of the VIE, the Company would consolidate the VIE in its accompanying consolidated financial statements and reflect such assets and liabilities as “Real estate inventories not owned.” In determining if the Company is the primary beneficiary, the Company considers, among other things, whether it has the ability to control the activities of the VIE that most significantly impact its economic performance. Such activities include, but are not limited to: the ability to determine the budget or scope of the VIE; the ability to control financing decisions for the VIE; and the ability to acquire or dispose of property owned or controlled by the VIE.

12

Based on the current provisions of the relevant accounting guidance, the Company evaluated its purchase and option agreements for real estate in place as of March 31, 2017 and December 31, 2016. None met consolidation criteria under the accounting guidance.

Income Taxes

The Company’s provision for income tax expense includes federal and state income taxes currently payable and those deferred because of temporary differences between the income tax and financial reporting basis of the Company’s assets and liabilities. The asset and liability method of accounting for income taxes also requires the Company to reflect the effect of a tax rate change on accumulated deferred income taxes in income in the period in which the change is enacted.

The Company evaluates deferred tax assets regularly to determine if adjustments to its valuation allowance are required based on all available positive and negative evidence to consider whether it is more likely than not that any of the deferred tax assets will be realized. If it is more likely than not that some or all of the deferred income tax assets will not be realized, a valuation allowance is recorded.

During the three months ended December 31, 2016, the Company evaluated all available evidence in determining the likelihood that it will be able to realize all or some portion of its deferred tax assets prior to their expiration. Upon completing this evaluation, the Company concluded that it is more likely than not that the Company will be able to realize its deferred tax assets. As of March 31, 2017, the Company continues to conclude that it is more likely than not that the Company will be able to realize its deferred tax assets.

The Company recognizes any uncertain income tax positions on income tax returns at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized unless it has a greater than 50% likelihood of being sustained. The Company recognizes any interest and penalties related to uncertain tax positions in income tax expense. For each of the periods presented, the Company did not record any interest or penalties related to uncertain tax positions. See Note 12, “Income Taxes” to the unaudited condensed consolidated financial statements for a further discussion of the Company’s income taxes for the applicable period.

Price Participation Interests

Certain land purchase contracts and other agreements include provisions for additional payments to the land sellers. These additional payments are contingent on certain future outcomes, such as selling homes above a certain preset price or achieving an internal rate of return above a certain preset level. These additional payments, if triggered, are accounted for as cost of sales when they become due, however, they are neither fully determinable, nor due, until the transfer of title to the buyer is complete. Accordingly, no liability is recorded until the sale is complete.

Noncontrolling Interest

The Company reports the share of the results of operations that are attributable to other owners of its consolidated subsidiaries that are less than wholly-owned as noncontrolling interest in the accompanying unaudited condensed consolidated financial statements. In the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss, the income or loss attributable to the noncontrolling interest is reported separately, and the accumulated income or loss attributable to the noncontrolling interest, along with any changes in ownership of the subsidiary, is reported as a component of total equity.

As of March 31, 2017 and December 31, 2016, the noncontrolling interest reported in the accompanying unaudited condensed consolidated financial statements includes PICO's share of 56.7% and 56.8%, respectively, of the income related to UCP, LLC. See Note 9, "Equity--Noncontrolling Interest" to the unaudited condensed consolidated financial statements for further discussion on noncontrolling interest.

Recently Issued Accounting Standards

There were no new accounting pronouncements as of March 31, 2017 that has had or is expected to have a material impact on the Company’s accompanying unaudited condensed consolidated financial statements. For a further discussion of recently issued accounting standards that are not yet required to be adopted by the Company, see the “Recently Issued Accounting Standards” disclosed in Company’s Annual Report on Form 10-K for the year ended December 31, 2016 that was filed with the SEC on March 3, 2017.

13

2. INCOME PER SHARE

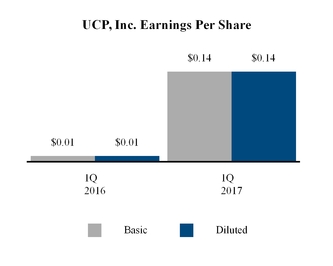

Basic income per share of Class A common stock is computed by dividing net income or loss attributable to UCP, Inc. by the weighted average number of shares of Class A common stock outstanding during the period. Diluted income per share of Class A common stock is computed similarly to basic income per share except that the weighted average number of shares of Class A common stock outstanding during the period is increased to include additional shares from the assumed exercise of any Class A common stock equivalents using the treasury stock method, if dilutive. The Company’s restricted stock units (“RSUs”) and stock options (“Options”) are considered Class A common stock equivalents for this purpose. For the three months ended March 31, 2017 and 2016, incremental Class A common stock equivalents of 152,239 and 854 shares, respectively, were included in calculating diluted income per share.

Basic and diluted net income per share of Class A common stock for the three months ended March 31, 2017 and 2016 have been computed as follows (in thousands, except share and per share amounts):

Three months ended March 31, | |||||||

2017 | 2016 | ||||||

Numerator | |||||||

Net income attributable to UCP, Inc. | $ | 1,146 | $ | 96 | |||

Denominator | |||||||

Weighted average number of shares of Class A common stock outstanding - basic | 7,950,723 | 8,021,747 | |||||

Effect of dilutive securities: | |||||||

RSUs | 152,239 | 854 | |||||

Total shares for purpose of calculating diluted net income per share | 8,102,962 | 8,022,601 | |||||

Earnings per share: | |||||||

Net income per share of Class A common stock - basic | $ | 0.14 | $ | 0.01 | |||

Net income per share of Class A common stock - diluted | $ | 0.14 | $ | 0.01 | |||

The following RSUs and Options issued were excluded in the computation of diluted EPS for the three months ended March 31, 2017 and 2016 because the effect would be anti-dilutive:

Three months ended March 31, | |||||

2017 | 2016 | ||||

Anti-dilutive securities | 454,301 | 190,329 | |||

14

3. REAL ESTATE INVENTORIES

Real estate inventories consisted of the following (in thousands):

March 31, 2017 | December 31, 2016 | ||||||

Deposits and pre-acquisition costs | $ | 10,223 | $ | 9,232 | |||

Land held and land under development | 113,004 | 101,609 | |||||

Finished lots | 73,350 | 86,622 | |||||

Homes completed or under construction | 165,081 | 148,627 | |||||

Model homes | 27,721 | 27,117 | |||||

Total | $ | 389,379 | $ | 373,207 | |||

Deposits and pre-acquisition costs include costs relating to land purchase or option contracts. Land held and land under development includes costs incurred during site development, such as land, development, indirect costs and permits. Homes completed or under construction and model homes include all costs associated with home construction, including land, development, indirect costs, permits and fees, and vertical construction.

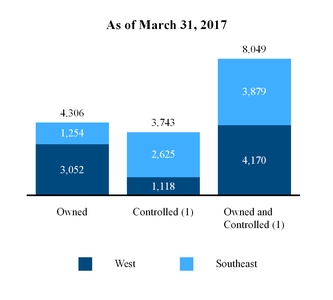

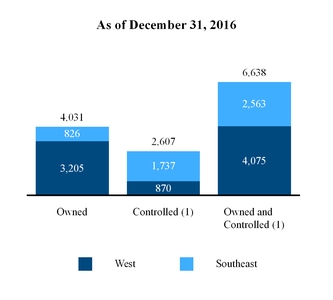

As of March 31, 2017, the Company had $10.2 million of deposits and pre-acquisition costs for 3,743 lots with an aggregate purchase price of approximately $124.4 million, net of deposits. As of December 31, 2016, the Company had $9.2 million of deposits and pre-acquisition costs for 2,607 lots with an aggregate purchase price of approximately $106.0 million, net of deposits.

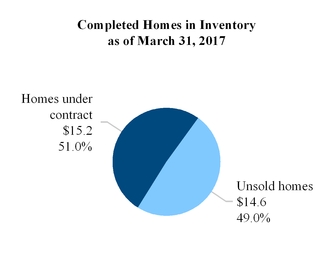

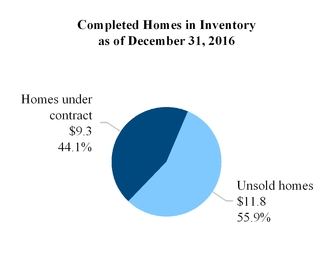

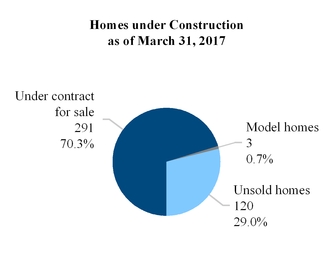

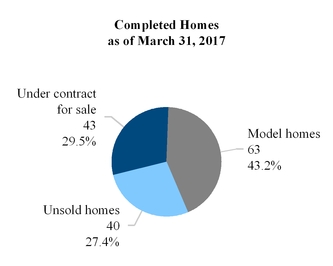

As of March 31, 2017 and December 31, 2016, the Company had completed homes included in inventories of approximately $29.8 million and $21.1 million, respectively, as shown in the charts below ($ in millions):

15

Interest Capitalization

Amounts capitalized to home inventories and land inventories were as follows (in thousands):

Three months ended March 31, | |||||||

2017 | 2016 | ||||||

Interest expense capitalized as cost of home inventory | $ | 2,662 | $ | 2,368 | |||

Interest expense capitalized as cost of land inventory | 418 | 575 | |||||

Total interest expense capitalized | 3,080 | 2,943 | |||||

Previously capitalized interest expense included in cost of sales - homebuilding | (2,350 | ) | (1,539 | ) | |||

Previously capitalized interest expense included in cost of sales - land development | (11 | ) | — | ||||

Net activity of capitalized interest | 719 | 1,404 | |||||

Capitalized interest expense in beginning inventory | 17,659 | 13,274 | |||||

Capitalized interest expense in ending inventory | $ | 18,378 | $ | 14,678 | |||

Interest is capitalized on real estate inventories during development. Interest capitalized is included in cost of sales in the Company’s accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss as related sales are recognized.

4. FIXED ASSETS, NET

Net fixed assets consisted of the following (in thousands):

March 31, 2017 | December 31, 2016 | ||||||

Computer hardware and software | $ | 2,049 | $ | 2,043 | |||

Office furniture and equipment and leasehold improvements | 933 | 911 | |||||

Vehicles | 161 | 83 | |||||

Total | 3,143 | 3,037 | |||||

Accumulated depreciation | (2,288 | ) | (2,154 | ) | |||

Fixed assets, net | $ | 855 | $ | 883 | |||

Depreciation expense for the three months ended March 31, 2017 and 2016 was $135,000 and $147,000, respectively. Depreciation expense is recorded in G&A expenses in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss.

5. INTANGIBLE ASSETS

Other purchased intangible assets consisted of the following:

March 31, 2017 | December 31, 2016 | ||||||||||||||||||||||

(in thousands) | Gross Carrying Amount | Accumulated Amortization | Ending Balance | Gross Carrying Amount | Accumulated Amortization | Ending Balance | |||||||||||||||||

Architectural plans | $ | 170 | $ | (103 | ) | $ | 67 | $ | 170 | $ | (94 | ) | $ | 76 | |||||||||

Land option | 583 | (568 | ) | 15 | 583 | (558 | ) | 25 | |||||||||||||||

Total | $ | 753 | $ | (671 | ) | $ | 82 | $ | 753 | $ | (652 | ) | $ | 101 | |||||||||

Amortization expense for the three months ended March 31, 2017 and 2016 related to the architectural plans was approximately $8,500 for both periods. The architectural plans intangible amortization period is 5 years. Amortization expense is recorded in G&A expenses in the accompanying unaudited cond

16

ensed consolidated statements of operations and comprehensive income or loss. Future estimated amortization expense related to the architectural plans intangibles over the next five years is as follows:

(in thousands) | December 31, | ||

Remainder of 2017 | $ | 25 | |

2018 | 34 | ||

2019 | 8 | ||

Total | $ | 67 | |

Additionally, $10,000 related to land options was capitalized to real estate inventories during the three months ended March 31, 2017, as compared to $20,000 for the three months ended March 31, 2016. For the three months ended March 31, 2017 and 2016, zero and $15,000, respectively, was related to abandonment.

6. ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in thousands):

7. NOTES PAYABLE AND SENIOR NOTES, NET

The Company obtains various types of debt financing in connection with its acquisition, development and construction of real estate inventories and its construction of homes. Often, these debt obligations are secured by the underlying real estate. Certain loans are funded in full at the initial loan closing and others are revolving facilities under which the Company may borrow, repay and reborrow up to a specified amount during the term of the loan. Acquisition indebtedness matures on various dates, but is generally repaid when lots are released from the lien securing the relevant loan based upon a specific release price, as defined in the relevant loan agreement, or the loan is refinanced. Construction and development debt is required to be repaid with proceeds from home closings based upon a specific release price, as defined in the relevant loan agreement.

Certain construction and development debt agreements include provisions that require minimum tangible net worth and liquidity; limit leverage and risk asset ratios; specify maximum loan-to-cost or loan-to-value ratios (whichever is lower). During the term of the loan, the lender may require the Company to obtain a third-party written appraisal of the fair value of the underlying real estate collateral. If the appraised fair value of the collateral securing the loan is below the specified minimum, the Company may be required to make principal payments in order to maintain the required loan-to-value ratios. As of March 31, 2017 and December 31, 2016, the Company had approximately $168.7 million and $164.0 million, respectively, of loan commitments related to its acquisition, development and construction loans (“ADC”). Of the total loan commitments, approximately $81.4 million and $77.2 million, respectively, was available to the Company. As of March 31, 2017 and December 31, 2016, the weighted average interest rate on the Company’s outstanding debt was 6.51% and 6.48%, respectively. Interest rates charged under the Company’s variable rate debt are based on the 30-day London Interbank Offered Rate (“LIBOR”) plus a spread ranging from 2.75% to 3.75% or the U.S. Prime rate (“Prime”) plus a spread of 0.99%.

The Company’s 2017 Senior Notes (the “2017 Notes”) with $75.0 million in principal outstanding mature in October of 2017, and an additional $30.1 million in ADC loans are also set to mature in the ordinary course of business during 2017. With respect to the $30.1 million in ADC loans, these loans are project specific loans and are scheduled to mature in the ordinary course of closing out of

17

the sales phase for each of these projects and we anticipate the sales proceeds from the designated home closings will provide a more than adequate source of cash for the repayment of these loans. For the 2017 Senior Notes our existing available cash, available borrowing capacity and cash expected to be generated from our backlog of home sales will be sufficient to repay this obligation when due.

On October 21, 2014, the Company completed the private offering of $75.0 million in aggregate principal amount of the 8.5% 2017 Notes. The net proceeds from the offering were approximately $72.5 million, after paying the debt issuance costs and offering expenses. The net proceeds from the offering were used for general corporate purposes, including financing construction of homes, acquisition of entitled land, development of lots and working capital.

The 2017 Notes were issued under an Indenture, dated as of October 21, 2014 (the “Indenture”), among the Company, certain subsidiary guarantors and Wilmington Trust, National Association, as trustee. The 2017 Notes bear interest at 8.5% per annum, payable on March 31, June 30, September 30 and December 31 of each year. The 2017 Notes mature on October 21, 2017, unless earlier redeemed or repurchased.

As of March 31, 2017, the Company was in compliance with the applicable financial covenants under the Indenture and all of its loan agreements.

Notes payable and 2017 Notes consisted of the following (in thousands):

Variable Interest Rate: | March 31, 2017 | December 31, 2016 | |||||

LIBOR + 3.50% through 2017 (a) | 3,894 | 4,693 | |||||

LIBOR + 3.75% through 2017 (a) | 20,558 | 31,533 | |||||

Prime + 0.25% through 2018 (b) | 2,338 | — | |||||

LIBOR + 2.75% through 2018 (a) | 8,700 | 10,500 | |||||

LIBOR + 3.75% through 2018 (a) | 42,073 | 26,444 | |||||

5.50% through 2017 | 1,844 | 2,476 | |||||

5.00% through 2017 | 3,807 | 5,607 | |||||

Total variable notes payable | $ | 83,214 | $ | 81,253 | |||

Fixed Interest Rate: | March 31, 2017 | December 31, 2016 | |||||

10.00% through 2017 | $ | — | $ | 1,604 | |||

8.00% through 2018 | 4,000 | 4,000 | |||||

Total fixed notes payable | $ | 4,000 | $ | 5,604 | |||

Senior notes, net of discount | 74,911 | 74,871 | |||||

Total notes payable and senior notes | $ | 162,125 | $ | 161,728 | |||

Debt issuance costs (c) | (574 | ) | (734 | ) | |||

Total notes payable and senior notes, net | $ | 161,551 | $ | 160,994 | |||

(a) | LIBOR is the 30-day London Interbank Offered Rate. As of March 31, 2017, LIBOR was 0.98278%. |

(b) | Prime is the U.S Prime Rate. At March 31, 2017, Prime was 4.00%. |

(c) | Debt issuance costs for non-revolver loans were $0.6 million and $0.7 million as of March 31, 2017 and December 31, 2016, respectively. |

18

As of March 31, 2017, principal maturities of notes payable and senior notes for the years ending December 31 are as follows:

(in thousands) | December 31, | ||

2017 | $ | 105,014 | |

2018 | 57,111 | ||

2019 and thereafter | — | ||

Total | $ | 162,125 | |

8. FAIR VALUE DISCLOSURES

The accounting guidance regarding fair value disclosures defines fair value as the price that would be received for selling an asset or the price paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions.

The Company determines the fair values of its financial instruments based on the fair value hierarchy established in accordance with ASC Topic 820 - Fair Value Measurements, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The classification of a financial asset or liability within the hierarchy is based upon the lowest level input that is significant to the fair value measurement. The fair value hierarchy prioritizes the inputs into three levels that may be used to measure fair value:

• | Level 1—Quoted prices for identical instruments in active markets |

• | Level 2—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are inactive; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets at measurement date |

• | Level 3—Valuations derived from techniques where one or more significant inputs or significant value drivers are unobservable in active markets at measurement date |

Estimated Fair Value of Financial Instruments Not Carried at Fair Value

As of March 31, 2017 and December 31, 2016, the fair values of cash and cash equivalents, accounts payable and receivable approximated their carrying values because of the short-term nature of these assets or liabilities. The estimated fair value of the Company’s debt is based on cash flow models discounted at current market interest rates for similar instruments, which are based on Level 3 inputs. There were no transfers between fair value hierarchy levels during the three months ended March 31, 2017 or the year ended December 31, 2016.

The following presents the carrying value and fair value of the Company’s financial instruments that are not carried at fair value:

March 31, 2017 | December 31, 2016 | ||||||||||||||||

(in thousands) | Level in Fair Value Hierarchy | Carrying Value | Estimated Fair Value | Carrying Value | Estimated Fair Value | ||||||||||||

Notes payable | Level 3 | $ | 87,214 | $ | 87,458 | $ | 86,857 | $ | 86,843 | ||||||||

2017 notes | Level 3 | 74,911 | 74,900 | 74,871 | 74,838 | ||||||||||||

Total debt | $ | 162,125 | $ | 162,358 | $ | 161,728 | $ | 161,681 | |||||||||

The estimated fair value of the Company's debt is the present value of the contractual debt payments, based on cash flow models, discounted at the then-current interest rates, plus an estimate of the then-current credit spread, which is an estimate of the rate at which the Company could obtain replacement debt. These parameters are Level 3 inputs in the fair value hierarchy. To estimate the contractual cash flows, discount rates, and thereby the debt fair value, the Company considers various internal and external factors including: (1) loan economic data, (2) collateral performance, (3) market interest rate data, (4) the discount curve and implied forward rate curve, and (5) other factors, which may include market, region and asset type evaluations. While the Company considered rates on existing and recently closed loan facilities in addition to the current refinancing fixed rate as of March 31, 2017, these unobservable inputs were not incorporated into its final estimate of fair value.

19

Recurring Financial Instruments Carried at Fair Value

The following presents the Company’s recurring financial instruments that are carried at fair value (in thousands):

Description | Level 1 | Level 2 | Level 3 | Balance at March 31, 2017 | ||||||||||

Contingent consideration | — | — | $ | 360 | $ | 360 | ||||||||

Description | Level 1 | Level 2 | Level 3 | Balance at December 31, 2016 | ||||||||||

Contingent consideration | — | — | $ | 360 | $ | 360 | ||||||||

Estimated Fair Value of Contingent Consideration

The change in estimated fair value of the contingent consideration relating to our 2014 acquisition of the assets and liabilities of Citizens Homes, Inc. used in the purchase of real estate and the construction and marketing of residential homes in North Carolina, South Carolina and Tennessee (the “Citizens Acquisition”) for the three months ended March 31, 2017 and 2016 consisted of the following (in thousands):

Contingent Consideration | ||||

Balance as of December 31, 2015 | $ | 2,707 | ||

Change in fair value | 8 | |||

Balance as of March 31, 2016 | $ | 2,715 | ||

Contingent Consideration | ||||

Balance as of December 31, 2016 | $ | 360 | ||

Change in fair value | — | |||

Balance as of March 31, 2017 | $ | 360 | ||

The contingent consideration arrangement relating to Citizens Acquisition requires the Company to pay up to a maximum of $6.0 million of additional consideration based upon the achievement of various pre-tax net income performance milestones ("performance milestones") by the assets acquired in the Citizens Acquisition over a five-year period that commenced on April 1, 2014. Payout calculations are made based on calendar year performance except for the sixth payout calculation which will be calculated based on the achievement of performance milestones from January 1, 2019 through March 25, 2019. Payouts are made on an annual basis. The potential undiscounted amount of all future payments that the Company could be required to make under the contingent consideration arrangement is between $0 and $6 million.

The fair value of the contingent consideration of $0.4 million as of March 31, 2017 was estimated based on applying the weighted probability of achievement of the performance milestones. There was no change in estimated fair value of the contingent consideration for the three months ended March 31, 2017. For the three months ended March 31, 2016, the change in estimated fair value of the contingent consideration was $8,000.

The fair value of the contingent consideration of $0.4 million as of March 31, 2017 was estimated based on significant inputs that are not observable in the market, which ASC Topic 820 - Fair Value Measurements, refers to as Level 3 inputs. Key assumptions include: (1) forecast adjusted pre-tax net income over the contingent consideration period; (2) revenue appreciation; (3) cost inflation; and (4) sales and marketing and general and administrative (“SG&A”) expenses. The estimated revenue appreciation of 4.5%, cost inflation of 1.5%, and SG&A expenses were applied to forecast adjusted net income over the contingent consideration period.

The fair value of the contingent consideration of $2.7 million as of March 31, 2016 was estimated based on applying the income approach and a weighted probability of achievement of the performance milestones. The estimated fair value of the contingent consideration was calculated by using a Monte Carlo simulation. The measurement is based on significant inputs that are not observable in the market, which ASC Topic 820 - Fair Value Measurements, refers to as Level 3 inputs. Key assumptions include: (1) forecast adjusted pre-tax net income over the contingent consideration period; (2) risk-adjusted discount rate reflecting the risk inherent in the forecast adjusted pre-tax net income; (3) risk-free interest rates; (4) volatility of adjusted pre-tax net income; and (5) the Company’s credit spread. The risk-adjusted discount rate applied to forecast adjusted net income was 12.7% plus the applicable risk-free rate, resulting in a discount rate ranging from 12.7% to 13.2% over the contingent consideration period. The estimated volatility rate of 18.6% and a credit spread of 11.0% were applied to forecast adjusted net income over the contingent consideration period.

20

Non-Financial Instruments Carried at Fair Value

Non-financial assets and liabilities include items such as inventory and long lived assets that are measured at fair value, on a nonrecurring basis, when events and circumstances indicate the carrying value is not recoverable.

Non-Recurring Estimated Fair Value of Real Estate Inventories

The following presents the Company’s non-financial instruments that were measured at fair value, on a non-recurring basis, by level within the fair value hierarchy (in thousands):

Description | Level 1 | Level 2 | Level 3 | Total Impairment During the Three Months Ended March 31, 2017 | ||||||||

Real estate and development costs - Glenmoor model home | $ | — | $ | 102 | ||||||||

Description | Level 1 | Level 2 | Level 3 | Total Impairment During the Year Ended December 31, 2016 | ||||||||

Real estate and development costs - Heathers at Westport project | $ | 1,066 | $ | 192 | ||||||||

Real estate and development costs - Sundance project | $ | 5,782 | $ | 2,397 | ||||||||

For the three months ended March 31, 2017, the Company had a non-recurring fair value measurement that resulted in a real estate impairment loss at its Glenmoor project in South Carolina. During the three months ended March 31, 2017, the Company recorded an impairment loss of $0.1 million with respect to the Company’s real estate inventories at Glenmoor for the model home that suffered damages due to a fire. The carrying value of Glenmoor model home was written down to its fair value. See Note 1, “Organization, Basis of Presentation and Summary of Significant Accounting Policies” to the accompanying unaudited condensed consolidated financial statements for further discussion on impairment of real estate inventories.

There were no such real estate impairment losses recorded for the three months ended March 31, 2016.

There were no other non-financial fair value measurements for the three months ended March 31, 2017 and year ended December 31, 2016.

21

9. EQUITY

Noncontrolling Interest

As of March 31, 2017 and December 31, 2016, the Company held an economic interest in UCP, LLC and is its sole managing member of approximately 43.3% and 43.2%, respectively. The noncontrolling interest reported in the accompanying unaudited condensed consolidated financial statements includes PICO’s 56.7% and 56.8% share of the income related to UCP, LLC as of March 31, 2017 and December 31, 2016, respectively.

The carrying value and ending balance as of March 31, 2017 and December 31, 2016 of the noncontrolling interest was calculated as follows (in thousands):

March 31, 2017 | December 31, 2016 | ||||||

Beginning balance of noncontrolling interest | $ | 126,258 | $ | 127,208 | |||

Net income attributable to noncontrolling interest | 2,310 | 5,210 | |||||

Re-allocation of stock issuances | (411 | ) | (1,962 | ) | |||

Stock-based compensation expense attributable to noncontrolling interest | 236 | 657 | |||||

Stock issuance attributable to noncontrolling interest | (158 | ) | (25 | ) | |||

Distribution to noncontrolling interest | (1,909 | ) | (4,830 | ) | |||

Ending balance of noncontrolling interest | $ | 126,326 | $ | 126,258 | |||

The distribution to the noncontrolling interest relates to cash distributions, which we refer to as “tax distributions,” that UCP, LLC is obligated to make as noted in the Company’s Annual Report on Form 10-K that was filed with the SEC on March 3, 2017.

Stock Repurchase Program

As part of the Board approved Stock Repurchase Program, between June 7, 2016 and June 1, 2018, management is authorized to repurchase up to $5.0 million of the Company’s Class A common stock in open market purchases, privately negotiated transactions or other transactions. The Stock Repurchase Program is subject to prevailing market conditions and other considerations, including our liquidity, the terms of our debt instruments, planned land investment and development spending, acquisition and other investment opportunities and ongoing capital requirements.

Since inception of the program through March 31, 2017, the Company repurchased an aggregate of 146,346 shares of Class A common stock for total consideration of $1.2 million, inclusive of commissions. The remaining value of shares that may be repurchased under the Stock Repurchase Program as of March 31, 2017 is approximately $3.8 million. For the three months ended March 31, 2017, the Company had no stock repurchases.

Re-Allocation from Stock Issuances

The Company allocates Class A common stock issued in connection with the vesting of RSUs issued under the UCP, Inc. 2013 Long-Term Incentive Plan (the “LTIP”) and stock-based compensation expense between additional paid-in-capital and noncontrolling interest within its accompanying unaudited condensed consolidated statements of equity. The equity allocations for the noncontrolling interest are based on the economic and voting interest percentages of the Company and its noncontrolling interest holder, PICO. Issuances of Class A common stock for RSUs affect the economic and voting interest percentages, which accordingly are adjusted at the end of each issuance period. The economic and voting interest percentages prevailing during the period are used to determine the current period equity allocations for the noncontrolling interest.

22

Stock-Based Compensation

The LTIP was adopted in July 2013 and provides for the grant of equity-based awards, including options to purchase shares of Class A common stock, Class A stock appreciation rights, Class A restricted stock, Class A RSUs and performance awards. The LTIP automatically expires on the tenth anniversary of its effective date. The Company’s board of directors may terminate or amend the LTIP at any time, subject to any stockholder approval required by applicable law, rule or regulation.

The number of shares of the Company’s Class A common stock authorized under the LTIP was 1,834,300 shares. To the extent that shares of the Company’s Class A common stock subject to an outstanding option, stock appreciation right, stock award or performance award granted under the LTIP are not issued or delivered by reason of the expiration, termination, cancellation or forfeiture of such award or the settlement of such award in cash, then such shares of the Company’s Class A common stock generally shall again be available under the LTIP, subject to certain exceptions.

The RSUs and Options granted to the Company’s employees and certain members of the Company’s board of directors are subject to the following vesting schedule:

Grant period | Award(s) Granted | Grant Recipient(s) | Vesting Schedule | |||

Year ended December 31, 2014 | RSUs and Options | Company’s employees | a) 10% vested on the first anniversary of the grant date, b) 20% vest on second anniversary of the grant date, c) 30% vest on the third anniversary of the grant date, and d) 40% vest on the fourth anniversary of the grant date | |||

Second quarter of 2016 | RSUs | Company’s employees | a) 20% vested on the first anniversary of the grant date, b) 20% vest on second anniversary of the grant date, c) 20% vest on the third anniversary of the grant date, d) 20% vest on the fourth anniversary of the grant date, and e) 20% vest on the fifth anniversary of the grant date | |||

Third quarter of 2016 | RSUs | Certain members of the Company’s board of directors | a) 25% vested on August 5, 2016, b) 25% vest on November 4, 2016, c) 25% vest on February 3, 2017, and d) 25% vest on May 4, 2017 | |||

First quarter of 2017 | RSUs | Company’s employees | a) 20% vested on the first anniversary of the grant date, b) 20% vest on second anniversary of the grant date, c) 20% vest on the third anniversary of the grant date, d) 20% vest on the fourth anniversary of the grant date, and e) 20% vest on the fifth anniversary of the grant date | |||

The grant-date fair value of the RSUs granted during the three months ended March 31, 2017 was $4.5 million. There were no Options granted during the three months ended March 31, 2017. For the three months ended March 31, 2016, there were no RSUs nor Options granted.

During the three months ended March 31, 2017, the Company recognized $0.4 million of stock-based compensation expense, which was, included in G&A expenses in the accompanying unaudited condensed consolidated statements of operations and other comprehensive income or loss. For the three months ended March 31, 2016, the Company recognized $0.2 million of stock-based compensation expense.

23

The following table summarizes the Options activity for the three months ended March 31, 2017 and 2016:

Shares | Weighted Average Exercise Price | Weighted Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands)(1) | |||||||

Outstanding at December 31, 2015 | 149,605 | $ | 16.20 | 8.20 | — | |||||

Options granted | — | — | — | — | ||||||

Options exercised | — | — | — | — | ||||||

Options forfeited | — | — | — | — | ||||||

Outstanding at March 31, 2016 | 149,605 | $ | 16.20 | 7.90 | — | |||||

Outstanding at December 31, 2016 | 116,652 | $ | 16.20 | 7.20 | — | |||||

Options granted | — | — | — | — | ||||||

Options exercised | — | — | — | — | ||||||

Options forfeited | — | — | — | — | ||||||

Outstanding at March 31, 2017 | 116,652 | $ | 16.20 | 6.90 | — | |||||

Options vested and exercisable as of March 31, 2017 | 69,992 | $ | 16.20 | — | — | |||||

Options expected to vest as of March 31, 2017 | 46,660 | |||||||||

(1) | The aggregate intrinsic value is calculated as the amount by which the fair value of the underlying stock exceeds the exercise price of the Option. The fair value of the Company’s Class A common stock as of March 31, 2017 was $10.15 per share. |

The Company uses the Black-Scholes option pricing model to determine the fair value of Options.

The following table summarizes the RSU activity for the three months ended March 31, 2017 and 2016:

Number of Shares | Weighted Average Grant Date Fair Value (per share) | |||||

Outstanding and unvested at December 31, 2015 | 48,531 | $15.99 | ||||

Granted | — | — | ||||

Vested | (18,610 | ) | $16.20 | |||

Forfeited | — | — | ||||

Outstanding and unvested at March 31, 2016 | 29,921 | $15.86 | ||||

Outstanding and unvested at December 31, 2016 | 284,313 | $8.88 | ||||

Granted | 383,288 | $ | 11.70 | |||

Vested | (85,387 | ) | $ | 9.22 | ||

Forfeited | — | — | ||||

Outstanding and unvested at March 31, 2017 | 582,214 | $10.69 | ||||

Unrecognized compensation cost for RSUs and Options issued under the LTIP was $6.1 million (net of estimated forfeitures) as of March 31, 2017; approximately $5.8 million of the unrecognized compensation costs related to RSUs and $0.3 million related to Options. The compensation expense is expected to be recognized over a weighted average period of 4.4 years for the RSUs and 0.9 years for the Options.

24

10. SEGMENT INFORMATION

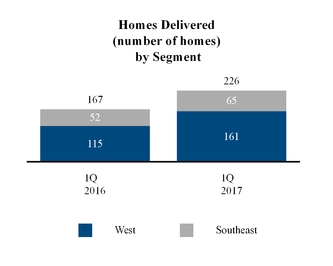

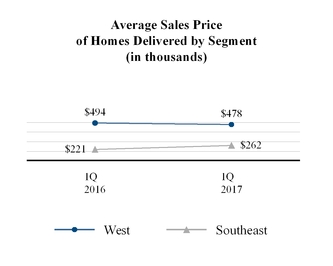

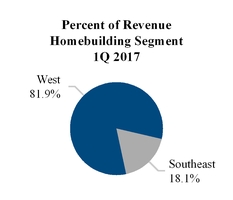

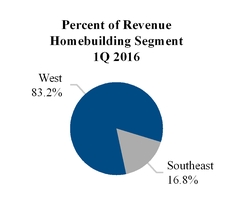

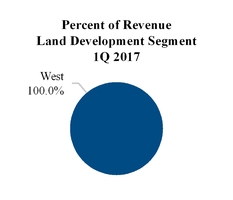

The Company segmented its operating activities into two operating segments, West and Southeast, and two reportable segments, Homebuilding and Land development.

Operating Segments | Reportable Segments | State | ||

West | Homebuilding | California, Washington | ||

Land development | California, Washington | |||

Southeast | Homebuilding | North Carolina, South Carolina, Tennessee | ||

Land development | North Carolina, South Carolina, Tennessee | |||

Each reportable segment includes real estate with similar economic characteristics, including similar historical and expected long-term gross margin percentages, product types, geography, production processes and methods of distribution.

The reportable segments follow the same accounting policies as the accompanying unaudited condensed consolidated financial statements described in Note 1, “Organization, Basis of Presentation and Summary of Significant Accounting Policies.” Operating results of each reportable segment are not necessarily indicative of the results that would have been achieved had the reportable segment been an independent, stand-alone entity during the periods presented.