Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GATX CORP | gmt-201603088xkoverviewofg.htm |

GATX Corporation 2016 Raymond James Annual Institutional Investors Conference Unless otherwise noted, GATX is the source for data provided

2 NYSE: GMT Forward-Looking Statements Forward-looking statements in this presentation that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements that reflect our current views with respect to, among other things, future events, financial performance and market conditions. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would,” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Specific risks and uncertainties include, but are not limited to, (1) inability to maintain our assets on lease at satisfactory rates, (2) weak economic conditions, financial market volatility, and other factors that may decrease demand for our assets and services, (3) decreased demand for portions of our railcar fleet due to adverse changes in commodity prices, including, but not limited to, sustained low crude oil prices, (4) events having an adverse impact on assets, customers, or regions where we have a large investment, (5) operational disruption and increased costs associated with increased railcar assignments following non-renewal of leases, compliance maintenance programs, and other maintenance initiatives, (6) financial and operational risks associated with long-term railcar purchase commitments, (7) reduced opportunities to generate asset remarketing income, (8) changes in railroad efficiency that could decrease demand for railcars; (9) operational and financial risks related to our affiliate investments, including the RRPF affiliates; (10) fluctuations in foreign exchange rates, (11) failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees, (12) the impact of new regulatory requirements for tank cars carrying crude, ethanol, and other flammable liquids, (13) deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs, (14) asset impairment charges we may be required to recognize, (15) competitive factors in our primary markets, (16) risks related to international operations and expansion into new geographic markets, (17) exposure to damages, fines, and civil and criminal penalties arising from a negative outcome in our pending or threatened litigation, (18) changes in or failure to comply with laws, rules, and regulations, (19) inability to obtain cost-effective insurance, (20) environmental remediation costs, (21) inadequate allowances to cover credit losses in our portfolio, and (22) other risks discussed in our filings with the US Securities and Exchange Commission (SEC), including our form 10-K for the year ended December 31, 2015, and our subsequently filed form 10-Q reports, all of which are available on the SEC’s website (www.sec.gov). Investors should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. The Company undertakes no obligation to publicly update or revise these forward-looking statements. Investor, corporate, financial, historical financial, photographic and news release information may be found at www.gatx.com.

3 GATX Corporation Clear vision and rich history Vision We strive to be recognized as the finest railcar leasing company in the world by our customers, our shareholders, our employees and the communities where we operate. History 1898 1919 2016 Founded as a railcar lessor Initiated quarterly dividends • Railcar leasing remains primary business • 96th consecutive year of uninterrupted dividends

4 Leading Market Positions Rail North America 69% Other 3% Asset Mix $7.4 billion NBV (assets on- and off-balance sheet) as of 12/31/15 Rail International 15% Portfolio Management 9% ASC(2) 4% Rail North America • One of the largest railcar lessors • 2nd largest tank car lessor • Diversified fleet and customer mix • Extensive maintenance network Rail International • 2nd largest European tank car lessor • Largest railcar lessor in India American Steamship Company • Largest US-flagged vessel operator on the Great Lakes Portfolio Management • RRPF affiliates(1) is the largest lessor of Rolls-Royce spare aircraft engines (1) Rolls-Royce & Partners Finance affiliates; a collection of 50%-owned joint ventures with Rolls-Royce plc (2) American Steamship Company See the Appendix for a reconciliation of non-GAAP measures

5 Owned 124,600 Affiliate 2,400 Managed 600 Total 127,600 Owned 23,000 GATX owns, manages or has an interest in more than 151,000 railcars worldwide, making it the largest global railcar lessor. Strong Global Presence Fleet data as of 12/31/15 Early stage presence in India

6 GATX Worldwide Railcar Fleet Refiners & Other Petroleum 30% Chemicals & Plastics 22% Railroads & Other Transports 18% Food & Agriculture 9% Mining, Minerals & Aggregates 11% Other 10% Industries Served Based on 2015 Rail North America & Rail International revenues General- Service Tank Cars 38% High-Pressure Tank Cars 11% Specialty & Acid Tank Cars 7% Gravity Covered Hoppers 11% Pneumatic & Specialty Covered Hoppers 9% Boxcars 12% Open-Top Cars 8% Other 4% Car Types Approximately 148,000 railcars as of 12/31/15

7 A Leader in Tank Car Leasing (1) UMLER as of January 2016 (2) GATX management estimate as of 12/31/15 GATX Rail Europe 26% VTG 36% Ermewa 19% Other 19% European Tank Car Leasing Market(2) Approximately 77,000 tank cars GATX 19% Union Tank Car 39% Trinity 15% ARL 8% Other 10% North American Tank Car Leasing Market(1) Approximately 313,300 tank cars CIT 9%

8 Creating Value through Railcar Leasing Railcar Leasing is our Core BUY the railcar at an economically attractive and competitively advantaged price LEASE the railcar to a quality customer at an attractive rate for a term that reflects the economic cycle SERVICE the railcar in a manner that maximizes safety, in-use time and customer satisfaction MAXIMIZE the value of the railcar by selling or scrapping at the appropriate time

9 BUY - Opportunistic Investments NEW RAILCARS Committed new railcar orders ensure a supply of new cars to meet customer needs in North America • Order for 12,500 railcars to deliver over a five-year period placed in early 2011 • Order for up to 8,950 railcars to deliver over a four-year period beginning in 2016 Investing in new tank cars in Europe as customers are focused on modernizing their rail fleets SECONDARY MARKET Acquired a fleet of more than 18,500 boxcars for $340 million in 2014 Acquired attractively priced railcars in North America during the downturn (late 2008 through 2010) • Invested nearly $1 billion for more than 18,000 cars

10* 12/31/15 Customer families sometimes include more than one customer account, therefore the S&P or equivalent ratings noted generally reflect the credit quality of the rated parent entity. Lease obligations of subsidiaries are not necessarily guaranteed by the rated parent entity. • Approximately 800 Rail North America customers − No customer exceeds 5.5% of GATX’s total lease income • Strong credit profile − Nearly 66% of the top 50 customer families are investment grade • Long-standing relationships − Average relationship tenure among top ten customers is 43 years LEASE - Impressive Worldwide Customer Base AAA & AA 10% A 22% BBB 34% BB or < 16% Not rated / Private 18% Credit Ratings of Top 50 Customer Families*

11 LEASE - Managing Through Cycles 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Approximate # of railcars(1) scheduled for renewal 20,000 20,000 17,500 15,000 17,000 21,000 20,000 21,000 20,000 17,000 15,000 LP I(2 ) d at a Rate change 16.8% 13.5% 5.2% -11.0% -15.8% 6.9% 25.6% 34.5% 38.8% 32.2% Flat to Slightly UpTerm (months) 64 67 63 41 35 45 60 62 66 54 Renewal success rate 77% 73% 60% 54% 62% 77% 82% 81% 86% 81% In favorable environments, GATX increases lease rates and stretches lease terms In weak environments, GATX shortens lease terms (1) Excludes the boxcar fleet (2) LPI = Lease Price Index: The average renewal lease rate change is reported as the % change between the average renewal lease rate and the average expiring lease rate, weighted by GATX’s North American fleet composition, excluding boxcars. North American railcar fleet(1): • Leases are typically fixed rate, paid monthly • The average remaining lease term is approximately four years

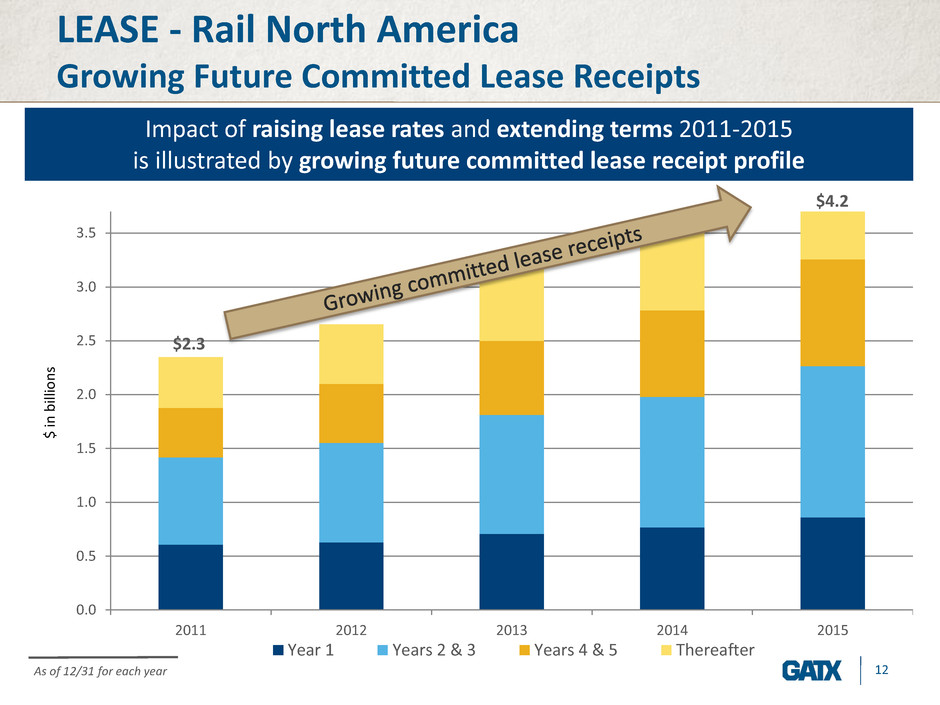

12 LEASE - Rail North America Growing Future Committed Lease Receipts 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2011 2012 2013 2014 2015 $ in b illi o n s Year 1 Years 2 & 3 Years 4 & 5 Thereafter Impact of raising lease rates and extending terms 2011-2015 is illustrated by growing future committed lease receipt profile As of 12/31 for each year $2.3 $4.2

13 • GATX consistently provides safe, reliable equipment and superior service to help our customers achieve their business objectives • Tank cars are service-intensive assets − GATX is a full-service railcar lessor − Customers value the high-quality service GATX provides • Extensive maintenance network in North America − Six major maintenance facilities − Five field maintenance facilities − Fourteen mobile units − Six customer site locations − Third party maintenance facilities • In 2015, GATX performed an aggregate of 79,000 maintenance events in its owned and third-party maintenance network in North America • In Europe, GATX has major maintenance facilities in Germany and Poland SERVICE - Maintaining Equipment to the Highest Standards Safety is GATX’s top priority

14 MAXIMIZE Value GATX continually optimizes its railcar fleet • Capitalizes on market dynamics • Maintains a diversified, high-performing railcar fleet GATX typically realizes gains when railcars are scrapped at the end of their useful lives Rail North America 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Approximate # of railcars sold 2,200 1,700 2,900 1,100 1,400 1,800 2,000 3,700 2,100 3,514 Asset remarketing income (millions) $19.7 $32.2 $31.4 $13.8 $17.4 $27.4 $45.7 $54.5 $62.6 $67.4 Rail North America & Rail International 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Approximate # of railcars scrapped 2,800 2,500 4,300 4,400 3,800 3,700 2,700 3,200 3,300 2,400 Scrapping gains (millions) $14.4 $15.4 $29.4 $9.7 $18.0 $27.0 $19.2 $20.7 $16.1 $9.5

15 Rail Market Environment Rail North America • 2015 leasing environment was consistent with our outlook coming into the year −Fleet utilization remained above 99% (excluding boxcars) −LPI showed a positive 32.2% renewal change (excluding boxcars) −Investment volume was approximately $525 million GATX used strong rail market of the last few years to optimize our fleet In 2016, only 12,500 cars with renewal lease exposure Many car types are experiencing decreasing demand Focus on maintaining utilization and shortening lease terms Rail International Trend toward newer, more efficient tank cars in Europe −High fleet utilization due to quick placement of new cars as customers upgrade fleets

16 American Steamship Company Capacity of US-flagged Vessel Operators* * GATX management estimate 12/31/15 ASC 35% Interlake Steamship Company 24% Great Lakes Fleet, Inc. 20% Grand River Navigation 10% Central Marine Logistics 7% Other 4% Total annual industry capacity 104 million net tons • ASC provides transportation of dry bulk commodities on the Great Lakes • ASC has been operating for more than 100 years, joining GATX in 1973 • Fleet of 17 self-unloading vessels − No shore-side assistance required − Can operate 24 hours a day, seven days a week

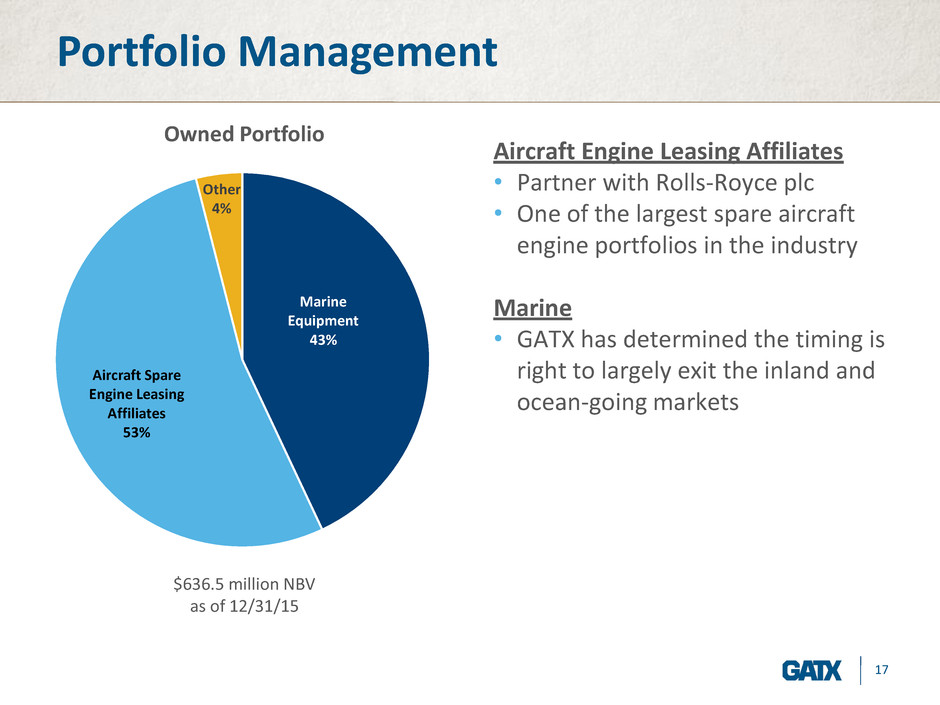

17 Portfolio Management Aircraft Engine Leasing Affiliates • Partner with Rolls-Royce plc • One of the largest spare aircraft engine portfolios in the industry Marine • GATX has determined the timing is right to largely exit the inland and ocean-going markets Marine Equipment 43% Aircraft Spare Engine Leasing Affiliates 53% Other 4% Owned Portfolio $636.5 million NBV as of 12/31/15

18 Portfolio Management Rolls-Royce and Partners Finance affiliates (RRPF) • GATX established its first partnership with Rolls-Royce plc in 1998 • Lease spare aircraft engines to commercial airlines and Rolls- Royce plc − The largest Rolls-Royce spare aircraft engine portfolio in the industry, with more than 435 engines* • History of strong and stable earnings through market cycles Based on NBV of approximately $3 billion 100% of RRPF’s portfolio as of 12/31/15 * As of 12/31/15 Trent 700 (A330) 30% V2500 (A320) 18% Trent 900 (A380) 13% Trent 800 (B777) 9% Trent 500 (A340 - 500/600) 6% XWB (A350) 9% Other 15% RRPF ENGINE TYPES

19 $2.54 $3.07 $3.49 $1.97 $1.59 $2.01 $2.81 $3.50 $4.48 $5.37 $5.25- $5.45 13% 14% 15% 9% 7% 9% 11% 13% 15% 18% ~17% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 0.00 1.00 2.00 3.00 4.00 5.00 6.00 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016F R O E $ p er s h ar e EPS ROE Financial Results • EPS and ROE exclude Tax Adjustments and Other Items. See the Appendix for a reconciliation of these non-GAAP measures. • 2016 Forecast is based on management’s EPS guidance range of $5.25 to $5.45 per diluted share as of January 2016. • Effective January 1, 2014, GATX changed the depreciable lives of the North American railcar fleet. The impact of this change is a $0.31 increase in earnings per diluted share and an approximately 1% increase in ROE in 2014.

20 Summary • GATX has been a market force in the rail industry for more than 117 years • GATX provides premium assets and services to a high-quality customer base • GATX is making disciplined investments in North America and in International rail markets • GATX is focused on generating attractive, risk-adjusted returns for our shareholders

21 Appendix

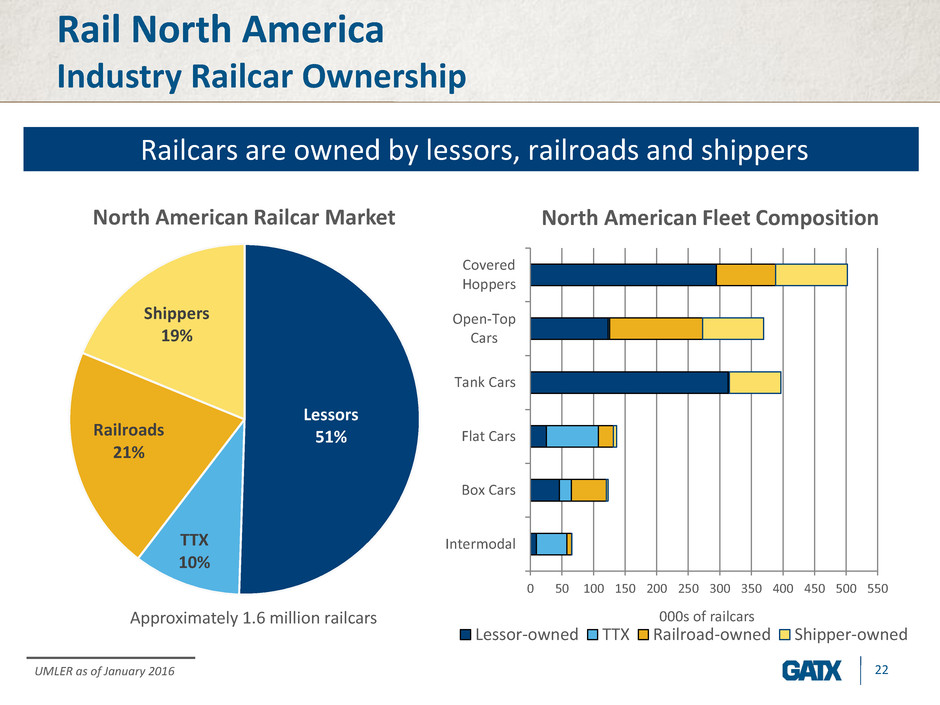

22 Rail North America Industry Railcar Ownership Lessors 51% TTX 10% Railroads 21% Shippers 19% Railcars are owned by lessors, railroads and shippers UMLER as of January 2016 North American Railcar Market Approximately 1.6 million railcars 0 50 100 150 200 250 300 350 400 450 500 550 Intermodal Box Cars Flat Cars Tank Cars Open-Top Cars Covered Hoppers Lessor-owned TTX Railroad-owned Shipper-owned 000s of railcars North American Fleet Composition

23 Railcar Manufacturing Backlog Railway Supply Institute North American Railcar Manufacturing Backlog 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 • Cyclicality of the industry is illustrated by the backlog of orders at the railcar manufacturers • The recent increase in tank car backlog is primarily due to growth in energy markets 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Tank Freight

24 Rail North America Managing Through Cycles • GATX used the strong market (2004 – early 2008) to prepare for the downturn • GATX maintained solid utilization throughout the downturn (late 2008 – 2010) • When the market improved, GATX increased lease rates and extended lease terms while maintaining high utilization (2011 – 2015) GATX Rail North America Fleet Utilization* 80% 82% 84% 86% 88% 90% 92% 94% 96% 98% 100% 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 1 Q 1 5 2 Q 1 5 3 Q 1 5 4 Q 1 5 95% 90% 99% * Excludes the boxcar fleet

25 6% 15% 12% 10% 4% 5% 8% 7% 3% 15% 10% 5% Rail North America GATX’s Fleet by Car Type 1 2 3 4 5 6 7 8 9 11 General-Service Tank Cars: 13K - 19K gallon General-Service Tank Cars: 20K – 25K gallon General-Service Tank Cars: >25K gallon High-Pressure Tank Cars Other Specialty Tank Cars Gravity Covered Hoppers: <4K cubic feet Gravity Covered Hoppers: >4K cubic feet Pneumatic Covered Hoppers Specialty Covered Hoppers Boxcars Open-Top Cars Other 1 2 3 4 5 6 7 8 9 11 12 12 Approximately 125,000 wholly owned cars 10 10 * As of 12/31/15

26 Rail North America GATX’s Car Types & Typical Commodities General-Service 13K-19K gallon 20K–25K gallon >25K gallon High-Pressure Other Specialty Covered Hoppers Gravity >4K cf Specialty Boxcars <4K cf Pneumatic OtherOpen-Top Cars sand cement roofing granules fly ash dry chemicals grain sugar fertilizer lime soda ash bentonite plastic pellets flour corn starch mineral powder lime clay cement aggregates coal pet coke met coke woodchips scrap metal steel coils flat cars intermodal automotive paper products lumber canned goods food and beverages molten sulfur clay slurry caustic soda corn syrup liquid fertilizers fuel oils asphalt food-grade oils chemicals (styrene, glycols, etc.) LPG VCM propylene carbon dioxide acids (sulfuric, hydrochloric, phosphoric, acetic, nitric, etc.) coal tar pitch dyes & inks specialty chemicals ethanol & methanol food-grade oils lubricating oils light chemicals (solvents, isopentane, alkylates, etc.) light petroleum products (crude oil, fuel oils, diesel, gasoline, etc.) Ta n k Ca rs Fr eig h t C ar s

27 Active Participant in the Regulatory Landscape ECONOMICS STB Surface Transportation Board SAFETY NTSB National Transportation Safety Board REGULATE/ ENFORCE DOT Dept of Transportation SECURITY DHS Department of Homeland Security TSA Transportation Security Administration AAR Association of American Railroads FRA Federal Railroad Administration PHMSA Pipeline and Hazardous Material Safety Administration Office of Safety SOMC Safety & Operations Mgmt Committee Railinc TTCI Transpor- tation Technology Center NEMC Network Efficiency Mgmt Committee TSWC Tech. Services Working Committee Interchange Rules / Stds. RMWC Risk Mgmt. Working Committee Environment & HAZMAT Tech. Subcommittees ARB Arbitration & Rules Committee Tank Car Committee * GATX interacts with agencies and routinely participates in or interacts with committees indicated in blue U.S. Government

28 Energy-related Railcar Demand Railcars • We are monitoring demand for small cube covered hoppers to transport frac sand and large tank cars to transport crude oil − Total manufacturing backlog of about 111,000 railcars(1), including approximately − 23,600 small cube covered hoppers − 30,800 tank cars The Market • Approximately 49,000 tank cars in crude service(2) • Crude-carrying cars subject to new regulations • Potential oversupply of energy-related railcar types may be impacted by: − Crude-oil price −Regulatory issues − Pipeline capacity (1) Railway Supply Institute as of 12/31/15 (2) Railway Supply Institute as of 6/30/14

29 GATX’s Prudent Approach to serving customers in the energy industry Limited exposure • Approximately 2,800 cars in frac sand service* • Approximately 2,500 cars in crude service* • GATX’s railcars serving these markets are: − Leased to customers with high credit ratings − On long-term leases Focus on safety • Safety is GATX’s top priority − GATX will move expeditiously to meet the new mandated regulatory deadlines Diverse customer base • GATX seeks a mix of growth opportunities in petroleum products, chemicals, food, agriculture and other industries * As of 12/31/15

30 Modification deadlines Tank cars in flammable liquid service Earliest deadlines for modification of existing cars • Approximately 13,700 GATX tank cars may be affected* • Modification deadline for approximately 90% of GATX’s potentially affected cars in 2023 or later* • Will not modify Legacy cars No jacket Jacket PG I (crude oil) May 2017 March 2018 PG II (ethanol) May 2023 May 2023 PG III May 2025 May 2025 PG I (crude oil) April 2020 May 2025 PG II (ethanol) July 2023 May 2025 PG III May 2025 May 2025 Le gac y G o o d Fait h * As of 12/31/15

31 Rail International GATX Rail Europe (GRE) Petroleum Wagons 65% LPG Wagons 14% Chemical Wagons 13% Bulk Wagons 8% Fleet Structure Approximately 23,000 railcars as of 12/31/15 Germany 40% Poland 26% Austria 12% Hungary 4% Czech Republic 3% Slovakia 3% Other 8% Geographies Served Based on 2015 GRE revenues Netherlands 4%

32 Rail International GRE Car Types & Typical Commodities Tank Wagons Chemical WagonsLPG Wagons Bulk Wagons Petroleum Wagons light mineral oil products - gasoline - jet fuel - diesel oils - light heating oils dark mineral oil products - heavy heating oils - lubricating oils - coal tar - bitumen - asphalt propane butane propylene butadiene light carbohydrate fractions cooling gas mixtures liquid fertilizers acids (hydrochloric, sulphur, phosphoric, etc.) bases (carbohydrate solutions, soda lye, sodium hypochlorite, etc.) aromas (benzene, toluene, xylenes, phenol, etc.) liquid sulphur hydrogen peroxide resins and glues solvents lime cement coal dust coal coke gravel sand silica sand

33 Operating Cash Flow and Portfolio Proceeds Strong Operating Cash Flow and Portfolio Proceeds $293 $340 $364 $267 $244 $307 $370 $401 $449 $534 $123 $247 $156 $68 $84 $154 $289 $385 $264 $482 0 200 400 600 800 1,000 1,200 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 $ in milli o n s Operating Cash Flow Portfolio Proceeds Continuing operations

34 Strong Balance Sheet 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 BBB-/Baa3 BBB/Baa2 Total Recourse Debt = On-Balance-Sheet Recourse Debt + Off-Balance-Sheet Recourse Debt + Capital Lease Obligations + Commercial Paper and Bank Credit Facilities, Net of Unrestricted Cash GATX primarily issues unsecured debt, leaving its assets largely unencumbered Sold aircraft leasing business & reduced leverage and secured assets

35 Reconciliation of non-GAAP measures

36 Reconciliation of Non-GAAP Measures Net Income Measures Net Income 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 (in millions) Net Income (GAAP) 147.3$ 183.8$ 194.8$ 81.4$ 80.8$ 110.8$ 137.3$ 169.3$ 205.0$ 205.3$ Tax Adjustments (5.9) (20.1) (6.8) (7.4) (11.4) (8.9) (24.0) 11.7 6.4 Other Items: Net loss on wholly owned Portfolio Management marine investments, net of taxes 5.7 Early retirement program, net of taxes 5.6 Impairment loss on Portfolio Management affiliate 11.9 Realized/unrealized (gains)/losses on interest rate swaps at AAE 20.7 9.3 (0.2) 20.5 (6.9) Pretax gain on sale of AAE (9.3) Litigation recoveries, no tax effect (4.1) (3.2) Gain on sale of office building (9.8) Environmental reserve reversal (6.6) Leveraged lease adjustment, net of tax (3.5) Net Income, excluding Tax Adjustments and Other Items 141.4$ 163.7$ 171.6$ 94.7$ 74.6$ 95.0$ 133.8$ 164.8$ 205.0$ 234.9$ Earnings per Share 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Diluted EPS (GAAP) 2.64$ 3.43$ 3.88$ 1.70$ 1.72$ 2.35$ 2.88$ 3.59$ 4.48$ 4.69$ Tax Adjustments (0.10) (0.36) (0.13) (0.15) (0.24) (0.19) (0.50) (0.24) 0.14 Other Items: Net loss on wholly owned Portfolio Management marine investments, net of taxes 0.13 Early retirement program, net of taxes 0.13 Impairment loss on Portfolio Management affiliate 0.27 Realized/unrealized (gains)/losses on interest rate swaps at AAE 0.06 0.42 0.20 0.43 (0.15) Pretax gain on sale of AAE 0.30 Litigation recoveries, no tax effect (0.09) (0.07) Gain on sale of office building (0.19) Environmental reserve reversal (0.13) Leveraged lease adjustment, net of tax (0.08) Net Income, excluding Tax Adjustments and Other Items * 2.54 3.07 3.49 1.97 1.59 2.01 2.81 3.50 4.48 5.37

37 Reconciliation of Non-GAAP Measures Balance Sheet Measures On- and Off-Balance Sheet Assets 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Consolidated on-balance-sheet assets 4,646.6$ 4,723.2$ 5,190.5$ 5,206.4$ 5,442.4$ 5,846.0$ 6,044.7$ 6,535.5$ 6,919.9$ 6,894.2$ Less: Assets of discontinued operations 232.2 - - - - - - - - - 4,414.4 4,723.2 5,190.5 5,206.4 5,442.4 5,846.0 6,044.7 6,535.5 6,919.9 6,894.2 Off-balance-sheet assets: Rail North America 1,313.0 1,230.1 1,056.5 1,012.1 968.1 884.5 863.5 887.9 606.1 488.7 ASC - - - - - - 21.0 16.5 11.7 6.8 Portfolio Management 8.0 5.8 4.7 4.0 3.4 2.6 - - - - Total On- and Off-Balance-Sheet-Assets 5,735.4$ 5,959.1$ 6,251.7$ 6,222.5$ 6,413.9$ 6,733.1$ 6,929.2$ 7,439.9$ 7,537.7$ 7,389.7$