Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - GATX CORP | gatx20170930-exhibit32.htm |

| EX-31.B - EXHIBIT 31B - GATX CORP | gatx20170930-exhibit31b.htm |

| EX-31.A - EXHIBIT 31A - GATX CORP | gatx20170930-exhibit31a.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

FORM 10-Q

__________________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-2328

GATX Corporation

(Exact name of registrant as specified in its charter)

New York | 36-1124040 |

(State of incorporation) | (I.R.S. Employer Identification No.) |

222 West Adams Street | |

Chicago, Illinois 60606-5314 | |

(Address of principal executive offices, including zip code) | |

(312) 621-6200 | |

(Registrant's telephone number, including area code) | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company (as defined in Rule 12b-2 of the Exchange Act).

x | Large accelerated filer | ¨ | Accelerated filer | ||

¨ | Non-accelerated filer | ¨ | Smaller reporting company | ||

¨ | Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Common shares outstanding were 38.3 million at September 30, 2017.

GATX CORPORATION

FORM 10-Q

QUARTERLY REPORT FOR THE PERIOD ENDED SEPTEMBER 30, 2017

INDEX

Item No. | Page No. | |

Part I - FINANCIAL INFORMATION | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II - OTHER INFORMATION | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 6. | ||

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and, accordingly, involve known and unknown risks and uncertainties that are difficult to predict and could cause our actual results, performance, or achievements to differ materially from those discussed. These statements include statements as to our future expectations, beliefs, plans, strategies, objectives, events, conditions, financial performance, prospects, or future events. In some cases, forward-looking statements can be identified by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,” and “would”, and similar words and phrases. Forward-looking statements are necessarily based on estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Accordingly, you should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and are not guarantees of future performance. We do not undertake any obligation to publicly update or revise these forward-looking statements.

A detailed discussion of the known material risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our Annual Report on Form 10-K for the year ended December 31, 2016, and in our other filings with the Securities and Exchange Commission ("SEC"). The following factors, in addition to those discussed under "Risk Factors", in our Annual Report on Form 10-K for the year ended December 31, 2016, could cause actual results to differ materially from our current expectations expressed in forward looking statements:

• exposure to damages, fines, criminal and civil penalties, and reputational harm arising from a negative outcome in litigation, including claims arising from an accident involving our railcars • inability to maintain our assets on lease at satisfactory rates due to oversupply of railcars in the market or other changes in supply and demand• weak economic conditions and other factors that may decrease demand for our assets and services • decreased demand for portions of our railcar fleet due to adverse changes in the price of, or demand for, commodities that are shipped in our railcars• higher costs associated with increased railcar assignments following non-renewal of leases, customer defaults, and compliance maintenance programs or other maintenance initiatives• events having an adverse impact on assets, customers, or regions where we have a concentrated investment exposure• financial and operational risks associated with long-term railcar purchase commitments• reduced opportunities to generate asset remarketing income• operational and financial risks related to our affiliate investments, including the Rolls-Royce & Partners Finance joint ventures (collectively the “RRPF affiliates”)• fluctuations in foreign exchange rates | • failure to successfully negotiate collective bargaining agreements with the unions representing a substantial portion of our employees• changes in railroad operations that could decrease demand for railcars, either due to increased railroad efficiency or decreased attractiveness of rail service relative to other modes• the impact of regulatory requirements applicable to tank cars carrying crude, ethanol, and other flammable liquids• asset impairment charges we may be required to recognize• deterioration of conditions in the capital markets, reductions in our credit ratings, or increases in our financing costs• competitive factors in our primary markets, including competitors with a significantly lower cost of capital than GATX• risks related to international operations and expansion into new geographic markets• changes in, or failure to comply with, laws, rules, and regulations• inability to obtain cost-effective insurance • environmental remediation costs• inadequate allowances to cover credit losses in our portfolio• inability to maintain and secure our information technology infrastructure from cybersecurity threats and related disruption of our business | |

1

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

September 30 | December 31 | ||||||

2017 | 2016 | ||||||

(Unaudited) | |||||||

Assets | |||||||

Cash and Cash Equivalents | $ | 199.2 | $ | 307.5 | |||

Restricted Cash | 3.7 | 3.6 | |||||

Receivables | |||||||

Rent and other receivables | 83.2 | 85.9 | |||||

Finance leases | 139.1 | 147.7 | |||||

Less: allowance for losses | (6.5 | ) | (6.1 | ) | |||

215.8 | 227.5 | ||||||

Operating Assets and Facilities | 8,915.9 | 8,446.4 | |||||

Less: allowance for depreciation | (2,814.6 | ) | (2,641.7 | ) | |||

6,101.3 | 5,804.7 | ||||||

Investments in Affiliated Companies | 449.3 | 387.0 | |||||

Goodwill | 84.6 | 78.0 | |||||

Other Assets | 208.0 | 297.1 | |||||

Total Assets | $ | 7,261.9 | $ | 7,105.4 | |||

Liabilities and Shareholders’ Equity | |||||||

Accounts Payable and Accrued Expenses | $ | 133.8 | $ | 174.8 | |||

Debt | |||||||

Commercial paper and borrowings under bank credit facilities | 15.7 | 3.8 | |||||

Recourse | 4,266.7 | 4,253.2 | |||||

Capital lease obligations | 12.8 | 14.9 | |||||

4,295.2 | 4,271.9 | ||||||

Deferred Income Taxes | 1,157.7 | 1,089.4 | |||||

Other Liabilities | 205.0 | 222.1 | |||||

Total Liabilities | 5,791.7 | 5,758.2 | |||||

Shareholders’ Equity | |||||||

Common stock, $0.625 par value: Authorized shares — 120,000,000 Issued shares — 67,071,263 and 66,953,606 Outstanding shares — 38,311,330 and 39,442,893 | 41.6 | 41.5 | |||||

Additional paid in capital | 695.8 | 687.8 | |||||

Retained earnings | 1,936.2 | 1,828.0 | |||||

Accumulated other comprehensive loss | (129.4 | ) | (211.1 | ) | |||

Treasury stock at cost (28,759,933 and 27,510,713 shares) | (1,074.0 | ) | (999.0 | ) | |||

Total Shareholders’ Equity | 1,470.2 | 1,347.2 | |||||

Total Liabilities and Shareholders’ Equity | $ | 7,261.9 | $ | 7,105.4 | |||

See accompanying notes to consolidated financial statements.

2

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

(In millions, except per share data)

Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Revenues | |||||||||||||||

Lease revenue | $ | 276.6 | $ | 281.8 | $ | 823.4 | $ | 847.5 | |||||||

Marine operating revenue | 62.9 | 62.1 | 135.0 | 139.7 | |||||||||||

Other revenue | 20.1 | 19.0 | 65.7 | 69.0 | |||||||||||

Total Revenues | 359.6 | 362.9 | 1,024.1 | 1,056.2 | |||||||||||

Expenses | |||||||||||||||

Maintenance expense | 84.9 | 79.6 | 247.7 | 244.6 | |||||||||||

Marine operating expense | 38.9 | 39.2 | 89.8 | 88.9 | |||||||||||

Depreciation expense | 78.6 | 75.9 | 227.9 | 221.0 | |||||||||||

Operating lease expense | 15.8 | 19.2 | 46.8 | 54.5 | |||||||||||

Other operating expense | 8.5 | 10.1 | 25.9 | 33.7 | |||||||||||

Selling, general and administrative expense | 42.8 | 48.1 | 128.8 | 127.8 | |||||||||||

Total Expenses | 269.5 | 272.1 | 766.9 | 770.5 | |||||||||||

Other Income (Expense) | |||||||||||||||

Net gain on asset dispositions | 9.4 | 62.7 | 56.3 | 122.8 | |||||||||||

Interest expense, net | (40.2 | ) | (36.2 | ) | (119.4 | ) | (109.9 | ) | |||||||

Other (expense) income | (2.1 | ) | 4.3 | (4.5 | ) | (2.9 | ) | ||||||||

Income before Income Taxes and Share of Affiliates’ Earnings | 57.2 | 121.6 | 189.6 | 295.7 | |||||||||||

Income taxes | (20.4 | ) | (41.1 | ) | (60.3 | ) | (98.6 | ) | |||||||

Share of affiliates’ earnings, net of taxes | 12.2 | 15.2 | 30.6 | 29.1 | |||||||||||

Net Income | $ | 49.0 | $ | 95.7 | $ | 159.9 | $ | 226.2 | |||||||

Other Comprehensive Income, Net of Taxes | |||||||||||||||

Foreign currency translation adjustments | 15.4 | 11.0 | 74.0 | 16.2 | |||||||||||

Unrealized gain on securities | — | 1.3 | — | 1.6 | |||||||||||

Unrealized gain (loss) on derivative instruments | 0.7 | 0.5 | 3.6 | (6.8 | ) | ||||||||||

Post-retirement benefit plans | 1.4 | (6.0 | ) | 4.1 | (3.3 | ) | |||||||||

Other comprehensive income | 17.5 | 6.8 | 81.7 | 7.7 | |||||||||||

Comprehensive Income | $ | 66.5 | $ | 102.5 | $ | 241.6 | $ | 233.9 | |||||||

Share Data | |||||||||||||||

Basic earnings per share | $ | 1.27 | $ | 2.39 | $ | 4.10 | $ | 5.55 | |||||||

Average number of common shares | 38.6 | 40.1 | 39.0 | 40.7 | |||||||||||

Diluted earnings per share | $ | 1.25 | $ | 2.36 | $ | 4.04 | $ | 5.49 | |||||||

Average number of common shares and common share equivalents | 39.2 | 40.6 | 39.6 | 41.2 | |||||||||||

Dividends declared per common share | $ | 0.42 | $ | 0.40 | $ | 1.26 | $ | 1.20 | |||||||

See accompanying notes to consolidated financial statements.

3

GATX CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

Nine Months Ended September 30 | |||||||

2017 | 2016 | ||||||

Operating Activities | |||||||

Net income | $ | 159.9 | $ | 226.2 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation expense | 238.5 | 230.6 | |||||

Change in accrued operating lease expense | (21.2 | ) | (11.0 | ) | |||

Net gains on sales of assets | (48.4 | ) | (41.3 | ) | |||

Deferred income taxes | 44.8 | 83.6 | |||||

Change in income taxes payable | (4.9 | ) | (8.1 | ) | |||

Share of affiliates’ earnings, net of dividends | (22.0 | ) | (29.0 | ) | |||

Other | (29.2 | ) | (15.5 | ) | |||

Net cash provided by operating activities | 317.5 | 435.5 | |||||

Investing Activities | |||||||

Additions to operating assets and facilities | (422.4 | ) | (442.6 | ) | |||

Investments in affiliates | (36.6 | ) | — | ||||

Portfolio investments and capital additions | (459.0 | ) | (442.6 | ) | |||

Purchases of previously leased-in assets | (93.2 | ) | (116.5 | ) | |||

Portfolio proceeds | 131.0 | 170.6 | |||||

Proceeds from sales of other assets | 24.3 | 18.6 | |||||

Proceeds from sale-leasebacks | 90.6 | 82.5 | |||||

Net cash used in investing activities | (306.3 | ) | (287.4 | ) | |||

Financing Activities | |||||||

Net proceeds from issuances of debt (original maturities longer than 90 days) | 297.5 | 801.8 | |||||

Repayments of debt (original maturities longer than 90 days) | (301.5 | ) | (798.7 | ) | |||

Net increase (decrease) in debt with original maturities of 90 days or less | 11.1 | (2.5 | ) | ||||

Stock repurchases | (75.0 | ) | (95.1 | ) | |||

Dividends | (51.8 | ) | (51.2 | ) | |||

Other | (2.8 | ) | (6.0 | ) | |||

Net cash used in by financing activities | (122.5 | ) | (151.7 | ) | |||

Effect of Exchange Rate Changes on Cash and Cash Equivalents | 3.1 | (0.2 | ) | ||||

Net decrease in Cash, Cash Equivalents, and Restricted Cash during the period | (108.2 | ) | (3.8 | ) | |||

Cash, Cash Equivalents, and Restricted Cash at beginning of period | 311.1 | 219.7 | |||||

Cash, Cash Equivalents, and Restricted Cash at end of period | $ | 202.9 | $ | 215.9 | |||

See accompanying notes to consolidated financial statements.

4

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. Description of Business

As used herein, "GATX," "we," "us," "our," and similar terms refer to GATX Corporation and its subsidiaries, unless indicated otherwise.

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through four primary business segments: Rail North America, Rail International, American Steamship Company (“ASC”), and Portfolio Management.

NOTE 2. Basis of Presentation

We prepared the accompanying unaudited consolidated financial statements in accordance with US Generally Accepted Accounting Principles ("GAAP") for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, our unaudited consolidated financial statements do not include all of the information and footnotes required for complete financial statements. We have included all of the normal recurring adjustments that we deemed necessary for a fair presentation.

Operating results for the nine months ended September 30, 2017, are not necessarily indicative of the results we may achieve for the entire year ending December 31, 2017. In particular, ASC's fleet is inactive for a significant portion of the first quarter of each year due to winter conditions on the Great Lakes. In addition, asset remarketing income does not occur evenly throughout the year. For more information, refer to the consolidated financial statements and footnotes in our Annual Report on Form 10-K for the year ended December 31, 2016.

New Accounting Pronouncements Adopted

Equity Method and Joint Ventures

In March 2016, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2016-07, Investments - Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting, which eliminates the requirement to retrospectively apply equity method accounting when an entity increases ownership or influence in a previously held investment. The new guidance was effective for us in the first quarter of 2017. Application of the new guidance did not impact our financial statements or related disclosures.

Stock Compensation

In March 2016, the FASB issued ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, which simplifies and clarifies certain aspects of share-based payments accounting and presentation. The update requires recognition of excess tax benefits and tax deficiencies, which arise due to differences between the measure of compensation expense and the amount deductible for tax purposes, to be recorded directly through earnings as a component of income tax expense. Previously, these differences were generally recorded in additional paid-in capital and thus had no impact on net income. The change in treatment of excess tax benefits and tax deficiencies also impacts the computation of diluted earnings per share, and the cash flows associated with those items are classified as operating activities on the consolidated statements of cash flows. The guidance also clarifies that all cash payments made to taxing authorities on the employees' behalf for withheld shares should be classified as financing activities on the consolidated statements of cash flows. Additionally, the guidance permits entities to make an accounting policy election for the impact of forfeitures on the recognition of expense for share-based payment awards. Forfeitures can be estimated as of the initial valuation date, as allowed under the previous guidance, or recognized when they occur. We changed our accounting policy to recognize forfeitures when they occur as part of this adoption. These amendments became effective in the first quarter of 2017, and we adopted this guidance as of January 1, 2017. Adoption of this new standard did not have a material impact on our financial statements or related disclosures.

5

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Statement of Cash Flows

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, which clarifies the classification and presentation of changes in restricted cash on the statement of cash flows. We elected to early adopt the new guidance as of January 1, 2017, using the retrospective method. Application of the new guidance requires presentation of restricted cash together with cash and cash equivalents on the consolidated statements of cash flows and eliminates the disclosure of the related changes in restricted cash within investing activities.

New Accounting Pronouncements Not Yet Adopted

Revenue from Contracts with Customers

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes most current revenue recognition guidance, including industry-specific guidance. Subsequently, the FASB has issued updates which provide additional implementation guidance. The new guidance requires companies to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration it expects to be entitled to in exchange for those goods or services. The FASB delayed the effective date of this guidance to the first quarter of 2018, with early adoption permitted as of the original effective date of the first quarter of 2017. We plan to adopt this guidance as of January 1, 2018, using the modified retrospective approach. Our primary source of revenue is lease revenue, which will continue to be within the scope of existing lease accounting guidance upon adoption of Topic 606. We have substantially completed our review of all other revenue sources in scope for the new standard and have concluded the new guidance will not have a material impact on our financial statements.

Leases

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes most current lease guidance. The new guidance requires companies to recognize most leases on the balance sheet and modifies accounting, presentation, and disclosure for both lessors and lessees. The new guidance is effective for us in the first quarter of 2019, with early adoption permitted. We plan to adopt this guidance on January 1, 2019, using a modified retrospective transition method, and we expect to utilize the package of three optional practical expedients as provided in the standard. We continue to assess the effect the new guidance will have on our consolidated financial statements and related disclosures.

Financial Instruments

In January 2016, the FASB issued ASU 2016-01, Financial Instruments - Overall (Topic 825): Recognition and Measurement of Financial Assets and Financial Liabilities, which modifies the accounting and reporting requirements for certain equity securities and financial liabilities. The new guidance is effective for us beginning in the first quarter of 2018, with certain provisions eligible for early adoption. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which modifies how entities will measure credit losses. The new guidance is effective for us in the first quarter of 2020, with early adoption permitted. We are evaluating the effect the new guidance will have on our financial statements and related disclosures.

Statement of Cash Flows

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, which clarifies the classification of certain cash receipts and payments in the statement of cash flows. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

6

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Income Taxes

In October 2016, the FASB issued ASU 2016-16, Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory, which modifies how an entity will recognize the income tax consequences of an intra-entity transfer of an asset when the transfer occurs. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We plan to adopt this guidance on January 1, 2018, applying the retrospective method. We do not expect the new guidance to have a material impact on our financial statements and related disclosures.

Compensation

In March 2017, the FASB issued ASU 2017-07, Compensation - Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost, which modifies how an entity must present service costs and other components of net benefit cost. The new guidance is effective for us in the first quarter of 2018, with early adoption permitted. We plan to adopt this guidance on January 1, 2018, applying the retrospective method. We do not expect the new guidance to have a significant impact on our financial statements and related disclosures.

Derivatives and Hedging

In August 2017, the FASB issued ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities, which expands and refines hedge accounting for both financial and non-financial risk components, aligns the recognition and presentation of the effects of hedging instruments and hedge items in the financial statements, and includes certain targeted improvements to ease the application of current guidance related to the assessment of hedge effectiveness. The update to the standard is effective for us beginning in the first quarter of 2019, with early adoption permitted in any interim period. We do not expect the new guidance to have a significant impact on our financial statements or related disclosures.

7

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 3. Fair Value Disclosure

The following tables show our assets and liabilities that are measured at fair value on a recurring basis (in millions):

Assets | Total September 30 2017 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Interest rate derivatives (1) | $ | 0.1 | $ | — | $ | 0.1 | $ | — | |||||||

Foreign exchange rate derivatives (1) | 2.6 | — | 2.6 | — | |||||||||||

Foreign exchange rate derivatives (2) | 0.3 | — | 0.3 | — | |||||||||||

Liabilities | |||||||||||||||

Interest rate derivatives (1) | 0.9 | — | 0.9 | — | |||||||||||

Foreign exchange rate derivatives (1) | 22.8 | — | 22.8 | — | |||||||||||

Foreign exchange rate derivatives (2) | 2.9 | — | 2.9 | — | |||||||||||

Assets | Total December 31 2016 | Quoted Prices in Active Markets for Identical Assets (Level 1) | Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Interest rate derivatives (1) | $ | 2.9 | $ | — | $ | 2.9 | $ | — | |||||||

Foreign exchange rate derivatives (1) | 12.2 | — | 12.2 | — | |||||||||||

Foreign exchange rate derivatives (2) | 1.3 | — | 1.3 | — | |||||||||||

Liabilities | |||||||||||||||

Interest rate derivatives (1) | 0.1 | — | 0.1 | — | |||||||||||

_________

(1) | Designated as hedges. |

(2) | Not designated as hedges. |

We value derivatives using a pricing model with inputs (such as yield curves and foreign currency rates) that are observable in the market or that can be derived principally from observable market data.

Derivative instruments

Fair Value Hedges

We use interest rate swaps to manage the fixed-to-floating rate mix of our debt obligations by converting the fixed rate debt to floating rate debt. For fair value hedges, we recognize changes in fair value of both the derivative and the hedged item as interest expense. We had eight instruments outstanding with an aggregate notional amount of $450.0 million as of September 30, 2017 that mature from 2018 to 2022 and eight instruments outstanding with an aggregate notional amount of $550.0 million as of December 31, 2016 with maturities ranging from 2017 to 2020.

8

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Cash Flow Hedges

We use interest rate swaps to convert floating rate debt to fixed rate debt. We use Treasury rate locks and swap rate locks to hedge our exposure to interest rate risk on anticipated transactions. We also use currency swaps to hedge our exposure to fluctuations in the exchange rates of the foreign currencies in which we conduct business. We had eleven instruments outstanding with an aggregate notional amount of $290.2 million as of September 30, 2017 that mature from 2017 to 2022 and nine instruments outstanding with an aggregate notional amount of $412.1 million as of December 31, 2016 with maturities ranging from 2017 to 2022. Within the next 12 months, we expect to reclassify $5.2 million ($3.3 million after-tax) of net losses on previously terminated derivatives from accumulated other comprehensive income (loss) to interest expense or operating lease expense, as applicable. We reclassify these amounts when interest and operating lease expense on the related hedged transactions affect earnings.

Non-designated Derivatives

We do not hold derivative financial instruments for purposes other than hedging, although certain of our derivatives are not designated as accounting hedges. We recognize changes in the fair value of these derivatives in other (income) expense immediately.

Some of our derivative instruments contain credit risk provisions that could require us to make immediate payment on net liability positions in the event that we default on certain outstanding debt obligations. The aggregate fair value of our derivative instruments with credit risk related contingent features that are in a liability position as of September 30, 2017, was $23.7 million. We are not required to post any collateral on our derivative instruments and do not expect the credit risk provisions to be triggered.

In the event that a counterparty fails to meet the terms of an interest rate swap agreement or a foreign exchange contract, our exposure is limited to the fair value of the swap, if in our favor. We manage the credit risk of counterparties by transacting with institutions that we consider financially sound and by avoiding concentrations of risk with a single counterparty. We believe that the risk of non-performance by any of our counterparties is remote.

The following table shows the impacts of our derivative instruments on our statement of comprehensive income (in millions):

Three Months Ended September 30 | Nine Months Ended September 30 | |||||||||||||||||

Derivative Designation | Location of Loss (Gain) Recognized | 2017 | 2016 | 2017 | 2016 | |||||||||||||

Fair value hedges (1) | Interest expense | $ | 0.6 | $ | 2.6 | $ | 1.5 | $ | (3.3 | ) | ||||||||

Cash flow hedges | Other comprehensive (income) loss (effective portion) | (11.1 | ) | (2.8 | ) | (34.8 | ) | (26.8 | ) | |||||||||

Cash flow hedges | Interest expense (effective portion reclassified from accumulated other comprehensive loss) | 1.7 | 1.7 | 5.1 | 5.1 | |||||||||||||

Cash flow hedges | Operating lease expense (effective portion reclassified from accumulated other comprehensive loss) | — | 0.7 | — | 1.1 | |||||||||||||

Cash flow hedges (2) | Other (income) expense (effective portion reclassified from accumulated other comprehensive loss) | 10.1 | 3.3 | 33.8 | 13.6 | |||||||||||||

Non-designated | Other (income) expense | (2.0 | ) | 2.2 | 4.1 | (0.1 | ) | |||||||||||

_________

(1) | The fair value adjustments related to the underlying debt equally offset the amounts recognized in interest expense. |

(2) | Includes (income) expense on foreign currency derivatives that are substantially offset by foreign currency remeasurement adjustments on related hedged instruments, also recognized in Other (income) expense. |

9

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Other Financial Instruments

The carrying amounts of cash and cash equivalents, restricted cash, rent and other receivables, accounts payable, and commercial paper and bank credit facilities approximate fair value due to the short maturity of those instruments. We base the fair values of investment funds, which are accounted for under the cost method, on the best information available, which may include quoted investment fund values. We estimate the fair values of loans and fixed and floating rate debt using discounted cash flow analyses that are based on interest rates currently offered for loans with similar terms to borrowers of similar credit quality. The inputs we use to estimate each of these values are classified in Level 2 of the fair value hierarchy because they are directly or indirectly observable inputs.

The following table shows the carrying amounts and fair values of our other financial instruments (in millions):

September 30, 2017 | December 31, 2016 | ||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||

Assets | |||||||||||||||

Investment funds | $ | 0.6 | $ | 1.2 | $ | 0.6 | $ | 1.2 | |||||||

Loans | 0.2 | 0.2 | 6.2 | 6.2 | |||||||||||

Liabilities | |||||||||||||||

Recourse fixed rate debt | $ | 3,864.6 | $ | 3,977.6 | $ | 3,858.5 | $ | 3,852.6 | |||||||

Recourse floating rate debt | 425.0 | 429.4 | 417.8 | 412.2 | |||||||||||

NOTE 4. Assets Held for Sale

The following table summarizes our assets held for sale (in millions):

September 30 | December 31 | ||||||

2017 | 2016 | ||||||

Rail North America | $ | 4.4 | $ | 43.9 | |||

Portfolio Management | 19.2 | 45.6 | |||||

$ | 23.6 | $ | 89.5 | ||||

For assets classified as held for sale, in the first nine months of 2017, we sold inland marine assets in the Portfolio Management segment with a carrying value of $26.4 million for proceeds of $28.2 million, resulting in a net gain of $1.8 million. At Rail North America, we sold certain railcars with a carrying value of $21.8 million for proceeds of $49.9 million, resulting in a net gain of $28.1 million. In addition, other railcars that were not sold with a carrying value of $19.7 million were reclassified out of assets held for sale and written down to their estimated fair value, resulting in the recognition of a $1.9 million impairment loss. All assets classified as held for sale at September 30 are expected to be sold in 2017.

10

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 5. Pension and Other Post-Retirement Benefits

The following table shows components of our pension and other post-retirement benefits expense for the three months ended September 30, 2017 and 2016 (in millions):

2017 Pension Benefits | 2016 Pension Benefits | 2017 Retiree Health and Life | 2016 Retiree Health and Life | ||||||||||||

Service cost | $ | 1.6 | $ | 1.5 | $ | — | $ | 0.1 | |||||||

Interest cost | 3.8 | 3.9 | 0.2 | 0.2 | |||||||||||

Expected return on plan assets | (5.9 | ) | (6.5 | ) | — | — | |||||||||

Settlement expense | — | 5.7 | — | — | |||||||||||

Amortization of (1): | |||||||||||||||

Unrecognized prior service credit | — | (0.2 | ) | — | (0.1 | ) | |||||||||

Unrecognized net actuarial loss | 2.2 | 2.6 | — | — | |||||||||||

Net expense | $ | 1.7 | $ | 7.0 | $ | 0.2 | $ | 0.2 | |||||||

The following table shows components of our pension and other post-retirement benefits expense for the nine months ended September 30, 2017 and 2016 (in millions):

2017 Pension Benefits | 2016 Pension Benefits | 2017 Retiree Health and Life | 2016 Retiree Health and Life | ||||||||||||

Service cost | $ | 4.9 | $ | 4.5 | $ | 0.1 | $ | 0.2 | |||||||

Interest cost | 11.5 | 11.8 | 0.7 | 0.7 | |||||||||||

Expected return on plan assets | (17.9 | ) | (19.5 | ) | — | — | |||||||||

Settlement expense | 0.1 | 5.7 | — | — | |||||||||||

Amortization of (1): | |||||||||||||||

Unrecognized prior service credit | — | (0.7 | ) | (0.1 | ) | (0.2 | ) | ||||||||

Unrecognized net actuarial loss (gain) | 6.9 | 7.7 | (0.2 | ) | (0.2 | ) | |||||||||

Net expense | $ | 5.5 | $ | 9.5 | $ | 0.5 | $ | 0.5 | |||||||

________

(1) Amounts reclassified from accumulated other comprehensive loss.

During the third quarter of 2016, we recorded a settlement accounting adjustment of $5.7 million attributable to lump sum payments elected by eligible retirees as part of a voluntary early retirement program offered in 2015.

NOTE 6. Share-Based Compensation

During the nine months ended September 30, 2017, we granted eligible incentive plan participants the aggregate of 354,400 non-qualified employee stock options, 49,840 restricted stock units, 63,710 performance shares, and 18,080 phantom stock units. For the three months and nine months ended September 30, 2017, total share-based compensation expense was $3.4 million and $10.6 million and the related tax benefits were $1.3 million and $4.1 million. For the three months and nine months ended September 30, 2016, total share-based compensation expense was $3.2 million and $9.1 million and the related tax benefits were $1.3 million and $3.5 million.

11

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The estimated fair value of our 2017 stock option awards and related underlying assumptions are shown in the table below.

2017 | |||

Estimated fair value, including present value of dividends | $ | 19.40 | |

Quarterly dividend rate | $ | 0.42 | |

Expected term of stock option awards, in years | 4.7 | ||

Risk-free interest rate | 1.9 | % | |

Dividend yield | 2.8 | % | |

Expected stock price volatility | 27.7 | % | |

Present value of dividends | $ | 7.50 | |

NOTE 7. Income Taxes

Our effective tax rate was 32% for the nine months ended September 30, 2017, compared to 33% for the nine months ended September 30, 2016. The difference in the effective rates for the current year compared to prior year is primarily attributable to the mix of pre-tax income among domestic and foreign jurisdictions which are taxed at different rates. Additionally, during the quarter, based upon the status of our current state income tax audits and our expectations of the ultimate resolution, we released the remaining balance of our liability for unrecognized tax benefits and recognized an income tax benefit of $4.3 million ($2.8 million, net of federal tax). Also, our consolidated state income tax rate increased, effective July 1, 2017, due to legislation enacted in the state of Illinois. Accordingly, we recorded a deferred state income tax adjustment of $3.1 million in the quarter. Finally, the 2017 effective tax rate reflects incremental benefits associated with equity awards in accordance with the adoption of new accounting rules and the impact of reductions in the statutory tax rates in Quebec and Saskatchewan, Canada and India, partially offset by an increase to the effective tax rate in Germany.

NOTE 8. Commercial Commitments

We have entered into various commercial commitments, such as guarantees, standby letters of credit, and performance bonds, related to certain transactions. These commercial commitments require us to fulfill specific obligations in the event of third-party demands. Similar to our balance sheet investments, these commitments expose us to credit, market, and equipment risk. Accordingly, we evaluate these commitments and other contingent obligations using techniques similar to those we use to evaluate funded transactions.

The following table shows our commercial commitments (in millions):

September 30 | December 31 | ||||||

2017 | 2016 | ||||||

Lease payment guarantees | $ | 7.6 | $ | 15.0 | |||

Standby letters of credit and performance bonds | 8.8 | 8.9 | |||||

Total commercial commitments (1) | $ | 16.4 | $ | 23.9 | |||

_______

(1) | The carrying value of liabilities on the balance sheet for commercial commitments was $2.3 million at September 30, 2017 and $3.0 million at December 31, 2016. The expirations of these commitments range from 2017 to 2023. We are not aware of any event that would require us to satisfy any of our commitments. |

Lease payment guarantees are commitments to financial institutions to make lease payments for a third party in the event they default. We reduce any liability that may result from these guarantees by the value of the underlying asset or group of assets.

We are also parties to standby letters of credit and performance bonds, which primarily relate to contractual obligations and general liability insurance coverages. No material claims have been made against these obligations, and no material losses are anticipated.

12

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 9. Earnings per Share

We compute basic earnings per share by dividing net income available to our common shareholders by the weighted average number of shares of our common stock outstanding. We weighted shares issued or reacquired during the period for the portion of the period that they were outstanding. Our diluted earnings per share reflect the impacts of our potentially dilutive securities, which include our equity compensation awards.

The following table shows the computation of our basic and diluted net income per common share (in millions, except per share amounts):

Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Numerator: | |||||||||||||||

Net income | $ | 49.0 | $ | 95.7 | $ | 159.9 | $ | 226.2 | |||||||

Denominator: | |||||||||||||||

Weighted average shares outstanding - basic | 38.6 | 40.1 | 39.0 | 40.7 | |||||||||||

Effect of dilutive securities: | |||||||||||||||

Equity compensation plans | 0.6 | 0.5 | 0.6 | 0.5 | |||||||||||

Weighted average shares outstanding - diluted | 39.2 | 40.6 | 39.6 | 41.2 | |||||||||||

Basic earnings per share | $ | 1.27 | $ | 2.39 | $ | 4.10 | $ | 5.55 | |||||||

Diluted earnings per share | $ | 1.25 | $ | 2.36 | $ | 4.04 | $ | 5.49 | |||||||

NOTE 10. Accumulated Other Comprehensive Income (Loss)

The following table shows the change in components for accumulated other comprehensive loss (in millions):

Foreign Currency Translation Gain (Loss) | Unrealized Gain (Loss) on Derivative Instruments | Post-Retirement Benefit Plans | Total | ||||||||||||

Balance at December 31, 2016 | (103.7 | ) | (20.3 | ) | (87.1 | ) | (211.1 | ) | |||||||

Change in component | 17.9 | (5.1 | ) | — | 12.8 | ||||||||||

Reclassification adjustments into earnings | — | 5.8 | 2.2 | 8.0 | |||||||||||

Income tax effect | — | 0.1 | (0.9 | ) | (0.8 | ) | |||||||||

Balance at March 31, 2017 | $ | (85.8 | ) | $ | (19.5 | ) | $ | (85.8 | ) | $ | (191.1 | ) | |||

Change in component | 40.7 | (18.4 | ) | — | 22.3 | ||||||||||

Reclassification adjustments into earnings | — | 21.3 | 2.2 | 23.5 | |||||||||||

Income tax effect | — | (0.8 | ) | (0.8 | ) | (1.6 | ) | ||||||||

Balance at June 30, 2017 | $ | (45.1 | ) | $ | (17.4 | ) | $ | (84.4 | ) | $ | (146.9 | ) | |||

Change in component | 15.4 | (10.5 | ) | — | 4.9 | ||||||||||

Reclassification adjustments into earnings | — | 11.8 | 2.2 | 14.0 | |||||||||||

Income tax effect | — | (0.6 | ) | (0.8 | ) | (1.4 | ) | ||||||||

Balance at September 30, 2017 | (29.7 | ) | (16.7 | ) | (83.0 | ) | (129.4 | ) | |||||||

________

See "Note 3. Fair Value Disclosure" and "Note 5. Pension and Other Post-Retirement Benefits" for impacts of the reclassification adjustments on the statement of comprehensive income.

13

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

NOTE 11. Legal Proceedings and Other Contingencies

Various legal actions, claims, assessments and other contingencies arising in the ordinary course of business are pending against GATX and certain of our subsidiaries. These matters are subject to many uncertainties, and it is possible that some of these matters could ultimately be decided, resolved or settled adversely. For a full discussion of our pending legal matters, please refer to "Note 22. Legal Proceedings and Other Contingencies" of our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2016.

Viareggio Derailment

In June 2009, a train consisting of fourteen liquefied petroleum gas (“LPG”) tank cars owned by GATX Rail Austria GmbH and its subsidiaries (collectively, “GRA”) derailed while passing through the City of Viareggio, in the province of Lucca, Italy. Five tank cars overturned and one of the overturned cars was punctured by a peg or obstacle along the side of the track, resulting in a release of LPG, which subsequently ignited. The accident resulted in multiple deaths, personal injuries and property damage. The LPG tank cars were leased to FS Logistica S.p.A., a subsidiary of the Italian state-owned railway, Ferrovie dello Stato S.p.A (the “Italian Railway”).

On December 14, 2012, the prosecutors for Lucca charged the Italian Railway, GRA, and a number of their maintenance, operations, and managerial employees with various negligence-based crimes related to the accident. A trial was held in the court of Lucca and, on January 31, 2017, the court announced guilty verdicts against various Italian Railway companies, GRA, and certain of their employees. The court imposed a fine of 1.4 million Euros against GRA and prison sentences against the employees. GRA disagrees with the trial court’s ruling and believes that the evidence shows it and its employees acted diligently and in accordance with all applicable laws and regulations at all times. On October 14, 2017, GRA filed its appeal of the trial court’s ruling with the Court of Appeal in Florence (Corte d’Appello di Firenze) and, pending the final disposition of the appeal, these fines and penalties are not enforceable.

With respect to civil claims, the insurers for the Italian Railway and GRA have fully settled and resolved most of the claims arising out of the accident. With respect to unsettled claims, the Lucca court ordered all convicted defendants (including various Italian Railway entities and GRA) to pay final damages or advances to the remaining 56 claimants. The amount of these awards is immaterial and GRA expects that its insurers will continue to cover most of these damages to claimants except for a small number of civil claims. GRA will continue to incur legal expenses for the criminal appeals although they are not expected to be material. We cannot predict the outcome of the appeals process and thus cannot reasonably estimate the possible amount or range of costs that may be ultimately incurred in connection with this litigation.

NOTE 12. Financial Data of Business Segments

The financial data presented below depicts the profitability, financial position, and capital expenditures of each of our business segments.

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through four primary business segments: Rail North America, Rail International, American Steamship Company (“ASC”), and Portfolio Management.

Rail North America is composed of our wholly owned operations in the United States, Canada, and Mexico, as well as an affiliate investment. Rail North America primarily provides railcars pursuant to full-service leases under which it maintains the railcars, pays ad valorem taxes and insurance, and provides other ancillary services.

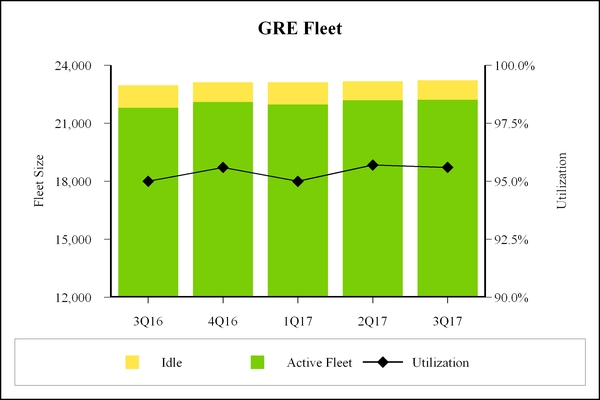

Rail International is composed of our wholly owned European operations ("GATX Rail Europe" or "GRE"), our wholly owned railcar leasing business in India ("Rail India"), and our wholly owned operations in Russia. GRE leases railcars to customers throughout Europe pursuant to full-service leases under which it maintains the railcars and provides value-adding services according to customer requirements.

ASC operates the largest fleet of US-flagged vessels on the Great Lakes, providing waterborne transportation of dry bulk commodities such as iron ore, coal, limestone aggregates, and metallurgical limestone.

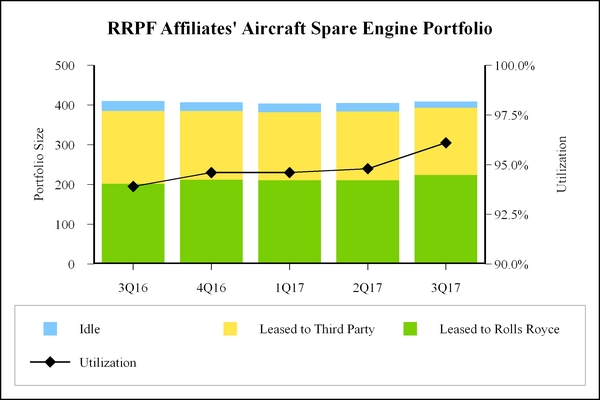

Portfolio Management is composed primarily of our ownership in a group of joint ventures with Rolls-Royce plc that lease aircraft spare engines, as well as five liquefied gas carrying vessels and assorted other marine assets. In prior years, Portfolio Management

14

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

generated leasing, marine operating, asset remarketing, and management fee income through a collection of diversified wholly owned assets and joint venture investments. We are in the process of disposing of the majority of the marine investments in this segment.

Segment profit is an internal performance measure used by the Chief Executive Officer to assess the performance of each segment in a given period. Segment profit includes all revenues, pre-tax earnings from affiliates, and net gains on asset dispositions that are attributable to the segments, as well as expenses that management believes are directly associated with the financing, maintenance, and operation of the revenue earning assets. Segment profit excludes selling, general and administrative expenses, income taxes, and certain other amounts not allocated to the segments. These amounts are included in Other.

We allocate debt balances and related interest expense to each segment based upon predetermined debt to equity leverage ratios. The leverage levels are 5:1 for Rail North America, 3:1 for Rail International, 1.5:1 for ASC, and 1:1 for Portfolio Management. We believe that by using this leverage and interest expense allocation methodology, each operating segment’s financial performance reflects appropriate risk-adjusted borrowing costs.

15

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

The following tables show certain segment data for each of our business segments (in millions):

Rail North America | Rail International | ASC | Portfolio Management | Other | GATX Consolidated | ||||||||||||||||||

Three Months Ended September 30, 2017 | |||||||||||||||||||||||

Profitability | |||||||||||||||||||||||

Revenues | |||||||||||||||||||||||

Lease revenue | $ | 224.5 | $ | 50.3 | $ | 1.1 | $ | 0.7 | $ | — | $ | 276.6 | |||||||||||

Marine operating revenue | — | — | 59.1 | 3.8 | — | 62.9 | |||||||||||||||||

Other revenue | 17.9 | 2.0 | — | 0.2 | — | 20.1 | |||||||||||||||||

Total Revenues | 242.4 | 52.3 | 60.2 | 4.7 | — | 359.6 | |||||||||||||||||

Expenses | |||||||||||||||||||||||

Maintenance expense | 66.1 | 11.1 | 7.7 | — | — | 84.9 | |||||||||||||||||

Marine operating expense | — | — | 34.7 | 4.2 | — | 38.9 | |||||||||||||||||

Depreciation expense | 60.1 | 12.8 | 4.0 | 1.7 | — | 78.6 | |||||||||||||||||

Operating lease expense | 15.5 | — | 0.3 | — | — | 15.8 | |||||||||||||||||

Other operating expense | 7.3 | 1.1 | — | 0.1 | — | 8.5 | |||||||||||||||||

Total Expenses | 149.0 | 25.0 | 46.7 | 6.0 | — | 226.7 | |||||||||||||||||

Other Income (Expense) | |||||||||||||||||||||||

Net gain on asset dispositions | 8.1 | 1.0 | — | 0.3 | — | 9.4 | |||||||||||||||||

Interest (expense) income, net | (30.5 | ) | (8.5 | ) | (1.4 | ) | (2.2 | ) | 2.4 | (40.2 | ) | ||||||||||||

Other (expense) income | (0.9 | ) | 0.3 | — | — | (1.5 | ) | (2.1 | ) | ||||||||||||||

Share of affiliates' pre-tax income | 0.1 | — | — | 16.0 | — | 16.1 | |||||||||||||||||

Segment profit | $ | 70.2 | $ | 20.1 | $ | 12.1 | $ | 12.8 | $ | 0.9 | 116.1 | ||||||||||||

Selling, general and administrative expense | 42.8 | ||||||||||||||||||||||

Income taxes (includes $3.9 related to affiliates' earnings) | 24.3 | ||||||||||||||||||||||

Net income | $ | 49.0 | |||||||||||||||||||||

Net Gain on Asset Dispositions | |||||||||||||||||||||||

Asset Remarketing Income: | |||||||||||||||||||||||

Disposition gains on owned assets | $ | 7.5 | $ | 0.1 | $ | — | $ | — | $ | — | $ | 7.6 | |||||||||||

Residual sharing income | 0.2 | — | — | 0.3 | — | 0.5 | |||||||||||||||||

Non-remarketing disposition gains (1) | 0.4 | 0.9 | — | — | — | 1.3 | |||||||||||||||||

$ | 8.1 | $ | 1.0 | $ | — | $ | 0.3 | $ | — | $ | 9.4 | ||||||||||||

Capital Expenditures | |||||||||||||||||||||||

Portfolio investments and capital additions | $ | 103.3 | $ | 22.9 | $ | 0.8 | $ | 36.6 | $ | 0.1 | $ | 163.7 | |||||||||||

Selected Balance Sheet Data at September 30, 2017 | |||||||||||||||||||||||

Investments in affiliated companies | $ | 9.8 | $ | — | $ | — | $ | 439.5 | $ | — | $ | 449.3 | |||||||||||

Identifiable assets | $ | 4,841.2 | $ | 1,290.0 | $ | 310.1 | $ | 616.8 | $ | 203.8 | $ | 7,261.9 | |||||||||||

__________

(1) Includes scrapping gains.

16

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Rail North America | Rail International | ASC | Portfolio Management | Other | GATX Consolidated | ||||||||||||||||||

Three Months Ended September 30, 2016 | |||||||||||||||||||||||

Profitability | |||||||||||||||||||||||

Revenues | |||||||||||||||||||||||

Lease revenue | $ | 233.0 | $ | 46.6 | $ | 1.0 | $ | 1.2 | $ | — | $ | 281.8 | |||||||||||

Marine operating revenue | — | — | 51.8 | 10.3 | — | 62.1 | |||||||||||||||||

Other revenue | 17.3 | 1.6 | — | 0.1 | — | 19.0 | |||||||||||||||||

Total Revenues | 250.3 | 48.2 | 52.8 | 11.6 | — | 362.9 | |||||||||||||||||

Expenses | |||||||||||||||||||||||

Maintenance expense | 62.8 | 10.7 | 6.1 | — | — | 79.6 | |||||||||||||||||

Marine operating expense | — | — | 31.5 | 7.7 | — | 39.2 | |||||||||||||||||

Depreciation expense | 58.4 | 11.6 | 4.2 | 1.7 | — | 75.9 | |||||||||||||||||

Operating lease expense | 17.2 | — | 2.0 | — | — | 19.2 | |||||||||||||||||

Other operating expense | 8.6 | 1.2 | — | 0.3 | — | 10.1 | |||||||||||||||||

Total Expenses | 147.0 | 23.5 | 43.8 | 9.7 | — | 224.0 | |||||||||||||||||

Other Income (Expense) | |||||||||||||||||||||||

Net gain on asset dispositions | 13.1 | 0.5 | — | 49.1 | — | 62.7 | |||||||||||||||||

Interest (expense) income, net | (27.1 | ) | (7.3 | ) | (1.1 | ) | (2.1 | ) | 1.4 | (36.2 | ) | ||||||||||||

Other (expense) income | (1.4 | ) | 5.5 | (0.1 | ) | — | 0.3 | 4.3 | |||||||||||||||

Share of affiliates' pre-tax (loss) income | — | (0.1 | ) | — | 15.2 | — | 15.1 | ||||||||||||||||

Segment profit | $ | 87.9 | $ | 23.3 | $ | 7.8 | $ | 64.1 | $ | 1.7 | 184.8 | ||||||||||||

Selling, general and administrative expense | 48.1 | ||||||||||||||||||||||

Income taxes (includes $0.1 tax benefit related to affiliates' earnings) | 41.0 | ||||||||||||||||||||||

Net income | $ | 95.7 | |||||||||||||||||||||

Net Gain on Asset Dispositions | |||||||||||||||||||||||

Asset Remarketing Income: | |||||||||||||||||||||||

Disposition gains on owned assets | $ | 11.9 | $ | — | $ | — | $ | (0.3 | ) | $ | — | $ | 11.6 | ||||||||||

Residual sharing income | 0.3 | — | — | 49.4 | — | 49.7 | |||||||||||||||||

Non-remarketing disposition gains (1) | 0.9 | 0.5 | — | — | — | 1.4 | |||||||||||||||||

$ | 13.1 | $ | 0.5 | $ | — | $ | 49.1 | $ | — | $ | 62.7 | ||||||||||||

Capital Expenditures | |||||||||||||||||||||||

Portfolio investments and capital additions | $ | 108.4 | $ | 10.8 | $ | — | $ | — | $ | 1.2 | $ | 120.4 | |||||||||||

Selected Balance Sheet Data at December 31, 2016 | |||||||||||||||||||||||

Investments in affiliated companies | $ | 10.5 | $ | 1.2 | $ | — | $ | 375.3 | $ | — | $ | 387.0 | |||||||||||

Identifiable assets | $ | 4,775.6 | $ | 1,128.7 | $ | 278.8 | $ | 593.5 | $ | 328.8 | $ | 7,105.4 | |||||||||||

__________

(1) Includes scrapping gains.

17

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Rail North America | Rail International | ASC | Portfolio Management | Other | GATX Consolidated | ||||||||||||||||||

Nine Months Ended September 30, 2017 | |||||||||||||||||||||||

Profitability | |||||||||||||||||||||||

Revenues | |||||||||||||||||||||||

Lease revenue | $ | 677.4 | $ | 139.8 | $ | 3.1 | $ | 3.1 | $ | — | $ | 823.4 | |||||||||||

Marine operating revenue | — | — | 113.2 | 21.8 | — | 135.0 | |||||||||||||||||

Other revenue | 60.0 | 4.7 | — | 1.0 | — | 65.7 | |||||||||||||||||

Total Revenues | 737.4 | 144.5 | 116.3 | 25.9 | — | 1,024.1 | |||||||||||||||||

Expenses | |||||||||||||||||||||||

Maintenance expense | 202.3 | 30.8 | 14.6 | — | — | 247.7 | |||||||||||||||||

Marine operating expense | — | — | 70.6 | 19.2 | — | 89.8 | |||||||||||||||||

Depreciation expense | 178.8 | 35.8 | 8.1 | 5.2 | — | 227.9 | |||||||||||||||||

Operating lease expense | 45.3 | — | 1.5 | — | — | 46.8 | |||||||||||||||||

Other operating expense | 21.7 | 3.5 | — | 0.7 | — | 25.9 | |||||||||||||||||

Total Expenses | 448.1 | 70.1 | 94.8 | 25.1 | — | 638.1 | |||||||||||||||||

Other Income (Expense) | |||||||||||||||||||||||

Net gain on asset dispositions | 42.6 | 2.6 | — | 11.1 | — | 56.3 | |||||||||||||||||

Interest (expense) income, net | (90.1 | ) | (24.5 | ) | (3.9 | ) | (6.8 | ) | 5.9 | (119.4 | ) | ||||||||||||

Other (expense) income | (4.1 | ) | (2.3 | ) | 0.8 | 2.3 | (1.2 | ) | (4.5 | ) | |||||||||||||

Share of affiliates' pre-tax income (loss) | 0.4 | (0.1 | ) | — | 39.9 | — | 40.2 | ||||||||||||||||

Segment profit | $ | 238.1 | $ | 50.1 | $ | 18.4 | $ | 47.3 | $ | 4.7 | 358.6 | ||||||||||||

Selling, general and administrative expense | 128.8 | ||||||||||||||||||||||

Income taxes (includes $9.6 related to affiliates' earnings) | 69.9 | ||||||||||||||||||||||

Net income | $ | 159.9 | |||||||||||||||||||||

Net Gain on Asset Dispositions | |||||||||||||||||||||||

Asset Remarketing Income: | |||||||||||||||||||||||

Disposition gains on owned assets | $ | 39.5 | $ | 0.1 | $ | — | $ | 1.8 | $ | — | $ | 41.4 | |||||||||||

Residual sharing income | 0.5 | — | — | 9.3 | — | 9.8 | |||||||||||||||||

Non-remarketing disposition gains (1) | 4.5 | 2.5 | — | — | — | 7.0 | |||||||||||||||||

Asset impairments | (1.9 | ) | — | — | — | — | (1.9 | ) | |||||||||||||||

$ | 42.6 | $ | 2.6 | $ | — | $ | 11.1 | $ | — | $ | 56.3 | ||||||||||||

Capital Expenditures | |||||||||||||||||||||||

Portfolio investments and capital additions | $ | 333.7 | $ | 74.7 | $ | 13.6 | $ | 36.6 | $ | 0.4 | $ | 459.0 | |||||||||||

__________

(1) Includes scrapping gains.

18

GATX CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) (Continued)

Rail North America | Rail International | ASC | Portfolio Management | Other | GATX Consolidated | ||||||||||||||||||

Nine Months Ended September 30, 2016 | |||||||||||||||||||||||

Profitability | |||||||||||||||||||||||

Revenues | |||||||||||||||||||||||

Lease revenue | $ | 703.0 | $ | 136.8 | $ | 3.1 | $ | 4.6 | $ | — | $ | 847.5 | |||||||||||

Marine operating revenue | — | — | 102.3 | 37.4 | — | 139.7 | |||||||||||||||||

Other revenue | 63.5 | 4.8 | — | 0.7 | — | 69.0 | |||||||||||||||||

Total Revenues | 766.5 | 141.6 | 105.4 | 42.7 | — | 1,056.2 | |||||||||||||||||

Expenses | |||||||||||||||||||||||

Maintenance expense | 196.2 | 36.1 | 12.3 | — | — | 244.6 | |||||||||||||||||

Marine operating expense | — | — | 64.0 | 24.9 | — | 88.9 | |||||||||||||||||

Depreciation expense | 173.0 | 34.2 | 8.6 | 5.2 | — | 221.0 | |||||||||||||||||

Operating lease expense | 50.6 | — | 4.0 | — | (0.1 | ) | 54.5 | ||||||||||||||||

Other operating expense | 25.0 | 3.8 | — | 4.9 | — | 33.7 | |||||||||||||||||

Total Expenses | 444.8 | 74.1 | 88.9 | 35.0 | (0.1 | ) | 642.7 | ||||||||||||||||

Other Income (Expense) | |||||||||||||||||||||||

Net gain on asset dispositions | 36.4 | 1.5 | — | 84.9 | — | 122.8 | |||||||||||||||||

Interest (expense) income, net | (81.2 | ) | (21.9 | ) | (3.3 | ) | (6.4 | ) | 2.9 | (109.9 | ) | ||||||||||||

Other (expense) income | (3.8 | ) | 2.0 | (0.3 | ) | — | (0.8 | ) | (2.9 | ) | |||||||||||||

Share of affiliates' pre-tax income (loss) | 0.3 | (0.2 | ) | — | 33.0 | — | 33.1 | ||||||||||||||||

Segment profit | $ | 273.4 | $ | 48.9 | $ | 12.9 | $ | 119.2 | $ | 2.2 | 456.6 | ||||||||||||

Selling, general and administrative expense | 127.8 | ||||||||||||||||||||||

Income taxes (includes $4.0 related to affiliates' earnings) | 102.6 | ||||||||||||||||||||||

Net income | $ | 226.2 | |||||||||||||||||||||

Net Gain on Asset Dispositions | |||||||||||||||||||||||

Asset Remarketing Income: | |||||||||||||||||||||||

Disposition gains on owned assets | $ | 32.5 | $ | — | $ | — | $ | 4.2 | $ | — | $ | 36.7 | |||||||||||

Residual sharing income | 0.7 | — | — | 82.5 | — | 83.2 | |||||||||||||||||

Non-remarketing disposition gains (1) | 3.2 | 1.5 | — | — | — | 4.7 | |||||||||||||||||

Asset impairments | — | — | — | (1.8 | ) | — | (1.8 | ) | |||||||||||||||

$ | 36.4 | $ | 1.5 | $ | — | $ | 84.9 | $ | — | $ | 122.8 | ||||||||||||

Capital Expenditures | |||||||||||||||||||||||

Portfolio investments and capital additions | $ | 366.7 | $ | 63.2 | $ | 9.1 | $ | — | $ | 3.6 | $ | 442.6 | |||||||||||

__________

(1) Includes scrapping gains.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

BUSINESS OVERVIEW

We lease, operate, manage, and remarket long-lived, widely-used assets, primarily in the rail market. We report our financial results through four primary business segments: Rail North America, Rail International, American Steamship Company (“ASC”), and Portfolio Management.

The following discussion and analysis should be read in conjunction with the MD&A in our Annual Report on Form 10-K for the year ended December 31, 2016. We based the discussion and analysis that follows on financial data we derived from the financial statements prepared in accordance with US Generally Accepted Accounting Standards ("GAAP") and on certain other financial data that we prepared using non-GAAP components. For a reconciliation of these non-GAAP components to the most comparable GAAP components, see “Non-GAAP Financial Measures” at the end of this item.

Operating results for the three and nine months ended September 30, 2017 are not necessarily indicative of the results we may achieve for the entire year ending December 31, 2017. In particular, ASC's fleet is inactive for a significant portion of the first quarter of each year due to winter conditions on the Great Lakes. In addition, asset remarketing income does not occur evenly throughout the year. For more information about our business, refer to our Annual Report on Form 10-K for the year ended December 31, 2016.

19

DISCUSSION OF OPERATING RESULTS

The following table shows a summary of our reporting segments and consolidated financial results for the three and nine months ended September 30 (in millions, except per share data):

Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Segment Revenues | |||||||||||||||

Rail North America | $ | 242.4 | $ | 250.3 | $ | 737.4 | $ | 766.5 | |||||||

Rail International | 52.3 | 48.2 | 144.5 | 141.6 | |||||||||||

ASC | 60.2 | 52.8 | 116.3 | 105.4 | |||||||||||

Portfolio Management | 4.7 | 11.6 | 25.9 | 42.7 | |||||||||||

$ | 359.6 | $ | 362.9 | $ | 1,024.1 | $ | 1,056.2 | ||||||||

Segment Profit | |||||||||||||||

Rail North America | $ | 70.2 | $ | 87.9 | $ | 238.1 | $ | 273.4 | |||||||

Rail International | 20.1 | 23.3 | 50.1 | 48.9 | |||||||||||

ASC | 12.1 | 7.8 | 18.4 | 12.9 | |||||||||||

Portfolio Management | 12.8 | 64.1 | 47.3 | 119.2 | |||||||||||

115.2 | 183.1 | 353.9 | 454.4 | ||||||||||||

Less: | |||||||||||||||

Selling, general and administrative expense | 42.8 | 48.1 | 128.8 | 127.8 | |||||||||||

Unallocated interest expense, net | (2.4 | ) | (1.4 | ) | (5.9 | ) | (2.9 | ) | |||||||

Other, including eliminations | 1.5 | (0.3 | ) | 1.2 | 0.7 | ||||||||||

Income taxes ($3.9 and $(0.1) QTR and $9.6 and $4.0 YTD related to affiliates' earnings) | 24.3 | 41.0 | 69.9 | 102.6 | |||||||||||

Net Income | $ | 49.0 | $ | 95.7 | $ | 159.9 | $ | 226.2 | |||||||

Net income, excluding tax adjustments and other items (non-GAAP) | $ | 49.0 | $ | 61.1 | $ | 158.8 | $ | 189.9 | |||||||

Diluted earnings per share (GAAP) | $ | 1.25 | $ | 2.36 | $ | 4.04 | $ | 5.49 | |||||||

Diluted earnings per share, excluding tax adjustments and other items (non-GAAP) | $ | 1.25 | $ | 1.50 | $ | 4.01 | $ | 4.61 | |||||||

Investment Volume | $ | 163.7 | $ | 120.4 | $ | 459.0 | $ | 442.6 | |||||||

The following table shows our return on equity ("ROE") for the trailing twelve months ended September 30:

2017 | 2016 | ||||

ROE (GAAP) | 13.4 | % | 21.5 | % | |

ROE, excluding tax adjustments and other items (non-GAAP) | 14.4 | % | 19.0 | % | |

Net income was $159.9 million, or $4.04 per diluted share, for the first nine months of 2017 compared to $226.2 million, or $5.49 per diluted share, in 2016. Results for the nine months ended September 30, 2017, and 2016, included net gains of approximately $1.1 million and $2.1 million, respectively, associated with the planned exit of the majority of Portfolio Management's marine investments. In addition, during the nine months ended September 30, 2016, net proceeds of $30.3 million were recorded as a result of the settlement of a residual sharing agreement, and a $3.9 million benefit from deferred income tax adjustments was recorded due to enacted statutory rate decreases in the United Kingdom. See "Non-GAAP Financial Measures" at the end of this item for further details. Excluding the impact of these items, net income decreased $31.1 million compared to the prior year.

20

Net income was $49.0 million, or $1.25 per diluted share, for the third quarter of 2017 compared to $95.7 million, or $2.36 per diluted share, in 2016. Results for the third quarter of 2016 included net gains of approximately $0.4 million associated with the planned exit of the majority of Portfolio Management's marine investments. In addition, during the third quarter of 2016, net proceeds of $30.3 million were recorded as a result of the settlement of a residual sharing agreement, and a $3.9 million benefit from deferred income tax adjustments was recorded due to enacted statutory rate decreases in the United Kingdom. See "Non-GAAP Financial Measures" at the end of this item for further details. Excluding the impact of these items, net income decreased $12.1 million compared to the prior year.

The decreases in both the quarter and year-to-date net income for 2017 were primarily driven by lower disposition gains and lower lease revenue at Rail North America, resulting from lower lease rates and fewer railcars on lease. In the prior year, disposition gains for both the quarter and year-to-date included sizeable residual sharing fees from the managed portfolio at our Portfolio Management segment.

SEGMENT OPERATIONS

Segment profit is an internal performance measure used by the Chief Executive Officer to assess the performance of each segment in a given period. Segment profit includes all revenues, pre-tax earnings from affiliates, and net gains on asset dispositions that are attributable to the segments, as well as expenses that management believes are directly associated with the financing, maintenance, and operation of the revenue earning assets. Segment profit excludes selling, general and administrative expenses, income taxes, and certain other amounts not allocated to the segments. These amounts are included in Other.

We allocate debt balances and related interest expense to each segment based upon predetermined debt to equity leverage ratios. The leverage levels are 5:1 for Rail North America, 3:1 for Rail International, 1.5:1 for ASC, and 1:1 for Portfolio Management. We believe that by using this leverage and interest expense allocation methodology, each operating segment’s financial performance reflects appropriate risk-adjusted borrowing costs.

RAIL NORTH AMERICA

Segment Summary

Challenging conditions continue in the North American railcar leasing market due to the oversupply of existing railcars and a large railcar manufacturing backlog. Despite this difficult environment, Rail North America has been successful in maintaining high utilization of its railcars across all tank and freight types.

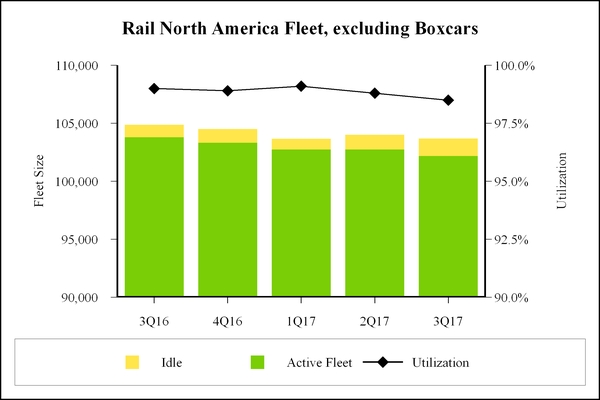

At September 30, 2017, Rail North America's wholly owned fleet, excluding boxcars, consisted of approximately 103,700 cars. Fleet utilization, excluding boxcars, was 98.5% at the end of September 30, 2017, compared to 98.8% at the end of prior quarter, and 99.0% at September 30, 2016. Fleet utilization for approximately 16,600 boxcars was 92.4% at the end of September 30, 2017, compared to 90.2% at the end of the prior quarter and 94.7% at September 30, 2016.

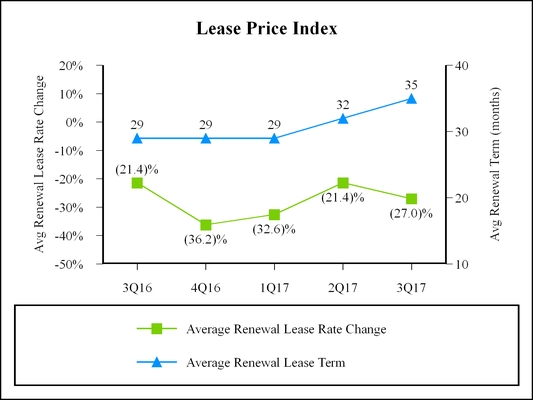

During the third quarter of 2017, the Lease Price Index (the "LPI", see definition below) decreased 27.0%, compared to decreases of 21.4% in the prior quarter and 21.4% in the third quarter of 2016. Lease terms on renewals for cars in the LPI averaged 35 months in the current quarter, compared to 32 months in the prior quarter, and 29 months in the third quarter of 2016. Additionally, the renewal success rate was 74.9% in the current quarter, compared to 75.1% in the prior quarter and 74.1% in the third quarter of 2016. As the challenging lease rate environment persists, we will continue to experience pressure on the LPI. For the third quarter of 2017, an average of approximately 102,600 railcars, excluding boxcars, were on lease, compared to 102,800 in the prior quarter and 103,500 in the third quarter of 2016.

As of September 30, 2017, leases for approximately 5,290 railcars in our term lease fleet and approximately 1,920 boxcars are scheduled to expire over the remainder of 2017. These amounts exclude railcars with leases expiring over the remainder of 2017 that have already been renewed or assigned to a new lessee.

21

The following table shows Rail North America's segment results (in millions):

Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Revenues | |||||||||||||||

Lease revenue | $ | 224.5 | $ | 233.0 | $ | 677.4 | $ | 703.0 | |||||||

Other revenue | 17.9 | 17.3 | 60.0 | 63.5 | |||||||||||

Total Revenues | 242.4 | 250.3 | 737.4 | 766.5 | |||||||||||

Expenses | |||||||||||||||

Maintenance expense | 66.1 | 62.8 | 202.3 | 196.2 | |||||||||||

Depreciation expense | 60.1 | 58.4 | 178.8 | 173.0 | |||||||||||

Operating lease expense | 15.5 | 17.2 | 45.3 | 50.6 | |||||||||||

Other operating expense | 7.3 | 8.6 | 21.7 | 25.0 | |||||||||||

Total Expenses | 149.0 | 147.0 | 448.1 | 444.8 | |||||||||||

Other Income (Expense) | |||||||||||||||

Net gain on asset dispositions | 8.1 | 13.1 | 42.6 | 36.4 | |||||||||||

Interest expense, net | (30.5 | ) | (27.1 | ) | (90.1 | ) | (81.2 | ) | |||||||

Other expense | (0.9 | ) | (1.4 | ) | (4.1 | ) | (3.8 | ) | |||||||

Share of affiliate's pre-tax income | 0.1 | — | 0.4 | 0.3 | |||||||||||

Segment Profit | $ | 70.2 | $ | 87.9 | $ | 238.1 | $ | 273.4 | |||||||

Investment Volume | $ | 103.3 | $ | 108.4 | $ | 333.7 | $ | 366.7 | |||||||

The following table shows the components of Rail North America's lease revenue (in millions):

Three Months Ended September 30 | Nine Months Ended September 30 | ||||||||||||||

2017 | 2016 | 2017 | 2016 | ||||||||||||

Railcars | $ | 195.9 | $ | 201.4 | $ | 591.8 | $ | 611.0 | |||||||

Boxcars | 18.9 | 21.7 | 56.3 | 62.5 | |||||||||||

Locomotives | 9.7 | 9.9 | 29.3 | 29.5 | |||||||||||

$ | 224.5 | $ | 233.0 | $ | 677.4 | $ | 703.0 | ||||||||

Lease Price Index

Our LPI is an internally-generated business indicator that measures lease rate pricing on renewals for our North American railcar fleet, excluding boxcars. We calculate the index using the weighted average lease rate for a group of railcar types that we believe best represents our overall North American fleet, excluding boxcars. The average renewal lease rate change is reported as the percentage change between the average renewal lease rate and the average expiring lease rate, weighted by fleet composition. The average renewal lease term is reported in months and reflects the average renewal lease term of railcar types in the LPI, weighted by fleet composition.

22

Rail North America Fleet Data

The following table shows fleet activity for Rail North America railcars, excluding boxcars for the quarter ended:

September 30 2016 | December 31 2016 | March 31 2017 | June 30 2017 | September 30 2017 | ||||||||||

Beginning balance | 105,368 | 104,874 | 104,522 | 103,672 | 104,007 | |||||||||

Cars added | 764 | 1,087 | 795 | 1,224 | 637 | |||||||||

Cars scrapped | (590 | ) | (579 | ) | (806 | ) | (640 | ) | (854 | ) | ||||

Cars sold | (668 | ) | (860 | ) | (839 | ) | (249 | ) | (98 | ) | ||||

Ending balance | 104,874 | 104,522 | 103,672 | 104,007 | 103,692 | |||||||||

Utilization rate at quarter end | 99.0 | % | 98.9 | % | 99.1 | % | 98.8 | % | 98.5 | % | ||||

Average active railcars | 103,479 | 103,702 | 102,976 | 102,760 | 102,555 | |||||||||

23

The following table shows fleet statistics for Rail North America boxcars:

September 30 2016 | December 31 2016 | March 31 2017 | June 30 2017 | September 30 2017 | ||||||||||

Ending balance | 18,089 | 17,706 | 17,415 | 17,138 | 16,555 | |||||||||

Utilization | 94.7 | % | 93.8 | % | 92.9 | % | 90.2 | % | 92.4 | % | ||||

Comparison of the First Nine Months of 2017 to the First Nine Months of 2016

Segment Profit

Segment profit was $238.1 million in the first nine months of 2017 compared to $273.4 million in the same period in the prior year. The decrease was driven by lower lease revenue and higher maintenance expense, partially offset by higher asset disposition gains.

Revenues

Lease revenue decreased $25.6 million in the first nine months of 2017, primarily due to lower lease rates and fewer railcars on lease. Other revenue decreased $3.5 million in the first nine months of 2017 due to lower repair revenue and lower lease termination fees. Other revenue in 2016 included a lease termination fee of approximately $10.0 million for allowing a customer to return railcars prior to the contractual end of an existing lease. Other revenue in the current year included $7.8 million for compensation of damages to returned cars. The expenses to repair these cars will be recognized as incurred. In some cases, it may be more economical to scrap the railcar rather than incur these expenses.

24

Expenses

Maintenance expense increased $6.1 million in the first nine months of 2017, primarily due to an increase in costs associated with cars assigned to new lessees, partially offset by lower expenses for the boxcar fleet and lower repairs performed by the railroads. Depreciation expense increased $5.8 million in the first nine months of 2017, largely due to new investments. Operating lease expense decreased $5.3 million in the first nine months of 2017, resulting from the purchase of railcars previously on operating leases in both years. Other operating expense decreased $3.3 million in the first nine months of 2017, primarily due to lower switching and freight costs.

Other Income (Expense)

Net gain on asset dispositions increased $6.2 million in the first nine months of 2017, in part due to higher average net gains on railcar and locomotive sales. In addition, higher scrapping gains, resulting from more railcars scrapped and higher scrap prices, were partially offset by an impairment loss recorded in the current year on certain railcars. Net interest expense increased $8.9 million in the first nine months of 2017, due to a higher average interest rate and a higher average debt balance. Other expense in the first nine months of 2017 was comparable to the same period in the prior year.

Investment Volume

During the first nine months of 2017, investment volume was $333.7 million compared to $366.7 million in the same period in 2016. We acquired 2,532 newly built railcars and purchased 212 railcars in the secondary market in the first nine months of 2017, compared to 2,361 newly built railcars and 25 railcars purchased in the secondary market in the same period in 2016.

Comparison of the Third Quarter of 2017 to the Third Quarter of 2016

Segment Profit

Segment profit was $70.2 million in the third quarter of 2017, compared to $87.9 million in the same period in the prior year. The decrease was driven by lower lease revenue and lower asset disposition gains.

Revenues

Lease revenue decreased $8.5 million in the third quarter of 2017, primarily due to lower lease rates and fewer cars on lease. Other revenue in the third quarter of 2017 was comparable to the same period in the prior year.

Expenses

Maintenance expense increased $3.3 million in the third quarter of 2017, primarily due to an increase in costs associated with cars assigned to new lessees, partially offset by lower expenses for the boxcar fleet and lower repairs performed by the railroads. Depreciation expense increased $1.7 million in the period, largely due to new investments. Operating lease expense decreased $1.7 million in the third quarter of 2017, resulting from the purchase of railcars previously on operating leases in both years. Other operating expense decreased $1.3 million in the period, primarily due to lower switching and freight costs.

Other Income (Expense)