Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Pattern Energy Group Inc. | pegi201512318kexhibit991.htm |

| 8-K - 8-K - Pattern Energy Group Inc. | pegi201512318kdoc.htm |

PATTERN ENERGY GROUP INC. Q4 2015 Earnings Call | February 29, 2016 Exhibit 99.2

SAFE HARBOR STATEMENT 2PATTERN ENERGY GROUP INC. The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995 and “forward-looking information” as defined in Canadian securities laws). The words “may,” “plan,” “forecast,” “seek,” “target,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements about Pattern Energy Group Inc. (the “Company”). By their nature, forward-looking statements are not statements of historical facts and involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future, many of which are outside the Company’s control. Such risks and uncertainties could cause the actual results, performance or achievements of the Company to be materially different from its current expectations and include, but are not limited to: the Company’s ability to complete construction of any construction projects and transition them into financially successful operating projects; the Company’s ability to complete acquisition of power projects; fluctuations in supply, demand, prices and other conditions for electricity; the Company’s electricity generation, projections thereof and factors affecting production including wind and other conditions, other weather conditions, availability and curtailment; changes in law; and the Company’s ability to keep pace with and take advantage of new technologies. In particular, this presentation contains the Company’s adjusted EBITDA and cash available for distribution, which are not measures under generally accepted accounting principles in the United States (“U.S. GAAP”). Adjusted EBITDA and cash available for distribution have been disclosed because the Company believes that these measures may assist investors in evaluating its financial performance and its ability to pay dividends. Neither adjusted EBITDA nor cash available for distribution should be considered the sole measure of the Company’s performance and should not be considered in isolation from, or as a substitute for, the Company’s U.S. GAAP measures, including, but not limited to, the most directly comparable U.S. GAAP measures, net (loss) income and net cash provided by operating activities, respectively. See pages 20-22 and Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Key Metrics in the Company’s annual report on Form 10-K for the year ended December 31, 2015, for a reconciliation of net cash provided by operating activities to cash available for distribution and net (loss) income to adjusted EBITDA. Forward looking measures of CAFD, run-rate CAFD and CAFD per share growth are non U.S. GAAP measures that cannot be reconciled to net cash provided by operating activates as the most directly comparable non U.S. GAAP financial measure with unreasonable effort. A description of the adjustments to determine CAFD can be found in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Key Metrics of the Company’s 2015 Annual Report on Form 10-K. All forward-looking statements speak only as of the date made, and the Company expressly disclaims any intention or obligation to revise or publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise except as may be required by applicable law. For additional information regarding known material risks that could cause the Company’s actual results to differ from its projected results please read “Risk Factors” in the Company’s 2015 annual report on Form 10-K. (All currencies are U.S. dollars unless specified otherwise.) Exhibit 99.2

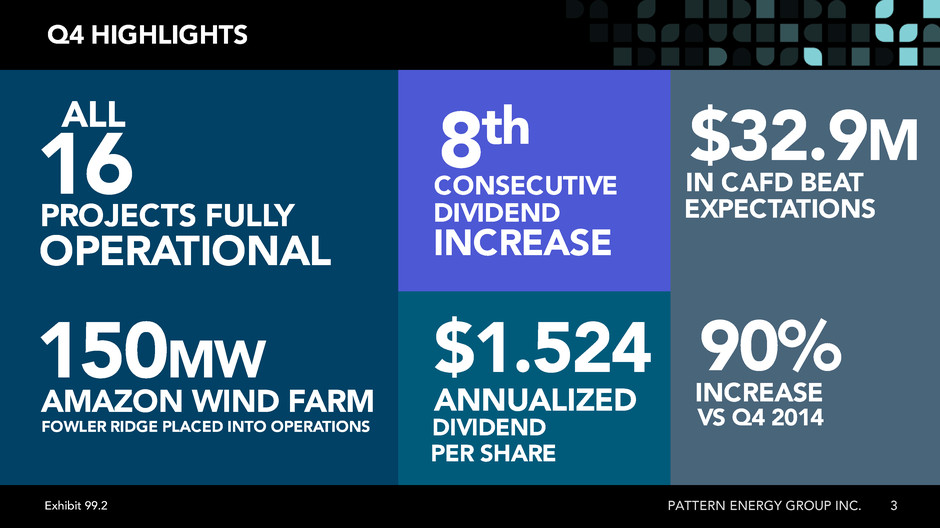

Q4 HIGHLIGHTS 3PATTERN ENERGY GROUP INC. DIVIDEND CONSECUTIVE INCREASE ANNUALIZED PER SHARE OPERATIONAL ALL $1.524 16 8th PROJECTS FULLY 150MW AMAZON WIND FARM FOWLER RIDGE PLACED INTO OPERATIONS DIVIDEND $32.9M IN CAFD BEAT 90% INCREASE EXPECTATIONS VS Q4 2014 Exhibit 99.2

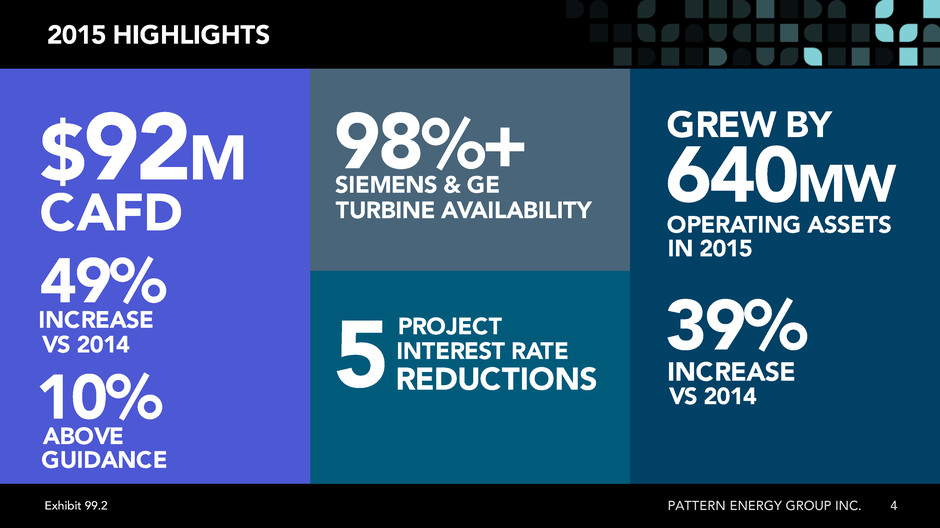

2015 HIGHLIGHTS 4PATTERN ENERGY GROUP INC. $92M CAFD 10% INTEREST RATE PROJECT REDUCTIONS ABOVE GUIDANCE 5 640MW GREW BY OPERATING ASSETS 98%+ TURBINE AVAILABILITY SIEMENS & GE 39% INCREASE 49% INCREASE VS 2014 IN 2015 VS 2014 Exhibit 99.2

INTEGRATED OPERATOR OF HIGH QUALITY ASSETS 5 + Drop downs Best-in-class equipment OUR STRATEGY FOR STABLE, GROWING RETURNS Creditworthy counterparties Long term power sales contracts PATTERN ENERGY GROUP INC. Wind Exhibit 99.2

PATTERN OUTLOOK PATTERN ENERGY GROUP INC. 6 SOUND STRATEGYBEST-IN-CLASS BUSINESS Built in CAFD Growth • Growing to $156M from $92M (FY 2015) • 8 consecutive dividend increases (22% increase since IPO) Driving Value Over 5 Years • Reducing operating costs by $10,000 – $20,000/turbine • Increasing production 3 – 5% • Increasing corporate efficiencies Wind Resources • ~7 years of on site data • Quarterly forecasting Patient Capital Needs • No equity required for current business • Capacity for 1+ drop down Best Equipment • Siemens/GE • <3 year average age • ~98% turbine availability Growing Responsibly • Strong 1.3 GW identified ROFO • Expanded Pattern Development capital Long-term Contracts • A- weighted average credit rating of off-takers • 90% of volume under long-term contract Expanding Business Opportunities • 5,000 MW by end of 2019 • Development Project Debt • Amortizing less than PPA term • <5% long-term fixed interest on project debt Lasting Capital Structure • Project debt • 3X corporate debt cash flow coverage Exhibit 99.2

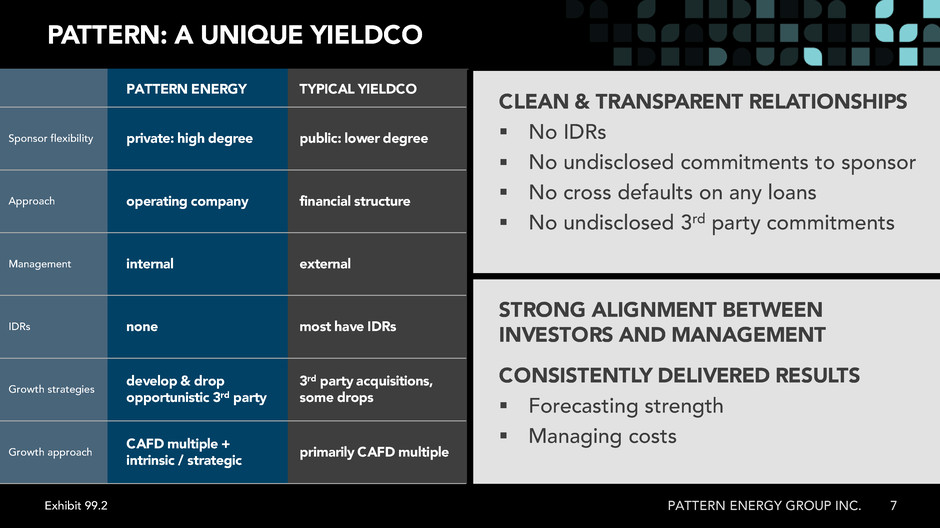

PATTERN: A UNIQUE YIELDCO 7PATTERN ENERGY GROUP INC. PATTERN ENERGY TYPICAL YIELDCO Sponsor flexibility private: high degree public: lower degree Approach operating company financial structure Management internal external IDRs none most have IDRs Growth strategies develop & drop opportunistic 3rd party 3rd party acquisitions, some drops Growth approach CAFD multiple + intrinsic / strategic primarily CAFD multiple CLEAN & TRANSPARENT RELATIONSHIPS No IDRs No undisclosed commitments to sponsor No cross defaults on any loans No undisclosed 3rd party commitments STRONG ALIGNMENT BETWEEN INVESTORS AND MANAGEMENT CONSISTENTLY DELIVERED RESULTS Forecasting strength Managing costs Exhibit 99.2

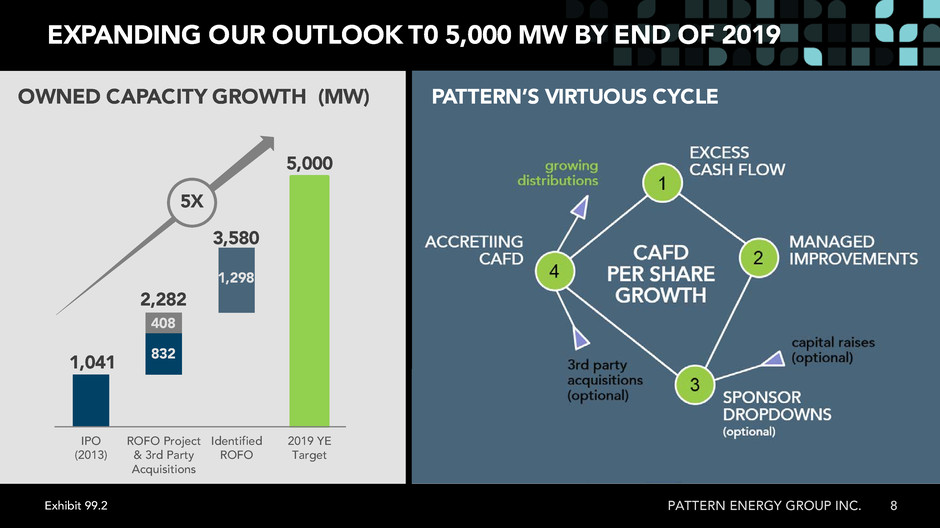

EXPANDING OUR OUTLOOK T0 5,000 MW BY END OF 2019 PATTERN ENERGY GROUP INC. 8 1,041 IPO (2013) ROFO Project & 3rd Party Acquisitions Identified ROFO 2019 YE Target 3,580 5,000 OWNED CAPACITY GROWTH (MW) 5X 2,282 408 832 1,298 PATTERN’S VIRTUOUS CYCLE Exhibit 99.2

FINANCIALS Exhibit 99.2

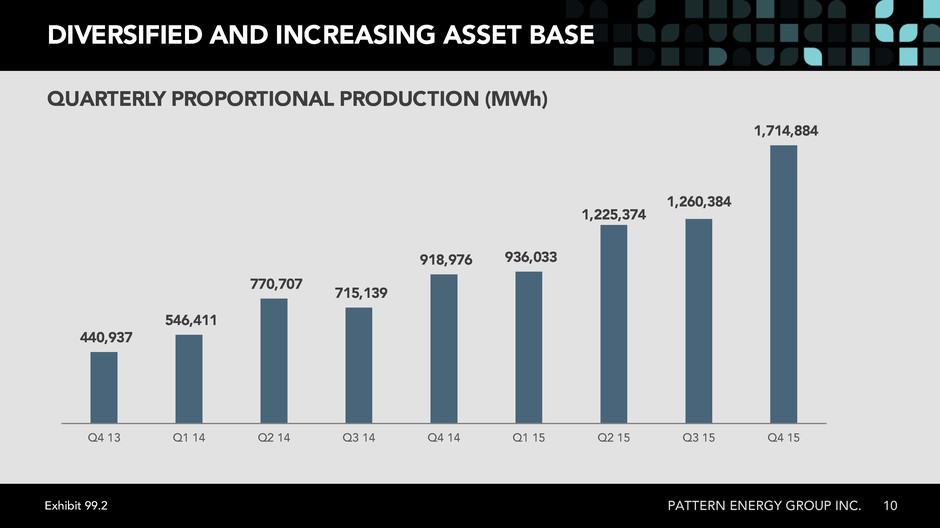

DIVERSIFIED AND INCREASING ASSET BASE 10PATTERN ENERGY GROUP INC. 440,937 546,411 770,707 715,139 918,976 936,033 1,225,374 1,260,384 1,714,884 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 QUARTERLY PROPORTIONAL PRODUCTION (MWh) Exhibit 99.2

Q4 AND FY 2015 FINANCIAL SUMMARY 11PATTERN ENERGY GROUP INC. 1) See pages 20-22 for a reconciliation of Q4 2015/2014 and FY 2015/2014 net cash provided by operating activities to Q4 2015/2014 and FY 2015/2014 cash available for distribution and net (loss) income to adjusted EBITDA $92.4 M: EXCEEDED 2015 CAFD ESTIMATE OF $81-87 M USD millions (except GWh) Q4 2015 Q4 2014 change 2015 2014 change GWh 1,715 919 87% 5,137 2,951 74% Revenue $90.6 $79.4 14% $329.8 $265.5 24% Adjusted EBITDA1 $78.3 $57.7 36% $250.5 $198.1 26% Cash Available for Distribution1 $32.9 $17.3 90% $92.4 $62.1 49% Exhibit 99.2

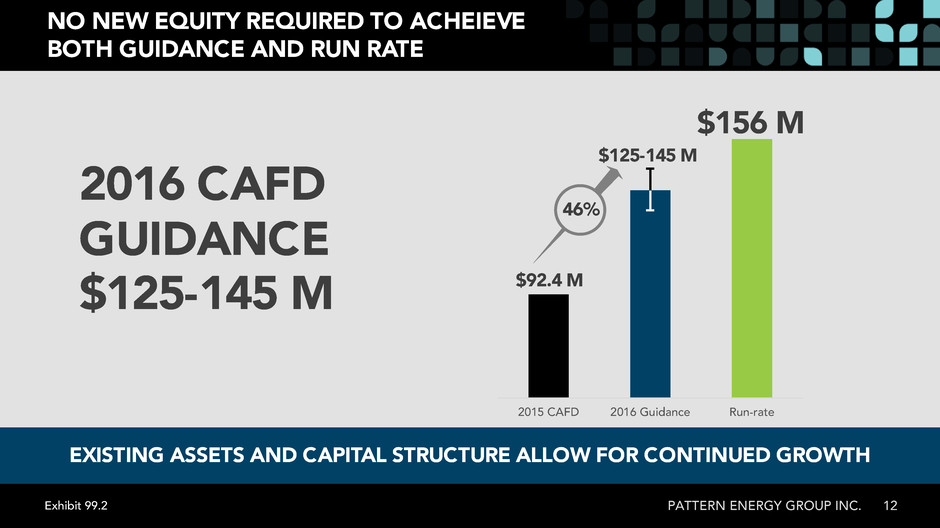

2015 CAFD 2016 Guidance Run-rate NO NEW EQUITY REQUIRED TO ACHEIEVE BOTH GUIDANCE AND RUN RATE PATTERN ENERGY GROUP INC. 12 EXISTING ASSETS AND CAPITAL STRUCTURE ALLOW FOR CONTINUED GROWTH $92.4 M $156 M 2016 CAFD $125-145 M GUIDANCE 46% $125-145 M Exhibit 99.2

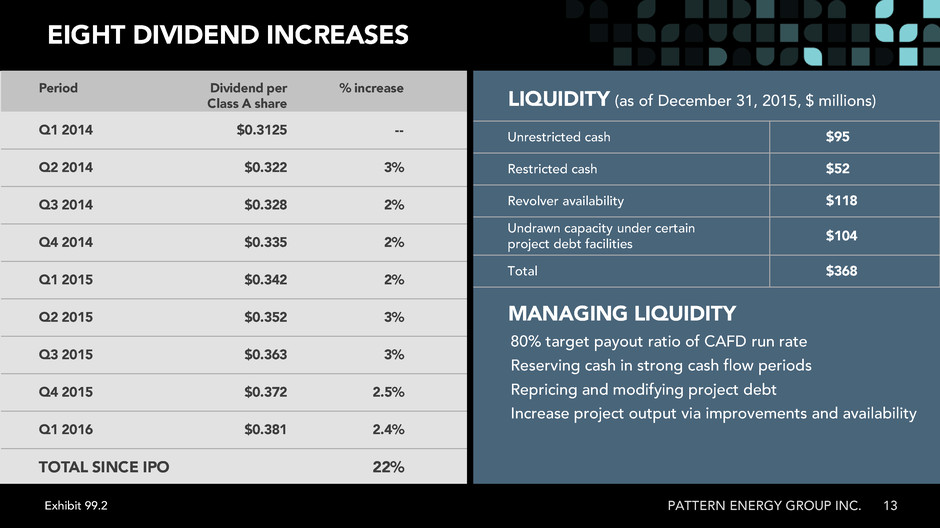

EIGHT DIVIDEND INCREASES 13PATTERN ENERGY GROUP INC. LIQUIDITY (as of December 31, 2015, $ millions) MANAGING LIQUIDITY Unrestricted cash $95 Restricted cash $52 Revolver availability $118 Undrawn capacity under certain project debt facilities $104 Total $368 80% target payout ratio of CAFD run rate Reserving cash in strong cash flow periods Repricing and modifying project debt Increase project output via improvements and availability Period Dividend per Class A share % increase Q1 2014 $0.3125 -- Q2 2014 $0.322 3% Q3 2014 $0.328 2% Q4 2014 $0.335 2% Q1 2015 $0.342 2% Q2 2015 $0.352 3% Q3 2015 $0.363 3% Q4 2015 $0.372 2.5% Q1 2016 $0.381 2.4% TOTAL SINCE IPO 22% Exhibit 99.2

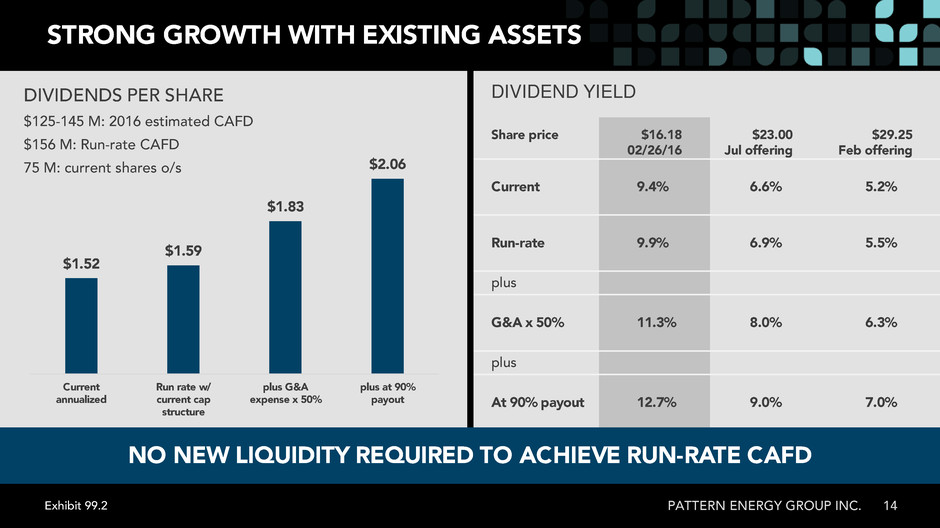

STRONG GROWTH WITH EXISTING ASSETS 14PATTERN ENERGY GROUP INC. DIVIDEND YIELD Share price $16.18 02/26/16 $23.00 Jul offering $29.25 Feb offering Current 9.4% 6.6% 5.2% Run-rate 9.9% 6.9% 5.5% plus G&A x 50% 11.3% 8.0% 6.3% plus At 90% payout 12.7% 9.0% 7.0% $1.52 $1.59 $1.83 $2.06 Current annualized Run rate w/ current cap structure plus G&A expense x 50% plus at 90% payout NO NEW LIQUIDITY REQUIRED TO ACHIEVE RUN-RATE CAFD DIVIDENDS PER SHARE $125-145 M: 2016 estimated CAFD $156 M: Run-rate CAFD 75 M: current shares o/s Exhibit 99.2

CLOSING REMARKS Exhibit 99.2

STARTING 2016 IN A STRONG POSITION 16PATTERN ENERGY GROUP INC. CERTAINTY GROWTH WITH NO NEW EQUITY ROFO GROWING LIST DELIVERED SINCE IPO CONSISTENTLY OF PTC HIGHER PATIENT, YET ACTIVE APPROACH DEMAND FROM EXPANDING DROP DOWNS ACCRETIVE RFSs & CPP LOWER kWh COSTS ONLY Exhibit 99.2

PATTERN ENERGY GROUP INC. Q&A | FEBRUARY 29, 2016 Exhibit 99.2

Project size Owned % Owned MW Revenue Off-Taker COD Turbines Contract Tenor % Under Contract Gulf Wind, TX 283 100% 283 Hedge Morgan Stanley Q3 2009 Mitsubishi 2019 ~58% Hatchet Ridge, CA 101 100% 101 PPA PG&E Q4 2010 Siemens 2025 100% St. Joseph, MB 138 100% 138 PPA Manitoba Hydro Q2 2011 Siemens 2039 100% Spring Valley, NV 152 100% 152 PPA NV Energy Q3 2012 Siemens 2032 100% Santa Isabel, Puerto Rico 101 100% 101 PPA PREPA Q4 2012 Siemens 2034 100% Ocotillo, CA 265 100% 265 PPA SDG&E Q4 2012/ Q2 2013 Siemens 2033 100% South Kent, ON 270 50% 135 PPA IESO Q2 2014 Siemens 2034 100% El Arrayán, Chile 115 70% 81 Hedge Minera Los Pelambres Q2 2014 Siemens 2034 ~74% Panhandle 1, TX 218 79% 172 Hedge Citigroup Energy Q2 2014 GE 2027 ~80% Panhandle 2, TX 182 81% 147 Hedge Morgan Stanley Q4 2014 Siemens 2027 ~80% Grand, ON 149 45% 67 PPA IESO Q4 2014 Siemens 2034 100% Post Rock, KS 201 60% 120 PPA Westar Q4 2012 GE 2032 100% Lost Creek, MO 150 100% 150 PPA Associated Electric Cooperative Q2 2010 GE 2030 100% K2, ON 270 33% 90 PPA IESO Q2 2015 Siemens 2035 100% Logan’s Gap, TX 200 82% 164 PPA / Hedge Wal-mart Stores Inc. / Financial institution Q3 2015 Siemens 2025/28 ~75% Amazon Wind Farm (F), IN 150 77% 116 PPA Amazon.com Q4 2015 Siemens 2028 100% Total Combined 2,945 2,282 14 years 89% 18PATTERN ENERGY GROUP INC. HIGH-QUALITY PORTFOLIO OF POWER PROJECTS Exhibit 99.2

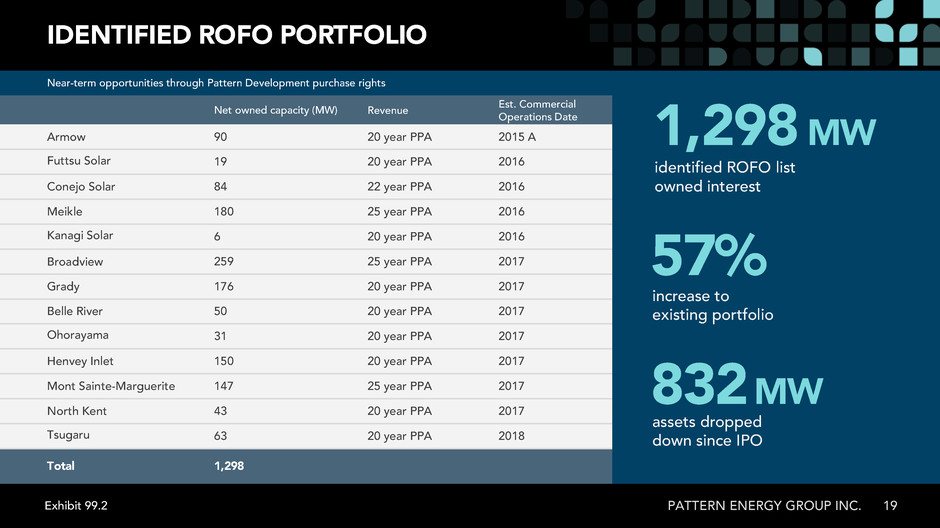

IDENTIFIED ROFO PORTFOLIO 19 Near-term opportunities through Pattern Development purchase rights Net owned capacity (MW) Revenue Est. Commercial Operations Date Armow 90 20 year PPA 2015 A Futtsu Solar 19 20 year PPA 2016 Conejo Solar 84 22 year PPA 2016 Meikle 180 25 year PPA 2016 Kanagi Solar 6 20 year PPA 2016 Broadview 259 25 year PPA 2017 Grady 176 20 year PPA 2017 Belle River 50 20 year PPA 2017 Ohorayama 31 20 year PPA 2017 Henvey Inlet 150 20 year PPA 2017 Mont Sainte-Marguerite 147 25 year PPA 2017 North Kent 43 20 year PPA 2017 Tsugaru 63 20 year PPA 2018 Total 1,298 PATTERN ENERGY GROUP INC. 1,298 MW identified ROFO list owned interest assets dropped down since IPO 832MW 57% increase to existing portfolio Exhibit 99.2

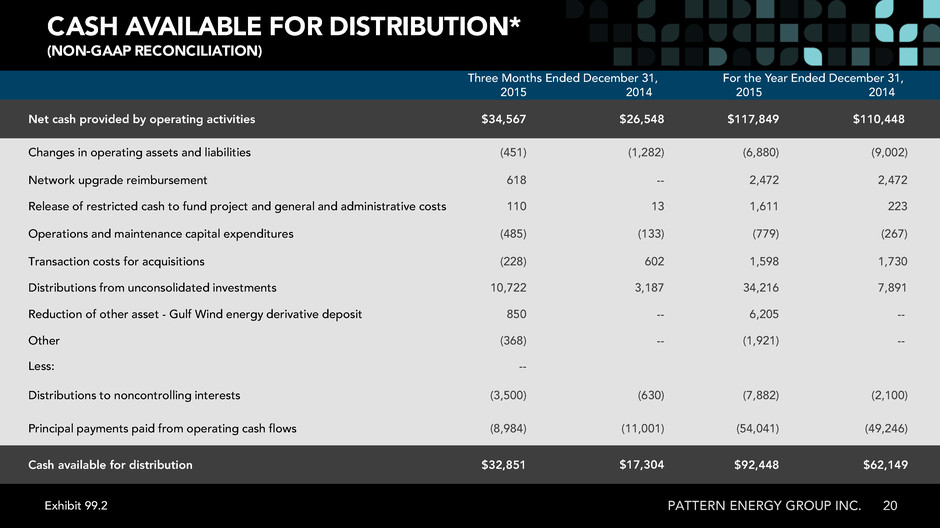

CASH AVAILABLE FOR DISTRIBUTION* (NON-GAAP RECONCILIATION) PATTERN ENERGY GROUP INC. 20 Three Months Ended December 31, For the Year Ended December 31, 2015 2014 2015 2014 Net cash provided by operating activities $34,567 $26,548 $117,849 $110,448 Changes in operating assets and liabilities (451) (1,282) (6,880) (9,002) Network upgrade reimbursement 618 -- 2,472 2,472 Release of restricted cash to fund project and general and administrative costs 110 13 1,611 223 Operations and maintenance capital expenditures (485) (133) (779) (267) Transaction costs for acquisitions (228) 602 1,598 1,730 Distributions from unconsolidated investments 10,722 3,187 34,216 7,891 Reduction of other asset - Gulf Wind energy derivative deposit 850 -- 6,205 -- Other (368) -- (1,921) -- Less: -- Distributions to noncontrolling interests (3,500) (630) (7,882) (2,100) Principal payments paid from operating cash flows (8,984) (11,001) (54,041) (49,246) Cash available for distribution $32,851 $17,304 $92,448 $62,149 Exhibit 99.2

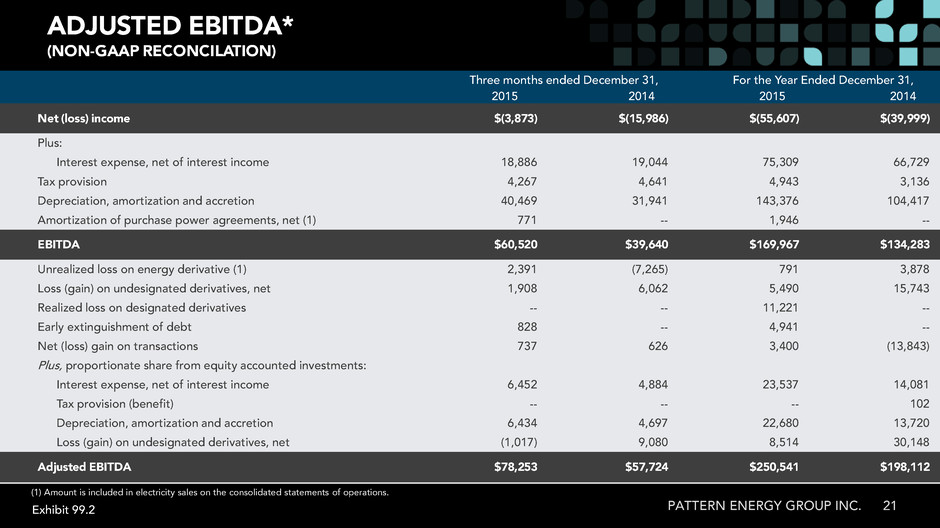

ADJUSTED EBITDA* (NON-GAAP RECONCILATION) PATTERN ENERGY GROUP INC. 21 Three months ended December 31, For the Year Ended December 31, 2015 2014 2015 2014 Net (loss) income $(3,873) $(15,986) $(55,607) $(39,999) Plus: Interest expense, net of interest income 18,886 19,044 75,309 66,729 Tax provision 4,267 4,641 4,943 3,136 Depreciation, amortization and accretion 40,469 31,941 143,376 104,417 Amortization of purchase power agreements, net (1) 771 -- 1,946 -- EBITDA $60,520 $39,640 $169,967 $134,283 Unrealized loss on energy derivative (1) 2,391 (7,265) 791 3,878 Loss (gain) on undesignated derivatives, net 1,908 6,062 5,490 15,743 Realized loss on designated derivatives -- -- 11,221 -- Early extinguishment of debt 828 -- 4,941 -- Net (loss) gain on transactions 737 626 3,400 (13,843) Plus, proportionate share from equity accounted investments: Interest expense, net of interest income 6,452 4,884 23,537 14,081 Tax provision (benefit) -- -- -- 102 Depreciation, amortization and accretion 6,434 4,697 22,680 13,720 Loss (gain) on undesignated derivatives, net (1,017) 9,080 8,514 30,148 Adjusted EBITDA $78,253 $57,724 $250,541 $198,112 (1) Amount is included in electricity sales on the consolidated statements of operations. Exhibit 99.2

*SUMMARY NON-GAAP FINANCIAL MEASURES Adjusted EBITDA represents net (loss) income before net interest expense, income taxes, depreciation, amortization and accretion, including our proportionate share of net interest expense, income taxes and depreciation, amortization, and accretion of joint venture investments that are accounted for under the equity method. Adjusted EBITDA also excludes the effect of certain mark-to-market adjustments and infrequent items not related to normal or ongoing operations, such as early payment of debt and realized derivative gain or loss from refinancing transactions, and gain or loss related to acquisitions or divestitures. We disclose adjusted EBITDA, which is a non-U.S. GAAP measure, because management believes this metric assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that our management believes are not indicative of our core operating performance. We use adjusted EBITDA to evaluate our operating performance. You should not consider adjusted EBITDA as an alternative to net (loss) income, determined in accordance with U.S. GAAP. Adjusted EBITDA has limitations as an analytical tool. Some of these limitations are: • adjusted EBITDA: • does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; • does not reflect changes in, or cash requirements for, our working capital needs; • does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; • does not reflect our income tax expense or the cash requirement to pay our taxes; and • does not reflect the effect of certain mark-to-market adjustments and non-recurring items; • although depreciation, amortization and accretion are non-cash charges, the assets being depreciated, amortized, and accreted will often have to be replaced in the future, and adjusted EBITDA does not reflect any cash requirements for such replacements; and • other companies in our industry may calculate adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with U.S. GAAP. Cash available for distribution represents net cash provided by operating activities as adjusted to (i) add or subtract changes in operating assets and liabilities, (ii) subtract net deposits into restricted cash accounts, which are required pursuant to the cash reserve requirements of financing agreements, to the extent they are paid from operating cash flows during a period, (iii) subtract cash distributions paid to noncontrolling interests, (iv) subtract scheduled project-level debt repayments in accordance with the related loan amortization schedule, to the extent they are paid from operating cash flows during a period, (v) subtract non-expansionary capital expenditures, to the extent they are paid from operating cash flows during a period, and (vi) add cash distributions received from unconsolidated investments, to the extent such distributions were derived from operating cash flows, and (vii) add or subtract other items as necessary to present the cash flows we deem representative of our core business operations. We disclose cash available for distribution because management recognizes that it will be used as a supplemental measure by investors and analysts to evaluate our liquidity. However, cash available for distribution has limitations as an analytical tool because it excludes depreciation, amortization, and accretion, does not capture the level of capital expenditures necessary to maintain the operating performance of our projects, is not reduced for principal payments on our project indebtedness except to the extent it is paid from operating cash flows during a period, and excludes the effect of certain other cash flow items, all of which could have a material effect on our financial condition and results from operations. Cash available for distribution is a non-U.S. GAAP measure and should not be considered an alternative to net cash provided by operating activities or any other liquidity measure determined in accordance with U.S. GAAP, nor is it indicative of funds available to fund our cash needs. In addition, our calculation of cash available for distribution is not necessarily comparable to cash available for distribution as calculated by other companies. PATTERN ENERGY GROUP INC. 22Exhibit 99.2