Attached files

| file | filename |

|---|---|

| EX-12.1 - EX-12.1 - Lazard Group LLC | d94944dex121.htm |

| EX-32.2 - EX-32.2 - Lazard Group LLC | d94944dex322.htm |

| EX-31.1 - EX-31.1 - Lazard Group LLC | d94944dex311.htm |

| EX-32.1 - EX-32.1 - Lazard Group LLC | d94944dex321.htm |

| EX-31.2 - EX-31.2 - Lazard Group LLC | d94944dex312.htm |

| EX-21.1 - EX-21.1 - Lazard Group LLC | d94944dex211.htm |

| EX-23.1 - EX-23.1 - Lazard Group LLC | d94944dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

333-126751

(Commission File Number)

LAZARD GROUP LLC

(Exact name of registrant as specified in its charter)

| Delaware |

51-0278097 | |

| (State or Other Jurisdiction of Incorporation | (I.R.S. Employer Identification No.) | |

| or Organization) |

30 Rockefeller Plaza

New York, NY 10112

(Address of principal executive offices)

Registrant’s telephone number: (212) 632-6000

| Securities Registered Pursuant to Section 12(b) of the Act: None | ||

| Securities Registered Pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x | Smaller reporting company ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2015, none of the Registrant’s common membership interests were held by non-affiliates.

As of January 29, 2016, in addition to profit participation interests, there were two managing member interests outstanding.

The Registrant meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format by omitting the information called for by the following items of Form 10-K: Item 10, Directors, Executive Officers and Corporate Governance; Item 11, Executive Compensation; Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters; and Item 13, Certain Relationships and Related Transactions, and Director Independence.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

INDEX

i

Table of Contents

When we use the terms “Lazard Group”, “Lazard”, “we”, “us”, “our” and “the Company”, we mean Lazard Group LLC, a Delaware limited liability company that is the current holding company for the subsidiaries that conduct our businesses. Lazard Ltd is a Bermuda exempt company whose shares of Class A common stock (the “Class A common stock”) are publicly traded on the New York Stock Exchange under the symbol “LAZ”. Lazard Ltd’s subsidiaries include Lazard Group and their respective subsidiaries. Lazard Ltd’s primary operating asset is its indirect ownership as of December 31, 2015 of all of the common membership interests in Lazard Group. Lazard Ltd controls Lazard Group through two of its indirect wholly-owned subsidiaries that are co-managing members of Lazard Group.

Lazard Group has granted profit participation interests in Lazard Group to certain of its managing directors. The profit participation interests are discretionary profits interests that are intended to enable Lazard Group to compensate its managing directors in a manner consistent with historical practices.

| Item 1. | Business |

Lazard is one of the world’s preeminent financial advisory and asset management firms. We have long specialized in crafting solutions to the complex financial and strategic challenges of a diverse set of clients around the world, including corporations, governments, institutions, partnerships and individuals. Founded in 1848 in New Orleans, we currently operate from 43 cities in key business and financial centers across 27 countries throughout North America, Europe, Asia, Australia, the Middle East, and Central and South America.

Principal Business Lines

We focus primarily on two business segments: Financial Advisory and Asset Management. We believe that the mix of our activities across business segments, geographic regions, industries and investment strategies helps to diversify and stabilize our revenue stream.

Financial Advisory

Our Financial Advisory business offers corporate, partnership, institutional, government, sovereign and individual clients across the globe a wide array of financial advisory services regarding mergers and acquisitions (“M&A”) and other strategic matters, restructurings, capital structure, capital raising, corporate preparedness and various other financial matters. We focus on solving our clients’ most complex issues, providing advice to key decision-makers, senior management, boards of directors and business owners, as well as governments and governmental agencies, in transactions that typically are of significant strategic and financial importance to them.

We continue to build our Financial Advisory business by fostering long-term, senior level relationships with existing and new clients as their independent advisor on strategic transactions and other matters. We seek to build and sustain long-term relationships with our clients rather than focusing simply on individual transactions, a practice that we believe enhances our access to senior management of major corporations and institutions around the world. We emphasize providing clients with senior level focus during all phases of transaction analysis and execution.

While we strive to earn repeat business from our clients, we operate in a highly competitive environment in which there are no long-term contracted sources of revenue. Each revenue-generating engagement is separately negotiated and awarded. To develop new client relationships, and to develop new engagements from historical client relationships, we maintain an active dialogue with a large number of clients and potential clients, as well as with their financial and legal advisors, on an ongoing basis. We have gained a significant number of new clients each year through our business development initiatives, through recruiting additional senior investment banking professionals who bring with them client relationships and through referrals from directors, attorneys and other third parties with whom we have relationships. At the same time, we lose clients each year as a result of the sale or merger of a client, a change in a client’s senior management, competition from other investment banks and other causes.

1

Table of Contents

For the years ended December 31, 2015, 2014 and 2013, our Financial Advisory segment net revenue totaled $1.280 billion, $1.207 billion and $981 million, respectively, accounting for approximately 54%, 53% and 49%, respectively, of our consolidated net revenue for such years. We earned $1 million or more from 268 clients, 281 clients and 235 clients for the years ended December 31, 2015, 2014 and 2013, respectively. For the years ended December 31, 2015, 2014 and 2013, the ten largest fee paying clients constituted approximately 17%, 15% and 19%, respectively, of our Financial Advisory segment net revenue, with no client individually contributing more than 10% of segment net revenue during any of these years. For the years ended December 31, 2015, 2014 and 2013, our Financial Advisory segment reported operating income of $274 million, $229 million and $21 million, respectively. Operating income in 2013 included charges of $47 million associated with the cost saving initiatives (as described in Note 16 of Notes to Consolidated Financial Statements) announced by the Company in October 2012. Excluding the impact of such charges, our Financial Advisory segment had operating income of $68 million in the year ended December 31, 2013. At December 31, 2015, 2014 and 2013, our Financial Advisory segment had total assets of $763 million, $786 million and $715 million, respectively.

We believe that we have been pioneers in offering financial advisory services on an international basis, with the establishment of our New York, Paris and London offices dating back to the nineteenth century. We maintain a major local presence in the United States (“U.S.”), the United Kingdom (the “U.K.”) and France, including a network of regional branch offices in the U.S., as well as a presence in Argentina, Australia, Belgium, Brazil, Chile, China, Colombia, Germany, Hong Kong, India, Italy, Japan, Korea, the Netherlands, Panama, Peru, Singapore, Spain, Sweden, Switzerland and the Middle East Region.

In addition to seeking business centered in the regions described above, we historically have focused in particular on advising clients with respect to cross-border transactions. We believe that we are particularly well known for our legacy of offering broad teams of professionals who are indigenous to their respective regions, who have long-term client relationships, capabilities and know-how in their respective regions, and who will coordinate with our professionals who have global sector expertise. We also believe that this positioning affords us insight around the globe into key industry, economic, governmental and regulatory issues and developments, which we can bring to bear on behalf of our clients.

Our Financial Advisory business has made certain business acquisitions and entered into other strategic business relationships. For example, in 2012, we integrated our Brazilian operations based in São Paulo, and established a Lazard Africa initiative to leverage our sovereign and corporate expertise in this rapidly growing region, for our clients in both developed and developing countries. In addition, in 2014, we acquired certain securities sales and trading assets that facilitate the execution of exchange offers and other transactions related to financial advice provided by our Capital Advisory and Convertible Securities practice groups, and we took other steps that have enabled us to act as an underwriter in public offerings and other distributions of securities in order to buttress our Financial Advisory business. In 2015, we established a Lazard Central and Eastern Europe initiative to provide financial advisory services to businesses and governments in the region, as well as to our clients outside the region that are active in the region.

Services Offered

We advise clients on a wide range of strategic and financial issues. When we advise clients on the potential acquisition of another company, business or certain assets, our services include evaluating potential acquisition targets, providing valuation analyses, evaluating and proposing financial and structural alternatives, and rendering, if appropriate, fairness opinions. We also may advise as to the timing, financing and pricing of a proposed acquisition and assist in negotiating and closing the acquisition. In addition, we may assist in executing an acquisition by acting as a dealer-manager in transactions structured as a tender or exchange offer.

When we advise clients that are contemplating the sale of certain businesses, assets or an entire company, our services include advising on the sale process for the situation, providing valuation analyses, assisting in preparing an offering circular or other appropriate sale materials and rendering, if appropriate, fairness opinions. We also identify and contact selected qualified acquirors and assist in negotiating and closing the proposed sale. As appropriate, we also advise our clients regarding potential financial and strategic alternatives to a sale, including recapitalizations, spin-offs, carve-outs and split-offs. We frequently provide advice with respect to the structure, timing and pricing of these alternatives.

2

Table of Contents

For companies in financial distress, our services may include reviewing and analyzing the business, operations, properties, financial condition and prospects of the company, evaluating debt capacity, assisting in the determination of an appropriate capital structure and evaluating financial and strategic alternatives. If appropriate, we may provide financial advice and assistance in developing and seeking approval of a restructuring or reorganization plan, which may include a plan of reorganization under Chapter 11 of the U.S. Bankruptcy Code or other similar court administered processes in non-U.S. jurisdictions. In such cases, we may assist in certain aspects of the implementation of such a plan, including advising and assisting in structuring and effecting the financial aspects of a sale or recapitalization, structuring new securities, exchange offers, other consideration or other inducements to be offered or issued, as well as assisting and participating in negotiations with affected entities or groups.

When we assist clients in connection with their capital structure, we typically review and analyze structural alternatives, assist in long-term capital planning and advise and assist with respect to rating agency discussions and relationships, among other things.

When we assist clients in connection with corporate preparedness matters, our services may include reviewing and analyzing the business and financial condition of the company and assisting in the evaluation of defense measures and strategic alternatives potentially available to the company.

When we assist clients in raising private or public market financing, our services include assisting clients in connection with securing, refinancing or restructuring bank loans or other debt, including convertible securities, originating and executing, or participating in, public underwritings and private placements of equity, debt and convertible securities and originating and executing private placements of partnership and similar interests in alternative investment funds such as leveraged buyout, mezzanine or real estate focused funds.

We are at the forefront of providing independent advice to governments and governmental agencies challenged by the current economic environment. Lazard’s Sovereign Advisory Group has advised a number of countries and institutions with respect to sovereign debt and other financial matters.

Staffing

We staff each of our assignments with a team of quality professionals who have appropriate product and industry expertise. We pride ourselves on, and we believe we differentiate ourselves from our competitors by, being able to offer a high level of attention from senior personnel to our clients and organizing ourselves in such a way that managing directors who are responsible for securing and maintaining client relationships also actively participate in providing related advice and services. Our managing directors have significant experience, and many of them are able to use this experience to advise on M&A, financings, restructurings, capital structure, corporate preparedness and other transactions or financial matters, depending on our clients’ needs. Many of our managing directors and senior employees come from diverse backgrounds, such as senior executive positions at corporations and in government, law and strategic consulting, which we believe enhances our ability to offer sophisticated advice and customized solutions to our clients. As of December 31, 2015, our Financial Advisory segment had 139 managing directors and 768 other professionals (which includes directors, vice presidents, associates and analysts).

Industries Served

We seek to offer our services across most major industry groups, including, in many cases, sub-industry specialties. Managing directors and professionals in our Mergers and Acquisitions practice are organized to provide advice in the following major industry practice areas:

| • | consumer; |

| • | financial institutions; |

| • | health care and life sciences; |

| • | industrial; |

| • | power and energy/infrastructure; |

3

Table of Contents

| • | real estate; and |

| • | technology, media and telecommunications. |

These groups are managed locally in each relevant geographic region and are coordinated globally, which allows us to bring local industry-specific knowledge to bear on behalf of our clients on a global basis. We believe that this enhances the scope and the quality of the advice that we can offer, which improves our ability to market our capabilities to clients.

In addition to our Mergers and Acquisitions and Restructuring practices, we also maintain specialties in the following distinct practice areas within our Financial Advisory business:

| • | government and sovereign advisory; |

| • | capital structure and debt advisory; |

| • | corporate preparedness and defense advisory; |

| • | fund raising for alternative investment funds; and |

| • | corporate finance and other services, including private placements, underwritten offerings related to our Financial Advisory business and transactions involving the exchange or issuance of convertible securities. |

We endeavor to coordinate the activities of the professionals in these areas with our Mergers and Acquisitions industry specialists in order to offer clients customized teams of cross-functional expertise spanning both industry and practice area expertise.

Strategy

Our focus in our Financial Advisory business is on:

| • | investing in our intellectual capital through senior professionals who we believe have strong client relationships and industry expertise; |

| • | increasing our contacts with existing clients to further enhance our long-term relationships and our efforts in developing new client relationships; |

| • | developing new client relationships; |

| • | expanding the breadth and depth of our industry expertise and selectively adding or reinforcing practice areas, such as our Capital Structure Advisory, Corporate Preparedness and Sovereign Advisory groups; |

| • | coordinating our industry specialty activities on a global basis and increasing the integration of our industry experts in Mergers and Acquisitions with our other professionals; |

| • | selectively bolstering our existing presence in certain local markets; |

| • | broadening our geographic presence by adding new offices, including, since the beginning of 2009, offices in Australia (Perth) and the Middle East Region, as well as integrating our Brazilian operations based in São Paulo and establishing the Lazard Africa and Lazard Central and Eastern Europe initiatives; and |

| • | deploying our intellectual capital, strong client relationships and other assets to generate new revenue streams, including, for example, revenue that may be generated by acting as an underwriter in public offerings and other distributions of securities related to the activities of our Financial Advisory business. |

In addition to the investments made as part of this strategy, we believe that our Financial Advisory business may benefit from external market factors, including:

| • | demand for independent, unbiased financial advice; |

| • | debt reduction, recapitalization and related activities that are occurring in developed and emerging markets; |

4

Table of Contents

| • | relatively low interest rates and high corporate cash balances in the current macroeconomic environment; and |

| • | favorable levels of cross-border M&A and large capitalization M&A, two of our areas of historical specialization. |

Going forward, our strategic emphasis in our Financial Advisory business is to leverage the investments we have made to grow our business and drive our productivity. We continue to seek to opportunistically attract outstanding individuals to our business. We routinely reassess our strategic position and may in the future seek opportunities to further enhance our competitive position.

Asset Management

Our Asset Management business offers a broad range of global investment solutions and investment management services in equity and fixed income strategies, alternative investments and private equity funds to corporations, public funds, sovereign entities, endowments and foundations, labor funds, financial intermediaries and private clients. Our goal in our Asset Management business is to produce superior risk-adjusted investment returns and provide customized investment solutions for our clients. Many of our equity investment strategies share an investment philosophy that centers on fundamental security selection with a focus on analyzing, among other things, a company’s financial position, outlook, opportunities and risks, together with its valuation.

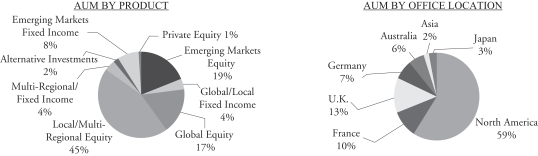

As of December 31, 2015, total assets under management (“AUM”) were $186 billion, of which approximately 81% was invested in equities, 16% in fixed income, 2% in alternative investments and 1% in private equity funds. As of the same date, within the equity asset class, approximately 35% of our AUM was invested in multi-regional (i.e., non-U.S. and regional non-U.S.) investment strategies, 24% in emerging markets strategies, 21% in global investment strategies and 20% in local investment strategies. Within the fixed income asset class, approximately 47% of our AUM was invested in emerging markets strategies, 26% in multi-regional (i.e., non-U.S. and regional non-U.S.) investment strategies, 14% in global investment strategies and 13% in local investment strategies. Our top ten clients accounted for 21%, 24% and 24% of our total AUM at December 31, 2015, 2014 and 2013, respectively, with no client individually contributing more than 10% of our Asset Management segment net revenue during any of the respective years. Approximately 89% of our AUM as of December 31, 2015 was managed on behalf of institutional clients, including corporations, labor unions, public pension funds, insurance companies and banks, and through sub-advisory relationships, mutual fund sponsors, broker-dealers and registered advisors, and approximately 11% of our AUM was managed on behalf of individual client relationships, which are principally with family offices and high-net worth individuals.

The charts below illustrate the mix of our AUM as of December 31, 2015, measured by broad product strategy and by office location.

5

Table of Contents

For the years ended December 31, 2015, 2014 and 2013, our Asset Management segment net revenue totaled $1.111 billion, $1.135 billion and $1.039 billion, respectively, accounting for approximately 47%, 49% and 52%, respectively, of our consolidated net revenue for such years. For the years ended December 31, 2015, 2014 and 2013, our Asset Management segment reported operating income of $374 million, $385 million and $335 million, respectively. Operating income in 2013 included charges of $0.2 million associated with the cost saving initiatives announced by the Company in October 2012, and a charge of $12 million relating to private equity incentive compensation (as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”). Excluding the impact of such charges, our Asset Management segment had operating income of $347 million for the year ended December 31, 2013. At December 31, 2015, 2014 and 2013, our Asset Management segment had total assets of $640 million, $588 million and $612 million, respectively.

LAM and LFG

Our largest Asset Management businesses are Lazard Asset Management LLC and its subsidiaries (“LAM”), with offices in New York, Boston, Chicago, Dubai, Dublin, Frankfurt, Hamburg, Hong Kong, London, Manama, Milan, Montreal, San Francisco, Seoul, Singapore, Sydney, Tokyo, Toronto and Zurich (aggregating approximately $168 billion in total AUM as of December 31, 2015), and Lazard Frères Gestion SAS (“LFG”), with offices in Paris, Bordeaux, Brussels, Lyon and Nantes (aggregating approximately $17 billion in total AUM as of December 31, 2015). These operations, with 90 managing directors and 392 professionals as of December 31, 2015, provide our Asset Management business with both a global presence and a local identity.

Primary distinguishing features of these operations include:

| • | a global footprint with global research, global mandates and global clients; |

| • | a broad-based team of investment professionals, including focused, in-house investment analysts across all products and platforms, many of whom have substantial industry or sector specific expertise; and |

| • | world-wide brand recognition and multi-channel distribution capabilities. |

Our Investment Philosophy, Process and Research. Our investment philosophy is generally based upon a fundamental security selection approach to investing. Across many of our products, we apply three key principles to investment portfolios:

| • | select securities, not markets; |

| • | evaluate a company’s financial position, outlook, opportunities and risks, together with its valuation; and |

| • | manage risk. |

In searching for equity investment opportunities, many of our investment professionals follow an investment process that incorporates several interconnected components that may include:

| • | analytical analysis and screening; |

| • | accounting analysis; |

| • | fundamental analysis; |

| • | security selection and portfolio construction; and |

| • | risk management. |

In our Asset Management business, we conduct investment research on a global basis to develop market, industry and company specific insights and evaluate investment opportunities. Our global equity analysts, located in our worldwide offices, are organized around six global industry sectors:

| • | consumer goods; |

| • | financial services; |

6

Table of Contents

| • | health care; |

| • | industrials; |

| • | power and energy; and |

| • | technology, media and telecommunications. |

Investment Strategies. Our Asset Management business provides equity, fixed income, cash management and alternative investment strategies to our clients, paying close attention to our clients’ varying and expanding investment needs. We offer the following product platform of investment strategies:

| Global |

Multi-Regional |

Local |

Emerging Markets | |||||

| Equity |

Global Large Capitalization Small Capitalization Thematic Convertibles Listed Infrastructure Quantitative Trend Real Estate Multi Strategies Managed Volatility

Global Ex Global Ex-U.K. Global Ex-Japan Global Ex-Australia |

Pan-European Large Capitalization Small Capitalization Quantitative

Eurozone Large Capitalization Small Capitalization

Continental European Small Cap Multi Cap Eurozone Euro-Trend (Thematic)

Asian Asia Ex-Japan Quantitative

Europe, Australasia and Far East Large Capitalization Small Capitalization Multi-Capitalization Quantitative Real Estate |

U.S. Large Capitalization Mid Capitalization Small/Mid Capitalization Small Capitalization Multi-Capitalization Real Estate

Other U.K. (Large Capitalization) U.K. (Small Capitalization) U.K. Quantitative Australia France (Large Capitalization) France (Small Capitalization) Japan Korea |

Global Large Capitalization Small Capitalization Quantitative Multi Strategies Managed Volatility

Latin America Latin America

Middle East North Africa Middle East North Africa | ||||

| Fixed Income and Cash Management | Global Core Fixed Income High Yield Short Duration |

Pan-European Core Fixed Income High Yield Cash Management Duration Overlay

Eurozone Fixed Income Cash Management Corporate Bonds |

U.S. Core Fixed Income High Yield Short Duration Municipals Cash Management

Non-U.S. U.K. Fixed Income |

Global Emerging Debt Emerging Corporates | ||||

| Alternative |

Global Fund of Hedge Funds Fund of Closed-End Funds Convertible Long/Short Equity Arbitrage/Relative Value Multi Asset |

European Long/Short Equity |

U.S. U.S. (Long/Short)

Non-U.S. Japan (Long/Short) |

Global Emerging Income Emerging Debt | ||||

In addition to the primary investment strategies listed above, we also provide locally customized investment solutions to our clients. In many cases, we also offer both diversified and more concentrated versions of our products. These products are generally offered on a separate account basis, as well as through pooled vehicles.

7

Table of Contents

Distribution. We distribute our products through a broad array of marketing channels on a global basis. LAM’s marketing, sales and client service efforts are organized through a global market delivery and service network, with distribution professionals located in cities including New York, Boston, Chicago, Dubai, Frankfurt, Hamburg, Hong Kong, London, Manama, Milan, Montreal, San Francisco, Seoul, Singapore, Sydney, Tokyo, Toronto and Zurich. We have developed a well-established presence in the institutional asset management arena, managing assets for corporations, labor unions, sovereign wealth funds and public pension funds around the world. In addition, we manage assets for insurance companies, savings and trust banks, endowments, foundations and charities.

We also have become a leading firm in managing mutual funds and separately managed accounts for many of the world’s largest broker-dealers, insurance companies, registered advisors and other financial intermediaries.

LFG markets and distributes its products through sales professionals based in France and Belgium, who directly target both individual and institutional investors.

Strategy

Our strategic plan in our Asset Management business is to focus on delivering superior investment performance and client service and broadening our product offerings and distribution in selected areas in order to continue to drive improved business results. Over the past several years, in an effort to improve our Asset Management business’ operations and expand our Asset Management business, we have:

| • | focused on enhancing our investment performance; |

| • | improved our investment management platform by adding a number of senior investment professionals (including portfolio managers and analysts); |

| • | continued to strengthen our marketing and consultant relations capabilities, including by expanding our marketing resources; |

| • | expanded our product platform, including through the addition of long/short equity strategies and an equity team focused on Middle East and North African markets; and |

| • | continued to expand the geographic reach of our Asset Management business, including through opening offices in Dubai, Singapore and Dublin. |

We believe that our Asset Management business has long maintained an outstanding team of portfolio managers and global research analysts. We intend to maintain and supplement our intellectual capital to achieve our goals. We routinely reassess our strategic position and may in the future seek acquisitions or other transactions, including the opportunistic hiring of new employees, in order to further enhance our competitive position. We also believe that our specific investment strategies, global reach, unique brand identity and access to multiple distribution channels may allow us to expand into new investment products, strategies and geographic locations. In addition, we may expand our participation in alternative investment activities through investments in new and successor funds, and through organic growth, acquisitions or otherwise. We may also continue to expand our geographic reach.

Alternative Investments

Since 2005, we have been engaged in selected alternative investments and private equity activities. In 2009, we established a private equity business with The Edgewater Funds (“Edgewater”), a Chicago-based private equity firm, through the acquisition of Edgewater’s management vehicles. As of December 31, 2015, Edgewater had approximately $1 billion of AUM and unfunded fee-earning commitments.

Historically, Lazard also has made selected investments with its own capital, often alongside capital of qualified institutional and individual investors in connection with Lazard’s selected alternative investments and

8

Table of Contents

private equity activities. These investments typically have been organized in funds that make substantial or controlling investments in private or public companies, generally through privately negotiated transactions and with a view to divest within two to seven years. While potentially risky and frequently illiquid, such investments, when successful, can yield investors substantial returns on capital and generate attractive management and performance fees for the sponsor of such funds.

Employees

We believe that our people are our most important asset, and it is their reputation, talent, integrity and dedication that underpin our success. As of December 31, 2015, we employed 2,610 people, which included 139 managing directors and 768 other professionals in our Financial Advisory segment and 90 managing directors and 405 other professionals in our Asset Management segment. We strive to maintain a work environment that fosters professionalism, excellence, diversity and cooperation among our employees worldwide. We generally utilize an evaluation process at the end of each year to measure performance, determine compensation and provide guidance on opportunities for improved performance. Generally, our employees are not subject to any collective bargaining agreements, except that our employees in certain of our offices, including France and Italy, are covered by national, industry-wide collective bargaining agreements. We believe that we have good relations with our employees.

Competition

The financial services industry, and all of the businesses in which we compete, are intensely competitive, and we expect them to remain so. Our competitors are other investment banking and financial advisory firms, broker-dealers, commercial and “universal” banks, insurance companies, investment management firms, hedge fund management firms, alternative investment firms and other financial institutions. We compete with some of them globally and with others on a regional, product or niche basis. We compete on the basis of a number of factors, including quality of people, transaction execution skills, investment track record, quality of client service, individual and institutional client relationships, absence of conflicts, range and price of products and services, innovation, brand recognition and business reputation.

While our competitors vary by country in our Financial Advisory business, we believe our primary competitors in securing engagements are Bank of America Merrill Lynch, Barclays, Centerview Partners LLC, Citigroup, Credit Suisse, Deutsche Bank, Evercore Partners, Goldman Sachs, Greenhill, JPMorgan Chase, Morgan Stanley, Rothschild and UBS. In our Restructuring practice, we believe our primary competitors are Centerview Partners, Evercore Partners, Houlihan Lokey, PJT Partners, Moelis & Company and Rothschild.

We believe that our primary global competitors in our Asset Management business include, in the case of LAM, Aberdeen, Schroders, Alliance Bernstein, Capital Management & Research, Fidelity, Franklin Templeton, Invesco, JP Morgan Asset Management, Lord Abbett, MFS, Neuberger Berman and, in the case of LFG, private banks with offices in France as well as large institutional banks and fund managers. We face competition in private equity both in the pursuit of outside investors for our private equity funds and the acquisition of investments in attractive portfolio companies. We compete with hundreds of other funds, many of which are subsidiaries of, or otherwise affiliated with, large financial service providers.

Competition is also intense in each of our businesses for the attraction and retention of qualified employees, and we compete, among other factors, on the level and nature of compensation and equity-based incentives for key employees. Our ability to continue to compete effectively in our businesses will depend upon our ability to attract new employees and retain and motivate our existing employees, in each case, at appropriate compensation levels.

Many of our competitors are large, consolidated financial institutions that have the ability to offer a wider range of products than we offer, including loans, deposit taking, insurance and brokerage services. Many of these firms also offer more extensive asset management and investment banking services, which may enhance their competitive

9

Table of Contents

position. They also may have the ability to support investment banking and securities products with commercial banking, insurance and other financial services revenue in an effort to gain market share, which could result in pricing pressure in our businesses. At the same time, demand for independent financial advice has increased and has created opportunities for new entrants, including a number of boutique financial advisory firms. These boutique firms frequently compete, among other factors, on the basis of their independent financial advice, and their activities also could result in pricing and other competitive pressure in our businesses.

Regulation

Our businesses, as well as the financial services industry generally, are subject to extensive regulation throughout the world. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets, not with protecting the interests of our stockholders or creditors. Many of our affiliates that participate in securities markets are subject to comprehensive regulations that include some form of minimum capital retention requirements and customer protection rules. In the U.S., certain of our subsidiaries are subject to such regulations promulgated by the United States Securities and Exchange Commission (the “SEC”), and/or the Financial Industry Regulatory Authority (“FINRA”). Standards, requirements and rules implemented throughout the European Union are broadly comparable in scope and purpose to the regulatory capital and customer protection requirements imposed under the SEC and FINRA rules. European Union directives also permit local regulation in each jurisdiction, including those in which we operate, to be more restrictive than the requirements of such European Union-wide directives. These sometimes burdensome local requirements can result in certain competitive disadvantages to us.

In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. FINRA is a voluntary, self-regulatory body composed of members, such as our broker-dealer subsidiaries, that have agreed to abide by FINRA’s rules and regulations. The SEC, FINRA and other U.S. and non-U.S. regulatory organizations may examine the activities of, and may expel, fine and otherwise discipline us and our employees. The laws, rules and regulations comprising this framework of regulation and the interpretation and enforcement of existing laws, rules and regulations are constantly changing. The effect of any such changes cannot be predicted and may impact the manner of operation and profitability of our businesses.

Our principal U.S. broker-dealer subsidiary, Lazard Frères & Co. LLC (“LFNY”), through which we conduct most of our U.S. Financial Advisory business, is currently registered as a broker-dealer with the SEC and FINRA, and as a broker-dealer in all 50 U.S. states, the District of Columbia and Puerto Rico. As such, LFNY is subject to regulations governing most aspects of the securities business, including minimum capital retention requirements, record-keeping and reporting procedures, relationships with customers, experience and training requirements for certain employees, and business procedures with firms that are not members of certain regulatory bodies. In addition, LFNY is a member organization of the New York Stock Exchange LLC and the NYSE MKT LLC and is subject to various rules and regulations that have been promulgated by these securities exchanges. Lazard Asset Management Securities LLC, a subsidiary of LAM, is registered as a broker-dealer with the SEC and FINRA and in all 50 U.S. states, the District of Columbia and Puerto Rico. Lazard Middle Market LLC, a subsidiary of Goldsmith, Agio, Helms & Lynner, LLC (“GAHL”), is registered as a broker-dealer with the SEC and FINRA, and as a broker-dealer in various U.S. states and territories.

Our U.S. broker-dealer subsidiaries, including LFNY, are subject to the SEC’s uniform net capital rule, Rule 15c3-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the net capital rules of FINRA, which may limit our ability to make withdrawals of capital from our broker-dealer subsidiaries. The uniform net capital rule sets the minimum level of net capital a broker-dealer must maintain and also requires that a portion of its assets be relatively liquid. FINRA may prohibit a member firm from expanding its business or paying cash dividends if it would result in net capital falling below FINRA’s requirements. In addition, our broker-dealer subsidiaries are subject to certain notification requirements related to withdrawals of excess net capital. Our broker-dealer subsidiaries are also subject to regulations, including the USA PATRIOT

10

Table of Contents

Act of 2001, which impose obligations regarding the prevention and detection of money-laundering activities, including the establishment of customer due diligence and other compliance policies and procedures. Failure to comply with these requirements may result in monetary, regulatory and, in certain cases, criminal penalties.

Certain U.K. subsidiaries of Lazard Group, including Lazard & Co., Limited (“LCL”), Lazard Fund Managers Limited and Lazard Asset Management Limited, which we refer to in this Annual Report on Form 10-K (this “Form 10-K”) as the “U.K. subsidiaries,” are authorized and regulated by the Financial Conduct Authority (the “FCA”), and are subject to various rules and regulations made by the FCA under the authorities conferred upon it by the Financial Services and Markets Act 2000, as amended by the Financial Services Act 2012. LCL has obtained the appropriate European investment services rights to provide cross-border services into a number of other members of the European Economic Area.

We also have other subsidiaries that are registered as broker-dealers (or have similar non-U.S. registration) in various jurisdictions.

Certain of our Asset Management subsidiaries are registered as investment advisors with the SEC. As a registered investment advisor, each is subject to the requirements of the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”), and the SEC’s regulations thereunder. Such requirements relate to, among other things, the relationship between an advisor and its advisory clients, as well as general anti-fraud prohibitions. LAM serves as an advisor to several mutual funds which are registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Investment Company Act regulates, among other things, the relationship between a mutual fund and its investment advisor (and other service providers) and prohibits or severely restricts principal transactions between an advisor and its advisory clients, imposes record-keeping and reporting requirements, disclosure requirements, limitations on trades where a single broker acts as the agent for both the buyer and seller, and limitations on affiliated transactions and joint transactions. Lazard Asset Management Securities LLC, a subsidiary of LAM, serves as an underwriter or distributor for mutual funds and hedge funds managed by LAM, and as an introducing broker to Pershing LLC for unmanaged accounts of LAM’s private clients.

Compagnie Financière Lazard Frères SAS (“CFLF”), our French subsidiary under which asset management and commercial banking activities are carried out in France, is subject to regulation by the Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) for its banking activities conducted through our Paris-based banking subsidiary, Lazard Frères Banque SA (“LFB”). The investment services activities of the Paris group, exercised through LFB and other subsidiaries of CFLF, primarily LFG (asset management), also are subject to regulation and supervision by the Autorité des Marchés Financiers. In addition, pursuant to the consolidated supervision rules in the European Union, LFB, in particular, as a French credit institution, is required to be supervised by a regulatory body, either in the U.S. or in the European Union. In 2013, the Company and the ACPR agreed on terms for the consolidated supervision of LFB and certain other non-Financial Advisory European subsidiaries of the Company (referred to herein, on a combined basis, as the “combined European regulated group”) under such rules. Under this supervision, the combined European regulated group is required to comply with minimum requirements for regulatory net capital to be reported on a quarterly basis and satisfy periodic financial and other reporting obligations. Additionally, the combined European regulated group, together with our European Financial Advisory entities, is required to perform an annual risk assessment and provide certain other information on a periodic basis, including financial reports and information relating to financial performance, balance sheet data and capital structure.

As a result of certain changes effected by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) related to the regulation of over-the-counter swaps and other derivative instruments, LAM and certain of its subsidiaries have registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) and the National Futures Association (the “NFA”), and are subject to certain aspects of the U.S. Commodity Exchange Act and the regulations thereunder, and to the rules of the NFA. The CFTC and the NFA

11

Table of Contents

have authority over the laws, rules and regulations related to commodities (including the over-the-counter swaps and derivatives markets), and regulate our relationship with clients who trade in these instruments. The U.S. Commodity Exchange Act and the regulations thereunder also impose additional record-keeping and reporting requirements and disclosure requirements on LAM and its subsidiaries.

In addition, the Japanese Ministry of Finance and the Financial Supervisory Agency, the Korean Financial Supervisory Commission, the Securities and Futures Commission of Hong Kong, the Monetary Authority of Singapore, the Australian Securities & Investments Commission, the Dubai Financial Services Authority and German banking authorities, among others, regulate relevant operating subsidiaries of the Company and also have capital standards and other requirements comparable to the rules of the SEC. Our business is also subject to regulation by other non-U.S. governmental and regulatory bodies and self-regulatory authorities in other countries where we operate.

Regulators are empowered to conduct periodic examinations and initiate administrative proceedings that can result, among other things, in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion or other disciplining of a broker-dealer or investment advisor or its directors, officers or employees.

We are also subject to various anti-bribery, anti-money laundering and counter-terrorist financing laws, rules and regulations in the jurisdictions in which we operate. The U.S. Foreign Corrupt Practices Act, for example, generally prohibits offering, promising or giving, or authorizing others to give, anything of value, either directly or indirectly, to a non-U.S. government official in order to influence official action or otherwise gain an unfair business advantage, such as to obtain or retain business. In addition, we are required to comply with economic sanctions and embargo programs administered by the U.S. Treasury’s Office of Foreign Assets Control and by similar governmental agencies and other authorities worldwide. Violations of any of these laws, rules, regulations and programs can give rise to administrative, civil or criminal penalties.

The U.S. and other governments and institutions have taken actions, and may continue to take further actions, that affect the global financial markets. Such further actions could include expanding current or enacting new standards, requirements and rules that may be applicable to us and our subsidiaries. The effect of any such expanded or new standards, requirements and rules is uncertain and could have adverse consequences to our business and results of operations. See Item 1A, “Risk Factors—Other Business Risks—Extensive regulation of our businesses limits our activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on our ability to conduct our businesses.”

Executive Officers of the Registrant

Set forth below are the name, age, present title, principal occupation and certain biographical information for each of our executive officers as of February 19, 2016, all of whom have been appointed by, and serve at the pleasure of, our board of directors.

Kenneth M. Jacobs, 57

Mr. Jacobs has served as Chairman of the Board of Directors and Chief Executive Officer of Lazard Ltd and Lazard Group since November 2009. Mr. Jacobs has served as a Managing Director of Lazard since 1991 and had been a Deputy Chairman of Lazard from January 2002 until November 2009. Mr. Jacobs also served as Chief Executive Officer of Lazard North America from January 2002 until November 2009. Mr. Jacobs initially joined Lazard in 1988. Mr. Jacobs is a member of the Board of Trustees of the University of Chicago and the Brookings Institution.

Matthieu Bucaille, 56

Mr. Bucaille has served as Chief Financial Officer of Lazard Ltd and Lazard Group since April 2011. Mr. Bucaille has served as a Managing Director of Lazard since 1998 and served as the Deputy Chief Executive Officer of LFB in Paris from October 2009 until December 2011. Mr. Bucaille joined Lazard in 1989 from the First Boston Corporation in New York.

12

Table of Contents

Ashish Bhutani, 55

Mr. Bhutani has served as a member of the Board of Directors of Lazard Ltd and Lazard Group since March 2010. Mr. Bhutani is a Vice Chairman and a Managing Director of Lazard and has been the Chief Executive Officer of LAM since March 2004. Mr. Bhutani previously served as Head of New Products and Strategic Planning for LAM from June 2003 to March 2004. Prior to joining Lazard, he was Co-Chief Executive Officer, North America, of Dresdner Kleinwort Wasserstein from 2001 to the end of 2002, and was a member of its Global Corporate and Markets Board, and a member of its Global Executive Committee. Mr. Bhutani worked at Wasserstein Perella Group (the predecessor to Dresdner Kleinwort Wasserstein) from 1989 to 2001, serving as Deputy Chairman of Wasserstein Perella Group and Chief Executive Officer of Wasserstein Perella Securities from 1994 to 2001. Mr. Bhutani began his career at Salomon Brothers in 1985, where he was a Vice President in Fixed Income. Mr. Bhutani is a member of the Board of Directors of four registered investment companies, which are part of the Lazard fund complex.

Scott D. Hoffman, 53

Mr. Hoffman has served as General Counsel of Lazard Ltd since May 2005. Mr. Hoffman has served as a Managing Director of Lazard since January 1999 and General Counsel of Lazard Group since January 2001. Mr. Hoffman previously served as Vice President and Assistant General Counsel from February 1994 to December 1997 and as a Director from January 1998 to December 1998. Prior to joining Lazard, Mr. Hoffman was an attorney at Cravath, Swaine & Moore LLP. Mr. Hoffman is a member of the Board of Trustees of the New York University School of Law.

Alexander F. Stern, 49

Mr. Stern has served as Chief Operating Officer of Lazard Ltd and Lazard Group since November 2008. Mr. Stern has served as a Managing Director of Lazard since January 2002, as Chief Executive Officer, Financial Advisory, since April 2015, and as Global Head of Strategy since February 2006. Mr. Stern previously served as a Vice President in Lazard’s Financial Advisory business from January 1998 to December 2000 and as a Director from January 2001 to December 2001. Mr. Stern initially joined Lazard in 1994 and previously held various positions with Patricof & Co. Ventures and IBM.

13

Table of Contents

Where You Can Find Additional Information

Lazard Group files current, annual and quarterly reports and other information required by the Exchange Act with the SEC. You may read and copy any document the Company files at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The Company’s SEC filings are also available to the public from the SEC’s internet site at http://www.sec.gov. Copies of these reports and other information can also be inspected at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005, U.S.A.

Our public website is http://www.lazard.com and the investor relations SEC filings section of our public website is located at http://www.lazard.com/InvestorRelations/SEC-Filings.aspx. We will make available free of charge, on or through the investor relations section of our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website, and available in print upon request of any Lazard Ltd shareholder to the Investor Relations Department, are charters for Lazard Ltd’s Audit Committee, Compensation Committee and Nominating & Governance Committee. Copies of these charters and Lazard Ltd’s Corporate Governance Guidelines and Code of Business Conduct and Ethics governing our directors, officers and employees are also posted on the investor relations section of our website in the corporate governance subsection.

| ITEM 1A. | RISK FACTORS |

You should carefully consider the following risks and all of the other information set forth in this Form 10-K, including our consolidated financial statements and related notes. The following risks comprise the material risks of which we are aware. If any of the events or developments described below actually occurred, our business, financial condition or results of operations would likely suffer.

Difficult market conditions can adversely affect our business in many ways, including by reducing the volume of transactions involving our Financial Advisory business and reducing the value or performance of the assets we manage in our Asset Management business, which, in each case, could materially reduce our revenue or income and adversely affect our financial position.

As a financial services firm, our businesses are materially affected by conditions in the global financial markets and economic conditions throughout the world. Unfavorable economic and market conditions can adversely affect our financial performance in both the Financial Advisory and Asset Management businesses. The future market and economic climate may deteriorate because of many factors, such as a general slowing of economic growth globally or regionally, periods of volatility in securities markets, volatility and tightening of liquidity in credit markets, volatility or significant realignments in currency markets, increases in interest rates, inflation, corporate or sovereign defaults, natural disasters, terrorism or political uncertainty.

In recent years, regional and global capital markets and economies have experienced periods of significant disruption and volatility. If these conditions continue or if current conditions materially worsen, our business may be adversely affected, which may have a material impact on our business and results of operations.

For example, revenue generated by our Financial Advisory business is directly related to the volume and value of the transactions in which we are involved. During periods of unfavorable market or economic conditions, the volume and value of M&A transactions may decrease, thereby reducing the demand for our Financial Advisory services and increasing price competition among financial services companies seeking such engagements. Our results of operations would be adversely affected by any such reduction in the volume or value

14

Table of Contents

of M&A transactions. In addition, our profitability would be adversely affected due to our fixed costs and the possibility that we would be unable to reduce our variable costs without reducing revenue or within a timeframe sufficient to offset any decreases in revenue relating to changes in market and economic conditions.

Within our Financial Advisory business, we have typically seen that, during periods of economic strength and growth, our Mergers and Acquisitions practice historically has been more active and our Restructuring practice has been less active. Conversely, during periods of economic weakness and contraction, we typically have seen that our Restructuring practice has been more active and our Mergers and Acquisitions practice has been less active. As a result, revenue from our Restructuring practice has tended to correlate negatively to our revenue from our Mergers and Acquisitions practice over the course of business cycles. These trends are cyclical in nature and subject to periodic reversal. However, these trends do not cancel out the impact of economic conditions in our Financial Advisory business, which may be adversely affected by a downturn in economic conditions leading to decreased Mergers and Acquisitions practice activity, notwithstanding improvements in our Restructuring practice. Moreover, revenue improvements in our Mergers and Acquisitions practice in strong economic conditions could be offset in whole or in part by any related revenue declines in our Restructuring practice. While we generally have experienced a counter-cyclical relationship between our Mergers and Acquisitions practice and our Restructuring practice, this relationship may not continue in the future, and there is no certainty that strength in one practice will offset weakness in the other.

Our Asset Management business also would be expected to generate lower revenue in a market or general economic downturn. Under our Asset Management business’s arrangements, investment advisory fees we receive typically are based on the market value of AUM. Accordingly, a decline in the prices of securities, or in specific geographic markets or sectors that constitute a significant portion of our AUM (e.g., our emerging markets strategies), would be expected to cause our revenue and income to decline by causing:

| • | the value of our AUM to decrease, which would result in lower investment advisory fees; |

| • | some of our clients to withdraw funds from our Asset Management business due to the uncertainty or volatility in the market, or in favor of investments they perceive as offering greater opportunity or lower risk, which would also result in lower investment advisory fees; |

| • | some of our clients or prospective clients to hesitate in allocating assets to our Asset Management business due to the uncertainty or volatility in the market, which would also result in lower investment advisory fees; or |

| • | negative absolute performance returns for some accounts which have performance-based incentive fees, which would result in a reduction of revenue from such fees. |

If our Asset Management revenue declines without a commensurate reduction in our expenses, our net income would be reduced. In addition, in the event of a market or general economic downturn, our alternative investment and private equity practices also may be impacted by a difficult fund raising environment and reduced exit opportunities in which to realize the value of their investments. Fluctuations in foreign currency exchange rates may also affect the levels of our AUM and our investment advisory fees. See “Fluctuations in foreign currency exchange rates could reduce our members’ equity and net income or negatively impact the portfolios of our Asset Management clients and may affect the levels of our AUM” below.

Due to the nature of our business, financial results could differ significantly from period to period, which may make it difficult for us to achieve steady earnings growth on a quarterly basis.

We experience significant fluctuations in quarterly revenue and profits. These fluctuations generally can be attributed to the fact that we earn a substantial portion of our Financial Advisory revenue upon the successful completion of a transaction or a restructuring, the timing of which is uncertain and is not subject to our control. As a result, our Financial Advisory business is highly dependent on market conditions and the decisions and actions of our clients, interested third parties and governmental authorities. For example, a client or counterparty

15

Table of Contents

could delay or terminate an acquisition transaction because of a failure to agree upon final terms, failure to obtain necessary regulatory consents or board of directors, or acquirer’s or stockholder approval, failure to secure necessary financing, adverse market conditions or because the seller’s business is experiencing unexpected operating or financial problems. Anticipated bidders for assets of a client during a restructuring transaction may not materialize or our client may not be able to restructure its operations or indebtedness, for example, due to a failure to reach agreement with its principal creditors. In addition, a bankruptcy court may deny our right to collect a “success” or “completion” fee. In these circumstances, other than in engagements where we receive monthly retainers, we often do not receive any advisory fees other than the reimbursement of certain expenses despite the fact that we devote resources to these transactions. Accordingly, the failure of one or more transactions to close either as anticipated or at all could cause significant fluctuations in quarterly revenue and profits and could materially adversely affect our business, financial condition and results of operations. For more information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

In addition, our Asset Management revenue is particularly sensitive to fluctuations in our AUM. Asset Management fees are predominantly based on average AUM as of the end of a quarter or month. As a result, a reduction in AUM at the end of a quarter or month (as a result of market depreciation, withdrawals, fluctuations in foreign currency exchange rates or otherwise) will result in a decrease in management fees. Similarly, timing of flows, contributions and withdrawals are often out of our control and may be inconsistent from quarter to quarter. Incentive fees are driven by investment performance (either absolute performance or relative to an established benchmark), which is directly impacted by market movements, and may therefore fluctuate from period to period.

As a result of quarterly fluctuations, it may be difficult for us to achieve steady earnings growth on a quarterly basis.

Our ability to retain our managing directors and other key professional employees is critical to the success of our business, including maintaining compensation levels at an appropriate level of costs, and failure to do so may materially adversely affect our results of operations and financial position.

Our people are our most important asset. We must retain the services of our managing directors and other key professional employees, and strategically recruit and hire new talented employees, to obtain and successfully execute the Financial Advisory and Asset Management engagements that generate substantially all our revenue.

In general, our industry continues to experience change and be subject to significant competitive pressures with respect to the retention of top talent, which makes it more difficult for us to retain professionals. Loss of key employees may occur due to perceived opportunity for promotion, compensation levels, work environment or other individual reasons, some of which may be beyond our control. If any of our managing directors and other key professional employees were to retire, join an existing competitor, form a competing company or otherwise leave us, some of our clients could eventually choose to use the services of that competitor or some other competitor instead of our services. In any such event, our investment banking fees, asset management fees or AUM could decline. The employment arrangements, non-competition agreements and retention agreements we have or will enter into with our managing directors and other key professional employees may not sufficiently prevent our managing directors and other key professional employees from resigning from practice or competing against us. In addition, these arrangements and agreements have a limited duration and expire after a certain period of time. We continue to be subject to intense competition in the financial services industry regarding the recruitment and retention of key professionals, and have experienced departures from and added to our professional ranks as a result.

Certain changes to our employee compensation arrangements may result in increased compensation and benefits expense. In addition, any changes to the mix of cash and deferred incentive compensation granted to our employees may affect certain financial measures applicable to our business, including ratios of compensation and benefits expense to revenue, and may result in increased levels of Lazard Ltd’s Class A common stock, par value $0.01 per share (“Class A common stock”) issued to our employees upon vesting of restricted stock units

16

Table of Contents

(“RSUs”), performance-based restricted stock units (“PRSUs”) or restricted stock awards in a particular year. Our compensation levels, results of operations and financial position may be significantly affected by many factors, including general economic and market conditions, our operating and financial performance, staffing levels and competitive pay conditions.

The financial services industry, and all of the businesses in which we compete, are intensely competitive.

The financial services industry is intensely competitive, and we expect it to remain so. We compete on the basis of a number of factors, including the quality of our advice, our employees and transaction execution, the range and price of our products and services, our innovation and our reputation. We have experienced intense fee competition in some of our businesses in recent years, and we believe that we may experience pricing pressures in these and other areas in the future as some of our competitors seek to obtain increased market share by reducing fees.

A number of factors increase the competitive risks of our Financial Advisory and Asset Management businesses:

| • | there are relatively few barriers to entry impeding the launch of new asset management and financial advisory firms, including a relatively low cost of entering these businesses, and the successful efforts of new entrants into our lines of business, including major banks and other financial institutions, have resulted in increased competition; |

| • | other industry participants will from time to time seek to recruit our employees away from us in order to compete in our lines of business; and |

| • | certain of our Financial Advisory practices and Asset Management products are newly established and relatively small. |

In addition, many of our competitors have the ability to offer a wide range of products, from loans, deposit-taking and insurance to brokerage, asset management and investment banking services, which may enhance their competitive position. They may also have the ability to support investment banking, including financial advisory services, with commercial banking, insurance and other financial services in an effort to gain market share, which could result in pricing pressure in our businesses.

Competitive pressure could adversely affect our ability to attract new or retain existing clients, make successful investments, retain our people or maintain AUM, any of which would adversely affect our revenue and earnings.

A substantial portion of our revenue is derived from Financial Advisory fees, which are not long-term contracted sources of revenue and are subject to intense competition, and declines in our Financial Advisory engagements could have a material adverse effect on our business, financial condition and results of operations.

We historically have earned a substantial portion of our revenue from advisory fees paid to us by our Financial Advisory clients, which usually are payable upon the successful completion of a particular transaction or restructuring. For example, for the year ended December 31, 2015, Financial Advisory services accounted for approximately 54% of our consolidated net revenue. We expect that we will continue to rely on Financial Advisory fees for a substantial portion of our revenue for the foreseeable future, and a decline in our advisory engagements or the market for advisory services would adversely affect our business, financial condition and results of operations.

In addition, we operate in a highly competitive environment where typically there are no long-term contracted sources of revenue. Each revenue-generating engagement typically is separately awarded and negotiated. Furthermore, many businesses do not routinely engage in transactions requiring our services and, as a

17

Table of Contents

consequence, our fee paying engagements with many clients are not likely to be predictable. We also lose clients each year, including as a result of the sale or merger of a client, a change in a client’s senior management and competition from other financial advisors and financial institutions. As a result, our engagements with clients are constantly changing and our Financial Advisory fees could decline quickly due to the factors discussed above.

If the number of debt defaults, bankruptcies or other factors affecting demand for our Restructuring services declines, our Restructuring revenue could suffer.

We provide various restructuring and restructuring-related advice to companies in financial distress or to their creditors or other stakeholders. Historically, the fees from restructuring related services have been a significant part of our Financial Advisory revenue, although the aggregate value of debt defaults has recently been low, consistent with the last several years. A number of factors could affect demand for these advisory services, including improving general economic conditions, the availability and cost of debt and equity financing and changes to laws, rules and regulations, including those that protect creditors, and the deregulation or privatization of particular industries.

Potential underwriting and trading activities may expose us to risk.

In 2014, we took steps that have enabled us to act as an underwriter in public offerings and other distributions of securities in order to buttress our Financial Advisory business. If we act as an underwriter, we may incur losses and be subject to reputational harm to the extent that, for any reason, we are unable to sell securities we purchased as an underwriter at the anticipated price levels. In addition, if we act as an underwriter, we may also be subject to liability for material misstatements or omissions in prospectuses and other offering documents relating to offerings we underwrite. In such cases, any indemnification provisions in the applicable underwriting agreement may not be available to us or may not be sufficient to protect us against losses arising from such liability. Operational risk in connection with any offering we underwrite could arise in the form of errors, deficiencies or noncompliance and also could expose us to risk. In addition, through indemnification provisions in our agreement with our clearing organization, customer trading and other activities may expose us to off-balance sheet credit risk. Securities may have to be purchased or sold at prevailing market prices in the event a customer fails to settle a trade on its original terms. We seek to manage the risks associated with underwriting and customer trading activities through screening, internal review and trading procedures and processes, but such procedures and processes may not be effective in all cases.

Our investment style in our Asset Management business, including the mix of asset classes and investment strategies comprising our AUM, may underperform other investment approaches, which may result in significant client or asset departures, or a reduction in AUM.

Even when securities prices are rising generally, performance can be affected by investment style and mix of asset classes. For example, many of the equity investment strategies in our Asset Management business share a common investment orientation towards relative value investing. We believe this style tends to outperform the market in some market environments and underperform it in others. In particular, a prolonged growth environment may cause some of our investment strategies to go out of favor with some clients, advisors, consultants or third-party intermediaries. In addition, all of our investment strategies are actively managed strategies which seek to outperform relative to a benchmark or generate an absolute return. Trends toward passively managed investment strategies may adversely affect demand for our strategies or result in fee pressure on our business overall. In combination with poor performance relative to peers, changes in personnel, extensive periods in particular market environments or other difficulties, the underperformance of our investment style may result in significant client or asset departures or a reduction in AUM.

We could lose clients and suffer a decline in our Asset Management revenue and earnings if the investments we choose in our Asset Management business perform poorly, regardless of overall trends in the prices of securities.

18

Table of Contents

Investment performance affects our AUM relating to existing clients and is one of the most important factors in retaining clients and competing for new Asset Management business. Poor investment performance could impair our revenue and growth because:

| • | existing clients might withdraw funds from our Asset Management business in favor of better performing products, which would result in lower investment advisory fees; |

| • | our incentive fees, which provide us with a set percentage of returns on some alternative investment and private equity funds and other accounts, would decline; |

| • | third-party financial intermediaries, rating services, advisors or consultants may rate our products poorly, which may result in client withdrawals and reduced asset flows; or |

| • | firms with which we have strategic alliances may terminate such relationships with us, and future strategic alliances may be unavailable. |

Over certain time periods, we may have a higher concentration of assets in certain strategies. To the extent that this is the case, underperformance, changes in investment personnel or other changes in these strategies may result in a withdrawal of assets. If a significant amount of clients withdraw from these strategies for any reason, our revenues would decline and our operating results would be adversely affected.

Because many of our Asset Management clients can remove the assets we manage on short notice, we may experience unexpected declines in revenue and profitability.