Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-krefebruaryinvestorp.htm |

Broadridge Financial Solutions, Inc. Investor Presentation February 2016 Exhibit 99.1

1 © 2015 | Forward-Looking Statements The Broadridge February 2016 Investor Presentation and other written or oral statements made from time to time by representatives of Broadridge may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as "expects," "assumes," "projects," "anticipates," "estimates," "we believe," could be" and other words of similar meaning, are forward-looking statements. In particular, information about our future performance objectives are forward- looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, "Item 1A. Risk Factors" of our Annual Report on Form 10-K for the fiscal year ended June 30, 2015 (the "2015 Annual Report"), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of the presentations and are expressly qualified in their entirety by reference to the factors discussed in the 2015 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward- looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Explanation of the Company’s Use of Non-GAAP Financial Measures and Definitions of Terms In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”) and should be viewed in addition to, and not as a substitute for, the Company’s reported results. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods. In addition, Broadridge believes this Non-GAAP information helps investors understand the effect of these items on reported results and provides a better representation of the Company’s performance. Our Non-GAAP historical and projected earnings results are adjusted to exclude the impact of certain significant events from our GAAP results such as Acquisition Amortization and Other Costs. Please see the Appendix provided at the end of this presentation entitled “Reconciliation of Non-GAAP to GAAP Measures” for reconciliations of our historical Non-GAAP measures to the comparable GAAP measures and the definitions of terms used in the presentation. Use of Material Contained Herein The information contained in Broadridge’s February 2016 Investor Presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in the presentations. You may reproduce information contained in the presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc.

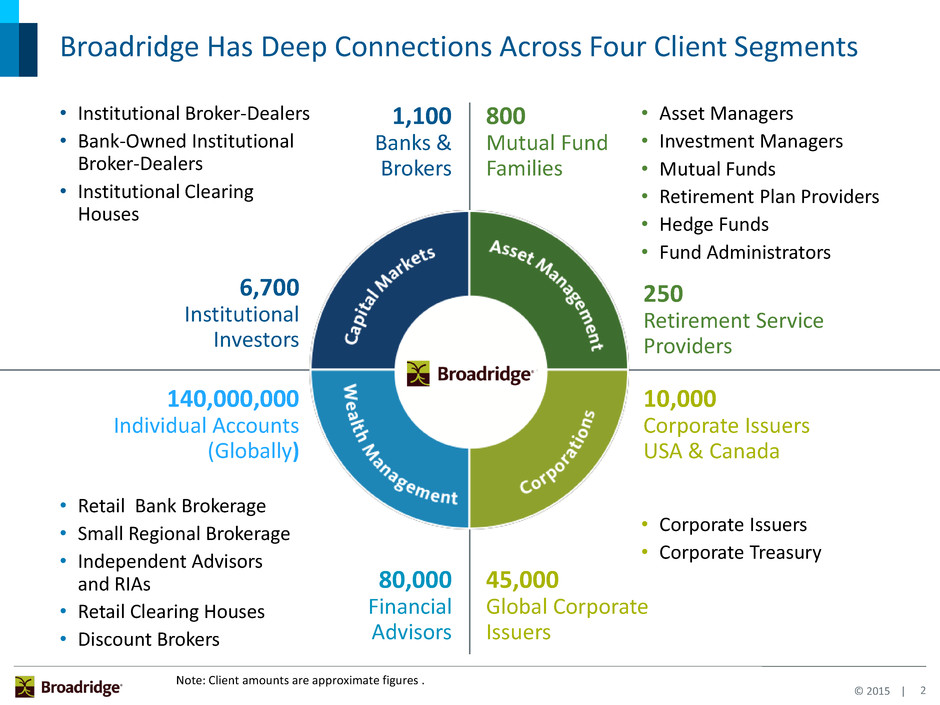

2 © 2015 | Broadridge Has Deep Connections Across Four Client Segments • Institutional Broker-Dealers • Bank-Owned Institutional Broker-Dealers • Institutional Clearing Houses • Asset Managers • Investment Managers • Mutual Funds • Retirement Plan Providers • Hedge Funds • Fund Administrators • Retail Bank Brokerage • Small Regional Brokerage • Independent Advisors and RIAs • Retail Clearing Houses • Discount Brokers • Corporate Issuers • Corporate Treasury 45,000 Global Corporate Issuers 140,000,000 Individual Accounts (Globally) 10,000 Corporate Issuers USA & Canada 250 Retirement Service Providers 800 Mutual Fund Families 6,700 Institutional Investors 1,100 Banks & Brokers 80,000 Financial Advisors Note: Client amounts are approximate figures .

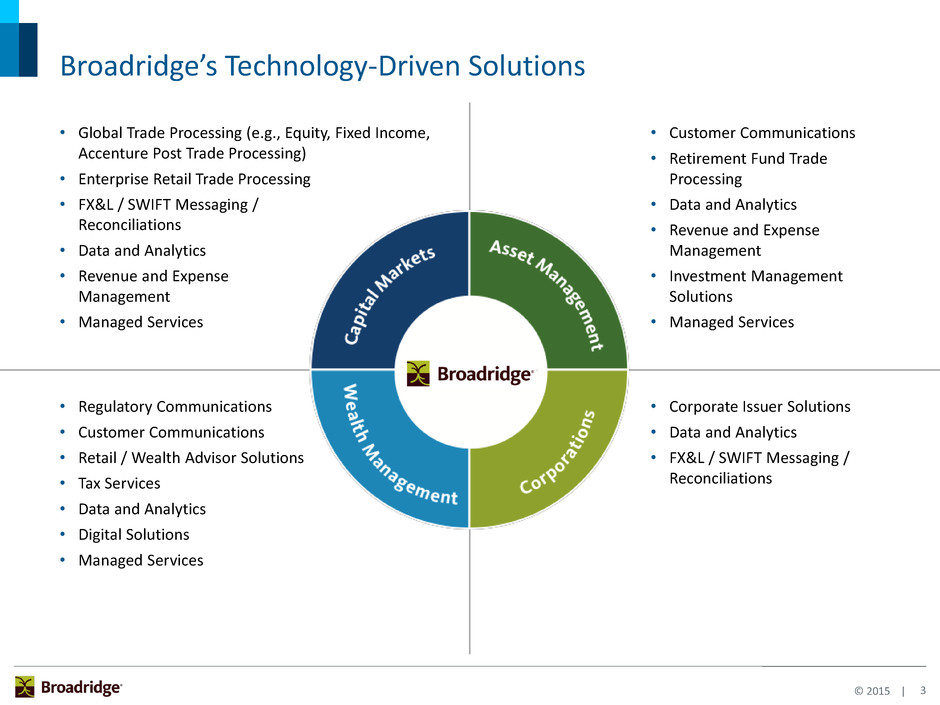

3 © 2015 | Broadridge’s Technology-Driven Solutions • Global Trade Processing (e.g., Equity, Fixed Income, Accenture Post Trade Processing) • Enterprise Retail Trade Processing • FX&L / SWIFT Messaging / Reconciliations • Data and Analytics • Revenue and Expense Management • Managed Services • Customer Communications • Retirement Fund Trade Processing • Data and Analytics • Revenue and Expense Management • Investment Management Solutions • Managed Services • Regulatory Communications • Customer Communications • Retail / Wealth Advisor Solutions • Tax Services • Data and Analytics • Digital Solutions • Managed Services • Corporate Issuer Solutions • Data and Analytics • FX&L / SWIFT Messaging / Reconciliations

4 © 2015 | Broadridge’s Unique Franchise in Financial Services 98% client revenue retention rate 50+ years of financial services experience of the top-101 global banks are our clients 10 #1 leading provider of U.S. beneficial proxy and prospectus, U.S. fixed income & Canadian equity processing Billion investor communications processed annually 2+ average daily in North American fixed income & equity trades $5+ Trillion of outstanding shares in U.S. processed, 50%+ rest of world 80%+ markets where we clear and settle trades 70+ Investor Communication Solutions Global Technology & Operations + 1. Top 10 global banks based on total revenues in equity, FICC and IBD per Coalition Research, 1Q’14. Note: All Broadridge results and statistics are for FY ended 6/30/15 other than 5-year average client revenue retention rate. Our solutions range from SaaS to customized managed services supporting full outsourcing

5 © 2015 | We Report Two Operating Segments 1. Investor Communication Solutions 2. Global Technology & Operations Broadridge has three segments, ICS, GTO, and Other.

6 © 2015 | $24B Market Opportunity Bolstered By Key Market Trends Current Addressable Market Key Market Trends $16B $8B Global Technology & Operations Investor Communication Solutions Mutualization Strong drive to standardize duplicative, non-differentiating industry capabilities Digitization Digital technologies that enable lower cost, higher touch interactions Data and Analytics Network and data assets that enable clients to create unique value

7 © 2015 | ICS Revenue Overview By Product1 Broad Client Base $809 40% $267 13% $149 7% $163 8% $225 11% $418 21% B A N K S B R O K E R - D E A L E R S M U T U A L F U N D S C O R P O R AT E I S S U E R S Distribution Emerging & Acquired and Other Fulfillment Transaction Reporting Interims Proxy Increase in electronic distribution reduces postage revenue and increases margins 1. Financial metrics in millions and statistics are for FY15 ended 6/30/15. Broadridge has three segments, ICS, GTO, and Other. $2,030 (75% of Broadridge)

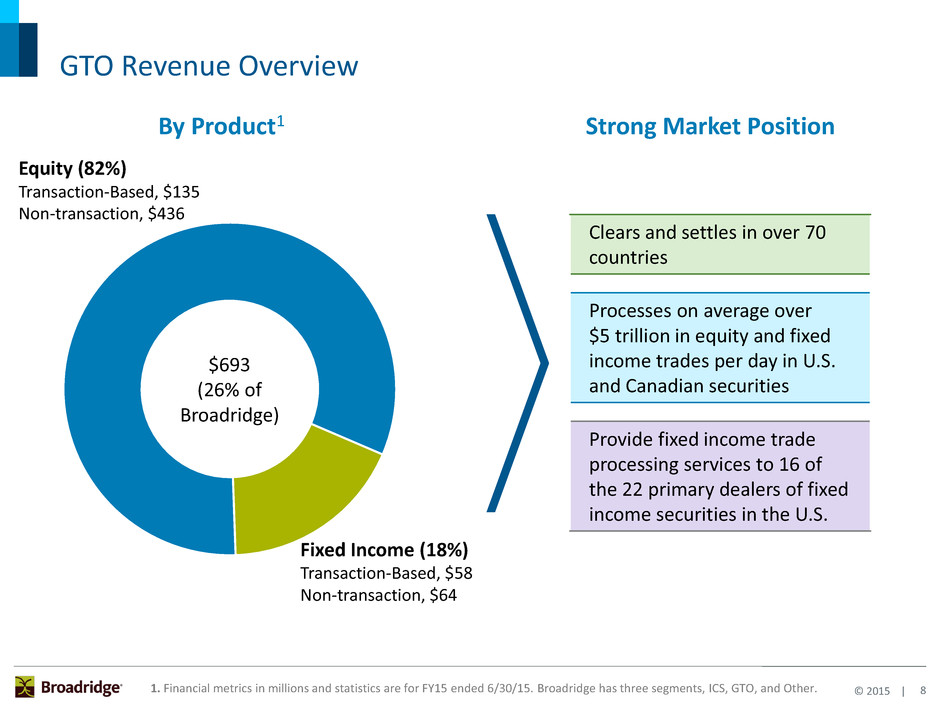

8 © 2015 | GTO Revenue Overview By Product1 Strong Market Position Clears and settles in over 70 countries Processes on average over $5 trillion in equity and fixed income trades per day in U.S. and Canadian securities Provide fixed income trade processing services to 16 of the 22 primary dealers of fixed income securities in the U.S. Equity (82%) Transaction-Based, $135 Non-transaction, $436 Fixed Income (18%) Transaction-Based, $58 Non-transaction, $64 1. Financial metrics in millions and statistics are for FY15 ended 6/30/15. Broadridge has three segments, ICS, GTO, and Other. $693 (26% of Broadridge)

9 © 2015 | Sustainable Growth, Operational Excellence, and a Sound Capital Deployment Strategy Will Drive Performance • Drive organic growth in current markets • Exploit adjacencies 7–10% Recurring Fee 3-Year CAGR (FY14–FY17F) Sustainable Growth • Realize efficiencies • Increase operational leverage Margin1 Expansion from 16% to ~18% (ending FY17F) Operational Excellence • Consistent, strong FCF • Balance investing and returning cash to shareholders Target ~45% payout ratio2 and share repurchases contributing 3–4% to TSR Capital Strategy Top Quartile Total Shareholder Return • Strong and resilient franchise • Ubiquitous presence in financial services • Deep industry expertise • Powerful service profit chain culture 1. Represents Earnings Before Interest and Taxes Margin; Broadridge also reports an Adjusted Operating Income Margin. 2. Dividend subject to Board approval

10 © 2015 | Broadridge Has a Strong and Predictable Business Model 98% client revenue retention rate Consistently high retention rate reflects the strength of our client relationships Long-term contracts Expanding portfolio of growth products Growth products now contribute ~25% of recurring fee revenue vs. ~10% in FY10 90%+ of total revenue is recurring Diverse revenue distribution • Over 1,100 broker-dealers • ~10,000 corporate issuers • ~800 mutual fund families Note: All Broadridge results and statistics are for FY ended 6/30/15 other than 5-year average revenue retention rate.

11 © 2015 | FY11 FY15 FY11-FY15 CAGR Total Revenue $2.2B $2.7B 6% Recurring Fee Revenue $1.3B $1.7B 7% Adjusted Operating Income $305M $497M 13% Adjusted Operating Income Margin 14.1% 18.5% 110 bps average p.a. Closed Sales $113M $146M 7% Strong Performance Provides Platform For Growth Note: Unaudited. Note: Adjusted Operating Income and Adjusted Operating Income Margin are Non-GAAP measures. See the Appendix for reconciliations to closest GAAP measures.

12 © 2015 | FY11–FY14 Recurring Fee Revenue Net New Business 5% Internal Growth 1% Acquisitions 2% 8% Total Revenue Recurring Fee 5% Event-Driven 0% Distribution/Other 1% 6% FY15–FY17F 5%–7% 0%–1% ~2% 7%–10% 4%–6% ~0% ~1% 5%–7% Revenue Growth History and Objectives 3-Year compounded annual growth rates (CAGRs)

13 © 2015 | P rio rit y Executing Our Capital Stewardship Strategy To Enhance Shareholder Value Committed to a strong dividend Targeting ~45% of net earnings Targeting tuck-in acquisitions to drive growth Selectively targeting about $400- $600M from FY15 to FY17 Share repurchases Increase targeted levels of share repurchases Maintain investment grade credit rating Using debt capacity for investments and capital return • Target 2:1 Adjusted Debt/EBITDAR ratio

14 © 2015 | Our Acquisition Track Record Is Strong Broadridge has invested $777M in 15 key acquisitions since becoming a public company • FY07 – FY09: Investigo, Access Data • FY10 – FY13: City Networks, StockTrans, NewRiver, Matrix, Forefield, Paladyne • FY14: Bonaire, Emerald Connect • FY15: Trade Processing Business from M&T Bank Corporation’s Wilmington Trust Retirement and Institutional Services Unit (WTRIS), Fiduciary Services and Competitive Intelligence unit from Thomson Reuters Lipper division, TwoFour Systems, Direxxis LLC • FY16: QED Financial Systems Our acquisitions portfolio is creating significant value for shareholders • Portfolio IRR tracking to 20%+ as of year ended 6/30/15 • Contributed meaningful recurring fee revenue and EBITDA in FY15 Note: Investment amounts reflect cash paid for acquisitions (net of cash acquired). Note: Including acquisitions completed through Q2 FY16.

15 © 2015 | Broadridge’s Investment Thesis • Resilient, predictable business model • Large market opportunity aligned with powerful industry trends • Unique franchise and ubiquitous presence • Track record driving growth through new products and tuck-in acquisitions • Low capital intensity and strong free cash flow enable effective capital stewardship • Proven track record delivering top quartile TSR • Experienced management and highly engaged associate team focused on delivering strong TSR

Appendix

17 © 2015 | FY16 Guidance (as of Q2 FY16 Earnings Call) Broadridge Financial Solutions, Inc. Recurring fee revenue growth 10 - 12% Total revenue growth 8 - 10% Adjusted Operating income margin ~18.4% Effective tax rate ~34.8% Adjusted Diluted earnings per share growth 8 - 12% Diluted earnings per share growth 7 - 12% Free cash flows $350M - $400M Closed sales $120M - $160M Segments ICS Total revenue growth 10 - 12% ICS Pre-tax margin ~18.9% GTO Total revenue growth 4 - 6% GTO Pre-tax margin ~17.3% Note: Current guidance remains unchanged from FY2016 guidance issued in August 7, 2015 webcast. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

18 © 2015 | Reconciliation of Non-GAAP to GAAP Measures – Adjusted Operating Income (Unaudited) Fiscal Year Ended June 30, 2015 2011 Adjusted Operating income (Non-GAAP) $ 497.1 $ 304.6 Acquisition Amortization and Other Costs (30.2 ) (19.2 ) IBM Migration Costs - (6.3 ) Operating income (GAAP) $ 466.9 $ 279.1 Adjusted Operating income margin (Non-GAAP) 18.5 % 14.1 % Operating income margin (GAAP) 17.3 % 12.9 % (1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the impact of Acquisition Amortization and Other Costs. (2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the impact of Acquisition Amortization and Other Costs.

19 © 2015 | Reconciliation of Non-GAAP to GAAP Measures – FY16 Guidance (Unaudited) Earnings Per Share Growth Rate (1) FY16 Guidance Adjusted Diluted earnings per share (Non-GAAP) 8% - 12% growth Diluted earnings per share (GAAP) 7% - 12% growth Operating Income Margin (2) FY16 Guidance Adjusted Operating income margin % (Non-GAAP) ~18.4% Operating income margin % (GAAP) ~17.3% (1) Adjusted Diluted EPS growth (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Diluted EPS guidance estimates exclude estimated Acquisition Amortization and Other Costs, net of taxes, of $0.18 per share. (2) Adjusted Operating income margin % (Non-GAAP) is adjusted to exclude the projected impact of Acquisition Amortization and Other Costs. Fiscal year 2016 Non-GAAP Adjusted Operating income margin % guidance estimates exclude estimated Acquisition Amortization and Other Costs of $34 million. Note: Guidance does not take into consideration the effect of any future acquisitions, additional debt, and/or share repurchases.

20 © 2015 | Definitions Acquisition Amortization and Other Costs represent amortization charges associated with acquired intangible asset values as well as other deal costs associated with the Company’s acquisition activity. Adjusted Debt/EBITDAR Ratio is calculated as (Debt + 8x Rent Expense) / (EBITDA + Rent Expense). Adjusted Operating Income is a Non-GAAP measure and is defined as operating income adjusted to exclude the impact of Acquisition Amortization and Other Costs. Closed Sales represent the expected recurring annual revenues for new client contracts that were signed by Broadridge during the periods referenced. The amount of the closed sale is generally a reasonable estimate of annual revenues based on client volumes or activity, excluding pass-through revenues such as distribution revenues. These types of sales were previously described as recurring revenue closed sales. Distribution revenues consist primarily of postage-related expenses incurred in connection with our Investor Communication Solutions segment. Earnings results and related metrics that are provided on a consolidated basis are Non-GAAP measures as they are adjusted to exclude the impact of certain significant events from our GAAP results such as the impact of Acquisition Amortization and Other Costs. Event-Driven revenues are based on the number of special events and corporate transactions we process. Event-driven activity is impacted by financial market conditions and changes in regulatory compliance requirements, resulting in fluctuations in the timing and levels of event-driven fee revenues. As such, the timing and level of event-driven activity and its potential impact on revenues and earnings is difficult to forecast. Free Cash Flows (FCF) is a Non-GAAP measure and is defined by Broadridge as net cash flows provided by operating activities, less capital expenditures, software purchases and capitalized internal use software. IBM Migration Costs are the costs incurred by Broadridge in connection with the migration of its data centers to IBM. Net New Business refers to recurring revenue from closed sales less recurring revenue from client losses.