Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Roadrunner Transportation Systems, Inc. | rrts-20160208x8xkinvestors.htm |

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 Investor Presentation

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 Certain statements contained in this presentation may be deemed to be "forward-looking statements" under the federal securities laws, and RRTS intends that such forward-looking statements be subject to the safe-harbor created thereby. These forward-looking statements include but are not limited to statements regarding RRTS' growth strategy, strategic plan, long-term goals and objectives, business models, business segments, acquisition strategy, acquired companies, acquisition pipeline, earnings, revenue, operating income and margin growth, avenues for enhancing earnings growth, operating initiatives, business expansion, cross-selling opportunities, service offerings, market opportunity, penetration of customers, industry, sales force, ability to capitalize on capacity constraints, margin expansion, management team, accelerated growth of acquired businesses, run-rate revenue of acquired business, and financial performance. These forward-looking statements are based on RRTS' current expectations and beliefs, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors, many of which are outside of RRTS' control, that could cause actual results to differ materially from those reflected by such forward-looking statements. You are cautioned not to place undue reliance on such forward-looking statements because actual results may vary materially from those expressed or implied. All forward-looking statements are based on information available as of the date of this presentation and RRTS or the presenter of this information assumes no obligation to and expressly disclaims any obligation to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. See "Risk Factors" in RRTS' prospectus supplement and RRTS’ other filings with the Securities and Exchange Commission for factors you should consider before buying shares of RRTS' common stock. This presentation includes certain non-GAAP financial measures as defined by SEC rules. As required by Regulation G, we have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the Appendix. 2

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 3 Since 2010 RRTS has Grown EBITDA at a CAGR of 30% Unparalleled acquisition strategy with a robust pipeline Strong organic growth with multiple avenues for expansion Broad geographic footprint supported by dedicated capacity network Comprehensive service offering with a scalable, variable cost structure Efficient business model generates strong FCF and high ROIC Deep leadership team with the ability to effectively manage substantial growth Leading full- service, asset-light transportation and logistics provider

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 4 From 2006 to 2015, CAGR in Revenue of 20% and EBITDA of 28% • Extend market share gains through cost-efficient / high-service models • Cross-sell full suite of services to increase customer penetration and enhance profitability • Strategic operational and selling initiatives to drive continuous improvements in operating ratio, maximize returns, and enhance customer value proposition • Optimize capacity networks and provide real-time data to enhance margins and drive profitability • Cash flow from operations increased 81% in 2015 • Focus in 2016 to enhance cash flow from operations with minimal growth capital required Organic Strategies Focus on Cash Flow

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 5 Ultimate International Origin / Destination U.S. Customs and Port Consolidation/ Deconsolidation Ultimate Domestic Origin / Destination or Outbound Location FTL / FCL LTL / LCL Note: LTL = less-than-truckload; LCL = less-than-container load; FTL = full truckload; FCL = full container load. TL, Consolidation & Warehousing Intermodal Dray International Ocean and Air LTL Expedited RRTS’ Comprehensive Service Offering is Unique and Enables Us to Satisfy Our Customers’ Total Logistics Needs

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 6 RRTS’ Differentiated Model Uniquely Positions Carrier Capabilities with Asset-Light Characteristics for High-Quality, Low-Cost Solutions for Customers RRTS Effectively Controls Capacity with Limited Capital Commitment RRTS is the carrier, capacity, and service provider for its transportation services Independent Contractors (ICs) are dedicated to RRTS Dedicated IC model is differentiated from brokers, who procure freight services on a purely transactional basis RRTS’ control of capacity drives margin expansion as industry capacity tightens Carrier vs. Broker Carrier Asset- Light RRTS operates a flexible, asset-light model allowing for a highly scalable cost structure Domestic capacity provided primarily through dedicated ICs and purchased power providers to ensure a balanced network RRTS continues to expand capacity via best-in-class recruiting and retention Enables rapid growth with low capital requirements Asset-Light vs. Asset-Based

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 7 Notes: LTL = less-than-truckload; TL = truckload (1) In Q4 2015, RRTS’ TL Logistics segment recorded revenues of $305 million. OEM Solutions accounted for 48% of revenue, TL Services accounted for 36%, Intermodal Solutions accounted for 10%, and Freight Consolidation and Inventory Management accounted for 6%. (2) Domestic LTL market is estimated to be $66.2 billion per the American Trucking Associations’ 2016 U.S. Freight Transportation Forecast. TL Logistics (58% of ‘15 Revenues) (1) • Non-asset, point-to-point LTL model ― Fewer handlings ― Efficient transit times ― Limited investment in equipment and real estate • Low-cost / high-service market position yields competitive advantage • Unique model allows for expansion without traditional inefficiencies • High incremental margins yield strong return on continued LTL market share gains (2) LTL (26% of ‘15 Revenues) • Comprehensive global supply chain solutions • Full freight and container management capabilities • Industry-leading IT and data management • Flexible, customizable solutions allow customers to manage freight spend based on their individual needs • Capabilities range from à la carte to complete management of transportation • Integration with broader RRTS network provides affordable access to capacity for all of Global Solutions and allows for optimization of RRTS capacity Global Solutions (16% of ‘15 Revenues) RRTS’ Capacity-Based, Asset-Light Business Model and Full Service Capabilities Provide Significant Revenue Growth with High Incremental Margins OEM Solutions / Air & Ground Expedite – Spot bid technology uniquely supported by owned/controlled air and ground assets Truckload Services ― Asset-light, capacity-driven network provides customers with flexible, cost efficient solutions ― Reefer, dry flatbed, and brokerage services Intermodal Solutions ― Capacity-driven dry and refrigerated services ― Drayage and other short-run offerings Freight Consolidation and Inventory Management ― High-service consolidation and inventory management ― Over 2.8 million sq. ft. of warehouse space nationally

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 8 • Sales efforts are supported by the Integrated Solutions sales team; designed to drive cross-selling of complete solutions across the enterprise capitalizing on individual cross-selling opportunities Investment in a Sales Force Equipped to Cross-Sell RRTS’ Capabilities Allows RRTS to Provide Each Customer Access to the Full RRTS Service Platform Penetration of Customers Utilizing Multiple Service Offerings Has Grown to 58% (1) and Acceleration Continues (1) Total revenue of customers using multiple services as a percent of total company revenue as of December 31, 2015. Over 35,000 customers and growing Over 80 LTL sales personnel Over 100 TL Logistics sales personnel and dispatchers Over 50 Global Solutions sales personnel

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 [Discuss Inclusion] 9 Average Driver Age Shipper Focus on Safety and Liability Exposure RRTS’ Unique Business Model Drives Significant Growth and Margin Expansion in Periods of Constrained Industry Capacity • Best-in-class track record of recruiting and retention – rated #1 by Transport Topics (1) ― More than quadrupled dedicated driver capacity to ~4,500 over last few years (2) • Recent acquisitions expand and enhance capacity • Expanded driver recruitment team to accommodate continued growth RRTS’ Dedicated Drivers (2) 1,500 1,800 2,100 2,400 2,700 3,000 3,300 3,600 3,900 4,200 4,500 4,800 2010 2015 ~4,500 ~1,100 (number of dedicated drivers) Factors Constraining Industry Capacity RRTS’ Advantageous Position (1) Source: www.ttnews.com, week of July 22, 2013. (2) 2010 and 2015 figures are as of 1/1/2010 and 12/31/2015, respectively. Tightening Capacity Increasing Regulation Anticipated Economic Uptick Increasing Costs for Owner Operators and Trucking Companies Escalating Average Driver Age Shipper Focus on Safety and Liability Exposure

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 $34.4 $51.1 $78.5 $101.7 $120.8 $129.0 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 2010 2011 2012 2013 2014 2015 $632.0 $843.6 $1,073.4 $1,361.4 $1,872.8 $1,995.0 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 2010 2011 2012 2013 2014 2015 10 (1) Excludes expenses related to the IPO in 2010. Positioned to Continue Achieving Earnings Growth in 2015 and Beyond EBITDA and Margin ($ in millions) Revenue ($ in millions) (1) 5.4% 6.1% 7.3% 7.5% 6.4% 6.5%

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 11 RRTS Remains a Compelling Value Compared to Peers – Strong business model fundamentals are driving industry-leading growth PEG Ratio (3) Comparison 0.32 1.56 1.44 1.16 1.30 1.21 0.00 0.50 1.00 1.50 2.00 EBITDA Growth (1) to 12/31/2015 P/E (2) Correlation E B IT D A C A G R LTM 9/30/2015 P/E (1) EBITDA CAGR from CY2012 to LTM 9/30/2015. (2) 12/31/2015 stock price divided by 9/30/2015 LTM diluted earnings per share. (3) Forecast 12 Month Forward PEG ratio per NASDAQ.com. 0% 5% 10% 15% 20% 25% 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x 35.0x

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 $123.1 $135.8 2014 2015 Adjusted EBITDA (1) ($ in millions) 12 $1,872.8 $1,995.0 2014 2015 Revenue ($ in millions) 6.5% Growth 10.3% Growth (1) Adjusted to remove the impact of $1.2 million of severance expenses related to the separation with a former company executive officer in 2015, a $5.0 million charge associated with the termination of certain independent contractor (“IC”) lease purchase guarantee programs in 2015, $0.6 million of acquisition transaction expenses in 2015, and $2.3 million of acquisition transaction expenses in 2014. • Strategic initiatives and service expansion over the past five years have positioned RRTS for the future • Continued growth in 2015 despite economic headwinds • Multiple avenues for organic growth across integrated service offering • Enhanced focus in 2016 on cash flow

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 13 $37 $36 $41 $73 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% $- $20 $40 $60 $80 2012 2013 2014 2015 Perc en t o f R eve nu e $ in mil lio ns Cash Flow From Operations CapEx as a % of Revenue • Cash flow from operations (CFFO) was impacted in 2012 to 2015 by strategic growth initiatives to position the Company for the long-term • Focus for 2016 is on enhancing CFFO with minimal growth capital required

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 ($ in millions) December 31, 2015 Revolver 143.1$ Term Loan 296.3 Other Debt 11.9 Total Debt 451.3$ Less: Cash (8.7) Net Debt 442.6$ Pro Forma EBITDA (1) 134.8$ Net Debt to EBITDA Ratio 3.28x • Goal is to reduce net debt to EBITDA ratio to under 2.5x within 12 to 18 months • Revolver capacity at 12/31/15 is $234 million—RRTS’ credit facility represents collateralized bank debt with a group of long-term, mid-market banks (1) EBITDA is pro forma to include the results of operations for the acquisition of Stagecoach as if that acquisition had been completed at the beginning of 2015, plus related transaction costs. Net Debt to EBITDA Capitalization ($ in millions) December 31, 2015 Net Debt 442.6$ Total Stockholder's Investment 613.2 Total Capitalization 1,055.8$ Net Debt / Capitalization 41.9% 14

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 RRTS’ Leadership Team is Well Equipped to Manage Substantial Growth Throughout Each Segment • Entrepreneurial culture and team with well-established track record • Proven ability to identify and assimilate strategic acquisitions, efficiently manage significant growth, and effectively control costs throughout economic cycles 15 Deep Team with Relevant Industry Experience, Strong Internal Support and Talent Years Experience Name Position Company Industry Mark DiBlasi Chief Executive Officer 10 36 Curt Stoelting President and Chief Operating Officer 1 1 Peter Armbruster Chief Financial Officer 25 25 Pat McKay President Truckload Logistics 4 29 Grant Crawford President, Less -than-Truckload 2 24 Bill Goodgion President, Global Solutions 1 25 Mark Peterson Executive Vice President Sales 2 30 Ben Kirkland President, Roadrunner Intermodal Services 19 38 Dave Schembri President, OEM Services 4 36 Bob Milane Vice President Risk Management 2 31

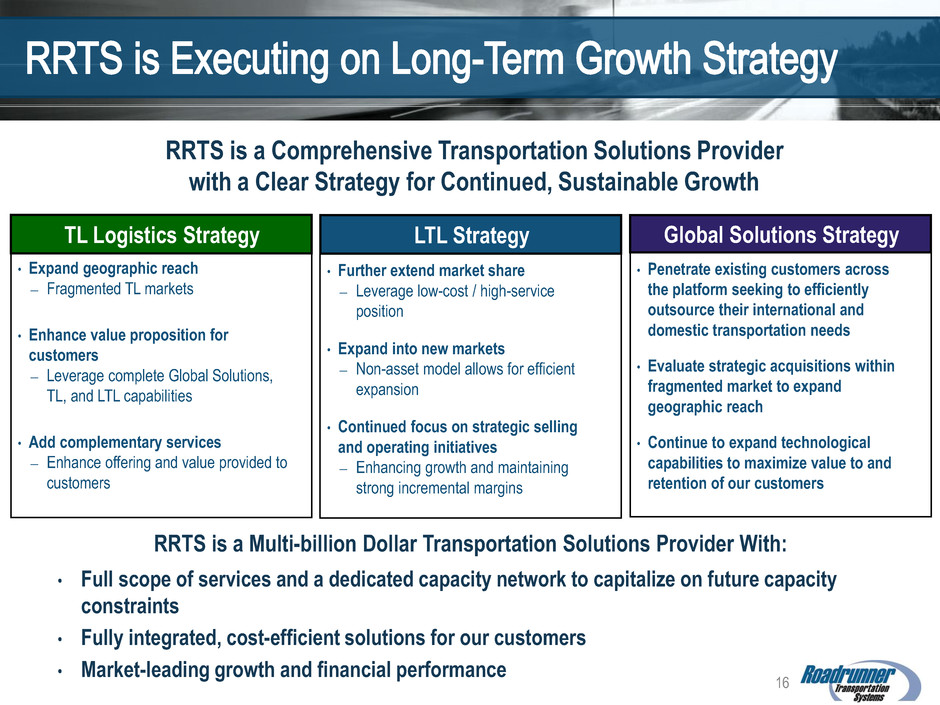

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 • Expand geographic reach ― Fragmented TL markets • Enhance value proposition for customers ― Leverage complete Global Solutions, TL, and LTL capabilities • Add complementary services ― Enhance offering and value provided to customers • Penetrate existing customers across the platform seeking to efficiently outsource their international and domestic transportation needs • Evaluate strategic acquisitions within fragmented market to expand geographic reach • Continue to expand technological capabilities to maximize value to and retention of our customers From 2005 to date, RRTS has grown from a $150 million, single- service provider to an $844 million, full- service transportation provider Over the next 5 years, our goal is to grow the company into a multi- billion transportation company providing industry leading service with a highly attractive financial profile 2016 RRTS is a Multi-billion Dollar Transportation Solutions Provider With: • Full scope of services and a dedicated capacity network to capitalize on future capacity constraints • Fully integrated, cost-efficient solutions for our customers • Market-leading growth and financial performance RRTS is a Comprehensive Transportation Solutions Provider with a Clear Strategy for Continued, Sustainable Growth Global Solutions Strategy TL Logistics Strategy LTL Strategy • Further extend market share ― Leverage low-cost / high-service position • Expand into new markets ― Non-asset model allows for efficient expansion • Continued focus on strategic selling and operating initiatives ― Enhancing growth and maintaining strong incremental margins 16

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 17

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 Reconciliation of Net Income to EBITDA ($ in thousands) Twelve Months Ended December 31, 2015 2014 2013 2012 2011 2010 Net income 48,000$ 51,974$ 48,996$ 37,530$ 25,871$ 21,007$ Plus: Provision for income taxes 29,234 30,349 28,484 23,390 15,929 2,108 Plus: Interest expense 19,439 13,363 7,883 8,030 4,335 8,154 Plus: Depreciation and amortization 32,323 25,078 16,311 9,499 4,978 3,114 EBITDA 128,996$ 120,764$ 101,674$ 78,449$ 51,113$ 34,383$ The following expenses have not been added to net income in the calculation of EBITDA above: Restructuring and IPO related expenses - - - - - 1,500 Loss on early extinguishment of debt - - - - - 15,916

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 Reconciliation of Pro Forma EBITDA ($ in thousands) Twelve Months Ended December 31, 2015 Acquired companies net income for the period prior to acquisition 2,492$ Plus: Provision for income taxes 994 Plus: Interest expense 159 Plus: Depreciation and amortization 1,546 Acqui ed companies EBITDA for the period prior to acquisition 5,191 Consolidated EBITDA 128,996 Plus: Acquisition transaction expenses 564 Pro forma EBITDA 134,751$

20 57 84 17 81 122 189 218 239 20 102 63 211 92 58 111 26 29 Reconciliation of EBITDA to Adjusted EBITDA ($ in millions) Twelve Months Executive Officer Termination of IC Adjusted Ended Separation Lease Purchase Transaction Twelve Months Ended December 31, 2015 Severance Expenses Guarantees Expenses December 31, 2015 Net income 48.0$ 1.2$ 5.0$ 0.6$ 54.8$ Plus: Provision for income taxes 29.2 - - - 29.2 Plus: Interest expense 19.4 - - - 19.4 Plus: Depreciation and amortization 32.3 - - - 32.3 EBITDA 129.0$ 1.2$ 5.0$ 0.6$ 135.8$ Twelve Months Executive Officer Termination of IC Adjusted Ended Separation Lease Purchase Transaction Twelve Months Ended December 31, 2014 Severance Expenses Guarantees Expenses December 31, 2014 Net income 52.0$ -$ -$ 2.3$ 54.3$ Plus: Provision for income taxes 30.3 - - - 30.3 Plus: Interest expense 13.4 - - - 13.4 Plus: Depreciation and amortization 25.1 - - - 25.1 EBITDA 120.8$ -$ -$ 2.3$ 123.1$