Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Genpact LTD | d46186dex991.htm |

| 8-K - FORM 8-K - Genpact LTD | d46186d8k.htm |

February 4, 2016 Ticker (NYSE: G) Genpact Q4 and FY 2015 Earnings Presentation Exhibit 99.2

Forward-looking statements These materials contain certain statements concerning our future growth prospects and forward-looking statements, as defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on Genpact’s current expectations and beliefs, as well as a number of assumptions concerning future events. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those in such forward-looking statements. These risks and uncertainties include but are not limited to a slowdown in the economies and sectors in which our clients operate, a slowdown in the BPO and IT Services sectors, the risks and uncertainties arising from our past and future acquisitions, our ability to convert bookings to revenues, our ability to manage growth, factors which may impact our cost advantage, wage increases, our ability to attract and retain skilled professionals, risks and uncertainties regarding fluctuations in our earnings, foreign currency fluctuations, dependence on tax legislation, general economic conditions affecting our industry as well as other risks detailed in our reports filed with the U.S. Securities and Exchange Commission (the “SEC”), including the Company's Annual Report on Form 10-K. These filings are available at www.sec.gov or on the investor relations section of our website, www.genpact.com. Genpact may from time to time make additional written and oral forward-looking statements, including statements contained in our filings with the SEC. The Company undertakes no obligation to update any forward-looking statements that may be made from time to time by or on behalf of the Company. These materials also include measures defined by the SEC as non-GAAP financial measures. Genpact believes that these non-GAAP measures can provide useful supplemental information to investors regarding financial and business trends relating to its financial condition and results of operations when read in conjunction with the Company’s reported results. Reconciliations of these non-GAAP measures from GAAP are available in this presentation and in our earnings release dated February 4, 2016. Non-GAAP Financial Measures

FY 2015 – Key Financial Highlights Solid Execution Drove Global Client Growth FY ‘15 versus FY ‘14 performance: Total Revenue: +8% (~ +10% on constant currency basis) Revenue from Global Clients: +10% (~ +13% on constant currency basis) GE Revenue: -1% (~ -1% on constant currency basis) New Bookings(1) +20% Adjusted Income from Operations grew 10%, with a margin(2) of 15.3% Adjusted Diluted Earnings Per Share grew 22% YoY to $1.26 Global Client growth was broad-based across most of our target verticals and service lines: BFS, CPG, Life Sciences, Insurance and High Tech all grew double digits Finance & Accounting, our Core Industry Vertical Operations, Analytics and Consulting Services also drove Global Client growth Notes: New bookings means the total contract value of new contracts, and certain renewals, extensions and changes to existing contracts. Regular renewals of contracts with no change in scope are not counted as new bookings. Adjusted income from operations is a non-GAAP measure. FY ‘15 GAAP income from operations margin was 13.6%.

FY 2015 – Key Accomplishments Continued to strengthen our client-facing teams Continued to invest in domain, digital and analytics capabilities Including acquisitions and strategic partnerships Launched Lean DigitalSM, our unique and highly differentiated approach to digital Invested in our employees to develop evolving and differentiated skills Signed 9 large transformational deals

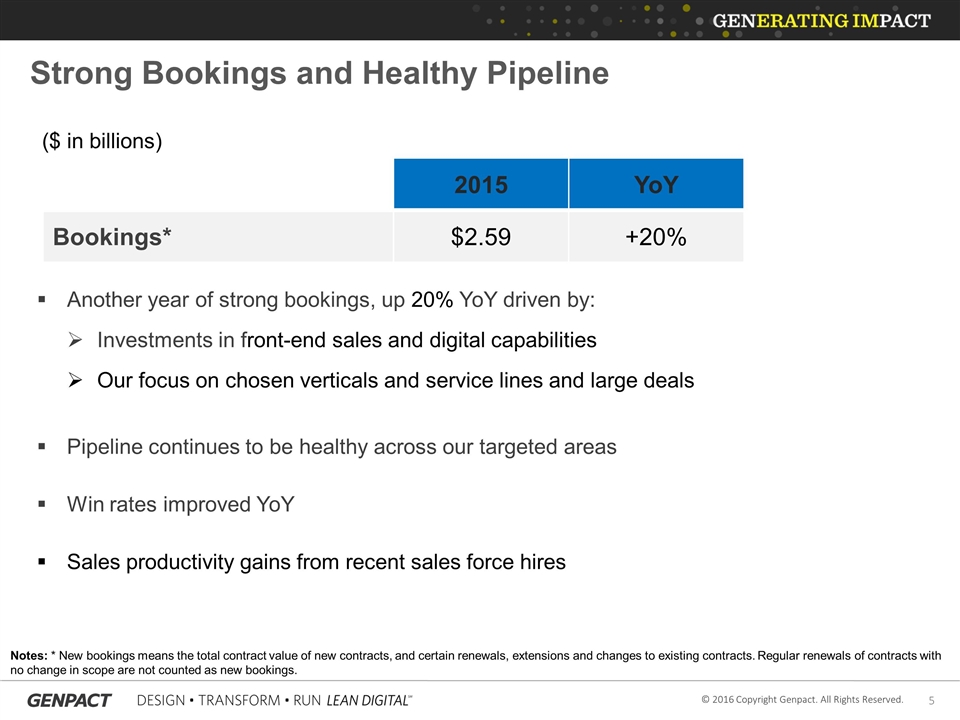

Strong Bookings and Healthy Pipeline Pipeline continues to be healthy across our targeted areas Win rates improved YoY Sales productivity gains from recent sales force hires ($ in billions) 2015 YoY Bookings* $2.59 +20% Notes: * New bookings means the total contract value of new contracts, and certain renewals, extensions and changes to existing contracts. Regular renewals of contracts with no change in scope are not counted as new bookings. Another year of strong bookings, up 20% YoY driven by: Investments in front-end sales and digital capabilities Our focus on chosen verticals and service lines and large deals

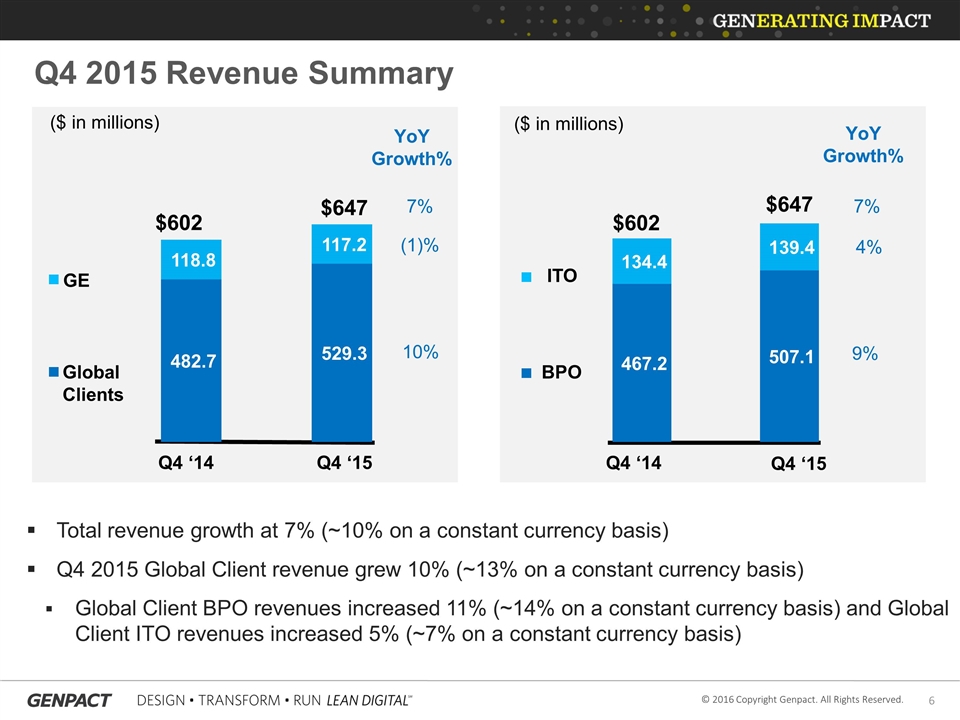

Total revenue growth at 7% (~10% on a constant currency basis) Q4 2015 Global Client revenue grew 10% (~13% on a constant currency basis) Global Client BPO revenues increased 11% (~14% on a constant currency basis) and Global Client ITO revenues increased 5% (~7% on a constant currency basis) Global Clients GE BPO ITO 7% YoY Growth% 10% (1)% 7% 4% 9% YoY Growth% Q4 ‘14 Q4 ‘15 Q4 ‘14 Q4 ‘15 ($ in millions) ($ in millions) $602 $647 $647 $602 Q4 2015 Revenue Summary

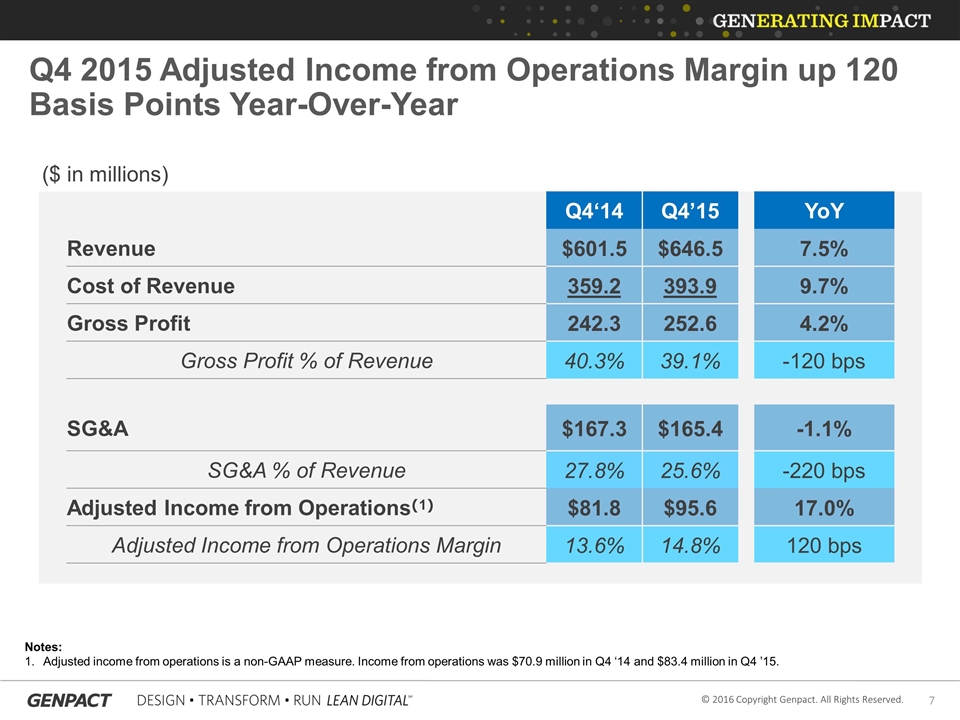

Q4‘14 Q4’15 YoY Revenue $601.5 $646.5 7.5% Cost of Revenue 359.2 393.9 9.7% Gross Profit 242.3 252.6 4.2% Gross Profit % of Revenue 40.3% 39.1% -120 bps SG&A $167.3 $165.4 -1.1% SG&A % of Revenue 27.8% 25.6% -220 bps Adjusted Income from Operations(1) $81.8 $95.6 17.0% Adjusted Income from Operations Margin 13.6% 14.8% 120 bps ($ in millions) Notes: Adjusted income from operations is a non-GAAP measure. Income from operations was $70.9 million in Q4 ‘14 and $83.4 million in Q4 ’15. Q4 2015 Adjusted Income from Operations Margin up 120 Basis Points Year-Over-Year

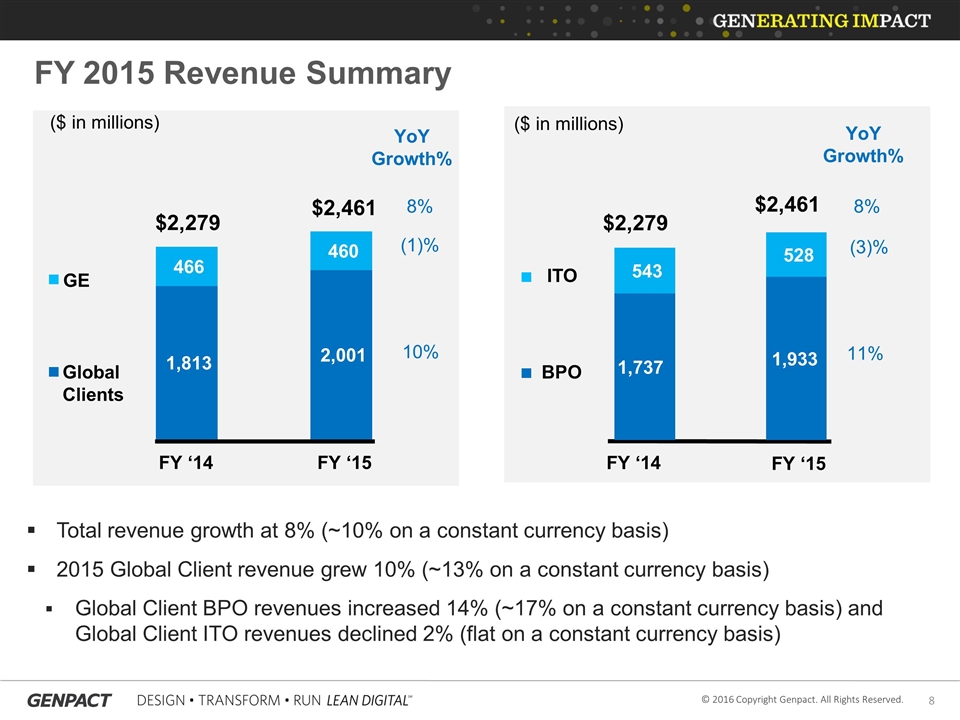

Total revenue growth at 8% (~10% on a constant currency basis) 2015 Global Client revenue grew 10% (~13% on a constant currency basis) Global Client BPO revenues increased 14% (~17% on a constant currency basis) and Global Client ITO revenues declined 2% (flat on a constant currency basis) Global Clients GE BPO ITO 8% YoY Growth% 10% (1)% 8% (3)% 11% YoY Growth% FY ‘14 FY ‘15 FY ‘14 FY ‘15 ($ in millions) ($ in millions) $2,279 $2,461 $2,461 $2,279 FY 2015 Revenue Summary

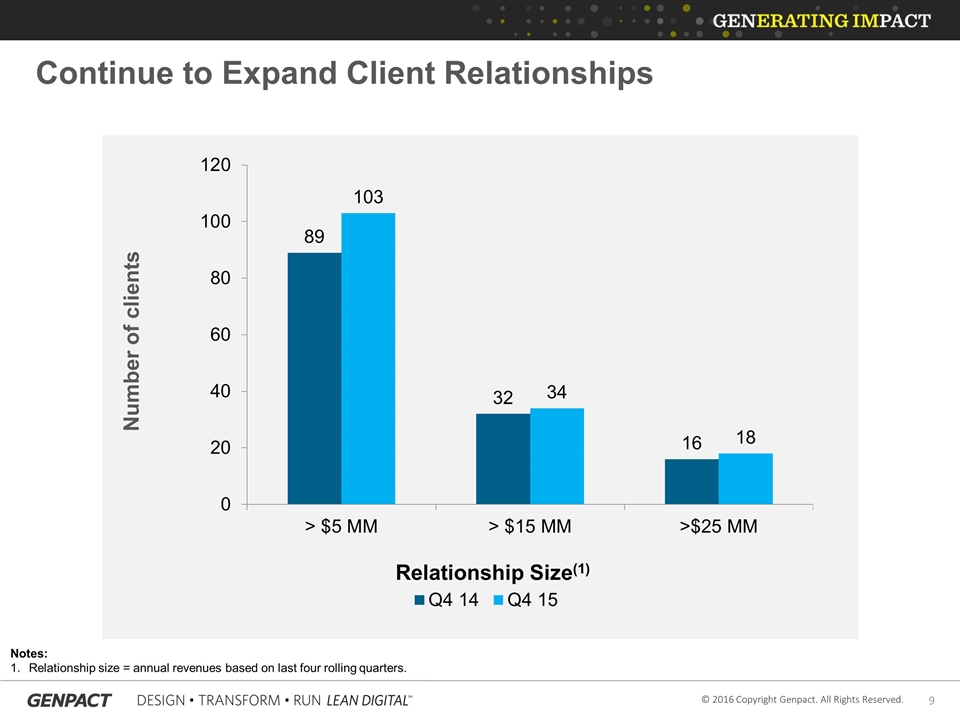

Number of clients Notes: Relationship size = annual revenues based on last four rolling quarters. Relationship Size(1) Continue to Expand Client Relationships

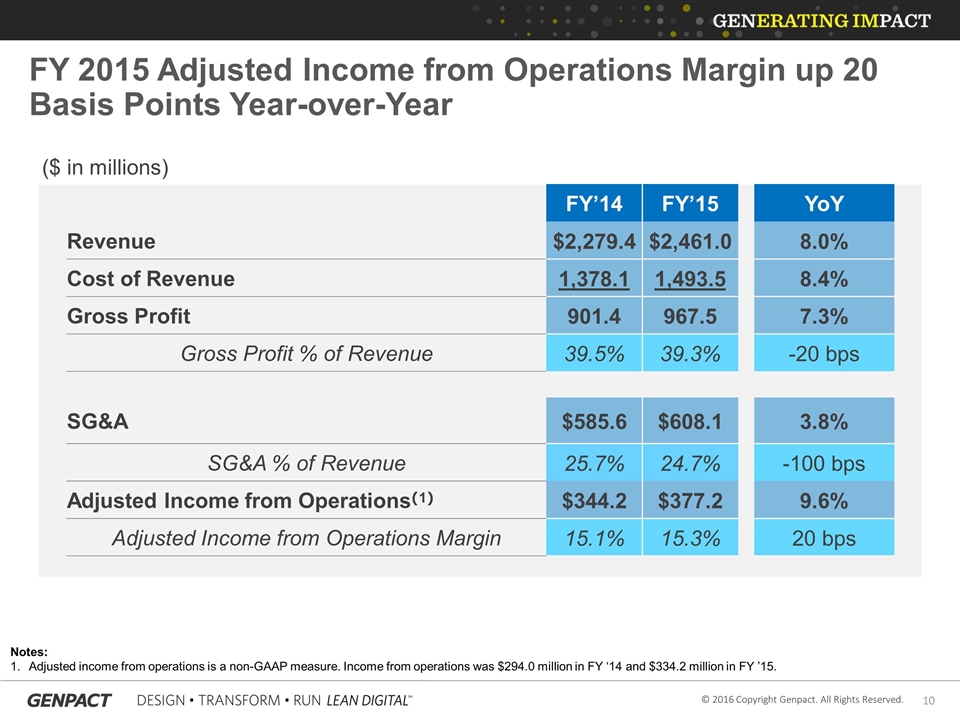

FY’14 FY’15 YoY Revenue $2,279.4 $2,461.0 8.0% Cost of Revenue 1,378.1 1,493.5 8.4% Gross Profit 901.4 967.5 7.3% Gross Profit % of Revenue 39.5% 39.3% -20 bps SG&A $585.6 $608.1 3.8% SG&A % of Revenue 25.7% 24.7% -100 bps Adjusted Income from Operations(1) $344.2 $377.2 9.6% Adjusted Income from Operations Margin 15.1% 15.3% 20 bps ($ in millions) Notes: Adjusted income from operations is a non-GAAP measure. Income from operations was $294.0 million in FY ‘14 and $334.2 million in FY ’15. FY 2015 Adjusted Income from Operations Margin up 20 Basis Points Year-over-Year

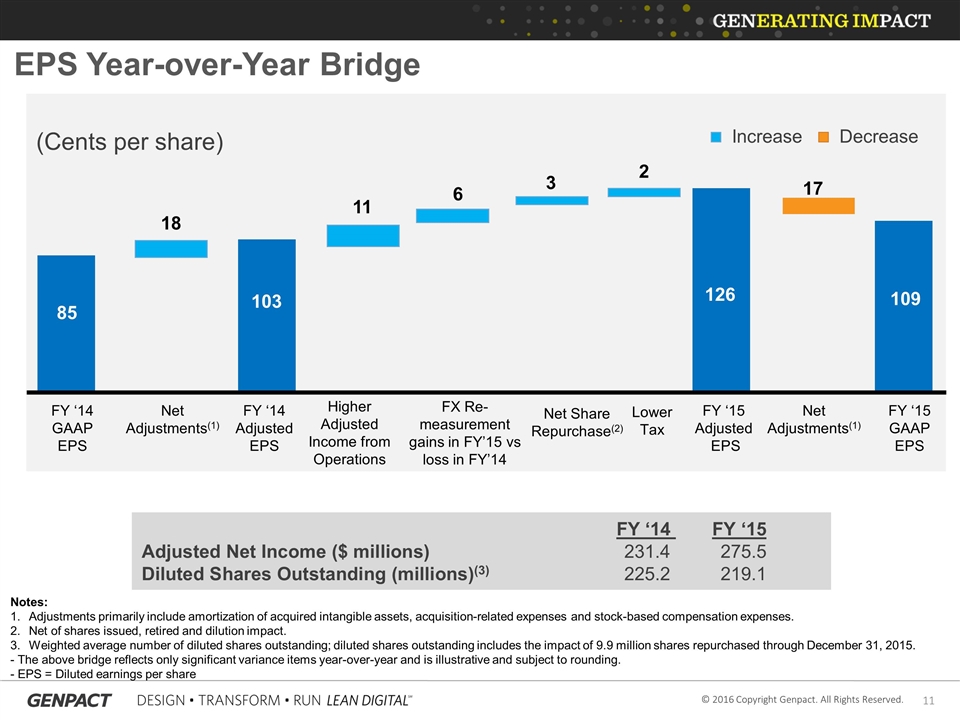

EPS Year-over-Year Bridge FY ‘14 FY ‘15 Adjusted Net Income ($ millions)231.4 275.5 Diluted Shares Outstanding (millions)(3) 225.2 219.1 85 11 FX Re-measurement gains in FY’15 vs loss in FY’14 FY ‘14 GAAP EPS 109 (Cents per share) Net Adjustments(1) 103 18 Net Adjustments(1) FY ‘14 Adjusted EPS FY ‘15 Adjusted EPS FY ‘15 GAAP EPS Higher Adjusted Income from Operations 17 Increase Decrease Notes: Adjustments primarily include amortization of acquired intangible assets, acquisition-related expenses and stock-based compensation expenses. Net of shares issued, retired and dilution impact. Weighted average number of diluted shares outstanding; diluted shares outstanding includes the impact of 9.9 million shares repurchased through December 31, 2015. - The above bridge reflects only significant variance items year-over-year and is illustrative and subject to rounding. - EPS = Diluted earnings per share 126 6 Lower Tax 3 2 Net Share Repurchase(2)

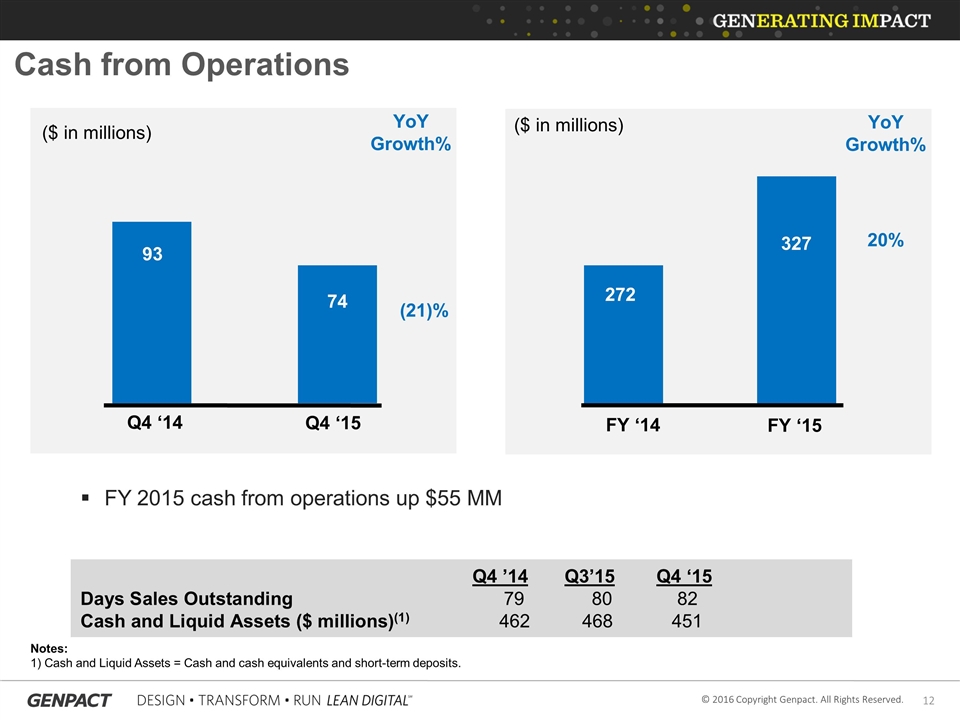

FY 2015 cash from operations up $55 MM Q4 ‘14 Q4 ‘15 (21)% Notes: 1) Cash and Liquid Assets = Cash and cash equivalents and short-term deposits. 20% FY ‘14 FY ‘15 YoY Growth% YoY Growth% ($ in millions) ($ in millions) Q4 ’14 Q3’15 Q4 ‘15 Days Sales Outstanding79 80 82 Cash and Liquid Assets ($ millions)(1) 462 468 451 Cash from Operations 327 272 93 74

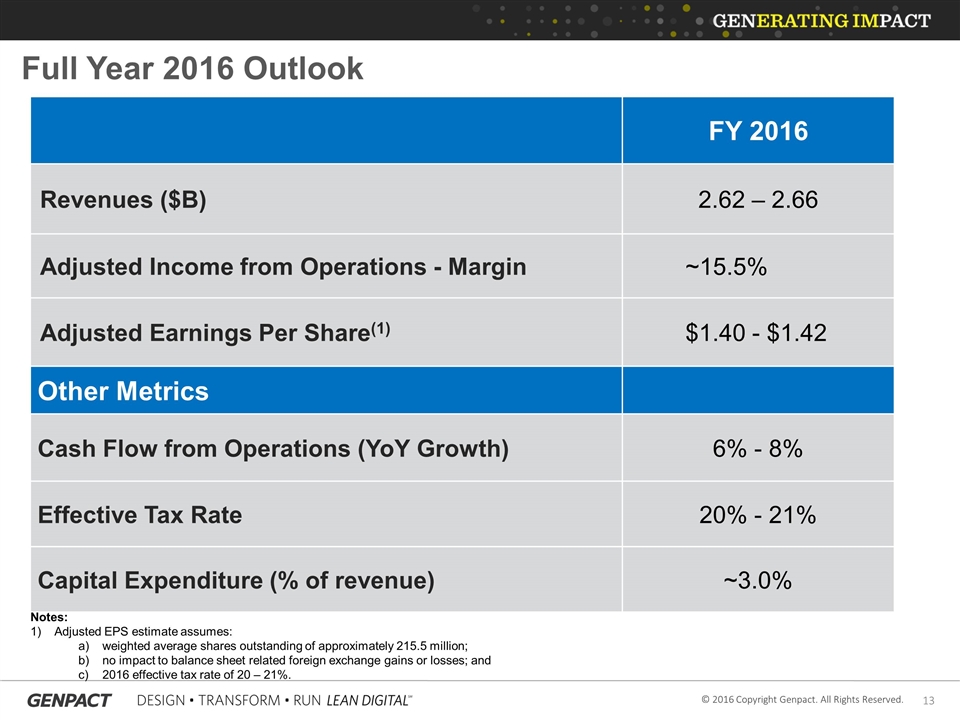

FY 2016 Revenues ($B) 2.62 – 2.66 Adjusted Income from Operations - Margin ~15.5% Adjusted Earnings Per Share(1) $1.40 - $1.42 Other Metrics Cash Flow from Operations (YoY Growth) 6% - 8% Effective Tax Rate 20% - 21% Capital Expenditure (% of revenue) ~3.0% Full Year 2016 Outlook Notes: Adjusted EPS estimate assumes: weighted average shares outstanding of approximately 215.5 million; no impact to balance sheet related foreign exchange gains or losses; and 2016 effective tax rate of 20 – 21%.

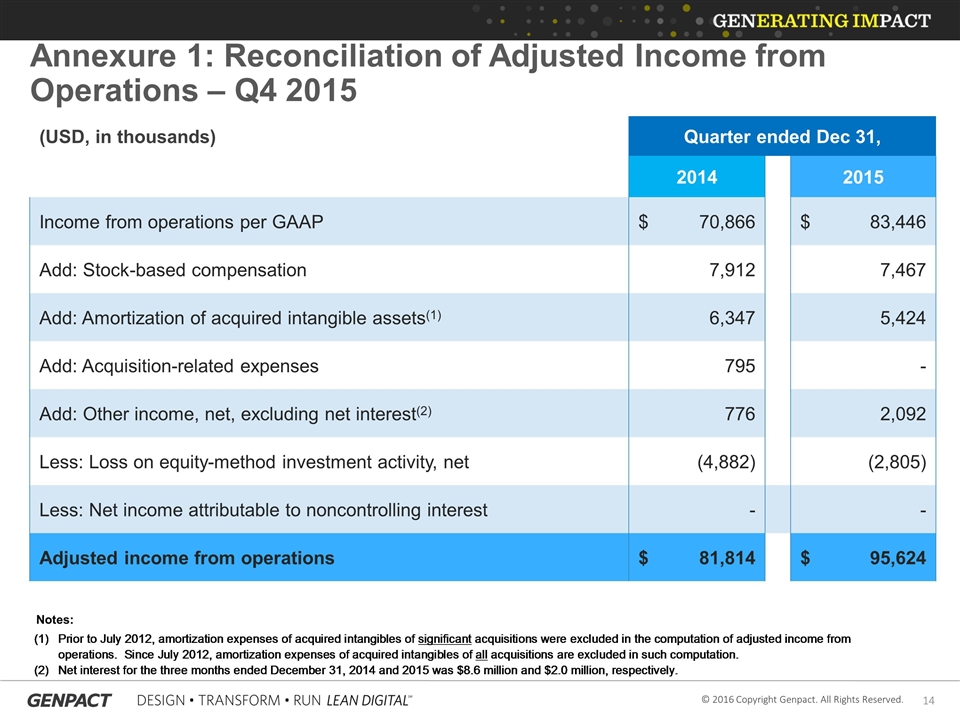

Annexure 1: Reconciliation of Adjusted Income from Operations – Q4 2015 (USD, in thousands) Quarter ended Dec 31, 2014 2015 Income from operations per GAAP $ 70,866 $ 83,446 Add: Stock-based compensation 7,912 7,467 Add: Amortization of acquired intangible assets(1) 6,347 5,424 Add: Acquisition-related expenses 795 - Add: Other income, net, excluding net interest(2) 776 2,092 Less: Loss on equity-method investment activity, net (4,882) (2,805) Less: Net income attributable to noncontrolling interest - - Adjusted income from operations $ 81,814 $ 95,624 Notes:Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded in the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded in such computation.Net interest for the three months ended December 31, 2014 and 2015 was $8.6 million and $2.0 million, respectively.

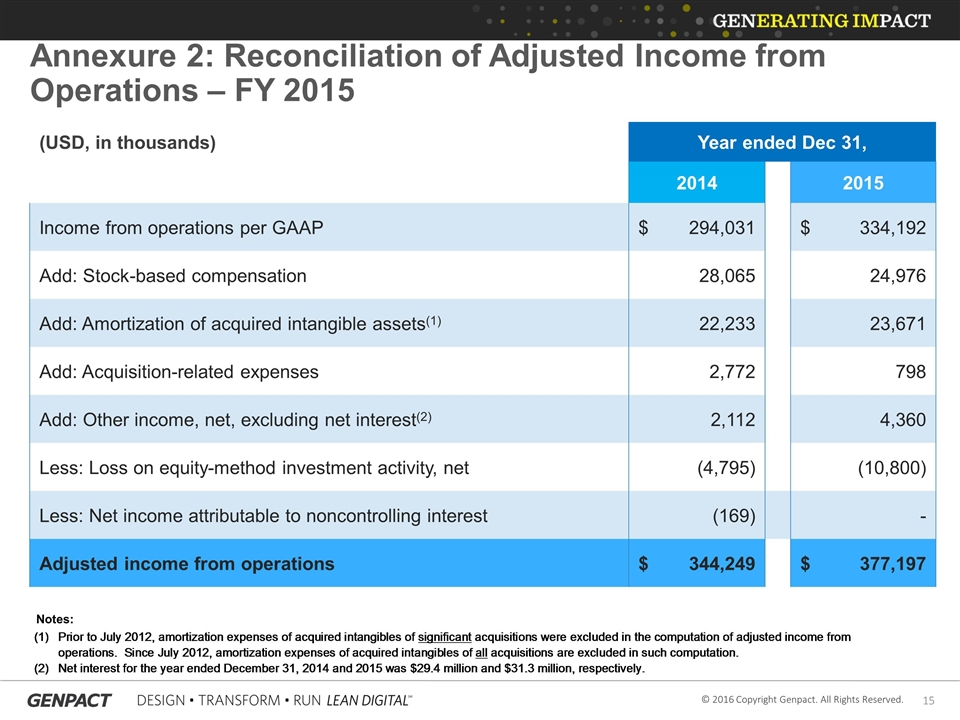

Annexure 2: Reconciliation of Adjusted Income from Operations – FY 2015 (USD, in thousands) Year ended Dec 31, 2014 2015 Income from operations per GAAP $ 294,031 $ 334,192 Add: Stock-based compensation 28,065 24,976 Add: Amortization of acquired intangible assets(1) 22,233 23,671 Add: Acquisition-related expenses 2,772 798 Add: Other income, net, excluding net interest(2) 2,112 4,360 Less: Loss on equity-method investment activity, net (4,795) (10,800) Less: Net income attributable to noncontrolling interest (169) - Adjusted income from operations $ 344,249 $ 377,197 Notes:Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded in the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded in such computation.Net interest for the year ended December 31, 2014 and 2015 was $29.4 million and $31.3 million, respectively.

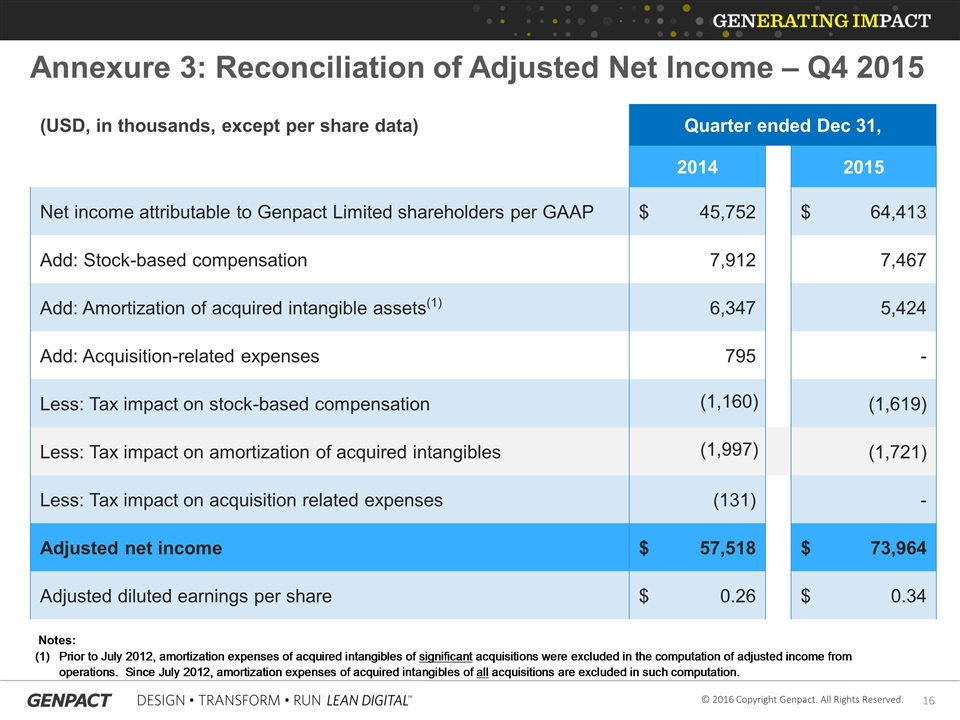

Annexure 3: Reconciliation of Adjusted Net Income – Q4 2015 (USD, in thousands, except per share data) Quarter ended Dec 31, 2014 2015 Net income attributable to Genpact Limited shareholders per GAAP $ 45,752 $ 64,413 Add: Stock-based compensation 7,912 7,467 Add: Amortization of acquired intangible assets(1) 6,347 5,424 Add: Acquisition-related expenses 795 - Less: Tax impact on stock-based compensation (1,160) (1,619) Less: Tax impact on amortization of acquired intangibles (1,997) (1,721) Less: Tax impact on acquisition related expenses (131) - Adjusted net income $ 57,518 $ 73,964 Adjusted diluted earnings per share $ 0.26 $ 0.34 Notes:Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded in the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded in such computation.

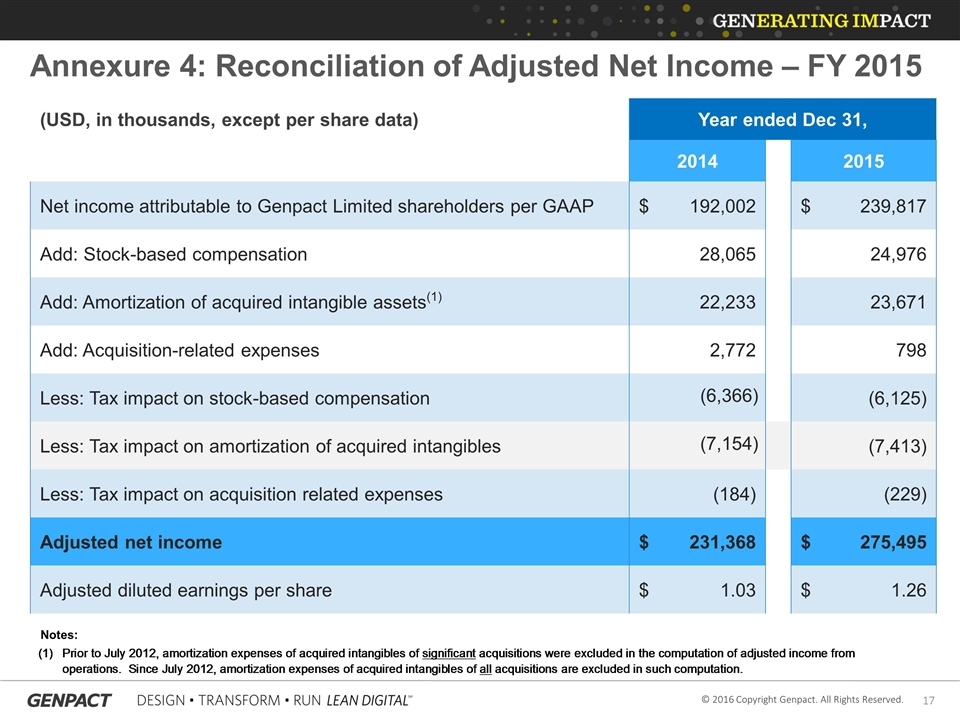

Annexure 4: Reconciliation of Adjusted Net Income – FY 2015 (USD, in thousands, except per share data) Year ended Dec 31, 2014 2015 Net income attributable to Genpact Limited shareholders per GAAP $ 192,002 $ 239,817 Add: Stock-based compensation 28,065 24,976 Add: Amortization of acquired intangible assets(1) 22,233 23,671 Add: Acquisition-related expenses 2,772 798 Less: Tax impact on stock-based compensation (6,366) (6,125) Less: Tax impact on amortization of acquired intangibles (7,154) (7,413) Less: Tax impact on acquisition related expenses (184) (229) Adjusted net income $ 231,368 $ 275,495 Adjusted diluted earnings per share $ 1.03 $ 1.26 Notes:Prior to July 2012, amortization expenses of acquired intangibles of significant acquisitions were excluded in the computation of adjusted income from operations. Since July 2012, amortization expenses of acquired intangibles of all acquisitions are excluded in such computation.

Thank You