Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - Aim Exploration Inc. | aexe_ex321.htm |

| EX-32.2 - CERTIFICATION - Aim Exploration Inc. | aexe_ex322.htm |

| EX-31.2 - CERTIFICATION - Aim Exploration Inc. | aexe_ex312.htm |

| EX-31.1 - CERTIFICATION - Aim Exploration Inc. | aexe_ex311.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2015

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________.

Commission file number 333-182071

AIM EXPLORATION INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

67-0682135

|

|

|

(State or Other Jurisdiction of Incorporation of Organization)

|

(I.R.S. Employer Identification No.)

|

701 North Green Valley Parkway, Suite 200david

Henderson, Nevada 89012

(Address of principal executive offices)

1-844-246-7378

(Registrant’s telephone number, including area code)

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value, Preferred Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “ large accelerated filer and “ accelerated filer ” and “ smaller reporting company ” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

Aggregate market value of the voting and non-voting stock of the registrant held by non-affiliates of the registrant as of the last day of the Company’s most recently-completed second fiscal quarter (February 27, 2015): $7,922,750.00.

As of December 15, 2015 the registrant’s outstanding stock consisted of 89,100,000 common shares and 100,000 preferred shares.

TABLE OF CONTENTS

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

17

|

|

Item 1B.

|

Unresolved Staff Comments

|

17

|

|

Item 2.

|

Properties

|

17

|

|

Item 3.

|

Legal Proceedings

|

17

|

|

Item 4.

|

Mine Safety Disclosures

|

17

|

|

Item 5.

|

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17

|

|

Item 6.

|

Selected Financial Data

|

19

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

21

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

21

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

37

|

|

Item 9A.

|

Controls and Procedures

|

37

|

|

Item 9B.

|

Other Information

|

37

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

38

|

|

Item 11.

|

Executive Compensation

|

40

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

41

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

42

|

|

Item 14.

|

Principal Accountant Fees and Services

|

42

|

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

42

|

2

Item 1. BUSINESS

We are an exploration stage company engaged in the acquisition and exploration of mineral properties with the intent to take properties into production. We were incorporated as a Nevada state corporation on February 18, 2010. As of August 31, 2015 we owned a 40% share of Pah-Hsu-Qhuin Philippines Mining also known as the Raval Claim. We acquired this asset on August 31, 2011 for 140,000 Philippine pesos. We also acquired mining concession properties in Peru during the fiscal year ended August 31, 2014.

We are considered an exploratory stage company, as we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on the property covered by the Raval claim, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the property, and there is no assurance that we will discover one.

As of August 31, 2015, we had cash reserves of $2,349 and a working capital deficit of $1,687,512. We do not have sufficient funds to enable us to complete the initial phase of our exploration programs for the mining claims, and will require additional financing in order to do so. There is no assurance that we be able to obtain additional financing. Both advanced exploration and an economic determination will be contingent upon the results of our preliminary exploration programs and our ability to raise additional financing in order to proceed with advanced exploration and an economic evaluation. There is no assurance that we will be able to obtain any additional financing to fund our exploration activities.

Philippine Mining Claims

Nature of Ownership

Our Philippine Mining claims are covered by Mining Lease Contracts under renewal by Alice Raval Ventura for 25 years. Alice Raval Ventura has entered into a sale of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp. to us. We have entered into a management agreement with Paladino Management and Development Corp to manage operations on the ground in the Philippines. Paladino will be responsible for managing, developing and operating our claims in the Philippines. The Agreement began on August 31, 2011 and continues for 10 years until August 31, 2021. In consideration of services provided to us, we have agreed to pay Paladino a manager fee equivalent to 5% of our annual gross sales from the claims, less any taxes payable. These amounts will be payable monthly, based on revenues for each month. Our right to the mining claims were acquired through the ownership of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp., and the exclusive mining management and operating agreement entered into between Alice Raval Ventura and Paladino Management and Development Corp.

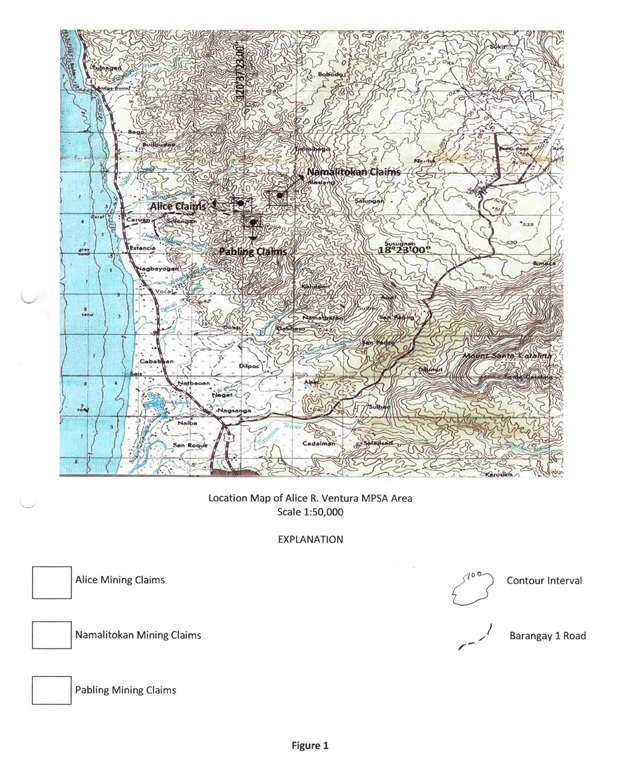

Description of the Properties

The properties consist of three mining claims covered by Lode Lease Contract Nos. V-319, V-425, and V-521, expiring in 2014, with a total area of twenty-four hectares. Names of the mines are “Pabling,” “Alice,” and “Namalitocan,” respectively.

Apart from the amounts paid for the shares of stock of Pah-Hsu-Qhuin Mining Phils. Corp., we are estimating to spend about $300,000 in the exploration and development of the mines. The $300,000 will be used to commission more detailed plans, secure the renewal of the mining claims for another twenty-five years, develop and extract the feldspar ore from the mines, and erect a crushing plant, which includes site development and improvements as well as connection of power supply to the grid.

We have allocated a total of $10,000 for the necessary plans, which include the following:

|

·

|

Mining Project Feasibility Study;

|

|

·

|

Location and Survey Plan;

|

|

·

|

Three-year Development and Work Program;

|

|

·

|

Environmental Protection and Enhancement Program; and

|

|

·

|

Social Development and Management Program.

|

Extraction of the feldspar ore will be through the open-cut mining method using backhoes and pay loaders. Due to the favorable geological terrain, only the clearing of the vegetation and over-burden is necessary to expose the raw material. Under existing conditions of the mines, it will take only one week to expose the feldspar ore. The mining operation will start where the feldspar deposits are already exposed. As the extraction advances, overburden is stripped and soil and other waste materials are set aside for future backfilling of mined-out areas. Extracted ore is then loaded onto dump truck for transfer to the crushing plant. A total of $100,000 will be required to develop the mine and extract an initial 12,000 metric tons.

The crushing plant is necessary to process the ore into customer-required granule sizes. The main equipment used includes mechanized crushers and vibrating screens. Completion time for the fabrication and erection of a 50 ton-per-hour plant is estimated at two months at a projected of $135,000. Working capital allotment is $50,000.

3

In the mine claim areas, initial source of power is through the use of generator sets. Ground water is available through deep wells. Electrical power through the local utility is available but may take up to three months to hook up. Generators will be used as a back power source.

Feldspar Market

Domestic Market

Major users of feldspar for glass are Asahi Glass Phils. (formerly Republic Glass), San Miguel Yamamura Packaging Corp., Asia Brewery, Arcya Packaging; and for ceramics, HCG and Royal Tern sanitary wares and Mariwasa tiles.

Both Royal Tern and San Miguel have expressed dismay with the local supply in terms of quality and reliability. Most suppliers are small-scale miners lacking proper processing equipment. The sole supplier of San Miguel is the only one with processing equipment acquired for then Republic Glass in the 1990’s. Their equipment has now become unreliable, and Asahi Glass remains the priority for delivery. Further, they are affected by an internal dispute among stakeholders. While Royal Tern is already importing part of its requirements, San Miguel has indicated they may also do so if the local supply situation does not improve.

Delivered feldspar price is currently PHP 2,950 per metric ton, based on a Purchase Order received by the Company on October 9, 2015.

Prices and volumes for domestic markets are based on an actual purchase order from Royal Tern and actual discussions with the purchasing group of San Miguel Corporation.

Acquisition of Our Raval Claim; Our Ownership Interest in the Raval Claim

The rights to the mining claims were acquired through the ownership of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp., and the exclusive mining management and operating agreement entered into between Alice Raval Ventura and Paladino Management and Development Corp.

We have entered into a share purchase agreement for a 40% share of Pah-Hsu-Qhuin Philippines Mining, as Philippines law does not allow 100% foreign ownership.

The Raval Claim mainly consists of the anticipated presence of Feldspar which is a light-colored rock-forming mineral used in the manufacture of glass products, ceramics and other products. Feldspar provides glass hardness, workability, strength, and makes it more resistant to chemicals. It also reduces the melting temperature so less energy is used. For ceramics, feldspar serves as a flux to form a glassy phase at low temperatures, and as a source of alkalis and alumina in glazes. It improves the strength, toughness, and durability of the ceramic body and cements the crystalline phase of other ingredients. Feldspar is also used in paint, in mild abrasives, urethane, latex foam, and as a welding rod coating.

On October 15, 2014, we entered into a Mining Concession Asset Acquisition Agreement with Paladino Mining and Development Corp. Pursuant to the Agreement, the Company has acquired 40% ownership of Paladino in exchange for: (1) the issuance of 5 million shares of common stock of the Company to Paladino (the “Shares”), (2) a cash payment of 540,000 Philippine Pesos, and (3) transfer of the Company’s 40% ownership of the Raval Mining Claim, also known as Pah-HSU-Qhuin Philippine Mining Claim, to Paladino. Paladino owns 648 hectares of land located at Brgys Caruan & Sulongan, Pasuquin, Ilocos Norte, Philippines. The land contains Feldspar, Silica, Limestone, etc.

The Shares will be held in escrow until certain conditions are met, including the issuance of Paladino shares to the Company as well as other conditions.

Property Description and Location of the Raval Claim

The Raval Mining Claims are located 350 meters above sea level, seven (7) kilometers from the Km. 511 post of the National Road in Barangay Sulongan, municipality of Pasuquin, in the province of Ilocos Norte. They are 518 kilometers north of Manila and 31 kilometers north of the Ilocos Norte capital city of Laoag. The nearest commercial port is at Currimao, some 57 kilometers to the south. Currimao Port is 420 nautical miles from the Taiwanese port of Keelung.

The area is located within the jurisdiction of Barangay Solongan, Pasuquin, Ilocos Norte and can be reached by four-wheel-drive vehicles through the mine roads which negotiate and wind up to the feldspar deposits. The area is located within the following geographic coordinates:

|

North Latitude

|

East Latitude

|

|||||||

|

Pabling Mineral Claim

|

18 | o 23’20” - 18o 18’28” | 120 | o 37’00” - 120o 37’08” | ||||

|

Alice Mineral Claim

|

18 | o 23’12” - 18o 23’32.5” | 120 | o 36’53” - 120o 37’03.5” | ||||

|

Namalitocan Mineral Claim

|

18 | o 23’36” - 18o 23’46” | 120 | o 37’14” - 120o 37’21” | ||||

4

Access, Climate, and Physiography, Local Resources and Infrastructure of Our Raval claim

The roads leading to the mine site had already been established since the time D’5 White Marketing and were upgraded by Pah-Hsu-Qhuin Philippines in 1997. The mine sites are accessible by four-wheel drive vehicles and dump trucks. Through the years, a significant number of feldspar pits have been established to specific customer requirements.

Prior Exploration

In 1954, Dr. Pablo J. Raval started exploring for feldspar in the mountains of Pasuquin, Ilocos Norte. By the early 1960’s, the Bureau of Mines granted spouses Pablo J. Raval and Lolita Lorenzana three (3) mining claims 25-year Mining Lode Lease Contracts over a total area of 24 hectares. Dr. Raval succeeded in developing the mines supplying a number of glass and ceramics clients, including: Philippine Standard, Pacific Ceramics, Republic Glass, Mariwasa Manufacturing, Pioneer Ceramics, Fil-Hispano, San Miguel Brewery, and Pacific Enamel & Glass.

The computations/estimates were made based on the measurement of outcrops within the claims. It is worth mentioning that the three claims were previously mined for feldspar in the last twenty years. And that the deposits were likewise estimated as regards its positive reserves through drilling and other conventional methods used in reserve estimation.

Upon the death of Dr. Raval in 1973, the eldest of the Raval siblings, Ms. Alice Raval took over the operations of the mining business under D’5 White Mountain Marketing, a single proprietorship owned by her. Meanwhile, in 1975, Philippine Standard entered into a fifteen-year operating agreement with the Raval family for the use of one of the mining claims with minimum guaranteed earnings for the Ravals. In 1985, prior to expiration of the lease contracts, Mrs. Alice Raval-Ventura renewed the Mining Lease.

Agreements for another 25 years on behalf of the heirs of Pablo J. Raval and Lolita Lorenzana. From 1983 to 1995, Mrs. Alice Raval-Ventura through her company, Pah-Hsu-Qhuin Philippines Mining Corporation exported some 350,000 MT of raw feldspar to Taiwan.

The mining leases were renewed in 1985 before their respective expirations. Expiration of the renewed leases is up to 2014. The mining leases were renewed in 1985 before their respective expirations. Expiration of the renewed leases is up to 2014.The three mining leases expire in the years 2010, 2012, and 2014. We have submitted the renewal for all three claims in one document, which is covered by a Mineral Production Sharing Agreement. This is currently under review by the Mines and Geosciences Bureau (“MGB”), and we expect to receive the approval for our renewals shortly.

Prior to the Mining Act of 1995, mining claims were covered by Mining/Lode Lease Agreements entered into with the Department of Natural Resources. Presently, mining rights are granted through the Mineral Production Sharing Agreement (MPSA), which is currently the subject of the renewal of the claims by Alice Raval Ventura.

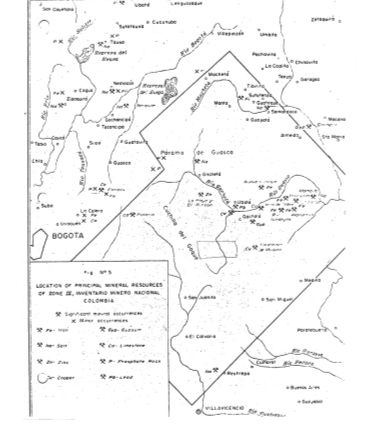

Maps of Our Raval Claim

Below are three maps of our claim.

5

6

7

Present Condition and Current State of Exploration

Through the years, roads and feldspar pits have been established. Restoring the mines will entail stripping and clearing of mine sites and their periphery to expose the raw material (removal of over-burden using backhoe and bulldozer). Test pitting and trenching shall be continuously undertaken to identify additional reserves and thereby extend the mine life.

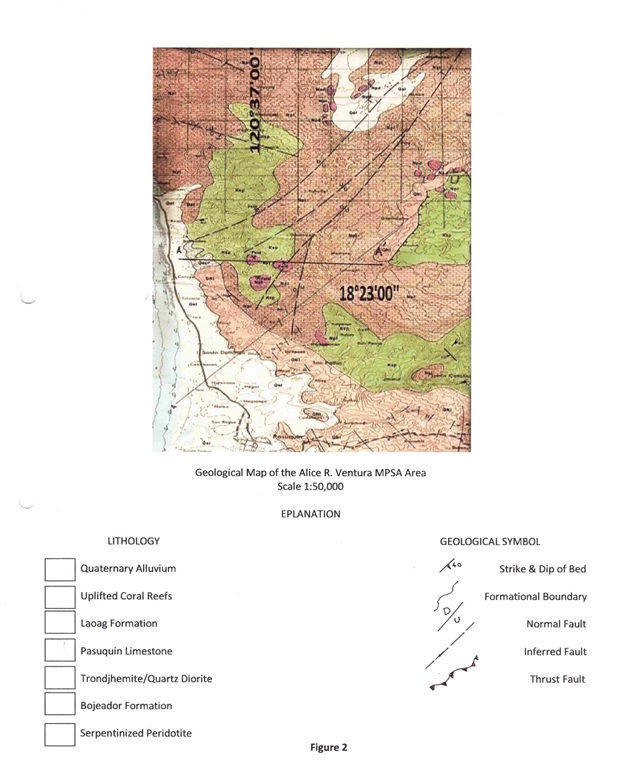

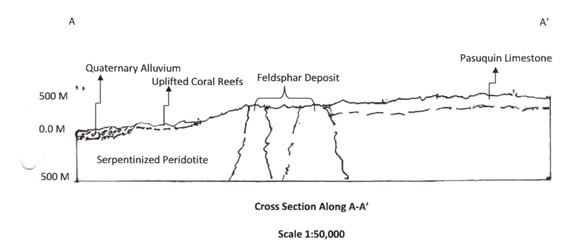

Geology of Our Raval claim

The mineral claims areas are mostly underlain by clastic sediments, followed by ultramafic rocks and the remaining small portion by collaine limestone.

The mineral deposits found in the areas are feldspar, silica quartz, and limestone. The deposits occur generally as discontinuous, irregularly shaped to lenticular, dike-like masses in intruding the serpentinized peridotite. Their contact with the host rock is sharp in almost all outcrops that could be observed. Large and small fault structures located within the vicinity of the claims are believed to be one of the main contributing factors in the localization of the feldspar deposits.

Regional Geochemical

Regionally the area is anomalous in feldspar values, but no systematic surveying of the area by government can be identified as useful to the definition of concentrations of placer deposits.

Our Planned Exploration Program

PHASE 1: Startup operations servicing live Purchase Orders from Royal Tern

ROYAL TERN Sanitary Wares – Royal Tern Sanitary Wares has been a long time customer of Pah-Hsu-Qhuin Philippines Mining. We will fulfill this purchase order once we commence operations.

Aside from Pah-Hsu-Qhuin, Royal Tern does not consider other domestic suppliers as reliable. Should domestic supply continue to be unreliable, Royal Tern intends to import all of their feldspar requirements. Royal Tern has also expressed serious interest in entering into an export agreement with Pah-Hsu-Qhuin Mining for supply of raw feldspar to Taiwan and China.

Except for the purchase order from Royal Tern, dealings with other customers are at an accreditation and negotiation stage with corresponding non-disclosure agreements. We have several interested customers and therefore do not believe that we will be dependent upon any one customer for success. We will not sign any supply agreements until our operations are underway.

In order to serve the requirements of Royal Tern would entail the following:

|

·

|

Rental of heavy equipment (i.e., backhoe, payloader, dump truck);

|

|

·

|

Stripping and clearing of mine sites and their periphery to expose the raw material;

|

|

·

|

Rehabilitation of Pah-Hsu-Qhuin’s warehouse and processing area;

|

|

·

|

Purchase of 4 units basic vibrating screens at PHP 120,000 per unit (USD $2,700);

|

|

·

|

Use of commercial truckers to deliver to customers.

|

8

Estimated costs for this phase are PHP 2,400,000 (USD $57,000) which will be used for the purchase of four (4) vibrating screens, pre-operating expenses, and initial working capital.

PHASE 2: Supply to San Miguel, export, and other domestic users

SAN MIGUEL YAMAMURA Glass – Due to current supply problems, SMYPC is actively sourcing additional suppliers to augment or replace their current sole supplier. Total potential volume is 1,800 MT per month. Last January 2011, Pah-Hsu-Qhuin Mining submitted a Letter-of-Intent to supply SMYPC with feldspar.

In Phase 2, the following shall be undertaken:

|

·

|

Renewal of mining lease agreements for an additional 25 years (@Php1.0M or $22,000);

|

|

·

|

Acquisition of a ball mill crusher for finer granulation (@Php2.0M or $44,000);

|

|

·

|

Rental of heavy equipment and use of commercial truckers shall continue until volumes justify purchase of equipment.

|

An additional PHP 9,000,000 (USD $210,000) will be needed for the acquisition of a ball mill crusher (for finer granulation), additional working capital, and renewal of mining lease agreements.

The lease contract is the subject of renewal for another 25 years. Alice Raval Ventura has filed for the renewal by way of an application for a Mineral Production Sharing Agreement (MPSA). Approval of the MPSA is expected by the end of the year. The leases are in the process of being renewed. They are currently under review by the MBG. We foresee no issues with renewal. All three Leases will be renewed as one lease.

Compliance with Government Regulation

To maintain a safe and healthy work environment, strict compliance with all rules and regulations embodied under the Mines Administrative Order known as “Mine Safety Rules and Regulations” shall be followed. A qualified Safety Engineer shall be designated and safety and health programs shall be undertaken for the entire duration of the project.

There is pending legislation that will rationalize the revenue sharing schemes and mechanisms and is expected to include an increase in government share from the current 2% excise tax to about 5% to 7% of gross revenues. Our mining claims are covered by the provisions of the Mining Act of 1995.

In addition, local governments are both beneficiaries and active participants in mineral resources management in accordance with the Philippine’s Constitution and local autonomy and empowerment. They get a share of 40% from the gross collection of the national government from mining taxes, royalties and other fees. In the case of occupation fees, the province gets 30% and host Municipalities get 70%.

Also, in accordance with the People’s Small Scale Mining Law, local governments are responsible for the issuance of permits for small scale mining and quarrying operations through the Provincial/City Mining Regulatory Board. In the issuance of Environmental Compliance Certificate, local governments actively participate in the process by which the communities reach an informed decision on the social acceptability of a project. They also participate in the monitoring of mining activities as member of the Multi-partite Monitoring Team and the Mine Rehabilitation Fund Committee. They can also act as mediator between the indigenous cultural communities and the mining contractor if the need arises.

Local governments are also recipients of social infrastructures and community development projects for the utilization and benefit of the host and neighboring communities. In the implementation of the Mining Act and its implementing rules and regulations, local governments coordinate and extend assistance the Department of Environment and Natural Resources and the Mines and Geosciences Bureau.

Description of the Philippine Properties (Raval Mining Claim)

As at August 31, 2015 the properties consisted of three mining claims covered by Lode Lease Contract Nos. V-319, V-425, and V-521, expiring in 2014, with a total area of twenty-four hectares. Names of the mines are “Pabling,” “Alice,” and “Namalitocan,” respectively.

As mentioned above, on October 15, 2014, we entered into a Mining Concession Asset Acquisition Agreement with Paladino Mining and Development Corp. Pursuant to the Agreement, the Company has acquired 40% ownership of Paladino.

It is the intention of the company to expand operations considerably we are estimating to spend about $300,000 to $500,000 in the exploration and development of the mines. These funds will be used to construct a building and acquire the equipment and install a crusher, this is necessary to not only increase production but also to refine the feldspar mineral so the product can be used for “clear glass” production, as well as connection of power supply to the grid.

Extraction of the feldspar ore will be through the open-cut mining method using backhoes and pay loaders. Due to the favorable geological terrain, only the clearing of the vegetation and over-burden is necessary to expose the raw material. Under existing conditions of the mines, it will take only one week to expose the feldspar ore. The mining operation will start where the feldspar deposits are already exposed. As the extraction advances, overburden is stripped and soil and other waste materials are set aside for future backfilling of mined-out areas. Extracted ore is then loaded onto dump truck for transfer to the crushing plant. A total of $100,000 will be required to develop the mine and extract an initial 12,000 metric tons.

9

The crushing plant is necessary to process the ore into customer-required granule sizes. The main equipment used is mechanized crushers and vibrating screens.

In the mine claim areas, Initial source of power is through the use of generator sets. Ground water is available through deep wells. Electrical power thru the local utility is available but may take up to 3 months to hook up. Generators will be used as back power source.

Feldspar Market

Major users of feldspar are: for glass, Asahi Glass Phils. (formerly Republic Glass), San Miguel Yamamura Packaging Corp., Asia Brewery, Arcya Packaging; for ceramics, HCG and Royal Tern sanitary wares and Mariwasa tiles.

Both Royal Tern and San Miguel have expressed dismay with the local supply in terms of quality and reliability. Most suppliers are small-scale miners lacking proper processing equipment. The sole supplier of San Miguel is the only one with processing equipment acquired for then Republic Glass in the 1990 ’ s. Their equipment has now become unreliable, and Asahi Glass remains the priority for delivery. Further, they are affected by an internal dispute among stakeholders. While Royal Tern is already importing part of its requirements, San Miguel has indicated they may also do so if the local supply situation does not improve.

From 11,850 MT per year in 2005, domestic production of feldspar has increased to 22,050 MT as of 2011. Delivered price of feldspar is about PHP 2,100 to 2,700 per metric ton (USD 48 to 62).

Competition: Except for the purchase order from Royal Tern, dealings with other customers are at an accreditation and negotiation stage with corresponding non-disclosure agreements. We have several interested customers and therefore do not believe that we will be dependent upon any one customer for success. We will not sign any supply agreements until our operations are underway.

SAN MIGUEL YAMAMURA Glass – Due to current supply problems, SMYPC is actively sourcing additional suppliers to augment or replace their current sole supplier. Total potential volume is 1,800MT per month. Last January 2011, Pah-Hsu-Qhuin Mining submitted a Letter-of-Intent to supply SMYPC with feldspar.

Peruvian Property

On June 23, 2014, Aim Exploration, Inc. entered into a Mining Concession Asset Acquisition Agreement (the “Agreement”) with Percana Mining Corp. (“Percana”). Pursuant to the Agreement, the Company has acquired three separate mining concessions. Two of the concession titles are unencumbered and these make up 40% of the mining concessions. These two concessions are known as El Tunel Del Tiempo 1 code 11060780 and El Tunel Del Tiempo 2 code 11060781, and the registered ownership of these two concessions have been transferred to the Company. The third concession property is Agujeros Negros MA-AG and makes up the remaining 60%, but has not yet been transferred to the Company. However, the Company has entered into a Contract of Mining Assignment and Option to Purchase the concession for a five-year term. This contract provides AIM with full rights and authorities over the concession.

In consideration for the above concessions, the Company has issued 15,750, 000 common shares to Percana in two separate blocks; the first block consists of 6,300,000 common shares which are to be held in escrow until either the Company raises $1,000,000 or when Percana waives this requirement. The second block consists of 9,450,000 shares which are to be held in escrow until such time as the Company is satisfied at its discretion that any arbitration issues have been resolved with the third concession, at which time the shares may be released out of escrow at the option of Percana. These Mining Concessions were acquired based on the assumption the properties are rich in high grade Anthracite Coal, currently there are 20 small tunnels on the property already producing anthracite coal which was being mined by illegal miners. Testing of the coal samples was performed indicating the presence of high-grade anthracite coal. Prior to acquisition AIM reviewed a non-compliant technical report prepared by Engineers/Geologists together with hiring a US based firm Gustavson Associates to visit the property and review the reports. The firm provided AIM with a report, which included recommendation for further exploration.

The Peruvian Property consists of three separate mining concessions, all are within one contiguous block of property, and all three concessions are located in the Province of Otuzco, La Libertad region. The formal transfer for two of the mining concessions known as El Tunel del Tiempo 1 (Unique code # 01-0209106 – 200 hectares) and El Tunel del Tiempo 2 (Unique code # 01-0209206 – 200 hectares) was executed August1, 2014 and made into public deed on August 5, 2014 within the Peruvian Public Registries.

The third mining concession, known as Agujeros Negros MA-AG (unique code # 01-0184000, 600 hectares) is under contract with AIM, as a Contract of Mining Assignment and Option to Purchase was executed on August 1, 2014 and was made into a Public Deed on August 5, 2014. By the Assignment and Option AIM has an irrevocable and exclusive option to purchase 100% of the rights and interests of this mining concession. This option was registered into public deed on August 5, 2014. The option to purchase is for 5 years from the date of registration which was completed Oct 2, 2014, in addition contained within the contract AIM has complete control over this mining concession for a period of 5 years following formal registration which was registered October 2, 2014.

The reason this concession was not formally transferred is the fact that AIM wanted to perform additional due diligence as there was an Arbitration process with the registered owners and the former concession owners of 80% of the concession. Subsequent to this time the former owners who commenced the arbitration process has abandoned the arbitration thus nullifying the process. AIM has now commenced the formal transfer process and is expected to be completed and registered prior to AIM fiscal year ending August 31, 2015.

10

Royalties

The combined concessions are known as “The Black Hole”, the first two concessions, El Tunel del Tiempo 1 & 2 do not have royalties payable. The third concession, Agujeros Negros WA-AG has a royalty consisting of payment of US $1.00 per each metric ton of anthracite coal extracted from and sold. The royalty applies from the time when the sales of anthracite coal reach US $150,000.

Process Whereby Mineral Rights Are Acquired in Peru (Peruvian System of Concessions)

In Peru, any individual or company can solicit (through a “Petition” to the Government, the grant of a mining concession. Through an administrative process at INGEMMET (the geological Mining and Metallurgical Institute), when all technical and legal requirements are complied with, the Government will grant the mining concession. The mining concession grants the titleholder the right to explore, exploits, process, transport, market and refine mineral whether it is metallic, non-metallic or coal mineral. Once the concession is granted it must be registered at the Public Registries and the concession titleholder can freely transfer, assign, encumber or exercise over it any kind of disposition act.

Rights and Obligations: Concession titleholder’s rights

|

·

|

The properties are all located on vacant land, and vacant land properties are entitled to the free mining use of the surface land that corresponds to the concession and outside of it, for its economic advantage without the need for any additional request, however that being said the titleholder does not have the right for the use of surface land without formal consent, the properties are owned by the government and for a total fee of approx. US$15,000.00 the surface rights are readily available to AIM.

|

|

·

|

The right to request from the mining authorities easements of third party lands that are necessary for the reasonable use the concession.

|

|

·

|

The right to free trade of extracted minerals provided they have the respective permits and authorizations.

|

|

·

|

To build on neighboring concessions the labor work that is necessary for the access, ventilation and drainage of their own concession, mineral transport and safety of the workers.

|

|

·

|

The right to use the water that is necessary for the domestic service of the staff workers and for the operations of the concession, in accordance with the legal provisions for these matters.

|

|

·

|

The right to inspect the work of neighboring or adjacent mining concessions when invasion is suspected or when there is danger of flooding, collapse or dire due to the bad state of the labor work of the neighbors or adjacent for the work they are carrying out.

|

Duties of the Concession titleholders:

|

·

|

Validity fee payment of US $3.00 per hectare, due June 30 every year. If not paid for two years, concession returns to the Government. Fee to be paid by AIM.

|

|

·

|

Payment of penalty fees if not in production is US $6.00 per year up to year seven increasing to US $20.00 per year from year 12. After failure to pay for two years the concession reverts to the Government. Fee to be paid by AIM.

|

|

·

|

Follow the occupational health and safety provided for in Regulations of Occupational Health and Safety.

|

|

·

|

Follow the Environment Management Instruments.

|

We confirm the Environmental Management permits are currently being applied for and we expect to have these in place within the ensuing six months.

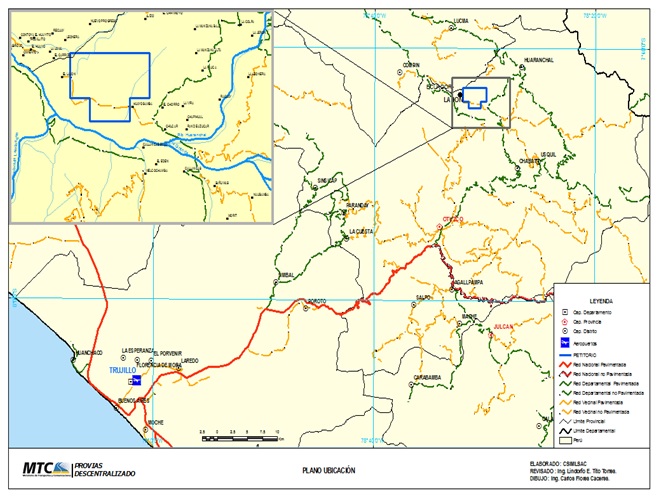

Peruvian Property Location

The property is accessible by standard vehicles; all roadways are drivable with the roadways being paved and or gravel roadways. The driving time is approx. 3 hours from the city of Trujillo Peru. In addition there is roadway running through the property making it feasible for exploration and drilling. The entire property consists of 1,000 hectares. The official location of the property is:

Republic: Peru

Department: La Libertad

Province: Otuzco

District: Huaranchal

Spot: Between Huayobamba and Lajon

Figure 1 is a map that shows the location of the project and the surrounding area. The coordinates near the centroid of the property are 7° 44’ 13.06” S and 78° 31’ 05.87” W. The property is 1,000 hectares and are all with one contiguous block of property.

11

↑ North

Note: This location map is copied from a previous geological report done for the property by MTC and the map was completed in May of 2012.

Figure 1 Property Location

Geology

The geology in the area of the property and surrounding areas in general have a regional stratigraphy, composed in large percentage of sequences of Mesozoic sedimentary rocks ranging from Jurassic in the western sector, then the Lower Cretaceous superior and in the northwest-northeast with Tertiary volcanic sequences, which cover much of the region, and the upper most are alluvial deposits from the recent Quaternary. There are also some Tertiary intrusive bodies that outcrop in the southwest area of the region.

The local geology for the property consists of sedimentary units, corresponding to the Chimú Chicama formations, Santa, Carhuaz and Farrat, and the Alto Chicama River basin is characterized by outcrops of Mesozoic rocks that have the have major folding and fracturing. This folding is apparent in the Jurassic sedimentary rocks (Chicama formation) at lower levels near the Alto Chicama River. Chicama Formation is characterized by the presence of dark gray shale with interbedded sandstones, and slate gray tuffaceous quartz at some levels. The Chimú Formation is present in most of the study area, and is the most noticeable towards the southwest and Chicama formation is exposed near the river. These formations are important because this is the horizon in the area of greatest interest because of the presence of coal seams and in some cases have the presence of sub-anthracite and anthracite, occurring with some areas as "lenses" in the bituminous coal. The following is the sedimentary sequence; sandstones, siltstones, shale, and black shale (Cobbing et al., 1996: 73-74). The two formations are exposed mostly in streams and Quina Shangala (erosional cut within the property), covering most of the local area. The Santa and Carhuaz formations, are not fully differentiated in the study area, having found areas with shale, siltstone, limestone, sandstone, quartzite and in some sectors they have small "lenses" of bituminous coal, but are of smaller magnitude. In summary these formations, especially the formation Chimú, are of great interest, as possible sources for economic development for the "Black Holes Property".

There are granodioritic intrusive rocks that outcrop in the form of stocks, with the presence of a large intrusive towards the left of the village of Lajon (northwest corner of the property). This area is heavily disturbed and altered, and has the presence of metallic minerals, which is an association of the coal deposits of the basin Chicama (usually Au.).

These various Shangala features (used in sampling activities) are essentially a creek that dissects perpendicular to the outcrops surrounding the river Alto Chicama, both sectors have significant levels of bituminous coal, quite broken, which could be of value in the economic exploration to exploitation of the property.

12

The oldest rocks in the prospect of coal formations are the Upper Jurassic Chicama and overlie rocks of the Chimú formation, this being the one with the anthracite coal and sub-anthracites plus it includes other sedimentary horizons with bituminous coal. These formations and especially above the village of Chimú is of great interest as a source of possible development of the mining project because they are the carriers of coal in the area and this is this geological unit which covers 80% of the area.

The studies done by MTC and later by Gustavson are not done to NI43-101 or coal industry standards to report resources and reserves. The property is currently without known reserves and current and planned exploration programs are exploratory in nature.

Current and planned exploration:

The previous work completed on or near the property has focused on geologic mapping and sampling via trenches at the outcrop areas and in old, existing tunnels. There are active small mining operations on the northwest area of the property that has also added information on the quality of the coal from the property.

The property’s evaluation and database will be greatly improved by a program of additional geologic mapping, trenching and most of all by completing 3-4 drill holes that provide core for sampling and testing, but also will be an important guide to the structure of the coal deposits. More drill holes are required to define resources; the first suggested drilling program may define the need for additional drill holes due to the structural complexity of the coal beds.

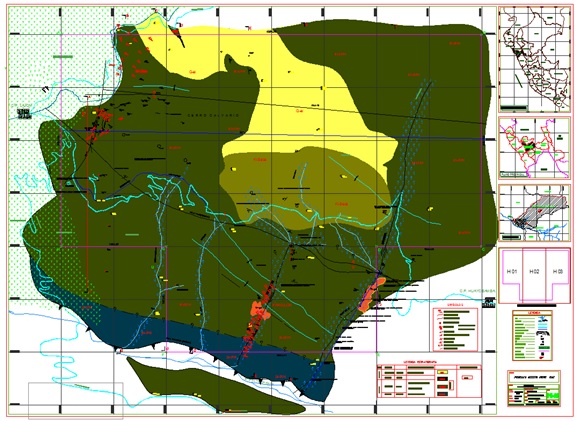

Figure 2 shows many relevant features of the property. The map is very busy so some explanation is required.

Note: this figure is also from the MTC Report of 2012 and shows many features of the property that are describe and explained in the text of this report.

Figure 2 Property Map showing Site Specific Features

The outline of the property is shown by a lavender line that defines a rectangle shape that is extended to the south. There is no north arrow, but there are grid lines that show north-south and east-west. The Alto Chicama River is in the south (bottom) of the figure and the features, some with red markings that cross the property in a northeast to southwest direction, are the features referred to as Shangalas. The small black marks towards the northwest are the small mines mentioned above.

The main feature from Figure 2 that will aid the exploration and drilling effort is the existing road that crosses the center of the property and is shown as a light blue, meandering line. The importance of this existing road is that it will give easy access to the center of the property where the proposed drill holes can be located. The coal deposits proposed to define first are south of the road and by setting up at various locations along the road and drilling at an angle towards the south will provide the best possibility to intersect and sample the coal seams. Four drill holes along the road can be spaced to provide data points to define some resources as Indicated. The exact drill sites will be defined in a combination of future site visits and geologic mapping, which is the first phase of exploration.

13

The cost and timing for the Phase I of drill hole siting and mapping is estimated at about $35,000 and will be started as soon as AIM has the necessary funds, the process is expected to take approximately 10 days. The planning for Phase 2, drilling, sampling, analysis and possible more trenching is estimated at $350,000 to include a drilling contractor, geologic support, sample analysis and reporting and could complete the 4 drilling program in 6 weeks. This data provided by Phase 1 and Phase 2 could then be utilized to develop a NI43-101 Resource Report and possible a Preliminary Economic Assessment (PEA).

The cost and timing for the required permitting for the property is as follows:

| COSTS BREAKDOWN | |||||

|

DESCRIPTION

|

COSTS $

|

TIME

|

|||

|

1. ENVIRONMENTAL IMPACT STUDY

|

50,000 |

6 months

|

|||

|

Conceptual hydrological and hydrogeological study

|

25,000 | ||||

|

2. START OF MINING OPERATIONS

|

4 months

|

||||

|

Authorization of the surface land (titleholder)

Mine plan

Detailed Ventilation Study

Detailed Geomechanics Study

Seismic risk studies

Design of explosives storage

Occupational Health and Safety Plan

Design of tailings storage

|

14,999

15,000

10,000

10,000

7,000

2,000

2,000

15,000

|

||||

|

3. CLOSURE PLAN

|

35,000 |

4 months

|

|||

|

4. PREPARATION OF FILE OF WATER USE ISSUED BY ANA

|

7,000 |

1 month

|

|||

|

5. PREPARATION OF FILE FOR DISPOSAL OF WATER (DIGESA AND ANA)

|

5,000 |

1 month

|

|||

|

6. LEGAL COSTS ASSOCIATED TO OBTAIN ALL THE AFOREMENTIONED PERMITS

|

50,000 |

Throughout the

process

|

|||

| TOTAL COSTS $ | $ | 247,999 | |||

Summary

Gustavson Associates based out of Boulder Colorado provided the technical information on the Peruvian property. Gustavson Associates is a mining consulting firm with over 30 years of extensive international experience. Mr. Karl D. Gurr of Gustavson Associates completed a site visit of the property together with visiting the Port of Salaverry located in Trujillo Peru and has reviewed numerous reports. Mr. Karl Gurr is a Registered Member of the Society of Mining Engineers and has degrees in Geology and Mining Engineering with over 25 years of direct experience in the coal industry, which defines Mr. Gurr’s status as a qualified person. As stated Mr. Gurr performed a property visit and a visit to the Port of Salaverry and confirms that the property is a known coal bearing area with sufficient past geologic study to merit additional work (exploration) to better define coal resource and eventually a plan for mining the resource. Any further exploration will be overseen and supervised by or through Mr. Gurr and will be focused on providing additional information to advance the project and to do it in a cost effective manner. Mr. Gurr has confirmed the infrastructure and property access already exists and the Port of Salaverry has the capability to store and ship the produced coal.

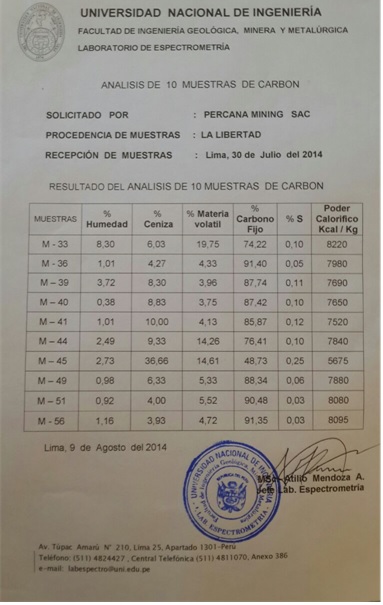

In addition to Mr. Gurr’s visit we solicited the efforts of mining engineer and geologist Manuel Chumpitaz Cama. Mr. Cama has known the property for many years and he attended to extractive of coal samples from various mine tunnels within the property. Through the supervision of Mr. Cama samples of coal were taken from the property and delivered to the local university lab for testing. Following is the official results of the testing.

The legal and permitting information was provided to AIM by their team of Peruvian legal advisors based in Lima Peru.

The table below shows the result of an analysis of coal samples obtained from Aim’s property in July 2014, the analysis was completed through the University in Peru.

14

WE WILL REQUIRE SIGNIFICANT ADDITIONAL FINANCING IN ORDER TO CONTINUE OUR EXPLORATION ACTIVITIES AND OUR ASSESSMENT OF THE COMMERCIAL VIABILITY OF OUR PROPERTIES. EVEN IF WE DISCOVER COMMERCIAL RESERVES OF PRECIOUS METALS ON OUR MINERAL PROPERTY, WE CAN PROVIDE NO ASSURANCE THAT WE WILL BE ABLE TO SUCCESSFULLY ADVANCE INTO COMMERCIAL PRODUCTION.

While we are very optimistic the properties contain minerals we are not sure. Our business plan calls for significant expenditures in connection with the exploration of the property. We will, however, require additional financing in order to complete the remaining phases of the exploration program, and to conduct the economic evaluation that would be necessary for us to assess whether sufficient mineral reserves exist to justify commercial exploitation. We currently are in the exploration stage and have no revenue from operations. We currently do not have any arrangements in place for additional financing, and we may not be able to obtain financing on terms that are acceptable to us, or at all. If we are unable to obtain additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of the property. Further, if we are able to establish that development of the property is commercially viable, our inability to raise additional financing at this stage would result in our inability to place the property into production and recover our investment.

15

Competition

We are a junior mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

As at August 31, 2015, we had cash reserves of $2,349 and working capital deficit of $1,209,747. We do not have sufficient funds to enable us to complete this initial phase of our exploration programs for the mining claims. We will require additional financing in order to commence the initial phases of exploration of the properties. There is no assurance that will be able to obtain additional financing. Both advanced exploration and an economic determination will be contingent upon the results of our preliminary exploration programs and our ability to raise additional financing in order to proceed with advanced exploration and an economic evaluation. There is no assurance that we will be able to obtain any additional financing to fund our exploration activities.

Patents, Trademarks, Franchises, Royalty Agreements or Labor Contracts

We have no current plans for any registrations such as patents, trademarks, copyrights, franchises, concessions, royalty agreements or labor contracts. We will assess the need for any copyright, trademark or patent applications on an ongoing basis.

Research and Development

We have not spent any amounts on research and development activities during the year ended August 31, 2015. We anticipate that we will not incur any expenses on research and development over the next 12 months. Our planned expenditures on our operations or a business combination are summarized under the section of this annual report entitled “Management’s Discussion and Analysis of Financial Position and Results of Operations”.

16

Employees and Employment Agreements

At present, we have no employees other than our executive officers and directors. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no personal benefits available to any officers, directors or employees.

Item 1A. RISK FACTORS

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1B. UNRESOLVED STAFF COMMENTS

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. PROPERTIES

Descriptions of the leases concerning our mining facilities can be found in Item 1 of this report on Form 10-K. We do not currently own any property or real estate of any kind. Our executive offices are located at 701 North Green Valley Parkway, Suite 200, Henderson Nevada, 89012.

Item 3. LEGAL PROCEEDINGS

We know of no material existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 4. MINE SAFETY DISCLOSURES

Not applicable.

Item 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

Market Information

There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained. A shareholder in all likelihood, therefore, will not be able to resell his or her securities should he or she desire to do so when eligible for public resales.

Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops. We would like to register our shares for resale by our selling stockholders and then obtain a trading symbol to trade our shares over the OTC Bulletin Board. However, there is no assurance that we will be successful in getting our common stock quoted on the OTC Bulletin Board.

Number of Holders

As of December 15, 2015, we had approximately 51 shareholders of record of our common stock.

As of December 15, 2015, we had 1 shareholder of record of our preferred stock.

Dividend Policy

We have not declared any cash dividends on our common stock since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On October 28, 2015, Aim Exploration Inc. (the “Company”) entered into a Note Purchase Agreement with Tangiers Investment Group, LLC (“Tangiers” or “Holder” in the event of assignment or succession) for the sale of a 10% convertible promissory note (the “Note”), in the principal amount of $330,000 (the “Principal Sum”), convertible into shares of common stock of the Company. Upon execution of the Note, Tangiers delivered $75,000 to the Company. The Note has an original issue discount of $7,500, which Tangiers retained for due diligence and legal bills related to the transaction. The financing closed on October 28, 2015 (the “Closing Date”). The Effective Date is that day when the Note is executed by both parties and the delivery of the first payment of consideration is made (the “Effective Date”).

17

The Note bears interest at the rate of 10% per annum. All interest and principal must be repaid one (1) year after the Effective Date (the “Maturity Date”). The Note is convertible into common stock, at Tangiers’ option, at the lower of (i) $0.10 per share or (ii) 50% of the lowest trading price of the Company’s common stock during the 25 consecutive trading days prior to the date on which Tangiers elects to convert all or part of the Note (the “Conversion Price”).

The Note may be prepaid by the Company, in whole or in party, according to the following: if under 30 days from the Effective Date, Prepayment amount shall be 100% of Principal sum plus accrued interest; between 31 and 60 days, 110% of Principal Sum plus accrued interest; between 61 and 90 days, 120% of Principal Sum plus accrued interest; between 91 and 120 days, 130% of Principal Sum plus accrued interest; between 121 and 150 days, 140% of the Principal Sum plus accrued interest; and between 151 and 180 days, 150% of Principal Sum plus accrued interest. After 180 days from the Effective Date, the Note may not be prepaid without written consent from the Holder.

In the event of a default, the Note may be accelerated by Tangiers, whereby the outstanding balance is immediately due and payable in cash at 150% of the outstanding Principal Sum of the Note. In addition, an interest rate of the lesser of 18% per annum or the maximum rate permitted under law will be applied to the outstanding balance. Tangiers is prohibited from owning more than 9.99% of the Company’s outstanding shares pursuant to the Note.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Act”) for the private placement of these securities pursuant to Section 4(2) of the Act and/or Regulation D promulgated there under since, among other things, the transaction did not involve a public offering, Tangiers is an accredited investor, Tangiers had access to information about the Company and their investment, Tangiers took the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of the securities.

Related to entering into the Note, the parties documented their intention that the Company’s obligations to repay under the terms of the Note be secured by certain assets, represented by the Security Agreement and Memorandum of Security Agreement, entered into by the parties on October 28, 2015.

On November 6, 2014, the Company issued to Adar Bays, LLC a convertible promissory note in the principal amount of $45,000. The note accrues interest at a rate of 8% per annum, with a maturity date of November 6, 2015. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 55% of the lowest trading price of the common stock during the fifteen trading days prior to issuing a notice of conversion to the Company. This note is secured by a security agreement entered into by the parties on November 6, 2014.

On June 8, 2015, the Company issued to LG Capital Funding, LLC a convertible promissory note in the principal amount of $57,875. The note accrues interest at a rate of 8% per annum, with a maturity date of June 5, 2016. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 55% of the lowest trading price of the common stock during the fifteen trading days prior to issuing a notice of conversion to the Company.

On July 20, 2015, the Company issued to JMJ Financial a convertible promissory note in the principal amount of $250,000. If the Company repays the outstanding principal in full within 90 days of the effective date, the interest rate shall be 0%. If the Company does not repay the outstanding principal in full within 90 days, a one-time interest charge of 12% shall be applied to the principal amount. Interest will not accrue if all outstanding principal is paid in full within 90 days of the effective date. The note matures two years from the effective date. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to the lesser of (i) $0.50 or (ii) 60 % of the lowest trading price of the common stock during the twenty-five trading days prior to issuing a notice of conversion to the Company.

On July 22, 2015, the Company issued to Darling Capital, LLC a convertible promissory note in the principal amount of $50,000, in connection with a securities purchase agreement entered into by the parties on May 19, 2015. The note accrues interest at a rate of 10% per annum, with a maturity date of April 20, 2016. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 55% of the lowest trading price of the common stock during the fifteen trading days prior to issuing a notice of conversion to the Company.

On August 14, 2015, the Company issued to Auctus Fund, LLC a convertible promissory note in the principal amount of $76,750, in connection with a securities purchase agreement entered into by the parties on August 14, 2015. The note accrues interest at a rate of 10% per annum, with a maturity date of May 14, 2016. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 55% of the lowest trading price of the common stock during the fifteen trading days prior to issuing a notice of conversion to the Company.

On August 31, 2015, the Company issued to St. George Investments LLC a convertible promissory note in the principal amount of $40,000, in connection with a securities purchase agreement entered into by the parties on August 31, 2015. The purchase price for this note and warrant (as described in the securities purchase agreement) shall be $25,000, computed as follows: original principal balance of $40,000, less a $10,000 original issue discount and $5,000 to cover lender’s legal fees, accounting costs, due diligence, and other transaction costs incurred in connection with the note. Interest does not accrue on the outstanding principal. The note matures six months after the purchase price is delivered to the Company by the lender. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 60% of the lowest trading price of the common stock during the twenty trading days prior to issuing a notice of conversion to the Company.

18

On September 17, 2015, the Company issued to EMA Financial, LLC a convertible promissory note in the principal amount of $40,000, in connection with a securities purchase agreement entered into by the parties on September 17, 2015. The note accrues interest at a rate of 12% per annum, with a maturity date of September 17, 2016. The holder of the note may convert any or all of the principal outstanding into shares of the Company’s common stock at a price equal to 55% of the lowest trading price of the common stock during the 20 trading days prior to issuing a notice of conversion to the Company.

Equity Compensation Plan Information

We do not have in effect any compensation plans under which our equity securities are authorized for issuance and we do not have any outstanding stock options.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended August 31, 2015.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis in conjunction with our financial statements, including the notes thereto, included in this Report. Some of the information contained in this Report may contain forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933, as amended (the “Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward looking statements as a result of various factors. We undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

Personnel Plan

We do not expect any material changes in the number of employees over the next 12-month period (although we may enter into employment or consulting agreements with our officers or directors). We do and will continue to outsource contract employment as needed.

Results of Operations for the Fiscal Year Ended August 31, 2015 compared to the Fiscal Year Ended August 31, 2014

We did not earn any revenues for the period from February 18, 2010 (Inception) to August 31, 2015. We incurred a net loss in the amount of $1,290,695 during the fiscal year ended August 31, 2015, compared to operating expenses of $183,032 for the fiscal year ended August 31, 2014. These operating expenses were comprised of a recapture of mineral property expenditures of $21,843 (2014: expense of $80,084), consulting fees of $128,451 (2014: $Nil), filing fees of $15,923 (2014: $11,664), finder’s fees of $34,925 (2014: $Nil), management fees of $241,500 (2014: $Nil), office and general fees of $70,806 (2014: $38,446), professional fees of $306,925 (2014: $52,838), and public relations expense of $180,452 (2014: $Nil). We wrote-down accounts payable by $11,285 (2014: $Nil), and incurred the following expenses related to the convertible notes issued during the fiscal year ended August 31, 2015: accretion of $72,001 (2014: $Nil), interest expense of $46,669 (2014: $Nil), finance costs of $238,472 (2014: $Nil) from amortization of debt discounts and excess of derivative liability over the face value of the notes, and a change in the fair value of the derivative liability of $12,301 (2014: $Nil

Revenues

We have had no operating revenues since our inception on February 18, 2010 to August 31, 2015.

19

Expenses

We incurred a net loss in the amount of $1,290,695 during the fiscal year ended August 31, 2015, compared to operating expenses of $183,032 for the fiscal year ended August 31, 2014. These operating expenses were comprised of a recapture of mineral property expenditures of $21,843 (2014: expense of $80,084), consulting fees of $128,451 (2014: $Nil), filing fees of $15,923 (2014: $11,664), finder’s fees of $34,925 (2014: $Nil), management fees of $241,500 (2014: $Nil), office and general fees of $70,806 (2014: $38,446), professional fees of $306,925 (2014: $52,838), and public relations expense of $180,452 (2014: $Nil). We wrote-down accounts payable by $11,285 (2014: $Nil), and incurred the following expenses related to the convertible notes issued during the fiscal year ended August 31, 2015: accretion of $72,001 (2014: $Nil), interest expense of $46,669 (2014: $Nil), finance costs of $238,472 (2014: $Nil) from amortization of debt discounts and excess of derivative liability over the face value of the notes, and a change in the fair value of the derivative liability of $12,301 (2014: $Nil).

Liquidity and Capital Resources

As at August 31, 2015, we had cash reserves of $2,349 and working capital deficit of $1,209,747. As at August 31, 2014, we had cash reserves of $1,862 and working capital deficit of $182,346.

Cash Used in Operating Activities

Net cash used in operating activities was $734,110 during the fiscal year ended August 31, 2015, compared to $149,378 for the fiscal year ended August 31, 2014.

Cash from Financing Activities

We have funded our business to date primarily from the issuance of convertible notes, loans from related parties, as well as sales of our common stock. During the fiscal year ended August 31, 2015, we raised a total of $734,597 in financing activities. This was comprised of the issuance of convertible debt in the amount of $306,875, issuance of convertible debt to a related party of $170,000, offset by repayment of convertible debt in the amount of $47,250, and loans from our director and key management personnel of $304,972. During the fiscal year ended August 31, 2014, we raised a total of $143,094 in financing activities, in loans from our director and key management personnel.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

We have not attained profitable operations and are dependent upon obtaining financing to pursue marketing and distribution activities. For these reasons, there is substantial doubt that we will be able to continue as a going concern.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Basis of Accounting

Our Company’s financial statements are prepared using the accrual method of accounting. The Company has elected an August year-end.

Cash Equivalents

Our Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

20

Stock-Based Compensation

Our Company records stock-based compensation in accordance with ASC 718, Compensation – Stock Based Compensation, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized based on the fair value of the equity instruments issued.

Recently Issued Accounting Pronouncements

Our Company has evaluated all the recent accounting pronouncements and believes that none of them will have a material effect on the company’s financial statement.

Contractual Obligations

As a “smaller reporting company” we are not required to provide tabular disclosure obligations.

As a “smaller reporting company” we are not required to provide the information required by this Item.

21

AIM EXPLORATION INC.

CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2015

22

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets of August 31, 2015 and 2014

Consolidated Statements of Operations for the years ended August 31, 2015 & 2014

Consolidated Statements of Stockholder’s Equity (Deficit)

Consolidated Statements of Cash Flows for the years ended August 31, 2015 and 2014

Notes to Consolidated Financial Statements

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors

AIM Exploration Inc.

701 North Green Valley Parkway, Suite 200

Henderson, NV 89012

We have audited the accompanying consolidated balance sheet of AIM Exploration Inc. (the “Company”) as of August 31, 2015, and the related consolidated statements of operations, changes in stockholders’ equity (deficit), and cash flows for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to the above present fairly, in all material respects, the financial position of AIM Exploration Inc. as of August 31, 2015, and the results of their operations and cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 3 to the financial statements, the Company has incurred an accumulated deficit from inception to August 31, 2015. This raises substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to this matter are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Anton & Chia, LLP

Newport Beach, California

December 15, 2015

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

Stockholders and Board of Directors

|

|

AIM Exploration, Inc.

|

|

(A Development Stage Company)

|

|

We have audited the accompanying consolidated balance sheets of AIM Exploration, Inc., (A Development Stage Company) as of August 31, 2014 and 2013, and the related consolidated statements of operations, stockholders' equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit. The cumulative consolidated statements of operations, stockholders' equity and cash flows for the period from February 18, 2010 (inception) to August 31, 2014 include amounts for the period from February 18, 2010 (inception) through August 31, 2013 which were audited by other auditors whose report has been furnished to us, and our opinion, insofar as it relates to the amounts included for the period from February 18, 2010 (inception) to August 31, 2013 is based solely on the report of the other auditors.

|

|

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

|

|