Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STEWART INFORMATION SERVICES CORP | v424790_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - STEWART INFORMATION SERVICES CORP | v424790_ex99-1.htm |

Exhibit 99.2

Stewart Information Services Corporation Investor Presentation – Winter 2015

Forward-looking Statements Certain statements in this news release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to future, not past, events and often address our expected future business and financial performance. These statements often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “will,” “foresee” or other similar words. Forward-looking statements by their nature are subject to various risks and uncertainties that could cause our actual results to be materially different than those expressed in the forward-looking statements. These risks and uncertainties include, among other things, the tenuous economic conditions; adverse changes in the level of real estate activity; changes in mortgage interest rates, existing and new home sales, and availability of mortgage financing; our ability to respond to and implement technology changes, including the completion of the implementation of our enterprise systems; the impact of unanticipated title losses on the need to strengthen our policy loss reserves; any effect of title losses on our cash flows and financial condition; the impact of vetting our agency operations for quality and profitability; changes to the participants in the secondary mortgage market and the rate of refinancings that affect the demand for title insurance products; regulatory non-compliance, fraud or defalcations by our title insurance agencies or employees; our ability to timely and cost-effectively respond to significant industry changes and introduce new products and services; the outcome of pending litigation; the impact of changes in governmental and insurance regulations, including any future reductions in the pricing of title insurance products and services; our dependence on our operating subsidiaries as a source of cash flow; the continued realization of expense savings from our continual focus on aligning our operations to quickly adapt our costs to transaction volumes and market conditions; our ability to access the equity and debt financing markets when and if needed; our ability to grow our international operations; and our ability to respond to the actions of our competitors. These risks and uncertainties, as well as others, are discussed in more detail in our documents filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2014, our quarterly reports on Form 10-Q, and our Current Reports on Form 8-K. We expressly disclaim any obligation to update any forward-looking statements contained in this news release to reflect events or circumstances that may arise after the date hereof, except as may be required by applicable law.

Non-GAAP Disclosures This presentation may contain certain financial measures that are not presented in accordance with generally accepted accounting principles (GAAP), including but not limited to, losses and litigation expenses arising from non-predictable title losses and adjusted pretax title margin, which is adjusted to exclude net realized investment gains or losses and reserve adjustments. Although these exclusions represent actual gains, losses or expenses to the Company, they may mask the periodic income and financial and operating trends associated with the Company’s business. The Company is presenting these non-GAAP financial measures because they provide the Company’s management and investors with additional insight into the operational performance of the Company relative to earlier periods and relative to the Company’s competitors. The Company does not intend for these non-GAAP financial measures to be a substitute for any GAAP financial information. In this presentation these non-GAAP financial measures have been presented with, and reconciled to, the most directly comparable GAAP financial measures. Investors should use these non-GAAP financial measures only in conjunction with the comparable GAAP financial measures.

Company Overview Stewart Information Services Title Insurance Segment Provide independent, third-party closing and settlement services Search, examine and insure the condition of the title to real estate property, providing security of ownership and reduced liability to lenders Offer products to both residential and commercial customers Primary operations in the United States (12.3% market share in 1H15, American Land Title Association), with international residential and commercial operations in Canada, the United Kingdom, Central Europe, Latin America, and Australia Additional products/services include 1031 Exchange, relocation services, timeshare and specialty insurance Mortgage Services Segment Diversified products and services supporting the mortgage processCentralized Title Insurance: Underwriting, escrow, centralized title solutions, REO and default title solutions and title curative Loan Origination Services: Valuation solutions, post-closing support and loan quality control Capital Market Solutions: Servicing oversight, servicing quality control, credit and compliance reviews, regulatory compliance and securitization support

Achievements Since Housing Crisis Strengthen Balance Sheet Increased shareholder’s equity from $448 million in 2010 to $676 million in 2014 Raised $65mm in convertible notes in 2009 to refinance bank debt that was callable at any time, with the notes subsequently converted into equity in 2014 Strengthened balance sheet has allowed focus to shift to growth (including acquisitions) and capital return to shareholders Increased underwriter surplus to $500+ million Increase Use of Direct Distribution Targeted 50/50 mix of title revenue generation from direct and independent agency channels Direct distribution increased from 38% of Stewart’s title business in 2010 to 48% in 1H15 Build Commercial Title Business Increased statutory surplus and multiple rating upgrades supported growth in higher margin, commercial title business U.S. and Canada commercial revenues increased from $93 million in 2010 to $156 million in 2014 Cost Saving Initiatives Achieved plan to eliminate $100+ million in annual operating expenses following the financial crisis Announced additional initiative in 2014 to eliminate additional $25 million of costs in 2014 and 2015; plan now essentially complete, with $30 million of annualized savings achieved Company will continue executing operating strategies around centralization, optimization, offshoring and technology rationalization for continued margin expansion. Capital Return Program Initiated $70 million capital return program in 2014. Repurchased $50 million in stock in 2014 and 2015; increased dividend from $0.10 annually to $1.00 annually in February 2015; and increased annual dividend from $1.00 to $1.20 in November 2015 Upon substantial completion of its capital return program, Board of Directors has authorized a new share repurchase program of up to $50 million

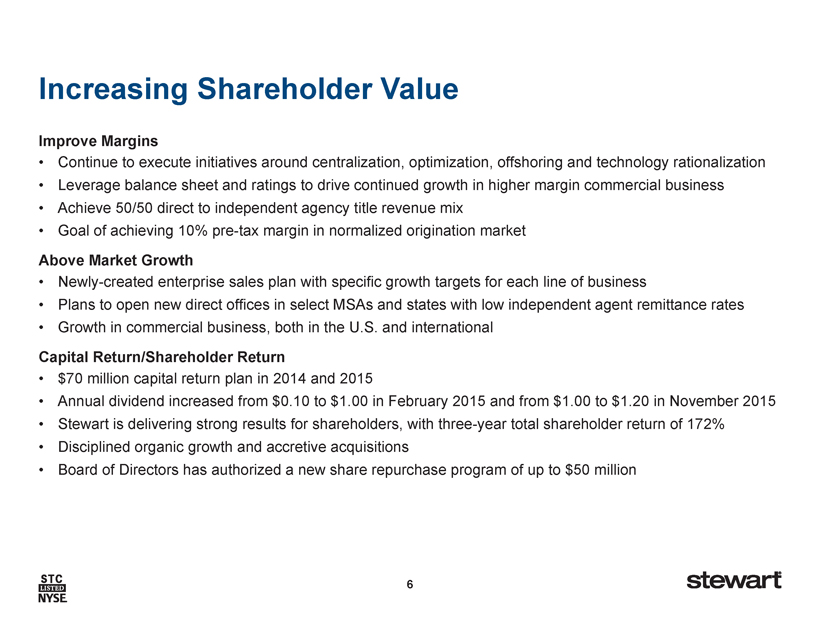

Increasing Shareholder Value Improve Margins Continue to execute initiatives around centralization, optimization, offshoring and technology rationalization Leverage balance sheet and ratings to drive continued growth in higher margin commercial business Achieve 50/50 direct to independent agency title revenue mix Goal of achieving 10% pre-tax margin in normalized origination market Above Market Growth Newly-created enterprise sales plan with specific growth targets for each line of business Plans to open new direct offices in select MSAs and states with low independent agent remittance rates Growth in commercial business, both in the U.S. and international Capital Return/Shareholder Return $70 million capital return plan in 2014 and 2015 Annual dividend increased from $0.10 to $1.00 in February 2015 and from $1.00 to $1.20 in November 2015 Stewart is delivering strong results for shareholders, with three-year total shareholder return of 172% Disciplined organic growth and accretive acquisitions Board of Directors has authorized a new share repurchase program of up to $50 million

Focused Growth Title Operations Increase direct market share in higher growth states and top MSAs where Stewart is below its national market share through organic sales growth and accretive acquisitions Independent agency growth in higher remittance rate states Commercial Title Operations Completed management alignment in 2013 Maintain/strengthen underwriter balance sheet and credit ratings Leverage well-respected underwriting expertise Target foreign commercial business Enterprise Sales Target annualized revenue growth across all lines of business independent of market conditions

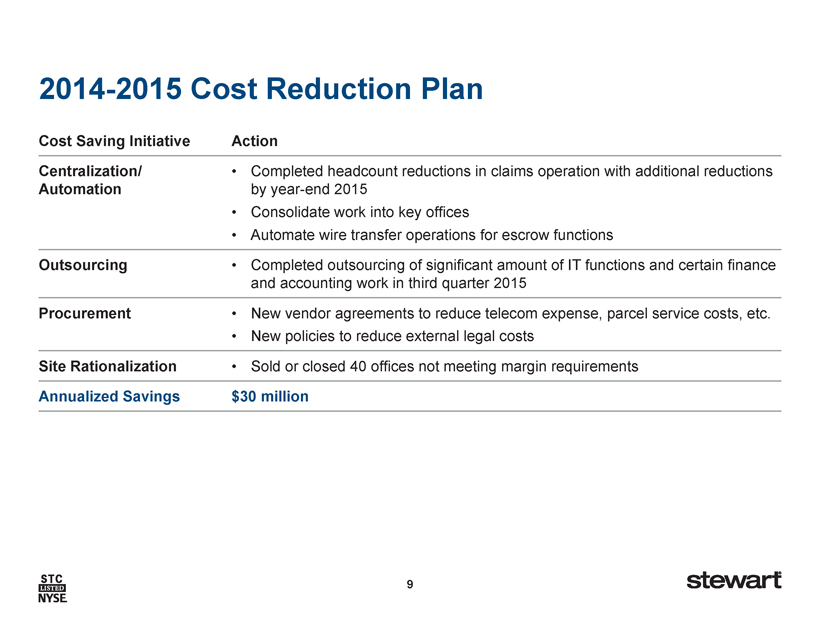

Improving Efficiency Post-Crisis Reductions in Cost Structure Post-crisis, Stewart changed operating model and reduced operating costs by $100+ million to reflect the new market environment (origination volume has been between $1-2 trillion since 2008, dropping from $2-4 trillion from 2001 to 2007)Created a centralized, shared services technology environment, reducing the need to support multiple, independent installations Consolidated legal entity structure (centralized accounting, human resources, marketing, and other support operations to reduce overlapping spending) Eliminated presence in smaller markets that are less cost effective Centralizing back office operations and technology has also increased Stewart’s ability to scale to a cyclical origination environment and has reduced the personnel required to enter / exit markets Increased revenue per agency by shedding less attractive agents while remaining revenue neutral Shed unprofitable businesses where company lacked a significant presence (e.g., flood insurance) Cost Reduction Plan Announced $25 million structural cost reduction target in Q1 2014, with plan to achieve these reductions by year-end 2015. Increased cost reduction target in Q2 2015 to $30 million of annualized savings; and achieved target savings in Q3 2015 Going Forward Continue to focus on centralization, optimization, offshoring and technology rationalization to further reduce operating expenses and achieve the company’s goal of a pre-tax margin of 10% in a normalized originations market, although current market projections are for sub-normal conditions in the next several years.

2014-2015 Cost Reduction Plan Cost Saving Initiative Action Centralization/Automation Completed headcount reductions in claims operation with additional reductions by year-end 2015 Consolidate work into key offices Automate wire transfer operations for escrow functions Outsourcing Completed outsourcing of significant amount of IT functions and certain finance and accounting work in third quarter 2015 Procurement New vendor agreements to reduce telecom expense, parcel service costs, etc. New policies to reduce external legal costs Site Rationalization Sold or closed 40 offices not meeting margin requirements Annualized Savings $30 million

Title Insurance – Market Share Map Source: American Land Title Association, 1H 2015 Market Share by Family Company and State

Commercial Title Growth Strategy Stewart has targeted growth in commercial business for higher margin profile and cyclical diversity from residential real estate trends Aligned sales teams to customer channels to increase capture rate of larger-liability and higher-margin transactions Leveraged higher financial ratings and statutory surplus to increase share of large dealsSeveral states only allow retaining risk on policies up to a particular level of surplusIncreased statutory surplus to $526mm in 2014 from $369mm in 2010 Commercial customers are more ratings sensitiveFinancial strength rating of A- by A.M. Best and Fitch The Company is well positioned to benefit from an upcoming surge in commercial refinance transactions over the next several years U.S. & Canada Commercial Title Premiums

Title Insurance – Loss Ratio by Policy Year Actuarial Claims as a % of Net Statutory Premiums Written – U.S. Operations Only Source: ALTA®, Family-Company Aggregates

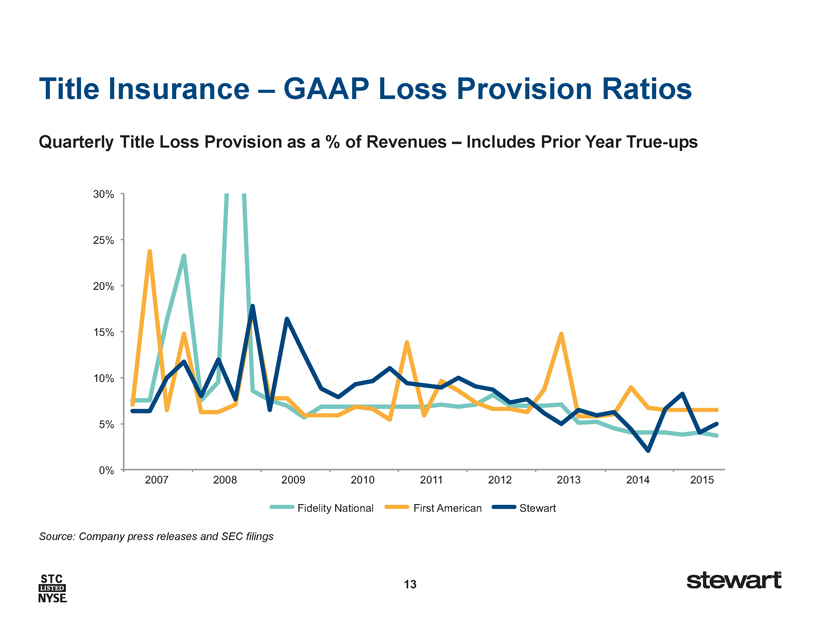

Title Insurance – GAAP Loss Provision Ratios Quarterly Title Loss Provision as a % of Revenues – Includes Prior Year True-ups Source: Company press releases and SEC filings

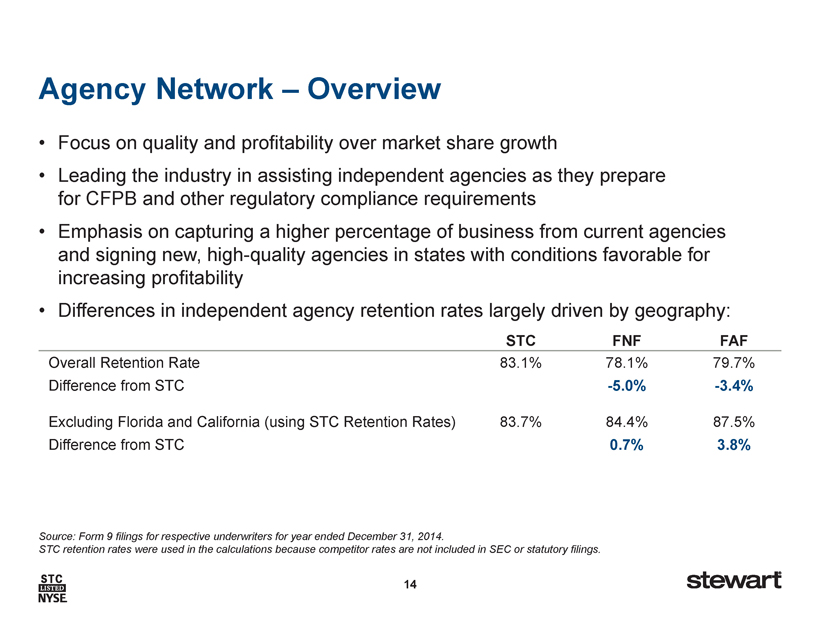

Agency Network – Overview Focus on quality and profitability over market share growth Leading the industry in assisting independent agencies as they preparefor CFPB and other regulatory compliance requirements Emphasis on capturing a higher percentage of business from current agencies and signing new, high-quality agencies in states with conditions favorable for increasing profitability Differences in independent agency retention rates largely driven by geography: STC FNF FAF Overall Retention Rate 83.1% 78.1% 79.7% Difference from STC -5.0% -3.4% Excluding Florida and California (using STC Retention Rates) 83.7% 84.4% 87.5% Difference from STC 0.7% 3.8% Source: Form 9 filings for respective underwriters for year ended December 31, 2014. STC retention rates were used in the calculations because competitor rates are not included in SEC or statutory filings.

Agency Network – Revenues Net of Retention Trailing 12 Months – $ Millions Net Revenue Number of Independent Agents Note: Number of independent agencies based on number of contractual relationships rather than number of physical locations of agencies.

Capital Priorities Underwriter Continue to strengthen balance sheet by growing $500+ million in statutory surplus consistent with pace of industry growth and in anticipation of increased commercial deal size Maintain Statutory liquidity ratio (liquid assets-to- liabilities) of at least 100% – liquidity ratio of 97% as of 3Q15 Business Model Look to increase direct residential and commercial title operations’ presence in top 30 MSAs where Stewart’s market share is below its national market average Anticipate accretive acquisition opportunities to drive scale in our core business Other $70 million capital return program announced in February 2014 Annual dividend per share increased to $1.00 from $0.10 in February 2015 and from $1.00 to $1.20 in November 2015 Up to $50 million share repurchase authorization announced in November 2015 Will continue to assess methods by which capital is allocated; including increasing the annual dividend and accretive acquisitions

Revenues and Pretax Earnings Trends $ Millions Revenue Pretax Earnings * Excludes one-time charges and benefits

Balance Sheet – September 30, 2015 Ratios Return on Equity, TTM 2.6% Debt-to-Equity 12.7% Debt-to-Capital 12.2% Book Value Per Share Book Value/Share $28.86 Tangible Book Value/Share $16.90 Statutory $ thousands Surplus 505,321 Liquidity Ratio 97% Premium Leverage 2.65x Assets $ thousands Cash & Cash Equivalents 211,315 Investments - Statutory Reserve Funds 480,132 Investments - Other 95,242 Other Assets 292,906 Goodwill & Intangibles 238,713 Total Assets 1,318,308 Liabilities Debt 82,051 Loss Reserves 478,629 Other Liabilities 113,483 Total Liabilities 674,163 Noncontrolling Interests 8,192 Equity Total Shareholders’ Equity 635,953 Total Liabilities and Shareholders’ Equity Total Liabilities and Shareholders’ Equity 1,318,308

Matt Morris CEO Allen Berryman CFO Nat Otis SVP, Finance and Director of Investor Relations nat.otis@stewart.com (713) 625-8360 direct (800) 729-1900, ext. 8360 toll free

Stewart Information Services Corporation Appendix

Market Conditions Home prices continue to increase – 5% increase in home prices equates to a 3.5%+ increase in revenue per transaction Commercial real estate market remains solid with expectations for increased refinancings Interest rates remain at historically low levels – although possibility for interest rate increase before year end 2015 Market returning to greater seasonality Housing inventory declining in many markets Heightened regulatory uncertainty given Dodd-Frank and CFPB

Stewart Revenues vs. Mortgage Origination Cycle U.S. Mortgage Origination / Refinancings ($tn) Gross Revenues ($bn) Source: MBA

U.S. Existing Housing Sales National Association of REALTORS® Seasonally Adjusted Annualized Rate – $ Millions Source: National Association of REALTORS® and Fannie Mae

Residential Lending Vs. Industry Premiums $ Trillions $ Billions Effective Lending = Purchase Lending + 60 Percent of Refinance Lending Data Sources: Lending = Fannie Mae®, Title Premiums = CDS Research, Demotech and ALTA

Title Revenues by Regulatory Oversight Stewart Family 2014 Title Industry 2014 Source: Form 9 filings (Schedule T) as compiled by ALTA

SISCO Organizational Structure

Corporate Governance Nine member Board of Directors is annually elected Majority vote standard Separate CEO and Chairman of the Board Seven of nine members of the Board are independent Shareholders can call special meetings Shareholders can act by written consent Declawed preferred stock No supermajority requirements Directors can be removed without cause Dual class ownership structure, five directors elected by Class A shareholders and four elected by Class B shareholders In April 2014, Stewart was recognized by Forbes as one of the 50 Most Trustworthy Financial Companies in America