Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - STEWART INFORMATION SERVICES CORP | ex3222016.htm |

| EX-32.1 - EXHIBIT 32.1 - STEWART INFORMATION SERVICES CORP | ex3212016.htm |

| EX-31.2 - EXHIBIT 31.2 - STEWART INFORMATION SERVICES CORP | ex3122016.htm |

| EX-31.1 - EXHIBIT 31.1 - STEWART INFORMATION SERVICES CORP | ex3112016.htm |

| EX-23.1 - EXHIBIT 23.1 - STEWART INFORMATION SERVICES CORP | ex231kpmgconsent2016.htm |

| EX-21.1 - EXHIBIT 21.1 - STEWART INFORMATION SERVICES CORP | ex211subsidiaries2016.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-02658

STEWART INFORMATION SERVICES CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 74-1677330 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1980 Post Oak Blvd., Houston TX | 77056 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (713) 625-8100

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $1 par value | New York Stock Exchange | |

(Title of each class of stock) | (Name of each exchange on which registered) | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | ¨ | ||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the Common Stock (based upon the closing sales price of the Common Stock of Stewart Information Services Corporation, as reported by the NYSE on June 30, 2016) held by non-affiliates of the Registrant was approximately $937,340,000.

At February 23, 2017, there were 23,431,279 outstanding shares of the issuer's Common Stock, $1 par value per share.

Documents Incorporated by Reference

Portions of the definitive proxy statement (the Proxy Statement) are incorporated herein by reference in Part III of this document.

FORM 10-K ANNUAL REPORT

YEAR ENDED DECEMBER 31, 2016

TABLE OF CONTENTS

Item | Page | |

1 | ||

1A. | ||

1B. | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

7A. | ||

8 | ||

9 | ||

9A. | ||

9B. | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

As used in this report, “we,” “us,” “our,” the “Company” and “Stewart” mean Stewart Information Services Corporation and our subsidiaries, unless the context indicates otherwise.

PART I

Item 1. Business

We are a Delaware corporation formed in 1970. We and our predecessors have been engaged in the title business since 1893.

Stewart Information Services Corporation (NYSE-STC) is a global real estate services company, offering products and services through our direct operations, network of Stewart Trusted Providers™ and family of companies. From residential and commercial title insurance and closing and settlement services to specialized offerings for the mortgage industry, we offer the comprehensive service, deep expertise and solutions our customers need for any real estate transaction. At Stewart, we believe in building strong relationships - and these partnerships are the cornerstone of every closing, every transaction and every deal.

Our international division delivers products and services protecting and promoting private land ownership worldwide. Currently, our primary international operations are in Canada, the United Kingdom, Australia and Central Europe.

We currently report our business in two segments: title insurance and related services (title) and ancillary services and corporate. Prior to 2016, we reported three operating segments: title, mortgage services and corporate. Refer to Note 19 to our audited consolidated financial statements and Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations for details regarding our change in reporting operating segments and financial information related to the title and ancillary services and corporate segments.

Title Segment

Title insurance and related services include the functions of searching, examining, closing and insuring the condition of the title to real property. The title segment also includes centralized title services (which include title and closing services, post-closing services, default and REO-related title services), home and personal insurance services and Internal Revenue Code Section 1031 tax-deferred exchanges.

Examination and closing. The purpose of a title examination is to ascertain the ownership of the property being transferred, debts that are owed on it and the scope of the title policy coverage. This involves searching for and examining documents such as deeds, mortgages, wills, divorce decrees, court judgments, liens, paving assessments and tax records.

At the closing or “settlement” of a sale transaction, the seller executes and delivers a deed to the new owner. The buyer typically signs new mortgage documents. Closing funds are then disbursed to the seller, the prior lender, real estate brokers, the title company and others. The documents are then recorded in the public records. A title insurance policy is generally issued to both the new lender and the owner.

Title insurance policies. Lenders in the United States generally require title insurance as a condition to making a loan on real estate, including securitized lending. This is to assure lenders of the priority of their lien position. The purchasers of the property want insurance to protect against claims that may arise against the title to the property. The face amount of the policy is normally the purchase price or the amount of the related loan.

Title insurance is substantially different from other types of insurance. Fire, auto, health and life insurance protect against future losses and events. In contrast, title insurance insures against losses from past events and seeks to protect the public by eliminating covered risks through the examination and settlement process. In essence, subject to its exceptions and exclusions, a title insurance policy provides a warranty to the policyholder that the title to the property is free from defects that might impair ownership rights, or in the case of a lender's policy, that there is priority of lien position. Most other forms of insurance provide protection for a limited period of time and, hence the policy must be periodically renewed. Title insurance, however, is issued for a one-time premium and the policy provides protection for as long as the owner owns the property or has liability in connection with the property. Also, a title insurance policy does not have a finite contract term, whereas most other lines of insurance have a definite beginning and ending date for coverage. Although a title insurance policy provides protection as long as the owner owns the property being covered, the title insurance company generally does not have information about which policies are still effective. Most other lines of insurance receive periodic premium payments and policy renewals thereby allowing the insurance company to know which policies are effective.

1

Losses. Losses on policies occur when a title defect is not discovered during the examination and settlement process. Reasons for losses include forgeries, misrepresentations, unrecorded or undiscovered liens, the failure to pay off existing liens, mortgage lending fraud, mishandling or defalcation of settlement funds, issuance by title agencies of unauthorized coverage and defending policyholders when covered claims are filed against their interest in the property.

Some claimants seek damages in excess of policy limits. Those claims are based on various legal theories. We vigorously defend against spurious claims and provide protection for covered claims up to the limits set forth in the policy. We have from time-to-time incurred losses in excess of policy limits.

Experience shows that most policy claims and claim payments are made in the first six years after the policy has been issued, although claims can also be incurred and paid many years later. By their nature, claims are often complex, vary greatly in dollar amounts and are affected by economic and market conditions and the legal environment existing at the time claims are processed.

Our liability for estimated title losses comprises both known claims and our estimate of claims that may be reported in the future. The amount of our loss reserve represents the aggregate future payments (net of recoveries) that we expect to incur on policy losses and in costs to settle claims. In accordance with industry practice, these amounts have not been discounted to their present values.

Estimating future title loss payments is difficult due to the complex nature of title claims, the length of time over which claims are paid, the significant variance in dollar amounts of individual claims and other factors. The amounts provided for policy losses are based on reported claims, historical loss payment experience, title industry averages and the current legal and economic environment. Estimated provisions for current year policy losses are charged to income in the same year the related premium revenues are recognized. Annual provisions for policy losses also include changes in the estimated aggregate liability on policies issued in prior years. Actual loss payment experience relating to policies issued in previous years, including the impact of large losses, is the primary reason for increases or decreases in our annual loss provision.

Amounts shown as our estimated liability for future loss payments are continually reviewed by us for reasonableness and adjusted as appropriate. We have consistently followed the same basic method of estimating and recording our loss reserves for more than 10 years. As part of our process, we also obtain input from third-party actuaries regarding our methodology and resulting reserve calculations. While we are responsible for determining our loss reserves, we utilize this actuarial input to assess the overall reasonableness of our reserve estimation.

See “Critical Accounting Estimates - Title Loss Reserves” for information on current year policy losses and consolidated balance sheet reserves.

Factors affecting revenues. Title insurance revenues are closely related to the level of activity in the real estate markets we serve and the prices at which real estate sales are made. Real estate sales are directly affected by the availability and cost of money to finance purchases. Other factors include consumer confidence and demand by buyers. In periods of low interest rates, loan refinancing transactions are also an important contributor to revenues. These factors may override the seasonal nature of the title business. Generally, our first quarter is the least active and our second and third quarters are the most active in terms of title insurance revenues.

Selected information from the U.S. Department of Housing and Urban Development and National Association of Realtors® for the U.S. real estate industry follows (2016 figures are preliminary and subject to revision):

2016 | 2015 | 2014 | |||||||

New home sales – in millions | 0.56 | 0.50 | 0.44 | ||||||

Existing home sales – in millions | 5.45 | 5.25 | 4.94 | ||||||

Existing home sales – median sales price in $ thousands | 233.9 | 222.4 | 208.3 | ||||||

2

Customers. The primary sources of title insurance business are attorneys, builders, developers, home buyers and home sellers, lenders, mortgage brokers, and real estate brokers and agents. No individual customer was responsible for as much as 10% or more of our consolidated revenues in any of the last three years. Titles insured include residential and commercial properties, undeveloped acreage, farms, ranches, wind and solar power installations and other energy-related projects.

Service, location, financial strength, company size and related factors affect customer acceptance. Increasing market share is accomplished primarily by providing superior service. The parties to a closing are concerned with accuracy, timeliness and cost. The rates charged to customers are regulated, to varying degrees, in most states.

The financial strength and stability of the title underwriter are important factors in maintaining and increasing our business, particularly commercial business. We are rated as investment grade by the title industry’s leading rating companies. Our principal underwriter, Stewart Title Guaranty Company (Guaranty), is currently rated “A” by Demotech Inc., "A-" by Fitch Ratings Ltd., "A-" by A.M. Best and "B+" by Kroll Bond Rating Agency Inc.

Market share. Title insurance statistics are compiled quarterly by the title industry’s national trade association. Based on 2016 unconsolidated statutory net premiums written through September 30, 2016, Guaranty is one of the leading title insurers in the United States.

Our principal competitors are Fidelity National Financial, Inc. (which includes Fidelity National Title Insurance Company, Chicago Title Insurance Company and Commonwealth Land Title Insurance Company), First American Financial Corporation (which includes First American Title Insurance Company) and Old Republic Title Insurance Group (which includes Old Republic National Title Insurance Company). We also compete with other independent title insurer companies, as well as abstractors, attorneys who issue title opinions and attorney-owned title insurance funds. A number of homebuilders, financial institutions, real estate brokers and others own or control title insurance agencies, some of which issue policies underwritten by Guaranty.

Title insurance revenues by geographic location. The approximate amounts and percentages of our consolidated title operating revenues were:

Amounts ($ millions) | Percentages | |||||||||||||||||

2016 | 2015 | 2014 | 2016 | 2015 | 2014 | |||||||||||||

Texas | 362 | 341 | 338 | 19 | 18 | 20 | ||||||||||||

New York | 226 | 250 | 238 | 12 | 13 | 14 | ||||||||||||

California | 125 | 142 | 123 | 7 | 8 | 7 | ||||||||||||

International | 116 | 107 | 118 | 6 | 6 | 7 | ||||||||||||

Florida | 87 | 88 | 73 | 5 | 5 | 4 | ||||||||||||

All others | 988 | 960 | 824 | 51 | 50 | 48 | ||||||||||||

1,904 | 1,888 | 1,714 | 100 | 100 | 100 | |||||||||||||

Regulations. Title insurance companies are subject to comprehensive state regulations covering premium rates, agency licensing, policy forms, trade practices, reserve requirements, investments and the transfer of funds between an insurer and its parent or its subsidiaries and any similar related party transactions. Kickbacks and similar practices are prohibited by most state and federal laws. (See Item 1A, Risk Factors - Our Insurance Subsidiaries Must Comply With Extensive Government Regulations.)

Ancillary Services and Corporate Segment

The segment is comprised of the parent holding company, our centralized administrative services departments and our ancillary services operations. Our ancillary services operations primarily provide appraisal and valuation services to the mortgage industry through Stewart Lender Services (SLS).

Factors affecting ancillary services revenues. As in the title segment, ancillary services revenues, particularly those generated by lender services, are closely related to the level of activity in the real estate market, including the volume of originations (new or refinancing), foreclosures or other distressed property activity. Revenues related to some services are generated on a project basis or through longer term contracts.

3

Companies that compete with our ancillary services businesses vary across a wide range of industries and include the major title insurance underwriters mentioned under “Title Segment - Market share” as well as other real estate technology and business process outsourcing providers.

Customers. Customers for our ancillary services products and services primarily include mortgage lenders and servicers, mortgage brokers and mortgage investors.

Many of the services and products offered by our ancillary services business are used by professionals and intermediaries who have been retained to assist consumers with the sale, purchase, mortgage, transfer, recording and servicing of real estate transactions. To that end, timely, accurate and compliant services are critical to our customers since these factors directly affect the service they provide to their customers. Financial strength, scale, robust processes to ensure legal and regulatory compliance, marketplace presence and reputation as a reliable, compliant solution are important factors in attracting new business.

General

Investment policies. Our investment portfolios reside in two domestic and two international regulated insurance underwriters. These underwriters maintain investments in accordance with certain statutory requirements for the funding of premium reserves and deposits, or, in the case of our international operations, for the maintenance of certain capital ratios required by regulators. The activities of the portfolios are overseen by investment committees comprised of certain senior executives. Their oversight includes such activities as policy setting, determining appropriate asset classes with different and distinct risk/return profiles so as to prudently diversify the portfolio, and to approve all service vendors (managers and custodians). We also utilize the expertise of third-party investment advisors to maximize returns while managing risk. Our investment policies are designed to comply with regulatory requirements as applicable law imposes restrictions upon the types and amounts of investments that may be made by the regulated insurance subsidiaries.

Our investment policies further provide that investments are to be managed with a view to balancing profitability, liquidity, and risk (interest rate risk, credit risk and liquidity risk) while mindful of negatively impacting earnings per share and income taxes.

As of December 31, 2016, approximately 94% of our combined debt and equity investment portfolios consisted of fixed income securities. As of that date, approximately 86% of the fixed income investments are held in securities that are A-rated or higher, and substantially all of the fixed income portfolios are rated investment grade or higher. Percentages are based on the market value of the securities. Credit ratings are based on Standard & Poor’s Rating Services and Moody’s Investor Services, Inc. published ratings. If a security was rated differently by both ratings agencies, the lower of the two ratings was selected.

In addition to our debt and equity investment securities portfolios, we maintain certain money-market and other short-term investments.

Trademarks. We have developed and acquired numerous automated products and processes that are crucial to both our title and ancillary services segments. These systems automate most facets of the real estate transaction. Among these trademarked products and processes are AIM+®, AgencySecure®, TitleWorkPlace™, LenderExpressQuote®, Stewart Online™, Property Profiles™, Stewart Select™, PropertyInfo®, SureClose®, TitleSearch®, Virtual Underwriter® and Stewart Access®. We consider these trademarks, which are perpetual in duration, to be important to our business.

Employees. As of December 31, 2016, we employed approximately 6,350 people. We consider our relationship with our employees to be good.

Available information. We file annual, quarterly and other reports and information with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended (Exchange Act). You may read and copy any material that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain additional information about the Public Reference Room by calling the SEC at (800) SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and other information statements, and other information regarding issuers that file electronically with the SEC.

4

We also make available upon written request, free of charge, or through our Internet site (www.stewart.com), our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Code of Ethics and, if applicable, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Transfer agent. Our transfer agent is Computershare, which is located at P.O. Box 30170, College Station, TX, 77842-3170. Its phone number is (888) 478-2392 and website is (www.computershare.com/investor).

CEO and CFO certifications. The CEO and CFO certifications required under Section 302 of the Sarbanes-Oxley Act are filed as exhibits to our 2016 Form 10-K. Stewart Information Services Corporation submitted in 2016 its annual CEO Certification under a Section 303A.12(a) of the New York Stock Exchange Listed Company Manual.

Item 1A. Risk Factors

You should consider the following risk factors, as well as the other information presented in this report and our other filings with the SEC, in evaluating our business and any investment in Stewart. These risks could materially and adversely affect our business, financial condition and results of operations. In that event, the trading price of our Common Stock could decline materially.

Adverse changes in economic conditions, especially those affecting the levels of real estate and mortgage activity, may reduce our revenues.

Our financial condition and results of operations are affected by changes in economic conditions, particularly mortgage interest rates, credit availability, real estate prices and consumer confidence. Our revenues and earnings have fluctuated in the past due to the cyclical nature of the housing industry and we expect them to fluctuate in the future.

The demand for our title insurance-related and mortgage services offerings is dependent primarily on the volume of residential and commercial real estate transactions. The volume of these transactions historically has been influenced by such factors as mortgage interest rates, availability of financing and the overall state of the economy. Typically, when interest rates are increasing or when the economy is experiencing a downturn, real estate activity declines. As a result, the title insurance industry tends to experience decreased revenues and earnings. Increases in interest rates may also have an adverse impact on our bond portfolio and the amount of interest we pay on our floating-rate bank debt.

Our revenues and results of operations have been and may in the future be adversely affected by a decline in home prices, real estate activity and the availability of financing alternatives. In addition, weakness or adverse changes in the level of real estate activity could have a material adverse effect on our consolidated financial condition or results of operations.

Our claims experience may require us to increase our provision for title losses or to record additional reserves, either of which would adversely affect our earnings.

We estimate our future loss payments and our assumptions about future losses may prove inaccurate. Provisions for policy losses on policies written within a given year are charged to income in the same year the related premium revenues are recognized. The amounts provided are based on reported claims, historical loss payment experience, title industry averages and the current legal and economic environment. Losses that are higher than anticipated are an indication that total losses for a given policy year may be higher than originally calculated. Changes in the total estimated future loss for prior policy years are recorded in the period in which the estimate changes. Claims are often complex and involve uncertainties as to the dollar amount and timing of individual payments. Claims are often paid many years after a policy is issued. From time-to-time, we experience large losses, including losses from independent agency defalcations, from title policies that have been issued or worsening loss payment experience, any of which may require us to increase our title loss reserves. These events are unpredictable and may have a material adverse effect on our earnings.

5

Competition in the title insurance industry may affect our revenues.

Competition in the title insurance industry is intense, particularly with respect to price, service and expertise. Larger commercial customers and mortgage originators also look to the size and financial strength of a title insurer. Although we are one of the leading title insurance underwriters based on market share, Fidelity National Financial, Inc., Old Republic Title Insurance Group and First American Financial Corporation each has substantially greater revenues than we do and their holding companies have significantly greater capital. Further, the other independent title insurance companies collectively hold a relatively small but considerable share of the market. Although we are not aware of any current initiatives to reduce regulatory barriers to entering our industry, any such reduction could result in new competitors, including financial institutions, entering the title insurance business. Competition among the title insurance companies and any new entrants could lower our premium and fee revenues. From time-to-time, new entrants enter the marketplace with alternative products to traditional title insurance, although many of these alternative products have been disallowed by title insurance regulators. Further, advances in technologies such as Blockchain could, over time, significantly disrupt the traditional business model of financial services companies, including title insurance. These alternative products or disruptive technologies, if permitted by regulators, could have a material adverse effect on our revenues and earnings.

Availability of credit may reduce our liquidity and negatively impact our ability to fund operations.

We expect that cash flows from operations and cash available from our underwriters, subject to regulatory restrictions, will be sufficient to fund our operations, pay our claims and fund operational initiatives. To the extent that these funds are not sufficient, we may be required to borrow funds on less than favorable terms or seek funding from the equity market, which may be on terms that are dilutive to existing shareholders.

A downgrade of our underwriters by rating agencies may reduce our revenues.

Ratings are a significant component in determining the competitiveness of insurance companies with respect to commercial title policies. Our principal underwriter, Guaranty, is currently rated “A” by Demotech, Inc., "A-" by Fitch, "A-" by A. M. Best and "B+" by Kroll Bond Rating Agency. Guaranty has historically been highly rated by the rating agencies that cover us. These ratings are not credit ratings. Instead, the ratings are based on quantitative, and in some cases qualitative, information and reflect the conclusions of the rating agencies with respect to our financial strength, results of operations and ability to pay policyholder claims. Our ratings are subject to continual review by the rating agencies and we cannot be assured that our current ratings will be maintained. If our ratings are downgraded from current levels by the rating agencies, our ability to retain existing customers and develop new customer relationships may be negatively impacted, which could result in a material adverse impact on our consolidated financial condition or results of operations.

Our insurance subsidiaries must comply with extensive government regulations. These regulations could adversely affect our ability to increase our revenues and operating results.

The Consumer Financial Protection Bureau (CFPB) is charged with protecting consumers by enforcing Federal consumer protection laws and regulations. The CFPB is an independent agency and funded by the United States Federal Reserve System. Its jurisdiction includes banks, credit unions, securities firms, payday lenders, mortgage servicing operations, foreclosure relief services, debt collectors and other financial companies. The nature and extent of these regulations include, but are not limited to:

• | conducting rule-making, supervision, and enforcement of Federal consumer protection laws; |

• | restricting unfair, deceptive, or abusive acts or practices; |

• | taking consumer complaints; |

• | promoting financial education; |

• | researching consumer behavior; |

• | monitoring financial markets for new risks to consumers; and |

• | enforcing laws that outlaw discrimination and other unfair treatment in consumer finance. |

Effective on October 3, 2015, the CFPB’s integrated disclosure rule for mortgage loan applications, known as "Know Before You Owe", imposed new requirements for us and other mortgage industry participants regarding required mortgage disclosures and forms. Compliance with the integrated disclosure also altered related business processes and interactions with customers.

6

Governmental authorities regulate our insurance subsidiaries in the various states and international jurisdictions in which we do business. These regulations generally are intended for the protection of policyholders rather than stockholders. The nature and extent of these regulations vary from jurisdiction to jurisdiction, but typically involve:

• | approving or setting of insurance premium rates; |

• | standards of solvency and minimum amounts of statutory capital and surplus that must be maintained; |

• | limitations on types and amounts of investments; |

• | establishing reserves, including statutory premium reserves, for losses and loss adjustment expenses; |

• | regulating underwriting and marketing practices; |

• | regulating dividend payments and other transactions among affiliates; |

• | prior approval for the acquisition and control of an insurance company or of any company controlling an insurance company; |

• | licensing of insurers, agencies and, in certain states, escrow officers; |

• | regulation of reinsurance; |

• | restrictions on the size of risks that may be insured by a single company; |

• | deposits of securities for the benefit of policyholders; |

• | approval of policy forms; |

• | methods of accounting; and |

• | filing of annual and other reports with respect to financial condition and other matters. |

These regulations may impede or impose burdensome conditions on rate increases or other actions that we might want to take to enhance our operating results.

We may also be subject to additional state or federal regulations prescribed by legislation such as the Dodd-Frank Act or by regulations issued by the CFPB, Department of Labor, Office of the Comptroller of the Currency or other agencies. Changes in regulations may have a material adverse effect on our business. In addition, state regulators perform periodic examinations of insurance companies, which could result in increased compliance or litigation expenses.

Rapid changes in our industry require secure, timely and cost-effective technological responses. Our earnings may be adversely affected if we are unable to effectively use technology to address regulatory changes and increase productivity.

We believe that our future success depends on our ability to anticipate changes in the industry and to offer products and services that meet evolving standards on a timely and cost-effective basis. To do so requires a flexible technology architecture which can continuously comply with changing regulations, improve productivity, lower costs, reduce risk and enhance the customer experience. Any unanticipated downtime in our technology may have a material adverse effect on our earnings.

We rely on dividends from our insurance underwriting subsidiaries.

We are a holding company and our principal assets are our insurance underwriting subsidiaries. Consequently, we depend on receiving sufficient dividends from our insurance subsidiaries to meet our debt service obligations and to pay our parent company's operating expenses and dividends to our stockholders. The insurance statutes and regulations of some states require us to maintain a minimum amount of statutory capital and restrict the amount of dividends that our insurance subsidiaries may pay to us. Guaranty is a wholly owned subsidiary of Stewart and the principal source of our cash flow. In this regard, the ability of Guaranty to pay dividends to us is dependent on the approval of the Texas Insurance Commissioner.

Claims by large classes of claimants may impact our financial condition or results of operations.

We are periodically involved in litigation arising in the ordinary course of business. In addition, we are currently, and have been in the past, subject to claims and litigation from large classes of claimants seeking substantial damages not arising in the ordinary course of business. Material pending legal proceedings, if any, not in the ordinary course of business, are disclosed in Item 3—Legal Proceedings included elsewhere in this report. To date, the impact of the outcome of these proceedings has not been material to our consolidated financial condition or results of operations. However, an unfavorable outcome in any litigation, claim or investigation against us could have a material adverse effect on our consolidated financial condition or results of operations.

7

Information technology systems present potential targets for cyber security attacks.

Our operations are reliant on technology. These systems are used to store and process sensitive information regarding our operations, financial position and any information pertaining to our customers and vendors. While we take the utmost precautions, we cannot guarantee safety from all cyber threats and attacks to our systems. Any successful breach of security could result in the spread of inaccurate or confidential information, disruption of operations, endangerment of employees, damage to our assets and increased costs to respond. Although we maintain cyber liability insurance to protect us financially, there is no assurance that the instances noted above would not have a negative impact on cash flows, litigation status and/or our reputation, which could have a material adverse effect on our business, financial condition and results of operations.

Unfavorable economic or other business conditions could cause us to record an impairment of all or a portion of our goodwill and other intangible assets.

We annually perform an impairment test of the carrying value of goodwill and other indefinite-lived intangible assets in the third quarter using June 30 balances. However, an evaluation may be made whenever events may indicate an impairment has occurred. In assessing whether an impairment has occurred, we consider whether the performance of our reporting units may be below projections, unexpected declines in our market capitalization, negative macroeconomic trends or negative industry and company-specific trends. If we conclude that the carrying values of these assets exceed the fair value, we may be required to record an impairment of these assets. As of December 31, 2016, the balances of our goodwill and other intangible assets were $217.1 million and $10.9 million, respectively. Any substantial impairment that may be required in the future could have a material adverse effect on our results of operations or financial condition.

Failures at financial institutions at which we deposit funds could adversely affect us.

We deposit substantial operating and fiduciary funds, which are third-party funds, in many financial institutions in excess of insured deposit limits. In the event that one or more of these financial institutions fail, there is no guarantee that we could recover the deposited funds in excess of federal deposit insurance, and, as such, we could be held liable for the funds owned by third parties. Under these circumstances, our liability could have a material adverse effect on our results of operations or financial condition.

Our investment portfolio is subject to interest rate and other risks and could experience losses.

We maintain a substantial investment portfolio, primarily consisting of fixed income debt securities and, to a lesser extent, equity securities. Our portfolio holdings are subject to certain economic and financial market risks, including credit and interest rate risk and/or liquidity risk. Instability in credit markets and economic conditions can increase the risk of loss in our portfolio. Periodically, we measure the fair value of the investments against the carrying value. If the carrying value of the investments exceeds the fair value, and we conclude the decline is other-than-temporary, we are required to record an impairment of the investments. The impairment could have a material adverse effect on our results of operations or financial condition.

8

Our business could be disrupted as a result of a threatened proxy contest and other actions of activist stockholders.

We have been, and may be, the subject of actions taken by activist stockholders. In 2016, we entered into settlement agreements with two of our shareholders, Starboard Value LP and Foundation Asset Management, LP, the terms of which are more specifically set forth in those agreements which were filed pursuant to a Form 8-K filing on or about October 17, 2016.

Should activist activities occur, then our business could be adversely affected because we may have difficulty attracting and retaining customers, agents, mortgage lenders, servicers, employees and board members due to perceived uncertainties as to our future direction and negative public statements about our business; such activities may materially harm our relationships with current and potential customers, investors, lenders, and others; may otherwise materially harm our business, may adversely affect our operating results and financial condition; responding to proxy contests and other similar actions by stockholders is likely to result in our incurring substantial additional costs, including, but not limited to, legal fees, fees for financial advisors, fees for investor relations advisors, and proxy solicitation fees; significantly divert the attention of management, our Board of Directors and our employees; and changes in the composition of our Board of Directors due to future activist campaigns may affect the Company's current strategic plan.

We cannot predict, and no assurances can be given as to, the outcome or timing of any matters relating to actions by activist stockholders or the ultimate impact on our business, liquidity, financial condition or results of operations.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We lease under a non-cancelable operating lease expiring in 2019 approximately 187,000 square feet in an office building in Houston, Texas, which is used for our corporate offices and for offices of several of our subsidiaries. In addition, we lease offices at approximately 570 additional locations for title office operations, production, administrative and technology centers. These additional locations include significant leased facilities in Houston, Texas; Glendale, California; Dallas, Texas; New York, New York; Wilmington, Delaware; Tampa, Florida; St. Louis, Missouri; San Diego, California; and Toronto, Canada.

Our leases expire from 2017 through 2026 and have an average term of 4.6 years, although our typical lease term ranges from three to five years. We believe we will not have any difficulty obtaining renewals of leases as they expire or, alternatively, leasing comparable properties. The aggregate annual rent expense under all leases was approximately $41.3 million in 2016.

We also own office buildings in Arizona, Texas, New York, New Mexico, Colorado and the United Kingdom. These owned properties are not material to our consolidated financial condition. We consider all buildings and equipment that we own or lease to be well maintained, adequately insured and generally sufficient for our purposes.

Item 3. Legal Proceedings

See discussion of legal proceedings in Note 18 to the audited consolidated financial statements included in Item 15 of Part IV of this report, which is incorporated by reference into this Part I, Item 3 of this report on Form 10-K for the year ended December 31, 2016.

Item 4. Mine Safety Disclosures

None.

9

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market, Holders and Dividends Information

Our Common Stock is listed on the New York Stock Exchange (NYSE) under the symbol “STC”. The following table sets forth the high and low sales prices of our Common Stock for each fiscal period indicated, as reported by the NYSE.

High | Low | |||||||

2016: | ||||||||

First quarter | $ | 36.99 | $ | 30.34 | ||||

Second quarter | 41.78 | 33.33 | ||||||

Third quarter | 48.60 | 41.06 | ||||||

Fourth quarter | 48.17 | 41.62 | ||||||

2015: | ||||||||

First quarter | $ | 41.83 | $ | 35.12 | ||||

Second quarter | 41.15 | 35.57 | ||||||

Third quarter | 41.74 | 37.25 | ||||||

Fourth quarter | 44.01 | 36.27 | ||||||

As of February 23, 2017, the number of stockholders of record was approximately 5,772 and the price of one share of our Common Stock was $45.32.

During 2016, the Company declared and paid quarterly dividends of $0.30 per share, or a total of $1.20 per share for the year. During 2015, the Company declared and paid dividends of $0.25 per share in the second and third quarters and $0.30 per share in the fourth quarter. Additionally, during 2016, the Company paid $12.0 million in cash to the holders of the Class B Common Stock pursuant to an agreement involving the exchange and subsequent retirement of the Class B Common Stock. Such payment was treated as a dividend for calculating earnings per share (refer to Note 14 to our audited consolidated financial statements).

Book value per share was $27.69 and $27.30 at December 31, 2016 and 2015, respectively. As of December 31, 2016, book value per share was based on approximately $648.8 million in stockholders’ equity and 23,431,279 shares of Common Stock outstanding. As of December 31, 2015, book value per share was based on approximately $637.1 million in stockholders’ equity and 23,341,106 shares of Common Stock and Class B Common Stock outstanding.

Stock Performance Graph

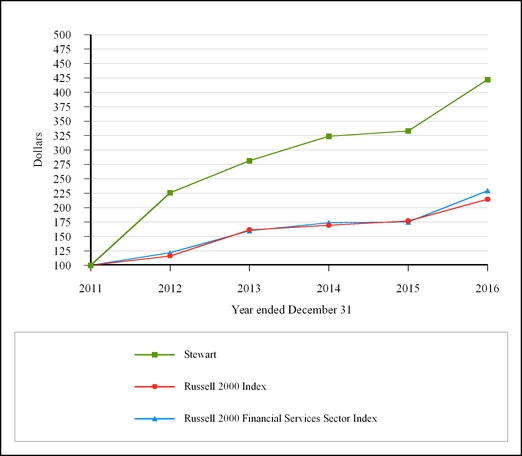

The following graph compares the yearly percentage change in our cumulative total stockholder return on Common Stock with the cumulative total return of the Russell 2000 Index and the Russell 2000 Financial Services Sector Index for the five years ended December 31, 2016. The graph assumes that the value of the investment in our Common Stock and each index was $100 at December 31, 2011 and that all dividends were reinvested.

10

2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||

Stewart | 100.00 | 225.97 | 281.34 | 323.80 | 333.04 | 422.08 | ||||||||||||

Russell 2000 Index | 100.00 | 116.30 | 161.46 | 169.35 | 176.82 | 214.45 | ||||||||||||

Russell 2000 Financial Services Sector Index | 100.00 | 121.65 | 159.85 | 174.01 | 175.05 | 229.41 | ||||||||||||

The performance graph above and the related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Exchange Act, as amended, except to the extent that the Company specifically incorporates it by reference into such filing.

Stock Repurchases

In November 2015, we announced a stock repurchase program which may return up to $50.0 million to stockholders over a three-year period starting in 2016. Under the stock repurchase program, we have the ability to purchase shares of our outstanding Common Stock in both open market and privately negotiated transactions as we deem appropriate. The timing, form and amount of share repurchases under the program will depend on a variety of factors including: market conditions, share price, our capital and liquidity position relative to internal and rating agency targets, legal requirements (including approval of the release of cash from Guaranty by the insurance regulators) and corporate and other considerations. There were no stock repurchases during 2016, except for repurchases of approximately 22,800 shares (aggregate purchase price of approximately $1.1 million) related to statutory income tax withholding on the vesting of restricted share grants to executives and senior management. The repurchases related to statutory tax withholding on vesting of shares are not included in the above stock repurchase program.

11

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data, which were derived from our consolidated financial statements and should be read in conjunction with our audited consolidated financial statements, including the Notes thereto, beginning on page F-1 of this report. See also Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||

($ millions, except share and per share data) | |||||||||||||||

Total revenues | 2,006.6 | 2,033.9 | 1,870.8 | 1,928.0 | 1,910.4 | ||||||||||

Title operating revenues | 1,904.1 | 1,888.4 | 1,714.4 | 1,810.0 | 1,745.5 | ||||||||||

Ancillary services revenues | 84.3 | 130.0 | 132.9 | 103.5 | 143.5 | ||||||||||

Investment income | 18.9 | 16.9 | 16.8 | 15.5 | 13.8 | ||||||||||

Investment and other (losses) gains | (0.7 | ) | (1.4 | ) | 6.7 | (1.1 | ) | 7.6 | |||||||

Title loss provisions | 91.1 | 106.3 | 81.3 | 106.3 | 140.0 | ||||||||||

% title operating revenues | 4.8 | 5.6 | 4.7 | 5.9 | 8.1 | ||||||||||

Pretax income(1) | 88.0 | 9.7 | 51.8 | 101.1 | 89.3 | ||||||||||

Net income (loss) attributable to Stewart | 55.5 | (6.2 | ) | 29.8 | 63.0 | 109.2 | |||||||||

Cash provided by operations | 123.0 | 80.5 | 64.0 | 87.1 | 120.5 | ||||||||||

Total assets | 1,341.7 | 1,321.6 | 1,392.5 | 1,326.1 | 1,291.2 | ||||||||||

Notes payable and convertible senior notes | 106.8 | 102.4 | 71.2 | 39.5 | 71.2 | ||||||||||

Stockholders’ equity | 648.8 | 637.1 | 700.5 | 663.1 | 580.4 | ||||||||||

Per share data: | |||||||||||||||

Average shares – dilutive (millions) | 23.5 | 23.5 | 24.7 | 24.7 | 24.4 | ||||||||||

Basic earnings (loss) attributable to Stewart | 1.86 | (0.26 | ) | 1.31 | 2.85 | 5.66 | |||||||||

Diluted earnings (loss) attributable to Stewart | 1.85 | (0.26 | ) | 1.24 | 2.60 | 4.61 | |||||||||

Cash dividends | 1.20 | 0.80 | 0.10 | 0.10 | 0.10 | ||||||||||

Stockholders’ equity | 27.69 | 27.30 | 29.18 | 29.47 | 29.91 | ||||||||||

Market price: | |||||||||||||||

High | 48.60 | 44.01 | 37.87 | 34.39 | 28.35 | ||||||||||

Low | 30.34 | 35.12 | 27.02 | 22.74 | 11.54 | ||||||||||

Year end | 46.08 | 37.33 | 37.04 | 32.27 | 26.00 | ||||||||||

(1) Pretax income figures are before noncontrolling interests.

12

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

MANAGEMENT’S OVERVIEW

We reported net income attributable to Stewart of $16.7 million ($0.71 per diluted share) for the fourth quarter 2016 compared to net income attributable to Stewart of $2.6 million ($0.11 per diluted share) for the fourth quarter 2015. Pretax income before noncontrolling interests for the fourth quarter 2016 was $23.0 million compared to pretax income before noncontrolling interests of $3.1 million for the fourth quarter 2015.

Fourth quarter 2016 results were influenced by:

• | $5.4 million of net realized losses, $4.9 million of which were in the ancillary services and corporate segment and $0.5 million in the title segment, and |

• | $2.4 million of income tax benefits related to previously unrecognized tax credits. |

Fourth quarter 2015 results were influenced by:

• | $2.1 million of net realized losses, $1.4 million of which were in the title segment and $0.7 million in the ancillary services and corporate segment, |

• | $2.7 million of depreciation, severance and goodwill impairment charges related to the exit of the delinquent loan servicing operations and $1.7 million of cost management program charges recorded in the ancillary services and corporate segment, |

• | $0.8 million of severance charges recorded in the title segment, and |

• | $2.2 million of income tax benefits, primarily from utilization of state tax loss carryforwards. |

Our title segment revenues, which include revenues from our centralized title services, were $511.6 million for the fourth quarter 2016, an increase of 8.2% from the fourth quarter 2015 and a decline of 3.4% from the third quarter 2016. In the fourth quarter 2016, the title segment generated pretax income of $38.1 million, a 7.4% margin, compared to the fourth quarter 2015 pretax income of $23.1 million, a 4.9% margin, and the third quarter 2016 pretax income of $50.3 million, a 9.5% margin. As mentioned above, the segment’s fourth quarter 2016 pretax income included $0.5 million of net realized losses, composed primarily of $1.7 million additional contingent consideration expense related to a prior successful acquisition, offset by net gains on sale of investments in securities available-for-sale and other assets. The fourth quarter 2015 segment results included $1.4 million of net realized losses (composed primarily of $3.7 million of asset impairment charges, offset by net gains on sale of investments in securities available-for-sale and other assets) and $0.8 million of severance costs.

Non-commercial domestic revenue includes revenues from purchase transactions and centralized title operations. Revenues from purchase transactions increased 6.9%, while centralized revenues declined 14.9% due primarily to decreased default-related title transactions, partially offset by higher refinancing transactions. Total international revenues increased 8.8% in the fourth quarter 2016 compared to the prior year quarter due to volume growth on a local currency basis, primarily from our Canada operations, partially offset by the weakening of the British pound against the U.S. dollar. Revenues from independent agency operations in the fourth quarter 2016 increased 11.3% compared to the fourth quarter 2015, but declined 1.7% sequentially compared to the third quarter 2016. The independent agency remittance rate was 18.2% in the fourth quarter 2016 compared to 19.0% and 18.0% in the fourth quarter 2015 and the third quarter 2016, respectively. As a result, revenues from independent agencies, net of retention, increased 6.3% from the prior year quarter, and declined approximately 1% sequentially from the third quarter 2016. The average independent agency remittance rate for the full year 2016 was 18.2%, essentially unchanged from 18.3% in 2015.

Operating revenues generated by our ancillary services and corporate segment declined to $19.1 million in the fourth quarter 2016 from $25.2 million in the fourth quarter 2015, primarily due to our exit of the delinquent loan servicing operations completed in the first quarter 2016. Sequentially, operating revenues decreased from $22.2 million in the third quarter 2016, primarily due to revenue declines in our search and valuation services operations. The segment reported a pretax loss of $15.1 million in the fourth quarter 2016 as compared with pretax losses of $19.9 million and $11.5 million in the fourth quarter 2015 and third quarter 2016, respectively.

13

As mentioned above, the fourth quarter 2016 segment pretax loss included $4.9 million of net realized losses, composed primarily of $3.3 million of realized losses on the sale of assets related to the loan file review and audit and government services lines of business and $1.6 million of early lease termination costs. Fourth quarter 2015 segment results included $0.7 million of net realized losses (primarily resulting from $1.0 million of early lease termination charges), $2.7 million of depreciation, severance and goodwill impairment charges related to the exit of the delinquent loan servicing operations and $1.7 million of cost management program charges. The third quarter 2016 pretax loss for the segment included $1.2 million of costs relating to shareholder activism offset by a $1.2 million realized gain on a cost-basis investment transaction.

CRITICAL ACCOUNTING ESTIMATES

Actual results can differ from our accounting estimates. While we do not anticipate significant changes in our estimates, there is a risk that such changes could have a material impact on our consolidated financial condition or results of operations for future periods.

Title loss reserves

Our most critical accounting estimate is providing for title loss reserves.

Provisions for title losses, as a percentage of title operating revenues, were 4.8%, 5.6% and 4.7% for the years ended December 31, 2016, 2015 and 2014, respectively. Actual loss payment experience, including the impact of large losses, is the primary reason for increases or decreases in our loss provision. A change of 100 basis points in the loss provisioning percentage, a reasonably likely scenario based on our historical loss experience, would have increased or decreased our provision for title losses and pretax operating results by approximately $19.0 million for the year ended December 31, 2016.

2016 | 2015 | 2014 | |||||||

($ in millions) | |||||||||

Provisions – Known Claims: | |||||||||

Current year | 20.6 | 14.1 | 18.4 | ||||||

Prior policy years | 64.8 | 81.0 | 48.3 | ||||||

85.4 | 95.1 | 66.7 | |||||||

Provisions – IBNR | |||||||||

Current year | 52.0 | 54.0 | 46.2 | ||||||

Prior policy years-bulk reserves | — | — | 10.7 | ||||||

Prior policy years | 18.5 | 38.2 | 6.0 | ||||||

70.5 | 92.2 | 62.9 | |||||||

Transferred IBNR to Known Claims | (64.8 | ) | (81.0 | ) | (48.3 | ) | |||

Total provisions | 91.1 | 106.3 | 81.3 | ||||||

Provisions for known claims relate primarily to prior policy years as claims are not typically reported until several years after policies are issued. Provisions - Incurred But Not Reported (IBNR) are estimates of claims expected to be incurred over the next 20 years and are subject to considerable judgment in their determination; therefore, it is not unusual or unexpected to experience adjustments to the provisions for both current and prior policy years as additional loss experience on policy years is obtained subsequent to the year of issuance. This loss experience may result in changes to our estimate of total ultimate losses expected (i.e., the IBNR policy loss reserve). Current year provisions - IBNR are recorded on policies issued in the current year as a percentage of premiums realized (provisioning rate). As claims become known, provisions are reclassified from IBNR to known claims. Adjustments relating to large claims (those individually in excess of $1.0 million) may impact provisions either for known claims or for IBNR.

14

In 2016, total known claims provisions decreased to $85.4 million from $95.1 million in 2015, primarily as a result of relatively lower dollar amount of claims reported to us during the year relating to policies issued in previous years. Current year provisions - IBNR decreased in 2016 by $2.0 million to $52.0 million compared to 2015, and increased in 2015 by $7.8 million to $54.0 million compared to 2014 principally due to the decrease and increase, respectively, of our provisioning rate for those years. As a percentage of title operating revenues, provisions - IBNR (current year) was 2.7%, 2.9% and 2.7% in 2016, 2015 and 2014, respectively. Provisions - IBNR relating to prior policy years decreased in 2016 as compared to 2015 mainly due to the losses experienced in 2015 relating to certain older policy years with higher than normal claims. In 2016, changes in the estimated aggregate loss associated with large claims resulted in a decrease to expense of $3.1 million compared with a $22.1 million increase in 2015 and an $8.0 million decrease in 2014.

In addition to title policy claims, we incur losses in our direct operations from escrow, closing and disbursement functions. These escrow losses typically relate to errors or other miscalculations of amounts to be paid at closing, including timing or amount of a mortgage payoff, payment of property or other taxes and payment of homeowners’ association fees. Escrow losses also arise in cases of mortgage fraud, and in those cases the title insurer incurs the loss under its obligation to ensure that an unencumbered title is conveyed. Escrow losses are recognized as expense when discovered or when contingencies associated with them (such as litigation) are resolved and are typically paid less than 12 months after the loss is recognized. For the years ended December 31, 2016 and 2015, we accrued approximately $3.3 million and $1.0 million, respectively, for policy loss reserves relating to legacy escrow losses arising principally from mortgage fraud.

We consider our actual claims payments and incurred loss experience, including consideration of the frequency and severity of claims compared to our actuarial estimates of claims payments and incurred losses in determining whether our overall loss experience has improved or worsened compared to prior periods. We also consider the impact of economic or market factors on particular policy years to determine whether the results of those policy years are indicative of future expectations. In addition, we evaluate the frequency and severity of large losses in determining whether our experience has improved or worsened. Our method for recording the reserves for title losses on both an interim and annual basis begins with the calculation of our current loss provision rate which is applied to our current premium revenues, resulting in a title loss expense for the period. This loss provision rate is set to provide for losses on current year policies and is determined using moving average ratios of recent actual policy loss payment experience (net of recoveries) to premium revenues.

At each quarter end, our recorded reserve for title losses begins with the prior period’s reserve balance for claim losses, adds the current period provision to that balance and subtracts actual paid claims, resulting in an amount that our management compares to its actuarially-based calculation of the ending reserve balance necessary to provide for future title losses. The actuarially-based calculation is a paid loss experience calculation where loss experience factors are selected based on company data and input from our third-party actuaries. We also obtain input from third-party actuaries in the form of a reserve analysis utilizing generally accepted actuarial methods. While we are responsible for determining our loss reserves, we utilize this actuarial input to assess the overall reasonableness of our reserve estimation. If our recorded reserve amount is not at the actuary’s point estimate but is within a reasonable range (+5.0%/-4.0%) of our actuarially-based reserve calculation and the actuary’s point estimate, our management assesses the major factors contributing to the different reserve estimates in order to determine the overall reasonableness of our recorded reserve, as well as the position of the recorded reserves relative to the point estimate and the estimated range of reserves. The major factors considered can change from period to period and include items such as current trends in the real estate industry (which management can assess although there is a time lag in the development of this data for use by the actuary), the size and types of claims reported and changes in our claims management process. If the recorded amount is not within a reasonable range of our third-party actuary’s point estimate, we will adjust the recorded reserves in the current period and reassess the provision rate on a prospective basis. Once our reserve for title losses is recorded, it is reduced in future periods as a result of claims payments and may be increased or reduced by revisions to our estimate of the overall level of required reserves.

15

Large claims, including large title losses due to independent agency defalcations, are analyzed and reserved for separately due to the potential higher dollar amount of loss, lower volume of claims reported and sporadic reporting of such claims. Large title losses due to independent agency defalcations typically occur when the independent agency misappropriates funds from escrow accounts under its control. Such losses are usually discovered when the independent agency fails to pay off an outstanding mortgage loan at closing (or immediately thereafter) from the proceeds of the new loan. Once the previous lender determines that its loan has not been paid off timely, it will file a claim against the title insurer. It is at this point that the title insurance underwriter is alerted to the potential theft and begins its investigation. As an industry practice, these claims are considered a claim on the newly issued title insurance policy since such policy insures the holder (in this case, the new lender) that all previous liens on the property have been satisfied. Accordingly, these claim payments are charged to policy loss expense. These incurred losses are typically more severe in terms of dollar value compared with traditional title policy claims since the independent agency is often able, over time, to conceal misappropriation of escrow funds relating to more than one transaction through the constant volume of funds moving through its escrow accounts. As long as new funds continue to flow into escrow accounts, an independent agency can mask one or more defalcations. In declining real estate markets, lower transaction volumes result in a lower incoming volume of funds, making it more difficult to cover up the misappropriation with incoming funds. Thus, when the defalcation is discovered, it often relates to several transactions. In addition, the overall decline in an independent agency’s revenues, profits and cash flows increases the agency’s incentive to improperly utilize the escrow funds from real estate transactions.

Internal controls relating to independent agencies include, but are not limited to, periodic audits, site visits and reconciliations of policy inventories and premiums. The audits and site visits cover examination of the escrow account bank reconciliations and an examination of a sample of closed transactions. In some instances, the scope of our review is limited by attorney agencies that cite client confidentiality. Certain states have mandated annual reviews of all agencies by their underwriter. We also determine whether our independent agencies have appropriate internal controls as defined by the American Land Title Association's best practices and us. However, even with adequate internal controls in place, their effectiveness can be circumvented by collusion or improper override of the controls by management at the independent agencies. To aid in the selection of independent agencies to review, we have developed an agency risk model that aggregates data from different areas to identify possible problems. This is not a guarantee that all independent agencies with deficiencies will be identified. In addition, we are typically not the only underwriter for which an independent agency issues policies, and independent agencies may not always provide complete financial records for our review. Due to improved agency internal controls as well as better overall economic conditions, we did not experience any significant agency defalcation losses during the three years ended December 31, 2016.

Due to the inherent uncertainty in predicting future title policy losses, significant judgment is required by both our management and our third party actuaries in estimating reserves. As a consequence, our ultimate liability may be materially greater or less than current reserves and/or our third party actuary’s calculated estimate.

Agency revenues

We recognize revenues on title insurance policies written by independent agencies (agencies) when the policies are reported to us. In addition, where reasonable estimates can be made, we accrue for revenues on policies issued but not reported until after period end. We believe that reasonable estimates can be made when recent and consistent policy issuance information is available. Our estimates are based on historical reporting patterns and other information about our agencies. We also consider current trends in our direct operations and in the title industry. In this accrual, we are not estimating future transactions; we are estimating revenues on policies that have already been issued by agencies but not yet reported to or received by us. We have consistently followed the same basic method of estimating unreported policy revenues for more than 10 years.

Our accruals for revenues on unreported policies from agencies were not material to our consolidated assets or stockholders’ equity as of December 31, 2016 and 2015. The differences between the amounts our agencies have subsequently reported to us compared to our estimated accruals are substantially offset by any differences arising from prior years’ accruals and have been immaterial to consolidated assets and stockholders’ equity during each of the three prior years. We believe our process provides the most reliable estimate of the unreported revenues on policies and appropriately reflects the trends in agency policy activity.

16

Goodwill and other long-lived assets

Goodwill is not amortized, but is reviewed annually during the third quarter using June 30 balances, or whenever occurrences of events indicate a potential impairment at the reporting unit level. We have an option to assess qualitative factors to determine whether it is more-likely-than-not that the fair value of a reporting unit is less than its carrying amount. If we decide not to use a qualitative assessment or if the reporting unit fails the qualitative assessment, then we perform a two-step quantitative analysis.

The step one analysis is performed, using a combination of the income approach (discounted cash flow (DCF) technique) and the market approach (guideline company and precedent transaction analyses), to determine if the carrying value of the goodwill exceeds its fair value, which would indicate a potential impairment. The DCF model utilizes historical and projected operating results and cash flows, initially driven by estimates of changes in future revenue levels, and risk-adjusted discount rates. Our projected operating results are primarily driven by anticipated mortgage originations, which we obtain from projections by industry experts, for our title reporting units and forecasted contractual revenues for our ancillary services reporting unit. Fluctuations in revenues, followed by our ability to appropriately adjust our employee count and other operating expenses, or large and unanticipated adjustments to title loss reserves, are the primary reasons for increases or decreases in our projected operating results. Our market-based valuation methodologies utilize (i) market multiples of earnings and/or other operating metrics of comparable companies and (ii) our market capitalization and a control premium based on market data and factors specific to our ownership and corporate governance structure. If we determine that the carrying value of the reporting unit's goodwill is greater than its fair value, we then perform the step two analysis to determine the implied fair value of the goodwill and calculate the amount of impairment.

In performing the step two analysis, the implied fair value of goodwill is determined in the same manner as the amount of goodwill recognized in a business combination. In this method, the estimated fair value of the reporting unit is allocated to all the assets and liabilities of that reporting unit (including any unrecognized intangible assets) as if the reporting unit had been acquired in a business combination and the estimated fair value is the purchase price paid. Any impairment of goodwill is treated as the difference between the implied fair value and the carrying amount of the goodwill and is charged to current operations.

While we are responsible for assessing whether an impairment of goodwill exists, we utilize inputs from third-party appraisers in performing the quantitative analysis for our impairment review. We evaluate goodwill based on four reporting units with goodwill balances (direct operations, agency operations, international operations and ancillary services). Goodwill is assigned to these reporting units at the time the goodwill is initially recorded. Once assigned to a reporting unit, the goodwill is pooled and no longer attributable to a specific acquisition. All activities within a reporting unit are available to support the carrying value of the goodwill. When a business component within a reporting unit is disposed, goodwill is allocated to the component based on the ratio of the component's fair value over the total fair value of the reporting unit.

In 2016, we performed a quantitative assessment for each of our reporting units to determine whether it was more likely than not that the fair value of each reporting unit was less than its carrying amount, including goodwill. Based on our analysis, management concluded that the goodwill related to each reporting unit was not impaired.

In 2015, we utilized the qualitative assessment option for the title reporting units and concluded that the goodwill related to the title reporting units was not impaired. Further, in 2015, based on our decision to exit the delinquent loan servicing activities included within the ancillary services reporting unit, we performed a two-step quantitative assessment of ancillary services' goodwill. Based on the impairment analysis, we recorded a $35.7 million impairment of goodwill for 2015, which was presented as impairment of goodwill in the 2015 consolidated statement of operations and comprehensive income (loss). As a result of realigning our reportable segments in 2016, we reclassified $1.6 million of the total goodwill impairment to the title segment (refer to Notes 8 and 19 for details).

17

We also evaluate the carrying values of title plants, other intangible assets and other long-lived assets when events occur that may indicate impairment. The process of determining impairment for such assets involves determining whether the carrying amount of the asset is recoverable using the undiscounted cash flows expected from the use and eventual disposition of the asset. If the carrying amount is determined not to be recoverable, we estimate the fair value of the asset using projections of future cash flows, operating results, discount rates and overall market conditions. Any excess of the carrying amount over the fair value is considered as an impairment of the asset. Uncertainties exist in these projections and they are subject to changes relating to factors such as interest rates and overall real estate and financial market conditions, our market capitalization and overall stock market performance. Actual market conditions and operating results may vary materially from our projections. In 2015 and 2014, as a result of our impairment analysis on our other intangible assets, we recorded impairment charges of $1.8 million and $1.7 million, respectively. No impairment loss was recognized during 2016.

Operations. As discussed in Note 19 to the audited consolidated financial statements, we changed our reportable operating segments to title insurance and related services (title) and ancillary services and corporate effective in the first quarter 2016. Our primary business is title insurance and settlement-related services. We close transactions and issue title policies on homes, commercial and other real properties located in all 50 states, the District of Columbia and international markets through policy-issuing offices, agencies and centralized title services centers. Our ancillary services and corporate segment includes our parent holding company expenses and certain enterprise-wide overhead costs, along with our remaining ancillary services operations, principally appraisal and valuation services.

Factors affecting revenues. The principal factors that contribute to changes in operating revenues for our title and ancillary services and corporate segments include:

• | mortgage interest rates; |

• | availability of mortgage loans; |

• | number and average value of mortgage loan originations; |

• | ability of potential purchasers to qualify for loans; |

• | inventory of existing homes available for sale; |

• | ratio of purchase transactions compared with refinance transactions; |

• | ratio of closed orders to open orders; |

• | home prices; |

• | consumer confidence, including employment trends; |

• | demand by buyers; |

• | number of households; |

• | premium rates; |

• | foreign currency exchange rates; |

• | market share; |

• | ability to attract and retain highly productive sales associates; |

• | independent agency remittance rates; |

• | opening of new offices and acquisitions; |

• | number of commercial transactions, which typically yield higher premiums; |

• | government or regulatory initiatives, including tax incentives and the implementation of the new integrated disclosure requirements; |

• | acquisitions or divestitures of businesses; |

• | volume of distressed property transactions; and |

• | seasonality and/or weather. |

Premiums are determined in part by the values of the transactions we handle. To the extent inflation or market conditions cause increases in the prices of homes and other real estate, premium revenues are also increased. Conversely, falling home prices cause premium revenues to decline. As an overall guideline, a 5% increase in median home prices results in an approximate 3.5% increase in title premiums. Home price changes may override the seasonal nature of the title insurance business. Historically, our first quarter is the least active in terms of title insurance revenues as home buying is generally depressed during winter months. Our second and third quarters are the most active as the summer is the traditional home buying season, and while commercial transaction closings are skewed to the end of the year, individually large commercial transactions can occur any time of year.

18

Industry data. Published mortgage interest rates and other selected residential housing data for the years ended December 31, 2016, 2015 and 2014 follow (amounts shown for 2016 are preliminary and subject to revision). The amounts below may not relate directly to or provide accurate data for forecasting our operating revenues or order counts.

Our statements on home sales, mortgage interest rates and loan activity are based on published industry data from sources including Fannie Mae, the National Association of Realtors®, the Mortgage Bankers Association and Freddie Mac.

2016 | 2015 | 2014 | |||||||

Mortgage interest rates (30-year, fixed-rate) – % | |||||||||

Averages for the year | 3.65 | 3.85 | 4.17 | ||||||

First quarter | 3.74 | 3.73 | 4.36 | ||||||

Second quarter | 3.59 | 3.83 | 4.23 | ||||||

Third quarter | 3.45 | 3.95 | 4.14 | ||||||

Fourth quarter | 3.81 | 3.90 | 3.97 | ||||||

Mortgage originations – $ billions | 1,940 | 1,730 | 1,301 | ||||||

Refinancings – % of originations | 47.5 | 46.7 | 39.8 | ||||||

New home sales – in $ millions | 0.56 | 0.50 | 0.44 | ||||||