Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Education Realty Trust, Inc. | a8-knareitpresentation.htm |

UNIVERSITY OF KENTUCKY WOODLAND GLEN –

EMBEDDED GROWTH BEST IN CLASS PORTFOLIO STABLE AND PREDICTABLE STUDENT HOUSING MARKET PROVEN GROWTH HISTORY MARKET VALUATION CAPITAL MANAGEMENT Key Themes 2

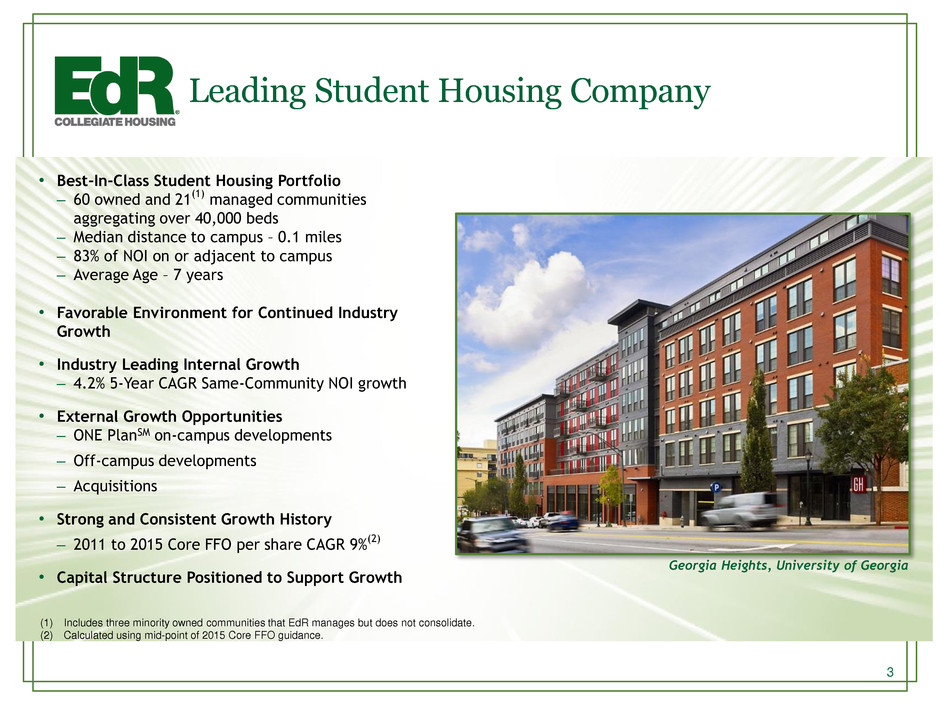

Leading Student Housing Company 3 • Best-In-Class Student Housing Portfolio – 60 owned and 21 (1) managed communities aggregating over 40,000 beds – Median distance to campus – 0.1 miles – 83% of NOI on or adjacent to campus – Average Age – 7 years • Favorable Environment for Continued Industry Growth • Industry Leading Internal Growth – 4.2% 5-Year CAGR Same-Community NOI growth • External Growth Opportunities – ONE PlanSM on-campus developments – Off-campus developments – Acquisitions • Strong and Consistent Growth History – 2011 to 2015 Core FFO per share CAGR 9% (2) • Capital Structure Positioned to Support Growth (1) Includes three minority owned communities that EdR manages but does not consolidate. (2) Calculated using mid-point of 2015 Core FFO guidance. Georgia Heights, University of Georgia

4 Best-In-Class Portfolio $830m ACQUISITIONS $720m DEVELOPMENTS $378m DISPOSITIONS September 30, 2015 (1) • $2.7 Billion Enterprise Value • 29% Debt to Gross Assets • 60 Communities • 30,761 Beds January 1, 2010 • $654 Million Enterprise Value • 43% Debt to Gross Assets • 40 Communities • 25,454 Beds Portfolio Transformation 1.8 miles 0.1 miles Sold Developments / Acquisitions Average Distance to Campus 21,382 27,834 Sold Developments / Acquisitions Average Enrollment $345 $812 Sold Developments / Acquisitions Average Rental Rate (1) Proforma for November 2, 2015 equity raise. Enterprise value is based on 56.4 million shares and share price of $36.20 on November 2, 2015.

5 Best-In-Class Portfolio Owned communities 60 University markets 38 Beds 30,761 Median distance to campus 0.1 miles Average distance to campus 0.4 miles % of NOI on or pedestrian to campus 83% % NOI on campus 28% Average full-time enrollment (2) 27,480 Average Rental Rate $726 Average age 7 years Portfolio Snapshot as of September 30, 2015 (1) (1) Includes only open and operating communities. (2) Based on 2014 full-time enrollment data.

• Best risk-adjusted return • Universities more accepting – Speed of completion – Reduced development and operating costs – Other demands on institutional funds – Modernization of on-campus housing • Significant competitive advantages – Proven on-campus development and management expertise – Well-capitalized balance sheet – Size and depth of resources – Public company transparency – Long-term owner of assets Best-In-Class Portfolio 28% of EdR’s 2015 forecasted NOI is from ONE Plan assets. Note: P3 means Public-Private Partnership (1) Based on average economic yield of 7.25% and cap rate of 5.0% (2) Current and announced ONE Plan investments 6 $26 $81 $111 $204 $342 $443 $527 2010 2011 2012 2013 2014 2015 2016 2017 ONE Plan investments Market Value(1) $969 Year-End Cumulative Cost in Millions (2) $668 CAGR-59% ONE PlanSM – On-Campus Assets

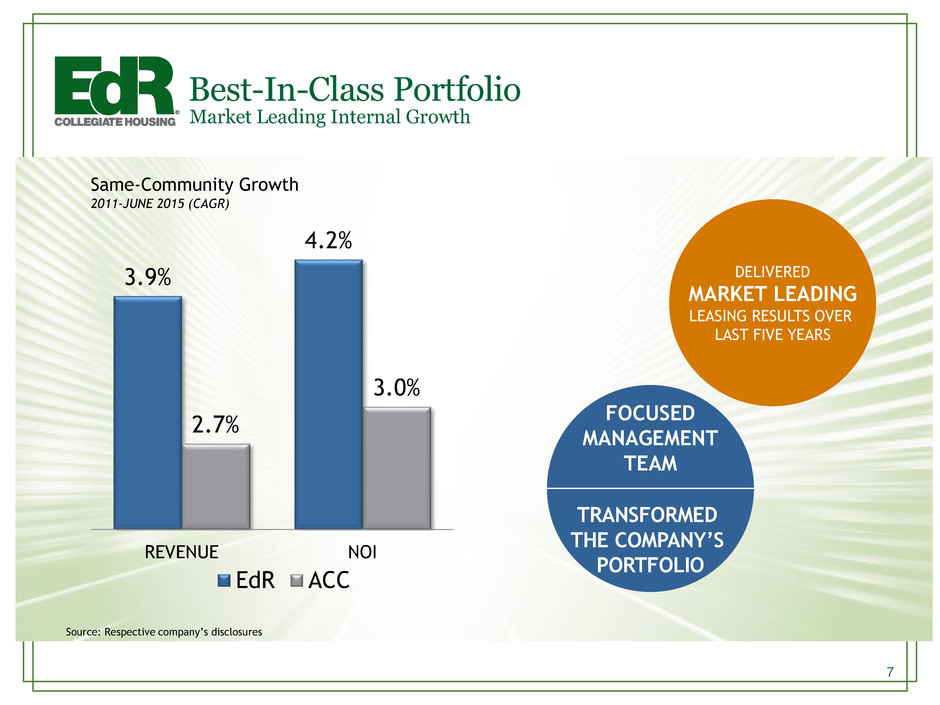

7 Market Leading Internal Growth Best-In-Class Portfolio Source: Respective company’s disclosures 3.9% 4.2% 2.7% 3.0% REVENUE NOI EdR ACC Same-Community Growth 2011-JUNE 2015 (CAGR) DELIVERED MARKET LEADING LEASING RESULTS OVER LAST FIVE YEARS FOCUSED MANAGEMENT TEAM TRANSFORMED THE COMPANY’S PORTFOLIO

1.7% 1.1% 1.2% 1.4% 1.4% 1.4% 1.2% 1.4% 1.1% 2014 2015 2016 2017 2018 2019 2020 2021 2022 Stable & Predictable Student Housing Market 8 • Favorable enrollment trends – +1.2% projected average annual full-time enrollment growth through 2022 • Higher education earnings gap – Millennials with only a high school diploma earn 62% of what the typical college graduate earns – Earnings gap between young adults with and without a bachelor’s degree has stretched to its widest level in nearly a half century • Modernization is in full swing – New student housing supply is replacing and modernizing older assets • 2016 supply growth in EdR markets expected to slow 20% Sources: Pew Research - Social & Demographic Trends: The Rising Cost of Not Going to College, February 11, 2014, National Center for Education Statistics (NCES) report titled “Projections of Education Statistics to 2022, Forty-first edition (Feb. 2014)”, the U.S. Bureau of Labor Statistics, AXIOMetrics and local market data $90,220 $67,600 $55,432 $40,820 $37,804 $33,904 $24,492 Professional Degree Master's Bachelor's Associate's Some Colleg , no Degree High School Less than High School Projected Full-Time Enrollment Growth Median Income by Education Level Projected Average % Growth 2014-2022 = 1.2% Key Market Drivers

EdR Market and Same-Community Revenue Growth Stable and Predictable Student Housing Market *Enrollment projection represents the 3-year enrollment CAGR through 2014 for our markets. 9 1.4% 2.2% 4.0% 2014 1.5% 2.0% 3.8% 2015* 2016* 1.5% EdR Market Growth and Same-Community Fall Leasing Revenue Growth Enrollment Growth Supply Growth EdR Same-Community Fall Leasing Revenue Growth New supply expected to slow 20% from 2015 to 2016 Housing Mix - EdR Markets Other Housing 47% On-Campus Housing 27% Off-campus Purpose Built Student Housing 26% 1.8%

Stable and Predictable Student Housing Market 10 Consistent and Strong Revenue Growth Compared to Multi-Family Student Housing Apartment 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Sa m e St o re R ev en u e Gro w th , y /y 8% 6% 4% 2% 0% ‐2% ‐4% ‐6% Source: SNL Financial and Goldman Sachs Global Investment Research Student Housing - 44 consecutive quarters with same store revenue growth. 3.4% Average 3.1% Average

Stable and Predictable Student Housing Market 11 • Enrollment trends are favorable. • New supply is manageable. • Modernization is in full swing. • Strong opening leasing for 2015-2016 lease term. Moving Forward Conclusion University of Kentucky

$51 $59 $68 $88 $114 2010 2011 2012 2013 2014 $33 $48 $63 $80 2011 2012 2013 2014 Core FFO $1.29 $1.41 $1.65 $1.86 $1,144 $1,500 $1,815 $2,022 2011 2012 2013 2014 Sources: Company’s respective annual and quarterly filings and National Center for Education Statistics (NCES) report titled “Projections of Education Statistics to 2022, Forty-first edition (Feb. 2014)” Note: Percentages in white represent annual growth rates. 12 Historical Core FFO Historical Gross Assets Historical NOI & NOI Margin NOI NOI Margin Drivers of Stable Growth • Favorable enrollment trends: +1.2% average annual full-time enrollment growth through 2022 • Well located assets and moderating supply growth • Strong community management teams and systems • Disciplined cost controls resulting in consistent NOI margins since 2011 • Meaningful external growth through development and acquisitions in millions in millions, except per share amounts in millions 28% 31% 21% 11% 27% 45% 27% 31% Proven Growth Strong and Consistent Growth Core FFO per share 22% CAGR 13% CAGR 23% CAGR 51.4% 53.7% 51.8% 52.3% 55.1% 16% 15% 29% 30%

Proven Growth EdR’s Share of Cost(1) (in millions) Market Value(2) (in millions) First Year Occupancy Second Year Occupancy First-Year Economic Yield Incremental NAV (4) 2015 Deliveries $180 $251 94.1% N / A 7% - 7.25%(3) $0.87 2014 Deliveries $257 $437 94.4% 95.0% 7.7% $1.64 2013 Deliveries $192 $271 92.4% 98.9% 7.4% $0.98 2012 Deliveries $91 $156 96.7% 99.3% 9.1% $1.03 Total / Weighted Average $720 $1,115 94.1% 97.1% 7.9% $4.52 13 (1) Represents majority owned and consolidated assets. While most developments were delivered below original budgeted costs, all projects were within 2% of original budget. (2) Based on first year economic yield as presented and cap rates of 5.0% for on-campus and 5.5% for off-campus developments. (3) Represents expected first-year economic yield (4) Assumes new developments funded with 35% debt and equity raised using September 30, 2015 share price of $32.95 and a base of 48.4 million shares at September 30, 2015. EdR developments have opened with average first year occupancy of 94.1% and first-year economic yields above 7% Successful Delivery of Developments

Embedded External Growth Recently Completed 2015 Deliveries $208mm 2016 – 2017 deliveries $299mm Median distance to campus(1) 0.1 miles Average distance to campus(1) 0.4 miles Average full-time enrollment(1) 23,068 Average rental rate(1) $867 Average development yields(1) 7.0% - 7.25% Recently Delivered and Active Developments 14 2015 – 2017 TRANSACTIONS WILL INCREASE COLLEGIATE HOUSING ASSETS BY 32% (1) The statistics presented include only our consolidated communities recently completed and under development. Average rate does not reflect the 2016-2017 deliveries as rates for these developments have not been finalized. 64% OF DEVELOPMENTS ARE ON-CAMPUS

15 Announced Developments Embedded External Growth University Property 2014 Enrollment Beds EdR’s Share of Cost (In Millions) Distance to Campus (miles) University of Kentucky Limestone Park I & II 26,226 1,141 84 On-Campus University of Mississippi The Retreat – Phase II 16,830 350 26 0.8 Virginia Tech Retreat at Blacksburg - Phase I 28,504 622 36 0.8 2016 - Total/Weighted Average 24,447 2,113 $ 146 0.4 University of Kentucky University Flats 26,226 771 74 On-Campus University of Kentucky Honors College 26,226 350 27 On-Campus Boise State University TBD 13,038 656 40 On-Campus Virginia Tech Retreat at Blacksburg – Phase II 28,504 207 12 0.8 2017 - Total/Weighted Average 23,499 1,984 $ 153 0.2 Total/Weighted Average 23,973 4,097 $ 299 0.3

Embedded External Growth 16 Development Funding $146 Property Sales / Capital Markets $0 $50 $100 $150 $200 $250 $300 $350 $57 – Already Funded Note: Announced Developments of $299 million and amount already funded of $57 million are as of September 30, 2015. (1) Assumed 35% debt to fund remaining development spend (2) 2014 dispositions had an average cap rate of 6.2%. Sources of Funding Announced Developments in Millions Proven History of Asset Sales/Recycling in Millions $378 $0 $100 $200 $300 $400 2014 Since 2010 $139 (2) $48 – Operating Cash $48 – Debt (1)

Embedded External Growth Development Year EdR’s Share of Cost(1) (in millions) Market Value(2) (in millions) Additional AV Creation (in millions) Incremental NAV per Share(3) Recently Completed 2015 Deliveries $180 $251 $71 $0.87 2016 Deliveries $146 $204 $58 $0.72 2017 Deliveries $153 $220 $67 $1.02 Total Active Developments $299 $424 $125 $1.74 Including Recently Delivered $2.61 17 (1) Represents majority owned and consolidated assets. (2) Based on a 7.25% average project yield and cap rates of 5.0% for on-campus and 5.5% for off-campus developments. (3) Assumes new developments funded with 35% debt and equity raised using , September 30, 2015 share price of $32.95 and a base of 48.4 million shares at September 30, 2015. (4) Based on average sell-side analyst estimates of NAV. EdR’s development pipeline creates incremental NAV as project yields are higher than current market cap rates. Value Creation of Developments 7.0% of Current NAV(4) 42% Value Creation

$60 $34 $24 $38 $55 $21 $65 $123 $250 2016 2017 2018 2019 2020 2021 2022 2023 2024 Construction Loans - Variable Rate Mortgage Debt - Variable Rate Mortgage Debt - Fixed Rate Unsecured Term Loan - Fixed Rate Unsecured Senior Notes Pro forma Debt Maturities as of September 30, 2015 (In Millions) Capital Management • Appropriate Leverage Levels – Debt to Gross Assets: 29% – Net Debt to Enterprise Value: 22%(1) – Net Debt to Adjusted EBITDA: 4.2x – Secured Debt to Gross Assets: 9% – Variable rate debt to total debt: 14% • Strong Coverage Levels – Interest Coverage Ratio: 5.2x • Well-staggered debt maturities • $500 million unsecured Credit Facility expandable to $1 billion • Attractive and well covered dividend(2) – Dividend Yield: 4.1% Pro forma Capital Structure 18 Note: The above capital structure presentation is as of September 30, 2015 with proforma adjustments for the November 2, 2015 equity raise. (1) Market equity includes 56,412 thousand shares of the Company's common stock and 318 thousand units outstanding, which are convertible into common shares, and is calculated using $36.20 per share, the closing price of the Company's common stock on November 3, 2015. (2) Based on stock price of $36.20 on November 3, 2015.

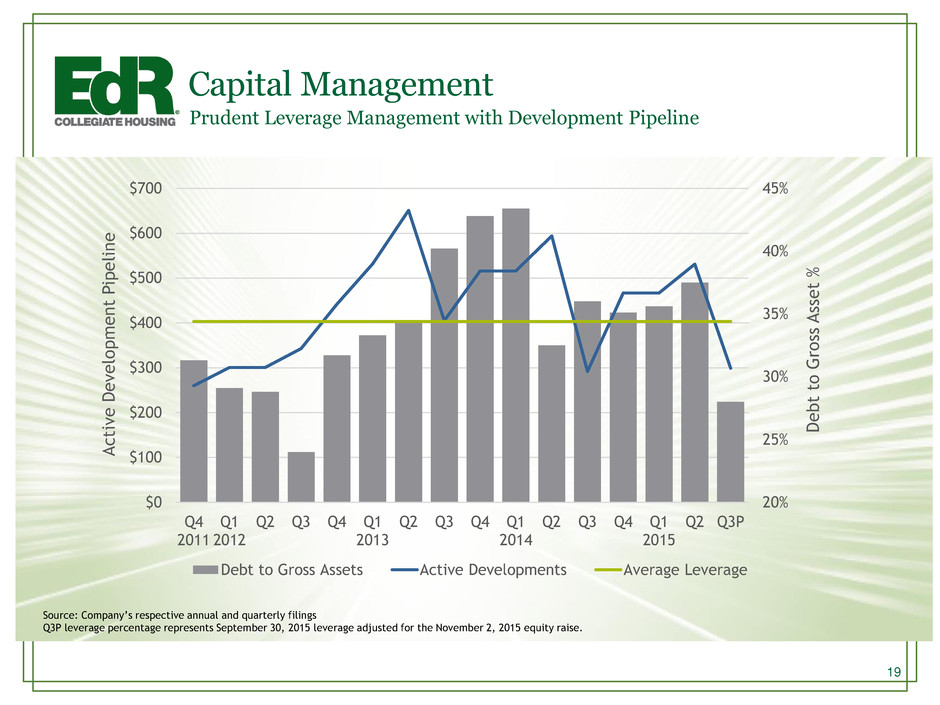

19 Capital Management Source: Company’s respective annual and quarterly filings Q3P leverage percentage represents September 30, 2015 leverage adjusted for the November 2, 2015 equity raise. Prudent Leverage Management with Development Pipeline 20% 25% 30% 35% 40% 45% $0 $100 $200 $300 $400 $500 $600 $700 Q4 2011 Q1 2012 Q2 Q3 Q4 Q1 2013 Q2 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Q3P D e bt t o Gr o ss Asse t % A ct iv e D e ve lo pm e n t P ip e li n e Debt to Gross Assets Active Developments Average Leverage

6% 47% 8% <1% 39% Other Private REIT Cross Boarder Institutional Market Transactions Market Valuation Source: Colliers presentation at 2015 NMHC. 20 Strong transaction volume and pricing with REIT participation in the student housing acquisition market down over the last three years. Market Participants - 2015 $2.9 $2.9 $3.3 2013 2014 2015E Student Housing Transaction Volume in Billions

Strong Returns to Shareholders Market Valuation Source: KeyBanc Corp 21 -30% -20% -10% 0% 10% 20% 30% 40% 50% 60% EdR ACC RMZ EdR #1 VS. ALL PUBLIC STUDENT HOUSING REITS EdR #2 VS. ALL PUBLIC MULTIFAMILY REITS EdR 87th Percentile ALL PUBLIC REITs 200% 120% 79% 20% 70% 120% 170% 220% EdR RMZ ACC Annual Total Shareholder Return Cumulative TSR (2010-2014)

Safe Harbor Statement Statements about the Company’s business that are not historical facts are “forward-looking statements,” which relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements are based on current expectations. You should not rely on our forward-looking statements because the matters that they describe are subject to known and unknown risks and uncertainties that could cause the Company’s business, financial condition, liquidity, results of operations, Core FFO, FFO and prospects to differ materially from those expressed or implied by such statements. Such risks are set forth under the captions “Risk Factors,” “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (or similar captions) in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q, and as described in our other filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date on which they are made, and, except as otherwise may be required by law, the Company undertakes no obligation to update publicly or revise any guidance or other forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law. Under the Private Securities Litigation Reform Act of 1995 22