Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2015

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-32833

TransDigm Group Incorporated (Exact name of registrant as specified in its charter) | ||

Delaware

(State or other jurisdiction of incorporation or organization)

41-2101738

(I.R.S. Employer Identification No.)

1301 East 9th Street, Suite 3000, Cleveland, Ohio | 44114 | |

(Address of principal executive offices) | (Zip Code) | |

(216) 706-2960

(Registrants’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock | New York Stock Exchange | |

(Title) | (Name of exchange on which registered) | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of March 27, 2015, based upon the last sale price of such voting and non-voting common stock on that date, was $10,927,295,559.

The number of shares outstanding of TransDigm Group Incorporated’s common stock, par value $.01 per share, was 53,687,448 as of November 3, 2015.

Documents incorporated by reference: The registrant incorporates by reference in Part III hereof portions of its definitive Proxy Statement for its 2016 Annual Meeting of Stockholders.

TABLE OF CONTENTS

Page | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

Special Note Regarding Forward-Looking Statements

This report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and 27A of the Securities Act of 1933, as amended. Discussions containing such forward-looking statements may be found in Items 1,1A, 2, 3, 5 and 7 hereof and elsewhere within this Report generally. In addition, when used in this Report, the words “believe,” “may,” “will,” “should,” “expect,” “intend,” “plan,” “predict,” “anticipate,” “estimate” or “continue” and other words and terms of similar meaning are intended to identify forward-looking statements. Although the Company (as defined below) believes that its plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made in this Report. The more important of such risks and uncertainties are set forth under the caption “Risk Factors” and elsewhere in this Report. Many such factors are outside the control of the Company. Consequently, such forward-looking statements should be regarded solely as our current plans, estimates and beliefs. We do not undertake, and specifically decline, any obligation, to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements.

Important factors that could cause actual results to differ materially from the forward-looking statements made in this Annual Report on Form 10-K include but are not limited to: the sensitivity of our business to the number of flight hours that our customers’ planes spend aloft and our customers’ profitability, both of which are affected by general economic conditions; future terrorist attacks; cyber-security threats and natural disasters; our reliance on certain customers; the U.S. defense budget and risks associated with being a government supplier; failure to maintain government or industry approvals; failure to complete or successfully integrate acquisitions; our substantial indebtedness; potential environmental liabilities; increases in raw material costs, taxes and labor costs that cannot be recovered in product pricing; risks and costs associated with our international sales and operations; and other factors.

In this report, the term “TD Group” refers to TransDigm Group Incorporated, which holds all of the outstanding capital stock of TransDigm Inc. The terms “Company,” “TransDigm,” “we,” “us,” “our” and similar terms refer to TD Group, together with TransDigm Inc. and its direct and indirect subsidiaries. References to “fiscal year” mean the year ending or ended September 30. For example, “fiscal year 2015” or “fiscal 2015” means the period from October 1, 2014 to September 30, 2015.

PART I

ITEM 1. BUSINESS

The Company

TransDigm Inc. was formed in 1993 in connection with a leveraged buyout transaction. TD Group was formed in 2003 to facilitate a leveraged buyout of TransDigm Inc. The Company was owned by private equity funds until its initial public offering in 2006. TD Group’s common stock is publicly traded on the New York Stock Exchange, or NYSE, under the ticker symbol “TDG.”

We believe we are a leading global designer, producer and supplier of highly engineered aircraft components for use on nearly all commercial and military aircraft in service today. Our business is well diversified due to the broad range of products we offer to our customers. We estimate that about 90% of our net sales for fiscal year 2015 were generated by proprietary products. In addition, for fiscal year 2015, we estimate that we generated about 80% of our net sales from products for which we are the sole source provider.

Most of our products generate significant aftermarket revenue. Once our parts are designed into and sold on a new aircraft, we generate net sales from aftermarket consumption over the life of that aircraft, which is generally estimated to be approximately 25 to 30 years. A typical platform can be produced for 20 to 30 years, giving us an estimated product life cycle in excess of 50 years. We estimate that approximately 54% of our net sales in fiscal year 2015 were generated from aftermarket sales, the vast majority of which come from the commercial and military aftermarkets. These aftermarket revenues have historically produced a higher gross margin and been more stable than sales to original equipment manufacturers, or OEMs.

Products

We primarily design, produce and supply highly-engineered proprietary aerospace components (and certain systems/subsystems) with significant aftermarket content. We seek to develop highly customized products to solve specific needs for aircraft operators and manufacturers. We attempt to differentiate ourselves based on engineering, service and manufacturing capabilities. We typically choose not to compete for non-proprietary “build to print” business because it frequently offers lower

1

margins than proprietary products. We believe that our products have strong brand names within the industry and that we have a reputation for high quality, reliability and customer support.

Our business is well diversified due to the broad range of products that we offer to our customers. Some of our more significant product offerings, substantially all of which are ultimately provided to end-users in the aerospace industry, include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, NiCad batteries and chargers, engineered latching and locking devices, rods and locking devices, engineered connectors and elastomers, cockpit security components and systems, specialized cockpit displays, aircraft audio systems, specialized lavatory components, seat belts and safety restraints, engineered interior surfaces and related components, lighting and control technology, military personnel parachutes and cargo loading, handling and delivery systems.

Segments

The Company’s businesses are organized and managed in three reporting segments: Power & Control, Airframe and Non-aviation.

The Power & Control segment includes operations that primarily develop, produce and market systems and components that predominately provide power to or control power of the aircraft utilizing electronic, fluid, power and mechanical motion control technologies. Major product offerings include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators and cargo loading and handling systems. Primary customers of this segment are engine and power system and subsystem suppliers, airlines, third party maintenance suppliers, military buying agencies and repair depots. Products are sold in the original equipment and aftermarket market channels.

The Airframe segment includes operations that primarily develop, produce and market systems and components that are used in non-power airframe applications utilizing airframe and cabin structure technologies. Major product offerings include engineered latching and locking devices, rods and locking devices, engineered connectors and elastomers, cockpit security components and systems, aircraft audio systems, specialized lavatory components, seat belts and safety restraints, engineered interior surfaces and related components, lighting and control technology, military personnel parachutes and cargo delivery systems. Primary customers of this segment are airframe manufacturers and cabin system suppliers and subsystem suppliers, airlines, third party maintenance suppliers, military buying agencies and repair depots. Products are sold in the original equipment and aftermarket market channels.

The Non-aviation segment includes operations that primarily develop, produce and market products for non-aviation markets. Major product offerings include seat belts and safety restraints for ground transportation applications, mechanical/electro-mechanical actuators and controls for space applications, and refueling systems for heavy equipment used in mining, construction and other industries. Primary customers of this segment are off-road vehicle suppliers and subsystem suppliers, child restraint system suppliers, satellite and space system suppliers and manufacturers of heavy equipment used in mining, construction and other industries.

For financial information about our segments, see Note 16, “Segments” to our Consolidated Financial Statements.

Sales and Marketing

Consistent with our overall strategy, our sales and marketing organization is structured to continually develop technical solutions that meet customer needs. In particular, we attempt to focus on products and programs that will lead to high-margin, repeatable sales in the aftermarket.

We have structured our sales efforts along our major product offerings, assigning a business unit manager to certain products. Each business unit manager is expected to grow the sales and profitability of the products for which he or she is responsible and to achieve the targeted annual level of bookings, sales, new business and profitability for such products. The business unit managers are assisted by account managers and sales engineers who are responsible for covering major OEM and aftermarket accounts. Account managers and sales engineers are expected to be familiar with the personnel, organization and needs of specific customers to achieve total bookings and new business goals at each account and, together with the product managers, to determine when additional resources are required at customer locations. Most of our sales personnel are evaluated, in part, on their bookings and their ability to identify and obtain new business opportunities.

Though typically performed by employees, the account manager function may be performed by independent representatives depending on the specific customer, product and geographic location. We also use a number of distributors to provide logistical support as well as primary customer contact with certain smaller accounts. Our major distributors are Aviall, Inc. (a subsidiary of The Boeing Company) and Satair A/S (a subsidiary of Airbus S.A.S.).

2

Manufacturing and Engineering

We maintain 52 principal manufacturing facilities. Most of our manufacturing facilities are comprised of manufacturing, distribution and engineering functions, and most facilities have certain administrative functions, including management, sales and finance. We continually strive to improve productivity and reduce costs, including rationalization of operations, developing improved control systems that allow for accurate product profit and loss accounting, investing in equipment, tooling, information systems and implementing broad-based employee training programs. Management believes that our manufacturing systems and equipment contribute to our ability to compete by permitting us to meet the rigorous tolerances and cost sensitive price structure of aircraft component customers.

We attempt to differentiate ourselves from our competitors by producing uniquely engineered products with high quality and timely delivery. Our engineering costs are recorded in Cost of Sales and in Selling and Administrative Expenses in our Consolidated Statements of Income. Total engineering expense represents approximately 6% of our operating units’ aggregate costs, or approximately 4% of our consolidated net sales. Our proprietary products, and particularly our new product initiatives, are designed by our engineers and are intended to serve the needs of the aircraft component industry. These proprietary designs must withstand the extraordinary conditions and stresses that will be endured by products during use and meet the rigorous demands of our customers’ tolerance and quality requirements.

We use sophisticated equipment and procedures to comply with quality requirements, specifications and Federal Aviation Administration (“FAA”) and OEM requirements. We perform a variety of testing procedures, including testing under different temperature, humidity and altitude levels, shock and vibration testing and X-ray fluorescent measurement. These procedures, together with other customer approved techniques for document, process and quality control, are used throughout our manufacturing facilities.

Customers

Our customers include: (1) distributors of aerospace components; (2) worldwide commercial airlines, including national and regional airlines; (3) large commercial transport and regional and business aircraft OEMs; (4) various armed forces of the United States and friendly foreign governments; (5) defense OEMs; (6) system suppliers; and (7) various other industrial customers. For the year ended September 30, 2015, The Boeing Company (which includes Aviall, Inc., a distributor of commercial aftermarket parts to airlines throughout the world) accounted for approximately 12% of our net sales and Airbus S.A.S. accounted for approximately 11% of our net sales. Our top ten customers for fiscal year 2015 accounted for approximately 46% of our net sales. Products supplied to many of our customers are used on multiple platforms.

Active commercial production programs include the Boeing 737, 747, 767, 777 and 787, the Airbus A319/20/21, A330/A340, A350 and A380, the Bombardier CRJ’s, Challenger and Learjets, the Embraer RJ’s, the Cessna Citation family, the Raytheon Premier and Hawker and most Gulfstream airframes. Military platforms include aircraft such as the Boeing C-17, F-15, F-18 and V-22, the Airbus A400M, the Lockheed Martin C-130J, F-16 and F-35 Joint Strikefighter, the Northrop Grumman E-2C Hawkeye, the Sikorsky UH-60 helicopter, CH-47 Chinook and AH-64 Apache helicopters, the General Atomics Predator Drone and the Raytheon Patriot Missile. TransDigm has been awarded numerous contracts for the development of engineered products for production on the Airbus A320 NEO, the Boeing 737 MAX, the Sikorsky S-97, JMR helicopter and Boeing P-8 Poseidon.

The demand for our aftermarket parts and services depends on, among other things, the breadth of our installed OEM base, revenue passenger miles (“RPMs”), the size and age of the worldwide aircraft fleet and, to a lesser extent, airline profitability. We believe that we are also a leading supplier of components used on U.S. designed military aircraft, including components that are used on a variety of fighter aircraft, military freighters and military helicopters.

Competition

The niche markets within the aerospace industry that we serve are relatively fragmented and we face several competitors for many of the products and services we provide. Due to the global nature of the commercial aircraft industry, competition in these categories comes from both U.S. and foreign companies. Competitors in our product offerings range in size from divisions of large public corporations to small privately-held entities, with only one or two components in their entire product portfolios.

We compete on the basis of engineering, manufacturing and marketing high quality products, which we believe meet or exceed the performance and maintenance requirements of our customers, consistent and timely delivery, and superior customer service and support. The industry’s stringent regulatory, certification and technical requirements, and the investments necessary in the development and certification of products, create barriers to entry for potential new competitors. As long as customers receive products that meet or exceed expectations and performance standards, we believe that they will have a reduced incentive to certify another supplier because of the cost and time of the technical design and testing certification process. In addition, we believe that the availability, dependability and safety of our products are reasons for our customers to continue long-term supplier relationships.

3

Government Contracts

Companies engaged in supplying defense-related equipment and services to U.S. Government agencies are subject to business risks specific to the defense industry. These risks include the ability of the U.S. Government to unilaterally: (1) suspend us from receiving new contracts pending resolution of alleged violations of procurement laws or regulations; (2) terminate existing contracts; (3) reduce the value of existing contracts; (4) audit our contract-related costs and fees, including allocated indirect costs; and (5) control and potentially prohibit the export of our products.

Governmental Regulation

The commercial aircraft component industry is highly regulated by the FAA in the United States and by the Joint Aviation Authorities in Europe and other agencies throughout the world, while the military aircraft component industry is governed by military quality specifications. We, and the components we manufacture, are required to be certified by one or more of these entities or agencies, and, in many cases, by individual OEMs, in order to engineer and service parts and components used in specific aircraft models.

We must also satisfy the requirements of our customers, including OEMs and airlines that are subject to FAA regulations, and provide these customers with products and services that comply with the government regulations applicable to commercial flight operations. In addition, the FAA requires that various maintenance routines be performed on aircraft components. We believe that we currently satisfy or exceed these maintenance standards in our repair and overhaul services. We also maintain several FAA approved repair stations.

In addition, our businesses are subject to many other laws and requirements typically applicable to manufacturers and exporters. Without limiting the foregoing, sales of many of our products that will be used on aircraft owned by foreign entities are subject to compliance with export control laws and the manufacture of our products and the operations of our businesses, including the disposal of hazardous wastes, are subject to compliance with applicable environmental laws.

Raw Materials

We require the use of various raw materials in our manufacturing processes. We also purchase a variety of manufactured component parts from various suppliers. At times, we concentrate our orders among a few suppliers in order to strengthen our supplier relationships. Most of our raw materials and component parts are generally available from multiple suppliers at competitive prices.

Intellectual Property

We have various trade secrets, proprietary information, trademarks, trade names, patents, copyrights and other intellectual property rights, which we believe, in the aggregate but not individually, are important to our business.

Backlog

As of September 30, 2015, the Company estimated its sales order backlog at $1,428 million compared to an estimated sales order backlog of $1,195 million as of September 30, 2014. The increase in estimated sales order backlog of approximately $233 million is primarily due to acquisitions. The majority of the purchase orders outstanding as of September 30, 2015 are scheduled for delivery within the next twelve months. Purchase orders may be subject to cancellation or deferral by the customer prior to shipment. The level of unfilled purchase orders at any given date during the year will be materially affected by the timing of the Company’s receipt of purchase orders and the speed with which those orders are filled. Accordingly, the Company’s backlog as of September 30, 2015 may not necessarily represent the actual amount of shipments or sales for any future period.

Foreign Operations

Although we manufacture a significant portion of our products in the United States, we manufacture some products in Belgium, China, Germany, Hungary, Malaysia, Mexico, Norway, Sri Lanka, Sweden, and the United Kingdom. Although the majority of sales of our products are made to customers (including distributors) located in the United States, our products are ultimately sold to and used by customers (including airlines and other end users of aircraft) throughout the world. A number of risks inherent in international operations could have a material adverse effect on our results of operations, including currency fluctuations, difficulties in staffing and managing multi-national operations, general economic and political uncertainties and potential for social unrest in countries in which we operate, limitations on our ability to enforce legal rights and remedies, restrictions on the repatriation of funds, change in trade policies, tariff regulation, difficulties in obtaining export and import licenses and the risk of government financed competition.

Our direct sales to foreign customers were approximately $881.1 million, $735.9 million and $572.0 million for fiscal years 2015, 2014 and 2013, respectively. Sales to foreign customers are subject to numerous additional risks, including foreign currency fluctuations, the impact of foreign government regulations, political uncertainties and differences in business practices. There can be no assurance that foreign governments will not adopt regulations or take other action that would have a

4

direct or indirect adverse impact on the business or market opportunities of the Company within such governments’ countries. Furthermore, there can be no assurance that the political, cultural and economic climate outside the United States will be favorable to our operations and growth strategy.

Environmental Matters

Our operations and facilities are subject to a number of federal, state, local and foreign environmental laws and regulations that govern, among other things, discharges of pollutants into the air and water, the generation, handling, storage and disposal of hazardous materials and wastes, the remediation of contamination and the health and safety of our employees. Environmental laws and regulations may require that the Company investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. Certain facilities and third-party sites utilized by the Company have been identified as potentially responsible parties under the federal Superfund laws and comparable state laws. The Company is currently involved in the investigation and remediation of a number of sites under applicable laws.

Estimates of the Company’s environmental liabilities are based on current facts, laws, regulations and technology. These estimates take into consideration the Company’s prior experience and professional judgment of the Company’s environmental advisors. Estimates of the Company’s environmental liabilities are further subject to uncertainties regarding the nature and extent of site contamination, the range of remediation alternatives available, evolving remediation standards, imprecise engineering evaluations and cost estimates, the extent of corrective actions that may be required and the number and financial condition of other potentially responsible parties, as well as the extent of their responsibility for the remediation.

Accordingly, as investigation and remediation proceed, it is likely that adjustments in the Company’s accruals will be necessary to reflect new information. The amounts of any such adjustments could have a material adverse effect on the Company’s results of operations or cash flows in a given period. Based on currently available information, however, the Company does not believe that future environmental costs in excess of those accrued with respect to sites for which the Company has been identified as a potentially responsible party are likely to have a material adverse effect on the Company’s financial condition.

Environmental liabilities are recorded when the liability is probable and the costs are reasonably estimable, which generally is not later than at completion of a feasibility study or when the Company has recommended a remedy or has committed to an appropriate plan of action. The liabilities are reviewed periodically and, as investigation and remediation proceed, adjustments are made as necessary. Liabilities for losses from environmental remediation obligations do not consider the effects of inflation and anticipated expenditures are not discounted to their present value. The liabilities are not reduced by possible recoveries from insurance carriers or other third parties, but do reflect anticipated allocations among potentially responsible parties at federal Superfund sites or similar state-managed sites, third party indemnity obligations, and an assessment of the likelihood that such parties will fulfill their obligations at such sites.

Employees

As of September 30, 2015, we had approximately 8,200 full-time, part-time and temporary employees. Approximately 8% of our full-time and part-time employees were represented by labor unions. Collective bargaining agreements between us and these labor unions expire at various dates ranging from April 2016 to May 2018. We consider our relationship with our employees generally to be satisfactory.

Legal Proceedings

We are from time to time subject to, and are presently involved in, litigation or other legal proceedings arising in the ordinary course of business. Based upon information currently known to us, we believe the outcome of such proceedings will not have, individually or in the aggregate, a material adverse effect on our business, our financial condition or results of operations.

Available Information

TD Group’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including any amendments, will be made available free of charge on the Company’s website, www.transdigm.com, as soon as reasonably practicable, following the filing of the reports with the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

Set forth below are important risks and uncertainties that could negatively affect our business and financial condition and could cause our actual results to differ materially from those expressed in forward-looking statements contained in this report.

5

Our business is sensitive to the number of flight hours that our customers’ planes spend aloft, the size and age of the worldwide aircraft fleet and our customers’ profitability. These items are, in turn, affected by general economic and geopolitical and other worldwide conditions.

Our business is directly affected by, among other factors, changes in revenue passenger miles (RPMs), the size and age of the worldwide aircraft fleet and, to a lesser extent, changes in the profitability of the commercial airline industry. RPMs and airline profitability have historically been correlated with the general economic environment, although national and international events also play a key role. For example, in the recent past, the airline industry has been severely affected by the downturn in the global economy, higher fuel prices, the increased security concerns among airline customers following the events of September 11, 2001, the Severe Acute Respiratory Syndrome, or SARS, epidemic and the conflicts in Afghanistan and Iraq, and could be impacted by future geopolitical or other worldwide conditions, such as war, terrorist acts, or a worldwide infectious disease outbreak. In addition, global market and economic conditions have been challenging with continued turbulence in the U.S. and international markets and economies and have prolonged declines in business and consumer spending. As a result of the substantial reduction in airline traffic resulting from these events, the airline industry incurred large losses and financial difficulties. Some carriers have also parked or retired a portion of their fleets and have reduced workforces and flights. During periods of reduced airline profitability, some airlines may delay purchases of spare parts, preferring instead to deplete existing inventories. If demand for new aircraft and spare parts decreases, there would be a decrease in demand for certain of our products.

Our sales to manufacturers of aircraft are cyclical, and a downturn in sales to these manufacturers may adversely affect us.

Our sales to manufacturers of large commercial aircraft, such as The Boeing Company, Airbus S.A.S, and related OEM suppliers, as well as manufacturers of business jets (which accounted for approximately 24% of our net sales in fiscal year 2015) have historically experienced periodic downturns. In the past, these sales have been affected by airline profitability, which is impacted by, among other things, fuel and labor costs, price competition, downturns in the global economy and national and international events, such as the events of September 11, 2001. In addition, sales of our products to manufacturers of business jets are impacted by, among other things, downturns in the global economy. Downturns adversely affect our net sales, gross margin and net income.

We rely heavily on certain customers for much of our sales.

Our two largest customers for fiscal year 2015 were The Boeing Company (which includes Aviall, Inc., a distributor of commercial aftermarket parts to airlines throughout the world) and Airbus S.A.S. The Boeing Company accounted for approximately 12% of our net sales and Airbus S.A.S. accounted for approximately 11% of our net sales in fiscal year 2015. Our top ten customers for fiscal year 2015 accounted for approximately 46% of our net sales. A material reduction in purchasing by one of our larger customers for any reason, including but not limited to economic downturn, decreased production, strike or resourcing, could have a material adverse effect on our net sales, gross margin and net income.

We generally do not have guaranteed future sales of our products. Further, when we enter into fixed price contracts with some of our customers, we take the risk for cost overruns.

As is customary in our business, we do not generally have long-term contracts with most of our aftermarket customers and, therefore, do not have guaranteed future sales. Although we have long-term contracts with many of our OEM customers, many of those customers may terminate the contracts on short notice and, in most cases, our customers have not committed to buy any minimum quantity of our products. In addition, in certain cases, we must anticipate the future volume of orders based upon the historic purchasing patterns of customers and upon our discussions with customers as to their anticipated future requirements, and this anticipated future volume of orders may not materialize.

We also have entered into multi-year, fixed-price contracts with some of our customers, pursuant to which we have agreed to perform the work for a fixed price and, accordingly, realize all the benefit or detriment resulting from any decreases or increases in the costs of making these products. Sometimes we accept a fixed-price contract for a product that we have not yet produced, and this increases the risk of cost overruns or delays in the completion of the design and manufacturing of the product. Most of our contracts do not permit us to recover increases in raw material prices, taxes or labor costs.

U.S. military spending is dependent upon the U.S. defense budget.

The military and defense market is significantly dependent upon government budget trends, particularly the U.S. Department of Defense (the “DOD”) budget. In addition to normal business risks, our supply of products to the United States Government is subject to unique risks largely beyond our control. DOD budgets could be negatively impacted by several factors, including, but not limited to, a change in defense spending policy by the current presidential administration, the U.S. Government’s budget deficits, spending priorities, the cost of sustaining the U.S. military presence in the Middle East and possible political pressure to reduce U.S. Government military spending, each of which could cause the DOD budget to remain

6

unchanged or to decline. A significant decline in U.S. military expenditures could result in a reduction in the amount of our products sold to the various agencies and buying organizations of the U.S. Government.

We intend to pursue acquisitions. Our business may be adversely affected if we cannot consummate acquisitions on satisfactory terms, or if we cannot effectively integrate acquired operations.

A significant portion of our growth has occurred through acquisitions. Any future growth through acquisitions will be partially dependent upon the continued availability of suitable acquisition candidates at favorable prices and upon advantageous terms and conditions. We intend to pursue acquisitions that we believe will present opportunities consistent with our overall business strategy. However, we may not be able to find suitable acquisition candidates to purchase or may be unable to acquire desired businesses or assets on economically acceptable terms. In addition, we may not be able to raise the capital necessary to fund future acquisitions. Because we may actively pursue a number of opportunities simultaneously, we may encounter unforeseen expenses, complications and delays, including regulatory complications or difficulties in employing sufficient staff and maintaining operational and management oversight.

We regularly engage in discussions with respect to potential acquisition and investment opportunities. If we consummate an acquisition, our capitalization and results of operations may change significantly. Future acquisitions could result in margin dilution and further likely result in the incurrence of additional debt and contingent liabilities and an increase in interest and amortization expenses or periodic impairment charges related to goodwill and other intangible assets as well as significant charges relating to integration costs.

Acquisitions involve risks that the businesses acquired will not perform in accordance with expectations and that business judgments concerning the value, strengths and weaknesses of businesses acquired will prove incorrect. In addition, we may not be able to successfully integrate any business we acquire into our existing business. The successful integration of new businesses depends on our ability to manage these new businesses and cut excess costs. The successful integration of future acquisitions may also require substantial attention from our senior management and the management of the acquired business, which could decrease the time that they have to service, attract customers and develop new products and services or attend to other acquisition opportunities.

We are subject to certain unique business risks as a result of supplying equipment and services to the U.S. Government.

Companies engaged in supplying defense-related equipment and services to U.S. Government agencies are subject to business risks specific to the defense industry. These risks include the ability of the U.S. Government to unilaterally:

• | suspend us from receiving new contracts pending resolution of alleged violations of procurement laws or regulations; |

• | terminate existing contracts; |

• | reduce the value of existing contracts; and |

• | audit our contract-related costs and fees, including allocated indirect costs. |

Most of our U.S. Government contracts can be terminated by the U.S. Government for its convenience without significant notice. Termination for convenience provisions provide only for our recovery of costs incurred or committed, settlement expenses and profit on the work completed prior to termination.

On contracts for which the price is based on cost, the U.S. Government may review our costs and performance, as well as our accounting and general business practices. Based on the results of such audits, the U.S. Government may adjust our contract-related costs and fees, including allocated indirect costs. In addition, under U.S. Government purchasing regulations, some of our costs, including most financing costs, amortization of intangible assets, portions of research and development costs, and certain marketing expenses may not be subject to reimbursement.

Furthermore, even where the price is not based on cost, the U.S. Government may seek to review our costs to determine whether our pricing is “fair and reasonable.” Our subsidiaries are periodically subject to a pricing review. Such a review could be costly and time consuming for our management and could distract from our ability to effectively manage the business. As a result of such a review, we could be subject to providing a refund to the U.S. Government or we could be asked to enter into an arrangement whereby our prices would be based on cost or the DOD could seek to pursue alternative sources of supply for our parts. Any of those occurrences could lead to a reduction in our revenue from, or the profitability of certain of our supply arrangements with, certain agencies and buying organizations of the U.S. Government.

Moreover, U.S. Government purchasing regulations contain a number of additional operation requirements, which do not apply to entities not engaged in government contracting. Failure to comply with such government contracting requirements could result in civil and criminal penalties that could have a material adverse effect on the Company's results of operations.

7

Our business may be adversely affected if we would lose our government or industry approvals or if more stringent government regulations are enacted or if industry oversight is increased.

The aerospace industry is highly regulated in the United States and in other countries. In order to sell our components, we and the components we manufacture must be certified by the FAA, the DOD and similar agencies in foreign countries and by individual manufacturers. If new and more stringent government regulations are adopted or if industry oversight increases, we might incur significant expenses to comply with any new regulations or heightened industry oversight. In addition, if material authorizations or approvals were revoked or suspended, our business would be adversely affected.

In addition to the aviation approvals, we are at times required to obtain approval from U.S. Government agencies to export our products. Failure to obtain approval to export or determination by the U.S. Government that we failed to receive required approvals or licenses could eliminate or restrict our ability to sell our products outside the United States, and the penalties that could be imposed by the U.S. Government for failure to comply with these laws could be significant.

Our substantial indebtedness could adversely affect our financial health and could harm our ability to react to changes to our business and prevent us from fulfilling our obligations under our indebtedness.

We have a significant amount of indebtedness. As of September 30, 2015, our total indebtedness was approximately $8,427.3 million, which was approximately 114.1% of our total book capitalization because of our prior year dividends being funded with indebtedness and the addition of approximately $954 million in total debt in fiscal 2015.

In addition, we may be able to incur substantial additional indebtedness in the future. For example, as of September 30, 2015, we had approximately $534 million of unused commitments under our revolving loan facility and $50 million of unused capacity under our trade receivable securitization facility (the “Securitization Facility”) (with the availability of the capacity under the Securitization Facility being dependent on the amount of our trade receivables outstanding). Although our senior secured credit facility and the indentures (the “Indentures”) governing the 5.50% Senior Subordinated Notes issued in October 2012 (the “2020 Notes”), the 7.50% Senior Subordinated Notes issued in July 2013 (the “2021 Notes”), the 6.00% Senior Subordinated Notes issued in June 2014 (the “2022 Notes), the 6.50% Senior Subordinated Notes issued June 2014 (the “2024 Notes”) and the 6.50% Senior Subordinated Notes issued May 2015 ((the “2025 Notes”) and together with the 2020 Notes, the 2021 Notes, the 2022 Notes, the 2024 Notes, the “Notes”) contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and the indebtedness incurred in compliance with these qualifications and exceptions could be substantial. If we incur additional debt, the risks associated with our substantial leverage would increase.

Our substantial debt could also have other important consequences to investors. For example, it could:

• | increase our vulnerability to general economic downturns and adverse competitive and industry conditions; |

• | increase the risk we are subjected to downgrade or put on a negative watch by the ratings agencies; |

• | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, research and development efforts and other general corporate purposes; |

• | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

• | place us at a competitive disadvantage compared to competitors that have less debt; and |

• | limit, along with the financial and other restrictive covenants contained in the documents governing our indebtedness, among other things, our ability to borrow additional funds, make investments and incur liens. |

In addition, all of our debt under the senior secured credit facility, which includes $4,377 million in term loans and a revolving loan facility of $550 million, bears interest at floating rates. Accordingly, if interest rates increase, our debt service expense will also increase. In order to reduce the floating interest rate risk, as of September 30, 2015, six interest rate cap agreements beginning on September 30, 2015 were in place to offset the variable interest rates based on an aggregate notional amount of $750 million of debt under the senior secured credit facility. Also, three forward starting interest rate swap agreements were in place that fix the interest on an aggregate notional amount of $1,000 million of debt under the senior secured credit facility. In addition, we entered into five forward starting interest rate swap agreements that fix the interest beginning March 31, 2016 on an aggregate notional amount of $750 million of debt under the senior secured credit facility.

Our substantial level of indebtedness increases the possibility that we may be unable to generate cash sufficient to pay, when due, the principal of, interest on or other amounts due in respect of our indebtedness, including the Notes. We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us under the senior secured credit facility or otherwise in amounts sufficient to enable us to service our indebtedness. If we cannot service our debt, we will have to take actions such as reducing or delaying capital investments, selling assets, restructuring or refinancing our debt or seeking additional equity capital.

8

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

Our ability to make payments on and to refinance our indebtedness, including the Notes, amounts borrowed under the senior secured credit facility, amounts due under our Securitization Facility, and to fund our operations, will depend on our ability to generate cash in the future, which, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot assure you that our business will generate sufficient cash flow from operations, that currently anticipated cost savings and operating improvements will be realized on schedule, or at all, or that future borrowings will be available to us under the senior secured credit facility or otherwise in amounts sufficient to enable us to service our indebtedness, including the amounts borrowed under the senior secured credit facility, amounts borrowed under our Securitization Facility and the Notes, or to fund our other liquidity needs. If we cannot service our debt, we will have to take actions such as reducing or delaying capital investments, selling assets, restructuring or refinancing our debt or seeking additional equity capital. We cannot assure you that any of these remedies could, if necessary, be effected on commercially reasonable terms, or at all. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments, the Securitization Facility, the Indentures and the senior secured credit facility may restrict us from adopting any of these alternatives. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness on acceptable terms and would otherwise adversely affect the Notes.

The terms of the senior secured credit facility and Indentures may restrict our current and future operations, particularly our ability to respond to changes or to take certain actions.

Our senior secured credit facility and the Indentures contain a number of restrictive covenants that impose significant operating and financial restrictions on TD Group, TransDigm Inc. and its subsidiaries (in the case of the senior secured credit facility) and TransDigm Inc. and its subsidiaries (in the case of the Indentures) and may limit their ability to engage in acts that may be in our long-term best interests. The senior secured credit facility and Indentures include covenants restricting, among other things, the ability of TD Group, TransDigm Inc. and its subsidiaries (in the case of the senior secured credit facility) and TransDigm Inc. and its subsidiaries (in the case of the Indentures) to:

• | incur or guarantee additional indebtedness or issue preferred stock; |

• | pay distributions on, redeem or repurchase our capital stock or redeem or repurchase our subordinated debt; |

• | make investments; |

• | sell assets; |

• | enter into agreements that restrict distributions or other payments from our restricted subsidiaries to us; |

• | incur or allow to exist liens; |

• | consolidate, merge or transfer all or substantially all of our assets; |

• | engage in transactions with affiliates; |

• | create unrestricted subsidiaries; and |

• | engage in certain business activities. |

A breach of any of these covenants could result in a default under the senior secured credit facility or the Indentures. If any such default occurs, the lenders under the senior secured credit facility and the holders of the Notes may elect to declare all outstanding borrowings, together with accrued interest and other amounts payable thereunder, to be immediately due and payable. The lenders under the senior secured credit facility also have the right in these circumstances to terminate any commitments they have to provide further borrowings. In addition, following an event of default under the senior secured credit facility, the lenders under that facility will have the right to proceed against the collateral granted to them to secure the debt, which includes our available cash, and they will also have the right to prevent us from making debt service payments on the Notes. If the debt under the senior secured credit facility or the Notes were to be accelerated, we cannot assure you that our assets would be sufficient to repay in full our debt.

9

We could incur substantial costs as a result of violations of or liabilities under environmental laws and regulations.

Our operations and facilities are subject to a number of federal, state, local and foreign environmental laws and regulations that govern, among other things, discharges of pollutants into the air and water, the generation, handling, storage and disposal of hazardous materials and wastes, the remediation of contamination and the health and safety of our employees. Environmental laws and regulations may require that the Company investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. Certain facilities and third-party sites utilized by subsidiaries of the Company have been identified as potentially responsible parties under the federal Superfund laws and comparable state laws. The Company is currently involved in the investigation and remediation of a number of sites under applicable laws.

Estimates of the Company’s environmental liabilities are based on current facts, laws, regulations and technology. These estimates take into consideration the Company’s prior experience and professional judgment of the Company’s environmental advisors. Estimates of the Company’s environmental liabilities are further subject to uncertainties regarding the nature and extent of site contamination, the range of remediation alternatives available, evolving remediation standards, imprecise engineering evaluations and cost estimates, the extent of corrective actions that may be required and the number and financial condition of other potentially responsible parties, as well as the extent of their responsibility for the remediation.

Accordingly, as investigation and remediation proceed, it is likely that adjustments in the Company’s accruals will be necessary to reflect new information. The amounts of any such adjustments could have a material adverse effect on the Company’s results of operations or cash flows in a given period. Based on currently available information, however, the Company does not believe that future environmental costs in excess of those accrued with respect to sites for which the Company has been identified as a potentially responsible party are likely to have a material adverse effect on the Company’s financial condition.

Environmental liabilities are recorded when the liability is probable and the costs are reasonably estimable, which generally is not later than at completion of a feasibility study or when the Company has recommended a remedy or has committed to an appropriate plan of action. The liabilities are reviewed periodically and, as investigation and remediation proceed, adjustments are made as necessary. Liabilities for losses from environmental remediation obligations do not consider the effects of inflation and anticipated expenditures are not discounted to their present value. The liabilities are not reduced by possible recoveries from insurance carriers or other third parties, but do reflect anticipated allocations among potentially responsible parties at federal Superfund sites or similar state-managed sites, third party indemnity obligations, and an assessment of the likelihood that such parties will fulfill their obligations at such sites.

We are dependent on our highly trained employees and any work stoppage or difficulty hiring similar employees could adversely affect our business.

Because our products are complicated and highly engineered, we depend on an educated and trained workforce. There is substantial competition for skilled personnel in the aircraft component industry, and we could be adversely affected by a shortage of skilled employees. We may not be able to fill new positions or vacancies created by expansion or turnover or attract and retain qualified personnel.

As of September 30, 2015, we had approximately 8,200 full-time, part-time and temporary employees. Approximately 8% of our full-time and part-time employees were represented by labor unions. Collective bargaining agreements between us and these labor unions expire at various dates ranging from April 2016 to May 2018. We consider our relationship with our employees generally to be satisfactory. Although we believe that our relations with our employees are satisfactory, we cannot assure you that we will be able to negotiate a satisfactory renewal of these collective bargaining agreements or that our employee relations will remain stable. Because we maintain a relatively small inventory of finished goods, any work stoppage could materially and adversely affect our ability to provide products to our customers.

Our business is dependent on the availability of certain components and raw materials from suppliers.

Our business is affected by the price and availability of the raw materials and component parts that we use to manufacture our components. Our business, therefore, could be adversely impacted by factors affecting our suppliers (such as the destruction of our suppliers’ facilities or their distribution infrastructure, a work stoppage or strike by our suppliers’ employees or the failure of our suppliers to provide materials of the requisite quality), or by increased costs of such raw materials or components if we were unable to pass along such price increases to our customers. Because we maintain a relatively small inventory of raw materials and component parts, our business could be adversely affected if we were unable to obtain these raw materials and components from our suppliers in the quantities we require or on favorable terms. Although we believe in most cases that we could identify alternative suppliers, or alternative raw materials or component parts, the lengthy and expensive FAA and OEM certification processes associated with aerospace products could prevent efficient replacement of a supplier, raw material or component part.

10

Our facilities are located near known earthquake fault zones and hurricane paths, and the occurrence of a natural disaster could cause damage to our facilities and equipment, which could require us to curtail or cease operations.

A number of our manufacturing facilities are located in the greater Los Angeles area, an area known for earthquakes, and are thus vulnerable to damage. In addition, a number of our manufacturing facilities are located along the Eastern seaboard area susceptible to hurricanes. We are also vulnerable to damage from other types of disasters, including power loss, fire, explosions, floods, communications failures, terrorist attacks and similar events. Disruptions could also occur due to cyber-attacks, computer or equipment malfunction (accidental or intentional), operator error or process failures. Any disruption of our ability to operate our business could result in a material decrease in our revenues or significant additional costs to replace, repair or insure our assets, which could have a material adverse impact on our financial condition and results of operations.

Operations and sales outside of the United States may be subject to additional risks.

A number of risks inherent in international operations could have a material adverse effect on our results of operations, including currency fluctuations, difficulties in staffing and managing multi-national operations, general economic and political uncertainties and potential for social unrest in countries in which we operate, limitations on our ability to enforce legal rights and remedies, restrictions on the repatriation of funds, change in trade policies, tariff regulation, difficulties in obtaining export and import licenses and the risk of government financed competition. Furthermore, the Company is subject to laws and regulations, such as the Foreign Corrupt Practices Act or similar local anti-bribery laws, which generally prohibit companies and their employees, agents and contractors from making improper payments to governmental officials for the purpose of obtaining or retaining business. Failure to comply with these laws could subject the Company to civil and criminal penalties that could materially adversely affect the Company’s results of operations.

We face significant competition.

We operate in a highly competitive global industry and compete against a number of companies. Competitors in our product lines are both U.S. and foreign companies and range in size from divisions of large public corporations to small privately held entities. We believe that our ability to compete depends on high product performance, consistent high quality, short lead-time and timely delivery, competitive pricing, superior customer service and support and continued certification under customer quality requirements and assurance programs. We may have to adjust the prices of some of our products to stay competitive.

We could be adversely affected if one of our components causes an aircraft to crash.

Our operations expose us to potential liabilities for personal injury or death as a result of the failure of an aircraft component that we have designed, manufactured or serviced. While we maintain liability insurance to protect us from future product liability claims, in the event of product liability claims our insurers may attempt to deny coverage or any coverage we have may not be adequate. We also may not be able to maintain insurance coverage in the future at an acceptable cost. Any liability not covered by insurance or for which third party indemnification is not available could result in significant liability to us.

In addition, a crash caused by one of our components could damage our reputation for quality products. We believe our customers consider safety and reliability as key criteria in selecting a provider of aircraft components. If a crash were to be caused by one of our components, or if we were to otherwise fail to maintain a satisfactory record of safety and reliability, our ability to retain and attract customers may be materially adversely affected.

We could incur substantial costs as a result of data protection concerns.

The interpretation and application of data protection laws in the U.S., Europe and elsewhere are uncertain and evolving. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our data practices. Compliance could cause us to incur substantial costs or require us to change our business practices in a manner adverse to our business.

In addition, despite our efforts to protect confidential information, our facilities and systems may be vulnerable to data loss, including cyber-attacks. This could lead to negative publicity, legal claims, theft, modification or destruction of proprietary or key information, damage to or inaccessibility of critical systems, manufacture of defective products, production downtimes, operational disruptions and other significant costs, which could adversely affect our reputation, financial condition and results of operations.

We have recorded a significant amount of intangible assets, which may never generate the returns we expect.

Mergers and acquisitions have resulted in significant increases in identifiable intangible assets and goodwill. Identifiable intangible assets, which primarily include trademarks, trade names, trade secrets, and technology, were approximately $1,539.9 million at September 30, 2015, representing approximately 18.3% of our total assets. Goodwill recognized in accounting for the mergers and acquisitions was approximately $4,686.2 million at September 30, 2015, representing approximately 55.6% of our total assets. We may never realize the full value of our identifiable intangible assets and goodwill, and to the extent we were to

11

determine that our identifiable intangible assets or our goodwill were impaired within the meaning of applicable accounting standards, we would be required to write-off the amount of any impairment.

Our stock price may be volatile, and your investment in our common stock could suffer a decline in value.

There has been significant volatility in the market price and trading volume of equity securities, which is unrelated to the financial performance of the companies issuing the securities. These broad market fluctuations may negatively affect the market price of our common stock. You may not be able to sell your shares at or above the purchase price due to fluctuations in the market price of our common stock caused by changes in our operating performance or prospects, including possible changes due to the cyclical nature of the aerospace industry and other factors such as fluctuations in OEM and aftermarket ordering, which could cause short-term swings in profit margins, or unrelated to our operating performance, including market conditions affecting the stock market generally or the stocks of aerospace companies more specifically.

Future sales of our common stock in the public market could lower our share price.

We may sell additional shares of common stock into the public markets or issue convertible debt securities to raise capital in the future. The market price of our common stock could decline as a result of sales of a large number of shares of our common stock in the public markets or the perception that these sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities to raise capital at a time and price that we deem appropriate.

Our corporate documents and Delaware law contain certain provisions that could discourage, delay or prevent a change in control of our company.

Provisions in our amended and restated certificate of incorporation and bylaws may discourage, delay or prevent a merger or acquisition involving us that our stockholders may consider favorable. For example, our amended and restated certificate of incorporation authorizes our Board of Directors to issue up to 149,600,000 shares of “blank check” preferred stock. Without stockholder approval, the Board of Directors has the authority to attach special rights, including voting and dividend rights, to this preferred stock. With these rights, holders of preferred stock could make it more difficult for a third party to acquire us. Our amended and restated certificate of incorporation also provides that the affirmative vote of the holders of at least 75% of the voting power of our issued and outstanding capital stock, voting together as a single class, is required for the alteration, amendment or repeal of certain provisions of our amended and restated certificate of incorporation and certain provisions of our amended and restated bylaws, including the provisions relating to our stockholders’ ability to call special meetings, notice provisions for stockholder business to be conducted at an annual meeting, requests for stockholder lists and corporate records, nomination and removal of directors, and filling of vacancies on our Board of Directors.

We are also subject to the anti-takeover provisions of Section 203 of the Delaware General Corporation Law. Under these provisions, if anyone becomes an “interested stockholder,” we may not enter into a “business combination” with that person for three years without special approval, which could discourage a third party from making a takeover offer and could delay or prevent a change of control. For purposes of Section 203, “interested stockholder” means, generally, someone owning 15% or more of our outstanding voting stock or an affiliate of ours that owned 15% or more of our outstanding voting stock during the past three years, subject to certain exceptions as described in Section 203.

We do not pay regular quarterly or annual cash dividends on our stock.

On October 15, 2012, July 3, 2013 and June 4, 2014 the Company’s board of directors authorized and declared special cash dividends of $12.85, $22.00 and $25.00, respectively, on each outstanding share of common stock and cash dividend equivalent payments to holders of options under its stock option plans.

Notwithstanding the special cash dividends paid in October 2012, July 2013 and June 2014, we do not anticipate declaring or paying regular quarterly or annual cash dividends on our common stock or any other equity security in the foreseeable future. The amounts that may be available to us to pay future special cash dividends are restricted under our debt and other agreements. Any payment of special cash dividends on our common stock in the future will be at the discretion of our Board of Directors and will depend on our results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions and other factors deemed relevant by our Board of Directors. Therefore, you should not rely on regular quarterly or annual dividend income from shares of our common stock and you should not rely on special dividends with any regularity or at all.

12

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

TransDigm’s owned properties as of September 30, 2015 are as follows:

Location | Business Segment | Square Footage | |

Miesbach, Germany | Power & Control | 242,000 | |

Liberty, SC | Power & Control | 219,000 | |

Waco, TX | Power & Control | 218,800 | |

Bridport, United Kingdom | Airframe | 193,200 | |

Ingolstadt, Germany | Airframe | 191,900 | |

Kent, OH | Airframe | 185,000 | |

Yakima, WA | Airframe | 142,000 | |

Phoenix, AZ | Airframe | 138,700 | |

Paks, Hungary | Airframe | 137,800 | |

Los Angeles, CA | Power & Control | 131,000 | |

Westbury, NY | Power & Control | 112,300 | |

Pinellas Park, FL | Airframe | 110,000 | |

Llangeinor, United Kingdom | Airframe | 110,000 | |

Letchworth, United Kingdom | Airframe | 88,200 | |

Placentia, CA | Airframe | 86,600 | |

Addison, IL | Power & Control | 83,300 | |

Painesville, OH | Power & Control | 63,900 | |

Clearwater, FL | Power & Control | 61,000 | |

South Euclid, OH | Power & Control | 60,000 | |

Wichita, KS | Power & Control | 57,000 | |

Earlysville, VA | Power & Control | 53,000 | |

Branford, CT | Airframe | 52,000 | |

Avenel, NJ | Power & Control | 48,500 | |

Herstal, Belgium | Airframe | 45,700 | |

Rancho Cucamonga, CA | Power & Control | 45,000 | |

Valencia, CA | Airframe | 38,000 | |

Pennsauken, NJ | Airframe | 38,000 | |

Rancho Cucamonga, CA | Airframe | 32,700 | |

Melaka, Malaysia | Power & Control | 24,800 | |

Deerfield Beach, FL | Non-aviation | 20,000 | |

The Liberty, Waco, Kent, Yakima, Phoenix, Los Angeles, Placentia, Addison, Painesville, South Euclid, Wichita, Avenel and Deerfield Beach properties and the two Rancho Cucamonga properties are subject to mortgage liens under our senior secured credit facility. The Pinellas Park property is currently under contract to sell. The Earlysville property is currently vacant.

TransDigm’s leased properties as of September 30, 2015 are as follows:

Location | Business Segment | Square Footage | |

Holmestrand, Norway | Airframe | 149,000 | |

Santa Ana, CA | Airframe | 144,300 | |

Dayton, NV | Airframe | 144,000 | |

Everett, WA | Airframe | 121,000 | |

Whippany, NJ | Power & Control | 114,300 | |

Nittambuwa, Sri Lanka | Airframe | 113,000 | |

Goldsboro, NC | Power & Control | 101,000 | |

13

Location | Business Segment | Square Footage | |

Fullerton, CA | Airframe | 100,000 | |

Anaheim, CA | Airframe | 99,900 | |

Collegeville, PA | Airframe | 90,000 | |

Miesbach, Germany | Power & Control | 81,000 | |

Kunshan, China | Non-aviation | 75,300 | |

Camarillo, CA | Power & Control | 70,000 | |

Matamoros, Mexico | Power & Control | 60,500 | |

Elkhart, IN | Non-aviation | 51,500 | |

Tempe, AZ | Power & Control | 40,200 | |

Chongqing, China | Airframe | 37,700 | |

Northridge, CA | Power & Control | 35,000 | |

Erie, PA | Airframe | 30,500 | |

London, United Kingdom | Airframe | 27,400 | |

Nogales, Mexico | Airframe | 27,000 | |

Kunshan, China | Airframe | 25,600 | |

Bridgend, United Kingdom | Airframe | 24,800 | |

Memphis, TN | Power & Control | 20,800 | |

Pennsauken, NJ | Airframe | 20,500 | |

Cleveland, OH | Corporate office | 20,100 | |

Lund, Sweden | Power & Control | 17,600 | |

Lake Elsinore, CA | Airframe | 16,100 | |

Cleveland, OH | Power & Control | 13,100 | |

Simi Valley, CA | Airframe | 10,000 | |

Rancho Cucamonga, CA | Power & Control | 8,900 | |

Placentia, CA | Airframe | 8,400 | |

Eloy, AZ | Airframe | 8,100 | |

Brize Norton, United Kingdom | Airframe | 7,200 | |

Westbury, NY | Power & Control | 6,800 | |

Singapore | Power & Control | 6,500 | |

Toulouse, France | Airframe | 5,400 | |

Pasadena, CA | Corporate office | 5,300 | |

TransDigm also leases certain of its other non-material facilities. Management believes that our machinery, plants and offices are in satisfactory operating condition and that it will have sufficient capacity to meet foreseeable future needs without incurring significant additional capital expenditures.

ITEM 3. LEGAL PROCEEDINGS

During the ordinary course of business, TransDigm is from time to time threatened with, or may become a party to, legal actions and other proceedings related to its businesses, products or operations. While TransDigm is currently involved in some legal proceedings, management believes the results of these proceedings will not have a material effect on its financial condition, results of operations, or cash flows.

14

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is traded on the New York Stock Exchange, or NYSE, under the ticker symbol “TDG.” The following chart sets forth, for the periods indicated, the high and low sales prices of the common stock on the NYSE.

Quarterly Stock Prices | |||||||

High | Low | ||||||

Fiscal 2014 | |||||||

For Quarter ended December 28, 2013 | $ | 162.95 | $ | 136.86 | |||

For Quarter ended March 29, 2014 | 187.64 | 158.87 | |||||

For Quarter ended June 28, 2014 | 198.29 | 162.20 | |||||

For Quarter ended September 30, 2014 | 191.15 | 164.74 | |||||

Fiscal 2015 | |||||||

For Quarter ended December 27, 2014 | $ | 201.04 | $ | 166.61 | |||

For Quarter ended March 28, 2015 | 226.21 | 194.30 | |||||

For Quarter ended June 27, 2015 | 232.18 | 211.33 | |||||

For Quarter ended September 30, 2015 | 244.90 | 208.35 | |||||

Holders

On November 3, 2015, there were 44 stockholders of record of our common stock. We estimate that there were approximately 50,215 beneficial stockholders as of November 3, 2015, which includes an estimated amount of stockholders who have their shares held in their accounts by banks and brokers.

Dividends

In June 2014, TD Group’s Board of Directors declared a special cash dividend of $25.00 on each outstanding share of common stock. No dividends were declared in fiscal 2015.

We do not anticipate declaring or paying regular quarterly or annual cash dividends on our common stock in the near future. Any payment of special cash dividends on our common stock in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions under our debt documents, the availability of surplus under Delaware law and other factors deemed relevant by our Board of Directors. TD Group is a holding company and conducts all of its operations through direct and indirect subsidiaries. Unless TD Group receives dividends, distributions, advances, transfers of funds or other payments from our subsidiaries, TD Group will be unable to pay any dividends on our common stock in the future. The ability of any subsidiaries to take any of the foregoing actions is limited by the terms of our debt documents and may be limited by future debt or other agreements that we may enter into.

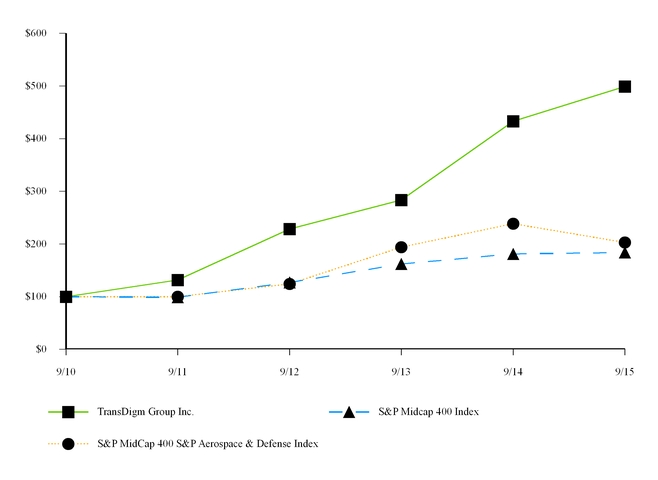

Performance Graph

Set forth below is a line graph comparing the cumulative total return of a hypothetical investment in the shares of common stock of TD Group with the cumulative total return of a hypothetical investment in each of the S&P Midcap 400 Index and the S&P MidCap 400 S&P Aerospace & Defense Index based on the respective market prices of each such investment on the dates shown below, assuming an initial investment of $100 on September 30, 2010.

The following performance graph and related information shall not be deemed “soliciting material” nor to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except to the extent we specifically incorporate it by reference into such filing.

15

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among TransDigm Group Inc., the S&P Midcap 400 Index,

and S&P MidCap 400 S&P Aerospace & Defense Index

*$100 invested on 9/30/10 in stock or index, including reinvestment of dividends.

Fiscal year ending September 30.

Copyright 2015 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

9/10 | 9/11 | 9/12 | 9/13 | 9/14 | 9/15 | ||||||||||

TransDigm Group Inc. | 100.00 | 131.62 | 228.64 | 283.53 | 432.98 | 498.94 | |||||||||

S&P Midcap 400 Index | 100.00 | 98.72 | 126.90 | 162.02 | 181.17 | 183.70 | |||||||||

S&P MidCap 400 S&P Aerospace & Defense Index | 100.00 | 100.07 | 124.06 | 194.01 | 238.41 | 202.94 | |||||||||

Purchases of Equity Securities by the Issuer or Affiliated Purchaser