Attached files

Exhibit 10.52 EXECUTION VERSION SECOND AMENDMENT TO THE RECEIVABLES PURCHASE AGREEMENT This SECOND AMENDMENT TO THE RECEIVABLES PURCHASE AGREEMENT (this "Amendment"), dated as of August 8, 2014, is entered into by and among the following parties: (i) TRANSDIGM RECEIVABLES LLC, a Delaware limited liability company, as Seller; (ii) TRANSDIGM, INC., a Delaware corporation, as Servicer; (iii) PNC BANK, NATIONAL ASSOCIATION, as a Committed Purchaser, as Purchaser Agent for its Purchaser Group and as Administrator ("PNC"); (iv) ATLANTIC ASSET SECURITIZATION LLC ("Atlantic"), as a Conduit Purchaser; and (v) CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK ("CACIB"), as a Committed Purchaser and as Purchaser Agent for its and Atlantic's Purchaser Group. Capitalized terms used but not otherwise defined herein (including such terms used above) have the respective meanings assigned thereto in the Receivables Purchase Agreement described below. BACKGROUND A. The parties hereto (other than CACIB and Atlantic) have entered into a Receivables Purchase Agreement, dated as of October 21, 2013 (as amended, restated, supplemented or otherwise modified through the date hereof, the "Receivables Purchase Agreement"). B. Concurrently herewith, the parties hereto are entering into that certain Amended and Restated Fee Letter (the "Amended Fee Letter"). C. The parties hereto desire to amend the Receivables Purchase Agreement as set forth herein. NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows: SECTION 1. Joinder of Purchasers; Rebalancing. (a) Joinder. Effective as of the date hereof, (i) Atlantic hereby becomes a party to the Receivables Purchase Agreement as a Conduit Purchaser thereunder with all the rights, interests, duties and obligations of a Conduit Purchaser set forth therein, (ii) CACIB hereby becomes a party to the Receivables Purchase Agreement as a Committed Purchaser thereunder with all the 709536582 13429494

rights, interests, duties and obligations of a Committed Purchaser set forth therein, (iii) Atlantic and CACIB shall constitute the members of a single new Purchaser Group, (iv) each of Atlantic and CACIB hereby appoints CACIB as its Purchaser Agent and (v) CACIB hereby becomes a party to the Receivables Purchase Agreement as a Purchaser Agent thereunder with all the rights, interests, duties and obligations of a Purchaser Agent set forth therein. In its capacity as a Committed Purchaser, CACIB's Commitment shall be the amount set forth on Schedule I attached hereto. (b) Rebalancing of Capital. On the date hereof, the Seller will repay $71,111,111.11 ofPNC's outstanding Capital; provided that all accrued and unpaid Discount with respect to such Capital so repaid shall be payable by the Seller to PNC on the next occurring Settlement Date. The Seller hereby requests that Atlantic or CACIB fund an initial Purchase on the date hereof in an amount of Capital equal to $71,111,111.11. Such Purchase shall be funded by Atlantic or CACIB on the date hereof in accordance with the terms of the Receivables Purchase Agreement and upon satisfaction of all conditions precedent thereto specified in the Receivables Purchase Agreement; provided, however, that no Purchase Notice shall be required therefor. For administrative convenience, the Seller hereby instructs Atlantic and CACIB to fund the foregoing Purchase by paying the proceeds thereof directly to the account specified by PNC to be applied as the foregoing repayment of PNC's Capital on the Seller's behalf. The Seller shall be deemed to have received the proceeds of such Purchase from Atlantic or CACIB (as applicable) for all purposes immediately upon PNC's receipt thereof. PNC shall notify Seller upon receipt of such proceeds from CACIB. (c) Consents. The parties hereto hereby consent to the joinder of Atlantic and CACIB as parties to the Receivables Purchase Agreement on the terms set forth in clause (a) above, to the non-ratable repayment of PNC's Capital on the terms set forth in clause (b) above and the foregoing non-ratable Purchase to be funded by Atlantic or CACIB on the terms set forth in clause (b) above, in each case, as set forth above on a one-time basis. (d) Credit Decision. Each of CACIB and Atlantic (i) confirms to PNC that it has received a copy of the Receivables Purchase Agreement, the other Transaction Documents, and such other documents and information as it has deemed appropriate to make its own credit analysis and decision to enter into this Amendment and (ii) agrees that it will, independently and without reliance upon PNC (in any capacity) or any of its Affiliates, based on such documents and information as CACIB or Atlantic (as the case may be) shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Receivables Purchase Agreement and any other Transaction Document. PNC makes no representation or warranty and assumes no responsibility with respect to (x) any statements, warranties or representations made in or in connection with the Receivables Purchase Agreement, any other Transaction Document or any other instrument or document furnished pursuant thereto or the execution, legality, validity, enforceability, genuineness, sufficiency or value of the Receivables Purchase Agreement or the Receivables, any other Transaction Document or any other instrument or document furnished pursuant thereto or (y) the financial condition of any of the Seller, the Servicer, the Performance Guarantor or the Originators or the performance or observance by any of the Seller, the Servicer, the Performance Guarantor or the Originators of any of their respective obligations under the Receivables Purchase Agreement, any other Transaction Document, or any instrument or document furnished pursuant thereto. 2 709536582 13429494

(e) Notice Addresses. Notices to Atlantic and CACIB, respective, under the Transaction Documents should be sent to the addresses set forth below, or such other addresses designated by Atlantic and CACIB from time to time in accordance with the Receivables Purchase Agreement : Ifto CACIB: Address: Attention: Telephone: Facsimile: Email: If to Atlantic: Address: Attention: Telephone: Facsimile: Email: Credit Agricole Corporate and Investment Bank 1301 Avenue ofthe Americas New York, NY 10019 Deric Bradford (212) 261-3470 (917) 849-5584 deric.bradford@ca-cib.com Atlantic Asset Securitization LLC c/o Credit Agricole Corporate and Investment Bank 1301 Avenue of the Americas New York, NY 10019 Deric Bradford (212) 261-3470 (917) 849-5584 deric.bradford@ca-cib.com SECTION 2. Amendments to the Receivables Purchase Agreement. The Receivables Purchase Agreement is hereby amended as follows: (a) Section 1.2(a) of the Receivables Purchase Agreement is hereby amended by replacing "thirty-five (35) days" with "two Business Days" where it appears therein. (b) Section 1.2(d) of the Receivables Purchase Agreement is hereby amended by adding the following new sentence at the end thereof: Except as otherwise permitted under this Agreement, the Administrator shall not release in writing any material portion of the Pool Assets from the security interest of the Administrator hereunder without the consent of the Majority Purchaser Agents. (c) The following defined terms and definitions thereof are added to Exhibit I of the Receivables Purchase Agreement in appropriate alphabetical order: "Atlantic" means Atlantic Asset Securitization LLC. "CACIB" means Credit Agricole Corporate and Investment Bank. "Sanctions Laws" shall mean any Applicable Laws relating to terrorism, trade sanctions programs and embargoes, import/export licensing, money 3 709536582 13429494

laundering or bribery, and any regulation, order, or directive promulgated, issued or enforced pursuant to such Applicable Laws, all as amended, supplemented or replaced from time to time and including, without limitation, OFAC's sanctions regulations. (d) The definition of "Commitment" set forth in Exhibit I to the Receivables Purchase Agreement is amended by replacing "on its signature page hereto" with "on Schedule I hereto". (e) The definition of "Dilution Volatility Component" set forth in Exhibit I to the Receivables Purchase Agreement is replaced in its entirety with the following: "Dilution Volatility Component" means, for any calendar month, (a) the positive difference, if any, between: (i) the highest average Dilution Ratio for any three consecutive calendar months during the twelve most recent calendar months and (ii) the arithmetic average of the Dilution Ratios for such twelve months times (b) the quotient of (i) the highest average Dilution Ratio for any three consecutive calendar months during the twelve most recent calendar months divided Q.y (ii) the arithmetic average of the Dilution Ratios for such twelve months. (f) The definition of "Facility Termination Date" set forth in Exhibit I to the Receivables Purchase Agreement is amended by replacing the date "October 20, 2014" where it appears therein with the date "August 7, 2015". (g) The definition of "Group Commitment" set forth in Exhibit I to the Receivables Purchase Agreement is amended by replacing "the amount set forth as such Purchaser Group's "Group Commitment" on its Purchaser Agent's signature page hereto" with "the aggregate amount of the Commitments of all Committed Purchasers in such Purchaser Group". (h) The definition of "Loss Horizon Ratio" set forth in Exhibit I to the Receivables Purchase Agreement is replaced in its entirety with the following: "Loss Horizon Ratio" means, as of any date of determination, the ratio (expressed as a percentage and rounded to the nearest Ill 00 of I%) computed by dividing: (a) the sum of (i) the aggregate initial Outstanding Balance of all Pool Receivables generated by the Originators during the four (4) calendar months most recently ended (provided, however, that at any time with five (5) Business Days prior written notice to the Seller and the Servicer the Administrator, in its sole discretion, may (or shall if so directed by any Purchaser Agent) increase the number of months set forth in this clause (i) from four ( 4) calendar months to five (5) calendar months for any future date of determination), plus (ii) five percent (5%) of the aggregate initial Outstanding Balance of all Pool Receivables generated by all Originators during the fifth most recently ended calendar month (or, if the number of calendar months in clause (i) above has been increased to five (5) calendar months, then the sixth most recently ended calendar month), plus (iii) five percent (5%) of the aggregate initial Outstanding Balance of all Pool Receivables generated by all Originators during the sixth most recently ended 4 709536582 13429494

calendar month (or, if the number of calendar months in clause (i) above has been increased to five (5) calendar months, then the seventh most recently ended calendar month) !IT (b) the Net Receivables Pool Balance as of such date. (i) The definition of "Sanctioned Country" set forth in Exhibit I to the Receivables Purchase Agreement is replaced in its entirety with the following: "Sanctioned Country" means (a) a country subject to a sanctions program maintained under any Sanctions Law, including, without limitation, a sanctions program identified on the list maintained by OF AC as published by OF AC from time to time, and (b) each of the following countries, without regard to whether such country is subject to a sanctions program maintained under any Sanctions Law: (i) Belarus, (ii) Central African Republic, (iii) Democratic Republic of Congo, (iv) Eritrea, (v) Guinea (Conakry), (vi) Ivory Coast, (vii) Lebanon, (viii) Liberia, (ix) Libya, (x) Myanmar (Burma), (xi) Somalia, (xii) Ukraine, (xiii) Zimbabwe, (xiv) Russia, (xv) Iraq, (xvi) Cuba, (xvii) Iran, (xviii) North Korea, (xix) South Sudan, (xx) Sudan and (xxi) Syria. G) The definition of "Sanctioned Person" set forth in Exhibit I to the Receivables Purchase Agreement is replaced in its entirety with the following: "Sanctioned Person" means (i) a person named on the list of "Specially Designated Nationals" or "Blocked Persons" maintained by OF AC available as published by OFAC from time to time, (ii) an agency of the government of a Sanctioned Country, (iii) an organization controlled by a Sanctioned Country, (iv) a natural person resident in a Sanctioned Country or (v) a Person that is organized or incorporated under the laws of, or has a chief executive office or principal place ofbusiness located in, a Sanctioned Country. (k) Clause (m) of Section 1 of Exhibit III to the Receivables Purchase Agreement is replaced in its entirety with the following: (m) Sanctions Laws. The Seller is not a Sanctioned Person and is not in violation of any Sanctions Law. To the Seller's knowledge, no Obligor was a Sanctioned Person at the time of origination of any Pool Receivable owing by such Obligor. The Seller and its Affiliates: (i) have less than 15% of their assets in Sanctioned Countries; and (ii) derive less than 15% of their operating income from investments in, or transactions with Sanctioned Persons or Sanctioned Countries. Neither the Seller nor any of its Subsidiaries engages in activities related to Sanctioned Countries except for such activities as are (A) specifically or generally licensed by OF AC and not otherwise in violation of any Sanctions Law, or (B) otherwise in compliance with Sanctions Laws. (l) Clause (k) of Section 2 of Exhibit III to the Receivables Purchase Agreement is replaced in its entirety with the following: (k) Sanctions Laws. The Servicer is not a Sanctioned Person and is not in violation of any Sanctions Law. To the Servicer's knowledge, no Obligor 5 709536582 13429494

was a Sanctioned Person at the time of origination of any Pool Receivable owing by such Obligor. The Servicer and its Affiliates: (i) have less than 15% of their assets in Sanctioned Countries; and (ii) derive less than 15% of their operating income from investments in, or transactions with Sanctioned Persons or Sanctioned Countries. Neither the Servicer nor any of its Subsidiaries engages in activities related to Sanctioned Countries except for such activities as are (A) specifically or generally licensed by OF AC and not otherwise in violation of any Sanctions Law, or (B) otherwise in compliance with Sanctions Laws. (m) Clause (q) of Section 1 of Exhibit IV to the Receivables Purchase Agreement is amended by replacing "[Reserved]." where it appears therein with the following: Minimum Funding Requirement. The Seller will at all times prior to the Facility Termination Date maintain a minimum outstanding amount of Aggregate Capital in an amount equal to the lesser of: (i) 75% of the Purchase Limit at such time and (ii) 100% of (a) the Net Receivables Pool Balance at such time minus (b) the Total Reserves at such time. (n) Clause (r) of Section 1 of Exhibit IV to the Receivables Purchase Agreement is replaced in its entirety with the following: (r) Sanctions Laws. The Seller has not used and will not use the proceeds of any Receivable or any Purchase hereunder in violation of any Sanctions Law or to fund any operations in, finance any investments or activities in or make any payments to, a Sanctioned Person or a Sanctioned Country. ( o) Clause (g)(ii) of Exhibit V to the Receivables Purchase Agreement is amended by replacing the percentage "2.00%" where it appears therein with the percentage 2.50%". (p) Schedule I to the Receivables Purchase Agreement is deleted and replaced in its entirety with Schedule I hereto, and PNC's Commitment is hereby reduced to the amount set forth on such Schedule I hereto. SECTION 3. Representations and Warranties of the Seller and Servicer. Each of the Seller and the Servicer hereby represents and warrants, as to itself, to the Administrator, each Purchaser and each Purchaser Agent, as follows: (a) Representations and Warranties. Immediately after giVIng effect to this Amendment, the representations and warranties made by such Person in the Transaction Documents to which it is a party are true and correct as of the date hereof (unless stated to relate solely to an earlier date, in which case such representations or warranties were true and correct as of such earlier date). (b) Enforceability. This Amendment and each other Transaction Document to which it is a party, as amended hereby, constitute the legal, valid and binding obligation of such Person enforceable against such Person in accordance with its respective terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization or other similar laws 6 709536582 13429494

affecting the enforcement of creditors' rights generally and by general principles of equity, regardless of whether enforceability is considered in a proceeding in equity or at law. (c) No Termination Event. No event has occurred and is continuing, or would result from the transactions contemplated hereby, that constitutes a Purchase and Sale Termination Event, an Unmatured Purchase and Sale Termination Event, a Termination Event or an Unmatured Termination Event. SECTION 4. Effect of Amendment. All provisions of the Receivables Purchase Agreement and the other Transaction Documents, as expressly amended and modified by this Amendment, shall remain in full force and effect. After this Amendment becomes effective, all references in the Receivables Purchase Agreement (or in any other Transaction Document) to "this Receivables Purchase Agreement", "this Agreement", "hereof'', "herein" or words of similar effect referring to the Receivables Purchase Agreement shall be deemed to be references to the Receivables Purchase Agreement as amended by this Amendment. This Amendment shall not be deemed, either expressly or impliedly, to waive, amend or supplement any provision of the Receivables Purchase Agreement other than as set forth herein. SECTION 5. Effectiveness. This Amendment shall become effective as of the date hereof upon the satisfaction of the following conditions precedent: (a) Execution of Amendment. The Administrator shall have received counterparts duly executed by each of the parties hereto. (b) Execution of Amended Fee Letter. The Administrator shall have received counterparts of the Amended Fee Letter duly executed by each of the parties thereto. (c) Receipt of Amendment Fee. The Administrator shall have received confirmation that the "Amendment Fees" set forth in the Amended Fee Letter have been paid in accordance with the terms thereof. SECTION 6. Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which when so executed shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this Amendment by facsimile or e-mail transmission shall be effective as delivery of a manually executed counterpart hereof. SECTION 7. GOVERNING LAW. THIS AMENDMENT SHALL BE DEEMED TO BE A CONTRACT MADE UNDER AND GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEW YORK (INCLUDING FOR SUCH PURPOSE SECTIONS 5-1401 AND 5- 1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK). SECTION 8. Section Headings. The various headings of this Amendment are included for convenience only and shall not affect the meaning or interpretation of this Amendment, the Receivables Purchase Agreement or any provision hereof or thereof. 7 709536582 13429494

IN WITNESS WHEREOF, the parties hereto have executed this Amendment by their duly authorized officers as of the date first above written. 709536582 13429494 TRANSDIGM RECEIVABLES LLC, as Seller TRANSDIGM, INC., as Initial Servicer By: _ _ ...>e;,; ~~Yf~IX-------- Narne: ~~tow} Title: e \lr • t..h ,_ ... ~..., S-1 Second Amendment to the Receivables Purchase Agl'cement (TransDigm Receivables LLC)

709536582 134291\94 PNC BANK, NATIONAL ASSOCIATION, a.'i a Committed Purchaser, as a Purchaser Agent -and/f)'"'J~/ ~ By.__ ·- - Name: Mark Falcione Title: Executive Vice President S-2 Second Amendment to the Receivables Purchase Agreement (I'rcmsDigm Receivables LLC)

7095.16582 13429494 ATLANTIC ASSET SECURITIZATION LLC, as a Conduit Purchaser By:_ Name: Title: S-3 Kostantfna Kourmpetls Managing Director ~ Roger Klepper Managing Director Second Amendment to the Receivables Purchase Agreement (Tran.lDigm Recehlables LLC)

709536582 13~29494 CREDIT AGRlCOLE CORPORATE AND INVESTMENT BANK, as a Committed Purchaser and as Purchaser Agent for its and Atlantic Asset Securitization LLC's Purcha72er Oro By:_ ~ Name: Tille: Kostantlna Kourmpetls S-4 Ma ~ing~r? ,. Roger Klepper ... llllli.~ Second Amendment to the Receivables Purchase Agreement (fransDigm Receivables LLC)

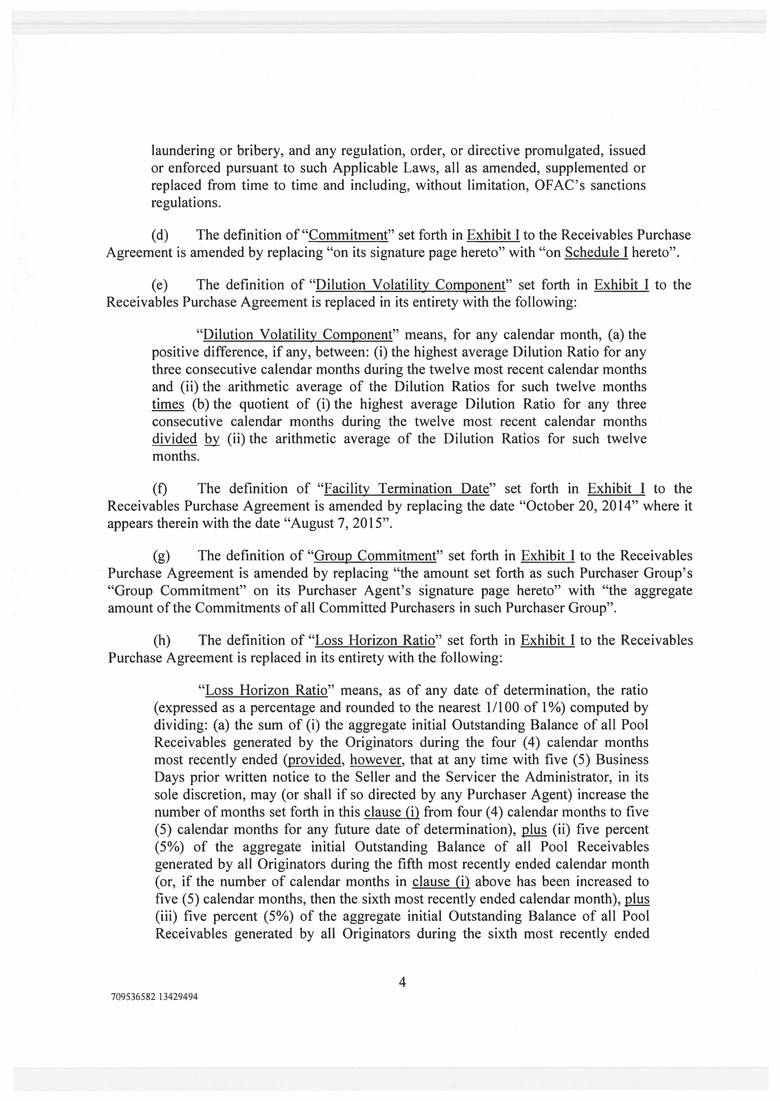

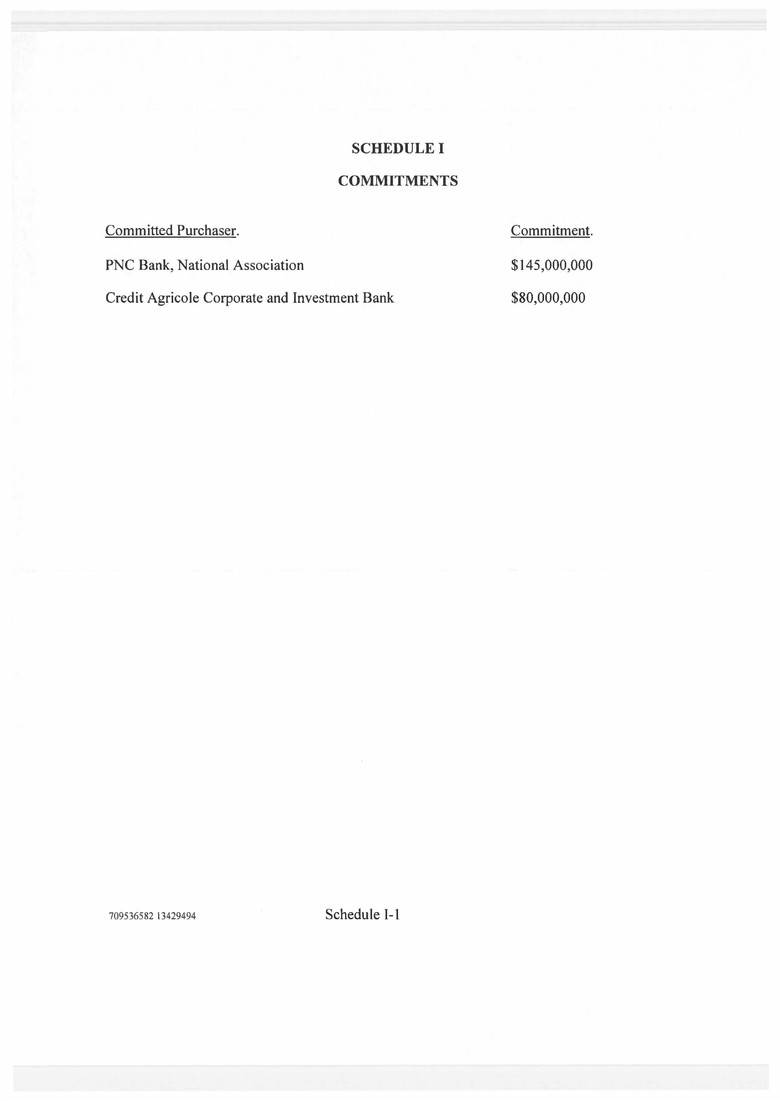

Committed Purchaser. PNC Bank, National Association SCHEDULE I COMMITMENTS Credit Agricole Corporate and Investment Bank 709536582 13429494 Schedule 1-1 Commitment. $145,000,000 $80,000,000