Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - NET 1 UEPS TECHNOLOGIES INC | exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the transition period from _________ To __________

Commission file number: 000-31203

NET 1 UEPS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Florida | 98-0171860 |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

President Place, 4th Floor, Cnr. Jan

Smuts Avenue and Bolton Road

Rosebank, Johannesburg 2196, South Africa

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 27-11-343-2000

Not Applicable

(Former Name, Former Address

and Former Fiscal Year, if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

YES [X] NO

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| [ ] Large accelerated filer | [X ] Accelerated filer |

| [ ] Non-accelerated filer | [ ] Smaller reporting company |

| (do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

YES [

] NO [X ]

As of November 3, 2015 (the latest practicable date), 47,322,702 shares of the registrant’s common stock, par value $0.001 per share, net of treasury shares, were outstanding.

Form 10-Q

NET 1 UEPS TECHNOLOGIES, INC.

Table of Contents

1

Part I. Financial Information

Item 1. Financial Statements

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed

Consolidated Balance Sheets

| Unaudited | (A) | |||||

| September 30, | June 30, | |||||

| 2015 | 2015 | |||||

| (In thousands, except share data) | ||||||

| ASSETS | ||||||

| CURRENT ASSETS | ||||||

| Cash and cash equivalents | $ | 125,610 | $ | 117,583 | ||

| Pre-funded social welfare grants receivable (Note 2) | 1,411 | 2,306 | ||||

| Accounts receivable, net of allowances of – September: $2,767; June: $1,956 | 153,453 | 148,768 | ||||

| Finance loans receivable, net of allowances of – September: $3,640; June: $4,227 | 33,921 | 40,373 | ||||

| Inventory (Note 3) | 12,335 | 12,979 | ||||

| Deferred income taxes | 6,829 | 7,298 | ||||

| Total current assets before settlement assets | 333,559 | 329,307 | ||||

| Settlement assets (Note 4) | 600,195 | 661,916 | ||||

| Total current assets | 933,754 | 991,223 | ||||

| PROPERTY, PLANT AND EQUIPMENT, net of accumulated depreciation of – | ||||||

| September: $92,145; June: $94,014 | 52,048 | 52,320 | ||||

| EQUITY-ACCOUNTED INVESTMENTS | 14,342 | 14,329 | ||||

| GOODWILL (Note 6) | 154,294 | 166,437 | ||||

| INTANGIBLE ASSETS, net (Note 6) | 40,862 | 47,124 | ||||

| OTHER LONG-TERM ASSETS, including reinsurance assets (Note 5 and Note 7) | 13,982 | 14,997 | ||||

| TOTAL ASSETS | 1,209,282 | 1,286,430 | ||||

| LIABILITIES | ||||||

| CURRENT LIABILITIES | ||||||

| Accounts payable | 15,527 | 21,453 | ||||

| Other payables | 49,011 | 45,595 | ||||

| Current portion of long-term borrowings (Note 9) | 8,359 | 8,863 | ||||

| Income taxes payable | 12,848 | 6,287 | ||||

| Total current liabilities before settlement obligations | 85,745 | 82,198 | ||||

| Settlement obligations (Note 4) | 600,195 | 661,916 | ||||

| Total current liabilities | 685,940 | 744,114 | ||||

| DEFERRED INCOME TAXES | 9,169 | 10,564 | ||||

| LONG-TERM BORROWINGS (Note 9) | 48,561 | 50,762 | ||||

| OTHER LONG-TERM LIABILITIES, including insurance policy liabilities (Note 7) | 2,178 | 2,205 | ||||

| TOTAL LIABILITIES | 745,848 | 807,645 | ||||

| COMMITMENTS AND CONTINGENCIES (Note 17) | ||||||

| EQUITY | ||||||

| COMMON STOCK (Note 10) | ||||||

| Authorized: 200,000,000 with $0.001 par value; | ||||||

| Issued and outstanding shares, net of treasury - September: 47,322,702; June: 46,679,565 | 64 | 64 | ||||

| PREFERRED STOCK | ||||||

| Authorized shares: 50,000,000 with $0.001 par value; | ||||||

| Issued and outstanding shares, net of treasury: September: -; June: - | - | - | ||||

| ADDITIONAL PAID-IN-CAPITAL | 218,384 | 213,896 | ||||

| TREASURY SHARES, AT COST: September: 18,057,228; June: 18,057,228 | (214,520 | ) | (214,520 | ) | ||

| ACCUMULATED OTHER COMPREHENSIVE LOSS | (182,545 | ) | (139,181 | ) | ||

| RETAINED EARNINGS | 640,888 | 617,868 | ||||

| TOTAL NET1 EQUITY | 462,271 | 478,127 | ||||

| NON-CONTROLLING INTEREST | 1,163 | 658 | ||||

| TOTAL EQUITY | 463,434 | 478,785 | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,209,282 | $ | 1,286,430 | ||

(A) – Derived from audited financial statements

See Notes to Unaudited Condensed Consolidated Financial Statements

2

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed

Consolidated Statements of Operations

| Three months ended | ||||||

| September 30, | ||||||

| 2015 | 2014 | |||||

| (In thousands, except per share data) | ||||||

| REVENUE | $ | 154,473 | $ | 156,441 | ||

| EXPENSE | ||||||

| Cost of goods sold, IT processing, servicing and support | 77,382 | 74,406 | ||||

| Selling, general and administration | 35,761 | 38,736 | ||||

| Depreciation and amortization | 10,115 | 10,174 | ||||

| OPERATING INCOME | 31,215 | 33,125 | ||||

| INTEREST INCOME | 4,275 | 4,090 | ||||

| INTEREST EXPENSE | 974 | 1,312 | ||||

| INCOME BEFORE INCOME TAX EXPENSE | 34,516 | 35,903 | ||||

| INCOME TAX EXPENSE (Note 16) | 10,897 | 11,648 | ||||

| NET INCOME BEFORE EARNINGS FROM EQUITY-ACCOUNTED INVESTMENTS | 23,619 | 24,255 | ||||

| EARNINGS FROM EQUITY-ACCOUNTED INVESTMENTS | 188 | 92 | ||||

| NET INCOME | 23,807 | 24,347 | ||||

| LESS NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTEREST | 787 | 258 | ||||

| NET INCOME ATTRIBUTABLE TO NET1 | $ | 23,020 | $ | 24,089 | ||

| Net income per share, in United States dollars (Note 13) | ||||||

| Basic earnings attributable to Net1 shareholders | $ | 0.49 | $ | 0.51 | ||

| Diluted earnings attributable to Net1 shareholders | $ | 0.49 | $ | 0.51 | ||

See Notes to Unaudited Condensed Consolidated Financial Statements

3

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed

Consolidated Statements of Comprehensive Income

| Three months ended | ||||||

| September 30, | ||||||

| 2015 | 2014 | |||||

| (In thousands) | ||||||

| Net income | $ | 23,807 | $ | 24,347 | ||

| Other comprehensive income (loss) | ||||||

| Net unrealized income (loss) on asset available for sale, net of tax | 50 | (226 | ) | |||

| Movement in foreign currency translation reserve | (43,696 | ) | (21,185 | ) | ||

| Total other comprehensive loss, net of taxes | (43,646 | ) | (21,411 | ) | ||

| Comprehensive (loss) income | (19,839 | ) | 2,936 | |||

| (Less) comprehensive income attributable to non- controlling interest | (505 | ) | (232 | ) | ||

| Comprehensive (loss)/income attributable to Net1 | $ | (20,344 | ) | $ | 2,704 | |

See Notes to Unaudited Condensed Consolidated Financial Statements

4

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed Consolidated

Statement of Changes in Equity for the three

months ended September 30, 2015 (dollar

amounts in thousands)

| Net 1 UEPS Technologies, Inc. Shareholders | |||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||

| Number of | Number of | Additional | other | Non- | |||||||||||||||||||||||||||||

| Number of | Treasury | Treasury | shares, net of | Paid-In | Retained | comprehensive | Total Net1 | controlling | |||||||||||||||||||||||||

| Shares | Amount | Shares | Shares | treasury | Capital | Earnings | loss | Equity | Interest | Total | |||||||||||||||||||||||

| Balance – July 1, 2015 | 64,736,793 | $ | 64 | (18,057,228 | ) | $ | (214,520 | ) | 46,679,565 | $ | 213,896 | $ | 617,868 | $ | (139,181 | ) | $ | 478,127 | $ | 658 | $ | 478,785 | |||||||||||

| Restricted stock granted (Note 12) | 319,492 | 319,492 | - | - | |||||||||||||||||||||||||||||

| Exercise of stock option (Note 12) | 323,645 | 323,645 | 3,762 | 3,762 | 3,762 | ||||||||||||||||||||||||||||

| Stock-based compensation charge (Note 12) | 726 | 726 | 726 | ||||||||||||||||||||||||||||||

| Net income | 23,020 | 23,020 | 787 | 23,807 | |||||||||||||||||||||||||||||

| Other comprehensive loss (Note 11) | (43,364 | ) | (43,364 | ) | (282 | ) | (43,646 | ) | |||||||||||||||||||||||||

| Balance – September 30, 2015 | 65,379,930 | $ | 64 | (18,057,228 | ) | $ | (214,520 | ) | 47,322,702 | $ | 218,384 | $ | 640,888 | $ | (182,545 | ) | $ | 462,271 | $ | 1,163 | $ | 463,434 | |||||||||||

See Notes to Unaudited Condensed Consolidated Financial Statements

5

NET 1 UEPS TECHNOLOGIES, INC.

Unaudited Condensed

Consolidated Statements of Cash Flows

| Three months ended | ||||||

| September 30, | ||||||

| 2015 | 2014 | |||||

| (In thousands) | ||||||

| Cash flows from operating activities | ||||||

| Net income | $ | 23,807 | $ | 24,347 | ||

| Depreciation and amortization | 10,115 | 10,174 | ||||

| Earnings from equity-accounted investments | (188 | ) | (92 | ) | ||

| Fair value adjustments | 1,433 | 413 | ||||

| Interest payable | 709 | 1,159 | ||||

| Profit on disposal of plant and equipment | (95 | ) | (122 | ) | ||

| Stock-based compensation charge | 726 | 916 | ||||

| Facility fee amortized | 34 | 82 | ||||

| (Increase) Decrease in accounts receivable,

pre-funded social welfare grants receivable and finance loans receivable |

(17,278 | ) | 9,470 | |||

| Increase in inventory | (931 | ) | (2,123 | ) | ||

| Increase (Decrease) in accounts payable and other payables | 2,972 | (10,933 | ) | |||

| Increase in taxes payable | 7,824 | 6,611 | ||||

| Decrease in deferred taxes | (1,026 | ) | (390 | ) | ||

| Net cash provided by operating activities | 28,102 | 39,512 | ||||

| Cash flows from investing activities | ||||||

| Capital expenditures | (10,698 | ) | (9,378 | ) | ||

| Proceeds from disposal of property, plant and equipment | 348 | 241 | ||||

| Proceeds from sale of business (Note 14) | - | 1,895 | ||||

| Net change in settlement assets | (21,575 | ) | (43,054 | ) | ||

| Net cash used in investing activities | (31,925 | ) | (50,296 | ) | ||

| Cash flows from financing activities | ||||||

| Proceeds from issue of common stock | 3,762 | 989 | ||||

| Long-term borrowings utilized | 720 | 1,097 | ||||

| Acquisition of treasury stock (Note 10) | - | (9,151 | ) | |||

| Sale of equity to non-controlling interest (Note 10) | - | 1,407 | ||||

| Net change in settlement obligations | 21,575 | 43,054 | ||||

| Net cash provided by financing activities | 26,057 | 37,396 | ||||

| Effect of exchange rate changes on cash | (14,207 | ) | (4,099 | ) | ||

| Net increase in cash and cash equivalents | 8,027 | 22,513 | ||||

| Cash and cash equivalents – beginning of period | 117,583 | 58,672 | ||||

| Cash and cash equivalents – end of period | $ | 125,610 | $ | 81,185 | ||

See Notes to Unaudited Condensed Consolidated Financial Statements

6

NET 1 UEPS TECHNOLOGIES, INC.

Notes to the

Unaudited Condensed Consolidated Financial Statements

for the three

months ended September 30, 2015 and 2014

(All amounts in tables

stated in thousands or thousands of United States Dollars, unless otherwise

stated)

| 1. |

Basis of Presentation and Summary of Significant Accounting Policies |

Unaudited Interim Financial Information

The accompanying unaudited condensed consolidated financial statements include all majority-owned subsidiaries over which the Company exercises control and have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the rules and regulations of the United States Securities and Exchange Commission for quarterly reports on Form 10-Q and include all of the information and disclosures required for interim financial reporting. The results of operations for the three months ended September 30, 2015 and 2014, are not necessarily indicative of the results for the full year. The Company believes that the disclosures are adequate to make the information presented not misleading.

These financial statements should be read in conjunction with the financial statements, accounting policies and financial notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments (consisting only of normal recurring adjustments), which are necessary for a fair representation of financial results for the interim periods presented.

References to the “Company” refer to Net1 and its consolidated subsidiaries, unless the context otherwise requires. References to Net1 are references solely to Net 1 UEPS Technologies, Inc.

Recent accounting pronouncements adopted

There were no accounting pronouncements adopted during the three months ended September 30, 2015.

Recent accounting pronouncements not yet adopted as of September 30, 2015

In May 2014, the FASB issued guidance regarding Revenue from Contracts with Customers. This guidance requires an entity to recognize revenue when a customer obtains control of promised goods or services in an amount that reflects the consideration to which the entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The guidance was effective for the Company beginning July 1, 2017, however this date has been extended as per subsequent guidance issued by the FASB. Early adoption is not permitted. The Company expects that this guidance will have a material impact on its financial statements and is currently evaluating the impact of this guidance on its financial statements on adoption.

In August 2015, the FASB issued guidance regarding Revenue from Contracts with Customers, Deferral of the Effective Date. This guidance defers the required implementation date specified in Revenue from Contracts with Customers to December 2017. Public companies may elect to adopt the standard along the original timeline. The Company expects that this guidance will have a material impact on its financial statements and is currently evaluating the impact of this guidance on its financial statements on adoption.

In August 2014, the FASB issued guidance regarding Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern. This guidance requires an entity to perform interim and annual assessments of its ability to continue as a going concern within one year of the date that its financial statements are issued. An entity must provide certain disclosures if conditions or events raise substantial doubt about the entity’s ability to continue as a going concern. The guidance is effective for the Company beginning July 1, 2017. Early adoption is permitted. The Company is currently assessing the impact of this guidance on its financial statements disclosure.

In February 2015, the FASB issued guidance regarding Amendments to the Consolidation Analysis. This guidance amends both the variable interest entity and voting interest entity consolidation models. The requirement to assess an entity under a different consolidation model may change previous consolidation conclusions. The guidance is effective for the Company beginning July 1, 2016. Early adoption is permitted. The Company is currently assessing the impact of this guidance on its financial statements disclosure.

7

| 1. |

Basis of Presentation and Summary of Significant Accounting Policies (continued) |

Recent accounting pronouncements not yet adopted as of September 30, 2015 (continued)

In July 2015, the FASB issued guidance regarding Simplifying the Measurement of Inventory. This guidance requires entities to measure most inventory “at the lower of cost and net realizable value,” thereby simplifying the current guidance under which an entity must measure inventory at the lower of cost or market (market in this context is defined as one of three different measures). The guidance will not apply to inventories that are measured by using either the last-in, first-out (“LIFO”) method or the retail inventory method (“RIM”). The guidance is effective for the Company beginning July 1, 2017. Early adoption is permitted. The Company is currently assessing the impact of this guidance on its financial statements disclosure.

| 2. |

Pre-funded social welfare grants receivable |

Pre-funded social welfare grants receivable represents amounts pre-funded by the Company to certain merchants participating in the merchant acquiring system. The October 2015 payment service commenced on October 1, 2015, but the Company pre-funded certain merchants participating in the merchant acquiring system on the last two days of September 2015.

| 3. |

Inventory |

The Company’s inventory comprised the following categories as of September 30, 2015 and June 30, 2015.

| September 30, | June 30, | ||||||

| 2015 | 2015 | ||||||

| Finished goods | $ | 12,335 | $ | 12,979 | |||

| $ | 12,335 | $ | 12,979 |

| 4. |

Settlement assets and settlement obligations |

Settlement assets comprise (1) cash received from the South African government that the Company holds pending disbursement to recipient beneficiaries of social welfare grants and (2) cash received from customers on whose behalf the Company processes payroll payments that the Company will disburse to customer employees, payroll-related payees and other payees designated by the customer.

Settlement obligations comprise (1) amounts that the Company is obligated to disburse to recipient beneficiaries of social welfare grants, and (2) amounts that the Company is obligated to pay to customer employees, payroll-related payees and other payees designated by the customer.

The balances at each reporting date may vary widely depending on the timing of the receipts and payments of these assets and obligations.

| 5. |

Fair value of financial instruments |

Initial recognition and measurement

Financial instruments are recognized when the Company becomes a party to the transaction. Initial measurements are at cost, which includes transaction costs.

Risk management

The Company seeks to reduce its exposure to currencies other than the South African Rand (“ZAR”) through a policy of matching, to the extent possible, assets and liabilities denominated in those currencies. In addition, the Company uses financial instruments in order to economically hedge its exposure to exchange rate and interest rate fluctuations arising from its operations. The Company is also exposed to equity price and liquidity risks as well as credit risks.

8

| 5. |

Fair value of financial instruments (continued) |

Risk management (continued)

Currency exchange risk

The Company is subject to currency exchange risk because it purchases inventories that it is required to settle in other currencies, primarily the euro and U.S. dollar. The Company has used forward contracts in order to limit its exposure in these transactions to fluctuations in exchange rates between the ZAR, on the one hand, and the U.S. dollar and the euro, on the other hand.

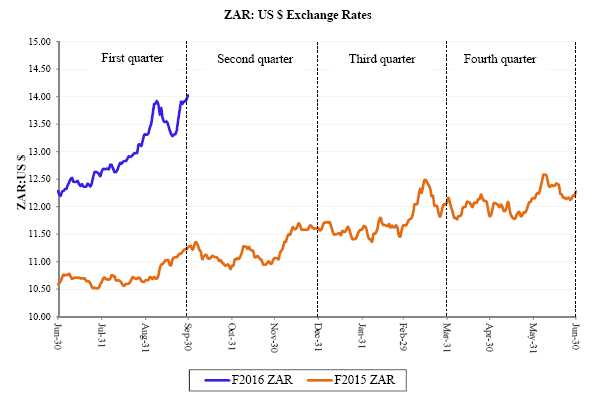

Translation risk

Translation risk relates to the risk that the Company’s results of operations will vary significantly as the U.S. dollar is its reporting currency, but it earns most of its revenues and incurs most of its expenses in ZAR. The U.S. dollar to ZAR exchange rate has fluctuated significantly over the past three years. As exchange rates are outside the Company’s control, there can be no assurance that future fluctuations will not adversely affect the Company’s results of operations and financial condition.

Interest rate risk

As a result of its normal borrowing and leasing activities, the Company’s operating results are exposed to fluctuations in interest rates, which it manages primarily through regular financing activities. The Company generally maintains limited investment in cash equivalents and has occasionally invested in marketable securities.

Credit risk

Credit risk relates to the risk of loss that the Company would incur as a result of non-performance by counterparties. The Company maintains credit risk policies with regard to its counterparties to minimize overall credit risk. These policies include an evaluation of a potential counterparty’s financial condition, credit rating, and other credit criteria and risk mitigation tools as the Company’s management deems appropriate.

With respect to credit risk on financial instruments, the Company maintains a policy of entering into such transactions only with South African and European financial institutions that have a credit rating of BBB or better, as determined by credit rating agencies such as Standard & Poor’s, Moody’s and Fitch Ratings.

UEPS-based microlending credit risk

The Company is exposed to credit risk in its UEPS-based microlending activities, which provides unsecured short-term loans to qualifying customers. The Company manages this risk by performing an affordability test for each prospective customer and assigns a “creditworthiness score”, which takes into account a variety of factors such as other debts and total expenditures on normal household and lifestyle expenses.

Equity price and liquidity risk

Equity price risk relates to the risk of loss that the Company would incur as a result of the volatility in the exchange-traded price of equity securities that it holds and the risk that it may not be able to liquidate these securities. The market price of these securities may fluctuate for a variety of reasons, consequently, the amount the Company may obtain in a subsequent sale of these securities may significantly differ from the reported market value.

Liquidity risk relates to the risk of loss that the Company would incur as a result of the lack of liquidity on the exchange on which these securities are listed. The Company may not be able to sell some or all of these securities at one time, or over an extended period of time without influencing the exchange traded price, or at all.

9

| 5. |

Fair value of financial instruments (continued) |

Financial instruments

The following section describes the valuation methodologies the Company uses to measure its significant financial assets and liabilities at fair value.

In general, and where applicable, the Company uses quoted prices in active markets for identical assets or liabilities to determine fair value. This pricing methodology applies to Level 1 investments. If quoted prices in active markets for identical assets or liabilities are not available to determine fair value, then the Company uses quoted prices for similar assets and liabilities or inputs other than the quoted prices that are observable either directly or indirectly. These investments are included in Level 2 investments. In circumstances in which inputs are generally unobservable, values typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques. Investments valued using such techniques are included in Level 3 investments.

Asset measured at fair value using significant unobservable inputs – investment in Finbond Group Limited (“Finbond”)

The Company's Level 3 asset represents an investment of 156,788,712 shares of common stock of Finbond, which are exchange-traded equity securities. Finbond’s shares are traded on the Johannesburg Stock Exchange (“JSE”) and the Company has designated such shares as available for sale investments. The Company has concluded that the market for Finbond shares is not active and consequently has employed alternative valuation techniques in order to determine the fair value of such stock. Finbond issues financial products and services under a mutual banking licence and also has a microlending offering. In determining the fair value of Finbond, the Company has considered amongst other things Finbond’s historical financial information (including its most recent public accounts), press releases issued by Finbond and its published net asset value. The Company believes that the best indicator of fair value of Finbond is its published net asset value and has used this value to determine the fair value.

Asset measured at fair value using significant unobservable inputs – investment in Finbond Group Limited (“Finbond”) (continued)

The fair value of these securities as of September 30, 2015, represented approximately 1% of the Company’s total assets, including these securities. The Company expects to hold these securities for an extended period of time and it is not concerned with short-term equity price volatility with respect to these securities provided that the underlying business, economic and management characteristics of the company remain sound.

Derivative transactions - Foreign exchange contracts

As part of the Company’s risk management strategy, the Company enters into derivative transactions to mitigate exposures to foreign currencies using foreign exchange contracts. These foreign exchange contracts are over-the-counter derivative transactions. Substantially all of the Company’s derivative exposures are with counterparties that have long-term credit ratings of BBB or better. The Company uses quoted prices in active markets for similar assets and liabilities to determine fair value (Level 2). The Company has no derivatives that require fair value measurement under Level 1 or 3 of the fair value hierarchy.

The Company’s outstanding foreign exchange contracts are as follows:

As of September 30, 2015

| Fair market | ||||||||||

| Notional amount | Strike price | value price | Maturity | |||||||

| EUR 526,263.00 | ZAR 15.3809 | ZAR15.5532 | October 20, 2015 | |||||||

| EUR 509,516.00 | ZAR 15.4728 | ZAR15.6435 | November 20, 2015 | |||||||

| EUR 529,865.00 | ZAR 15.5654 | ZAR15.7402 | December 21, 2015 | |||||||

| EUR 526,663.00 | ZAR 15.6625 | ZAR15.8358 | January 20, 2016 |

10

| 5. |

Fair value of financial instruments (continued) |

Financial instruments (continued)

As of June 30, 2015

| Fair market | ||||||||||

| Notional amount | Strike price | value price | Maturity | |||||||

| EUR 526,263.00 | ZAR 15.1145 | ZAR 13.6275 | July 20, 2015 | |||||||

| EUR 526,263.00 | ZAR 15.2025 | ZAR 13.7062 | August 20, 2015 | |||||||

| EUR 526,263.00 | ZAR 15.2944 | ZAR 13.7898 | September 21, 2015 | |||||||

| EUR 526,263.00 | ZAR 15.3809 | ZAR 13.8683 | October 20, 2015 | |||||||

| EUR 509,516.00 | ZAR 15.4728 | ZAR 13.9540 | November 20, 2015 | |||||||

| EUR 529,865.00 | ZAR 15.5654 | ZAR 14.0397 | December 21, 2015 | |||||||

| EUR 526,663.00 | ZAR 15.6625 | ZAR 14.1239 | January 20, 2016 |

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis as of September 30, 2015, according to the fair value hierarchy:

| Quoted | |||||||||||||

| Price in | |||||||||||||

| Active | Significant | ||||||||||||

| Markets for | Other | Significant | |||||||||||

| Identical | Observable | Unobservable | |||||||||||

| Assets | Inputs | Inputs | |||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||

| Assets | |||||||||||||

| Related to insurance business (included in other long-term assets): | |||||||||||||

| Cash and cash equivalents | $ | 1,884 | $ | - | $ | - | $ | 1,884 | |||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 6,618 | 6,618 | |||||||||

| Other | - | 1,069 | - | 1,069 | |||||||||

| Total assets at fair value | $ | 1,884 | $ | 1,069 | $ | 6,618 | $ | 9,571 |

The following table presents the Company’s assets and liabilities measured at fair value on a recurring basis as of June 30, 2015, according to the fair value hierarchy:

| Quoted | |||||||||||||

| Price in | |||||||||||||

| Active | Significant | ||||||||||||

| Markets for | Other | Significant | |||||||||||

| Identical | Observable | Unobservable | |||||||||||

| Assets | Inputs | Inputs | |||||||||||

| (Level 1) | (Level 2) | (Level 3) | Total | ||||||||||

| Assets | |||||||||||||

| Related to insurance business (included in other long-term assets): | |||||||||||||

| Cash and cash equivalents | $ | 1,640 | $ | - | $ | - | $ | 1,640 | |||||

| Investment in Finbond (available for sale assets included in other long-term assets) | - | - | 7,488 | 7,488 | |||||||||

| Other | - | 1,259 | - | 1,259 | |||||||||

| Total assets at fair value | $ | 1,640 | $ | 1,259 | $ | 7,488 | $ | 10,387 | |||||

| Liabilities | |||||||||||||

| Foreign exchange contracts | $ | - | $ | 452 | $ | - | $ | 452 | |||||

| Total liabilities at fair value | $ | - | $ | 452 | $ | - | $ | 452 |

11

| 5. |

Fair value of financial instruments (continued) |

Financial instruments (continued)

Changes in the Company’s investment in Finbond (Level 3 that are measured at fair value on a recurring basis) were insignificant during the three months ended September 30, 2015 and 2014, respectively. There have been no transfers in or out of Level 3 during the three months ended September 30, 2015 and 2014, respectively.

Assets and liabilities measured at fair value on a nonrecurring basis

The Company measures its assets at fair value on a nonrecurring basis when they are deemed to be other-than-temporarily impaired. The Company has no liabilities that are measured at fair value on a nonrecurring basis. The Company reviews the carrying values of its assets when events and circumstances warrant and considers all available evidence in evaluating when declines in fair value are other-than-temporary. The fair values of the Company’s assets are determined using the best information available, and may include quoted market prices, market comparables, and discounted cash flow projections. An impairment charge is recorded when the cost of the assets exceeds its fair value and the excess is determined to be other-than-temporary. The Company has not recorded any impairment charges during the reporting periods presented herein.

| 6. |

Goodwill and intangible assets, net |

Goodwill

Summarized below is the movement in the carrying value of goodwill for the three months ended September 30, 2015:

| Accumulated | Carrying | |||||||||

| Gross value | impairment | value | ||||||||

| Balance as of June 30, 2015 | $ | 166,437 | $ | - | $ | 166,437 | ||||

| Foreign currency adjustment (1) | (12,143 | ) | - | (12,143 | ) | |||||

| Balance as of September 30, 2015 | $ | 154,294 | $ | - | $ | 154,294 |

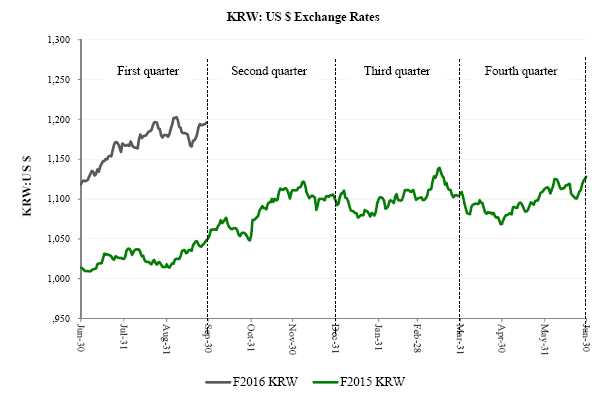

(1) – The foreign currency adjustment represents the effects of the fluctuations between the South African rand and the Korean won, and the U.S. dollar on the carrying value.

Goodwill has been allocated to the Company’s reportable segments as follows:

| South | Financial | ||||||||||||

| African | International | inclusion and | |||||||||||

| transaction | transaction | applied | Carrying | ||||||||||

| processing | processing | technologies | value | ||||||||||

| Balance as of June 30, 2015 | $ | 24,579 | $ | 115,519 | $ | 26,339 | $ | 166,437 | |||||

| Foreign currency adjustment (1) | (3,053 | ) | (6,537 | ) | (2,553 | ) | (12,143 | ) | |||||

| Balance as of September 30, 2015 | $ | 21,526 | $ | 108,982 | $ | 23,786 | $ | 154,294 |

(1) – The foreign currency adjustment represents the effects of the fluctuations between the South African rand and the Korean won, and the U.S. dollar on the carrying value.

12

| 6. |

Goodwill and intangible assets, net (continued) |

Intangible assets, net

Carrying value and amortization of intangible assets

Summarized below is the carrying value and accumulated amortization of the intangible assets as of September 30, 2015 and June 30, 2015:

| As of September 30, 2015 | As of June 30, 2015 | ||||||||||||||||||

| Gross | Net | Gross | Net | ||||||||||||||||

| carrying | Accumulated | carrying | carrying | Accumulated | carrying | ||||||||||||||

| value | amortization | value | value | amortization | value | ||||||||||||||

| Finite-lived intangible assets: | |||||||||||||||||||

| Customer relationships | $ | 82,160 | $ | (44,008 | ) | $ | 38,152 | $ | 88,109 | $ | (45,312 | ) | $ | 42,797 | |||||

| Software and unpatented technology | 27,872 | (27,491 | ) | 381 | 29,964 | (28,323 | ) | 1,641 | |||||||||||

| FTS patent | 2,731 | (2,731 | ) | - | 3,119 | (3,119 | ) | - | |||||||||||

| Exclusive licenses | 4,506 | (4,506 | ) | - | 4,506 | (4,506 | ) | - | |||||||||||

| Trademarks | 5,589 | (3,260 | ) | 2,329 | 6,094 | (3,408 | ) | 2,686 | |||||||||||

| Total finite-lived intangible assets | $ | 122,858 | $ | (81,996 | ) | $ | 40,862 | $ | 131,792 | $ | (84,668 | ) | $ | 47,124 | |||||

Aggregate amortization expense on the finite-lived intangible assets for the three months ended September 30, 2015 and 2014, was approximately $3.3 million and $3.9 million, respectively.

Future estimated annual amortization expense for the next five fiscal years and thereafter, assuming an exchange rate prevailing on September 30, 2015, is presented in the table below. Actual amortization expense in future periods could differ from this estimate as a result of acquisitions, changes in useful lives, exchange rate fluctuations and other relevant factors.

| 2016 | $ | 10,105 | ||

| 2017 | 7,929 | |||

| 2018 | 7,928 | |||

| 2019 | 7,634 | |||

| 2020 | 7,463 | |||

| Thereafter | $ | 3,088 |

| 7. |

Reinsurance assets and policy holder liabilities under insurance and investment contracts |

Reinsurance assets and policy holder liabilities under insurance contracts

Summarized below is the movement in reinsurance assets and policy holder liabilities under insurance contracts during the three months ended September 30, 2015:

| Reinsurance | Insurance | ||||||

| assets (1) | contracts (2) | ||||||

| Balance as of June 30, 2015 | $ | 183 | $ | (567 | ) | ||

| Foreign currency adjustment (3) | (23 | ) | 71 | ||||

| Balance as of September 30, 2015 | $ | 160 | $ | (496 | ) |

(1) Included in other long-term assets.

(2) Included in other long-term liabilities.

(3) The foreign currency

adjustment represents the effects of the fluctuations between the ZAR against

the U.S. dollar.

The Company has agreements with reinsurance companies in order to limit its losses from large insurance contracts, however, if the reinsurer is unable to meet its obligations, the Company retains the liability.

Policyholders' liabilities under insurance contracts are derived from actual claims submitted which had not been settled as of September 30, 2015 and June 30, 2015, respectively, and represents management’s estimate of the net present value of future claims and benefits under existing insurance contracts, offset by probable future premiums to be received (net of expected service cost).

13

| 7. |

Reinsurance assets and policy holder liabilities under insurance and investment contracts (continued) |

Assets and policy holder liabilities under investment contracts

Summarized below is the movement in assets and policy holder liabilities under investment contracts during the three months ended September 30, 2015:

| Investment | |||||||

| Assets (1) | contracts (2) | ||||||

| Balance as of June 30, 2015 | $ | 593 | $ | (593 | ) | ||

| Foreign currency adjustment (3) | (73 | ) | 73 | ||||

| Balance as of September 30, 2015 | $ | 520 | $ | (520 | ) |

(1) Included in other long-term assets.

(2) Included in other long-term liabilities.

(3) The foreign currency

adjustment represents the effects of the fluctuations between the ZAR against

the U.S. dollar.

The Company does not offer any investment products with guarantees related to capital or returns.

| 8. |

Short-term credit facility |

The Company’s short-term credit facilities are described in Note 12 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2015.

South Africa

The Company’s short-term South African credit facility with Nedbank Limited comprises an overdraft facility of up to ZAR 50 million and indirect and derivative facilities of up to ZAR 150 million, which include letters of guarantee, letters of credit and forward exchange contracts. As of September 30, 2015, the interest rate on the overdraft facility was 8.35% . As of each of September 30, 2015 and June 30, 2015, respectively, the Company had not utilized any of its overdraft facility. As of September 30, 2015, the Company had utilized approximately ZAR 128.2 million ($9.1 million, translated at exchange rates applicable as of September 30, 2015) of its ZAR 150 million indirect and derivative facilities to obtain foreign exchange contracts from the bank and to enable the bank to issue guarantees, including stand-by letters of credit, in order for the Company to honor its obligations to third parties requiring such guarantees (refer to Note 17). As of June 30, 2015, the Company had utilized approximately ZAR 139.6 million ($11.4 million, translated at exchange rates applicable as of June 30, 2015) of its indirect and derivative facilities.

Korea

The Company had not utilized any of its KRW 10 billion ($8.4 million, translated at exchange rates applicable as of September 30, 2015) overdraft facility as of September 30, 2015 and June 30, 2015. As of September 30, 2015, the interest rate on the overdraft facility was 3.20% . The facility expires in January 2016.

| 9. |

Long-term borrowings |

The Company’s Korean senior secured loan facility is described in Note 13 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2015. The current carrying value as of September 30, 2015, is $60.0 million. As of September 30, 2015, the carrying amount of the long-term borrowings approximated fair value. The interest rate in effect on September 30, 2015, was 4.74% .

Interest expense incurred during the three months ended September 30, 2015 and 2014, was $0.7 million and $1.1 million, respectively. Prepaid facility fees amortized during the three months ended September 30, 2015 and 2014, was $0.03 million and $0.1 million, respectively.

The next scheduled principal payment of $8.4 million (translated at exchange rates applicable as of September 30, 2015) will be made on April 29, 2016.

14

| 10. |

Capital structure |

The following table presents reconciliation between the number of shares, net of treasury, presented in the unaudited condensed consolidated statement of changes in equity during the three months ended September 30, 2015 and 2014, respectively, and the number of shares, net of treasury, excluding non-vested equity shares that have not vested during the three months ended September 30, 2015 and 2014, respectively:

| Sept 30, | Sept 30, | ||||||

| 2015 | 2014 | ||||||

| Number of shares, net of treasury: | |||||||

| Statement of changes in equity | 47,322,702 | 46,475,623 | |||||

| Less: Non-vested equity shares that have not vested (Note 12) | (589,447 | ) | (453,333 | ) | |||

| Number of shares, net of treasury excluding non-vested equity shares that have not vested | 46,733,255 | 46,022,290 |

Common stock repurchases and transaction with non-controlling interests

The Company did not repurchase any of its shares during the three months ended September 30, 2015 and 2014, under its share repurchase authorization. However, on August 27, 2014, the Company entered into a Subscription and Sale of Shares Agreement with Business Venture Investments No 1567 Proprietary Limited (RF) (“BVI”), one of the Company’s BEE partners, in preparation for any new potential SASSA tender. Pursuant to the agreement: (i) the Company repurchased BVI’s remaining 1,837,432 shares of the Company’s common stock for approximately ZAR 97.4 million in cash ($9.2 million translated at exchange rates prevailing as of August 27, 2014) and (ii) BVI has subscribed for new ordinary shares of Cash Paymaster Services (Pty) Ltd (“CPS”) representing 12.5% of CPS’ ordinary shares outstanding after the subscription for ZAR 15.0 million in cash (approximately $1.4 million translated at exchange rates prevailing as of August 27, 2014). In connection with transactions described above, the CPS shareholder agreement that was negotiated as part of the original December 2013 Relationship Agreement became effective.

| 11. |

Accumulated other comprehensive loss |

The table below presents the change in accumulated other comprehensive (loss) income per component during the three months ended September 30, 2015:

| Three months ended | ||||||||||

| September 30, 2015 | ||||||||||

| Accumulated | ||||||||||

| Net | ||||||||||

| unrealized | ||||||||||

| Accumulated | income on | |||||||||

| Foreign | asset | |||||||||

| currency | available for | |||||||||

| translation | sale, net of | |||||||||

| reserve | tax | Total | ||||||||

| Balance as of June 30, 2015 | $ | (140,221 | ) | $ | 1,040 | $ | (139,181 | ) | ||

| Movement in foreign currency translation reserve | (43,414 | ) | - | (43,414 | ) | |||||

| Unrealized gain on asset available for sale, net of tax of $11 | - | 50 | 50 | |||||||

| Balance as of September 30, 2015 | $ | (183,635 | ) | $ | 1,090 | $ | (182,545 | ) | ||

There were no reclassifications from accumulated other comprehensive loss to comprehensive (loss) income during the three months ended September 30, 2015 or 2014, respectively.

15

| 12. |

Stock-based compensation |

Stock option and restricted stock activity

Options

The following table summarizes stock option activity for the three months ended September 30, 2015 and 2014:

| Weighted | Weighted | |||||||||||||||

| Weighted | Average | Average | ||||||||||||||

| average | Remaining | Aggregate | Grant | |||||||||||||

| exercise | Contractual | Intrinsic | Date Fair | |||||||||||||

| Number of | price | Term | Value | Value | ||||||||||||

| shares | ($) | (in years) | ($’000) | ($) | ||||||||||||

| Outstanding – June 30, 2015 | 2,401,169 | 15.34 | 4.74 | 11,516 | ||||||||||||

| Exercised | (323,645 | ) | 11.62 | 2,669 | ||||||||||||

| Outstanding – September 30, 2015 | 2,077,524 | 15.92 | 4.33 | 7,509 | ||||||||||||

| Outstanding – June 30, 2014 | 2,710,392 | 14.16 | 5.38 | 3,909 | ||||||||||||

| Granted under Plan: August 2014 | 464,410 | 11.23 | 10.00 | 2,113 | 4.55 | |||||||||||

| Exercised | (688,633 | ) | 8.24 | 3,697 | ||||||||||||

| Outstanding – September 30, 2014 | 2,486,169 | 15.24 | 5.45 | 1,820 |

No stock options were awarded during the three months ended September 30, 2015. The fair value of each option is estimated on the date of grant using the Cox Ross Rubinstein binomial model that uses the assumptions noted in the following table. The estimated expected volatility is calculated based on the Company’s 250 day volatility. The estimated expected life of the option was determined based on historical behavior of employees who were granted options with similar terms. The Company has estimated no forfeitures for options awarded in August 2014.

The table below presents the range of assumptions used to value options granted during the three months ended September 30, 2015 and 2014:

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| Expected volatility | n/a | 60% | |||||

| Expected dividends | n/a | 0% | |||||

| Expected life (in years) | n/a | 3 | |||||

| Risk-free rate | n/a | 1.0% | |||||

There were no forfeitures during each of the three months ended September 30, 2015 and 2014.

The following table presents stock options vested and expecting to vest as of September 30, 2015:

| Weighted | |||||||||||||

| Weighted | Average | ||||||||||||

| average | Remaining | Aggregate | |||||||||||

| exercise | Contractual | Intrinsic | |||||||||||

| Number of | price | Term | Value | ||||||||||

| shares | ($) | (in years) | ($’000) | ||||||||||

| Vested and expecting to vest – September 30, 2015 | 2,077,524 | 15.92 | 4.33 | 7,509 |

These options have an exercise price range of $7.35 to $24.46.

16

| 12. |

Stock-based compensation (continued) |

Stock option and restricted stock activity (continued)

The following table presents stock options that are exercisable as of September 30, 2015:

| Weighted | |||||||||||||

| Weighted | Average | ||||||||||||

| average | Remaining | Aggregate | |||||||||||

| exercise | Contractual | Intrinsic | |||||||||||

| Number of | price | Term | Value | ||||||||||

| shares | ($) | (in years) | ($’000) | ||||||||||

| Exercisable – September 30, 2015 | 1,764,931 | 16.93 | 3.55 | 5,496 |

During the three months ended September 30, 2015 and 2014, respectively, 330,967 and 273,633 stock options became exercisable. During the three months ended September 30, 2015, the Company received approximately $3.8 million from the exercise of 323,645 stock options. During the three months ended September 30, 2014, the Company received approximately $1.0 million from the exercise of 116,395 stock options. The remaining 572,238 stock options were exercised through recipients delivering 336,584 shares of the Company’s common stock to the Company on September 9, 2014, to settle the exercise price due. The Company issues new shares to satisfy stock option exercises.

Restricted stock

The following table summarizes restricted stock activity for the three months ended September 30, 2015 and 2014:

| Weighted | |||||||

| Number of | Average | ||||||

| Shares of | Grant Date | ||||||

| Restricted | Fair Value | ||||||

| Stock | ($’000) | ||||||

| Non-vested – June 30, 2015 | 341,529 | 1,759 | |||||

| Granted – August 2015 | 319,492 | 581 | |||||

| Vested – August 2015 | (71,574 | ) | 6,406 | ||||

| Non-vested – September 30, 2015 | 589,447 | 7,622 | |||||

| Non-vested – June 30, 2014 | 385,778 | 3,534 | |||||

| Granted – August 2014 | 141,707 | 581 | |||||

| Vested – August 2014 | (74,152 | ) | 828 | ||||

| Non-vested – September 30, 2014 | 453,333 | 3,568 |

The August 2015 grants comprise 301,537 and 17,955 shares of restricted stock awarded to employees and non-employee directors, respectively. The shares of restricted stock awarded to employees in August 2015 are subject to time-based and performance-based vesting conditions. In order for any of the shares to vest, the recipient must remain employed by the Company on a full-time basis on the date that it files its Annual Report on Form 10-K for the fiscal year ended June 30, 2018. If that condition is satisfied, then the shares will vest based on the level of Fundamental EPS the Company achieves for the fiscal year ended June 30, 2018 (“2018 Fundamental EPS”), as follows:

| • | One-third of the shares will vest if the Company achieves 2018 Fundamental EPS of $2.88; | |

| • | Two-thirds of the shares will vest if the Company achieves 2018 Fundamental EPS of $3.30; and | |

| • | All of the shares will vest if the Company achieves 2018 Fundamental EPS of $3.76. |

17

| 12. |

Stock-based compensation (continued) |

Stock-based compensation charge and unrecognized compensation cost

Restricted stock (continued)

At levels of 2018 Fundamental EPS greater $2.88 and less than $3.76, the number of shares that will vest will be determined by linear interpolation relative to 2018 Fundamental EPS of $3.30. Any shares that do not vest in accordance with the above-described conditions will be forfeited. All shares of restricted stock have been valued utilizing the closing price of the Company’s stock quoted on The Nasdaq Global Select Market on the date of grant.

The August 2014 grants comprise 127,626 and 14,081 shares of restricted stock awarded to employees and non-employee directors, respectively. The shares of restricted stock awarded to employees in August 2014 will vest in full only on the date, if any, the following conditions are satisfied: (1) the closing price of the Company’s common stock equals or exceeds $19.41 (subject to appropriate adjustment for any stock split or stock dividend) for a period of 30 consecutive trading days during a measurement period commencing on the date that the Company files its Annual Report on Form 10-K for the fiscal year ended 2017 and ending on December 31, 2017 and (2) the recipient is employed by the Company on a full-time basis when the condition in (1) is met. If either of these conditions is not satisfied, then none of the shares of restricted stock will vest and they will be forfeited.

The shares of restricted stock, other than the shares awarded to employees in August 2014, have been valued utilizing the closing price of the Company’s stock quoted on The Nasdaq Global Select Market on the date of grant. The shares of restricted stock awarded to employees in August 2014 are effectively forward starting knock-in barrier options with a strike price of zero. The fair value of these shares of restricted stock was calculated utilizing an adjusted Monte Carlo simulation discounted cash flow model which was developed for the purpose of the valuation of these shares. For each simulated share price path, the market share price condition was evaluated to determine whether or not the shares would vest under that simulation. The “adjustment” to the Monte Carlo simulation model incorporates a “jump diffusion” process to the standard Geometric Brownian Motion simulation, in order to capture the discontinuous share price jumps observed in the Company’s share price movements on stock exchanges on which it is listed. Therefore, the simulated share price paths capture the idiosyncrasies of the observed Company share price movements.

In scenarios where the shares do not vest, the final vested value at maturity is zero. In scenarios where vesting occurs, the final vested value on maturity is the share price on vesting date. The value of the grant is the average of the discounted vested values. The Company used an expected volatility of 76.01%, an expected life of approximately three years, a risk-free rate of 1.27% and no future dividends in its calculation of the fair value of the shares of restricted stock awarded to employees in August 2014. Estimated expected volatility was calculated based on the Company’s 30 day VWAP share price using the exponentially weighted moving average of returns.

The fair value of restricted stock vesting during the three months ended September 30, 2015 and 2014, respectively, was $1.4 million and $0.8 million.

Stock-based compensation charge and unrecognized compensation cost

The Company has recorded a stock-based compensation charge of $0.7 million and $0.9 million, respectively, during the three months ended September 30, 2015 and 2014, which comprised:

| Allocated to cost | ||||||||||

| of goods sold, IT | Allocated to | |||||||||

| processing, | selling, general | |||||||||

| Total | servicing and | and | ||||||||

| charge | support | administration | ||||||||

| Three months ended September 30, 2015 Stock-based compensation charge | $ | 726 |

$ |

- | $ | 726 | ||||

| Total – three months ended September 30, 2015 | $ | 726 | $ | - | $ | 726 | ||||

| Three months ended September 30, 2014 Stock-based compensation charge | $ | 916 | $ | - | $ | 916 | ||||

| Total – three months ended September 30, 2014 | $ | 916 | $ | - | $ | 916 |

The stock-based compensation charges have been allocated to selling, general and administration based on the allocation of the cash compensation paid to the employees.

18

| 12. |

Stock-based compensation (continued) |

Stock-based compensation charge and unrecognized compensation cost (continued)

Restricted stock (continued)

As of September 30, 2015, the total unrecognized compensation cost related to stock options was approximately $1.5 million, which the Company expects to recognize over approximately three years. As of September 30, 2015, the total unrecognized compensation cost related to restricted stock awards was approximately $1.2 million, which the Company expects to recognize over approximately two years.

As of September 30, 2015 and June 30, 2015, respectively, the Company has recorded a deferred tax asset of approximately $1.5 million and $1.6 million related to the stock-based compensation charge recognized related to employees and directors of Net1 as it is able to deduct the grant date fair value for taxation purposes in the United States.

| 13. |

Earnings per share |

Basic earnings per share include shares of restricted stock that meet the definition of a participating security because these shares are eligible to receive non-forfeitable dividend equivalents at the same rate as common stock. Basic earnings per share have been calculated using the two-class method and basic earnings per share for the three months ended September 30, 2015 and 2014, reflects only undistributed earnings. The computation below of basic earnings per share excludes the net income attributable to shares of unvested restricted stock (participating non-vested restricted stock) from the numerator and excludes the dilutive impact of these unvested shares of restricted stock from the denominator.

Diluted earnings per share have been calculated to give effect to the number of shares of additional common stock that would have been outstanding if the potential dilutive instruments had been issued in each period. Stock options are included in the calculation of diluted earnings per share utilizing the treasury stock method and are not considered to be participating securities as the stock options do not contain non-forfeitable dividend rights. The calculation of diluted earnings per share includes the dilutive effect of a portion of the restricted stock granted to employees in February 2012, August 2013, August 2014, November 2014 and August 2015 as these shares of restricted stock are considered contingently returnable shares for the purposes of the diluted earnings per share calculation and the vesting conditions in respect of a portion of the restricted stock had been satisfied. The vesting conditions are discussed in Note 18 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2015.

19

| 13. |

Earnings per share (continued) |

The following table presents net income attributable to Net1 (income from continuing operations) and the share data used in the basic and diluted earnings per share computations using the two-class method:

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| (in thousands except percent | |||||||

| and | |||||||

| per share data) | |||||||

| Numerator: | |||||||

| Net income attributable to Net1 | $ | 23,020 | $ | 24,089 | |||

| Undistributed earnings | 23,020 | 24,089 | |||||

| Percent allocated to common shareholders (Calculation 1) | 99% | 99% | |||||

| Numerator for earnings per share: basic and diluted | $ | 22,817 | $ | 23,847 | |||

| Denominator: | |||||||

| Denominator for

basic earnings per share: weighted-average common shares outstanding |

46,209 | 46,751 | |||||

| Effect of dilutive securities: | |||||||

| Stock options | 460 | 109 | |||||

| Denominator

for diluted earnings per share: adjusted weighted average common shares outstanding and assumed conversion |

46,669 | 46,860 | |||||

| Earnings per share: | |||||||

| Basic | $ | 0.49 | $ | 0.51 | |||

| Diluted | $ | 0.49 | $ | 0.51 | |||

| (Calculation 1) | |||||||

| Basic weighted-average common shares outstanding (A) | 46,209 | 46,751 | |||||

| Basic weighted-average

common shares outstanding and unvested restricted shares expected to vest (B) |

46,620 | 47,226 | |||||

| Percent allocated to common shareholders (A) / (B) | 99% | 99% | |||||

Options to purchase 874,443 shares of the Company’s common stock at prices ranging from $22.51 to $24.46 per share were outstanding during the three months ended September 30, 2015, but were not included in the computation of diluted earnings per share because the options’ exercise price were greater than the average market price of the Company’s common stock. The options, which expire at various dates through August 27, 2018, were still outstanding as of September 30, 2015.

| 14. |

Supplemental cash flow information |

The following table presents supplemental cash flow disclosures for the three months ended September 30, 2015 and 2014:

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| Cash received from interest | $ | 4,265 | $ | 4,163 | |||

| Cash paid for interest | $ | 939 | $ | 1,218 | |||

| Cash paid for income taxes | $ | 4,066 | $ | 5,160 | |||

The sale of the Company’s NUETS business is described in Note 19 to its audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2015. The Company received cash sale proceeds of $1.9 million related to this transaction in July 2014.

As discussed in Note 12, during the three months ended September 30, 2014, employees exercised stock options through the delivery 336,584 shares of the Company’s common stock at the closing price on September 9, 2014 or $13.93 under the terms of their option agreements.

20

| 15. |

Operating segments |

The Company discloses segment information as reflected in the management information systems reports that its chief operating decision maker uses in making decisions and to report certain entity-wide disclosures about products and services, major customers, and the countries in which the entity holds material assets or reports material revenues. A description of the Company’s operating segments is contained in Note 23 to the Company’s audited consolidated financial statements included in its Annual Report on Form 10-K for the year ended June 30, 2015.

The reconciliation of the reportable segments revenue to revenue from external customers for the three months ended September 30, 2015 and 2014, respectively, is as follows:

| Revenue | ||||||||||

| From | ||||||||||

| Reportable | Inter- | external | ||||||||

| Segment | segment | customers | ||||||||

| South African transaction processing | $ | 55,639 | $ | 3,627 | $ | 52,012 | ||||

| International transaction processing | 41,229 | - | 41,229 | |||||||

| Financial inclusion and applied technologies | 67,360 | 6,128 | 61,232 | |||||||

| Total for the three months ended September 30, 2015 | 164,228 | 9,755 | 154,473 | |||||||

| South African transaction processing | 60,252 | 5,121 | 55,131 | |||||||

| International transaction processing | 43,204 | - | 43,204 | |||||||

| Financial inclusion and applied technologies | 65,197 | 7,091 | 58,106 | |||||||

| Total for the three months ended September 30, 2014 | $ | 168,653 | $ | 12,212 | $ | 156,441 | ||||

The Company does not allocate interest income, interest expense or income tax expense to its reportable segments. The Company evaluates segment performance based on segment operating income before acquisition-related intangible asset amortization which represents operating income before acquisition-related intangible asset amortization and allocation of expenses allocated to Corporate/Eliminations, all under GAAP. The reconciliation of the reportable segments measure of profit or loss to income before income taxes for the three months ended September 30, 2015 and 2014, respectively, is as follows:

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| Reportable segments measure of profit or loss | $ | 36,608 | $ | 38,595 | |||

| Operating income: Corporate/Eliminations | (5,393 | ) | (5,470 | ) | |||

| Interest income | 4,275 | 4,090 | |||||

| Interest expense | (974 | ) | (1,312 | ) | |||

| Income before income taxes | $ | 34,516 | $ | 35,903 | |||

The following tables summarize segment information which is prepared in accordance with GAAP for the three months ended September 30, 2015 and 2014:

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| Revenues | |||||||

| South African transaction processing | $ | 55,639 | $ | 60,252 | |||

| International transaction processing | 41,229 | 43,204 | |||||

| Financial inclusion and applied technologies | 67,360 | 65,197 | |||||

| Total | 164,228 | 168,653 | |||||

| Operating income (loss) | |||||||

| South African transaction processing | 13,511 | 13,639 | |||||

| International transaction processing | 6,543 | 7,349 | |||||

| Financial inclusion and applied technologies | 16,554 | 17,607 | |||||

| Subtotal: Operating segments | 36,608 | 38,595 | |||||

| Corporate/Eliminations | (5,393 | ) | (5,470 | ) | |||

| Total | $ | 31,215 | $ | 33,125 | |||

21

| 15. |

Operating segments (continued) |

| Three months ended | |||||||

| September 30, | |||||||

| 2015 | 2014 | ||||||

| Depreciation and amortization | |||||||

| South African transaction processing | $ | 1,795 | $ | 1,722 | |||

| International transaction processing | 4,696 | 4,372 | |||||

| Financial inclusion and applied technologies | 240 | 179 | |||||

| Subtotal: Operating segments | 6,731 | 6,273 | |||||

| Corporate/Eliminations | 3,384 | 3,901 | |||||

| Total | 10,115 | 10,174 | |||||

| Expenditures for long-lived assets | |||||||

| South African transaction processing | 1,447 | 682 | |||||

| International transaction processing | 8,038 | 8,327 | |||||

| Financial inclusion and applied technologies | 1,213 | 369 | |||||

| Subtotal: Operating segments | 10,698 | 9,378 | |||||

| Corporate/Eliminations | - | - | |||||

| Total | $ | 10,698 | $ | 9,378 | |||

The segment information as reviewed by the chief operating decision maker does not include a measure of segment assets per segment as all of the significant assets are used in the operations of all, rather than any one, of the segments. The Company does not have dedicated assets assigned to a particular operating segment. Accordingly, it is not meaningful to attempt an arbitrary allocation and segment asset allocation is therefore not presented.

It is impractical to disclose revenues from external customers for each product and service or each group of similar products and services.

| 16. |

Income tax |

Income tax in interim periods

For the purposes of interim financial reporting, the Company determines the appropriate income tax provision by first applying the effective tax rate expected to be applicable for the full fiscal year to ordinary income. This amount is then adjusted for the tax effect of significant unusual or extraordinary items, for instance, changes in tax law, valuation allowances and non-deductible transaction-related expenses that are reported separately, and have an impact on the tax charge. The cumulative effect of any change in the enacted tax rate, if and when applicable, on the opening balance of deferred tax assets and liabilities is also included in the tax charge as a discrete event in the interim period in which the enactment date occurs.

For the three months ended September 30, 2015, the tax charge was calculated using the expected effective tax rate for the year. The Company’s effective tax rate for the three months ended September 30, 2015, was 31.6% and was higher than the South African statutory rate as a result of a valuation allowance for foreign tax credits and non-deductible expenses (including consulting and legal fees).

The Company’s effective tax rate for the three months ended September 30, 2014, was 32.4%, and was higher than the South African statutory rate primarily as a result of non-deductible expenses (including interest expense related to the Company’s long-term Korean borrowings and stock-based compensation charges).

Uncertain tax positions

The Company increased its unrecognized tax benefits by approximately $0.1 million during the three months ended September 30, 2015. As of September 30, 2015, the Company had accrued interest related to uncertain tax positions of approximately $2.3 million on its balance sheet.

The Company does not expect changes related to its unrecognized tax benefits will have a significant impact on its results of operations or financial position in the next 12 months.

22

| 16. |

Income tax (continued) |

Uncertain tax positions (continued)

As of September 30, 2015 and June 30, 2015, the Company has unrecognized tax benefits of $2.4 million and $2.3 million, respectively, all of which would impact the Company’s effective tax rate. The Company files income tax returns mainly in South Africa, South Korea, India, the United Kingdom, Botswana and in the U.S. federal jurisdiction. As of September 30, 2015, the Company’s South African subsidiaries are no longer subject to income tax examination by the South African Revenue Service for periods before June 30, 2011. The Company is subject to income tax in other jurisdictions outside South Africa, none of which are individually material to its financial position, results of operations or cash flows.

| 17. |

Commitments and contingencies |

Guarantees

The South African Revenue Service and certain of the Company’s customers, suppliers and other business partners have asked the Company to provide them with guarantees, including standby letters of credit, issued by a South African bank. The Company is required to procure these guarantees for these third parties to operate its business.

Nedbank has issued guarantees to these third parties amounting to ZAR 124.9 million ($8.9 million, translated at exchange rates applicable as of September 30, 2015) and thereby utilizing part of the Company’s short-term facility. The Company in turn has provided nonrecourse, unsecured counter-guarantees to Nedbank for ZAR 124.9 million ($8.9 million, translated at exchange rates applicable as of September 30, 2015). The Company pays commission of between 0.2% per annum to 2.0% per annum of the face value of these guarantees and does not recover any of the commission from third parties.

The Company has not recognized any obligation related to these counter-guarantees in its consolidated balance sheet as of September 30, 2015 and June 30, 2015. The maximum potential amount that the Company could pay under these guarantees is ZAR 124.9 million ($8.9 million, translated at exchange rates applicable as of September 30, 2015). The guarantees have reduced the amount available for borrowings under the Company’s short-term credit facility described in Note 8.

Contingencies

Dismissal of U.S. Securities Litigation

On September 16, 2015, the United States District Court for the Southern District of New York dismissed the purported securities class action litigation originally filed on December 24, 2013, against the Company, its Chief Executive Officer and its Chief Financial Officer. In its opinion, the District Court provided plaintiff with 30 days to file a second amended complaint. This deadline passed without plaintiff taking any action. Accordingly, the case has been closed. Plaintiff may file a notice of appeal until November 23, 2015. The Company intends to vigorously defend any appeal of the District Court’s ruling.

The Company is subject to a variety of insignificant claims and suits that arise from time to time in the ordinary course of business.

Management currently believes that the resolution of these matters, individually or in the aggregate, will not have a material adverse impact on the Company’s financial position, results of operations or cash flows.

23

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our Annual Report on Form 10-K for the year ended June 30, 2015, and the unaudited condensed consolidated financial statements and the accompanying notes included in this Form 10-Q.

Forward-looking statements

Some of the statements in this Form 10-Q constitute forward-looking statements. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed, implied or inferred by these forward-looking statements. Such factors include, among other things, those listed under Item 1A.—“Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended June 30, 2015. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms and other comparable terminology.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we do not know whether we can achieve positive future results, levels of activity, performance, or goals. Actual events or results may differ materially. We undertake no obligation to update any of the forward-looking statements after the date of this Form 10-Q to conform those statements to reflect the occurrence of unanticipated events, except as required by applicable law.

You should read this Form 10-Q and the documents that we reference herein and the documents we have filed as exhibits hereto and thereto and which we have filed with the Securities and Exchange Commission completely and with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Recent Developments

Cancellation of SASSA Tender

In late 2014, the South African Social Security Agency SASSA, or SASSA, issued a request for proposal, or RFP, as ordered by the South African Constitutional Court. In May 2015, after careful consideration of all the relevant factors, we decided to withdraw from the tender process and did not submit a bid.

On October 15, 2015, SASSA filed an update on the tender process with the Constitutional Court, which reported that the Chief Executive Officer, or CEO, of SASSA decided not to award the SASSA tender, in accordance with the recommendation received from the Bid Adjudication Committee, or BAC. The BAC recommended that the tender not be awarded as a result of the non-responsiveness of all the bids received with the mandatory requirements contained in the RFP.

Accordingly, the BAC recommended that the CEO should allow our current SASSA contract to continue until completion of the five-year period for which the contract was initially awarded (March 31, 2017), in accordance with the Constitutional Court’s judgment of April 2014. The BAC also recommended that the CEO should file a report with the Constitutional Court within 14 days of the decision not to award the tender, setting out all the relevant information on whether and when SASSA will be ready to assume the duty to pay grants itself.

Accordingly, we expect that we will continue to provide our social grants payment service to SASSA through March 31, 2017. We cannot predict at this time whether or not we will continue to provide our service after that date. We are committed to continue with the provision of a high level service to SASSA and the social grant beneficiaries in accordance with the service level agreement and the Constitutional Court’s order.

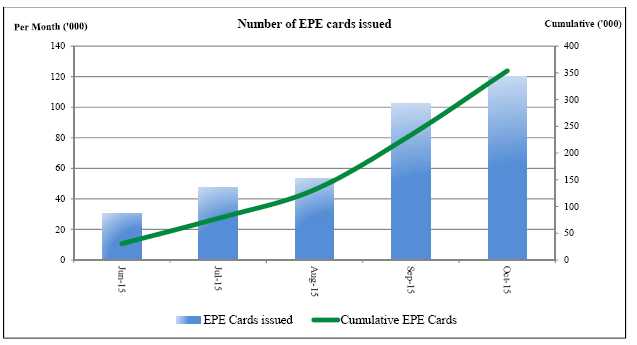

Introduction of EasyPay Everywhere “EPE” and EPE ATMs in South Africa

In June 2015, we began the rollout of EPE our business-to-consumer, or B2C, offering in South Africa and had opened approximately 350,000 bank accounts as at the end of October 2015. EPE is a fully transactional account created to serve the needs of South Africa’s unbanked and under-banked population, and is available to all consumers regardless of their financial or social status. The EPE account offers customers a comprehensive suite of financial and various financial inclusion services, such as prepaid products, in an economical, convenient and secure solution. EPE provides account holders with a UEPS-EMV debit MasterCard, mobile and internet banking services, ATM and POS services, as well as loans, insurance and other financial products and value-added services.

24

To support the rollout of EPE, we have deployed ATMs, which are both EMV-and UEPS-compliant, and provided biometric verification as well as proof of life functionality, in South Africa. We placed these ATMs with our merchant partners and within our own branches, creating a new delivery channel for our products and services that did not previously exist. ATM rollout has continued to make a positive contribution to our reported results and we have been able to expand our customer base because our ATMs accept all EMV-compliant cards. We currently have approximately 750 operational ATMs, and are actively deploying more ATMs in high demand areas. We will continue to expand our ATM footprint in fiscal 2016.

Smart Life resumes writing new insurance policies

We have complied with all the conditions imposed by the South African Financial Services Board, or FSB, to uplift the suspension of Smart Life’s license to provide long-term insurance products, which resulted in the FSB withdrawing the prohibition to conduct new business issued by it approximately two years ago. In September 2015, we resumed marketing and business development activities in selected areas for the distribution of our simple, low-cost life insurance products and have sold approximately 5,700 new policies as at the end of October 2015. We are currently recruiting staff members to expand our marketing activities across South Africa during fiscal 2016.

Critical Accounting Policies

Our unaudited condensed consolidated financial statements have been prepared in accordance with U.S. GAAP, which requires management to make estimates and assumptions about future events that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities. As future events and their effects cannot be determined with absolute certainty, the determination of estimates requires management’s judgment based on a variety of assumptions and other determinants such as historical experience, current and expected market conditions and certain scientific evaluation techniques.