Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - NET 1 UEPS TECHNOLOGIES INC | exhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - NET 1 UEPS TECHNOLOGIES INC | exhibit31-1.htm |

| EX-23 - EXHIBIT 23 - NET 1 UEPS TECHNOLOGIES INC | exhibit23.htm |

| EX-21 - EXHIBIT 21 - NET 1 UEPS TECHNOLOGIES INC | exhibit21.htm |

| EX-12 - EXHIBIT 12 - NET 1 UEPS TECHNOLOGIES INC | exhibit12.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2018

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number: 000-31203

NET 1 UEPS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Florida | 98-0171860 |

| (State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization) | Identification No.) |

President Place, 4th Floor, Cnr. Jan

Smuts Avenue and Bolton Road

Rosebank, Johannesburg 2196, South

Africa

(Address of principal executive offices)

Registrant’s telephone number, including area code: 27-11-343-2000

| Securities registered pursuant to section 12(b) of the Act: | |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, | |

| par value $0.001 per share | NASDAQ Global Select Market |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filings requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

| [ ] | Large accelerated filer | [X] | Accelerated filer |

| [ ] | Non-accelerated filer | [ ] | Smaller reporting company |

| (Do not check if a smaller reporting company) | |||

| [ ] | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of December 31, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter), based upon the closing price of the common stock as reported by The Nasdaq Global Select Market on such date, was $387,520,188. This calculation does not reflect a determination that persons are affiliates for any other purposes.

As of September 6, 2018, 56,369,737 shares of the registrant’s common stock, par value $0.001 per share were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the definitive Proxy Statement for our 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

NET 1 UEPS TECHNOLOGIES, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

Year Ended

June 30, 2018

1

PART I

FORWARD LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in Item 1A—“Risk Factors.” In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms and other comparable terminology. You should not place undue reliance on these forward-looking statements, which reflect our opinions only as of the date of this Annual Report. We undertake no obligation to release publicly any revisions to the forward-looking statements after the date of this Annual Report. You should carefully review the risk factors described in other documents we file from time to time with the Securities and Exchange Commission, including the Quarterly Reports on Form 10-Q to be filed by us during our 2019 fiscal year, which runs from July 1, 2018 to June 30, 2019.

| ITEM 1. | BUSINESS |

Overview

We are a leading provider of transaction processing services, financial inclusion products and services and payment and cryptographic technology across multiple industries and in a number of emerging and developed economies.

Our core payment technology is called the Universal Electronic Payment System, or UEPS, and its EMV interoperable derivative, UEPS/EMV, uses decentralized and biometrically secure smart cards that operate in real-time but both off-line and on-line, unlike traditional payment systems offered by major banking institutions that require immediate access through a communications network to a centralized computer.

Our off-line UEPS system also offers the highest level of availability and affordability by removing any components that are costly and prone to outages. Our latest version of the UEPS technology has been certified by the EuroPay, MasterCard and Visa global standard, or EMV, which enables our traditional proprietary UEPS system to interoperate with the global EMV standard and allows card holders to transact at any EMV-enabled point of sale terminal or automated teller machine, or ATM. The UEPS/EMV technology has been deployed on an extensive scale in South Africa through the issuance of MasterCard-branded UEPS/EMV cards to our under-banked customers, including social welfare grant recipients. In addition to effecting purchases, cash-backs and any form of payment, our system can be used for banking, healthcare management, international money transfers, voting and identification.

Our transaction processing services include multiple forms of payment and payroll processing. We operate leading processors in South Africa through EasyPay and in South Korea through KSNET, as well as end-to-end issuing, acquiring and processing services across Asia and Europe through our International Payments Group, or IPG. We manage more than 300,000 merchants worldwide and process more than three billion transactions annually. IPG has also established a leadership position in partnership with Bank Frick & Co. AG, or Bank Frick, a Liechtenstein-based bank, in Europe focused on cryptocurrency processing and the development of a number of block-chain related products.

We also provide a number of financial inclusion products and services, which are typically bundled and offered as part of our UEPS-based core banking system. In South Africa, this system is currently deployed under the brand EasyPay Everywhere, or EPE, and is a fully transactional low-cost bank account, which offers easy accessibility including in rural areas and highly-competitive loans, insurance and telecommunication products. During the fiscal year ended June 30, 2018, we distributed pension and welfare grants, on behalf of the South African government, to more than three million active EPE customers and an additional five million social grant recipient customers. In addition, we offer telecommunication products such as prepaid airtime on behalf of all network operators in South Africa and own 55% of DNI-4PL Contracts Proprietary Limited, or DNI, the largest distributor of starter packs for the third-largest network, Cell C (Pty) Limited, or Cell C.

Our technology businesses include the development and deployment of our UEPS and MVC solutions worldwide, cryptographic solutions including the STS-6 standard for utility vending solutions, hardware security modules or HSM, chip and subscriber identity module, or SIM, cards, and the reselling of point of sale equipment. Through DNI, we provide financing to Cell C to assist in the roll out of their telecommunications network infrastructure. DNI also has a micro-jobbing platform called Money 4Jam which connects parties for the execution of micro-jobs.

2

All references to “the Company,” “we,” “us,” or “our” are references to Net 1 UEPS Technologies, Inc. and its consolidated subsidiaries, collectively, and all references to “Net1” are to Net 1 UEPS Technologies, Inc. only, except as otherwise indicated or where the context indicates otherwise.

Market Opportunity

Services for the under-banked: According to the latest World Bank’s Global Findex Database, 69% of adults worldwide have access to an account at a financial institution or through a mobile money service. In developing economies, this percentage is 63%. As a result, 1.7 billion adults around the world remain entirely excluded from the financial system. This situation arises when banking fees are either too high relative to an individual’s income, a bank account provides little or no meaningful benefit or there is insufficient infrastructure to provide financial services economically in the individual’s geographic location. We refer to these people as the unbanked and the under-banked. These individuals typically receive wages, welfare benefits, money transfers or loans in the form of cash, and conduct commercial transactions, including the purchase of food and clothing, also in cash.

The use of cash, however, presents significant risks. In the case of welfare recipients, they generally have no secure way of protecting their cash other than by converting it immediately into goods, carrying it with them or hiding it. In cases where an individual has access to a bank account, the typical deposit, withdrawal and account fees meaningfully reduce the money available to meet basic needs. For government agencies and employers, using cash to pay welfare benefits or wages results in significant expense due to the logistics of obtaining that cash, moving it to distribution points and protecting it from theft or fraud.

Our target under-banked customer base in most emerging economies, and particularly in sub-Saharan Africa, has limited access to formal financial services and therefore relies heavily on the unregulated informal sector for such services. By leveraging our smart card and mobile technologies, we are able to offer affordable, secure and reliable financial services such as transacting accounts, loans and insurance products to these consumers and alleviate some of the challenges they face in dealing with the informal sector.

With over 30 million cards issued in more than ten developing countries around the world, our track record and scale uniquely positions us to continue further geographical penetration of our technology in additional emerging countries.

Transaction processing services: The continued global growth of retail credit and debit card transactions is reflected in the April 2018 Nilson Report, according to which worldwide annual general purpose card dollar volume increased 10.7% to $28.2 trillion in 2017, while transaction volume increased by 18% to 296 billion transactions and cards issued increased by 7.9% to 11.95 billion cards during the same period. General purpose cards include the major card network brands such as MasterCard, Visa, UnionPay and American Express. In South Africa, we operate the largest bank-independent transaction processing service through EasyPay, where we have developed a suite of value-added services such as bill payment, airtime top-up, gift card, money transfer and prepaid utility purchases that we offer as a complete solution to merchants and retailers. In South Korea, through KSNET, we are one of the top three VAN processors, and we provide card processing, banking value-added services and payment gateway functionality to more than 240,000 retailers. IPG, comprising Transact24 and Masterpayment, are established, growing end-to-end providers of issuing, acquiring, and processing, particularly for small merchants or those with significant cross-border operations. Another key differentiator of IPG is its extensive catalog of licenses and regulated entities, including some within the fast-growing fields of cryptocurrencies and blockchain. IPG is ably supported by Bank Frick, a European bank in which we have a sizeable strategic investment.

Mobile payments: The rapid growth of online commerce and the emergence of mobile devices as the preferred access channel for transacting online has created a global opportunity for the provision of secure payment services to online retailers and service providers. We have a business unit focused on providing secure payment solutions for all card-not-present transactions through the application of our Mobile Virtual Card, or MVC and other proprietary solutions.

Despite lacking access to formal financial services, large proportions of the under-banked customer segment own and utilize mobile phones. The World Bank’s research has confirmed the rising popularity of using mobile phones to transfer money and for banking that often does not require setting up an account at a brick-and-mortar bank. The World Bank has stated that mobile banking, which allows account holders to pay bills, make deposits or conduct other transactions via text messaging, has rapidly expanded in Sub-Saharan Africa, where traditional banking has been hampered by transportation and other infrastructure problems. The 2017 Global Findex Database: Measuring Financial Inclusion and the Fintech Revolution states that 21% of adults in Sub-Saharan Africa have a mobile-money account – nearly twice the percentage compared to 2014. In developing economies, 19% of adults reported making at least one direct payment using a mobile money account, a mobile phone, or the internet.

3

Mobile phones are therefore increasingly viewed as a channel through which this underserved population can gain access to formal financial and other services. Our UEPS and MVC solutions are enabled to run on the SIM cards in or as applications on mobile phones and provide our users with secure payment and banking functionality.

Telecommunications: In addition to financial services, unbanked and under-banked customers have a strong demand for affordable telecommunication products and, increasingly so, for data. We address this market opportunity specifically in South Africa through our strategic investment in Cell-C, the third largest network in the country, as well as through DNI, its largest distributor.

The symbiotic relationship between Cell-C, DNI and Net1, allows us to create new, relevant products across both telecommunication and financial services being demanded by the unbanked and under-banked populations in South Africa.

Our Core Proprietary Technologies

UEPS and UEPS/EMV

We developed our core UEPS technology to enable the affordable delivery of financial products and services to the world’s unbanked and under-banked populations. Our native UEPS technology is designed to provide the secure delivery of these products and services in the most under-developed or rural environments, even in those that have little or no communications infrastructure. Unlike a traditional credit or debit card where the operation of the account occurs on a centralized computer, each of our smart cards effectively operates as an individual bank account for all types of transactions. All transactions that take place through our system occur between two smart cards at the point of service, or POS, as all of the relevant information necessary to perform and record transactions reside on the smart cards.

The transfer of money or other information can take place without any communication with a centralized computer since all validation, creation of audit records, encryption, decryption and authorization take place on, or are generated between, the smart cards themselves. Importantly, the cards are protected through the use of biometric fingerprint identification, which is designed to ensure the security of funds and card holder information and is more secure than traditional PIN identification. Transactions are generally settled by merchants and other commercial participants in the system by sending transaction data to a mainframe computer on a batch basis. Settlements can be performed online or offline. The mainframe computer provides a central database of transactions, creating a complete audit trail that enables us to replace lost smart cards while preserving the notional account balance, and to identify fraud.

Our UEPS technology incorporates the software, smart cards, payment terminals, back-end processing infrastructure, biometric systems and transaction security to provide a complete payment and transaction processing solution.

Our latest version of the UEPS technology is interoperable with the global EMV standard, allowing the cards to be used wherever EMV cards are accepted, while also providing all the additional functionality offered by UEPS. This UEPS/EMV functionality is especially relevant in areas where there is an established payment system and provides flexibility to our customers to be serviced at any POS (including contactless), such as point of sale devices and ATMs. Our UEPS/EMV solution therefore expands our addressable market to include developed economies with established payment networks. The UEPS/EMV technology removes the hurdle, often perceived in developed economies, of operating a proprietary or “closed-loop” system by providing a truly inter-operable payment solution.

Mobile Virtual Card

We developed MVC, an innovative mobile phone-based payment solution that enables secure purchases with no disruption to existing merchant infrastructures and provides significant incentives for all stakeholders.

MVC utilizes existing and traditional payment methods but enhances them by replacing or tokenizing plastic card data with one-time-use virtual card data, hence eliminating the risk of theft, phishing, skimming, spoofing, etc. The virtual card data replaces, digit-for-digit, the credit (or debit) card number, the expiration date and the card verification value for each transaction with only the issuer bank identification number (first 6-digit) remaining constant.

MVC uses mobile phones to generate virtual cards offline. Mobile phones are the most available, cost-effective, secure and portable platform for generating virtual cards for remote payments (online purchasing, money transfers, phone and catalogue orders).

4

Following a simple registration process, the virtual card application is activated over-the-air, enabling the phone to generate virtual card numbers completely off-line. MVCs are used like traditional plastic credit or debit cards, except that as soon as the transaction is authorized, the generated card number expires once the preset monetary amount has been utilized or after completion of the specific transaction that it was generated for. While MVC has been focused primarily on card-not-present transactions for internet payments in our initial deployments, we are constantly expanding the applicability of the software to incorporate new trends such as presentation through near field communication, or NFC, or Quick Response, or QR, Codes.

Consumers can easily generate a new card on their mobile phones to shop on the internet or to place a catalogue or telephone order. MVCs are completely secure and can also be sent in a single click to family, friends, and service providers. Once the authorization request reaches the issuing bank processor, our servers decrypt the virtual card data, authenticate the consumer and pass the transaction request to the card issuer for authorization. MVC can be offered as a prepaid solution or directly linked to a subscriber’s credit or debit card or other funding account. Subscribers can load prepaid virtual accounts with cash at participating locations, or electronically via their bank accounts, direct deposit or other electronic wallets.

The benefits of MVC include, for:

| • |

Card issuers—increased transactional revenues from existing accounts, driving more transactional revenues and elimination of fraudulent card use. | |

| • |

Mobile network operators—revenues from payments, reduced churn and opportunities for powerful co-branding schemes. | |

| • |

Consumers—convenience, peace of mind, ease of use and rewards. | |

| • |

Merchants—elimination of charge-backs and fraud at no extra cost. |

Incognito TSM cryptographic solutions

Our internally-developed range of PIN encryption devices, card acceptance modules and hardware security modules are primarily aimed at the financial, retail, telecommunication, cryptocurrency, utilities and petroleum sectors. These devices and modules are suited for high-speed transaction processing requirements, acceptance of multiple payment tokens, value-added services at point of transaction, and adherence to stringent transaction security and payment association standards such as TDES and EMV.

Our Strategy

Our core purpose is to improve people’s lives by bringing financial inclusion to the world’s under-banked customers and helping small businesses access the financial services they need to prosper. We achieve this through our unique ability to efficiently digitize or tokenize the expensive and difficult to achieve last mile of financial inclusion. This includes our UEPS/EMV technology, which is accepted globally, and is protected with biometric security and enables offline and online transacting that works anywhere, anytime and with no reliance on mobile networks.

To achieve these goals, we are pursuing the following strategies:

Build on our significant and established infrastructures—We control significant components of the payment infrastructure in South Africa, South Korea, Botswana and Namibia and we believe that we are well-positioned to leverage our existing asset base to continue to gain market share and build upon the critical mass that we have developed.

For example, in South Africa, we are one of the leading independent transaction processors, we have deployed the most extensive distribution network comprising of mobile and fixed ATM’s and POS devices to the country’s large unbanked and under-banked population, we are the largest third-party processor of retail merchant transactions, bill payments and third-party payroll payments. We believe that our large cardholder base, specialized technology and payment infrastructure, together with our strong business relationships, position us at the epicenter of commerce in the country. Through our national distribution platform and relationships with a number of leading companies across multiple industries, we believe that we can provide many of the services consumed by our cardholders who would normally not have access to these services or would otherwise have to rely on the informal sector. We have already introduced several services to our cardholder and merchant base, such as low cost, high functionality bank accounts, microloans, life insurance, bill payment, prepaid mobile top-up and prepaid utility services. We have a network of mobile ATMs to provide services to our cardholders, and we have established a national fixed ATM and POS network. We aim to increase the adoption of our existing services by expanding our cardholder base and our transacting network, and we aim to increase our service offerings by developing new products and distribution networks and by forging partnerships with industry participants who share our vision and can accelerate the implementation of our business plan, such as Cell C, the third largest mobile operator in South Africa and our core focus remains the development and provision of our technological expertise.

5

We have established significant operational assets to ensure the rapid deployment of our technology. As these deployments mature, we may share or dispose of these operational assets if we believe this will result in higher efficiencies and synergistic benefits where we are able to provide technology to an expanded base of clients and operations.

Our banking product, EasyPay Everywhere, provides our target market with an affordable all-inclusive transactional bank account with access to financially inclusive services such as microloans, life insurance, remittances, value added services such as prepaid utilities and bill payments through their mobile phones and our national network of ATMs and POS devices. While the growth of this product is currently facing challenges due to the transition of the social welfare distribution service to the South African Post Office, or SAPO, we still believe this product forms a compelling offering to our target market and that its growth will resume once the transition is complete.

Our strength in South Africa has been further enhanced by the acquisition of DNI, since it significantly expands our distribution network in a complementary manner and allows us to bundle telecommunications products into our existing suite of products to improve the value adding nature of our services to this under-served customer base.

We plan to follow a similar approach in the other markets where we have an established infrastructure, taking into account the requirements of the local legislation, the composition of the local payment system and the specific components that we own or control. In markets where we do not have an established infrastructure, we intended to collaborate with local partners to provide a similar end-to-end solution.

Leveraging our new payment technologies to gain access to developed and developing economies—While our business has traditionally focused on marketing products and services to the world’s unbanked and under-banked population, we have developed and acquired proprietary technology, with a specific focus on mobile payments, that is particularly relevant to developed economies as well. Our MVC application for mobile telephones, for example, is designed to eliminate fraud associated with card-not-present credit card transactions effected by telephone or over the internet and are prevalent in developed economies such as the United States. We believe that mobile payments, mobile wallets and the related applications should be a critical component of a payment processor’s future strategy and we have dedicated a significant portion of our research and development and business development resources to ensure that we remain at the forefront of this rapidly evolving technological space. While some of our mobile solutions are more relevant in developed markets such as the United States and Europe, we are targeting our mobile payment solutions at developing economies, where mobile transacting is seen as the best solution to rapidly leapfrog the antiquated payment solutions typically available in these countries at minimal cost. We plan to expand our market share in the mobile solutions and card-not-present processing markets by pursuing partnerships or supply relationships with online merchants, virtual card issuers, payment services processors, mobile remittance providers and other online service providers.

Pursue strategic acquisition opportunities or partnerships to gain access to new markets or complementary product—We will continue to pursue acquisition opportunities and partnerships that provide us with an entry point for our existing products into a new market, or provide us with technologies or solutions complementary to our current offerings. Our recent investments in Cell C and DNI in South Africa open up new distribution channels for our products as well as providing access to telecommunications products that we can assist in defining and pricing and market to our existing customer base. Our investment into Bank Frick has assisted us with access to the leading global card issues, acquirers and processors and has been very complimentary to the Masterpayment and Transact24 acquisitions of the previous fiscal year. We have accordingly acquired or obtained the required licenses and regulated entities to offer an end-to-end card issuing, acquiring and processing solution to the many underserved small and medium enterprises in Europe. In addition, our core and proven competencies in the fields of cryptography, biometrics and blockchain technology enables us to design products and solutions for the rapidly growing cryptocurrency industry, within a fully regulated environment through collaboration with Bank Frick.

Our Businesses

Our company is organized into the following businesses:

Financial Services

We have developed a suite of financial services that is offered to customers utilizing our payment solutions. We are able to provide our UEPS/EMV cardholders with competitive transacting accounts, microfinance, life insurance and money transfer products based on our understanding of their risk profiles, demographics and lifestyle requirements. Our financial services offerings are designed on the principles of simplicity and cost-efficiency as they bring financial inclusion to our millions of cardholders who were previously unable to access any formal financial services. Our banking product, EasyPay Everywhere, provides our target market with an affordable all-inclusive transactional bank account with unfettered access to financial services such as microloans, life insurance, remittances, value added services such as prepaid utilities and bill payments through their mobile phones and our national network of ATMs and POS devices.

6

Our largest financial services offering is the provision of short-term microloans to our South African UEPS/EMV cardholders, where we provide the loans using our surplus cash reserves and earn revenue from the service fees charged on these loans. We believe our loans are the most affordable form of credit available to our target market as, unlike our competitors, we do not charge interest or credit life insurance premiums on our loans. Our Smart Life business unit owns a life insurance license and offers our customer base affordable insurance products applicable to this market segment, focusing on group life and funeral insurance policies.

This business unit has been allocated to our Financial inclusion and applied technologies reporting segment.

KSNET

Our KSNET business unit is based in Seoul, South Korea, and is a national payment solutions provider. KSNET has one of the broadest product offerings in the South Korean payment solutions market, a base of approximately 240,000 merchants and an extensive direct and indirect sales network. The merchant base is predominantly serviced via a network of independent agents. KSNET’s core operations comprise three primary product offerings, namely card VAN, payment gateway, or PG, and banking VAN. KSNET is able to realize significant synergies across these core operations because it is the only payment solutions provider that offers all three of these offerings in South Korea. Approximately 81% of KSNET’s revenue comes from the provision of payment processing services to merchants and card issuers through its card VAN. KSNET has also started providing working capital financing to those merchants where we provide payment processing services.

KSNET’s core product offerings are described in more detail below:

| • |

Card VAN—KSNET’s card VAN offering manages credit and other non-cash alternative payment mechanisms for retail transaction processing for a wide range of merchants and every credit card issuer in South Korea. Non-cash alternative payment mechanisms for which KSNET provides processing services include all credit and debit cards and e-currency (K-cash and TMoney). KSNET also records cash transactions for the South Korean National Tax Service in the form of cash receipts. | |

| • |

PG—KSNET offers PG services to the rapidly growing number of merchants that are moving online in South Korea. PG provides these merchants with a host of alternative payment solutions including the ability to accept credit and debit cards, gift and other prepaid cards, and bank account transfers. PG also provides virtual account capabilities. | |

| • |

Banking VAN—KSNET’s banking VAN operations currently include account transaction processing services, payment and collections to banks, corporate firms, governmental bodies, and educational institutions. We distinguish card VAN from banking VAN because in the South Korean VAN market, banking VAN is recognized as a distinct service from card VAN. We are the only card VAN provider that also provides banking VAN services. Because the banking VAN business industry is at a nascent stage, the market is relatively small. |

This business unit has been allocated to our International transaction processing reporting segment.

DNI

Our DNI business unit is based in Johannesburg, South Africa, and offers a number of technology and distribution services to the telecommunications industry. Through its DNI Retail subsidiary, DNI is the largest wholesaler of Cell-C starter packs nationwide. It also has an extensive distribution network comprising of more than 2,000 sales agents and a fleet of vehicles, mainly selling Cell C starter packs and airtime directly into urban communities. In addition, through its International Tower Corporation, or ITC, subsidiary, the company provides financing and project management to develop and maintain Cell C’s tower network in the country. It also has a micro-jobbing platform, known as Money4Jam, which through the use of mobile phone technology connects companies and job-seekers for the completion of micro-jobs.

This business unit has been allocated to our Financial inclusion and applied technologies reporting segment.

International Payments Group

IPG is based out of Hong Kong, China, and is an end-to-end payment service provider. IPG includes our Masterpayment processing business based in Munich, Germany. Transact24 in Hong Kong, holds e-money licenses in the United Kingdom and in Europe, and provides debit and credit card acquiring in Europe, the UK, and Asia including China. Additionally, IPG provides Automated Clearing House, or ACH, processing in the United States, and card acquiring services for cryptocurrency exchanges such as Bitstamp and Bitpanda.

In collaboration with Bank Frick, IPG provides a number of banking and processing services to small merchants. Through a joint, collaborative approach, IPG and Bank Frick have established a blockchain development division to create new, first-to market differentiated solutions to harness the capabilities of a bank and a processor.

7

This business unit has been allocated to our International transaction processing reporting segment.

EasyPay

Our EasyPay business unit operates the largest bank-independent financial switch in South Africa and is based in Cape Town, South Africa. EasyPay focuses on the provision of high-volume, secure and convenient payment, prepayment and value-added services to the South African market. EasyPay’s infrastructure connects into all major South African banks and switches both debit and credit card EFT transactions for some of South Africa’s leading retailers and petroleum companies. It is a South African Reserve Bank, or SARB, approved third-party payment processor. In addition to its core transaction processing and switching operations, EasyPay provides a complete end-to-end reconciliation and settlement service to its customers. This service includes dynamic reconciliation as well as easy-to-use report and screen-query tools for down-to-store-level, management and control purposes.

The EasyPay suite of services includes:

| • |

EFT—EasyPay switches credit, debit and fleet card transactions for leading South African retailers and petroleum companies. | |

| • |

EasyPay bill payment—EasyPay offers consumers a point-of-sale bill payment service which is integrated into a large number of national retailers, the internet, self service kiosks and mobile handsets. EasyPay processes monthly account payment transactions for a number of bill issuers including major local authorities, telephone companies, utilities, medical service providers, traffic departments, mail order companies, banks and insurance companies. | |

| • |

EasyPay prepaid electricity—EasyPay enables local utility companies such as Eskom Holdings Limited and a growing number of local authorities on a national basis to sell prepaid electricity to their customers. | |

| • |

Prepaid airtime—EasyPay vends airtime at retail POS terminals for all the South African mobile telephone network operators. | |

| • |

Electronic gift voucher—EasyPay supports the electronic generation, issuance and redemption of paper or card-based gift vouchers. | |

| • |

EasyPay licenses—EasyPay enables the issuance of new South African Broadcasting Corporation, or SABC, television licenses and the capturing of existing license details within retail environments via a web-based user interface. | |

| • |

Third party switching and processing support—EasyPay switches transactions from retail POS systems to the relevant back-end systems. | |

| • |

Hosting services—EasyPay’s infrastructure supports the hosting of payment or back-up servers and applications on behalf of third parties, including utility companies. | |

| • |

EasyPay Kiosk—We have developed a biometrically enabled self-service kiosk that allows our customers to access all the value-added services provided by EasyPay and to create and load their EasyPay virtual wallets with value. | |

| • |

EasyPay Web and Mobile—This service enables EasyPay customers to access all the value-added services provided by EasyPay, such as bill payments and the purchase of prepaid airtime and utilities through a secure website or mobile application. |

EasyPay provides 24x7 monitoring and support services, reconciliation, automated clearing bureau settlement, reporting, full disaster recovery and redundancy services.

This business unit has been allocated to our South African transaction processing reporting segment.

Cash Paymaster Services

Our CPS business unit is based in Johannesburg, South Africa, and has deployed our UEPS/EMV–Social Grant Distribution technology to distribute social welfare grants on a monthly basis to over ten million recipient cardholders in South Africa for the last six and a half years. These social welfare grants were distributed on behalf of the South African Social Security Agency, or SASSA. During our 2018, 2017, and 2016 fiscal years, we derived approximately 19%, 22%, and 21% of our revenues respectively, from CPS’ social welfare grant distribution business. The contract under which we provided this service is in the process of winding down and will terminate on September 30, 2018. Upon termination of the contract, CPS will discontinue its operations and we will seek to utilize its assets and capabilities in other parts of our Company.

This business unit has been allocated to our South African transaction processing and Financial inclusion and applied technologies reporting segments.

8

Applied Technology

Our Applied Technology business unit is managed from Johannesburg, South Africa, and is responsible for various individual lines of business:

| • |

Payment Infrastructure—The deployment of our South African ATM and POS network and the sale of biometric and POS solutions to various South African banks, retailers and financial services providers. Our biometrically-enabled ATM network is fully EMV-compliant and integrated into the South African national payment system. We deploy our ATMs in areas where our UEPS/EMV cardholders have limited access to the national payment system, or where the cost of accessing the national payment system through other service providers is prohibitive for our cardholders. | |

| • |

Third Party Payments—Through FIHRST we are the largest provider of third party and payroll associated payments in South Africa, servicing over 2,270 employee groups that represent approximately 766,000 employees. | |

| • |

Prepaid Vending —Our Prepaid Vending business line handles multichannel distribution of electronic products and services aimed at a variety of markets. Across Africa and abroad, our Virtual Top Up (VTU) solutions create a separate revenue stream for Mobile Network Operators, or MNOs, and other clients. The stability and scalability of our VTU offerings enables our customers to facilitate more than 100 million monthly transactions. | |

| • |

Chip & SIM—Through our partnerships with MNOs as well as card and semiconductor manufacturers, we provide a strong lineup of feature rich chip and SIM solutions. All of these offerings include our wide range of GSM Masks and custom software that enables mobile telephony, transactions and on-chip VAS. We support the above chip and SIM developments with dedicated chip-card based commerce frameworks. These incorporate POS, terminal and interbank transaction switching and clearance aimed at national government, petroleum and retail industries. | |

| • |

Cryptography—Our Cryptography business line focuses on security-orientated products which include our range of PIN encryption devices, card acceptance modules and Hardware Security Modules. These focus on financial, retail, cryptocurrency, telecommunications, utilities and petroleum sectors. In order to constantly enhance and improve our product offerings, special attention is placed on the development of security initiatives including Triple Data Encryption Algorithm, also known as TDES, EMV and Payment Card Industry, or PCI. We are a member of the STS Association, actively participating in developing new and improved standards that address the needs of the modern cryptographic market. |

This business unit has been allocated to our South African transaction processing and Financial inclusion and applied technologies reporting segments.

Corporate

The Corporate unit provides global support services to our business units, joint ventures and investments for the following activities:

| • |

Group executive—Responsible for the overall company management, defining our global strategy, investor relations and corporate finance activities. | |

| • |

Finance and administration—Provides company-wide support in the areas of accounting, treasury, human resources, administration, legal, secretarial, taxation, compliance and internal audit. | |

| • |

Group information technology—Defines our overall IT strategy and the overall systems architecture and is responsible for the identification and management of the group’s research and development activities. | |

| • |

Joint ventures and investments unit—Provides governance support to our joint ventures and assists with the evaluation of new investment opportunities. |

Competition

In addition to competition that our UEPS system faces from the use of cash, checks, credit and debit cards, existing payment systems and the providers of financial services, there are a number of other products that use smart card technology in connection with a funds transfer system. While it is impossible for us to estimate the total number of competitors in the global payments marketplace, we believe that the most competitive product in this marketplace is EMV, a system that is promoted by most of the major card companies such as Visa, MasterCard, JCB and American Express. The competitive advantage of our UEPS offering is that our technology can operate real-time, but in an off-line environment, using biometric identification instead of the standard PIN methodology employed by our competitors. We have enhanced our competitive advantage through the development of our latest version of the UEPS technology that has been certified by EMV, which facilitates our traditionally proprietary UEPS system to interoperate with the global EMV standard and allows card holders to transact at any EMV-enabled point of sale terminal or ATM. The UEPS/EMV technology has been deployed on an extensive scale in South Africa through the issuance of MasterCard-branded UEPS/EMV cards to our social welfare grant recipient cardholders.

9

We further intend to differentiate our value proposition for our end users by offering bundled lifestyle products to include affordable telephony solutions in addition to banking and finance, as well as the development of new payment technologies specifically for mobile phones. We estimate that we process less than 1% of all global payment transactions in the international marketplace.

In South Africa, and specifically in the payment of salaries and wages and our affordable EasyPay Everywhere transactional account and our financial services offering, our competitors include the local banks, insurance companies, micro-lenders and other transaction processors. The South African banks and SAPO also offer low cost bank accounts that enable account holders to receive their salaries, wages or social grants through the formal banking payment networks.

EasyPay’s competitors include BankservAfrica, UCS, eCentric and Transaction Junction. BankservAfrica is the largest transaction processor in South Africa, which processes all transactions on behalf of the South African banks and processes more than 2.5 billion transactions per annum.

In the South African ATM network market, we compete against the South African banks, ATM Solutions and Spark ATM Systems, who collectively have a market share in excess of 90%.

DNI’s competitors in the resale of mobile phone starter packs would include the resellers for the other major mobile operator networks, being Blue Label Telecoms, SmartCall and various other starter pack distributors in South Africa.

We have identified 13 major card VAN companies in South Korea, of which KSNET is one of the three largest. The other two large VAN companies are NICE Information & Telecommunication Inc. and Korea Information & Communications Company, Inc. Entities operating in the VAN industry in South Korea compete on pricing and customer service.

IPG competitors typically include local or regional issuers, acquirers and processors as well as a few large multinational companies such as Wirecard and WorldPay. A number of new fintech entrants, usually locally or occasionally regionally such as Revolut, Klarna, Transferwise, and Digibank are also rapidly establishing their market presence.

In addition to our traditional competitors, we expect that we will increasingly compete with a number of emerging entities in the mobile payments industry. While the industry is still rapidly evolving, a number of entities are establishing their presence in this space. Specifically identified entities include traditional payment networks such as Visa, MasterCard and American Express; commercial banks such as Barclays and Citigroup; established technology companies such as Apple, Google, Facebook, Samsung and PayPal; mobile operators such as AT&T, Verizon, Vodafone, MTN and Bharti Airtel; as well as companies specifically focused on mobile payments such as Ant Financial, WeChat, M-Pesa and Square

Research and Development

During fiscal 2018, 2017 and 2016, we incurred research and development expenditures of $1.8 million, $2.0 million and $2.3 million, respectively. These expenditures consist primarily of the salaries of our software engineers and developers. Our research and development activities relate primarily to the continual revision and improvement of our core UEPS and UEPS/EMV software and its functionality as well as the design and development of our MVC concept and mobile payment applications. We have recently established a dedicated research and development team focused on blockchain technology and the development of solutions and products for the rapidly growing cryptocurrency industry. Our research and development efforts also focus on taking advantage of improvements in hardware platforms that are not proprietary to us but form part of our system.

Intellectual Property

Our success depends in part on our ability to develop, maintain and protect our intellectual property. We rely on a combination of patents, copyrights, trademarks and trade secret laws, as well as non-disclosure agreements to protect our intellectual property. We seek to protect new intellectual property developed by us by filing new patents worldwide. We hold a number of trademarks in various countries.

10

Financial Information about Geographical Areas and Operating Segments

Note 22 to our consolidated financial statements included in this annual report contains detailed financial information about our operating segments for fiscal 2018, 2017 and 2016. Revenues based on the geographic location from which the sale originated and geographic location where long-lived assets are held for the years ended June 30, are presented in the table below:

| Revenue | Long-lived assets | |||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | 2016 | |||||||||||||

| $’000 | $’000 | $’000 | $’000 | $’000 | $’000 | |||||||||||||

| South Africa | 433,421 | 434,124 | 422,022 | 498,418 | 74,370 | 69,213 | ||||||||||||

| South Korea | 153,314 | 153,403 | 158,609 | 177,388 | 192,473 | 221,459 | ||||||||||||

| Rest of world | 26,154 | 22,539 | 10,118 | 116,643 | 77,723 | 49,105 | ||||||||||||

| Total | 612,889 | 610,066 | 590,749 | 792,449 | 344,566 | 339,777 | ||||||||||||

Employees

Our number of employees allocated on a segmental basis as of the years ended June 30, are presented in the table below:

| Number of employees | |||||||||

| 2018(1) | 2017 | 2016 | |||||||

| Management | 272 | 236 | 241 | ||||||

| South African transaction processing | 1,902 | 2,487 | 2,571 | ||||||

| International transaction processing | 330 | 354 | 310 | ||||||

| Financial inclusion and applied technologies(2) | 5,875 | 2,281 | 2,576 | ||||||

| Total | 8,379 | 5,358 | 5,701 | ||||||

(1) Fiscal 2018 number of employees includes 2,651 DNI employees, of which 51 are included in management and 2,600 are included in Financial inclusion and applied technologies;

(2) Financial inclusion and applied technologies includes employees allocated to corporate/ eliminations activities.

On a functional basis, six of our employees were part of executive management, 2,661 were employed in sales and marketing, 328 were employed in finance and administration, 319 were employed in information technology and 5,065 were employed in operations.

As of June 30, 2018, approximately 58 of the 1,902 and 99 of the 5,875 employees we have in South Africa who were performing transaction-based and financial inclusion activities, respectively, were members of unions in South Africa and approximately 186 of the 247 employees we have in South Korea who perform international transaction-based activities were members of a union in Korea. We believe that we have a good relationship with our employees and these unions.

Corporate history

Net1 was incorporated in Florida in May 1997. In 2004, Net1 acquired Net1 Applied Technology Holdings Limited, or Aplitec, a public company listed on the Johannesburg Stock Exchange, or JSE. In 2005, Net1 completed an initial public offering and listed on the Nasdaq Stock Market. In 2008, Net1 listed on the JSE in a secondary listing, which enabled the former Aplitec shareholders (as well as South African residents generally) to hold Net1 common stock directly.

Available information

We maintain a website at www.net1.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge through the “SEC filings” portion of our website, as soon as reasonably practicable after they are filed with the Securities and Exchange Commission. The information contained on, or accessible through, our website is not incorporated into this Annual Report on Form 10-K.

11

Executive Officers of the Registrant

The table below presents our executive officers, their ages and their titles:

| Name | Age | Title |

| Herman G. Kotzé | 48 | Chief Executive Officer and Director |

| Alex M.R. Smith | 49 | Chief Financial Officer, Treasurer, Secretary, and Director |

| Philip S. Meyer | 61 | Managing Director: International Payments Group |

| Phil-Hyun Oh | 59 | Chief Executive Officer and President, KSNET, Inc. |

| Nanda Pillay | 47 | Managing Director: Southern Africa |

| Nitin Soma | 51 | Chief Technology Officer |

Herman Kotzé has been our Chief Executive Officer since May 2017 and was our Chief Financial Officer, Secretary and Treasurer from June 2004 to February 2018. From January 2000 until June 2004, he served on the board of Aplitec as Group Financial Director. Mr. Kotzé joined Aplitec in November 1998 as a strategic financial analyst. Prior to joining Aplitec, Mr. Kotzé was a business analyst at the Industrial Development Corporation of South Africa. Mr. Kotzé has a bachelor of commerce honors degree, a post graduate diploma in treasury management, a higher diploma in taxation, completed his articles at KPMG, and is a member of the South African Institute of Chartered Accountants.

Alex M.R. Smith has been our Chief Financial Officer, Treasurer and Secretary since March 2018. Mr. Smith joined Allied Electronics Corporation Limited, or Altron, a JSE-listed company in 2006 and from August 2008 until February 2018, Mr. Smith served as a director and its Chief Financial Officer. Prior to joining Altron, Mr. Smith worked in various positions at PricewaterhouseCoopers in Edinburgh, Scotland and Johannesburg from 1991 to 2005. Mr. Smith holds a bachelor of law (honours) degree from the University of Edinburgh and is a member of the Institute of Chartered Accountants of Scotland.

Philip Meyer has been the Managing Director of IPG since February 2018 and also serves as the Managing Director of Transact24 Limited since he founded the company in 2006. Mr. Meyer has worked in the payments industry for over 20 years. Prior to incorporating Transact24, he was employed by Naspers, a global media group, as its Chief Executive: Information Technology and New Media and was responsible for all existing and new technology and media for Naspers. Mr. Meyer is a qualified engineer with a masters degree in engineering (electronic) and has a postgraduate diploma in strategic management. Mr. Meyer is registered with the Engineering Counsel of South Africa, is a member of the South Africa Institute of Electrical Engineers and is also a member of the Digital, Information & Telecommunications Committee and Asia & Africa Committee, Hong Kong General Chamber of Commerce.

Phil-Hyun Oh has served as Chief Executive Officer and President of KSNET since 2007. He is the Chairman of the VAN Association in South Korea. Prior to that, he was the Managing Partner at Dasan Accounting Firm and was the Head of the Investment Banking Division at Daewoo Securities. Mr. Oh is responsible for the day to day operations of KSNET and as its Chief Executive Officer and President is instrumental in setting and implementing its strategy and objectives.

Nanda Pillay joined us in May 2000 and is responsible for our Southern African operations, including CPS, Financial Services, EasyPay, and SmartSwitch Botswana.

Nitin Soma has served as our Chief Technology Officer since June 2004. Mr. Soma joined Aplitec in 1997. He specializes in transaction switching and interbank settlements and designed the Stratus back-end system for Aplitec. Mr. Soma has over 20 years of experience in the development and design of smart card payment systems. Mr. Soma has a bachelor of science (computer science and applied mathematics) degree.

12

| ITEM 1A. | RISK FACTORS |

OUR OPERATIONS AND FINANCIAL RESULTS ARE SUBJECT TO VARIOUS RISKS AND UNCERTAINTIES, INCLUDING THOSE DESCRIBED BELOW, THAT COULD ADVERSELY AFFECT OUR BUSINESS, FINANCIAL CONDITION, RESULTS OF OPERATIONS, CASH FLOWS, AND THE TRADING PRICE OF OUR COMMON STOCK.

Risks Relating to Our Business

In fiscal 2018, we derived a significant portion of our revenues from our SASSA contract and the related bank accounts, which we will lose when we no longer provide a service to SASSA.

We derive a significant portion of our revenue from our contract with SASSA for the payment of social grants. Our SASSA contract, which we were awarded through a competitive tender process in 2012, was originally scheduled to expire in March 2017, and then extended to the end of March 2018. In March 2018, the Constitutional Court of South Africa, which retained oversight of SASSA as a result of litigation related to the original award of the contract to us in 2012, ruled that SASSA and CPS have a constitutional obligation to continue to pay social welfare grants and ordered that the contract be extended for an additional six months in respect of the payment of grant beneficiaries at cash pay points. Refer to “Item 3—Legal Proceedings” for a summary of the Constitutional Court’s order.

We do not expect our contract with SASSA to be extended beyond September 2018 and, therefore, we expect to lose revenues from the payment of social welfare grants at the time of the expiration of the SASSA contract. In addition, SASSA has publicly conveyed its expectation that most of the SASSA/Grindrod cards will be replaced by SAPO cards and, therefore, we expect that our revenue generated from the provision of SASSA/Grindrod bank accounts is also likely to be lost. Unless we are able to replace most or all of this revenue from other sources, our results of operations, financial position, cash flows and future growth are likely to suffer materially.

It is possible that SASSA might request us to enter into a transition agreement in order to phase out our services if their plan to do so is not completed within the required timeframe. The Constitutional Court reaffirmed in its March 2017 ruling that CPS is deemed to be an “organ of state” for the purposes of the contract between SASSA and CPS, and that CPS has “constitutional obligations” that go beyond its contractual obligations. We cannot predict what the financial or other implications may be if we are required to provide our services without a valid contract, or during any transitional period required for the orderly transfer of our services to SASSA and SAPO.

Our South African business practices remain under intense scrutiny in the South African media. We continue to publicly refute what we believe to be misleading or factually incorrect statements that have damaged our reputation. However, our ability to operate effectively and efficiently in South Africa in the future will be adversely impacted if we are unable to communicate persuasively that our business practices comply with South African law and are fair to the customers who purchase our financial services products.

The South African public, media, non-governmental organizations and political parties have utilized a number of platforms, including social media, to criticize SASSA over its failure to implement the orders of the Constitutional Court over the last two years and express their dissatisfaction with the state of affairs. Among the criticisms, we have been accused of being responsible for SASSA’s inability to bring the payment service in-house. In addition, we were publicly accused of illegally providing our services and defrauding social welfare grant recipients. We have publicly denied these accusations and believe they have no merit.

These allegations continue to be made and are being emphasized during this transition period as a justification for requiring grant beneficiaries to move to the SAPO card. We continue to deny the accusations made against us.

Our reputation in South Africa has been tarnished as a result of these accusations. We have attempted to refute the allegations made against us and have appointed a public relations firm to assist us in communicating effectively to the public and our stakeholders that our business practices comply with South African law and are fair to the social welfare grant recipients who purchase the financial services products that we offer. It is difficult to quantify to what extent we have been successful in effectively repudiating these unsubstantiated allegations against us. If we are unable to communicate persuasively that our business practices comply with South African law and are fair to the customers who purchase our financial services products, our ability to operate effectively and efficiently in South Africa in the future will be adversely impacted, and our results of operations, financial position and cash flows would be adversely affected.

13

SASSA and other organizations continue to challenge our ability to conduct certain aspects of our financial services business in a commercial manner through their interpretations of recently adopted regulations under the Social Assistance Act. We are in litigation with SASSA and the Black Sash over its interpretation of these regulations. If SASSA or the Black Sash were to prevail in this legal proceeding, our business will suffer.

As described under “Item 3—Legal Proceedings— Litigation Regarding Legality of Debit Orders under Social Assistance Act Regulations,” the High Court of the Republic of South Africa Gauteng Division, Pretoria, or Pretoria High Court, has issued the declaratory order sought by us that the Social Assistance Act and Regulations do not restrict social grant recipients in the operation of their banks accounts. SASSA continues to challenge our ability to operate certain aspects of our financial services business in a commercial manner in the South African courts. The Black Sash has also served applications petitioning the South African Supreme Court of Appeal, or the Supreme Court, to grant them leave to appeal the Pretoria High Court order through either the Supreme Court or to a full bench of the Pretoria High Court. The petitions served on the Supreme Court applying for leave to appeal were heard on August 16 and 17, 2018. We cannot predict whether leave to appeal will be granted or if granted, how the Supreme Court will rule on this matter.

If SASSA or the Black Sash were to prevail with their legal actions, our ability to operate our business, specifically our micro-lending and insurance businesses in a commercially viable manner would be impaired, which would likely have a material adverse effect on our business and might harm our reputation. Regardless of the outcome, management will be required to devote further time and resources to these legal proceedings, which may impact their ability to focus their attention on our business.

We have been ordered by the High Court to repay to SASSA certain reimbursed implementation costs. We are appealing this decision, but if we are unsuccessful and are ultimately required to repay substantial monies to SASSA, such repayment would adversely affect our results of operations, financial position and cash flows.

In March 2015, Corruption Watch, a South African non-profit civil society organization, commenced a legal proceeding in the High Court seeking an order by the Court to review and set aside the decision of SASSA’s Chief Executive Officer to approve a payment to us of ZAR 317.0 million (approximately ZAR 277 million, excluding VAT) and directing us to repay the aforesaid amount, plus interest. Corruption Watch claimed that there was no lawful basis to make the payment to us, and that the decision was unreasonable and irrational and did not comply with South African legislation. We were named as a respondent in this legal proceeding.

On February 22, 2018, the matter was heard by the Gauteng Division, Pretoria of the High Court of South Africa. On March 23, 2018, the High Court ordered that the June 15, 2012 variation agreement between SASSA and CPS be reviewed and set aside. CPS was ordered to refund ZAR 317.0 million to SASSA, plus interest from June 2014 to date of payment. On April 4, 2018, we filed an application seeking leave to appeal the whole order and judgment of the High Court because we believe that the High Court erred in its application of the law and/or in fact in its findings. On April 25, 2018, the High Court rejected the application seeking leave to appeal. CPS is in the process of filing an application seeking leave to appeal the whole order and judgment of the High Court with the Supreme Court of Appeal. However, we cannot predict whether leave to appeal will be granted or if granted, how the Supreme Court of Appeal will rule on the matter.

In addition, in an April 2014 ruling, the Constitutional Court ordered SASSA to re-run the tender process and required us to file with the Court, after completion of our SASSA contract in March 2017, an audited statement of our expenses, income and net profit under the contract. The March 2018 Constitutional Court order contains a similar requirement that we file an audited statement of our expenses, income and net profit within 30 days of the completion of the contract. We expect to file the required information with the Constitutional Court as ordered. Parties to the March 2018 court proceedings also requested the Constitutional Court to consider further orders, including the repayment of any profits derived by CPS under its SASSA contract. The Constitutional Court did not provide such order in its March 2018 order; however, one or more third parties may in the future institute litigation challenging our right to retain a portion of the amounts we will have received from SASSA under our contract. We cannot predict whether any such litigation will be instituted, or if it is, whether it would be successful.

Any successful challenge to our right to receive and retain payments from SASSA that requires substantial repayments would adversely affect our results of operations, financial position and cash flows.

14

The pricing recommended by National Treasury to the Constitutional Court for our services provided at pay points for the period from April 1, 2018 through September 30, 2018, has not yet been approved by the Constitutional Court. If the amount payable to us is not commercially reasonable, our results of operations, financial position and cash flows may be adversely affected.

Under the Constitutional Court order of March 23, 2018, related to the extension of the SASSA contract to September 30, 2018 in respect of the recipients paid at cash pay points, we were granted permission to approach National Treasury to request revised pricing of the contract. National Treasury provided a recommendation to the Constitutional Court in compliance with their order at a price per recipient of R51.00 (VAT inclusive) per month. Although we offered to accept this amount in respect of the three months ended June 30, 2018 when the number of recipients paid approximated two million per month, we have asked the Constitutional Court to reconsider the last three months of the contract. Neither the Treasury recommendation or our proposal have been approved by the Constitutional Court to date and as a result we have only recognised revenue at the rate set forth in the original contract since April 1, 2018 while we await an order from the Constitutional Court.

In line with SASSA’s public statements, we have seen a material reduction in the number of recipients paid at the pay points during July and August, and this is expected to continue into September. This would result in a material decrease in the revenue from the provision of this service if National Treasury’s recommendation is applied and CPS would then operate at an even greater loss for the three months to the end of the contract. If we are unable to reach a commercially reasonable settlement for this period, then this will adversely affect our results of operations, financial position and cash flows during the first quarter of fiscal 2019.

In order to meet our obligations under our current SASSA contract, we are required to deposit government funds with financial institutions in South Africa before commencing the payment cycle and are exposed to counterparty risk.

In order to meet our obligations under our current SASSA contract, we are required to deposit government funds, which will ultimately be used to pay social welfare grants, with financial institutions in South Africa before commencing the payment cycle. If these financial institutions are unable to meet their commitments to us, in a timely manner or at all, we would be unable to discharge our obligations under our SASSA contract and could be subject to financial losses, penalties, loss of reputation and potentially, the cancellation of our contract. As we are unable to influence these financial institutions’ operations, including their internal information technology structures, capital structures, risk management, business continuity and disaster recovery programs, or their regulatory compliance systems, we are exposed to counterparty risk.

We may undertake acquisitions or make strategic investments that could increase our costs or liabilities or be disruptive to our business.

Acquisitions and strategic investments are an integral part of our long-term growth strategy as we seek to grow our business internationally and to deploy our technologies in new markets both inside and outside South Africa. However, we may not be able to locate suitable acquisition or investment candidates at prices that we consider appropriate. If we do identify an appropriate acquisition or investment candidate, we may not be able to successfully negotiate the terms of the transaction, finance it or, if the transaction occurs, integrate the new business into our existing business. These transactions may require debt financing or additional equity financing, resulting in additional leverage or dilution of ownership. For instance, in July 2017, we invested in Cell C utilizing a combination of existing cash reserves and external debt from South African banks. Refer to Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Developments During Fiscal 2018— CPS and SASSA Contract Termination.”

Acquisitions of businesses or other material operations and the integration of these acquisitions or their businesses will require significant attention from our senior management which may divert their attention from our day to day business. The difficulties of integration may be increased by the necessity of coordinating geographically dispersed organizations, integrating personnel with disparate business backgrounds and combining different corporate cultures. We also may not be able to maintain key employees or customers of an acquired business or realize cost efficiencies or synergies or other benefits that we anticipated when selecting our acquisition candidates.

In addition, we may need to record write-downs from future impairments of goodwill or other intangible assets, which could reduce our future reported earnings. For instance, in March 2018, we recorded an impairment loss of $19.9 million related to the goodwill identified in the Masterpayment and Masterpayment Financial Services acquisitions. Finally, acquisition candidates may have liabilities or adverse operating issues that we fail to discover through due diligence prior to the acquisition.

15

We may not achieve the expected benefits from our recent Cell C and DNI investments.

We have invested more than $240 million, in aggregate, to acquire a 15% interest in Cell C and a 55% controlling interest in DNI. We believe that there are potential synergies that we can derive from each of these transactions, including the integration of certain of our service offerings with those of Cell C and DNI. However, we may not realize some or any of the benefits we expect to achieve from these investments.

Attempting to integrate these service offerings may be disruptive to us, and we may not be able to integrate these offerings successfully. Even if we are able to achieve this integration, our customers may not use these services to the extent that we expect they will. Any such failure could adversely impact our business or the businesses of Cell C and DNI, which could, in turn, reduce the value of our investments in them. Additionally, attempting to integrate Cell C’s and DNI’s offerings with our own may adversely impact our other business and operational relationships. Our inability to achieve the expected synergies from the Cell C and DNI transactions may have a material adverse effect on our business, results of operations or financial condition. In addition, Cell C and DNI may not be able to successfully execute their respective business plans, which may adversely affect, or impair, the carrying value of our investments in them.

DNI generates most of its revenue by providing services to or on behalf of Cell C, principally through the sale of mobile phone starter packs. Our results of operations, financial condition and cash flow would suffer materially if DNI were to lose its contractual relationships with Cell C.

DNI’s business comprises of a number of separate entities that are primarily involved in the distribution of mobile phone starter packs, mainly on behalf of Cell C. We also provide funding for the expansion of Cell C’s mobile telecommunications infrastructure. If Cell C were to terminate any of these contractual relationships that have multi-year notice periods, it would have a material adverse effect on our results of operations, financial condition and cash flow as a consequence of the impact on DNI.

We have indebtedness that requires us to comply with restrictive and financial covenants. If we are unable to comply with these covenants, we could default on this debt, which would have a material adverse effect on our business and financial condition.

We financed our investments in Cell C and DNI through South African bank borrowings of ZAR 1.46 billion, which has since reduced to ZAR 683.8 million through the Company meeting its scheduled repayments ($49.8 million, translated at exchange rates applicable as of June 30, 2018). The loans are secured by intercompany cross-guarantees and a pledge by Net1 Applied Technologies South Africa Proprietary Limited, or Net1 SA, of its entire equity interests in Cell C and DNI. The terms of the lending arrangement contain customary covenants that require Net1 SA to remain below a specified total net leverage ratio and restrict the ability of Net1 SA, and certain of its subsidiaries to make certain distributions with respect to their capital stock, prepay other debt, encumber their assets, incur additional indebtedness, make investment above specified levels, engage in certain business combinations and engage in other corporate activities without the approval of the lenders.

In addition, DNI has obtained a three year revolving credit facility of ZAR 200 million ($14.6 million, translated at exchange rates applicable as of June 30, 2018) from Rand Merchant Bank, a division of FirstRand Bank Limited, a South African bank, to expand its operations. The revolving credit facility is secured by intercompany cross-guarantees within the DNI group and a pledge by DNI of its entire equity interests in its subsidiaries. The terms of the lending arrangement contain customary covenants that require DNI to remain in accordance with specified net senior debt to EBITDA and EBITDA to net senior interest ratios and restrict the ability of DNI, and certain of its subsidiaries to make certain distributions with respect to their capital stock, prepay other debt, encumber their assets, incur additional indebtedness, make investment above specified levels, engage in certain business combinations and engage in other corporate activities without the approval of the lenders.

Although these covenants only apply to certain of our South African subsidiaries, these security arrangements and covenants may reduce our operating flexibility or our ability to engage in other transactions that may be beneficial to us. If we are unable to comply with the covenants in South Africa, we could be in default and the indebtedness could be accelerated. If this were to occur, we might not be able to obtain waivers of default or to refinance the debt with another lender and as a result, our business and financial condition would suffer.

16

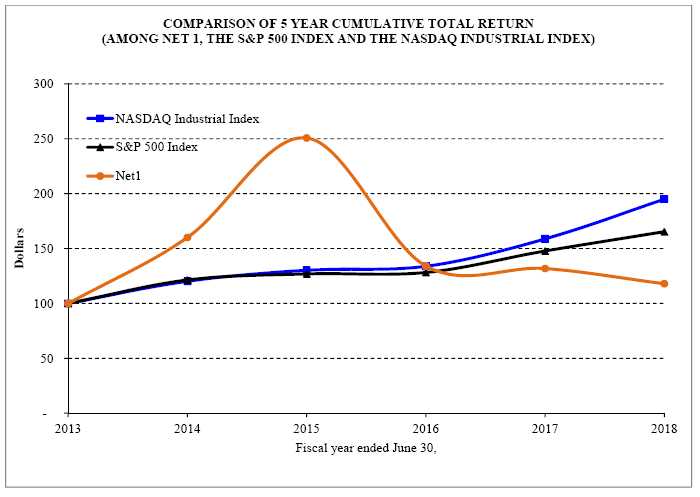

We may be unable to secure the necessary facilities that will enable us to maintain the cash requirements for our ATM network