Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Integer Holdings Corp | gff8k_082715.htm |

| EX-99.1 - EXHIBIT 99.1 - Integer Holdings Corp | exh_991.htm |

EXHIBIT 99.2

1 Creating a Global Leader to Advance the Medical Device Industry August 27, 2015

2 Forward-Looking Statements Some of the statements made in this presentation whether written or oral maybe“forward-lookingstatements”withinthemeaningofSection27Aof theSecuritiesActof1933,asamended,andSection21EoftheSecurities Exchange Act of 1934, as amended, and involve a number of risks and uncertainties. These statements can be identified by terminology such as

“may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,”“estimates,” “predicts,”“potential”,or“continue”,orvariationsor thenegativeofthesetermsorothercomparableterminology. These statements are based on the company’s current expectations. The company’sactualresultscoulddiffermateriallyfromthosestatedorimplied insuchforward-lookingstatements.Thecompanyassumesnoobligationsto updateforward-lookinginformation,includinginformationinthispresentation, toreflectchangedassumptions,theoccurrence ofunanticipatedeventsor changes in future operating results, financial conditions, prospects or otherwise.

3 Call Participants THOMAS J. HOOK President & CEO MICHAEL DINKINS Executive Vice President &

Chief Financial Officer

4 Creating a Global Leader to Advance the Medical Device Industry 1) $1.5 billion of revenue based on 2014 pro forma 2) $1.73 billion consists of $478 million cash, $1 billion of net debt pay-off, and 5.1M shares and options issued valued at $253million based on August 26, 2015 closing price of $49.89 3) Cash EPS excluding transaction related expenses, purchase accounting, intangible amortization, stock based compensation expenses, and non- recurring adjustments ▪ Market-leading portfolio of products and services to OEM customers

▪ Lake Region’s market focus complements Greatbatch technology portfolio ▪ Added scale and diversification across geographies, markets and customers with $1.5 billion of combined revenue (1) ▪ Decades of experience and full capabilities in innovating, designing and manufacturing products for OEM customers ▪ Excellence in R&D product development and innovation ▪ Cash and stock transaction valued at approximately $1.73 billion (2) ▪ Approximately $25 million pre-tax synergies in 2016, increasing to at least $60 million in 2018 ▪ Transaction expected to be double-digit adjusted cash EPS (3) accretive to shareholders in 2016 and meaningfully more accretive thereafter

5 Transaction Overview 1) Greatbatch to issue 5.1 million shares and options at closing valued at $253million based on the August 26, 2015 closing price of $49.89 •Cash consideration totaling $1.47 billion •Lake Region shareholders own approximately 16.6% of the combined entity or 5.1 million Greatbatch shares and options valued at $253million (1) Consideration

•Committed financing from M&T Bank, Credit Suisse, and KeyBancCapital Markets •Pro forma leverage of approximately 5.0x net debt to adjusted EBITDA at closing Financing ▪ Closing expected in the fourth quarter of 2015 (subject to regulatory approvals)

6 ▪ Cardio and Vascular – Electrophysiology and stimulation – Vascular access – Cardiovascular and structural heart – Peripheral, neuro, urology, oncology ▪ Advanced Surgical – Joint preservation and reconstruction – Laparoscopy and general surgery – Arthroscopy – Biopsy / drug delivery Revenue (LTM 6/30/15) Greatbatch and Lake Region at a Glance Highly Complementary Markets Served Employees Manufacturing Facilities ▪ Cardiac and Neuromodulation ▪ Vascular ▪ Portable Medical ▪ Orthopaedics ▪

Environmental, Military, Energy $678M $806M 11 17 ~3,700 ~5,500 Adj. EBITDA (LTM 6/30/15) $149M$160M

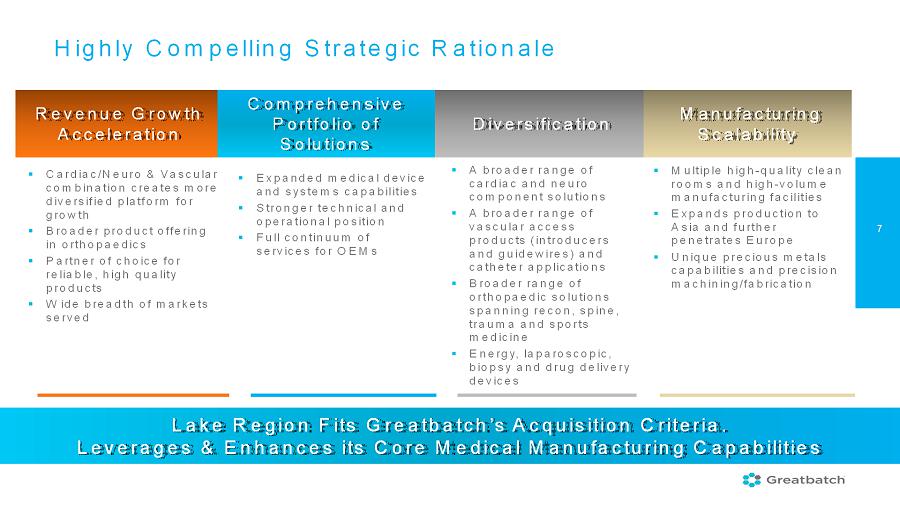

7 Highly Compelling Strategic Rationale Manufacturing Scalability Revenue Growth Acceleration Diversification Comprehensive Portfolio of Solutions Lake Region Fits Greatbatch’s Acquisition Criteria. Leverages & Enhances its Core Medical Manufacturing Capabilities

▪ Expanded medical device and systems capabilities ▪ Stronger technical and operational position ▪ Full continuum of services for OEMs ▪ A broader range of cardiac and neuro component solutions ▪ A broader range of vascular access products (introducers and guidewires) and catheter applications ▪ Broader range of orthopaedic solutions spanning recon, spine, trauma and sports medicine ▪ Energy, laparoscopic, biopsy and drug delivery devices ▪ Cardiac/Neuro & Vascular combination creates more diversified platform for growth ▪ Broader product offering in orthopaedics ▪ Partner of choice for reliable, high quality products ▪ Wide breadth of markets served ▪ Multiple high-quality clean rooms and high-volume manufacturing facilities ▪ Expands production to Asia and further penetrates Europe ▪ Unique precious metals capabilities and precision machining/fabrication

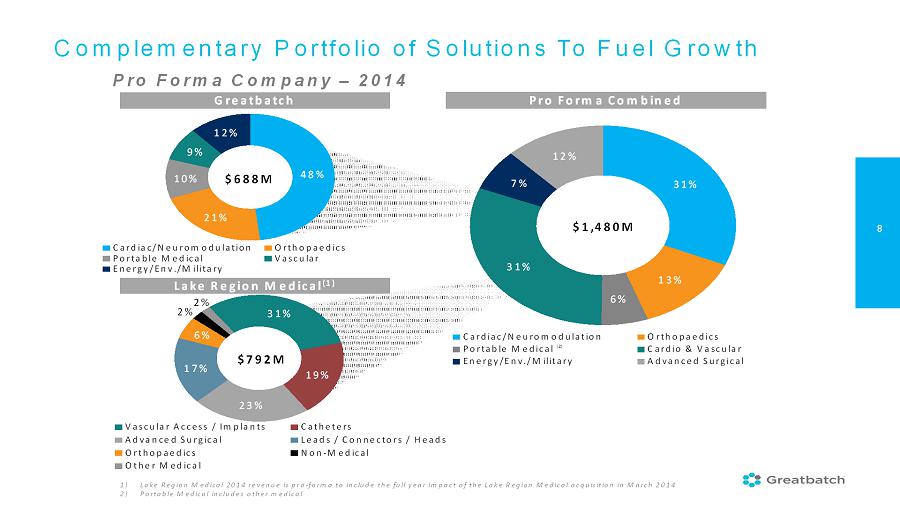

8 Greatbatch Lake Region Medical (1) Complementary Portfolio of Solutions To Fuel Growth Pro Forma Company –2014 Pro Forma Combined $792M $688M $1,480M 31% 13% 6% 31% 7% 12% Cardiac/Neuromodulation Orthopaedics Portable Medical Cardio & Vascular Energy/Env./Military Advanced Surgical 1) Lake Region Medical 2014 revenue is pro-forma to include the full year impact of the Lake Region Medical acquisition in March 2014 2) Portable Medical includes other medical (2) 48% 21% 10% 9% 12% Cardiac/Neuromodulation Orthopaedics Portable Medical Vascular Energy/Env./Military 31% 19% 23% 17% 6% 2% 2% Vascular Access / Implants Catheters Advanced Surgical Leads / Connectors / Heads Orthopaedics Non-Medical Other Medical

9 World-Class Medical Operating Capabilities & Infrastructure ▪ Operational Excellence:

– Global footprint (America’s, Europe, Asia) – Scalable operating infrastructure – Multiple award winning sites – Proven low cost offerings – Enterprise lean manufacturing practices ▪ Unmatched technical and operational capabilities ▪ Long standing reputation for quality and reliability ▪ Agile and integrated supply chain ▪ Excellence in R&D design and innovation ▪ Decades-long customer partnerships

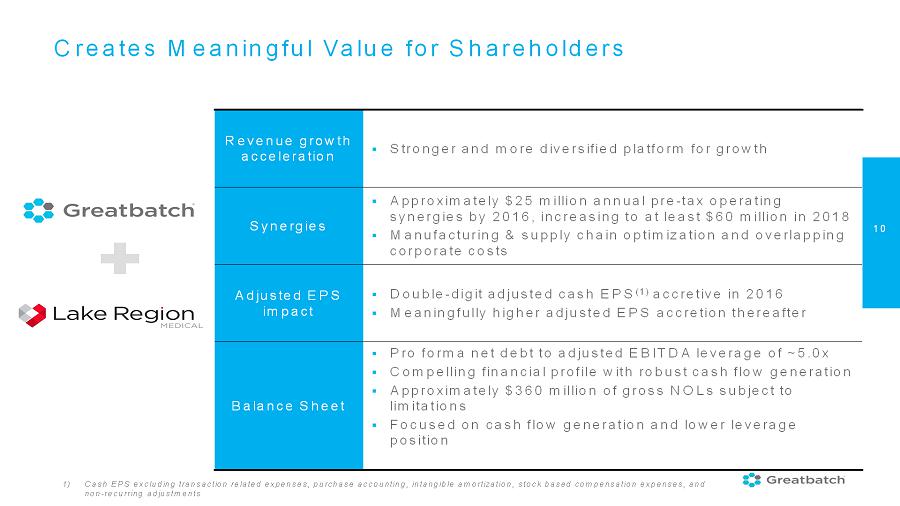

10 Creates Meaningful Value for Shareholders Revenue growth acceleration ▪ Stronger and more diversified platform for growth Synergies ▪ Approximately $25 million annual pre-tax operating synergies by 2016,increasing to at least $60 million in 2018 ▪ Manufacturing & supply chain optimization and overlapping corporate costs Adjusted EPS impact ▪ Double-digit adjusted cash EPS (1) accretive in 2016 ▪ Meaningfully higher adjusted EPS accretion thereafter Balance Sheet ▪ Pro forma net debt to adjusted EBITDA leverage of ~5.0x ▪ Compelling financial profile with robust cash flow generation ▪ Approximately $360 million of gross NOLs subject to limitations ▪

Focused on cash flowgeneration and lower leverage position 1) Cash EPS excluding transaction related expenses, purchase accounting, intangible amortization, stock based compensation expenses, and non-recurring adjustments

11 ▪ $25 million of annual pre-tax operating synergies in 2016

▪ At least $60 million of annual pre-tax operating synergies to be delivered by the end of 2018 ▪ Investment to achieve synergies estimated at $69 million which consists of $22 million in capital and $47 million in expense over the course of 3 years Overview of Anticipated Synergies ▪ Improved manufacturing overhead utilization ▪ Facility optimization ▪ Procurement savings ▪ In-sourcing opportunities Manufacturing and Supply Chain ▪ Back-office synergies ▪ Efficient global corporate overhead structure Corporate Overhead ▪ Integrated product development ▪ Leverage combined intellectual property portfolio R&D Optimization Synergies Deliver Net Positive Operating Contribution in 2017

12 Imagine What We Will Innovate and Build Together 12

13 Questions and Answers