Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GENERAL STEEL HOLDINGS INC | v418631_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - GENERAL STEEL HOLDINGS INC | v418631_ex99-1.htm |

Exhibit 99.2

1 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. Second Quarter 2015 Earnings Call Presentation August 22, 2015 ,

2 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. Safe Harbor Statement This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 , as amended , and Section 21 E of the Securit

ies Exchange Act of 1934 , as amended . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, any comments relating to our financial performance, the competitive nature of the marketplace, the condition of the worldwide economy and other factors that have been or will be detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . gshi - steel . com . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise .

3 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. China Steel Industry Dynamics Agenda Internet - of - Things Opportunities and Pipelines CEO Comments Review of Second Quarter 2015 Financials

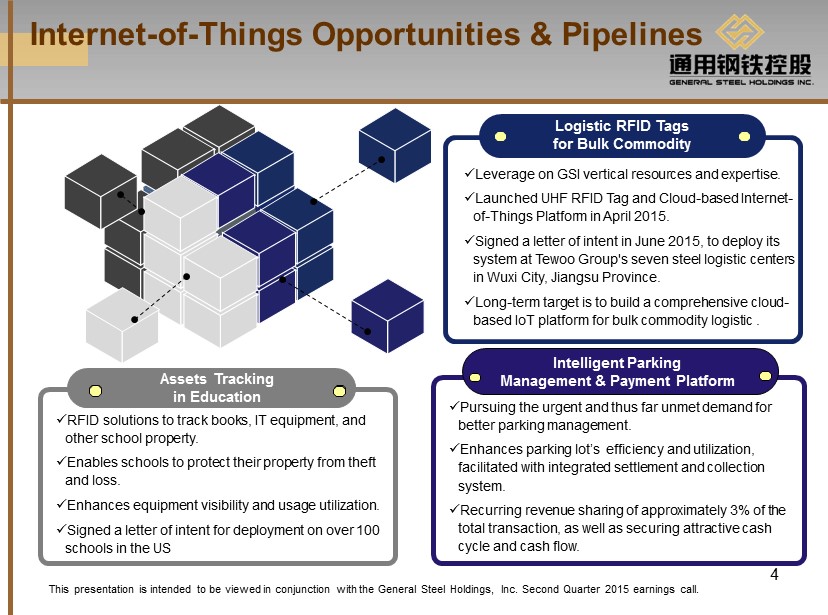

4 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. Internet - of - Things Opportunities & Pipelines Intelligent Parking Management & Payment Platform x L everage on GSI vertical resources and expertise . x Launched UHF RFID Tag and Cloud - based Internet - of - Things Platform in April 2015. x Signed a letter of intent in J

une 2015, to deploy its system at Tewoo Group's seven steel logistic centers in Wuxi City, Jiangsu Province. x L ong - term target is to build a comprehensive cloud - based IoT platform for bulk commodity logistic . Logistic RFID Tags for Bulk Commodity x Pursuing the urgent and thus far unmet demand for better parking management. x Enhances parking lot’s efficiency and utilization, facilitated with integrated settlement and collection system. x R ecurring revenue sharing of approximately 3% of the total transaction , as well as securing attractive cash cycle and cash flow . x RFID solutions to track books, IT equipment, and other school property. x Enables schools to protect their property from theft and loss. x Enhances equipment visibility and usage utilization . x Signed a letter of intent for deployment on over 100 schools in the US Assets Tracking in Education

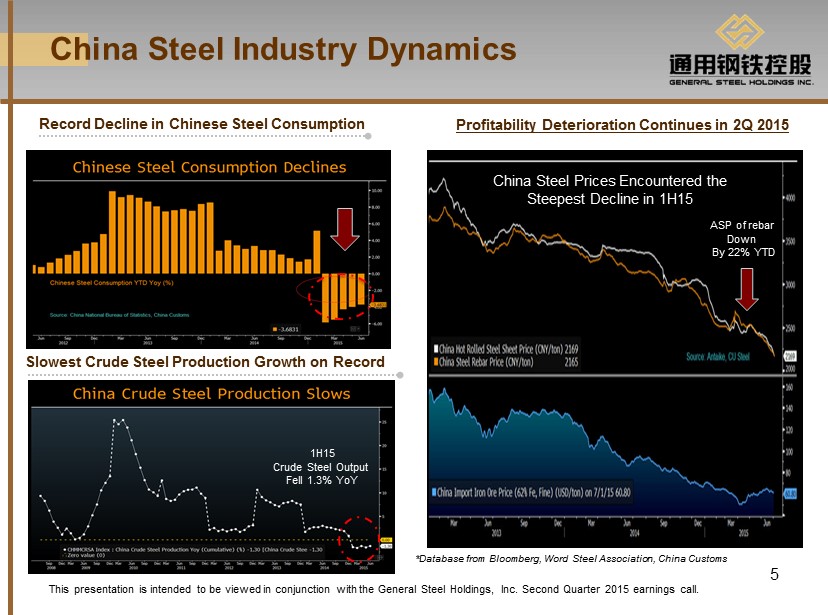

5 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. China Steel Industry Dynamics Profitability Deterioration Continues in 2Q 2015 Record Decline in Chinese Steel Consumption Slowest Crude Steel Production Growth on Record *Database from Bloomberg, Word Steel Association, China Customs China Steel Prices Encountered the Steep

est Decline in 1H15 ASP of rebar Down By 22% YTD 1H15 Crude Steel Output Fell 1.3% YoY

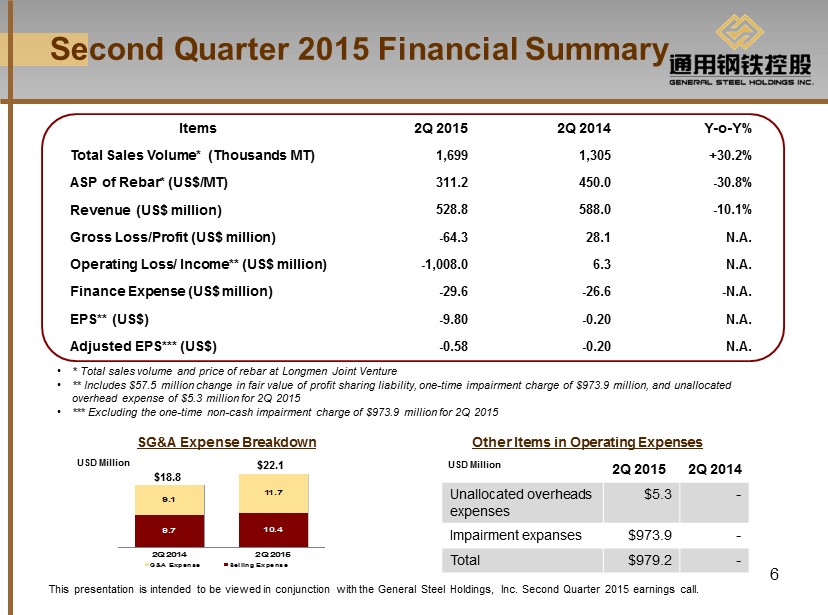

6 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. Items 2Q 2015 2Q 2014 Y - o - Y% Total Sales Volume* (Thousands MT) 1,699 1,305 +30.2% ASP of Rebar * (US$ /MT) 311.2 450.0 - 30.8% Revenue (US$ million) 528.8 588.0 - 10.1% Gross Loss/Profit (US$ million) - 64.3 28.1 N.A. Operating Loss/ Income** (US$ million) - 1,008

.0 6.3 N.A. Finance Expense (US$ million) - 29.6 - 26.6 - N.A. EPS ** (US$) - 9.80 - 0.20 N.A. Adjusted EPS*** (US$) - 0.57 - 0.20 N.A. Second Quarter 2015 Financial Summary • * Total sales volume and price of rebar at Longmen Joint Venture • ** Includes $57.5 million change in fair value of profit sharing liability, one - time impairment charge of $973.9 million, and unallocated overhead expense of $5.3 million for 2Q 2015 • *** Excluding the one - time non - cash impairment charge of $973.9 million for 2Q 2015 SG&A Expense Breakdown 9.7 10.4 9.1 11.7 2Q 2014 2Q 2015 G&A Expense Selling Expense USD Million $18.8 $22.1 Other Items in Operating Expenses 2Q 2015 2Q 2014 Unallocated overheads expenses $5.3 - Impairment expanses $973.9 - Total $979.2 - USD Million

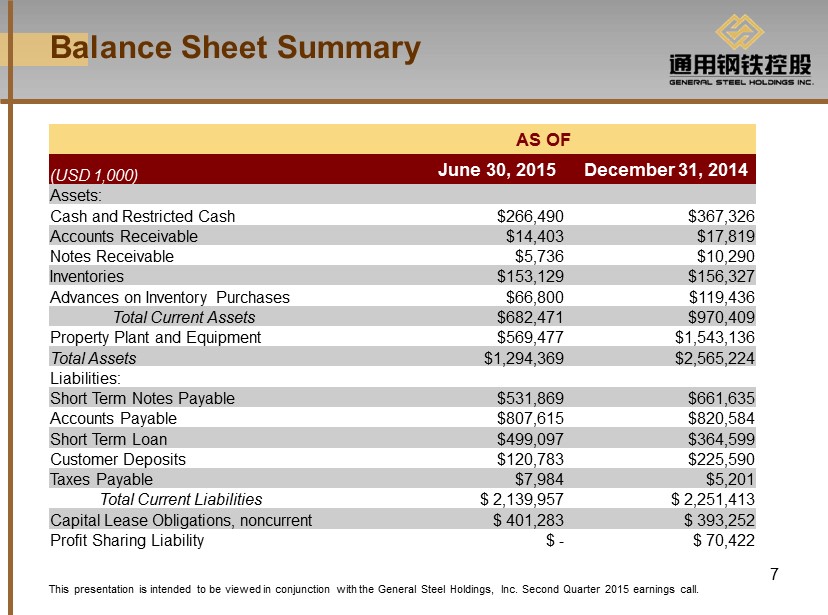

7 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. Balance Sheet Summary AS OF (USD 1,000) June 30, 2015 December 31, 2014 Assets: Cash and Restricted Cash $266,490 $367,326 Accounts Receivable $14,403 $17,819 Notes Receivable $5,736 $10,290 Inventories $153,129 $156,327 Advances on Inventory Purchases $66,800 $119,436 Total Cu

rrent Assets $682,471 $970,409 Property Plant and Equipment $ 569,477 $ 1,543,136 Total Assets $1,294,369 $ 2,565,224 Liabilities: Short Term Notes Payable $531,869 $661,635 Accounts Payable $807,615 $820,584 Short Term Loan $499,097 $364,599 Customer Deposits $120,783 $225,590 Taxes Payable $7,984 $5,201 Total Current Liabilities $ 2,139,957 $ 2,251,413 Capital Lease Obligations, noncurrent $ 401,283 $ 393,252 Profit Sharing Liability $ - $ 70,422

8 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. Second Quarter 2015 earnings call. 8 Q&A Joyce Sung General Steel Holdings, Inc. Tel: +1 - 347 - 534 - 1435 Email: joyce.sung@gshi - steel.com ,