Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - PetroShare Corp. | Financial_Report.xls |

| EX-10.1 - EXHIBIT 10.1 - PetroShare Corp. | ex10x1.htm |

| EX-31.1 - EXHIBIT 31.1 - PetroShare Corp. | ex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - PetroShare Corp. | ex32x1.htm |

| EX-10.2 - EXHIBIT 10.2 - PetroShare Corp. | ex10x2.htm |

| EX-10.3 - EXHIBIT 10.3 - PetroShare Corp. | ex10x3.htm |

| 10-Q - FORM 10-Q FOR THE PERIOD ENDED 3/31/2015 - PetroShare Corp. | petroshare_10q-033115.htm |

Exhibit 10.4

PARTICIPATION AGREEMENT

This Participation Agreement (hereinafter “Agreement”) is made and entered into effective May 13, 2015, by and between PetroShare Corp. (“PetroShare”), and Providence Energy Operators, LLC (“Participant”).

RECITALS:

| A. | PetroShare represents that it has acquired certain oil and gas leases, being described on Exhibit “A” attached hereto (the “Existing Leases”). |

| B. | Participant wishes to participate with PetroShare in the drilling and development of the Leases (defined below) pursuant to the provisions of this Agreement. |

| C. | In addition, Participant, as “Lender”, is providing a revolving line of credit facility (“Credit Facility”) for the benefit of PetroShare, as “Borrower”, pursuant to that certain Revolving Line of Credit Facility dated May 13, 2015. |

Now, therefore, the parties hereto, for the mutual promises contained herein and other good and valuable consideration, the sufficiency of which is hereby acknowledged, do hereby contract and agree as follows, hereby also incorporating the recitals above:

I. DEFINITIONS

| 1. | AMI Acquisition Cost or Costs: Shall include all Lease Costs and all other expenditures related to the acquisition of the AMI Leases which would be treated as a direct cost under Section II of the Accounting Procedure attached to the Operating Agreement, including but not limited to, expenditures for contract brokers, expenses associated with Exhibit C - Kingdom Resources Service Agreement, abstracts, and outside attorneys, and, in the case of options and contractual rights shall include an assumption by the Non-Acquiring Party of its proportionate share of all burdens imposed on Acquiring Party by the related contract, but shall not include any charges for Acquiring Party’s own personnel or overhead or which would be treated as “indirect costs” under Section III of said Accounting Procedure. |

| 2. | AMI Lease(s): Any Lease which the Parties hereto elect to acquire within the AMI. |

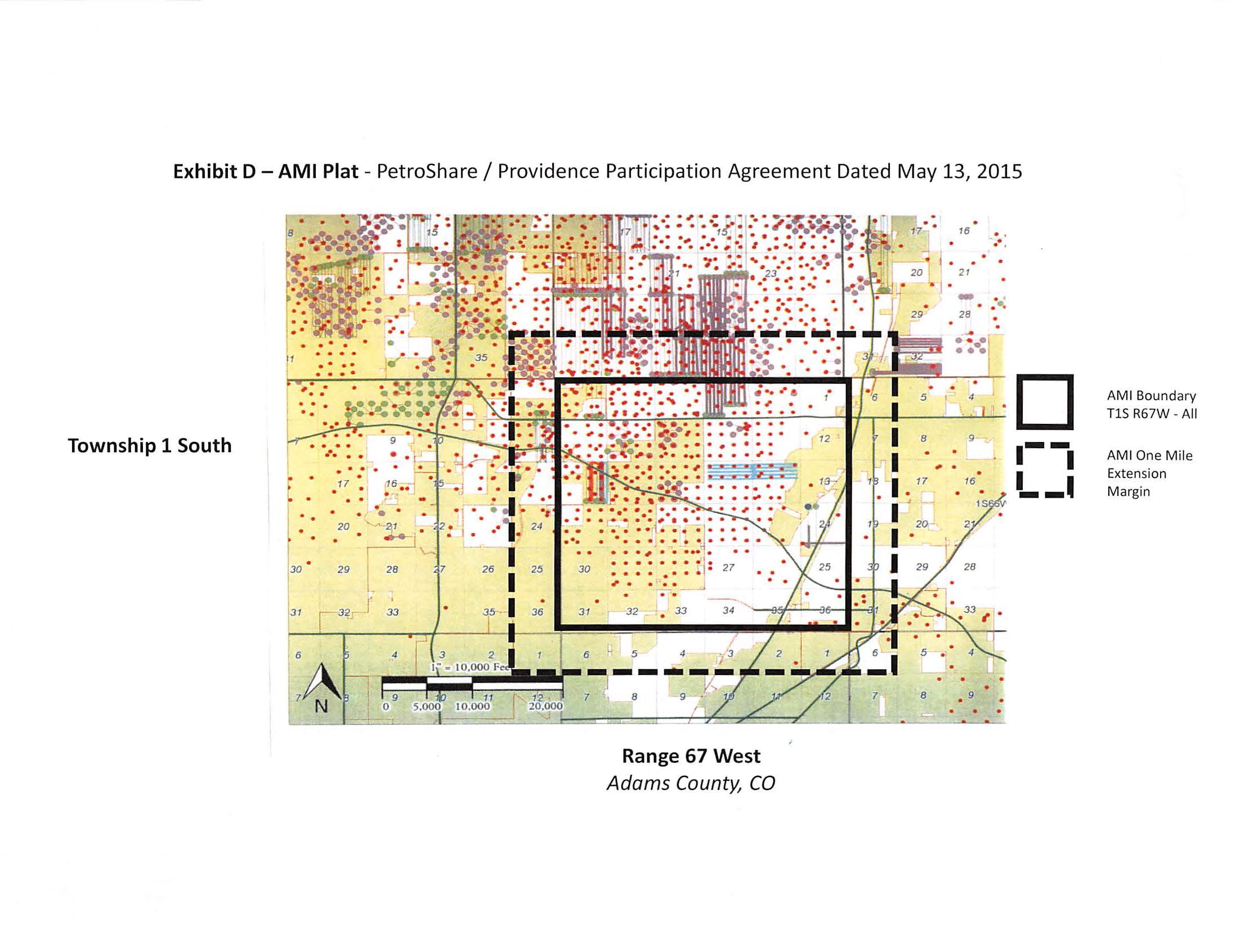

| 3. | Area of Mutual Interest or AMI: The Area of Mutual Interest shall consist of the lands identified on Exhibit “D” attached hereto, plus an additional one mile in diameter surrounding the outer boundaries of the lands identified on Exhibit D. |

| 4. | Effective Date: The Effective Date of this Agreement is May 13, 2015. |

| 5. | Existing Leases: The oil and gas leases on Exhibit “A” attached hereto. |

| 6. | Leases: Collectively, the Existing Leases and AMI Leases. |

1

| 7. | Net Revenue Interest: The share of the gross production proceeds net of all royalty interests, overriding royalty interests and similar burdens and also net of applicable production, severance and ad valorem taxes. |

| 8. | Operator: As set forth in the applicable JOA. |

| 9. | Operating Agreement or JOA: A joint operating agreement in the form attached hereto as Exhibit “B”, as may be modified by the designated Operator at the time of any modification; or, if any of the Leases are subject to an existing joint operating agreement with a third party, such joint operating agreement will be the applicable JOA for such Leases, as to the lands covered by said third party JOA. |

| 10. | Party or Parties: Shall refer to Participant and/or PetroShare, individually or collectively. |

| 11. | Participant Interest: A Working Interest in any of the Leases on a pro rata basis of 50.0%, having a net revenue interest of not less than 80.00%, unless otherwise mutually agreed to in writing by Participant and PetroShare. |

| 12. | Project Area: Shall be any area(s) within the AMI in which there is ongoing operations, including, but not limited to leasing, drilling and completion operations, seismic operations, and/or producing wells. |

| 13. | Well or Wells: Any well which has been proposed within the Project Area or the AMI. |

| 14. | Working Interest: The cost bearing interest created by, through and from oil and gas leases. |

| 15. | Credit Facility: That certain revolving line of credit facility (“Credit Facility”) by and between Participant (aka “Lender”) and PetroShare (aka “Borrower”) dated May 13, 2015. |

II. EXISTING LEASES AND LEASE EXPENSES

A. Existing Lease. Upon full execution of this Agreement, Participant shall be assigned an undivided fifty percent (50.0%) of PetroShare’s right, title and interest in and to the Existing Leases. All assignments hereunder will be subject to all royalties, overriding royalties, production payments, net profits interests and similar burdens existing of record as of the date of this Agreement.

B. Lease Expenses. With respect to the Existing Leases, and in the event any other Lease is acquired within the AMI and Participant elects to acquire its full 50% share of PetroShare’s right, title and interest in the Lease as outlined herein (an “AMI Lease’), Participant shall pay its pro rata share of lease acquisition expenses and the expenses necessary to maintain the Lease in full force and effect (including without limitation delay rentals, minimum royalties and shut-in payments). At the outset of this Agreement, PetroShare agrees to and shall grant Participant a onetime credit against Existing Leases’ acquisition expenses equal to $105,000 for Participant’s 50% share of such lease acquisition expenses.

2

III. DRILLING AND DEVELOPMENT.

A. Participation Wells. Participant shall have the right to participate in any Well proposed within the Project Area or on any of the Leases in the AMI, or on lands pooled or to be pooled therewith, in accordance with the associated Operating Agreement and the provisions of this Agreement, with Participant being responsible for its Participant Interest, subject to any elections to not participate in such Well.

IV. OPERATIONS WITHIN PROJECT AREA

A. Operating Agreement. All operations within the Project Area shall be conducted pursuant to one or more JOA’s, in the form attached hereto as Exhibit “B”, reference to which is hereby made for all purposes, except as expressly modified by the terms hereof. In the event of a conflict between this Agreement and the Operating Agreement that has been executed by the Parties, the Operating Agreement associated with any proposed Well shall control. In the event that any of the Leases are subject to a JOA in existence prior to the date of this Agreement which has been disclosed to Participant prior to execution of this Agreement, or are included in units that will be operated by a third party, then the prior JOA’s or the third party operator’s JOA shall control.

B. Cash Advances. Cash Advances shall be due and payable and made in accordance with the Operating Agreement governing a Well.

V. AMI

Acquisition of AMI Leases. The Parties hereby establish the AMI, as described on Exhibit D attached hereto. The term of AMI shall be for a period three (3) years from the Effective Date, and as long as thereafter as any well drilled pursuant to this Agreement is producing oil and/or natural gas in paying quantities or any of the Leases are in effect (“AMI Term”). During the AMI Term, if either Party acquires any AMI Leases, the other Party shall have the right to acquire its proportionate 50% interest in and to such AMI Leases, in accordance with the terms and conditions of this Agreement. The following provisions shall apply to the AMI and AMI Leases:

| 1. | Either Party to Acquire. Either Party shall have the right to lease or otherwise acquire AMI Leases within the AMI. AMI Leases shall be subject to the AMI and provisions below. |

| 2. | Notification Upon Acquiring Oil and Gas Rights. The Party acquiring an AMI Lease (“Acquiring Party”), shall notify the other Party (“Non-Acquiring Party”) in writing within 20 days of such acquisition. Such lease notice shall include a full description of the AMI Lease so acquired, a copy of the instrument by which such rights were acquired, together with all documentation relevant thereto, including without limitation copies of the leases, abstracts, title memos, assignments, subleases, farm outs or other contracts affecting the AMI Lease, plus an itemized breakdown of the AMI Acquisition Cost (defined below). |

3

| 3. | Option to Participate. Within 15 days after the Non-Acquiring Party’s receipt of the notice and information referred to in paragraph A.2. above, the Non-Acquiring Party may elect to acquire its share in the AMI Leases so acquired by notifying the Acquiring Party of such election in writing. If the Non-Acquiring Party so elects to acquire its proportionate share in the acquired AMI Leases, the interests of the Parties in said AMI Leases shall be: |

| Participant: | 50.0% |

| PetroShare: | 50.0% |

If the Non-Acquiring Party does not timely elect or elects to not acquire its interest in any such AMI Leases, then it shall have no interest in any such leases.

| 4. | Acceptance and Reimbursement. Promptly after the acceptance of an offered AMI Lease, the Acquiring Party shall invoice the Non-Acquiring Party for Non-Acquiring Party’s Share of the AMI Acquisition Costs associated with the acquired AMI Lease. The Non-Acquiring Party shall promptly reimburse Acquiring Party for the Non-Acquiring Party’s share of the AMI Acquisition Costs, as reflected by the invoice. Upon receipt of such reimbursement at a closing or otherwise, Acquiring Party shall simultaneously convey the right, title and interest in and to such Non-Acquiring Party’s 50% interest in said AMI Lease(s) through a proper Assignment thereof. If Acquiring Party does not receive the amount due from the Non-Acquiring Party within thirty (30) days after the receipt by such Non-Acquiring Party of the invoice for its costs, such failure shall constitute a withdrawal by Non-Acquiring Party of its former election to acquire the interest, and Non-Acquiring Party shall no longer have the right to acquire an interest in the offered AMI Lease, unless the Acquiring Party agrees in writing to do so. The Acquiring Party, at its sole option, may elect by written notice to the Non-Acquiring Party to extend the reimbursement timeframe. During such extension of reimbursement timeframe, if granted, the Non-Acquiring Party shall remain liable for payment. |

| 5. | Failure to Respond. If Acquiring Party shall not have received notice of the election of Non-Acquiring Party to acquire its proportionate interest within the fifteen (15) day election period pursuant to the terms of Paragraph A.3. of this Agreement, such failure to respond shall be deemed conclusively to be an election by Non-Acquiring Party to not acquire its interest in the AMI Lease being offered. If the Non-Acquiring Party elects in writing to not participate in any AMI Leases, the Acquiring Party may retain such AMI Leases free and clear of all of the terms of this Agreement, the AMI and any operating agreements among the Parties. |

4

| 6. | Responsive Notices. Responsive notices required hereunder, including, but not limited to elections to participate in an acquisition, may be given verbally by phone or in person, or E-mail but to be effective must be followed by written notice delivered by mail, courier, personally, E-mail or by facsimile within 24 hours of the delivery of the verbal notice. |

| 7. | Assignee Requirements. Each Party agrees to require any assignee who acquires an interest in any Leases within the AMI from such Party to agree to be bound by the terms of the AMI set forth herein. |

| 8. | Participant will have the right on an ongoing basis, to participate for its proportionate share (50%), in the acquisition or construction of any gathering, processing, pipelines or plant facilities that may be necessary or convenient for the production or transmission of any gas produced under the terms of this Agreement and the associated AMI in which Participant has an interest. |

VI. PROPORTIONATE REDUCTION

Proportionate Reduction Clause: If an oil and gas lease or other Mineral Interest covers less than the entire mineral fee estate in the lands covered thereby, or if a party’s interest in the applicable Lease or Mineral Interest is less than a 100% ownership interest, any interest conveyed or reserved pursuant to this Agreement is intended to be proportionately reduced to (i) the proportion of interest covered by the relevant oil and gas lease or other Mineral Interest, and (ii) the proportion of ownership held by the conveying party, in the case of a conveyance, or the burdened party, in the case of a reservation of interest.

VII. REVOLVING CREDIT FACILITY

Loan Agreement: Participant (as Lender) and PetroShare (as Borrower) have entered into a $5,000,000 revolving line of Credit Facility dated May 13, 2015, which is secured by the Leases and resulting production contemplated hereunder. In the event of a conflict between this Participation Agreement and the Credit Facility, the Credit Facility shall control.

VIII. CONFIDENTIALITY

A. Confidentiality. The Parties acknowledge that the information that is the subject matter of this Agreement (including but not limited to all well information acquired by operations conducted under an Operating Agreement) is sensitive and confidential proprietary information belonging to the Parties. Accordingly, each Party, for itself and its Affiliates, agrees not to release or disclose or otherwise make the information available to or to furnish any of said information to any third party without (i) obtaining the agreement of the third party to maintain such information confidential and to not use such information other than in connection with investing in or participating with or purchasing interests from the disclosing party, or (ii) first obtaining the express written consent of the other party. Any such release or disclosure if approved shall be conditioned upon the third party expressly agreeing to all terms herein and becoming a party to and subject to a Confidentiality Agreement. Nothing contained above shall restrict or impair any Party’s right to use or disclose any of the information which is: (1) at the time of disclosure available to the public through no act or omission of that Party; (2) can be shown was lawfully in that Party’s possession prior to the time of this Agreement; or (3) is independently made available to that Party by a third party who is independently entitled to disclose such information and that party shows that the right of such third party to disclosure existed prior to the date of this Agreement. Also, nothing contained above shall restrict Participant from providing production results to its investors or lending institutions for the purposes of financing or requisite reporting.

5

B. Public Disclosure. Subject to the exceptions set forth below, and unless otherwise agreed upon by the Parties, prior to substantial leasing completion in the AMI as contemplated by this Agreement, the Parties intend to keep material information concerning the entering into of this Agreement and the location of the Project Area confidential to the extent any disclosure thereof could impair the leasing activities of the Parties. Notwithstanding such intent, either Party may make any public disclosure to the extent that, upon advice of such Party’s counsel, such disclosure is advisable to comply with United States or state securities laws, rules or regulations. Any proposed press release or other disclosure, shall be provided to the other Party in advance on a confidential basis for its information and comment.

IX. TAX ELECTION

This Agreement is not intended to create, and shall not be construed to create, a relationship of partnership or an association for profit between or among the Parties hereto except as provided herein. Each Party hereby affected elects to be excluded from the application of all the provisions of Subchapter “K”, Chapter 1, Subtitle “A”, of the Internal Revenue Code of 1986 and all amendments thereto.

X. PAYMENT OF DELAY RENTALS AND LEASE EXTENSIONS

The designated Operator of any Well covered by this Agreement shall be responsible for making any payment of delay rentals, shut in royalties and minimum royalty payments on the Leases. Participant shall bear and pay its share of such payments. Participant shall be billed and shall pay for said costs in the manner set forth for the billing and paying of direct costs in the COPAS accounting procedures attached to the form of Operating Agreement. Operator shall not be liable for any loss of a Lease or Leases, unless said loss is due to bad faith, gross negligence or willful misconduct by the Operator.

6

XI. NO JOINT LIABILITY

The rights, duties, obligations and liabilities of the Parties hereto shall be several and not joint or collective. Each Party hereto shall be responsible only for its obligations as herein set out and shall be liable only for its share of the cost and expense as herein provided; it being the express purpose and intention of the Parties that their interest in this Agreement and the rights and property acquired in connection herewith shall be held by them as tenants-in-common. Except for the tax election which the Parties may have made, it is not the purpose or intention of this Agreement to create any mining partnership, commercial partnership or other partnership, and it shall be deemed not to have done so.

XII. ASSIGNMENTS OF LEASES

Any assignment of any interest pursuant to this Agreement by and between the Parties hereto shall be made with a special warranty of title by through and under the assignor, but not otherwise and on the form attached hereto as Exhibit “E” which shall be for recording in the official records of the county in which the Lease lies. Where applicable, separate assignments of operating rights shall likewise be made on such State and Federal forms as required by rule or regulation. Any assignment hereafter executed shall specifically refer to, and be made subject to, the terms and conditions hereof, and shall convey a working interest equal to the Participant Interest.

XIII. FORCE MAJEURE

Should any Party be prevented or hindered from complying with any obligation created under this Agreement, other than the obligation to pay money, by reason of fire, flood, storm, act of God, governmental authority, governmental action or inaction, failure or delay in obtaining any necessary permits, labor disputes, war, the inability to secure qualified labor, geoscience data, title abstracts, curative title work, lease brokers, entry onto the land, drilling equipment and drilling rig(s) at prevailing market rates, drilling tools, materials or transportation, or any other cause not enumerated herein but which is beyond the normal control of the Party whose performance is affected, then the performance of any such obligation shall be suspended during the period of such prevention or hindrance, provided the affected Party promptly notifies the other Party of such force majeure circumstances and exercises all reasonable diligence to remove the cause of force majeure.

XIV. EXHIBITS

The following exhibits are attached to this Agreement and incorporated herein by reference:

Exhibit “A” – List of Existing Leases

Exhibit “B” – Form of Joint Operating Agreement

Exhibit “C” – Kingdom Resources LLC Service Agreement

Exhibit “D” – AMI Plat

Exhibit “E” – Form of Assignment

7

If the terms or provisions of any of these Exhibits conflict with the terms of this Agreement, this Agreement shall control.

XV. MISCELLANEOUS

A. Assignment: Either Party may assign its interest under this Agreement provided that the assigning Party remains liable for or guarantees the performance of its assignee and provided that the assigning Party gives the non-assigning Party appropriate documentation evidencing such assignment.

B. Governing Law: This Agreement and other instruments executed in accordance with it, except for assignments of lands, or the execution hereof shall be governed by and interpreted according to the laws of the State of Colorado. Forum and venue shall be exclusively in Denver, Colorado. As to assignments of lands, they shall be governed by the laws of the State of Colorado, unless otherwise agreed to in writing by the Parties.

C. Entire Agreement: This Agreement, the documents to be executed hereunder and the Exhibits attached hereto constitute the entire agreement between the Parties, supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written, of the parties, and there are no warranties, representations or other agreements between the Parties as to the substance and matters referenced in and made a part of this Agreement, except as specifically set forth herein. No supplement, amendment, alteration, modification, waiver or termination of the Agreement shall be binding unless executed in writing by the parties hereto.

D. Waiver: No waiver of any of the provisions of the Agreement shall be deemed or shall constitute a waiver of any other provisions hereof (whether or not similar), nor shall such waiver constitute a continuing waiver unless otherwise expressly provided.

E. Captions; Definition of “Including”: The captions in this Agreement are for convenience only and shall not be considered a part of or affect the construction or interpretation of any provision of this Agreement. The term “including” or “includes”, as used herein, shall mean “including, without limitation,” and “includes, without limitation”.

F. Binding: This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective permitted successors, assigns and legal representatives.

G. Notices: Any notice hereunder shall be given in writing by mail, courier, personally, E-mail or by facsimile and shall be effective when delivered to the party intended to be notified. The contact information for each Party is as follows:

8

If to PetroShare:

PetroShare Corp.

7200 So. Alton Way, Ste B220

Centennial, CO 80112

Attn: Frederick J. Witsell

(303) 500-1168 Office

(303) 770-6885 fax

(303) 881-2157 cell

fwitsell@petrosharecorp.com

If to Participant:

Providence Energy Operators, LLC

Attn: Jim Sinclair

16400 N Dallas Parkway, Ste 400

Dallas, TX 75248

Phone: 214.522.9131

Email: jsinclair@providence-energy.com

With a copy to:

Providence Energy Operators, LLC

Attn: Mark L. Nastri

16400 N Dallas Parkway, Ste 400

Dallas, Texas 75248

Phone: 214.522.9131

Email: mnastri@providence-energy.com

(Any Party may change their foregoing contact information by notice to the other Party.)

H. Expenses: Except as otherwise provided herein, each Party shall be solely responsible for all expenses incurred by it in connection with this transaction (including fees and expenses of its own counsel and accountants), other than those otherwise agreed to and allocated herein.

I. Execution: This Agreement may be executed in multiple original counterparts, all of which shall together constitute a single agreement and each of which, when executed, shall be binding for all purposes thereof on the executed Party, its successors and assigns.

9

J. Severability: If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any materially adverse manner to either Party.

K. Arbitration: Any dispute arising under this Agreement (“Arbitrable Dispute”) shall be referred to and resolved by binding arbitration in Denver, Colorado, to be administered by and in accordance with the Commercial Arbitration Rules of the American Arbitration Association. Arbitration shall be initiated within the applicable time limits set forth in this Agreement and not thereafter or if no time limit is given, within the time period allowed by the applicable statute of limitations, by one party (“Claimant”) giving written notice to the other party (“Respondent”) and to the Denver Regional Office of the American Arbitration Association (“AAA”), that the Claimant elects to refer the Arbitrable Dispute to arbitration. All arbitrators must be neutral parties who have never been officers, directors or employees of the parties or any of their Affiliates, must have not less than ten (10) years’ experience in the oil and gas industry, and must have a formal financial/accounting, engineering and/or legal education. The hearing shall be commenced within sixty (60) days after the selection of the arbitrator. The Parties and the arbitrators shall proceed diligently and in good faith in order that the arbitral award shall be made as promptly as possible. The interpretation, construction and effect of this Agreement shall be governed by the Laws of Colorado, and to the maximum extent allowed by law, in all arbitration proceedings the Laws of Colorado shall be applied, without regard to any conflicts of laws principles. All statutes of limitation and of repose that would otherwise be applicable shall apply to any arbitration proceeding. The tribunal shall not have the authority to grant or award indirect or consequential damages, punitive damages or exemplary damages.

L. Further Assurances: During the time in which this Agreement is in effect, the Parties shall, at any time and from time to time, and without further consideration, execute and deliver or use reasonable efforts to cause to be executed and delivered such other instruments of conveyance and contract, and to take such other actions as either Party may reasonably may request effect the intent of this Agreement.

M. Not to be Construed Against Drafter: The Parties acknowledge that they have had an adequate opportunity to review each and every provision contained in this Agreement, that they have participated equally in the drafting hereof and that they have had adequate time to submit same to legal counsel for review and comment. Based on said review and consultation, the parties agree with each and every term contained in this Agreement. Based on the foregoing, the parties agree that the rule of construction that a contract be construed against the drafter, if any, shall not be applied in the interpretation and construction of this Agreement.

N. Laws and Regulations: Any reference to any federal, state, local, or foreign statute or law will be deemed also to refer to all rules and regulations promulgated thereunder, unless the context otherwise requires.

10

O. Third-Party Beneficiaries: This Agreement is not intended to confer any rights or remedies upon any Person other than the parties and their respective successors and permitted assigns.

P. Investment Representations: Participant understands that the interests evidenced by this Agreement have not been registered under the Securities Act of 1933, the Colorado Securities Act or any other state securities laws (the “Securities Acts”).

Q. Preferential Rights: Notwithstanding anything contained in this Agreement to the contrary, each Party shall have a first right of refusal to acquire any interest in the Wells, Leases or AMI which a party (“Selling Party”) decides to sell or otherwise transfer to a unrelated third party, other than an affiliate, under the same terms and conditions as are being offered by the third party. The non-selling Party (“Non-Selling Party”) shall notify the Selling Party of its election to participate in any additional interest or project under this provision within thirty (30) days of its receipt of notice of the availability of said interest and the terms related thereto. If the Non-Selling Party does not elect to acquire the rights or interest being offered within said thirty (30) day period, then the Selling Party shall be free to sell or transfer the interest to the unrelated third party at the terms so tendered to the Selling Party. In the event the sale of the interest is not closed under the same terms and conditions as originally proposed within 120 days from the written notice to the Non-Selling Party of the proposed sale, then the Preferential Right as set forth herein shall be reinstated. Notwithstanding anything to the contrary herein, this Preferential Right shall expire in its entirety on the maturity date of the Credit Facility or any extension thereof.

R. Tag-Along Rights: In the event that PetroShare elects to transfer to any third party in a transaction or series of related transactions all or substantially all of PetroShare’s interests in the AMI, then Participant (at its sole discretion) may require that PetroShare cause the third party to include all or a portion of Participant’s corresponding interest in the AMI for the terms, conditions and consideration as PetroShare’s intended sale.

IN WITNESS WHEREOF, this Agreement is executed effective as of the date hereinabove provided.

Parties:

|

PETROSHARE CORP.

By: /s/ Stephen J. Foley

Name: Stephen J. Foley, CEO

|

PROVIDENCE ENERGY OPERATORS, LLC

By: /s/ Jim Sinclair

Name: Jim Sinclair, COO

|

11

EXHIBIT “A”

EXISTING LEASES

Those certain leases Pursuant to the Lease Acceptance Letter dated February 27, 2015, by and between PetroShare Corp. and Kingdom Resources LLC, as amended and Extended to May 13, 2015, comprising the general area described below:

Township 1 South, Range 67 West, Adams Co., CO 6th PM

Section 10: various parcels covering 203 net acres

Section 15: various parcels covering approx. 128 net acres

(detailed lease descriptions to be attached)

|

C S M K F

|

CARVER SCHWARZ McNAB

KAMPER & FORBES, LLC

|

|

LAWYERS

HUDSON'S BAY CENTRE

1600 STOUT STREET, SUITE 1700

DENVER, COLORADO 80202

MAIN LINE: 303.893.1815

FACSIMILE: 303.893.1829

|

PETER C. FORBES PFORBES@CSMKF.COM

303.893.1827

|

May 6, 2015

VIA EMAIL

Frederick J. Witsell President

PetroShare Corp.

7200 South AltonWay Suite B220

Centennial, CO 80111

|

Re:

|

Kingdom Resources/Todd Creek Farms

|

Dear Fred:

TCF has cleared title to an additional approximately 22 acres of mineral interests acres in Filings 1, 2 and 5, as reflected in the attached updated spreadsheet. I have also enclosed copies of the lease amendments adding this additional acreage to the TCF/Kingdom Lease. To the extent you think a modification of the Kingdom/Petroshare lease assignment is necessary to include these amendments, let me know and we can prepare one.

Because TCF's total net mineral acreage has increased to 333.24 net acres, I have enclosed a revised Bonus Payment order and a revised Contractor’s Fee invoice. Finally, I have included the additional invoices from our firm for charges incurred after our original submission that arc payable pursuant to the Contractor’s Agreement.

Therefore, assuming the closing goes forward on May 15, 2015 as scheduled, the total amount payable (including the Borders invoices and the CSMKF invoices included with our original submission) will be $785,630.10, broken down as follows:

|

Payee

|

Item

|

Amount

|

|||

|

TCF

|

Bonus

|

$

|

683,142.00

|

||

|

Kingdom

|

Contractor's Fee

|

$

|

68,314.20

|

||

|

Kingdom

|

Borders Invoices

|

$

|

15,110.90

|

||

|

Kingdom

|

CSMKF Invoices

|

$

|

19,063.00

|

||

Frederick J. Witsell

May 6, 2015

Page 2

CSMKF

Lawyers

Also, there is one additional lot in Filing 5 where TCF obtained a QCMD, but where the homeowner had already executed a lease with Ward. Therefore, TCF’s interest in that lot is limited to the 17.5% landowner royalty provided by the Ward lease. Kingdom has not included any net acreage for that lot in this submission, because that lease does not comply with the parameters set forth in the Contractor’s Agreement. If that royalty is of interest to Ward, however, let us know and we can discuss an appropriate payment arrangement for that lot.

Thanks much, and as always let me know if you have any questions.

Very truly yours,

/s/ Peter C. Forbes

Peter C. Forbes

cc: Gene Osborne

Enclosure

Todd Creek Farms

|

SUMMARY OF NET ACREAGE ALL FILINGS

|

||||||

|

Homeowner

Leases

|

Summary

Judgments

|

Defaults

|

Quit

claims

|

ROW

|

TOTALS

|

|

|

Filling 1

|

1.86

|

3.635

|

35.96

|

30.72

|

12.12

|

84.29

|

|

Filing 2

|

0

|

13.79

|

39.51

|

6.58

|

18.68

|

64.77

|

|

Filing 3

|

0

|

0

|

0.00

|

0.00

|

0.00

|

0.00

|

|

Filing 4

|

0

|

0

|

24.10

|

3.29

|

67.06

|

94.45

|

|

Filings

|

0

|

0

|

32.99

|

14.02

|

28.93

|

75.94

|

|

TOTAL

|

1.860

|

17.425

|

132.560

|

54.605

|

126.790

|

333.240

|

TOTAL NET ACRES: 333.240

Page 1 of 9

Todd Creek Farms

|

FILING 1

|

||||||||||

|

Defaults

|

Quit Claim Mineral Deeds

|

|||||||||

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

|

|

15

|

3

|

1.57

|

1.570

|

5

|

2

|

1.74

|

0.870

|

50% Reduction - Tract 1

|

||

|

4

|

4

|

1.5

|

1.500

|

8

|

2

|

2.18

|

1.090

|

50% Reduction - Tract 1

|

||

|

2

|

1

|

1.59

|

1.590

|

11

|

3

|

1.73

|

1.730

|

|||

|

6

|

4

|

1.5

|

1.500

|

10

|

3

|

1.75

|

1.750

|

|||

|

15

|

2

|

2

|

1.000

|

50% Reduction - Tract 1

|

16

|

3

|

2.43

|

2.430

|

||

|

8

|

4

|

1.5

|

1.500

|

7

|

3

|

1.86

|

0.930

|

50% Reduction - Tract 1

|

||

|

12

|

2

|

2

|

1.000

|

50% Reduction - Tract 1

|

1

|

2

|

1.68

|

1.680

|

||

|

3

|

4

|

1.5

|

1.500

|

5

|

3

|

1.99

|

0.995

|

50% Reduction - Tract 1

|

||

|

2

|

5

|

1.97

|

1.970

|

19

|

3

|

1.94

|

0.970

|

50% Reduction - Tract 1

|

||

|

5

|

4

|

1.5

|

1.500

|

6

|

3

|

1.82

|

0.910

|

50% Reduction- Tract 1

|

||

|

10

|

2

|

2.49

|

1.245

|

50% Reduction - Tract 1

|

3

|

3

|

1.78

|

1.780

|

||

|

14

|

3

|

1.63

|

1.630

|

7

|

2

|

2.87

|

1.435

|

50% Reduction - Tract 1

|

||

|

13

|

3

|

1.94

|

1.940

|

1

|

3

|

1.86

|

1.860

|

|||

|

13

|

2

|

2

|

1.000

|

50% Reduction - Tract 1

|

16

|

2

|

2

|

1.000

|

50% Reduction - Tract 1

|

|

|

22

|

3

|

2.09

|

1.045

|

50% Reduction - Tract 1

|

12

|

3

|

2.18

|

2.180

|

||

|

1

|

5

|

1.62

|

1.620

|

9

|

3

|

1.86

|

1.860

|

|||

|

17

|

3

|

2.32

|

2.320

|

8

|

3

|

1.82

|

1.820

|

|||

|

14

|

2

|

2

|

1.000

|

50% Reduction - Tract 1

|

3

|

5

|

2.26

|

2.260

|

||

|

21

|

3

|

2.09

|

1.045

|

50% Reduction - Tract 1

|

11

|

2

|

2.13

|

1.065

|

50% Reduction - Tract 1

|

|

|

4

|

5

|

2.64

|

2.640

|

4

|

3

|

2.1

|

2.100

|

|||

|

7

|

4

|

1.5

|

1.500

|

TOTALS

|

39.98

|

30.72

|

||||

|

1

|

4

|

1.5

|

1.500

|

|||||||

|

9

|

2

|

2.07

|

1.035

|

50% Reduction - Tract 1

|

||||||

|

1

|

1

|

1.81

|

1.810

|

|||||||

|

TOTALS

|

44.330

|

35.960

|

||||||||

|

|

TOTAL ACREAGE FOR FILING NO. 1 LOTS:

|

84.31

|

|

|

|

|

REDUCTIONS:

|

17.64

|

|

|

|

|

TOTAL NET ACREAGE FOR FILING NO. 1 LOTS

|

66.68

|

|

|

|

|

|

|

|

Page 2 of 9

Todd Creek Farms

|

FILING 2

|

||||||||||||

|

Defaults

|

Quit Claim Mineral Deeds

|

|||||||||||

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Plat

|

Comments

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Plat

|

Comments

|

|

|

1

|

5

|

1.69

|

1.69

|

Original

|

2

|

1

|

1.89

|

1.89

|

Amended

|

|||

|

3

|

5

|

1.96

|

1.96

|

Original

|

7

|

3

|

2.90

|

1.45

|

Original

|

50% Reduction - Tract 1

|

||

|

6

|

5

|

1.51

|

1.51

|

Original

|

1

|

1

|

1.94

|

0.97

|

Original

|

50% Reduction - Tract 1

|

||

|

3

|

3

|

2.05

|

2.05

|

Original

|

3

|

1

|

1.87

|

1.87

|

Original

|

|||

|

8

|

7

|

2.01

|

2.01

|

Original

|

Tract D

|

0.40

|

0.40

|

|||||

|

4

|

3

|

2.15

|

2.15

|

Original

|

TOTALS

|

9.00

|

6.58

|

|||||

|

2

|

4

|

1.69

|

1.69

|

Original

|

||||||||

|

2

|

7

|

1.96

|

1.96

|

Original

|

||||||||

|

1

|

4

|

1.49

|

1.49

|

Original

|

||||||||

|

2

|

5

|

2.29

|

2.29

|

Original

|

||||||||

|

5

|

1

|

2.15

|

2.15

|

Amended

|

||||||||

|

5

|

3

|

2.25

|

2.25

|

Original

|

||||||||

|

5

|

5

|

2.18

|

2.18

|

Original

|

||||||||

|

4

|

5

|

2.14

|

2.14

|

Original

|

||||||||

|

1

|

2

|

1.68

|

1.68

|

Amended

|

||||||||

|

3

|

2

|

1.54

|

0.77

|

Original

|

50% Reduction - Tract 1

|

|||||||

|

7

|

7

|

2.28

|

2.28

|

Original

|

||||||||

|

1

|

3

|

2.29

|

2.29

|

Original

|

||||||||

|

1

|

1

|

2.96

|

2.96

|

Amended

|

||||||||

|

3

|

9

|

2.01

|

2.01

|

Original

|

||||||||

|

TOTALS

|

40.28

|

39.51

|

||||||||||

|

TOTAL ACREAGE FOR FILING NO. 2

|

49.28

|

|

|

REDUCTIONS:

|

3.19

|

|

|

TOTAL NET ACREAGE FOR FILING NO. 2

|

46.09

|

Page 3 of 9

Todd Creek Farms

|

Filing 3

|

||||||||||

|

Default

s

|

Quit Claim Mineral Deeds

|

|||||||||

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

Lot | Block | Total Acres | Net Acres |

Comments

|

|

|

11

|

4

|

1.73

|

0.00

|

HBP Issue (1.73)

|

6 | 3 | 1.81 | 0.00 |

HBP Issue (1.81)

|

|

|

TOTALS

|

1.73

|

0.00

|

TOTALS | 1.81 | 0.00 | |||||

|

TOTAL ACREAGE FOR FILING NO. 3

|

3.54

|

|

|

REDUCTIONS:

|

0.00

|

|

|

TOTAL NET ACREAGE FOR FILING NO.

|

0.00

|

Page 4 of 9

Todd Creek Farms

|

Filing 4

|

||||||||||

|

Defaults

|

Quit Claim Mineral Deeds

|

|||||||||

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

Lot

|

Block |

Total Acres

|

Net Acres

|

Comments

|

|

|

7

|

5

|

2.13

|

2.13

|

Guard Lease (void)

|

26

|

2 |

1.72

|

1.72

|

||

|

5

|

5

|

1.81

|

1.81

|

6

|

3 |

1.57

|

1.57

|

|||

|

14

|

4

|

1.79

|

1.79

|

TOTAL ACREAGE

|

3.29

|

3.29

|

||||

|

9

|

7

|

1.95

|

1.95

|

|||||||

|

37

|

2

|

1.53

|

1.53

|

|||||||

|

33

|

2

|

1.61

|

1.61

|

|||||||

|

12

|

4

|

1.59

|

1.59

|

Extraction Lease (void)

|

||||||

|

23

|

2

|

1.51

|

1.51

|

|||||||

|

16

|

3

|

1.54

|

1.54

|

Guard Lease {void)

|

||||||

|

40

|

4

|

1.88

|

1.88

|

|||||||

|

38

|

4

|

1.78

|

1.78

|

|||||||

|

9

|

4

|

1.88

|

1.88

|

Extraction Lease (void)

|

||||||

|

34

|

2

|

1.60

|

1.60

|

|||||||

|

21

|

2

|

1.50

|

1.50

|

|||||||

|

TOTAL ACREAGE

|

24.10

|

24.10

|

||||||||

|

TOTAL ACREAGE FOR FILING NO. 4

|

27.39

|

|

|

REDUCTIONS:

|

0

|

|

|

TOTAL NET ACREAGE FOR FILING NO. 4 LOTS:

|

27.39

|

Page 5 of 9

Todd Creek Farms

|

Filing 5

|

||||||||||

|

Defaults

|

Quit Claim Mineral Deeds

|

|||||||||

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

Lot

|

Block

|

Total Acres

|

Net Acres

|

Comments

|

|

|

25

|

1

|

1.67

|

1.67

|

38

|

1

|

1.67

|

1.67

|

|||

|

30

|

1

|

1.80

|

1.80

|

3

|

3

|

1.52

|

0.00

|

Lease prior to QCMD

|

||

|

12

|

2

|

2.10

|

2.10

|

12

|

1

|

1.98

|

1.98

|

|||

|

35

|

4

|

2.00

|

2.00

|

24

|

1

|

1.52

|

1.52

|

|||

|

6

|

3

|

1.76

|

1.76

|

25

|

4

|

2.46

|

2.46

|

|||

|

30

|

2

|

1.80

|

1.80

|

26

|

4

|

1.98

|

1.98

|

|||

|

14

|

2

|

1.80

|

1.80

|

38

|

1

|

1.67

|

1.67

|

|||

|

29

|

3

|

1.53

|

1.53

|

40

|

4

|

2.11

|

2.11

|

|||

|

4

|

2

|

1.56

|

1.56

|

Outlots A, B, C, D. E

|

0.63

|

0.63

|

||||

|

13

|

1

|

1.86

|

1.86

|

TOTALS

|

15.54

|

14.02

|

||||

|

12

|

4

|

1.67

|

1.67

|

|||||||

|

31

|

1

|

1.80

|

1.80

|

|||||||

|

10

|

2

|

1.69

|

1.69

|

|||||||

|

36

|

1

|

1.61

|

1.61

|

|||||||

|

18

|

3

|

1.60

|

1.60

|

|||||||

|

29

|

2

|

1.72

|

1.72

|

|||||||

|

8

|

3

|

1.63

|

1.63

|

Guard Lease (void)

|

||||||

|

35

|

3

|

1.50

|

0.00

|

Title transfer issue (1.50)-Montano

|

||||||

|

10

|

3

|

1.71

|

1.71

|

|||||||

|

17

|

1

|

1.68

|

1.68

|

|||||||

|

TOTALS

|

34.49

|

32.99

|

||||||||

|

TOTAL ACREAGE FOR FILING NO. 5

|

50.03

|

|

|

REDUCTIONS:

|

4.58

|

|

|

TOTAL NET ACREAGE FOR FILING NO. 5 LOTS:

|

47.01

|

Page 6 of 9

Todd Creek Farms

|

ROW

|

||||

|

Total Acres

|

Reduction

|

Net Acreage

|

Comments

|

|

|

Filing 1

|

14.49

|

2.37

|

12.12

|

50% Reduction - Tract 1

|

|

Filing 2

|

18.92

|

0.24

|

18.68

|

50% Reduction - Tract 1

|

|

Filing 3

|

20.72

|

20.72

|

0.00

|

HBP Issue

|

|

Filing 4

|

67.06

|

0

|

67.06

|

|

|

Filing 5

|

28.93

|

0

|

28.93

|

|

|

TOTALS

|

150.12

|

23.33

|

126.79

|

|

Page 7 of 9

Todd Creek Farms

|

Amendment No. 1 - Summary Judgments

|

|||||

|

Filing

|

Lot

|

Block

|

Total

Acres

|

Net

Acres

|

Comments

|

|

1

|

2

|

2

|

1.64

|

1.64

|

|

|

1

|

20

|

3

|

2.12

|

1.06

|

50% Reduction Tract 1

|

|

1

|

6

|

2

|

1.87

|

0.935

|

50% Reduction Tract 1

|

|

2

|

1

|

2

|

2.31

|

2.31

|

|

|

2A

|

2

|

2

|

1.89

|

1.89

|

|

|

2A

|

3

|

1

|

2.2

|

1.100

|

50% Reduction Tract 1

|

|

2

|

2

|

3

|

2.11

|

2.11

|

|

|

2

|

2

|

2

|

2.29

|

2.29

|

|

|

2

|

6

|

4

|

1.91

|

1.91

|

|

|

2

|

3

|

7

|

2.18

|

2.18

|

|

|

TOTALS

|

20.520

|

17.425

|

|||

Page 8 of 9

Todd Creek Farms

|

Amendment No. 2 - Homeowner Leases

|

|||||

|

Filing

|

Lot

|

Block |

Total

Acres

|

Net Acres

|

Comments

|

|

1

|

2

|

3 |

1.86

|

1.86

|

85/15 Lease

|

|

TOTALS

|

1.860

|

1.860

|

|||

Page 9 of 9

KINGDOM RESOURCES, LLC

7501 Village Square Drive Suite 205

Castle Pines, CO 80108

ORDER OF PAYMENT

May 5, 2015

On approval of the Oil and Gas Lease associated herewith and on approval of the title to same, Kingdom Resources, LLC will make or cause to be made the payment indicated herein by check no later than May 15, 2015. Payment is deemed complete upon mailing or dispatch. No default shall be declared for failure to make payment until 10 days after receipt of written notice from payee of intention to declare such default.

If the Oil and Gas Lease referenced herein covers less than the entire undivided interest in the oil and gas or other rights in such land, then the dollar amount listed herein shall be paid to the Lessor only in the proportion which the interest in said lands covered by this Agreement bears to the entire undivided interest therein. Further, should Lessor own more or less than the net interest defined herein, Lessee shall increase or reduce the dollar amount payable hereunder proportionately.

PAY TO: Todd Creek Farms, LLC

THE AMOUNT OF: Six Hundred Eighty Three Thousand One Hundred Forty Two and No/100 Dollars ($683,142.00)

ADDRESS: 7501 Village Square Drive, Suite 205, Castle Pines, CO 80108

Consideration for execution of a new Paid Up Oil and Gas Lease dated November 28, 2014 covering portions of Sections 10 and 15, Township 1 South, Range 67 West of the 6th P.M, as amended.

|

KINGDOM RESOURCES, LLC

LESSOR

|

TODD CREEK FARMS, LLC

LESSEE

|

|

|

|

|

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Manager

|

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Authorized Agent

|

|

|

|

INVOICE

|

Date

|

Invoice #

|

|

5/5/2015

|

101

|

Kingdom Resources, LLC

7501 Village Square Dr.#205

Castle Pines, CO 80108

Bill to:

PetroShare Corp.

Frederick J. Witsell

7200 South Albion Way, Suite B220

Centennial, CO 80111

|

Description

|

Amount

|

|

|

|

|

Contract Fee pursuant to Article 1 of Exhibit B of the "Services Agreement"

|

$68,314.20

|

|

TOTAL

|

$68,134.20

|

AMENDMENT NO. 1 TO PAID UP OIL AND GAS LEASE

The terms of that certain Paid-Up Oil and Gas Lease dated as of November 24, 2014 by and between Todd Creek Farms, LLC and Kingdom Resources, LLC, as recorded with the Clerk and Recorder of Adams County, Colorado on or about January 13, 2015 at Reception No.

2015000002735 (the "Lease") are hereby amended as follows:

The description of the property subject to the Lease is amended to include the property in Exhibit A-4 to this Amendment, which is incorporated into the Lease, and the description of the acreage covered by the Lease is amended to read "containing 373.16 acres more or less."

Other than as set forth above, the terms of the Lease are not amended in any way.

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Authorized Agent

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DENVER

|

)

|

|

The foregoing instrument was acknowledged before me on this 14th day of April, 2015, by Gene Osborne, as Authorized Agent for Todd Creek Farms, LLC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

MARY BAYER

NOTARY PUBLIC

STATE OF COLORADO

NOTARY ID 20044029804

MY COMMISSION EXPIRES 02/27/2017

|

/s/ Mary Bayer

Notary Public – State of Colorado

My Commission Expires: 2/27/2017

|

|

|

|

|

|

|

Consented and Agreed To:

KINGDOM RESOURCES, LLC

| By: /s/ Gene Osborne |

Name: Gene Osborne

Title: Manager

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DENVER

|

)

|

|

The foregoing instrument was acknowledged before me on this 14th day of April, 2015, by Gene Osborne, as Manager of Todd Creek Farms, LLC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

MARY BAYER

NOTARY PUBLIC

STATE OF COLORADO

NOTARY ID 20044029804

MY COMMISSION EXPIRES 02/27/2017

|

/s/ Mary Bayer

Notary Public – State of Colorado

My Commission Expires: 2/27/2017

|

|

|

|

|

|

|

EXHIBIT "A-4"

TODD CREEK FARMS SUBDIVISION

Attached to and made part of that certain oil and gas lease dated November 24, 2014 by and between Todd Creek Farms, LLC as Lessor and Kingdom Resources, LLC as Lessee:

|

1.

|

Lot 2, Block 2 of Filing No. 1 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on March 22, 1996, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 9195 E. 159th Avenue, Brighton, CO 80602 and containing 1.64 acres more or less.

|

|

2.

|

Lot 20, Block 3 of Filing No. 1 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on March 22, 1996, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 15775 Dallas Street, Brighton, CO 80602 and containing 2.12 acres more or less.

|

|

3.

|

Lot 6, Block 2 of Filing No. 1 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on March 22, 1996, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 9395 East 159th Avenue, Brighton, CO 80602 and containing

|

1.87 acres more or less.

|

4.

|

Lot 1, Block 2 of Filing No. 2 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on May 22, 1997, and, as amended, March 19, 1998, located in Section 10, Township 1 South, Range 67 West of the 61 P.M. and also known as 15600 Boston Street, Brighton, CO 80602 and containing 2.31 acres more or less.

|

|

5.

|

Lot 2, Block 2 of Filing No. 2 as shown on the amended plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on March 19, 1998, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 15250 Akron Street, Brighton, CO 80602 and containing 1.89 acres more or less.

|

|

6.

|

Lot 3, Block 1 of Filing No. 2 as shown on the amended plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on March 19, 1998, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 9081 East 153rd Avenue, Brighton, CO 80602 and containing 2.2 acres more or less.

|

|

7.

|

Lot 2, Block 3 of Filing No. 2 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on May 22, 1997, and, as amended, March 19, 1998, located in Section 10, Township 1 South,

|

Range 67 West of the 6th P.M. and also known as 9303 East 155th Drive, Brighton, CO 80602 and containing 2.11 acres more or less.

|

8.

|

Lot 2, Block 2 of Filing No. 2 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on May 22, 1997, and, as amended, March 19, 1998, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 9453 East 155th Drive,

|

Brighton, CO 80602 and containing 2.29 acres more or less.

|

9.

|

Lot 6, Block 4 of Filing No. 2 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on May 22, 1997, and, as amended, March 19, 1998, located in Section l 0, Township 1 South, Range 67 West of the 6th P.M. and also known as 9347 East 153rd Avenue, Brighton, CO 80602 and containing 1.91 acres more or less.

|

|

10.

|

Lot 3, Block 7 of Filing No. 2 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County on May 22, 1997, and, as amended, March 19, 1998, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 9204 East 153rd Avenue, Brighton, CO 80602 and containing 2.18 acres more or less.

|

AMENDMENT NO. 2 TO PAID UP OIL AND GAS LEASE

The terms of that certain Paid-Up Oil and Gas Lease dated as of November 24, 2014 by and between Todd Creek Farms, LLC and Kingdom Resources, LLC, as recorded with the Clerk and Recorder of Adams County, Colorado on or about January 13, 2015 at Reception No. 2015000002735 (the "Lease") are hereby amended as follows:

The description of the property subject to the Lease is amended to include the property in Exhibit A-5 to this Amendment, which is incorporated into the Lease, and the description of the acreage covered by the Lease is amended to read "containing 375.02 acres more or less."

Other than as set forth above, the terms of the Lease are not amended in any way.

TODD CREEK FARMS, LLC

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Authorized Agent

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DENVER

|

)

|

|

The foregoing instrument was acknowledged before me on this 13th day of April, 2015, by Gene Osborne, as Authorized Agent for Todd Creek Farms, LLC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

MARY BAYER

NOTARY PUBLIC

STATE OF COLORADO

NOTARY ID 20044029804

MY COMMISSION EXPIRES 02/27/2017

|

/s/ Mary Bayer

Notary Public – State of Colorado

My Commission Expires: 2/27/2017

|

|

|

|

|

|

|

Consented and Agreed To:

KINGDOM RESOURCES, LLC

| By: /s/ Gene Osborne |

Name: Gene Osborne

Title: Manager

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DENVER

|

)

|

|

The foregoing instrument was acknowledged before me on this 14th day of April, 2015, by Gene Osborne, as Manager of Todd Creek Farms, LLC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

MARY BAYER

NOTARY PUBLIC

STATE OF COLORADO

NOTARY ID 20044029804

MY COMMISSION EXPIRES 02/27/2017

|

/s/ Mary Bayer

Notary Public – State of Colorado

My Commission Expires: 2/27/2017

|

|

|

|

|

|

|

EXHIBIT "A-5"

TODD CREEK FARMS SUBDIVISION

Attached to and made part of that certain oil and gas lease dated November 24, 2014 by and between Todd Creek Farms, LLC as Lessor and Kingdom Resources, LLC as Lessee:

|

1.

|

Lot 1, Block 3 of Filing No. 1 as shown on the plat of the Todd Creek Farms subdivision, as recorded with the Clerk and Record of Adams County, Colorado on March 22, 1996, located in Section 10, Township 1 South, Range 67 West of the 6th P.M. and also known as 15985 Alton Street, Brighton, CO 80602 and containing 1.86 acres more or less.

|

AMENDMENT NO. 3 TO PAID UP OIL AND GAS LEASE

The terms of that certain Paid-Up Oil and Gas Lease dated as of November 24, 2014 by and between Todd Creek Farms, LLC and Kingdom Resources, LLC, as recorded with the Clerk and Recorder of Adams County, Colorado on or about January 13, 2015 at Reception No.

2015000002735 (the "Lease") are hereby amended as follows:

Exhibit A-2 to the Lease is amended to include the following property:

Tract D, Todd Creek Farms Filing No. 2, according to the plat thereof recorded May 22, 1997 in File 17, Map 688, as amended according to the plat thereof recorded March 19, 1998 in File 17, Map 815 at County of Adams, State of Colorado, consisting of 0.40 acres, more or less

Outlots A, B, C, D and E, Todd Creek Farms Filing No. 5, according to the plat thereof recorded May 1, 2000 in File 18, Map 211, at County of Adams, State of Colorado, consisting of 0.63 acres, more or less

And the description of the acreage covered by the Lease is amended to read ''containing 376.05 acres more or less."·

Other than as set forth above, the terms of the Lease are not amended in any way.

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Authorized Agent

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DOUGLAS

|

)

|

|

The foregoing instrument was acknowledged before me on this 5th day of May, 2015, by Gene Osborne, as Authorized Agent for Todd Creek Farms, LLC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

KIM T HARRISON

NOTARY PUBLIC

STATE OF COLORADO

MY COMM EXP 05/23/2016

|

/s/ Kim T. Harrision

Notary Public – State of Colorado

My Commission Expires: 5/23/16

|

|

|

|

|

|

|

Consented and Agreed To:

KINGDOM RESOURCES, LLC

By: /s/ Gene Osborne

Name: Gene Osborne

Title: Manager

|

STATE OF COLORADO

|

)

|

|

|

|

) ss.

|

|

|

COUNTY OF DOUGLAS

|

)

|

|

The foregoing instrument was acknowledged before me on this 5th day of May, 2015, by Gene Osborne, as Manager of Kingdom Resources, LC, a Colorado limited liability company, on behalf of said entity.

|

[SEAL]

KIM T HARRISON

NOTARY PUBLIC

STATE OF COLORADO

MY COMM EXP 05/23/2016

|

/s/ Kim T. Harrision

Notary Public – State of Colorado

My Commission Expires: 5/23/16

|

|

|

|

|

|

|

CARVER SCHWARZ McNAB KAMPER & FORBES, LLC

ATTORNEYS AT LAW

EIN No. 20-0509232

HUDSON'S BAY CENTRE

1600 STOUT STREET. SUITE 1700

DENVER. COLORADO 80202-3164

TELEPHONE 303.893.1815

FAX 303.893.1829

March 06, 2015

Kingdom Resources, LLC

Attn: Gene A. Osborne

7501 Village Square Dr. #205

Castle Rock, CO 80108

Invoice Number 19419

In Reference To: Kingdom Resources, LLC - Lease Matters - 33030.002

Professional Services

| Hours | Amount | |||||||||

|

2/6/2015

|

PCF

|

Drafting correspondence to Petroshare concerning lease assignment.

|

0.60

|

255.00

|

||||||

|

2/10/2015

|

PCF

|

Work on matters concerning finalization of lease assignment;

|

2.60

|

1,105.00

|

||||||

|

2/11/2015

|

PCF

|

Work on resolution of various issues concerning lease submission;

|

1.00

|

425.00

|

||||||

|

2/12/2015

|

MB

|

Review exhibits with deed information per P. Forbes.

|

1.70

|

178.50

|

||||||

|

|

PCF

|

Reconciliation of matters for submission to Petroshare; revise and finalize documents for Petroshare.

|

1.10

|

467.50

|

||||||

|

2/13/2015

|

MB

|

Review lot information on map and lease exhibits per P. Forbes.

|

2.40

|

252.00

|

||||||

|

|

PCF |

Follow up on information request from Mr. Witsell.

|

1.30

|

552.50

|

||||||

|

2/24/2015

|

PCF

|

Follow up on questions from Mr. Witsell.

|

0.20

|

85.00

|

||||||

|

2/26/2015

|

PCF

|

Prepare for and attend meeting with Mr. Osborne, Mr. Witsell, Mr. Foley at Petroshare.

|

3.80

|

1,615.00

|

||||||

|

2/27/2015

|

PCF

|

Draft acceptance letter for Petroshare and correspondence concerning same; telecon Mr. Osborne.

|

1.20

|

510.00

|

||||||

|

For professional services rendered

|

15.90

|

$

|

5,445.50

|

|||||||

|

Previous balance

|

$

|

11,790.00

|

||||||||

CARVER SCHWARZ McNAB KAMPER & FORBES, LLC

Page 2

Kingdom Resources, LLC

| Amount | |||

|

|

|||

|

Balance due

|

$17,235.50

|

||

CARVER SCHWARZ McNAB KAMPER & FORBES, LLC

ATTORNEYS AT LAW

EIN No. 20-0509232

HUDSON'S BAY CENTRE

1600 STOUT STREET. SUITE 1700

DENVER. COLORADO 80202-3164

TELEPHONE 303.893.1815

FAX 303.893.1829

April 08, 2015

Kingdom Resources, LLC

Attn: Gene A. Osborne

7501 Village Square Dr. #205

Castle Rock, CO 80108

Invoice Number 19478

In Reference To: Kingdom Resources, LLC - Lease Matters - 33030.002

Professional Services

| Hours | Amount | ||

|

3/2/2015 PCF

|

Research issues concerning ownership of mineral rights under E-470

|

1.10

|

467.50

|

|

and condemnation issues; begin work on Filing No. 2 MSJ Response.

|

|||

|

3/6/2015 PCF

|

Follow up on various matters raised by Mr. Wltsel and various emails.

|

0.80

|

340.00

|

|

3/16/2015 PCF

|

Review documents, office conferences Ms. Bayer; draft letter concerning

|

0.30

|

127.50

|

|

supplemental acreage and various emails regarding same.

|

|||

|

For professional services rendered

|

2.20

|

$935.00

|

|

|

Previous balance

|

$17,235.50

|

||

|

Balance due

|

$18,170.50

|

||

CARVER SCHWARZ McNAB KAMPER & FORBES, LLC

ATTORNEYS AT LAW

EIN No. 20-0509232

HUDSON'S BAY CENTRE

1600 STOUT STREET. SUITE 1700

DENVER. COLORADO 80202-3164

TELEPHONE 303.893.1815

FAX 303.893.1829

May 6, 2015

Kingdom Resources, LLC

Attn: Gene A. Osborne

7501 Village Square Dr. #205

Castle Rock, CO 80108

Invoice Number 19523

In Reference To: Kingdom Resources, LLC - Lease Matters - 33030.002

Professional Services

|

4/14/2015 PCF

|

Work on matters relating to additional lots to add to lease; office conferences Ms. Bayer; letter to Mr. Witsell regarding extending closing

|

1.10

|

467.50

|

|

date; letter to Mr. Witsell regarding additional lots added to lease.

|

|||

|

5/5/2015 PCF

|

Prepare additional lease amendment; review matters concerning title transfer issues; revise and finalize net acreage spreadsheet; various

|

1.00

|

425.00

|

|

emails Mr. Osborne; draft letter to Mr. Witsell.

|

|||

|

For professional services rendered

|

2.10

|

$892.50

|

|

|

Previous balance

|

$18,170.50

|

||

|

Balance due

|

$19,063.00

|

||

EXHIBIT B

(There is no Exhibit B)

FORM OF DEED TO NOTE

DEED OF TRUST, MORTGAGE, ASSIGNMENT OF PRODUCTION,

SECURITY AGREEMENT AND FINANCING STATEMENT

from

_________________________

(Federal Income Tax Identification No. ________________)

(“Grantor,” “Mortgagor” and “Debtor”)

to

the PUBLIC TRUSTEE OF ______________ COUNTY, COLORADO, TRUSTEE

for the benefit of

_________________________________

(Federal Income Tax Identification No. _____________)

(“Grantee,” “Mortgagee” and “Secured Party,” as nominee)

A REPRODUCTION OF THIS INSTRUMENT IS SUFFICIENT AS A FINANCING STATEMENT. FOR PURPOSES OF FILING THIS INSTRUMENT AS A FINANCING STATEMENT, THE ADDRESS OF THE GRANTOR AND DEBTOR IS:

AND THE ADDRESS OF THE GRANTEE AND SECURED PARTY IS:

THIS INSTRUMENT CONTAINS AFTER-ACQUIRED PROPERTY PROVISIONS.

THIS INSTRUMENT SECURES PAYMENT OF FUTURE ADVANCES.

THIS INSTRUMENT COVERS PROCEEDS OF COLLATERAL.

THIS INSTRUMENT COVERS PRODUCTS OF COLLATERAL.

THIS INSTRUMENT COVERS MINERALS AND OTHER SUBSTANCES OF VALUE WHICH MAY BE EXTRACTED FROM THE EARTH (INCLUDING, WITHOUT LIMITATION, OIL AND GAS). THIS FINANCING STATEMENT IS TO BE FILED FOR RECORD, AMONG OTHER PLACES, IN THE REAL ESTATE RECORDS OF THE COUNTY RECORDER OF WELD COUNTY, COLORADO. THE GRANTOR HAS AN INTEREST OF RECORD IN THE REAL ESTATE CONCERNED, WHICH INTEREST IS DESCRIBED IN EXHIBIT A ATTACHED HERETO.

THIS INSTRUMENT WAS PREPARED BY AND WHEN RECORDED OR FILED SHOULD BE RETURNED TO:

DEED OF TRUST, MORTGAGE, ASSIGNMENT OF PRODUCTION,

SECURITY AGREEMENT AND FINANCING STATEMENT

________________, a _____________ corporation (hereinafter referred to as “Grantor”), for and in consideration of the sum of TEN DOLLARS ($10.00) to Grantor in hand paid by ______________________, a __________ limited liability company, as “Grantee,” “Holder” or “Secured Party” of the obligations as hereinafter recited, and in order to secure the payment and performance of the obligations, covenants, warranties, agreements and undertakings of Grantor hereinafter described, does hereby GRANT, BARGAIN, SELL, CONVEY, MORTGAGE, PLEDGE, TRANSFER, ASSIGN and SET OVER to the Public Trustee of _________ County, Colorado (hereinafter called the “Trustee”) for the benefit of Grantee, and IN TRUST WITH POWER OF SALE, the following property to the fullest extent such described interests are assignable:

(a) All of Grantor’s rights, titles, and interests in, under and attributable to the oil and gas leases described in Exhibit A (the “Leases”) including, without limitation, any and all royalty interests and all other interests of whatsoever nature or kind and however characterized in, under or attributable to the Leases;

(b) All Grantor’s rights, titles and interests in the mineral estate, whether now owned or hereafter acquired, in the Lands described on attached Exhibit A hereto (the “Lands”), including, without limitation, any and all reversionary interests or other interests of whatsoever nature or kind and however characterized in the Lands described on attached Exhibit A, all of which such rights, titles, interests and estates of Grantor and howsoever characterized, together with the rights, title and interests in the Leases described in subparagraph (a) being hereinafter collectively called the “Mineral Interests”;

(c) All rights, titles, interests and estates now owned or hereafter acquired by Grantor in and to (i) the properties now or hereafter pooled or unitized with any part of the Mineral Interests insofar as they are attributable to or derive from the Mineral Interests; and (ii) all presently existing or future unitization, communitization, pooling agreements and declarations of pooled units and the units created thereby (including, without limitation, all units created under orders, regulations, rules or other official acts of any Federal, State or other governmental body or agency having jurisdiction), insofar as they are attributable to or derive from the Mineral Interests;

(d) Without limitation, all rights, titles and interests now owned or hereinafter acquired by Grantor in oil and gas wells located on the Lands (the “Wells”);

(e) All rights, titles, and interests now owned or hereafter acquired by Grantor in and to all oil, gas, casinghead gas, condensate, distillate, liquid hydrocarbons, gaseous hydrocarbons and all products refined therefrom and all other minerals (collectively called the “Hydrocarbons”) in, under and which may be produced and saved from the Lands or attributable to the Mineral Interests, including all oil in tanks and all rents, issues, profits, proceeds, products, revenues and other income and proceeds from the sale or use of Hydrocarbons;