Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PINNACLE FINANCIAL PARTNERS INC | d916993d8k.htm |

| EX-2.1 - EX-2.1 - PINNACLE FINANCIAL PARTNERS INC | d916993dex21.htm |

| EX-99.1 - EX-99.1 - PINNACLE FINANCIAL PARTNERS INC | d916993dex991.htm |

| EX-99.2 - EX-99.2 - PINNACLE FINANCIAL PARTNERS INC | d916993dex992.htm |

| Exhibit 99.3

|

Expansion into Memphis, TN

Acquisition of Magna Bank & Memphis Lift Out

M. Terry Turner, President and CEO

Harold R. Carpenter, EVP and CFO

April 29, 2015

|

|

Safe Harbor Statement

All statements, other than statements of historical fact included in this presentation, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” and similar expressions are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking including statements about the benefits to Pinnacle Financial Partners, Inc. (“Pinnacle”) of the proposed mergers of Pinnacle Bank with Magna Bank (“Magna”) and CapitalMark Bank & Trust (“CapitalMark”), Pinnacle’s future financial and operating results (including the anticipated impact of the mergers of Pinnacle Bank and Magna (the “Magna Merger”) and Pinnacle Bank and CapitalMark (the “CapitalMark Merger” and together with the Magna Merger, the “Mergers”) on Pinnacle’s earnings, capital ratios and tangible book value) and Pinnacle’s plans, objectives and intentions. All forward-looking statements are subject to risks, uncertainties and other facts that may cause the actual results, performance or achievements of Pinnacle to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies from the Mergers may not be realized or take longer than anticipated to be realized, (2) disruption from the Mergers with customers, suppliers or employee relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of either of the merger agreements related to the Mergers, (4) the risk of successful integration of Pinnacle’s business with the business of Magna and CapitalMark, (5) the failure of Magna’s or CapitalMark’s shareholders to approve the Mergers, (6) the amount of the costs, fees, expenses and charges related to the Mergers, (7) the ability to obtain required governmental approvals of the proposed terms of the Mergers, (8) reputational risk and the reaction of the parties’ customers to the proposed Mergers, (9) the failure of the closing conditions for either of the Mergers to be satisfied, (10) the risk that the integration of Magna’s or CapitalMark’s operations with Pinnacle’s will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Mergers may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by Pinnacle’s issuance of additional shares of its common stock in the Mergers and (13) general competitive, economic, politics of and market conditions. Additional factors which could affect the forward looking statements can be found in Pinnacle’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with or furnished to the Securities and Exchange Commission (the “SEC”) and available on the SEC’s website at http://www.sec.gov. Pinnacle, Magna and CapitalMark disclaim any obligation to update or revise any forward-looking statements contained in this presentation which speak only as of the date hereof, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

In connection with the proposed mergers of Pinnacle Bank and Magna and Pinnacle Bank and CapitalMark, Pinnacle intends to file registration statements on Form S-4 with the SEC to register the shares of Pinnacle common stock that will be issued to Magna’s and CapitalMark’s shareholders in connection with the Mergers. The registration statements will include a proxy statement/prospectus (that will be delivered to Magna’s and CapitalMark’s shareholders, as applicable, in connection with their required approval of the proposed Mergers) and other relevant materials in connection with the proposed merger transaction involving Pinnacle Bank and each of Magna and CapitalMark.

INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE APPLICABLE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGERS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PINNACLE, MAGNA, CAPITALMARK AND THE PROPOSED MERGERS.

Investors and security holders may obtain free copies of these documents once they are available through the website maintained by the SEC at http://www.sec.gov. Free copies of the proxy statement/prospectus also may be obtained by directing a request by telephone or mail to Pinnacle Financial Partners Inc., 150 3rd Avenue South, Suite 980, Nashville, TN 37201, Attention: Investor Relations (615) 744-3742 or Magna, 6525 Quail Hollow Drive, Suite 513, Memphis, TN 38120, Attention: Shareholder Services (901) 259-5600 or CapitalMark, 801 Broad Street, Chattanooga, TN 37402, Attention: Investor Relations (423) 386-2828.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

2

|

|

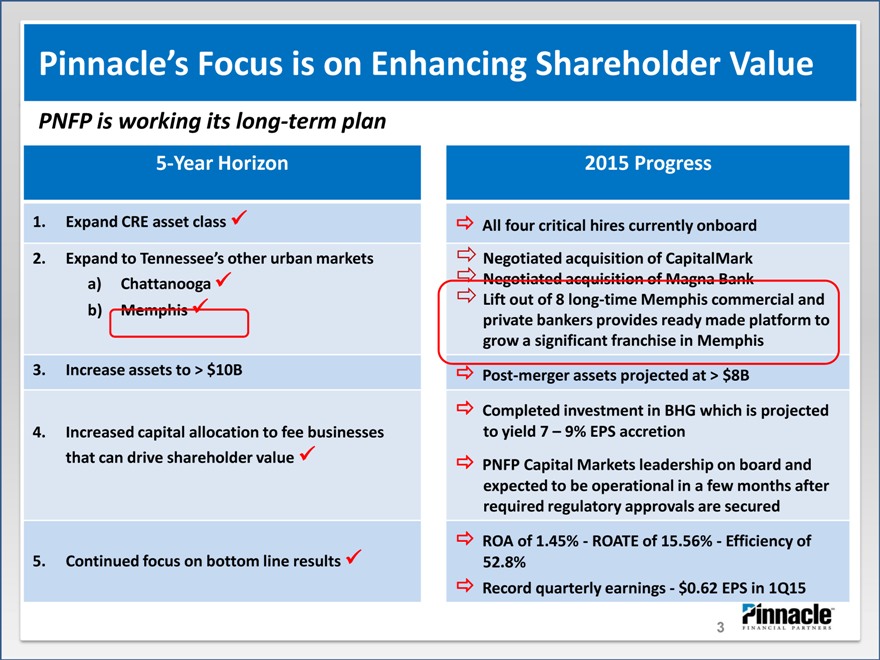

Pinnacle’s Focus is on Enhancing Shareholder Value

PNFP is working its long-term plan

5-Year Horizon 2015 Progress

1. Expand CRE asset class All four critical hires currently onboard

2. Expand to Tennessee’s other urban markets Negotiated acquisition of CapitalMark

a) Chattanooga Negotiated acquisition of Magna Bank

b) Memphis Lift out of 8 long-time Memphis commercial and

private bankers provides ready made platform to

grow a significant franchise in Memphis

3. Increase assets to > $10B Post-merger assets projected at > $8B

Completed investment in BHG which is projected

4. Increased capital allocation to fee businesses to yield 7 – 9% EPS accretion

that can drive shareholder value PNFP Capital Markets leadership on board and

expected to be operational in a few months after

required regulatory approvals are secured

ROA of 1.45%—ROATE of 15.56%—Efficiency of

5. Continued focus on bottom line results 52.8%

Record quarterly earnings—$0.62 EPS in 1Q15

3

|

|

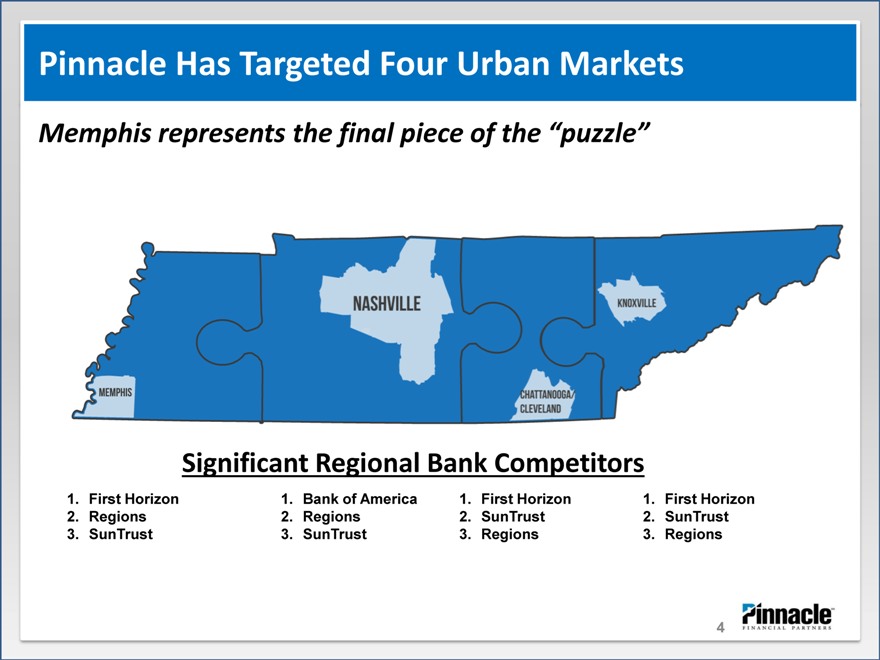

Pinnacle Has Targeted Four Urban Markets

Memphis represents the final piece of the “puzzle”

Significant Regional Bank Competitors

1. First Horizon 1. Bank of America 1. First Horizon 1. First Horizon

2. Regions 2. Regions 2. SunTrust 2. SunTrust

3. SunTrust 3. SunTrust 3. Regions 3. Regions

| 4 |

|

|

|

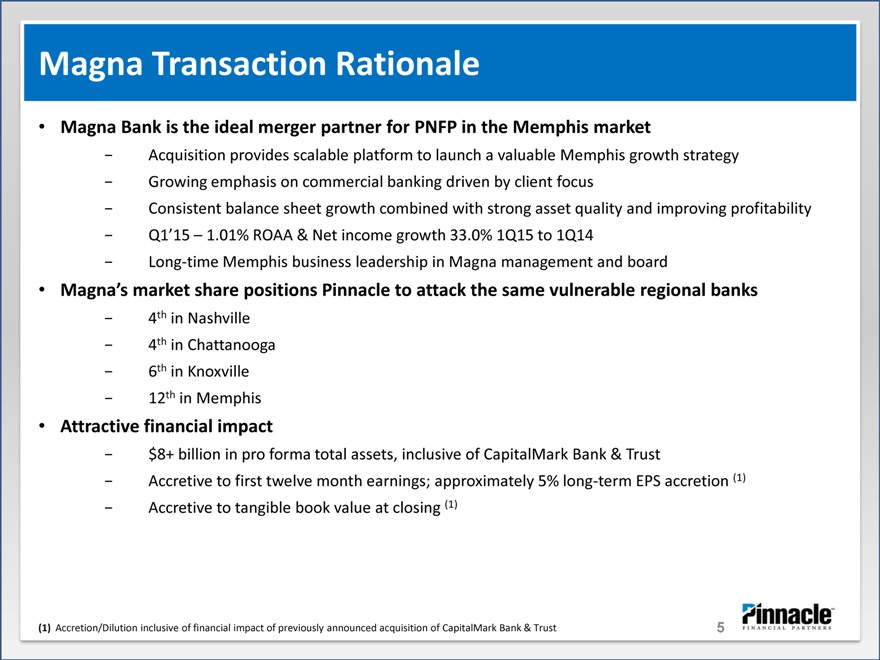

Magna Transaction Rationale

Magna Bank is the ideal merger partner for PNFP in the Memphis market

Acquisition provides scalable platform to launch a valuable Memphis growth strategy

Growing emphasis on commercial banking driven by client focus

Consistent balance sheet growth combined with strong asset quality and improving profitability

Q1’15 – 1.01% ROAA & Net income growth 33.0% 1Q15 to 1Q14

Long-time Memphis business leadership in Magna management and board

Magna’s market share positions Pinnacle to attack the same vulnerable regional banks

4th in Nashville

4th in Chattanooga

6th in Knoxville

12th in Memphis

Attractive financial impact

$8+ billion in pro forma total assets, inclusive of CapitalMark Bank & Trust

Accretive to first twelve month earnings; approximately 5% long-term EPS accretion (1)

Accretive to tangible book value at closing (1)

(1) Accretion/Dilution inclusive of financial impact of previously announced acquisition of CapitalMark Bank & Trust

| 5 |

|

|

|

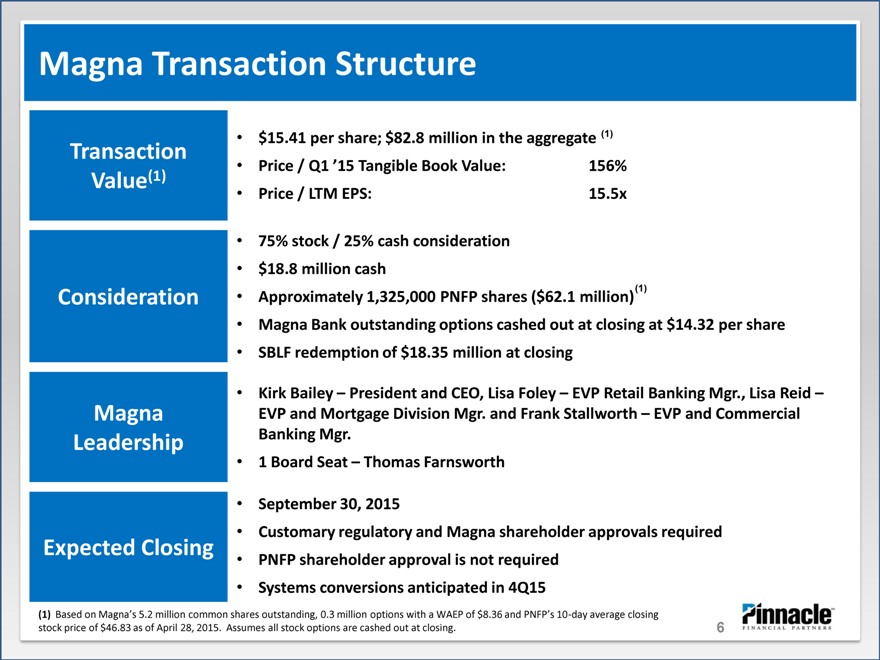

Magna Transaction Structure

• $15.41 per share; $82.8 million in the aggregate (1)

Transaction

• Price / Q1 ’15 Tangible Book Value: 156%

Value(1) • Price / LTM EPS: 15.5x

• 75% stock / 25% cash consideration

• $18.8 million cash

Consideration • Approximately 1,325,000 PNFP shares ($62.1 million) (1)

• Magna Bank outstanding options cashed out at closing at $14.32 per share

• SBLF redemption of $18.35 million at closing

• Kirk Bailey – President and CEO, Lisa Foley – EVP Retail Banking Mgr., Lisa Reid –

Magna EVP and Mortgage Division Mgr. and Frank Stallworth – EVP and Commercial

Leadership Banking Mgr.

• 1 Board Seat – Thomas Farnsworth

• September 30, 2015

• Customary regulatory and Magna shareholder approvals required

Expected Closing • PNFP shareholder approval is not required

• Systems conversions anticipated in 4Q15

(1) Based on Magna’s 5.2 million common shares outstanding, 0.3 million options with a WAEP of $8.36 and PNFP’s 10-day average closing stock price of $46.83 as of April 28, 2015. Assumes all stock options are cashed out at closing.

6

|

|

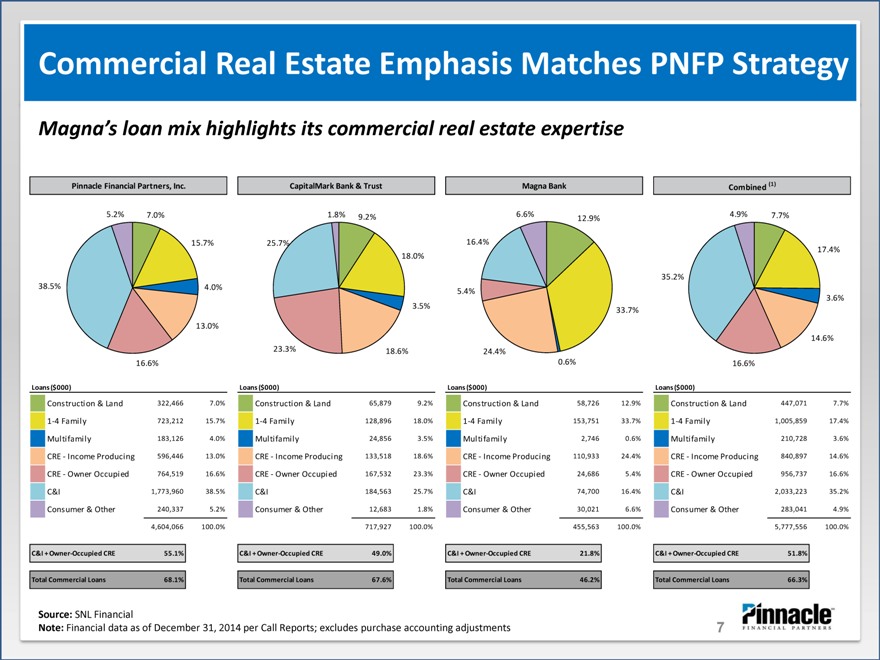

Commercial Real Estate Emphasis Matches PNFP Strategy

Magna’s loan mix highlights its commercial real estate expertise

Pinnacle Financial Partners, Inc. CapitalMark Bank & Trust Magna Bank Combined (1)

5.2% 7.0% 1.8% 9.2% 6.6% 12.9% 4.9% 7.7%

15.7% 25.7% 16.4%

17.4%

18.0%

35.2%

38.5% 4.0% 5.4%

3.6%

3.5% 33.7%

13.0%

14.6%

23.3% 18.6% 24.4%

16.6% 0.6% 16.6%

Loans ($000) Loans ($000) Loans ($000) Loans ($000)

Construction & Land 322,466 7.0% Construction & Land 65,879 9.2% Construction & Land 58,726 12.9% Construction & Land 447,071 7.7%

1-4 Family 723,212 15.7% 1-4 Family 128,896 18.0% 1-4 Family 153,751 33.7% 1-4 Family 1,005,859 17.4%

Multifamily 183,126 4.0% Multifamily 24,856 3.5% Multifamily 2,746 0.6% Multifamily 210,728 3.6%

CRE—Income Producing 596,446 13.0% CRE—Income Producing 133,518 18.6% CRE—Income Producing 110,933 24.4% CRE—Income Producing 840,897 14.6%

CRE—Owner Occupied 764,519 16.6% CRE—Owner Occupied 167,532 23.3% CRE—Owner Occupied 24,686 5.4% CRE—Owner Occupied 956,737 16.6%

C&I 1,773,960 38.5% C&I 184,563 25.7% C&I 74,700 16.4% C&I 2,033,223 35.2%

Consumer & Other 240,337 5.2% Consumer & Other 12,683 1.8% Consumer & Other 30,021 6.6% Consumer & Other 283,041 4.9%

4,604,066 100.0% 717,927 100.0% 455,563 100.0% 5,777,556 100.0%

C&I + Owner-Occupied CRE 55.1% C&I + Owner-Occupied CRE 49.0% C&I + Owner-Occupied CRE 21.8% C&I + Owner-Occupied CRE 51.8%

Total Commercial Loans 68.1% Total Commercial Loans 67.6% Total Commercial Loans 46.2% Total Commercial Loans 66.3%

Source: SNL Financial

Note: Financial data as of December 31, 2014 per Call Reports; excludes purchase accounting adjustments

7

|

|

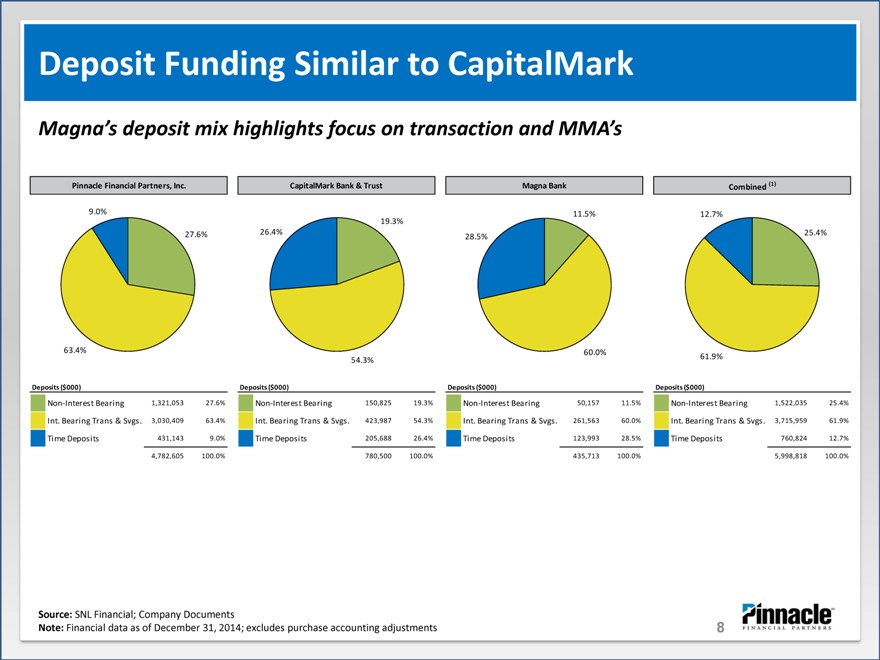

Deposit Funding Similar to CapitalMark

Magna’s deposit mix highlights focus on transaction and MMA’s

Pinnacle Financial Partners, Inc. CapitalMark Bank & Trust Magna Bank Combined (1)

9.0% 11.5% 12.7%

19.3%

27.6% 26.4% 28.5% 25.4%

63.4% 60.0%

54.3% 61.9%

Deposits ($000) Deposits ($000) Deposits ($000) Deposits ($000)

Non-Interest Bearing 1,321,053 27.6% Non-Interest Bearing 150,825 19.3% Non-Interest Bearing 50,157 11.5% Non-Interest Bearing 1,522,035 25.4%

Int. Bearing Trans & Svgs. 3,030,409 63.4% Int. Bearing Trans & Svgs. 423,987 54.3% Int. Bearing Trans & Svgs. 261,563 60.0% Int. Bearing Trans & Svgs. 3,715,959 61.9%

Time Deposits 431,143 9.0% Time Deposits 205,688 26.4% Time Deposits 123,993 28.5% Time Deposits 760,824 12.7%

4,782,605 100.0% 780,500 100.0% 435,713 100.0% 5,998,818 100.0%

Source: SNL Financial; Company Documents

Note: Financial data as of December 31, 2014; excludes purchase accounting adjustments

8

|

|

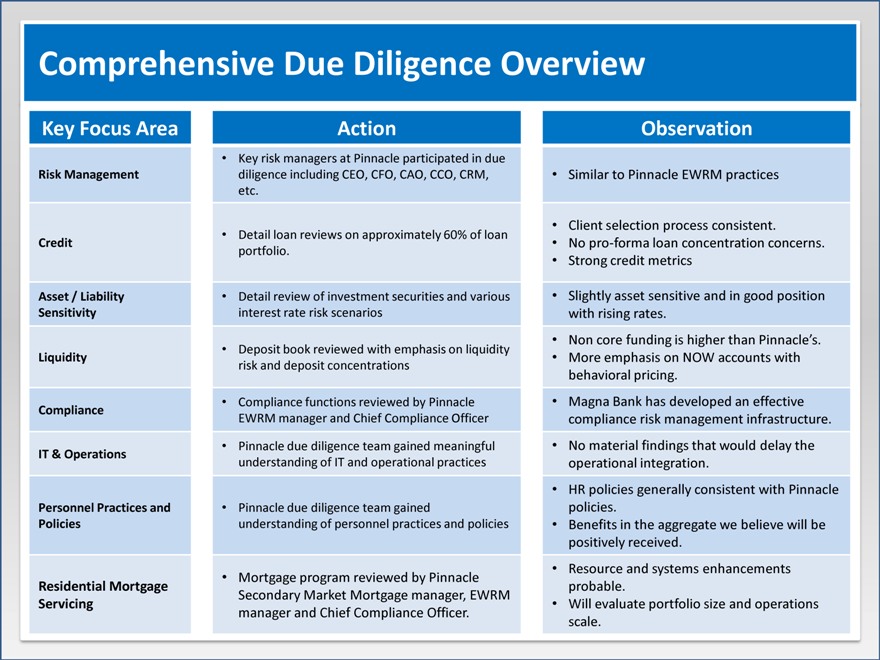

Comprehensive Due Diligence Overview

Key Focus Area Action Observation

• Key risk managers at Pinnacle participated in due

Risk Management diligence including CEO, CFO, CAO, CCO, CRM, • Similar to Pinnacle EWRM practices

etc.

• Client selection process consistent.

• Detail loan reviews on approximately 60% of loan

Credit • No pro-forma loan concentration concerns.

portfolio.

• Strong credit metrics

Asset / Liability • Detail review of investment securities and various • Slightly asset sensitive and in good position

Sensitivity interest rate risk scenarios with rising rates.

• Non core funding is higher than Pinnacle’s.

• Deposit book reviewed with emphasis on liquidity

Liquidity • More emphasis on NOW accounts with

risk and deposit concentrations

behavioral pricing.

• Compliance functions reviewed by Pinnacle • Magna Bank has developed an effective

Compliance

EWRM manager and Chief Compliance Officer compliance risk management infrastructure.

• Pinnacle due diligence team gained meaningful • No material findings that would delay the

IT & Operations

understanding of IT and operational practices operational integration.

• HR policies generally consistent with Pinnacle

Personnel Practices and • Pinnacle due diligence team gained policies.

Policies understanding of personnel practices and policies • Benefits in the aggregate we believe will be

positively received.

• Mortgage program reviewed by Pinnacle • Resource and systems enhancements

Residential Mortgage probable.

Secondary Market Mortgage manager, EWRM

Servicing • Will evaluate portfolio size and operations

manager and Chief Compliance Officer.

scale.

|

|

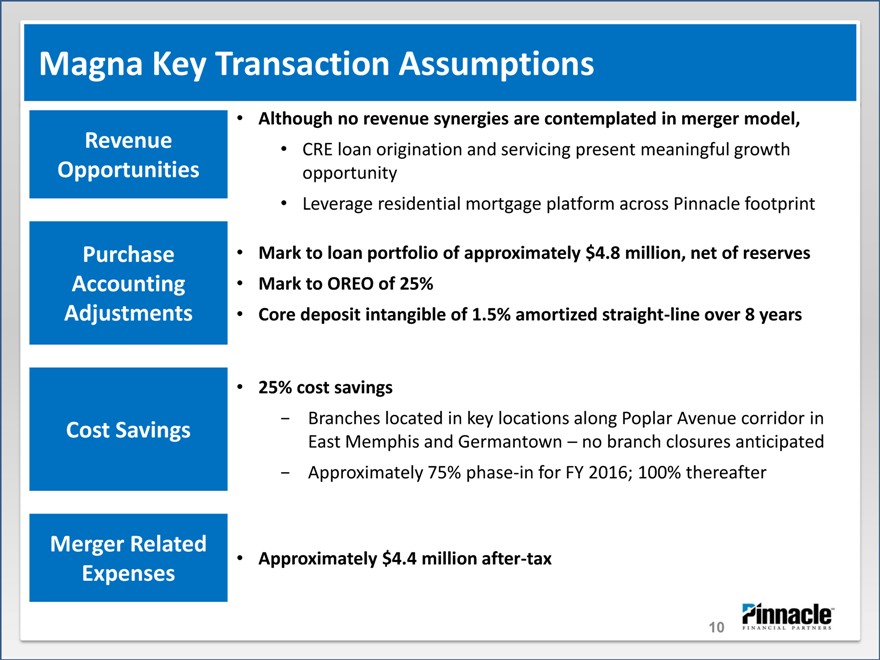

Magna Key Transaction Assumptions

• Although no revenue synergies are contemplated in merger model,

Revenue • CRE loan origination and servicing present meaningful growth

Opportunities opportunity

• Leverage residential mortgage platform across Pinnacle footprint

Purchase • Mark to loan portfolio of approximately $4.8 million, net of reserves

Accounting • Mark to OREO of 25%

Adjustments • Core deposit intangible of 1.5% amortized straight-line over 8 years

• 25% cost savings

Cost Savings — Branches located in key locations along Poplar Avenue corridor in

East Memphis and Germantown – no branch closures anticipated

— Approximately 75% phase-in for FY 2016; 100% thereafter

Merger Related

• Approximately $4.4 million after-tax

Expenses

10

|

|

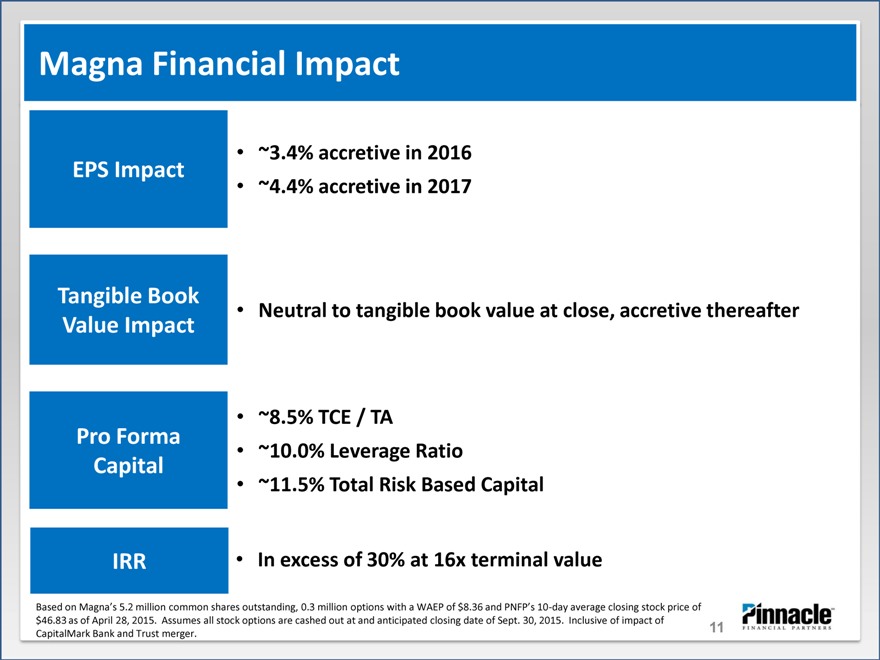

Magna Financial Impact

• ~3.4% accretive in 2016

EPS Impact

• ~4.4% accretive in 2017

Tangible Book • Neutral to tangible book value at close, accretive thereafter

Value Impact

• ~8.5% TCE / TA

Pro Forma • ~10.0% Leverage Ratio

Capital

• ~11.5% Total Risk Based Capital

IRR • In excess of 30% at 16x terminal value

Based on Magna’s 5.2 million common shares outstanding, 0.3 million options with a WAEP of $8.36 and PNFP’s 10-day average closing stock price of $46.83 as of April 28, 2015. Assumes all stock options are cashed out at and anticipated closing date of Sept. 30, 2015. Inclusive of impact of CapitalMark Bank and Trust merger.

11

|

|

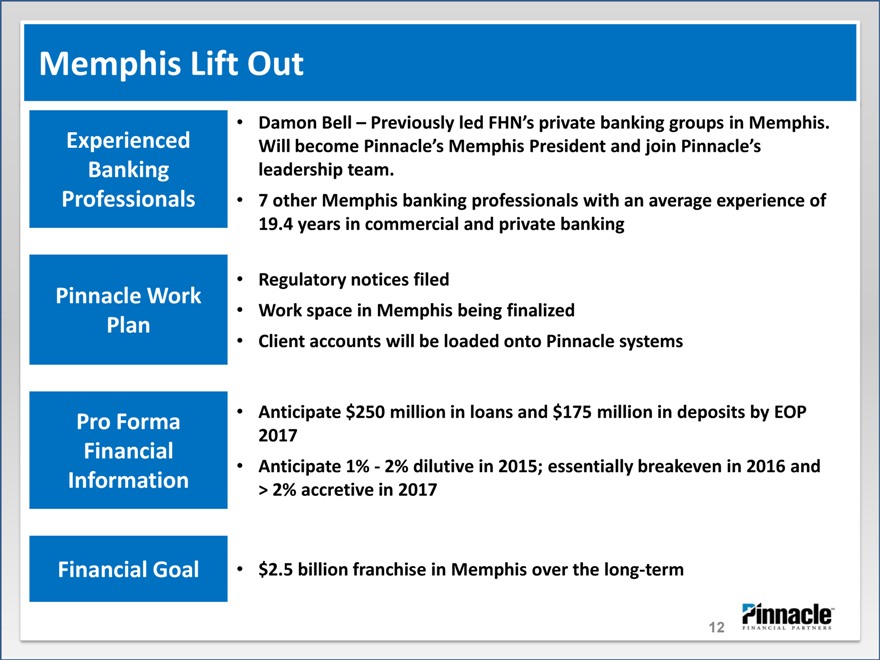

Memphis Lift Out

• Damon Bell – Previously led FHN’s private banking groups in Memphis.

Experienced Will become Pinnacle’s Memphis President and join Pinnacle’s

Banking leadership team.

Professionals • 7 other Memphis banking professionals with an average experience of

19.4 years in commercial and private banking

• Regulatory notices filed

Pinnacle Work

• Work space in Memphis being finalized

Plan

• Client accounts will be loaded onto Pinnacle systems

Pro Forma • Anticipate $250 million in loans and $175 million in deposits by EOP

2017

Financial

• Anticipate 1%—2% dilutive in 2015; essentially breakeven in 2016 and

Information > 2% accretive in 2017

Financial Goal • $2.5 billion franchise in Memphis over the long-term

12

|

|

PNFP Shareholder Value Grows in Memphis

PNFP working its long-term plan

Memphis represents the final piece of the market expansion puzzle

Magna Bank is the ideal platform for PNFP to launch its Memphis franchise

Major lift out provides meaningful commercial thrust

Magna Bank merger is financially attractive to both shareholder groups

Memphis franchise offers significant revenue opportunities in C&I, CRE and affluent segments

13

|

|

Appendix

Overview of Magna Bank

Magna 5-year Financial Summary

Biographical Summaries

Memphis and Tennessee Market Demographics

Deposit Market Share – Tennessee

Deposit Market Share – MSAs

14

|

|

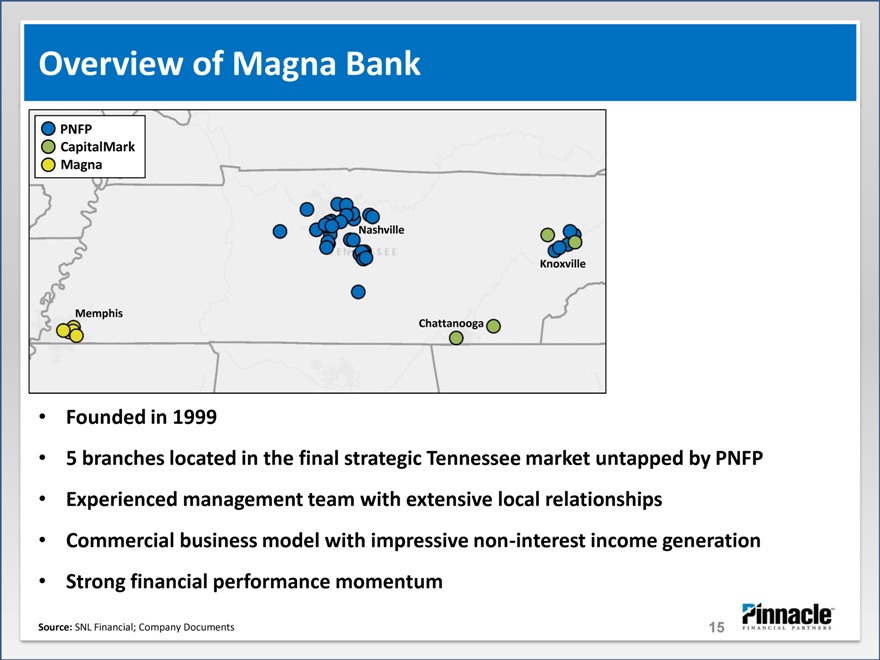

Overview of Magna Bank

PNFP CapitalMark Magna

Nashville

Knoxville

Memphis

Chattanooga

Founded in 1999

5 branches located in the final strategic Tennessee market untapped by PNFP

Experienced management team with extensive local relationships

Commercial business model with impressive non-interest income generation

Strong financial performance momentum

Source: SNL Financial; Company Documents

15

|

|

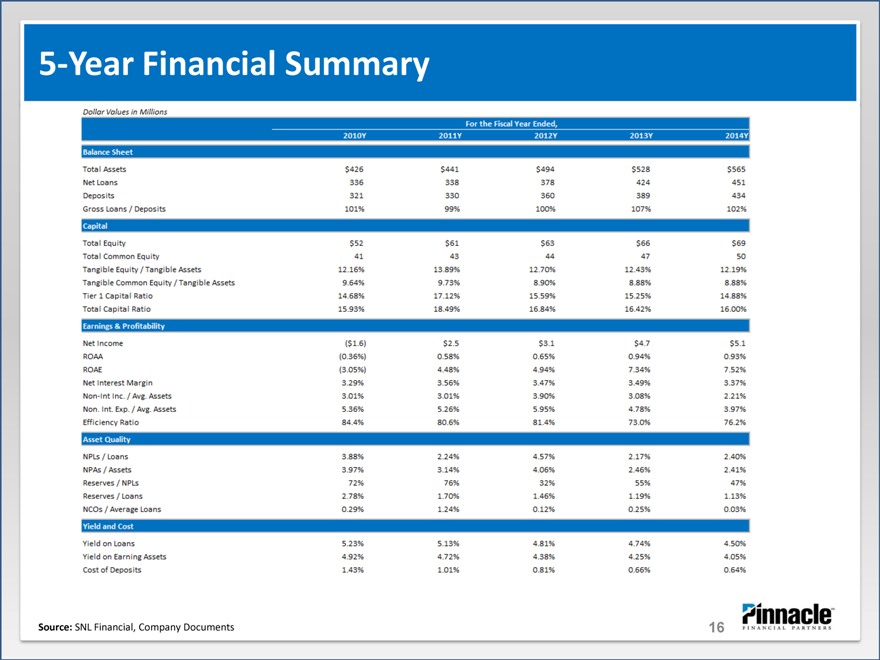

5-Year Financial Summary

Source: SNL Financial, Company Documents

16

|

|

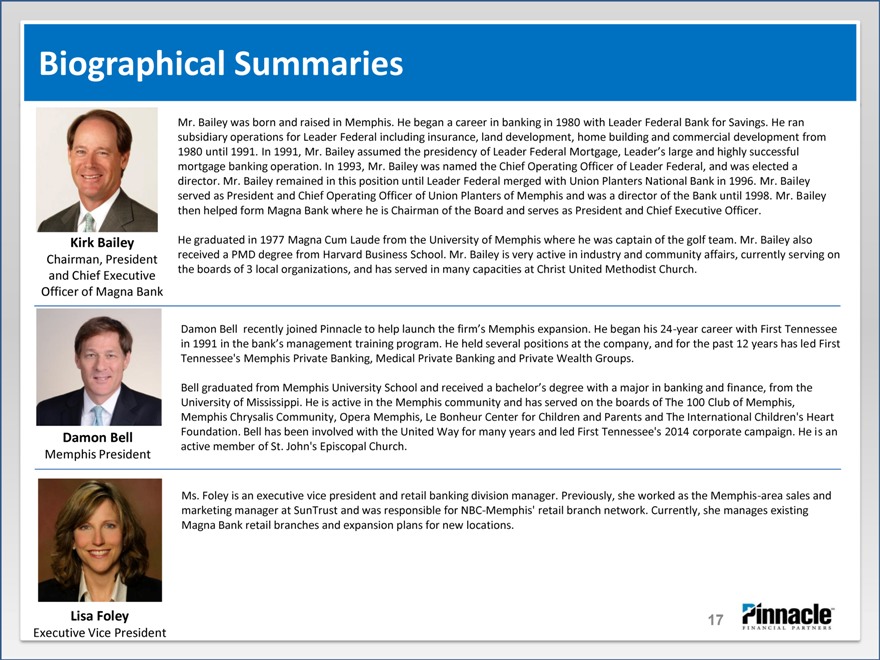

Biographical Summaries

Mr. Bailey was born and raised in Memphis. He began a career in banking in 1980 with Leader Federal Bank for Savings. He ran

subsidiary operations for Leader Federal including insurance, land development, home building and commercial development from

1980 until 1991. In 1991, Mr. Bailey assumed the presidency of Leader Federal Mortgage, Leader’s large and highly successful

mortgage banking operation. In 1993, Mr. Bailey was named the Chief Operating Officer of Leader Federal, and was elected a

director. Mr. Bailey remained in this position until Leader Federal merged with Union Planters National Bank in 1996. Mr. Bailey

served as President and Chief Operating Officer of Union Planters of Memphis and was a director of the Bank until 1998. Mr. Bailey

then helped form Magna Bank where he is Chairman of the Board and serves as President and Chief Executive Officer.

Kirk Bailey He graduated in 1977 Magna Cum Laude from the University of Memphis where he was captain of the golf team. Mr. Bailey also

Chairman, President received a PMD degree from Harvard Business School. Mr. Bailey is very active in industry and community affairs, currently serving on

and Chief Executive the boards of 3 local organizations, and has served in many capacities at Christ United Methodist Church.

Officer of Magna Bank

Damon Bell recently joined Pinnacle to help launch the firm’s Memphis expansion. He began his 24-year career with First Tennessee

in 1991 in the bank’s management training program. He held several positions at the company, and for the past 12 years has led First

Tennessee’s Memphis Private Banking, Medical Private Banking and Private Wealth Groups.

Bell graduated from Memphis University School and received a bachelor’s degree with a major in banking and finance, from the

University of Mississippi. He is active in the Memphis community and has served on the boards of The 100 Club of Memphis,

Memphis Chrysalis Community, Opera Memphis, Le Bonheur Center for Children and Parents and The International Children’s Heart

Damon Bell Foundation. Bell has been involved with the United Way for many years and led First Tennessee’s 2014 corporate campaign. He is an

active member of St. John’s Episcopal Church.

Memphis President

Ms. Foley is an executive vice president and retail banking division manager. Previously, she worked as the Memphis-area sales and

marketing manager at SunTrust and was responsible for NBC-Memphis’ retail branch network. Currently, she manages existing

Magna Bank retail branches and expansion plans for new locations.

Lisa Foley

Executive Vice President

17

|

|

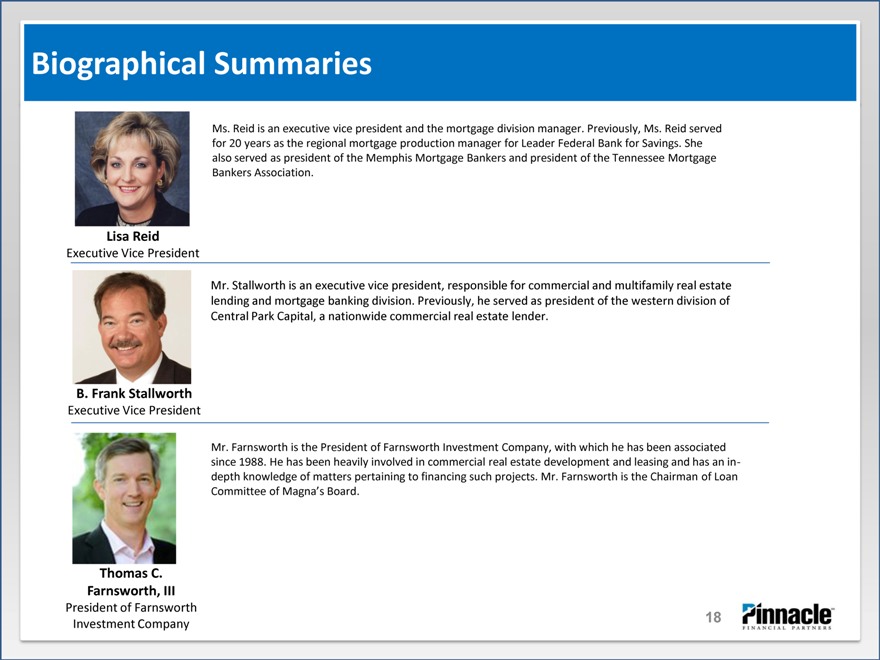

Biographical Summaries

Ms. Reid is an executive vice president and the mortgage division manager. Previously, Ms. Reid served for 20 years as the regional mortgage production manager for Leader Federal Bank for Savings. She also served as president of the Memphis Mortgage Bankers and president of the Tennessee Mortgage Bankers Association.

Lisa Reid

Executive Vice President

Mr. Stallworth is an executive vice president, responsible for commercial and multifamily real estate lending and mortgage banking division. Previously, he served as president of the western division of Central Park Capital, a nationwide commercial real estate lender.

B. Frank Stallworth

Executive Vice President

Mr. Farnsworth is the President of Farnsworth Investment Company, with which he has been associated since 1988. He has been heavily involved in commercial real estate development and leasing and has an in-depth knowledge of matters pertaining to financing such projects. Mr. Farnsworth is the Chairman of Loan

Committee of Magna’s Board.

Thomas C. Farnsworth, III

President of Farnsworth Investment Company

18

|

|

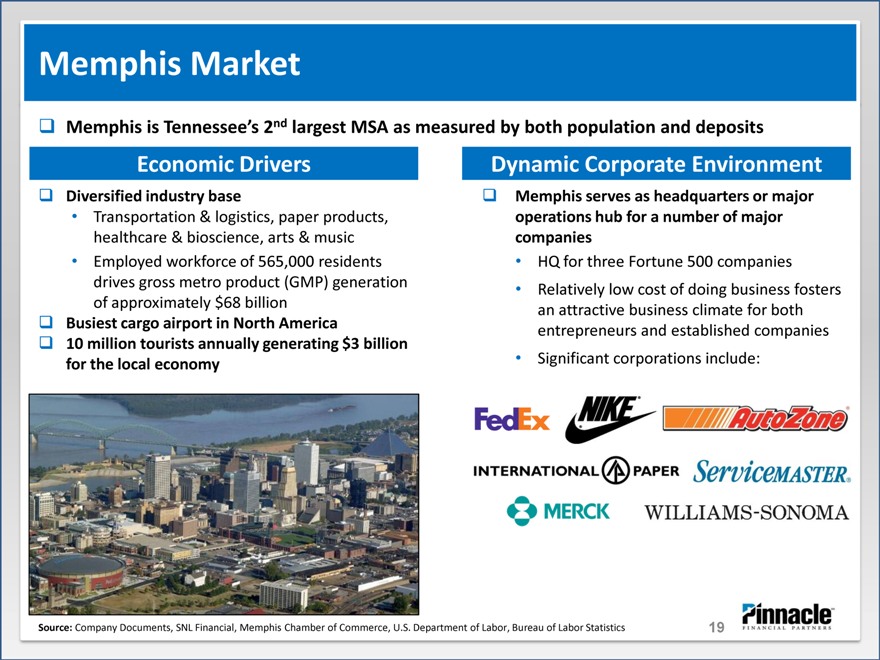

Memphis Market

Memphis is Tennessee’s 2nd largest MSA as measured by both population and deposits

Economic Drivers Dynamic Corporate Environment

Diversified industry base Memphis serves as headquarters or major

• Transportation & logistics, paper products, operations hub for a number of major

healthcare & bioscience, arts & music companies

• Employed workforce of 565,000 residents • HQ for three Fortune 500 companies

drives gross metro product (GMP) generation • Relatively low cost of doing business fosters

of approximately $68 billion an attractive business climate for both

Busiest cargo airport in North America entrepreneurs and established companies

10 million tourists annually generating $3 billion

for the local economy • Significant corporations include:

Source: Company Documents, SNL Financial, Memphis Chamber of Commerce, U.S. Department of Labor, Bureau of Labor Statistics

19

|

|

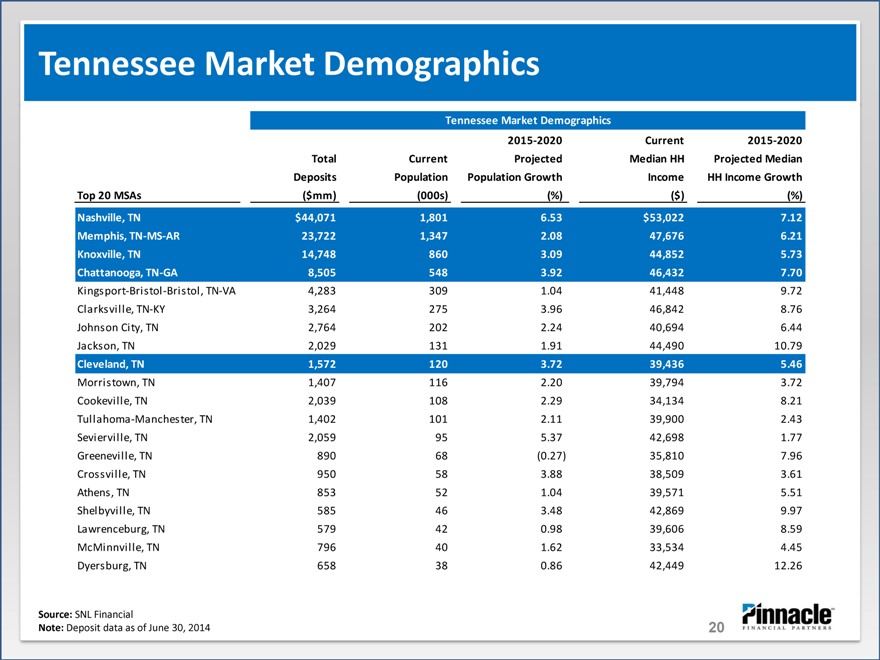

Tennessee Market Demographics

Tennessee Market Demographics

2015-2020 Current 2015-2020

Total Current Projected Median HH Projected Median

Deposits Population Population Growth Income HH Income Growth

Top 20 MSAs ($mm) (000s) (%) ($) (%)

Nashville, TN $44,071 1,801 6.53 $53,022 7.12

Memphis, TN-MS-AR 23,722 1,347 2.08 47,676 6.21

Knoxville, TN 14,748 860 3.09 44,852 5.73

Chattanooga, TN-GA 8,505 548 3.92 46,432 7.70

Kingsport-Bristol -Bristol, TN-VA 4,283 309 1.04 41,448 9.72

Clarksville, TN-KY 3,264 275 3.96 46,842 8.76

Johnson City, TN 2,764 202 2.24 40,694 6.44

Jackson, TN 2,029 131 1.91 44,490 10.79

Cleveland, TN 1,572 120 3.72 39,436 5.46

Morristown, TN 1,407 116 2.20 39,794 3.72

Cookeville, TN 2,039 108 2.29 34,134 8.21

Tullahoma-Manchester, TN 1,402 101 2.11 39,900 2.43

Sevierville, TN 2,059 95 5.37 42,698 1.77

Greeneville, TN 890 68 (0.27) 35,810 7.96

Crossville, TN 950 58 3.88 38,509 3.61

Athens, TN 853 52 1.04 39,571 5.51

Shelbyville, TN 585 46 3.48 42,869 9.97

Lawrenceburg, TN 579 42 0.98 39,606 8.59

McMinnville, TN 796 40 1.62 33,534 4.45

Dyersburg, TN 658 38 0.86 42,449 12.26

Source: SNL Financial

Note: Deposit data as of June 30, 2014

20

|

|

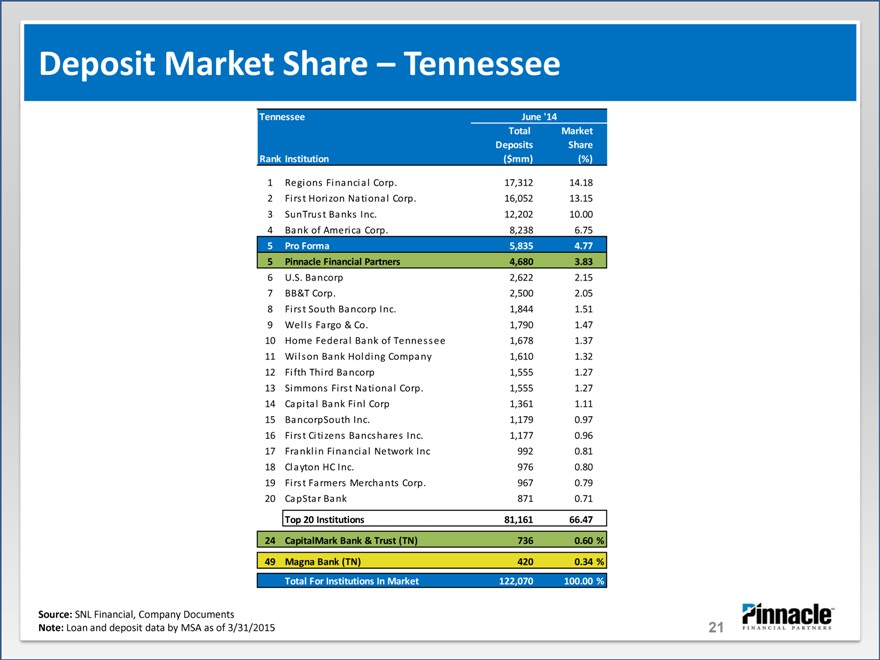

Deposit Market Share – Tennessee

Tennessee June ‘14

Total Market

Deposits Share

Rank Institution ($mm) (%)

1 Regions Financial Corp. 17,312 14.18

2 First Horizon National Corp. 16,052 13.15

3 SunTrust Banks Inc. 12,202 10.00

4 Bank of America Corp. 8,238 6.75

5 Pro Forma 5,835 4.77

5 Pinnacle Financial Partners 4,680 3.83

6 U.S. Bancorp 2,622 2.15

7 BB&T Corp. 2,500 2.05

8 First South Bancorp Inc. 1,844 1.51

9 Wells Fargo & Co. 1,790 1.47

10 Home Federal Bank of Tennessee 1,678 1.37

11 Wilson Bank Holding Company 1,610 1.32

12 Fifth Third Bancorp 1,555 1.27

13 Simmons First National Corp. 1,555 1.27

14 Capital Bank Finl Corp 1,361 1.11

15 BancorpSouth Inc. 1,179 0.97

16 First Citizens Bancshares Inc. 1,177 0.96

17 Franklin Financial Network Inc 992 0.81

18 Clayton HC Inc. 976 0.80

19 First Farmers Merchants Corp. 967 0.79

20 CapStar Bank 871 0.71

Top 20 Institutions 81,161 66.47

24 CapitalMark Bank & Trust (TN) 736 0.60 %

49 Magna Bank (TN) 420 0.34 %

1 Total For Institutions In Market 122,070 100.00 %

Source: SNL Financial, Company Documents

Note: Loan and deposit data by MSA as of 3/31/2015

21

|

|

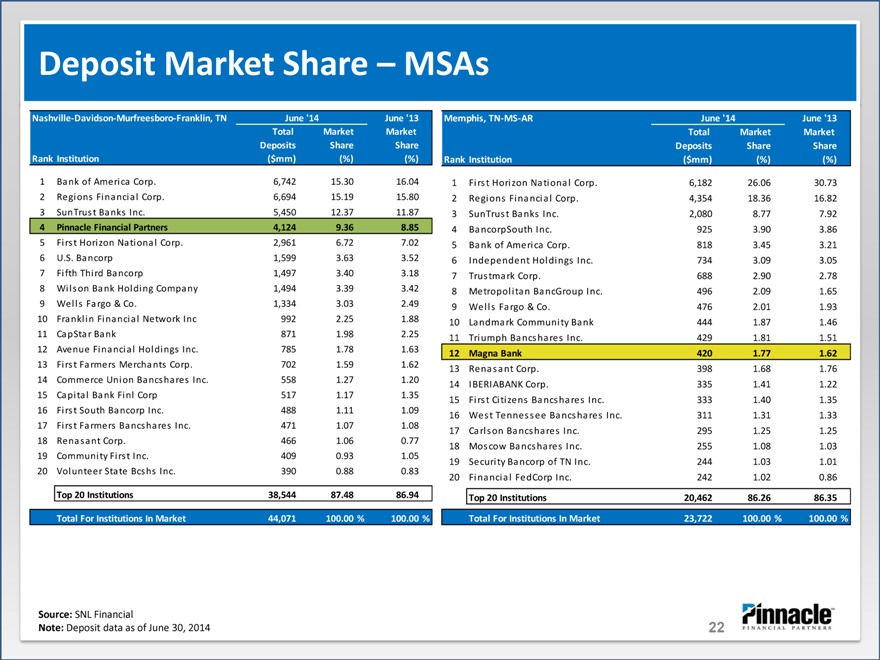

Deposit Market Share – MSAs

Nashville-Davidson-Murfreesboro-Franklin, TN June ‘14 June ‘13 Memphis, TN-MS-AR June ‘14 June ‘13

Total Market Market Total Market Market

Deposits Share Share Deposits Share Share

Rank Institution ($mm) (%) (%) Rank Institution ($mm) (%) (%)

1 Bank of America Corp. 6,742 15.30 16.04 1 First Horizon National Corp. 6,182 26.06 30.73

2 Regions Financial Corp. 6,694 15.19 15.80 2 Regions Financial Corp. 4,354 18.36 16.82

3 SunTrust Banks Inc. 5,450 12.37 11.87 3 SunTrust Banks Inc. 2,080 8.77 7.92

4 Pinnacle Financial Partners 4,124 9.36 8.85 4 BancorpSouth Inc. 925 3.90 3.86

5 First Horizon National Corp. 2,961 6.72 7.02 5 Bank of America Corp. 818 3.45 3.21

6 U.S. Bancorp 1,599 3.63 3.52 6 Independent Holdings Inc. 734 3.09 3.05

7 Fifth Third Bancorp 1,497 3.40 3.18 7 Trustmark Corp. 688 2.90 2.78

8 Wilson Bank Holding Company 1,494 3.39 3.42 8 Metropolitan BancGroup Inc. 496 2.09 1.65

9 Wells Fargo & Co. 1,334 3.03 2.49 9 Wells Fargo & Co. 476 2.01 1.93

10 Franklin Financial Network Inc 992 2.25 1.88 10 Landmark Community Bank 444 1.87 1.46

11 CapStar Bank 871 1.98 2.25 11 Triumph Bancshares Inc. 429 1.81 1.51

12 Avenue Financial Holdings Inc. 785 1.78 1.63 12 Magna Bank 420 1.77 1.62

13 First Farmers Merchants Corp. 702 1.59 1.62 13 Renasant Corp. 398 1.68 1.76

14 Commerce Union Bancshares Inc. 558 1.27 1.20 14 IBERIABANK Corp. 335 1.41 1.22

15 Capital Bank Finl Corp 517 1.17 1.35 15 First Citizens Bancshares Inc. 333 1.40 1.35

16 First South Bancorp Inc. 488 1.11 1.09 16 West Tennessee Bancshares Inc. 311 1.31 1.33

17 First Farmers Bancshares Inc. 471 1.07 1.08 17 Carlson Bancshares Inc. 295 1.25 1.25

18 Renasant Corp. 466 1.06 0.77 18 Moscow Bancshares Inc. 255 1.08 1.03

19 Community First Inc. 409 0.93 1.05 19 Security Bancorp of TN Inc. 244 1.03 1.01

20 Volunteer State Bcshs Inc. 390 0.88 0.83

20 Financial FedCorp Inc. 242 1.02 0.86

Top 20 Institutions 38,544 87.48 86.94 Top 20 Institutions 20,462 86.26 86.35

1 Total For Institutions In Market 44,071 100.00 % 100.00 % 1 Total For Institutions In Market 23,722 100.00 % 100.00 %

Source: SNL Financial

Note: Deposit data as of June 30, 2014

22

|

|

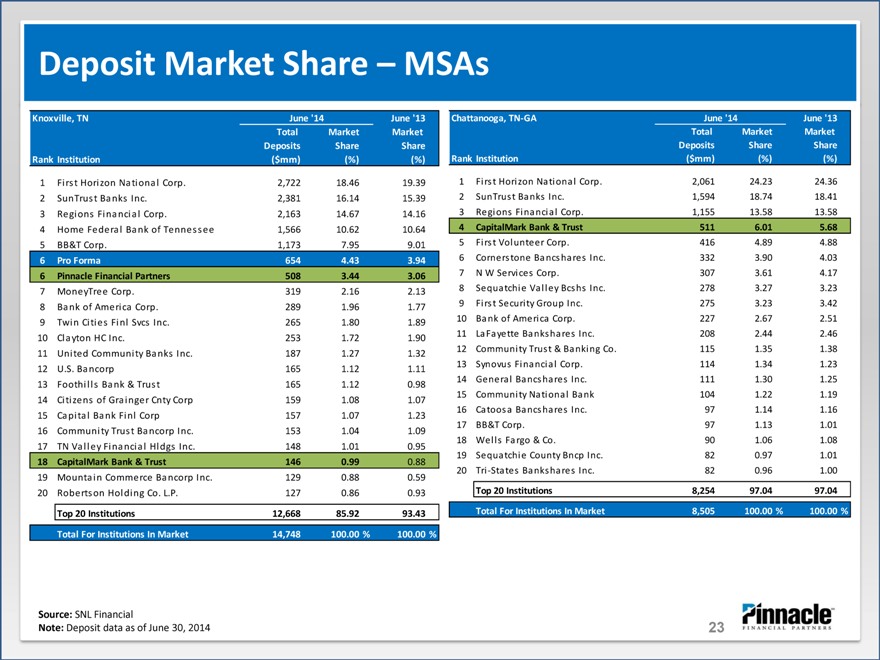

Deposit Market Share – MSAs

Knoxville, TN June ‘14 June ‘13 Chattanooga, TN-GA June ‘14 June ‘13

Total Market Market Total Market Market

Deposits Share Share Deposits Share Share

Rank Institution ($mm) (%) (%) Rank Institution ($mm) (%) (%)

1 First Horizon National Corp. 2,722 18.46 19.39 1 First Horizon National Corp. 2,061 24.23 24.36

2 SunTrust Banks Inc. 2,381 16.14 15.39 2 SunTrust Banks Inc. 1,594 18.74 18.41

3 Regions Financial Corp. 2,163 14.67 14.16 3 Regions Financial Corp. 1,155 13.58 13.58

4 Home Federal Bank of Tennessee 1,566 10.62 10.64 4 CapitalMark Bank & Trust 511 6.01 5.68

5 BB&T Corp. 1,173 7.95 9.01 5 First Volunteer Corp. 416 4.89 4.88

6 Pro Forma 654 4.43 3.94 6 Cornerstone Bancshares Inc. 332 3.90 4.03

6 Pinnacle Financial Partners 508 3.44 3.06 7 N W Services Corp. 307 3.61 4.17

7 MoneyTree Corp. 319 2.16 2.13 8 Sequatchie Valley Bcshs Inc. 278 3.27 3.23

8 Bank of America Corp. 289 1.96 1.77 9 First Security Group Inc. 275 3.23 3.42

9 Twin Cities Finl Svcs Inc. 265 1.80 1.89 10 Bank of America Corp. 227 2.67 2.51

10 Clayton HC Inc. 253 1.72 1.90 11 LaFayette Bankshares Inc. 208 2.44 2.46

11 United Community Banks Inc. 187 1.27 1.32 12 Community Trust & Banking Co. 115 1.35 1.38

12 U.S. Bancorp 165 1.12 1.11 13 Synovus Financial Corp. 114 1.34 1.23

13 Foothills Bank & Trust 165 1.12 0.98 14 General Bancshares Inc. 111 1.30 1.25

14 Citizens of Grainger Cnty Corp 159 1.08 1.07 15 Community National Bank 104 1.22 1.19

16 Catoosa Bancshares Inc. 97 1.14 1.16

15 Capital Bank Finl Corp 157 1.07 1.23

17 BB&T Corp. 97 1.13 1.01

16 Community Trust Bancorp Inc. 153 1.04 1.09

18 Wells Fargo & Co. 90 1.06 1.08

17 TN Valley Financial Hldgs Inc. 148 1.01 0.95

19 Sequatchie County Bncp Inc. 82 0.97 1.01

18 CapitalMark Bank & Trust 146 0.99 0.88

20 Tri -States Bankshares Inc. 82 0.96 1.00

19 Mountain Commerce Bancorp Inc. 129 0.88 0.59

20 Robertson Holding Co. L.P. 127 0.86 0.93 Top 20 Institutions 8,254 97.04 97.04

Top 20 Institutions 12,668 85.92 93.43 1 Total For Institutions In Market 8,505 100.00 % 100.00

1 Total For Institutions In Market 14,748 100.00 % 100.00 %

Source: SNL Financial

Note: Deposit data as of June 30, 2014

23