Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Aim Exploration Inc. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - Aim Exploration Inc. | exhibit312.htm |

| EX-32.1 - EXHIBIT 32.1 - Aim Exploration Inc. | exhibit321.htm |

| EX-32.2 - EXHIBIT 32.2 - Aim Exploration Inc. | exhibit322.htm |

| EX-31.1 - EXHIBIT 31.1 - Aim Exploration Inc. | exhibit311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 2

þ ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2014

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________.

Commission file number 333-182071

AIM EXPLORATION INC.

(Exact name of registrant as specified in its charter)

| Nevada |

| 67-0682135 |

| (State or Other Jurisdiction of Incorporation of Organization) |

| (I.R.S. Employer Identification No.) |

701 North Green Valley Parkway, Suite 200

Henderson, Nevada 89012

(Address of principal executive offices)

1-844-246-7378

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No þ

Aggregate market value of the voting and non-voting stock of the registrant held by non-affiliates of the registrant as of December 15, 2014: $31,500.00 (no public market value, so price is based on last sale price to investors of $0.001)

As of December 15, 2014 the registrant’s outstanding stock consisted of 83,750,000 common shares.

Explanatory Note:

This Amendment No. 2 on Form 10-K/A (this “Amendment”) amends the Registrant’s Amended Annual Report on Form 10-K/A for the fiscal year ended August 31, 2014 which the Registrant previously filed with the Securities and Commission on March 11, 2015 (the “Original Amended Filing”). The Registrant is filing this Amendment to make changes to the Original Amended Filing in response to a comment letter that it has received from the Commission.

Except as set forth above, the Original Amended Filing has not been amended, updated or otherwise modified. Other events occurring after the filing of the Form 10-K/A or other disclosures necessary to reflect subsequent events have been addressed in our reports filed with the Securities and Exchange Commission subsequent to the filing of this Form 10-K/A.

| 2 |

AIM EXPLORATION INC.

TABLE OF CONTENTS

| Business | 3 | |

| Risk Factors | 21 | |

| Unresolved Staff Comments | 21 | |

| Properties | 21 | |

| Legal Proceedings | 21 | |

| Mine Safety Disclosures | 21 | |

| Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 22 | |

| Selected Financial Data | 23 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 23 | |

| Quantitative and Qualitative Disclosures About Market Risk | 25 | |

| Financial Statements and Supplementary Data | 26 | |

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 27 | |

| Controls and Procedures | 27 | |

| Item 9B. | Other Information | 28 |

| Directors, Executive Officers and Corporate Governance | 29 | |

| Executive Compensation | 32 | |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 34 | |

| Certain Relationships and Related Transactions, and Director Independence | 35 | |

| Principal Accountant Fees and Services | 36 | |

| Exhibits, Financial Statement Schedules | 37 |

| 3 |

PART 1

Item 1.

Business

We are an exploration stage company engaged in the acquisition and exploration of mineral properties with the intent to take properties into production. We were incorporated as a Nevada state corporation on February 18, 2010. As at August 31, 2014 we owned a 40% share of Pah-Hsu-Qhuin Philippines Mining also known as the Raval Claim, we acquired this asset on August 31, 2011 for 140,000 pesos. We also acquired mining concession properties in Peru during the past fiscal year.

We are considered an exploratory stage company as we are involved in the examination and investigation of land that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. There is no assurance that a commercially viable mineral deposit exists on the property covered by the Raval claim, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our future exploration is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the property, and there is no assurance that we will discover one.

As at August 31, 2014, we had cash reserves of $1,862 and working capital deficit of $182,346. We do not have sufficient funds to enable us to complete this initial phase of our exploration programs for the mining claims. We will require additional financing in order to commence the initial phases of exploration of the properties. There is no assurance that will be able to obtain additional financing. Both advanced exploration and an economic determination will be contingent upon the results of our preliminary exploration programs and our ability to raise additional financing in order to proceed with advanced exploration and an economic evaluation. There is no assurance that we will be able to obtain any additional financing to fund our exploration activities.

Philippine Mining Claims

Nature of Ownership

Our Philippine Mining claims are covered by Mining Lease Contracts under renewal by Alice Raval Ventura for 25 years. Alice Raval Ventura has entered into a sale of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp. to us. We have entered into a management agreement with Paladino Management and Development Corp to manage operations on the ground in the Philippines. Paladino will be responsible for managing, developing and operating our claims in the Philippines. The Agreement began on August 31, 2011 and continues for 10 years until August 31, 2021. In consideration of services provided to us, we have agreed to pay Paladino a manager fee equivalent to 5% of our annual gross sales from the claims, less any taxes payable. These amount will be payable monthly, based on revenues for each month. Our right to the mining claims were acquired through the ownership of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp., and the exclusive mining management and operating agreement entered into between Alice Raval Ventura and Paladino Management and Development Corp.

Description of the Properties

The properties consist of three mining claims covered by Lode Lease Contract Nos. V-319, V-425, and V-521, expiring in 2014, with a total area of twenty-four hectares. Names of the mines are “Pabling”, “Alice”, and “Namalitocan”, respectively.

Apart from the amounts paid for the shares of stock of Pah-Hsu-Qhuin Mining Phils.Corp. we are estimating to spend about $300,000 in the exploration and development of the mines.

The $300,000 will be used to commission more detailed plans, secure the renewal of the mining claims for another twenty-five years, develop and extract the feldspar ore from the mines, and erect a crushing plant, which includes site development and improvements as well as connection of power supply to the grid.

We have allocated a total of $10,000 for the necessary plans, which include the following:

1. Mining Project Feasibility Study;

2. Location and Survey Plan;

3. Three-year Development and Work Program;

4. Environmental Protection and Enhancement Program; and

5. Social Development and Management Program.

4

Extraction of the feldspar ore will be through the open-cut mining method using backhoes and pay loaders. Due to the favorable geological terrain, only the clearing of the vegetation and over-burden is necessary to expose the raw material. Under existing conditions of the mines, it will take only one week to expose the feldspar ore. The mining operation will start where the feldspar deposits are already exposed. As the extraction advances, overburden is stripped and soil and other waste materials are set aside for future backfilling of mined-out areas. Extracted ore is then loaded onto dump truck for transfer to the crushing plant. A total of $100,000 will be required to develop the mine and extract an initial 12,000 metric tons.

The crushing plant is necessary to process the ore into customer-required granule sizes. The main equipment used are mechanized crushers and vibrating screens. Completion time for the fabrication and erection of a 50 ton per hour plant is estimated at two months at a projected of $135,000. Working capital allotment is $50,000.

In the mine claim areas, Initial source of power is through the use of generator sets. Ground water is available through deep wells. Electrical power thru the local utility is available but may take up to three months to hook up. Generators will be used as back power source.

Feldspar Market

Domestic Market

Major users of feldspar are: for glass, Asahi Glass Phils. (formerly Republic Glass), San Miguel Yamamura Packaging Corp., Asia Brewery, Arcya Packaging; for ceramics, HCG and Royal Tern sanitary wares and Mariwasa tiles.

Both Royal Tern and San Miguel have expressed dismay with the local supply in terms of quality and reliability. Most suppliers are small-scale miners lacking proper processing equipment. The sole supplier of San Miguel is the only one with processing equipment acquired for then Republic Glass in the 1990’s. Their equipment has now become unreliable, and Asahi Glass remains the priority for delivery. Further, they are affected by an internal dispute among stakeholders. While Royal Tern is already importing part of its requirements, San Miguel has indicated they may also do so if the local supply situation does not improve.

From 11,850 MT per year in 2005, domestic production of feldspar has increased to 16,394 MT as of 2009. Delivered price of feldspar is about Php 2,100 to 2,700 per metric ton (USD 48 to 62).

Prices and volumes for domestic markets are based on an actual purchase order from Royal Tern and actual discussions with the purchasing group of San Miguel Corporation.

Acquisition of Our Raval claim/ Our Ownership Interest in the Raval Claim

The rights to the mining claims was acquired through the ownership of shares of stock of Pah-Hsu-Qhuin Phils. Mining Corp., and the exclusive mining management and operating agreement entered into between Alice Raval Ventura and Paladino Management and Development Corp.

We have entered into a share purchase agreement for a 40% share of Pah-Hsu-Qhuin Philippines Mining as Philippines law does not allow 100% foreign ownership.

The Raval Claim mainly consists of the anticipated presence of Feldspar which is a light-colored rock-forming mineral used in the manufacture of glass products, ceramics and other products. Feldspar provides glass hardness, workability, strength, and makes it more resistant to chemicals. It also reduces the melting temperature so less energy is used. For ceramics, feldspar serves as a flux to form a glassy phase at low temperatures, and as a source of alkalis and alumina in glazes. It improves the strength, toughness, and durability of the ceramic body and cements the crystalline phase of other ingredients. Feldspar is also used in paint, in mild abrasives, urethane, latex foam, and as a welding rod coating.

Subsequent to August 31, 2014, on October 15, 2014, we entered into a Mining Concession Asset Acquisition Agreement with Paladino Mining and Development Corp. Pursuant to the Agreement, the Company has acquired 40% ownership of Paladino in exchange for: (1) the issuance of 5 million shares of common stock of the Company to Paladino (the “Shares”), (2) a cash payment of 540,000 Philippine Pesos, and (3) transfer of the Company’s 40% ownership of the Raval Mining Claim, also known as Pah-HSU-Qhuin Philippine Mining Claim, to Paladino. Paladino owns 648 hectares of land located at Brgys Caruan & Sulongan, Pasuquin, Ilocos Norte, Philippines. The land contains Feldspar, Silica, Limestone, etc.

The Shares will be held in escrow until certain conditions are met, including the issuance of Paladino shares to the Company as well as other conditions.

| 5 |

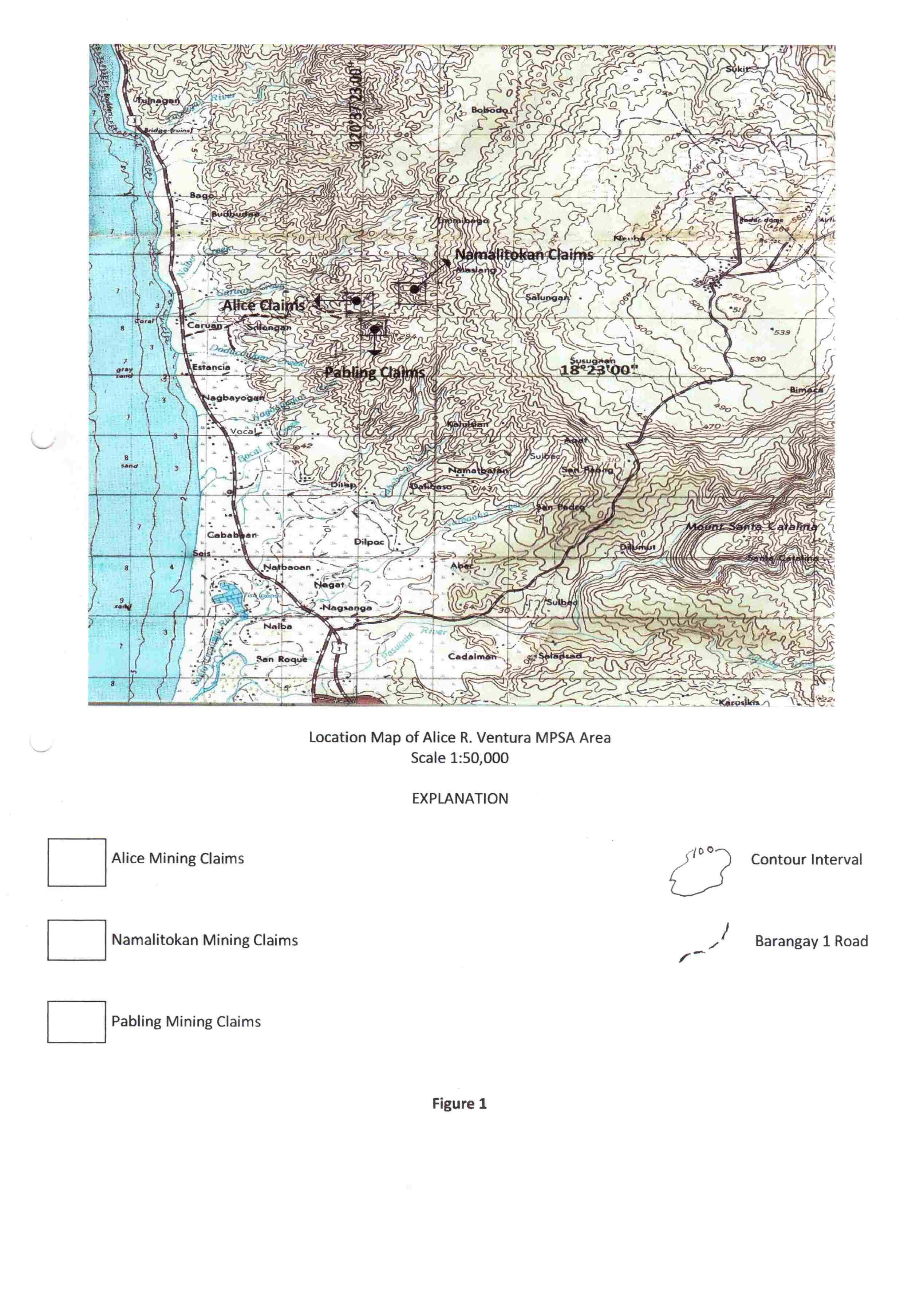

Property Description and Location of Our Raval claim

The Raval Mining Claims are located 350 meters above sea level, seven (7) kilometers from the Km. 511 post of the National Road in Barangay Sulongan, municipality of Pasuquin, in the province of Ilocos Norte. They are 518 kilometers north of Manila and 31 kilometers north of the Ilocos Norte capital city of Laoag. The nearest commercial port is at Currimao, some 57 kilometers to the south. Currimao Port is 420 nautical miles from the Taiwanese port of Keelung.

The area is located within the jurisdiction of Barangay Solongan, Pasuquin, Ilocos Norte and can be reached by four-wheel-drive vehicles through the mine roads which negotiate and wind up to the feldspar deposits. The area is located within the following geographic coordinates:

|

| North Latitude | East Latitude |

| Pabling Mineral Claim | 18o23’20”- 18o18’28” | 120o37’00”- 120o37’08” |

| Alice Mineral Claim | 18o23’12”- 18o23’32.5” | 120o36’53”- 120o37’03.5” |

| Namalitocan Mineral Claim | 18o23’36”- 18o23’46” | 120o37’14”- 120o37’21” |

Access, Climate, and Physiography, Local Resources and Infrastructure of Our Raval claim

The roads leading to the mine site had already been established since the time D’5 White Marketing and were upgraded by Pah-Hsu-Qhuin Philippines in 1997. The mine sites are accessible by 4 x 4 vehicles and dump trucks. Through the years, a significant number of feldspar pits have been established identified to specific to customer requirements.

Prior Exploration

In 1954, Dr. Pablo J. Raval started exploring for feldspar in the mountains of Pasuquin, Ilocos Norte. By the early 1960’s, the Bureau of Mines granted spouses Pablo J. Raval and Lolita Lorenzana three (3) mining claims 25-year Mining Lode Lease Contracts over a total area of 24 hectares. Dr. Raval succeeded in developing the mines supplying a number of glass and ceramics clients, including: Philippine Standard, Pacific Ceramics, Republic Glass, Mariwasa Manufacturing, Pioneer Ceramics, Fil-Hispano, San Miguel Brewery, and Pacific Enamel & Glass.

The computations/estimates were made based on the measurement of outcrops within the claims. It is worth mentioning that the three claims were previously mined for feldspar in the last twenty years. And that the deposits were likewise estimated as regards its positive reserves through drilling and other conventional methods used in reserve estimation.

Upon the death of Dr. Raval in 1973, the eldest of the Raval siblings, Ms. Alice Raval took over the operations of the mining business under D’5 White Mountain Marketing, a single proprietorship owned by her. Meanwhile, in 1975, Philippine Standard entered into a fifteen year operating agreement with the Raval family for the use of one of the mining claims with minimum guaranteed earnings for the Ravals.

In 1985, prior to expiration of the lease contracts, Mrs. Alice Raval-Ventura renewed the Mining Lease

Agreements for another 25 years on behalf of the heirs of Pablo J. Raval and Lolita Lorenzana. From 1983 to 1995, Mrs. Alice Raval-Ventura through her company, Pah-Hsu-Qhuin Philippines Mining Corporation exported some 350,000 MT of raw feldspar to Taiwan.

The mining leases were renewed in 1985 before their respective expirations. Expiration of the renewed leases is up to 2014. The mining leases were renewed in 1985 before their respective expirations. Expiration of the renewed leases is up to 2014.The three mining leases expire in the years 2010, 2012, and 2014. We have submitted the renewal for all three claims in one document which is covered by a Mineral Production Sharing Agreement. This is currently under review by the Mines and Geosciences Bureau (“MGB”), and we expect to receive the approval for our renewals shortly.

Prior to the Mining Act of 1995, mining claims were covered by Mining/Lode Lease Agreements entered into with the Department of Natural Resources. Presently, mining rights are granted through the Mineral Production Sharing Agreement (MPSA), which is currently the subject of the renewal of the claims by Alice Raval Ventura.

| 6 |

Maps of Our Raval Claim

Below are three maps of our claim.

| 7 |

| 8 |

| 9 |

Present Condition and Current State of Exploration

Through the years, roads and feldspar pits had already been established. Restoring the mines will entail stripping and clearing of mine sites and their periphery to expose the raw material (removal of over-burden using backhoe and bulldozer). Test pitting and trenching shall be continuously undertaken to identify additional reserves and thereby extend the mine life.

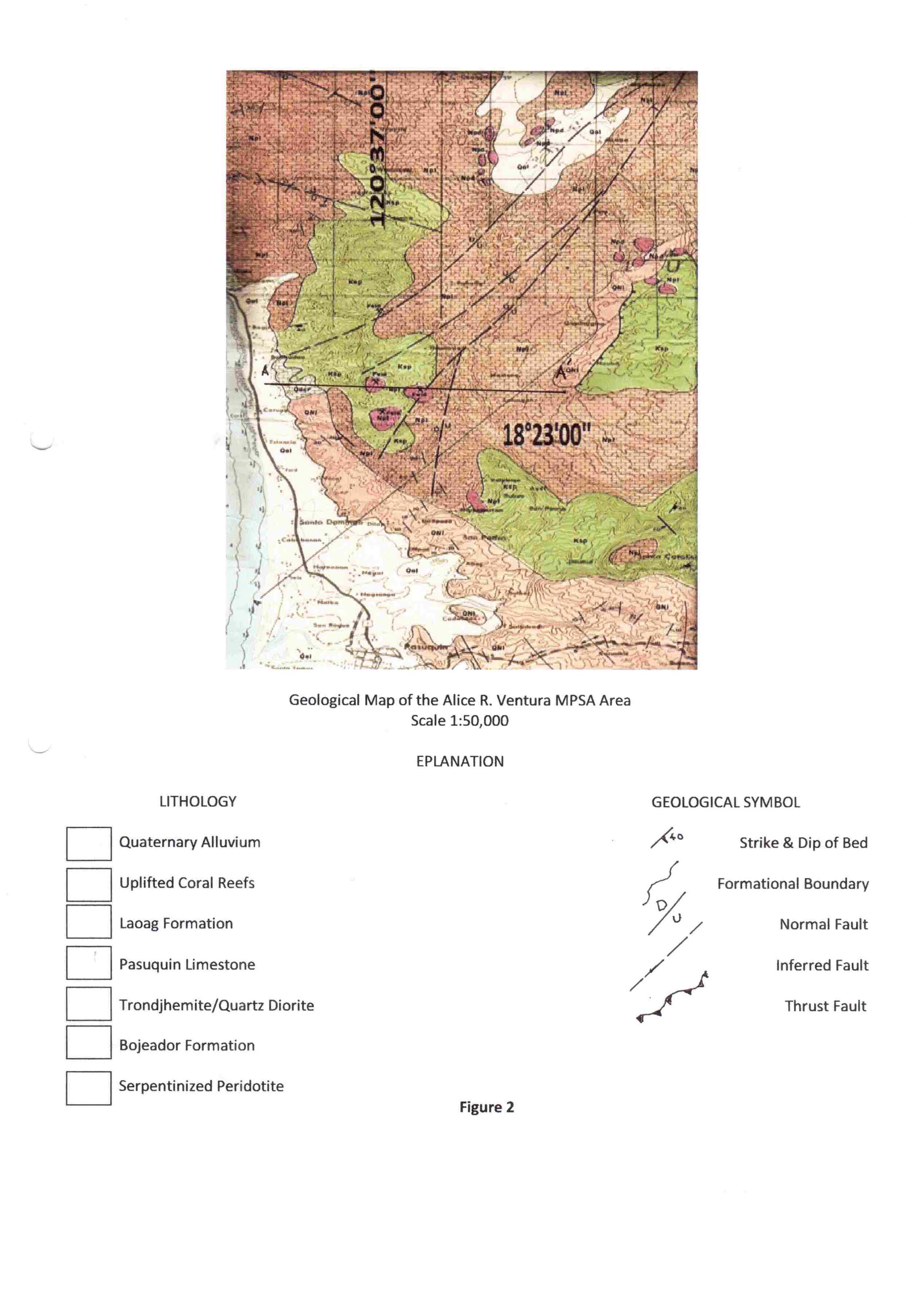

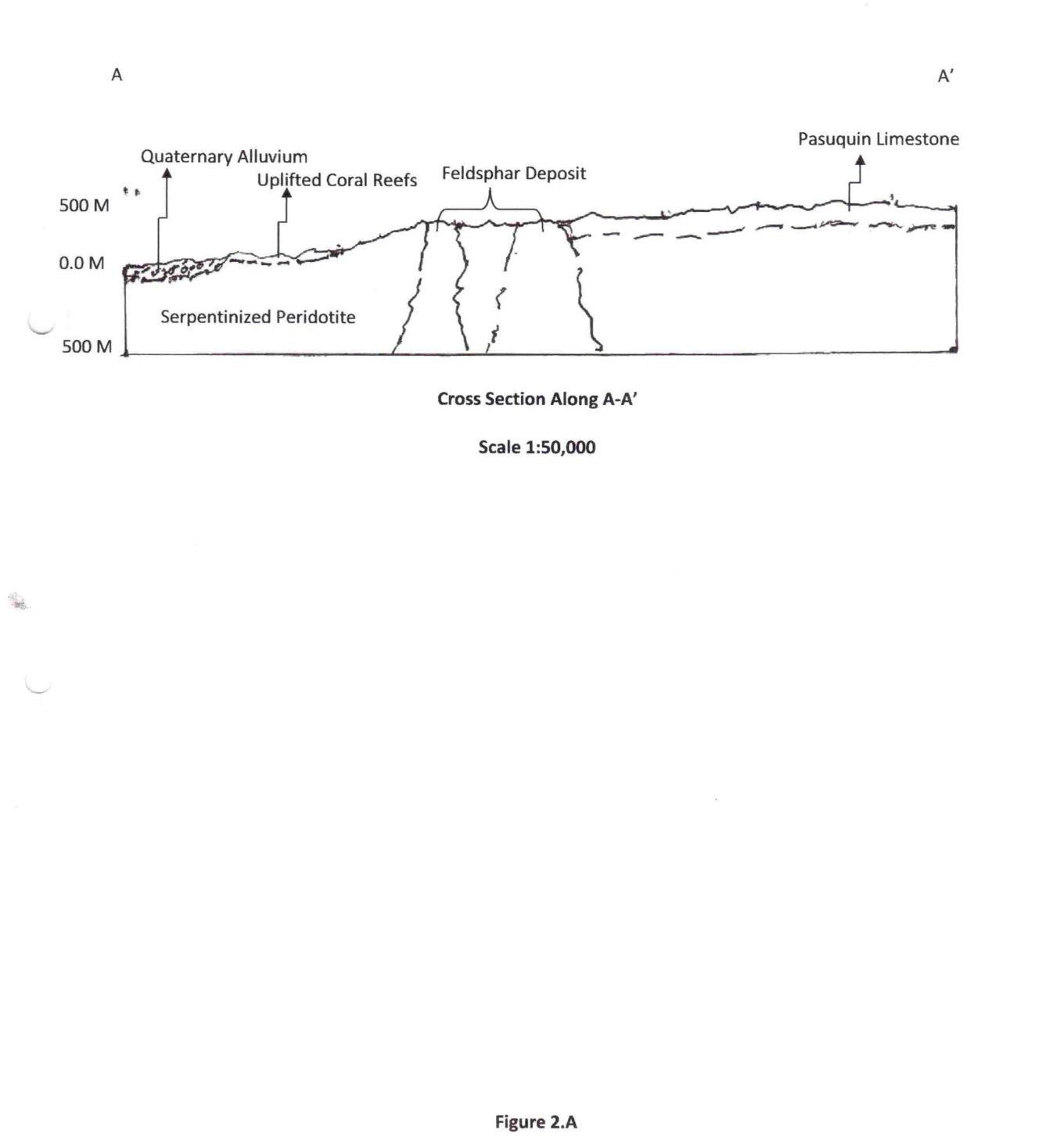

Geology of Our Raval claim

The mineral claims areas are mostly underlain by clastic sediments, followed by ultramafic rocks and the remaining small portion by collaine limestone.

The mineral deposits found in the areas are feldspar, silica quartz, and limestone. The deposits occur generally as discontinuous, irregularly shaped to lenticular, dike-like masses in intruding the serpentinized peridotite. Their contact with the host rock is sharp in almost all outcrops that could be observed. Large and small fault structures located within the vicinity of the claims are believed to be one of the main contributing factors in the localization of the feldspar deposits.

Regional Geochemical

Regionally the area is anomalous in feldspar values, but no systematic surveying of the area by government can be identified as useful to the definition of concentrations of placer deposits.

Our Planned Exploration Program

PHASE 1: Startup operations servicing live Purchase Orders from Royal Tern

ROYAL TERN Sanitary Wares – Royal Tern Sanitary Wares has been a long time customer of Pah-Hsu-Qhuin Philippines Mining. Their last Purchase Order with Pah-Hsu Qhuin Mining was in 2007 for 3,500MT. In late 2010, Royal Tern requested Pah-Hsu-Qhuin Mining to revive operations due to current problems in domestic supply. A Purchase Order for 3,600 MT was issued for delivery in 2011 at 400 MT per month. We will fulfill this purchase order once we commence operations.

Aside from Pah-Hsu-Qhuin, Royal Tern does not consider other domestic suppliers as reliable. Should domestic supply continue to be unreliable, Royal Tern intends to import all of their feldspar requirements. Royal Tern has also expressed serious interest in entering into an export agreement with Pah-Hsu-Qhuin Mining for supply of raw feldspar to Taiwan and China.

Except of the purchase order from Royal Tern, dealings with other customers are at an accreditation and negotiation stage with corresponding non-disclosure agreements. We have several interested customers and therefore do not believe that we will be dependent upon any one customer for success. We will not sign any supply agreements until our operations are underway.

In order to serve the requirements of Royal Tern would entail the following:

·

Rental of heavy equipment (i.e., backhoe, payloader, dump truck);

·

Stripping and clearing of mine sites and their periphery to expose the raw material;

·

Rehabilitation of Pah-Hsu-Qhuin’s warehouse and processing area;

·

Purchase of 4 units basic vibrating screens @Php120,000 per unit ($2,700);

·

Use of commercial truckers to deliver to customers.

Estimated costs for this phase are Php 2.4M (USD $57,000) which will be used for the purchase of four (4) vibrating screens, pre-operating expenses, and initial working capital.

PHASE 2: Supply to San Miguel, export, and other domestic users

SAN MIGUEL YAMAMURA Glass – Due to current supply problems, SMYPC is actively sourcing additional suppliers to augment or replace their current sole supplier. Total potential volume is 1,800MT per month. Last January 2011, Pah-Hsu-Qhuin Mining submitted a Letter-of-Intent to supply SMYPC with feldspar.

In Phase 2, the following shall be undertaken:

·

Renewal of mining lease agreements for an additional 25 years (@Php1.0M or $22,000);

·

Acquisition of a ball mill crusher for finer granulation (@Php2.0M or $44,000);

·

Rental of heavy equipment and use of commercial truckers shall continue until volumes justify purchase of equipment.

An additional Php 9M (USD $210,000) will be needed for the acquisition of a ball mill crusher (for finer granulation), additional working capital, and renewal of mining lease agreements.

The lease contract is the subject of renewal for another 25 years. Alice Raval Ventura has filed for the renewal by way of an application for a Mineral Production Sharing Agreement (MPSA). Approval of the MPSA is expected by the end of the year. The leases are in the process of being renewed. They are currently under review by the MBG. We foresee no issues with renewal. All three Leases will be renewed as one lease.

| 10 |

Compliance with Government Regulation

To maintain a safe and healthy work environment, strict compliance with all rule and regulations embodied under the Mines Administrative Order known as “Mine Safety Rules and Regulations” shall be followed. A qualified Safety Engineer shall be designated and safety and health programs shall be undertaken for the entire duration of the project.

There is pending legislation which will rationalize the revenue sharing schemes and mechanisms and is expected to include an increase in government share from the current 2% excise tax to about 5% to 7% of gross revenues. Our mining claims are covered by the provisions of the Mining Act of 1995.

In addition, local governments are both beneficiaries and active participants in mineral resources management in accordance with the Philippine’s Constitution and local autonomy and empowerment. They get a share of 40% from the gross collection of the national government from mining taxes, royalties and other fees. In the case of occupation fees, the province gets 30% and host Municipalities get 70%.

Also, in accordance with the People’s Small Scale Mining Law, local governments are responsible for the issuance of permits for small scale mining and quarrying operations through the Provincial/City Mining Regulatory Board. In the issuance of Environmental Compliance Certificate, local governments actively participate in the process by which the communities reach an informed decision on the social acceptability of a project. They also participate in the monitoring of mining activities as member of the Multi-partite Monitoring Team and the Mine Rehabilitation Fund Committee. They can also act as mediator between the indigenous cultural communities and the mining contractor if the need arises.

Local government are also recipients of social infrastructures and community development projects for the utilization and benefit of the host and neighboring communities. In the implementation of the Mining Act and its implementing rules and regulations, local governments coordinate and extend assistance the Department of Environment and Natural Resources and the Mines and Geosciences Bureau.

Description of the Philippine Properties (Raval Mining Claim)

As at August 31, 2014 the properties consisted of three mining claims covered by Lode Lease Contract Nos. V-319, V-425, and V-521, expiring in 2014, with a total area of twenty-four hectares. Names of the mines are “Pabling”, “Alice”, and “Namalitocan”, respectively.

As mentioned above, on October 15, 2014, we entered into a Mining Concession Asset Acquisition Agreement with Paladino Mining and Development Corp. Pursuant to the Agreement, the Company has acquired 40% ownership of Paladino.

It is the intention of the company to expand operations considerably we are estimating to spend about $300,000 to $500,000 in the exploration and development of the mines. These funds will be used to construct a building and acquire the equipment and install a crusher, this is necessary to not only increase production but also to refine the feldspar mineral so the product can be used for “clear glass” production, as well as connection of power supply to the grid.

Extraction of the feldspar ore will be through the open-cut mining method using backhoes and pay loaders. Due to the favorable geological terrain, only the clearing of the vegetation and over-burden is necessary to expose the raw material. Under existing conditions of the mines, it will take only one week to expose the feldspar ore. The mining operation will start where the feldspar deposits are already exposed. As the extraction advances, overburden is stripped and soil and other waste materials are set aside for future backfilling of mined-out areas. Extracted ore is then loaded onto dump truck for transfer to the crushing plant. A total of $100,000 will be required to develop the mine and extract an initial 12,000 metric tons.

The crushing plant is necessary to process the ore into customer-required granule sizes. The main equipment used is mechanized crushers and vibrating screens.

In the mine claim areas, Initial source of power is through the use of generator sets. Ground water is available through deep wells. Electrical power thru the local utility is available but may take up to 3 months to hook up. Generators will be used as back power source.

Feldspar Market

Major users of feldspar are: for glass, Asahi Glass Phils. (formerly Republic Glass), San Miguel Yamamura Packaging Corp., Asia Brewery, Arcya Packaging; for ceramics, HCG and Royal Tern sanitary wares and Mariwasa tiles.

Both Royal Tern and San Miguel have expressed dismay with the local supply in terms of quality and reliability. Most suppliers are small-scale miners lacking proper processing equipment. The sole supplier of San Miguel is the only one with processing equipment acquired for then Republic Glass in the 1990 ’ s. Their equipment has now become unreliable, and Asahi Glass remains the priority for delivery. Further, they are affected by an internal dispute among stakeholders. While Royal Tern is already importing part of its requirements, San Miguel has indicated they may also do so if the local supply situation does not improve.

From 11,850 MT per year in 2005, domestic production of feldspar has increased to 16,394 MT as of 2009. Delivered price of feldspar is about Php 2,100 to 2,700 per metric ton (USD 48 to 62).

Competion: Except of the purchase order from Royal Tern, dealings with other customers are at an accreditation and negotiation stage with corresponding non-disclosure agreements. We have several interested customers and therefore do not believe that we will be dependent upon any one customer for success. We will not sign any supply agreements until our operations are underway.

SAN MIGUEL YAMAMURA Glass – Due to current supply problems, SMYPC is actively sourcing additional suppliers to augment or replace their current sole supplier. Total potential volume is 1,800MT per month. Last January 2011, Pah-Hsu-Qhuin Mining submitted a Letter-of-Intent to supply SMYPC with feldspar.

| 11 |

Peruvian Property

on June 23, 2014, Aim Exploration, Inc. entered into a Mining Concession Asset Acquisition Agreement (the “Agreement”) with Percana Mining Corp. (“Percana”). Pursuant to the Agreement, the Company has acquired three separate mining concessions. Two of the concession titles are unencumbered and these make up 40% of the mining concessions. These two concessions are known as El Tunel Del Tiempo 1 code 11060780 and El Tunel Del Tiempo 2 code 11060781, and the registered ownership of these two concessions have been transferred to the Company. The third concession property known as Agujeros Negros MA-AG which makes up the remaining 60% has not yet been transferred to the Company, however the Company has entered into a Contract of Mining Assignment and Option to Purchase the concession for a five year term. This contract provides AIM with full rights and authorities over the concession.

In consideration for the above concessions, the Company has issued 15,750, 000 common shares to Percana in two separate blocks; the first block consists of 6,300,000 common shares which are to be held in escrow until either the Company raises $1,000,000 or when Percana waives this requirement. The second block consists of 9,450,000 shares which are to be held in escrow until such time as the Company is satisfied at its discretion that any arbitration issues have been resolved with the third concession, at which time the shares may be released out of escrow at the option of Percana. These Mining Concessions were acquired based on the assumption the properties are rich in high grade Anthracite Coal, currently there are 20 small tunnels on the property already producing anthracite coal which was being mined by illegal miners. Testing of the coal samples was performed indicating the presence of high-grade anthracite coal. Prior to acquisition AIM reviewed a non-compliant technical report prepared by Engineers/Geologists together with hiring a US based firm Gustavson Associates to visit the property and review the reports. The firm provided AIM with a report, which included recommendation for further exploration.

The Peruvian Property consists of three separate mining concessions , all are within one contiguous block of property, and all three concessions are located in the Province of Otuuzco, La Libertad region. The formal transfer for two of the mining concessions known as El Tunel del Tiempo 1 (Unique code # 01-0209106 – 200 hectares) and El Tunel del Tiempo 2 (Unique code # 01-0209206 – 200 hectares) was executed August1, 2014 and made into public deed on August 5, 2014 within the Peruvian Public Registries.

The third mining concession , known as Agujeros Negros MA-AG (unique code # 01-0184000 – 600 hectares is under contract with AIM, the Contract of Mining Assignment and Option to Purchase was executed on August 1, 2014 and was made into a Public Deed on August 5, 2014. By the Assignment and Option AIM has an irrevocable and exclusive option to purchase 100% of the rights and interests of this mining concession. This option was registered into public deed on August 5, 2014. The option to purchase is for 5 years from the date of registration which was completed Oct 2, 2014, in addition contained within the contract AIM has complete control over this mining concession for a period of 5 years following formal registration which was registered October 2, 2014.

The reason this concession was not formally transferred is the fact that AIM wanted to perform additional due diligence as there was an Arbitration process with the registered owners and the former concession owners of 80% of the concession. Subsequent to this time the former owners who commenced the arbitration process has abandoned the arbitration thus nullifying the process. AIM has now commenced the formal transfer process and it is expected to be completed and registered prior to AIM fiscal year ending August 31, 2015.

Royalties

The combined concessions are known as “The Black Hole”, the first two concessions, El Tunel del Tiempo 1 & 2 do not have royalties payable. The third concession, Agujeros Negros WA-AG has a royalty consisting of payment of US $1.00 per each metric ton of anthracite coal extracted from and sold. The royalty applies from the time when the sales of anthracite coal reach US$150,000.00

Process Whereby Mineral Rights Are Acquired in Peru (Peruvian System of Concessions)

In Peru, any individual or company can solicit (through a “Petition” to the Government, the grant of a mining concession. Through an administrative process at INGEMMET, (the geological Mining and Metallurgical Institute), when all technical and legal requirements are complied with, the Government grand the mining concession. The mining concession grants the titleholder the right to explore, exploits, process, transport, market and refine mineral whether it is metallic, non-metallic or coal mineral. Once the concession is granted it must be registered at the Public Registries and the concession titleholder can freely transfer, assign, encumber or exercise over it any kind of disposition act.

A mining concession in Peru does not have duration of time limit. However, it carries an obligation to pay annual Validity fees to prevent cancellation from the Government as in Peru the nature of a mining concession entails a duty for its development and production in order to grant it added value. In the General Regime this is for medium and large mining, the payment of validity fees is US$ 3.00 per hectare per year.

Rights and Obligations: Concession titleholder’s rights

·

The properties are all located on vacant land, and vacant land properties are entitled to the free mining use of the surface land that corresponds to the concession and outside of it, for its economic advantage without the need for any additional request, however that being said the titleholder does not have the right for the use of surface land without formal consent, the properties are owned by the government and for a total fee of approx. US$15,000.00 the surface rights are readily available to AIM.

·

The right to request from the mining authorities easements of third party land that are necessary of the rational use the concession.

·

The right to free trade of extracted minerals provided they have the respective permits and authorizations

·

To build on neighboring concessions the labor work that is necessary for the access, ventilation and drainage of their own concession, mineral transport and safety of the workers

·

The right to use the water that is necessary for the domestic service of the staff workers and for the operations of the concession, in accordance with the legal provisions for these matters

·

The right to inspect the work of neighboring or adjacent mining concessions when invasion is suspected or when there is danger of flooding, collapse or dire due to the bad state of the labor work of the neighbors or adjacent for the work they are carrying out

| 12 |

Duties of the Concession titleholders:

·

Validity fee payment, due June 30th every year US$ 3.00 per hectare, if not paid for two years concession returns to the Government fee to be paid for by AIM

·

Payment of penalty fees if not in production US$6.00 per year up to year seven increasing to US$20.00 per year form year 12. Failure to pay for two years the concession reverts to the Government – fee to be paid for by AIM

·

Follow the occupational health and safety provided for in Regulations of Occu pational Health and Safety

·

Follow the Environment Management Instruments

We confirm the Environmental Management permits are currently being applied for and we expect to have these in place within the ensuing six months.

Peruvian Property Location

The property is accessible by standard vehicles; all roadways are drivable with the roadways being paved and or gravel roadways. The driving time is approx. 3 hours from the city of Trujillo Peru. In addition there is roadway running through the property making it feasible for exploration and drilling.

The entire property consists of 1,000 hectares.

The official location of the property is:

·

Republic:

Peru

·

Department:

La Libertad

·

Province:

Otuzco

·

District

:

Huaranchal

·

Spot:

Between Huayobamba and Lajon

Figure 1 is a map that shows the location of the project and the surrounding area. The coordinates near the centroid of the property are 7° 44’ 13.06” S and 78° 31’ 05.87” W. The property is 1,000 hectares and are all with one contiguous block of property.

| 13 |

↑North

Note: This location map is copied from a previous geological report done for the property by MTC and the map was completed in May of 2012.

Figure 1 Property Location

| 14 |

Geology

The geology in the area of the property and surrounding areas in general have a regional stratigraphy, composed in large percentage of sequences of Mesozoic sedimentary rocks ranging from Jurassic in the western sector, then the Lower Cretaceous superior and in the northwest-northeast with Tertiary volcanic sequences, which cover much of the region, and the upper most are alluvial deposits from the recent Quaternary. There are also some Tertiary intrusive bodies that outcrop in the southwest area of the region.

The local geology for the property consists of sedimentary units, corresponding to the Chimu Chicama formations, Santa, Carhuaz and Farrat, and the Alto Chicama River basin is characterized by outcrops of Mesozoic rocks that have the have major folding and fracturing. This folding is apparent in the Jurassic sedimentary rocks (Chicama formation) at lower levels near the Alto Chicama River. Chicama Formation is characterized by the presence of dark gray shales with interbedded sandstones, and slate gray tuffaceous quartz at some levels. The Chimu Formation is present in most of the study area, and is the most noticeable towards the south west and Chicama formation is exposed near the river. These formations are important because this is the horizon in the area of greatest interest because of the presence of coal seams and in some cases have the presence of sub-anthracite and anthracite, occurring with some areas as "lenses" in the bituminous coal. The following is the sedimentary sequence; sandstones, siltstones, shales, and black shales (Cobbing et al., 1996: 73-74). The two formations are exposed mostly in streams and Quina Shangala (erosional cut within the property), covering most of the local area. The Santa and Carhuaz formations, are not fully differentiated in the study area, having found areas with shales, siltstones, limestones, sandstones, quartzites and in some sectors they have small "lenses" of bituminous coal, but are of smaller magnitude. In summary these formations, especially the formation Chimú, are of great interest, as possible sources for economic development for the "Black Holes Property".

There are granodioritic intrusive rocks that outcrop in the form of stocks, with the presence of a large intrusive towards the left of the village of Lajon (northwest corner of the property). This area is heavily disturbed and altered, and has the presence of metallic minerals, which is an association of the coal deposits of the basin Chicama (usually Au.).

These various Shangala features (used in sampling activities) are essentially a creek that dissects perpendicular to the outcrops surrounding the river Alto Chicama, both sectors have significant levels of bituminous coal, quite broken, which could be of value in the economic exploration to exploitation of the property.

The oldest rocks in the prospect of coal formations are the Upper Jurassic Chicama and overlie rocks of the Chimu formation, this being the one with the anthracite coal and sub-anthracites plus it includes other sedimentary horizons with bituminous coal. These formations and especially above the village of Chimú is of great interest as a source of possible development of the mining project because they are the carriers of coal in the area and this is this geological unit which covers 80% of thearea.

The studies done by MTC and later by Gustavson are not done to NI43-101 or coal industry standards to report resources and reserves. The property is currently without known reserves and current and and planned exploration programs are exploratory in nature.

Current and planned exploration:

The previous work completed on or near the property has focused on geologic mapping and sampling via trenches at the outcrop areas and in old, existing tunnels. There are active small mining operations on the northwest area of the property that has also added information on the quality of the coal from the property.

The property’s evaluation and database will be greatly improved by a program of additional geologic mapping, trenching and most of all by completing 3-4 drill holes that provide core for sampling and testing, but also will be an important guide to the structure of the coal deposits. More drill holes are requires to define resources; the first suggested drilling program may define the need for additional drill holes due to the structural complexity of the coal beds.

| 15 |

Figure 2 shows many relevant features of the property. The map is very busy so some explanation is required.

Note: this figure is also from the MTC Report of 2012 and shows many features of the property that are describe and explained in the text of this report.

Figure 2 Property Map showing Site Specific Features

| 16 |

The outline of the property is shown by a lavender line which defines a rectangle shape that is extended to the south. There is no north arrow, but there are grid lines that show north-south and east-west. The Alto Chicama River is in the south (bottom) of the figure and the features, some with red markings that cross the property in a northeast to southwest direction are the features referred to as Shangalas. The small black marks towards the northwest are the small mines mentioned above.

The main feature from Figure 2 that will aid the exploration and drilling effort is the existing road that crosses the center of the property and is shown as a light blue, meandering line. The importance of this existing road is that it will give easy access to the center of the property where the proposed drill holes can be located. The coal deposits proposed to define first are south of the road and by setting up at various locations along the road and drilling at an angle towards the south will provide the best possibility to intersect and sample the coal seams. Four drill holes along the road can be spaced to provide data points to define some resources as Indicated. The exact drill sites will be defined in a combination of future site visits and geologic mapping, which is the first phase of exploration.

The cost and timing for the Phase I of drill hole siting and mapping is estimated at about $35,000 and will be started as soon as AIM has the necessary funds, the process is expected to take approximately 10 days. The planning for Phase 2, drilling, sampling, analysis and possible more trenching is estimated at $350,000 to include a drilling contractor, geologic support, sample analysis and reporting and could complete the 4 drilling program in 6 weeks. This data provided by Phase 1 and Phase 2 could then be utilized to develop a NI43-101 Resource Report and possible a Preliminary Economic Assessment (PEA).

The cost and timing for the required permitting for the property is as follows:

| COSTS BREAKDOWN | ||

| DESCRIPTION | COSTS $ | TIME |

| 1. ENVIRONMENTAL IMPACT STUDY | 50,000 | 6 months |

| Conceptual hydrological and hydrogeological study | 25,000 |

|

| 2. START OF MINING OPERATIONS |

| 4 months |

| Authorization of the surface land (titleholder) Mine plan Detailed Ventilation Study Detailed Geomechanics Study Seismic risk studies Design of explosives storage Occupational Health and Safety Plan Design of tailings storage | 14,999 15,000 10,000 10,000 7,000 2,000 2,000 15,000 |

|

| 3. CLOSURE PLAN | 35,000 | 4 months |

| 4. PREPARATION OF FILE OF WATER USE ISSUED BY ANA | 7,000 | 1 month |

| 5. PREPARATION OF FILE FOR DISPOSAL OF WATER (DIGESA AND ANA) | 5,000 | 1 month |

| 6. LEGAL COSTS ASSOCIATED TO OBTAIN ALL THE AFOREMENTIONED PERMITS | 50,000 | Throughout the process |

| TOTAL COSTS $ 247,999 | ||

Summary

Gutavson Associates based out of Boulder Colorado provided the technical information on the Peruvian property. Gustavson Associates is a mining consulting firm with over 30 years of extensive international experience. Mr. Karl D. Gurr of Gustavson Associates completed a site visit of the property together with visiting the Port of Salaverry located in Trujillo Peru and has reviewed numerous reports. Mr. Karl Gurr is a Registered Member of the Society of Mining Engineers and has degrees in Geology and Mining Engineering with over 25 years of direct experience in the coal industry, which defines Mr. Gurr’s status as a qualified person. As stated Mr. Gurr performed a property visit and a visit to the Port of Salaverry and confirms that the property is a known coal bearing area with sufficient past geologic study to merit additional work (exploration) to better define coal resource and eventually a plan for mining the resource. Any further exploration will be overseen and supervised by or through Mr. Gurr and will be focused on providing additional information to advance the project and to do it in a cost effective manner. Mr. Gurr has confirmed the infrastructure and property access already exists and the Port of Salaverry has the capability to store and ship the produced coal .

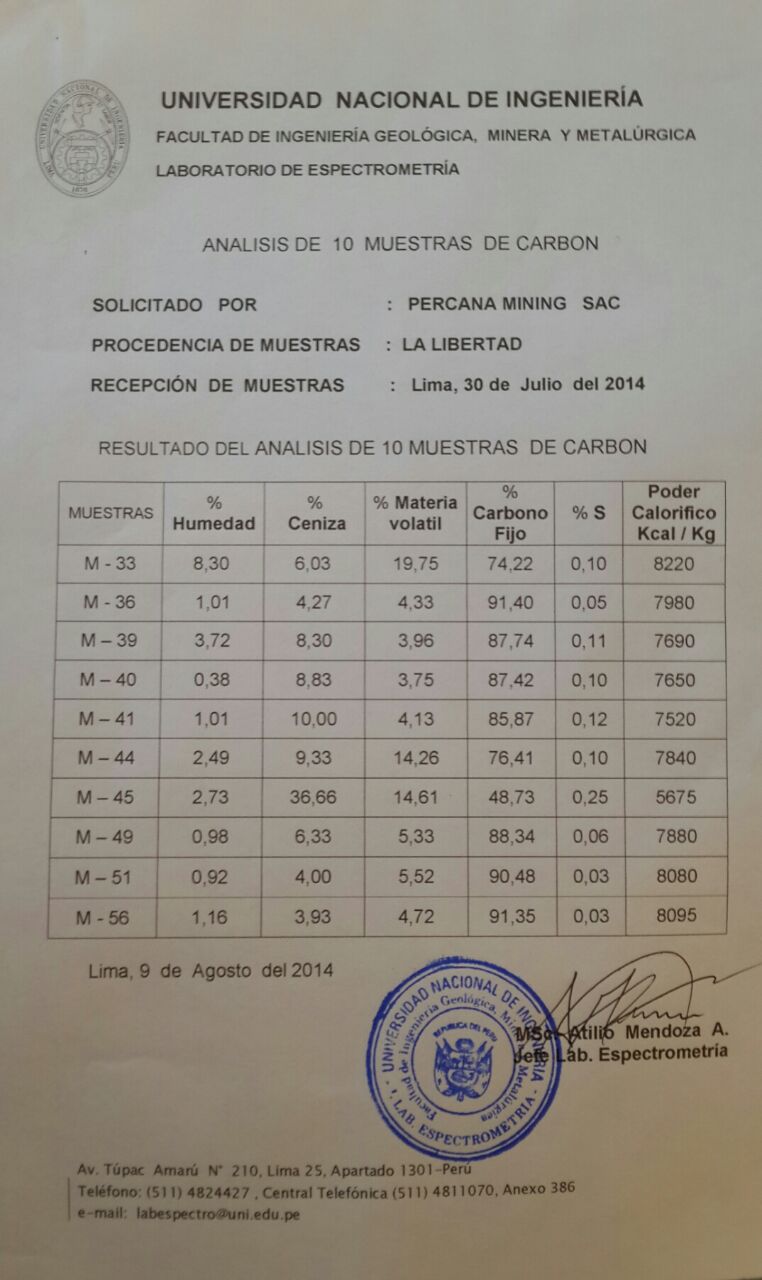

In addition to Mr. Gurr’s visit we solicited the efforts of a Mining Engineer/Geologist Mr. Manuel Chumpitaz Cama. Mr. Cama has known the property for many years and he attended to extractive of coal samples from various mine tunnels within the property. Through the supervision of Mr. Cama samples of coal were taken from the property and delivered to the local university lab for testing. Following is the official results of the testing.

The legal and permitting information was provided to AIM by their team of Peruvian legal advisors based in Lima Peru.

| 17 |

Analysis of Coal Samples

The table below shows the result of an analysis of coal samples obtained from Aim’s property in July 2014, the analysis was completed through the University in Peru.

| 18 |

WE WILL REQUIRE SIGNIFICANT ADDITIONAL FINANCING IN ORDER TO CONTINUE OUR EXPLORATION ACTIVITIES AND OUR ASSESSMENT OF THE COMMERCIAL VIABILITY OF OUR PROPERTIES. EVEN IF WE DISCOVER COMMERCIAL RESERVES OF PRECIOUS METALS ON OUR MINERAL PROPERTY, WE CAN PROVIDE NO ASSURANCE THAT WE WILL BE ABLE TO SUCCESSFULLY ADVANCE INTO COMMERCIAL PRODUCTION .

While we are very optimistic the properties contain minerals we are not sure. Our business plan calls for significant expenditures in connection with the exploration of the property. We will, however, require additional financing in order to complete the remaining phases of the exploration program, and to conduct the economic evaluation that would be necessary for us to assess whether sufficient mineral reserves exist to justify commercial exploitation. We currently are in the exploration stage and have no revenue from operations. We currently do not have any arrangements in place for additional financing, and we may not be able to obtain financing on terms that are acceptable to us, or at all. If we are unable to obtain additional financing, we will not be able to continue our exploration activities and our assessment of the commercial viability of the property. Further, if we are able to establish that development of the property is commercially viable, our inability to raise additional financing at this stage would result in our inability to place the property into production and recover our investment.

| 19 |

Competition

We are a junior mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

As at August 31, 2014, we had cash reserves of $1,862 and working capital deficit of $182,346. We do not have sufficient funds to enable us to complete this initial phase of our exploration programs for the mining claims. We will require additional financing in order to commence the initial phases of exploration of the properties. There is no assurance that will be able to obtain additional financing. Both advanced exploration and an economic determination will be contingent upon the results of our preliminary exploration programs and our ability to raise additional financing in order to proceed with advanced exploration and an economic evaluation. There is no assurance that we will be able to obtain any additional financing to fund our exploration activities.

Patents, Trademarks, Franchises, Royalty Agreements or Labor Contracts

We have no current plans for any registrations such as patents, trademarks, copyrights, franchises, concessions, royalty agreements or labor contracts. We will assess the need for any copyright, trademark or patent applications on an ongoing basis.

Research and Development

We have not spent any amounts on research and development activities during the year ended August 31, 2014. We anticipate that we will not incur any expenses on research and development over the next 12 months. Our planned expenditures on our operations or a business combination are summarized under the section of this annual report entitled “Management’s Discussion and Analysis of Financial Position and Results of Operations”.

Employees and Employment Agreements

At present, we have no employees other than our President and CEO/Director. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no personal benefits available to any officers, directors or employees.

| 20 |

Item 1A. Risk Factors

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

We do not currently own any property or real estate of any kind. Our executive offices are located at 701 North Green Valley Parkway, Suite 200, Henderson Nevada, 89012.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

Not applicable.

| 21 |

PART II

Item 5.

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained. A shareholder in all likelihood, therefore, will not be able to resell his or her securities should he or she desire to do so when eligible for public resales.

Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops. We would like to register our shares for resale by our selling stockholders and then obtain a trading symbol to trade our shares over the OTC Bulletin Board. However, there is no assurance that we will be successful in getting our common stock quoted on the OTC Bulletin Board.

Number of Holders

As of December 15, 2014, we had approximately 49 shareholders of record of our common stock.

Dividend Policy

We have not declared any cash dividends on our common stock since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Other than as disclosed below, we did not sell any equity securities which were not registered under the Securities Act during the year ended August 31, 2014 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended August 31, 2014.

Equity Compensation Plan Information

We do not have in effect any compensation plans under which our equity securities are authorized for issuance and we do not have any outstanding stock options.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended August 31, 2014.

| 22 |

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with our financial statements, including the notes thereto, included in this Report. Some of the information contained in this Report may contain forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933, as amended (the “Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. These forward-looking statements are based on assumptions that may be incorrect, and there can be no assurance that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward looking statements as a result of various factors. We undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the next twelve months.

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period (although we may enter into employment or consulting agreements with our officers or directors). We do and will continue to outsource contract employment as needed.

Results of Operations for the Fiscal Year Ended August 31, 2014 compared to the Fiscal Year Ended August 31, 2013 and the Period from February 18, 2010 (Inception) to August 31, 2014

We did not earn any revenues for the period from February 18, 2010 (Inception) to August 31, 2014. We incurred operating expenses in the amount of $183,032 during the fiscal year ended August 31, 2014, compared to operating expenses of $47,901 for the fiscal year ended August 31, 2013. These operating expenses were comprised of mineral property expenditures of $80,084 (2013-$nil), filing fees of $11,664 (2013-$nil), office and general fees of $38,446 (2013 - $19,154), professional fees of $52,838 (2013 - $26,712), and imputed interest of $Nil (2013 - $2,035). From the period from February 18, 2010 (Inception) to August 31, 2014, we incurred total operating expenses of $307,381. These operating expenses were comprised of mineral property expenditures of $80,084, filing fees of $11,664, office and general fees of $65,349, professional fees of $144,914, imputed interest of $2,035, and an impairment of an investment of $3,335. The professional fees consist of the expenses associated with this offering such as legal, accounting and auditing fees.

Revenues

We have had no operating revenues since our inception on February 18, 2010 to August 31, 2014. We anticipate that we will not generate any revenues for so long as we are an exploration stage company.

| 23 |

Expenses

We incurred operating expenses in the amount of $183,032 during the fiscal year ended August 31, 2014, compared to operating expenses of $47,901 for the fiscal year ended August 31, 2013. These operating expenses were comprised of mineral property expenditures of $80,084 (2013-$nil), filing fees of $11,664 (2013-$nil), office and general fees of $38,446 (2013 - $19,154), professional fees of $52,838 (2013 - $26,712), and imputed interest of $Nil (2013 - $2,035). From the period from February 18, 2010 (Inception) to August 31, 2014, we incurred total operating expenses of $307,381. These operating expenses were comprised of mineral property expenditures of $80,084, filing fees of $11,664, office and general fees of $65,349, professional fees of $144,914, imputed interest of $2,035, and an impairment of an investment of $3,335. The professional fees consist of the expenses associated with this offering such as legal, accounting and auditing fees. The office and general expenses consists of utilities, insurance and office supplies.

Liquidity and Capital Resources

As at August 31, 2014, we had cash reserves of $1,862 and working capital deficit of $182,346. As at August 31, 2013, we had cash reserves of $8,146 and working capital deficit of $54,314.

Cash Used in Operating Activities

Net cash used in operating activities was $149,378 during the fiscal year ended August 31, 2014, compared to $42,532 for the fiscal year ended August 31, 2013. From the period from February 18, 2010 (Inception) to August 31, 2014 we used net cash of $239,619 in operating activities.

Cash from Financing Activities

We have funded our business to date primarily from sales loans from related parties, as well as sales of our common stock. During the fiscal year ended August 31, 2014, we raised a total of $143,094 in financing activities. This was comprised of a loan from our director and key management personnel of $143,094. During the fiscal year ended August 31, 2013, we raised a total of $29,887 in financing activities. From our inception, on February 18, 2010, to August 31, 2014, we have raised a total of $241,481 from financing activities, including $68,000 from the sale of our common stock and $173,481 in loans from a director and key management personnel.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

We have not attained profitable operations and are dependent upon obtaining financing to pursue marketing and distribution activities. For these reasons, there is substantial doubt that we will be able to continue as a going concern.

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Basis of Accounting

Our company’s financial statements are prepared using the accrual method of accounting. The Company has elected an August year-end.

| 24 |

Cash Equivalents

Our company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Stock-Based Compensation

Our company records stock-based compensation in accordance with ASC 718, Compensation – Stock Based Compensation, using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. Equity instruments issued to employees and the cost of the services received as consideration are measured and recognized based on the fair value of the equity instruments issued.

Recently Issued Accounting Pronouncements

Our company has evaluated all the recent accounting pronouncements and believes that none of them will have a material effect on the company’s financial statement.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Item 7A.

Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| 25 |

Item 8. Financial Statements and Supplementary Data

AIM EXPLORATION INC.

(A Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014

Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets of August 31, 2014 and 2013 Consolidated Statements of Operations for the years ended August 31, 2014 & 2013 and for the period from February 18, 2010 (inception) through August 31, 2014 Consolidated Statements of Stockholder’s Equity (Deficit) Consolidated Statements of Cash Flows for the years ended August 31, 2014 and 2013 and for the period from February 18, 2010 (inception) through August 31, 2014 Notes to Consolidated Financial Statements

F-1 F-2 F-3 F-4 F-5 F-6

26

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Stockholders and Board of Directors

AIM Exploration, Inc.

(An Exploration Stage Company)

We have audited the accompanying consolidated balance sheets of AIM Exploration, Inc., (An Exploration Stage Company) as of August 31, 2014 and 2013, and the related consolidated statements of operations, stockholders' equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit. The cumulative consolidated statements of operations, stockholders' equity and cash flows for the period from February 18, 2010 (inception) to August 31, 2014 include amounts for the period from February 18, 2010 (inception) through August 31, 2013 which were audited by other auditors whose report has been furnished to us, and our opinion, insofar as it relates to the amounts included for the period from February 18, 2010 (inception) to August 31, 2013 is based solely on the report of the other auditors.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of AIM Exploration, Inc., ( An Exploration Stage Company) as of August 31, 2014 and 2013, and results of its operations and its cash flows for the years ended August 31, 2014 and 2013, and for the period from inception (February 18, 2010) to August 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 3 to the consolidated financial statements, the Company has suffered a loss from operations and is in the exploration stage. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to this matter are also discussed in Note 3. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ David A. Aronson, CPA, P.A.

--------------------------------------------

David A. Aronson, CPA. P.A.

North Miami Beach, Florida

December 15, 2014

| F-1 |

AIM EXPLORATION INC.

(A Exploration Stage Company)

CONSOLIDATED BALANCE SHEETS

|

| ||

| ASSETS | Aug 31, 2014 | Aug 31, 2013 |

| CURRENT ASSETS | ||

| Cash | $ 1,862 | $ 8,146 |

| Deposits | 25,505 | 0 |

| Total Current Assets | 8,146 | |

| Mineral property | 326,969 | 0 |

| TOTAL ASSETS | $ 8,146 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||

| CURRENT LIABILITIES | ||

| Accounts payable and accrued liabilities | $ 26,232 | $ 22,073 |

| Loans from Related Party | 183,481 | 40,387 |

| Total Current Liabilities | 62,460 | |

|

|

|

|

| Provisions | 55,000 | 0 |

| TOTAL LIABILITIES | 62,460 | |

| STOCKHOLDERS' EQUITY (DEFICIT) | ||

| Capital Stock (Authorized 250,000,000 shares of common stock, $.001 par value; | 83,750 | 68,000 |

| Additional paid in capital | 313,254 | 2,035 |

| Deficit accumulated during the exploration stage | (307,381) | (124,349) |

| TOTAL STOCKHOLDERS' EQUITY (DEFICIT) | (54,314) | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | $ 8,146 |

The accompanying notes are an integral part of these consolidated financial statements

F-2

AIM EXPLORATION INC.

(A Exploration Stage Company)

CONSOLIDATED STATEMENTS OF OPERATIONS

| 12 months ended | 12 months ended | Cumulative results from inception | |

| REVENUE | |||

| Total Revenue | |||

| Gross Profit | 0 | ||

| MINERAL PROPERTY OPERATIONS |

|

|

|

| Acquisition expenses | 55,000 | - | 55,000 |

| Exploration expenses | 25,084 | - | 25,084 |

| Total Mineral Property Operations | 80,084 | - | 80,084 |

|

|

|

|

|

| EXPENSES | |||

| Filing Fees | 11,664 | - | 11,664 |

| Office & General | 19,154 | ||

| Loss on impairment | - | - | 3,335 |

| Professional Fees | 52,838 | 26,712 | 144,914 |

| Total Expenses | 45,866 | ||

| Net Income (Loss) | (45,866) | ||

| Interest expense | - | (2,035) | (2,035) |

| Total Other Income | (2,035) | (2,035) | |

| Net Income (Loss) | $ (47,901) | ||

| BASIC AND DILUTED LOSS PER COMMON SHARE | $ 0.00 | $ 0.00 |

|

|

| |||

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | 83,750,000 | 64,252,055 |

|

The accompanying notes are an integral part of these consolidated financial statements

F-3

AIM EXPLORATION INC.

(A Exploration Stage Company)

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

Common Stock Number of shares Amount Additional Paid-in Capital Accumulated Deficit Total $ $ $ $ Balance at inception – February 18, 2010 Founders shares, issued for cash - 10,000,000 - 10,000 - - - (10,000) - - - - Net Loss to August 31, 2010 - - - - (29,400) (29,400) Balance, August 31, 2010 10,000,000 10,000 - (10,000) (29,400) (29,400) Subscription Received Common stock issued for cash Net loss for the year ended August 31, 2011 - 40,000,000 - - 40,000 - - - - 10,000 - - - - (18,939) 10,000 40,000 (18,939) Balance, August 31, 2011 50,000,000 50,000 - - (48,339) 1,661 Net loss to August 31, 2012 – – - - (28,109) (28,109) Balance, August 31, 2012 50,000,000 50,000 - - (76,448) (26,448) Sale of common stock 18,000,000 common shares at $0.001 par value 18,000,000 18,000 - - - 18,000 Imputed Interest - - 2,035 - - 2,035 Net loss for the year ended August 31, 2013 - - - - (47,901) (47,901) Balance, August 31, 2013 68,000,000 68,000 2,035 - (124,349) (54,314) 15,750,000 common shares at $0.001 par value 15,750,000 15,750 311,219 - - 326,969 Net loss for the year ended August 31, 2014 - - - - (183,032) (183,032) Balance, August 31, 2014 83,750,000 83,750 313,254 - (307,381) (89,623)

Share Subscriptions Receivable

The accompanying notes are an integral part of these consolidated financial statements

F-4

AIM EXPLORATION INC.

(A Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

12 months ended 12 months ended Feb 18, 2010 OPERATING ACTIVITIES Net Loss $ (183,032) $ (47,901) $ (307,381) Imputed Interest - 2,035 2,035 Adjustments to reconcile Net Income (Loss) to net Deposits (25,505) (25,505) Accounts Payable 4,159 3,334 36,232 Provisions 55,000 - 55,000 NET CASH PROVIDED BY (USED IN) (42,532) (239,619) FINANCING ACTIVITIES Proceeds from sale of common stock - 18,000 68,000 Loans from Related Party 143,094 29,887 173,481 NET CASH PROVIDED BY FINANCING ACTIVITIES 47,887 NET INCREASE (DECREASE) IN CASH (6,284) 5,355 CASH, BEGINNING OF PERIOD 2,791 CASH, END OF PERIOD $ 8,146

Aug 31, 2014

Aug 31, 2013

(date of inception) to Aug 31, 2013

Cash used in operating activities:

OPERATING ACTIVITIES

The accompanying notes are an integral part of these consolidated financial statements

F-5

AIM EXPLORATION INC.

(A Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014

NOTE 1 – NATURE OF OPERATIONS AND BASIS OF PRESENTATION

Aim Exploration, Inc. (“Company”) is an exploration stage company as defined by FASB ASC 915. The Company was organized to engage in mineral exploration and has incurred losses totaling $307,381 since inception. The Company was incorporated on February 18, 2010 in the State of Nevada and established a fiscal year end at August 31.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements present the consolidated balance sheets, consolidated statements of operations, consolidated stockholders' equity (deficit) and consolidated cash flows of the Company. These financial statements are presented in United States dollars and have been prepared in accordance with accounting principles generally accepted in the United States.

Principles of Consolidation

The consolidated statements incorporate the financial statements of the Company and its wholly-owned subsidiary, Aim Exploration SA, of Peru. All significant intercompany accounts and transactions have been eliminated in consolidation.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers highly liquid financial instruments purchased with a maturity of three months or less to be cash equivalents. There were no cash equivalents at August 31, 2014 or 2013.

Advertising

Advertising costs are expensed as incurred. As of August 31, 2014, no advertising costs have been incurred.

Property

The Company does not own or rent any property. The Company’s office space is being provided by the president at no charge to the Company .

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

The Company follows the liability method of accounting for income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax balances. Deferred tax assets and liabilities are measured using enacted or substantially enacted tax rates expected to apply to the taxable income in the years in which those differences are expected to be recovered or settled. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the date of enactment or substantive enactment.

F-6

AIM EXPLORATION INC.

(A Exploration Stage Company)

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2014

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Exploration-Stage Company

The Company is considered an exploration -stage company, having limited operating revenues during the period presented, as defined by the FASB standard. This standard requires companies to report their operations, shareholders’ deficit and cash flows since inception through the date that revenues are generated from management’s intended operations, among other things. Management has provided financial data since February 18, 2010, “Inception,” in the financial statements. Since inception, the Company has incurred a net loss of $307,381. The Company’s working capital has been generated through the sale of common stock and shareholder loans.

Fair Value of Financial Instruments