Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 17, 2015

ZAIS Group Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-35848 | 46-1314400 | ||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

Two Bridge Avenue, Suite 322

Red Bank, New Jersey 07701

(Address of Principal executive offices, including Zip Code)

(732) 530-3610

(Registrant’s telephone number, including area code)

HF2 Financial Management Inc.

999 18th Street, Suite 3000, Denver, Colorado 80202

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Introductory Note

On March 17, 2015 (the “Closing Date”), the registrant consummated the previously announced business combination (the “Business Combination”) between the registrant and ZAIS Group Parent, LLC (“ZGP”) pursuant to the Investment Agreement, dated as of September 16, 2014, as amended on October 31, 2014 and March 4, 2015 (the “Investment Agreement”), by and among the registrant, ZGP and the members of ZGP (the “Founder Members”), which provided for the contribution by the registrant of cash to ZGP in exchange for newly issued Class A Units of ZGP (“Class A Units”) and the transfer of all of the outstanding shares of Class B common stock, par value $0.000001, of the registrant (the “Class B Common Stock”) to the Founder Members on a pro rata basis, and the immediate contribution of the Class B Common Stock to a newly created irrevocable trust (the “Trust”) of which Mr. Christian Zugel, the founder, Chief Investment Officer and former Managing Member of ZGP, is the sole trustee (the “Trustee”).

In connection with the closing of the Business Combination, the registrant changed its name from HF2 Financial Management Inc. to ZAIS Group Holdings, Inc. (the “Company”).Unless the context otherwise requires, “we,” “us,” “our,” and “ZAIS” refer to the combined company and its subsidiaries, and “HF2” refers to the registrant prior to the closing of the Business Combination. References to "ZGP" are to pre- and post-Business Combination and thereafter.

Item 1.01. Entry into a Material Definitive Agreement.

Amended and Restated LLC Agreement

On March 17, 2015, the Company, ZGP and the Founder Members entered into an Amended and Restated Limited Liability Company Agreement of ZGP (the “LLC Agreement”). A description of the material terms of the LLC Agreement is included in HF2’s definitive proxy statement on Schedule 14A dated January 29, 2015 (as supplemented, the “Proxy Statement”) in the section entitled “Proposal No. 1—Approval of the Business Combination—Related Agreements—Second Amended and Restated Limited Liability Company Agreement” and is incorporated herein by reference. The description of the LLC Agreement does not purport to be complete and is qualified in its entirety by the text of the LLC Agreement, as amended. The LLC Agreement is included as Exhibit 10.1 to this Current Report on Form 8-K and the First Amendment to the LLC Agreement, entered into on March 20, 2015, is included as Exhibit 10.2, and both are incorporated herein by reference.

Exchange Agreement

On March 17, 2015, the Company, ZGP, the Founder Members and the Trustee entered into an Exchange Agreement (the “Exchange Agreement”). A description of the material terms of the Exchange Agreement is included in the Proxy Statement in the section entitled “Proposal No. 1—Approval of the Business Combination—Related Agreements—Exchange Agreement” and is incorporated herein by reference. The description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by the text of the Exchange Agreement, which is included as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

Registration Rights Agreement

On March 17, 2015, the Company and the Founder Members entered into a Registration Rights Agreement (the “Registration Rights Agreement”). A description of the material terms of the Registration Rights Agreement is included in the Proxy Statement in the section entitled “Proposal No. 1—Approval of the Business Combination—Related Agreements—Registration Rights Agreement” and incorporated herein by reference. The description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the text of the Registration Rights Agreement, which is included as Exhibit 10.4 to this Current Report on Form 8-K and incorporated herein by reference.

| 1 |

Tax Receivable Agreement

On March 17, 2015, the Company and the Founder Members entered into a Tax Receivable Agreement (the “Tax Receivable Agreement”). A description of the material terms of the Tax Receivable Agreement is included in the Proxy Statement in the section entitled “Proposal No. 1—Approval of the Business Combination—Related Agreements—Tax Receivable Agreement” and incorporated herein by reference. The description of the Tax Receivable Agreement does not purport to be complete and is qualified in its entirety by the text of the Tax Receivable Agreement, which is included as Exhibit 10.5 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The disclosure set forth under “Introductory Note” above is incorporated in this Item 2.01 by reference. The material provisions of the Investment Agreement are described in the Proxy Statement in the section entitled “Proposal No. 1—Approval of the Business Combination—The Investment Agreement,” which is incorporated herein by reference and under Item 1.01 of our Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 4, 2015 which is incorporated herein by reference. In the Business Combination, HF2 contributed approximately $78.2 million to ZGP in exchange for 13,870,917 Class A Units, and all of the Class B Common Stock was transferred from the HF2 Class B Trust to the Founder Members, on a pro rata basis, and immediately contributed by the Founder Members to the Trust. The Business Combination is structured as an “Up-C” transaction.

The Business Combination was approved by HF2’s stockholders at the Special Meeting in lieu of 2014 Annual Meeting of the Stockholders held on March 9, 2015 (the “Special Meeting”). There are 20,000,000 shares of HF2 Class B Common Stock, par value $0.000001 per share (the “Class B Common Stock”), issued and outstanding, and each share of Class B Common Stock is entitled to 10 votes. At the Special Meeting, 20,953,203 shares of HF2 Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) were voted in favor of the proposal to approve the Business Combination and 1,966,300 shares of Class A Common Stock were voted against that proposal. In addition, 182,841,687 votes of Class B Common Stock were voted in favor of the proposal to approve the Business Combination and 17,158,313 votes of Class B Common Stock were voted against that proposal. Pursuant to the Company’s amended and restated certificate of incorporation, shares of Class B Common Stock were voted in proportion to the vote of the shares of Class A Common Stock on the proposal to approve the Business Combination.

In connection with the closing, the Company redeemed a total of 9,741,193 shares of its Class A Common Stock pursuant to the terms of the Company’s amended and restated certificate of incorporation, resulting in a total payment to redeeming stockholders of approximately $102.3 million. In addition, HF2’s founders transferred 3,492,745 shares held by them to d.Quant Special Opportunities Fund, LP, an entity affiliated with Neil Ramsey in connection with the acquisition by Mr. Ramsey of shares of Class A Common Stock that were otherwise tendered for redemption.

As of the Closing Date, there were 13,870,917 shares of Class A Common Stock outstanding, of which the Founder Members owned approximately 3.5%, the HF2 founders owned approximately 11.3% and the pre-closing HF2 public stockholders owned approximately 10.1%.

Prior to the closing, HF2 was a shell company with no operations, formed as a vehicle to effect a business combination with one or more operating businesses. After the closing, the Company became a holding company whose assets primarily consist of interests in its majority-owned subsidiary, ZGP. The following information is provided about the business of the Company reflecting the consummation of the Business Combination.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Company makes forward-looking statements in this Current Report on Form 8-K. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for our business. Specifically, forward-looking statements may include statements relating to:

| • | The benefits of the Business Combination; |

| • | the future financial performance of the Company following the Business Combination; |

| • | expansion plans and opportunities; and |

| 2 |

| • | other statements preceded by, followed by or that include the words “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or similar expressions. |

These forward-looking statements are based on information available as of the date of this Current Report on Form 8-K, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| · | the ability to realize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably; |

| · | the outcome of any legal proceedings that may be instituted against us, ZGP or others following the consummation of the Business Combination; |

| · | the inability to meet the listing standards of and to continue to be listed on The NASDAQ Stock Market; |

| · | the risk that the Business Combination disrupts current plans and operations of us as a result of the announcement and consummation of the transactions described herein; |

| · | costs related to the Business Combination; |

| · | changes in political, economic or industry conditions, the interest rate environment or financial and capital markets, which could result in changes in demand for products or services or in the value of assets under management; |

| · | the relative and absolute investment performance of advised or sponsored investment products; |

| · | the impact of future acquisitions or divestitures; |

| · | the impact, extent and timing of technological changes and the adequacy of intellectual property protection; |

| · | the impact of legislative and regulatory actions and reforms and regulatory, supervisory or enforcement actions of government agencies relating to us; |

| · | terrorist activities and international hostilities, which may adversely affect the general economy, financial and capital markets, specific industries, and us; |

| · | the ability to attract and retain highly talented professionals; |

| · | the impact of changes to tax legislation and, generally, our tax position; and |

| · | other risks and uncertainties set forth in the Proxy Statement in the section entitled “Risk Factors” beginning on page 33. |

Business

Overview

The Company is the holder of a majority of the membership interests of ZGP, whose wholly owned subsidiary is ZAIS Group, LLC (“ZAIS Group”), an alternative asset management company with approximately $4.1 billion of assets-under-management (“AUM”) as of December 31, 2014, focused on specialized credit investments. As an asset manager, ZAIS Group uses its investment expertise to make investments on behalf of the entities that ZAIS Group manages (the “ZAIS Managed Entities”). The ZAIS Managed Entities include two hedge funds that are “open-end” funds, a publicly traded real estate investment trust and structured vehicles such as CLOs and CDOs. ZAIS Group also manages customized managed accounts for its larger institutional clients that are tailored to specified investment parameters and risk preferences. ZAIS Group’s objective is to achieve above average returns for its clients through investing in primarily corporate and mortgage-related fixed income instruments (including residential mortgage backed securities (“RMBS”), commercial mortgage backed securities (“CMBS”), CLOs and residential whole loans, including derivatives of these instruments. Since its inception in 1997, ZAIS Group has built long-term relationships with an international investor base, including public and private pension funds, endowments and foundations, insurance companies, family offices, fund of funds, sovereign wealth funds and investment advisors. ZAIS Group’s AUM is primarily comprised of (i) cash plus aggregate principal balance of investments with respect to certain non-mark-to-market structured vehicles; (ii) cash plus market value of investments with respect to certain structured vehicles; (iii) total assets for mark-to-market funds and separately managed accounts; and (iv) uncalled capital commitments, if any, for funds that are not in liquidation. AUM also includes assets in the warehouse phase for new structured credit vehicles and does not treat leverage and other operating liabilities as a reduction of AUM. ZAIS Group’s December 31, 2014 AUM uses values for: Epics I, Ltd. and Co-Epics I, Ltd. as of December 22, 2014, Euro Epics and Galleria CDO V, Ltd. as of December 10, 2014, ZAIS Investment Grade Limited IX as of December 3, 2014, ZAIS CLO 1, Limited as of December 4, 2014, ZAIS CLO 2 Limited as of December 16, 2014 and ZAIS Financial Corp. as of September 30, 2014.

| 3 |

ZAIS Group’s approach to disciplined and opportunistic credit investing focuses on investing in cash flowing assets and structures that offer liquidity-complexity premiums. ZAIS Group defines the liquidity-complexity premium of a particular instrument as the increased loss-adjusted yield or return relative to a more liquid, less complex instrument of similar risk. ZAIS Group manages complexity with individual and institutional depth of experience and expertise, combined with proprietary analytics. Based in Red Bank, New Jersey, with offices in London and Shanghai, ZAIS Group employs over 120 professionals (subject to reduction upon the termination of business operation in Shanghai as set forth in Item 2.05) across its investment management, client relations, information technology, analytics, law, compliance, risk management and operations as of March 20, 2015. The investment team at ZAIS Group, which includes over 45 investment professionals as of March 20, 2015, is led by Christian Zugel, ZAIS Group’s founder, Chairman and Chief Investment Officer.

ZAIS Group has an established track record of investing through multiple market cycles and believes that its performance across these cycles and the credit spectrum in which it invests is largely attributable to several distinguishing elements of its platform:

| • | Disciplined Investing: ZAIS Group’s disciplined approach to credit investing coupled with robust risk mitigation leads to attractive relative returns for its clients. |

| • | Broad Credit Expertise: ZAIS Group’s proficiency at evaluating every level of the capital structure, in both mortgage and corporate credit assets and related derivative securities, enables ZAIS Group to effectively assess relative value and deploy capital opportunistically in what ZAIS Group views as the most attractive investment opportunities. |

| • | Flexible Approach: ZAIS Group’s significant infrastructure and technical experience allow ZAIS Group to manage various types of investment vehicles, including separate accounts, commingled funds, permanent capital vehicles and structured credit products, depending on the characteristics of the investment opportunity. |

| • | Proprietary Analytics: ZAIS Group’s proprietary analytics and technology platform provide significant capability in evaluating, structuring, and executing investments. |

| • | Experienced and Committed Team: ZAIS Group attracts, develops and retains highly accomplished investment professionals who not only demonstrate deep and broad investment experience, but also display a strong commitment to ZAIS Group. |

Company History

ZAIS Group management’s principal operating strategy throughout ZAIS Group’s 17-year history has been to seek to grow by expanding existing businesses and entering into attractive new businesses. Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those discussed in this Current Report on Form 8-K or will make any profit or will be able to avoid incurring substantial losses. None of the information in this Current Report on Form 8-K constitutes an offer of or solicitation to buy or sell any of ZAIS Group’s products or services, nor is any such information a recommendation for any of ZAIS Group’s products or services. The following lists various new businesses and initiatives that ZAIS Group has implemented since its founding in 1997:

| 4 |

1997

| • | ZAIS Group was formed. |

1999

| • | ZAIS Group issued the first CDO backed solely by mezzanine CDO tranches. |

2000 – 2003

| • | ZAIS Group launched a series of funds primarily focused on distressed CDO securities across the capital structure. |

2002 – 2007

| • | ZAIS Group launched a series of CDO offerings to buy cheap credit with term financing. |

2003

| • | ZAIS Group launched the first Synthetic Global CDO of ABS. |

| • | ZAIS Group launched a hedge fund focused primarily on structured credit employing long/short strategies. |

2004

| • | ZAIS Group took over a CDO of ABS. |

2006 – 2007

| • | ZAIS Group formed a series of funds focused on CLOs, CDO securities and RMBS assets and predominately subordinate and distressed credit. |

| • | ZAIS Group engaged in short RMBS trades through a series of funds. |

| • | ZAIS Group served as collateral manager for a CDO focused on non-agency RMBS assets. |

2007 – 2008

| • | ZAIS Group launched a series of funds and managed accounts that invested in distressed RMBS. |

| • | ZAIS Group formed a series of funds focused on CLO mezzanine and equity tranches. |

2008

| • | ZAIS Group launched a private equity style fund focused on residential mortgage loans. |

2009

| • | ZAIS Group took over a series of funds from the Lehman bankruptcy estate. |

| 5 |

2012 – 2013

| • | ZAIS Group was retained to manage several separately managed accounts to invest in distressed RMBS. |

2013

| • | ZAIS Financial Corp., a publicly traded real estate investment trust for which a subsidiary of ZAIS Group acts as the external manager (“ZFC REIT”), completed its IPO. |

| • | ZAIS Group launched a hedge fund investing in a combined rates/credit strategy. |

2014

| • | ZAIS Group closed two CLOs including the first CLO managed by ZAIS Group. |

Competitive Strengths

With ZAIS Group’s attractive investment track record and established platform poised for continued growth with the availability of new funding to support capital-intensive businesses such as CLO management, ZAIS believes it is well-positioned to capitalize on market opportunities due to the following attributes:

Significant Experience. ZAIS Group has been an active investor in specialized credit and other specialized credit products since 1997. Members of ZAIS Group’s senior team, including those employees on ZAIS Group’s Investment Committee and Management Advisory Committee, have, on average, more than 20 years of industry experience, covering investment management, fixed income trading, research, investment banking and financial services. ZAIS believes that its extensive track record and broad experience in managing credit investments through a variety of economic, credit and interest rate environments provides it with a competitive advantage over more recent entrants.

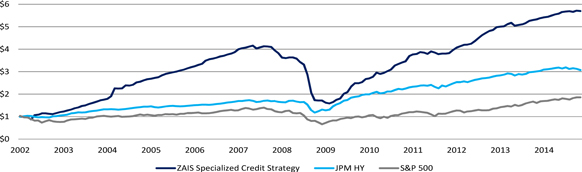

Distinguished Investment Track Record Across Multiple Market Cycles. Since inception, ZAIS Group has designed investment portfolios to perform well across a range of macroeconomic scenarios or capitalize on specific market opportunities. The ZAIS Specialized Credit Composite (“ZAIS Composite” or “Composite”), presented below, includes 31 separately managed accounts, funds of one and commingled funds that vary in size and are managed for a broad range of specialized credit mandates. The ZAIS Composite is not a stock performance chart. Rather, it shows how one dollar invested in 2002 would have performed if it had been invested in the vehicles described above, which include accounts that are managed similarly to, and that hold similar targeted assets as, the mix of assets envisioned for recent broad specialized credit mandates, including a current mandate managed for an institutional client.

ZAIS Specialized Credit Composite(1)

Growth of a Dollar

| 6 |

| ANNUALIZED TOTAL RETURNS | ANNUAL TOTAL RETURNS | |||||||||||||||||||||||||||

| ZAIS Specialized | JP Morgan | ZAIS Specialized | JP Morgan | |||||||||||||||||||||||||

| Credit | Domestic High | Credit | Domestic High | |||||||||||||||||||||||||

| Composite | Yield Index | +/- | Composite | Yield Index | +/- | |||||||||||||||||||||||

| 1 - Year | 6.96 | % | 2.17 | % | 4.79 | % | 2014 | (3) | 6.96 | % | 2.17 | % | 4.79 | % | ||||||||||||||

| 3 - Year | 14.15 | % | 8.46 | % | 5.69 | % | 2013 | 9.79 | % | 8.24 | % | 1.55 | % | |||||||||||||||

| 5 - Year | 17.58 | % | 9.38 | % | 8.20 | % | 2012 | 26.72 | % | 15.39 | % | 11.33 | % | |||||||||||||||

| 7 - Year | 5.36 | % | 8.92 | % | -3.56 | % | 2011 | 10.50 | % | 6.96 | % | 3.54 | % | |||||||||||||||

| Since Inception(2) | 14.32 | % | 9.08 | % | 5.24 | % | 2010 | 36.70 | % | 14.73 | % | 21.97 | % | |||||||||||||||

| (1) | The ZAIS Composite includes 31 separately managed accounts, funds of one and commingled funds that are managed for a broad range of specialized credit mandates, varying in size. The ZAIS Composite includes accounts that are managed similarly to, and have similar targeted assets as, the mix of assets envisioned for recent broad structured credit mandates, including an active mandate managed for an institutional client. The ZAIS Composite excludes funds during their “ramp-up” periods. For potential broad structured credit mandates, ZAIS Group would opportunistically invest in non-agency residential mortgage backed securities (“RMBS”), collateralized loan obligation (“CLO”) mezzanine tranches, CLO equity tranches and, selectively, commercial mortgage backed securities (“CMBS”). As such, ZAIS Group excluded from the Composite those ZAIS Group managed funds and accounts that currently invest in other assets (e.g., senior CLO tranches, residential whole loans, agency interest only securities), structured product vehicles managed by ZAIS Group, ZFC REIT, and funds and managed accounts where ZAIS Group assumed management of the vehicles from prior managers. Since monthly performance information was not required for Matrix I and Matrix II funds, ZAIS Group did not include these funds in the ZAIS Composite (Matrix I net IRR was 11.87%; Matrix II-A net IRR was 17.64%; Matrix II-B net IRR was 6.13%). The ZAIS Composite is calculated by asset weighting the individual monthly returns of each component using the aggregated beginning-of-period capital balances and external cash flows as if the composite were one portfolio. The Composite’s Year-to-Date net returns are considered time-weighted since they are the cumulative result of compounding all monthly net return results. The ZAIS Composite return results: (i) are not a guarantee, prediction, or indicator of future returns; future investors could make a lesser profit or could incur substantial losses; (ii) are net of accrued management fees, incentive fees/allocations, if any, and foreign currency translation gains and losses; (iii) are based on capital activity for both fee paying and non-fee paying investors; (iv) reflect a mix of active and liquidated vehicles; (v) reflect the reinvestment of dividends, interest and earnings; (vi) treat client directed intra-month cash flows, if any, in separately managed accounts as if inflows occurred at the start of the month and outflows at the end of the month for purposes of calculating monthly returns; (vii) treat redemption or withdrawal charges of redeeming or withdrawing investors that were retained in the fund for the benefit of remaining investors as profit to the remaining investors (this increase in capital for remaining investors are not treated as profits under accounting principles generally accepted in the United States ("GAAP")); and (viii) treat capital activity during July 2006 to November 2006 in one vehicle as if all the activity occurred in the month of November 2006 because the vehicle was ramping up during that time period. A structured product industry standard performance benchmark does not exist. As a result, there is no exact data point against which ZAIS Group can compare its performance. ZAIS Group does, however, closely monitor several sources of data to assess its performance relative to indices composed of relevant, if not identical, assets, including the J.P. Morgan Domestic High Yield Index (the “JPM HY”), ABX, PrimeX, CMBX and various proprietary dealer constructed indices. These indices each contain strengths and weaknesses. ZAIS Group has benchmarked the ZAIS Composite against the JPM HY mainly because of the relevance of the asset class and the fact that the index has been in existence for a period predating the inception of the Composite. Over shorter holding periods, tracking error relative to the proposed benchmark could be quite significant. |

| (2) | From February 2002 to December 2014. |

| (3) | As of December 31, 2014. |

| 7 |

ZAIS Opportunity Fund, ZAIS Group’s commingled opportunistic structured credit fund, has over a ten-year track record, ranking No. 15 in Barron’s Top 100 Hedge Funds in 2013, after previously holding the No. 1 ranking in 2011 and 2012. The Barron’s ranking is based on three year compounded annual returns, includes funds with at least $300 million in assets, and does not include single sector or country funds.

ZAIS Opportunity Fund Performance(1)

| Year | YTD | ITD | ||||||

| 2003 | 18.98 | % | 18.98 | % | ||||

| 2004 | 42.25 | % | 69.24 | % | ||||

| 2005 | 15.43 | % | 95.35 | % | ||||

| 2006 | 16.26 | % | 127.12 | % | ||||

| 2007 | 2.31 | % | 132.37 | % | ||||

| 2008 | -73.57 | % | -38.58 | % | ||||

| 2009 | 103.74 | %(2) | 25.13 | %(2) | ||||

| 2010 | 111.71 | % | 164.91 | %(2) | ||||

| 2011 | 31.75 | %(2) | 249.01 | %(2) | ||||

| 2012 | 22.66 | % | 328.08 | %(2) | ||||

| 2013 | 8.57 | % | 364.76 | %(2) | ||||

| 2014 | 8.37 | % | 403.65 | %(2) | ||||

(1) All inception to date (‘‘ITD’’) returns and all 2014 return information are unaudited. The year to date (‘‘YTD’’) and ITD returns represent the cumulative effect of compounding the monthly returns for the relevant time period. There could be some differences in the YTD returns in this table compared to those reflected in the respective annual reports due to the compounded returns in this table were calculated using a blended calculation of all sub-series if multiple sub-series existed and the annual report reflecting results for only the oldest sub-series. Returns are net of fees including incentive allocation, if any, and expenses. Results reflect the reinvestments of dividends, interest and earnings. Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those above or will make any profit or will be able to avoid incurring substantial losses. Net returns reflect an investment in ZAIS Opportunity Domestic Feeder Fund, LP (‘‘Domestic Feeder’’) Series A Interests that are subject to advisory fees and incentive allocation. Returns would differ for an investment in Domestic Feeder Series B, ZAIS Opportunity Fund, Ltd. Series A and Series B. An individual investor’s return may vary based on timing of capital transactions. Effective April 1, 2012, management fee rates were reduced from 1.50% to 1.25% for Series A and from 1.00% to 0.75% for Series B. Effective January 1, 2013, incentive fees or allocation rates were reduced from 25% to 20% for Series A and from 20% to 15% for Series B.

(2) The Domestic Feeder's returns for January 2009 and February 2011 have been adjusted to account for an increase of capital resulting from redemption penalties retained in the fund for the benefit of the remaining investors. As a result, the adjusted 2009 and 2011 year-to-date returns are different from the GAAP year-to-date returns reported in the Domestic Feeder Fund's 2009 and 2011 annual reports. Due to this adjustment, inception-to-date GAAP returns for years after 2008 would be different from the adjusted returns presented.

| 8 |

The following tables summarize ZAIS Group’s investment performance in corporate credit funds, mortgage related strategies and multi-strategy funds & accounts.

Corporate Credit Investment Performance

Overview of Corporate Credit Funds (1),(2)

| Total Capital | Total Capital | |||||||||||||||||||||||||||

| Inception | End Date | Fund(18) | Strategy | Description | Drawn (mm) (3) | Returned (mm) (3,4) | NAV (mm)(5) | Net IRR (6) | JPM HY (7) | |||||||||||||||||||

| Sep-00 | Dec-06 | Matrix I (8) | CBO Mezz | Commingled Fund | $ | 147.8 | $ | 226.5 | $ | - | (9) | 11.87 | % | 8.68 | % | |||||||||||||

| Apr-01 | Dec-06 | Matrix IIA (8) | CBO Mezz | Commingled Fund | $ | 56.3 | $ | 102.0 | $ | - | (9) | 17.64 | % | 9.79 | % | |||||||||||||

| Apr-01 | Dec-06 | Matrix IIB | CBO Mezz | Commingled Fund | $ | 27.7 | $ | 34.2 | $ | - | (9) | 6.13 | % | 9.79 | % | |||||||||||||

| Feb-02 | Dec-06 | Matrix IIIA (8) | CLO Mezz / Equity | Commingled Fund | $ | 126.9 | $ | 346.5 | $ | - | (9) | 49.64 | % | 11.01 | % | |||||||||||||

| Feb-02 | Dec-06 | Matrix IIIB (8) | CLO Mezz / Equity | Commingled Fund | $ | 38.9 | $ | 84.7 | $ | - | (9) | 31.59 | % | 11.01 | % | |||||||||||||

| Oct-03 | May-05 | Matrix IV | CLO Senior | Commingled Fund | $ | 100.0 | $ | 133.9 | $ | - | (9) | 32.82 | % | 8.92 | % | |||||||||||||

| Oct-07 | May-14 | ZAIS Zephyr A-1, LTD | CLO Mezz / Equity | Fund of One | € | 28.5 | € | 48.5 | € | - | (9) | 12.19 | % | 9.66 | % | |||||||||||||

| Oct-07 | Open | ZAIS Zephyr A-2, LTD | CLO Mezz / Equity | Commingled Fund | $ | 45.0 | $ | 67.7 | $ | - | (10) | 10.51 | % | 8.43 | % | |||||||||||||

| Oct-07 | Jul-11 | ZAIS Zephyr A-3, LTD | CLO Mezz / Equity | Fund of One | € | 10.0 | € | 13.5 | € | - | (9) | 9.10 | % | 9.42 | % | |||||||||||||

| Oct-07 | Open | ZAIS Zephyr A-4, LLC | CLO Mezz / Equity | Commingled Fund | $ | 25.0 | $ | 40.0 | $ | - | (10) | 10.52 | % | 8.43 | % | |||||||||||||

| Jul-09 | Feb-11 | Lubeck II-A | CLO Senior | Fund of One | $ | 80.0 | $ | 104.9 | $ | - | (9) | 24.21 | % | 22.08 | % | |||||||||||||

| Apr-10 | Apr-13 | Lubeck II-C | CLO Senior | Fund of One | $ | 70.0 | $ | 72.7 | $ | - | (9) | 1.65 | % | 11.60 | % | |||||||||||||

| Apr-10 | Jun-13 | Empiricus A | CLO Mezz / Equity | Fund of One | $ | 16.0 | $ | 18.9 | $ | - | (9) | 13.36 | % | 9.86 | % | |||||||||||||

| Aug-10 | Open | Empiricus B-B (11) | CLO Mezz / Equity | Fund of One | $ | 40.0 | $ | 0.2 | $ | 53.4 | 11.57 | % | 8.93 | % | ||||||||||||||

| Jul-09 | Open | Zephyr Recovery 2004-1 LP (12) | Structured Corporate Credit | Commingled Fund | $ | 41.3 | $ | 154.9 | $ | - | (10) | 78.29 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery 2004-2 LP (12) | Structured Corporate Credit | Commingled Fund | $ | 35.5 | $ | 148.6 | $ | - | (10) | 90.21 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery 2004-3 LP (12) | Structured Corporate Credit | Commingled Fund | $ | 6.3 | $ | 25.1 | $ | - | (10) | 91.33 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr 2004-4 LLC (12) | Structured Corporate Credit | Commingled Fund | $ | 26.5 | $ | 97.7 | $ | - | (10) | 77.43 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery II-A LP (12) | Structured Corporate Credit | Commingled Fund | $ | 49.6 | $ | 313.2 | $ | - | (10) | 105.69 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery II-B LP (12) | Structured Corporate Credit | Commingled Fund | € | 5.0 | € | 23.6 | € | - | (10) | 76.73 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery II-C LP (12) | Structured Corporate Credit | Commingled Fund | $ | 27.8 | $ | 143.4 | $ | - | (10) | 45.63 | % | 12.59 | % | |||||||||||||

| Jul-09 | Open | Zephyr Recovery Mezz 2005-1 Unit Trust (12) | CLO Senior/Mezz | Commingled Fund | $ | 41.4 | $ | 22.4 | $ | 151.5 | 32.93 | % | 12.59 | % | ||||||||||||||

| Sep-09 | Open | ZAIS Leda Fund | CLO Senior/Mezz | Fund of One | € | 433.2 | € | 487.8 | € | - | (10) | 2.54 | % | 10.76 | % | |||||||||||||

| Jul-09 | Open | ZAIS Tydeus Fund | CLO Senior/Mezz/Equity | Fund of One | € | 178.8 | € | 250.9 | € | - | (10) | 13.52 | % | 12.54 | % | |||||||||||||

| Nov-11 | Open | Corporate Loan Master Fund | Leverage Loans | Fund of One | € | 99.5 | € | 1.8 | € | 111.7 | 4.30 | % | 8.39 | % | ||||||||||||||

| Dec-07 | Open | Insurance Company #1a | CLO Mezz | Managed Account | $ | 166.6 | $ | 148.1 | $ | 74.6 | 5.64 | % | 8.92 | % | ||||||||||||||

| Nov-11 | Open | Insurance Company #1b | Structured Settlements | Managed Account | $ | 108.0 | $ | 8.6 | $ | 110.6 | 6.37 | % | 8.40 | % | ||||||||||||||

| Mar-14 | Open | Insurance Company #1c | CLO Mezz | Managed Account | $ | 150.0 | $ | - | $ | 147.7 | -2.27 | % | -0.81 | % | ||||||||||||||

| Dec-14 | Open | Insurance Company #2b | CLO/RMBS | Managed Account | $ | 25.0 | $ | - | $ | 25.0 | -0.26 | % | -7.15 | % | ||||||||||||||

| Jul-10 | Open | German Insurance Company #1 | CLO Mezz | Managed Account | € | 132.9 | € | 60.5 | € | 89.0 | 4.09 | % | 9.03 | % | ||||||||||||||

| Oct-14 | Open | Managed Account #6 (13) | Leverage Loans | Managed Account | $ | 2.7 | $ | - | $ | 2.7 | -0.26 | % | -5.93 | % | ||||||||||||||

| Jun-05 | Open | Co-Epics I Ltd | CLO Equity | Passthrough Vehicle | $ | 9.5 | $ | 18.2 | $ | 0.1 | 12.56 | % | 8.19 | % | ||||||||||||||

| Jun-05 | Open | Epics I Ltd | CLO Equity | Passthrough Vehicle | $ | 173.4 | $ | 315.4 | $ | 2.6 | 9.70 | % | 8.19 | % | ||||||||||||||

| Mar-07 | Open | ZAIS Investment Grade Limited IX(14) | CLO/RMBS | Structured Vehicle | $ | 29.0 | $ | 6.1 | $ | - | -87.70 | % | 7.97 | % | ||||||||||||||

| Mar-14 | Open | ZAIS CLO 1, Limited(15) | Leverage Loans | Structured Vehicle | $ | 25.7 | $ | 3.6 | $ | 24.6 | 14.41 | % | -1.21 | % | ||||||||||||||

| Sep-14 | Open | ZAIS CLO 2, Limited(16) | Leverage Loans | Structured Vehicle | $ | 33.5 | $ | - | $ | 31.8 | -17.69 | % | -4.42 | % | ||||||||||||||

| Aug-14 | Open | ZAIS CLO 3 Warehouse (17) | Leverage Loans | Structured Vehicle | $ | 30.0 | $ | - | $ | 31.4 | NA | NA | ||||||||||||||||

Please refer to following page for corresponding notes

| 9 |

| (1) | All amounts are as of December 31, 2014. The funds, managed accounts and structured vehicles included represent vehicles managed by ZAIS Group that have been predominantly focused on investing in CLOs and corporate credit. Excludes a European Structured Vehicle with approximately $50.2 million of AUM as of December 10, 2014 for which ZAIS Group acts as a servicer. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors that have fully redeemed or withdrawn). The total capital drawn for all the Zephyr Recovery funds represents the net asset value as of the date ZAIS Group assumed asset management responsibilities from a prior manager on July 10, 2009. For structured vehicles this amount represents the capital contributions and distributions for the equity tranches of each vehicle from inception through December 31, 2014. |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and penalties (if applicable) paid by the investor. The total capital returned for the Zephyr Recovery funds represents amounts returned to investors since ZAIS Group assumed asset management responsibilities from a prior manager. For structured vehicles this amount represents the distributions for the equity tranches of each vehicle through December 31, 2014. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014, or the liquidation date, for investors remaining in the funds or managed accounts as of December 31, 2014, or the liquidation date, which are subject to management fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle as of December 31, 2014. |

| (7) | The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge the general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respective fund through December 31, 2014, or the termination of the respective fund where applicable. |

| (8) | The functional currency of the funds is United States Dollars (“USD”). Euro denominated notes were issued by the funds to its investors. The Capital Drawn and Capital Returned were converted to USD at the effective spot rates (“USD Equivalent”). The IRR reflects the performance of the fund and was computed based on the USD equivalent of the capital drawn from and returned to the investors. |

| (9) | Liquidated prior to December 31, 2014. |

| 10 |

| (10) | These funds are in the process of being liquidated and the only remaining asset is cash. |

| (11) | Represents Strategy B of the Empiricus B Fund. |

| (12) | The Zephyr Recovery Funds were launched by Lehman Brothers Holdings Inc. (“Lehman”) between November 30, 2004 and March 20, 2007. Following Lehman’s bankruptcy, ZAIS Group assumed the asset management responsibilities for these funds on July 10, 2009 and the names of these funds were changed after ZAIS Group assumed management responsibilities. The inception date for these Funds is deemed to be July 10, 2009. |

| (13) | IRR is calculated based on the date the account commenced trading which was in October 2014. |

| (14) | The amount listed represents the equity investment in ZAIS Investment Grade Limited IX. The total initial notional of all classes of securities issued in the related transaction was approximately $406 million. |

| (15) | The amount listed represents the equity investment in ZAIS CLO 1, Limited. The total initial notional of all classes of securities issued in the related transaction was approximately $309.9 million. The structured vehicle closed on March 27, 2014 at which time the vehicle moved out of the warehouse. Additionally, the entity made its first payment to the equity holders in the amount of approximately $3.6 million on October 15, 2014. This resulted in a significant increase in the IRR compared to September 30, 2014. |

| (16) | The amount listed represents the equity investment in ZAIS CLO 2, Limited. The total initial notional of all classes of securities issued in the related transaction was approximately $333.75 million. The Structured vehicle closed on September 29, 2014 at which time the vehicle moved out of the warehouse. The entity has not yet made any payments to the noteholders. As a result, the net IRR was calculated using the amount drawn on the notes and the fair value of the notes at December 31, 2014. The result is a negative IRR. |

| (17) | Entity is in the Warehouse stage. |

| (18) | The following vehicles included in the performance table are consolidated in the financial statements of ZGP for the periods indicated: |

| Vehicle | 2012 | 2013 | 2014 | |||||||||

| Epics I, Ltd. | √ | √ | √ | |||||||||

| Co-Epics I, Ltd. | √ | √ | √ | |||||||||

| ZAIS Investment Grade Limited IX | √ | √ | √ | |||||||||

| ZAIS CLO I, Limited | - | - | √ | |||||||||

| ZAIS CLO II, Limited | - | - | √ | |||||||||

| 11 |

Mortgage Related Strategies Investment Performance

Overview of Mortgage Related Strategies(1),(2)

| Total Capital | Total Capital | ABX. HE (13) | ||||||||||||||||||||||||||||||

| Inception | End Date | Fund(19) | Strategy | Description | Drawn (mm)(3) | Returned (mm)(3)(4) | NAV (mm)(5) | Net IRR (6) | 06-1 AAA | 07-1 AAA | ||||||||||||||||||||||

| MATRIX V FUNDS | ||||||||||||||||||||||||||||||||

| Jul-06 | Dec-12 | Matrix V-C | RMBS / CLO / ABS CDOs / Shorts | Fund of One | $ | 182.5 | $ | 308.1 | $ | - | (7) | 15.63 | % | -0.46 | % | NA | ||||||||||||||||

| Nov-06 | Dec-12 | Matrix V-A | RMBS / CLO / ABS CDOs | Commingled Fund | $ | 143.6 | $ | 120.3 | $ | - | (7) | -5.10 | % | -0.48 | % | NA | ||||||||||||||||

| Nov-06 | Dec-12 | Matrix V-B | RMBS / CLO / ABS CDOs | Commingled Fund | $ | 103.0 | $ | 86.5 | $ | - | (7) | -5.63 | % | -0.48 | % | NA | ||||||||||||||||

| D I S T R E S S E D N O N - A G E N C Y R M B S F O C U S E D F U N D S & R E L A T E D A C C O U N T S | ||||||||||||||||||||||||||||||||

| Sep-07 | Dec-12 | Matrix VI-C | RMBS | Fund of One | $ | 276.7 | $ | 329.0 | $ | - | (7) | 6.45 | % | -0.16 | % | -10.63 | % | |||||||||||||||

| Jan-08 | Dec-12 | Matrix VI-A | RMBS | Commingled Fund | $ | 232.7 | $ | 312.8 | $ | - | (7) | 9.87 | % | 0.42 | % | -6.87 | % | |||||||||||||||

| Jan-08 | Dec-12 | Matrix VI-B | RMBS | Commingled Fund | $ | 111.2 | $ | 145.9 | $ | - | (7) | 13.51 | % | 0.42 | % | -6.87 | % | |||||||||||||||

| Jan-08 | Sep-10 | Matrix VI-D | RMBS | Fund of One | $ | 75.0 | $ | 87.9 | $ | - | (7) | 8.75 | % | -3.25 | % | -17.28 | % | |||||||||||||||

| Jan-08 | Dec-12 | Matrix VI-F | RMBS | Fund of One(15) | $ | 108.9 | $ | 144.6 | $ | - | (7) | 8.45 | % | 0.42 | % | -6.87 | % | |||||||||||||||

| Mar-08 | Sep-10 | ZAIS CL | RMBS | Fund of One(15) | $ | 116.9 | $ | 132.4 | $ | - | (7) | 7.64 | % | -0.96 | % | -8.51 | % | |||||||||||||||

| Apr-08 | Dec-12 | Matrix VI-I | RMBS | Fund of One | $ | 75.1 | $ | 106.6 | $ | - | (7) | 10.63 | % | 0.53 | % | -4.64 | % | |||||||||||||||

| May-09 | Nov-12 | Managed Account #2 | RMBS | Managed Account | $ | 25.0 | $ | 38.4 | $ | - | (7) | 19.08 | % | 8.96 | % | 17.44 | % | |||||||||||||||

| Sep-09 | Feb-11 | Managed Account #4 | RMBS | Managed Account | $ | 50.0 | $ | 61.5 | $ | - | (7) | 20.75 | % | 10.39 | % | 31.98 | % | |||||||||||||||

| Mar-10 | Jun-12 | Managed Account #1 | RMBS | Managed Account | $ | 19.5 | $ | 23.1 | $ | - | (7) | 9.36 | % | 2.01 | % | -0.63 | % | |||||||||||||||

| Mar-12 | Dec-13 | ZAIS Mortgage Securities | RMBS | Fund of One(15) | $ | 172.2 | $ | 211.0 | $ | - | (7) | 17.24 | % | 4.04 | % | 23.38 | % | |||||||||||||||

| Sep-06 | Mar-10 | Scepticus I | RMBS Short | Fund of One | $ | 58.9 | $ | 554.1 | $ | - | (7) | 754.71 | % | NA | NA | |||||||||||||||||

| Sep-06 | Dec-08 | Scepticus II | RMBS Short | Managed Account | $ | 8.4 | $ | 114.7 | $ | - | (7) | 1,129.42 | % | NA | NA | |||||||||||||||||

| Dec-06 | Jan-09 | Scepticus III | RMBS Short | Managed Account | $ | 12.0 | $ | 115.2 | $ | - | (7) | 1,116.59 | % | NA | NA | |||||||||||||||||

| Mar-07 | Jun-08 | Hartshorne CDO I, Ltd(8)(16) | RMBS | Structured Vehicle | $ | 50.0 | $ | 9.7 | $ | - | (7) | -96.94 | % | -6.37 | % | -42.24 | % | |||||||||||||||

| Aug-02 | Open | Galleria CDO V, Ltd(17) | RMBS | Structured Vehicle | $ | 12.0 | $ | 1.8 | $ | - | -87.11 | % | NA | NA | ||||||||||||||||||

| Jun-09 | Open | Managed Account #3 | RMBS | Managed Account | $ | 40.0 | $ | 15.0 | $ | 46.8 | 15.98 | % | 6.56 | % | 21.04 | % | ||||||||||||||||

| Apr-12 | Open | 2012 Managed Account(14) | RMBS With Overlay | Managed Account | $ | 71.3 | $ | 88.0 | $ | 0.3 | 11.82 | % | 3.75 | % | 29.38 | % | ||||||||||||||||

| Jul-12 | Open | INARI Fund | RMBS With Overlay | Fund of One | $ | 300.0 | $ | - | $ | 360.6 | 8.74 | % | 2.77 | % | 25.23 | % | ||||||||||||||||

| May-13 | Open | Managed Account #5 | RMBS With Overlay | Managed Account | $ | 125.0 | $ | - | $ | 135.0 | 4.77 | % | -0.08 | % | 16.66 | % | ||||||||||||||||

| R E S I D E N T I A L W H O L E L O A N S A N D C O M M E R C I A L R E A L E S T A T E | ||||||||||||||||||||||||||||||||

| Jan-09 | Open | ZAIS Value Added Real Estate Fund I, LP (9) | Commercial Real Estate | Non-fee Paying Investors | $ | 21.7 | $ | 6.1 | $ | 10.3 | -5.47 | % | NA | NA | ||||||||||||||||||

| Aug-08 | Open | SerVertis Master Fund I LP (10)(11) | Residential Whole Loans | Commingled Fund | $ | 726.9 | $ | 1,030.7 | $ | - | 8.43 | % | 1.53 | % | 6.67 | % | ||||||||||||||||

| Jul-11 | Open | ZAIS Financial Corp. | Residential Whole Loans | Public REIT | $ | 212.0 | (18) | $ | 68.9 | (18) | $ | 193.4 | 25.40 | %(12) | 2.75 | % | 18.40 | % | ||||||||||||||

| 12 |

| (1) | All amounts are as of December 31, 2014. These entities represent private equity style funds and managed accounts (including certain private equity style funds and managed accounts whose predominant investment thesis was the shorting of residential mortgage backed securities), structured vehicles, and a publicly traded mortgage real estate investment trust that are or have been primarily focused on investing in residential mortgage related assets. The performance table also includes one vehicle which invested in commercial real estate properties. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors which have fully redeemed or withdrawn). For structured vehicles this amount represents the capital contributions and distributions for the equity tranches of each vehicle from inception through December 31, 2014. |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and redemption or withdrawal penalties (if applicable) paid by the investor. For structured vehicles this amount represents the distributions for the equity tranches of each vehicle through December 31, 2014. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014 or the liquidation date for investors remaining in the fund or account as of December 31, 2014 or the liquidation date which are subject to management fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle. |

| (7) |

Liquidated prior to December 31, 2014. |

| (8) | The structured vehicle invested in asset backed securities that primarily referenced the mezzanine tranches of non-agency RMBS. In November 2007, the entity triggered an Event of Default and as a result ZAIS Group was removed as Collateral Manager and a trustee was retained to liquidate the entity. As a result, ZAIS Group was not involved in the final liquidation pricing and disposition of the collateral and therefore does not have access to the data relating to the liquidation of the investments of the vehicle. |

| (9) | The investors in ZAIS Value Added Real Estate Fund I, L.P. (“ZVAREF”) consist of ZAIS Group and certain current and former ZAIS Group employees and owners that received their equity interests through a distribution-in-kind. Prior to the aforementioned distribution-in-kind, ZAIS Group was both the GP and the sole member. ZAIS Group does not receive any fees from the investors of ZVAREF. The capital drawn, capital returned and net IRR reflect the activity from the date of the distribution-in-kind through December 31, 2014. Capital drawn includes the value of the distribution-in-kind. Additionally, since ZVAREF does not have any fee paying investors, the net IRR reflects the return for all investors in ZVAREF. |

| 13 |

| (10) | This fund is in the process of being liquidated and the only remaining asset is cash. |

| (11) | Both ZAIS Group and Green Tree Investment Management LLC are jointly responsible for the investment decisions of the fund. Therefore, performance should not be considered solely attributable to ZAIS Group. |

| (12) | The result was calculated based on the share price as of December 31, 2014, plus cumulative dividends per share through December 31, 2014, compared to the exchange price of $20.00 per share. |

| (13) | The ABX.HE.06-1 AAA Index and ABX.HE. 07-1 AAA (the “ABX index”) is referred to only because it represents an index typically used to gauge the general performance of US subprime residential mortgage backed securities. The use of this index is not meant to be indicative of the asset composition or volatility of the portfolio of securities held by the funds, which may or may not have included securities which comprise the ABX Index, and which may hold considerably fewer than the number of different securities that make up the ABX Index. As such, an investment in the fund should be considered riskier than an investment in the ABX Index. The ABX Index returns have been calculated for the period from inception of the respective fund through December 31, 2014 or the termination of the respective fund where applicable. The ABX Index returns exclude the coupon payment and any applicable principal losses payable. |

| (14) | This managed account is currently in the process of being liquidated. Substantially all of the assets have been liquidated as of March 20, 2015. |

| (15) | These funds were established for specific managers and contained various investors for whom the manager maintained discretionary control. |

| (16) | The amount listed represents the equity investment in Hartshorne CDO I, Ltd. The total initial notional of all classes of securities issued in the related transaction was approximately $1 billion. |

| (17) | The amount listed represents the equity investment in Galleria CDO V, Ltd. The total initial notional of all classes of securities issued in the related transaction was approximately $300 million. |

| (18) | Capital drawn includes the initial exchange offer, subsequent issuances of common stock and operating partnership units during the private phase and gross proceeds raised in the initial public offering. Capital returned includes redemptions of stock during the private phase and dividends and distributions paid to investors during the private phase and subsequent to the initial public offering. |

| (19) | The following vehicles included in the performance table are consolidated in the financial statements of ZGP for the periods indicated: |

| Vehicle | 2012 | 2013 | 2014 | |||||||||

| Matrix V-A | √ | - | - | |||||||||

| Galleria CDO V, LTD | √ | √ | √ | |||||||||

| ZAIS Value Added Real Estate Fund I, LP | √ | √ | √ | |||||||||

| 14 |

Multi-Strategy Funds and Accounts

Overview of Multi-Strategy Funds and Accounts(1),(2)

| Total Capital | Total Capital | |||||||||||||||||||||||||||

| Inception | End Date | Fund(10) | Strategy | Description | Drawn (mm) (3) | Returned (mm) (3,4) | NAV (mm) (5) | Net IRR (6) | JPM HY (7) | |||||||||||||||||||

| Oct-03 | Open | ZAIS Opportunity Domestic Feeder Fund, LP | CLO/RMBS/CMBS | Commingled Fund | NA | NA | NA | 15.44 | %(8) | 8.50 | % | |||||||||||||||||

| Oct-13 | Open | ZAIS Atlas Fund, LP | RMBS / CLO / CMBS | Commingled Fund | NA | NA | NA | 2.58 | %(9) | 4.78 | % | |||||||||||||||||

| Mar-12 | Open | Pension Fund | CLO / RMBS / CMBS | Managed Account | $ | 169.0 | $ | - | $ | 183.7 | 6.70 | %(11) | 7.24 | % | ||||||||||||||

| Apr-14 | Open | Insurance Company #2 | RMBS / CLO | Managed Account | $ | 72.9 | $ | - | $ | 73.8 | 2.11 | % | -2.53 | % | ||||||||||||||

| (1) | All amounts are as of December 31, 2014. These funds and managed accounts represent hedge funds and managed accounts that invest in a combination of corporate debt instruments, such as CLOs, leveraged loans and high yield bonds, as well as residential and commercial mortgage related strategies. In addition, some funds invest in various derivative based instruments including, but not limited to swaps, interest only securities, inverse interest only securities and swaptions. |

| (2) | Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses. |

| (3) | Amounts reflected herein are from inception through December 31, 2014 for all investors (including those investors which have fully redeemed or withdrawn). |

| (4) | Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if any, and redemption or withdrawal penalties (if applicable) paid by the investor. |

| (5) | Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of December 31, 2014. |

| (6) | IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through December 31, 2014 for investors remaining in the fund or account as of December 31, 2014 which are subject to management fees and incentive fees/allocations, if any. |

| (7) | The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge the general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respective fund through December 31, 2014. |

| (8) | Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a single investor in ZAIS Opportunity Domestic Feeder Fund, LP ("Opportunity Fund Domestic Feeder") Series A Interests that is subject to advisory fees and incentive allocation. Net IRR would differ for an investment in Opportunity Fund Domestic Feeder Series B, ZAIS Opportunity Fund, Ltd. Series A and Series B, as a result of timing of capital transactions, differences in fund expenses and lower or no management fees and incentive fees/allocations, if any. Effective April 1, 2012, management fee rates were reduced from 1.50% to 1.25% for Series A and from 1.00% to 0.75% for Series B. Effective January 1, 2013, incentive fee or allocation rates were reduced from 25% to 20% for Series A and from 20% to 15% for Series B. The Opportunity Fund Domestic Feeder's returns for January 2009 and February 2011 have been adjusted to account for an increase of capital resulting from redemption penalties retained in the fund for the benefit of the remaining investors. |

| (9) | Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a single investor in ZAIS Atlas Fund, LP (“Atlas Domestic Feeder”) Sub-Class A-1 Interests that is subject to full advisory fees and incentive allocations. This net IRR result is based on pro forma returns based on what the highest fee paying Sub-Class A-1 of Atlas Domestic Feeder would have returned if actual investments had been made in that Sub-Class. These pro forma results do not reflect an actual investment in the full fee paying Sub-Class for the period October 2013 to November 2014 which was not offered to investors until April 1, 2014 because the Master Feeder fund structure was in its start-up phase and Sub-Class A-3, a reduced fee paying Sub-Class for the Founder’s shares, of the Atlas Domestic Feeder and ZAIS Atlas Offshore Ltd. was offered to investors. The monthly returns beginning December 1, 2014 reflect an actual investment in the full fee paying sub-class. Net IRR would differ for an investment in Atlas Domestic Feeder Sub-Class A-2 and A-3, as well as ZAIS Atlas Fund, Ltd. Sub-Class A-1 and A-3, as a result of timing of capital transactions, differences in fund expenses and lower or no management fees and incentive fees/allocations, if any. |

| (10) | The following vehicles included in the performance table are consolidated in the financial statements of ZGP for the periods indicated: |

| Vehicle | 2012 | 2013 | 2014 | |||

| ZAIS Opportunity Fund | √ | √ | √ | |||

| ZAIS Atlas Fund (*) | - | √ | √ |

(*) The on-shore feeder fund in this master / feeder structure is consolidated for the periods indicated. The master fund and the off-shore feeder fund are not required to be consolidated for the periods indicated.

| (11) | The returns for this vehicle do not take into account a fee rebate for the investor’s separate interest in a ZAIS Group-managed fund. If the IRR had included the effect of the rebate, the stated returns would have been higher. |

Broad Credit Investment Products Platform. ZAIS Group is an active investor across a broad range of product sectors, including securitized credit and related investments. ZAIS Group’s current investments include, but are not limited to, non-agency RMBS, residential whole loans, agency MBS derivatives, CRE investments including CMBS, mezzanine loans and commercial properties, corporate CLOs, individual corporate debt securities, leveraged loans, and structured corporate synthetics. Within these products, ZAIS Group invests in senior, mezzanine and equity investments. ZAIS Group’s involvement in investing across the specialized credit market provides ZAIS Group with context for assessing cross-sector relative value. The depth of ZAIS Group’s credit insight can then be used to source what ZAIS Group believes are the most attractive investment opportunities.

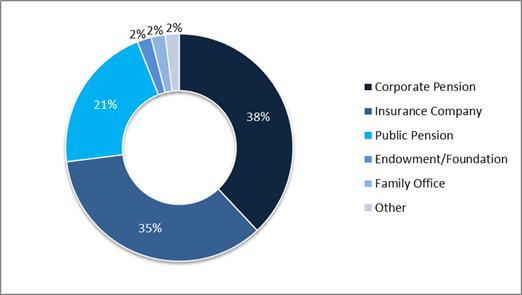

Diverse Client Base and Product Mix. Since its inception in 1997, ZAIS Group has built long-term relationships with an international investor base, including public and private pension funds, endowments, foundations, insurance companies, family offices, funds of funds, sovereign wealth funds and investment advisors. ZAIS Group manages assets using a range of strategies and investment vehicles, including hedge funds, separately managed accounts, structured vehicles as well as through the management of the ZFC REIT. ZAIS Group believes this broad client base and diverse suite of investment vehicles provides important diversification for its business. The chart set forth below provides a breakdown of our AUM by investor type.

| 15 |

AUM by Investor Type(1)(2)

| (1) | As of December 31, 2014. Percentages are approximate and subject to change. |

| (2) | This graph is based on a denominator of approximately $2 billion which includes various funds and vehicles. The graph excludes non fee-paying assets, investments in the ZFC REIT, and some structured vehicles in which ZAIS Group does not know the identity or type of investor, as this information is only available for related ownership interests that are traded in secondary markets. Accordingly, the above investor breakdown does not reflect all clients of and investors in vehicles managed by ZAIS Group. |

ZAIS Group has also evolved as a customized investment management provider to its clients. By developing strong working relationships with its clients to identify their needs and investment parameters, ZAIS Group has increased its managed account offerings over the past seven years. In ZAIS Group’s experience, certain institutional investors demand more transparency, control, and liquidity in the current yield environment, and ZAIS Group can deliver those attributes through customized solutions. As of December 31, 2014, ZAIS Group managed over $1.7 billion in 17 managed accounts/funds of one.

| 16 |

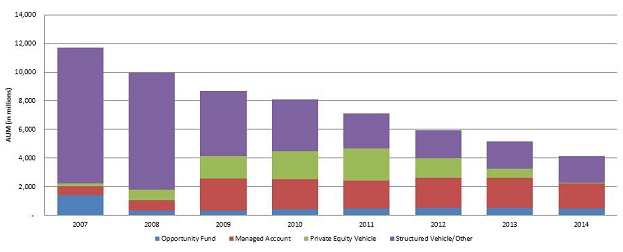

For holdings from January 1, 2014 forward, ZAIS Group has revised its methodology for calculating AUM. Management believes the new methodology, which now includes assets in the warehouse phase for new structured vehicles and does not treat leverage and other operating liabilities as a reduction of AUM, more clearly reflects the total assets actively managed by ZAIS Group. In the above chart, AUM for years 2007 through 2010 are presented per the former methodology, AUM for years 2011 through 2013 are presented on a pro forma basis consistent with the revised methodology and AUM for 2014 is presented per the revised methodology.

Robust Proprietary Analytics Platform. ZAIS Group has developed a proprietary analytics platform over the past 17 years. ZAIS Group has built a common loan-level model across RMBS and whole loans. ZAIS Group possesses comprehensive analytics and data infrastructure, which includes credit modeling, loan and securities valuation, loan data management and servicing oversight capabilities. ZAIS Group supports corporate loan and consumer loan level analytics to generate scenario analysis across the specialized credit markets. ZAIS Group maintains a private database of corporate CDO structures, including covenants, waterfall rules, portfolios, and performance. For RMBS, ZAIS Group maintains an advanced loan-level collateral performance database, feeding ZAIS Group’s proprietary loan-level mortgage credit models. ZAIS Group has built tools to provide transparency into the output of its mortgage credit models, thereby increasing their utilization and effectiveness across the firm. ZAIS Group’s analytics allow it to compare investments under various assumptions, such as different macroeconomic conditions, credit spread and market volatility observations, and default and recovery rates. Utilizing a common analytics platform for both securities and loans enables ZAIS Group to make relative value allocations across these sectors. ZAIS Group supports this platform with technology specialists and a dedicated analytics team.

In the CLO asset class, ZAIS Group believes that discrete differences among CLO managers and CLO structures are often mispriced by the market, creating a premium for credit selection. Approximately 90% of the tradable CLO universe is modeled internally. ZAIS Group places emphasis on identifying key structural features from transaction documentation, and incorporating the information into ZAIS Group’s investment selection process.

In the residential mortgage asset class, ZAIS Group believes that significant variances in risks and rewards among different classes of Non-Agency RMBS place a premium on prudent sector/security selection. ZAIS Group’s residential loan-level model incorporates updated credit bureau scores and a proprietary home price database, supporting RMBS and whole loan investment within a single platform.

Institutionalized Operations Infrastructure. ZAIS Group has developed a significant operational platform with capacity in areas such as finance and accounting, administration, compliance, investor relations, trade execution, securities valuation, risk management and information technology. ZAIS Group currently manages the ZFC REIT, which is a publicly traded vehicle which is required to comply with the requirements of the Sarbanes-Oxley Act. ZAIS Group’s infrastructure provides it with a foundation for future growth.

| 17 |

Use of Investment Proceeds Received from the Business Combination

ZAIS intends to use a substantial portion of the proceeds from the Business Combination to pursue and explore opportunities to grow its residential mortgage business and to expand its corporate CLO business. ZAIS may acquire newly originated mortgage loans directly or on behalf of a fund or funds for which it serves as investment manager. ZAIS may either retain the loans for investment or may aggregate and securitize these newly originated loans into new issue RMBS to be sold either to a third party or to a fund or funds for which ZAIS serves as the investment manager. ZAIS may also invest in mortgage servicing rights and pursue opportunities to acquire mortgage origination businesses.

With the constrained lending environment within the traditional banking community, ZAIS sees an opportunity to build on its CLO business, which commenced in 2014 with two completed CLO transactions. ZAIS intends to deploy or reserve proceeds to launch new CLO transactions and to meet new risk retention requirements facing CLO collateral managers beginning in 2016. ZAIS also intends to consider exploring CLO collateral management agreement acquisition opportunities.

ZAIS is also evaluating other potential uses of proceeds from the Business Combination, including seeding an alternative investment vehicle structured as a mutual fund that would be advised or sub-advised by the Company, seeding a new commingled investment vehicle focused on the emerging credit trading opportunities arising from ongoing regulatory changes and originating or purchasing newly originated bridge loans for commercial real estate (CRE) and securitizing them into new CRE CLO securities or CMBS. There is no assurance that ZAIS will pursue any of these potential opportunities, that these opportunities can be adequately funded and that, if pursued, the opportunities will generate significant revenue for ZAIS.

In addition to the foregoing, ZAIS anticipates utilizing up to $7 million of the proceeds of the Business Combination to fund its working capital requirements.

| 18 |

ZAIS’s Investment Strategies and Vehicles

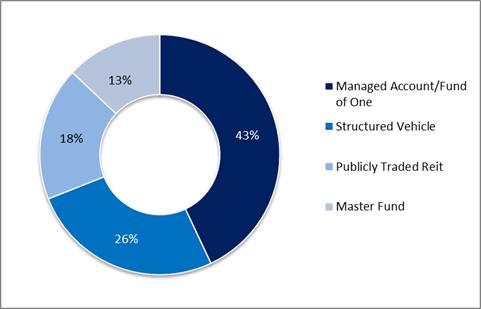

As an asset manager, ZAIS Group uses its investment expertise to make investments on behalf of the ZAIS Managed Entities. As an alternative asset manager, ZAIS Group focuses on hedge funds, separately managed accounts and structured vehicles that generally make investments that are relatively illiquid in nature. ZAIS Group’s two hedge funds are “open-end” funds where new and existing fund investors can contribute capital on a periodic basis (typically monthly) and can redeem their capital on a periodic basis. These funds have an indefinite life as long as they have investors. ZAIS Group may also create hybrid private equity style funds that are “closed-end” funds where fund investors make capital commitments when the fund is formed and these commitments are drawn down as the fund makes investments. Capital is returned to fund investors on distribution dates after the investment period has ended (averaging three years) and there is a set termination date. In general, fund investors may not withdraw or redeem capital during the investment period and additional fund investors are not permitted to join the fund after the fund’s final closing date. ZAIS Group also manages separately managed accounts that are tailored to the investment objectives of investors. The investors in these managed accounts may generally contribute additional capital or withdraw capital with little or no notice. Structured vehicles such as CDOs or CLOs purchase debt or loans and finance the purchases through the issuance of new debt and equity notes. A series of notes are issued with different risk-return profiles based on their position in the capital structure and payment waterfall. The equity notes typically take the first loss and are entitled to any excess returns in the transaction. Should the credit quality of the portfolio deteriorate, the equity notes will often be cut off from any distributions in order to speed up amortization on the debt tranches. The chart below shows our AUM by strategy and form of investment vehicle.

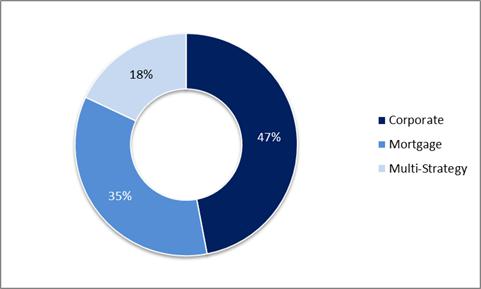

Mortgage Strategies

ZAIS Group’s mortgage investment platform combines a skilled team of experienced mortgage investors with analytical and risk management systems focused on the residential and commercial mortgage sectors. ZAIS Group has organized its internal resources to address opportunities across the mortgage markets as such opportunities evolve. Over time, ZAIS Group has successfully positioned its platform to capitalize on market dislocations and the subsequent recovery of the mortgage securities and whole loan markets. ZAIS Group has built a fully integrated investment platform focused on analyzing and managing both securitized and whole loan assets. ZAIS Group’s mortgage team is actively engaged in asset selection, underwriting, and servicing processes. ZAIS Group believes these strategies are well suited to the current mortgage environment to capitalize on market conditions including limited mortgage credit availability. As of December 31, 2014, ZAIS Group has approximately $1.43 billion deployed in mortgage strategies.

Corporate Debt Strategies

ZAIS Group’s corporate credit expertise and proprietary analytics platform and experienced credit analysts allow ZAIS Group to provide solutions and insight to optimize portfolios backed by corporate debt. ZAIS Group believes, regardless of product form or credit ratings, that integrating a breadth of information across corporate credit markets can generate investment ideas and risk management processes capable of generating above average returns. ZAIS Group has consistently sought to offer its investors opportunities to capitalize on dislocated markets across the corporate credit spectrum. As of December 31, 2014, ZAIS Group has approximately $1.93 billion deployed in corporate debt strategies.

Multi-Strategy Vehicles

ZAIS Group also uses its credit expertise and analytics platform to manage four multi strategy funds that focus on various other specialized credit investments. Some of these multi strategy funds contain investments in mortgage and corporate debt strategies referred to above. As of December 31, 2014, ZAIS Group has approximately $770 million deployed in multi-strategy funds.

| 19 |

AUM by Strategy(1)

AUM by Vehicle Type(1)

| (1) | As of December 31, 2014. Percentages are approximate and subject to change. ZAIS Group’s AUM is primarily comprised of (i) cash plus aggregate principal balance of investments with respect to certain non-mark-to-market structured vehicles; (ii) cash plus market value of investments with respect to certain structured vehicles; (iii) total assets for mark-to-market funds and separately managed accounts; and (iv) uncalled capital commitments, if any, for funds that are not in liquidation. AUM also includes assets in the warehouse phase for new structured credit vehicles and does not treat leverage and other operating liabilities as a reduction of AUM. ZAIS Group’s December 31, 2014 AUM uses values for: Epics I, Ltd. and Co-Epics I, Ltd. as of December 22, 2014, Euro Epics and Galleria CDO V, Ltd. as of December 10, 2014, ZAIS Investment Grade Limited IX as of December 3, 2014, ZAIS CLO 1, Limited as of December 4, 2014, ZAIS CLO 2 Limited as of December 16, 2014, ZAIS Financial Corp. as of September 30, 2014. |

| 20 |

Investment Operations and Information Technology

Since inception, ZAIS Group has developed proprietary, integrated analytics, trading, accounting, and portfolio management applications as a technological foundation for its businesses. These applications are maintained and supported by technology and analytics professionals located in the United States. ZAIS Group’s technology platform was initially developed at a time when vendor solutions were either unavailable or deemed inadequate to support its requirements. Going forward, for each new business ZAIS Group considers, the technological requirements and costs to support that business are included in the assessment of the investment opportunity. ZAIS Group is constantly evaluating whether to build or buy the requisite technology needed by its businesses.

Fee and Income Structure

For the management of its investment products and other vehicles, ZAIS Group receives fees and other income as follows:

Management Fees

Management fee income is typically based on a fixed annual percentage of assets ZAIS Group manages for each ZAIS Managed Entity, and it is intended to compensate ZAIS for the time and effort ZAIS Group expends in researching, and managing investments.

Hedge funds and accounts: Management fees earned by ZAIS Group for funds and accounts with hedge fund-style fee arrangements generally range from 0.50% to 1.25%, annually, based on net asset value of these funds and accounts prior to the accrual of incentive fees/allocations.

Private equity funds and accounts: Management fees earned by ZAIS Group for funds and accounts with private equity-style fee arrangements generally range from 0.25% to 0.50%, annually, based on either the net asset value of these funds and accounts prior to the accrual of incentive fees/allocations or on the amount of capital committed to these funds and accounts by its investors.

Structured Vehicles (CDOs): Management fees earned by ZAIS Group for the CDOs managed by ZAIS Group generally range from 0.15% to 0.50%, annually, and generally are based on the par value of the collateral and cash held in the CDOs.

ZFC REIT: Management fees earned by ZAIS Group for the ZFC REIT is 1.50%, annually, based on ZFC REIT's stockholders' equity, as defined in the amended and restated investment advisory agreement between ZAIS Group and ZFC REIT.

Incentive Income

In some cases, ZAIS Group receives incentive income when certain pre-agreed financial hurdles have been met.

Hedge funds and accounts: For funds and accounts with hedge fund-style fee arrangements, incentive income earned by ZAIS Group generally ranges from 10% to 20% of the net realized and unrealized profits attributable to each investor, subject to a hurdle (if any) set forth in each respective entity’s operative agreement. Additionally, all of ZAIS Group’s funds and accounts with hedge fund-style fee arrangements are subject to a perpetual loss carry forward or perpetual “high-water mark,” meaning that the funds and accounts will not pay incentive fees/allocations to ZAIS Group with respect to positive investment performance generated for an investor in any year following negative investment performance until that loss is recouped, at which point an investor’s capital balance surpasses the high-water mark. The funds and accounts pay incentive fees/allocations to ZAIS Group on any net profits in excess of the high-water mark.

Private equity funds and accounts: For funds and accounts with private equity-style fee arrangements, incentive income earned by ZAIS Group is generally 20% of all profits, subject to the return of contributed capital (and subordinate management fees, if any), and a preferred return as specified in each fund’s advisory agreement.

| 21 |

Structured Vehicles (CDOs): For CDOs, incentive income earned by ZAIS Group generally ranges from 10% to 20% of all profits, subject to the return of contributed capital (and subordinate management fees, if any), and a preferred return as specified in the respective CDO’s collateral management agreements.

Capital Invested In and Through ZAIS Group’s Products

As further alignment of ZAIS Group’s interests with those of its investors, ZAIS Group and various of its eligible professionals have invested capital in the products ZAIS Group sponsors and manages.

Regulatory and Compliance Matters