Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ZAIS Group Holdings, Inc. | v471869_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ZAIS Group Holdings, Inc. | v471869_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ZAIS Group Holdings, Inc. | v471869_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - ZAIS Group Holdings, Inc. | v471869_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35848

ZAIS GROUP HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 46-1314400 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

Two Bridge Avenue, Suite 322

Red Bank, NJ 07701-1106

(Address of Principal Executive Offices and Zip Code)

(732) 978-7518

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if smaller reporting company) | |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 14, 2017, 14,480,782 shares of Class A common stock, par value $0.0001 per share, and 20,000,000 shares of Class B Common Stock, par value $0.000001 per share, were issued and outstanding.

TABLE OF CONTENTS

| EXHIBIT 31.1 CERTIFICATIONS |

| EXHIBIT 31.2 CERTIFICATIONS |

| EXHIBIT 32.1 CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002, 18 U.S.C. SECTION 1350 |

| EXHIBIT 32.2 CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002, 18 U.S.C. SECTION 1350 |

| 2 |

PART I – FINANCIAL INFORMATION

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Financial Condition

(Unaudited)

(Dollars in thousands, except share amounts)

| June 30, 2017 | December 31, 2016 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 16,970 | $ | 38,712 | ||||

| Income and fees receivable | 1,869 | 8,805 | ||||||

| Investments in affiliates, at fair value | 10,288 | 5,273 | ||||||

| Due from related parties | 1,101 | 734 | ||||||

| Property and equipment, net | 319 | 274 | ||||||

| Prepaid expenses | 1,907 | 906 | ||||||

| Other assets | 385 | 348 | ||||||

| Assets of Consolidated Funds | ||||||||

| Cash and cash equivalents | 13,416 | 37,080 | ||||||

| Investments, at fair value | 446,707 | 404,365 | ||||||

| Due from broker | 12,095 | 16,438 | ||||||

| Other assets | 1,007 | 1,210 | ||||||

| Total Assets | $ | 506,064 | $ | 514,145 | ||||

| Liabilities and Equity | ||||||||

| Liabilities | ||||||||

| Notes payable | $ | — | $ | 1,263 | ||||

| Compensation payable | 4,594 | 7,836 | ||||||

| Due to related parties | 31 | 31 | ||||||

| Fees payable | — | 2,439 | ||||||

| Other liabilities | 1,147 | 1,127 | ||||||

| Liabilities of Consolidated Funds | ||||||||

| Notes payable of consolidated CLO, at fair value | 384,519 | 384,901 | ||||||

| Due to broker | 21,974 | 24,462 | ||||||

| Other liabilities | 2,579 | 2,121 | ||||||

| Total Liabilities | 414,844 | 424,180 | ||||||

| Commitments and Contingencies (Note 12) | — | — | ||||||

| Equity | ||||||||

| Preferred Stock, $0.0001 par value; 2,000,000 shares authorized; 0 shares issued and outstanding. | — | — | ||||||

| Class A Common Stock, $0.0001 par value; 180,000,000 shares authorized; 14,480,782 and 13,900,917 shares issued and outstanding at June 30, 2017 and December 31, 2016, respectively. | 1 | 1 | ||||||

| Class B Common Stock, $0.000001 par value; 20,000,000 shares authorized; 20,000,000 shares issued and outstanding. | — | — | ||||||

| Additional paid-in capital | 64,210 | 63,413 | ||||||

| Retained earnings (Accumulated deficit) | (23,779 | ) | (18,965 | ) | ||||

| Accumulated other comprehensive income (loss) | (44 | ) | (70 | ) | ||||

| Total stockholders’ equity, ZAIS Group Holdings, Inc. | 40,388 | 44,379 | ||||||

| Non-controlling interests in ZAIS Group Parent, LLC | 19,417 | 22,258 | ||||||

| Non-controlling interests in Consolidated Funds | 31,415 | 23,328 | ||||||

| Total Equity | 91,220 | 89,965 | ||||||

| Total Liabilities and Equity | $ | 506,064 | $ | 514,145 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(Dollars in thousands, except share and per share amounts)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenues | ||||||||||||||||

| Management fee income | $ | 3,689 | $ | 3,571 | $ | 6,796 | $ | 7,140 | ||||||||

| Incentive income | 2,884 | 143 | 3,181 | 295 | ||||||||||||

| Reimbursement revenue | 383 | — | 877 | — | ||||||||||||

| Other revenues | 77 | 79 | 170 | 159 | ||||||||||||

| Income of Consolidated Funds | 404 | — | 404 | — | ||||||||||||

| Total Revenues | 7,437 | 3,793 | 11,428 | 7,594 | ||||||||||||

| Expenses | ||||||||||||||||

| Compensation and benefits | 5,609 | 7,999 | 13,033 | 17,006 | ||||||||||||

| General, administrative and other | 3,879 | 2,950 | 7,548 | 6,160 | ||||||||||||

| Depreciation and amortization | 71 | 64 | 111 | 127 | ||||||||||||

| Expenses of Consolidated Funds | 30 | 29 | 73 | 48 | ||||||||||||

| Total Expenses | 9,589 | 11,042 | 20,765 | 23,341 | ||||||||||||

| Other income (loss) | ||||||||||||||||

| Net gain (loss) on investments | 39 | 55 | 114 | 37 | ||||||||||||

| Other income (expense) | 32 | 87 | 16 | 692 | ||||||||||||

| Net gain (loss) of Consolidated Funds’ investments | 1,607 | 2,176 | 2,714 | 3,693 | ||||||||||||

| Net gain (loss) on beneficial interest of collateralized financing entity | 909 | — | 1,498 | — | ||||||||||||

| Total Other Income (Loss) | 2,587 | 2,318 | 4,342 | 4,422 | ||||||||||||

| Income (loss) before income taxes | 435 | (4,931 | ) | (4,995 | ) | (11,325 | ) | |||||||||

| Income tax (benefit) expense | 5 | 4 | 10 | 9 | ||||||||||||

| Consolidated net income (loss), net of tax | 430 | (4,935 | ) | (5,005 | ) | (11,334 | ) | |||||||||

| Other comprehensive income (loss), net of tax: | ||||||||||||||||

| Foreign currency translation adjustment | 9 | (147 | ) | 39 | (201 | ) | ||||||||||

| Total Comprehensive Income (Loss) | $ | 439 | $ | (5,082 | ) | $ | (4,966 | ) | $ | (11,535 | ) | |||||

| Allocation of Consolidated Net Income (Loss), net of tax | ||||||||||||||||

| Non-controlling interests in Consolidated Funds | $ | 1,397 | $ | 1,052 | $ | 2,207 | $ | 1,786 | ||||||||

| Stockholders’ equity, ZAIS Group Holdings, Inc. | (652 | ) | (4,076 | ) | (4,814 | ) | (8,910 | ) | ||||||||

| Non-controlling interests in ZAIS Group Parent, LLC | (315 | ) | (1,911 | ) | (2,398 | ) | (4,210 | ) | ||||||||

| Total Allocation of Consolidated Net Income (Loss), net of tax | $ | 430 | $ | (4,935 | ) | $ | (5,005 | ) | $ | (11,334 | ) | |||||

| Allocation of Total Comprehensive Income (Loss) | ||||||||||||||||

| Non-controlling interests in Consolidated Funds | $ | 1,397 | $ | 1,052 | $ | 2,207 | $ | 1,786 | ||||||||

| Stockholders’ equity, ZAIS Group Holdings, Inc. | (646 | ) | (4,174 | ) | (4, 788 | ) | (9,044 | ) | ||||||||

| Non-controlling interests in ZAIS Group Parent, LLC | (312 | ) | (1,960 | ) | (2,385 | ) | (4,277 | ) | ||||||||

| Total Allocation of Total Comprehensive Income (Loss) | $ | 439 | $ | (5,082 | ) | $ | (4,966 | ) | $ | (11,535 | ) | |||||

| Consolidated Net Income (Loss), net of tax per Class A common share applicable to ZAIS Group Holdings, Inc. – Basic | $ | (0.05 | ) | $ | (0.29 | ) | $ | (0.34 | ) | $ | (0.64 | ) | ||||

| Consolidated Net Income (Loss), net of tax per Class A common share applicable to ZAIS Group Holdings, Inc. – Diluted | $ | (0.05 | ) | $ | (0.29 | ) | $ | (0.34 | ) | $ | (0.64 | ) | ||||

| Weighted average shares of Class A common stock outstanding: | ||||||||||||||||

| Basic | 14,473,642 | 13,892,016 | 14,231,320 | 13,881,466 | ||||||||||||

| Diluted | 21,473,642 | 20,892,016 | 21,231,320 | 20,881,466 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements

of Changes in Equity and Non-controlling Interests (Unaudited)

(Dollars in thousands except share amounts)

Six Months Ended June 30, 2017 | Class A Common Stock | Class B Common Stock | Additional paid-in-capital | Retained (Accumulated | Accumulated other comprehensive income (loss) | Non-controlling interests in ZAIS

Group | Non-controlling interests in Consolidated Funds | Total Equity | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||||||||||

| December 31, 2016 | 13,900,917 | $ | 1 | 20,000,000 | $ | - | $ | 63,413 | $ | (18,965 | ) | $ | (70 | ) | $ | 22,258 | $ | 23,328 | $ | 89,965 | ||||||||||||||||||||

| Settlement of RSU awards | 579,865 | - | - | - | 447 | - | - | (447 | ) | - | - | |||||||||||||||||||||||||||||

| Payment of employee taxes in connection with net settlement of RSUs | (801 | ) | - | (801 | ) | |||||||||||||||||||||||||||||||||||

| Modification of equity awards to liability awards | - | - | - | - | (17 | ) | - | - | (9 | ) | - | (26 | ) | |||||||||||||||||||||||||||

| Capital contributions | - | - | - | - | - | - | - | - | 5,880 | 5,880 | ||||||||||||||||||||||||||||||

| Equity-based

compensation charges | - | - | - | - | 1,168 | - | - | - | - | 1,168 | ||||||||||||||||||||||||||||||

| Consolidated

net income (loss) | - | - | - | - | - | (4,814 | ) | - | (2,398 | ) | 2,207 | (5,005 | ) | |||||||||||||||||||||||||||

| Other comprehensive income (loss) | - | - | - | - | - | - | 26 | 13 | - | 39 | ||||||||||||||||||||||||||||||

| June 30, 2017 | 14,480,782 | $ | 1 | 20,000,000 | $ | - | $ | 64,210 | $ | (23,779 | ) | $ | (44 | ) | $ | 19,417 | $ | 31,415 | $ | 91,220 | ||||||||||||||||||||

| Six Months Ended June 30, 2016 | Class

A Common Stock | Class

B Common Stock | Additional paid-in-capital | Retained (Accumulated | Accumulated other comprehensive income (loss) | Non-controlling interests in ZAIS

Group | Non-controlling interests in Consolidated Funds | Total Equity | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||||||||||

| December 31, 2015 | 13,870,917 | $ | 1 | 20,000,000 | $ | - | $ | 60,817 | $ | (13,805 | ) | $ | 158 | $ | 23,716 | $ | 14,916 | $ | 85,803 | |||||||||||||||||||||

| Settlement of RSU awards | 30,000 | - | - | - | 30 | - | - | (30 | ) | - | - | |||||||||||||||||||||||||||||

| Capital contributions | - | - | - | - | - | - | - | - | 4,907 | 4,907 | ||||||||||||||||||||||||||||||

| Capital distributions | - | - | - | - | - | - | - | (284 | ) | - | (284 | ) | ||||||||||||||||||||||||||||

| Equity-based compensation charges | - | - | - | - | 1,118 | - | - | 564 | - | 1,682 | ||||||||||||||||||||||||||||||

| Consolidated net income (loss) | - | - | - | - | - | (8,910 | ) | - | (4,210 | ) | 1,786 | (11,334 | ) | |||||||||||||||||||||||||||

| Other comprehensive income (loss) | - | - | - | - | - | - | (134 | ) | (67 | ) | - | (201 | ) | |||||||||||||||||||||||||||

| June 30, 2016 | 13,900,917 | $ | 1 | 20,000,000 | $ | - | $ | 61,965 | $ | (22,715 | ) | $ | 24 | $ | 19,689 | $ | 21,609 | $ | 80,573 | |||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows (Unaudited)

(Dollars in thousands)

| Six Months Ended June 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Consolidated net income (loss) | $ | (5,005 | ) | $ | (11,334 | ) | ||

| Adjustments to reconcile consolidated net income (loss) to net cash provided by (used in) operating activities: | ||||||||

| Depreciation and amortization | 111 | 127 | ||||||

| Net (gain) loss on investments | (114 | ) | (37 | ) | ||||

| Non-cash stock-based compensation | 1,168 | 1,682 | ||||||

| Interest expense on notes payable | — | 4 | ||||||

| Operating cash flows due to changes in: | ||||||||

| Income and fees receivable | 6,936 | 874 | ||||||

| Due from related parties | (367 | ) | (634 | ) | ||||

| Prepaid expenses | (1,001 | ) | (1,170 | ) | ||||

| Other assets | (27 | ) | (1 | ) | ||||

| Compensation payable | (3,269 | ) | 728 | |||||

| Due to related parties | — | (33 | ) | |||||

| Fees payable | (2,439 | ) | (754 | ) | ||||

| Other liabilities | 19 | (748 | ) | |||||

| Proceeds from investments in affiliates | 90 | — | ||||||

| Items related to Consolidated Funds: | ||||||||

| Purchases of investments and investments in affiliated securities | (295,989 | ) | (10,000 | ) | ||||

| Change in unrealized (gain) loss on investments | — | (3,693 | ) | |||||

| Proceeds from sale of investments | 201,635 | — | ||||||

| Proceeds from sale of beneficial interest of collateralized financing entity | 54,262 | — | ||||||

| Net (gain) loss on investments | (4,130 | ) | — | |||||

| Net gain (loss) on beneficial interest of collateralized financing entity | 1,499 | — | ||||||

| Change in cash and cash equivalents | 23,665 | 33 | ||||||

| Change in other assets | 223 | — | ||||||

| Change in due from broker | 4,343 | — | ||||||

| Change in due to broker | (2,488 | ) | — | |||||

| Change in other liabilities | 437 | — | ||||||

| Net Cash Provided by (Used in) Operating Activities | (20,441 | ) | (24,956 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Purchases of fixed assets | (152 | ) | (17 | ) | ||||

| Distributions from investments in affiliates | — | 87 | ||||||

| Purchases of investments in affiliates | (5,000 | ) | — | |||||

| Purchases of investments, at fair value | — | (11 | ) | |||||

| Proceeds from sales of investments, at fair value | — | 8,174 | ||||||

| Net Cash Provided by (Used in) Investing Activities | (5,152 | ) | 8,233 | |||||

| Cash Flows from Financing Activities | ||||||||

| Contributions from non-controlling interests in Consolidated Funds | 5,880 | 4,907 | ||||||

| Payment of employee taxes in connection with net settlement of RSUs | (801 | ) | — | |||||

| Repayment of notes payable | (1,263 | ) | — | |||||

| Distributions to non-controlling interests in ZGP | — | (284 | ) | |||||

| Net Cash Provided by (Used in) Financing Activities | 3,816 | 4,623 | ||||||

| Net increase (decrease) in cash and cash equivalents denominated in foreign currency | 35 | (187 | ) | |||||

| Net increase (decrease) in cash and cash equivalents | (21,742 | ) | (12,287 | ) | ||||

| Cash and cash equivalents, beginning of period | 38,712 | 44,351 | ||||||

| Cash and cash equivalents, end of period | $ | 16,970 | $ | 32,064 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 6 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

1. Organization

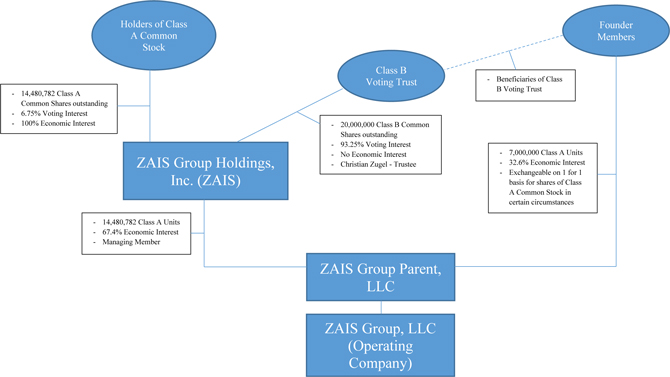

ZAIS Group Holdings, Inc. (“ZAIS”, and collectively with its consolidated subsidiaries, as the context may require, the “Company”) is a holding company conducting substantially all of its operations through ZAIS Group, LLC (“ZAIS Group”), an investment advisory and asset management firm focused on specialized credit which commenced operations in July 1997 and is headquartered in Red Bank, New Jersey. ZAIS Group also maintains an office in London. ZAIS Group is a wholly-owned consolidated subsidiary of ZAIS Group Parent, LLC (“ZGP”), a majority-owned consolidated subsidiary of ZAIS. ZAIS is the managing member of ZGP.

ZAIS Group is registered with the SEC under the Investment Advisors Act of 1940 and with the Commodity Futures Trading Commission as a Commodity Pool Operator and Commodity Trading Advisor. ZAIS Group provides investment advisory and asset management services to private funds, separately managed accounts, structured vehicles (collateralized debt obligation vehicles and collateralized loan obligation vehicles, together referred to as “CLOs”) and, through October 31, 2016, ZAIS Financial Corp. (“ZFC REIT”), a publicly traded mortgage real estate investment trust (collectively, the “ZAIS Managed Entities”).

On February 15, 2017, the Board of Directors of the Company (the “Board of Directors”) established a Special Committee of independent and disinterested directors to consider any proposals by management or third parties for strategic transactions. The Board of Directors has been undertaking a strategic review of the Company’s business in order to enhance shareholder value, and has engaged a financial advisor for this purpose. Various alternatives have been and are being considered, including a possible sale or combination or other similar transaction, or a going private transaction which would result in the termination of the registration of ZAIS Class A common stock (“Class A Common Stock”) so as to cease periodic and other public company compliance and reporting. The Company has received from and provided to potential counterparties certain due diligence information. In addition, the Company’s management and financial advisor have held and expect to continue to hold preliminary discussions with potential counterparties and participants. There is no assurance that any of the preliminary discussions which have taken place or may in the future take place will result in any transaction or that any of the strategic alternatives under consideration will be implemented. The Company does not intend to provide periodic public updates on any of these matters except as required by law or regulation

The ZAIS Managed Entities predominantly invest in a variety of specialized credit instruments including corporate credit instruments such as CLOs, securities backed by residential mortgage loans, bank loans and various securities and instruments backed by these asset classes. ZAIS Group had the following assets under management (“AUM”):

| Reporting Period | Approximately (in billions) | |||

| As of June 30, 2017 (1) | $ | 3.752 | ||

| As of December 31, 2016 | $ | 3.444 | ||

(1) On April 19, 2017, the ZAIS Opportunity Fund, Ltd. received a redemption request for a redemption of approximately $68.3 million (value date of June 30, 2017) from a European investor impacted by regulatory constraints. This redemption is expected to be effectuated on August 31, 2017. The AUM amount presented has not been reduced for this redemption request.

ZAIS Group also serves as the general partner to certain ZAIS Managed Entities, which are generally organized as pass-through entities for U.S. federal income tax purposes.

The Company’s primary sources of revenues are (i) management fee income, which is based predominantly on the net asset values of the ZAIS Managed Entities and (ii) incentive income, which is based on the investment performance of the ZAIS Managed Entities. Any management fee income and incentive income earned by ZAIS Group from the consolidated ZAIS Managed Entities (the “Consolidated Funds”) is eliminated in consolidation.

| 7 |

Additionally, a significant source of the Company’s revenues and other income is derived from income of Consolidated Funds, net gains of Consolidated Funds’ investments and net gains on beneficial interests in collateralized financing entities which invest in bank loans. A portion of income of Consolidated Funds and net gains of Consolidated Funds’ investments are allocated to non-controlling interests in Consolidated Funds.

2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited, interim, consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") as contained within the Financial Accounting Standards Board’s ("FASB") Accounting Standards Codification ("ASC") and the rules and regulations of the SEC for interim reporting. In the opinion of management, all adjustments considered necessary for a fair statement of the Company's financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for the interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP as contained in the ASC have been condensed or omitted from the unaudited interim condensed consolidated financial statements according to the SEC rules and regulations. The information and disclosures contained in these unaudited interim condensed consolidated financial statements and notes should be read in conjunction with the consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K. Certain comparative amounts in the consolidated financial statements have been reclassified to conform to the current period presentation.

Segment Reporting

The Company currently is comprised of one reportable segment, the investment management segment, and substantially all of the Company’s operations are conducted through this segment. The investment management segment provides investment advisory and asset management services to the ZAIS Managed Entities.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. While management believes that the estimates used in preparing the consolidated financial statements are reasonable and prudent, actual results may ultimately materially differ from those estimates.

Principles of Consolidation

The consolidated financial statements included herein are the financial statements of ZAIS, its subsidiaries and the Consolidated Funds. All intercompany balances and transactions are eliminated in consolidation, including ZAIS’s investment in ZGP and ZGP’s investment in ZAIS Group. The Company's fiscal year ends on December 31.

The consolidated financial statements include non-controlling interests in ZGP which is comprised of Class A Units of ZGP (“Class A Units”) held by Christian Zugel, the former managing member of ZGP and the founder and Chief Investment Officer of ZAIS Group, and certain related parties (collectively, the “ZGP Founder Members”).

The Company’s consolidated financial statements also include variable interest entities for which ZAIS Group is considered the primary beneficiary, and certain entities that are considered voting interest entities in which ZAIS Group has a controlling financial interest.

| 8 |

The Consolidated Funds include the following entities for the reporting periods presented:

| As of | Three Months Ended June 30, |

Six Months Ended June 30, | ||||||||||

| Entity | June 30, 2017 |

December 31, 2016 |

2017 | 2016 | 2017 | 2016 | ||||||

| ZAIS Zephyr A-6, LP (“Zephyr A-6”) | ü | ü | ü | ü | ü | ü | ||||||

| ZAIS CLO 5, Limited (“ZAIS CLO 5”) |

ü | ü | ü | — | ü | — | ||||||

The Consolidated Funds, except for consolidated CLOs, are deemed to be investment companies under U.S. GAAP, and therefore, the Company has retained the specialized investment company accounting of these consolidated entities in its consolidated financial statements. The economic interests which are held by third-party investors are reflected as non-controlling interests in Consolidated Funds.

The Company has elected the fair value option for the assets and liabilities held by the Consolidated Funds that otherwise would not have been carried at fair value. See Notes 4 and 5 for further disclosure on the assets and liabilities of the Consolidated Funds for which the fair value option has been elected.

For consolidated CLOs, the Company uses the measurement alternative included in the collateralized financing entity guidance (the “Measurement Alternative”). The Company measures both the financial assets and financial liabilities of the consolidated CLO in its consolidated financial statements using the fair value of the financial assets of the consolidated CLO, which are more observable than the fair value of the financial liabilities of the consolidated CLO. As a result, the financial assets of the consolidated CLO are measured at fair value and the financial liabilities are measured in consolidation as: the sum of the fair value of the financial assets and the carrying value of any non-financial assets that are incidental to the operations of the CLO less (ii) the sum of the fair value of any beneficial interests retained by the reporting entity (other than those that represent compensation for services) and the Company’s carrying value of any beneficial interests that represent compensation for services. The resulting amount is allocated to the individual financial liabilities (other than the beneficial interest retained by the Company) using a reasonable and consistent methodology. Under the Measurement Alternative, the Company’s consolidated net income reflects the Company’s own economic interests in the consolidated CLO including changes in the (i) fair value of the beneficial interests retained by the Company and (ii) beneficial interests that represent compensation for collateral management services. Such changes are presented in Net gain (loss) on beneficial interest of collateralized financing entity in the Consolidated Statements of Comprehensive Income (Loss).

The majority of the economic interests in the CLOs are held by outside parties, and are reported as notes payable of consolidated CLOs in the consolidated financial statements. The notes payable issued by the CLOs are backed by diversified collateral asset portfolios consisting primarily of loans or structured debt. In exchange for managing the collateral for the CLOs, ZAIS Group may earn investment management fees, including, in some cases, subordinated management fees and contingent incentive fees. All of the management fee income, incentive income and Net gain (loss) on investments earned by ZAIS Group from the Consolidated Funds are eliminated in consolidation.

| 9 |

Reimbursement Revenue

ZAIS Group may pay research and data services expenses relating to the management of the ZAIS Managed Entities directly to vendors and may allocate a portion of these costs to the respective ZAIS Managed Entities per the terms of the related agreements (the “Research Costs”). These amounts may be reimbursable by the respective ZAIS Managed Entities and are recorded as Reimbursement revenue in the Consolidated Statements of Comprehensive Income (Loss) to the extent the Company is the primary obligor for such expenses and if the costs are charged back to the respective funds. The amounts for the three and six months ended June 30, 2016 were not material and therefore were not separately reported in the Consolidated Statements of Comprehensive Income (Loss).

Income of Consolidated Funds

Income of Consolidated Funds reflects the interest income recognized by Zephyr A-6 related to its investments in unconsolidated CLOs. Any discounts and premiums on fixed income securities purchased are accreted or amortized into income or expense using the effective interest rate method over the lives of such securities. The effective interest rates are calculated using projected cash flows including the impact of paydowns on each of the aforementioned securities.

Non-Controlling Interests

The non-controlling interests within the Consolidated Statements of Financial Condition may be comprised of (i) redeemable non-controlling interests reported outside of the permanent capital section when investors have the right to redeem their interests from a Consolidated Fund or ZAIS Group, (ii) equity attributable to non-controlling interests in Consolidated Funds (excluding CLOs) reported inside the permanent capital section when the investors do not have the right to redeem their interests and (iii) equity attributable to non-controlling interests in ZGP inside the permanent capital section, if applicable.

The Company records non-controlling interests in the Consolidated Funds (excluding CLOs) to reflect the economic interests in those funds held by investors other than interests attributable to ZAIS Group. Income allocated to non-controlling interests in ZGP includes the portion of management fee income received from ZFC REIT that was payable to holders of Class B interests in ZAIS REIT Management, LLC (“ZAIS REIT Management”), a majority owned subsidiary of ZAIS Group which was the external adviser to ZFC REIT prior to October 31, 2016 (see Note 6 – “Management Fee Income and Incentive Income”).

Recent Accounting Pronouncements

Since May 2014, the FASB has issued ASU Nos. 2014-09, 2015-14, 2016-08, 2016-10 and 2016-12, Revenue from Contracts with Customers. The objective of the guidance is to clarify the principles for recognizing revenue and supersedes most current revenue recognition guidance, including industry-specific guidance. The guidance is to be applied retrospectively to all prior periods presented or through a cumulative adjustment in the year of adoption, for interim and annual periods beginning after December 15, 2017. The Company currently recognizes incentive income subject to contingent repayment once all contingencies have been resolved. Whereas the new guidance requires an entity to recognize such revenue when it concludes that it is probable that a significant reversal in the cumulative amount of revenue recognized will not occur when the uncertainty is resolved. As such, the adoption of the new guidance may require the Company to recognize incentive income earlier than as prescribed under current guidance. The Company is currently evaluating the impact of adopting this new standard.

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments─Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”). The amendments, among other things, (i) requires equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income; (ii) requires public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes; (iii) requires separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables) and (iv) eliminates the requirement for public business entities to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost. ASU 2016-01 is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. The Company is currently evaluating the impact of adopting this new standard. The adoption of ASU 2016-01 is not expected to have a material effect on the Company’s consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-02”). Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for those leases previously classified as operating leases. The amendments in ASU No. 2016-02 are effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period with early adoption permitted. The Company is currently evaluating the impact of adopting this new standard.

| 10 |

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (“ASU 2016-15”). This ASU addresses the following eight specific cash flow issues: Debt prepayment or debt extinguishment costs; settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing; contingent consideration payments made after a business combination; proceeds from the settlement of insurance claims; proceeds from the settlement of corporate-owned life insurance policies (including bank-owned life insurance policies); distributions received from equity method investees; beneficial interests in securitization transactions; and separately identifiable cash flows and application of the predominance principle. ASU 2016-15 is effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early application is permitted, including adoption in an interim period. The adoption of ASU 2016-15 is not expected to have a material effect on the Company's consolidated financial statements.

In December 2016 the FASB issued ASU 2016-19, Technical Corrections and Improvements. As part of this guidance, ASU 2016-19 amends FASB ASC 820 to clarify the difference between a valuation approach and a valuation technique. The amendment also requires an entity to disclose when there has been a change in either or both a valuation approach and/or a valuation technique. ASU 2016-19 is effective on a prospective basis for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. The Company has adopted ASU 2016-19 on its consolidated financial statements and disclosures. The adoption of ASU 2016-19 has not had a material impact on its consolidated financial statements.

3. Investments in Affiliates

In February 2017, ZAIS Group made a $5.0 million commitment to a ZAIS Managed Entity which focuses on investing in non-ZAIS managed CLOs, none of which has been called as of August 14, 2017.

In June 2017, ZAIS Group made a $5.0 million commitment to a ZAIS Managed Entity which carries first loss risk. ZAIS Group funded its entire $5.0 million commitment on June 29, 2017.

At June 30, 2017 and December 31, 2016, the Company held investments in six and five unconsolidated ZAIS Managed Entities (excluding an investment in a ZAIS Managed Entity for which no capital has been called as of August 14, 2017), respectively.

The Company applied the Fair Value Option to its investments in the ZAIS Managed Entities that are not consolidated. The Company believes that reporting the fair value of these investments is more indicative of the Company’s financial position than historical cost.

The fair value of these investments was as follows:

| June

30, 2017 | December

31, 2016 | |||||

| (Dollars in thousands) | ||||||

| $ | 10,288 | $ | 5,273 | |||

The Company recorded a change in unrealized gain (loss) associated with the investments still held at the end of each respective period as follows:

| Three Months Ended | Six Months Ended | |||||||||||||

| June 30, 2017 | June 30, 2016 | June 30, 2017 | June 30, 2016 | |||||||||||

| (Dollars in thousands) | ||||||||||||||

| $ | 2 | $ | 25 | $ | 15 | $ | (22 | ) | ||||||

Such amounts are included in Net gain (loss) on investments in the Consolidated Statements of Comprehensive Income (Loss).

At June 30, 2017 and December 31, 2016, no equity investment, individually or in the aggregate, held by the Company exceeded 20% of its total consolidated assets. Additionally, the Company did not have any income related to these investments, individually or in the aggregate, which exceeded 20% of its total Consolidated net income net of tax for the six months ended June 30, 2017 or June 30, 2016. As such, the Company did not present separate or summarized financial statements for any of its investees.

| 11 |

4. Fair Value Measurements

ASC 820 Fair Value Measurements defines fair value, establishes a framework for measuring fair value, and requires certain disclosures about fair value measurements under U.S. GAAP. Specifically, this guidance defines fair value based on exit price, or the price that would be received upon the sale of an asset or the transfer of a liability in an orderly transaction between market participants at the measurement date. Fair value under U.S. GAAP represents an exit price in the normal course of business, not a forced liquidation price. If the Company was forced to sell assets in a short period to meet liquidity needs, the prices it receives could be substantially less than their recorded fair values.

The Company follows the fair value measurement and disclosure guidance under U.S. GAAP, which establishes a hierarchical disclosure framework. This framework prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is affected by a number of factors, including the type of investment, the characteristics specific to the investment and the state of the marketplace including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices in an orderly market generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value. In all cases, an instrument’s level within the hierarchy is based upon the market pricing transparency of the instrument and does not necessarily correspond to the Company’s perceived risk or liquidity of the instrument.

The Company considers observable data to be market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given investment is based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires significant judgment and considers factors specific to the investment.

Assets and liabilities that are measured and reported at fair value are classified and disclosed in one of the following categories:

Level 1 — Fair value is determined based on quoted prices for identical assets or liabilities in an active market at measurement date. Assets and liabilities included in Level 1 include listed securities. As required in the fair value measurement and disclosure guidance under U.S. GAAP, the Company does not adjust the quoted price for these investments. The hierarchy gives highest priority to Level 1.

Level 2 — Fair value is determined based on inputs other than quoted prices that are observable for the asset or liability either directly or indirectly as of the reporting date. Assets and liabilities which are generally included in this category include corporate bonds and loans, less liquid and restricted equity securities and certain over-the-counter derivatives, including foreign exchange forward contracts whose values are based on the following:

| • | Quoted prices for similar assets or liabilities in active markets. |

| • | Quoted prices for identical or similar assets or liabilities in non-active markets. |

| • | Pricing models whose inputs are observable for substantially the full term of the asset or liability. |

| • | Pricing models whose inputs are derived principally from or corroborated by observable market data for substantially the full term of the asset or liability. |

Level 3 — Fair value is determined based on inputs that are unobservable for the investment and includes situations where there is little, if any, market activity for the asset or liability. The inputs into the determination of fair value require significant management judgment or estimation and the Company may use models or other valuation methodologies to arrive at fair value. Investments that are included in this category generally include distressed debt, less liquid corporate debt securities, non-investment grade residual interests in securitizations, collateralized debt obligations and certain derivative contracts. The hierarchy gives the lowest priority to Level 3.

| 12 |

The Company has established a valuation process that applies for all levels of investments in the valuation hierarchy to ensure that the valuation techniques are consistent and verifiable. The valuation process includes discussions between the valuation team, portfolio management team and the valuation committee (the “Valuation Committee”). The Valuation Committee consists of senior members of ZAIS Group and is chaired by the Chief Financial Officer of ZAIS Group. The Valuation Committee meets to review and approve the results of the valuation process which are used in connection with the preparation of quarterly and annual financial statements. The Valuation Committee is responsible for oversight and review of the written valuation policies and procedures and ensuring that they are applied consistently.

The lack of an established, liquid secondary market for some of the Company’s holdings may have an adverse effect on the market value of those holdings and on the Company’s ability to dispose of them. Additionally, the public markets for the Company’s holdings may experience periods of volatility and periods of reduced liquidity and the Company’s holdings may be subject to certain other transfer restrictions that may further contribute to illiquidity. Such illiquidity may adversely affect the price and timing of liquidations of the Company’s holdings.

The following is a description of the valuation techniques used to measure fair value:

Investments in Bank Loans

The Company uses a nationally recognized pricing source to provide pricing for the bank loans held by the Consolidated Funds.

Investments in CLOs

ZAIS determined the fair value of the investments in CLOs generally with input from a third party pricing source. ZAIS verifies that the quotes received from the valuation source are reflective of fair value as defined in U.S. GAAP, generally by comparing trading activity for similar asset classes, pricing research provided by banks and brokers, indicative broker quotes and results from an external cash flows analytics tool.

Collateralized Loan Obligation – Warehouses

A Collateralized Loan Obligation Warehouse ("CLO Warehouse") is an entity organized for the purpose of holding syndicated bank loans, also known as leveraged loans, prior to the issuance of securities from that same vehicle. During the warehouse period, a CLO Warehouse will secure investments and build a portfolio of primarily leveraged loans and other debt obligations. The warehouse period terminates when the collateralized loan obligation vehicle issues various tranches of securities to the market. At this time, financing through the issuance of debt and equity securities is used to repay the bank financing.

The fair value of a CLO Warehouse is determined by adding the excess spread (accrued interest plus interest received less financing cost) to the CLO Warehouse equity contribution made by the Consolidated Funds, unless ZAIS Group determines that the securitization will not be achieved, in which case, the fair value of a CLO Warehouse will be established based on the fair value of the underlying bank loan positions which are valued in a manner consistent with ZAIS Group’s valuation policy and procedures. CLO warehouses can be exposed to credit events, mark to market changes, rating agency downgrades and financing cost changes. Changes in the fair value of a CLO Warehouse are reported in Net gain (loss) of Consolidated Funds’ investments in the Consolidated Statements of Comprehensive Income (Loss).

Investment in Affiliates

Under U.S. GAAP, the Company is permitted, as a practical expedient, to estimate the fair value of its investments in other investment companies using the net asset value (or its equivalent) of the related investment company. Accordingly, the Company utilizes the net asset value in valuing its investments in the unconsolidated ZAIS Managed Entities, which is an amount equal to the sum of the Company’s proportionate interest in the capital accounts of the affiliated entities at fair value. The fair value of the assets and liabilities of the ZAIS Managed Entities are determined by the Company in accordance with its valuation policies described above. Investments measured at fair value using the practical expedient are not required to be categorized within the fair value hierarchy. The resulting net gains or losses on investments are included in Net gain (loss) on investments in the Consolidated Statements of Comprehensive Income (Loss).

| 13 |

The valuation of the Company’s investments in unconsolidated ZAIS Managed Entities represents the amount the Company would receive at June 30, 2017 and December 31, 2016, respectively, if it were to liquidate its investments in these entities. ZAIS Group has the ability to liquidate its investments according to the provisions of the respective entities’ operative agreements.

Notes payable of Consolidated CLO

The fair value of notes payable of Consolidated CLO is determined by applying the Measurement Alternative.

The following tables summarize the Company’s assets and liabilities measured at fair value on a recurring basis within the fair value hierarchy levels or based on net asset values, as applicable:

| June 30, 2017 | ||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Net Asset Value | Total | ||||||||||||||||

| Assets, at fair value: | ||||||||||||||||||||

| Cash equivalents | $ | 16,103 | $ | — | $ | — | $ | — | $ | 16,103 | ||||||||||

| Investments in affiliates, at fair value | — | — | — | 10,288 | 10,288 | |||||||||||||||

| Assets of Consolidated Funds | ||||||||||||||||||||

| Investments, at fair value: | ||||||||||||||||||||

| Bank loans | — | — | 396,408 | — | 396,408 | |||||||||||||||

| CLOs: | ||||||||||||||||||||

| Senior notes | — | — | 18,998 | — | 18,998 | |||||||||||||||

| Mezzanine notes | — | — | 3,950 | — | 3,950 | |||||||||||||||

| Subordinated notes | — | — | 2,346 | — | 2,346 | |||||||||||||||

| Warehouse | — | — | 25,005 | — | 25,005 | |||||||||||||||

| Total – investments, at fair value | — | — | 446,707 | — | 446,707 | |||||||||||||||

| Total assets, at fair value | $ | 16,103 | $ | — | $ | 446,707 | $ | 10,288 | $ | 473,098 | ||||||||||

| Liabilities, at fair value: | ||||||||||||||||||||

| Liabilities of Consolidated Funds | ||||||||||||||||||||

| Notes payable of Consolidated CLO, at fair value | — | — | 384,519 | — | 384,519 | |||||||||||||||

| Total liabilities, at fair value | $ | — | $ | — | $ | 384,519 | $ | — | $ | 384,519 | ||||||||||

| 14 |

| December 31, 2016 | ||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Net Asset Value | Total | ||||||||||||||||

| Assets, at fair value: | ||||||||||||||||||||

| Cash equivalents | $ | 36,971 | $ | — | $ | — | $ | — | $ | 36,971 | ||||||||||

| Investments in affiliates, at fair value | — | — | — | 5,273 | 5,273 | |||||||||||||||

| Assets of Consolidated Funds | ||||||||||||||||||||

| Investments, at fair value: | ||||||||||||||||||||

| Bank loans | — | — | 389,329 | — | 389,329 | |||||||||||||||

| CLOs: | ||||||||||||||||||||

| Warehouse | — | — | 15,036 | — | 15,036 | |||||||||||||||

| Total – investments, at fair value | — | — | 404,365 | — | 404,365 | |||||||||||||||

| Total assets, at fair value | $ | 36,971 | $ | — | $ | 404,365 | $ | 5,273 | $ | 446,609 | ||||||||||

| Liabilities, at fair value: | ||||||||||||||||||||

| Liabilities of Consolidated Funds | ||||||||||||||||||||

| Notes payable of Consolidated CLO, at fair value | — | — | 384,901 | — | 384,901 | |||||||||||||||

| Total liabilities, at fair value | $ | — | $ | — | $ | 384,901 | $ | — | $ | 384,901 | ||||||||||

The following tables summarize the changes in the Company’s Level 3 assets:

| Six Months Ended June 30, 2017 | ||||||||||||||||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||||||||||||||

| Beginning Balance January 1, 2017 | Purchases/ Issuances | Sales/ Redemptions/ Settlements | Total Realized and Change in Unrealized Gains (Losses) | Amortization of Discounts/ Premiums | Transfers to (from) Level 3 | Ending Balance June 30, 2017 | Change in Unrealized Gains/Losses Relating to Assets and Liabilities Still Held at June 30, 2017 | |||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||

| Bank loans | $ | 389,329 | $ | 211,967 | $ | (201,635 | ) | $ | (3,939 | ) | $ | 686 | $ | — | $ | 396,408 | $ | (2,655 | ) | |||||||||||||

| CLOs: | ||||||||||||||||||||||||||||||||

| Senior notes | — | 19,000 | — | (106 | ) | 104 | — | 18,998 | (106 | ) | ||||||||||||||||||||||

| Mezzanine notes | — | 3,950 | — | (44 | ) | 44 | — | 3,950 | (44 | ) | ||||||||||||||||||||||

| Subordinated notes | — | 6,072 | (3,872 | ) | 113 | 33 | — | 2,346 | (111 | ) | ||||||||||||||||||||||

| Warehouse | 15,036 | 55,000 | (45,000 | ) | (31 | ) | — | — | 25,005 | (5 | ) | |||||||||||||||||||||

| Total investments, at fair value | $ | 404,365 | $ | 295,989 | $ | (250,507 | ) | $ | (4,007 | ) | $ | 867 | $ | — | $ | 446,707 | $ | (2,921 | ) | |||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||

| Notes payable of Consolidated CLO, at fair value | $ | 384,901 | $ | — | $ | — | $ | (382 | ) | $ | $ | — | $ | 384,519 | $ | (382 | ) | |||||||||||||||

| Total liabilities, at fair value | $ | 384,901 | $ | — | $ | — | $ | (382 | ) | $ | $ | — | $ | 384,519 | $ | (382 | ) | |||||||||||||||

| 15 |

| Six Months Ended June 30, 2016 | ||||||||||||||||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||||||||||||||||

| Beginning Balance January 1, 2016 | Purchases/ Issuances | Sales/ Redemptions/ Settlements | Total Realized and Change in Unrealized Gains (Losses) | Transfers to (from) Level 3 | Ending Balance June 30, 2016 | Change in Unrealized Gains/Losses Relating to Assets and Liabilities Still Held at June 30, 2016 | ||||||||||||||||||||||

| CLOs: | ||||||||||||||||||||||||||||

| Warehouse | $ | 30,509 | $ | 10,000 | $ | — | $ | 3,692 | $ | — | $ | 44,201 | $ | 3,692 | ||||||||||||||

| Total investments, at fair value | $ | 30,509 | $ | 10,000 | $ | — | $ | 3,692 | $ | — | $ | 44,201 | $ | 3,692 | ||||||||||||||

The Company’s policy is to record transfers between Level 1, Level 2 and Level 3, if any, at the beginning of the period. There were no transfers between Level 1, Level 2 and Level 3 during the six months ended June 30, 2017 or June 30, 2016.

The tables below summarize information about the significant unobservable inputs used in determining the fair value of the Level 3 assets and liabilities held by the Consolidated Funds:

| Investment Type | Fair Value at June 30, 2017 | Valuation Technique | Unobservable Input | Amount/ Percentage | Min | Max | Weighted Average | |||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||

| Assets of Consolidated Funds: | ||||||||||||||||||||||

| Bank loans | $ | 396,408 | Third party pricing source | Not applicable | Not applicable | — | — | — | ||||||||||||||

| CLOs: | ||||||||||||||||||||||

| Senior notes | 18,998 | Third party pricing source | Not applicable | Not applicable | — | — | — | |||||||||||||||

| Mezzanine notes | 3,950 | Third party pricing source | Not applicable | Not applicable | — | — | — | |||||||||||||||

| Subordinated notes | 2,346 | Third party pricing source | Not applicable | Not applicable | — | — | — | |||||||||||||||

| Warehouse | 25,005 | Cost plus excess spread | Excess spread | 0.02% | — | — | — | |||||||||||||||

| Total – Investments, at fair value | $ | 446,707 | ||||||||||||||||||||

| Liabilities of Consolidated Funds: | ||||||||||||||||||||||

| Notes payable of Consolidated CLO, at fair value | $ | 384,519 | Measurement Alternative | Not applicable | Not applicable | — | — | — | ||||||||||||||

| Total – Notes payable of Consolidated CLO, at fair value | $ | 384,519 | ||||||||||||||||||||

| 16 |

| Investment Type | Fair Value at December 31, 2016 | Valuation Technique | Unobservable Input | Amount/ Percentage | Min | Max | Weighted Average | |||||||||||||||

| (Dollars in Thousands) | ||||||||||||||||||||||

| Assets of Consolidated Funds: | ||||||||||||||||||||||

| Bank loans | $ | 389,329 | Third party valuation source | Not applicable | Not applicable | — | — | — | ||||||||||||||

| CLOs: | ||||||||||||||||||||||

| Warehouse | 15,036 | Cost plus excess spread | Excess spread | 0.2% | — | — | — | |||||||||||||||

| Total – Investments, at fair value | $ | 404,365 | ||||||||||||||||||||

| Liabilities of Consolidated Funds: | ||||||||||||||||||||||

| Notes payable of Consolidated CLO, at fair value | $ | 384,901 | Measurement Alternative | Not applicable | Not applicable | — | — | — | ||||||||||||||

| Total – Notes payable of Consolidated CLO, at fair value | $ | 384,901 | ||||||||||||||||||||

5. Variable Interest Entities

In the ordinary course of business, ZAIS Group sponsors the formation of variable interest entities (“VIEs”) that can be broadly classified into the following categories: hedge funds, hybrid private equity funds and CLOs. ZAIS Group generally serves as the investment advisor or collateral manager with certain investment-related, decision-making authority for these entities. The Company has not recorded any liabilities with respect to VIEs that are not consolidated.

| 17 |

Funds

The Company has determined that the fee it receives from several of the hedge funds and hybrid private equity funds ZAIS Group manages do not represent a variable interest, because ZAIS Group’s fee arrangements are commensurate with the level of effort performed and include only customary terms that do not represent variable interests. The Company considered investments its related parties have in these entities when determining if ZAIS Group’s fee represented a variable interest.

ZAIS Group owns 51% of a majority-owned affiliate, Zephyr A-6, which was formed to invest in collateralized loan obligation vehicles, including during the related warehouse period of such vehicles. The Company has determined that ZAIS Group is the primary beneficiary of Zephyr A-6 and therefore has consolidated Zephyr A-6 in its consolidated financial statements at June 30, 2017 and December 31, 2016 and for the three and six months ended June 30, 2017 and June 30, 2016. ZAIS Group is the primary beneficiary since it is deemed to have (i) the power to direct activities of the entity that most significantly impact its economic performance and (ii) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the entity.

Zephyr A-6’s investments are as follows:

ZAIS CLO 5

ZAIS CLO 5, which priced on September 23, 2016 and closed on October 26, 2016, invests primarily in first lien senior secured bank loans and had a total capitalization of $408.5 million at the time of closing, which consisted of senior and mezzanine notes with an aggregate par amount of $368.0 million and subordinated notes of $40.5 million. The CLO matures in October 2028. In connection with the closing, Zephyr A-6 recognized a dividend of $8.8 million which represents gains that were realized under the terms of the CLO Warehouse agreement.

Zephyr A-6’s initial investment in ZAIS CLO 5 was $20.3 million ($20.5 million par), which represented approximately a 2.1% economic interest in the senior and mezzanine notes and approximately 31.8% economic interest in the subordinated notes. The Company determined that it is the primary beneficiary of ZAIS CLO 5 based on (i) its ability to impact the activities which most significantly impact ZAIS CLO 5’s economic performance as collateral manger and (ii) Zephyr A-6’s significant investment in the subordinated notes of ZAIS CLO 5. Therefore, the Company consolidated ZAIS CLO 5 in its financial statements at June 30, 2017 and December 31, 2016 and for the three and six months ended June 30, 2017.

In February 2017 Zephyr A-6 sold its interest in the Class A-1 tranche of ZAIS CLO 5 for a sales price of approximately $5.4 million and recognized a loss of approximately $81,000. Such amount is included in Net gain (loss) on beneficial interest of collateralized financing entity in the Consolidated Statements of Comprehensive Income (Loss).

Zephyr A-6 had an investment of $12.7 million and $19.5 million in ZAIS CLO 5, at fair value, at June 30, 2017 and December 31, 2016, respectively. These investments represent approximately a 0.6% economic interest in the senior and mezzanine notes and a 31.8% economic interest in the subordinated notes of ZAIS CLO 5 at June 30, 2017. These investments represent approximately a 2.1% economic interest in the senior and mezzanine notes and a 31.8% economic interest in the subordinated notes of ZAIS CLO 5 at December 31, 2016.

ZAIS CLO 5 was in the warehouse phase during the three and six months ended June 30, 2016 and continued to finance the majority of its loan purchases using its warehouse facility (the “ZAIS CLO 5 Warehouse Period”). The Company was not required to consolidate ZAIS CLO 5 during the ZAIS CLO 5 Warehouse Period.

ZAIS CLO 6, Limited (“ZAIS CLO 6”)

ZAIS CLO 6, which priced on May 3, 2017 and closed on June 1, 2017 (the “ZAIS CLO 6 Closing Date”), invests primarily in first lien senior secured bank loans and had a total capitalization of $512.0 million on the ZAIS CLO 6 Closing Date, which consisted of senior and mezzanine notes with an aggregate par amount of $460.0 million and subordinated notes of $52.0 million. The CLO matures in July 2029. In connection with the closing, Zephyr A-6 recognized a dividend of $2.7 million which represents gains that were realized under the terms of the CLO Warehouse agreement. Zephyr A-6’s initial investment of $29.0 million in ZAIS CLO 6 represented approximately a 5.0% economic interest in the senior and mezzanine note tranches and approximately a 13.5% economic interest in the equity tranche.

| 18 |

In May 2017 Zephyr A-6 sold a portion of its interest in the subordinated notes of ZAIS CLO 6 for a sales price of approximately $3.9 million and recognized a gain of approximately $223,500. Such amount is included in Net gain (loss) on beneficial interest of collateralized financing entity in the Consolidated Statements of Comprehensive Income (Loss).

Zephyr A-6’s investment in ZAIS CLO 6 was $25.3 million at fair value, at June 30, 2017 ($25.6 million par), which represented approximately a 5.0% economic interest in the senior, mezzanine and subordinated notes based on notional value. The Company determined that it is not the primary beneficiary of ZAIS CLO 6 based on Zephyr A-6’s minimal investment in the subordinated notes of ZAIS CLO 6. Therefore, the Company was not required to consolidate ZAIS CLO 6 in its financial statements at June 30, 2017 or for the three and six months ended June 30, 2017.

ZAIS CLO 6 was in the warehouse phase from its inception date through the ZAIS CLO 6 Closing Date (the “ZAIS CLO 6 Warehouse Period”). During this time ZAIS CLO 6 continued to finance the majority of its loan purchases using its warehouse facility. The Company was not required to consolidate ZAIS CLO 6 during the ZAIS CLO 6 Warehouse Period.

ZAIS CLO 7, Limited (“ZAIS CLO 7”)

ZAIS CLO 7 was formed in June 2017 and is in the warehouse phase at June 30, 2017. During the warehouse phase, ZAIS CLO 7 continues to finance the majority of its loan purchases using its warehouse facility (the “ZAIS CLO 7 Warehouse Period”).

Zephyr A-6 had an investment of $25.0 million in ZAIS CLO 7, at fair value, at June 30, 2017.

The Company was not required to consolidate ZAIS CLO 7 during the ZAIS CLO 7 Warehouse Period.

Net gain (loss) of Consolidated Funds’ Investments

Net gain (loss) related to Zephyr A-6’s investments in ZAIS CLO 5, ZAIS CLO 6 and ZAIS CLO 7 for the period which the investments were not consolidated by the Company includes the following:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| ZAIS CLO 5: | ||||||||||||||||

| Change in unrealized gain or loss | $ | — | $ | 2,176 | $ | — | $ | 3,693 | ||||||||

| ZAIS CLO 6: | ||||||||||||||||

| Change in unrealized gain or loss | (1,370 | ) | — | (263 | ) | — | ||||||||||

| Realized gains | 2,972 | — | 2,972 | — | ||||||||||||

| Total – ZAIS CLO 6 | 1,602 | — | 2,709 | — | ||||||||||||

ZAIS CLO 7: | ||||||||||||||||

| Change in unrealized gain or loss | 5 | — | 5 | — | ||||||||||||

Total – Net gain (loss) of Consolidated Funds’ investments | $ | 1,607 | $ | 2,176 | $ | 2,714 | $ | 3,693 | ||||||||

| 19 |

Securitized Structures

ZAIS Group and certain of its wholly owned subsidiaries act as collateral manager for CLOs that are VIEs. These CLOs are entities that issue collateralized notes which offer investors the opportunity for returns that vary commensurately with the risks they assume. The notes issued by the CLOs are generally backed by asset portfolios consisting of loans, other debt or other derivatives. For acting as the collateral manager for these structures, ZAIS Group receives collateral management fees comprised of senior collateral management fees, subordinated collateral management fees and incentive collateral management fees (subject to hurdle rates). In some cases, all of the collateral management fees are waived as a result of certain ZAIS Managed Entities owning equity tranches of the related CLO.

For CLOs in which the Company has no economic interests other than its fee arrangement, the Company has determined that the fee it receives from the CLOs does not represent a variable interest because ZAIS Group’s fee arrangements are commensurate with the level of effort performed and include only customary terms that do not represent variable interests. The Company considered investments its related parties have in the CLOs when determining if ZAIS Group’s fee represented a variable interest. The Company will continue to assess its investments in the CLOs to determine whether or not the Company is required to consolidate the CLOs in its financial statements.

The Dodd-Frank credit risk retention rules, which became effective on December 24, 2016, apply to any newly issued CLOs or certain cases in which an existing CLO is refinanced, issues additional securities or is otherwise materially amended. The risk retention rules specify that for each CLO, the relevant collateral manager must purchase and hold, unhedged, directly or through a majority-owned affiliate, either (i) 5% of the face amount of each tranche of the CLO’s securities, (ii) an amount of the CLO’s equity equal to 5% of the aggregate fair value of all of the CLO’s securities or (iii) a combination of the two for a total of 5%. The required risk must be retained until the latest of (i) the date that the CLO has paid down its securities to 33% of their original principal amount, (ii) the date that the CLO has sold down its assets to 33% of their original principal amount or (iii) the date that is two years after closing.

The Company determined that it is not the primary beneficiary of CLO Warehouses, which are VIEs, because the financing counterparty must approve all significant financing requests and, as a result, the Company does not have the power to direct activities of the entity that most significantly impacts its economic performance.

VIEs

Consolidated VIEs

At June 30, 2017 and December 31, 2016 the Consolidated Funds consist of Zephyr A-6 and ZAIS CLO 5. Both entities are VIEs.

The assets and liabilities of the consolidated VIEs are presented on a gross basis prior to eliminations in the tables in Note 16 – “Supplemental Financial Information” under the columns titled “Consolidated Funds.”

The assets presented belong to the investors in Zephyr A-6 and ZAIS CLO 5, are available for use only by the entity to which they belong and are not available for use by the Company. The Consolidated Funds have no recourse to the general credit of ZAIS Group with respect to any liability.

Unconsolidated VIEs

At June 30, 2017 and December 31, 2016, the Company’s unconsolidated VIEs consisted of the Company’s investments in certain ZAIS Managed Entities as well as the Consolidated Fund’s investments in certain collateralized financing entities.

| 20 |

The carrying amounts of the unconsolidated VIEs are as follows:

| Investment In | Financial Statement

Line Item | June

30, 2017 | December

31, 2016 | |||||||

| (Dollars in thousands) | ||||||||||

| Certain ZAIS Managed Entities | Investment in affiliates, at fair value | $ | 288 | $ | 273 | |||||

| CLOs | Assets of Consolidated Funds – Investments at fair value | 25,294 | — | |||||||

| CLO Warehouses | Assets of Consolidated Funds – Investments at fair value | 25,005 | 15,036 | |||||||

| Total | $ | 50,587 | $ | 15,309 | ||||||

Such amounts are included in the Consolidated Statements of Financial Condition.

ZAIS Group has a minimal direct ownership, if any, in the unconsolidated VIEs and its involvement is generally limited to providing asset management services. ZAIS Group’s exposure to loss from these entities is limited to a decrease in the management fee income and incentive income that has been earned and accrued, as well as any change in fair value of its direct equity ownership in the VIEs.

Zephyr A-6, one of the Consolidated Funds, contributed the following amounts to ZAIS CLO 5, ZAIS CLO 6 and ZAIS CLO 7 during the warehouse periods:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| ZAIS CLO 5 | $ | — | $ | — | $ | — | $ | 10,000 | ||||||||

| ZAIS CLO 6 | — | — | 30,000 | — | ||||||||||||

| ZAIS CLO 7 | 25,000 | — | 25,000 | — | ||||||||||||

| Total | $ | 25,000 | $ | — | $ | 55,000 | $ | 10,000 | ||||||||

Notes Payable of Consolidated CLO

Notes payable of ZAIS CLO 5, the consolidated CLO, are collateralized by the assets held by the ZAIS CLO 5. This collateral primarily consists of bank loans.

The fair value of the assets and liabilities of ZAIS CLO 5 and the eliminations for the Consolidated Fund’s investment in ZAIS CLO 5 are as follows:

| June 30, 2017 | December

31, 2016 | |||||||

| (Dollars in thousands) | ||||||||

| Cash and cash equivalents | $ | 12,634 | $ | 23,987 | ||||

| Investments, at fair value | 396,407 | 389,329 | ||||||

| 409,041 | 413,316 | |||||||

| Other assets (liabilities), net | (11,488 | ) | (8,909 | ) | ||||

| Notes payable of consolidated CLO, at fair value | 397,553 | 404,407 | ||||||

| Elimination of Consolidated Funds’ investments in CLO | (13,034 | ) | (19,506 | ) | ||||

| Notes payable of consolidated CLO, at fair value (net of eliminations) | $ | 384,519 | $ | 384,901 | ||||

| 21 |

The Company has elected to carry these notes at fair value in its Consolidated Statements of Financial Condition. Accordingly, the Company measured the fair value of the notes payable (as a group including both the senior and subordinated notes) as (1) the sum of the fair value of the financial assets and the carrying value of any non-financial assets, less (2) the sum of the fair value of any beneficial interests retained by the Company (other than those that represent compensation for services) and the Company’s carrying value of any beneficial interests that represent compensation for services. The Company allocated the resulting amount to the different classes of notes based on the CLO’s waterfall on an as liquidated basis.

The tables below present information related to ZAIS CLO 5’s notes payable outstanding. The subordinated notes have no stated interest rate, and are entitled to any excess cash flows after contractual payments are made to the senior notes.

| June 30, 2017 | ||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| Unpaid Principal Outstanding | Fair Value | Weighted Average Interest Rate | Weighted Average Maturity (in Years) | Stated Maturity Dates | ||||||||||||||

| Senior and Mezzanine Secured Notes | $ | 365,745 | $ | 357,507 | 3.35 | % | 11.33 | October 2028 | ||||||||||

| Subordinated Notes | 27,635 | 27,012 | N/A | 11.33 | October 2028 | |||||||||||||

| Total | $ | 393,380 | $ | 384,519 | ||||||||||||||

| December 31, 2016 | ||||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||

| Unpaid Principal Outstanding | Fair Value | Weighted Average Interest Rate | Weighted Average Maturity (in Years) | Stated Maturity Dates | ||||||||||||||

| Senior and Mezzanine Secured Notes | $ | 360,395 | $ | 357,489 | 2.97 | % | 11.83 | October 2028 | ||||||||||

| Subordinated Notes | 27,635 | 27,412 | N/A | 11.83 | October 2028 | |||||||||||||

| Total | $ | 388,030 | $ | 384,901 | ||||||||||||||

6. Management Fee Income and Incentive Income

ZAIS Group earns management fees for the funds and accounts which are generally based on (i) the net asset value of these funds and accounts prior to the accrual of incentive fees/allocations or (ii) drawn capital during the investment period.

Management fee income earned for the CLOs which ZAIS Group manages are generally based on the par value of the collateral and cash held in the CLOs. Additionally, subordinated management fees may be earned from CLOs for which ZAIS Group and certain of its wholly owned subsidiaries act as collateral manager. The subordinated management fee is an additional payment for the same collateral management service, but has a lower priority in the CLOs’ cash flows and is contingent upon the economic performance of the respective CLO. If the CLOs experience a certain level of asset defaults, these fees may not be paid. There is no recovery by the CLOs of previously paid subordinated fees.

Prior to October 31, 2016, ZAIS Group earned management fee income from ZFC REIT, quarterly, based on ZFC REIT's stockholders' equity, as defined in the amended and restated investment advisory agreement between ZAIS REIT Management and ZFC REIT. Twenty percent of the management fee income received from ZFC REIT was paid to holders of Class B interests in ZAIS REIT Management. The payment to the Class B interests in ZAIS REIT Management was recorded as distributions to non-controlling interests in ZAIS Group Parent, LLC. The income was recorded as Management fee income in the Consolidated Statements of Comprehensive Income (Loss), and the portion of the management fees allocated to the holders of Class B interests in ZAIS REIT Management was included in the Allocation of Consolidated Net Income (Loss) to Non-controlling interests in ZAIS Group Parent, LLC. On October 31, 2016, the management agreement with ZFC REIT was terminated upon the completion of the merger between ZFC REIT and Sutherland Asset Management Corp (the “Termination Agreement”). Pursuant to the Termination Agreement, ZAIS REIT Management received a termination payment in the amount of $8.0 million.

| 22 |

Management fees are generally collected on a monthly or quarterly basis.

ZAIS Group manages certain ZAIS Managed Entities from which it may earn incentive income based on hedge fund-style and private equity-style fee arrangements. ZAIS Managed Entities with hedge fund-style fee arrangements are those that pay ZAIS Group, on an annual basis, an incentive fee/allocation based on a percentage of net realized and unrealized profits attributable to each investor, subject to a hurdle (if any) set forth in each respective entity’s operative agreements. Additionally, all ZAIS Managed Entities with hedge fund-style fee arrangements are subject to a perpetual loss carry forward, or a perpetual “high-water mark,” meaning that the relevant ZAIS Managed Entity will not pay incentive fees/allocations with respect to positive investment performance generated for an investor in any year following negative investment performance until that loss is recouped, at which point an investor’s capital balance surpasses the high-water mark. ZAIS Managed Entities with private equity-style fee arrangements are those that pay an incentive fee/allocation based on a priority of payments under which investor capital must be returned and a preferred return must be paid, as specified in each related ZAIS Managed Entity’s operative agreement, to the investor prior to any payments of incentive-based income to ZAIS Group. For CLOs, incentive income is earned based on a percentage of cumulative profits, subject to the return of contributed capital, payment of subordinate management fees (if any) and a preferred inception to date return as specified in the respective CLOs’ collateral management agreements. The advisory agreement between ZAIS REIT Management and ZFC REIT did not provide for incentive fees.

The following tables represent the gross amounts of management fee income and incentive income earned prior to eliminations due to consolidation of the Consolidated Funds and the net amount reported in the Company’s Consolidated Statements of Comprehensive Income (Loss):

Three Months Ended June 30, 2017 | ||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||

| Management Fee Income (1) | ||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 2,745 | $ | (329 | ) | $ | 2,416 | ||||||

| CLOs | 0.15% - 0.50% | 1,273 | — | 1,273 | ||||||||||

| Total | $ | 4,018 | $ | (329 | ) | $ | 3,689 | |||||||

| Incentive Income (1) (2) | ||||||||||||||

| Funds and accounts | 10% - 20% | $ | 2,784 | $ | — | $ | 2,784 | |||||||

| CLOs | 20% | 100 | — | 100 | ||||||||||

| Total | $ | 2,884 | $ | — | $ | 2,884 | ||||||||

Three Months Ended June 30, 2016 | ||||||||||||||

| (Dollars in thousands) | ||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||

| Management Fee Income (1) | ||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 2,373 | $ | — | $ | 2,373 | |||||||

| CLOs | 0.15% - 0.50% | 425 | — | 425 | ||||||||||

| ZFC REIT(3) | 1.50% | 773 | — | 773 | ||||||||||

| Total | $ | 3,571 | $ | — | $ | 3,571 | ||||||||

| Incentive Income (1) (2) | ||||||||||||||

| Funds and accounts | 10% - 20% | $ | 143 | $ | — | $ | 143 | |||||||

| CLOs | 20% | — | — | — | ||||||||||

| Total | $ | 143 | $ | — | $ | 143 | ||||||||

| 23 |

Six Months Ended June 30, 2017 | ||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||