Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - ZAIS Group Holdings, Inc. | v451610_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - ZAIS Group Holdings, Inc. | v451610_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ZAIS Group Holdings, Inc. | v451610_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - ZAIS Group Holdings, Inc. | v451610_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35848

ZAIS GROUP HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 46-1314400 |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

Two Bridge Avenue, Suite 322

Red Bank, NJ 07701-1106

(Address of Principal Executive Offices and Zip Code)

(732) 978-7518

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x |

| Non-accelerated filer ¨ | Smaller reporting company ¨ |

| (Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 3, 2016, 13,900,917 shares of Class A common stock, par value $0.0001 per share, and 20,000,000 shares of Class B Common Stock, par value $0.000001 per share, were issued and outstanding.

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | 3 |

| Item 1. Financial Statements | 3 |

| Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 31 |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 49 |

| Item 4. Controls and Procedures | 50 |

| PART II − OTHER INFORMATION | 51 |

| Item 1A. Risk Factors | 51 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 51 |

| Item 3. Defaults Upon Senior Securities | 51 |

| Item 4. Mine Safety Disclosures | 51 |

| Item 5. Other Information | 51 |

| Item 6. Exhibits | 51 |

| SIGNATURES | 52 |

| EXHIBIT 31.1 CERTIFICATIONS | |

| EXHIBIT 31.2 CERTIFICATIONS | |

| EXHIBIT 32.1 CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002, 18 U.S.C. SECTION 1350 | |

| EXHIBIT 32.2 CERTIFICATION PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002, 18 U.S.C. SECTION 1350 |

| 2 |

PART I – FINANCIAL INFORMATION

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Financial Condition (Unaudited)

(Dollars in thousands)

| September 30, 2016 | December 31, 2015 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 29,421 | $ | 44,351 | ||||

| Income and fees receivable | 5,311 | 2,529 | ||||||

| Investments, at fair value | — | 8,169 | ||||||

| Investments in affiliates, at fair value | 5,174 | 5,242 | ||||||

| Due from related parties | 912 | 748 | ||||||

| Prepaid expenses | 1,445 | 776 | ||||||

| Other assets | 458 | 310 | ||||||

| Fixed assets, net | 340 | 544 | ||||||

| Assets of Consolidated Funds | ||||||||

| Cash and cash equivalents | — | 33 | ||||||

| Investments, at fair value | 20,348 | 30,509 | ||||||

| Receivable for securities sold | 40,000 | — | ||||||

| Dividend receivable | 8,317 | — | ||||||

| Total Assets | $ | 111,726 | $ | 93,211 | ||||

| Liabilities and Equity | ||||||||

| Liabilities | ||||||||

| Notes payable | $ | 1,261 | $ | 1,255 | ||||

| Compensation payable | 5,672 | 3,575 | ||||||

| Due to related parties | 144 | 175 | ||||||

| Fees payable | — | 756 | ||||||

| Other liabilities | 973 | 1,546 | ||||||

| Liabilities of Consolidated Funds | ||||||||

| Payable for securities purchased | 20,348 | — | ||||||

| Other liabilities | 76 | 101 | ||||||

| Total Liabilities | 28,474 | 7,408 | ||||||

| Commitments and Contingencies (Note 12) | ||||||||

| Equity | ||||||||

| Preferred Stock, $0.0001 par value; 2,000,000 shares authorized; 0 shares issued and outstanding. | — | — | ||||||

| Class A Common Stock, $0.0001 par value; 180,000,000 shares authorized; 13,900,917 and 13,870,917 shares issued and outstanding at September 30, 2016 and December 31, 2015, respectively. | 1 | 1 | ||||||

| Class B Common Stock, $0.000001 par value; 20,000,000 shares authorized; 20,000,000 shares issued and outstanding at September 30, 2016 and December 31, 2015, respectively. | — | — | ||||||

| Additional paid-in capital | 62,809 | 60,817 | ||||||

| Retained earnings (Accumulated deficit) | (23,001 | ) | (13,805 | ) | ||||

| Accumulated other comprehensive income (loss) | (16 | ) | 158 | |||||

| Total stockholders’ equity, ZAIS Group Holdings, Inc. | 39,793 | 47,171 | ||||||

| Non-controlling interests in ZAIS Group Parent, LLC | 19,948 | 23,716 | ||||||

| Non-controlling interests in Consolidated Funds | 23,511 | 14,916 | ||||||

| Total Equity | 83,252 | 85,803 | ||||||

| Total Liabilities and Equity | $ | 111,726 | $ | 93,211 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(Dollars in thousands)

| Three Months Ended September 30, 2016 | Three Months Ended September 30, 2015 (1) | Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2015 (1) | |||||||||||||

| Revenues | ||||||||||||||||

| Management fee income | $ | 3,654 | $ | 4,175 | $ | 10,794 | $ | 12,009 | ||||||||

| Incentive income | 3,614 | 3,870 | 3,909 | 5,991 | ||||||||||||

| Other revenues | 79 | 81 | 238 | 218 | ||||||||||||

| Total Revenues | 7,347 | 8,126 | 14,941 | 18,218 | ||||||||||||

| Expenses | ||||||||||||||||

| Compensation and benefits | 6,908 | 6,488 | 23,914 | 20,418 | ||||||||||||

| General, administrative and other | 2,963 | 4,370 | 9,123 | 13,470 | ||||||||||||

| Depreciation | 79 | 445 | 206 | 654 | ||||||||||||

| Expenses of Consolidated Funds | 16 | — | 64 | — | ||||||||||||

| Total Expenses | 9,966 | 11,303 | 33,307 | 34,542 | ||||||||||||

| Other income (loss) | ||||||||||||||||

| Net gain (loss) on investments | 46 | (11 | ) | 83 | 34 | |||||||||||

| Other income (expense) | 53 | 83 | 745 | 88 | ||||||||||||

| Net gains (losses) of Consolidated Funds’ investments | 4,115 | — | 7,808 | — | ||||||||||||

| Total Other Income (Loss) | 4,214 | 72 | 8,636 | 122 | ||||||||||||

| Income (loss) before income taxes | 1,595 | (3,105 | ) | (9,730 | ) | (16,202 | ) | |||||||||

| Income tax (benefit) expense | (21 | ) | (1,528 | ) | (12 | ) | (4,111 | ) | ||||||||

| Consolidated net income (loss), net of tax | 1,616 | (1,577 | ) | (9,718 | ) | (12,091 | ) | |||||||||

| Other comprehensive income (loss), net of tax: | ||||||||||||||||

| Foreign currency translation adjustment | (61 | ) | (160 | ) | (262 | ) | 323 | |||||||||

| Total Comprehensive Income (Loss) | $ | 1,555 | $ | (1,737 | ) | $ | (9,980 | ) | $ | (11,768 | ) | |||||

| Allocation of Consolidated Net Income (Loss), net of tax | ||||||||||||||||

| Non-controlling interests in Consolidated Funds | $ | 1,902 | $ | — | $ | 3,688 | $ | — | ||||||||

| Stockholders’ equity, ZAIS Group Holdings, Inc. | (286 | ) | (568 | ) | (9,196 | ) | (4,337 | ) | ||||||||

| Non-controlling interests in ZAIS Group Parent, LLC | — | (1,009 | ) | (4,210 | ) | (7,754 | ) | |||||||||

| $ | 1,616 | $ | (1,577 | ) | $ | (9,718 | ) | $ | (12,091 | ) | ||||||

| Allocation of Total Comprehensive Income (Loss) | ||||||||||||||||

| Non-controlling interests in Consolidated Funds | $ | 1,902 | $ | — | $ | 3,688 | $ | — | ||||||||

| Stockholders’ equity, ZAIS Group Holdings, Inc. | (326 | ) | (674 | ) | (9,370 | ) | (4,122 | ) | ||||||||

| Non-controlling interests in ZAIS Group Parent, LLC | (21 | ) | (1,063 | ) | (4,298 | ) | (7,646 | ) | ||||||||

| $ | 1,555 | $ | (1,737 | ) | $ | (9,980 | ) | $ | (11,768 | ) | ||||||

| Consolidated Net Income (Loss), net of tax per Class A common share applicable to ZAIS Group Holdings, Inc. – Basic | $ | (0.02 | ) | $ | (0.04 | ) | $ | (0.66 | ) | $ | (0.43 | ) | ||||

| Consolidated Net Income (Loss), net of tax per Class A common share applicable to ZAIS Group Holdings, Inc. – Diluted | $ | (0.02 | ) | $ | (0.06 | ) | $ | (0.66 | ) | $ | (0.54 | ) | ||||

| Weighted average shares of Class A common stock outstanding: | ||||||||||||||||

| Basic | 13,900,917 | 13,870,917 | 13,887,997 | 10,009,416 | (3) | |||||||||||

| Diluted (2) | 20,900,917 | 20,870,917 | 20,887,997 | 17,009,416 | (3) | |||||||||||

| (1) | Subsequent to the filing of the 10-Q for the three months ended March 31, 2015, the Company elected to early adopt ASU 2015-02 with an effective date of January 1, 2015. As a result of this adoption, the majority of the ZAIS Managed Entities which were consolidated in the 10-Q for the three months ended March 31, 2015 were deconsolidated. Additionally, subsequent to the filing of the June 30, 2015 and September 30, 2015 10-Q’s, in December 2015 additional interpretations of ASU 2015-02 became available to the Company. As a result of these new interpretations, the Company reviewed its previous conclusions and determined that additional entities should be deconsolidated. There was no impact on the income (loss) allocated to ZAIS Group Holdings, Inc. Stockholders Equity as a result of this adoption. The September 30, 2015 figures above reflect the consolidated results of the Company for the three and nine months ended September 30, 2015, subsequent to the adoption of ASU 2015-02. |

| (2) | Number of diluted shares outstanding for periods after the Business Combination (as defined in Note 1) takes into account non-controlling interests in ZAIS Group Parent, LLC that may be exchanged for Class A common stock under certain circumstances. |

| (3) | Pro-rated based on the portion of the period preceding and following the Business Combination. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statement of Changes in Equity

and Non-controlling Interests (Unaudited)

(Dollars in thousands except share amounts)

| Class

A Common Stock | Class B Common Stock | Additional paid-in-capital | Retained (Accumulated | Accumulated other comprehensive income (loss) | Non-controlling interests in ZAIS

Group | Non-controlling interests in Consolidated Funds | Total Equity | |||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||||||||||

| December 31, 2015 | 13,870,917 | $ | 1 | 20,000,000 | $ | - | $ | 60,817 | $ | (13,805 | ) | $ | 158 | $ | 23,716 | $ | 14,916 | $ | 85,803 | |||||||||||||||||||||

| Vesting of RSUs | 30,000 | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||

| Capital contributions | - | - | - | - | - | - | - | - | 4,907 | 4,907 | ||||||||||||||||||||||||||||||

| Capital distributions | - | - | - | - | - | - | - | (429 | ) | - | (429 | ) | ||||||||||||||||||||||||||||

| Equity-based compensation charges | - | - | - | - | 1,962 | - | - | 989 | - | 2,951 | ||||||||||||||||||||||||||||||

| Consolidated net income (loss) | - | - | - | - | - | (9,196 | ) | - | (4,210 | ) | 3,688 | (9,718 | ) | |||||||||||||||||||||||||||

| Rebalancing of ownership between the Company and non-controlling interest in ZAIS Group Parent, LLC | - | - | - | - | 30 | - | - | (30 | ) | - | - | |||||||||||||||||||||||||||||

| Other comprehensive income (loss) | - | - | - | - | - | - | (174 | ) | (88 | ) | - | (262 | ) | |||||||||||||||||||||||||||

| September 30, 2016 | 13,900,917 | $ | 1 | 20,000,000 | $ | - | $ | 62,809 | $ | (23,001 | ) | $ | (16 | ) | $ | 19,948 | $ | 23,511 | $ | 83,252 | ||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows (Unaudited)

(Dollars in thousands)

| Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2015 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Consolidated net income (loss) | $ | (9,718 | ) | $ | (12,091 | ) | ||

| Adjustments to reconcile consolidated net income (loss) to net cash provided by (used in) operating activities: | ||||||||

| Depreciation | 206 | 654 | ||||||

| Net (gain) loss on investments | (83 | ) | (34 | ) | ||||

| Non-cash equity-based compensation | 2,951 | 3,351 | ||||||

| Interest expense on notes payable | 6 | 3 | ||||||

| Operating cash flows due to changes in: | ||||||||

| Income and fees receivable | (2,781 | ) | 9,146 | |||||

| Due from related parties | (164 | ) | 120 | |||||

| Prepaid expenses | (669 | ) | (13 | )(2) | ||||

| Other assets | (157 | ) | 338 | |||||

| Deferred tax asset | — | (4,320 | ) | |||||

| Compensation payable | 2,097 | (3,633 | ) | |||||

| Due to related parties | (31 | ) | 142 | |||||

| Fees payable | (756 | ) | (151 | )(2) | ||||

| Other liabilities | (574 | ) | 117 | (2) | ||||

| Consolidated Funds related items: | ||||||||

| Purchases of investments in affiliated securities | (30,348 | ) | — | (1) | ||||

| Proceeds from sale of securities | 40,000 | — | (1) | |||||

| Change in unrealized (gain) loss on investments | 509 | — | (1) | |||||

| Change in cash and cash equivalents | 33 | — | (1) | |||||

| Change in receivable for securities sold | (40,000 | ) | — | (1) | ||||

| Change in dividend receivable | (8,317 | ) | — | (1) | ||||

| Change in payable for securities purchased | 20,348 | — | (1) | |||||

| Change in other liabilities | (25 | ) | — | (1) | ||||

| Net Cash Provided by (Used in) Operating Activities | (27,473 | ) | (6,371 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Purchases of fixed assets | (17 | ) | (178 | ) | ||||

| Distributions from investments in affiliates | 165 | — | (2) | |||||

| Purchases of investments | (11 | ) | (11,152 | )(2) | ||||

| Proceeds from sales of investments | 8,174 | 16 | ||||||

| Net Cash Provided by (Used in) Investing Activities | 8,311 | (11,314 | ) | |||||

| Cash Flows from Financing Activities | ||||||||

| Net proceeds from Business Combination | — | 73,516 | ||||||

| Ending cash at HF2 Financial Management, Inc. | — | 2 | (2) | |||||

| Proceeds from issuance of notes payable | — | 1,250 | ||||||

| Contributions from non-controlling interests in Consolidated Funds | 4,907 | — | ||||||

| Distributions to non-controlling interests in ZGP | (429 | ) | (518 | ) | ||||

| Net Cash Provided by (Used in) Financing Activities | 4,478 | 74,250 | ||||||

| Net increase (decrease) in cash and cash equivalents denominated in foreign currency | (246 | ) | 326 | |||||

| Net increase (decrease) in cash and cash equivalents | (14,930 | ) | 56,891 | |||||

| Cash and cash equivalents, beginning of period | 44,351 | 7,664 | ||||||

| Cash and cash equivalents, end of period | $ | 29,421 | $ | 64,555 | ||||

| (1) | Subsequent to the filing of the 10-Q for the three months ended March 31, 2015, the Company elected to early adopt ASU 2015-02 with an effective date of January 1, 2015. As a result of this adoption, the majority of the ZAIS Managed Entities which were consolidated in the 10-Q for the three months ended March 31, 2015 were deconsolidated. Additionally, subsequent to the filing of the June 30, 2015 and September 30, 2015 10-Q’s, in December 2015 additional interpretations of ASU 2015-02 became available to the Company. As a result of these new interpretations, the Company reviewed its previous conclusions and determined that additional entities should be deconsolidated. There was no impact on the income (loss) allocated to ZAIS Group Holdings, Inc. Stockholders Equity as a result of this adoption. The September 30, 2015 figures above reflect the consolidated results of the Company for the nine months ended September 30, 2015, subsequent to the adoption of ASU 2015-02. |

| (2) | Amounts have been adjusted to conform to current period presentation. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 6 |

ZAIS GROUP HOLDINGS, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

1. Organization

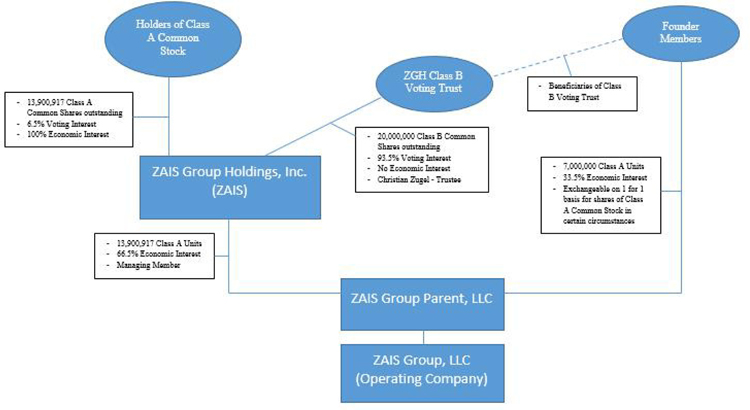

ZAIS Group Holdings, Inc. (“ZAIS”) is a holding company conducting substantially all of its operations through ZAIS Group, LLC (“ZAIS Group”), an investment advisory and asset management firm focused on specialized credit which commenced operations in July 1997 and is headquartered in Red Bank, New Jersey and has an office in London. ZAIS Group is a wholly-owned consolidated subsidiary of ZAIS Group Parent, LLC (“ZGP”), a majority-owned consolidated subsidiary of ZAIS. ZGP became the sole member and 100% equity owner of ZAIS Group on March 31, 2014 pursuant to a merger transaction which is described in detail in ZAIS’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on March 23, 2015 (the “Closing 8-K”). References to the “Company” in these condensed consolidated financial statements refer to ZAIS, together with its consolidated subsidiaries.

ZAIS Group is an investment advisor registered with the SEC under the Investment Advisors Act of 1940 and is also registered with the Commodity Futures Trading Commission as a Commodity Pool Operator and Commodity Trading Advisor. ZAIS Group provides investment advisory and asset management services to private funds, separately managed accounts, structured vehicles and, through October 31, 2016, ZAIS Financial Corp. (“ZFC REIT”), a publicly traded mortgage real estate investment trust (collectively, the “ZAIS Managed Entities”).

ZAIS REIT Management, LLC (“ZAIS REIT Management”), a majority owned subsidiary of ZAIS Group, is the external investment advisor to ZFC REIT. On April 7, 2016, ZFC REIT announced that it had entered into an agreement and plan of merger (the “Merger Agreement”). The ZFC REIT merger closed on October 31, 2016. In connection with the Merger Agreement, ZAIS REIT Management entered into a termination agreement (the “Termination Agreement”), whereby the current advisory agreement under which ZAIS REIT Management receives management fees from ZFC REIT was terminated upon closing of the merger on October 31, 2016 (see Note 17, “Subsequent Events”).

The ZAIS Managed Entities predominantly invest in a variety of specialized credit instruments including bank loans, corporate credit instruments such as collateralized debt obligations (“CDOs”), collateralized loan obligations (together with CDOs referred to as “CLOs”) and various securities and instruments backed by these asset classes. ZAIS Group had approximately $3.844 billion of assets under management (“AUM”) as of September 30, 2016. As a result of the ZFC REIT merger (see above), ZAIS Group’s AUM related to mortgage strategies is expected to decrease by $0.589 billion, based on the REIT AUM at September 30, 2016.

ZAIS Group also serves as the general partner to certain ZAIS Managed Entities, which are generally organized as pass-through entities for U.S. federal income tax purposes.

The Company’s primary sources of revenues are (i) management fee income, which is based predominantly on the AUM of the ZAIS Managed Entities (ii) incentive income, which is based on the investment performance of the ZAIS Managed Entities and (iii) income of the consolidated ZAIS Managed Entities (the “Consolidated Funds”) which is based on the income generated from the portfolios of the Consolidated Funds, a portion of which is allocated to non-controlling interests in Consolidated Funds. All of the management fee income and incentive income earned by ZAIS Group from the Consolidated Funds is eliminated in consolidation.

On March 20, 2015, ZAIS made a decision to terminate the business operations of its Shanghai subsidiary. ZAIS Group ceased conducting regular business activities in Shanghai and the office is now closed. Final clearance from the relevant government authorities on the plan of liquidation is expected in the fourth quarter of 2016.

Recapitalization as a Result of a Business Combination

On October 5, 2012, HF2 Financial Management Inc. (“HF2”) was formed as a blank check company whose objective was to acquire, through a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization or similar business combination, one or more businesses or entities. On September 16, 2014, HF2 entered into an Investment Agreement, as defined in the Closing 8-K, with ZGP and the members of ZGP (including Christian Zugel, the former managing member of ZGP and the founder and Chief Investment Officer of ZAIS Group, and certain related parties, collectively, the “ZGP Founder Members”), under which HF2 agreed to contribute cash to ZGP in exchange for newly issued Class A Units of ZGP (“Class A Units”) representing a majority financial interest in ZGP (the “Business Combination”) and to cause the transfer of all of its outstanding shares of Class B Common Stock, par value $0.000001 (the “Class B Common Stock”) to the ZGP Founder Members. All Class B Common Stock was then immediately deposited into a newly created irrevocable voting trust (the “ZGH Class B Voting Trust”), of which Mr. Zugel is the sole trustee. The Class B Common Stock has no economic rights and therefore is not considered participating securities for purposes of allocation of consolidated net income (loss).

On March 9, 2015, the stockholders of HF2 approved the Business Combination and the transaction closed on March 17, 2015 (the “Closing”). In connection with the Closing, HF2 changed its name to ZAIS Group Holdings, Inc. The Business Combination is described in detail in ZAIS’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the "Annual Report on Form 10-K”). Prior to the Closing, HF2 was a shell company with no operations. Upon the Closing, ZAIS became a holding company whose assets primarily consist of an approximate 66.5% interest in its majority-owned subsidiary, ZGP. Prior to the Closing, Christian Zugel served as the managing member of ZGP. Upon the Closing, ZAIS became the managing member of ZGP.

| 7 |

2. Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited, interim, consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") as contained within the Financial Accounting Standards Board’s ("FASB") Accounting Standards Codification ("ASC") and the rules and regulations of the SEC for interim reporting. In the opinion of management, all adjustments considered necessary for a fair statement of the Company's financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for the interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. Certain information and note disclosures normally included in financial statements prepared in accordance with U.S. GAAP as contained in the ASC have been condensed or omitted from the unaudited interim condensed consolidated financial statements according to the SEC rules and regulations. The information and disclosures contained in these unaudited interim condensed consolidated financial statements and notes should be read in conjunction with the consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K.

Segment Reporting

The Company currently is comprised of one reportable segment, the investment management segment, and substantially all of the Company’s operations are conducted through this segment. The investment management segment provides investment advisory and asset management services to the ZAIS Managed Entities.

Use of Estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. While management believes that the estimates used in preparing the consolidated financial statements are reasonable and prudent, actual results may ultimately differ from those estimates.

Recent Accounting Pronouncements

Since May 2014, the FASB has issued ASU Nos. 2014-09, 2015-14, 2016-08, 2016-10 and 2016-12, "Revenue from Contracts with Customers". The objective of the guidance is to clarify the principles for recognizing revenue and supersedes most current revenue recognition guidance, including industry-specific guidance. The guidance is to be applied retrospectively to all prior periods presented or through a cumulative adjustment in the year of adoption, for interim and annual periods beginning after December 15, 2017. The Company is currently evaluating the impact of adopting this new standard.

In August 2014, the FASB issued ASU No. 2014-15, Presentation of Financial Statements – Going Concern (Subtopic 205-04) Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern ("ASU 2014-15"), which requires management to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern within one year after the date the financial statements are issued. If conditions or events indicate it is probable that an entity will be unable to meet its obligations as they become due within one year after the financial statements are issued, the update requires additional disclosures. The update is effective for periods ending after December 15, 2016 with early adoption permitted. Adoption of ASU 2014-15 is not expected to have a material effect on the Company's consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 428) (“ASU 2016-02”). Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for those leases previously classified as operating leases. The amendments in ASU No. 2016-02 are effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period with early adoption permitted. Adoption of ASU 2016-02 is not expected to have a material effect on the Company's consolidated financial statements.

In March 2016, the FASB issued ASU No. 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”). The objective of the guidance is to simplify several aspects of the accounting for employee share-based payment transactions, including income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The update is effective for interim and annual periods beginning after December 15, 2016 with early adoption permitted. Adoption of ASU 2016-09 is not expected to have a material effect on the Company's consolidated financial statements.

| 8 |

In August 2016, the FASB issued ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments” (“ASU 2016-15”). This ASU addresses the following eight specific cash flow issues: Debt prepayment or debt extinguishment costs; settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing; contingent consideration payments made after a business combination; proceeds from the settlement of insurance claims; proceeds from the settlement of corporate-owned life insurance policies (including bank-owned life insurance policies); distributions received from equity method investees; beneficial interests in securitization transactions; and separately identifiable cash flows and application of the predominance principle. ASU 2016-15 is effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early application is permitted, including adoption in an interim period. Adoption of ASU 2016-15 is not expected to have a material effect on the Company's consolidated financial statements.

Principles of Consolidation

The consolidated financial statements included herein are the financial statements of ZAIS, its subsidiaries and certain funds that are required to be consolidated. All intercompany balances and transactions have been eliminated in consolidation, including ZAIS’s investment in ZGP and ZGP’s investment in ZAIS Group. The Company's fiscal year ends on December 31.

The consolidated financial statements include non-controlling interests in ZGP which are primarily comprised of Class A Units of ZGP held by the ZGP Founder Members.

Subsequent to the filing of the 10-Q for the three months ended March 31, 2015, the Company elected to early adopt ASU 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis (“ASU 2015-02”) with an effective date of January 1, 2015 modifying the analysis it must perform to determine whether it should consolidate certain types of legal entities. The guidance does not amend the existing disclosure requirements for variable interest entities (“VIEs”) or voting interest model entities. The guidance, however, modified the requirements to qualify under the voting interest model. Under the revised guidance, ZAIS Group and ZGP are variable interest entities of the Company. As these entities are already consolidated in the balance sheets of the Company, the identification of these entities as variable interest entities has no impact on the consolidated financial statements of the Company.

3. Investments in Affiliates

The Company applied the fair value option to its interests in the ZAIS Managed Entities that are not consolidated, and would have otherwise been subject to the equity or historical cost methods of accounting. The Company believes that reporting the fair value of these investments is more indicative of the Company’s financial position than historical cost.

At September 30, 2016 and December 31, 2015, the fair value of these investments was as follows:

| September 30, 2016 | December 31, 2015 | |||||

| (Dollars in thousands) | ||||||

| $ | 5,174 | $ | 5,242 | |||

The Company recorded a change in unrealized gain (loss) for three and nine months ended September 30, 2016 and September 30, 2015 associated with the investments still held at the end of each respective period as follows:

| Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, 2016 | September 30, 2015 | September 30, 2016 | September 30, 2015 | |||||||||||

| (Dollars in thousands) | ||||||||||||||

| $ | (32 | ) | $ | (11 | ) | $ | (55 | ) | $ | 14 | ||||

Such amounts are included in net gain (loss) on investments in the consolidated statements of comprehensive income (loss).

At September 30, 2016 and December 31, 2015, no equity investment, individually or in the aggregate, held by the Company exceeded 10% of its total consolidated assets or income. As such, the Company did not present separate or summarized financial statements for any of its investees.

| 9 |

4. Fair Value of Investments

ASC 820 Fair Value Measurements defines fair value, establishes a framework for measuring fair value, and requires certain disclosures about fair value measurements under U.S. GAAP. Specifically, this guidance defines fair value based on exit price, or the price that would be received upon the sale of an asset or the transfer of a liability in an orderly transaction between market participants at the measurement date. Fair value under U.S. GAAP represents an exit price in the normal course of business, not a forced liquidation price. If the Company was forced to sell assets in a short period to meet liquidity needs, the prices it receives could be substantially less than their recorded fair values.

The Company follows the fair value measurement and disclosure guidance under U.S. GAAP, which establishes a hierarchical disclosure framework. This framework prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is affected by a number of factors, including the type of investment, the characteristics specific to the investment and the state of the marketplace including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices in an orderly market generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value. In all cases, an instrument’s level within the hierarchy is based upon the market pricing transparency of the instrument and does not necessarily correspond to the Company’s perceived risk or liquidity of the instrument.

The Company considers observable data to be market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given investment is based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires significant judgment and considers factors specific to the investment.

Assets and liabilities that are measured and reported at fair value are classified and disclosed in one of the following categories:

Level 1 — Fair value is determined based on quoted prices for identical assets or liabilities in an active market. Assets and liabilities included in Level 1 include listed securities. As required in the fair value measurement and disclosure guidance under U.S. GAAP, the Company does not adjust the quoted price for these investments. The hierarchy gives highest priority to Level 1.

Level 2 — Fair value is determined based on inputs other than quoted prices that are observable for the asset or liability either directly or indirectly as of the reporting date. Assets and liabilities which are generally included in this category include corporate bonds and loans, less liquid and restricted equity securities and certain over-the-counter derivatives, including foreign exchange forward contracts whose values are based on the following:

| · | Quoted prices for similar assets or liabilities in active markets. |

| · | Quoted prices for identical or similar assets or liabilities in non-active markets. |

| · | Pricing models whose inputs are observable for substantially the full term of the asset or liability. |

| · | Pricing models whose inputs are derived principally from or corroborated by observable market data for substantially the full term of the asset or liability. |

Level 3 — Fair value is determined based on inputs that are unobservable for the investment and includes situations where there is little, if any, market activity for the asset or liability. The inputs into the determination of fair value require significant management judgment or estimation and the Company may use models or other valuation methodologies to arrive at fair value. Investments that are included in this category generally include distressed debt, less liquid corporate debt securities, non-investment grade residual interests in securitizations, collateralized debt obligations and certain derivative contracts. The hierarchy gives the lowest priority to Level 3.

The Company has established a valuation process that applies for all levels of investments in the valuation hierarchy to ensure that the valuation techniques are consistent and verifiable. The valuation process includes discussions between the valuation team, portfolio management team and the valuation committee (the “Valuation Committee”). The Valuation Committee consists of senior members of ZAIS Group and is co-chaired by the Chief Risk Officer and Chief Financial Officer of ZAIS Group. The Valuation Committee meets to review and approve the results of the valuation process which are used in connection with the preparation of quarterly and annual financial statements. The Valuation Committee is responsible for oversight and review of the written valuation policies and procedures and ensuring that they are applied consistently.

The lack of an established, liquid secondary market for some of the Company’s holdings may have an adverse effect on the market value of those holdings and on the Company’s ability to dispose of them. Additionally, the public markets for the Company’s holdings may experience periods of volatility and periods of reduced liquidity and the Company’s holdings may be subject to certain other transfer restrictions that may further contribute to illiquidity. Such illiquidity may adversely affect the price and timing of liquidations of the Company’s holdings.

| 10 |

The following is a description of the valuation techniques used to measure fair value and the classification of these instruments pursuant to the fair value hierarchy:

Investments

The Company determines the fair value of investments in short term high investment grade mutual funds using quoted market prices and, accordingly, the Company classifies these investments as Level 1. Net gains or losses on investments are included in net gain (loss) on investments in the consolidated statements of comprehensive income (loss).

Collateralized Loan Obligation – Warehouses

A Collateralized Loan Obligation Warehouse ("CLO - Warehouse") is organized for the purpose of holding syndicate bank loans, also known as leveraged loans, during the warehouse period of an impending collateralized loan obligation vehicle. During the warehouse period, a CLO - Warehouse will secure investments and build a portfolio of primarily leveraged loans and other debt obligations. The warehouse period terminates when the collateralized loan obligation vehicle closes. At this time, the underlying assets held by a CLO - Warehouse are securitized into a collateralized loan obligation vehicle which then receives financing through the issuance of debt and equity securities and repays its bank financing.

The fair value of a CLO - Warehouse is determined by adding the excess spread (accrued interest plus interest received less financing cost) to the CLO - Warehouse equity contribution made by the Consolidated Funds, unless ZAIS Group determines that the securitization period will not be achieved, in which case, the fair value of a CLO - Warehouse will be established based on the fair value of the underlying bank loan positions which are valued in a manner consistent with ZAIS Group’s valuation policy and procedures. The net excess spread was 1.7% as of December 31, 2015. The Company did not have any investments in CLO-Warehouses at September 30, 2016.

CLO warehouses can be exposed to credit events, mark to market changes, rating agency downgrades and financing cost changes. Changes in the fair value of a CLO - Warehouse are reported in net gains (losses) of Consolidated Funds’ investments in the consolidated statements of comprehensive income (loss).

Investment in Affiliates

Under U.S. GAAP, the Company is permitted, as a practical expedient, to estimate the fair value of its investments in other investment companies using the NAV (or its equivalent) of the related investment company. Accordingly, the Company utilizes the practical expedient in valuing its investments in the unconsolidated ZAIS Managed Entities, which is an amount equal to the sum of the Company’s proportionate interest in the capital accounts of the affiliated funds at fair value. The fair value of the assets and liabilities of the ZAIS Managed Entities are determined by the Company in accordance with its valuation policies described above. Pursuant to ASU No. 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities that Calculate Net Asset Value per Share (or its Equivalent) (“ASU 2015-07”), the Company no longer is required to categorize these investments within the fair value hierarchy. The resulting net gains or losses on investments are included in net gain (loss) on investments in the consolidated statements of comprehensive income (loss).

At September 30, 2016 and December 31, 2015, the Company held investments in five unconsolidated ZAIS Managed Entities. The valuation of the investments in these entities represents the amount the Company would receive at September 30, 2016 and December 31, 2015, respectively, if it were to liquidate its investments in these entities. ZAIS Group has the ability to liquidate its investments according to the provisions of the respective entities’ operative agreements.

The following tables summarize the Company’s assets measured at fair value on a recurring basis within the fair value hierarchy levels at September 30, 2016 and December 31, 2015:

| September 30, 2016 | ||||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets, at fair value | ||||||||||||||||

| Investments in affiliates, at net asset value | $ | — | $ | — | — | $ | 5,174 | |||||||||

| Investments, at fair value | ||||||||||||||||

| ZAIS CLO 5, Limited | — | — | 20,348 | 20,348 | ||||||||||||

| Total assets, at fair value | $ | — | $ | — | 20,348 | $ | 25,522 | |||||||||

The fair value of ZAIS CLO 5, Limited (“ZAIS CLO 5”) was determined by a recent market transaction.

| December 31, 2015 | ||||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets, at fair value | ||||||||||||||||

| Investments in affiliates, at net asset value | $ | — | $ | — | $ | — | $ | 5,242 | ||||||||

| Investments, at fair value | ||||||||||||||||

| Short term high investment grade mutual funds | 8,169 | — | — | 8,169 | ||||||||||||

| CLO – Warehouse | — | — | 30,509 | 30,509 | ||||||||||||

| Total investments, at fair value | 8,169 | — | 30,509 | 38,678 | ||||||||||||

| Total assets, at fair value | $ | 8,169 | $ | — | $ | 30,509 | $ | 43,920 | ||||||||

| 11 |

The following tables summarize the changes in the Company’s Level 3 assets for the nine months ended September 30, 2016 and year ended December 31, 2015:

| Nine Months Ended September 30, 2016 | ||||||||||||||||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||||||||||||||||

| Beginning Balance January 1, 2016 | Purchases/ Issuances | Sales/ Redemptions/ Settlements | Total Realized and Change in Unrealized Gains (Losses) | Transfers to (from) Level 3 | Ending Balance September 30, 2016 | Change in Unrealized Gains/Losses Relating to Assets and Liabilities Still Held at September 30, 2016 | ||||||||||||||||||||||

| CLO - Warehouse | $ | 30,509 | $ | 10,000 | $ | (48,317 | ) | $ | 7,808 | $ | — | $ | — | $ | — | |||||||||||||

| ZAIS CLO 5 | — | 20,348 | — | — | — | 20,348 | — | |||||||||||||||||||||

| Total investments, at fair value | $ | 30,509 | $ | 30,348 | $ | (48,317 | ) | $ | 7,808 | $ | — | $ | 20,348 | $ | — | |||||||||||||

The following table summarizes the changes in the Company’s Level 3 assets for the year ended December 31, 2015:

| Year Ended December 31, 2015 | ||||||||||||||||||||||||||||

| ( Dollars in thousands ) | ||||||||||||||||||||||||||||

| Beginning Balance January 1, 2015 | Purchases/ Issuances | Sales/ Redemptions/ Settlements | Total Realized and Change in Unrealized Gains (Losses) | Transfers to (from) Level 3 | Ending Balance December 31, 2015 | Change in Unrealized Gains/Losses Relating to Assets and Liabilities Still Held at December 31, 2015 | ||||||||||||||||||||||

| CLO - Warehouse | $ | — | $ | 30,000 | $ | — | $ | 509 | $ | — | $ | 30,509 | $ | 509 | ||||||||||||||

| Total investments, at fair value | $ | — | $ | 30,000 | $ | — | $ | 509 | $ | — | $ | 30,509 | $ | 509 | ||||||||||||||

The Company’s policy is to record transfers between Level 1, Level 2 and Level 3, if any, at the beginning of the period. There were no transfers between Level 1, Level 2 and Level 3 during the nine months ended September 30, 2016 and the year ended December 31, 2015.

5. Variable Interest Entities (“VIEs”)

In the ordinary course of business, ZAIS Group sponsors the formation of VIEs that can be broadly classified into the following categories: hedge funds, hybrid private equity funds and securitized structures (CLOs). ZAIS Group generally serves as the investment advisor or collateral manager with certain investment-related, decision-making authority for these entities. The Company has not recorded any liabilities with respect to VIEs that are not consolidated. Certain ZAIS Managed Entities, including the CLOs, are VIEs. The Company applies the guidance of ASU 2015-02 when determining which ZAIS Managed Entities are required to be consolidated.

Funds

The Company has determined that the fee it receives from several of the hedge funds and hybrid private equity funds ZAIS Group manages does not represent a variable interest because under ASU 2015-02, ZAIS Group’s fee arrangements are commensurate with the level of effort performed and include only customary terms that do not represent variable interests. The Company considered investments its related parties have in these entities when determining if ZAIS Group’s fee represented a variable interest.

| 12 |

ZAIS Group owns 51% of a majority-owned affiliate, ZAIS Zephyr A-6, LP (“Zephyr A-6”), which was established to invest in CLOs, including at the warehouse stage of a CLO. As of September 30, 2016 and December 31, 2015, the Company has determined that ZAIS Group is the primary beneficiary of Zephyr A-6 which is consolidated in these unaudited consolidated financial statements. ZAIS Group is the primary beneficiary since it is deemed to have (i) the power to direct activities of the entity that most significantly impacts its economic performance and (ii) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the entity.

At September 30, 2016, Zephyr A-6’s sole investment was an investment in ZAIS CLO 5. As of September 30, 2016, ZAIS CLO 5 continued to finance the majority of its loan purchases using the warehouse facility. At December 31, 2015, ZAIS CLO 5 was in the warehouse phase (“ZAIS CLO 5 Warehouse”). Zephyr A-6’s sole investment at December 31, 2015 was an investment in the ZAIS CLO 5 Warehouse.

ZAIS CLO 5

ZAIS CLO 5 priced on September 23, 2016 and closed on October 26, 2016 (see Note 17, “Subsequent Events”). ZAIS CLO 5 invests primarily in first lien senior secured bank loans and has a total capitalization of $408.5 million, which consists of debt of $368.0 million and equity of $40.5 million.

At September 30, 2016, Zephyr A-6 had (i) an investment of $20.3 million in debt and equity tranches in ZAIS CLO 5 and a corresponding payable of $20.3 million for its obligation to purchase the securities, (ii) a dividend receivable of $8.3 million which represents gains that were realized under the terms of the CLO Warehouse agreement, and (iii) a receivable for securities sold of $40.0 million for the return of its initial investment in ZAIS CLO 5 Warehouse. Such amounts are included in the consolidated statements of financial condition.

Zephyr A-6’s investment of $20.3 million in ZAIS CLO 5 represents approximately 2% economic interest in the debt tranches and approximately 32% economic interest in the equity tranche.

For the three and nine months ended September 30, 2016, net gains (losses) of Consolidated Funds’ investments is as follows:

| Three Months

Ended September 30, 2016 |

Nine Months Ended September 30, 2016 |

|||||||

| (Dollars in thousands) | ||||||||

| Change in unrealized gain or loss | $ | (4,202 | ) | $ | (509 | ) | ||

| Dividend income | 8,317 | 8,317 | ||||||

| Total | $ | 4,115 | $ | 7,808 | ||||

The change in unrealized gain or loss for the three months ended September 30, 2016 is related to the reversal of previously recognized unrealized gain or loss.

Securitized Structures

ZAIS Group and certain of its wholly owned subsidiaries act as collateral manager for CLOs that are VIEs. These CLOs are entities that issue collateralized notes which offer investors the opportunity for returns that vary commensurately with the risks they assume. The notes issued by the CLOs are generally backed by asset portfolios consisting of loans, other debt or other derivatives. For acting as the collateral manager for these structures, ZAIS Group receives collateral management fees comprised of senior collateral management fees, subordinated collateral management fees and incentive collateral management fees (subject to hurdle rates). In come cases, all the collateral management fees are waived in lieu of certain ZAIS Managed Entities owning equity tranches of the related CLO.

The Company has determined that the fee it receives from the CLOs does not represent a variable interest because under ASU 2015-02, ZAIS Group’s fee arrangements are commensurate with the level of effort performed and include only customary terms that do not represent variable interests. The Company considered investments its related parties have in the CLOs when determining if ZAIS Group’s fee represented a variable interest.

| 13 |

The Dodd-Frank credit risk retention rules will apply to any CLO that closes (or in certain cases are materially amended) on or after December 24, 2016. As currently drafted, the rules specify that for each such CLO, the relevant collateral manager must purchase and hold, unhedged, directly or through a majority-owned affiliate, either (i) 5% of each tranche of the CLO’s securities, (ii) an amount of the CLO’s equity equal to 5% of the aggregate fair value of all of the CLO’s securities or (iii) a combination of the two. The required risk must be retained until the latest of (i) the date that the CLO has paid down its securities to 33% of their original principal amount, (ii) the date that the CLO has sold down its assets to 33% of their original principal amount and (iii) the date that is two years after closing. The Company will continue to assess its investments in the CLOs to determine whether or not the Company will be required to consolidate the CLOs in its financial statements.

The Company determined that it is not the primary beneficiary of CLO – Warehouses, which are VIEs, because the financing counterparty must approve all significant financing requests and, as a result, the Company does not have the power to direct activities of the entity that most significantly impacts its economic performance.

VIEs

The following table presents the assets and liabilities of entities that are VIEs, and consolidated by the Company on a gross basis prior to eliminations due to consolidation at September 30, 2016 and December 31, 2015:

| September 30, 2016 | December 31, 2015 | |||||||

| (Dollars in thousands) | ||||||||

| Assets | ||||||||

| Assets of Consolidated Funds | ||||||||

| Cash and cash equivalents | $ | — | $ | 33 | ||||

| Investments, at fair value | 20,348 | 30,509 | ||||||

| Receivable for securities sold | 40,000 | — | ||||||

| Dividend receivable | 8,317 | — | ||||||

| Total Assets | $ | 68,665 | $ | 30,542 | ||||

| Liabilities | ||||||||

| Liabilities of Consolidated Funds | ||||||||

| Payable for securities purchased | $ | 20,348 | $ | — | ||||

| Other liabilities | 336 | 101 | ||||||

| Total Liabilities | $ | 20,684 | $ | 101 | ||||

The assets presented in the table above belong to the investors in Zephyr A-6, are available for use only by the entity to which they belong and are not available for use by the Company. The Consolidated Funds have no recourse to the general credit of ZAIS Group with respect to any liability.

ZAIS Group has a minimal direct ownership, if any, in the non-consolidated entities that are VIEs and its involvement is generally limited to providing asset management services. ZAIS Group’s exposure to loss from these entities is limited to a decrease in the management fees and incentive income that has been earned and accrued, as well as any direct equity ownership in the VIEs. The Company did not hold any material variable interests in unconsolidated VIEs at September 30, 2016 or December 31, 2015.

6. Management Fee Income and Incentive Income

ZAIS Group earns management fees for funds and accounts, monthly or quarterly, based on the net asset value of these funds and accounts prior to the accrual of incentive fees/allocations. Management fees earned for the CLOs which it manages are generally based on the par value of the collateral and cash held in the CLOs. Management fees earned by ZAIS Group from ZFC REIT, quarterly, are based on ZFC REIT's stockholders' equity, as defined in the amended and restated investment advisory agreement between ZAIS Group’s consolidated subsidiary ZAIS REIT Management and ZFC REIT. Twenty percent of the management fee income received from ZFC REIT is paid to holders of Class B interests in ZAIS REIT Management. The income is recorded as management fee income in the consolidated statements of comprehensive income (loss), and the portion of the management fees allocated to the holders of Class B interests in ZAIS REIT Management is included in the allocation of income (loss) to non-controlling interests in ZAIS Group Parent, LLC. The payment to the Class B interests in ZAIS REIT Management is recorded as distributions to non-controlling interests in ZAIS Group Parent, LLC.

Pursuant to the Termination Agreement, the current advisory agreement with ZAIS REIT Management was terminated on October 31, 2016. ZAIS REIT Management received a termination fee in the amount of $8,000,000 upon termination of the agreement (see Note 17, “Subsequent Events”). ZAIS REIT Management will recognize the termination fee as revenue upon termination of the agreement and the entire amount will be allocated to ZAIS Group.

In addition to the management fee income mentioned above, subordinated management fees may be earned from CLOs for which ZAIS Group and certain of its wholly owned subsidiaries act as collateral manager. The subordinated management fee is an additional payment for the same collateral management service, but has a lower priority in the CLOs’ cash flows. The subordinated management fee is contingent upon the economic performance of the respective CLO. If the CLOs experience a certain level of asset defaults, these fees may not be paid. There is no recovery by the CLOs of previously paid subordinated fees. ZAIS Group recognizes the subordinated management fee income when collection is reasonably assured and all related contingencies have been removed.

| 14 |

ZAIS Group manages certain funds and managed accounts from which it may earn incentive income based on hedge fund-style and private equity-style fee arrangements. Funds and accounts with hedge fund-style fee arrangements are those that pay ZAIS Group, on an annual basis, an incentive fee/allocation based on a percentage of net realized and unrealized profits attributable to each investor, subject to a hurdle (if any) set forth in each respective entity’s operative agreement. Additionally, all funds and accounts with hedge fund-style fee arrangements are subject to a perpetual loss carry forward, or perpetual “high-water mark,” meaning that the funds and accounts will not pay incentive fees/allocations with respect to positive investment performance generated for an investor in any year following negative investment performance until that loss is recouped, at which point an investor’s capital balance surpasses the high-water mark. The funds and accounts pay incentive fees/allocations on any net profits in excess of the high-water mark. Funds and accounts with private equity-style fee arrangements are those that pay an incentive fee/allocation based on a priority of payments under which investor capital must be returned and a preferred return, as specified in each fund’s operative agreement, must be paid to the investor prior to any payments of incentive-based income to ZAIS Group. For CLOs, incentive income is earned based on a percentage of cumulative profits, subject to the return of contributed capital (and subordinate management fees, if any), and a preferred inception to date return as specified in the respective CLOs’ collateral management agreements. The advisory agreement between ZAIS Group and ZFC REIT did not provide for incentive fees.

The following tables represent the gross amounts of management fee income and incentive income earned prior to eliminations due to consolidation of the Consolidated Funds and the net amount reported in the Company’s consolidated statements of comprehensive income (loss) for the three and nine months ended September 30, 2016 and September 30, 2015. September 30, 2015 amounts have been adjusted to conform to current period presentation:

| Three Months Ended September 30, 2016 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||||

| Management Fee Income | ||||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 2,669 | $ | (218 | ) | $ | 2,451 | ||||||||

| CLOs | 0.15% - 0.50% | 481 | — | 481 | ||||||||||||

| ZFC REIT | 1.50% | 722 | — | 722 | ||||||||||||

| Total | $ | 3,872 | $ | (218 | ) | $ | 3,654 | |||||||||

| Incentive Income (1) | ||||||||||||||||

| Funds and accounts | 10% - 20% | $ | 3,614 | $ | — | $ | 3,614 | |||||||||

| CLOs | 20% | — | — | — | ||||||||||||

| Total | $ | 3,614 | $ | — | $ | 3,614 | ||||||||||

| Three Months Ended September 30, 2015 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||||

| Management Fee Income | ||||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 3,007 | $ | — | $ | 3,007 | |||||||||

| CLOs | 0.15% - 0.50% | 408 | — | 408 | ||||||||||||

| ZFC REIT | 1.50% | 760 | — | 760 | ||||||||||||

| Total | $ | 4,175 | $ | — | $ | 4,175 | ||||||||||

| Incentive Income (1) | ||||||||||||||||

| Funds and accounts | 10% - 20% | $ | 3,870 | $ | — | $ | 3,870 | |||||||||

| CLOs | 20% | — | — | — | ||||||||||||

| Total | $ | 3,870 | $ | — | $ | 3,870 | ||||||||||

| 15 |

| Nine Months Ended September 30, 2016 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||||

| Management Fee Income | ||||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 7,438 | $ | (218 | ) | $ | 7,220 | ||||||||

| CLOs | 0.15% - 0.50% | 1,311 | — | 1,311 | ||||||||||||

| ZFC REIT | 1.50% | 2,263 | — | 2,263 | ||||||||||||

| Total | $ | 11,012 | $ | (218 | ) | $ | 10,794 | |||||||||

| Incentive Income (1) | ||||||||||||||||

| Funds and accounts | 10% - 20% | $ | 3,909 | $ | — | $ | 3,909 | |||||||||

| CLOs | 20% | — | — | — | ||||||||||||

| Total | $ | 3,909 | $ | — | $ | 3,909 | ||||||||||

| Nine Months Ended September 30, 2015 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Fee Range | Gross Amount | Elimination | Net Amount | |||||||||||||

| Management Fee Income | ||||||||||||||||

| Funds and accounts | 0.50% - 1.25% | $ | 8,984 | $ | — | $ | 8,984 | |||||||||

| CLOs | 0.15% - 0.50% | 837 | — | 837 | ||||||||||||

| ZFC REIT | 1.50% | 2,188 | — | 2,188 | ||||||||||||

| Total | $ | 12,009 | $ | — | $ | 12,009 | ||||||||||

| Incentive Income (1) | ||||||||||||||||

| Funds and accounts | 10% - 20% | $ | 5,118 | $ | — | $ | 5,118 | |||||||||

| CLOs | 10% - 20% | 873 | — | 873 | ||||||||||||

| Total | $ | 5,991 | $ | — | $ | 5,991 | ||||||||||

| (1) | Incentive income earned for certain of the ZAIS Managed Entities is subject to a hurdle rate of return as specified in each respective ZAIS Managed Entities’ operative agreement. |

The management fee income and incentive income amounts above are net of the following credits:

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2016 | September 30, 2015 | September 30, 2016 | September 30, 2015 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Management fee income credit | $ | 52 | $ | 61 | $ | 156 | $ | 165 | ||||||||

| Incentive income credit | $ | — | $ | — | $ | — | $ | 59 | ||||||||

Management fee income and incentive income which was accrued, but not received at September 30, 2016 and December 31, 2015 is as follows:

September

30, | December

31, | |||||||

| (Dollars in thousands) | ||||||||

| Management fee income | $ | 2,049 | $ | 1,670 | ||||

| Incentive income | 3,262 | 859 | ||||||

| Total | $ | 5,311 | $ | 2,529 | ||||

Such amounts are included in income and fees receivable in the consolidated statements of financial condition.

| 16 |

7. Debt Obligations

Notes Payable

On March 17, 2015, in conjunction with the closing of the Business Combination, ZAIS issued two promissory notes with an aggregate principal balance of $1,250,000 to EarlyBirdCapital, Inc. and Sidoti & Company, LLC. The notes accrue interest at an annual rate equal to the annual applicable federal rate as published by the Internal Revenue Service (“AFR”) until the principal amount of, and all accrued interest on, the notes have been paid in full. The notes mature on March 17, 2017 at which time the principal balance and accrued interest will be due and payable. The notes were issued in lieu of paying certain underwriting costs at the closing of the Business Combination and, accordingly, treated as a direct cost attributable to the Business Combination and capitalized to equity. The Company accrued interest on the notes for the three and nine months ended September 30, 2016 and September 30, 2015, which is included in other income (expense) in the consolidated statements of comprehensive income (loss).

8. Compensation

Employees are eligible to receive discretionary incentive cash compensation (the “Bonus Award”) on an annual basis. The amount of the Bonus Award is based on, among other factors, both individual performance and the financial results of ZAIS Group. For certain employees, as documented in an underlying agreement (the “Bonus Agreement”), the Bonus Award may be further subject to a retention-based payout schedule that generally provides for 30% of the Bonus Award to vest and be paid incrementally over a three-year period. The Company expenses all current cash incentive compensation award payments ratably in the first year. All future payments are amortized equally over the required service period over the remaining term of the Bonus Award as defined in the Bonus Award Agreements. In the event an award is forfeited pursuant to the terms of the Bonus Agreement, the corresponding accruals will be reversed.

On March 29, 2016, the Compensation Committee of the Board of Directors of ZAIS adopted a retention payment plan for certain employees of ZAIS Group (the "Retention Payment Plan"). The Retention Payment Plan applies to approximately 60 employees of ZAIS Group who have an annual base salary of less than $300,000. The purpose of the Retention Payment Plan is to enable ZAIS Group to retain the services of its employees in order to ensure that ZAIS Group is not disrupted or adversely affected by the possible loss of personnel or their commitment to ZAIS Group. Under the Retention Payment Plan, the participating employees are entitled to receive cash retention payments on each of April 15, 2016, August 15, 2016 and November 15, 2016, if the employee remains employed by ZAIS Group on such dates. The maximum aggregate amount of retention payments that may be paid to all participants under the Retention Payment Plan is approximately $4.5 million. All payments under the Retention Payment Plan will be amortized equally over the required service period ending on each of the three payment dates discussed above. In the event an award is forfeited pursuant to the terms of a respective Retention Payment Plan agreement, the corresponding accruals will be reversed.

The Company incurred the following expenses relating to the Retention Payment Plan for the three and nine months ended September 30, 2016:

Three

Months Ended | Nine

Months Ended | |||||

| (Dollars in thousands) | ||||||

| $ | 1,253 | $ | 4,309 | |||

Such amounts are included in compensation and benefits in the consolidated statements of comprehensive income (loss).

In addition, on March 1, 2016, the Compensation Committee of the Board of Directors of ZAIS approved a retention payment of $900,000 to Howard Steinberg, the Company's General Counsel, which was paid on March 15, 2016 and is included in compensation and benefits in the consolidated statements of comprehensive income (loss) for the nine months ended September 30, 2016.

ZAIS Group has entered into agreements with certain of its employees whereby certain employees and former employees have been granted rights to participate in a portion of the incentive income received from certain ZAIS Managed Entities (referred to as “Points”). There were no payments made or amounts accrued relating to Points for the three months ended September 30, 2016 and September 30, 2015 and the nine months ended September 30, 2016.

In 2013, ZAIS Group established the Income Unit Plan. Under the Income Unit Plan, certain employees were entitled to receive a fixed percentage of ZAIS Group’s distributable income, as defined in the Income Unit Plan agreement. Pursuant to the terms of the Income Unit Plan, a payout of 85% of the estimated award was made in December of the applicable performance year and the remaining balance was payable within 30 days of the issuance of ZAIS Group’s audit report for the prior year. An employee must have been actively employed by ZAIS Group on each scheduled payment date to have received their relevant payment. The Income Unit Plan was terminated effective December 31, 2014.

| 17 |

On March 8, 2016, the Company commenced a reduction in force and other restructuring which has resulted in a decrease of 23 employees of ZAIS Group. The Company has incurred total severance charges in the amount of approximately $762,000 relating to the reduction in force which was recognized during the six months ended June 30, 2016. The Company immediately recognized all severance expense for employees who were not required to provide services or those employees who were not being retained beyond the 60 day notification period. Conversely, for all employees who were required to provide services or those who were retained beyond the 60 day notification period, the related severance expense was amortized equally over the required service period.

The following table presents a detailed breakout of compensation expense recorded for the three and nine months ended September 30, 2016 and September 30, 2015:

| Three Months Ended September 30, 2016 | Three Months Ended September 30, 2015 | Nine Months Ended September 30, 2016 | Nine Months Ended September 30, 2015 | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Salaries | $ | 2,497 | $ | 3,572 | $ | 8,370 | $ | 10,587 | ||||||||

| Bonus (1) | 2,808 | 865 | 10,208 | 3,094 | ||||||||||||

| Points | — | — | — | 32 | ||||||||||||

| Commissions | — | 30 | 3 | 75 | ||||||||||||

| Income Unit Plan | — | — | — | 198 | ||||||||||||

| Equity-Based Compensation | 1,269 | 1,410 | 2,951 | 3,288 | ||||||||||||

| Severance | 27 | 113 | 789 | 1,087 | ||||||||||||

| Payroll taxes and benefits | 307 | 498 | 1,593 | 2,057 | ||||||||||||

| Total compensation and benefits | $ | 6,908 | $ | 6,488 | $ | 23,914 | $ | 20,418 | ||||||||

(1) Includes amounts incurred under the Retention Payment Plan.

Equity-Based Compensation

In conjunction with the closing of the Business Combination on March 17, 2015, ZGP authorized 1,600,000 Class B-0 Units eligible to be granted to certain employees of ZAIS Group. The Class B-0 Units are subject to a two year cliff-vesting provision, whereby all Class B-0 Units granted to an employee will be forfeited if the employee resigns or is terminated prior to the two year anniversary of the closing of the Business Combination. Subsequent to the two year anniversary of the Business Combination, an employee will only forfeit vested Class B-0 Units if the employee is terminated for cause. The Class B-0 Units are not entitled to any distributions from ZGP (and thus will not participate in, or be allocated any, income or loss) or other material rights until such Class B-0 Units vest. Upon vesting the Class B-0 Units will have the same rights as Class A Units of ZGP and are exchangeable on a one for one basis for Class A common shares subject to the restrictions set forth in the Exchange Agreement included in the Closing 8-K. In accordance with ASC 718, Compensation - Stock Compensation, the Company is measuring the compensation expense associated with these awards based on grant date fair value adjusted for estimated forfeitures. This compensation expense will be amortized equally over the two-year vesting period and will be cumulatively adjusted for changes in estimated forfeitures at each reporting date.

The following table presents the unvested Class B-0 Units’ activity during the nine months ended September 30, 2016:

| Number of B-0 Units | Weighted Average Grant Date Fair Value per Unit | |||||||

| Balance at December 31, 2015 | 1,337,486 | $ | 9.67 | |||||

| Granted | 100,000 | 6.34 | ||||||

| Forfeited | (321,600 | ) | 9.70 | |||||

| Vested | — | — | ||||||

| Balance at September 30, 2016 | 1,115,886 | $ | 9.36 | |||||

The Company incurred compensation expense relating to the Class B-0 Units for the three and nine months ended September 30, 2016 and September 30, 2015 as follows:

| Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, 2016 | September 30, 2015 | September 30, 2016 | September 30, 2015 | |||||||||||

| (Dollars in thousands) | ||||||||||||||

| $ | 1,310 | $ | 1,336 | $ | 2,876 | $ | 3,164 | |||||||

| 18 |

The total compensation expense expected to be recognized in all future periods associated with the Class B-0 Units is $2,393,000 at September 30, 2016, which is expected to be recognized over the remaining weighted average period of 0.46 years. During the three months ended March 31, 2016, the Company increased its forfeiture estimate from 8% to 29.6%. This increase includes approximately a 17.2% increase relating to the reduction in force announced in the Company’s Current Report on Form 8-K filed on March 10, 2016 and approximately a 4.4% increase relating to the change in management’s estimated forfeitures based on actual forfeitures since the grant date. The cumulative impact of the increase in estimated forfeitures of $983,000 was recognized as a reduction in compensation and benefits for the nine months ended September 30, 2016. The expense relating to the Class B-0 Units is included in compensation and benefits on the consolidated statements of comprehensive income (loss).

Non-employee directors of ZAIS receive restricted stock units (“RSUs”) pursuant to ZAIS’s 2015 Stock Incentive Plan as a component of compensation for their service as directors of ZAIS. The awards are unvested at the time they are granted and, as such, are not entitled to any dividends or distributions from ZAIS or other material rights until such RSUs vest. The RSUs vest in full on the one-year anniversary of the grant date. Upon vesting ZAIS will issue the recipient shares of Class A Common Stock equal to the number of vested RSUs. In accordance with ASC 718, Compensation - Stock Compensation, the Company is measuring the expense associated with these awards based on the fair value on the grant date adjusted for estimated forfeitures. This expense is being amortized equally over the one-year vesting period and adjusted on a cumulative basis for changes in estimated forfeitures at each reporting date.

The following table presents the RSU activity during the nine months ended September 30, 2016:

| Number of RSUs | Weighted Average Grant Date Fair Value per Unit | |||||||

| Balance at December 31, 2015 | 30,000 | $ | 9.85 | |||||

| Granted | 30,942 | 3.22 | ||||||

| Forfeited | — | — | ||||||

| Vested | (30,000 | ) | 9.85 | |||||

| Balance at September 30, 2016 | 30,942 | $ | 3.22 | |||||

The Company incurred compensation expense relating to the RSUs for the three and nine months ended September 30, 2016 and September 30, 2015 as follows:

| Three Months Ended | Nine Months Ended | |||||||||||||

| September 30, 2016 | September 30, 2015 | September 30, 2016 | September 30, 2015 | |||||||||||

| (Dollars in thousands) | ||||||||||||||

| $ | (41 | ) | $ | 74 | $ | 75 | $ | 124 | ||||||

The total expense expected to be recognized in all future periods associated with the RSUs, considering estimated forfeitures of 0%, is $55,000 at September 30, 2016, which is expected to be recognized over the remaining weighted average period of 0.56 years. The expense relating to these RSUs is included in compensation and benefits on the consolidated statements of comprehensive income (loss).

9. Income Taxes

Prior to the closing of the Business Combination on March 17, 2015, ZGP and its subsidiaries were pass-through entities for U.S. income tax purposes and their earnings flowed through to the owners without being subject to entity level income taxes. Accordingly, no income tax (benefit) expense has been recorded for the period prior to the closing of the business combination other than that related to ZGP’s foreign subsidiaries, which are branches for U.S. income tax purposes but paid income taxes in their respective foreign jurisdictions.

Following the reorganization, while ZGP and its subsidiaries continue to operate as pass-through entities for U.S. income tax purposes not subject to entity level taxes, ZAIS is taxable as a corporation for U.S. tax purposes. Accordingly, the Company’s consolidated financial statements include U.S. federal, state and local income taxes on the ZAIS’ allocable share of the consolidated results of operations, as well as taxes payable to jurisdictions outside the U.S related to the foreign subsidiaries.

| 19 |

The Company recorded income tax (benefit) of $(21,000) and $(12,000) respectively for the three and nine months ended September 30, 2016, related solely to foreign taxes receivable from jurisdictions outside the U.S. related to the Company’s foreign subsidiaries. The Company recorded income tax (benefit) of $(1,528,000) and $(4,111,000) for the three and nine months ended September 30, 2015, related to foreign taxes payable to jurisdictions outside the U.S. related to the Company’s foreign subsidiaries, and U.S. federal, state and local income taxes on the Company’s allocable share of the consolidated results of operations as well as the Company’s net operating losses and development stage start-up expenses incurred during the period from its inception and prior to the closing of the Business Combination with ZGP.