Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BLACKSTONE MORTGAGE TRUST, INC. | d873557d8k.htm |

| EX-99.1 - EX-99.1 - BLACKSTONE MORTGAGE TRUST, INC. | d873557dex991.htm |

Blackstone Mortgage Trust, Inc.

February 17, 2015

Full Year and Fourth Quarter 2014 Results

Exhibit 99.2

*

*

*

*

*

*

*

* |

Blackstone Mortgage Trust

1

Fourth Quarter 2014 Highlights

Core

Earnings

of

$0.52

per

share

for

the

quarter,

a

27%

increase

from

the

fourth

quarter

of

2013,

supporting an increase in our fourth quarter dividend to $0.52 per share.

100%

floating

rate

Loan

Origination

portfolio

of

$4.4

billion

with

a

weighted

average

loan-to-

value

of

64%.

Closed

8

senior

loans

representing

total

commitments

of

$781

million,

with

one

additional

$315

million

senior loan closing immediately subsequent to quarter-end.

Funded $770 million of loan commitments, offset by $216 million of full or

partial repayments. Added

$743

million

of

financing

capacity,

bringing

total

capacity

to

$4.4

billion

with

$2.9

billion

outstanding.

GAAP

net

income

of

$0.37

per

share

includes

net

loss

of

$0.08

per

share

in

the

CT Legacy portfolio;

consolidated book value of $25.10 per share.

Information included in this presentation is as of or for the period ended December 31, 2014,

unless otherwise indicated. See Appendix for a definition of Core Earnings and a

reconciliation to GAAP net income, as well as certain per share calculations that are referenced throughout this presentation. |

Blackstone Mortgage Trust

2

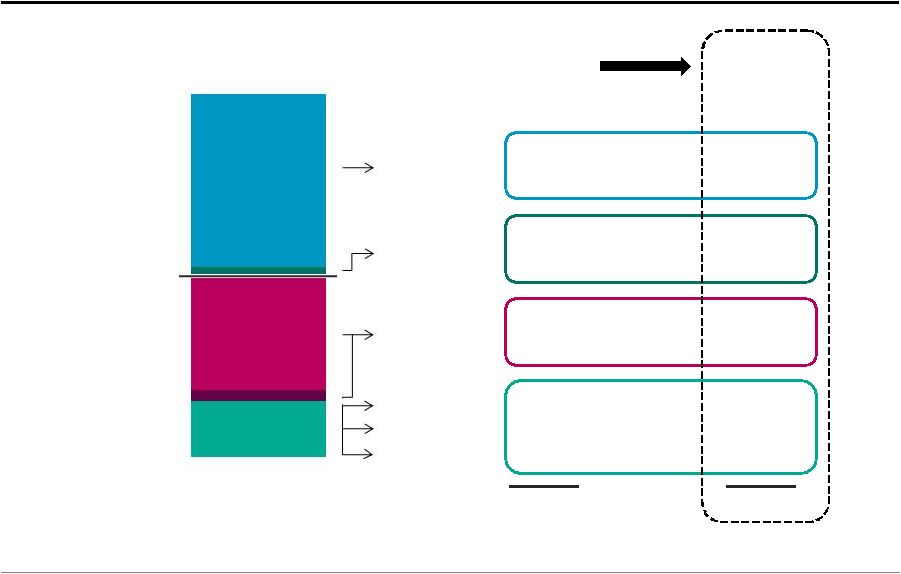

Fourth Quarter 2014 Balance Sheet, Net Income, and Core Earnings

(Dollars in Millions)

CT Legacy portfolio

($4.8)

Secured financings

($21.3)

Equity

and

other

(b)

($2.5)

($6.3)

($1.1)

Loan Origination

portfolio

$57.5

$21.5

$4.8

$0.4

$-

Interest income

Interest expense

Non-cash comp.

G&A expenses

Net results

$57.5

$-

($20.9)

Core

Earnings

(a)

Net

Income

$30.1

+

+

+

+

Convertible notes,

net

Balance

Sheet

Mgmt./Incen. fees

$2.5

$0.8

$-

$-

($5.5)

($1.1)

$1,424

$162

$2,865

$22

$4,429

(a) See Appendix for a definition of Core Earnings and a reconciliation to GAAP

net income.

(b) Includes stockholders’ equity of $1.5 billion, less the net of (i)

cash and cash equivalents of $51.8 million, (ii) accrued interest receivable, prepaid expenses,

and other assets of $36.5 million, and (iii) accounts payable, accrued expenses, and other

liabilities of $47.3 million. |

Blackstone Mortgage Trust

3

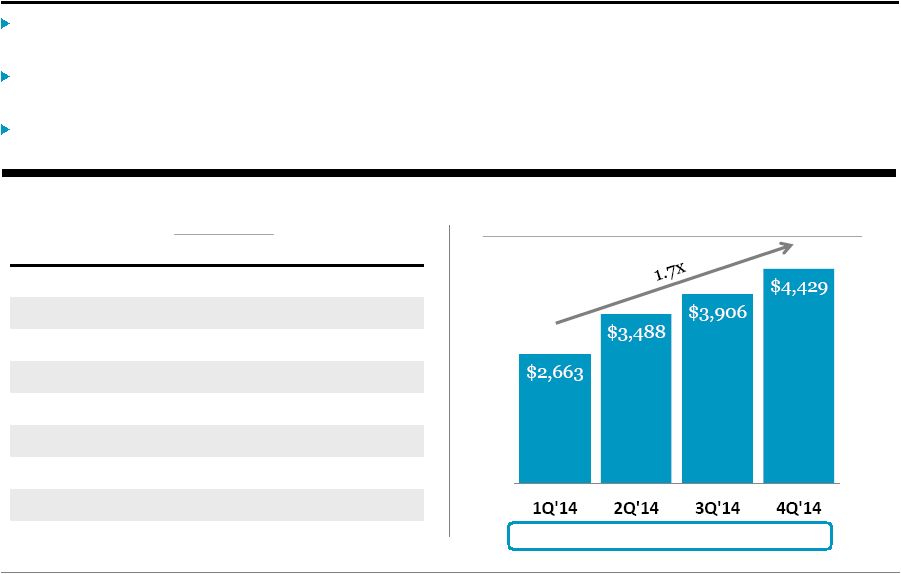

Increase

in

quarterly

Core

Earnings

of 150% during 2014.

Disciplined

issuance

of

28.3

million

shares

of

common

stock

during

2014,

resulting

in

Core

Earnings

per share growth of 27%.

Achieved

full

coverage

of

dividend

per

share

in

3Q

and

4Q

as

steady

deployment

of

capital

and

increasing

scale

drove

growth

in

Core Earnings per share.

Core Earnings and Dividend Growth

Core Earnings

(a)

(Dollars in Millions)

$0.41

$0.43

$0.43

$0.50

$0.52

Core Earnings

Per share

Loan originations of $3.4 billion during 2014 drove consistent growth in Core

Earnings per share and dividends per share.

$0.45

$0.48

$0.48

$0.50

$0.52

Dividends

Per share

(a)

See Appendix for a definition of Core Earnings and reconciliations to GAAP net income. |

Blackstone Mortgage Trust

4

Loan Origination Portfolio

Closed

$781

million

of

loans

during

the

fourth

quarter

with

an

average

commitment

of

$121

million,

including

a

C$196

million

loan

secured

by

an

office

portfolio

in

Canada.

Total

loan

originations

for

2014

of

$3.4

billion,

bringing

cumulative

originations

since

the

May

2013

re-IPO

to $5.9 billion.

Portfolio

Gross

ROI

(a)

continues

to

remain

stable

in

the

L

+

12-13%

range

as

improved

financing

terms

have

generally balanced modestly lower portfolio asset yields.

Loan Origination Portfolio Statistics

(Dollars in Millions)

Loan Origination Portfolio

(Net

Book

Value

and

Gross

ROI

(a)

,

Dollars

in

Millions)

L+12.7% L+12.7%

L+12.9% L+12.8% Gross

ROI:

Number of loans

60

Principal balance

$4,463

Net book value

$4,429

Wtd. avg. origination loan-to-value

64%

Wtd. avg. cash coupon

L + 4.36%

Wtd. avg. all-in yield

L + 4.81%

Wtd. avg. gross return on investment

(a)

L + 12.8%

Wtd. avg. maximum maturity

(b)

3.9 yrs.

(a)

Weighted average gross return on investment (“Gross ROI”) is based on each

asset’s all-in yield, assuming current rates with no dispositions, early payments,

or defaults, and all-in cost of secured debt, assuming full leverage at the asset level

based on the maximum available leverage in place or in negotiation for each

investment, notwithstanding the amount actually borrowed. Gross ROI excludes costs related to convertible notes, management fees, and corporate-

level expenses. Gross ROI is presented solely for informational purposes and is not

representative of net income recognized in prior or future periods.

(b)

Maximum maturity assumes all extension options are exercised, however BXMT’s floating

rate loans may be repaid prior to such dates. |

Blackstone Mortgage Trust

5

Portfolio Diversification

BXMT’s

$4.4

billion

floating

rate

portfolio

is

diversified

by

collateral

property

type

and

geographic

location,

and

is

primarily

comprised

of

senior

mortgages

and

similar

credit

quality

loans.

$316,934,052

$416,559,099

Collateral Diversification

(Net Book Value, % of Total)

Floating rate Loans

(Net Book Value, % of Total)

100.0%

Office

Multifamily

Hotel

Condo

Senior Loans

(Net Book Value, % of Total)

98.0%

Geographic Diversification

(Net Book Value, % of Total)

Other

Retail

CA

13.1%

IL

7.2%

FL

6.3%

WA

2.3%

TX

5.2%

GA

4.9%

CO

2.1%

DC

1.8%

AZ

1.6%

VA

1.5%

HI

1.1%

RI

OR

NV

0.2%

MI

0.2%

OH

0.2%

KY

0.1%

NC

0.2%

0.7%

0.9%

NY

30.5%

CAN

3.1% |

Blackstone Mortgage Trust

6

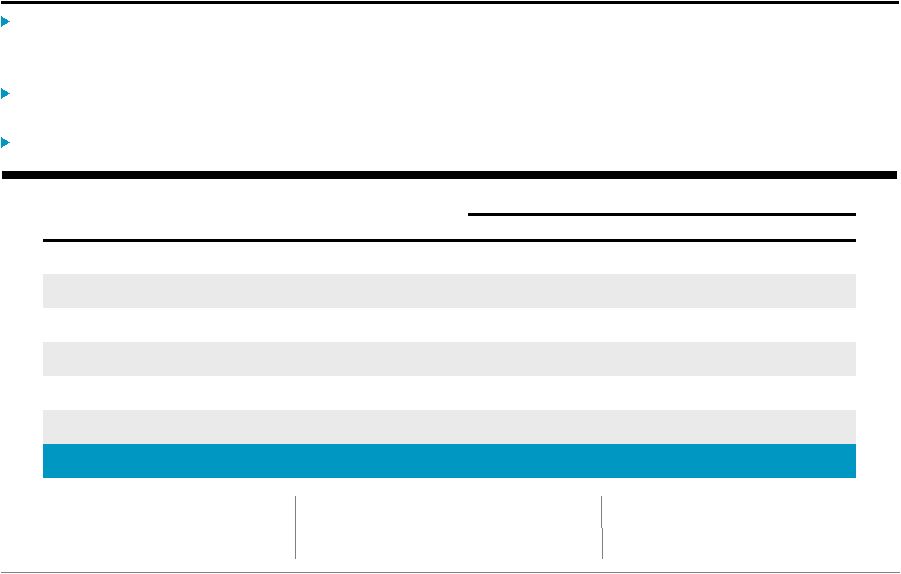

Floating Rate Business Model

BXMT’s

LIBOR-based

(a)

lending

and

funding

business

model

generates

increasing

returns

with

rising

short-term interest rates.

All

else

equal,

a

100bp

increase

in

LIBOR

would

increase

annual

net

interest

income

by

$0.26

per

share

(b)

.

Loan Capitalization

(c)

(Principal Balance, Dollars in Millions)

Floating rate

loans

Floating rate

borrowings

Floating rate

Net investment

Income Sensitivity to LIBOR

(b)

(Dollars

of

Net

Interest

Income

per

share

(d)

)

$2.30

$2.35

$2.40

$2.45

$2.50

$2.55

$2.60

$2.65

$2.70

$2.75

$2.80

(a)

Our floating rate loans and related liabilities are indexed to the various benchmark rates

relevant in each case in terms of currency and payment frequency. Therefore the net

exposure to each benchmark rate is in direct proportion to our net assets indexed to that rate.

(b)

Gives effect to LIBOR floors for loan receivable investments. All else equal, a 10bp decrease

in LIBOR would decrease annual net interest income by $0.02 per share.

(c)

Includes only the Loan Origination portfolio with an aggregate principal balance of $4.5

billion, capitalized with $2.9 billion of secured borrowings, and with a $1.6 billion

net investment. Excludes the assets, liabilities, and equity of the CT Legacy portfolio.

(d)

Based on annualized net interest income for the quarter-ended December 31, 2014, and

shares outstanding as of December 31, 2014.

$0.26

LIBOR |

Blackstone Mortgage Trust

7

Credit Facilities and Liquidity

$385 million

Available Borrowings

L + 2.11%

Wtd. Avg. All-in Cost of Credit Facilities

$3.4 billion

Total Credit Facility Capacity

(a) Total liquidity includes $52 million of cash and $385

million of available borrowings. Potential loan originations assumes 3.5x asset-level leverage on total

liquidity, net of $81

million of minimum liquidity requirements under applicable debt covenants.

(b) Potential borrowings represent the total amount that could

be drawn under each facility based on collateral already approved and pledged. When undrawn,

these amounts do not incur interest, but are immediately available to BXMT at its sole

discretion under the terms of each revolving credit facility.

(c) The maximum facility size for JP Morgan is composed of a

$250 million facility and a £153 million ($238 million) facility. The maximum facility size for Morgan

Stanley represents a £250 million ($389 million) facility that may be drawn in GBP or

EUR. Maximum

Collateral Asset

Debt Obligations

(b)

(Dollars in Thousands)

Facility Size

Principal Balance

Potential

Outstanding

Available

Wells Fargo

1,000,000

$

747,256

$

585,737

$

484,365

$

101,372

$

Citibank

500,000

621,025

472,080

392,455

79,625

Bank of America

500,000

557,810

441,201

389,347

51,854

JP Morgan

(c)

488,155

544,654

422,249

341,487

80,762

MetLife

500,000

476,499

366,902

305,889

61,013

Morgan Stanley

(c)

389,050

174,297

137,181

127,240

9,941

Total

3,377,205

$

3,121,541

$

2,425,350

$

2,040,783

$

384,567

$

During

the

quarter,

BXMT

closed

a

$500

million

upsize

of

an

existing

revolving

credit

facility,

bringing

total

credit

facility

capacity

to

$3.4

billion,

including

$627

million

of

GBP

and

EUR

multi-currency

facilities.

Currency-matched

financings

hedge

foreign

currency

denominated

loans

to

the

extent

of

leverage

employed.

Total

liquidity

of

$436

million

(a)

at

quarter-end,

providing

for

$1.6

billion

(a)

of

potential

loan

originations

and

fundings. |

Blackstone Mortgage Trust

8

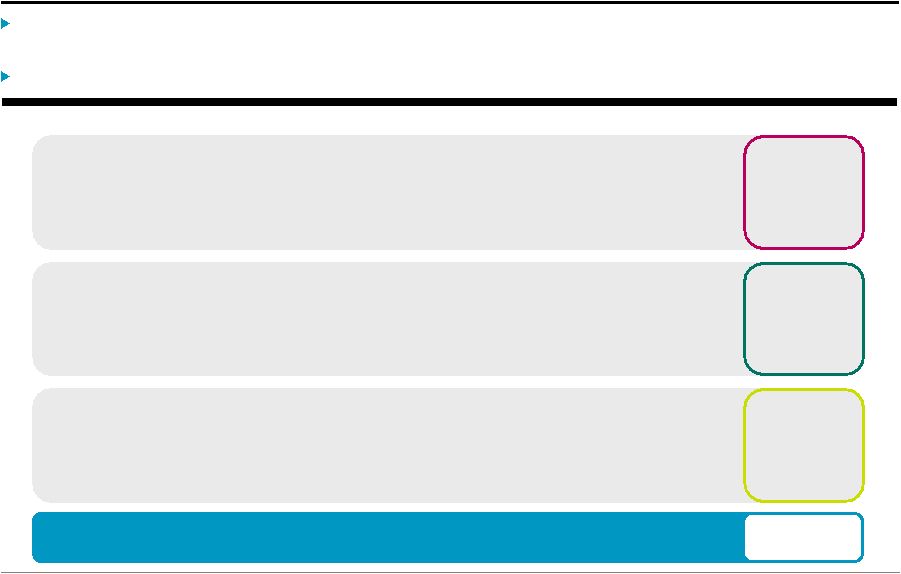

Asset-Specific Financings

(a)

BXMT

closed

two

additional

asset-specific

financings

totaling

$243

million

of

financing

capacity,

bringing

asset-specific

capacity

to

$981

million

and

total

financing

capacity

to

$4.4

billion

including

credit

facilities.

Opportunistic

use

of

asset-specific

financings

preserves

capacity

of

revolving

repurchase

facilities.

$981

Total

Asset-Specific

Financing

Capacity

(Dollars in Millions)

$372

•

Non-cross collateralized, with limited recourse and margin call

provisions

•

Three agreements with $325 million outstanding and $47 million of

future funding commitments

•

$429 million of collateral assets

Asset-Specific

Repurchase

Agreements

$499

•

Senior loan participations sold by BXMT

•

Four participation sales totaling $499 million

•

$636 million of whole loans financed

Loan

Participations

Sold

$110

•

Transaction structures resulting in realized sales of senior interests

•

One $110 million senior interest sold in a $144 million property

financing

•

$34 million mezzanine loan remains in BXMT’s portfolio

Non-Consolidated

Senior Interests

(a) BXMT’s balance sheet includes asset-specific financings

of $325 million classified as asset-specific repurchase agreements and $499 million classified as loan

participations sold. See pages 11-12, Consolidated and Segment Balance Sheets.

|

Appendix

*

*

*

*

*

*

*

*

*

* |

Blackstone Mortgage Trust

10

Loan Origination Segment Portfolio Details

The following table provides details of BXMT’s Loan Origination Segment

portfolio: (Dollars in Millions)

Origination

Date

Loan Type

Total

Commitment

Principal

Balance

Book

Value

Cash

Coupon

All-In

Yield

Maximum

Maturity

(a)

Geographic

Location

Property

Type

Origination

LTV

Loan 1

5/22/14

Senior loan

311.2

$

311.2

$

307.1

$

L + 4.00%

L + 4.34%

5/22/19

UK

Hotel

57%

Loan 2

11/21/13

Senior loan

181.0

181.0

179.8

L + 4.50%

L + 4.86%

11/9/18

NY

Condo

68%

Loan 3

12/9/14

Senior loan

210.7

163.3

161.8

L + 3.80%

L + 4.31%

12/9/19

Diversified-US

Office

65%

Loan 4

7/31/14

Senior loan

190.0

153.9

152.8

L + 3.50%

L + 4.01%

8/9/19

IL

Office

71%

Loan 5

1/7/14

Senior loan

160.0

151.8

150.6

L + 4.75%

L + 5.14%

1/7/19

Diversified-US

Other

71%

Loan 6

11/20/14

Senior loan

149.4

149.4

147.9

L + 3.40%

L + 3.62%

11/20/19

UK

Hotel

62%

Loan 7

12/17/13

Senior loan

139.8

139.8

139.1

L + 4.75%

L + 5.27%

1/9/19

NY

Office

70%

Loan 8

11/17/14

Senior loan

168.8

138.6

137.0

L + 5.50%

L + 5.96%

12/9/19

CAN

Office

53%

Loan 9

1/30/14

Senior loan

145.9

133.4

133.0

L + 4.30%

L + 4.63%

12/1/17

NY

Hotel

39%

Loan 10

6/20/14

Senior loan

137.5

120.4

119.4

L + 5.75%

L + 6.39%

6/20/16

CA

Hotel

44%

Loan 11

2/25/14

Senior loan

166.0

119.4

118.0

L + 4.40%

L + 4.81%

3/9/19

Diversified-US

Hotel

51%

Loan 12

2/20/14

Senior loan

100.0

97.7

97.4

L + 4.40%

L + 4.58%

3/9/19

NY

Office

70%

Loan 13

10/30/13

Senior loan

100.0

97.7

97.3

L + 4.38%

L + 4.61%

11/9/18

CA

Hotel

72%

Loan 14

3/4/14

Senior loan

121.4

95.1

94.0

L + 4.00%

L + 4.58%

3/4/18

UK

Office

55%

Loan 15

9/30/13

Senior loan

111.1

89.5

89.4

L + 3.70%

L + 3.83%

9/30/20

NY

Multifamily

62%

Loans 16-60

Various

Various

(b)

2,583.3

2,320.7

2,303.9

L + 4.41%

L + 4.92%

Various

Various

Various

67%

Total/Wtd. avg.

4,976.1

$

4,462.9

$

4,428.5

$

L + 4.36%

L + 4.81%

3.9 years

64%

(a) Maximum maturity date assumes all extension options

areexercised, however BXMT’s floating rate loans may be repaid prior to such dates.

(b) Includes (i) 43 senior loans with an aggregate principal

balance of $2.3 billion, (ii) one subordinate mortgage participation with a principal balance of $54 million,

and (iii) one mezzanine loan with a principal balance of $34 million resulting from

BXMT’s disposition of a non-consolidated senior interest as a financing strategy

in connection with the origination of the overall property financing.

|

Blackstone Mortgage Trust

11

Consolidated Balance Sheet

(Dollars in Thousands, Except per Share Data)

December 31, 2014

December 31, 2013

Assets

Cash and cash equivalents

51,810

$

52,342

$

Restricted cash

11,591

10,096

Loans receivable, net

4,428,500

2,047,223

Equity investments in unconsolidated subsidiaries

10,604

22,480

Accrued interest receivable, prepaid expenses, and other assets

86,016

80,639

Total assets

4,588,521

$

2,212,780

$

Liabilities and equity

Accounts payable, accrued expenses, and other liabilities

61,013

$

97,153

$

Revolving repurchase facilities

2,040,783

863,622

Asset-specific repurchase agreements

324,553

245,731

Loan participations sold

499,433

90,000

Convertible notes, net

161,853

159,524

Total liabilities

3,087,635

1,456,030

Equity

Class A common stock, $0.01 par value

583

295

Additional paid-in capital

2,027,404

1,252,986

Accumulated other comprehensive (loss) income

(15,024)

798

Accumulated deficit

(547,592)

(536,170)

Total

Blackstone

Mortgage

Trust,

Inc.

stockholders’

equity

1,465,371

717,909

Non-controlling interests

35,515

38,841

Total equity

1,500,886

756,750

Total liabilities and equity

4,588,521

$

2,212,780

$

|

Blackstone Mortgage Trust

12

Consolidated Balance Sheet: Segment Allocation

December 31, 2014

(Dollars in Thousands)

Loan

Origination

CT Legacy

Portfolio

Total

Assets

Cash and cash equivalents

51,810

$

-

$

51,810

$

Restricted cash

-

11,591

11,591

Loans receivable, net

4,428,500

-

4,428,500

Equity investments in unconsolidated subsidiaries

-

10,604

10,604

Accrued interest receivable, prepaid expenses, and other assets

36,531

49,485

86,016

Total assets

4,516,841

$

71,680

$

4,588,521

$

Liabilities and equity

Accounts payable, accrued expenses, and other liabilities

47,328

$

13,685

$

61,013

$

Revolving repurchase facilities

2,040,783

-

2,040,783

Asset-specific repurchase agreements

324,553

-

324,553

Loan participations sold

499,433

-

499,433

Convertible notes, net

161,853

-

161,853

Total liabilities

3,073,950

13,685

3,087,635

Equity

Total Blackstone Mortgage Trust, Inc. stockholders’equity

1,442,891

22,480

1,465,371

Non-controlling interests

-

35,515

35,515

Total equity

1,442,891

57,995

1,500,886

Total liabilities and equity

4,516,841

$

71,680

$

4,588,521

$ |

Blackstone Mortgage Trust

13

Consolidated Statement of Operations

Three Months Ended December 31,

Year Ended December 31,

(Dollars in Thousands, Except per Share Data)

2014

2013

2014

2013

Income from loans and other investments

Interest and related income

58,258

$

26,837

$

184,766

$

53,164

$

Less: Interest and related expenses

21,446

11,525

69,143

18,017

Income from loans and other investments, net

36,812

15,312

115,623

35,147

Other expenses

Management and incentive fees

6,272

2,521

19,491

5,937

General and administrative expenses

5,876

5,408

27,799

11,505

Total other expenses

12,148

7,929

47,290

17,442

Impairments, provisions, and valuation adjustments

5,654

3,012

13,258

8,676

Loss on deconsolidation of subsidiary

(8,615)

-

(8,615)

-

Other income

-

-

-

38

Income from equity investments in

unconsolidated subsidiaries 3,742

-

28,036

-

Income before income taxes

25,445

10,395

101,012

26,419

Income tax provision

107

667

518

995

Net income

25,338

$

9,728

$

100,494

$

25,424

$

Net income attributable to non-controlling interests

(3,848)

(2,649)

(10,449)

(10,392)

Net income attributable to Blackstone Mortgage Trust, Inc.

21,490

$

7,079

$

90,045

$

15,032

$

Per share information (basic and diluted)

Weighted-average shares of common stock outstanding

58,190,324

29,364,448

48,394,478

18,520,052

Net income per share of common stock

0.37

$

0.24

$

1.86

$

0.81

$

|

Blackstone Mortgage Trust

14

Consolidated Statement of Operations: Segment Allocation

Three Months Ended December 31, 2014

Year Ended December 31, 2014

(Dollars in Thousands)

Loan

Origination

CT Legacy

Portfolio

Total

Loan

Origination

CT Legacy

Portfolio

Total

Income from loans and other investments

Interest and related income

57,527

$

731

$

58,258

$

180,654

$

4,112

$

184,766

$

Less: Interest and related expenses

21,256

190

21,446

68,098

1,045

69,143

Income from loans and other investments, net

36,271

541

36,812

112,556

3,067

115,623

Other expenses

Management and incentive fees

6,272

-

6,272

19,491

-

19,491

General and administrative expenses

3,613

2,263

5,876

12,665

15,134

27,799

Total other expenses

9,885

2,263

12,148

32,156

15,134

47,290

Impairments, provisions, and valuation adjustments

-

5,654

5,654

-

13,258

13,258

Loss on deconsolidation of subsidiary

-

(8,615)

(8,615)

-

(8,615)

(8,615)

Income from equity investments in unconsolidated subsidiaries

-

3,742

3,742

-

28,036

28,036

Income (loss) before income taxes

26,386

(941)

25,445

80,400

20,612

101,012

Income tax provision

63

44

107

194

324

518

Net income (loss)

26,323

$

(985)

$

25,338

$

80,206

$

20,288

$

100,494

$

Net income attributable to non-controlling interests

-

(3,848)

(3,848)

-

(10,449)

(10,449)

Net

income

(loss)

attributable

to

Blackstone

Mortgage

Trust,

Inc.

26,323

$

(4,833)

$

21,490

$

80,206

$

9,839

$

90,045

$ |

Blackstone Mortgage Trust

15

Consolidated Statement of Operations: Loan Origination Segment

Three Months Ended

(Dollars in Thousands)

December 31, 2014

September 30, 2014

$ Change

% Change

Income from loans and other investments

Interest and related income

57,527

$

49,720

$

7,807

$

15.7%

Less: Interest and related expenses

21,256

19,713

1,543

7.8%

Income from loans and other investments, net

36,271

30,007

6,264

20.9%

Other expenses

Management and incentive fees

6,272

5,412

860

15.9%

General and administrative expenses

3,613

2,705

908

33.6

%

Total other expenses

9,885

8,117

1,768

21.8%

Income before income taxes

26,386

21,890

4,496

20.5%

Income tax provision

63

-

63

N/M

Net income

26,323

$

21,890

$

4,433

$

20.3% |

Blackstone Mortgage Trust

16

Per Share Calculations

(Dollars in Thousands, Except per Share Data)

Core Earnings

Reconciliation

Book Value per

Share:

Segment Allocation

Earnings per Share:

Segment Allocation

Three Months Ended December 31, 2014

Three Months Ended September 30, 2014

Loan

Origination

CT Legacy

Portfolio

Total

Loan

Origination

CT Legacy

Portfolio

Total

Net income (loss)

26,323

$

(4,833)

$

21,490

$

21,890

$

134

$

22,024

$

Weighted-average shares

outstanding, basic and diluted

58,190

58,190

58,190

49,211

49,211

49,211

Earnings per share, basic and diluted

0.45

$

(0.08)

$

0.37

$

0.45

$

0.00

$

0.45

$

Three Months Ended

December 31, 2014

September 30, 2014

Net income

21,490

$

22,024

$

CT Legacy Portfolio segment net loss

(income) 4,833

(134)

Amortization of discount on convertible notes

408

404

Incentive management fees

817

842

Non-cash compensation expense

2,528

1,619

Core Earnings

30,076

$

24,755

$

58,190

49,211

Core Earnings per share, basic and diluted

0.52

$

0.50

$

December 31,

2014 September 30, 2014

Loan

Origination

CT Legacy

Portfolio

Total

Loan

Origination

CT Legacy

Portfolio

Total

1,442,891

$

22,480

$

1,465,371

$

1,448,384

$

29,355

$

1,477,739

$

Shares

Class A common stock

58,270

58,270

58,270

57,680

57,680

57,680

Deferred stock units

119

119

119

113

113

113

58,389

58,389

58,389

57,793

57,793

57,793

Book value per share

24.71

$

0.39

$

25.10

$

25.06

$

0.51

$

25.57

$

Stockholders’ equity Weighted-average

shares outstanding, basic and diluted |

Blackstone Mortgage Trust

17

Reconciliation of Net Income to Core Earnings

Three Months Ended

(Dollars in Thousands, Except per Share Data)

December 31,

2013

Mach 31,

2014

June 30,

2014

September 30,

2014

December 31,

2014

Net income

7,079

$

13,065

$

33,466

$

22,024

$

21,490

$

CT Legacy Portfolio segment net loss (income)

3,670

970

(15,508)

(134)

4,833

Amortization of discount on convertible notes

130

391

397

404

408

Unrealized

(gain)

loss

on

foreign

currency

remeasurement

(23)

32

(235)

-

-

Incentive management fees

-

-

-

842

817

Non-cash compensation expense

1,158

1,834

2,382

1,619

2,528

Core Earnings

12,014

$

16,292

$

20,502

$

24,755

$

30,076

$

Weighted-average shares outstanding, basic and diluted

29,364

37,967

47,978

49,211

58,190

Net income per share, basic and diluted

0.24

$

0.34

$

0.70

$

0.45

$

0.37

$

Core Earnings per share, basic and diluted

0.41

$

0.43

$

0.43

$

0.50

$

0.52

$

|

Blackstone Mortgage Trust

18

Definitions

Blackstone

Mortgage

Trust,

Inc.

(“BXMT”)

discloses

Core

Earnings,

a

financial

measure

that

is

calculated

and

presented

on

the

basis

of

methodologies

other

than

in

accordance

with

generally

accepted

accounting

principles

in

the

United

States

of

America

(“GAAP”)

in

this

presentation.

Core

Earnings

is

an

adjusted

measure

that

helps

BXMT

evaluate

its

performance

excluding

the

effects

of

certain

transactions

and

GAAP

adjustments

that

it

believes

are

not

necessarily

indicative

of

its

current

loan

origination

portfolio

and

operations.

BXMT

also

uses

Core

Earnings

to

calculate

the

incentive

and

base

management

fees

due

to

its

manager

under

its

management

agreement

and,

as

such,

BXMT

believes

that

the

disclosure

of

Core

Earnings

is

useful

to

investors.

Core

Earnings

is

defined

as

GAAP

net

income

(loss),

including

realized

losses

not

otherwise

included

in

GAAP

net

income

(loss),

and

excluding

(i)

net

income

(loss)

attributable

to

the

CT

Legacy

Portfolio

segment,

(ii)

non-cash

equity

compensation

expense,

(iii)

incentive

management

fees,

(iv)

depreciation

and

amortization,

and

(v)

unrealized

gains

(losses)

or

similar

non-cash

items.

Core

Earnings

may

also

be

adjusted

from

time

to

time

to

exclude

one-time

events

pursuant

to

changes

in

GAAP

and

certain

other

non-cash

charges

as

determined

by

BXMT’s

manager,

subject

to

approval

by

a

majority

of

its

independent

directors.

Core

Earnings

does

not

represent

net

income

or

cash

generated

from

operating

activities

and

should

not

be

considered

as

an

alternative

to

GAAP

net

income,

or

an

indication

of

BXMT’s

GAAP

cash

flows

from

operations,

a

measure

of

BXMT’s

liquidity,

or

an

indication

of

funds

available

for

its

cash

needs.

In

addition,

BXMT’s

methodology

for

calculating

Core

Earnings

may

differ

from

the

methodologies

employed

by

other

companies

to

calculate

the

same

or

similar

supplemental

performance

measures,

and

accordingly,

its

reported

Core

Earnings

may

not

be

comparable

to

the

Core

Earnings

reported

by

other

companies. |

Blackstone Mortgage Trust

19

Forward-Looking Statements

This

presentation

may

contain

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended,

which

reflect

Blackstone

Mortgage

Trust’s

current

views

with

respect

to,

among

other

things,

Blackstone

Mortgage

Trust’s

operations

and

financial

performance.

You

can

identify

these

forward-looking

statements

by

the

use

of

words

such

as

“outlook,”

“indicator,”

“believes,”

“expects,”

“potential,”

“continues,”

“may,”

“will,”

“should,”

“seeks,”

“approximately,”

“predicts,”

“intends,”

“plans,”

“estimates,”

“anticipates”

or

the

negative

version

of

these

words

or

other

comparable

words.

Such

forward-looking

statements

are

subject

to

various

risks

and

uncertainties.

Accordingly,

there

are

or

will

be

important

factors

that

could

cause

actual

outcomes

or

results

to

differ

materially

from

those

indicated

in

these

statements.

Blackstone

Mortgage

Trust

believes

these

factors

include

but

are

not

limited

to

those

described

under

the

section

entitled

“Risk

Factors”

in

its

Annual

Report

on

Form

10-K

for

the

fiscal

year

ended

December

31,

2014,

as

such

factors

may

be

updated

from

time

to

time

in

its

periodic

filings

with

the

Securities

and

Exchange

Commission

which

are

accessible

on

the

SEC’s

website

at

www.sec.gov.

These

factors

should

not

be

construed

as

exhaustive

and

should

be

read

in

conjunction

with

the

other

cautionary

statements

that

are

included

in

this

presentation

and

in

the

filings.

Blackstone

Mortgage

Trust

assumes

no

obligation

to

update

or

supplement

forward-looking

statements

that

become untrue because of subsequent events or circumstances. |