Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SYNOPSYS INC | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - SYNOPSYS INC | exhibit312.htm |

| EX-32.1 - EXHIBIT 32.1 - SYNOPSYS INC | exhibit321.htm |

| EX-21.1 - EXHIBIT 21.1 - SYNOPSYS INC | exhibit211.htm |

| EX-31.1 - EXHIBIT 31.1 - SYNOPSYS INC | exhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - SYNOPSYS INC | exhibit231.htm |

| EX-31.3 - EXHIBIT 31.3 - SYNOPSYS INC | exhibit313.htm |

| EX-10.24 - EXHIBIT 10.24 - SYNOPSYS INC | exhibit1024.htm |

| EX-10.25 - EXHIBIT 10.25 - SYNOPSYS INC | exhibit1025.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended October 31, 2014

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-19807

SYNOPSYS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 56-1546236 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

700 East Middlefield Road, Mountain View, California 94043

(Address of principal executive offices, including zip code)

(650) 584-5000

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | NASDAQ Global Select Market | |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller Reporting Company ¨ | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $3.8 billion. Aggregate market value excludes an aggregate of approximately 53.9 million shares of common stock held by the registrant’s executive officers and directors and by each person known by the registrant to own 5% or more of the outstanding common stock on such date. Exclusion of shares held by any of these persons should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under common control with the registrant.

On December 10, 2014, 153,103,327 shares of the registrant’s Common Stock, $0.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to the registrant’s 2015 Annual Meeting of Stockholders, scheduled to be held on April 2, 2015, are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. Except as expressly incorporated by reference, the registrant’s Proxy Statement shall not be deemed to be part of this report.

SYNOPSYS, INC.

ANNUAL REPORT ON FORM 10-K

Year ended October 31, 2014

TABLE OF CONTENTS

Page No. | ||||

Item 1. | ||||

Item 1A. | ||||

Item 1B. | ||||

Item 2. | ||||

Item 3. | ||||

Item 4. | ||||

Item 5. | ||||

Item 6. | ||||

Item 7. | ||||

Item 7A. | ||||

Item 8. | ||||

Item 9. | ||||

Item 9A. | ||||

Item 9B. | ||||

Item 10. | ||||

Item 11. | ||||

Item 12. | ||||

Item 13. | ||||

Item 14. | ||||

Item 15. | ||||

i

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this Form 10-K or Annual Report) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), which are subject to the “safe harbor” created by those sections. Any statements herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “expect,” “intend,” “believe,” “estimate,” “project” or “continue” and the negatives of such terms are intended to identify forward-looking statements. This Form 10-K includes, among others, forward-looking statements regarding our expectations about:

• | our business, product and platform strategies; |

• | our business outlook; |

• | prior and future acquisitions, including the expected benefits of completed acquisitions; |

• | the impact of macroeconomic conditions on our business and our customers’ businesses; |

• | demand for our products and our customers’ products; |

• | customer license renewals; |

• | the completion of development of our unfinished products, or further development, integration, or broader release of our existing products; |

• | technological trends in integrated circuit design; |

• | our ability to successfully compete in the electronic design automation industry; |

• | the continuation of current industry trends towards vendor and customer consolidation; |

• | our license mix; |

• | litigation; |

• | our ability to protect our intellectual property rights; |

• | our cash, cash equivalents and cash generated from operations; and |

• | our future liquidity requirements. |

These statements involve certain known and unknown risks, uncertainties and other factors that could cause our actual results, time frames or achievements to differ materially from those expressed or implied in our forward-looking statements. Accordingly, we caution readers not to place undue reliance on these statements. Such risks and uncertainties include, among others, those listed in Part I, Item 1A, Risk Factors of this Form 10-K. The information included herein represents our estimates and assumptions as of the date of this filing. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. All subsequent written or oral forward-looking statements attributable to Synopsys or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Readers are urged to carefully review and consider the various disclosures made in this report and in other documents we file from time to time with the Securities and Exchange Commission (SEC) that attempt to advise interested parties of the risks and factors that may affect our business.

Fiscal Year End

Our fiscal year generally ends on the Saturday nearest to October 31 and consists of 52 weeks, with the exception that approximately every five years, we have a 53-week year.

Fiscal 2014 and 2013 were 52-week years ending on November 1, 2014 and November 2, 2013, respectively. Fiscal 2012 was a 53-week year ending on November 3, 2012. The extra week in fiscal 2012 resulted in approximately $26 million of additional revenue, related primarily to time-based licenses, and approximately $16 million of additional expenses.

For presentation purposes, this Form 10-K refers to October 31 as the end of our fiscal year.

1

PART I

Item 1. Business |

Introduction

Synopsys, Inc. is a global leader in providing software, intellectual property and services used to design integrated circuits and electronic systems. For more than 25 years, we have supplied the electronic design automation (EDA) software that engineers use to design and test integrated circuits (ICs), commonly called chips. We also provide intellectual property (IP) products, which are pre-designed circuits that engineers use as components of larger chip designs instead of designing those circuits themselves. We provide software and hardware used to develop the electronic systems that incorporate chips and the software that runs on them. To complement these product offerings, we provide technical services to support our solutions and help our customers develop chips and electronic systems. We are also a leading provider of software tools that developers use to improve the quality, security, and time-to-market of software code in a wide variety of industries, including electronics, financial services, energy, and industrials.

Corporate Information

We incorporated in 1986 in North Carolina and reincorporated in Delaware in 1987. Our headquarters are located at 700 East Middlefield Road, Mountain View, California 94043, and our telephone number there is (650) 584-5000. We expect that our headquarters will change to 690 East Middlefield Road, Mountain View, California 94043, in early 2015. We have approximately 98 offices worldwide.

Our annual and quarterly reports on Forms 10-K and 10-Q (including related filings in XBRL format), current reports on Form 8-K, and Proxy Statements relating to our annual meetings of stockholders, including any amendments to these reports, as well as filings made by our executive officers and directors, are available through the Investor Relations page of our Internet website (www.synopsys.com) free of charge as soon as practicable after we file them with, or furnish them to, the SEC (www.sec.gov). We use our Investor Relations page as a routine channel for distribution of important information, including news releases, analyst presentations, and financial information. The contents of our website are not part of this Form 10-K.

Background

Recent years have seen a remarkable proliferation of consumer and wireless electronic products, particularly mobile devices. The growth of the Internet and cloud computing has provided people with new ways to create, store and share information. At the same time, the increasing use of electronics in cars, buildings, and appliances and other consumer products is expanding the landscape of “smart” devices.

These developments depend, in large part, on chips. It is common for a single chip to combine many components (processor, communications, memory, custom logic, input/output) into a single System-on-Chip (SoC), resulting in highly complex chip designs. The most complex chips today contain more than a billion transistors, the basic building blocks for integrated circuits, each of which may have features that are less than 1/1,000th the diameter of a human hair. At such small dimensions, the wavelength of light itself can become an obstacle to production, becoming too big to create such dense features and requiring creative and complicated new approaches from designers. Designers have turned to new manufacturing techniques, such as double patterning lithography and FinFET transistors, which introduce their own challenges in design and production.

In addition, due to the popularity of mobile devices and other electronic products, there is increasing demand for integrated circuits and systems with greater functionality and performance, reduced size, and less power consumption. The designers of these products—our customers—are facing intense pressure to deliver innovative products at ever shorter times-to-market, as well as at lower prices. In other words, innovation in chip and system design often hinges on “better,” “sooner,” and “cheaper.”

A similar dynamic is at work in the software industry, where the pace of innovation requires developers to deliver high quality software, which can include millions of lines of code, in increasingly shrinking release cycles. Bugs, defects, and security vulnerabilities in code can be difficult to detect and expensive to fix. But, at a time when software is prevalent in many industries and in an increasing array of smart devices, it can be crucial to do so.

Synopsys is at the heart of accelerating innovation in the electronics industry. We provide the software tools, IP, hardware and other technologies that designers use to create chips and systems. We also provide the software tools that software developers use to detect critical flaws in their code.

2

The task of the chip and system designer is to determine how best to locate and connect the building blocks of chips, verifying that the resulting design behaves as intended and ensuring that the design can be manufactured efficiently and cost-effectively. This task is a complicated, multi-step process that is both expensive and time-consuming. We offer a wide range of products that help designers at different steps in the overall design process, both for the design of individual integrated circuits and for the design of larger systems. Our products can increase designer productivity and efficiency by automating tasks, keeping track of large amounts of design data, adding intelligence to the design process, facilitating reuse of past designs and reducing errors. Our IP products offer proven, high-quality pre-configured circuits that are ready-to-use in a chip design, saving customers time and enabling them direct resources to features that differentiate their products. Our global service and support engineers also provide expert technical support and design assistance to our customers.

The task of the software developer is to write code that not only accomplishes the developer's goal as efficiently as possible but that also runs securely and free of errors. We offer products that can help developers write better, more secure code by analyzing their code for quality defects and security vulnerabilities, adding intelligence and automation to the software testing process, and helping to eliminate quality and security defects in a systematic manner. Our products can enable software developers to catch flaws earlier in the development cycle, when they can be less costly to fix.

Products and Services

Revenue from our products and services is reported in four groups:

• | Core EDA, which includes our digital and custom IC design products, our verification products, and our field-programmable gate array (FPGA) design products; |

• | IP and Software Solutions, which includes our DesignWare® IP portfolio, our system-level design tools, and our Coverity® software quality and security testing solutions; |

• | Manufacturing Solutions; and |

• | Professional Services. |

Core EDA Solutions

The process of designing integrated circuits contains many complex steps: architecture definition, RTL (register transfer level) design, functional/RTL verification, logic design or synthesis, gate-level verification, floorplanning, and place and route, to name just a few. Designers use our Core EDA products to automate the integrated circuit design process and to reduce errors. We offer a large number of Core EDA products intended to address the process comprehensively. Our Core EDA products generally fall into the following categories:

• | Digital and Custom IC Design, which includes tools to design an integrated circuit; |

• | Verification, which includes technology to verify that an integrated circuit behaves as intended; and |

• | FPGA Design, which includes tools to design FPGAs, a complex, configurable form of integrated circuit. |

Digital and Custom IC Design

Our Galaxy™ Design Platform provides our customers with a single, integrated chip design solution that includes industry-leading individual products and incorporates common libraries and consistent timing, delay calculation and constraints throughout the design process. The platform allows designers the flexibility to integrate internally developed and third-party tools. With this advanced functionality, common foundation and flexibility, our Galaxy Design Platform helps reduce design times, decrease integration costs and minimize the risks inherent in advanced, complex integrated circuit designs. Our products span digital, custom and analog/mixed-signal designs.

In fiscal 2014, we introduced our IC Compiler™ II physical design solution and expect to continue to broaden its availability in fiscal 2015. IC Compiler II is a complete place-and-route system, built on new, multi-threaded infrastructure, that offers faster runtime, uses less memory, and delivers superior chip design results in area, timing, and power, which can help designers reduce their design iterations and boost design productivity.

Our other principal design products, also available as part of the Galaxy Design Platform, are our IC Compiler physical design solution, Design Compiler® logic synthesis product, Galaxy Custom Designer® and Laker® Layout

3

custom design solutions, CustomSim™ tool for analog/mixed-signal verification, PrimeTime® timing analysis products, StarRC™ product for extraction, and IC Validator tool for physical verification.

Verification

In fiscal 2014, we introduced our Verification Continuum™ Platform to accelerate industry innovation by enabling earlier software bring-up and shorter times-to-market for advanced SoCs. Verification Continuum is built from our industry-leading and fastest verification technologies, providing virtual prototyping, static and formal verification, simulation, emulation, FPGA-based prototyping, and debug in a unified environment with verification IP and planning and coverage technology. Elements of the platform are in various stages of release, with some elements available currently and others expected to be generally available in calendar year 2015.

The individual products included in Verification Continuum span both our Core EDA and IP and Software Solutions revenue groups. The solutions reported in Core EDA revenue include the following:

• | Our Verification Compiler™ solution, released in fiscal 2014, which is a complete portfolio of integrated, next-generation verification technologies that include advanced debug (our Verdi® solution), simulation (our VCS® comprehensive RTL verification technology), new static and formal verification technology, verification IP, and planning and coverage technology. In addition to their inclusion in our Verification Compiler solution, these verification technologies also continue to be sold as individual point tools. |

• | ZeBu® emulation systems, which use high-performance hardware to emulate SoC designs so that designers can accelerate verification of large complex SoCs and perform earlier verification of the SoC together with software. |

• | Our other principal individual verification solutions, including CustomSim™ FastSPICE and FineSim® SPICE/FastSPICE circuit simulation and analysis products, HSPICE® circuit simulator, and CustomExplorer™ Ultra mixed-signal regression and analysis environment. |

The virtual prototyping and FPGA-based prototyping solutions that are part of our Verification Continuum platform are included in our IP and Software Solutions revenue group.

FPGA Design

FPGAs are complex chips that can be customized or programmed to perform a specific function after they are manufactured. For FPGA design, we offer Synplify® Pro and Premier implementation and Identify® debug software tools.

IP and Software Solutions

IP Products

As more functionality converges into a single device or even a single chip, and chip designs grow more complex, the number of third-party IP blocks incorporated into designs is rapidly increasing. Synopsys is a leading provider of high-quality, silicon-proven IP solutions for SoCs. Our broad DesignWare® IP portfolio includes:

• | high-quality solutions for widely used interfaces such as USB, PCI Express, DDR, Ethernet, SATA, MIPI, and HDMI; |

• | analog IP for analog-to-digital data conversion and audio; |

• | SoC infrastructure IP including minPower datapath components, ARM® AMBA® interconnect fabric and peripherals, and verification IP; |

• | logic libraries and embedded memories, including SRAMs and non-volatile memory; |

• | configurable processor cores and application-specific instruction-set processors (ASIPs) for embedded and deeply embedded designs; and |

• | IP subsystems for audio and sensor functionality that combine IP blocks and software into an integrated, pre-verified solution. |

4

Our IP Accelerated initiative augments our established, broad portfolio of silicon-proven DesignWare IP with DesignWare IP Prototyping Kits, DesignWare IP Virtual Development Kits, and customized IP subsystems to accelerate prototyping, software development, and integration of IP into SoCs.

System-Level Solutions

Optimizing the system-level design earlier in the development cycle, including both hardware and software components, is increasingly important for customers to meet their performance, time-to-market, and development cost goals. Synopsys has the industry’s broadest portfolio of tools, models and services for the system-level design of SoCs.

Our Platform Architect™ software enables early and rapid exploration of SoC architectural trade-offs. To speed the creation, implementation and verification of differentiated IP blocks, we offer SPW™ and System Studio™ tools for algorithm design, Processor Designer™ software for custom processor design, and Synphony Model™ and C Compilers for high-level synthesis.

Escalating software content and complexity in today’s electronic devices are driving the adoption of new tools and methods to accelerate software development and ease hardware-software integration and system validation. Our system-level portfolio includes prototyping technologies that can improve the productivity of both hardware and software development teams. These prototyping technologies are also an important component of our Verification Continuum Platform. Our Virtualizer™ tool and broad portfolio of transaction-level models enable the creation of virtual prototypes, fully functional software models of complete systems that enable engineers to start software development up to twelve months earlier than traditional methods. Our HAPS® FPGA-based prototyping systems integrate high performance hardware and software tools with real-world interfaces to enable faster hardware-software integration and full system validation. Our hybrid prototyping solution combines both approaches to prototyping, integrating Virtualizer virtual prototyping with HAPS FPGA-based prototyping.

Synopsys also provides a series of tools used in the design of optical systems and photonic devices. Our CODE V® solution enables engineers to model, analyze and optimize designs for optical imaging and communication systems. Our LightTools® design and analysis software allows designers to simulate and improve the performance of a broad range of illumination systems, from vehicle lighting to projector systems.

Software Solutions

In the second quarter of fiscal 2014, we acquired Coverity, Inc. (Coverity), a leading provider of software quality, testing, and security tools. Coverity products help software developers reduce the risk of errors and security defects in their code before it is released. Our Coverity Code Advisor solution includes the Quality Advisor™ and Security Advisor™ tools, which analyze software code to find crash-causing bugs, incorrect program behavior, memory leaks and other flaws that degrade performance, security vulnerabilities, violations of security best practices, and other critical code issues, many of which may be difficult to detect by other means. Our Coverity Test Advisor™ solutions allow developers to focus their test development on the most critical code and to prioritize their test execution for the tests that are the most relevant for a particular set of code additions or changes. Our Coverity Connect™ platform assists software development teams in tracking and managing their code issues.

Manufacturing Solutions

Our Manufacturing Solutions products and technologies enable semiconductor manufacturers to more quickly develop new fabrication processes that produce production-level yields. These products are used in the early research and development phase and the production phase. In the production phase, manufacturers use these products to convert IC design layouts into the masks used to manufacture the devices.

Our Manufacturing Solutions include Sentaurus™ Technology-CAD (TCAD) device and process simulation products, Proteus optical proximity correction (OPC) and lithography rule check (LRC) products, CATS® mask data preparation product, and Yield Explorer® and Odyssey/Yield Manager Yield Management solutions.

Professional Services and Training

Synopsys provides consulting and design services that address all phases of the SoC development process. These services assist our customers with new tool and methodology adoption, chip architecture and specification development, functional and low-power design and verification, and physical implementation and signoff. We also provide a broad range of expert training and workshops on our latest tools and methodologies.

5

Customer Service and Technical Support

A high level of customer service and support is critical to the adoption and successful use of our products. We provide technical support for our products through both field-based and corporate-based application engineering teams. Customers who purchase Technology Subscription Licenses (TSLs) receive software maintenance services bundled with their license fee. Customers who purchase term licenses and perpetual licenses may purchase these services separately. See Product Sales and Licensing Agreements below.

Software maintenance services include minor product enhancements, bug fixes and access to our technical support center for primary support. Software maintenance also includes access to the SolvNet® portal, our web-based support solution that gives customers access to Synopsys’ complete design knowledge database. Updated daily, the SolvNet portal includes documentation, design tips and answers to user questions. Customers can also engage, for additional charges, our worldwide network of applications consultants for additional support needs.

In addition, Synopsys also offers training workshops designed to increase customer design proficiency and productivity with our products. Workshops cover our products and methodologies used in our design and verification flows, as well as specialized modules addressing system design, logic design, physical design, simulation and test. We offer regularly scheduled public and private courses in a variety of locations worldwide, as well as Virtual Classroom on-demand and live online training.

Product Warranties

We generally warrant our products to be free from defects in media and to substantially conform to material specifications for a period of 90 days for our software products and for up to 6 months for our HAPS FPGA-based prototyping systems. In many cases, we also provide our customers with limited indemnification with respect to claims that their use of our software products infringes on United States patents, copyrights, trademarks or trade secrets. We have not experienced material warranty or indemnity claims to date.

Support for Industry Standards

We actively create and support standards that help our customers increase productivity, facilitate efficient design flows, improve interoperability of tools from different vendors, and ensure connectivity, functionality and interoperability of IP building blocks. Standards in the electronic design industry can be established by formal accredited organizations, industry consortia, company licensing made available to all, de facto usage, or through open source licensing.

Synopsys’ products support more than 35 standards, including the most commonly used hardware description languages: SystemVerilog, Verilog, VHDL, and SystemC. Our products utilize numerous industry standard data formats, application programming interfaces, and databases for the exchange of design data among our tools, other EDA vendors’ products, and applications that customers develop internally. We also comply with a wide range of industry standards within our IP product family to ensure usability and interconnectivity.

Sales, Distribution and Backlog

Our EDA and IP customers are primarily semiconductor and electronics systems companies. The customers for our Coverity software solutions products include many of these companies as well as companies in a wider array of industries, including financial services, energy, and industrials. We market our products and services principally through direct sales in the United States and principal foreign markets. We typically distribute our software products and documentation to customers electronically, but provide physical media (e.g., DVD-ROMs) when requested by the customer.

We maintain sales/support centers throughout the United States. Outside the United States, we maintain sales, support or service offices in Canada, multiple countries in Europe, Israel, Japan, China, Korea, Taiwan and other countries in Asia. Our foreign headquarters for financial and tax purposes are located in Dublin, Ireland. Our offices are further described under Part I, Item 2, Properties.

6

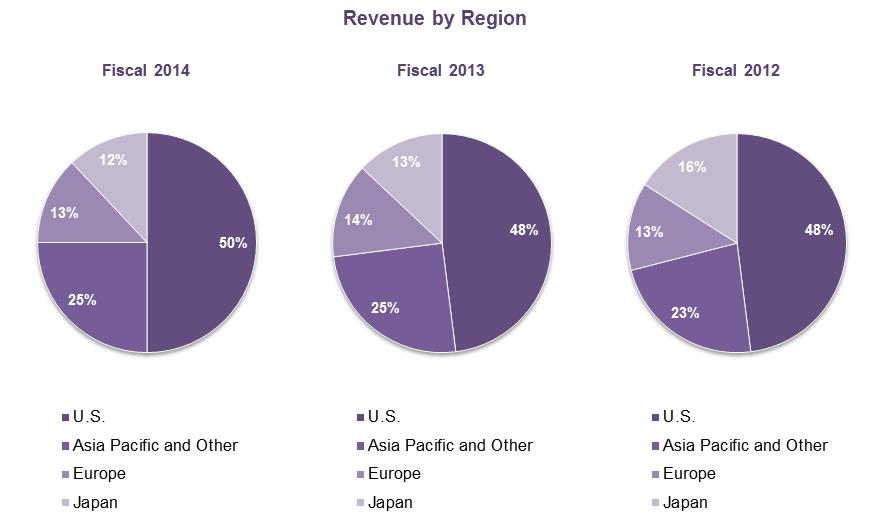

In fiscal 2014, 2013 and 2012, an aggregate of 50%, 52% and 52%, respectively, of Synopsys’ total revenue was derived from sales outside of the United States. Geographic revenue, which is based on customer server site location, is shown below as a percentage of total revenue for the last three fiscal years:

Additional information relating to domestic and foreign operations, including revenue and long-lived assets by geographic area, is contained in Note 13 of Notes to Consolidated Financial Statements in Part II, Item 8, Financial Statements and Supplementary Data. Risks related to our foreign operations are described in Part I, Item 1A, Risk Factors.

Our backlog was approximately $3.5 billion on October 31, 2014, representing a 13% increase from backlog of $3.1 billion on October 31, 2013, which resulted primarily from the renewal in fiscal 2014 of large multi-year contracts, business growth, and to a lesser extent, acquisitions. Backlog represents committed orders that are expected to be recognized as revenue over the following three years. We currently expect that $1.7 billion of our backlog will be recognized after fiscal 2015. Backlog may not be a reliable predictor of our future sales as business conditions may change and technologies may evolve, and customers may seek to renegotiate their arrangements or may default on their payment obligations. For this and other reasons, we may not be able to recognize expected revenue from backlog when anticipated.

7

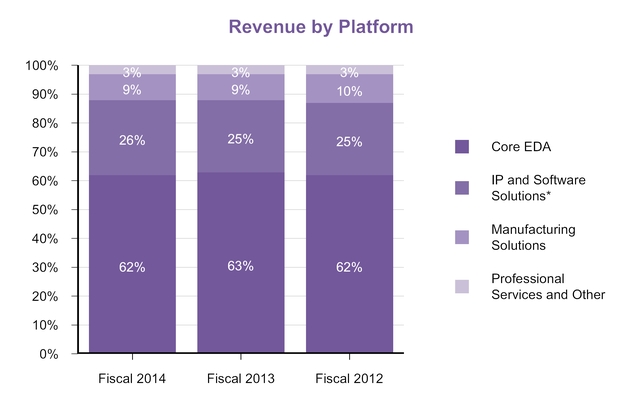

Revenue attributable to each of our four platforms established for management reporting purposes is shown below as a percentage of total revenue for the last three fiscal years:

*Our IP and Software Solutions platform was referred to as IP and System-Level Solutions in fiscal 2013 and 2012.

Revenue derived from Intel Corporation and its subsidiaries in the aggregate accounted for 10.5%, 11.3% and 10.5% of our total revenue in fiscal 2014, 2013 and 2012, respectively.

Research and Development

Our future performance depends in large part on our ability to further enhance and extend our design and verification platforms and to expand our manufacturing, IP, system-level and software solutions product offerings. Research and development of existing and new products is primarily conducted within each product group. We also use targeted acquisitions to augment our own research and development efforts.

Our research and development expenses were $718.8 million, $669.2 million and $581.6 million in fiscal 2014, 2013 and 2012, respectively. Our capitalized software development costs were approximately $3.6 million, $3.6 million and $3.3 million in fiscal 2014, 2013 and 2012, respectively.

Competition

The EDA industry is highly competitive. We compete against other EDA vendors and against our customers’ own design tools and internal design capabilities. In general, we compete principally on technology leadership, product quality and features (including ease-of-use), license terms, price and payment terms, post-contract customer support, and interoperability with our own and other vendors’ products. No one factor drives an EDA customer’s buying decision, and we compete on all fronts to capture a higher portion of our customers’ budgets.

Our competitors include EDA vendors that offer varying ranges of products and services, such as Cadence Design Systems, Inc. and Mentor Graphics Corporation. We also compete with other EDA vendors, including frequent new entrants to the marketplace, that offer products focused on one or more discrete phases of the IC design process, as well as with customers’ internally developed design tools and capabilities. In the IP area, we compete generally on product quality and features, ease of integration with customer designs, compatibility with design tools, license terms, price and payment terms, and customer support. In the software solutions area, we compete with numerous tool providers, some of which focus on specific aspects of software security or quality

8

analysis, as well as frequent new entrants, which include start-up companies as well as more established software companies.

Product Sales and Licensing Agreements

We typically license our software to customers under non-exclusive license agreements that transfer title to the media only and restrict use of our software to specified purposes within specified geographical areas. The majority of our licenses are network licenses that allow a number of individual users to access the software on a defined network, including, in some cases, regional or global networks. License fees depend on the type of license, product mix and number of copies of each product licensed.

In many cases, we provide our customers the right to “re-mix” a portion of the software they initially licensed for other specified Synopsys products. For example, a customer may use our front-end design products for a portion of the license term and then exchange such products for back-end place and route software for the remainder of the term in order to complete the customer’s IC design. This practice helps assure the customer’s access to the complete design flow needed to design its product. The ability to offer this right to customers often gives us an advantage over competitors who offer a narrower range of products because customers can obtain more of their design flow from a single vendor. At the same time, because in such cases the customer need not obtain a new license and pay an additional license fee for the use of the additional products, the use of these arrangements could result in reduced revenue compared to licensing the individual products separately without re-mix rights.

We currently offer our software products under various license types: renewable TSLs, term licenses and perpetual licenses. For a full discussion of these licenses, see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates and Results of Operations—Revenue Background.

We typically license our DesignWare Core intellectual property products under nonexclusive license agreements that provide usage rights for specific applications. Fees under these licenses are typically charged on a per design basis plus, in some cases, royalties.

Finally, our Global Technical Services team typically provides design consulting services to our customers under consulting agreements with statements of work specific to each project.

Proprietary Rights

Synopsys primarily relies upon a combination of copyright, patent, trademark and trade secret laws and license and nondisclosure agreements to establish and protect its proprietary rights. We have a diversified portfolio of more than 2,100 United States and foreign patents issued, and we will continue to pursue additional patents in the future. Our issued patents have expiration dates through 2033. Our patents primarily relate to our products and the technology used in connection with our products. Our source code is protected both as a trade secret and as an unpublished copyrighted work. However, third parties may develop similar technology independently. In addition, effective copyright and trade secret protection may be unavailable or limited in some foreign countries. We are not significantly dependent upon any single patent, copyright, trademark or license with respect to our proprietary rights.

In many cases, under our customer agreements and other license agreements, we offer to indemnify our customers if the licensed products infringe on a third party’s intellectual property rights. As a result, we may from time to time need to defend claims that our customers’ use of our products infringes on these third-party rights.

Employees

As of October 31, 2014, Synopsys had 9,436 employees, of which 3,706 were based in the United States.

9

Executive Officers of the Registrant

The executive officers of Synopsys and their ages as of December 12, 2014 were as follows:

Name | Age | Position | ||

Aart J. de Geus | 60 | Co-Chief Executive Officer and Chairman of the Board of Directors | ||

Chi-Foon Chan | 65 | Co-Chief Executive Officer and President | ||

Brian M. Beattie | 61 | Executive Vice President, Business Operations and Chief Administrative Officer | ||

Trac Pham | 45 | Chief Financial Officer | ||

Joseph W. Logan | 55 | Executive Vice President, Worldwide Sales and Corporate Marketing | ||

John F. Runkel, Jr. | 59 | General Counsel and Corporate Secretary | ||

Aart J. de Geus co-founded Synopsys and has served as Chairman of our Board of Directors since February 1998 and Chief Executive Officer since January 1994. He has served as Co-Chief Executive Officer with Dr. Chi-Foon Chan since May 2012. Since the inception of Synopsys in December 1986, Dr. de Geus has held a variety of positions, including President, Senior Vice President of Engineering and Senior Vice President of Marketing. He has served as a member of Synopsys’ Board of Directors since 1986, and served as Chairman of our Board from 1986 to 1992 and again from 1998 until present. Dr. de Geus has also served on the board of directors of Applied Materials, Inc. since July 2007. Dr. de Geus holds an M.S.E.E. from the Swiss Federal Institute of Technology in Lausanne, Switzerland and a Ph.D. in Electrical Engineering from Southern Methodist University.

Chi-Foon Chan has served as our Co-Chief Executive Officer since May 2012 and as our President and a member of our Board of Directors since February 1998. Prior to his appointment as our Co-Chief Executive Officer in May 2012, he had served as our Chief Operating Officer since April 1997. Dr. Chan joined Synopsys in May 1990 and has held various senior management positions, including Executive Vice President, Office of the President from September 1996 to February 1998 and Senior Vice President, Design Tools Group from February 1994 to April 1997. Dr. Chan has also held senior management and engineering positions at NEC Electronics and Intel Corporation. Dr. Chan holds a B.S. in Electrical Engineering from Rutgers University, and an M.S. and a Ph.D. in Computer Engineering from Case Western Reserve University.

Brian M. Beattie is our Executive Vice President, Business Operations and Chief Administrative Officer. Prior to his promotion to that role in December 2014, Mr. Beattie served as our Chief Financial Officer since January 2006. From October 1999 to January 2006, he was Executive Vice President of Finance and Administration and Chief Financial Officer of SupportSoft, Inc. From May 1998 to May 1999, he served as Vice President of Finance, Mergers and Acquisitions of Nortel Networks Corporation. From July 1996 to April 1998, Mr. Beattie served as Group Vice President of Meridian Solutions of Nortel Networks Corporation. From February 1993 to June 1996, Mr. Beattie served as Vice President of Finance, Enterprise Networks, for Nortel Networks Corporation. Mr. Beattie served on the board of directors of Unwired Planet, Inc. from December 2010 until November 2012. Mr. Beattie holds a Bachelor of Commerce and an M.B.A. from Concordia University in Montreal.

Trac Pham was appointed our Chief Financial Officer in December 2014. Mr. Pham joined Synopsys in November 2006 as Vice President, Financial Planning and Strategy. He became our Vice President, Corporate Finance, in August 2012, assuming additional responsibility for our tax and treasury functions. Mr. Pham holds a Bachelor of Arts in Economics from the University of California, Berkeley and an MPIA (Master of Pacific International Affairs) from the University of California, San Diego.

Joseph W. Logan serves as our Executive Vice President of Worldwide Sales and Corporate Marketing. He became Senior Vice President of Worldwide Sales in September 2006, assumed responsibility for our Corporate Marketing organization in August 2013, and became Executive Vice President in December 2013. Previously, Mr. Logan was head of sales for Synopsys’ North America East region from September 2001 to September 2006. Prior to Synopsys, Mr. Logan was head of North American Sales and Support at Avant! Corporation. Mr. Logan holds a B.S.E.E. from the University of Massachusetts, Amherst.

John F. Runkel, Jr. has served as our General Counsel and Corporate Secretary since May 2014. From October 2008 to March 2013, he served as Executive Vice President, General Counsel, and Corporate Secretary of Affymetrix, Inc. He served as Senior Vice President, General Counsel and Corporate Secretary of Intuitive Surgical, Inc. from 2006 to 2007. Mr. Runkel served in several roles at VISX, Inc. from 2001 to 2005, most recently as Senior Vice President of Business Development and General Counsel. Mr. Runkel was also a partner at the law firm of

10

Sheppard, Mullin, Richter & Hampton LLP for eleven years. He holds a Bachelor of Arts and a Juris Doctorate from the University of California, Los Angeles.

There are no family relationships among any Synopsys executive officers or directors.

Item 1A. Risk Factors |

A description of the risk factors associated with our business is set forth below. Investors should carefully consider these risks and uncertainties before investing in our common stock.

The continued uncertainty in the global economy, and its potential impact on the semiconductor and electronics industries in particular, may negatively affect our business, operating results and financial condition.

While the global economy has shown improvement, there are still uncertainties surrounding the strength of the recovery in many regions. Weakness in the global economy has adversely affected consumer confidence and the growth of the semiconductor industry in recent years, causing semiconductor companies to behave cautiously and focus on their costs, including their research and development budgets, which capture spending on electronic design automation (EDA) products and services. Further uncertainty caused by a global recession could lead some of our customers to postpone their decision-making, decrease their spending and/or delay their payments to us. Continuing caution by semiconductor companies could, among other things, limit our ability to maintain or increase our sales or recognize revenue from committed contracts and in turn could adversely affect our business, operating results and financial condition.

We cannot predict when widespread global economic confidence will be restored. Events such as the timing and execution of the tapering of asset purchases by the U.S. Federal Reserve may continue to drive stock market and interest rate volatility, consumer confidence and product demand. In addition, should further economic instability affect the banking and financial services industry and result in credit downgrades of the banks we rely on for foreign currency forward contracts, credit and banking transactions, and deposit services, or cause them to default on their obligations, it could adversely affect our financial results and our business. Accordingly, our future business and financial results are subject to uncertainty, and our stock price is at risk of volatile change. If economic conditions deteriorate in the future, or, in particular, if the semiconductor industry does not grow, our future revenues and financial results could be adversely affected. Conversely, in the event of future improvements in economic conditions for our customers, the positive impact on our revenues and financial results may be deferred due to our business model.

The growth of our business depends on the semiconductor and electronics industries.

The growth of the EDA industry as a whole, and our business in particular, is dependent on the semiconductor and electronics industries. A substantial portion of our business and revenue depends upon the commencement of new design projects by semiconductor manufacturers and their customers. The increasing complexity of designs of systems-on-chips and integrated circuits, and customers’ concerns about managing costs, have previously led and in the future could lead to a decrease in design starts and design activity in general, with some customers focusing more on one discrete phase of the design process or opting for less advanced, but less risky, manufacturing processes that may not require the most advanced EDA products. Demand for our products and services could decrease and our financial condition and results of operations could be adversely affected if growth in the semiconductor and electronics industries slows or stalls. Additionally, as the EDA industry matures, consolidation may result in stronger competition from companies better able to compete as sole source vendors. This increased competition may cause our revenue growth rate to decline and exert downward pressure on our operating margins, which may have an adverse effect on our business and financial condition.

Furthermore, the semiconductor and electronics industries have become increasingly complex ecosystems. Many of our customers outsource the manufacture of their semiconductor designs to foundries. Our customers also frequently incorporate third-party intellectual property (IP), whether provided by us or other vendors, into their designs to improve the efficiency of their design process. We work closely with major foundries to ensure that our EDA, IP, and manufacturing solutions are compatible with their manufacturing processes. Similarly, we work closely with other major providers of semiconductor IP, particularly microprocessor IP, to optimize our EDA tools for use with their IP designs and to assure that their IP and our own IP products, which may each provide for the design of separate components on the same chip, work effectively together. If we fail to optimize our EDA and IP solutions for

11

use with major foundries’ manufacturing processes or major IP providers’ products, or if our access to such foundry processes or third-party IP products is hampered, then our solutions may become less desirable to our customers, resulting in an adverse effect on our business and financial condition.

We may not be able to realize the potential financial or strategic benefits of the acquisitions we complete, or find suitable target businesses and technology to acquire, which could hurt our ability to grow our business, develop new products or sell our products.

Acquisitions are an important part of our growth strategy. We have completed a significant number of acquisitions in recent years. We expect to make additional acquisitions in the future, but we may not find suitable acquisition targets or we may not be able to consummate desired acquisitions due to unfavorable credit markets, commercially unacceptable terms, or other risks, which could harm our operating results. Acquisitions are difficult, time-consuming, and pose a number of risks, including:

• | Potential negative impact on our earnings per share; |

• | Failure of acquired products to achieve projected sales; |

• | Problems in integrating the acquired products with our products; |

• | Difficulties entering into new markets in which we are not experienced or where competitors may have stronger positions; |

• | Potential downward pressure on operating margins due to lower operating margins of acquired businesses, increased headcount costs and other expenses associated with adding and supporting new products; |

• | Difficulties in retaining and integrating key employees; |

• | Substantial reductions of our cash resources and/or the incurrence of debt; |

• | Failure to realize expected synergies or cost savings; |

• | Difficulties in integrating or expanding sales, marketing and distribution functions and administrative systems, including information technology and human resources systems; |

• | Dilution of our current stockholders through the issuance of common stock as part of the merger consideration; |

• | Assumption of unknown liabilities, including tax and litigation, and the related expenses and diversion of resources; |

• | Disruption of ongoing business operations, including diversion of management’s attention and uncertainty for employees and customers, particularly during the post-acquisition integration process; |

• | Potential negative impact on our relationships with customers, distributors and business partners; |

• | Exposure to new operational risks, regulations, and business customs to the extent acquired businesses are located in regions where we are not currently conducting business; |

• | The need to implement controls, processes and policies appropriate for a public company at acquired companies that may have lacked such controls, processes and policies; |

• | Negative impact on our earnings resulting from the application of Accounting Standards Codification (ASC) 805, Business Combinations; and |

• | Requirements imposed by government regulators in connection with their review of an acquisition, including required divestitures or restrictions on the conduct of our business or the acquired business. |

If we do not manage these risks, the acquisitions that we complete may have an adverse effect on our business and financial condition.

For example, we recently completed our acquisition of Coverity, Inc. (Coverity), a leading provider of software quality, testing, and security tools. This is a new, though adjacent, technology space for us. Coverity's customer base is more diverse and includes industries with which we do not have experience. We may need to develop new sales and marketing strategies and meet new customer service requirements. At the same time, Coverity competes with different competitors from those for our existing products, and these competitors may have more financial resources, industry experience or established customer relationships than we do. To successfully develop our Coverity offerings, we will need to skillfully balance our investment in the software quality, testing and security tools space with investment in our existing products, as well as attract and retain employees with expertise in these new fields. If we fail to do so, we may not realize the expected benefits of the Coverity acquisition, and it may have a negative effect on our earnings and financial condition.

12

Consolidation among our customers, as well as within the industries in which we operate, may negatively impact our operating results.

A number of business combinations, including mergers, asset acquisitions and strategic partnerships, among our customers and in the semiconductor and electronics industries have occurred recently, and more could occur in the future. Consolidation among our customers could lead to fewer customers or the loss of customers, increased customer bargaining power, or reduced customer spending on software and services. The loss of customers or reduced customer spending could adversely affect our business and financial condition. In addition, we and our competitors from time to time acquire businesses and technologies to complement and expand our respective product offerings. If any of our competitors consolidate or acquire businesses and technologies which we do not offer, they may be able to offer a larger technology portfolio, a larger support and service capability, or lower prices, which could negatively impact our business and operating results.

Changes in accounting principles or standards, or in the way they are applied, could result in unfavorable accounting charges or effects and unexpected financial reporting fluctuations, and could adversely affect our reported operating results.

We prepare our consolidated financial statements in conformity with U.S. generally accepted accounting principles (U.S. GAAP). These principles are subject to interpretation by the Securities and Exchange Commission (SEC) and various bodies formed to interpret and create appropriate accounting principles and guidance. A change in existing principles, standards or guidance can have a significant effect on our reported results, may retroactively affect previously reported results, could cause unexpected financial reporting fluctuations, and may require us to make costly changes to our operational processes.

For example, the Financial Accounting Standards Board (FASB) is currently working together with the International Accounting Standards Board (IASB) to converge certain accounting principles and facilitate more comparable financial reporting between companies that are required to follow U.S. GAAP and those that are required to follow International Financial Reporting Standards (IFRS). In connection with this initiative, the FASB issued a new accounting standard for revenue recognition in May 2014 – Accounting Standards Update (ASU) 2014-09, "Revenue from Contracts with Customers (Topic 606)" – that supersedes nearly all existing U.S. GAAP revenue recognition guidance. Although we are currently in the process of evaluating the impact of ASU 2014-09 on our consolidated financial statements, it could change the way we account for certain of our sales transactions. Adoption of the standard could have a significant impact on our financial statements and may retroactively affect the accounting treatment of transactions completed before adoption.

Further efforts by the FASB and IASB to converge U.S. GAAP and IFRS accounting principles may have a material impact on the way we report financial results in areas including, but not limited to, lease accounting and financial statement presentation. In addition, the SEC may make a determination in the future regarding the incorporation of IFRS into the financial reporting system for U.S. companies. Changes in accounting principles from U.S. GAAP to IFRS, or to converged accounting principles, may have a material impact on our financial statements and may retroactively affect the accounting treatment of previously reported transactions.

Our operating results may fluctuate in the future, which may adversely affect our stock price.

Our operating results are subject to quarterly and annual fluctuations, which may adversely affect our stock price. Our historical results should not be viewed as indicative of our future performance due to these periodic fluctuations.

Many factors may cause our revenue or earnings to fluctuate, including:

• | Changes in demand for our products due to fluctuations in demand for our customers’ products and due to constraints in our customers’ budgets for research and development and EDA products and services; |

• | Product competition in the EDA industry, which can change rapidly due to industry or customer consolidation and technological innovation; |

• | Our ability to innovate and introduce new products and services or effectively integrate products and technologies that we acquire; |

• | Failures or delays in completing sales due to our lengthy sales cycle, which often includes a substantial customer evaluation and approval process because of the complexity of our products and services; |

• | Our ability to implement effective cost control measures; |

13

• | Our dependence on a relatively small number of large customers, and on such customers continuing to renew licenses and purchase additional products from us, for a large portion of our revenue; |

• | Expenses related to our acquisition and integration of businesses and technology; |

• | Changes to our effective tax rate; |

• | Delays, increased costs or quality issues resulting from our reliance on third parties to manufacture our hardware products; and |

• | General economic and political conditions that affect the semiconductor and electronics industries. |

The timing of revenue recognition may also cause our revenue and earnings to fluctuate, due to factors that include:

• | Cancellations or changes in levels of license orders or the mix between upfront license revenue and time-based license revenue; |

• | Delay of one or more orders for a particular period, particularly orders generating upfront license revenue; |

• | Delay in the completion of professional services projects that require significant modification or customization and are accounted for using the percentage of completion method; |

• | Delay in the completion and delivery of IP products in development that customers have paid for early access to; |

• | Customer contract amendments or renewals that provide discounts or defer revenue to later periods; |

• | The levels of our hardware revenues, which are recognized upfront and are primarily dependent upon our ability to provide the latest technology and meet customer requirements, and which may also impact our levels of excess and obsolete inventory expenses; and |

• | Changes in or challenges to our revenue recognition model. |

These factors, or any other factors or risks discussed herein, could negatively impact our revenue or earnings and cause our stock price to decline. Additionally, our results may fail to meet or exceed the expectations of securities analysts and investors, or such analysts may change their recommendation regarding our stock, which could cause our stock price to decline.

We operate in highly competitive industries, and if we do not continue to meet our customers’ demand for innovative technology at lower costs, our business and financial condition will be harmed.

We compete against EDA vendors that offer a variety of products and services, such as Cadence Design Systems, Inc. and Mentor Graphics Corporation. We also compete with other EDA vendors, including frequent new entrants to the marketplace, that offer products focused on one or more discrete phases of the integrated circuit (IC) design process, as well as vendors of IP products and system-level solutions. Moreover, our customers internally develop design tools and capabilities that compete with our products.

The industries in which we operate are highly competitive and the demand for our products and services is dynamic and depends on a number of factors, including demand for our customers’ products, design starts and our customers’ budgetary constraints. Technology in these industries evolves rapidly and is characterized by frequent product introductions and improvements and changes in industry standards and customer requirements. Semiconductor device functionality requirements continually increase while feature widths decrease, substantially increasing the complexity, cost and risk of chip design and manufacturing. At the same time, our customers and potential customers continue to demand an overall lower total cost of design, which can lead to the consolidation of their purchases with one vendor. In order to succeed in this environment, we must successfully meet our customers’ technology requirements and increase the value of our products, while also striving to reduce their overall costs and our own operating costs.

We compete principally on the basis of technology, product quality and features (including ease-of-use), license or usage terms, post-contract customer support, interoperability among products, and price and payment terms. Specifically, we believe the following competitive factors affect our success:

• | Our ability to anticipate and lead critical development cycles and technological shifts, innovate rapidly and efficiently, improve our existing products, and successfully develop or acquire new products; |

• | Our ability to offer products that provide both a high level of integration into a comprehensive platform and a high level of individual product performance; |

14

• | Our ability to enhance the value of our offerings through more favorable terms such as expanded license usage, future purchase rights, price discounts and other unique rights, such as multiple tool copies, post-contract customer support, “re-mix” rights that allow customers to exchange the software they initially licensed for other Synopsys products, and the ability to purchase pools of technology; and |

• | Our ability to compete on the basis of payment terms. |

If we fail to successfully manage these competitive factors, fail to successfully balance the conflicting demands for innovative technology and lower overall costs, or fail to address new competitive forces, our business and financial condition will be adversely affected.

If we fail to protect our proprietary technology, our business will be harmed.

Our success depends in part upon protecting our proprietary technology. Our efforts to protect our technology may be costly and unsuccessful. We rely on agreements with customers, employees and others and on intellectual property laws worldwide to protect our proprietary technology. These agreements may be breached, and we may not have adequate remedies for any breach. Additionally, despite our measures to prevent piracy, other parties may attempt to illegally copy or use our products, which could result in lost revenue. Some foreign countries do not currently provide effective legal protection for intellectual property and our ability to prevent the unauthorized use of our products in those countries is therefore limited. Our trade secrets may also be stolen, otherwise become known, or be independently developed by competitors.

We may need to commence litigation or other legal proceedings in order to:

• | Assert claims of infringement of our intellectual property; |

• | Defend our products from piracy; |

• | Protect our trade secrets or know-how; or |

• | Determine the enforceability, scope and validity of the propriety rights of others. |

If we do not obtain or maintain appropriate patent, copyright or trade secret protection, for any reason, or cannot fully defend our intellectual property rights in some jurisdictions, our business and operating results would be harmed. In addition, intellectual property litigation is lengthy, expensive and uncertain and legal fees related to such litigation will increase our operating expenses and may reduce our net income.

Our operating results could be adversely affected by an increase in our effective tax rate as a result of tax law changes, changes in our geographical earnings mix, an unfavorable government review of our tax returns, or by material differences between our forecasted and actual annual effective tax rates.

Our operations are subject to income and transaction taxes in the United States and in multiple foreign jurisdictions, with a significant amount of our foreign earnings generated by our subsidiaries organized in Ireland and Hungary. Because we have a wide range of statutory tax rates in the multiple jurisdictions in which we operate, any changes in our geographical earnings mix, including those resulting from our intercompany transfer pricing, could materially impact our effective tax rate. Furthermore, a change in the tax law of the jurisdictions where we do business, including an increase in tax rates or an adverse change in the treatment of an item of income or expense, could result in a material increase in our tax expense. In addition, U.S. income taxes and foreign withholding taxes have not been provided for on undistributed earnings for certain of our non-U.S. subsidiaries to the extent such earnings are considered to be indefinitely reinvested in the operations of those subsidiaries.

Further changes in the tax laws of foreign jurisdictions could arise as a result of the base erosion and profit shifting (BEPS) project being undertaken by the Organisation for Economic Co-operation and Development (OECD). The OECD, which represents a coalition of member countries, is contemplating changes to numerous long-standing tax principles. These contemplated changes, if finalized and adopted by countries, could increase tax uncertainty and may adversely affect our provision for income taxes. In the U.S., a number of proposals for broad reform of the corporate tax system are under evaluation by various legislative and administrative bodies, but it is not possible to accurately determine the overall impact of such proposals on our effective tax rate at this time.

Our tax filings are subject to review or audit by the Internal Revenue Service and state, local and foreign taxing authorities. We exercise significant judgment in determining our worldwide provision for income taxes and, in the ordinary course of our business, there may be transactions and calculations where the ultimate tax determination is uncertain. We are also liable for potential tax liabilities of businesses we acquire. Although we believe our tax estimates are reasonable, the final determination in an audit may be materially different than the treatment reflected in our historical income tax provisions and accruals. An assessment of additional taxes because

15

of an audit could adversely affect our income tax provision and net income in the periods for which that determination is made.

Forecasting our annual effective tax rate is highly complex, as it depends on forward-looking financial projections of our annual income and geographical mix of earnings, our interpretations of the tax laws of numerous jurisdictions, and the possible outcomes of tax audits, among other estimates and assumptions. Some items cannot be forecasted or may be treated as discrete to the future periods when they occur. If our estimates and assumptions prove incorrect, then there may be a material difference between our forecasted and actual effective tax rates, which could have a material impact on our results of operations. In addition, we maintain significant deferred tax assets related to federal research credits and certain state tax credits. Our ability to use these credits is dependent upon having sufficient future taxable income in the relevant jurisdiction. Changes in our forecasts of future income could result in an adjustment to the deferred tax asset and a related charge to earnings that could materially affect our financial results.

We may have to invest more resources in research and development than anticipated, which could increase our operating expenses and negatively affect our operating results.

We devote substantial resources to research and development. New competitors, technological advances in the semiconductor industry or by competitors, our acquisitions, our entry into new markets, or other competitive factors may require us to invest significantly greater resources than we anticipate. If we are required to invest significantly greater resources than anticipated without a corresponding increase in revenue, our operating results could decline. Additionally, our periodic research and development expenses may be independent of our level of revenue, which could negatively impact our financial results. Finally, there can be no guarantee that our research and development investments will result in products that create significant, or even any, revenue.

The global nature of our operations exposes us to increased risks and compliance obligations that may adversely affect our business.

We derive more than half of our revenue from sales outside the United States, and we expect our orders and revenue to continue to depend on sales to customers outside the U.S. In addition, we have expanded our non-U.S. operations significantly in the past several years. This strategy requires us to recruit and retain qualified technical and managerial employees, manage multiple remote locations performing complex software development projects and ensure intellectual property protection outside of the U.S. Our international operations and sales subject us to a number of increased risks, including:

• | Ineffective legal protection of intellectual property rights; |

• | International economic and political conditions, such as political tensions between countries in which we do business; |

• | Difficulties in adapting to cultural differences in the conduct of business, which may include business practices that we are prohibited from engaging in by the Foreign Corrupt Practices Act or other anti-corruption laws; |

• | Financial risks such as longer payment cycles and difficulty in collecting accounts receivable; |

• | Inadequate local infrastructure that could result in business disruptions; |

• | Government trade restrictions, including tariffs, export licenses, or other trade barriers; |

• | Additional taxes and penalties; and |

• | Other factors beyond our control such as natural disasters, terrorism, civil unrest, war and infectious diseases. |

If any of the foreign economies in which we do business deteriorate or if we fail to effectively manage our global operations, our business and results of operations will be harmed.

In addition, our global operations are subject to numerous U.S. and foreign laws and regulations, including those related to anti-corruption, tax, corporate governance, imports and exports, financial and other disclosures, privacy and labor relations. These laws and regulations are complex and may have differing or conflicting legal standards, making compliance difficult and costly. If we violate these laws and regulations we could be subject to fines, penalties or criminal sanctions, and may be prohibited from conducting business in one or more countries. Although we have implemented policies and procedures to ensure compliance with these laws and regulations, there can be no assurance that our employees, contractors or agents will not violate these laws and regulations.

16

Any violation individually or in the aggregate could have a material adverse effect on our operations and financial condition.

Our financial statements are also affected by fluctuations in foreign currency exchange rates. A weakening U.S. dollar relative to other currencies increases expenses of our foreign subsidiaries when they are translated into U.S. dollars in our consolidated statement of operations. Likewise, a strengthening U.S. dollar relative to other currencies, especially the Japanese Yen, reduces revenue of our foreign subsidiaries upon translation and consolidation. Exchange rates are subject to significant and rapid fluctuations, and therefore we cannot predict the prospective impact of exchange rate fluctuations. Although we engage in foreign currency hedging activity, we may be unable to hedge all of our foreign currency risk, which could have a negative impact on our results of operations.

Liquidity requirements in our U.S. operations may require us to raise cash in uncertain capital markets, which could negatively affect our financial condition.

As of October 31, 2014, approximately 83.6% of our worldwide cash and cash equivalents balance is held by our international subsidiaries in their own accounts outside the United States. At present, such foreign funds are considered to be indefinitely reinvested abroad, to the extent they are derived from foreign earnings we have indefinitely reinvested in our foreign operations. We intend to meet our U.S. cash spending needs through our existing U.S. cash balances, ongoing U.S. cash flows, and available credit under our term loan and revolving credit facilities. As of October 31, 2014, we had outstanding debt of $75.0 million under our $150 million term loan facility and no outstanding debt under our $350 million revolving credit facility. In December 2014, we drew down $250.0 million under our revolving credit facility. Should our U.S. cash spending needs rise and exceed these liquidity sources, we may be required to incur additional debt at higher than anticipated interest rates or access other funding sources, which could negatively affect our results of operations, capital structure or the market price of our common stock.

From time to time we are subject to claims that our products infringe on third-party intellectual property rights.

We are from time to time subject to claims alleging our infringement of third-party intellectual property rights, including patent rights. For example, we and Emulation & Verification Engineering S.A. (EVE), a company we acquired in October 2012, are party to ongoing patent infringement lawsuits involving Mentor Graphics Corporation. The jury in one of the lawsuits returned a verdict of approximately $36 million in assessed damages against us for patent infringement, which we plan to appeal. Further information regarding the EVE lawsuits is contained in Part I, Item 3, Legal Proceedings. In addition, under our customer agreements and other license agreements, we agree in many cases to indemnify our customers if our products infringe a third party’s intellectual property rights. Infringement claims can result in costly and time-consuming litigation, require us to enter into royalty arrangements, subject us to damages or injunctions restricting our sale of products, invalidate a patent or family of patents, require us to refund license fees to our customers or to forgo future payments or require us to redesign certain of our products, any one of which could harm our business and operating results.

Product errors or defects could expose us to liability and harm our reputation and we could lose market share.

Software products frequently contain errors or defects, especially when first introduced, when new versions are released or when integrated with technologies developed by acquired companies. Product errors could affect the performance or interoperability of our products, could delay the development or release of new products or new versions of products and could adversely affect market acceptance or perception of our products. In addition, allegations of manufacturability issues resulting from use of our IP products could, even if untrue, adversely affect our reputation and our customers’ willingness to license IP products from us. Any such errors or delays in releasing new products or new versions of products or allegations of unsatisfactory performance could cause us to lose customers, increase our service costs, subject us to liability for damages and divert our resources from other tasks, any one of which could materially and adversely affect our business and operating results.

17

Cybersecurity threats or other security breaches could compromise sensitive information belonging to us or our customers and could harm our business and our reputation, particularly that of our Coverity security testing solutions.