Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | form8-krenovemberinvestorp.htm |

Continued Market Leadership through Execution and Innovation Investor Presentation November 2014 Exhibit 99.1

1 © 2014 | Forward-Looking Statements This presentation and other written or oral statements made from time to time by representatives of Broadridge may contain “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical in nature, and which may be identified by the use of words such as “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “we believe,” could be” and other words of similar meaning, are forward-looking statements. In particular, information appearing in the “Fiscal Year 2015 Financial Guidance” section are forward-looking statements. These statements are based on management’s expectations and assumptions and are subject to risks and uncertainties that may cause actual results to differ materially from those expressed. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended June 30, 2014 (the “2014 Annual Report”), as they may be updated in any future reports filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by reference to the factors discussed in the 2014 Annual Report. These risks include: the success of Broadridge in retaining and selling additional services to its existing clients and in obtaining new clients; Broadridge’s reliance on a relatively small number of clients, the continued financial health of those clients, and the continued use by such clients of Broadridge’s services with favorable pricing terms; changes in laws and regulations affecting Broadridge’s clients or the services provided by Broadridge; declines in participation and activity in the securities markets; any material breach of Broadridge security affecting its clients’ customer information; the failure of Broadridge’s outsourced data center services provider to provide the anticipated levels of service; a disaster or other significant slowdown or failure of Broadridge’s systems or error in the performance of Broadridge’s services; overall market and economic conditions and their impact on the securities markets; Broadridge’s failure to keep pace with changes in technology and demands of its clients; Broadridge’s ability to attract and retain key personnel; the impact of new acquisitions and divestitures; and competitive conditions. Broadridge disclaims any obligation to update or revise forward-looking statements that may be made to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events, other than as required by law. Explanation of the Company’s Use of Non-GAAP Financial Measures In certain circumstances, results have been presented that are not generally accepted accounting principles measures (“Non-GAAP”) and should be viewed in addition to, and not as a substitute for, the Company’s reported results. These Non-GAAP measures are indicators that management uses to provide additional meaningful comparisons between current results and prior reported results, and as a basis for planning and forecasting for future periods. In addition, Broadridge believes this Non-GAAP information helps investors understand the effect of these items on reported results and provides a better representation of the Company’s performance. Accompanying this presentation is a reconciliation of these Non-GAAP measures to the comparable GAAP measures. Use of Material Contained Herein The information contained in this presentation is being provided for your convenience and information only. This information is accurate as of the date of its initial presentation. If you plan to use this information for any purpose, verification of its continued accuracy is your responsibility. Broadridge assumes no duty to update or revise the information contained in this presentation. You may reproduce information contained in this presentation provided you do not alter, edit, or delete any of the content and provided you identify the source of the information as Broadridge Financial Solutions, Inc., which owns the copyright. Broadridge and the Broadridge logo are registered trademarks of Broadridge Financial Solutions, Inc.

2 © 2014 | Broadridge Overview

3 © 2014 | Broadridge’s Strategic Vision and Journey to Drive Top Quartile Total Shareholder Return Leading provider of Investor Communications and Technology-Driven Solutions to banks, broker-dealers, mutual funds, and corporate issuers globally • We have strong positions in large and attractive markets with lots of room to grow • We have a balanced and diverse product portfolio across related businesses: Bank/Broker-Dealer Investor Communications Corporate Issuer Solutions Mutual Fund and Retirement Solutions Global Technology and Operations Solutions • We will grow this portfolio by capitalizing on three disruptive market macro trends: Digitization of Investor Communications - digital technologies that enable lower cost, higher touch interactions Cost/Capability Mutualization - tremendous industry drive to standardize duplicative, non- differentiating industry costs Intelligence created from unique Data - enables us to provide clients unrivaled intelligence and create unique value through our network and data • We expect to do so with a combination of organic growth, partnerships and acquisitions • This balanced approach, including payment of a meaningful dividend and use of excess cash to make share repurchases is expected to drive top quartile total stockholder returns As we move to the next phase of our journey we will target our opportunities across our related businesses as follows…

4 © 2014 | Bank/Broker-Dealer Investor Communications and Corporate Issuer Solutions We enable the global financial services industry to communicate private and significant financial information securely and cost effectively Broadridge’s Business Unit Strategy Global Technology and Operations Solutions We are a scalable technology solutions provider of equity and fixed income processing to North American sell-side institutions with a growing international and buy-side presence We will leverage the jointly launched post-trade processing platform with Accenture to scale our unique platform available in over 70 countries globally while continuing to drive our core solutions and addressing new needs in adjacent markets (e.g. fixed income, buy-side, derivatives) We will lead the adoption of digital and “big data” capabilities to enhance investors’, brokers’ and corporate issuers’ efficiency and decision making and expand our offerings to provide other communications of equal significance Mutual Fund and Retirement Solutions We are a rapidly growing provider of data-driven reporting, trade processing, compliance, 401(k), and marketing solutions to the mutual fund, retirement and insurance industries across the entire transaction lifecycle Today Focus of the Journey’s next phase Leading provider of Investor Communications and Technology-Driven Solutions to banks, broker-dealers, mutual funds, and corporate issuers globally ICS-BBDI ICS-Mutual Funds SPS We will add new data-driven capabilities to enable deeper linkages between mutual funds and their broker-dealer distribution partners by fully leveraging our unique network serving the brokerage industry, which continues to lead mutual fund distribution

5 © 2014 | We are a Leader in a Number of Large and Attractive Markets Investor Communication Solutions Securities Processing Solutions U.S. and Global Banks/Broker-Dealers Regulatory Communications U.S. Banks/Broker-Dealers Transactional Communications U.S. Corporate Issuer Regulatory Communications U.S. Brokerage Processing U.S. Fixed Income Processing Canadian Brokerage Processing International Brokerage Processing Our leadership positions contribute to our growing recurring fee revenues

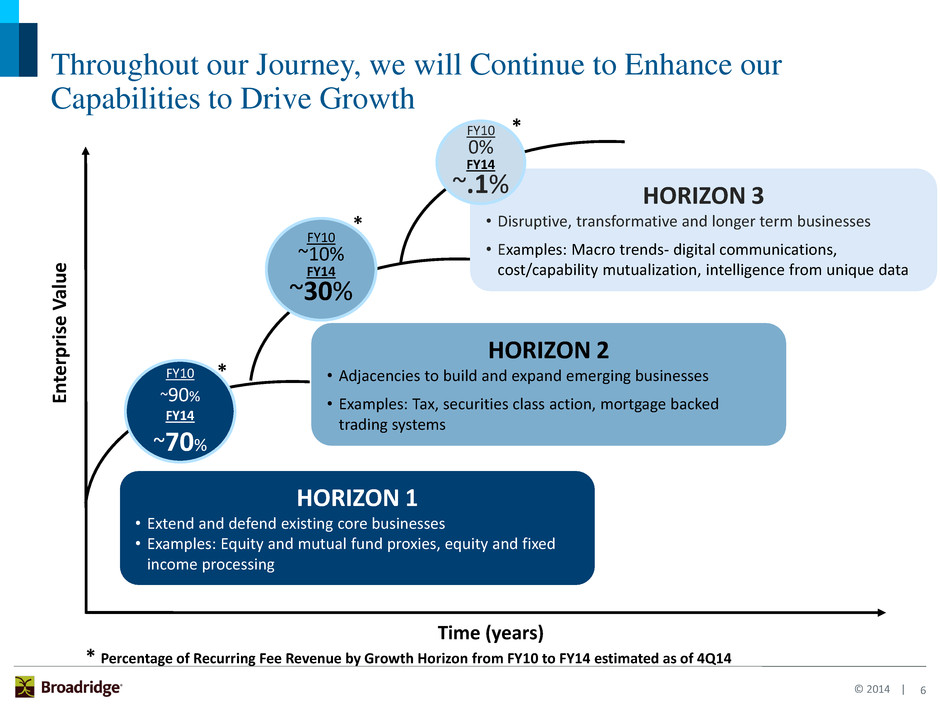

6 © 2014 | HORIZON 1 • Extend and defend existing core businesses • Examples: Equity and mutual fund proxies, equity and fixed income processing En ter p rise V al u e Time (years) HORIZON 2 • Adjacencies to build and expand emerging businesses • Examples: Tax, securities class action, mortgage backed trading systems Throughout our Journey, we will Continue to Enhance our Capabilities to Drive Growth HORIZON 3 • Disruptive, transformative and longer term businesses • Examples: Macro trends- digital communications, cost/capability mutualization, intelligence from unique data FY10 ~90% FY14 ~70% FY10 ~10% FY14 ~30% FY10 0% FY14 ~.1% * Percentage of Recurring Fee Revenue by Growth Horizon from FY10 to FY14 estimated as of 4Q14 * * *

7 © 2014 | Investor Communication Solutions

8 © 2014 | Mutual Fund—Natural adjacencies Transaction reporting Imaging and workflow, etc. Mutual Fund—Core Retirement processing Data aggregation Marketing communications Proxy/solicitation Large and attractive markets – Investor Communications is a $10B+ market BBD—Emerging products Global proxy and communications Tax reporting and outsourcing Security class actions Advisor solutions Bank/Broker-Dealer (BBD)—Core Regulatory communications (proxy, interims, etc.) Customer communications (transaction statements, etc.) Total addressable market $10B+ fee revenue Issuer Transfer agency Shareholder analytics Investor communications BBD—Natural adjacencies Enterprise archiving On-boarding International tax reclaim $1.3B $0.9B $2.0B $3.0B $1.8B $1.7B Sources: BCG, Bain, Patpatia, Broadridge internal estimates as of 4Q14

9 © 2014 | ICS Operates a Unique Business Systems Processing Model Proxy and Interim processing system is the “plumbing” supporting the voting process for corporate governance PROXY & INTERIMS PROCESSING OVERVIEW "THE PLUMBING" Broker/Bank 1 Issuer 1 / Fund 1 Broker/Bank 2 Issuer 2 / Fund 2 Broker/Bank 3 Issuer 3 / Fund 3 Broker/Bank 4 Issuer 4 / Fund 4 Broker/Bank 5 Issuer 5 / Fund 5 Broker/Bank 6 Issuer 6 / Fund 6 Broker/Bank 7 Issuer 7 / Fund 7 Broker/Bank 8 Issuer 8 / Fund 8 Broker/Bank 9 Issuer 9 / Fund 9 Broker/Bank 10+ Issuer 10+ / Fund 10+ Annual Corporate Issuer and Mutual Fund Events Proxy Distribution Accounts may require special processing Vote Processing Majority of all shares are held in street-side Shareholder Preferences Shareholder Consent Equity and Mutual Fund Shareholders In FY14, Broadridge processed over 80% of U.S. shares outstanding Electronic or Physical Vote Return Data Hub and Platform Electronic or Physical Delivery Street-side Processing Registered Processing Hard Copy Mailings May Be Eliminated via E-Delivery and Suppressions Shares Can Be Voted Electronically BROADRIDGE Proxy Processing System

10 © 2014 | Increase in electronic distribution reduces postage revenue and increases margins Primarily Postage ICS has a Diversified Revenue Base ICS is highly resilient due to our deep customer relationships with our Bank/Broker-Dealer clients By product1 Broad client base 1 Financial metrics and statistics are for FY14 ended 6/30/14 Banks Broker-Dealers Mutual Funds Corporate Issuers Distribution $764M (41%) Emerging & Acquired, and Other $200M (11%) Fulfillment $144M (8%) Transaction Reporting $158M (8%) Interims $214M (11%) Proxy $388M (21%)

11 © 2014 | ICS-Bank/Broker-Dealer Investor Communication Solutions What We Do: Regulatory communications – Beneficial proxy and interims for equities – Beneficial mutual fund compliance communications Customer communications – Transaction statements, trade confirmations and other reporting Emerging and Acquired products – Advisor solutions – Global proxy and communications – Tax reporting and outsourcing – Securities class actions Competitive Advantages: Indispensible data hub with established relationships with majority of BBDs Strong market position and innovative leadership – First/only certified voting results – First e-delivery, phone, web and mobile voting platform Proprietary systems, network and databases – ProxyEdge® – institutional voting and record keeping platform – Preference and consent database Unmatched scale with highest level data security (ISO 27001)

12 © 2014 | What We Do: Beneficial Proxy Solutions Registered shareholder communications – Registered proxy solutions – Interim communications Transfer agency (TA) – Stock share registry, ownership transfers and dividend calculation Enhanced issuer solutions – Shareholder Data Services – Virtual shareholder meetings – Shareholder Forums – Global proxy solutions Competitive Advantages: Market Position – only full service provider of shareholder communications to all types of shareholders Unmatched Scale – able to leverage one billion plus shareholder communications annually as well as record-keeping, corporate actions and other shareholder account servicing Unmatched Data – unique dataset of investors and positions allows Issuers to more effectively reach their shareholders Thought Leadership – unmatched expertise to innovate the proxy process and help guide Issuers through a complex regulatory environment ICS-Corporate Issuer Solutions

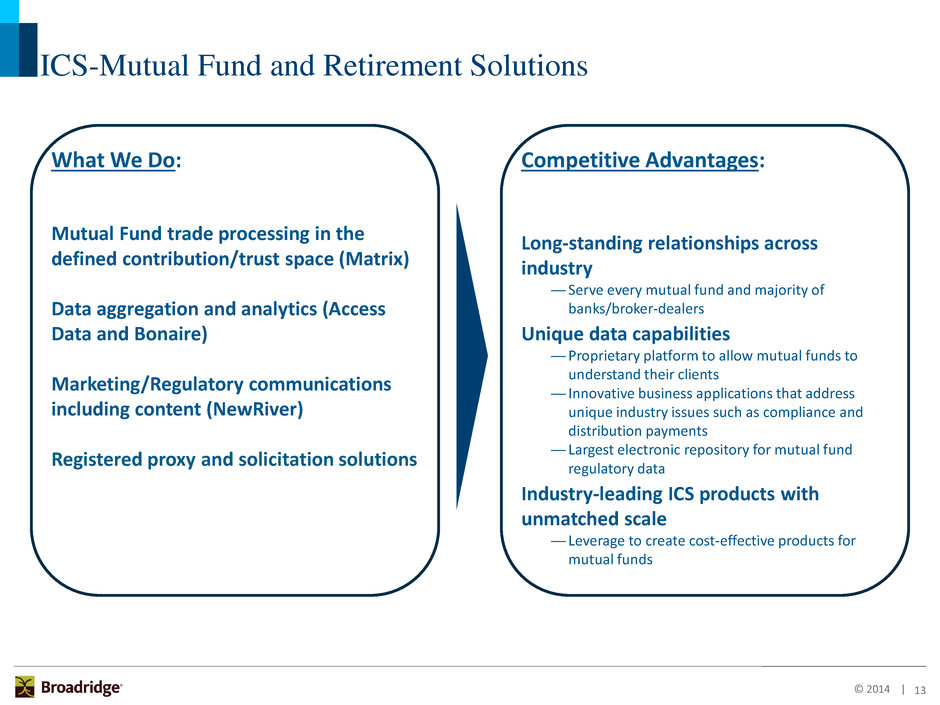

13 © 2014 | What We Do: Mutual Fund trade processing in the defined contribution/trust space (Matrix) Data aggregation and analytics (Access Data and Bonaire) Marketing/Regulatory communications including content (NewRiver) Registered proxy and solicitation solutions Competitive Advantages: Long-standing relationships across industry ― Serve every mutual fund and majority of banks/broker-dealers Unique data capabilities ―Proprietary platform to allow mutual funds to understand their clients ― Innovative business applications that address unique industry issues such as compliance and distribution payments ― Largest electronic repository for mutual fund regulatory data Industry-leading ICS products with unmatched scale ― Leverage to create cost-effective products for mutual funds ICS-Mutual Fund and Retirement Solutions

14 © 2014 | Securities Processing Solutions (SPS)

15 © 2014 | Sources: Tower Group, Chartis, Aite, IM2, Broadridge internal estimates as of 4Q14 Technology and Operations spend adds ~$14B to our SPS addressable market Securities and investment firms’ overall technology and operations spend is over $100 billion and growing at 5% $1.2B $2.8B ~$5.0B Adjacent markets Middle-office Buy-side services Derivatives processing Fixed Income market data and analytics ~$5.2B North American BPO Middle- and back-office Data center services Select corporate functions U.S. Brokerage Processing Core equities and fixed income Global Processing Core equities and fixed income Global BPO Reconciliations Total addressable market ~ $14B fee revenue

16 © 2014 | Broadridge global processing behind the scenes Broadridge simplifies complex processes

17 © 2014 | Fixed Income (~16%) Transaction-Based, $58M Non-transaction, $57M Equity (~84%) Transaction-Based, $133M Non-transaction, $448M Securities Processing Market Overview By product1 Strong Market Position Clears and settles in over 70 countries Processes on average over $5 trillion in equity and fixed income trades per day in U.S. and Canadian securities Provide fixed income trade processing services to 16 of the 22 primary dealers of fixed income securities in the U.S. 1 Financial metrics and statistics are for FY14 ended 6/30/14 Over 50 years of history in providing innovative solutions to financial services firms

18 © 2014 | SPS’s Client Base is Diversified Across Financial Institutions SPS client relationships are stable in volatile markets

19 © 2014 | What We Do: Best-of-breed processing solutions – Leading global platform – Broad asset class coverage Broad suite of add-on or point solutions – Desktop applications used by brokers and traders – Workflow and reconciliation applications – Data aggregation and warehousing tools Industry-leading global business process outsourcing (BPO) solutions Competitive Advantages: Unique global technology platform provides processing access to over 70 countries Breadth of asset classes on single “platform” Leading market position and scale Flexible business model that can be tailored to unique client needs Trusted brand SPS-Global Technology and Operations Solutions

20 © 2014 | Financial Strategy

21 © 2014 | Our Financial Strategy is a key part of our value creation strategy • Target paying out 45% of Non-GAAP net earnings in dividends, but expect no less than $1.08 cents per share annually (subject to quarterly Board approval) • Organic growth with limited financial risk – Avoid significant balance sheet risk – Invest in projects delivering at least 20% IRR • Tuck-in acquisitions with clear growth profile and returns – Accretive to growth, margins, and earnings – >20% IRR in conservative business case • Long-term investment-grade debt rating – Adjusted Debt/EBITDAR ratio1 target is 2:1 • Excess cash used opportunistically to offset dilution and reduce share count through buybacks 1. Adjusted Debt/EBITDAR ratio calculated as (Debt + 8x Rent Expense) / (EBITDA + Rent Expense) Pr iorit y

22 © 2014 | Appendix

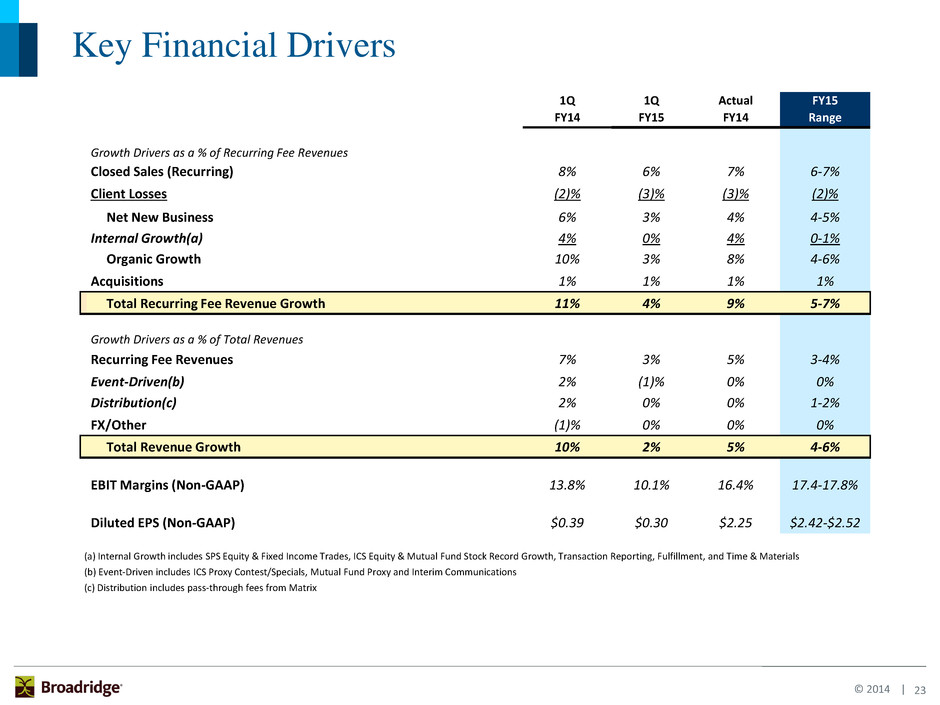

23 © 2014 | 1Q 1Q Actual FY15 FY14 FY15 FY14 Range Growth Drivers as a % of Recurring Fee Revenues Closed Sales (Recurring) 8% 6% 7% 6-7% Client Losses (2)% (3)% (3)% (2)% Net New Business 6% 3% 4% 4-5% Internal Growth(a) 4% 0% 4% 0-1% Organic Growth 10% 3% 8% 4-6% Acquisitions 1% 1% 1% 1% Total Recurring Fee Revenue Growth 11% 4% 9% 5-7% Growth Drivers as a % of Total Revenues Recurring Fee Revenues 7% 3% 5% 3-4% Event-Driven(b) 2% (1)% 0% 0% Distribution(c) 2% 0% 0% 1-2% FX/Other (1)% 0% 0% 0% Total Revenue Growth 10% 2% 5% 4-6% EBIT Margins (Non-GAAP) 13.8% 10.1% 16.4% 17.4-17.8% Diluted EPS (Non-GAAP) $0.39 $0.30 $2.25 $2.42-$2.52 (a) Internal Growth includes SPS Equity & Fixed Income Trades, ICS Equity & Mutual Fund Stock Record Growth, Transaction Reporting, Fulfillment, and Time & Materials (b) Event-Driven includes ICS Proxy Contest/Specials, Mutual Fund Proxy and Interim Communications (c) Distribution includes pass-through fees from Matrix Key Financial Drivers

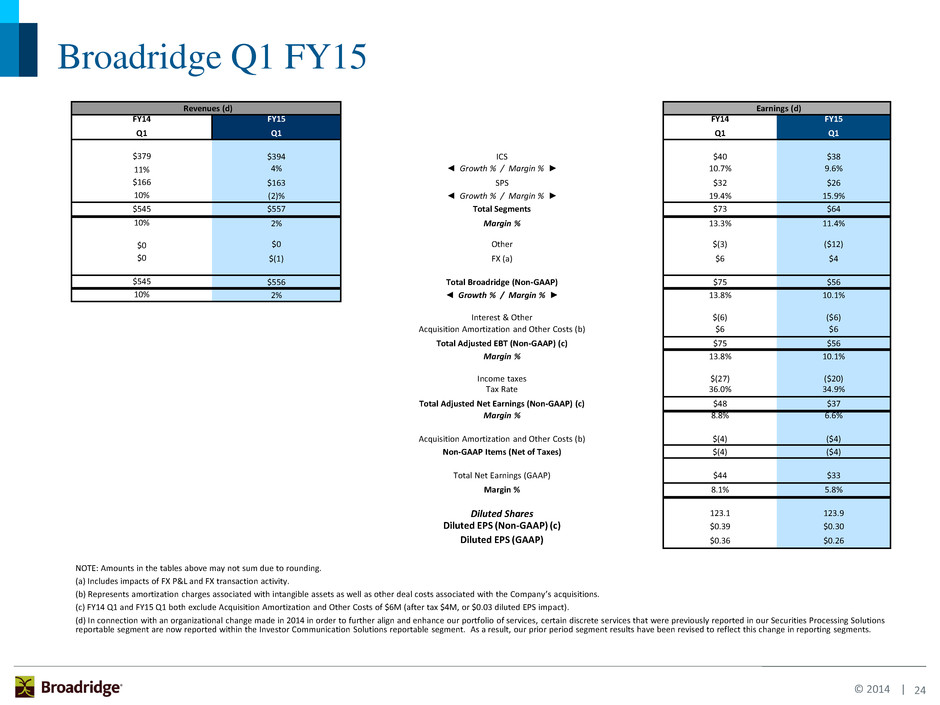

24 © 2014 | Revenues (d) Earnings (d) FY14 FY15 FY14 FY15 Q1 Q1 Q1 Q1 $379 $394 ICS $40 $38 11% 4% ◄ Growth % / Margin % ► 10.7% 9.6% $166 $163 SPS $32 $26 10% (2)% ◄ Growth % / Margin % ► 19.4% 15.9% $545 $557 Total Segments $73 $64 10% 2% Margin % 13.3% 11.4% $0 $0 Other $(3) ($12) $0 $(1) FX (a) $6 $4 $545 $556 Total Broadridge (Non-GAAP) $75 $56 10% 2% ◄ Growth % / Margin % ► 13.8% 10.1% Interest & Other $(6) ($6) Acquisition Amortization and Other Costs (b) $6 $6 Total Adjusted EBT (Non-GAAP) (c) $75 $56 Margin % 13.8% 10.1% Income taxes $(27) ($20) Tax Rate 36.0% 34.9% Total Adjusted Net Earnings (Non-GAAP) (c) $48 $37 Margin % 8.8% 6.6% Acquisition Amortization and Other Costs (b) $(4) ($4) Non-GAAP Items (Net of Taxes) $(4) ($4) Total Net Earnings (GAAP) $44 $33 Margin % 8.1% 5.8% Diluted Shares Diluted Shares 123.1 123.9 Diluted EPS (Non-GAAP) (c) $0.39 $0.30 Diluted EPS (GAAP) $0.36 $0.26 NOTE: Amounts in the tables above may not sum due to rounding. (a) Includes impacts of FX P&L and FX transaction activity. (b) Represents amortization charges associated with intangible assets as well as other deal costs associated with the Company’s acquisitions. (c) FY14 Q1 and FY15 Q1 both exclude Acquisition Amortization and Other Costs of $6M (after tax $4M, or $0.03 diluted EPS impact). (d) In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Securities Processing Solutions reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results have been revised to reflect this change in reporting segments. Broadridge Q1 FY15

25 © 2014 | Broadridge FY15 Guidance Revenues (d) Earnings (d) FY14 FY15 Range (e) FY14 FY15 Range (e) Actual Low High Actual Low High $1,881 $1,976 $2,009 ICS $336 $367 $378 6% 5% 7% ◄ Growth % / Margin % ► 17.9% 18.6% 18.8% $681 $697 $709 SPS $119 $124 $137 6% 2% 4% ◄ Growth % / Margin % ► 17.5% 17.7% 19.3% $2,562 $2,673 $2,718 Total Segments $455 $490 $515 6% 4% 6% Margin % 17.8% 18.3% 19.0% $0 $0 $0 Other $(50) $(42) $(49) $(4) $(7) $(7) FX (a) $16 $16 $16 $2,558 $2,666 $2,711 Total Broadridge (Non-GAAP) $420 $464 $483 5% 4% 6% ◄ Growth % / Margin % ► 16.4% 17.4% 17.8% Interest & Other $(25) $(26) $(26) Acquisition Amortization and Other Costs (b) $25 $24 $24 Total EBT (Non-GAAP) (c) $420 $462 $480 Margin % 16.4% 17.3% 17.7% Income taxes $(141) $(162) $(168) Recurring Revenue Closed Sales Tax Rate 33.6% 35.0% 35.0% FY15 Range (e) Segments Low High Total Net Earnings (Non-GAAP) (c) $279 $300 $312 ICS $70 $90 Margin % 10.9% 11.3% 11.5% SPS $40 $60 Total $110 $150 Acquisition Amortization and Other Costs (b) $(16) $(16) $(16) Non-GAAP Items (Net of Taxes) $(16) $(16) $(16) Total Net Earnings (GAAP) $263 $285 $297 Margin % 10.3% 10.7% 10.9% Diluted Shares 124 124 124 Diluted EPS (Non-GAAP) (c) $2.25 $2.42 $2.52 Diluted EPS (GAAP) $2.12 $2.29 $2.39 NOTE: Amounts in the tables above may not sum due to rounding. (a) Includes impacts of FX P&L and FX Transaction Activity. (b) Represents amortization charges associated with intangible assets as well as other deal costs associated with the Company’s acquisitions. (c) FY14 excludes Acquisition Amortization and Other Costs of $25M (after tax $16M or $0.13 diluted EPS impact). FY15 excludes Acquisition Amortization and Other Costs of $24M (after tax $16M or $0.13 diluted EPS impact). (d) In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Securities Processing Solutions reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results and FY15 guidance have been revised to reflect this change in reporting segments. (e) Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

26 © 2014 | Cash Flows - Q1 FY15 Results and FY15 Guidance Three Months Ended FY15 Range (a) September 2014 Low High Free Cash Flows: Net earnings from operations (GAAP) $33 $285 $297 Depreciation and amortization (includes other long-term assets) 25 100 105 Stock-based compensation expense 8 35 40 Other (10) (25) (22) Subtotal 57 395 420 Working capital charges (34) 25 35 Long-term assets & liabilities changes (6) (25) (15) Net cash flows provided by operating activities 17 395 440 Cash Flows From Investing Activities Capital expenditures and software purchases (7) (75) (70) Free Cash Flows (Non-GAAP) $10 $320 $370 Cash Flows From Other Investing and Financing Activities Acquisitions — — — Stock repurchases net of options proceeds — — — Dividends paid (25) (123) (123) Other (1) 20 25 Net change in cash and cash equivalents (16) 217 272 Cash and cash equivalents, at the beginning of year 348 348 348 Cash and cash equivalents, at the end of period $331 $565 $620 NOTE: Amounts in this table may not sum due to rounding. (a) Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

27 © 2014 | Revenues and Closed Sales FY09-FY14 CAGR FY15 Recurring Fee Revenues (c) FY09 FY10 FY11 FY12 FY13 FY14 FY09-FY14 Range ICS $ 598 $ 636 $ 725 $ 811 $ 866 $ 961 10% $1,020-1,043 Growth 5 % 6 % 14 % 12 % 7 % 11 % 6-9% SPS $ 555 $ 532 $ 589 $ 642 $ 645 $ 681 4% $697-709 Growth 4 % -4 % 11 % 9 % 0 % 6 % 2-4% Total Recurring Fee Revenues $ 1,153 $ 1,168 $ 1,313 $ 1,453 $ 1,511 $ 1,642 7% $1,717-1,752 Growth 5 % 1 % 12 % 11 % 4 % 9 % 5-7% Event-Driven $ 180 $ 257 $ 135 $ 132 $ 156 $ 156 -3% ~$153 Growth -10 % 43 % -47 % -2 % 18 % 0 % ~(2)% Distribution $ 757 $ 781 $ 704 $ 704 $ 755 $ 764 0% $803-813 Growth -6 % 3 % -10 % 0 % 7 % 1 % 5-6% Other/FX $ (17 ) $ 4 $ 14 $ 14 $ 10 $ (4 ) ~$(7) Total Revenues $ 2,072 $ 2,209 $ 2,167 $ 2,304 $ 2,431 $ 2,558 4% $2,666-2,711 Growth -3 % 7 % -2 % 6 % 6 % 5 % 4-6% Recurring Closed Sales $ 95 $ 119 $ 113 $ 120 $ 121 $ 127 6% $110-150 Growth 16 % 25 % -5 % 6 % 0 % 5 % (13)-18% CAGR FY15 Event-Driven Fee Revenues (a) FY09 FY10 FY11 FY12 FY13 FY14 FY09-FY14 Range Mutual Fund Proxy $ 55 $ 150 $ 39 $ 28 $ 43 $ 57 1% $52 Mutual Fund Supplemental 58 48 44 47 58 41 -7% $44 Contest/ Specials/ Other Communications 67 59 52 57 54 58 -3% $57 Total Event-Driven Fee Revenues $ 180 $ 257 $ 135 $ 132 $ 156 $ 156 -3% ~$153 Growth -10 % 43 % -47 % -2 % 18 % 0 % -2% Recurring Distribution Revenues (b) $ 567 $ 564 $ 573 $ 597 $ 629 $ 659 3% $695-705 Growth -2 % -1 % 2 % 4 % 5 % 5 % 5-6% Event-Driven Distribution Revenues (b) $ 190 $ 217 $ 131 $ 107 $ 126 $ 105 -11% $109 Growth -17 % 14 % -39 % -18 % 17 % -16 % 4% Total Distribution Revenues $ 757 $ 781 $ 704 $ 704 $ 755 $ 764 0% $803-813 Growth -6 % 3 % -10 % 0 % 7 % 1 % 5-6% NOTE: Amounts in this table may not sum due to rounding. (a) Includes reclassification of Pre-sale Fulfillment from event-driven revenues to recurring revenues. (b) Includes reclassification of Pre-sale Fulfillment related distribution revenues from event-driven distribution to recurring distribution and Matrix pass-through administrative services revenues from recurring fee to recurring distribution. (c) In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Securities Processing Solutions reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results and FY15 guidance have been revised to reflect this change in reporting segments.

28 © 2014 | Reconciliation of Non-GAAP to GAAP Measures Reconciliation of EPS 1Q14 1Q15 FY14 FY15 Range (a) Actual Actual Actual Low High Adjusted Diluted EPS (Non-GAAP) $0.39 $0.30 $2.25 $2.42 $2.52 Acquisition Amortization and Other Costs, net of taxes (0.03) (0.03) (0.13) (0.13) (0.13) Diluted EPS (GAAP) $0.36 $0.26 $2.12 $2.29 $2.39 Reconciliation of EBT 1Q14 1Q15 FY14 FY15 Range (a) Actual Actual Actual Low High Adjusted Total EBT (Non-GAAP) $75 $56 $420 $462 $480 Margin % 13.8% 10.1% 16.4% 17.3% 17.7% Acquisition Amortization and Other Costs, net of taxes $(6) $(6) $(25) $(24) $(24) Total EBT (GAAP) $69 $50 $396 $438 $457 Margin % 12.7% 9.0% 15.5% 16.4% 16.8% NOTE: Amounts in this table may not sum due to rounding. Three Months Ended FY15 Range (a) September 2014 Low High Free Cash Flows: Net earnings from operations (GAAP) $33 $285 $297 Depreciation and amortization (includes other long-term assets) 25 100 105 Stock-based compensation expense 8 35 40 Other (10) (25) (22) Subtotal $57 395 440 Working capital changes (34) 25 35 Long-term assets & liabilities changes (6) (25) (15) Net cash flows provided by operating activities $17 395 440 Cash Flows From Investing Activities Capital expenditures and software purchases (7) (75) (70) Free Cash Flows (Non-GAAP) $10 $320 $370 NOTE: Amounts in this table may not sum due to rounding. (a) Guidance does not take into consideration the effect of any future acquisitions, additional debt and/or share repurchases.

29 © 2014 | ICS Key Segment Revenue Stats RC= Recurring ED= Event-Driven In millions Fee Revenues (e) 1Q14 1Q15 Type Proxy Equities $ 26.0 $ 26.6 RC Stock Record Position Growth 1 % 7 % Pieces 21.5 19.3 0.6 Mutual Funds $ 15.8 $ 10.0 ED Pieces 20.4 14.6 0.6 Contests/Specials $ 4.2 $ 3.8 ED Pieces 4.4 3.4 Total Proxy $ 46.0 $ 40.4 Total Pieces 46.3 37.3 Notice and Access Opt-in % 57 % 56 % Suppression % 57 % 58 % Interims Mutual Funds (Annual/Semi-Annual Reports/Annual Prospectuses) $ 38.8 $ 40.7 RC Position Growth 12 % 8 % Pieces 173.5 197.5 Mutual Funds (Supplemental Prospectuses) & Other $ 12.2 $ 12.3 ED Pieces 71.8 61.1 Total Interims $ 51.0 $ 53.1 Total Pieces 245.3 258.5 Transaction Reporting Transaction Reporting/Customer Communications $ 36.8 $ 39.3 RC Fulfillment Fulfillment $ 40.0 $ 36.7 RC Emerging, Acquired Emerging/Acquired (a) $ 36.3 $ 52.2 RC and Other Other (b) $ 8.4 $ 8.8 ED Total Emerging, Acquired, and Other $ 44.7 $ 61.0 Total Fee Revenues $ 218.5 $ 230.5 Total Distribution Revenues (c) $ 160.6 $ 163.9 Total Revenues $ 379.1 $ 394.4 FY15 Range (e) Low High Total RC Fees $ 177.9 $ 195.6 $1,020 $1,043 % RC Growth 11 % 10 % 6% 9% Total ED Fees $ 40.6 $ 34.9 ~$153M Low High Sales 5 % 7 % 5% 7% Key Losses (1 )% (2 )% (1)% (1)% Revenue Net New Business 4 % 5 % 4% 6% Drivers Internal growth 6 % 2 % 1% 2% (Recurring) Recurring (Excluding Acquisitions) 10 % 7 % 5% 8% Acquisitions 1 % 3 % 1% 1% Total Recurring 11 % 10 % 6% 9% Low High Key Recurring, Net (d) 5 % 5 % 3% 4% Revenue Event-Driven 3 % (2 )% —% —% Drivers Distribution 3 % 1 % 2% 3% (Total) TOTAL 11 % 4 % 5% 7% NOTE: Amounts in this table may not sum due to rounding. (a) Emerging and Acquired includes fee revenues from the following: Access Data, NewRiver, Matrix, Transfer Agency, Forefield, Bonaire, Investigo, Emerald, Tax Services, Vote Recommendation, Class Actions and Fluent. (b) Other includes other event-driven fee revenues such as corporate actions, NOBO lists, and development. (c) Total Distribution Revenues primarily include pass-through revenues related to the physical mailing of Proxy, Interims, Transaction Reporting, and Fulfillment as well as Matrix administrative services. (d) Recurring, Net includes contribution from Net New Business, Internal Growth, and Acquisitions (e) In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Securities Processing Solutions reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results and FY15 guidance have been revised to reflect this change in reporting segments.

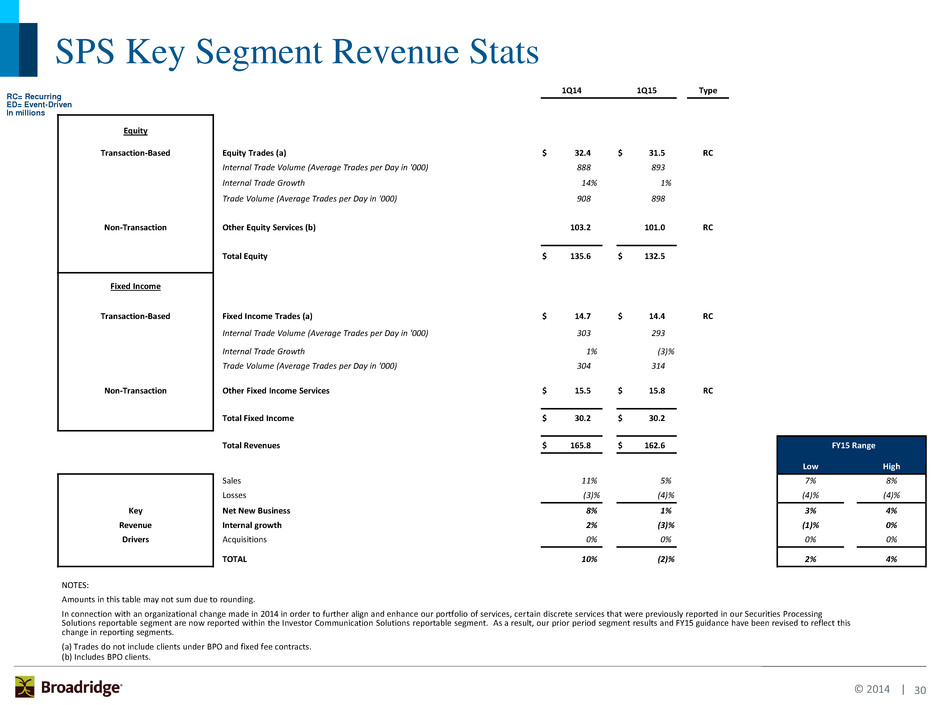

30 © 2014 | SPS Key Segment Revenue Stats RC= Recurring ED= Event-Driven In millions 1Q14 1Q15 Type Equity Transaction-Based Equity Trades (a) $ 32.4 $ 31.5 RC Internal Trade Volume (Average Trades per Day in '000) 888 893 Internal Trade Growth 14 % 1 % Trade Volume (Average Trades per Day in '000) 908 898 Non-Transaction Other Equity Services (b) 103.2 101.0 RC Total Equity $ 135.6 $ 132.5 Fixed Income Transaction-Based Fixed Income Trades (a) $ 14.7 $ 14.4 RC Internal Trade Volume (Average Trades per Day in '000) 303 293 Internal Trade Growth 1 % (3 )% Trade Volume (Average Trades per Day in '000) 304 314 Non-Transaction Other Fixed Income Services $ 15.5 $ 15.8 RC Total Fixed Income $ 30.2 $ 30.2 Total Revenues $ 165.8 $ 162.6 FY15 Range Low High Sales 11 % 5 % 7% 8% Losses (3 )% (4 )% (4)% (4)% Key Net New Business 8 % 1 % 3% 4% Revenue Internal growth 2 % (3 )% (1)% 0% Drivers Acquisitions 0 % 0 % 0% 0% TOTAL 10 % (2 )% 2% 4% NOTES: Amounts in this table may not sum due to rounding. In connection with an organizational change made in 2014 in order to further align and enhance our portfolio of services, certain discrete services that were previously reported in our Securities Processing Solutions reportable segment are now reported within the Investor Communication Solutions reportable segment. As a result, our prior period segment results and FY15 guidance have been revised to reflect this change in reporting segments. (a) Trades do not include clients under BPO and fixed fee contracts. (b) Includes BPO clients.

31 © 2014 | Broadridge ICS Definitions Proxy Equities - Refers to the proxy services we provide in connection with annual stockholder meetings for publicly traded corporate issuers. Annual meetings of public companies include shares held in "street name" (meaning that they are held of record by brokers or banks, which in turn hold the shares on behalf of their clients, the ultimate beneficial owners) and shares held in "registered name" (shares registered in the name of their beneficial owners). Mutual Funds - Refers to the proxy services we provide for funds, classes or trusts of an investment company. Mutual Funds are not required to have annual meetings. As a result, mutual fund proxy services are driven by a "triggering event". These triggering events can be a change in directors, fee structures, investment restrictions, or mergers of funds. Contests - Refers to the proxy services we provide when a separate proxy agenda is put forth by one or more stockholders that are generally in opposition to the proposals presented by management of the company. Specials - Refers to the proxy services we provide in connection with non-routine stockholder meetings held outside of the normal annual meeting cycle and are primarily driven by special events (e.g., business combinations in which the company being acquired is a public company and therefore needs the approval of its stockholders). Interims Mutual Fund Annual/Semi-Annual/Prospectuses – Refers to the services we provide investment companies in connection with information they are required to distribute periodically to their investors. These reports contain pertinent information such as holdings, fund performance, and other required disclosures. Mutual Funds (Supplemental Prospectuses) – Refers primarily to information required to be provided by mutual funds to supplement information previously provided in an annual mutual fund prospectus (e.g., change in portfolio managers, closing funds or class of shares to investors, or restating or clarifying items in the original prospectus). The events could occur at any time throughout the year. Other – Refers generally to marketing communications provided to stockholders including newsletters, investor education materials and other information not required to be distributed by regulation. Transaction Reporting Transaction Reporting– Refers primarily to the printing and distribution of account statements and trade confirmations to account holders, including electronic delivery and archival services. Fulfillment Post-Sale Fulfillment – Refers primarily to the distribution of mutual fund prospectuses, offering documents, and required regulatory disclosure information to investors in connection with purchases of securities. Pre-Sale Fulfillment – Refers to the distribution of marketing literature, welcome kits, enrollment kits, and investor information to prospective investors, existing stockholders and other targeted recipients on behalf of broker-dealers, mutual fund companies and 401(k) administrators. Emerging, Acquired, and Other Communications Emerging – Refers to the services provided by our emerging products portfolio (e.g. Tax Services, Vote Recommendations, Class Actions, and Fluent) Acquired – Refers to the services provided by our acquisitions portfolio (e.g. Access Data, NewRiver, Matrix, Transfer Agency, Forefield, Bonaire, Emerald, and Investigo) Other – Refers to the services we provide in connection with communication material not included in the above definitions such as non-objecting beneficial owners (NOBO) list, and corporate actions such as tender offer transactions.