Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GENERAL STEEL HOLDINGS INC | v394298_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - GENERAL STEEL HOLDINGS INC | v394298_ex99-1.htm |

Exhibit 99.2

1 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Third Quarter 2014 Earnings Call Presentation November 14, 2014

2 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Safe Harbor Statement This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, any comments relating to our financial performance, the competitive nature of the marketplace, the condition of the worldwide economy and other factors that have been or will be detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . gshi - steel . com . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise .

3 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Review of Progress on Key Initiatives Agenda China Steel Industry Dynamics Third Quarter 2014 Highlights Equipment Upgrades to Further Improve I ron S melting Efficiency Review of Third Quarter 2014 Financials

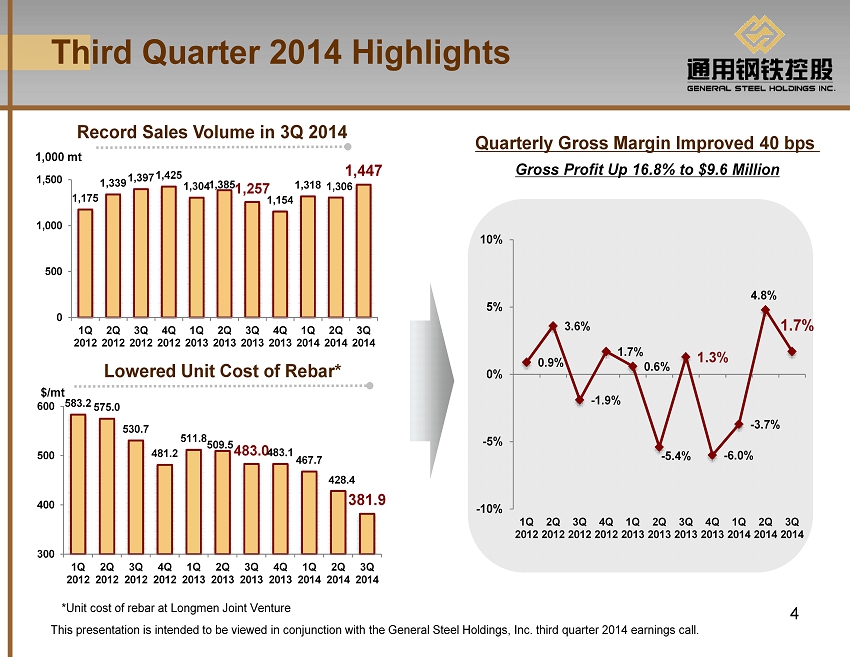

4 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Third Quarter 2014 Highlights 0.9% 3.6% - 1.9% 1.7% 0.6% - 5.4% 1.3% - 6.0% - 3.7% 4.8% 1.7% -10% -5% 0% 5% 10% 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 Quarterly Gross Margin Improved 40 bps Gross Profit Up 16 .8% to $9.6 Million Record Sales Volume in 3Q 2014 1,175 1,339 1,397 1,425 1,304 1,385 1,257 1,154 1,318 1,306 1,447 0 500 1,000 1,500 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 1,000 mt Lowered Unit Cost of Rebar* 583.2 575.0 530.7 481.2 511.8 509.5 483.0 483.1 467.7 428.4 381.9 300 400 500 600 1Q 2012 2Q 2012 3Q 2012 4Q 2012 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 3Q 2014 $ / mt *Unit cost of rebar at Longmen Joint Venture

5 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. China Steel Industry Dynamics ASP Support during APEC Summit » In July 2014, MIIT announced the first batch of capacity to be closed: • 44 iron - making companies with total capacity of 25.4 million tons • 30 steel - making companies with total capacity of 21.5 million tons • Deadline of closure by September 30, 2014 Steel Capacity Trimming Underway Improving China Steel Mills Profitability in 3Q 2014 0% 1% 2% 3% Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Industry Average Net Margin 12.1% 9.8% 6.6% 6.8% 7.3% 4.6% 6.2% 12.8% 11.0% 9.2% 4.2% 6.5% 2.2% 2.1% 2.6% 4.5% 1.5% 1.0% 1.8% 0 2,000 4,000 6,000 8,000 Jan/13 Feb/13 Mar/13 Apr/13 May/13 Jun/13 Jul/13 Aug/13 Sep/13 Oct/13 Nov/13 Dec/13 Feb/14 Mar/14 Apr/14 May/14 Jun/14 Jul/14 Aug/14 Sep/14 3Q 2014 Crude Steel Output Growth Rate Contracted to 2.34% YoY Source: Changjiang Securities • Tier 1 control area - 100km radius around Beijing: 100 % production halt • Tier 2 control area - 100 - 200km radius around Beijing: P roduction halts for unqualified producers , and P roduction limit for qualified producers; • Normal control area: P roduction halts or production limit when heavy smog » S trict steel production controls » Covering 93 % of Hebei Province’s total steel capacity , or approximately 20% of China's total capacity

6 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Ramped - Up Continuous Rolling Capacity Optimized Procurement Channel Continued Progress on Key Initiatives General Steel has continually made progress in optimizing sourcing mechanisms, upgrading production lines and implementing continuous technical improvements. x Partnered with local SOEs to secure high quality and steady supply of local raw materials x Signed direct supply agreement with Rio Tinto in April 2014 for 1,500,000 metric tons of imported iron ore x 3 Q 2014, unit cost of iron ore and coke decreased by 25.3 % and 1 5.8 % , respectively x Effective reduction of overall unit production cost x Fully ramped - up utilization Unit cost of rebar manufactured Down by 20 .9 % YoY □ Rolling yield 101.43% in 3Q 2014 VS 101.16% in 1H 2014 , □ Rebar rolling processing cost RMB 134.9 million in 3Q 2014 Saving of RMB 50/mt compared with outsourced - processing x Overall production cost saving of over RMB 52 million in 3Q 2014 by internal estimation

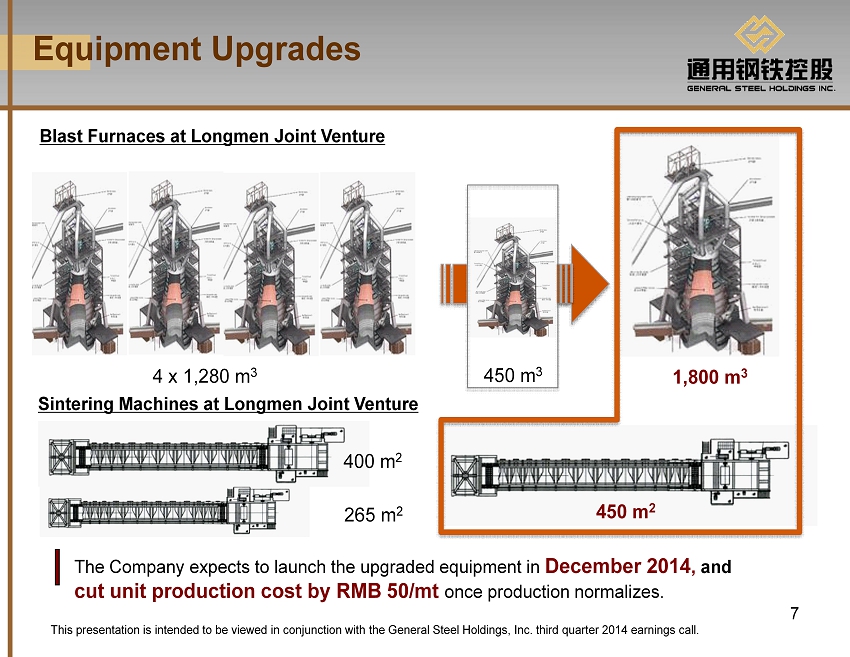

7 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Equipment Upgrades Blast Furnaces at Longmen Joint Venture Sintering Machines at Longmen Joint Venture 4 x 1,280 m 3 450 m 3 1,800 m 3 4 50 m 2 4 00 m 2 The Company expects to launch the upgraded equipment in December 2014 , and cut unit production cost by RMB 50/mt once production normalizes. 265 m 2

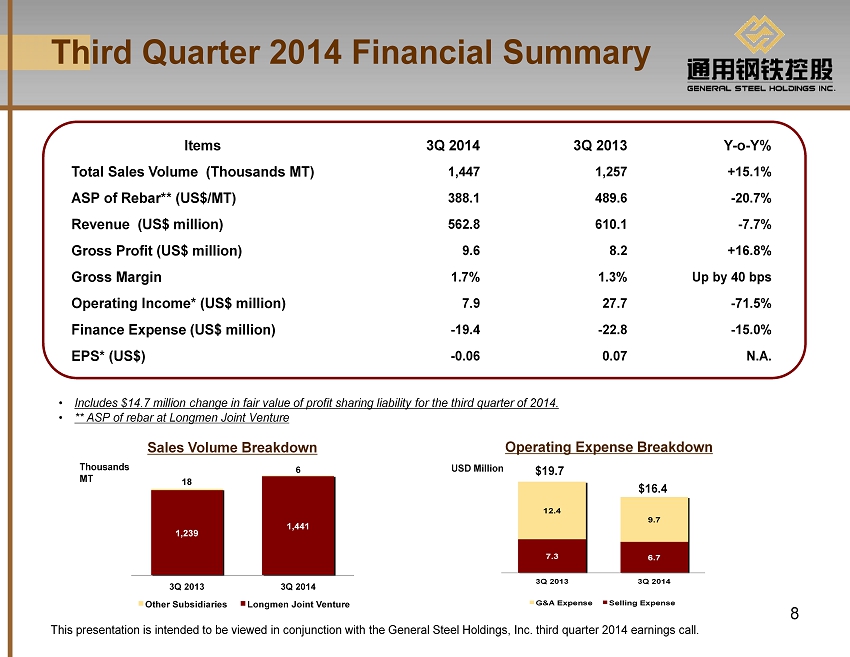

8 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Items 3Q 2014 3Q 2013 Y - o - Y% Total Sales Volume (Thousands MT) 1,447 1,257 +15.1% ASP of Rebar** (US$ /MT) 388.1 489.6 - 20.7% Revenue (US$ million) 562.8 610.1 - 7.7% Gross Profit (US$ million) 9.6 8.2 +16.8% Gross Margin 1.7% 1.3% Up by 40 bps Operating Income* (US$ million) 7.9 27.7 - 71.5% Finance Expense (US$ million) - 19.4 - 22.8 - 15.0% EPS* (US$) - 0.06 0.07 N.A. Third Quarter 2014 Financial Summary Sales Volume Breakdown • Includes $14.7 million change in fair value of profit sharing liability for the third quarter of 2014. • ** ASP of rebar at Longmen Joint Venture Thousands MT Operating Expense Breakdown 7.3 6.7 12.4 9.7 3Q 2013 3Q 2014 G&A Expense Selling Expense USD Million 1,239 1,441 18 6 3Q 2013 3Q 2014 Other Subsidiaries Longmen Joint Venture $19.7 $16.4

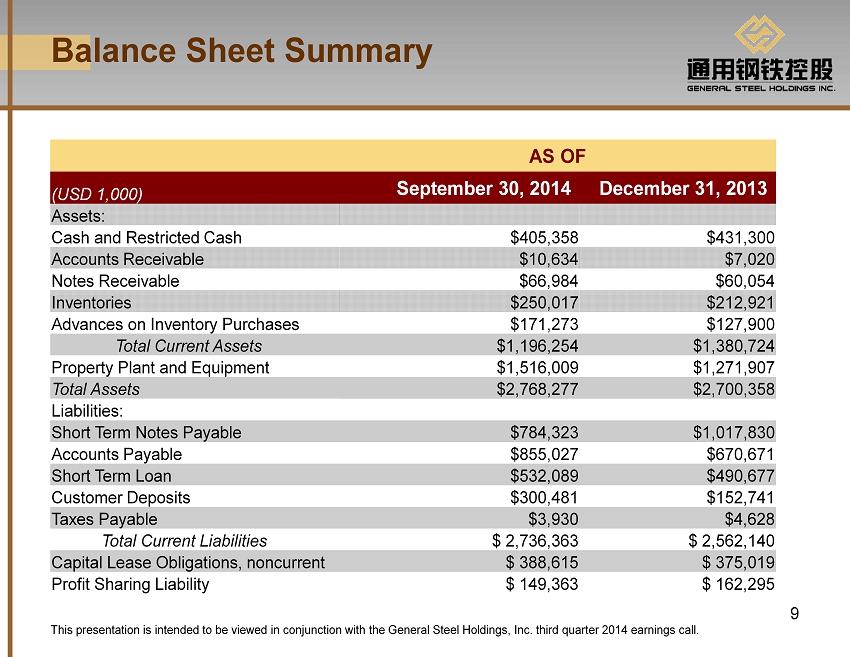

9 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. Balance Sheet Summary AS OF (USD 1,000) September 30, 2014 December 31, 2013 Assets: Cash and Restricted Cash $405,358 $431,300 Accounts Receivable $10,634 $7,020 Notes Receivable $66,984 $60,054 Inventories $ 250,017 $212,921 Advances on Inventory Purchases $171,273 $127,900 Total Current Assets $ 1,196,254 $1,380,724 Property Plant and Equipment $ 1,516,009 $1,271,907 Total Assets $ 2,768,277 $2,700,358 Liabilities: Short Term Notes Payable $784,323 $1,017,830 Accounts Payable $855,027 $670,671 Short Term Loan $532,089 $490,677 Customer Deposits $300,481 $152,741 Taxes Payable $3,930 $4,628 Total Current Liabilities $ 2,736,363 $ 2,562,140 Capital Lease Obligations, noncurrent $ 388,615 $ 375,019 Profit Sharing Liability $ 149,363 $ 162,295

10 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. third quarter 2014 earnings call. 10 Q&A Joyce Sung General Steel Holdings, Inc. Tel: +1 - 347 - 534 - 1435 Email: joyce.sung@gshi - steel.com