Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Sunshine Biopharma, Inc | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Sunshine Biopharma, Inc | ex_312.htm |

| EX-32 - CERTIFICATION - Sunshine Biopharma, Inc | ex_32.htm |

| EX-31.1 - CERTIFICATION - Sunshine Biopharma, Inc | ex_311.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

Quarterly Report Under

the Securities Exchange Act of 1934

For Quarter Ended: September 30, 2014

Commission File Number: 000-52898

SUNSHINE BIOPHARMA INC.

(Exact name of small business issuer as specified in its charter)

|

Colorado

|

20-5566275

|

|

|

(State of other jurisdiction of incorporation)

|

(IRS Employer ID No.)

|

469 Jean-Talon West

3rd Floor

Montreal, Quebec, Canada H3N 1R4

(Address of principal executive offices)

(514) 764-9698

(Issuer’s Telephone Number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes þNo o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

þ

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

The number of shares of the registrant’s only class of common stock issued and outstanding as of November 10, 2014, was 68,911,041 shares.

TABLE OF CONTENTS

PART I.

FINANCIAL INFORMATION

|

Page No.

|

||||

|

Item 1.

|

Financial Statements

|

4

|

||

|

Consolidated Balance Sheet as of September 30, 2014 (unaudited)

|

4

|

|||

|

Unaudited Statement of Operations for the Nine Month Period Ended September 30, 2014

|

5

|

|||

|

Unaudited Consolidated Statement of Cash Flows for the for the Nine Month Periods Ended September 30, 2014 and 2013

|

8

|

|||

|

Notes to Consolidated Financial Statements

|

9

|

|||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations/Plan of Operation.

|

13

|

||

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

20

|

||

|

Item 4.

|

Controls and Procedures.

|

20

|

||

|

PART II

|

||||

|

OTHER INFORMATION

|

||||

|

Item

|

||||

|

Item 1.

|

Legal Proceedings

|

20

|

||

|

1A.

|

Risk Factors

|

20

|

||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

20

|

||

|

Item 3.

|

Defaults Upon Senior Securities

|

21

|

||

|

Item 4.

|

Mine Safety Disclosures

|

21

|

||

|

Item 5.

|

Other Information

|

21

|

||

|

Item 6.

|

Exhibits

|

21

|

||

|

Signatures

|

22

|

2

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based upon our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “approximately,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” or the negative of these terms or other comparable terminology, although the absence of these words does not necessarily mean that a statement is not forward-looking. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

Factors that may cause or contribute actual results to differ from these forward-looking statements include, but are not limited to, for example:

• adverse economic conditions;

• risks related to the construction market;

• risks related to the U.S. import market;

• the inability to attract and retain qualified senior management and technical personnel;

• other risks and uncertainties related to the changing lighting market and our business strategy.

All forward-looking statements speak only as of the date of this report. We undertake no obligation to update any forward-looking statements or other information contained herein. Stockholders and potential investors should not place undue reliance on these forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements in this report are reasonable, we cannot assure stockholders and potential investors that these plans, intentions or expectations will be achieved. We disclose important factors that could cause our actual results to differ materially from expectations under “Risk Factors” and elsewhere in this current report. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Quarterly Report on Form 10-Q. All subsequent written and oral forward-looking statements concerning other matters addressed in this Quarterly Report on Form 10-Q and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Quarterly Report on Form 10-Q.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

3

PART I.

ITEM 1. FINANCIAL STATEMENTS

|

Sunshine Biopharma, Inc.

|

||||||||

|

Balance Sheet

|

||||||||

|

Unaudited

|

Audited

|

|||||||

|

September 30,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 173,857 | $ | 31,240 | ||||

|

Prepaid expenses

|

6,419 | - | ||||||

|

Total Current Assets

|

180,276 | 31,240 | ||||||

|

TOTAL ASSETS

|

$ | 180,276 | $ | 31,240 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Current portion of note payable

|

396,000 | 12,500 | ||||||

|

Accounts payable

|

51,320 | 23,809 | ||||||

|

Interest payable

|

9,320 | 2,641 | ||||||

|

TOTAL LIABILITIES

|

456,640 | 38,950 | ||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Preferred stock, $0.10 par value per share;

|

||||||||

|

Authorized 5,000,000 Shares; Issued

|

||||||||

|

and outstanding -0- shares.

|

- | - | ||||||

|

Common Stock, $0.001 per share;

|

||||||||

|

Authorized 200,000,000 Shares; Issued

|

||||||||

|

and outstanding 68,911,041and 60,299,061 at

|

||||||||

|

September 30, 2014 and December 31, 2013 respectively

|

68,911 | 60,299 | ||||||

|

Capital paid in excess of par value

|

6,749,367 | 5,426,140 | ||||||

|

Accumulated other comprehesive (Loss)

|

- | - | ||||||

|

(Deficit) accumulated during the development stage

|

(7,094,642 | ) | (5,494,149 | ) | ||||

|

TOTAL SHAREHOLDERS' EQUITY

|

(276,364 | ) | (7,710 | ) | ||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 180,276 | $ | 31,240 | ||||

| See Accompanying Notes To These Financial Statements. | ||||||||

4

|

Sunshine Biopharma, Inc.

|

||||||||

|

Unaudited Statement Of Operations

|

||||||||

|

Unaudited

|

Unaudited

|

|||||||

|

3 Months

|

3 Months

|

|||||||

|

Ended

|

Ended

|

|||||||

|

September

|

September

|

|||||||

|

2014

|

2013

|

|||||||

|

Revenue:

|

$ | - | $ | - | ||||

|

General & Administrative Expenses

|

||||||||

|

Accounting

|

1,620 | 1,620 | ||||||

|

Financial Consulting

|

215,500 | 95,000 | ||||||

|

Legal

|

20,152 | 27,873 | ||||||

|

Licenses & fees

|

30,000 | 50,000 | ||||||

|

Office

|

8,934 | 2,660 | ||||||

|

Public relations

|

- | - | ||||||

|

Research & development

|

- | - | ||||||

|

Stock Transfer Fee

|

1,221 | 530 | ||||||

|

Total G & A

|

277,427 | 177,683 | ||||||

|

(Loss) from operations

|

$ | (277,427 | ) | $ | (177,683 | ) | ||

|

Other (expense) interest

|

(3,422 | ) | (375 | ) | ||||

|

Net (loss)

|

$ | (280,849 | ) | $ | (178,058 | ) | ||

|

Basic (Loss) per common share

|

(0.00 | ) | (0.00 | ) | ||||

|

Weighted Average Common Shares Outstanding

|

67,820,603 | 56,914,063 | ||||||

| See Accompanying Notes To These Financial Statements. | ||||||||

5

|

Sunshine Biopharma, Inc.

|

||||||||

|

Unaudited Statement Of Operations

|

||||||||

|

Unaudited

|

Unaudited

|

|||||||

|

9 Months

|

9 Months

|

|||||||

|

Ended

|

Ended

|

|||||||

|

September 30,

|

September 30,

|

|||||||

|

2014

|

2013

|

|||||||

|

Revenue:

|

$ | - | $ | - | ||||

|

General & Administrative Expenses

|

||||||||

|

Research and Development

|

323,000 | 23,400 | ||||||

|

Accounting

|

38,820 | 7,020 | ||||||

|

Consulting

|

541,500 | 779,610 | ||||||

|

Legal

|

234,929 | 52,562 | ||||||

|

Licenses

|

183,333 | 375,000 | ||||||

|

Office

|

21,824 | 10,939 | ||||||

|

Merger Cost

|

- | - | ||||||

|

Public Relations

|

100,000 | - | ||||||

|

Stock Transfer Fee

|

5,408 | 2,136 | ||||||

|

Writedown of intangible assets

|

- | - | ||||||

|

Total G & A

|

1,448,814 | 1,250,667 | ||||||

|

(Loss) from operations

|

(1,448,814 | ) | (1,250,667 | ) | ||||

|

Other (expense):

|

||||||||

|

Interest expense

|

(151,679 | ) | (6,080 | ) | ||||

|

Beneficial conversion feature

|

- | (548,951 | ) | |||||

|

Total Other (Expense)

|

(151,679 | ) | (555,031 | ) | ||||

|

Net (loss)

|

$ | (1,600,493 | ) | $ | (1,805,698 | ) | ||

|

Basic (Loss) per common share

|

$ | (0.02 | ) | $ | (0.03 | ) | ||

|

Weighted Average Common Shares Outstanding

|

64,688,934 | 55,136,962 | ||||||

| See Accompanying Notes To These Financial Statements. | ||||||||

6

|

Sunshine Biopharma, Inc.

|

||||||||||||||||||||||||||||||

|

Statement of Shareholders' Equity

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Number Of Common | Common | Capital Paid in Excess | Number Of Preferred | Preferred | Stock Subscription |

Comprehensive

|

Deficit accumulated During the development | |||||||||||||||||||||||

|

Shares Issued

|

Stock

|

of Par Value

|

Shares Issued

|

Stock

|

Receivable

|

Income

|

stage

|

Total

|

||||||||||||||||||||||

|

Balance at December 31, 2012

|

51,416,092 | $ | 51,416 | $ | 3,021,676 | - | $ | - | $ | - | $ | - | $ | 3,002,666 | $ | 70,426 | ||||||||||||||

|

January 11, 2013 issued 350,000 shares

|

|

|||||||||||||||||||||||||||||

|

of par value $0.001 common stock for services

|

|

|||||||||||||||||||||||||||||

|

valued at $ 136,500 or $0.39 per share

|

350,000 | 350 | 136,150 | 136,500 | ||||||||||||||||||||||||||

|

March 28, 2013 issued 918,500 shares

|

|

|||||||||||||||||||||||||||||

|

of par value $0.001 common stock for services

|

|

|||||||||||||||||||||||||||||

|

valued at $ 220,440 or $0.24 per share

|

918,500 | 919 | 219,522 | - | - | 220,440 | ||||||||||||||||||||||||

|

March 30, 2013 issued 259,043 shares

|

|

|||||||||||||||||||||||||||||

|

of par value $0.001 common stock for services

|

|

|||||||||||||||||||||||||||||

|

valued at $ 219,370 or $0.24 per share

|

914,043 | 914 | 218,456 | 219,370 | ||||||||||||||||||||||||||

| March 30, 2013 issued 2,590,42

of par value $0.001 common stock for conversion

8 shares

of debt in the amount of $513,000 and interest

|

|

|||||||||||||||||||||||||||||

|

of $5,086 or $0.24 per share

|

2,590,426 | 2,590 | 515,496 | 518,086 | ||||||||||||||||||||||||||

|

Beneficial conversion feature

|

548,951 | 548,951 | ||||||||||||||||||||||||||||

|

May 14, 2013 issued 250,000 shares

of par value $0.001 common stock for services |

250,000 | 250 | 59,750 | 60,000 | ||||||||||||||||||||||||||

|

August 1, 2013 issued 150,000 shares

of par value $0.001 common stock for services

valued at $ 30,000 or $0.20 per share |

150,000 | 150 | 29,850 | 30,000 | ||||||||||||||||||||||||||

|

August 23, 2013 issued 250,000 shares

of par value $0.001 common stock for services |

250,000 | 250 | 49,750 | 50,000 | ||||||||||||||||||||||||||

|

October 4, 2013 issued 60,0000 shares

of par value $0.001 common stock for services |

60,000 | 60 | 14,940 | 15,000 | ||||||||||||||||||||||||||

|

November 4, 2013 issued 500,000 shares

of par value $0.001 common stock for cash

of $95,000 or $0.19 per share |

500,000 | 500 | 94,500 | 95,000 | ||||||||||||||||||||||||||

|

November 20, 2013 issued 425,000 shares

of par value $0.001 common stock for cash |

425,000 | 425 | 84,575 | 85,000 | ||||||||||||||||||||||||||

|

November 20, 2013 issued 600,000 shares

of par value $0.001 common stock for services |

600,000 | 600 | 113,400 | 114,000 | ||||||||||||||||||||||||||

|

December 2, 2013 issued 75,000 shares

of par value $0.001 common stock for cash |

75,000 | 75 | 14,925 | 15,000 | ||||||||||||||||||||||||||

|

December 27, 2013 issued 1,800,000 shares

of par value $0.001 common stock for services |

1,800,000 | 1,800 | 304,200 | 306,000 | ||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (2,491,483 | ) | (2,491,483 | ) | |||||||||||||||||||||||

|

Balance at December 31, 2013

|

60,299,061 | $ | 60,299 | $ | 5,426,140 | - | $ | - | $ | - | $ | - | $ | 511,183 | $ | (7,710 | ) | |||||||||||||

|

January 6, 2014 issued 200,000 shares

of par value $0.001 common stock for cash

of $40,000 or $0.20 per share |

200,000 | 200 | 39,800 | 40,000 | ||||||||||||||||||||||||||

|

January 30, 2014 issued 600,000 shares

of par value $0.001 common stock for services

valued at $ 96,000 or $0.16 per share |

600,000 | 600 | 95,400 | 96,000 | ||||||||||||||||||||||||||

|

February 14, 2014 issued 66,667 shares

of par value $0.001 common stock for cash

of $13,333 or $0.20 per share |

66,667 | 67 | 13,266 | 13,333 | ||||||||||||||||||||||||||

|

March 2, 2014 issued 10,000 shares

of par value $0.001 common stock for services

valued at $ 1,400 or $0.14 per share |

10,000 | 10 | 1,390 | 1,400 | ||||||||||||||||||||||||||

|

March 14, 2014 issued 1,000,000 shares

of par value $0.001 common stock for services

valued at $ 170,000 or $0.17 per share |

1,000,000 | 1,000 | 169,000 | 170,000 | ||||||||||||||||||||||||||

|

March 27, 2014 issued 500,000 shares

of par value $0.001 common stock for prepaid

interest valued at $ 75,000 or $0.15 per share |

500,000 | 500 | 74,500 | 75,000 | ||||||||||||||||||||||||||

|

April 14, 2014 issued 500,000 shares

of par value $0.001 common stock for services

valued at $ 100,000 or $0.20 per share |

500,000 | 500 | 99,500 | 100,000 | ||||||||||||||||||||||||||

|

April 17, 2014 issued 1,700 000 shares

of par value $0.001 common stock for services

valued at $323,000 or $0.19 per share |

1,700,000 | 1,700 | 321,300 | 323,000 | ||||||||||||||||||||||||||

|

April 25, 2014 issued 400,000 shares

of par value $0.001 common stock for services

valued at $ 60,000 or $0.15 per share |

400,000 | 400 | 59,600 | 60,000 | ||||||||||||||||||||||||||

|

May 15, 2014 issued 500,0000 shares

of par value $0.001 common stock for services

valued at $ 80,000 or $0.16 per share |

500,000 | 500 | 79,500 | 80,000 | ||||||||||||||||||||||||||

|

June 12, 2014 issued 190,000 shares

of par value $0.001 common stock for services

valued at $ 30,400 or $0.16 per share |

190,000 | 190 | 30,210 | 30,400 | ||||||||||||||||||||||||||

|

July 7, 2014 issued 975,000 shares

of par value $0.001 common stock for services |

975,000 | 975 | 135,525 | 136,500 | ||||||||||||||||||||||||||

|

July 24, 2014 issued 400,000 shares

of par value $0.001 common stock for services |

400,000 | 400 | 51,600 | 52,000 | ||||||||||||||||||||||||||

|

August 7, 2014 issued 930,233 shares

of par value $0.001 common stock for cash |

930,233 | 930 | 99,070 | 100,000 | ||||||||||||||||||||||||||

|

September 8, 2014 issued 300,000 shares

of par value $0.001 common stock for services |

300,000 | 300 | 26,700 | 27,000 | ||||||||||||||||||||||||||

|

September 19, 2014 issued 340,080 shares

of par value $0.001 common stock for services |

340,080 | 340 | 26,866 | 27,206 | ||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (1,600,493 | ) | (1,600,493 | ) | |||||||||||||||||||||||

|

Balance at September 30, 2014 (Unaudited)

|

68,911,041 | $ | 68,911 | $ | 6,749,367 | - | $ | - | $ | - | $ | - | $ | (1,089,310 | ) | $ | (276,364 | ) | ||||||||||||

7

|

Sunshine Biopharma, Inc.

|

||||||||

|

Unaudited Statement Of Cash Flows

|

||||||||

|

Unaudited

|

Unaudited

|

|||||||

|

9 Months

|

9 Months

|

|||||||

|

Ended

|

Ended

|

|||||||

|

September 30,

|

September 30,

|

|||||||

|

2014

|

2013

|

|||||||

|

Cash Flows From Operating Activities:

|

||||||||

|

Net (Loss)

|

$ | (1,600,493 | ) | $ | (1,805,698 | ) | ||

|

Adjustments to reconcile net loss to net cash used in

|

||||||||

|

operating activities:

|

||||||||

|

Stock issued for licenses, services, and other assets

|

1,085,985 | 716,310 | ||||||

|

Stock issued for payment interest on notes payable

|

75,000 | 5,086 | ||||||

|

Stock issued for payment of expenses

|

60,854 | |||||||

|

Beneficial conversion feature on note conversion

|

- | 548,951 | ||||||

|

(Increase) Decrease in prepaid expenses

|

(6,419 | ) | 1,538 | |||||

|

Increase (Decrease) in Accounts Payable

|

27,511 | 8,168 | ||||||

|

Increase in interest payable

|

6,679 | 994 | ||||||

|

Net Cash Flows (used) in operations

|

(350,883 | ) | (524,651 | ) | ||||

|

Cash Flows From Investing Activities:

|

||||||||

|

Net Cash Flows (used) in Investing activities

|

- | - | ||||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Proceed from note payable

|

273,500 | 463,000 | ||||||

|

Note payable used to pay expenses

|

60,000 | - | ||||||

|

Note payable used to pay origionation fees

|

50,000 | - | ||||||

|

Sale of common stock

|

110,000 | - | ||||||

|

Net Cash Flows provided by financing activities

|

493,500 | 463,000 | ||||||

|

|

||||||||

|

Net Increase (Decrease) In Cash and cash equivalents

|

142,617 | (61,651 | ) | |||||

|

Cash and cash equivalents at beginning of period

|

31,240 | 132,638 | ||||||

|

Cash and cash equivalents at end of period

|

$ | 173,857 | $ | 70,987 | ||||

|

Supplementary Disclosure Of Cash Flow Information:

|

$ | - | ||||||

|

Stock issued for services, licenses and other assets

|

$ | 818,585 | $ | 716,310 | ||||

|

Stock issued for note conversions

|

$ | - | $ | 513,000 | ||||

|

Stock issued for net deficit of MWBS

|

$ | - | $ | - | ||||

|

Stock issued for interest

|

$ | 170,000 | $ | - | ||||

|

Stock issued for payment of expenses

|

$ | 43,333 | $ | - | ||||

|

Loan proceeds used to pay expenses

|

$ | 40,000 | $ | - | ||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

|

Cash paid for income taxes

|

||||||||

|

See Accompanying Notes To These Financial Statements.

|

||||||||

8

Sunshine Biopharma, Inc.

Notes To Unaudited Financial Statements

For The Nine Month Interim Period Ended September 30, 2014

Note 1 – Nature of Operations/Activities

Sunshine Biopharma, Inc. (the "Company"), f/k/a Mountain West Business Solutions, Inc. (“MWBS”) was incorporated August 31, 2006 in the State of Colorado. Sunshine Etopo, Inc. (formerly Sunshine Biopharma, Inc.) was incorporated in the State of Colorado on August 17, 2009. Effective October 15, 2009 MWBS was acquired by Sunshine Etopo, Inc. in a transaction classified as a reverse acquisition. MWBS concurrently changed its name to Sunshine Biopharma, Inc. The financial statements represent the activity of Sunshine Etopo, Inc. from August 17, 2009 (inception) through October 15, 2009, and the consolidated activity of Sunshine Etopo, Inc. and Sunshine Biopharma Inc. from October 15, 2009 forward. Sunshine Etopo, Inc. and Sunshine Biopharma Inc. are hereinafter referred to collectively as the "Company". The Company was formed for the purposes of conducting research, development and commercialization of drugs for the treatment of various forms of cancer. The Company may also engage in any other business that is permitted by law, as designated by the Board of Directors of the Company.

During the last nine-month period the Company has continued to raise money through stock sales and borrowings.

The Company’s activities are subject to significant risks and uncertainties, including failing to secure additional funding to operationalize the Company’s current technology before another company develops a similar technology and drug.

Note 2 – Unaudited Financial Information

The unaudited financial information included for the nine-month interim period ended September 30, 2014 was taken from the books and records without audit. However, such information reflects all adjustments, consisting only of normal recurring adjustments, which in the opinion of management are necessary to reflect properly the results of the interim periods presented. The results of operations for the nine-month interim period ended September 30, 2014 are not necessarily indicative of the results expected for the fiscal year ending December 31, 2014.

Note 3 – Notes Payable

The Company had outstanding loans of $12,500 accruing interest at a rate of 12% and $100,000 accruing interest at 10%, and $113,500 accruing interest at 8%. At September 30, 2014 and December 31, 2013 accrued interest was $9,320 and $2,641, respectively.

9

Sunshine Biopharma, Inc.

Notes To Unaudited Financial Statements

For The Nine Month Interim Period Ended September 30, 2014

Note 4 – Issuance of Common Stock

During the nine-months ended September 30, 2014 the Company issued 8,611,980 shares of $0.001 par value Common Stock as follows:

In January 2014 the Company issued 200,000 shares of $0.001 par value Common Stock for cash of $40,000 or $0.20 per share and was paid directly to an affiliated company for licensing rights.

In January 2014 the Company issued 600,000 shares of $0.001 par value Common Stock for R&D services valued at $96,000 or $0.16 per share.

In February 2014 the Company issued 66,667 shares of $0.001 par value Common Stock for cash of $13,333 or $0.20 per share and $3,333 was paid directly to an affiliated company for licensing rights.

In March 2014 the Company issued 10,000 shares of $0.001 par value Common Stock for services valued at $1,400 or $0.14 per share.

In March 2014 the Company issued 1,000,000 shares of $0.001 par value Common Stock for services valued at $170,000 or $0.17 per share.

On March 27, 2014 the Company issued 500,000 shares of $0.001 par value Common Stock for origination fee valued at $75,000 or $0.15 per share as part of a convertible note payable for $100,000.

On April 14, 2014 the Company issued 500,000 shares of $0.001 par value Common Stock for services valued at $100,000 or $0.20 per share.

On April 17, 2014 the Company issued 1,700,000 shares of $0.001 par value Common Stock for services valued at $323,000 or $0.19 per share.

10

Sunshine Biopharma, Inc.

Notes To Unaudited Financial Statements

For The Nine Month Interim Period Ended September 30, 2014

Note 4 – Issuance of Common Stock (Continued)

On April 25, 2014 the Company issued 400,000 shares of $0.001 par value Common Stock for services valued at $60,000 or $0.15 per share.

On May 15, 2014 the Company issued 500,000 shares of $0.001 par value Common Stock for services valued at $80,000 or $0.16 per share.

On June 12, 2014 the Company issued 190,000 shares of $0.001 par value Common Stock for services valued at $30,400 or $0.16 per share.

On July 7, 2014 the Company issued 975,000 shares of $0.001 par value Common Stock for services valued at $136,500 or $0.14 per share.

On July 24, 2014 the Company issued 400,000 shares of $0.001 par value Common Stock for services valued at $52,000 or $0.13 per share.

On August 7, 2014 the Company issued 930,233 shares of $0.001 par value Common Stock for cash of $100,000 or $0.1075 per share.

On September 8, 2014 the Company issued 300,000 shares of $0.001 par value Common Stock for services valued at $27,000 or $0.09 per share.

On September 19, 2014 the Company issued 340,080 shares of $0.001 par value Common Stock for services valued at $27,206 or $0.08 per share.

Note 5 – Convertible Notes

On March 27, 2014, the Company issued a Convertible Note to one accredited investor (as that term is defined under the Securities Act of 1933, as amended) in the principal amount of $100,000, plus 500,000 Common Shares (paid) and $20,000 (unpaid) for an origination fee. This Convertible Note accrues interest at the rate of 10% per annum and was convertible at the option of the Holder into shares of the Company’s Common Stock at $0.20 per share on or before September 27, 2014. On September 26, 2014, this note was extended to November 27, 2014. Since the Note was issued at a premium and ar the date of the extension it remained at a premium no value is apportioned to the conversion feature when recording the issue per ASC 470-20-05. The debt and its interest are reported as if it were a nonconvertible debt. Upon Conversion, the stock may be valued at either the book value or the then market value.

11

Sunshine Biopharma, Inc.

Notes To Unaudited Financial Statements

For The Nine Month Interim Period Ended September 30, 2014

Note 5 – Convertible Notes (Continued)

On May 7, 2014, the Company issued a Convertible Note to one accredited investor (as that term is defined under the Securities Act of 1933, as amended) in the principal amount of $500,000. At execution, the Company paid an origination fee of $50,000 and also received proceeds of $100,000 on this Note. Additional draw downs on this note can only be made in the discretion of the lender. The note is due May 6, 2016 and allows interest at the rate of 10% per annum, which began to accrue August 7, 2014. The note is convertible into shares of the Company's common stock beginning November 7, 2014 at the lower of $.20 per share or 60% of the lowest traded price in the 25 trading days prior to conversion.

On September 8, 2014 we issued a Convertible Promissory Note in the principal amount of $113,500 to one accredited investor. This Note is due June 8, 2015 and accrues interest at the rate of 8% per annum. The Note may be converted into shares of the Company's Common Stock beginning March 8, 2015 ar a conversion price equal to 65% of the lowest three (3) trading bid prices during the ten (10) trading days prior to the conversion date. If the Company fails to deliver the shares of Common Stock in a timely manner following conversion the Company is subject to extraordinary penalties.

Since the Note was issued at a premium no value is apportioned to the conversion feature when recording the issue per ASC 470-20-05. The debt and its interest are reported as if it were a nonconvertible debt. Upon Conversion, the stock may be valued at either the book value or the then market value.

Note 6 – Financial Statements

For a complete set of footnotes, reference is made to the Company’s Report on Form 10-K for the year ended December 31, 2013 as filed with the Securities and Exchange Commission and the audited financial statements included therein.

12

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview and History

Sunshine Biopharma, Inc. ("we", "us", "our", "Sunshine" or the "Company") was incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” During our fiscal year ended July 31, 2009, our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies. Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation (“SBI”), in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction our officers and directors resigned their positions with us and were replaced by our current management. Following completion of this transaction we changed our name to “Sunshine Biopharma, Inc.”. On December 21, 2011, Advanomics Corporation, a privately held Canadian company (“Advanomics”), and our licensor, exercised its right to convert the 850,000 shares of Series “A” Preferred Stock it held in our Company into 17,000,000 shares of Common Stock.

Our principal place of business is located at 469 Jean-Talon West, 3rd Floor, Montreal, Quebec, Canada H3N 1R4. Our phone number is (514) 764-9698 and our website address is www.sunshinebiopharma.com.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Results Of Operations

Comparison of Results of Operations for the nine months ended September 30, 2014 and 2013

For the nine months ended September 30, 2014 and 2013 we did not generate any revenues.

General and administrative expenses during the nine month period ended September 30, 2014 were $1,448,814, compared to general and administrative expense of $1,250,667 incurred during the nine month period ended September 30, 2013, an increase of $198,147. This increase is the net result of an increase in research and development costs of approximately $300,000, along with increases in legal expense of approximately $180,000, primarily as a result of our attempts to re-domicile into Canada, several registration statements we filed with the SEC and the cost of defending against litigation, public relations fees of $100,000 and accounting expense of approximately $30,000. However, during these nine months our consulting fees decreased by approximately $240,000 and licensing fees decreased by approximately $190,000. Most of our other expenses remained relatively constant during the nine month period ended September 30, 2014 compared to the similar period in 2013.

We also incurred $151,679 in interest expense during the nine months ended September 30, 2014, compared to $6,080 in interest expense during the similar period in 2013. Finally, in 2013 we incurred $548,951 in costs associated with a beneficial conversion feature to our then outstanding convertible debentures. No such costs were incurred in 2014.

As a result, we incurred a net loss of $1,600,493 (approximately $0.02 per share) for the nine month period ended September 30, 2014, compared to a net loss of $1,805,698 (approximately $0.03 per share) during the nine month period ended September 30, 2013.

Comparison of Results of Operations for the three months ended September 30, 2014 and 2013

For the three months ended September 30, 2014 and 2013 we did not generate any revenues.

13

General and administrative expenses during the three month period ended September 30, 2014 were $277,427, compared to general and administrative expense of $177,683 incurred during the three month period ended September 30, 2013, an increase of $99,744. This increase is primarily attributable to increased financial consulting costs of $120,500 during this period. All other costs either decreased or remained constant except for licensing fees, which decreased by $20,000. We also incurred $3,422 in interest expense during the three months ended September 30, 2014, compared to $375 in interest expense during the similar period in 2013.

As a result, we incurred a net loss of $280,849 (less than $0.01 per share) for the three month period ended September 30, 2014, compared to a net loss of $178,058 (less than $0.01 per share) during the three month period ended September 30, 2013.

Because we did not generate any revenues since our inception, following is our Plan of Operation.

Plan of Operation

We are currently a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. The preclinical studies for our lead compound, Adva-27a, a multi-purpose antitumor compound, were successfully completed in late 2011. We are now continuing our clinical development of Adva-27a by conducting the next sequence of steps comprised of Good Manufacturing Practice (“GMP”) manufacturing, Investigational New Drug (“IND”)-enabling studies, regulatory filing and Phase I clinical trials. We plan to conduct our Phase I clinical trials for Adva-27a at the Jewish General Hospital, Montreal, Canada, one of McGill University’s Hospital Centers. The planned indication will be pancreatic cancer in parallel to multidrug resistant breast cancer as Adva-27a has shown a positive effect on both of these cancer types for which there is currently little or no treatment options available. See “Clinical Trials” below.

We have licensed our technology on an exclusive basis from Advanomics Corporation, and we are planning to initiate our own research and development program as soon as practicable once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials. See Part I, Item 2, Management's Discussion and Analysis of Financial Condition-Liquidity and Capital Resources below.

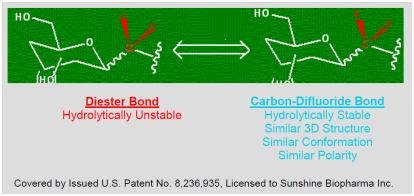

Carbon-Difluoride Platform Technology

Many therapeutically important compounds contain diester bonds that link different parts of the molecule together. Diester bonds are naturally unstable often leading to suboptimal performance when the molecule is administered to patients. Diester bonds have specific nine-dimensional, as well as electrostatic properties that cannot be easily mimicked by other bonds. Bonds that do not mimic the diester bond correctly invariably render the compound inactive. In collaboration with Institut National des Sciences Appliquées de Rouen in France (“INSA”), Advanomics Corporation has developed a way to replace the diester bond with a Carbon-Difluoride bond which acts as a diester isostere. An isostere is a different chemical structure that mimics the properties of the original. In the body, Carbon-Difluoride compounds are resistant to metabolic degradation but recognized similarly to the diester compounds (see Figure 1).

While no assurances can be provided, we are planning to expand our product line through acquisitions and/or in-licensing as well as in-house research and development.

Figure 1

14

Our Lead Compound (Adva-27a)

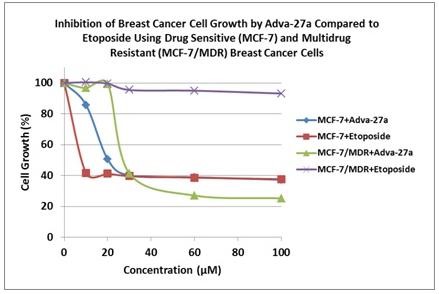

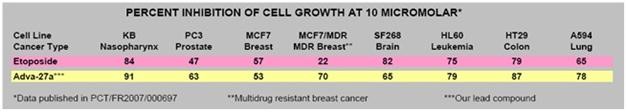

Our initial drug candidate is Adva-27a, a GEM-difluorinated C-glycoside derivative of Podophyllotoxin, targeted for various forms of cancer. If we are successful in our current financing efforts, Adva-27a is expected to enter Phase I clinical trials for pancreatic cancer and multidrug resistant breast cancer in mid to late 2015 (see “Clinical Development Path” and “Clinical Trials” below). Etoposide, which is also a derivative of Podophyllotoxin, is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Like Etoposide, Adva-27a is a Topoisomerase II inhibitor; however, unlike Etoposide and other anti-tumor drugs currently in use, Adva-27a is able to destroy multidrug resistant cancer cells. Adva-27a is a new chemical entity and has been shown to have distinct and more desirable biological properties compared to Etoposide. Most notably, Adva-27a is very effective against multidrug resistant breast cancer cells while Etoposide has no activity against this aggressive form of cancer (see Figure 2). In other side-by-side studies against Etoposide as a reference, Adva-27a showed markedly improved cell killing activity in various other cancer types, particularly prostate, colon and lung cancer (see Table 1). Our preclinical studies to date have shown that:

|

●

|

Adva-27a is effective at killing different types of multidrug resistant cancer cells, including:

|

|

|

-

|

Breast Cancer Cells (MCF-7/MDR)

|

|

|

-

|

Small Cell Lung Cancer Cells (H69AR)

|

|

-

|

Uterine Cancer (MES-SA/Dx5)

|

|

●

|

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

|

|

●

|

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

|

|

●

|

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

|

|

●

|

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar (this number has recently been reduce to 1.44 micromolar as a result of resolving the two isomeric forms of Adva-27a).

|

|

●

|

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

|

|

●

|

Adva-27a does not inhibit tubulin assembly.

|

These and other preclinical data have recently been published in ANTICANCER RESEARCH, a peer-reviewed International Journal of Cancer Research and Treatment. The manuscript entitled “Adva-27a, a Novel Podophyllotoxin Derivative Found to Be Effective Against Multidrug Resistant Human Cancer Cells” appeared in print in the October 2012 issue of the journal [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. A copy of the full manuscript as it appeared in the journal is available on our website at www.sunshinebiopharma.com.

15

Figure 2

Table 1

Clinical Development Path

The early stage preclinical studies for our lead compound, Adva-27a, were successfully completed in late 2011 and the results have been published [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. We are now continuing our clinical development program of Adva-27a by conducting the next sequence of steps comprised of the following:

|

●

|

GMP Manufacturing of 1 kilogram for use in IND-Enabling Studies and Phase I Clinical Trials

|

|

●

|

IND-Enabling Studies

|

|

●

|

Regulatory Filing (Fast-Track Status Anticipated)

|

|

●

|

Phase I Clinical Trials (Multidrug Resistant Breast Cancer Indication)

|

Clinical Trials

Adva-27a’s initial indication will be pancreatic cancer and multidrug resistant breast cancer for which there are currently little or no treatment options. In June 2011 we concluded an agreement with McGill University’s Jewish General Hospital in Montreal, Canada to conduct Phase I clinical trials for this indication. All aspects of the planned clinical trials in Canada will employ U.S. Food and Drug Administration (“FDA”) standards at all levels. As a result of the Dutchess Agreement described below, we now anticipate that Phase I clinical trials will commence in mid to late 2015 and we estimate that it will take 18 months to complete, at which time we, together with our licensor, expect to file for limited marketing approval with the regulatory authorities in Canada and the FDA in the U.S. See “Marketing,” below.

Marketing

According to the American Cancer Society, nearly 1.5 million new cases of cancer are diagnosed in the U.S. each year. Given the terminal and limited treatment options available for the multidrug resistant breast cancer indication we are planning to study, we anticipate being granted limited marketing approval (“compassionate-use”) for our Adva-27a following receipt of funding and a successful Phase I clinical trial. There are no assurances that either will occur. Such limited approval will allow us to make the drug available to various hospitals and health care centers for experimental therapy and/or “compassionate-use”, thereby generating some revenues in the near-term.

16

We believe that upon successful completion of Phase I Clinical Trials we may receive one or more offers from large pharmaceutical companies to buyout or license our drug. However, there are no assurances that our Phase I Trials will be successful, or if successful, that any pharmaceutical companies will make an acceptable offer to us. In the event we do not consummate such a transaction, we will require significant capital in order to manufacture and market our new drug.

Intellectual Property

We are the exclusive licensee for the U.S. territory of Advanomics Corporation’s Adva-27a which is covered by international patent applications filed on April 27, 2007 (PCT/FR2007/000697). These patent applications, which are now issued in Europe and the United States (US 8,236,935) and are still pending elsewhere around the world, were originally owned by Institut National des Sciences Appliquées de Rouen (France) and have recently been purchased by Advanomics Corporation. On January 14, 2013, Advanomics Corporation filed a new patent application covering Adva-27a manufacturing processes as well as new Adva-27a derivatives and compositions.

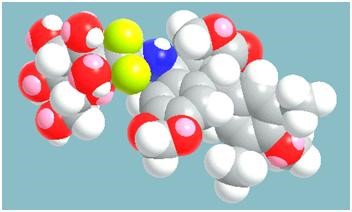

Our Lead Anti-Cancer Compound, Adva-27a, in 3D

Development of New Business

On July 25, 2014, we formed Sunshine Biopharma Canada Inc., a Canadian wholly owned subsidiary for the purposes of conducting pharmaceutical business in Canada and elsewhere around the globe. While no assurances can be provided, we anticipate that Sunshine Biopharma Canada will soon secure a Drug Establishment License (DEL) from Health Canada and proceed to signing manufacturing, marketing, sales and distribution contracts for various generic pharmaceuticals and biomedical products. This new effort broadens our business scope and provides us with the opportunity to generate revenues in the near to mid-term. We anticipate revenues to be generated through the export of generic pharmaceuticals overseas. There are no assurances that we will be able to sign applicable contracts or generate profits from these anticipated new operating. In addition to revenue generation, we anticipate that as a result of these activities, Sunshine Biopharma Canada will then be well positioned for the marketing and distribution of Adva-27a, our flagship oncology drug candidate currently being developed for the treatment of pancreatic cancer and multidrug resistant breast cancer, provided that Adva-27A is approved for such marketing and distribution, of which there can be no assurance.

17

Government Regulations

Our existing and proposed business operations are subject to extensive and frequently changing federal, state, provincial and local laws and regulations. We will be subject to significant regulations in the U.S. in order to obtain the approval of the FDA to offer our product on the market. The approximate procedure for obtaining FDA approval involves an initial filing of an IND application following which the FDA would give the go ahead with Phase I clinical (human) trials. As a result of the Dutchess Agreement described below, we now anticipate that this process will commence in mid to late 2015 and we estimate that this procedure will take 18 months to complete. Following completion of Phase I, the results are filed with the FDA and a request is made to proceed to Phase II. Similarly, following completion of Phase II the data are filed with the FDA and a request is made to proceed to Phase III. Following completion of Phase III, a request is made for marketing approval. Depending on various issues and considerations, the FDA could provide limited marketing approval on a humanitarian basis if the drug treats terminally ill patients with limited treatment options available. As of the date of this Report we have not made any filings with the FDA or other regulatory bodies in other jurisdictions. We have however had extensive discussions with clinicians at the McGill University’s Jewish General Hospital in Montreal where we plan to undertake our Phase I study for multidrug resistant breast cancer they believe that Health Canada is likely to grant us a so-called fast-track process on the basis of the terminal nature of the cancer which we will be treating. There are no assurances this will occur.

Liquidity and Capital Resources

As of September 30, 2014, we had cash or cash equivalents of 173,857.

Net cash used in operating activities was $350,883 during the nine month period ended September 30, 2014, compared to $524,651 for the nine month period ended September 30, 2013. The decrease is primarily due to a beneficial conversion charge of $548,951 incurred during the nine months ended September 30, 2013 which we did not incur during the similar period in 2014. However, stock issued for licenses and services, stock issued for payment of interest on notes payable, and stock issued for payment of expenses all increased significantly during the nine months ended September 30, 2014. We anticipate that overhead costs in current operations will increase in the future once our research and development activities discussed above increase.

Cash flows from financing activities were $493,500 for the nine month periods ended September 30, 2014, compared to $463,000 during the nine months ended September 30, 2013. Cash flows used by investing activities were $0 for the nine month periods ended September 30, 2014 and 2013.

In June 2012, we conducted a private placement of our Common Stock for the purposes of supporting our working capital whereby we sold 250,000 shares at a price of $0.20 per share and received proceeds of approximately $50,000 therefrom.

Between July and October 2012, we conducted a private placement of our Common Stock to fund our drug development program whereby we sold 1,410,000 shares of our Common Stock at a price of $0.25 per share and received proceeds of approximately $352,500 therefrom.

In December 2012, we commenced a private offering of Convertible Notes. We issued nine Convertible Notes to nine accredited investors (as that term is defined under the Securities Act of 1933, as amended) in the aggregate amount of $513,000. These notes accrued interest at the rate of 6% per annum and were convertible at our option into shares of our Common Stock at $0.20 per share on or before September 30, 2013. We elected to convert these notes with interest accrued thereon and issued an aggregate of 2,590,426 shares of Common Stock to these investors. The Convertible Notes were considered to have a beneficial conversion feature and under ASC 470-20-25-10 the beneficial conversion feature was calculated to be $548,951 in total based on the issuance date and the share price on that date. This amount was booked to interest expense and Additional Paid in Capital for the period as all of the Convertible Notes were converted by September 30, 2013.

During the nine months ended September 30, 2014 we conducted a private placement of our Common Stock for the purposes of supporting our working capital whereby we sold 266,667 shares at a price of $0.20 per share and received proceeds of approximately $53,333 therefrom.

On March 27, 2014, we issued a Convertible Note to one accredited investor (as that term is defined under the Securities Act of 1933, as amended) in the principal amount of $100,000 plus 500,000 Common Shares (paid) and $20,000 (unpaid) for origination fee. This Convertible Note accrues interest at the rate of 10% per annum and is convertible at the option of the Holder into shares of our Common Stock at $0.20 per share on or before September 27, 2014. On September 26, 2014 this Note was extended until November 26, 2014. Since the Note was issued at a premium no value is apportioned to the conversion feature when recording the issue per ASC 470-20-05. The debt and its interest are reported as if it were a nonconvertible debt. Upon conversion the issued stock may be valued at either the book value or the market value.

On May 7, 2014, we issued a Convertible Note to one accredited investor (as that term is defined under the Securities Act of 1933, as amended) in the principal amount of $500,000. At execution, we paid an origination fee of $50,000 and also received proceeds of $100,000 on this Note. Additional draw downs on this note can only be made in the discretion of the lender. The note is due May 6, 2016 and allows interest at the rate of 10% per annum, which began to accrue August 7, 2014. The note is convertible into shares of our Common Stock beginning November 7, 2014 at the lower of $.20 per share or 60% of the lowest traded price in the 25 trading days prior to conversion. Since the Note was issued at a premium no value is apportioned to the conversion feature when recording the issue per ASC 470-20-05. The debt and its interest are reported as if it were a nonconvertible debt. Upon conversion, the stock may be valued at either the book value or the market value.

On September 8, 2014, we issued a convertible Promissory Note in the principal amount of $113,500 to one accredited investor. This Note is due June 8, 2015 and accrues interest at the rate of 8% per annum. The Note may be converted into shares of our Common Stock beginning March 8, 2015 ar a conversion price equal to 65% of the lowest three (3) trading bid prices during the ten (10) trading days prior to the conversion date. If we fail to deliver the shares of common stock in a timely manner following conversion we are subject to extraordinary penalties. Since the Note was issued at a premium no value is apportioned to the conversion feature when recording the issue per ASC 470-20-05. The debt and its interest are reported as if it were a nonconvertible debt. Upon Conversion, the stock may be valued at either the book value or the market value.

18

We are not generating revenue from our operations, and our ability to implement our business plan for the future will depend on the future availability of financing. Such financing will be required to enable us to further develop our drug research and development capabilities and continue operations. We estimate that we will require approximately $5 million in debt and/or equity capital to fully implement our business plan in the future and there are no assurances that we will be able to raise this capital. During the nine months ended September 30, 2014, we did, on April 23, 2014, enter into an Investment Agreement (the “Investment Agreement”) with Dutchess Opportunity Fund, II, LP (“Dutchess”), for the sale of up to $2.5 million of shares of our Common Stock over a three-year commitment period. Under the terms of the Investment Agreement, we may, from time to time and in our sole discretion, issue shares of our Common Stock to Dutchess at a price equal to ninety percent (90%) of the lowest daily volume weighted average price during a Trading Day of our Common Stock during the five (5) consecutive Trading Days immediately preceding the Put Notice Date, up to $2.5 million. In connection with the Investment Agreement, we also issued to Dutchess an engagement fee in the form of 400,000 “restricted” shares of our Common Stock.

The amount of each tranche under the Investment Agreement is limited to maximum $100,000 and we may only issue a Put Notice (as defined under the Investment Agreement) ten (10) Trading Days after each prior Put Notice Date. We are not obligated to utilize any of the $2.5 million available under the Investment Agreement and there are no minimum commitments or minimum use penalties.

The Investment Agreement does not impose any restrictions on our operating activities. During the term of the Investment Agreement, Dutchess is prohibited from engaging in any short selling or hedging transactions, either directly or indirectly, related to our Common Stock.

As a material term of the Dutchess Agreement, we were required to register the 400,000 shares of our Common Stock already issued to Dutchess, as well as 13,000,000 additional shares of our Common Stock reserved for issuance upon our drawing down funds pursuant to the Investment Agreement. We filed the registration statement with the SEC on May 22, 2014 and it became effective July 23, 2014. On August 7, 2014, we elected to issue our initial put notice to Dutchess, wherein we requested that Dutchess purchase 930,233 shares of our Common Stock for $100,000. We utilized the proceeds from the sale of these shares to repay debt. We anticipate that the proceeds from the next put notice shall be utilized to commence IND studies on our Adva-27a drug.

Despite the Dutchess Agreement there can be no assurances that we will have sufficient capital to complete the implementation of our business plan, as we currently estimate we will need up to $5 million to do so. We expect to raise the additional capital necessary to fully implement our business plan either by the sale of our securities, or through generating revenues as described in Plan of Operation above. There are no assurances that either scenario will be successfully implemented. As of the date of this report we have not reached any agreement with any party that has agreed to provide us with the additional capital we think may be necessary to fully implement our business plan, or whether we will generate sufficient revenues to allow us to do so. Our inability to obtain additional sufficient funds from external sources if and when needed may have a material adverse effect on our plan of operation, results of operations and financial condition.

Our cost to continue operations as they are now conducted is nominal, but these are expected to increase in the near future once we commence Phase I clinical trials. We do not have sufficient funds to cover the anticipated increase in these expenses. We need to raise additional funds in order to continue our existing operations, to initiate research and development activities, and to finance our plans to expand our operations for the next year. If we are successful in raising additional funds, our research and development efforts will continue and expand.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the nine month period ended September 30, 2014.

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

19

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company and are not required to provide the information under this item pursuant to Regulation S-K.

Disclosure Controls and Procedures - Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this report.

These controls are designed to ensure that information required to be disclosed in the reports we file or submit pursuant to the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission, and that such information is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Based on this evaluation, our CEO and CFO concluded that our disclosure controls and procedures were effective as of September 30, 2014, at the reasonable assurance level. We believe that our consolidated financial statements presented in this Form 10-Q fairly present, in all material respects, our financial position, results of operations, and cash flows for all periods presented herein.

Inherent Limitations - Our management, including our Chief Executive Officer and Chief Financial Officer, do not expect that our disclosure controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdown can occur because of simple error or mistake. In particular, many of our current processes rely upon manual reviews and processes to ensure that neither human error nor system weakness has resulted in erroneous reporting of financial data.

Changes in Internal Control over Financial Reporting - There were no changes in our internal control over financial reporting during the nine month period ended September 30, 2014, which were identified in conjunction with management’s evaluation required by paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

We are not party to any material legal proceedings, nor have any such actions been threatened against us.

We are a smaller reporting company and are not required to provide the information under this item pursuant to Regulation S-K.

During the nine months ended September 30, 2014 we conducted a private placement of our Common Stock for the purposes of supporting our working capital whereby we sold 266,667 shares at a price of $0.20 per share and received proceeds of approximately $53,333 therefrom. We relied upon the exemption from registration provided by Regulation D promulgated under the Securities Act of 1933, as amended, to issue these shares.

20

On March 1, 2014, we issued aggregate of 1,000,000 shares in favor of Harllon Holdings LLC in exchange for public relations/market management services. Of these shares, 500,000 were authorized for issuance on April 1, 2014, with the balance of 500,000 shares authorized for issuance on November 1, 2014.

On March 27, 2014, we issued a Convertible Note to one accredited investor (as that term is defined under the Securities Act of 1933, as amended) in the aggregate amount of $100,000 plus 500,000 Common shares (paid) and $20,000 (unpaid) for origination fee.

On August 7, 2014, we elected to issue our initial put notice to Dutchess, wherein we requested that Dutchess purchase 930,233 shares of our Common Stock for $100,000. We utilized the proceeds from the sale of these shares to repay debt. We anticipate that the proceeds from the next put notice shall be utilized to commence IND studies on our Adva-27a drug. The shares issued had been registered in our applicable registration statement.

On September 17, 2014, we issued an aggregate of 340,080 shares of our Common Stock to two individuals in consideration for providing us with legal services relevant to outstanding litigation.

Except as indicated above, in each of the above instances we relied upon the exemption from registration provided by Section 4/2 of the Securities Act of 1933, as amended, to issue the relevant securities.

None

Not Applicable

None

|

Exhibit No.

|

Description

|

|

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Executive Officer and Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

21

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities and Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized on November 10, 2014.

|

SUNSHINE BIOPHARMA, INC.

|

|||

|

By:

|

s/ Dr. Steve N. Slilaty

|

||

|

Dr. Steve N. Slilaty,

|

|||

|

Principal Executive Officer

|

|||

|

By:

|

s. Camille Sebaaly

|

||

|

Camille Sebaaly,

Principal Financial Officer and

|

|||

|

Principal Accounting Officer

|

|||

22