Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Sunshine Biopharma, Inc | Financial_Report.xls |

| EX-32 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex32.htm |

| EX-31.1 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex311.htm |

| EX-31.2 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex312.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

Quarterly Report Under the Securities Exchange Act of 1934

For Quarter Ended: March 31, 2012

Commission File Number: 000-52898

SUNSHINE BIOPHARMA INC.

(Exact name of small business issuer as specified in its charter)

|

Colorado

|

20-5566275

|

|

|

(State of other jurisdiction of incorporation)

|

(IRS Employer ID No.)

|

2015 Peel Street

5th Floor

Montreal, Quebec, Canada H3A 1T8

(Address of principal executive offices)

(514) 764-9698

(Issuer’s Telephone Number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes þ No o.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o (Do not check if a smaller reporting company) |

Smaller reporting company

|

þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

The number of shares of the registrant’s only class of common stock issued and outstanding as of May 8, 2012, was 48,728,842 shares.

TABLE OF CONTENTS

PART I.

FINANCIAL INFORMATION

|

Page No.

|

|||||

|

Item 1.

|

Financial Statements

|

3 | |||

|

Consolidated Balance Sheet as of March 31, 2012 (unaudited)

|

3 | ||||

|

Unaudited Statement of Operations for the Three Month Period Ended March 31, 2012

|

4 | ||||

|

Unaudited Consolidated Statement of Cash Flows for the for the Three Month Periods Ended March 31, 2012 and 2011

|

5 | ||||

|

Notes to Consolidated Financial Statements

|

6 | ||||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations/Plan of Operation.

|

10 | |||

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

14 | |||

|

Item 4.

|

Controls and Procedures.

|

14 | |||

| PART II | |||||

| OTHER INFORMATION | |||||

|

Item 1.

|

Legal Proceedings.

|

15 | |||

|

Item 1A.

|

Risk Factors

|

15 | |||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds.

|

15 | |||

|

Item 3.

|

Defaults Upon Senior Securities.

|

15 | |||

|

Item 4.

|

[Removed and Reserved]

|

15 | |||

|

Item 5.

|

Other Information.

|

15 | |||

|

Item 6.

|

Exhibits.

|

16 | |||

|

Signatures

|

17 | ||||

2

PART I.

ITEM 1. FINANCIAL STATEMENTS

|

Sunshine Biopharma, Inc.

|

|||||

|

Balance Sheet

|

|||||

|

(A Development Stage Company)

|

|||||

|

Unaudited

|

Audited

|

|||||||

|

March 31,

|

December 31,

|

|||||||

|

2012

|

2011

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 38,435 | $ | 60,692 | ||||

|

Prepaid expenses

|

45,745 | 45,745 | ||||||

|

Total Current Assets

|

84,180 | 106,437 | ||||||

|

TOTAL ASSETS

|

$ | 84,180 | $ | 106,437 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Current portion of note payable

|

12,500 | - | ||||||

|

Interest payable

|

16 | - | ||||||

|

Accounts payable

|

8,002 | 3,434 | ||||||

|

TOTAL LIABILITIES

|

20,518 | 3,434 | ||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Preferred stock, $0.10 par value per share;

|

||||||||

|

Authorized 5,000,000 Shares; Issued

|

||||||||

|

and outstanding -0- shares.

|

- | - | ||||||

|

Common Stock, $0.001 per share;

|

||||||||

|

Authorized 200,000,000 Shares; Issued

|

||||||||

|

and outstanding 48,728,842 at

|

||||||||

|

March 31, 2012 and December 31, 2011

|

48,729 | 48,729 | ||||||

|

Capital paid in excess of par value

|

2,348,988 | 2,348,988 | ||||||

|

Accumulated other comprehesive (Loss)

|

- | - | ||||||

|

(Deficit) accumulated during the development stage

|

(2,334,055 | ) | (2,294,714 | ) | ||||

|

TOTAL SHAREHOLDERS' EQUITY

|

63,662 | 103,003 | ||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 84,180 | $ | 106,437 | ||||

See Accompanying Notes To These Financial Statements.

3

|

Sunshine Biopharma, Inc.

|

||||

|

Unaudited Statement Of Operations

|

||||

|

(A Development Stage Company)

|

||||

|

3 Months

|

3 Months

|

August 17,

|

||||||||||

|

Ended

|

Ended

|

2009 (inception)

|

||||||||||

|

March 31,

|

March 31,

|

through March 31,

|

||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Revenue:

|

$ | - | $ | - | $ | - | ||||||

|

General & Administrative Expenses

|

||||||||||||

|

Research and Development

|

- | 17,650 | 142,650 | |||||||||

|

Accounting

|

4,280 | 3,250 | 35,725 | |||||||||

|

Financial Consulting

|

25,000 | - | 187,357 | |||||||||

|

Legal

|

9,440 | 4,111 | 150,528 | |||||||||

|

Licenses

|

- | - | 450,000 | |||||||||

|

Office

|

- | 3,650 | 11,723 | |||||||||

|

Merger Cost

|

- | - | 155,150 | |||||||||

|

Public Relations

|

- | 15,119 | 241,768 | |||||||||

|

Stock Transfer Fee

|

605 | 5,436 | 13,162 | |||||||||

|

Writedown of intangible assets

|

- | - | 945,976 | |||||||||

|

Total G & A

|

39,325 | 49,216 | 2,334,039 | |||||||||

|

(Loss) from operations

|

(39,325 | ) | (49,216 | ) | (2,334,039 | ) | ||||||

|

Other (expense) interest

|

(16 | ) | - | (16 | ) | |||||||

|

Net (loss)

|

$ | (39,341 | ) | $ | (49,216 | ) | $ | (2,334,055 | ) | |||

|

Basic (Loss) per common share

|

$ | 0.00 | $ | 0.00 | ||||||||

|

Weighted Average Common Shares Outstanding

|

48,728,842 | 30,677,674 | ||||||||||

See Accompanying Notes To These Financial Statements.

4

|

Sunshine Biopharma, Inc.

|

|||||

|

Unaudited Statement Of Cash Flows

|

|||||

|

(A Development Stage Company)

|

|||||

|

3 Months

|

3 Months

|

August 17,

|

||||||||||

|

Ended

|

Ended

|

2009 (inception)

|

||||||||||

|

March 31,

|

March 31,

|

through March 31,

|

||||||||||

|

2012

|

2011

|

2012

|

||||||||||

|

Cash Flows From Operating Activities:

|

||||||||||||

|

Net (Loss)

|

$ | (39,341 | ) | $ | (49,216 | ) | $ | (2,334,055 | ) | |||

|

Adjustments to reconcile net loss to net cash used in

|

||||||||||||

|

operating activities:

|

||||||||||||

|

Stock issued for licenses, services, and other assets

|

- | 12,000 | 1,154,517 | |||||||||

|

Increase in prepaid expenses

|

- | 3,960 | (45,745 | ) | ||||||||

|

Increase in Accounts Payable

|

4,568 | (11,074 | ) | 8,002 | ||||||||

|

Increase in interest payable

|

16 | - | 16 | |||||||||

|

Net Cash Flows (used) in operations

|

(34,757 | ) | (44,330 | ) | (1,217,265 | ) | ||||||

|

Cash Flows From Investing Activities:

|

||||||||||||

|

Net Cash Flows (used) in Investing activities

|

- | - | - | |||||||||

|

Cash Flows From Financing Activities:

|

||||||||||||

|

Proceed from note payable

|

12,500 | - | 12,500 | |||||||||

|

Issuance of common stock

|

- | - | 1,243,200 | |||||||||

|

Net Cash Flows provided by financing activities

|

12,500 | - | 1,255,700 | |||||||||

|

|

||||||||||||

|

Net Increase (Decrease) In Cash and cash equivalents

|

(22,257 | ) | (44,330 | ) | 38,435 | |||||||

|

Cash and cash equivalents at beginning of period

|

60,692 | 162,391 | - | |||||||||

|

Cash and cash equivalents at end of period

|

$ | 38,435 | $ | 118,061 | $ | 38,435 | ||||||

|

Supplementary Disclosure Of Cash Flow Information:

|

||||||||||||

|

Stock issued for services, licenses and other assets

|

$ | - | $ | 12,000 | $ | 890,132 | ||||||

|

Stock issued for note conversions

|

$ | - | $ | - | $ | 29,465 | ||||||

|

Stock issued for net deficit of MWBS

|

$ | - | $ | - | $ | (29,465 | ) | |||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

See Accompanying Notes To These Financial Statements.

5

Sunshine Biopharma, Inc.

(a development stage company)

Notes to Unaudited Consolidated Financial Statements

For The Three Month Interim Period Ended March 31, 2012

Note 1 – Significant Accounting Policies

Basis of Presentation:

The accompanying unaudited financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In our opinion the financial statements include all adjustments (consisting of normal recurring accruals) necessary in order to make the financial statements not misleading. Operating results for the three months ended March 31, 2012 are not necessarily indicative of the results that may be expected for the year ended December 31, 2012. For more complete financial information, these unaudited financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2011 included in our Form 10-K filed with the SEC.

Development Stage Company – We are a development stage enterprise in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 7, “Accounting and Reporting by Development Stage Enterprises” now referred to as ACS 915 “Development Stage Entities”. We have been in the development stage since Inception (August 17, 2009). Among the disclosures required as a development stage company are that our financial statements are identified as those of a development stage company, and that the statements of operations, stockholders' deficit and cash flows disclose activity since the date of our inception (August 17, 2009) as a development stage company.

Use of Estimates – The preparation of our consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Actual results could differ from those estimates. Due to uncertainties inherent in the estimation process, it is possible that these estimates could be materially revised within the next year.

Cash and Cash Equivalents – Cash and cash equivalents consist of cash and highly liquid debt instruments with original maturities of less than three months.

Foreign Currency Translation – The Company's functional currency and its reporting currency is the United States dollar.

6

Property and Equipment – We owned no property and equipment during the three months ended March 31, 2012 or 2011 and consequently we recorded no depreciation expense during the three months ended March 31, 2012 or 2011.

Deferred Costs and Other – Offering costs with respect to issue of common stock, warrants or options by us were initially deferred and ultimately offset against the proceeds from these equity transactions if successful or expensed if the proposed equity transaction is unsuccessful. We had no deferred costs and other as at March 31, 2012 or 2011.

Impairment of Long-Lived and Intangible Assets – In the event that facts and circumstances indicated that the cost of long-lived and intangible assets may be impaired, an evaluation of recoverability was performed. If an evaluation was required, the estimated future undiscounted cash flows associated with the asset were compared to the asset's carrying amount to determine if a write-down to market value or discounted cash flow value was required.

Financial Instruments – The estimated fair values for financial instruments was determined at discrete points in time based on relevant market information. These estimates involved uncertainties and could not be determined with precision. The carrying amounts of notes receivable, accounts receivable, accounts payable and accrued liabilities approximated fair value because of the short-term maturities of these instruments. The fair value of notes payable approximated to their carrying value as generally their interest rates reflected our effective annual borrowing rate.

Income Taxes – We account for income taxes under the liability method, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial statements and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse.

Advertising Costs – Advertising costs are expensed as incurred. No advertising costs were incurred during the three months ended March 31, 2012 or 2011.

Comprehensive Income (Loss) – Comprehensive income is defined as all changes in stockholders' equity (deficit), exclusive of transactions with owners, such as capital investments. Comprehensive income includes net income or loss, changes in certain assets and liabilities that are reported directly in equity such as translation adjustments on investments in foreign subsidiaries and unrealized gains (losses) on available-for-sale securities. From our inception there were no differences between our comprehensive loss and net loss.

Our comprehensive loss was identical to our net loss for the three months ended March 31, 2012 and 2011.

7

Income (Loss) Per Share – Income (loss) per share is presented in accordance with Accounting Standards Update (“ASU”), Earning Per Share (Topic 260) which requires the presentation of both basic and diluted earnings per share (“EPS”) on the consolidated income statements. Basic EPS would exclude any dilutive effects of options, warrants and convertible securities but does include the restricted shares of common stock issued. Diluted EPS would reflect the potential dilution that would occur if securities of other contracts to issue common stock were exercised or converted to common stock. Basic EPS calculations are determined by dividing net income by the weighted average number of shares of common stock outstanding during the year. Diluted EPS calculations are determined by dividing net income by the weighted average number of common shares and dilutive common share equivalents outstanding.

Basic and diluted EPS were identical for the three months ended March 31, 2012 and 2011 as we had no stock options or warrants outstanding during those periods.

Stock-Based Compensation – We have adopted ASC Topic 718 (formerly SFAS 123R), “Accounting for Stock-Based Compensation”, which establishes a fair value method of accounting for stock-based compensation plans. In accordance with guidance now incorporated in ASC Topic 718, the cost of stock options and warrants issued to employees and non-employees is measured on the grant date based on the fair value. The fair value is determined using the Black-Scholes option pricing model. The resulting amount is charged to expense on the straight-line basis over the period in which we expect to receive the benefit, which is generally the vesting period. The fair value of stock warrants was determined at the date of grant using the Black-Scholes option pricing model. The Black-Scholes option model requires management to make various estimates and assumptions, including expected term, expected volatility, risk-free rate, and dividend yield.

No stock based compensation was issued or outstanding during the three months ending March 31, 2012 or 2011.

Business Segments – We believe that our activities during the three months ended March 31, 2012 and 2011 comprised a single segment.

Recently Issued Accounting Pronouncements – We have reviewed all recently issued, but not yet effective, accounting pronouncements and do not believe the future adoption of any such pronouncements may be expected to cause a material impact on our financial condition or the results of our operations.

Note 2 – Going Concern and Liquidity

The consolidated financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future.

The Company has incurred losses since inception resulting in an accumulated deficit of $2,334,055 as of March 31, 2012 and further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern.

8

In our financial statements for the fiscal years ended December 31, 2011 and 2010, the Report of the Independent Registered Public Accounting Firm includes an explanatory paragraph that describes substantial doubt about our ability to continue as a going concern.

We are not generating revenue from our operations, and our ability to implement our business plan for the future will depend on the future availability of financing. Such financing will be required to enable us to further develop our drug research and development capabilities and continue operations. We intend to raise funds through private placements of our common stock, through short-term borrowing and by application for grants in conjunction with SUNY Binghamton with whom we have entered into a research and development agreement in January 2011. We estimate that we will require approximately $5 million in debt and/or equity capital to fully implement our business plan in the future and there are no assurances that we will be able to raise this capital. While we have engaged in discussions with various investment banking firms and venture capitalists to provide us these funds, as of the date of this report we have not reached any agreement with any party that has agreed to provide us with the capital necessary to effectuate our business plan. Our inability to obtain sufficient funds from external sources when needed will have a material adverse effect on our plan of operation, results of operations and financial condition.

Our cost to continue operations as they are now conducted is nominal, but these are expected to increase once we commence Phase I clinical trials. We do not have sufficient funds to cover the anticipated increase in these expenses. We need to raise additional funds in order to continue our existing operations, to initiate research and development activities, and to finance our plans to expand our operations for the next year. If we are successful in raising additional funds, our research and development efforts will continue and expand.

Note 3 – Notes Payable

During the three months ended March 31, 2012, the Company received a loan of $12,500 accruing interest at a rate of 12%. The loan matures on August 31, 2012.

Note 4 – Subsequent Events

We have evaluated subsequent events through May 8, 2012. Other than those set out above, there have been no subsequent events after March 31, 2012 for which disclosure is required.

9

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview and History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” During our fiscal year ended July 31, 2009 our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies. Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation (“SBI”), in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction our officers and directors resigned their positions with us and were replaced by our current management. Also as a result of this transaction we have changed our name to “Sunshine Biopharma, Inc.” As of the date of this report we are a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer.

On April 19, 2010, the holders of a majority of our voting securities executed their written consent to amend our Articles of Incorporation to increase our authorized capital stock from 50,000,000 shares of Common Stock, par value $0.001 per share, and 1,000,000 shares of Preferred Stock, to 200,000,000 shares of Common Stock having a par value of $0.001 per share and 5,000,000 shares of Preferred Stock, $0.10 par value per share.

Our principal place of business is located at 2015 Peel Street, 5th Floor, Montreal, Quebec, Canada H3A 1T8. Our phone number is (514) 764-9698 and our website address is www.sunshinebiopharma.com.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Results Of Operations

Comparison of Results of Operations for the three months ended March 31, 2012 and 2011

For the three months ended March 31, 2012 and 2011 we did not generate any revenues.

General and administrative expenses during the three month period ended March 31, 2012 were $39,325, compared to general and administrative expense of $49,216 incurred during the three month period ended March 31, 2011, a decrease of $9,891. During the aforesaid period in 2012, we incurred $25,000 in financial consulting fees that we did not incur during the similar period in 2011. However, during the three month period ended March 31, 2011 we incurred pubic relation fees of $15,119 and $17,650 in research and development costs that we did not incur during the similar period in 2012. As a result, we incurred a net loss of $39,341 (less than $0.01 per share) for the three month period ended March 31, 2012, compared to a net loss of $49,216 during the three month period ended March 31, 2011.

Because we did not generate any revenues since our inception, following is our Plan of Operation.

10

Plan of Operation

We are currently a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. The preclinical studies for our lead compound, Adva-27a, a multi-purpose anti-tumor compound, were successfully completed in 2011. We are now continuing our clinical development of Adva-27a by conducting the next sequence of steps comprised of GMP manufacturing, IND-enabling studies, regulatory filing and Phase I clinical trials. We plan to conduct our Phase I clinical trials for Adva-27a at the Jewish General Hospital, Montreal, Canada, one of McGill University’s Hospital Centers. The planned indication will be multidrug resistant breast cancer as Adva-27a has shown a positive effect on this type of cancer for which there is currently little or no treatment options (see “Clinical Trials” below).

We have licensed our technology on an exclusive basis from Advanomics Corporation (”Advanomics”), and we are planning to initiate our own research and development program as soon as practicable once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials.

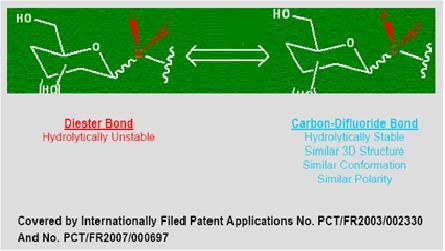

Carbon-Difluoride Platform Technology

Many therapeutically important compounds contain diester bonds that link different parts of the molecule together. Diester bonds are naturally unstable often leading to suboptimal performance when the molecule is administered to patients. Diester bonds have specific three-dimensional, as well as electrostatic properties that cannot be easily mimicked by other bonds. Bonds that do not mimic the diester bond correctly invariably render the compound inactive. In collaboration with Institut National des Sciences Appliquées de Rouen in France (“INSA”), Advanomics has developed a way to replace the diester bond with a Carbon-Difluoride bond which acts as a diester isostere. An isostere is a different chemical structure that mimics the properties of the original. In the body, Carbon-Difluoride compounds are resistant to metabolic degradation but recognized similarly to the diester compounds (see Figure 1).

Figure 1

While no assurances can be provided, we are planning to expand our product line through acquisitions and/or in-licensing as well as in-house research and development.

11

Our Lead Compound (Adva-27a)

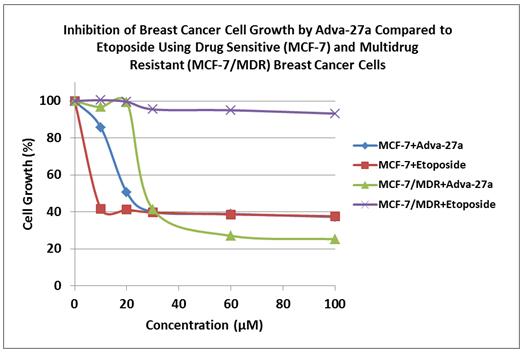

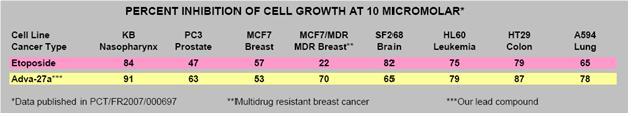

Our initial drug candidate is Adva-27a, a GEM-difluorinated C-glycoside derivative of Podophyllotoxin, targeted for various forms of cancer. If sufficient funding can be obtained, Adva-27a is expected to enter Phase I clinical trials for multidrug resistant breast cancer in late 2013 (see “Clinical Development Path” and “Clinical Trials” below). Etoposide, which is also a derivative of Podophyllotoxin, is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Adva-27a is a new chemical entity and has been shown to have distinct and more desirable biological properties compared to Etoposide. Most notably, Adva-27a appears to be effective against multidrug resistant breast cancer cells while Etoposide has no activity against this aggressive type of cancer (see Figure 2). In other side-by-side studies against Etoposide as a reference, Adva-27a showed markedly improved cell killing activity in various other cancer types, particularly prostate, colon and lung cancer (see Table 1). Our preclinical studies to date have shown that:

|

•

|

Adva-27a is 16-times more effective at killing multidrug resistant breast cancer cells than Etoposide.

|

|

•

|

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

|

|

•

|

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

|

|

•

|

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

|

|

•

|

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar.

|

|

•

|

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

|

Figure 2

Table 1

12

Clinical Development Path

The early stage preclinical studies for our lead compound, Adva-27a, were successfully completed in late 2011. We are now continuing our clinical development program of Adva-27a by conducting the next sequence of steps comprised of the following:

|

•

|

GMP Manufacturing (for use in IND-Enabling Studies and Phase I Clinical Trials)

|

|

•

|

IND-Enabling Studies

|

|

•

|

Regulatory Filing (Fast-Track Status Anticipated)

|

|

•

|

Phase I Clinical Trials (Multidrug Resistant Breast Cancer Indication)

|

Clinical Trials

Adva-27a’s initial indication will be multidrug resistant breast cancer for which there are little or no treatment options. In June 2011 we concluded an agreement with McGill University’s Jewish General Hospital in Montreal, Canada to conduct Phase I clinical trials for this indication. All aspects of the planned clinical trials in Canada will employ FDA standards at all levels. We anticipate that the clinical trials will be completed by late 2014, at which time we, together with our licensor, expect to file for limited marketing approval with the regulatory authorities in Canada and the FDA in the U.S.

Liquidity and Capital Resources

As of March 31, 2012, we had cash or cash equivalents of $38,435.

Net cash used in operating activities was $34,757 during the three month period ended March 31, 2012, compared to $44,330 for the three month period ended March 31, 2011. We anticipate that overhead costs in current operations will increase in the future once our research and development activities discussed above increase.

Cash flows provided or used in investing activities were $0 for the three month periods ended March 31, 2012 and 2011. Cash flows provided or used by financing activities were also $0 for the three month periods ended March 31, 2012 and 2011.

We are not generating revenue from our operations, and our ability to implement our business plan for the future will depend on the future availability of financing. Such financing will be required to enable us to further develop our drug research and development capabilities and continue operations. We intend to raise funds through private placements of our common stock, through short-term borrowing and by application for grants in conjunction with SUNY Binghamton with whom we have entered into a research and development agreement in January 2011. We estimate that we will require approximately $5 million in debt and/or equity capital to fully implement our business plan in the future and there are no assurances that we will be able to raise this capital. While we have engaged in discussions with various investment banking firms and venture capitalists to provide us these funds, as of the date of this report we have not reached any agreement with any party that has agreed to provide us with the capital necessary to effectuate our business plan. Our inability to obtain sufficient funds from external sources when needed will have a material adverse effect on our plan of operation, results of operations and financial condition.

Our cost to continue operations as they are now conducted is nominal, but these are expected to increase once we commence Phase I clinical trials. We do not have sufficient funds to cover the anticipated increase in these expenses. We need to raise additional funds in order to continue our existing operations, to initiate research and development activities, and to finance our plans to expand our operations for the next year. If we are successful in raising additional funds, our research and development efforts will continue and expand.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during the three month period ended March 31, 2012.

13

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company and are not required to provide the information under this item pursuant to Regulation S-K.

ITEM 4. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures - Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this report.

These controls are designed to ensure that information required to be disclosed in the reports we file or submit pursuant to the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Securities and Exchange Commission, and that such information is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Based on this evaluation, our CEO and CFO concluded that our disclosure controls and procedures were effective as of March 31, 2012, at the reasonable assurance level. We believe that our consolidated financial statements presented in this Form 10-Q fairly present, in all material respects, our financial position, results of operations, and cash flows for all periods presented herein.

Inherent Limitations - Our management, including our Chief Executive Officer and Chief Financial Officer, do not expect that our disclosure controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdown can occur because of simple error or mistake. In particular, many of our current processes rely upon manual reviews and processes to ensure that neither human error nor system weakness has resulted in erroneous reporting of financial data.

Changes in Internal Control over Financial Reporting - There were no changes in our internal control over financial reporting during the three month period ended March 31, 2012, which were identified in conjunction with management’s evaluation required by paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

14

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None

ITEM 1A. RISK FACTORS

We are a smaller reporting company and are not required to provide the information under this item pursuant to Regulation S-K.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4. [REMOVED AND RESERVED.]

ITEM 5. OTHER INFORMATION

None

15

ITEM 6. EXHIBITS

|

Exhibit No.

|

Description

|

|

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

||

|

Certification of Chief Executive Officer and Chief Financial Officer Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

|

16

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities and Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized on May 8, 2012.

| SUNSHINE BIOPHARMA, INC. | |||

| By : |

s/ Dr. Steve N. Slilaty

|

||

| Dr. Steve N. Slilaty, Principal Executive Officer | |||

| By: |

s/ Camille Sebaaly

|

||

|

Camille Sebaaly, Principal Financial Officer

and Principal Accounting Officer

|

|||

17