Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - General Motors Financial Company, Inc. | d809816d8k.htm |

| EX-99.1 - EX-99.1 - General Motors Financial Company, Inc. | d809816dex991.htm |

3

rd

Quarter 2014

Earnings Call

October 23, 2014

Exhibit 99.2 |

2

Safe Harbor Statement

This presentation contains several “forward-looking statements”. Forward-looking

statements are those that use words such as “believe”, “expect”,

“anticipate”, “intend”, “plan”, “may”, “likely”, “should”, “estimate”, “continue”, “future” or other

comparable expressions. These words indicate future events and trends. Forward-looking statements

are General Motors Financial Company, Inc.’s (the “Company’s”) current

views with respect to future events and financial performance. These forward-looking

statements are subject to many assumptions, risks and uncertainties that could cause actual results to

differ significantly from historical results or from those anticipated by the Company. The most

significant risks are detailed from time to time in the Company’s filings and reports with

the Securities and Exchange Commission, including the Company’s Report on Form 10-K

for the year ended December 31, 2013. Such risks include - but are not limited to - our

ability to close the acquisition of Ally Financial’s equity interest in its auto finance and

financial services operations in China and operate that business successfully, changes in

general economic and business conditions, GM’s ability to sell new vehicles that we

finance in the markets we serve in North America, Europe and Latin America, interest rate and

currency fluctuations, our financial condition and liquidity, as well as future cash flows and

earnings, competition, the effect, interpretation or application of new or existing laws,

regulations, court decisions and accounting pronouncements, the availability of sources of

financing, the level of net credit losses, delinquencies and prepayments on the loans and

leases we originate, the viability of GM-franchised dealers that are commercial loan customers,

the prices at which used cars and end of term leased vehicles are sold in the wholesale

markets, and changes in business strategy, including acquisitions and expansion of product

lines and credit risk appetite. If one or more of these risks or uncertainties materializes, or

if underlying assumptions prove incorrect, actual events or results may differ materially. It is advisable not

to place undue reliance on the Company’s forward-looking statements. The Company undertakes

no obligation to, and does not, publicly update or revise any forward-looking statements,

except as required by federal securities laws, whether as a result of new information, future

events or otherwise. |

3

rd

Quarter 2014 Highlights

Operating Results

–

Strong origination volume, driven by

North America loan and lease originations at record levels

Higher

retail

penetration

in

the

United

States,

Europe

and

Latin

America

–

U.S. prime lending update

$162

million

of

prime

originations

in

the

quarter,

rolled

out

to

approximately

1,600

GM

dealers

Expanding

offering

to

all

GM

dealers

on

November

1

st

–

Solid profitability with $208 million in pretax earnings in the quarter

China JV Acquisition Update

–

Progressing through the regulatory process and expect to close in late 2014 or

early 2015 Financing

–

Raised $3.5 billion in Senior Unsecured Notes in the U.S.

–

Entered into a support agreement with GM which provides for leverage limits and

liquidity support to GMF, if needed

–

Upgraded to investment grade by S&P and GMF’s ratings equalized to

GM’s across all four agencies (S&P, Moody’s, Fitch and

DBRS) 3 |

4

Key Metrics

September 2014 Quarter

September 2013 Quarter

($MM)

North

America

1

International

2

Total Co.

North

America

1

International

2

Total Co.

Earnings Before Tax

$150

$58

$208

3

$175

$63

$239

3

Ending Earning Assets

$20,972

$17,253

$38,225

$15,921

$11,689

$27,610

Total Originations (Loan & Lease)

$ 3,699

$2,140

$5,839

$ 1,997

$ 1,233

$ 3,230

GM as a % of Total Originations

65.5%

87.7%

73.6%

56.0%

85.0%

67.1%

Annualized Net Credit Loss as a % of Avg.

Consumer Finance Receivable

3.2%

0.8%

2.0%

2.8%

0.4%

1.9%

1.

United States and Canada

2.

Brazil

acquired

on

October

1,

2013;

Brazil

included

in

September

2014 metrics but excluded in September 2013 metrics

3.

Reflects net impact of intercompany allocations |

North

America GM and GMF Penetration Statistics

5

Sept-14

June-14

Sept-13

GMF as a % of GM Retail Sales

U.S.

10.5%

8.9%

5.7%

Canada

15.5%

27.6%

8.6%

GMF Wholesale Dealer Penetration

U.S.

7.5%

6.7%

4.5%

Canada

9.7%

8.8%

7.3%

GM as % of GMF Consumer Originations

(GM New / GMF Consumer Loan & lease)

U.S.

62.1%

59.7%

52.3%

Canada

98.8%

99.6%

97.6% |

North

America Consumer Loan Originations

Loan

origination

volume

up

driven

by

strong

new

and

used

vehicle

sales

and

growth

in GM related business, including prime lending

GMF as % of

GM U.S. Subprime

29.0%

30.0%

31.5%

32.7%

32.8%

6

$722

$673

$814

$855

$905

$156

$160

$196

$191

$372

$392

$313

$354

$507

$680

$0

$500

$1,000

$1,500

$2,000

$2,500

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Quarterly

($MM)

Loans originated

on new vehicles

by GM dealers

Loans originated

on used vehicles

by GM dealers

Loans originated

on vehicles by

non-GM dealers

$1,270

$1,146

$1,364

$1,553

$1,957 |

7

North America

Consumer Loan Credit Performance

Credit metrics impacted by seasonality and normalizing credit environment

–

Credit metrics continue to moderate, reflecting current credit environment and

portfolio mix –

Recovery rates migrating toward historical levels

Comparable performance of GM new remains favorable relative to performance of

non-GM

2.8%

3.5%

3.1%

2.3%

3.2%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Recovery Rate

58.7%

56.7%

59.1%

61.5%

56.6%

Annualized quarterly

net credit losses

31-60 day

delinquency

61+ day delinquency

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Credit Metrics |

North

America Lease Originations

Total lease volume up sequentially and year-over-year driven by broader, more

competitive product offerings and improved dealer acceptance

GMF as a percentage of GM’s U.S. lease business doubled over the past

year Credit performance reflects the predominantly prime credit profile of the

portfolio At September 30, 2014, substantially all of our leases were current

with minimal defaults to date GM Market Penetration

Sep-13

Sep-14

Sep-13

Sep-14

U.S. Lease

21.3%

22.3%

24.1%

25.6%

Canada Lease

8.1%

15.9%

19.2%

22.1%

GMF as a % of

GM U.S. Lease

1

16.6%

15.2%

17.0%

28.8%

33.2%

1.

GMF is exclusive GM lease provider in Canada

8

$577

$383

$519

$1,048

$1,417

$150

$267

$254

$501

$325

$3.1B

$3.4B

$3.7B

$4.7B

$5.8B

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Canada Lease Volume ($MM)

U.S. Lease Volume ($MM)

Lease Portfolio ($B)

Industry

Average

(excluding

GM) |

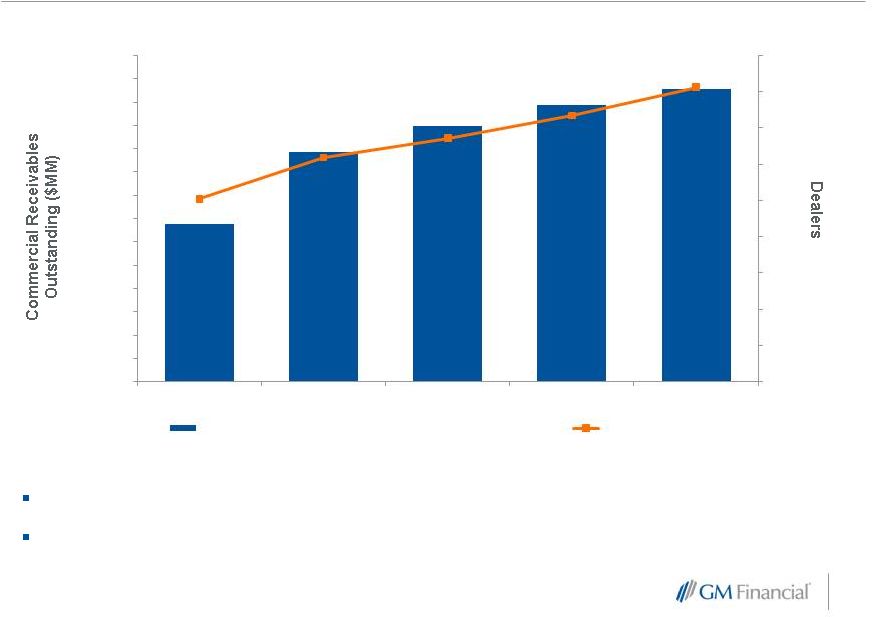

9

North America

Commercial Lending

Floorplan financing represented the largest share of the portfolio at 88%

Roll-out of prime lending program and increases in leasing penetration expected

to boost commercial lending growth

$1,357

$1,975

$2,190

$2,373

$2,513

252

309

336

367

406

-

50

100

150

200

250

300

350

400

450

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

$2,400

$2,600

$2,800

Commercial Finance Receivables Outstanding

Number of Dealers |

International Operations

GM and GMF Penetration Statistics

10

-

Brazil reflected beginning with the December 2013 quarter

Sept-14

June-14

Sept-13

GMF as a % of GM Retail Sales

Europe

39.3%

36.9%

30.7%

Latin America

47.8%

43.3%

33.5%

GMF Wholesale Dealer Penetration

Europe

97.7%

98.4%

97.1%

Latin America

92.1%

93.2%

89.8%

GM as % of GMF Consumer Originations

(GM New / GMF Consumer Loan and Lease)

Europe

80.0%

80.5%

81.1%

Latin America

95.7%

94.4%

96.0% |

11

International Operations

Loan Origination Volume

Stable origination volume quarter over quarter across International

Operations

-

Brazil reflected beginning with the December 2013 quarter

$0

$500

$1,000

$1,500

$2,000

$2,500

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Quarterly

($MM)

Latin America

Consumer Loan

Europe Consumer Loan

$1,233

$2,121

$2,048

$2,080

$2,127 |

12

International Operations

Consumer Loan Credit Performance

•

Credit losses reflect strong performance in Latin America and remain

consistently low in Europe

-

Brazil reflected beginning with the December 2013 quarter

0.4%

0.8%

0.6%

0.6%

0.8%

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Annualized quarterly

net credit losses

61+ day delinquency

Credit Metrics

31-60 day

delinquency

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14 |

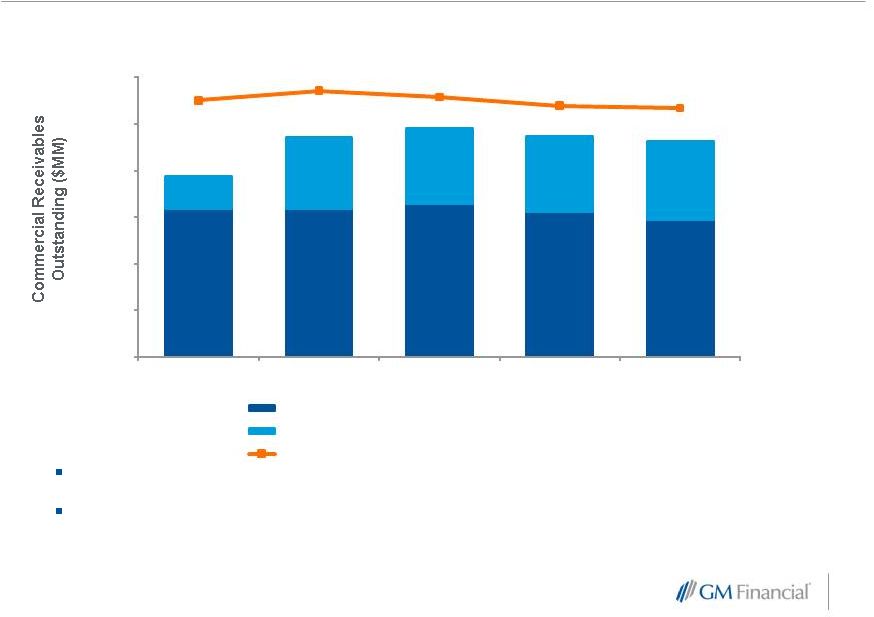

13

International Operations

Commercial

Commercial receivable balance and credit performance remain stable

Dealer count down sequentially due to discontinuation of Chevrolet brand in

Europe

-

Brazil reflected beginning with the December 2013 quarter

2,387

2,646

2,473

2,241

2,174

$3,889

$4,725

$4,918

$4,741

$4,638

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Sep

-13

Dec

-13

Mar-14

Jun

-14

Sep-14

Europe Commercial Finance Receivables Outstanding

Latin America Commercial Finance Receivables Outstanding

Number of dealers |

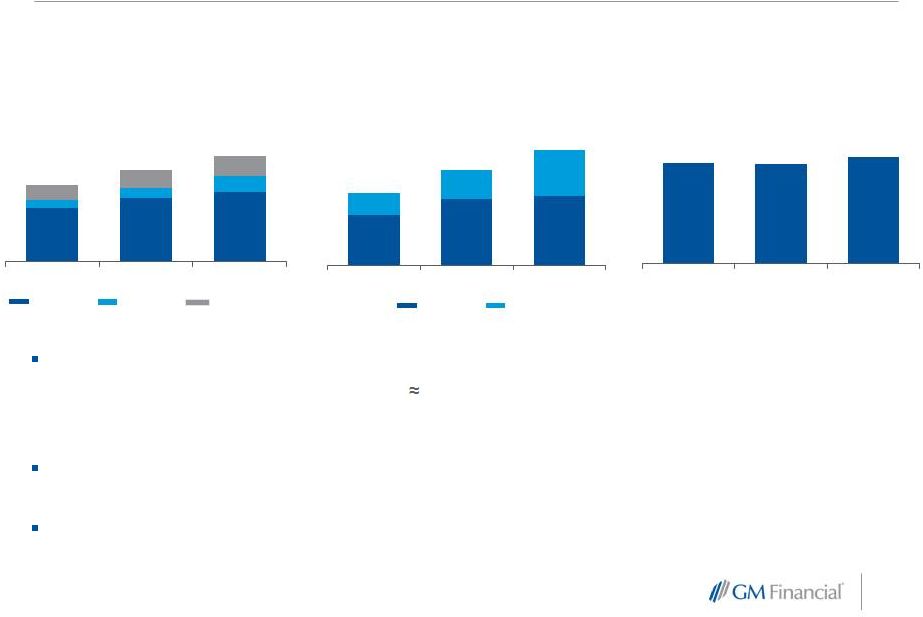

14

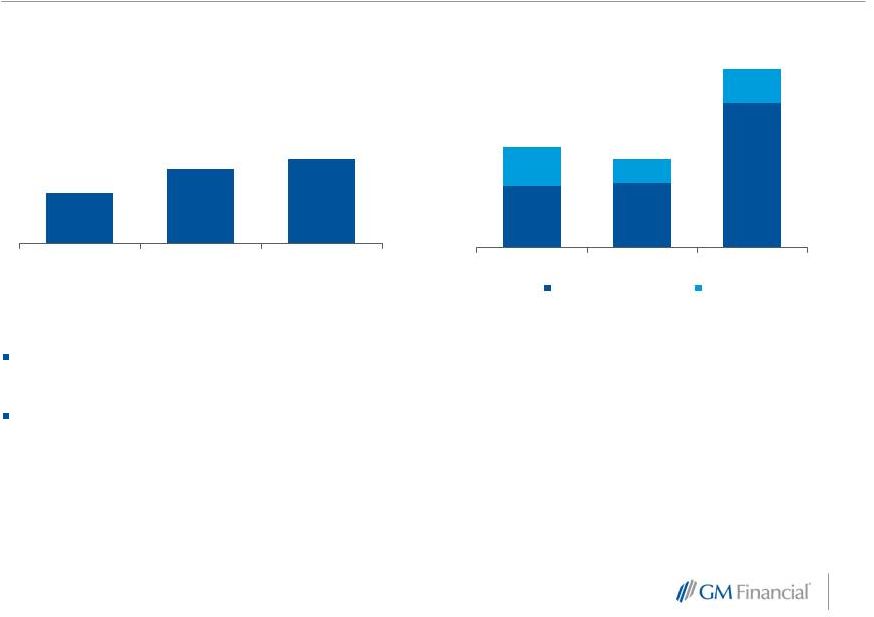

Financial Results

Earnings

Before

Taxes

($MM)

1,

2

YTD earnings drivers:

North America earnings down due to runoff of higher yielding pre-acquisition

receivables portfolio, normalizing credit trends, provisioning for asset

growth and increased interest expense associated with unsecured debt

issuance, with the majority of growth in higher credit quality, lower margin assets

International Operations earnings increased as a result of the Brazil

acquisition Operating expense as a percentage of average earning assets is

stable at 3.1% and expected to trend down over time as origination platforms

continue to scale 1.

Brazil included beginning with the December 2013 quarter

2.

Results include acquisition and integration expenses of $7 and $29 million for the

three and nine months ended September 30, 2013, respectively 3.

Reflects net impact of intercompany allocations

3

3

$208

$150

$58

$239

$175

$63

Total Co.

North America

International

2014

2013

Three Months Ended September 30,

$695

$504

$202

$673

$564

$100

Total Co.

North America

International

2014

2013

Nine Months Ended September 30, |

15

Financial Results

Allowance for Loan Losses

Consumer and commercial allowance consistent with credit performance

North America consumer allowance reflective of normalizing credit trends

Consumer and commercial allowance collectively includes reserve for discontinuing

Chevrolet brand in Europe, originally established at $15 million in December

2013 Wind

down

of

Chevrolet

portfolio

in

Europe

over

90%

complete

-

$11

million

of

initial

reserve

released

in

the

first

nine months of 2014

2.6%

2.3%

2.3%

2.4%

2.5%

4.4%

4.4%

4.5%

4.5%

4.4%

0.6%

0.8%

0.7%

0.6%

0.5%

1.0%

0.9%

0.7%

0.7%

0.7%

0.0%

2.0%

4.0%

6.0%

Sep-13

Dec-13

Mar-14

Jun-14

Sep-14

Consumer Allowance

Commercial Allowance

North America Only

North America Only |

16

Solid Balance Sheet Metrics

Composition

of

earning

assets

shifting

to

more

“prime-like”

credit

profile

–

Subprime

loan

portfolio

represented

30%

of

ending

earning

assets

at

September

30,

2014

and percentage is expected to decline with continued growth in the commercial and

lease portfolios and the prime loan rollout in North America

Unsecured

debt

as

a

percentage

of

total

debt

increased

to

32%

at

September

30,

2014 from 22% at September 30, 2013

GM to provide a $700M equity contribution upon closing of the China JV

$23.7

$29.0

$33.8

Sep-13

Dec-13

Sep-14

Total Debt

($B)

$27.6

$33.3

$38.2

Sep-13

Dec-13

Sep-14

Ending Earning

Assets

($B)

$5.0

$5.0

$5.3

Sep-13

Dec-13

Sep-14

Tangible Net Worth

($B)

Consumer

Lease

Consumer

Loan

Commercial

Loan

Unsecured

Debt

Secured

Debt |

17

Solid Balance Sheet Metrics

Liquidity increase primarily driven by $3.5B in unsecured debt issuance in the

quarter 5.4x

6.5x

7.0x

Sep-13

Dec-13

Sep-14

Leverage

Sep-13

Dec-13

Sep-14

Liquidity

($B)

Borrowing capacity

Cash

$4.5

$3.9

$8.0

Leverage below support threshold as defined in support agreement (net earning assets to

tangible net worth plus outstanding junior subordinated debt) |

18

Funding Overview

Committed credit facilities totaling $18.6B, provided by

27 banks

–

North America: Renewed and upsized Canada lease warehouse to

C$1B from C$800M

–

International Operations: Renewed and/or upsized 11 committed

credit

facilities

in

the

quarter

totaling

$1.3

billion

of

capacity

across

eight countries

Permanent securitization funding

–

North America:

Lease

securitization

(144A),

$709M

-

September

2014

AMCAR

2014-3

(subprime

loan),

$1.0B

-

August

2014

–

International Operations:

E-Carat 7 Germany (retail loan) €337M/$462M

E-Carat

4

UK

(retail

loan),

£457/$741M

–

September

2014

Senior note issuances

–

US$1.5B in July 2014 (3 and 5 year tenors)

–

US$2.0B in September 2014 (3 and 7 year tenors)

–

In

October

2014,

issued

inaugural

€500M

senior

note

offering

in

Europe (5 year tenor)

Credit Facilities

$3.0B

Unsecured

$10.9B

Secured

$22.9B

Credit

Facilities

$6.4B

Securitization

Notes Payable

$16.5B

Sr. Notes

$7.9B

$33.8B

9/30/2014 |

|