Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Escalera Resources Co. | d778576d8k.htm |

Exhibit 99.1

| Big Ideas = Bigger Opportunity EnerCom: The Oil & Gas Conference Denver, CO August 20, 2014 |

| Corporate Disclaimer This presentation may contain projections and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Any such projections or statements reflect the Company's current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that such projections will be achieved and actual results could differ materially from those projected. A discussion of important factors that could cause actual results to differ materially from those projected, such as decreases in oil and gas prices and/or unexpected decreases in oil and gas production, is included in the Company's periodic reports filed with the Securities and Exchange Commission. Cautionary Note to U.S. Investors - The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Effective for the Company's December 31, 2010 Form 10-K, SEC guidelines were changed to also allow for disclosure of "probable" and "possible" reserves. We may use these terms in this presentation. Investors are urged to consider closely the disclosure in our 2013 Form 10-K, File No. 1-33571, available from us at Escalera Resources Co., 1675 Broadway, Suite 2200, Denver, Colorado 80202, attention Investor Relations. Alternatively, you may also access this form at the SEC's website at www.sec.gov. |

| ESCALERA OVERVIEW |

| Escalera Overview New management team PROVEN HISTORY Leading with a visionary, innovative and proven team of experienced professionals dedicated to the optimization of our current assets and the aggressive pursuit and ethical development of quality dry natural gas related opportunities New strategy FOCUS AND EXECUTION Maximizing the value of the dry natural gas we have and will acquire by investing in abundant low cost dry natural gas, combined with efficient operations to control costs and risks Enhancing the value of dry natural gas GAS-TO-LIQUIDS Giving core assets new relevance, adding value through proven GTL technology with emphasis on high-value transportation diesel |

| Proven Management Team Charles F. Chambers Career Highlights: Acquired over 1.4 TCF of proved natural gas reserves through corporate and asset transactions (Calpine Natural Gas and Rosetta Resources) Integral role in the formation of Rosetta Resources, raising $1 Billion under a 144A transaction with institutional investors to launch the company. Key participant in taking the company public in February 2006 Oversight of 350+ Bcfe of proved reserves (96% gas) located in South Texas, Sacramento Basin of California, San Juan and DJ Basins in the Rockies, and the Gulf of Mexico. Production in these areas exceeded 150 Mmcfe/d (Rosetta Resources) At Calpine Natural Gas, Mr. Chambers purchased over $2 billion of proved reserves, primarily natural gas. Calpine's reserves were located in Western Canada, Gulf Coast of Texas & Louisiana, Oklahoma, Sacramento Basin of California, Piceance Basin of Colorado and the San Juan Basin of New Mexico with proved reserves exceeding 1 TCF of gas and production of over 450 Mmcfe/d President, CEO and Chairman Mr. Chambers has spent over 40 years in the upstream business. He has amassed an impressive list of global contacts coupled with a proven track record in acquiring natural gas and raising capital for acquisitions. |

| Proven Management Team Clark Huffman, Ph.D. Career Highlights: Developed, practiced, and taught analytic and empirical methods for reservoir and completion characterization Commercialized production data analysis software VRAPA which was a product of doctoral dissertation research Conducted reservoir studies of many low permeability and unconventional reservoirs including Bakken, Baxter, Lance, and Mesa Verde formations VP, Operations Dr. Huffman has over 30 years of experience in petroleum engineering and field operations, both on-shore and off-shore, domestic and international. His particular expertise centers around reservoir evaluation to maximize value. Gregory A. Whiting VP, Business Development Mr. Whiting has spent over 25 years in the energy sector, with a proven track record and particular expertise in natural gas acquisition, financing, structuring, accounting and transaction integration. Career Highlights: Integral role in the acquisition (including valuation, due diligence, negotiation and integration) of multiple upstream assets Participated in over $6.0B of Municipal Gas Prepaid transactions in multiple roles of the structure Involved in multiple structured financing vehicles including a refined products linefill credit facility, pad gas financings, volumetric production payment portfolios, and taxable prepayment structures Integral role in restructuring several distressed financing vehicles |

| Proven Management Team Adam Fenster CFO Mr. Fenster has over 20 years of financial and accounting experience with companies both public and private. His broad-based business experience affords him a unique perspective for small cap companies looking to develop successful growth strategies coupled with disciplined execution. Career Highlights: Principal in AW Fenster & Co., providing strategic consulting and executive level management services in finance and accounting, primarily to public oil and gas clients While at NAFTA Traders, Inc., led the startup of e- commerce business, Shoebacca.com, which generated revenue of over $4 million during its first year, and achieved revenue of over $20 million in its fourth year of business Key participant in several initial public offerings and debt re-financings William A. Sidwell, III VP, Corporate Strategy Mr. Sidwell oversees corporate strategy development, business planning and implementation along with all internal and external communications. During his 30 year career, Mr. Sidwell has assisted several companies in realizing greater levels of success. Career Highlights: Repositioned Ryder from an 85-year old trucking company into a solutions provider that helps companies manage their supply chain functions Repositioned NRG Energy from a base load power generator into "The Energy Company for the 21st Century". Completed company-wide re-brand in less than 12 weeks with no loss of retail customers or market position Increased Hewlett Packard's ("HP's") brand value by 73%; branded premiums increased 53.1% Developed business strategy and operating model for HP's Brand Licensing Practice. Revenues exceeded $20M in first year; $200M in year 2 |

| "Invest in big ideas from small companies." -Statoil |

| FOCUS AND EXECUTION |

| Escalera Business Strategy Establish Escalera as the vehicle of choice for those wanting to partner with and invest in the acquisition of low cost dry natural gas and enhance its value significantly. Optimization Vehicle NATURAL GAS CAPITAL GTL Strategy: Use capital as "Dials"...(spend and/or reinvest; increase and decrease as needed) Exploit availability of low cost natural gas supplies through acquisitions Funded by equity offerings, debt, joint ventures and/or any combination thereof Leverage Escalera's proven experience (low cost operator/producer) Manage natural gas assets in stand-alone fashion; acquire assets with development potential, develop current assets Value creation via management, operational and technical expertise Deploy capital for GTL engineering development & advancement |

| Proven Execution - Wyoming Assets Proven Execution - Wyoming Assets Escalera Production & Leasehold (NON-OP) Building shareholder value by owning and acquiring dry natural gas Escalera Production & Leasehold (OP & NON-OP) |

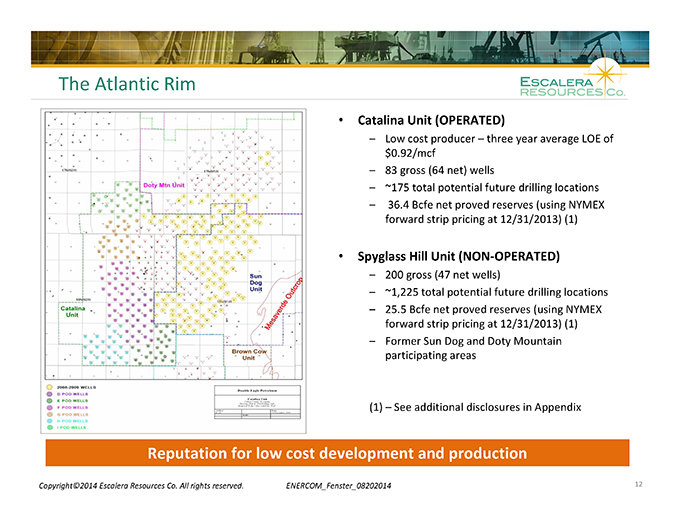

| The Atlantic Rim The Atlantic Rim Catalina Unit (OPERATED) Low cost producer - three year average LOE of $0.92/mcf 83 gross (64 net) wells ~175 total potential future drilling locations 36.4 Bcfe net proved reserves (using NYMEX forward strip pricing at 12/31/2013) (1) Spyglass Hill Unit (NON-OPERATED) 200 gross (47 net wells) ~1,225 total potential future drilling locations 25.5 Bcfe net proved reserves (using NYMEX forward strip pricing at 12/31/2013) (1) Former Sun Dog and Doty Mountain participating areas (1) - See additional disclosures in Appendix Reputation for low cost development and production |

| Pinedale Anticline 13 13 Producing Assets (NON-OPERATED) Operated by QEP 219 producing wells in three units: Mesa A - 45 wells Mesa B - 140 wells Mesa C - 34 wells 30 Bcfe of 2P reserves (using NYMEX forward strip pricing at 12/31/2013) (1) 43% PD; 35% PUD; 22% Prob Long-lived reserves Upside Potential Mesa C to be drilled up beginning in 2017-2018; 166 potential additional locations. Escalera has an approximate 6% reversionary carried WI Mesa A drilling in 2014; 100 potential additional locations; Escalera has a 0.3125% ORRI (1) - See additional disclosures in Appendix Strong development potential |

| GAS TO LIQUIDS (GTL) |

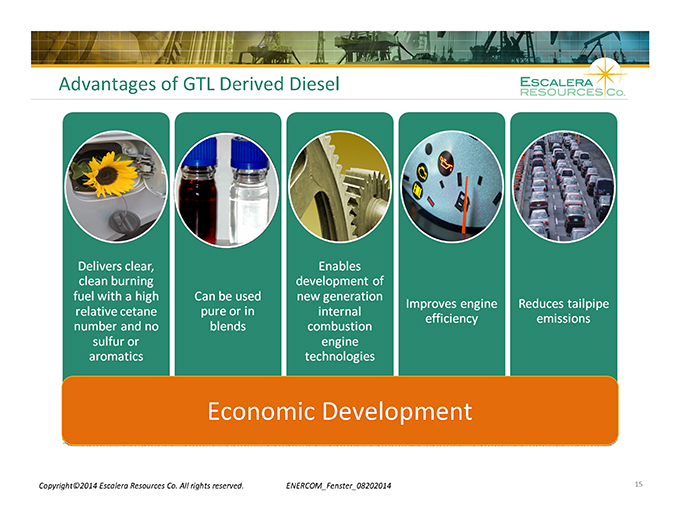

| Advantages of GTL Derived Diesel Advantages of GTL Derived Diesel Economic Development |

| Why Change Natural Gas to Liquids? Crude Oil $15.68 per MMBtu $4.49 per MMBtu Energy Information Administration (EIA) expects average 2015 prices for crude oil (WTI) to be $90.92 per barrel (One barrel crude has 5.8 MMBtu, $90.92/5.8 = $15.68 per MMBtu for crude. Natural gas (NYMEX) to be $4.49 per MMBtu Natural Gas Valuation by BTU Content Unrefined crude oil is almost 3.5 times more valuable than natural gas 3.5 Diesel from Crude Oil Diesel from Natural Gas $19.28 per MMBtu $21.15 per MMBtu GTL diesel is 4.7 times more valuable than natural gas 4.7 |

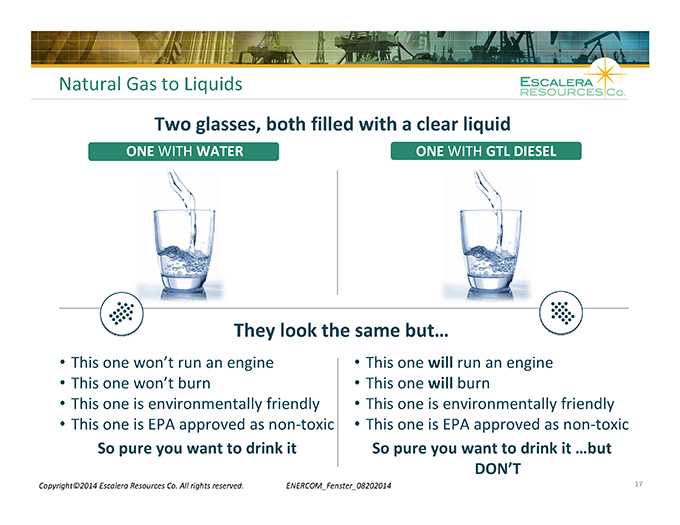

| Natural Gas to Liquids Two glasses, both filled with a clear liquid ONE WITH WATER ONE WITH GTL DIESEL They look the same but... This one won't run an engine This one won't burn This one is environmentally friendly This one is EPA approved as non-toxic So pure you want to drink it This one will run an engine This one will burn This one is environmentally friendly This one is EPA approved as non-toxic So pure you want to drink it ...but DON'T |

| Conclusion Escalera has a well-defined view of the market: Contrarian Position: Acquire dry natural gas cheaply; exploit production economically, develop as market conditions allow and identify opportunities to enhance its value significantly Escalera has a focused strategy: Approach: Dry natural gas focus; buy opportunistically Value Drivers: Low cost dry natural gas (accretive now), operational expertise, technical & developmental expertise Capital re-investment Escalera has initiatives to deliver growth: Stand alone, significant dry natural gas acquisition program Dry natural gas asset development Opportunity to acquire and convert abundant, low cost dry natural gas to high value diesel using gas-to-liquids (GTL) technology Escalera has execution ability Proven natural gas acquisition leadership - acquisition, development and exploitation Management team with proven ability to execute Strong operational reputation Copyright(c)2014 Escalera Resources Co. All rights reserved. |

| "Invest in big ideas from small companies." -Statoil |

| Appendix Proved Reserves Forward NYMEX strip pricing at December 31, 2013 utilizes NYMEX pricing for the next five years, with subsequent pricing on a per mcf basis held constant and/or escalating at various rates per year to $4.00 per mcf in 2033. Our pricing for 2013 year-end reserves in our 2013 10-K was $3.24 per mcf. |