Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GENERAL STEEL HOLDINGS INC | v378684_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - GENERAL STEEL HOLDINGS INC | v378684_ex99-1.htm |

Exhibit 99.2

1 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. First Quarter 2014 Earnings Call Presentation May 15, 2014 ,

2 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. Safe Harbor Statement This presentation (including the financial projections and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of General Steel Holdings, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, any comments relating to our financial performance, the competitive nature of the marketplace, the condition of the worldwide economy and other factors that have been or will be detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . gshi - steel . com . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise . This presentation is intended to be viewed in conjunction with the General Steel Holding, Inc. fourth quarter and fiscal year 20 10 earnings call. This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings c all .

3 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. Review of Progress on Key Initiatives Agenda China Steel Industry Dynamics First Quarter 2014 Highlights Henry Yu, Chief Executive Officer John Chen, Chief Financial Officer Q&A Review of F inancials

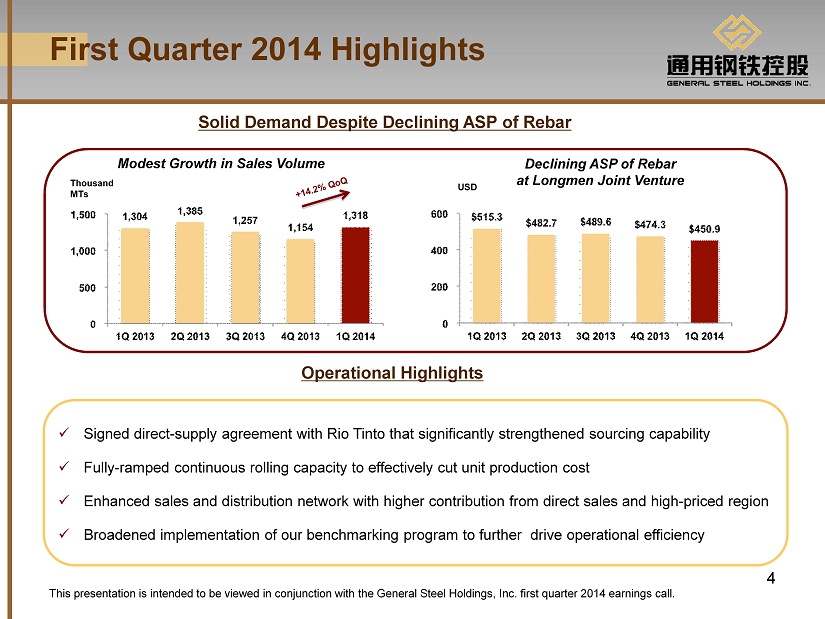

4 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. First Quarter 2014 Highlights Modest Growth in Sales Volume Operational Highlights x Signed direct - supply agreement with Rio Tinto that significantly strengthened sourcing capability x Fully - ramped continuous rolling capacity to effectively cut unit production cost x Enhanced sales and distribution network with higher contribution from direct sales and high - priced region x Broadened implementation of our benchmarking program to further drive operational efficiency Declining ASP of Rebar at Longmen Joint Venture Solid Demand Despite Declining ASP of Rebar Thousand MTs USD

5 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. » Increasing demand in peak seasons in 2Q 2014 ▪ PMI for steel industry in April rebounded to 52.6%, (improvement of 8.4% MoM) » Stabilized steel pricing environment and decreasing purchasing price of iron ore » Government raised overcapacity reduction targets in China for 2014 » GSI’s sole election as qualified steel maker in Shaanxi province by MIIT » ASP of rebar at GSI’s Longmen Joint Venture of $450.9/ton (down 12.5% YoY and down 4.9% QoQ) » Crude steel production of 202.7 million metric tons (YoY growth rate of 2.4%) » Roughly 45% of steel companies running at loss Sharp Drop in ASP and Continued Over - capacity China Steel Industry Dynamics Depressed China Steel Sector in 1Q 2014 Potential Catalysts in 2H 2014 China Steel Production and Pricing Monthly Mln MT Rmb/t * Source: China Iron and Steel Association Downward Trend for Iron Ore in 2014 Rmb/t China Iron Ore Spot Price Hebei/Tangshan Source: Morgan Stanley Source: Bloomberg

6 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. Strengthened Direct Sales Yielded Positive Benchmarking Savings Ramped Up Continuous Rolling Capacity Continued Progress on Key Initiatives General Steel made continued progress in enhancing its own effectiveness and efficiency of management and operations. x Further eliminating intermediate re - heating costs, transportation, and outsourced - processing cost, thereby reducing overall unit production cost x Fully ramped up utilization x Saved overall production cost by over RMB 22 million in 1 Q 2014 by internal estimation x Enhanced sales to high - priced region x Strengthened direct sales to government and SOEs Statistics in 1Q 2014 based on GSI’s internal assessment: x Unit ferrous charges consumption per ton of rebar decreased to 1,014.40 kg/ton x Comprehensive energy consumption per ton of rebar decreased to 484.73 kgec/ton x Both metrics reached industry - leading level Top five Distributors , 20% Sales Channel Breakdown in 1Q 2014

7 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. 1,255 1,317 49 1 1Q 2013 1Q 2014 Other Subsidiaries Longmen Joint Venture Items 1Q 2014 1Q 2013 Y - o - Y% Total Sales Volume (Thousands MT) 1,318 1,304 +1.1% ASP of Rebar** (US$/per MT) 450.9 515.3 - 12.5% Revenue (US$ million) 594.2 651.3 - 8.8% Gross (Loss)/Profit (US$ million) - 22.6 4.1 N.A. Operating Income (Loss)* (US$ million) - 43.7 31.9 N.A. Finance Expense (US$ million) - 28.7 - 24.9 +15.4% Net (Loss)/Income Attributable to General Steel Holdings.* (US$ million) - 43.6 3.1 N.A. EPS* (US$) - 0.78 0.06 N.A. First Quarter 2014 Financial Summary Sales Volume Breakdown * Includes $(49,000) change in fair value of profit sharing liability for the first quarter of 2014; * ASP of rebar at Longme n J oint Venture Thousands MT Operating Expense Breakdown 8.1 8.3 10.9 12.7 1Q 2013 1Q 2014 Selling Expense G&A Expense USD Million

8 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. Balance Sheet Summary AS OF (USD 1,000) March 31, 2014 December 31, 2013 Assets: Cash and Restricted Cash $464,993 $431,300 Accounts Receivable $8,862 $7,020 Notes Receivable $81,998 $60,054 Inventories $210,761 $212,921 Advances on Inventory Purchases $164,764 $127,900 Total Current Assets $1,336,795 $1,380,724 Property Plant and Equipment $1,269,199 $1,271,907 Total Assets $2,701,512 $2,700,358 Liabilities: Short Term Notes Payable $963,357 $1,017,830 Accounts Payable $795,937 $670,671 Short Term Loan $383,893 $490,677 Customer Deposits $252,368 $152,741 Taxes Payable $7,276 $4,628 Total Current Liabilities $ 2,634,383 $ 2,562,140 Capital Lease Obligations, noncurrent $ 376,025 $ 375,019 Profit Sharing Liability $ 160,956 $ 162,295

9 This presentation is intended to be viewed in conjunction with the General Steel Holdings, Inc. first quarter 2014 earnings call. 9 Q&A Jenny Wang Joyce Sung General Steel Holdings, Inc. General Steel Holdings, Inc. Tel: + 86 - 10 - 5775 - 7691 Tel: +1 - 347 - 534 - 1435 Email: jenny.wang@gshi - steel.com Email: joyce.sung@gshi - steel.com ,