Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Pittsburgh | d691026d8k.htm |

Exhibit 99.1

WELCOME

Regional Conferences

March 2014 |

| Cautionary Statement Regarding

Forward-Looking Information

2

Statements contained in these slides, including statements describing the objectives, projections,

estimates, or predictions of the future of the Bank, may be “forward-looking

statements.” These statements may use forward-looking terms, such as “anticipates,”

“believes,” “could,” “estimates,” “may,” “should,”

“will,” or their negatives or other variations on these terms. The Federal Home Loan

Bank of Pittsburgh (the Bank) cautions that, by their nature, forward-looking statements involve risk or uncertainty and that

actual results could differ materially from those expressed or implied in these forward-looking

statements or could affect the extent to which a particular objective, projection, estimate, or

prediction is realized. These forward-looking statements involve risks and uncertainties

including, but not limited to, the following: economic and market conditions, including, but not limited to, real estate,

credit and mortgage markets; volatility of market prices, rates, and indices related to financial

instruments; political, legislative, regulatory, litigation, or judicial events or actions;

changes in assumptions used in the quarterly Other-Than-Temporary Impairment (OTTI)

process; risks related to mortgage-backed securities; changes in the assumptions used in the allowance for

credit losses; changes in the Bank’s capital structure; changes in the Bank’s capital

requirements; membership changes; changes in the demand by Bank members for Bank advances; an

increase in advances’ prepayments; competitive forces, including the availability of other

sources of funding for Bank members; changes in investor demand for consolidated obligations and/or the

terms of interest rate exchange agreements and similar agreements; changes in the FHLBank

System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new

products and services to meet market demand and to manage successfully the risks associated

with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on

consolidated obligations for which it is the primary obligor and with respect to which the Bank has

joint and several liability; applicable Bank policy requirements for retained earnings and the

ratio of the market value of equity to par value of capital stock; the Bank’s ability to

maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and

capital plan adjustments and amendments; technology risks; and timing and volume of market activity.

We do not undertake to update any forward-looking information. Some of the data set forth

herein is unaudited. |

2013

Highlights and 2014 Strategy Winthrop Watson

March 2014

a |

| 2013

Highlights: Delivering Member Value •

Increased member activity

•

Strong financial performance

•

Increased contributions to the Affordable Housing

Program

•

Technology improvements that support operational

integrity |

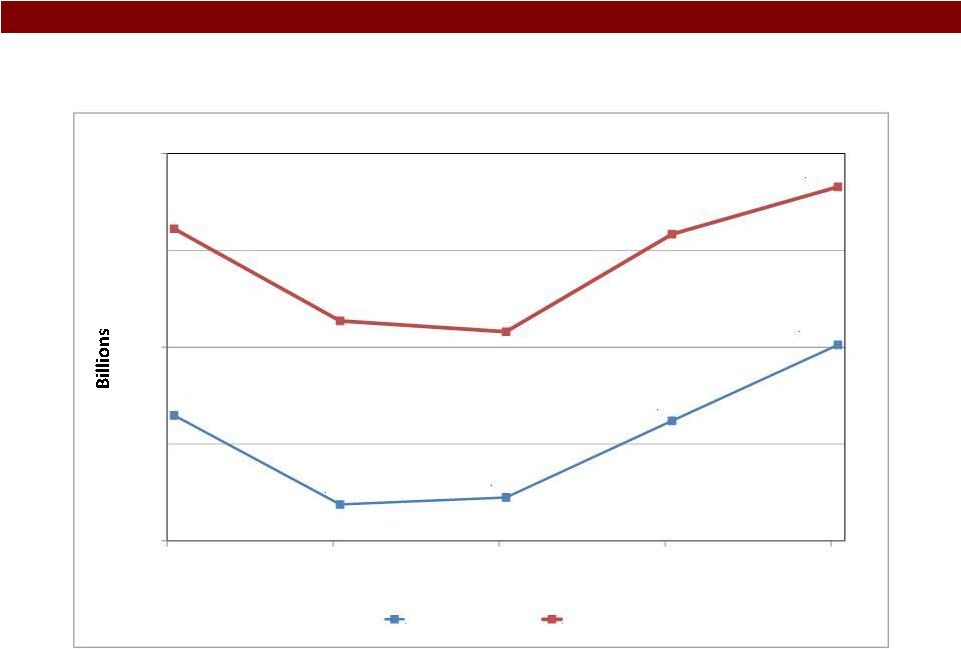

Advance and Asset Trend

6

$41.2

$29.7

$30.6

$40.5

$50.3

$65.3

$53.4

$52.0

$64.6

$70.7

$25

$50

$75

12/09

12/10

12/11

12/12

12/13

Advances

Assets |

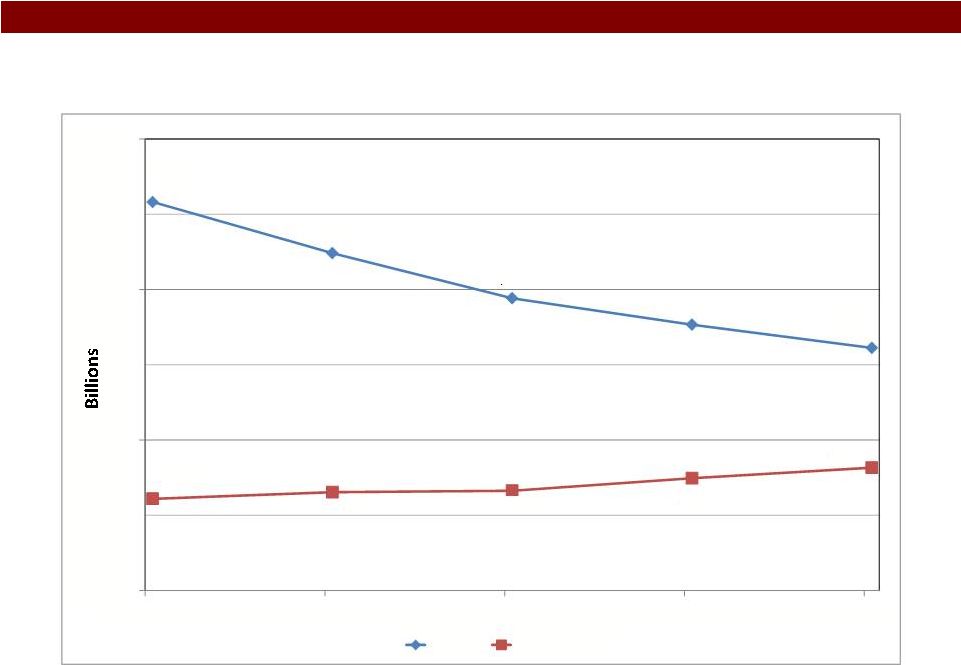

Increased Member Activity -

Advances

-

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

45.0

2009

2010

2011

2012

2013

Top Ten

Borrowers

-

2.0

4.0

6.0

8.0

10.0

12.0

2009

2010

2011

2012

2013

Membership

Minus Top Ten |

Letters of Credit

7

$8.5

$9.6

$6.6

$7.2

$14.7

$5

$10

$15

12/09

12/10

12/11

12/12

12/13 |

Mortgages Held for Portfolio (MPF Program)

8

$5.2

$4.5

$3.9

$3.5

$3.2

$1.2

$1.3

$1.3

$1.5

$1.6

$-

$2

$4

$6

12/09

12/10

12/11

12/12

12/13

MPF

Original |

Market Value / Capital Stock

74%

93%

97%

115%

128%

50%

100%

150%

12/09

12/10

12/11

12/12

12/13

Par |

Net

Income 4

$(37.5)

$8.3

$38.0

$129.7

$147.8

$(50)

$-

$50

$100

$150

2009

2010

2011

2012

2013 |

Increased AHP Contributions

In millions

$0

$2

$4

$6

$8

$10

$12

$14

$16

2009

2010

2011

2012

2013 |

Excess Capital Stock Repurchased

Monthly

repurchases

began

$1.2

$1.9

$1.3

$0.6

$0.0

$-

$1

$2

12/09

12/10

12/11

12/12

12/13 |

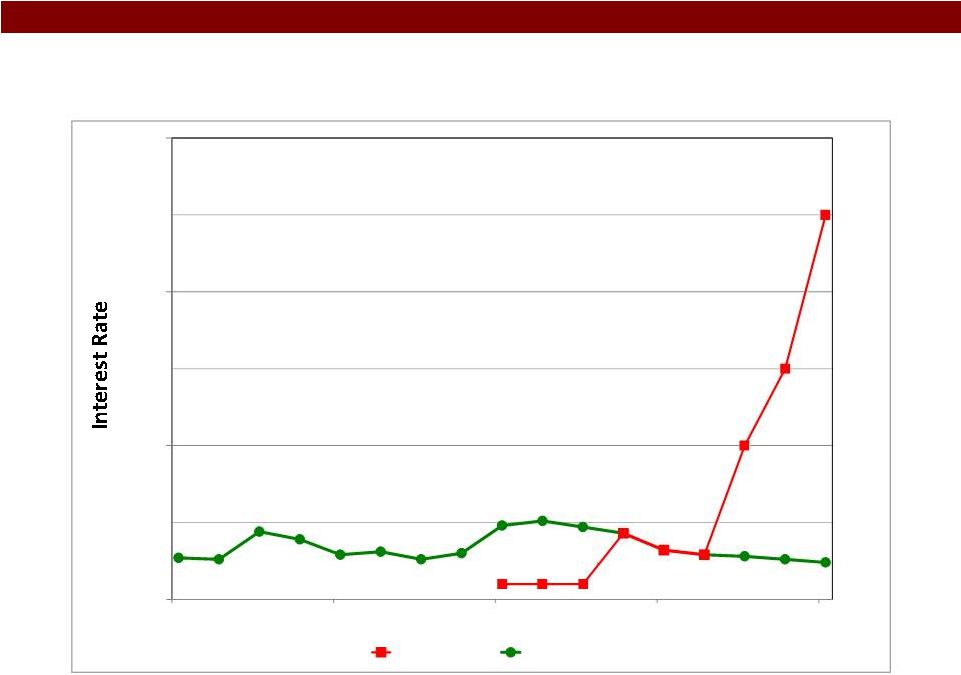

Dividend

11

0.10%

0.10%

0.10%

0.43%

0.32%

0.29%

1.00%

1.50%

2.50%

0.0%

1.0%

2.0%

3.0%

12/09

12/10

12/11

12/12

12/13

Dividend

3-month LIBOR |

Earned Dividend Spread (EDS)

5

EDS -

Return on member capital stock in excess of 3-month LIBOR |

Dividend Considerations

•

Specific factors that will impact

the amount of future dividends

include:

–

The

level of retained

earnings with respect to the

Bank’s retained earnings

target and total AOCI

–

Market value to capital

stock ratio above 90%

–

Adequate excess regulatory

capital

–

Positive quarterly GAAP

earnings

Retained Earnings Framework |

Dividend Considerations

Regulatory Capital

Retained Earnings net of AOCI

Net Income

Market Value / Capital Stock |

High Performance FHLBank

17

2013 –

2017 Strategic Plan

Build Strength and

Flexibility

Embrace Operational

Excellence

Serve the Membership

Vitalize Communities |

High

Performance FHLBank Historically

Currently

Prospectively |

Capital Stock Plan Changes

Kris Williams

March 2014 |

| Objectives of the Capital Stock Plan

•

Assure a fair and equitable allocation of the Bank’s

capital needs and requirements between total

membership and activity-based users of the cooperative

•

Support effective management and capitalization of the

Bank’s balance sheet

–

Membership liquidity

•

Enable the Bank to meet our regulatory capital

requirements

–

Capital ratio

–

Leverage ratio

–

Risk-based capital |

| Current Capital Stock Plan Recap

–

Membership:

0.35% of MAV

–

Advances:

4.00% (effective September 2013)

–

MPF:

4.00%

–

Letters of Credit (LCs):

0.75% (effective March 18, 2014)

•

Plan consists of membership and activity requirements

•

Activity-based capital accounts for the majority of

contributed capital

•

Recap of current requirements:

•

Similar structure to most FHLBanks |

| Why

Modify the Capital Stock Plan? •

Bank’s Strategic Plan calls for revision of the Capital

Plan to make it:

•

Retained earnings have grown considerably and will

account for an increasing percentage of capital

1.

More dynamic and reflective of the projected growth in retained

earnings

2.

An active tool to create subclasses of stock and potential to

reward product usage |

Capital Plan Modifications Summary

** B1 may be tied to a market benchmark

Component

Current

Proposed

Stock requirement range

Advances

3.00% -

6.00%

2.00% -

6.00%

Letters of Credit

0.00% -

3.00%

0.00% -

4.00%

Forward starting advances*

None

0.00% -

6.00%

Stock subclasses

None

B2 -

Activity

Dividend distinctions

None

May declare different

dividends for each

subclass (intend for B2

dividend to exceed B1

dividend)**

* Applies to advances starting more than 30 days from trade date

** For example, B1 dividend may be tied to a benchmark

B1 -

Membership

|