Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VISTEON CORP | d681270d8k.htm |

Tim Leuliette

February 25, 2014

2014 Investor Day

Exhibit 99.1 |

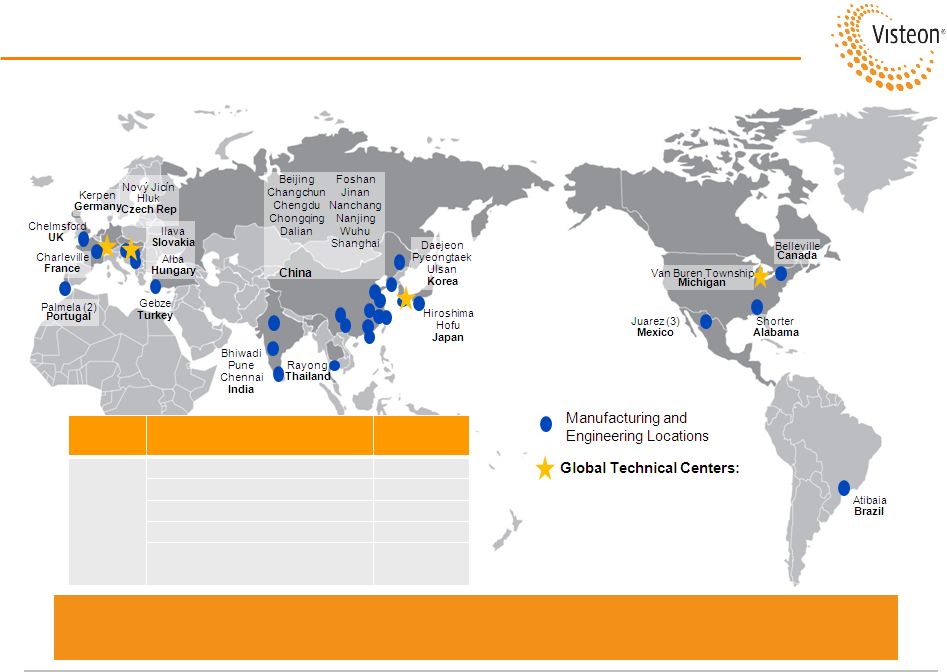

Overview

Global auto supplier of climate, electronics and interiors products

Worldwide

manufacturing/engineering

footprint

with

emphasis

on

low-cost

regions

Strategically positioned to capitalize on emerging-market growth

2013 consolidated sales of $7.4 billion

$4.9 Billion

Climate

Interiors

Electronics

Visteon Today

$1.5 Billion

($3.0

Billion

w/

YFVE

Consolidation

and

JCI

Acquisition)

$1.3 Billion

Page 2

2013

Sales

Key Businesses

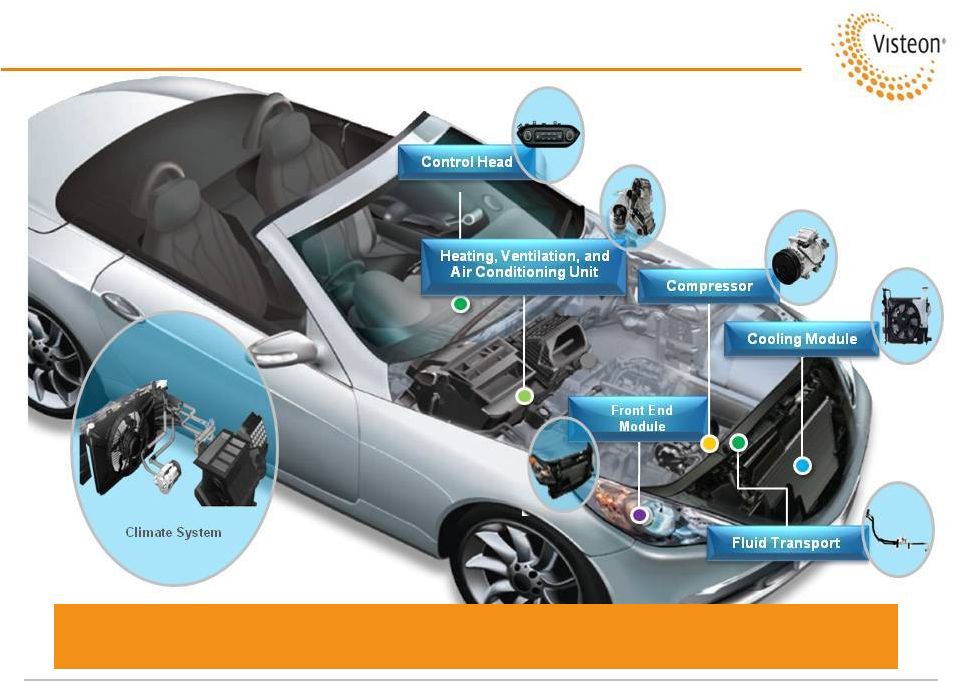

HVAC Systems

Powertrain Cooling

EV & Hybrid Battery Cooling

Compressors

Fluid Transport

Audio and Infotainment

Information and Controls

Vehicle Electronics

Cockpit Modules

Instrument Panels

Consoles

Door Trim |

Page 3

Visteon Continues to Deliver Value

Solid financial performance

–

2013 Adjusted EBITDA (including equity income and NCI) of $704 million, up $78

million Y/Y Visteon business drastically simplified and easier to

understand –

Contributed Climate business to Halla in Q1 2013 to create Halla-Visteon

Climate Control (HVCC) –

Announced sale of YFV for net cash proceeds of ~$1.2 billion (pre-tax)

–

Consolidating YFVE, through increased ownership

–

Simplified corporate structure and fixed cost / SG&A reductions

Focused on two world-class, market-leading businesses

–

#2 in Climate, becoming #2 in Driver Information and Controls with acquisition of

JCI electronics –

Two high growth, high margin businesses with industry-leading

technologies Focused on Optimizing Visteon’s Core Business

Portfolio |

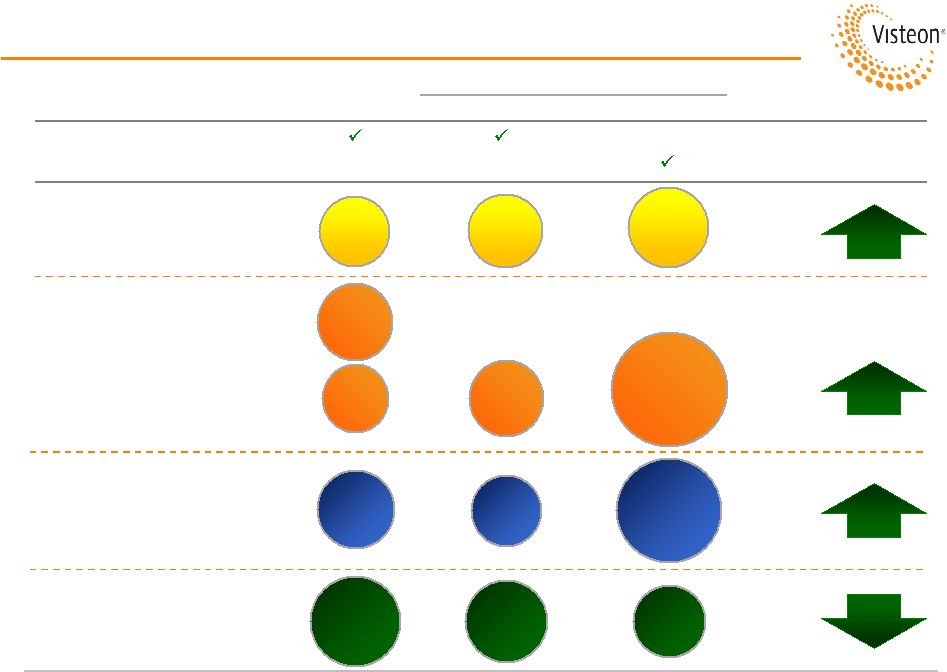

Page 4

10.6%

Climate

Interiors

Electronics

8.3%

1.9%

(1) Represents 2013 sales and Adjusted EBITDA margin (ex. equity income /

NCI). % Margin

(1)

#2 climate player globally

One

of

only

two

“full-line”

suppliers

$680 million backlog

Plans in place to divest

Continue to invest in business

#3 global market position in

information and controls post

JCI acquisition

Full cockpit electronics portfolio

$4.9 Billion

$1.5 Billion

$1.3 Billion

Sales

(1)

Continue to Optimize Our Product Portfolio

Product Portfolio

Focused on Two Highest Margin Products |

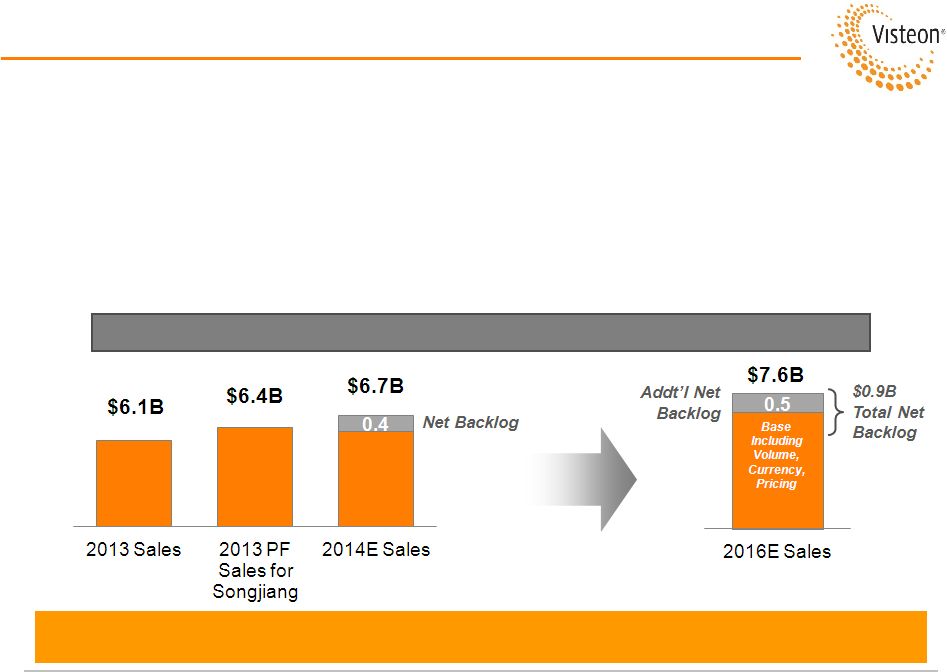

Climate and Electronics (Excluding Interiors and JCI Electronics)

Page 5

Strong Products & Technology Driving Growth

•

At last year’s Deutsche Bank Conference, Visteon disclosed an $800 million

backlog (new

incremental

business

net

of

lost

business

which

will

launch

over

the

next

3

years)

–

99% related to core Climate and Electronics

–

48% of the backlog launched in 2013 (2013 sales projected to be over $500 million

higher than 2012) •

Visteon current three-year backlog for core Climate and Electronics stands at

~$900 million –

$350 million in 2014, $400 million in 2015, $150 million in 2016

Page 5

Strong Three–Year Backlog in Core Climate & Electronics

|

$149M

$7.4B

$600M

51.1M

135%

2017 Targets: The Investment Premise

Page 6

Sales

Adjusted EBITDA

(2013 Definition)

‘17 vs. ‘13

31%

67%

Wt. Avg. Shares

Outstanding

(3)

(1)

2013

and

2014

exclude

impact

of

Interiors

exit

and

JCI

Electronics

acquisition.

(2)

Excludes

Equity

Income

and

NCI.

(3)

Assumes

$500

million

in

share

repurchases

in

2014.

Assumes

full

$875

million

authorized

program

completed

by

end

of

2015.

Adjusted

Free Cash Flow

(ex. impact of YFV transaction)

21%

2017E

~$350M

~$9.7B

~$1,000M

~40.2M

2013A

(1)

Adjusted

EBITDA

(2014/Peer Definition)

(2)

$704M

Guidance Midpoint

(1)

2014E

$125M

$7.8B

$680M

~45.5M

Includes Interiors

Includes JCI Electronics

x

x

x |

Page 7

Our Near Term Focus to Achieve 2017 Targets…

Maintain Focus on Core Value-Creating Assets

–

Climate and Electronics businesses are market leaders

–

Both exhibit higher than segment growth

Optimize Electronics

–

Address Electronics’

strategy and global position and integrate JCI Electronics

–

Integrate Yanfeng Electronics non-consolidated operations

Divest Interiors

–

Non-core business

–

Sale or alternative strategic placement of business

Drive Further Overhead Cost Savings

–

Continue to execute fixed cost and SG&A cost reductions

–

Achieve lean corporate overhead structure

Focused on Growing our Core Businesses and Addressing Legacy Issues

Continue to Address Legacy Issues |

www.visteon.com

*

*

*

* |

YH

Park Feb. 25, 2014

HVCC Product / Technology Strategy |

HVCC at a glance -

Video

Page 2 |

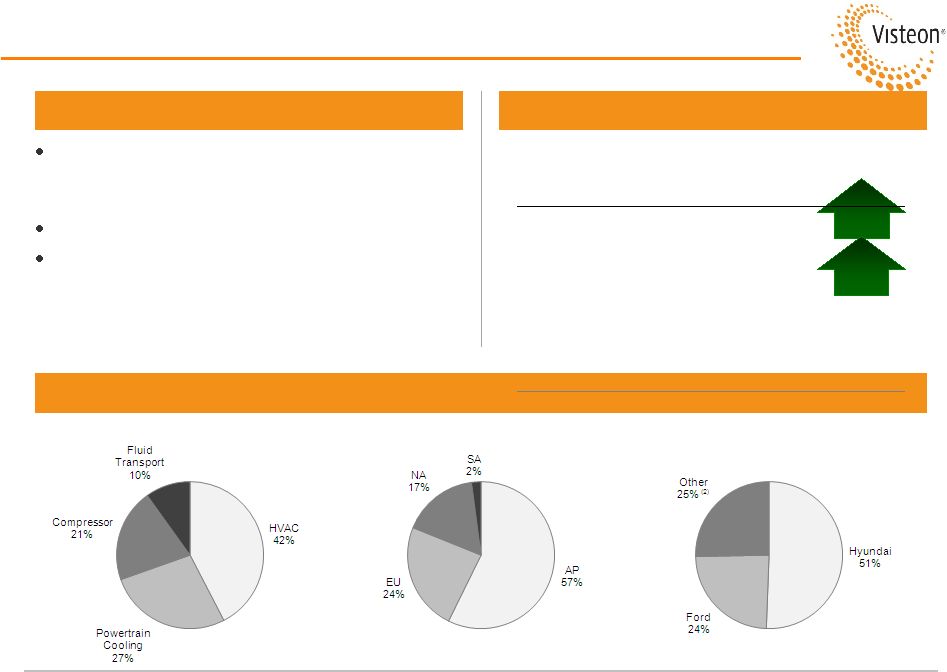

Financial Highlights

Page 3

Financial Highlights

FY 2013 Financial Results

2013 Sales Breakdown

Strong growth profile with $680 million backlog

–

7% sales CAGR between 2014 and 2017

–

China sales now exceed $900 million annually

Strong balance sheet, with net cash position

Stock price up 64% in 2013

(Dollars in Millions)

2013

B/(W)

‘12

Sales

$4,871

+14%

Adjusted

EBITDA

(1)

$514

+21%

% Margin

(1)

10.6%

By Product

By Region

By Customer

(1) Excludes equity income and non-controlling interests. (2)

Multiple customers all under 2% share |

Positioned for Growth

Clear #2 global climate player, with 13% market share

Leading product and technology portfolio

One of only two “full-line”

suppliers

Customer-focused solutions provider with a worldwide presence

Global manufacturing footprint supporting OEMs

Gaining share in growing markets

Page 4

A World-Class Climate Organization |

Global Footprint

Page 5

Market

Countries

# of MFG

(%)

Emerging

China

10

South Asia

4

Eastern Europe/Russia

7

Mexico/South America

5

Subtotal

26

74%

35 Manufacturing Facilities and Four Technical

Centers Headquarters:

Daejeon, Korea |

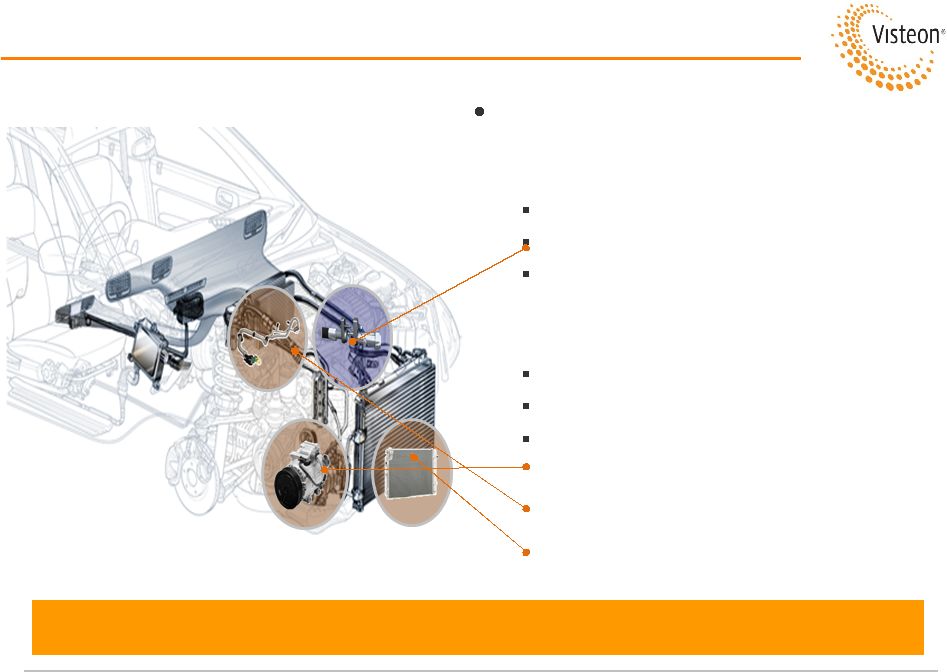

Automotive Climate Control Systems

Page 6

One of Two Full-Line Systems Providers |

Fuel Economy

Page 7

A/C System Operation Impacts Fuel Economy |

Regulations

Page 8

Strict Fuel Economy Standards and Emissions-Related

Regulations * EPA : Environmental Protection Agency

* NHTSA : National Highway Traffic Safety Administration

* CAFE: Corporate Average Fuel Economy

* Legislated by EPA and NHTSA

* Legislated by Chinese and Japanese governments

* Legislated by EU Committee |

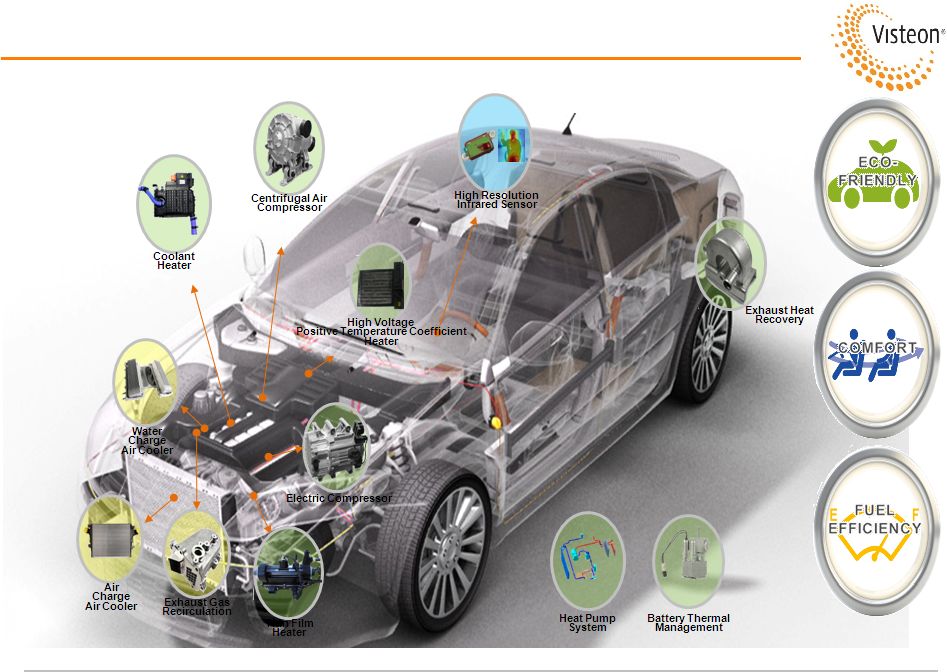

Market Drivers and Trends

Demand increase for

HEV / EV / FC

Alternative refrigerant

systems

R744 and R1234yf

Cabin air quality

Comfort control

Reduced noise, vibration

and harshness (NVH)

High efficiency system for

fuel economy

Engine downsizing

with turbo charger

Weight reduction

Heat recovery

Stop-Start

Page 9

Solutions That Address Market and Industry Demands |

Products Delivering Value Today

Conventional products to meet

regulations:

–

Direct contribution

Metal Seal Fitting

R744 System

1234yf System

–

Indirect contribution

Variable Compressor

Internal Heat Exchanger (HEX)

Improved Condenser and Evaporator

Page 10

Conventional Market Appreciated Products |

Thermal Energy Management Solutions

Page 11 |

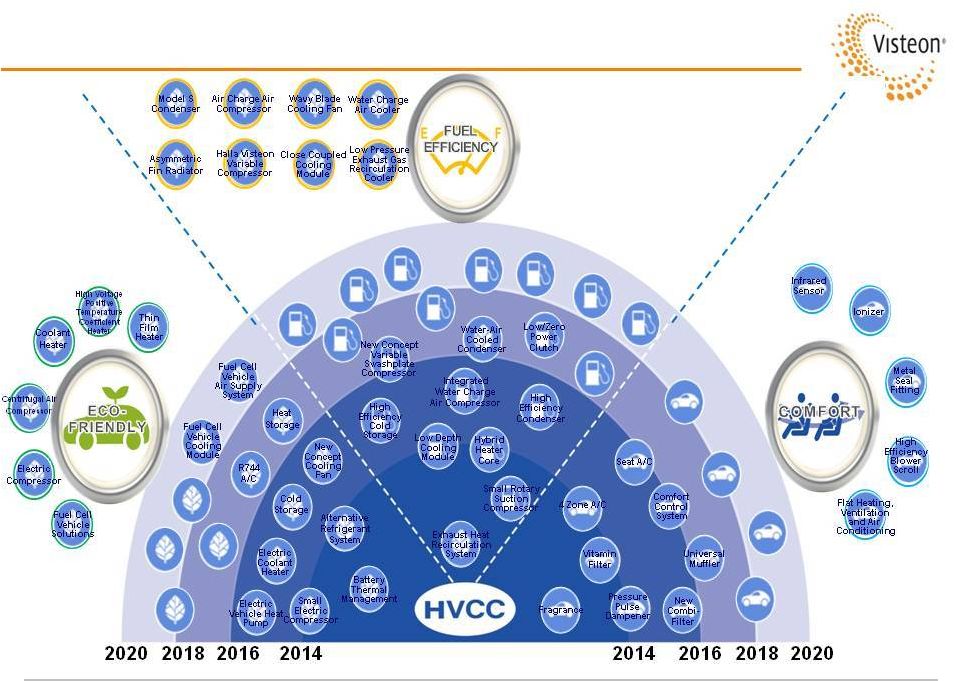

HVCC Technology Roadmap

Page 12 |

HVCC: World-Class, Innovative Product Portfolio

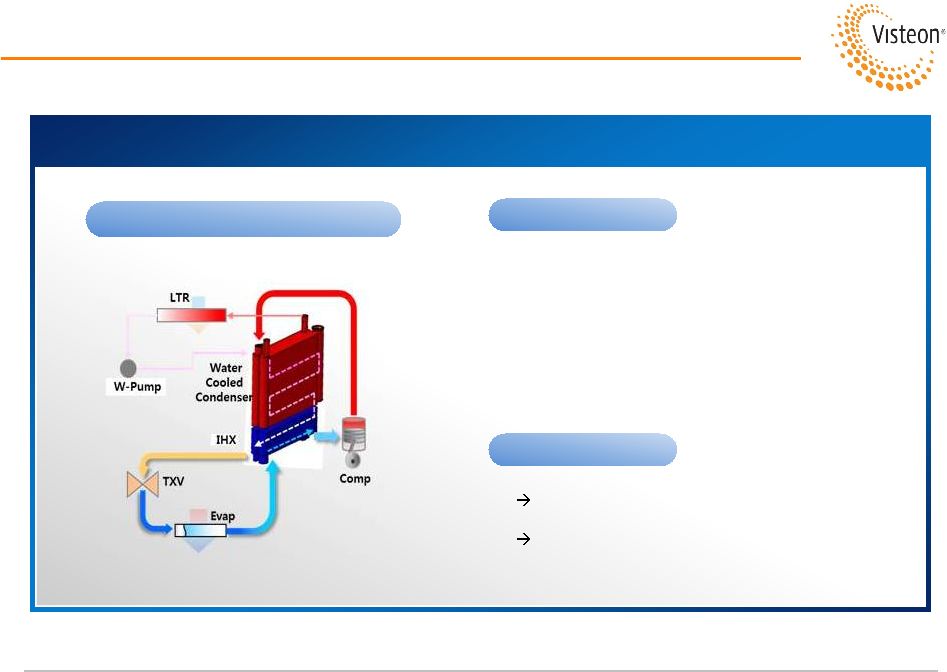

IHX Sub-Cooled Water Cooled Condenser

IHX Sub-Cooled Water Cooled Condenser

Page 13

Mechanism

•

Water cooled condenser provides better cooling

performance, compared to conventional air cooled

condensers

•

IHX cools down again refrigerant that is already cooled

by water cooled condenser

Customer Benefit

•

Compressor power consumption reduced by 20%

Provides additional 1.1 g/mile CO2

credits to customers

•

Integration of IHX with water cooled condenser

World’s first

IHX : Internal Heat Exchanger |

HVCC: World-Class, Innovative Product Portfolio

High Resolution IR Sensor

Adaptive Temperature Control Using High Resolution IR Sensor

Page 14

Mechanism

The infrared red sensor:

•

Detects a human body separate from cabin with

increased accuracy

•

Analyzes vehicle occupants (e.g., number of passengers,

seating area, height, weight, clothes, body heat, etc.) to

optimize and fully automate the climate control

Customer Benefit

•

Offers customized passenger thermal comfort

•

Improves fuel efficiency 3%

2013 award for excellence in new technology by HMG

IR Sensor : Infrared Sensor |

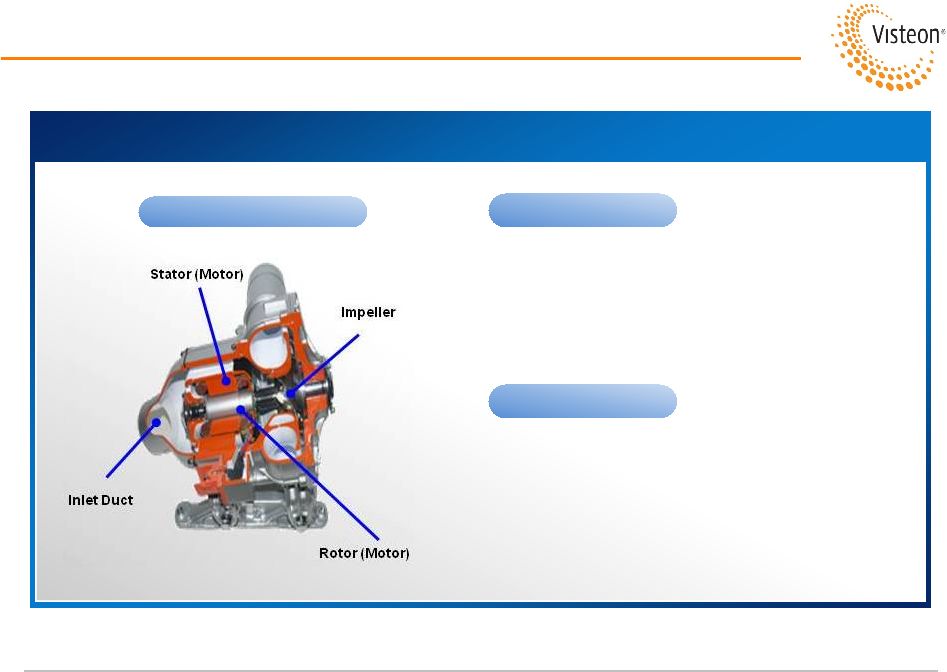

HVCC: World-Class, Innovative Product Portfolio

Centrifugal Air Compressor

Centrifugal Air Compressor

Page 15

Mechanism

•

Provides compressed and pressurized air as needed to

the fuel cell stack to create a hydrogen chemical reaction

Customer Benefit

•

17% improvement of performance, compared to screw

type for a 2% fuel efficiency improvement

•

Compact size and weight

•

Operates at high rotating speeds with low noise

Fuel cell: powers fuel cell vehicle |

Industry Technology Achievements

Page 16

Centrifugal Air

Compressor

Zero Waste Dispense

Compressor Coating

Metal Seal Fitting

Wavy Blade

Fan

Industry Recognition for Innovative Technology Development

|

Summary

Market-leading and differentiated solutions

Ready to earn maximum U.S. regulation A/C credits

Focused on delivering innovative solutions that are eco-friendly, efficient and

deliver comfort

Above market growth through customer diversification and continuous stream of

new products

Margin performance based on operational efficiency and technical

innovation

Page 17

Automotive Thermal Energy Management Solution Provider

|

www.visteon.com

*

*

*

* |

Martin Thall

President Electronics Group

February 25, 2014

Visteon Electronics |

Our

World Is Changing Page 2 |

|

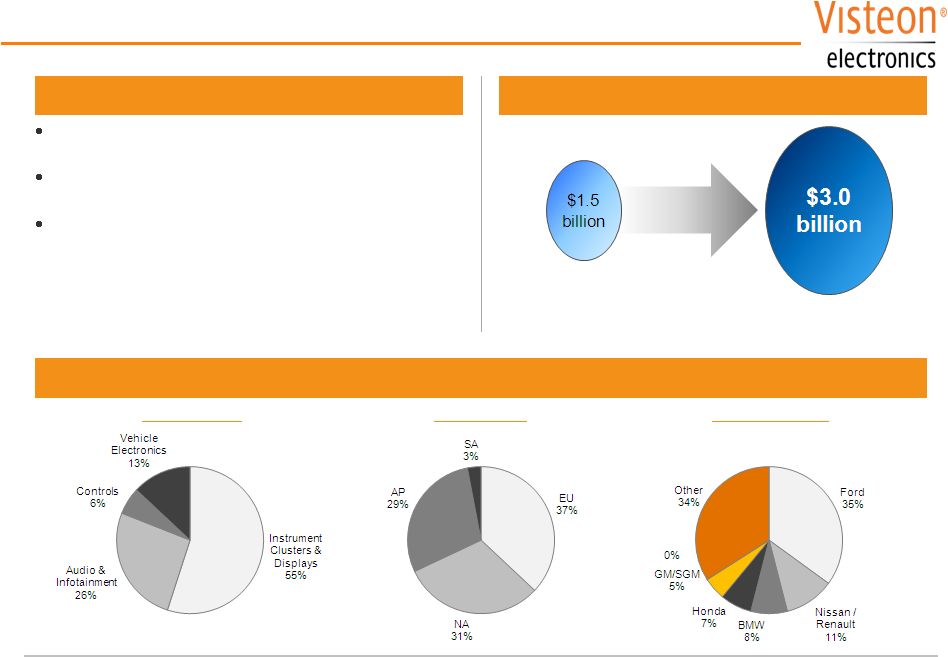

Visteon Electronics: Financial Highlights

Page 4

Visteon Electronics Today

FY 2013 Sales

2013 Pro Forma Sales Breakdown (Post JCI Acquisition)

Strong global market position in cockpit ecosystem, with

above market growth and industry leading technology

2012 to 2017 12% revenue CAGR forms solid foundation

for value creation

YFVE consolidation and acquisition of JCI Electronics

will transform Visteon Electronics to one of three large

consolidators in exploding cockpit ecosystem along with

Conti and Denso

By Product

By Region

By Customer

(1) Excludes equity income and non-controlling interests.

Pro Forma for YFVE

and JCI Acquisition

Visteon as Reported |

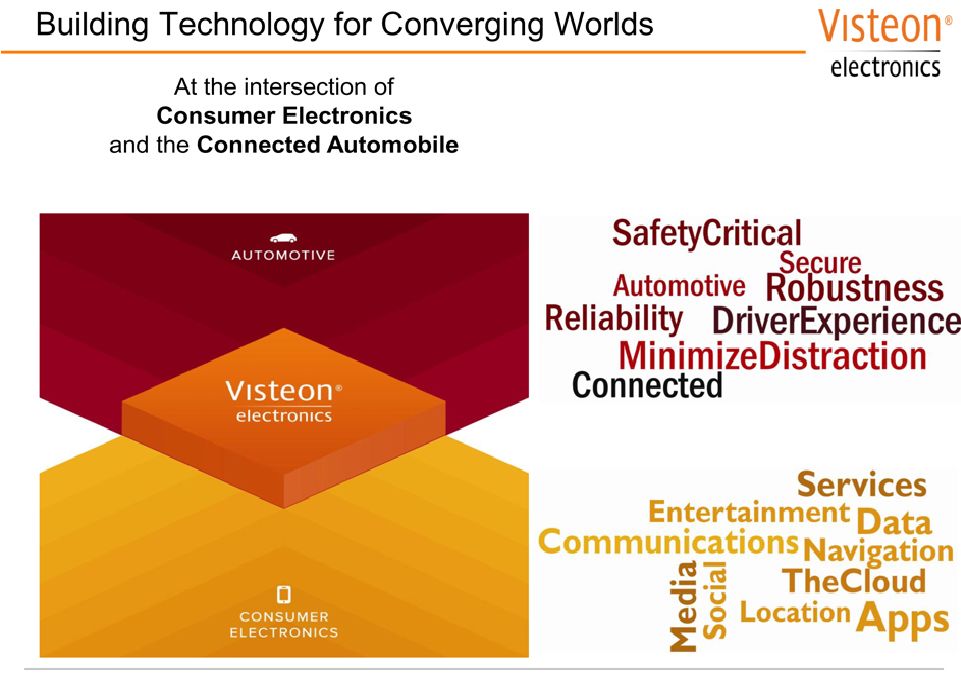

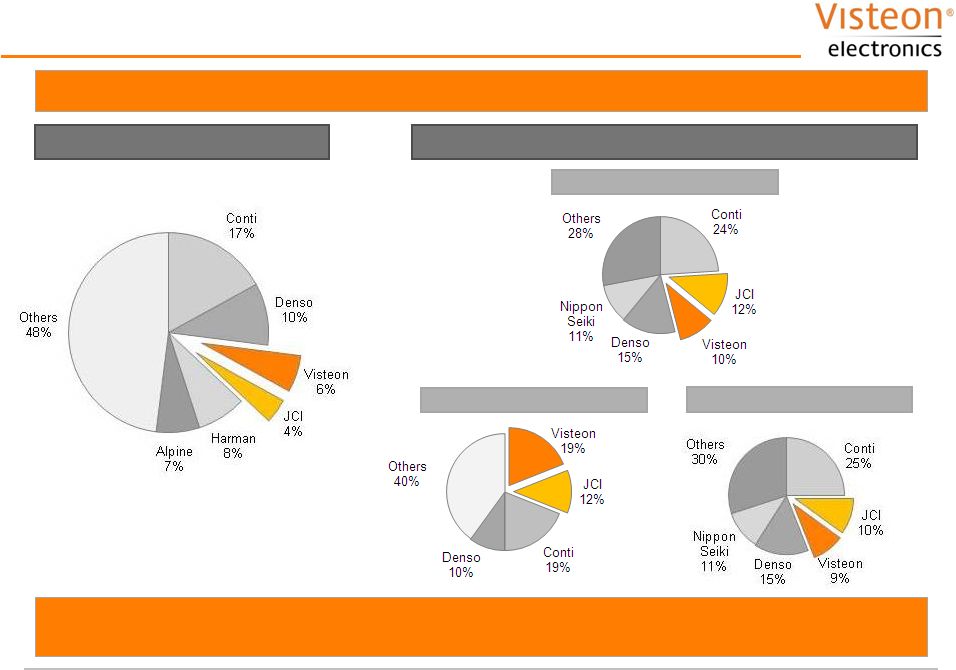

Page 5

Visteon Electronics Competitive Position

Visteon

is

Positioned

to

Be

One

of

the

Major

Forces

in

the

HMI

Conversion

of

the

Vehicle

to

the

“Largest

Mobile

Device

a

Consumer

Will

Ever

Purchase”

Please see important disclosures regarding “Forward Looking

Information” Cockpit Electronics

Combined

22%

Driver Information

Displays

Combined

31%

Instrument Clusters

Combined

19%

Combined

10%

Pro Forma Market Share

Key Visteon Cockpit Electronics Markets |

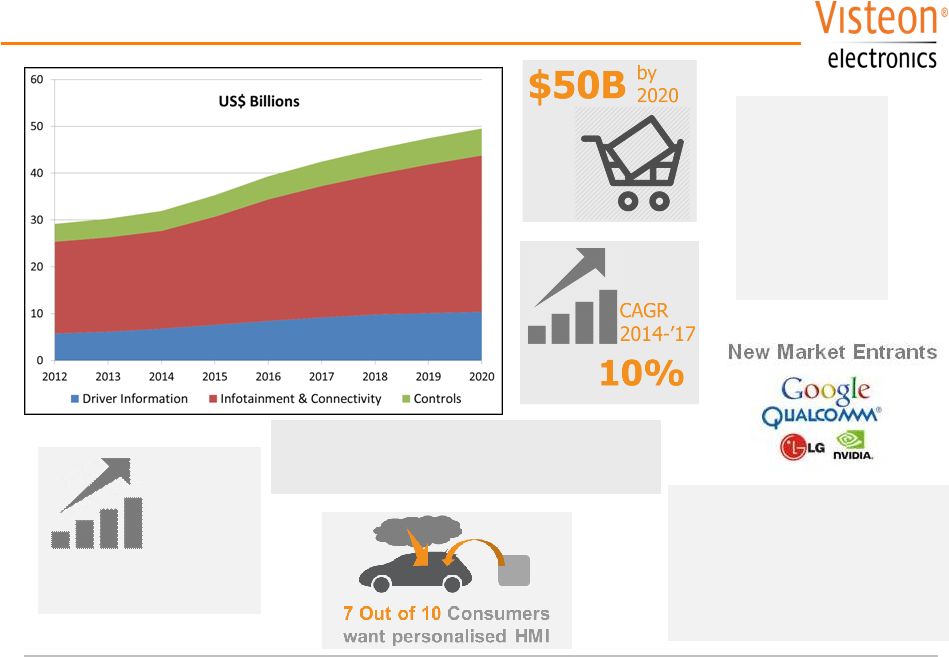

Cockpit Electronics Market

Page 6

Infotainment

growth

forecast

shifts

to

entry/mid

systems

(26%

in

2014)

Color Display

Market Value $

16%

CAGR

2014-’17

Connectivity

Devices in

2020 exceed

40M / year.

25%

Heads Up Display

Goes Mainstream

>25%

CAGR

Sources:

Visteon

global

display

and

infotainment

forecast

Feb

2014,

Visteon

consumer

research

Oct

2013,

GSMA/SBD

telematics

forecast

Feb

2014,

Strategy

Analytics

Metrix

forecast

Feb

2014 |

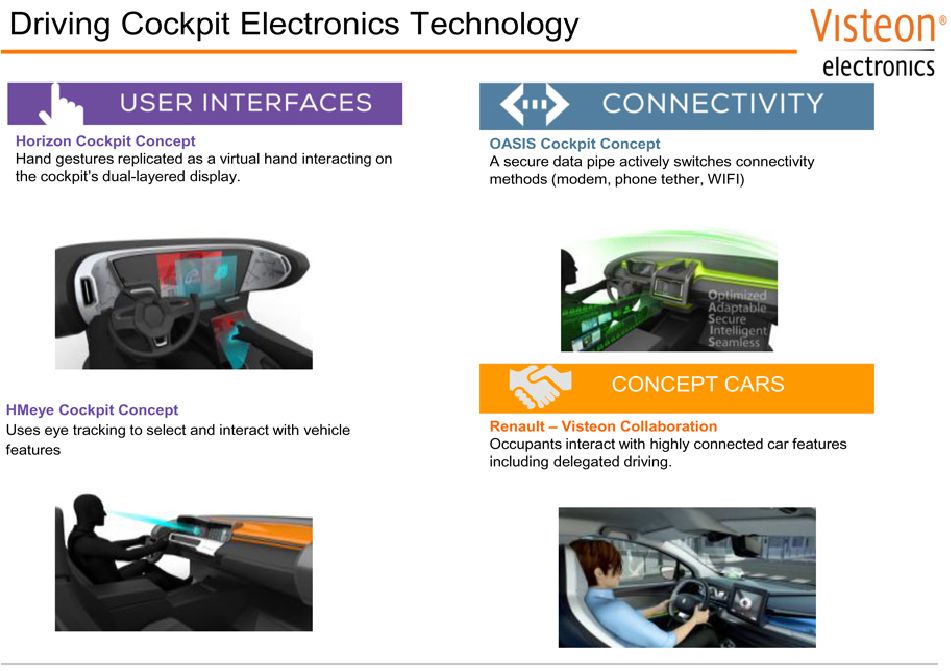

Page 7

Information and Controls Portfolio

Instrument

Clusters

Climate

Controls

Control

Panels

Displays

LightScape™

|

|

Reconfigurable

High

Resolution

Color

Display

Launched in January 2014

@ CES2014 |

Page 8

Audio and Infotainment Portfolio

Audio

Head Units

Infotainment

Connectivity

Solutions

Audio

Components

OpenAir™

HMI Command

& Control

Open

Architecture

Access Off-board

content & services

|

|

Launched in January 2014

@ CES2014 |

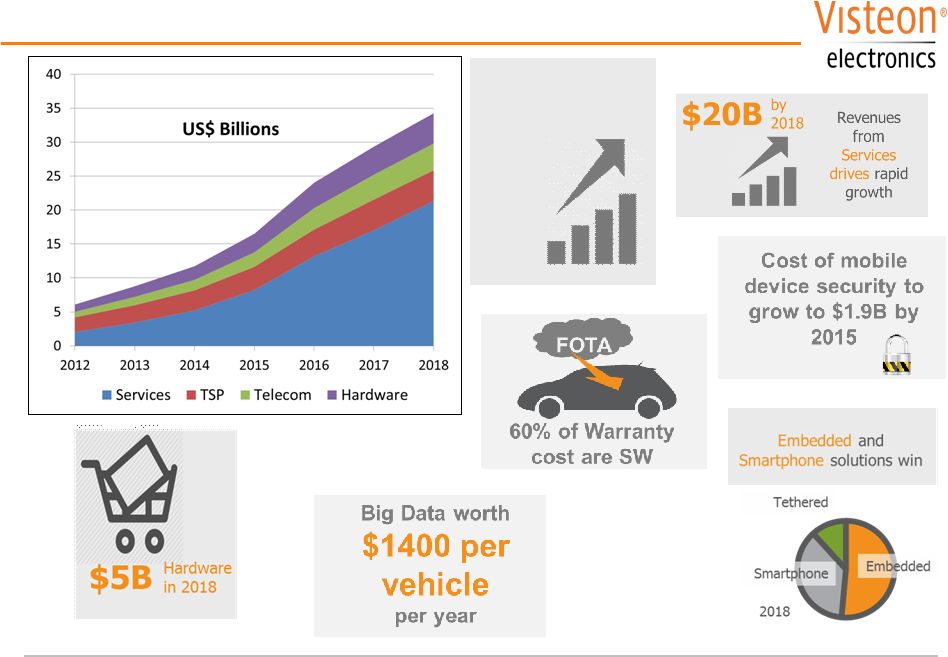

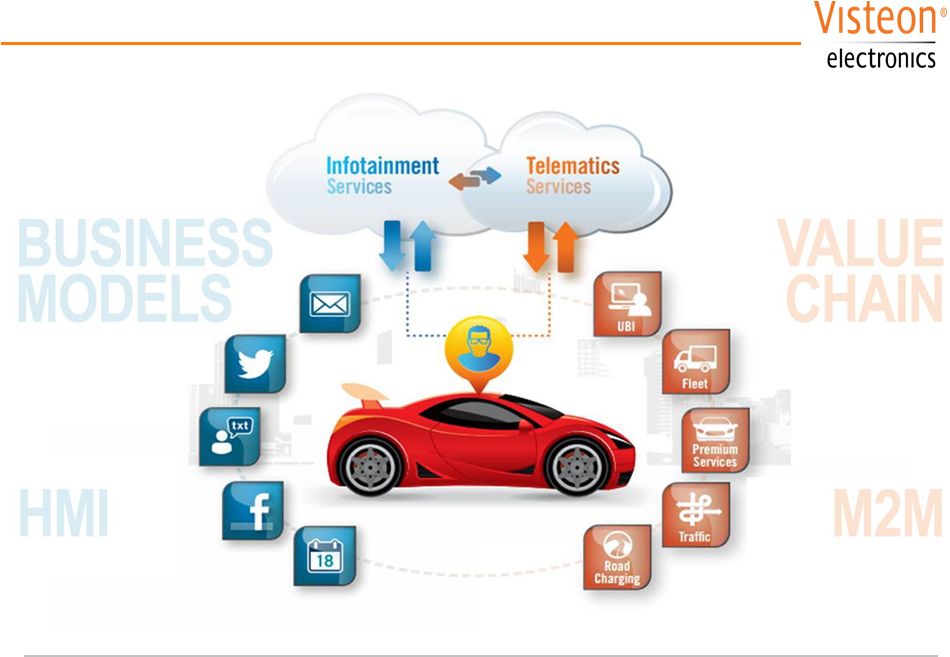

Connected Services Market

Page 9

Sources:

Visteon

infotainment

&

connectivity

forecast

Feb

2014,

Cisco

IBSG

practice

Connected

Vehicle

Report,

Frost

and

Sullivan

Connected

Car

Big

data

Webinar

Jan

2014,

Microsoft

Security

Intelligence

Report,

Panda

Security,

Consumer

Reports,

GSMA/SBD

telematics

forecast

Feb

2014,

Strategy

Analytics

Metrix

forecast

Feb

2014

$30B

by

2018 |

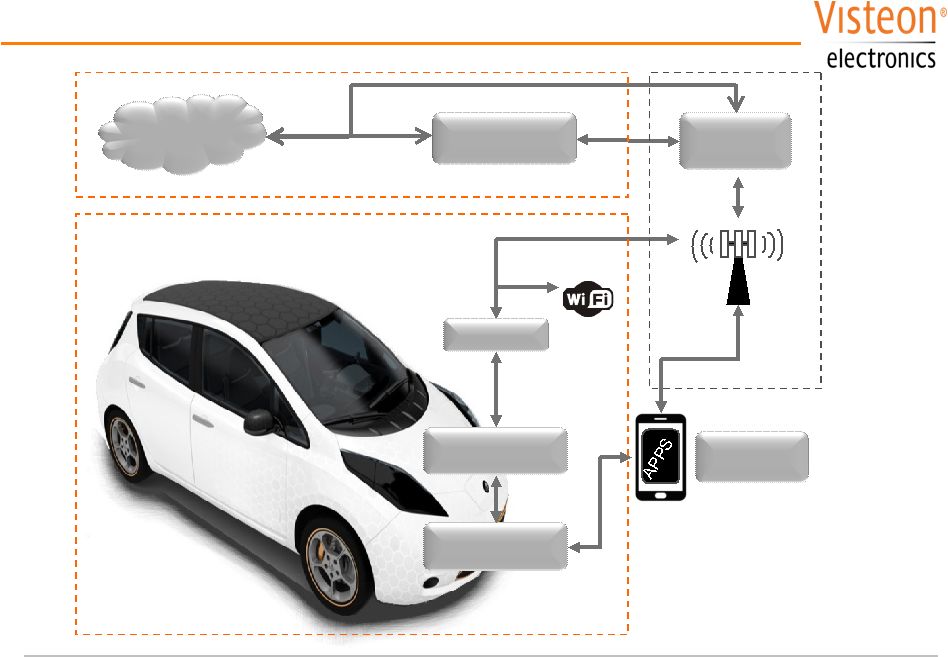

Connected Car Architecture

Mobile

Network

Data Center

Internet

Services

Wi-Fi

& Bluetooth

2G, 3G,

4G/LTE

2G,3G,

4G/LTE

Antenna

Wireless

Gateway

Infotainment &

User Interface

Consumer’s

Smartphone

Cockpit Electronics

Connected Services

Page 10 |

Connected Car Services

Page 11 |

Why

Visteon Electronics? Leveraging

strengths

in

Human

Machine

Interfaces

and

Connectivity

with

a

Focus

on

Safety

Page 12 |

|

www.visteon.com

*

*

*

*

*

*

* |