Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d670948d8k.htm |

| EX-99.1 - EX-99.1 - BROADRIDGE FINANCIAL SOLUTIONS, INC. | d670948dex991.htm |

©

2014 Broadridge Financial Solutions, Inc.

Broadridge and the Broadridge logo are registered trademarks of Broadridge

Financial Solutions, Inc. February 6, 2014

Earnings Webcast & Conference Call

Second Quarter 2014

Exhibit

99.2 |

1 |

2

Today’s Agenda

Opening Remarks

Rich Daly, President and CEO

Second Quarter and YTD 2014

Michael Liberatore,

Highlights and Segment Results

Acting Principal Financial Officer

Summary

Rich Daly, President and CEO

Q&A

Rich Daly, President and CEO

Michael Liberatore,

Acting Principal Financial Officer

Closing Remarks

Rich Daly, President and CEO |

3

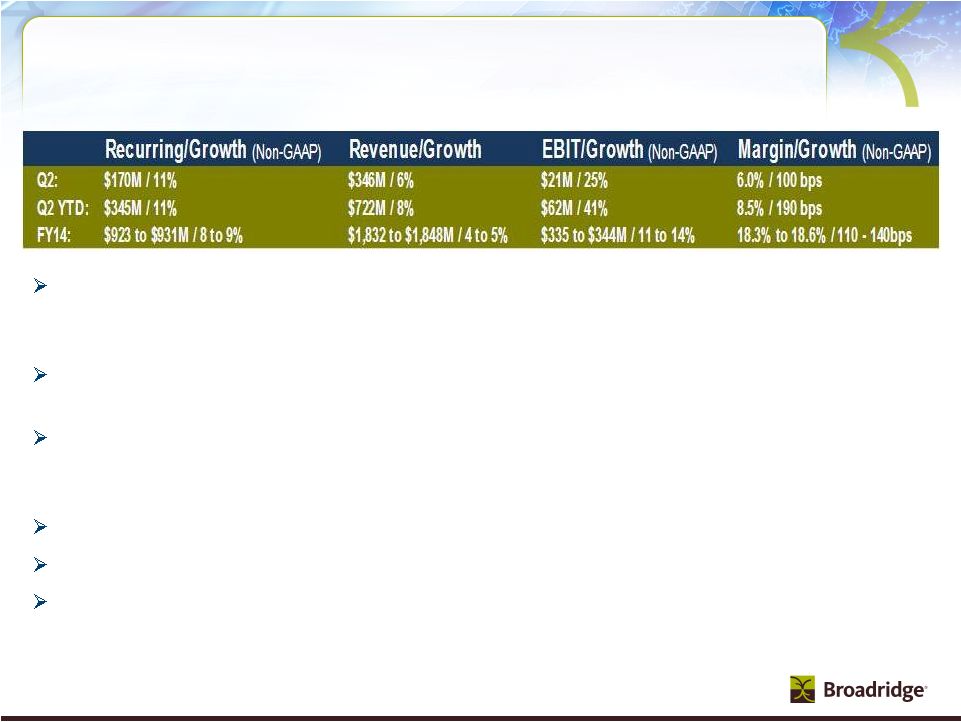

Financial Highlights

Recurring revenue growth momentum continues

Q2 Recurring revenue was up 9% (YTD 10%)

Primarily due to Net New Business (closed sales less client losses) and

internal growth

Q2 Event-driven fees were flat (YTD were up $9M primarily from mutual

fund proxy activities)

Q2 Non-GAAP diluted Earnings Per Share (EPS) of $0.25 was up 47%

Record YTD Non-GAAP diluted EPS of $0.64 was up 83%

Q2 GAAP diluted EPS of $0.22 was up 69% (YTD $0.58 was up 115%)

Primarily due to increased revenues and improved productivity from strategic

initiatives

Raising fiscal year 2014 guidance

7-8% recurring revenue growth (4-5% total revenue growth)

$2.15-2.25 Non-GAAP diluted EPS ($2.03-2.13 GAAP diluted EPS)

Free cash flow of $300M (at mid-point of range) |

4

Closed Sales Performance

Q2 Recurring revenue closed sales were up 13% (YTD 12%)

Recurring revenue closed sales were $23M compared to $20M in the

prior

year (YTD $38M compared to $34M)

Historically, first half closed sales of less than $5M contribute a lower

amount than second half to the full year

No large transactions of $5M or greater

Sales pipeline remains very strong

Continued momentum across both segments which includes Emerging and

Acquired (E&A) products and the jointly launched Accenture Post-Trade

Processing Platform

Reaffirming fiscal year 2014 recurring revenue closed sales guidance of

$110-150M

Achievement of this range requires closing $20-40M of large transactions of

$5M or greater

Anticipate closing at least one large transaction and would be disappointed if

this did not occur during this fiscal year |

5

Key Updates

Current favorable market-based activities continue to positively impact

internal growth

Expect equity and Interim position growth to remain in a positive and stable

range Trade

volumes

and

Post-sale

activity

are

less

predictable

and

expect

growth

to

continue

for

remainder of the year

We anticipate that the mean of event-driven revenues over the next years will

remain relatively stable

Positioning our E&A portfolio for long term growth

Acquisitions on track to generate ~$210M in fee revenue with ~$65M in EBITDA

(Non-GAAP) in fiscal year 2014

•

Actively seeking strategic tuck-in acquisitions that meet our investment

criteria •

Will be disappointed if we are not able to close additional strategic tuck-in

acquisitions this year

E&A

products

approaching

50%

of

recurring

revenue

closed

sales

in

FY14

Increasing strategic investments across the three key macro-trends

Digital transformation of investor communications

Cost/Capability mutualization

Intelligence created from our unique data

Total investments of $28 million or approximately $0.14 impact to EPS

NYSE EBIP regulations and new proxy distribution fees live for meetings that

have record dates on or after January 1, 2014 |

6

Key Financial Drivers

2Q

2Q YTD

Actual

FY14

FY14

FY14

FY13

Range

Growth Drivers as a % of Recurring Revenue

Closed Sales (Recurring)

7%

8%

6%

7%

Client Losses

(3%)

(3%)

(1%)

(3%)

Net New Business

4%

5%

5%

4%

Internal Growth

(a)

4%

4%

(1%)

2-3%

Organic Growth

8%

9%

4%

6-7%

Acquisitions

1%

1%

0%

1%

Total Recurring Revenue Growth

9%

10%

4%

7-8%

Growth Drivers as a % of Total Revenue

Recurring Revenue

6%

6%

3%

4-5%

Event-Driven

(b)

0%

1%

1%

0%

Distribution

(c)

0%

1%

2%

0%

FX/Other

0%

0%

0%

0%

Total Revenue Growth

6%

8%

6%

4-5%

EBIT Margin (Non-GAAP)

9.4%

11.7%

14.8%

16.5-17.1%

EPS (Non-GAAP)

$0.25

$0.64

$1.88

$2.15-2.25

(a) Internal Growth includes SPS Equity & Fixed Income Trades, ICS Equity & Mutual Fund Stock

Record Growth, Transaction Reporting, Fulfillment, and Time & Materials (b) Event-Driven

includes ICS Proxy Contest/Specials, Mutual Fund Proxy and Interim Communications (c)

Distribution includes pass-through fees from Matrix |

7

Segment Results & Forecast –

Investor Communication Solutions

Q2 and YTD recurring revenue growth driven by continued higher than expected

internal growth from market-based activities (Interims and

Post-sale) and expected Net New Business

Raising full year recurring revenue guidance as favorable market-based

activities (fulfillment, interims and equity stock record position growth)

are expected to continue Increasing event-driven fee revenue guidance to

be in-line with the prior year (expecting mutual fund proxy “new

normal” activity level of 14-19% of estimated total beneficial

positions)

Margin improvements for Q2, YTD and expected full year reflects operating

leverage Client revenue retention rate remains at 99%

Recurring revenue closed sales of $16M for Q2 ($26M YTD) and reaffirming guidance

of $60-70M (range does not include transactions of $5M or greater)

|

8

Q2 and YTD revenues increased due to Net New Business and

higher than expected trade activity

Reaffirming high-end of full year revenue range of 5% growth

(narrowed low end to 4%) as current trade volumes are expected

to continue

Strong margin expansion for Q2, YTD, and expected full year

driven by operating leverage and greater than expected

productivity improvements

Reaffirming full year recurring revenue closed sales range of $30-

40M (range does not include transactions of $5M or greater)

Revenue/Growth

EBIT/Growth (Non-GAAP)

Margin/Growth (Non-GAAP)

Q2:

$174M / 6%

$35M / 73%

19.9% / 770 bps

Q2 YTD:

$343M / 8%

$66M / 126%

19.3% / 1000 bps

FY14:

$687 to 695M / 4 to 5%

$117 to 125M / 38 to 47%

17.0% to 18.0% / 410 to 510 bps

Segment Results & Forecast –

Securities Processing Solutions |

9

Summary

Record first half diluted EPS with both segments contributing

Recurring revenue continues to be strong led by Net New Business

Recurring closed sales pipeline is very strong and growing

Positive impact from favorable market-based activities

Strong client revenue retention rate of 98%

Raising fiscal year 2014 guidance

7-8% recurring revenue growth (4-5% total revenue growth)

$2.15-2.25 Non-GAAP diluted EPS ($2.03-2.13 GAAP diluted EPS)

Free cash flow of $300M (at mid-point of range)

Strong business model includes stable recurring revenue with slight internal

growth, consistent closed sales results, plus E&A execution driving top

quartile performance Well known and highly respected brand in

providing investor communications and securities processing solutions

Both segments contributing to top and bottom line results

Stable

recurring

revenue

and

slight

internal

growth

Strong and reliable free cash flows

Best suited to benefit from three strategic disruptive macro-trends

Proven ability to create diversity of growth opportunities in all markets through

our E&A product portfolio Ongoing journey to sustainable top quartile

performance with momentum Paying meaningful dividend currently targeting 40%

payout ratio Reinvesting in our business with a focus on 3 key

macro-trends and strategic tuck-in acquisitions Opportunistic share

repurchases to offset dilution and reduce share count All of the above while

maintaining investment grade credit rating Highly engaged associates aligned

to service profit chain Recognized as one of the Best Companies to Work

for in New York State for the seventh consecutive year

|

10

Q&A

There are no slides during this portion of the presentation

|

11

Closing Comments

There are no slides during this portion of the presentation

|

12

Appendix |

13

Segment Results & Forecast –

Other & Foreign Exchange (FX)

Corporate

Expenses:

Increased

full

year

guidance

range

as

expenses

are

expected to be in line with growth in the business and increased

strategic

investments

Interest

Expense,

net:

Reflects

higher

interest

rate

from

previous

year

due

to

refinancing of term loan with senior fixed-rate notes

|

14

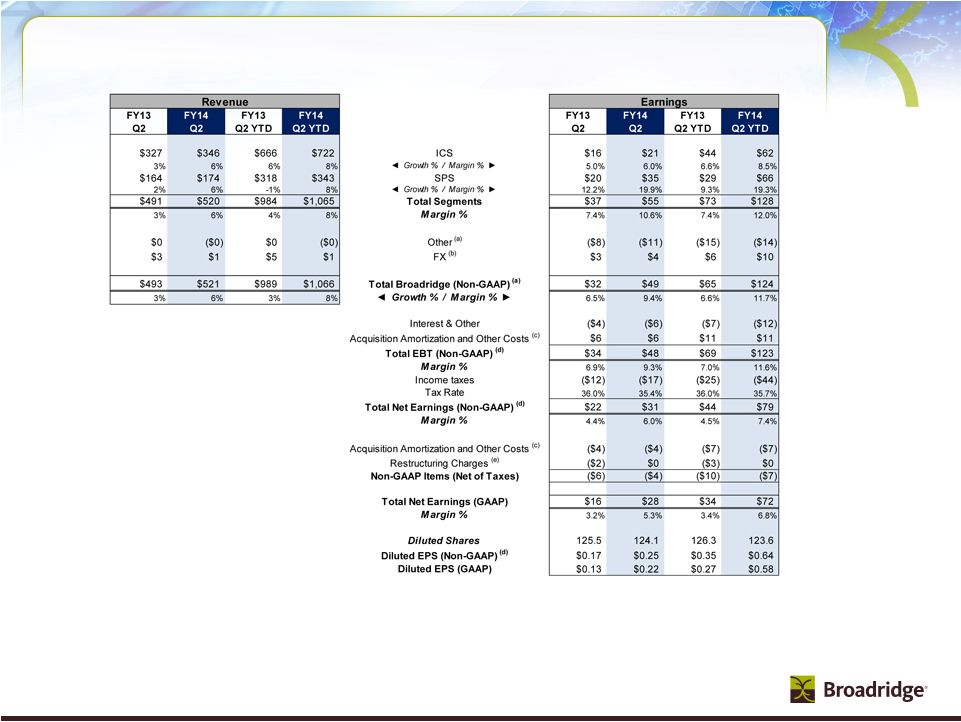

Broadridge Q2 and YTD FY14

(a) FY13 Q2 excludes Restructuring Charges of $4M (after tax $2M, or $0.01 EPS

impact). FY13 Q2 YTD excludes Restructuring Charges of $4M (after tax $3M, or $0.02 EPS impact).

(b) Includes impacts of FX P&L and FX transaction activity.

(c) Represents amortization charges associated with intangible asset values as

well as other deal costs associated with the Company’s acquisitions.

(d) FY13 Q2 excludes Restructuring Charges of $4M (after tax $2M, or $0.01 EPS

impact) and Acquisition Amortization and Other Costs of $6M (after tax $4M, or $0.03 EPS impact).

FY13 Q2 YTD excludes Restructuring Charges of $4M (after tax $3M, or $0.02 EPS

impact) and Acquisition Amortization and Other Costs of $11M (after tax $7M, or $0.06 EPS impact).

FY14

Q2

excludes

Acquisition

Amortization

and

Other

Costs

of

$6M

(after

tax

$4M,

or

$0.03

EPS

impact)

and

FY14

Q2

YTD

excludes

Acquisition

Amortization

and

Other

Costs

of

$11M

(after

tax $7M,

or

$0.06

EPS

impact).

(e) FY13 represents transition costs related to termination of the Penson

agreement including shutdown costs. |

15

Broadridge FY14 Guidance

(a) FY13 excludes Restructuring and Impairment Charges, net of $20M (after tax

$13M, or $0.10 EPS impact). (b) Includes impacts of FX P&L and FX

Transaction Activity. (c) Represents amortization charges associated with

intangible asset values as well as other deal costs associated with the Company’s acquisitions.

(d) FY13 excludes Acquisition Amortization and Other Costs of $24M (after tax $15M

or $0.12 EPS impact), Restructuring Charges of $20M (after tax $13M, or

$0.10

EPS

impact)

and

a

one

time

tax

credit

of

$4M

(or

$0.03

EPS

impact).

FY14

guidance

excludes

Acquisition

Amortization

and

Other

Costs

of

$23M

(after

tax

$15M or $0.12 EPS impact).

(e) FY13 represents transition costs related to termination of the Penson agreement

including shutdown costs, a one-time cost to restructure and outsource certain

processing related to our decktop applications and one-time tax credit.

* Guidance does not take into consideration the effect of any future acquisitions,

additional debt and/or share repurchases. |

16

Cash Flow –YTD FY14 Results and FY14 Forecast

Six Months Ending

December 2013

Low

High

Free Cash Flow

(Non-GAAP)

:

Net earnings from operations (GAAP)

72

$

252

$

265

$

Depreciation and amortization (includes other LT assets)

46

100

110

Stock-based compensation expense

15

33

35

Other

(4)

(5)

5

Subtotal

129

380

415

Working capital changes

(40)

(5)

5

Long-term assets & liabilities changes

2

(35)

(35)

Net cash flow (used in) provided by operating activities

91

340

385

Cash Flows From Investing Activities

Capital expenditures and software purchases

(31)

(65)

(60)

Free cash flow (Non-GAAP)

60

$

275

$

325

$

Cash Flows From Other Investing and Financing Activities

Acquisitions

(38)

(38)

(38)

Stock repurchases net of options proceeds

(2)

(2)

(2)

Proceeds from borrowing net of debt repayments

(1)

(1)

(1)

Dividends paid

(47)

(96)

(96)

Other

2

(5)

5

Net change in cash and cash equivalents

(26)

133

193

Cash and cash equivalents, at the beginning of year

266

266

266

Cash and cash equivalents, at the end of period

240

$

399

$

459

$

(a) Guidance does not take into consideration the effect of any future acquisitions, additional debt

and/or share repurchases. FY14 Range

(a)

Free Cash Flow -

Non-GAAP

Unaudited

($ millions) |

17

Recurring Revenue Closed Sales to Revenue

Contribution

($ in millions)

Closed Sales

Revenue Contribution

(a)

Backlog

(b)

Forecast

Forecast

Forecast

FY14

FY14

FY14

ICS (less than $5M deals)

$60-70

~$45-55

~$60-70

~Contribution to recurring revenue growth

~6%

SPS (less than $5M deals)

$30-40

~$50-55

~$70-90

~Contribution to recurring revenue growth

~8%

Total deals (less than $5M)

$90-110

~$95-110

~$130-160

~Contribution to recurring revenue growth

7-8%

Large Deals ($5M or greater)

$20-40

$0

~$20-40

~Contribution to recurring revenue growth

Total Recurring Revenue Closed Sales

$110-150

~$95-110

~$150-200

~Contribution to recurring revenue growth

7-8%

(a)

Revenue from current year and prior year Closed Sales.

(b)

Closed Sales expected to convert to revenue in future years. |

18

Revenues and Closed Sales FY08-FY13

(a) Includes reclassification of Pre-sale Fulfillment from event-driven

revenues to recurring revenues. (b) Includes reclassification of

Pre-sale Fulfillment related distribution revenues from event-driven distribution to recurring distribution and Matrix pass-through administrative services revenues from recurring

fee to recurring distribution. |

Reconciliation

of Non-GAAP to GAAP Measures Free Cash Flow -

Non-GAAP

Unaudited

($ millions)

19 |

20

ICS Key Segment Revenue Stats

RC= Recurring

ED= Event-Driven

In millions

Fee Revenues

2Q13

2Q14

YTD FY13

YTD FY14

Type

Proxy

Equities

25.3

$

24.4

$

50.9

$

50.4

$

RC

Stock Record Position Growth

4%

1%

1%

1%

Pieces

20.8

20.0

41.1

41.5

Mutual Funds

9.1

$

10.7

$

15.6

$

26.5

$

ED

Pieces

15.4

15.5

23.6

35.9

Beneficial Proxy Activity as a % of Est Total Market

Contests/Specials

2.0

$

2.4

$

5.0

$

6.6

$

ED

Pieces

1.9

2.4

4.6

6.8

Total Proxy

36.4

$

37.5

$

71.5

$

83.5

$

Total Pieces

38.1

37.9

69.3

84.2

Notice and Access Opt-in %

75%

74%

61%

66%

Suppression %

59%

58%

57%

58%

Interims

Mutual Funds (Annual/Semi-Annual Reports/Annual Prospectuses)

31.5

$

39.0

$

63.3

$

77.8

$

RC

Position Growth

11%

13%

10%

12%

Pieces

153.2

187.5

303.9

361.0

Mutual Funds (Supplemental Prospectuses) & Other

9.1

$

7.8

$

23.8

$

20.0

$

ED

Pieces

46.2

35.7

121.6

107.5

Total Interims

40.6

$

46.8

$

87.1

$

97.8

$

Total Pieces

199.4

223.2

425.5

468.5

Transaction

Transaction Reporting/Customer Communications

37.9

$

35.8

$

78.5

$

71.9

$

RC

Reporting

Fulfillment

Fulfillment

31.9

$

36.2

$

65.1

$

76.1

$

RC

Emerging, Acquired

Emerging/Acquired (a)

26.4

$

34.9

$

52.2

$

69.1

$

RC

and Other

Other (b)

7.5

$

7.1

$

15.6

$

15.5

$

ED

Total Emerging, Acquired and Other

33.9

$

42.0

$

67.8

$

84.6

$

Total Fee Revenues

180.7

$

198.3

$

370.0

$

413.9

$

Total Distribution Revenues (c)

146.1

$

147.6

$

296.3

$

308.2

$

Total Revenues as reported -GAAP

326.8

$

345.9

$

666.3

$

722.1

$

FY14 Forecast Ranges

FY14 Plan Ranges

Low

High

Total RC Fees

153.1

$

170.3

$

310.1

$

345.3

$

923

$

931

$

% RC Growth

5%

11%

7%

11%

8%

9%

Total ED Fees

27.6

$

28.0

$

59.9

$

68.6

$

Low

High

Sales

4%

5%

5%

5%

6%

6%

Key

Losses

-1%

-1%

-1%

-2%

-2%

-2%

Revenue

Net New Business

3%

4%

4%

3%

4%

4%

Drivers

Internal growth

1%

6%

2%

6%

3%

4%

(Recurring)

Recurring (Excluding Acquisitions)

4%

10%

6%

9%

7%

8%

Acquisitions

0%

1%

0%

2%

1%

1%

Total Recurring

4%

11%

6%

11%

8%

9%

Low

High

Key

Recurring, Net (d)

2%

5%

3%

5%

4%

5%

Revenue

Event-Driven

0%

0%

1%

1%

0%

0%

Drivers

Distribution

1%

1%

2%

2%

0%

0%

(Total)

TOTAL

3%

6%

6%

8%

4%

5%

(a) Emerging and Acquired includes fee revenues from acquisitions (i.e. Access

Data, NewRiver, Matrix, Transfer Agency, Forefield, and Bonaire) and the portfolio of emerging products (i.e. TaxServices, Vote Recommendations, and Class Actions).

(b) Other includes other event-driven fee revenues such as corporate actions

and development. (c) Total Distribution Revenues primarily include

pass-through revenues related to the physical mailing of Proxy, Interims, Transaction Reporting, and Fulfillment as well as Matrix administrative services.

(d) Recurring, Net includes contribution from Net New Business, Internal Growth,

and Acquisitions ~$156 |

21

SPS Key Segment Revenue Stats

RC= Recurring

ED= Event-Driven

In millions

Note: Outsourcing is now included in Other Equity Services

2Q13

2Q14

YTD FY13

YTD FY14

Type

Equity

Transaction-Based

Equity Trades

31.1

$

33.4

$

61.1

$

65.9

$

RC

Internal Trade Volume

792

934

786

913

Internal Trade Growth

-6%

18%

-13%

16%

Trade Volume (Average Trades per Day in '000)

860

953

844

931

Non-Transaction

Other Equity Services

107.1

111.4

205.6

$

219.4

$

RC

Total Equity

138.1

$

144.9

$

266.7

$

285.3

$

Fixed Income

Transaction-Based

Fixed Income Trades

13.6

$

14.5

$

27.5

$

29.2

$

RC

Internal Trade Volume

293

293

294

296

Internal Trade Growth

-1%

0%

0%

1%

Trade Volume (Average Trades per Day in '000)

293

297

294

299

Non-Transaction

Other Fixed Income Services

12.0

$

14.7

$

23.5

$

28.3

$

RC

Total Fixed Income

25.6

$

29.2

$

51.0

$

57.5

$

Total Net Revenue as reported - GAAP

163.8

$

174.1

$

317.7

$

342.8

$

FY14 Ranges

Low

High

Sales

5%

9%

4%

10%

8%

8%

Losses

-2%

-4%

-2%

-3%

-4%

-3%

Key

Net New Business

3%

5%

2%

7%

4%

5%

Revenue

Internal growth

-1%

1%

-5%

1%

0%

0%

Drivers

Acquisitions

0%

0%

2%

0%

0%

0%

TOTAL

2%

6%

-1%

8%

4%

5% |

22

Broadridge ICS Definitions |