Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Simulations Plus, Inc. | simulations_8k-010914.htm |

| EX-99.1 - PRESS RELEASE - Simulations Plus, Inc. | simulations_8k-ex9901.htm |

Exhibit 99.2

Simulations Plus, Inc. (NASDAQ:SLP) First Quarter Fiscal Year 2014 Conference Call and Webinar January 9, 2014

| 1 |

With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement

| 2 |

• 1QFY14 compared to 1QFY13: – Sales up 15.3% to First Quarter Record $2.64 million from $2.29 million – Gross profit up 15.2% to $2.193 million from $1.903 million – SG&A increased 15.0% to $1.071 million from $0.931 million • As a percent of revenues, SG&A decreased slightly to 40.6% from 40.7% – R&D expense decreased 10.1% to $162,000 from $180,000 • More time was spent on capitalized software activities and NCE project costs were lower – Net Income increased 16.7% to $0.685 million from $0.587 million – Diluted earnings per share increased 16.7% to $0.042 from $0.036 – Approximately $643,000 was distributed to shareholders as a cash dividend • Strong balance sheet: – Cash of $10.55 million at 11/30/13 after the ~$643,000 dividend distribution • Cash as of January 9 = $10.25 million – Shareholders’ equity on November 30 = $14.35 million – We continue to have no debt SLP 1QFY14 Highlights Quarter ended 11/30/13:

| 3 |

Income Statement 1QFY14 vs 1QFY13 ($ millions) 1QFY14 1QFY13 Net sales 2.641 2.290 Gross profit 2.193 1.903 Gross profit margin 83.0% 83.1% SG&A 1.071 0.931 R&D 0.162 0.180 Total operating expenses 1.233 1.111 Income from operations 0.959 0.792 Other income 0.033 0.104 Income from operations before income taxes 0.992 0.896 Net income 0.685 0.587 Earnings per share 0.043 0.036

| 4 |

Revenues by Quarter (pro forma prior to 2012) $1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 $3.1 $3.1 $1.6 2.64 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014

| 5 |

$1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 $2.62 $2.64 $1.26 $2.19 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 Gross Profit by Fiscal Quarter (pro forma prior to 2012)

| 6 |

$0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.27 $1.23 $1.38 $1.48 $0.58 $1.09 $1.76 $1.73 $0.44 $1.20 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 EBITDA by Fiscal Quarter

| 7 |

Net Income by Quarter (pro forma prior to 2012) $0.33 $0.47 $0.53 $0.17 $0.44 $0.85 $0.74 $0.21 $0.56 $0.91 $1.05 $0.17 $0.76 $0.84 $0.87 $0.35 $0.59 $1.06 $0.99 $0.24 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014

| 8 |

10 11 9 9 14 17 12 14 15 21 13 10 18 18 16 9 15 Q1 Q2 Q3 Q4 2010 2011 2012 2013 2014 New Customers by Quarter

| 9 |

Selected Balance Sheet Items ($ millions) November 30, 2013 August 31, 2013 Cash and cash equivalents $10.555 $10.179 Cash per fully diluted share 0.64 0.62 Total current assets 13.136 12.972 Total assets 16.405 16.063 Total current liabilities 0.791 0.626 Total liabilities 2.054 1.821 Current ratio 16.6 20.7 Shareholders’ equity 14.350 14.242 Total liabilities and shareholders’ equity 16.405 16.063 Shareholders’ equity per diluted share 0.877 0.870

| 10 |

$1.59 $0.80 $0.80 $2.24 $0.00 $0.48 $0.48 $0.64 $1.97 $12.66 $13.24 $12.89 $12.70 $11.38 $9.33 $9.76 $10.00 $10.18 $10.56 Q4FY11 Q1FY12 Q2FY12 Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 $ Millions Dividend Paid Proceeds from Sale of Subsidiary Cash Returning Cash to Shareholders

| 11 |

N H O OH O CH 3 CH 3 CH 3 Discovery Preclinical Clinical MedChem Studio™ MedChem Designer™ GastroPlus™ DDDPlus™ ADMET Predictor™ Simulations Plus Products & Services Consulting Services & Collaborations MembranePlus ™

| 12 |

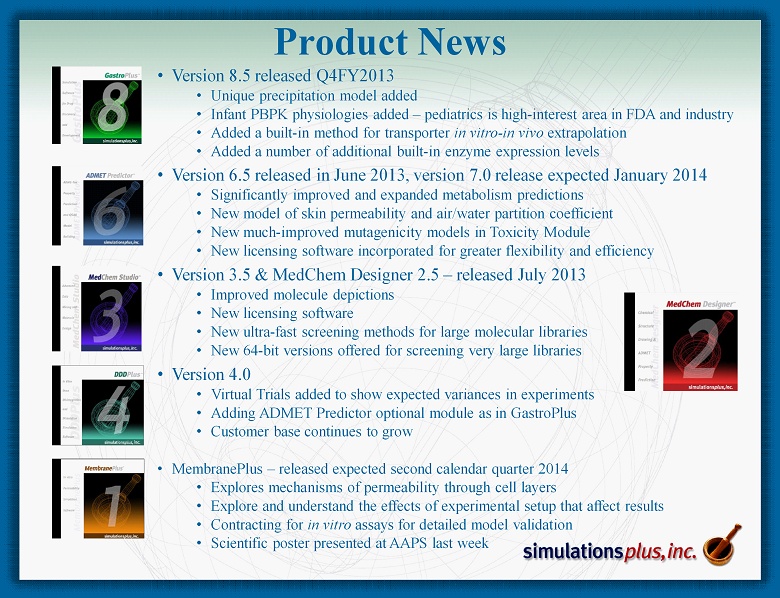

Product News • Version 8.5 released Q4FY2013 • Unique precipitation model added • Infant PBPK physiologies added – pediatrics is high - interest area in FDA and industry • Added a built - in method for transporter in vitro - in vivo extrapolation • Added a number of additional built - in enzyme expression levels • Version 6.5 released in June 2013, version 7.0 release expected January 2014 • Significantly improved and expanded metabolism predictions • New model of skin permeability and air/water partition coefficient • New much - improved mutagenicity models in Toxicity Module • New licensing software incorporated for greater flexibility and efficiency • Version 3.5 & MedChem Designer 2.5 – released July 2013 • Improved molecule depictions • New licensing software • New ultra - fast screening methods for large molecular libraries • New 64 - bit versions offered for screening very large libraries • Version 4.0 • Virtual Trials added to show expected variances in experiments • Adding ADMET Predictor optional module as in GastroPlus • Customer base continues to grow • MembranePlus – released expected second calendar quarter 2014 • Explores mechanisms of permeability through cell layers • Explore and understand the effects of experimental setup that affect results • Contracting for in vitro assays for detailed model validation • Scientific poster presented at AAPS last week

| 13 |

Marketing and Sales Program • Conferences /Scientific Meetings continue to be primary source of leads • During Q1 we participated in 13 scientific meetings and conferences in the U.S . and Europe with 13 scientific posters and presentations • Trainings and Workshops • Conducted 7 on - site training courses at client sites in Q1 and hosted 1 st workshop in Japan • Spent several weeks traveling through Japan and China to present at >20 companies • Strategic Digital Marketing Initiatives continue • Hosted 3 webinars on our new software updates & applications - over 5 00 registrations • LinkedIn, Facebook, Twitter accounts and website redesign help with outreach programs • Collaborations/Consulting/Grants – Ongoing 5 - year collaboration with the FDA Center for Food Safety and Applied Nutrition to build toxicity models with ADMET Predictor/Modeler™ for food additives and contaminants – Consulting studies continue – 4 active projects, 4 in proposal stage – Finalized collaboration with Bayer Pharma for enhancement of pKa model in ADMET Predictor – Finalized funded collaborations for enhancement of the GastroPlus oral cavity & dermal models – Discussions with CROs to partner on modeling & simulation support services • We believe fundamental industry shift continues – Four recent submissions from our consulting contracts using GastroPlus modeling results were accepted by regulatory agencies – plus other submissions without our consulting – GastroPlus User Group was formed by industry users, now 350 members on LinkedIn – 15 new customers during Q1 (includes new companies as well as new departments within existing large customers ) – Several new industry clients closed in China and Japan

| 14 |

NCE (New Chemical Entity) Project • New NCE project initiated , molecules synthesis just completed • Selection of contractor for experiments is imminent – results expected by March 1 • COX - 2 selected as target (Celebrex® target) • COX - 1 also needs to be inhibited, but at a lesser level (Aspirin target) • Used newest versions of our ADMET Design Suite™ (ADMET Predictor , MedChem Studio , MedChem Designer ) as well as GastroPlus • Goal: further demonstrate the powerful lead compound design capabilities of the ADMET Design Suite • Good results came from our malaria NCE project last year – new licenses already recouped investment

| 15 |

Growth Opportunities • MembranePlus™ - new software product to simulate in vitro permeability experiments • similar concept to DDDPlus ™ - unique capability in the industry • Continued enhancement of current software products to expand coverage into new areas • Dermal dosing module in GastroPlus ™ • Addition of large animals to GastroPlus • Cloud offering – we’re investigating how cloud computing might provide a means to offer our software and services • AEROModeler ™ - new software product to predict aerodynamic force coefficients for arbitrary missile shapes at any Mach number and angle of attack • Penetration of clinical pharmacology departments to provide more detailed mechanistic modeling for clinical trail data analysis • COX - 2/COX - 1 NCE project expected to : further demonstrate the powerful lead compound design capabilities of the ADMET Design Suite • Goal is to demonstrate the speed and cost efficiency of designing new lead molecules • Potential upside: licensing of one or more molecules (if results are exceptional)

| 16 |

Summary • For 1QFY14: - Record revenues and earnings = continued 6 - year - plus profitable trend - Earnings growth 16.7% on 15.3% revenue growth • Continuing to Grow: - Three new Ph.D.s added in FY13 - Continuing to seek and interview additional scientists and engineers - Life Sciences team strengthens and supports marketing and sales • Aggressive Marketing and Sales Activities - Continue intensive conference/trade show/ workshop schedule - Workshops scheduled for North America, Europe and Asia in 2014 - New courses offered which focus on specific research functions - Trips to India, Japan, China, Korea, and Australia to visit clients and host seminars scheduled over next several months – growing interest in Asia • Strong cash position and no debt – returning cash to shareholders - Cash dividends totaling approximately $7 million have been distributed, yet cash remains at over $10.55 million as of today. Dividend expected to remain at $0.05/ share/ quarter

| 17 |

Q&A

| 18 |