Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYNOSURE INC | d633849d8k.htm |

Exhibit 10.1

FIFTH AMENDMENT

THIS FIFTH AMENDMENT (the “Fifth Amendment”) is made and entered into as of the 18th day of November, 2013 (“Execution Date”), by and between GLENBOROUGH WESTFORD CENTER, LLC, a Delaware limited liability company (“Landlord”), and CYNOSURE, INC., a Delaware corporation (“Tenant”).

RECITALS

| A. | Landlord and Tenant are parties to that certain lease dated January 31, 2005, as amended by a First Amendment to Lease dated September 16, 2005, a Second Amendment dated September 28, 2007, a Third Amendment dated as of July 1, 2011, and a Fourth Amendment dated as of December 20, 2012 (collectively, the “Lease”). Pursuant to the Lease, Landlord has leased to Tenant space currently containing 68,317 rentable square feet (the “Original Premises”), of which 40,092 rentable square feet are located on the first (1st) floor, and 28,225 rentable square feet are located on the second (2nd) floor of the building located at 5 Carlisle Road, Westford, Massachusetts 01886 (hereinafter referred to as the “5 Carlisle Building”). |

| B. | Tenant has requested that the following additional space be added to the Original Premises: |

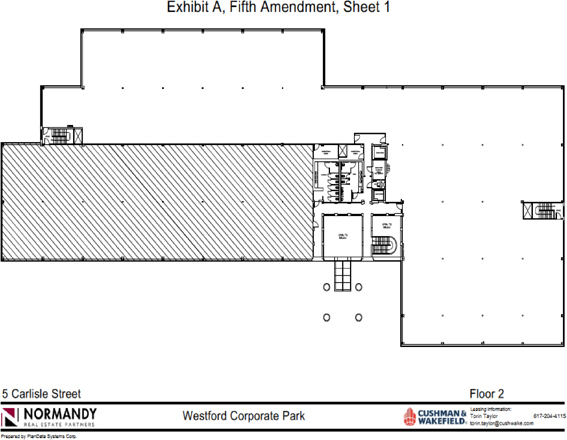

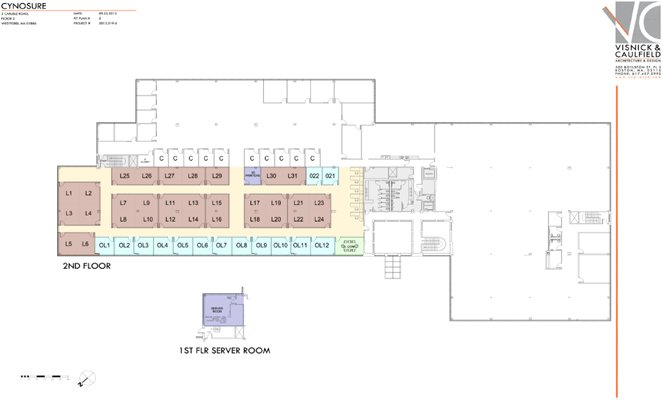

| 1. | 13,710 rentable square feet on the second (2nd) floor of the 5 Carlisle Building (“5 Carlisle Expansion Space”), as shown on Exhibit A, Fifth Amendment, Sheet 1, attached hereto; |

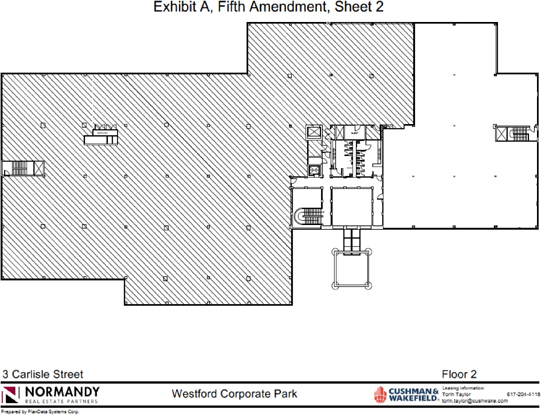

| 2. | 33,737 rentable square feet on the second (2nd) floor of the building (“2nd Floor-3 Carlisle Expansion Space”) known as 3 Carlisle Road (“3 Carlisle Building”), as shown on Exhibit A, Fifth Amendment, Sheet 2, attached hereto |

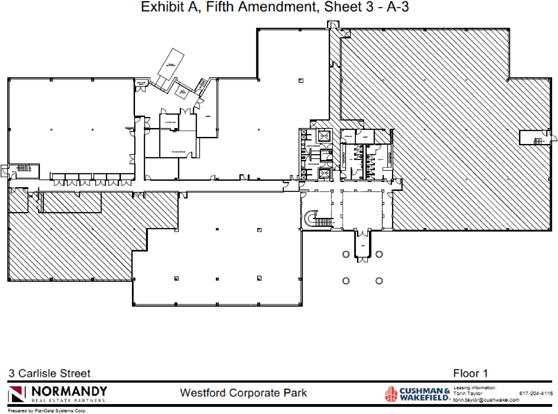

| 3. | Approximately 28,777 rentable square feet on the first (1st) floor of the 3 Carlisle Building, known as Suite 150, and a portion of Suite 108, as shown on Exhibit A, Fifth Amendment, Sheet 3, attached hereto, and comprising the following: |

| • | “Area A-3 Carlisle Expansion Space”: containing 20,988 rentable square feet; and |

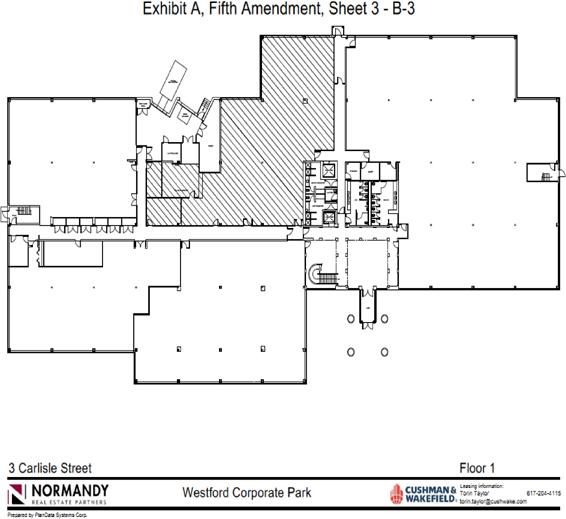

| • | “Area B-3 Carlisle Expansion Space”: containing 7,789 rentable square feet. |

Area A-3 Carlisle Expansion Space and Area B-3 Carlisle Expansion Space are sometimes hereinafter referred to collectively as the “1st Floor-3 Carlisle Expansion Space”.

| 4. | For purposes of this Fifth Amendment, the 5 Carlisle Expansion Space, the 2nd Floor-3 Carlisle Expansion Space, and Area A-3 Carlisle Expansion Space shall be referred to herein as the “First Expansion Space”, and Area B-3 Carlisle Expansion Space shall be referred to herein as the “Second Expansion Space”. Unless otherwise specifically referred to herein, the First Expansion Space and the Second Expansion Space shall be referred to collectively herein as the “Expansion Space”. |

| C. | The Lease by its terms shall expire on June 30, 2018 (“Prior Termination Date”), and the parties desire to extend the Term of the Lease, all on the following terms and conditions. |

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Landlord and Tenant agree as follows:

| I. | Delivery of Possession/Expansion. |

On the Execution Date, Landlord shall deliver possession of the First Expansion Space to Tenant free of all occupants and personal property of others and in broom-clean condition.

The “First Expansion Space Effective Date” shall mean the date that is six months after the Execution Date.

Landlord shall use commercially reasonable efforts to deliver possession of the Second Expansion Space to Tenant free of all occupants and personal property of others and in broom-clean condition on or before the date that is five (5) days of the date that the existing tenant vacates the Second Expansion Space (estimated to be February 1, 2014). The date on which Landlord actually so delivers the Second Expansion Date is referred to as the “Second Expansion Space Delivery Date”. The “Second Expansion Space Effective Date” shall mean the later to occur of (i) the Second Expansion Space Delivery Date; or (ii) the First Expansion Space Effective Date. If the Second Expansion Space Delivery Date has not occurred by April 30, 2014, Tenant shall be entitled to a one (1) day extension of the Second Expansion Space Rent Abatement Period for each day beginning on May 1, 2014, and continuing until the Second Expansion Space Delivery Date.

From and after the First Expansion Space Effective Date, references in the Lease to the Premises shall be deemed to refer to the Original Premises and the First Expansion Space, collectively, and from and after the Second Expansion Space Effective Date, references in the Lease to the Premises shall be deemed to refer to the Original Premises, the First Expansion Space, and the Second Expansion Space, collectively.

The Term for the Expansion Space shall end on the Second Extended Termination Date (as hereinafter defined). The Expansion Space is subject to all the terms and conditions of the Lease except as expressly modified herein and except that Tenant shall not be entitled to receive any allowances, abatements or other financial concessions granted with respect to the Original Premises except for such concessions, allowances and contributions that are expressly provided for herein.

| II. | Extension. |

The Term of the Lease is hereby extended for a period commencing as of July 1, 2018, and expiring on the date that is the day before the date that is thirteen (13) years after the First Expansion Space Effective Date (“Second Extended Termination Date”), unless sooner terminated in accordance with the terms of the Lease. That portion of the Term commencing on First Expansion Space Effective Date and ending on the Second Extended Termination Date, shall be referred to herein as the “Second Extended Term”.

-2-

| III. | Base Rent. |

| A. | Base Rent for Original Premises. Tenant shall continue to pay Base Rent, Additional Rent and all other charges under the Lease with respect to the Original Premises in accordance with the terms of the Lease (i.e., without taking into consideration this Fifth Amendment) through the day before the Rent Adjustment Date, as hereinafter defined. |

| B. | Adjusted Base Rent for Original Premises. In consideration of the agreements contained herein, the Base Rent with respect to the Original Premises shall be adjusted as of the First Expansion Space Effective Date, such date being also referred to herein as the “Rent Adjustment Date”. The schedule of Base Rent payable with respect to the Original Premises (i.e., 68,317 rentable square feet) from the Rent Adjustment Date through the Second Extended Termination Date is as follows: |

| Months |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| Rent Adjustment Date through Month* 21 |

$ | -0- | $ | -0- | $ | -0- | ||||||

| Months 22-84 |

$ | 19.50 | $ | 1,332,181.50 | $ | 111,015.13 | ||||||

| Months 85-156 |

$ | 21.50 | $ | 1,468,815.50 | $ | 122,401.29 | ||||||

| * | As used herein and in Subsections C and D below, a “Month” means any one-month period commencing on the day of the month on which the Rent Adjustment Date occurs. |

Tenant shall have no obligation to pay Base Rent with respect to the Original Premises for the period commencing as of the Rent Adjustment Date through Month 21 (the “Original Premises Rent Abatement Period”). During the Original Premises Rent Abatement Period, only Base Rent shall be abated, and all additional rent and other costs and charges specified in the Lease shall remain as due and payable pursuant to the provisions of the Lease.

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease.

-3-

| C. | Base Rent for First Expansion Space. As of the First Expansion Space Effective Date, the schedule of Base Rent with respect to the First Expansion Space (i.e., 68,435 rentable square feet) shall be as follows: |

| Months |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| First Expansion Space Effective Date – Month 21 |

$ | -0- | $ | -0- | $ | -0- | ||||||

| Months 22-84 |

$ | 19.50 | $ | 1,334,482.50 | $ | 111,206.88 | ||||||

| Months 85-156 |

$ | 21.50 | $ | 1,471.352.50 | $ | 122,612.71 | ||||||

Tenant shall have no obligation to pay Base Rent with respect to the First Expansion Space for the period commencing as of the First Expansion Space Effective Date, and expiring at the end of Month 21 (the “First Expansion Space Rent Abatement Period”). During the First Expansion Space Rent Abatement Period, only Base Rent shall be abated, and all additional rent and other costs and charges specified in the Lease shall remain as due and payable pursuant to the provisions of the Lease.

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease.

| D. | Base Rent for Second Expansion Space. As of the Second Expansion Space Effective Date, the schedule of Base Rent with respect to the Second Expansion Space (i.e., 7,789 rentable square feet) shall be as follows: |

| Months |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| Second Expansion Space Effective Date – Month 25 |

$ | -0- | $ | -0- | $ | -0- | ||||||

| Months 26-84 |

$ | 19.50 | $ | 151,885.50 | $ | 12,657.13 | ||||||

| Months 85-156 |

$ | 21.50 | $ | 167,463.50 | $ | 13,955.29 | ||||||

Tenant shall have no obligation to pay Base Rent with respect to the Second Expansion Space for the period commencing as of the Second Expansion Space Effective Date, and expiring at the end of Month 25 (the “Second Expansion Space Rent Abatement Period”). During the Second Expansion Space Rent Abatement Period, only Base Rent shall be abated, and all additional rent and other costs and charges specified in the Lease shall remain as due and payable pursuant to the provisions of the Lease

All such Base Rent shall be payable by Tenant in accordance with the terms of the Lease.

| IV. | Security Deposit. |

The parties hereby acknowledge that Landlord is currently holding a Security Deposit in the amount of Two Hundred Thousand and 00/100 Dollars ($200,000.00) pursuant to Sections 2.16, 8, and 41 of the Lease, as amended by Section VIII of the Third Amendment. The Security Deposit was not reduced as contemplated by Section VIII of the Third Amendment, and, therefore, Landlord shall continue to hold the Security Deposit in accordance with

-4-

Section 8 of the Lease through the Second Extended Termination Date, as the same may be extended. In addition, concurrently with the execution and delivery hereof, Tenant shall pay to Landlord an additional security deposit of $50,000.00, which shall be added to and held with the existing Security Deposit so that the aggregate Security Deposit will be $250,000.00. The Security Deposit shall not be subject to reduction pursuant to Section 41 of the Lease (but shall be subject to increase and reduction as set forth below), and therefore, Section 41 of the Lease and Section VIII of the Third Amendment are each hereby deleted and are of no further force or effect. In addition to the foregoing, at such time, if any, as the shareholder equity in Tenant, as disclosed by the most recently filed 10-Q quarterly report of Tenant, falls below $225,000,000, Tenant shall deposit with Landlord an additional security deposit of $1,000,000, which additional amount shall be paid within thirty (30) days after Landlord’s demand therefor and shall thereafter be held by Landlord together with the existing Security Deposit. If the Security Deposit shall be increased as provided in the preceding sentence and thereafter the shareholder equity in Tenant, as disclosed by Tenant’s quarterly 10-Q reports, shall exceed $325,000,000 for at least four (4) consecutive quarters, then, within ten (10) days after Tenant’s written demand therefor, Landlord shall refund to Tenant such $1,000,000 additional security deposit. The security deposit shall be subject to increase or reduction from time to time during the Term in accordance with the foregoing provisions of this Section IV; provided, however, that in no event shall the Security Deposit be reduced below $250,000.

At the election of Tenant, The Security Deposit may be in the form of an irrevocable letter of credit (the “Letter of Credit”), which Letter of Credit shall: (a) be in the initial amount of $250,000.00; (b) be issued on the form attached hereto as Exhibit G; (c) name Landlord as its beneficiary; and (d) be drawn on an FDIC insured financial institution reasonably satisfactory to the Landlord that satisfies both the Minimum Rating Agency Threshold and the Minimum Capital Threshold (as those terms are defined below). The “Minimum Rating Agency Threshold” shall mean that the issuing bank has outstanding unsecured, uninsured and unguaranteed senior long-term indebtedness that is then rated (without regard to qualification of such rating by symbols such as “+” or “-” or numerical notation) “Baa” or better by Moody’s Investors Service, Inc. and/or “BBB” or better by Standard & Poor’s Rating Services, or a comparable rating by a comparable national rating agency designated by Landlord in its discretion. The “Minimum Capital Threshold” shall mean that the Issuing Bank has combined capital, surplus and undivided profits of not less than $10,000,000,000. The Letter of Credit (and any renewals or replacements thereof) shall be for a term of not less than one (1) year. If the issuer of the Letter of Credit gives notice of its election not to renew such Letter of Credit for any additional period, Tenant shall be required to deliver a substitute Letter of Credit satisfying the conditions hereof at least thirty (30) days prior to the expiration of the term of such Letter of Credit. If the issuer of the Letter of Credit fails to satisfy either or both of the Minimum Rating Agency Threshold or the Minimum Capital Threshold, Tenant shall be required to deliver a substitute letter of credit from another issuer reasonably satisfactory to the Landlord and that satisfies both the Minimum Rating Agency Threshold and the Minimum Capital Threshold not later than twenty (20) Business Days after Landlord notifies Tenant of such failure. Tenant agrees that it shall from time to time, as necessary, whether as a result of a draw on the Letter of Credit by Landlord pursuant to the terms hereof or as a result of the expiration of the Letter of Credit then in effect, renew or replace the original and any subsequent Letter of Credit so that a Letter of Credit, in the amount required hereunder, is in effect until a date which is at least sixty (60) days after the Termination Date of the Lease. If Tenant fails to furnish such renewal or replacement at least sixty (60) days prior to the stated expiration date of the Letter of Credit then held by Landlord, Landlord may draw upon such Letter of Credit and hold the proceeds thereof (and

-5-

such proceeds need not be segregated) as a Security Deposit pursuant to the terms of this Article 6. Any renewal or replacement of the original or any subsequent Letter of Credit shall meet the requirements for the original Letter of Credit as set forth above, except that such replacement or renewal shall be issued by a national bank reasonably satisfactory to Landlord at the time of the issuance thereof.

If Landlord draws on the Letter of Credit as permitted in the Lease or the Letter of Credit, then, upon demand of Landlord, Tenant shall restore the amount available under the Letter of Credit to its original amount by providing Landlord with an amendment to the Letter of Credit evidencing that the amount available under the Letter of Credit has been restored to its original amount.

In addition, the third full paragraph of Section 8 of the Lease (beginning with “If Tenant defaults …“) is hereby deleted in its entirety.

| V. | Tenant’s Proportionate Share; Additional Rent. |

| A. | Tenant’s Proportionate Share for the Original Premises is 83.21%. |

Tenant’s Proportionate Share for the Expansion Space shall be as follows:

| 1. | 5 Carlisle Expansion Space (13,710 s.f.): 16.79% (based on 81,632 s.f. in the 5 Carlisle Building); |

| 2. | 2nd Floor-3 Carlisle Expansion Space (33,737 s.f.): 40.34% (based on 83,636 s.f. in the 3 Carlisle Building); |

| 3. | Area A-3 Carlisle Expansion Space (20,988 s.f.): 25.09% (based on 83,636 s.f. in the 3 Carlisle Building); and |

| 4. | Area B-3 Carlisle Expansion Space (7,789 s.f.): 9.31% (based on 83,636 s.f. in the 3 Carlisle Building). |

| B. | In light of the fact that the Premises are located in two separate buildings in the Westford Corporate Center, Landlord and Tenant agree that, for purposes of determining additional rent payable under Sections 6.3 and 6.4 of the Lease, Tax Costs and Operating Expenses shall be calculated, reimbursed, and accounted for separately with respect to the 3 Carlisle Building and the 5 Carlisle Building. To that end, for and with respect to the portion of the Premises located in the 3 Carlisle Building, references in the Lease to the “Project” shall be deemed to refer to the 3 Carlisle Building and, for and with respect to the portion of the Premises located in the 5 Carlisle Building, references in the Lease to the “Project” shall be deemed to refer to the 5 Carlisle Building. The percentages set forth in Subsection V.A. above shall refer to the proportionate share of each component of the Premises in the building in which such component is located. |

| VI. | Expenses and Taxes. |

| A. | Original Premises. Tenant shall continue to pay for Tenant’s Proportionate Share of Operating Expenses and Tax Costs applicable to the Original Premises in accordance with the terms of the Lease through the day before the Rent |

-6-

| Adjustment Date. Tenant’s liability for Operating Expenses and Tax Costs applicable to the Original Premises for the portion of calendar year 2014 occurring before the Rent Adjustment Date shall be equitably pro-rated. From and after the Rent Adjustment Date, Tenant shall pay Tenant’s Proportionate Share of Operating Expenses and Tax Costs applicable to the Original Premises in accordance with the terms of the Lease, except as follows: |

| (i) | the Base Year shall mean calendar year 2014 for Operating Expenses; and |

| (ii) | the Base Year for Taxes shall mean whichever of the following two (2) Fiscal Years has the higher Tax Costs: (x) Fiscal Year 2012 (i.e., July 1, 2011, through June 30, 2012), or (y) Fiscal Year 2014 (i.e., July 1, 2013, through June 30, 2014). |

| B. | First Expansion Space. For the period commencing with the First Expansion Space Effective Date, Tenant shall pay for Tenant’s Proportionate Share of Operating Expenses and Tax Costs applicable to the First Expansion Space in accordance with the terms of the Lease, except as follows: |

| (i) | the Base Year shall mean calendar year 2014 for Operating Expenses; and |

| (ii) | the Base Year for Taxes shall mean whichever of the following two (2) Fiscal Years has the higher Tax Costs: (x) Fiscal Year 2012 (i.e., July 1, 2011, through June 30, 2012), or (y) Fiscal Year 2014 (i.e., July 1, 2013, through June 30, 2014). |

| C. | Second Expansion Space. For the period commencing with the Second Expansion Space Effective Date, Tenant shall pay for Tenant’s Proportionate Share of Operating Expenses and Tax Costs applicable to the Second Expansion Space in accordance with the terms of the Lease, except as follows: |

| (i) | the Base Year shall mean calendar year 2014 for Operating Expenses; and |

| (ii) | the Base Year for Taxes shall mean whichever of the following two (2) Fiscal Years has the higher Tax Costs: (x) Fiscal Year 2012 (i.e., July 1, 2011, through June 30, 2012), or (y) Fiscal Year 2014 (i.e., July 1, 2013, through June 30, 2014). |

| D. | Effective as of the Execution Date of this Fifth Amendment, the phrase “ninety-five percent (95%)” in Section 6.3 of the Lease is deleted, and the phrase “one hundred percent (100%)” is substituted in its place. |

| E. | The parties acknowledge and agree that Tax Costs and Operating Expenses are incurred, calculated, accounted for, and passed through as Additional Rent under the Lease separately with respect to each of the 5 Carlisle Building and the 3 Carlisle Building. Accordingly, for purposes of determining Additional Rent for Increases in Tax Costs and Operating Expenses for the Premises, the parties agree as follows: |

-7-

| (i) | For the Original Premises and the 5 Carlisle Expansion Space, references to the “Project” shall be deemed to refer to the 5 Carlisle Building and the tax parcel on which such building is located; and |

| (ii) | For the 2nd Floor-3 Carlisle Expansion Space and the 1st Floor-3 Carlisle Expansion Space, references to the “Project” shall be deemed to refer to the 3 Carlisle Building. |

| VII. | Improvements to Expansion Space. |

| A. | Condition of Expansion Space. Tenant has inspected the Expansion Space and agrees to accept the same “as is” without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements, except as may be expressly provided otherwise in this Amendment. Notwithstanding the foregoing, Landlord agrees that all base building systems serving the Expansion Space will be in good working order at the time Landlord delivers the Expansion Space to Tenant hereunder. |

| B. | Responsibility for Improvements to Expansion Space. Tenant may perform improvements to the Premises and the Expansion Space in accordance with the Work Letter attached hereto as Exhibit B, and Tenant shall be entitled to an improvement allowance in connection with such work as more fully described in Exhibit B. |

| VIII. | Early Access to Expansion Space |

| During the period prior to the First Expansion Space Effective Date, Tenant shall, with respect to its use and occupancy of the First Expansion Space, comply with all terms and provisions of the Lease, except those provisions requiring payment of Base Rent or Additional Rent as to the First Expansion Space. During the period, if any, between the Second Expansion Space Delivery Date and the Second Expansion Space Effective Date, Tenant shall, with respect to its use and occupancy of the Second Expansion Space, comply with all terms and provisions of the Lease, except those provisions requiring payment of Base Rent or Additional Rent as to the Second Expansion Space. |

| IX. | Electricity with Respect to the Expansion Space. The consumption of electricity in the Expansion Space shall be measured by separate meters to be installed by Landlord, at Landlord’s cost, prior to the respective Expansion Space Effective Dates. Tenant shall pay for electricity in the Expansion Space in accordance with Section 10 of the Lease. |

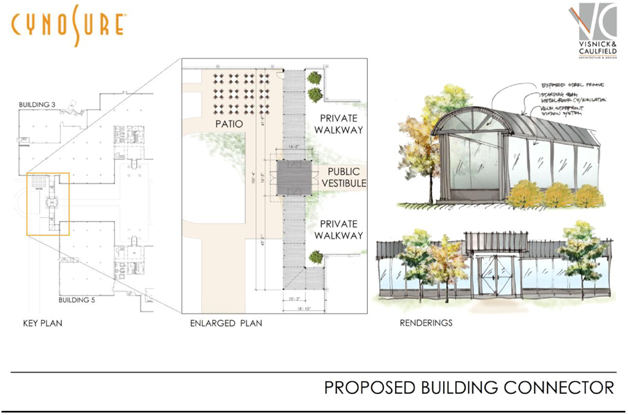

| X. | Tenant’s Building Connector Work. Tenant shall have the right, at Tenant’s cost and expense, but subject to Landlord’s Connector Work Contribution, as hereinafter defined, and subject to Landlord’s prior written approval as to size, design, finish and materials, such approval not to be unreasonably withheld or delayed (subject to the following provisions of this Section X), to construct a structure (“Building Connector”) connecting the 3 Carlisle Building to the 5 Carlisle Building (“Connector Work”). Notwithstanding the foregoing, Landlord may withhold its consent to the Connector Work if and to the extent that the exterior appearance thereof is not substantially consistent with the connector shown on the sketch attached hereto as Exhibit E. The Connector Work shall be performed in compliance with all applicable laws, local building codes and ordinances |

-8-

| and receipt of all governmental permits and related and required permits and approvals from the Town of Westford, Massachusetts required in connection therewith. Landlord shall provide to Tenant a contribution toward the costs incurred in the performance of the Connector Work in the amount of One Hundred Fifty Thousand and 00/100 Dollars ($150,000.00) (“Landlord’s Connector Work Contribution”). Landlord’s Connector Work Contribution shall be paid to Tenant within thirty (30) days after completion of the Connector Work and delivery to Landlord of the documentation required pursuant to Subparagraph B of the Workletter attached hereto as Exhibit B, Fifth Amendment, evidencing payment of such costs. If Landlord fails to pay Landlord’s Connector Work Contribution in accordance with the foregoing, which failure continues for more than thirty (30) days after Tenant gives Landlord notice of such failure, then Tenant may offset the amount of Landlord’s Connector Work Contribution that Landlord failed to pay against the next installment(s) of Base Rent due hereunder. Tenant shall pay Landlord a construction management fee equal to three percent (3%) of the hard costs of the performance of the Connector Work. Except for a portion of the Building Connector, substantially as shown as “Public Vestibule” in Exhibit B, which portion shall be for the use by Tenant in common with other tenants of the Westford Corporate Center and shall be accessible from the exterior areas on either side of the Building Connector, the Building Connector shall be for the exclusive use by Tenant. |

| XI. | Landlord’s 3 Carlisle Building Lobby Work. Landlord shall, at Landlord’s cost and expense, renovate the lobby of the 3 Carlisle Building to a condition at least equivalent to that of other first-class suburban office buildings in the Boston Metro/West area (the “Lobby Work”). The Lobby Work shall be performed on or before the date that is twelve (12) months after the Execution Date (“Estimated Completion Date”), provided however, that Landlord’s failure to complete the Lobby Work on or before the Estimated Completion Date shall not affect any of the terms of this Fifth Amendment, nor shall Tenant have any claims for abatement of rent or damages on account of the completion of Landlord’s 3 Carlisle Building Lobby Work after the Estimated Completion Date. If Landlord substantially modifies the entry to the 3 Carlisle Building, as part of the Lobby Work (i.e., as opposed to the mere renovation of the existing lobby), then Landlord shall, at Landlord’s cost and expense, perform the same modifications to the entry to the 5 Carlisle Building by no later than six months after completion of the 3 Carlisle Building Lobby Work. |

| XII. | Extension Options. Tenant shall continue to have the Extension Terms (i.e., two (2) additional periods of five (5) years each), pursuant to Section X of the Third Amendment (which replaced Section 38 of the Addendum to Lease). |

| XIII. | Tenant’s Right of First Offer. |

| A. | Grant of Option; Conditions. Tenant shall have a continuous right of first offer (the “Right of First Offer”) with respect to any space in the 3 Carlisle Building becoming available from and after the Execution Date (the “Offering Space”). Tenant’s Right of First Offer shall be exercised as follows: at any time after Landlord has determined that the existing tenant in the Offering Space will not exercise its right under its lease to extend or renew the term of its lease for the Offering Space (but prior to leasing such Offering Space to a party other than the existing tenant), Landlord shall give Tenant written notice (the “Advice”) of the rental terms (base rent, Base Year for additional rent, and free rent, if any), delivery and/or commencement date, build-out provisions (i.e., delivery condition |

-9-

| of the Offering Space), and other material business terms under which Landlord is prepared to lease the Offering Space to Tenant for the remainder of the Term. In any event, the term for the Offering Space shall be conterminous with the Term of the Lease. The rental rate shall reflect the Prevailing Market (hereinafter defined) rate for such Offering Space as reasonably determined by Landlord. Tenant may lease such Offering Space under such terms, by delivering written notice of exercise to Landlord (the “Notice of Exercise”) within ten (10) business days after the date of the Advice, except that Tenant shall have no such Right of First Offer and Landlord need not provide Tenant with an Advice, if: |

| 1. | Tenant is in Default under the Lease beyond any applicable cure periods at the time that Landlord would otherwise deliver the Advice; or |

| 2. | the Premises, or more than 25% of the Premises is sublet (other than pursuant to Section 18.1.1.2 of the Lease) at the time Landlord would otherwise deliver the Advice; or |

| 3. | the Lease has been assigned (other than pursuant to Section 18.1.1.2 of the Lease) prior to the date Landlord would otherwise deliver the Advice; or |

| 4. | the existing tenant in the Offering Space exercises an extension option set forth in its lease and listed on Exhibit D attached hereto (or agrees to an extension in lieu of the exercise of such existing option); or |

| 5. | less than two (2) years remains in the then-current Term (provided, however, that if Tenant still has the right to exercise its Extension Option, then Landlord shall nevertheless give the Advice and Tenant may elect to exercise the Right of First Offer provided that, simultaneously with giving the Notice of Exercise, Tenant gives Landlord an Initial Extension Notice under Section 38 of the Lease (and, in such instance, Tenant may give the Initial Extension Notice more than fifteen (15) months prior to the expiration of the then-current Term, but Landlord shall not be required to advise Tenant of the Base Rent for the Extension Term until the date that is twelve (12) months before the expiration of such Term). |

| B. | Terms for Offering Space. |

| 1. | The term for the Offering Space shall commence upon the commencement date stated in the Advice and expire on the Termination Date and thereupon such Offering Space shall be considered a part of the Premises, provided that the material business terms stated in the Advice shall govern Tenant’s leasing of the Offering Space and only to the extent that they do not conflict with the Advice, the terms and conditions of this Lease shall apply to the Offering Space. |

| 2. | If Tenant leases any Offering Space during the first (1st) twenty-four (24) months of the Second Extended Term, then the initial annual Base Rent rate per rentable square foot for such Offering Space shall be the same as the Base Rent rate per rentable square foot for the Premises demised to Tenant under the Lease on the date the term for such Offering Space |

-10-

| commences. The Base Rent rate for such Offering Space shall increase at such times and in such amount as Base Rent for the Premises demised to Tenant under the Lease, it being the intent of Landlord and Tenant that the Base Rent rate per rentable square foot for such Offering Space shall always be the same, pursuant to this Section B.2, as the Base Rent rate per rentable square foot for the Premises demised to Tenant under the Lease. Base Rent attributable to such Offering Space shall be payable in monthly installments in accordance with the terms and conditions of Article 6 of the Lease. Tenant shall pay Additional Rent (i.e. Taxes and Expenses) for such Offering Space on the same terms and conditions set forth in this Fifth Amendment, including the same Base Year that is applicable to the Premises demised to Tenant under the Lease, and Tenant’s Proportionate Share shall increase appropriately to account for the addition of such Offering Space. In addition, Tenant shall, in such circumstance, receive a prorated tenant improvement allowance and a prorated free rent period as follows: (i) the allowance shall be in an amount equal to the product of (a) $20.00 per square foot of floor area in the applicable Offering Space multiplied by (b) the Proration Factor (defined below), and (ii) the free rent period shall be the number of months from and after the commencement date with respect to the applicable Offering Space equal to the product of (x) twenty-one (21) multiplied by (y) the Proration Factor. As used herein, the “Proration Factor” shall mean a fraction, the numerator of which is the number of full calendar months remaining in the Second Extended Term from and after the commencement date of the applicable Offering Space, and the denominator of which is one hundred fifty-six (156). |

| 3. | If Tenant does not lease such Offering Space during the first (1st) twenty-four (24) months of the Second Extended Term, then Tenant shall pay Base Rent and Additional Rent for the Offering Space in accordance with the terms and conditions of the Advice, which terms and conditions shall reflect the Prevailing Market rate for the Offering Space as determined in Landlord’s reasonable judgment. |

| 4. | The Offering Space shall be accepted by Tenant in its condition and as-built configuration existing on the date of Landlord’s delivery of the Offering Space to Tenant free of all occupants and the personal property of others and in broom-clean condition, unless the Advice specifies any work to be performed by Landlord in the Offering Space, in which case Landlord shall perform such work in the Offering Space prior to delivering possession to Tenant. If Landlord is delayed in delivering possession of the Offering Space due to the holdover or unlawful possession of such space by any party, Landlord shall use reasonable efforts to obtain possession of the space, and the commencement of the term for the Offering Space shall be postponed until the date Landlord delivers possession of the Offering Space to Tenant free from occupancy by any party. |

-11-

| C. | Termination of Right of First Offer. The rights of Tenant hereunder with respect to the Offering Space shall terminate on the earlier to occur of: (i) Tenant’s failure to exercise its Right of First Offer within the ten (10) business day period provided in Section A above; and (ii) the date Landlord would have provided Tenant an Advice except that one or more of the conditions set forth in Section A above applied and therefore Landlord was not required to deliver the Advice. Notwithstanding the foregoing, within one hundred eighty (180) days from the Advice (or the date Landlord would have delivered the Advice pursuant to subsection (ii) above), Landlord shall not offer for lease or lease such Offering Space to a third party at a Net Effective Rent (defined below) less than eighty-five percent (85%) of the Net Effective Rent set forth in the Advice without first having re-offered the Offering Space to Tenant at such lower Net Effective Rent in accordance with this Section XIII. As used herein, the term “Net Effective Rent” shall mean the net present value over the balance of the term of this Lease of the base rent, additional rent, and other charges that would be payable to Landlord under the terms of any proposed lease for the Offering Space thereof, taking into account any construction allowance, the cost of any leasehold improvements proposed to be performed by Landlord, any free rent, and any other monetary inducements payable by Landlord under such proposed lease. In addition, if Landlord fails to execute a lease with a third party for the Offering Space within one hundred eighty (180) days from the date of the Advice, Landlord shall re-offer the Offering Space to Tenant prior to offering the Offering Space to a third party. |

| D. | Offering Amendment. If Tenant exercises its Right of First Offer, Landlord shall prepare an amendment (the “Offering Amendment”) adding the Offering Space to the Premises on the terms set forth in the Advice and reflecting the changes in the Base Rent, Rentable Square Footage of the Premises, Tenant’s Pro Rata Share, Parking Spaces, and other appropriate terms. A copy of the Offering Amendment shall be sent to Tenant within a reasonable time after Landlord’s receipt of the Notice of Exercise executed by Tenant, and, if the terms and conditions of the Offering Amendment are reasonably acceptable to Tenant, then Tenant shall execute and return the Offering Amendment to Landlord within fifteen (15) days thereafter, but an otherwise valid exercise of the Right of First Offer shall be fully effective whether or not the Offering Amendment is executed. |

| E. | Subordination. Notwithstanding anything herein to the contrary, Tenant’s Right of First Offer are subject and subordinate only to the extension rights and expansion rights (whether such rights are designated as a right of first offer, right of first refusal, expansion option or otherwise) of the tenants of the 3 Carlisle Building existing on the date hereof and set forth in Exhibit D attached hereto. |

| F. | For purposes of this Right of First Offer provision, “Prevailing Market” shall mean the annual rental rate per square foot for space comparable to the Offering Space in the 3 Carlisle Building and office buildings comparable to the 3 Carlisle Building located within ten (10) miles of the 3 Carlisle Building under leases and renewal and expansion amendments being entered into at or about the time that Prevailing Market is being determined, giving appropriate consideration to tenant concessions, brokerage commissions, tenant improvement allowances, existing improvements in the space in question, and the method of allocating operating expenses and taxes. Notwithstanding the foregoing, space leased under any of the following circumstances shall not be considered to be comparable for purposes hereof: (i) the lease term is for less than the lease term of the Offering Space, (ii) the space is encumbered by the option rights of another tenant, or (iii) the space has a lack of windows and/or an awkward or unusual shape or configuration. The foregoing is not intended to be an exclusive list of space that will not be considered to be comparable. As set forth above, Prevailing Market rate shall be reasonably determined by Landlord taking into account the above factors. |

-12-

| XIV. | Parking. Tenant shall continue to have Tenant’s Parking Rights, as initially defined in Section 2.12 of the Lease, and subsequently deleted and replaced with Section 6.01 of the Second Amendment, and as amended by Section V of the Third Amendment. In addition, Tenant shall be entitled to, with respect to the Expansion Space, additional parking at the ratio of 3.3 parking spaces per 1,000 rentable square feet of the Expansion Space (i.e., 258 additional parking spaces). |

| XV. | Signage. |

In addition to Tenant’s signage rights set forth in Section 40 of the Addendum to Lease, Exhibit F to the Lease and Section XV of the Third Amendment, Tenant shall have the following additional rights:

| A. | 5 Carlisle Building |

Tenant shall have the right, with respect to the 5 Carlisle Expansion Space, to list Tenant’s name on the Building directory in the 5 Carlisle Building. The initial listing of Tenant’s name shall be at Landlord’s cost and expense. Any changes, replacements or additions by Tenant to such directory shall be at Tenant’s sole cost and expense. Tenant shall have the right to display Tenant’s logo inside the main entrance to the 5 Carlisle Building. In addition to the foregoing, Tenant shall have the exclusive right to install, at Tenant’s sole expense (including, without limitation, the expense of obtaining any governmental approvals for such signage, which shall be Tenant’s responsibility) exterior signage on the 5 Carlisle Building (the “5 Carlisle Exterior Signage”). So long as Tenant leases at least seventy-five (75%) of the rentable area of the 5 Carlisle Building, neither Landlord nor any other tenant shall have the right to install any signage on the exterior of the 5 Carlisle Building while this Lease is in effect. The 5 Carlisle Exterior Signage shall (i) be subject to Landlord’s approval as to location, size and appearance of the 5 Carlisle Exterior Signage, which approval shall not be unreasonably withheld, and (ii) be in compliance with all applicable laws, codes and ordinances, all governmental permits and approvals required in connection therewith, and any and all permits and approvals required by regulatory authorities having jurisdiction with respect to the 5 Carlisle Exterior Signage. Tenant shall remove the 5 Carlisle Exterior Signage at the expiration or earlier termination of the Lease. The installation, maintenance and removal of the 5 Carlisle Exterior Signage shall be performed at Tenant’s expense in accordance with Section 40 of the Lease.

| B. | 3 Carlisle Building |

Tenant shall have the right, with respect to the 3 Carlisle Building to list Tenant’s name on the Building directory in the 3 Carlisle Building. The initial listing of Tenant’s name shall be at Landlord’s cost and expense. Any changes, replacements or additions by Tenant to such directory shall be at Tenant’s sole cost and expense. In addition, Tenant shall have the right to display Tenant’s logo inside the main entrance to the portion of the 3 Carlisle Building in which the

-13-

Premises are located. In addition to the foregoing, Tenant shall have the non-exclusive right to install, at Tenant’s sole expense (including, without limitation, the expense of obtaining any governmental approvals for such signage, which shall be Tenant’s responsibility) exterior signage on the 3 Carlisle Building (the “3 Carlisle Exterior Signage”). The 3 Carlisle Exterior Signage shall not exceed in size the aggregate maximum exterior signage allowed as of right on the 3 Carlisle Building under applicable law multiplied by a fraction, the numerator of which is the square footage of the portion of the Premises located in the 3 Carlisle Building and the denominator of which is the total square footage of the 3 Carlisle Building; provided, however, if the applicable sign regulations do not permit more than one exterior sign on the Building, then Tenant shall have the exclusive right to such exterior signage at the maximum size permissable. The 3 Carlisle Exterior Signage shall (i) be subject to Landlord’s approval as to location, size and appearance of the 3 Carlisle Exterior Signage, which approval shall not be unreasonably withheld, and (ii) be in compliance with all applicable laws, codes and ordinances, all governmental permits and approvals required in connection therewith, and any and all permits and approvals required by regulatory authorities having jurisdiction with respect to the 3 Carlisle Exterior Signage. Tenant shall remove the 3 Carlisle Exterior Signage at the expiration or earlier termination of the Lease. The installation, maintenance and removal of the 3 Carlisle Exterior Signage shall be performed at Tenant’s expense in accordance with Section 40 of the Lease.

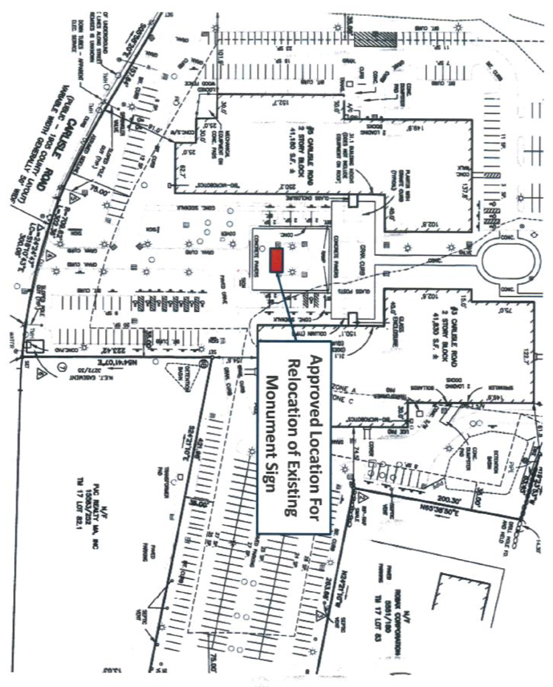

| C. | Monument Signs |

Tenant shall have the right to relocate Tenant’s monument sign currently located in front of the 5 Carlisle Building to the location shown on Exhibit F attached hereto. Such work shall be performed at Tenant’s expense in accordance with plans and specifications therefor approved in writing, in advance by Landlord, which approval shall not be unreasonably withheld. In addition, Tenant shall have the right to install two new monument signs, one near the entrance to the 3 Carlisle Building and one near the entrance to the 5 Carlisle Building. Notwithstanding the provisions of Section XV of the Third Amendment, Tenant shall have the exclusive use of the monument sign, if any, at the entrance to the 5 Carlisle Building. The monument sign at the entrance to the 3 Carlisle Building, if any, shall be used by Tenant in common with such other occupants of such building as may be designated from time to time by Landlord. Tenant shall be solely responsible for obtaining all governmental permits and approvals required for the installation of such monument signs, which shall be installed at locations and in accordance with plans and specifications therefor that have been approved in advance, in writing by Landlord, which approval shall not be unreasonably withheld.

XVI. Subordination, Non-Disturbance and Attornment Agreement. Landlord represents and warrants that as of the Execution Date, the Project (meaning both the 5 Carlisle and 3 Carlisle Drive properties) are not encumbered by any mortgages except for a mortgage held by Berkadia Commercial Mortgage LLC (“Lender”). Simultaneously with the execution of this Amendment, Landlord, Lender and Tenant shall enter into a subordination, non-disturbance and attornment agreement in the form attached hereto as Exhibit C, Fifth Amendment, with such commercially reasonable changes as may be agreed upon by the parties, and Landlord shall pay any charges (including legal fees) required by this Lender as a condition to entering into such agreement.

-14-

Section 21 of the Lease is hereby deleted and the following is substituted therefore:

This Lease will be subject and subordinate to any mortgage encumbering the Project entered into by Landlord after the date of this Lease provided that Tenant receives from any such mortgagee a nondisturbance agreement substantially in the form attached hereto as Exhibit C, or upon such other commercially reasonable form that does not materially adversely affect any of Tenant’s rights or obligations under this Lease, and that recognizes Tenant’s rights under the Lease, and at no cost to Tenant.

| XVII. | Notices. For all purposes of the Lease, the notice address and rent payment address for Landlord and Tenant are as follows: |

Landlord’s Notice Address:

Glenborough Westford Center, LLC

c/o Normandy Real Estate Management, LLC

7/57 Wells Avenue

Newton, Massachusetts 02459

Attention: Jeff Rines, Senior Vice President

With a copy to:

Normandy Real Estate Partners, LLC

53 Maple Avenue

Morristown, New Jersey 07960

Attention: Corporate Counsel

With a copy to:

Normandy Real Estate Partners, LLC

53 Maple Avenue

Morristown, New Jersey 07960

Attention: Steve Smith, Director

Landlord’s Rent Payment Address:

Glenborough Westford Center, LLC

P.O. Box 30930 New York,

New York 10087-0903

Tenant’s Notice Address:

CYNOSURE, INC.

5 Carlisle Road

Westford, MA 01886

Attn: Patricia A. Davis

SVP, General Counsel & Secretary

-15-

| XVIII. | Inapplicable, Deleted and Amended Lease Provisions. |

| A. | Tenant’s Use. Section 2.20 of the Lease is deleted and the following is substituted therefore: |

TENANT’S USE (Section 9): Office, research and development, clinical testing, light manufacturing and assembly.

| B. | Hazardous Materials. The first two sentences in Section 9.6 are hereby deleted and the following substituted therefor: |

Tenant shall not create, generate, use, bring, allow, emit, dispose or permit on the Premises, Building or Project any toxic or hazardous gases, liquid or solid material or waste or any other hazardous materials defined or listed in any applicable federal, state or local law, rule, regulation or ordinance (“Hazardous Material”); provided, however, Tenant may use and store Hazardous Materials in the Premises in the ordinary course of Tenant’s business and Tenant’s use of such Hazardous Materials shall be in all respects in compliance with all applicable laws, including without limitation, all requirements as to the use, handling, storage, and disposal of such Hazardous Materials. Tenant shall upon request of Landlord provide Landlord with a list of all such Hazardous Materials being used or stored in the Premises.

| C. | Services and Utilities. The last sentence in the third paragraph of Section 10 is hereby deleted and the following substituted therefor: |

Notwithstanding the foregoing, if the HVAC and electrical services Landlord is required to provide to the Premises hereunder are not provided to the Premises or any portion thereof for a period of more than five (5) consecutive days following Tenant’s notice to Landlord of the absence of such service(s), and if a materially adverse effect on Tenant’s ability to conduct its business in the Premises results from the absence of such service(s), such that Tenant is prevented from using and does not use the Premises or any portion thereof, then all rental under this Lease shall abate starting on the sixth (6th) consecutive day and continuing during the period such service(s) is not provided in proportion to the portion of the Premises that Tenant is prevented from using and does not use and such abatement shall continue until such date and time as such service(s) is re-established.

| D. | Repairs and Maintenance. |

| (i) | Landlord’s Obligations. The word “Premises” in the second line of Section 11.1 is hereby deleted and the word “Common Areas of the Project” substituted therefor. |

| (ii) | Tenant’s Obligations. The phrase “and exterior” is hereby deleted in the sixth line of Section 11.2.1. Landlord shall be responsible for repair and maintenance of exterior windows, the cost of which shall be included in Operating Expenses. |

-16-

| E. | Alterations. |

| (i) | The first two sentences in Section 12.3 are hereby deleted and the following substituted therefor: |

Except for the Initial Alterations as provided for in Exhibit B to this Amendment, Tenant shall not make or suffer to be made any alterations, additions, or improvements to the Premises, without the prior written consent of Landlord. Landlord’s consent shall not be unreasonably withheld, conditioned or delayed with respect to alterations which (i) are not structural in nature, (ii) are not visible from outside the Premises, and (iii) do not adversely affect or require modification of the Building’s electrical, mechanical, plumbing, HVAC or other systems. In any event, Landlord’s consent may be conditioned on Tenant removing any such alterations, additions, or improvements upon the expiration of the Term and restoring the affected portion of the Premises to its condition immediately preceding the installation of such alterations, additions, or improvements. Landlord and Tenant acknowledge that Landlord’s consent shall not be required for minor modifications such as the installation or relocation of electrical or data/communications outlets, painting, carpeting and installation or relocation of interior walls or partitions.

| (ii) | The last paragraph in Section 12.3 is hereby deleted in its entirety. |

| F. | Leasehold Improvements. Section 12.5 is hereby deleted in its entirety and Section 13.1 is hereby deleted in its entirety and the following is substituted therefor: |

All fixtures (other than Tenant’s trade fixtures), HVAC equipment, and alterations or leasehold improvements attached to or built into the Premises at the commencement or during the Term, whether or not at the expense of Tenant, shall be and remain a part of the Premises, shall be the property of Landlord and shall not be removed by Tenant, except as set forth in Section 13.2. In the event that Landlord desires for any alterations or improvements made by Tenant after the Execution Date of this Amendment (and excluding the Initial Alterations) to be removed by Tenant upon the termination of the Lease, Landlord shall provide written notification of the removal requirement at the time that consent for such alterations is granted or within thirty (30) days after Tenant notifies Landlord in writing of any such alterations or improvements for which Landlord’s consent is not required. Notwithstanding anything to the contrary in the Lease, Landlord shall have no right to require Tenant to remove at the expiration or earlier termination of the Lease any leasehold improvements that exist as of the Execution Date.

| G. | Insurance. |

Sections 15.1 through 15.5, and Section 15.7 inclusive, of the Lease are hereby deleted and the following is inserted in their place:

“15.1 Tenant’s Insurance. Tenant shall obtain, and shall keep in full force and effect, the following insurance, with insurers that are authorized to do business in the Commonwealth of Massachusetts and are rated at least A (Class X) in Best’s Key Rating Guide:

-17-

(a) Commercial General Liability Insurance, which shall include premises liability, contractual liability covering Tenant’s indemnity obligations under this Lease (to the extent covered as an Insured Contract in a standard ISO GCL Policy), fire legal liability, personal & advertising injury and products/completed operations coverage. Policy shall insure against claims for bodily injury, personal injury, death or property damage occurring on, in or about the Premises with limits of not less than $1,000,000.00 per occurrence and $2,000,000.00 in the aggregate. If the policy covers other locations owned or leased by Tenant, then such policy must include an aggregate limit per location endorsement.

(b) Special Form (“All Risk”) Property, insuring all equipment, trade fixtures, inventory, fixtures and personal property (“Tenant’s Property”) and any Alterations or other Leasehold Improvements which are the responsibility of Tenant, located on or in the Premises with an agreed amount endorsement and equal to the full replacement cost value of such property.

(c) Workers’ Compensation Insurance as required by applicable laws of the State in which the Premises is located, including Employers’ Liability Insurance with limits of not less than: (x) $100,000 per accident; (y) $500,000 disease, policy limit; and (z) $100,000 disease, each employee.

(d) Business Interruption Insurance with limits of not less than the amount necessary to cover continuing expenses including rents and extra expenses for at least one (1) year; provided that if Tenant elects not to carry or self-insure business interruption insurance, Tenant shall not be in Default under the terms of this Lease and Tenant further acknowledges that Landlord is released from any and all liability arising during the Lease Term which would have been covered by business interruption insurance had Tenant carried such insurance.

(e) Excess or Umbrella Liability Insurance with limits of not less than Two Million Dollars ($2,000,000.00) per occurrence and in the aggregate providing coverage excess and follow-form of the primary general and employer’s liability insurances required hereinto.

(f) Such other insurance as Landlord deems necessary and prudent or as may be required by any Mortgagee (defined below).

(g) In addition to the above aforementioned insurances, and during any such time as any alterations or work is being performed at the Premises (except that work being performed by the Landlord or on behalf of Landlord) Tenant, at its sole cost and expense, shall carry, or shall cause to be carried and shall deliver to Landlord at least ten (10) days prior to commencement of any such alteration or work, evidence of insurance with respects to (a) workers compensation insurance covering all persons employed in connection with the proposed alteration or work in statutory limits, (b) general/excess liability insurance, in an amount commensurate with the work to be performed but not less than Two Million Dollars ($2,000,000) per occurrence and in the aggregate, for ongoing and completed operations insuring against bodily injury and property damage and naming all additional insured parties as outlined below and required of Tenant and shall include a waiver of subrogation in favor of such parties, (c) builders risk insurance, to the extent such alterations or work may require, on a

-18-

completed value form including permission to occupy, covering all physical loss or damages, in an amount and kind reasonable satisfactory to Landlord, and (d) such other insurance, in such amounts, as Landlord deems reasonably necessary to protect Landlord’s interest in the Premises from any act or omission of Tenant’s contactors or subcontractors.

15.2 Policy Requirements. The policies of insurance required to be maintained by Tenant pursuant to this Section 15 must be reasonably satisfactory to Landlord and must be written as primary policy coverage and not contributing with, or in excess of, any coverage carried by Landlord. All policies must name Tenant as the named insured party and (except for worker’s compensation and property insurance) all policies shall name as additional insureds for on-going and completed operations, Landlord, Normandy Real Estate Partners, LLC, Normandy Real Estate Management Co., LLC, the Mortgagees under any Mortgage defined below, and all of their respective affiliates, members, officers, employees, agents and representatives, managing agents, and other designees of Landlord and its successors as the interest of such designees shall appear. In addition Tenant agrees and shall provide thirty (30) days’ prior written notice of suspension, cancellation, termination, or non-renewal of coverage to Landlord. Tenant shall not self-insure for any insurance coverage required to be carried by Tenant under this Lease. The deductible for any insurance policy required hereunder must not exceed $10,000. Tenant shall have the right to provide the insurance coverage required under this Lease through a blanket policy, provided such blanket policy expressly affords coverage to the Premises and to Landlord as required by this Lease.

15.3 Certificates of Insurance. Prior to the Commencement Date, Tenant shall deliver to Landlord certificates of insurance evidencing all insurance Tenant is obligated to carry under this Lease, together with a copy of the endorsement(s), specifically but not limited to Waiver of Rights to Recover From Others, Additional Insureds (on-going and completed operations) and Contractual Liability endorsements. Within ten (10) days prior to the expiration of any such insurance, Tenant shall deliver to Landlord certificates of insurance evidencing the renewal of such insurance. Tenant’s certificates of insurance must be on: (i) Acord Form 27 with respect to property insurance; and (ii) Acord Form 25-S with respect to liability insurance or, in each case, on successor forms approved by Landlord, and in any event state as the certificate holder: Compliance Services Corporation, on behalf of Normandy Real Estate Partners, LLC, P.O. Box 2750, Montgomery Village, MD 20886.

15.4 No Separate Insurance. Tenant shall not obtain or carry separate insurance concurrent in form or contributing in the event of loss with that required by Section 15.1(a) unless Landlord and Tenant are named as insureds therein.

15.5 Tenant’s Failure to Maintain Insurance. If Tenant is in default for failing to obtain the insurance coverage or the certificates and endorsements required by this Lease, and such default continues for ten (10) days after notice from Landlord, Landlord, may, at its option, obtain such insurance for Tenant and Tenant shall promptly reimburse Landlord, as Additional Rent, for the reasonable cost thereof.”

| H. | Damage or Destruction. Section 16 of the Lease is hereby deleted in its entirety and the provisions set forth following new Section 16 is substituted therefor: |

16.1 Casualty. If all or any portion of the Premises becomes untenantable by fire or other casualty to the Premises (collectively a “Casualty”), Landlord, with reasonable promptness, shall cause a general contractor selected by Landlord to provide Landlord and Tenant with a good

-19-

faith written estimate of the amount of time required using standard working methods to Substantially Complete the repair and restoration of the Premises and any Common Areas necessary to provide access to the Premises (“Completion Estimate”). If the Completion Estimate indicates that the Premises or any Common Areas necessary to provide access to the Premises cannot be made tenantable within nine (9) months from the date of the Casualty, then Tenant shall have the right to terminate this Lease upon written notice to Landlord within thirty (30) days after receipt of the Completion Estimate. In addition to Tenant’s right to terminate the lease entirely under such circumstances, each of Landlord and Tenant shall have the following termination rights, which shall be exercised, if at all, by written notice to the other party within thirty (30) days after receipt of the Completion Estimate: (i) if the Casualty affects only the portion of the Premises in the 3 Carlisle Building, each of Landlord and Tenant may elect to terminate the Lease with respect to the 3 Carlisle Building Premises only and the Lease shall continue with respect to the 5 Carlisle Building Premises; and (ii) if the Casualty affects only the portion of the Premises in the 5 Carlisle Building, each of Landlord and Tenant may elect to terminate the Lease with respect to the 5 Carlisle Building Premises only and the Lease shall continue with respect to the 3 Carlisle Building Premises. In the event of a partial termination hereunder, the parties agree to enter into an amendment of this Lease to reflect the reduction of the Premises effected by such partial termination. In addition, if the Premises have been materially damaged and there is less than two (2) years of the Term remaining on the date of the Casualty (unless Tenant elects to exercise any remaining extension options), then either party may terminate this Lease by delivery of notice of termination to the other party within thirty (30) days after the date of the Casualty.

Further, provided that Landlord maintains the property insurance required to be maintained by Landlord under the Lease, if an uninsured Casualty occurs that would cost in excess of $250,000 to repair, Landlord may elect to terminate the Lease with respect only to that portion of the Premises located in the building(s) affected by the casualty, by giving Tenant notice of such election within thirty (30) days after occurrence of the Casualty. Notwithstanding the foregoing provisions of this paragraph, if only the Premises have been affected by the Casualty and Landlord elects to terminate under this paragraph, Tenant may elect to nullify Landlord’s termination election by (i) giving Landlord written notice (the “Nullification Notice”) of such election not later than ten (10) business days after delivery of Landlord’s termination notice, and (ii) paying to Landlord the Restoration Funds (defined below) not later than ten (10) business days after Landlord delivers to Tenant the Restoration Estimate (defined below). If Tenant fails timely to deliver the Nullification Notice, or having delivered such notice, fails timely to pay the Restoration Funds, then any purported election by Tenant to nullify Landlord’s termination shall automatically become void. If Tenant elects to nullify Landlord’s termination, then, within thirty (30) days after Tenant delivers the Nullification Notice to Landlord, Landlord shall cause a general contractor selected by Landlord to prepare an estimate of the cost to repair and restore such casualty (the “Restoration Estimate”) and shall deliver same to Tenant. The amount set forth in the Restoration Estimate is referred to herein as the “Restoration Funds”. The Restoration Funds shall be held in trust by Landlord for the sole purpose of funding the restoration of such casualty and any portion of the Restoration Funds remaining unexpended after completion of such restoration shall be promptly refunded to Tenant. Forthwith after receipt of the Restoration Funds, Landlord shall restore the Premises as otherwise provided in this Section 16. If the cost of such restoration exceeds the Restoration Funds, Tenant shall pay to Landlord, as Additional Rent, the amount of such excess within thirty (30) days after delivery of Landlord’s demand therefor accompanied by copies of third party invoices evidencing the amount of such cost of restoration. Notwithstanding anything to the contrary contained in this Lease, in the event that Tenant so nullifies Landlord’s termination election under this paragraph, Rent shall abate only if, as, and to the extent that Landlord actually receives proceeds from rental interruption insurance maintained by or for the benefit of Landlord. In no event shall Landlord have any obligation to reimburse Tenant or give Tenant a credit against Rent for any amount paid by Tenant to fund a restoration made pursuant to this paragraph.

-20-

16.2 Restoration. If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and the Common Areas to substantially the same condition that existed prior to the Casualty, except for modifications required by Law or any other modifications to the Common Areas deemed desirable by Landlord (collectively, “Landlord’s Restoration Work”). Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof.

If Landlord’s Restoration Work has not been substantially completed on or before the later to occur of (i) the date that is nine (9) months after the date of the Casualty and (ii) the last day of the restoration period set forth in the Completion Estimate, as each such date may be extended (but not by more than sixty (60) days in the aggregate) by force majeure, and Tenant is unable to occupy all or substantially all of the Premises for the Permitted Use, then Tenant may elect to terminate this Lease, either in whole or in part as expressly provided above, by giving Landlord notice of such election at any time after the applicable deadline and before Landlord has completed the Landlord Restoration Work, in which event this Lease shall terminate, in whole or in part, as aforesaid, on the date that his thirty (30) days after Tenant delivers such termination notice to Landlord unless, on or before the expiration of such thirty-day period, Landlord completes Landlord’s Restoration Work, in which event Tenant’s election to terminate shall automatically become void.

16.3 Rent. If the Lease is terminated in whole or in part pursuant to any of the provisions of Section 16.1 or 16.2, the termination shall be effective on the date that is thirty (30) days after the delivery of a termination notice, and the Base Rent and Additional Rent or a just and proportionate part thereof, according to the nature and extent to which the Premises shall have been so rendered unfit (and taking into account whether this Lease has been terminated in whole or in part), shall be suspended or abated from the date of the Casualty to the date of termination of the Lease. If this Lease is not terminated as a result of a Casualty pursuant to this Section 16, then Base Rent and Additional Rent shall abate for the portion of the Premises that is untenantable and not used by Tenant for the period from the date of Casualty to the date of substantial completion of Landlord’s Restoration Work.

16.4. Casualty Affecting Building. In the event of any Casualty affecting the Common Areas (but not affecting the Premises), Landlord shall diligently repair and restore the Common Areas to the substantially the same condition they were in prior to such Casualty, except for modifications required by law or any other modifications to the Common Areas deemed desirable by Landlord.

| I. | Eminent Domain. The following phrase is inserted at the end of Section 17.2, subsection (a): “or if more than twenty-five percent of the parking spaces serving the Project are taken” (unless Landlord shall, within thirty (30) days after the effective date of such taking, shall provide Tenant alternative parking facilities in the Westford Corporate Center such that Tenant has the right to use at least seventy-five percent (75%) of the parking spaces to which Tenant is entitled under this Lease). |

-21-

| J. | Assignment & Subletting. |

| (i) | The following phrase is inserted after the phrase “assign the Lease” in the eighth line of Section 18.1.1.2: “or sublet all or any portion of the Premises” |

| (ii) | The word “materially” is hereby inserted after the phrase “will not” in the third line of Section 18.2.1.2 |

| K. | Default. |

| (i) | Section 19.1.1 is hereby deleted and the following substituted therefore: |

If Tenant abandons the Premises or vacates substantially all the Premises for a period in excess of twelve consecutive months, other than as a result of a casualty or in connection with a proposed assignment or subletting transaction.

| (ii) | Section 19.1.5 is hereby deleted in its entirety. |

| L. | Tenant Estoppel. Section 22.2 is hereby amended by deleting the same in its entirety and substituting in its place the following: |

“Tenant’s failure to execute and deliver such statement within the time required above, which failure continues for more than ten (10) business days after written notice to Tenant thereof, shall constitute a default under this Lease.”

| M. | Miscellaneous. (Section 36) |

Section 36.12 is hereby amended by adding the following sentence at the end of this Section:

“The provisions of Section 36.12 shall not be applicable during any period in which Tenant is a public company.”

| N. | Section 4 of the Lease (Delivery of Possession), Exhibit D to the Lease (Landlord’s Work), Section 37 of the Addendum to Lease (Tenant Improvements), Exhibit B to Second Amendment (Tenant Work Letter), and Section VII of the Third Amendment (Landlord’s Contribution) shall have no applicability with respect to this Fifth Amendment. |

| O. | Whereas, Tenant is leasing the Refusal Space (as defined in Section XI of the Third Amendment, which replaced Section 39 of the Addendum to Lease), Section XI of the Third Amendment is hereby deleted and is of no further force or effect. Exhibit F to the Lease (Sign Standards for the Park) is hereby deleted and is of no further force or effect. |

| P. | Exhibit G to the Third Amendment (Form of Subordination, Non-Disturbance and Attornment Agreement) is replaced with Exhibit C, Fifth Amendment, Form of Subordination, Non-Disturbance and Attornment Agreement. |

-22-

| XIX. | Use of Pad. |

Landlord agrees to remove the existing chiller plant equipment from the Pad located outside the 5 Carlisle Building (the “Pad”) within six (6) months after the Execution Date. Not later than thirty (30) days after the completion of such removal and delivery to Tenant of copies of third party invoices evidencing the cost to Landlord of such removal, Tenant shall, as additional rent, reimburse Landlord an amount equal to the lesser of (i) fifty percent (50%) of the cost of such removal, and (ii) $5,000. Following such removal, Tenant shall have the exclusive right throughout the Term of the Lease to use the Pad for the storage of hydrogen tanks or such other lawful use approved in advance in writing by Landlord, which approval shall not be unreasonably withheld, subject to the provisions hereof. Tenant shall be solely responsible for obtaining at its expense any and all permits and approvals required for the use of the Pad for such purpose, including any approvals required by governmental authorities or by Landlord’s property insurer. Tenant’s use of the Pad, including, without limitation, any installations on the Pad, shall strictly comply with all applicable laws, regulations, and orders of public authorities, including, without limitation, NFPA 55. Tenant shall construct an enclosure around the Pad that prohibits anyone from entering the Pad Area without a key or other controlled access device. In addition, Tenant shall install such alarm, fire suppression, and other equipment or installations as Landlord may reasonably require with respect to such use of the Pad, provided that such installations are commonly required by other owners of properties containing a facility for the outdoor storage of hydrogen tanks. In addition to the foregoing, if Tenant uses the Pad for any purpose other than the storage of hydrogen tanks, Landlord shall have the right to impose, and Tenant agrees to comply with, such reasonable restrictions, conditions, and requirements as Landlord may deem necessary by reason of such alternative use, which may include the requirement that Tenant make additional installations at its expense, and, in such circumstances, the parties agree to amend the Lease to incorporate any such additional restrictions, conditions, and requirements. All such work shall (i) be performed by Tenant, at its expense, in accordance with plans and specifications therefor that have been approved in advance, in writing by Landlord, which approval shall not be unreasonably withheld and (ii) be removed by Tenant at its expense at the expiration or earlier termination of the Tenant of the Lease.

| XX. | Miscellaneous. |

| A. | This Fifth Amendment sets forth the entire agreement between the parties with respect to the matters set forth herein. There have been no additional oral or written representations or agreements. Under no circumstances shall Tenant be entitled to any Rent abatement, improvement allowance, leasehold improvements, or other work to the Premises, or any similar economic incentives that may have been provided Tenant in connection with entering into the Lease, unless specifically set forth in this Fifth Amendment. |

| B. | Except as herein modified or amended, the provisions, conditions and terms of the Lease shall remain unchanged and in full force and effect. |

| C. | In the case of any inconsistency between the provisions of the Lease and this Fifth Amendment, the provisions of this Fifth Amendment shall govern and control. |

| D. | Submission of this Fifth Amendment by Landlord is not an offer to enter into this Fifth Amendment but rather is a solicitation for such an offer by Tenant. Landlord shall not be bound by this Fifth Amendment until Landlord has executed and delivered the same to Tenant. |

-23-

| E. | The capitalized terms used in this Fifth Amendment shall have the same definitions as set forth in the Lease to the extent that such capitalized terms are defined therein and not redefined in this Fifth Amendment. |

| F. | Tenant hereby represents to Landlord that Tenant has dealt with no broker in connection with this Fifth Amendment, other than Cushman & Wakefield of Massachusetts, Inc. (the “Broker”). Tenant agrees to indemnify and hold Landlord, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, mortgagee(s) and agents, and the respective principals and members of any such agents harmless from all claims of any brokers claiming to have represented Tenant in connection with this Fifth Amendment, other than the Broker. Landlord hereby represents to Tenant that Landlord has dealt with no broker in connection with this Fifth Amendment, other than the Broker. Landlord agrees to indemnify and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, employees, and agents, and the respective principals and members of any such agents harmless from all claims of any brokers claiming to have represented Landlord in connection with this Fifth Amendment, other than the Broker. Landlord shall pay a brokerage commission to Broker pursuant to a separate agreement between Landlord and the Broker. |

| G. | Each signatory of this Fifth Amendment represents hereby that he or she has the authority to execute and deliver the same on behalf of the party hereto for which such signatory is acting. |

[SIGNATURES ARE ON FOLLOWING PAGE]

-24-

IN WITNESS WHEREOF, Landlord and Tenant have duly executed this Amendment as of the day and year first above written.

| WITNESS/ATTEST: | LANDLORD: | |

| GLENBOROUGH WESTFORD CENTER, LLC, a Delaware limited liability company | ||

| Name: /s/ Candace Cobb Print: Candace Cobb |

By: /s/ Joseph Adamo Name: Joseph Adamo Title: Vice President | |

| WITNESS/ATTEST: | TENANT: | |

| CYNOSURE, INC., a Delaware corporation | ||

| Name: /s/ Patty Davis Print: Patty Davis |

By: /s/ Timothy W. Baker Name: Timothy W. Baker Title: EVP, COO & CFO | |

-25-

EXHIBIT A, FIFTH AMENDMENT, SHEET 1

OUTLINE AND LOCATION OF 5 CARLISLE EXPANSION SPACE

EXHIBIT A, FIFTH AMENDMENT, SHEET 1

EXHIBIT A, FIFTH AMENDMENT, SHEET 2

OUTLINE AND LOCATION OF 2ND FlOOR-3 CARLISLE EXPANSION SPACE

EXHIBIT A, FIFTH AMENDMENT, SHEET 2

EXHIBIT A, FIFTH AMENDMENT, SHEET 3

OUTLINE AND LOCATION OF 1st FlOOR-3 CARLISLE EXPANSION SPACE

EXHIBIT A, FIFTH AMENDMENT, SHEET 3

EXHIBIT A, FIFTH AMENDMENT, SHEET 3 - B-3

OUTLINE AND LOCATION OF 1st FlOOR-3 CARLISLE EXPANSION SPACE

EXHIBIT A, FIFTH AMENDMENT, SHEET 3 – B-3

EXHIBIT B, FIFTH AMENDMENT

WORK LETTER

As used in this Workletter, the “Premises” shall be deemed to mean the Original Premises and the Expansion Space, as defined in the attached Amendment.

Alterations and Allowance.