Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BLACKSTONE MORTGAGE TRUST, INC. | d605228d8k.htm |

October 2013

Blackstone Mortgage Trust (BXMT)

Exhibit 99.1 |

Blackstone Mortgage Trust

1

Disclaimer

This presentation contains forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, which reflect the current

views of Blackstone Mortgage Trust, Inc. (“Blackstone Mortgage

Trust”) with respect to, among other things, its operations and financial

performance. You can identify these forward-looking statements by the use of

words such as “outlook,” “believes,”

“expects,”

“potential,”

“continues,”

“may,”

“will,”

“should,”

“seeks,”

“approximately,”

“predicts,”

“intends,”

“plans,”

“estimates,”

“anticipates”

or the negative version of these words or other comparable words. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or

results to differ materially from those indicated in these statements. Blackstone

Mortgage Trust believes these factors include but are not limited to those

described under the section entitled “Risk Factors” in its

Annual Report on Form 10-K for the fiscal year ended December 31, 2012

and subsequent quarterly reports on Form 10- Q as such factors may be

updated from time to time in its periodic filings with the Securities and

Exchange Commission, which are accessible on the SEC’s website at

www.sec.gov. These factors should not be construed as exhaustive

and should be read in conjunction with the other

cautionary statements that are included in this presentation and

in the filings. Blackstone Mortgage Trust undertakes no

obligation to publicly update or review any forward-looking statement,

whether as a result of new information, future developments or

otherwise. |

Blackstone Mortgage Trust

2

Blackstone Mortgage Trust Overview

Blackstone Mortgage Trust, Inc. (NYSE: BXMT) is a real estate investment trust

that primarily originates and purchases senior mortgage loans

collateralized by properties in the United States and Europe.

We are managed by Blackstone (“BX”), a world leader in real estate

investing with over $60 billion

AUM

and

over

$120

billion

of

owned

real

estate

(1)

•

Blackstone’s CRE lending platform, Blackstone Real Estate Debt Strategies

(“BREDS”), currently

has

approximately

$10

billion

AUM

(1)

•

Significant alignment of interest: $70

million BX investment

(2)

Dislocation

among

CRE

lenders

coupled

with

increased

transaction

volume

creates

a

compelling lending environment in the U.S. and Europe

•

BXMT

has

a

demonstrated

ability

to

originate

target

assets,

with

over

$2.0

billion

of

originations

since

May 2013

equity

re-capitalization

(3)

BXMT is primarily a floating-rate lender and is designed to provide investors

with attractive current income and potential for value appreciation

________________________________________________

(1)

Includes July 2013 closings for the most recent debt strategies drawdown fund.

(2)

Based upon closing price on the NYSE on September 27, 2013. Includes BX employees

and associates. (3)

As of September 30, 2013. |

Superior Real Estate Platform

Blackstone Real Estate

Blackstone Real Estate

Debt Strategies (“BREDS”)

Blackstone Real Estate

Partners (“BREP”)

________________________________________

(1)

Includes July 2013 closings for the most recent debt strategies drawdown fund.

BX investment committee process and investment philosophy

Superior sourcing capabilities through long-standing industry

relationships Underwriting process includes proprietary data from extensive

investment holdings $54 billion AUM

174 professionals

$10

billion

AUM

(1)

51

professionals

+/-200 separate loans

Actively managed CMBS

hedge funds ($1 billion)

Blackstone Mortgage Trust

3 |

Blackstone Mortgage Trust

4

Seasoned and Fully Integrated Platform

21 Professionals

Origination

Peter Sotoloff

Thomas Ruffing

Randall

Rothschild

Douglas

Armer

Anthony

Marone

Robert Harper

Asset Management

Capital Markets / Finance

6 Professionals

5 Professionals

Stephen Plavin

CEO & President

SMD of BREDS

Legal /

Compliance

Geoffrey Jervis

CFO

MD of BREDS

Michael Nash

Executive Chairman

CIO of BREDS

Jonathan Gray

Global Head of Real Estate

Member of Blackstone Board of Directors

Member of BXMT Investment Committee

John Schreiber

Co-Founder of Blackstone Real Estate Advisors

Member of BXMT Board of Directors

Chair of BXMT Investment Committee

1 Professional |

U.S. CMBS Issuance Volume

(Dollars in billions)

U.S. CRE Debt Maturities

(Dollars in billions)

European CRE Debt Maturities

(Euros in billions)

European CMBS Issuance Volume

(Euros in billions)

The supply/demand imbalance for debt capital creates an attractive

lending environment in the U.S. and Europe

________________________________________________

Source: Commercial Mortgage Alert (February 2013), Trepp LLC (December 2012), DTZ Research

(November 2012) and Barclays (November 2012). Real Estate Debt Market

Overview 2013

2014

2015

2016

2017

$374

$350

$346

$321

$326

2013

2014

2015

€240

€261

€285

2006

2007

2008

2009

2010

2011

2012

€69

€66

€8

€25

€5

€2

€4

2006

2007

2008

2009

2010

2011

2012

$198

$228

$12

$3

$12

$33

$48

Blackstone Mortgage Trust

5 |

Blackstone Mortgage Trust

6

Increased regulation and overleveraged balance sheets have reduced the

lending capacity of European banks in the U.S. and Europe

Banking Environment

Overleveraged Banks

European banks have 2-3x the leverage of U.S. banks

________________________________________________

Source: IMF (October 2012). |

Blackstone Mortgage Trust

7

Limited new supply coupled with modest growth is a favorable investment

environment for senior commercial real estate debt

________________________________________________

Source: Citi (June 2013), BEA (December 2012).

U.S. Aggregate Construction Starts

(Annualized)

U.S. GDP

($ in billions)

Current Investment Environment |

Blackstone Mortgage Trust

8

Today’s market conditions provide BXMT the opportunity to take relatively

less risk while generating higher returns

(1)

Equity

Senior Debt

L + 1.50%

Equity

Senior Debt

L + 4.00%

2007

$100

(2)

Today

$80

(2)

Mezzanine Debt

L + 3.00%

BXMT

Target

Assets

Current Opportunity

________________________________________________

(1)

(2)

Opinions expressed reflect the opinions of BXMT as of the date appearing in this material

only. These are representative capital stacks and it should not be assumed that any

BXMT investments bear resemblance to these. There is no assurance that BXMT will achieve

its objectives or avoid substantial losses.

Example of hypothetical asset values and decline based on Moody’s CPPI as of March 2013.

|

Blackstone Mortgage Trust

9

Target Investments

Loan Size

Property Type

Geographies

Loan to Value

Collateral

$50mm to $500mm

First mortgages on stabilized or transitional assets

All commercial property types

North America and Europe

Last dollar, 60-80%

Rate

Amortization

Fees

Prepayment

Term

LIBOR + 3.75% and higher, scaled to risk

3 to 5 years

Typically, interest only

Typically, 1.0% origination fee and 0.25% extension fees

12 to 24 months of yield maintenance |

Blackstone Mortgage Trust

10

Capital Deployment

BXMT has executed on its first mortgage direct origination strategy with rapid

success •

Since May, BXMT has closed $1.5 billion of loans; and another $529 million of

loans are currently in closing

•

18 transactions closed; 5 in closing; Median loan size is $68 million

$ -

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

22-May-13

22-Jun-13

22-Jul-13

22-Aug-13

22-Sep-13

Cumulative BXMT Loan Origintions |

Blackstone Mortgage Trust

11

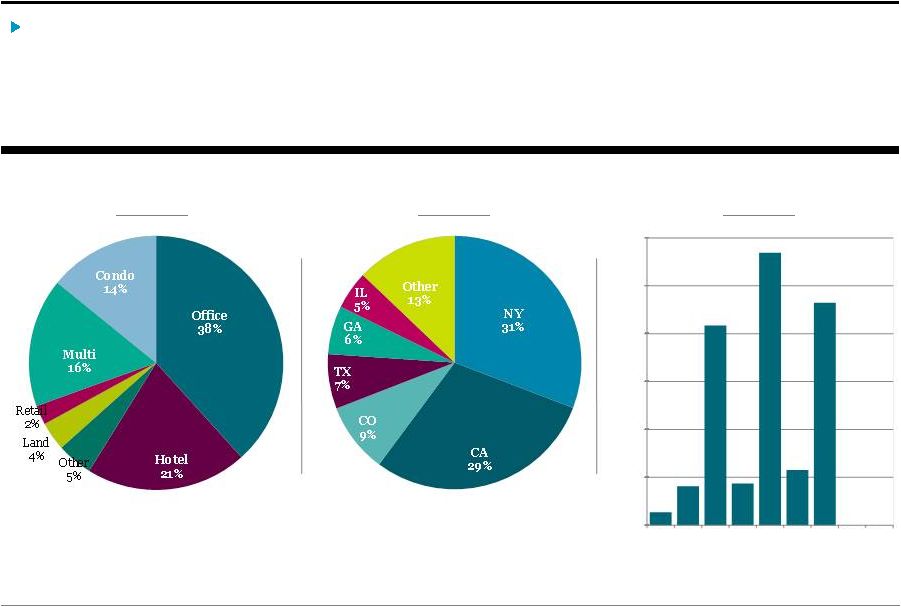

Portfolio Snapshot

The BXMT loan portfolio is comprised of select transitional, senior lending

opportunities •

100% of BXMT’s new loans are floating rate

•

The portfolio has a weighted average LTV of 67% and all-in yield of

L+5.44% ________________________________________________

Note: Statistics and charts represent data for closed loans and loans in closing.

$ -

$100

$200

$300

$400

$500

$600

Property Type

Geography

Loan to Value

0% -

50%

50% -

55%

55% -

60%

60% -

65%

65% -

70%

70% -

75%

75% -

80%

80% -

85%

85% -

100% |

Blackstone Mortgage Trust

12

Financing

________________________________________________

(1)

Availability of borrowings up to $1.5 billion depending on amount of collateral pledged.

Closing of a $250 million credit facility increase currently in negotiation is included in the $1.5 billion total.

(2)

Assuming 5 year senior mortgage transactions; includes applicable origination and extension

fees. Prudent use of leverage to enhance returns and diversification

Develop

diversified

funding

sources

from

traditional

lenders

and

capital

markets

•

Obtained leverage that is advantageous in terms of structuring and pricing

Debt Facilities ($1.8 billion in total)

Revolving

debt

facilities

totaling

$1.5

billion

(1)

from

3

lenders

•

All-in Pricing

(2)

: L + 2.00% -

L + 2.50%

•

Advance Rate: 75% -

80%

•

Term: advances are term matched to the collateral loan maturities (term out

provisions) •

Asset Specific Mark to Market; no capital markets marks

•

Index Matched

Non-Recourse Asset Specific Financings totaling $342 million

Other Potential Funding Sources

•

A-Note sale (third party & CMBS)

•

CLO issuance

•

Corporate finance options |

Blackstone Mortgage Trust

BXMT Investment Highlights

________________________________________________

(1)

As of September 27, 2013.

(2)

As of April 30, 2013.

(3)

As of September 30, 2013.

Superior Sponsorship

•

Affiliation with Blackstone Real Estate, the largest private equity real estate

business in the world

•

Significant

Alignment

of

Interest:

$70

million

BX

Investment

(1)

BX Debt Investment Experience

•

BREDS

has

approximately

$10

billion

AUM

(2)

Strong Origination Platform

•

$2.0

billion

loans

have

closed

or

are

in-closing

(3)

•

Robust pipeline generated from BX network

Attractive Market Opportunity

•

Dislocation amongst CRE lenders coupled with increased transaction volume

Floating Rate Business Model

•

Returns increase with rising short-term interest rates

13 |

Blackstone Mortgage Trust

14

Appendix |

Blackstone Mortgage Trust

15

Alignment of Interest and Governance

Blackstone

Common Share

Investment

$70

million investment by BX

(1)

180-day lockup for Issuer and its directors/officers, and BX

affiliates/certain employees, entered into May 2013

Base

Management Fee

Structure

Incentive Fee

Corporate

Governance

1.5% of Equity per annum, payable in cash, quarterly in arrears

20% of Core Earnings with a 7% annual hurdle rate , payable in cash, quarterly

in arrears No

incentive

fee

is

payable

unless

Core

Earnings

for

the

12

prior

quarters

(2)

is

greater

than

zero

A majority of the board of directors is independent as determined by the

requirements of the NYSE

No staggered board

No poison pill

_______________________________________

(1)

(2)

Based upon closing price on the NYSE on September 27, 2013. Included BX employees and

associates. Or such lesser number of completed calendar quarters from May 29, 2013, the

closing date of the company’s recent common stock offering. |

BXMT

Ownership Structure Management

Agreement

90%

10%

100%

CT

Legacy

Assets

(1)

$268 million

Loan Originations

$2.0 billion

BXMT Advisors

L.L.C.

Blackstone

Employee/Associate

Investment

Blackstone Corporate

Investment

Third Party Stockholders

Blackstone Mortgage Trust

16

(1)

CT Legacy Assets include consolidated assets of wholly owned and non-wholly owned

subsidiaries and securitization vehicles. GAAP value as of June 30, 2013.

________________________________________ |

Blackstone Mortgage Trust

17

BXMT Investment Committee

Name

Years of Experience

Position Held with Blackstone or Blackstone Affiliate

Investment Committee

John Schreiber (Chair)

41

Partner and Co-Founder of Blackstone Real Estate Advisors

Jonathan Gray

21

Global Head of Real Estate

Robert Harper

13

Managing Director of Blackstone Real Estate Debt Strategies (Europe)

Geoffrey Jervis

19

Managing Director of Blackstone Real Estate Debt Strategies

Michael Nash

24

Senior Managing Director of Blackstone Real Estate Debt Strategies

Stephen Plavin

28

Senior Managing Director of Blackstone Real Estate Debt Strategies

Randall Rothschild

16

Managing

Director

and

Chief

Operating

Officer

of

Blackstone

Real

Estate

Debt

Strategies

Peter Sotoloff

12

Managing Director of Blackstone Real Estate Debt Strategies (U.S.)

Other Officers

Douglas Armer

15

Principal of Blackstone Real Estate Debt Strategies

Anthony Marone

9

Vice President of Blackstone Real Estate Debt Strategies

Our Manager’s investment committee approves our loans and investments, and

advises our senior management team on investment strategy and portfolio

holdings |

Blackstone Mortgage Trust

18

Blackstone Mortgage Trust, Inc.

Second Quarter 2013 Results

*EXCERPTS* |

Blackstone Mortgage Trust

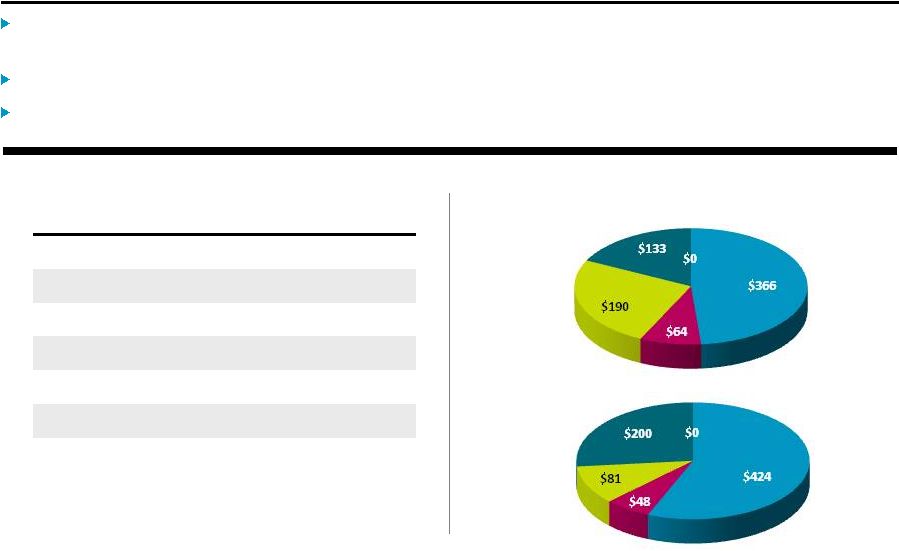

Loan Originations

During the quarter, we closed eight new loans with total commitments of $765.2

million. Of this amount, we funded $756.6 million as of June 30,

2013. Weighted-average LTV of new loan originations of 65%.

All newly originated loans are floating rate senior mortgage loans.

Land

Office

Multifamily

Hotel

Midwest

West

Southeast

Northeast

________________________________________________

(1)

As of June 30, 2013, includes only our newly originated loan portfolio. For information on

loans in our CT Legacy Portfolio, refer to our Form 10-Q, filed on July 30, 2013

(2)

Maximum maturity assumes all extension options are exercised.

Portfolio Diversification

(1)

(Dollars in Millions)

(Dollars in Thousands)

Portfolio Statistics

(1)

Number of loans

8

Principal

balance 756,638

$

Net book value

753,101

$

Wtd. Avg. cash coupon

L + 4.44%

Wtd. Avg. all-in yield

L + 5.26%

Wtd. Avg. maximum maturity

(2)

4.0 yrs.

19 |

Blackstone Mortgage Trust

Loans Receivable Portfolio

The

following

table

provides

details

of

our

loan

portfolio

(1)

as

of

June

30,

2013:

________________________________________________

(1)

Includes only our newly originated loan portfolio. For information on loans in our CT Legacy

Portfolio, refer to our Form 10-Q, filed on July 30, 2013. (2)

All loans are floating rate loans indexed to LIBOR as of June 30, 2013. LIBOR was 0.19% as of

June 30, 2013. (3)

Maximum maturity date assumes all extension options are exercised.

(Dollars in Millions)

Loan Type

Principal

Balance

Book

Value

Cash

Coupon

(2)

All-In

Yield

(2)

Maximum

Maturity

(3)

Geographic

Location

Property

Type

Origination

LTV

Loan 1

Sr. mortgage

68.3

$

68.1

$

L + 3.95%

L + 4.05%

6/9/18

West

Office

71%

Loan 2

Sr. mortgage

300.0

298.5

L + 3.80%

L + 3.98%

6/15/18

West

Office

59%

Loan 3

Sr. mortgage

109.8

109.0

L + 5.25%

L + 8.41%

7/9/14

Northeast

Multifamily

80%

Loan 4

Sr. mortgage

58.0

57.4

L + 3.50%

L + 4.50%

7/9/18

West

Hotel

74%

Loan 5

Sr. mortgage

48.4

48.4

L + 5.00%

L + 5.68%

12/9/16

Midwest

Hotel

53%

Loan 6

Sr. mortgage

27.1

27.1

L + 3.87%

L + 3.87%

7/9/17

Northeast

Hotel

32%

Loan 7

Sr. mortgage

81.0

80.6

L + 3.85%

L + 4.03%

7/9/18

Southeast

Multifamily

75%

Loan 8

Sr. mortgage

64.0

64.0

L + 8.00%

L + 9.67%

2/9/15

Northeast

Land

69%

Total/Wtd. Avg.

756.6

$

753.1

$

L + 4.44%

L + 5.26%

4.0 years

65%

20 |

Blackstone Mortgage Trust

$756.6 million of floating-rate loans, indexed

to one-month LIBOR.

$165.2 million of floating-rate liabilities, also

indexed to one-month LIBOR.

Return on $591.4 million of equity capital is

highly correlated to LIBOR.

All else equal, as of June 30, 2013, a

100bps increase in LIBOR would increase

our

net

income

by

$5.9

million

(2)

per

annum.

Our equity value is insulated from changes in

interest rates because both our loans and

borrowings are LIBOR-based.

Floating-Rate Business Model

Because of our LIBOR-based lending and funding business model, our returns

increase with rising short- term interest rates, and therefore our

asset and equity values are insulated from such increases. 21

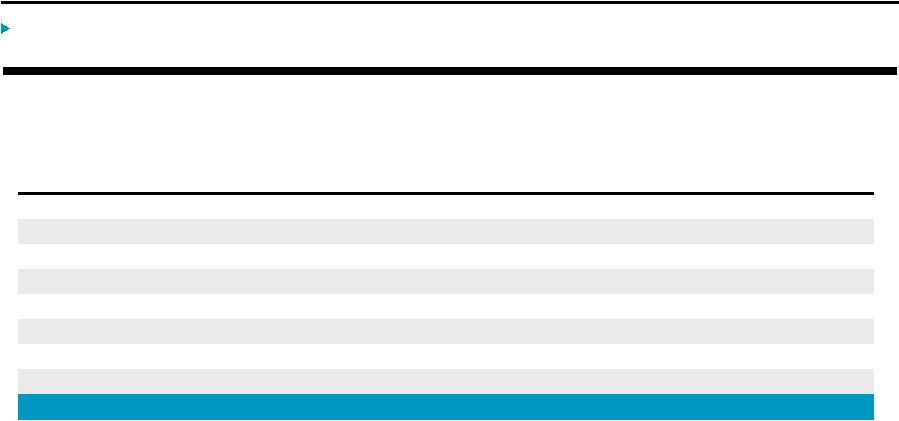

Loan Capitalization

(1)

(Dollars in Millions)

Floating-Rate

Loans

Floating-Rate

Borrowings

$756.6

$165.2

$591.4

________________________________________________

(1)

Includes only our newly originated loan portfolio of $756.6 million, capitalized with $165.2

million of debt and $591.4 million of equity. Excludes the assets, liabilities, and equity

of our CT Legacy Portfolio.

(2)

Excludes the impact of LIBOR floors on certain of our loans receivable investments.

Equity Capital |

Blackstone Mortgage Trust

22

Stockholders’

Equity and Book Value per Share

Stockholders’

equity totaled $712.7 million, or $24.67 per share as of June 30, 2013.

•

On

May

29,

2013,

we

completed

an

offering

of

25.9

million

shares

of

class

A

common

stock

for

gross

proceeds of $656.8 million, and net proceeds of $633.6 million after underwriter

discounts and expenses.

•

On July 26, 2013, we filed an S-3 universal shelf registration with the SEC,

which permits us to periodically offer various debt and equity securities

to the public. Future equity offerings remain subject to the 180-day

lock-up agreement we executed in conjunction with our May 2013 offering of class A

common stock.

•

Our book value per share includes $22.45 attributable to our loan origination

business and $2.22 attributable to our CT Legacy Portfolio.

________________________________________________

(1)

Stock units are granted to certain members of our board of directors in lieu of cash

compensation for services and in lieu of dividends earned on previously granted stock units.

See Note 12 to our financial statements contained in the Form 10-Q, filed on July 30,

2013, for additional details. (Dollars in Thousands, Except per Share Data)

Loan Origination

CT Legacy

Portfolio

Total

Stockholders' equity

648,693

$

63,996

$

712,689

$

Shares

Class A common stock

28,801,651

28,801,651

28,801,651

Stock units

(1)

92,824

92,824

92,824

Total

28,894,475

28,894,475

28,894,475

Book value per share

22.45

$

2.22

$

24.67

$

|

Blackstone Mortgage Trust

23

CT Legacy Portfolio

Our

CT

Legacy

Portfolio

consists

of:

our

investment

in

CT

Legacy

Partners,

our

residual

interests

in

CT

CDO

I,

and

our

carried

interest

in

CT

Opportunity

Partners

I,

LP

(“CTOPI”).

As we focus on the growth of our loan origination business, we continue to

aggressively asset manage the remaining investments in our CT Legacy

Portfolio. •

$99.4 million of principal collections on legacy assets during the quarter.

•

$6.0 million of positive valuation and mark-to-market adjustments on the

CT Legacy Partners and CT CDO I loan portfolios during the quarter.

•

Net carried interest allocation from CTOPI increased $1.7 million during the

quarter to $12.1 million. Recognition

of

the

revenue

related

to

the

CTOPI

carried

interest

has

been

deferred,

resulting

in

a

net

book value of zero as of June 30, 2013.

•

Repaid $102.9 million of legacy debt and interest rate swap liabilities during

the quarter. $2.22

CT Legacy Portfolio

Book Value per Share

$6.0 million

Positive Valuation Adjustments in 2Q

CT Legacy

Partners

CT CDO I

Other

Net Book Value

(Dollars in Millions)

$0.0

$9.0

$4.9

$50.1

$0.0 |

Blackstone Mortgage Trust

24

CT Legacy Portfolio: CT Legacy Partners

CT Legacy Partners is the March 2011 restructuring vehicle that owns our remaining

legacy asset portfolio

(1)

. Blackstone Mortgage Trust owns a controlling interest in CT Legacy Partners,

subject to liabilities under its secured notes and management incentive

awards plan. During the second quarter, CT Legacy Partners had $36.9

million of realizations. Proceeds were used to repay the remaining $20.2

million outstanding under its repurchase facility and terminate its remaining

interest rate swap agreements.

•

Refer

to

our

Form

10-Q,

filed

on

July

30,

2013,

for

additional

details

of

CT

Legacy

Partners’

loans

receivable portfolio.

________________________________________________

(1)

(2)

(3)

See Note 8 to our financial statements contained in the Form 10-Q, filed on July 30, 2013,

for additional details on the CT Legacy Partners structure.

Includes the full potential prepayment premium on secured notes. This liability is carried at

its amortized basis of $8.8 million on our balance sheet as of June 30, 2013.

Assumes full payment of the management incentive awards plan based on a hypothetical GAAP

liquidation value of CT Legacy Partners as of June 30, 2013. As of June 30, 2013,

our balance sheet includes $6.8 million in accounts payable and accrued expenses for the management incentive awards plan.

(Dollars in Thousands)

June 30, 2013

Gross investment in CT Legacy Partners

Restricted cash

21,972

$

Loans receivable, at fair value

117,549

Equity investments (three-hotel portfolio)

4,108

Accrued interest receivable, other assets, and accounts payable,

net

17,355

Noncontrolling interests

(88,978)

Total gross investment in CT Legacy Partners

72,006

$

Secured notes, including prepayment premium

(1)(2)

(11,059)

Management incentive awards plan, fully vested

(1)(3)

(10,867)

Net investment in CT Legacy Partners

50,080

$

|

Blackstone Mortgage Trust

25

CT Legacy Portfolio: CT CDO I

CT CDO I is a collateralized debt obligation issued in 2004. Blackstone Mortgage

Trust owns the residual debt and equity positions of CT CDO I.

During the second quarter, CT CDO I had $62.5 million of investment repayments.

Proceeds were used to repay its senior outstanding securitized debt

obligations. Refer to our Form 10-Q, filed on July 30, 2013, for

additional details of CT CDO I’s loans receivable portfolio.

(Dollars in Thousands)

June 30, 2013

Assets and liabilities of CT CDO I

Loans receivable, net

77,000

$

Loans held-for-sale, net

3,800

Accrued interest receivable, prepaid expenses, and

other assets 2,838

Total assets

83,638

Accounts payable, accrued expenses and other liabilities

155

Securitized debt

obligations 74,472

Total liabilities

74,627

Net investment in CT CDO I

9,011

$

|

Blackstone Mortgage Trust

26

CT Legacy Portfolio: CTOPI

CTOPI

is

a

private

equity

real

estate

fund

that

we

sponsored

and

formed

in

2007.

The

fund

invested

$491.5 million in 39 transactions between 2007 and 2012, of which $291.8 million

has been realized and

$199.7

million

remains

outstanding

(carried

at

137%

of

cost)

as

of

June

30,

2013.

The carried interest in CTOPI entitles us to earn incentive compensation in an

amount equal to 17.7% of the fund’s profits, after a 9% preferred

return and 100% return of capital to the CTOPI limited partners. •

We own a net 55% of the carried interest of CTOPI’s general partner; the

remaining 45% is payable under incentive awards to our former

employees. As of June 30, 2013, Blackstone Mortgage Trust was allocated

$13.5 million of carried interest from CTOPI based on a hypothetical

liquidation of the fund, reduced by tax-advance distributions received

for a net asset of $12.1 million. Other than tax-advance distributions, we

have not received any cash payments from CTOPI.

•

The net carried interest allocation of $12.1 million, increased $1.7 million from

1Q, and is based on the fair value of CTOPI’s net assets.

•

Recognition

of

the

revenue

related

to

the

CTOPI

carried

interest

has

been

deferred,

resulting

in

no

contribution

to

book

value

from

the

$12.7

million

of

net

carried

interest. |

Blackstone Mortgage Trust (BXMT) |