Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PIONEER ENERGY SERVICES CORP | a8kinvpres9-11x13.htm |

BARCLAYS CEO ENERGY POWER CONFERENCE September 11th, 2013

Forward-looking Statements This presentation contains various forward-looking statements and information that are based on management’s current expectations and assumptions about future events. Forward-looking statements are generally accompanied by words such as “estimate,” “project,” “predict,” “expect,” “anticipate,” “plan,” “intend,” “seek,” “will,” “should,” “goal” and other words that convey the uncertainty of future events and outcomes. Forward-looking information includes, among other matters, statements regarding the Company’s anticipated growth, quality of assets, rig utilization rate, capital spending by oil and gas companies, production rates, the Company's growth strategy, and the Company's international operations. Although the Company believes that the expectations and assumptions reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. Such statements are subject to certain risks, uncertainties and assumptions, including general economic and business conditions and industry trends, levels and volatility of oil and gas prices, decisions about exploration and development projects to be made by oil and gas exploration and production companies, risks associated with economic cycles and their impact on capital markets and liquidity, the continued demand for the drilling services or production services in the geographic areas where we operate, the highly competitive nature of our business, our future financial performance, including availability, terms and deployment of capital, future compliance with covenants under our senior secured revolving credit facility and our senior notes, the supply of marketable drilling rigs, well servicing rigs, coiled tubing and wireline units within the industry, the continued availability of drilling rig, well servicing rig, coiled tubing and wireline unit components, the continued availability of qualified personnel, the success or failure of our acquisition strategy, including our ability to finance acquisitions, manage growth and effectively integrate acquisitions, and changes in, or our failure or inability to comply with, governmental regulations, including those relating to the environment. Should one or more of these risks, contingencies or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those expected. Many of these factors have been discussed in more detail in the Company's annual report on Form 10-K for the fiscal year ended December 31, 2012. Unpredictable or unknown factors that the Company has not discussed in this presentation or in its filings with the Securities and Exchange Commission could also have material adverse effects on actual results of matters that are the subject of the forward-looking statements. All forward-looking statements speak only as the date on which they are made and the Company undertakes no duty to update or revise any forward-looking statements. We advise our shareholders to use caution and common sense when considering our forward-looking statements. 2

Overview Ticker Symbol: PES Market Cap: $440.0 million (September 6th, 2013) Stock price: $7.10 (September 6th, 2013) Average 3-month daily trading volume: 381,714 shares Public float: Approximately 62 million shares Employees: 3,700 Headquarters: San Antonio, Texas Website: www.pioneeres.com 3

Pioneer Energy Services 109 Well Servicing Rigs in 11 Locations Approximately 7th largest well servicing provider 120 Wireline Units in 26 Locations 104 cased-hole 16 open-hole 13 Coiled Tubing Units in 4 Locations Approximately 11th largest coiled tubing provider 9 onshore units 4 offshore units 70 Drilling Rigs in 7 Locations Approximately 9th largest contract driller 4

Company Objectives Target U.S. shale and unconventional plays with premium drilling and production services Grow core businesses (drilling, wireline, well servicing and coiled tubing services) organically if returns and terms justify capital investment Achieve targeted 20% debt-to-book capitalization over time 5

Investment Merits Leverage to increasing rig and well count Improving rig count would lead to improved pricing in all business lines Higher well count is a positive for production services activity as horizontal wells require a higher frequency of intervention Reduced capital spending in 2013 and 2014 will lead to debt reduction and stock price appreciation A $250 million reduction in debt implies a stock price increase of approximately $4 per share and debt-to-book capitalization of approximately 36%(1) Greater stability in cash flow Geographic and business diversification 74%(2) of drilling rigs earning revenue are under term contract 10 new-build A/C rigs performing well on multi-year term contracts 33 other drilling rigs currently earning revenue on term contracts 6 (1) Based on Q22013 balance sheet and fully diluted shares outstanding (2) As of the Q2 2013 earnings conference call on 7/30/13

Recent Updates Drilling Drilling current utilization is 80%(1) (maintain activity guidance from Q2 2013 earnings call) Colombia Seven of eight rigs in Colombia are currently working Six rigs are under term contract through the end of 2013 One of the two remaining rigs is currently bidding additional work One rig is expected to work into the first quarter of 2014 Production Services Well servicing quarter-to-date utilization through August 31st is 90% Coiled tubing quarter-to-date utilization through August 31st is 51% 7 (1) As of September 9th, 2013

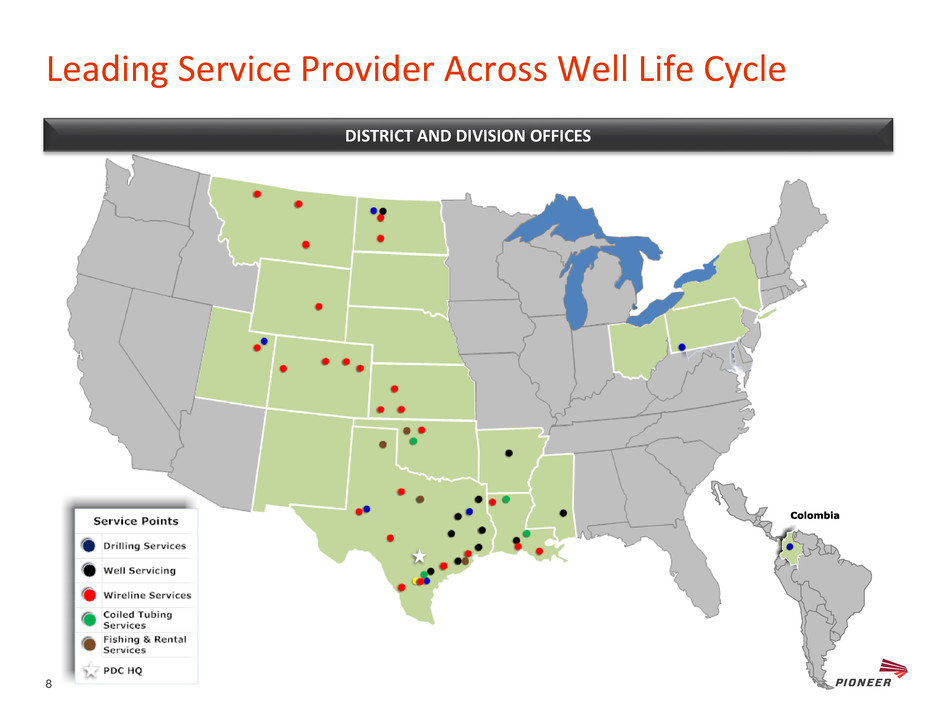

Leading Service Provider Across Well Life Cycle DISTRICT AND DIVISION OFFICES 8

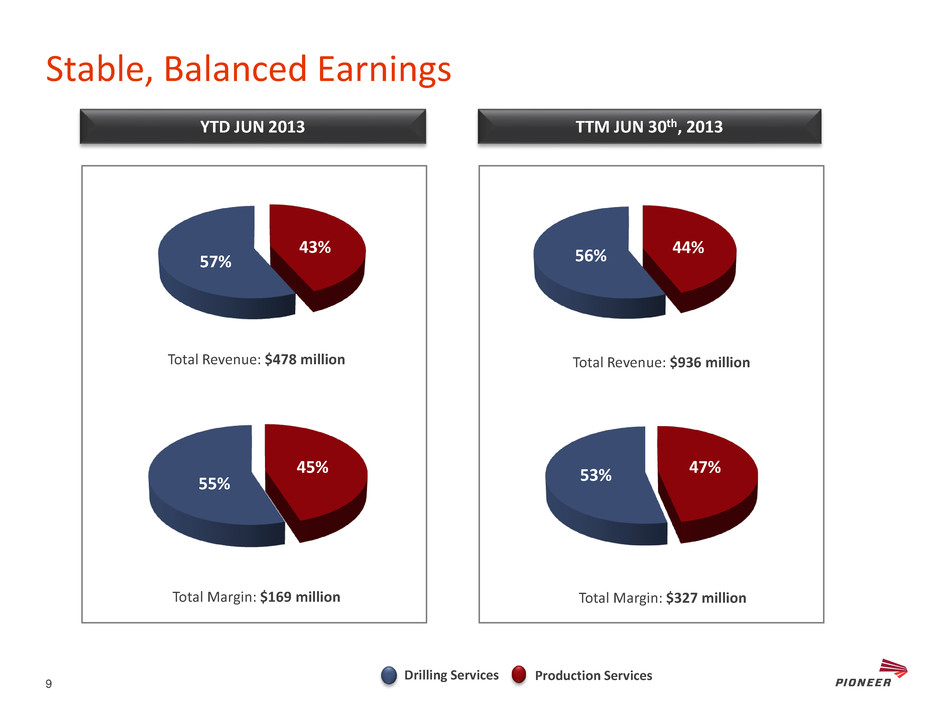

47% 53% 45% 55% 43% 57% 44% 56% Stable, Balanced Earnings TTM JUN 30th, 2013 Total Revenue: $936 million Total Margin: $327 million YTD JUN 2013 Total Revenue: $478 million Total Margin: $169 million Drilling Services Production Services 9

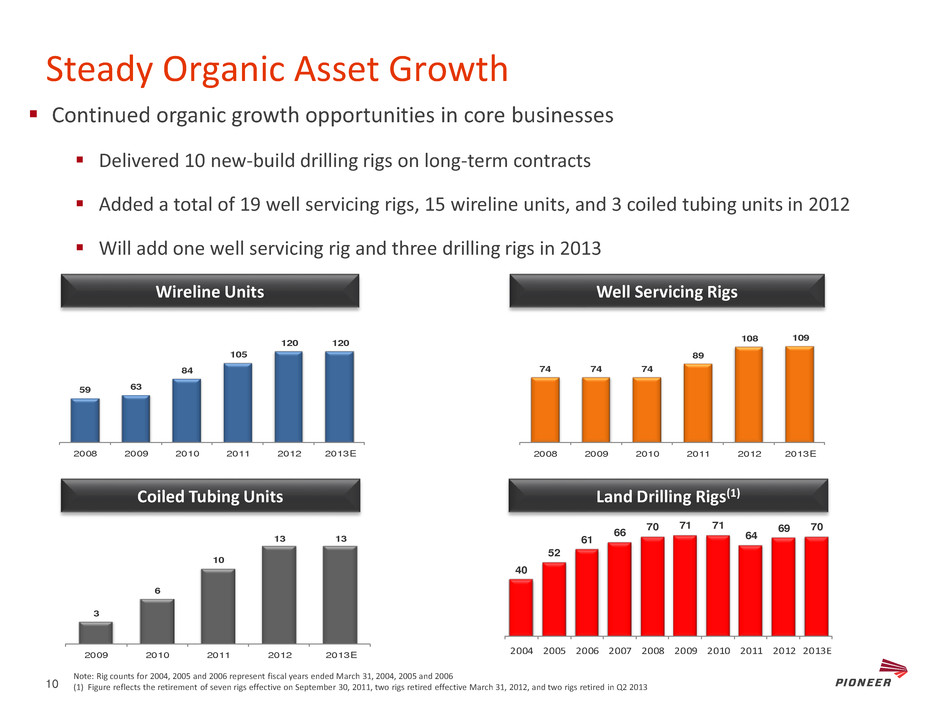

Steady Organic Asset Growth 40 52 61 66 70 71 71 64 69 70 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013E 3 6 10 13 13 2009 2010 11 2012 2013E Coiled Tubing Units Wireline Units Land Drilling Rigs(1) Well Servicing Rigs Continued organic growth opportunities in core businesses Delivered 10 new-build drilling rigs on long-term contracts Added a total of 19 well servicing rigs, 15 wireline units, and 3 coiled tubing units in 2012 Will add one well servicing rig and three drilling rigs in 2013 Note: Rig counts for 2004, 2005 and 2006 represent fiscal years ended March 31, 2004, 2005 and 2006 (1) Figure reflects the retirement of seven rigs effective on September 30, 2011, two rigs retired effective March 31, 2012, and two rigs retired in Q2 2013 59 63 84 105 120 120 2008 2009 2010 2011 2012 2013E 74 74 74 89 108 109 20 8 2009 2010 2011 2012 2013E 10

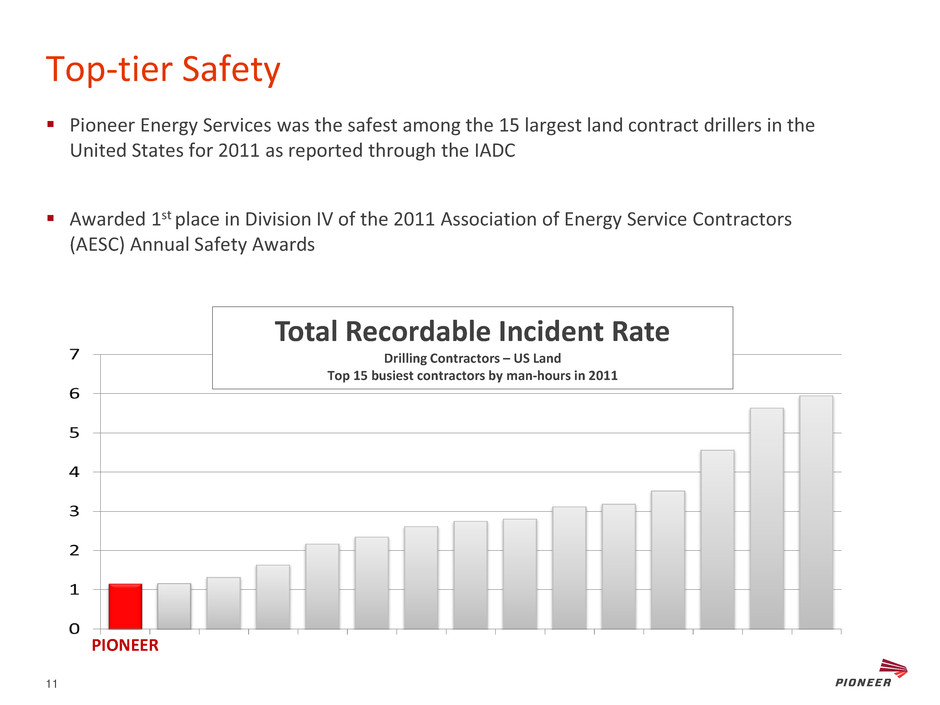

Top-tier Safety PIONEER Total Recordable Incident Rate Drilling Contractors – US Land Top 15 busiest contractors by man-hours in 2011 Pioneer Energy Services was the safest among the 15 largest land contract drillers in the United States for 2011 as reported through the IADC Awarded 1st place in Division IV of the 2011 Association of Energy Service Contractors (AESC) Annual Safety Awards 11

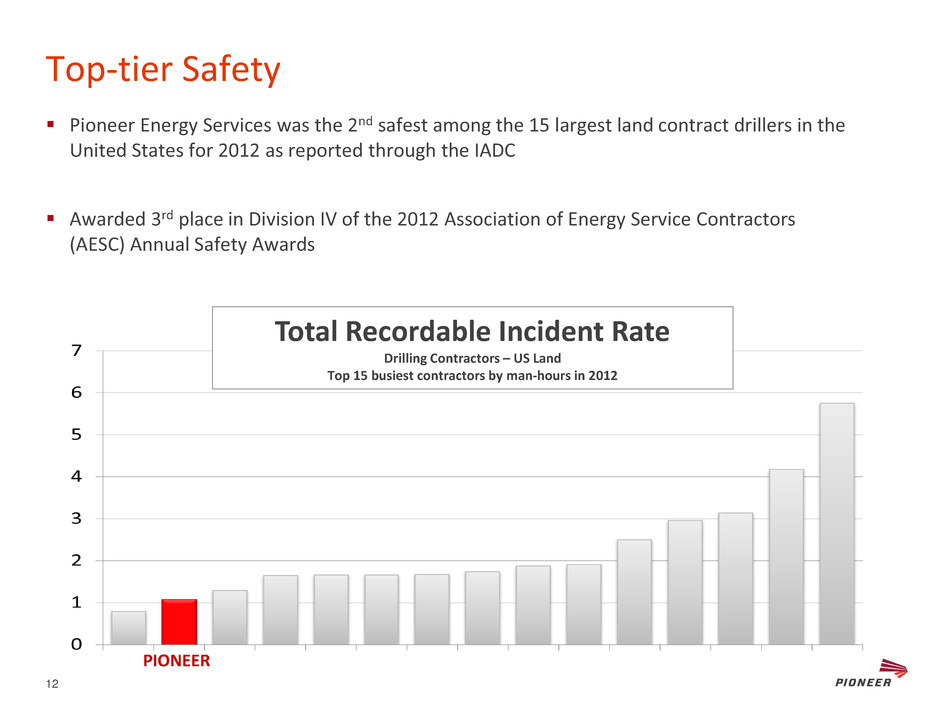

Top-tier Safety PIONEER Total Recordable Incident Rate Drilling Contractors – US Land Top 15 busiest contractors by man-hours in 2012 Pioneer Energy Services was the 2nd safest among the 15 largest land contract drillers in the United States for 2012 as reported through the IADC Awarded 3rd place in Division IV of the 2012 Association of Energy Service Contractors (AESC) Annual Safety Awards 12

Well Servicing 100% of rigs are capable of working in the unconventional plays Newest well servicing fleet in the industry with an average age of less than five years Highest average horsepower fleet in the industry with all rigs either 550HP or 600HP Highest percentage of taller mast rigs in the industry with all masts either 104’, 112’ or 116’ in height Highest utilization rate of top-tier well servicing providers for the past two years Highest average hourly rate of top-tier well servicing providers for the past two years 13

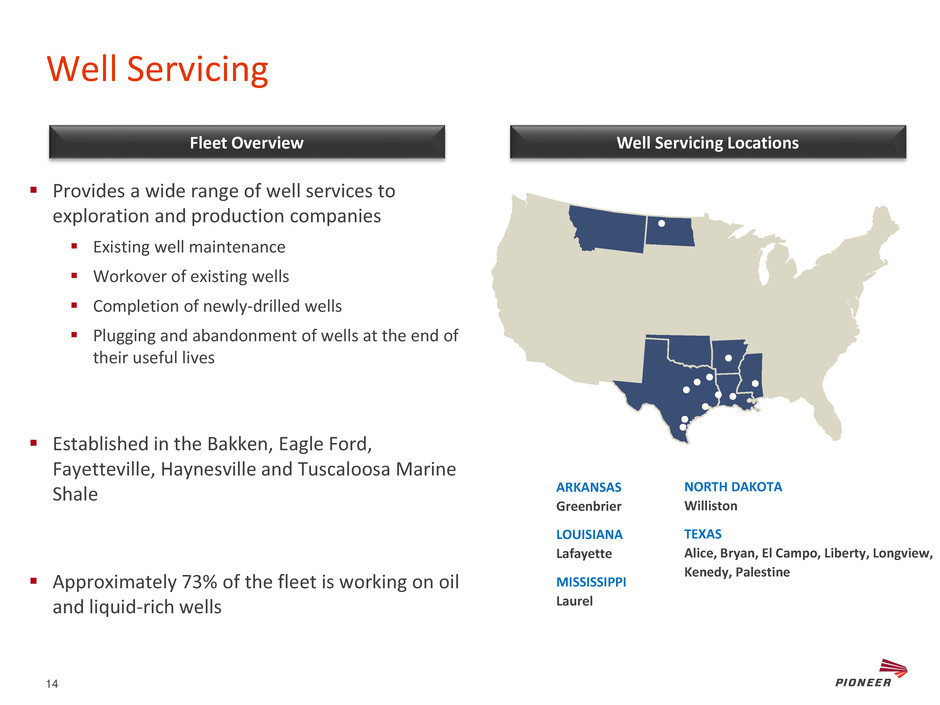

Well Servicing Provides a wide range of well services to exploration and production companies Existing well maintenance Workover of existing wells Completion of newly-drilled wells Plugging and abandonment of wells at the end of their useful lives Established in the Bakken, Eagle Ford, Fayetteville, Haynesville and Tuscaloosa Marine Shale Approximately 73% of the fleet is working on oil and liquid-rich wells Fleet Overview Well Servicing Locations ARKANSAS Greenbrier LOUISIANA Lafayette MISSISSIPPI Laurel NORTH DAKOTA Williston TEXAS Alice, Bryan, El Campo, Liberty, Longview, Kenedy, Palestine 14

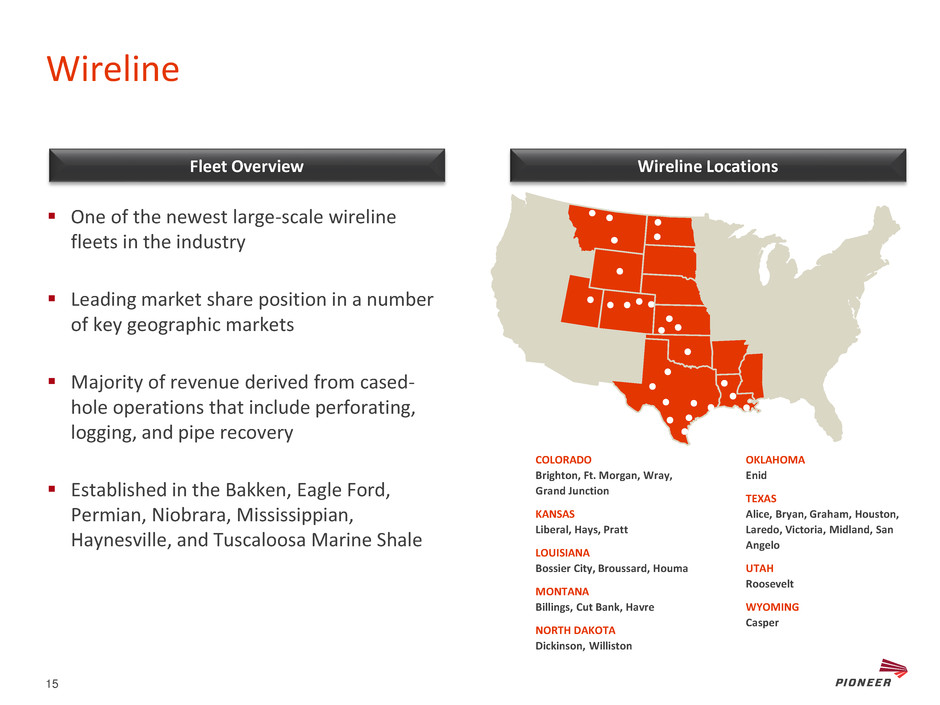

Wireline One of the newest large-scale wireline fleets in the industry Leading market share position in a number of key geographic markets Majority of revenue derived from cased- hole operations that include perforating, logging, and pipe recovery Established in the Bakken, Eagle Ford, Permian, Niobrara, Mississippian, Haynesville, and Tuscaloosa Marine Shale Fleet Overview Wireline Locations COLORADO Brighton, Ft. Morgan, Wray, Grand Junction KANSAS Liberal, Hays, Pratt LOUISIANA Bossier City, Broussard, Houma MONTANA Billings, Cut Bank, Havre NORTH DAKOTA Dickinson, Williston OKLAHOMA Enid TEXAS Alice, Bryan, Graham, Houston, Laredo, Victoria, Midland, San Angelo UTAH Roosevelt WYOMING Casper 15

Coiled Tubing Significant player in the offshore coiled tubing market Young fleet with all 13 units placed into service since 2009 Established in the Eagle Ford, Haynesville, Granite Wash, and offshore Gulf of Mexico 16

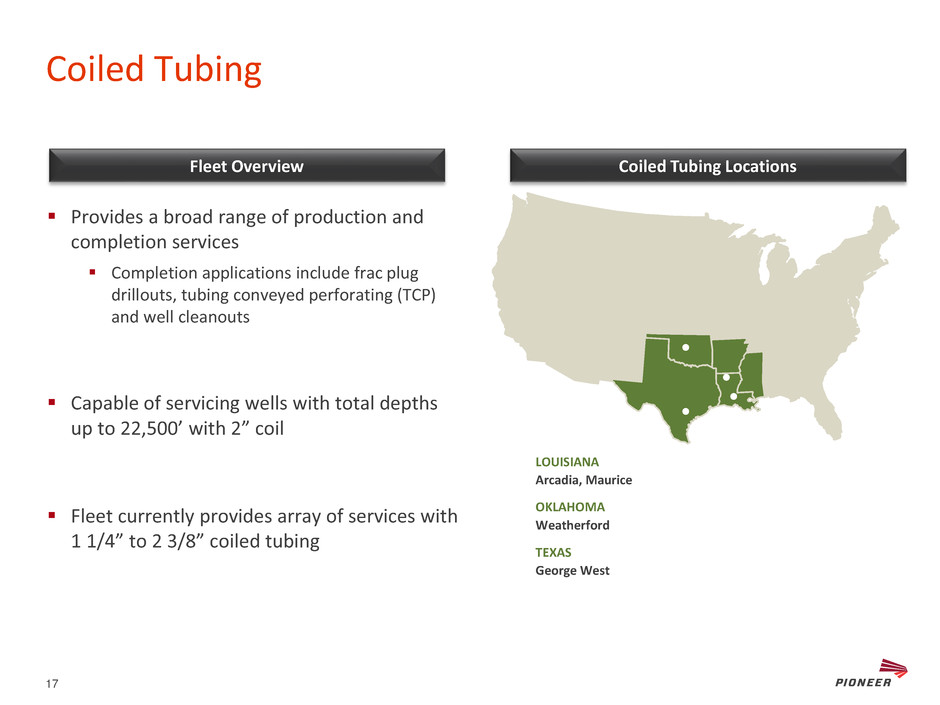

Coiled Tubing Provides a broad range of production and completion services Completion applications include frac plug drillouts, tubing conveyed perforating (TCP) and well cleanouts Capable of servicing wells with total depths up to 22,500’ with 2” coil Fleet currently provides array of services with 1 1/4” to 2 3/8” coiled tubing Fleet Overview Coiled Tubing Locations LOUISIANA Arcadia, Maurice OKLAHOMA Weatherford TEXAS George West 17

Drilling Services 18

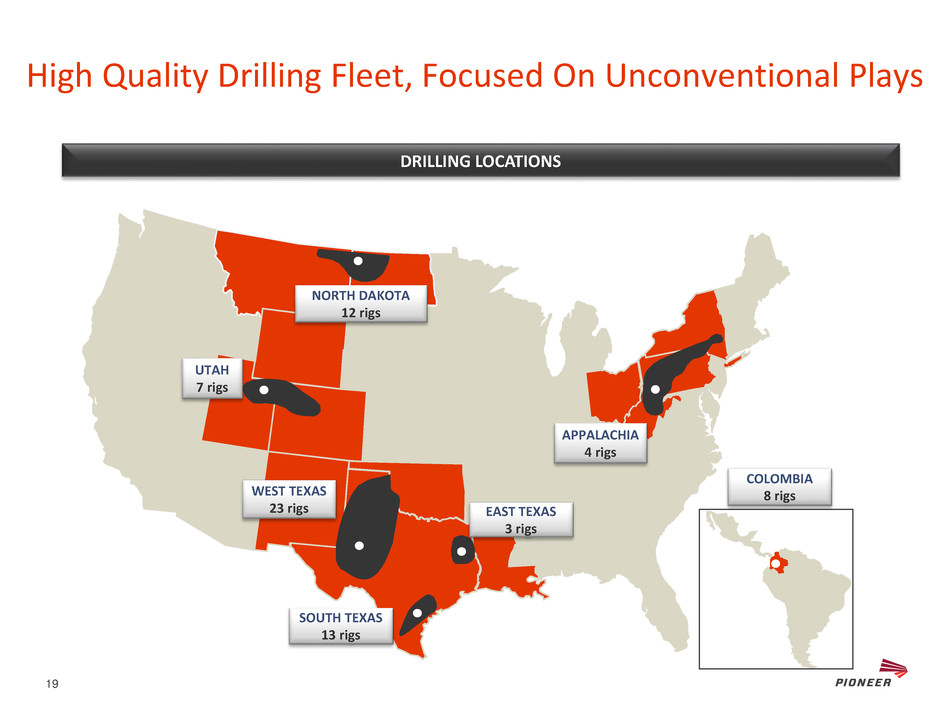

High Quality Drilling Fleet, Focused On Unconventional Plays SOUTH TEXAS 13 rigs EAST TEXAS 3 rigs NORTH DAKOTA 12 rigs UTAH 7 rigs COLOMBIA 8 rigs APPALACHIA 4 rigs DRILLING LOCATIONS WEST TEXAS 23 rigs 19

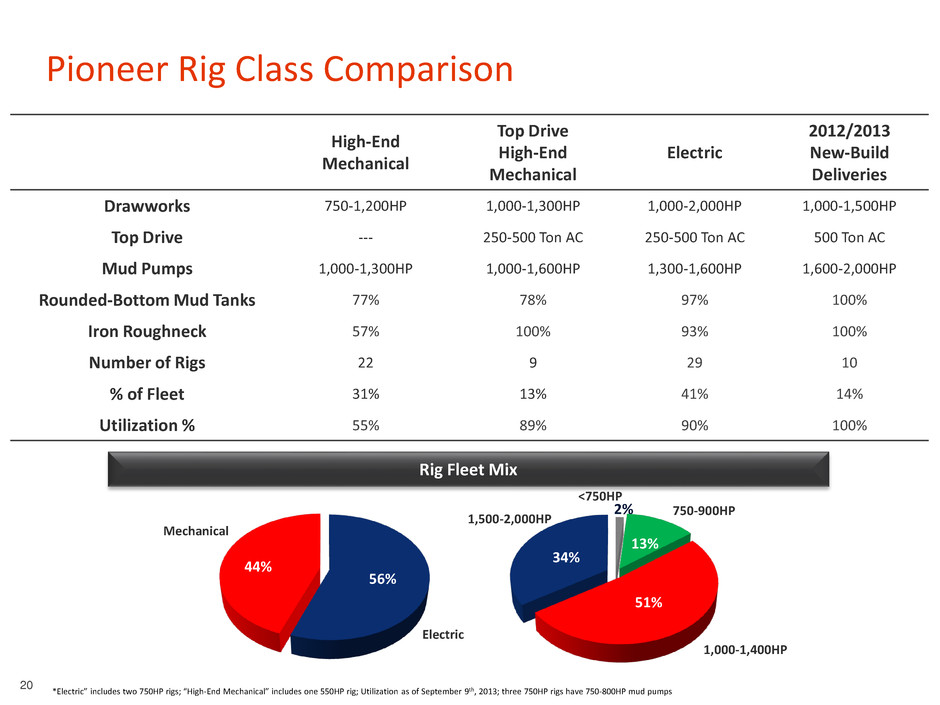

56% 44% 2% 13% 51% 34% Pioneer Rig Class Comparison High-End Mechanical Top Drive High-End Mechanical Electric 2012/2013 New-Build Deliveries Drawworks 750-1,200HP 1,000-1,300HP 1,000-2,000HP 1,000-1,500HP Top Drive --- 250-500 Ton AC 250-500 Ton AC 500 Ton AC Mud Pumps 1,000-1,300HP 1,000-1,600HP 1,300-1,600HP 1,600-2,000HP Rounded-Bottom Mud Tanks 77% 78% 97% 100% Iron Roughneck 57% 100% 93% 100% Number of Rigs 22 9 29 10 % of Fleet 31% 13% 41% 14% Utilization % 55% 89% 90% 100% *Electric” includes two 750HP rigs; “High-End Mechanical” includes one 550HP rig; Utilization as of September 9th, 2013; three 750HP rigs have 750-800HP mud pumps Rig Fleet Mix Electric Mechanical 750-900HP 1,000-1,400HP 1,500-2,000HP <750HP 20

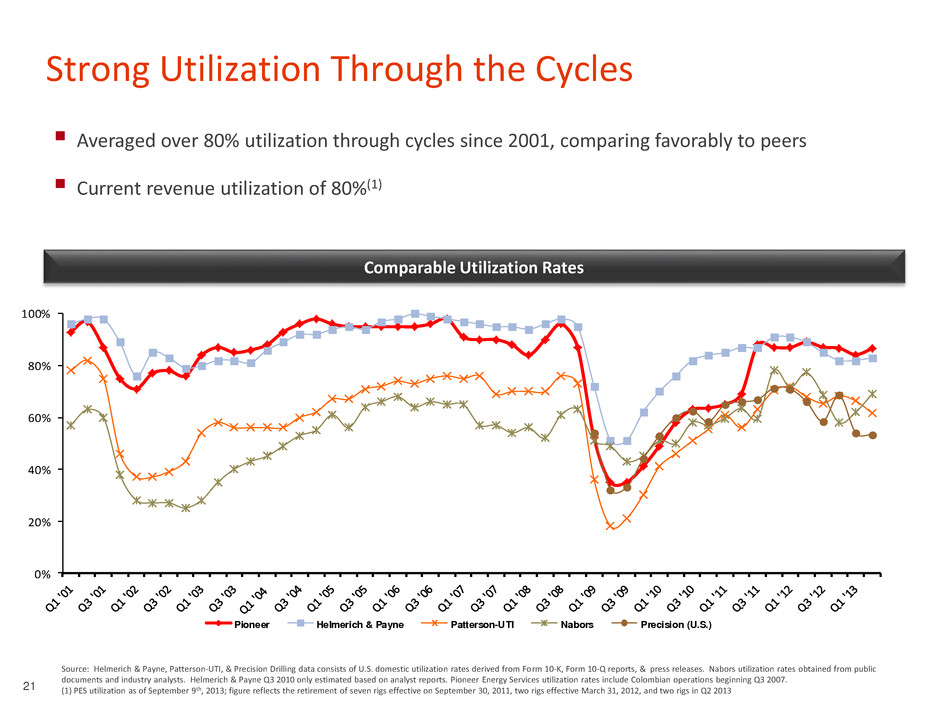

0% 20% 40% 60% 80% 100% Pioneer Helmerich & Payne Patterson-UTI Nabors Precision (U.S.) Strong Utilization Through the Cycles Source: Helmerich & Payne, Patterson-UTI, & Precision Drilling data consists of U.S. domestic utilization rates derived from Form 10-K, Form 10-Q reports, & press releases. Nabors utilization rates obtained from public documents and industry analysts. Helmerich & Payne Q3 2010 only estimated based on analyst reports. Pioneer Energy Services utilization rates include Colombian operations beginning Q3 2007. (1) PES utilization as of September 9th, 2013; figure reflects the retirement of seven rigs effective on September 30, 2011, two rigs effective March 31, 2012, and two rigs in Q2 2013 Averaged over 80% utilization through cycles since 2001, comparing favorably to peers Current revenue utilization of 80%(1) Comparable Utilization Rates 21

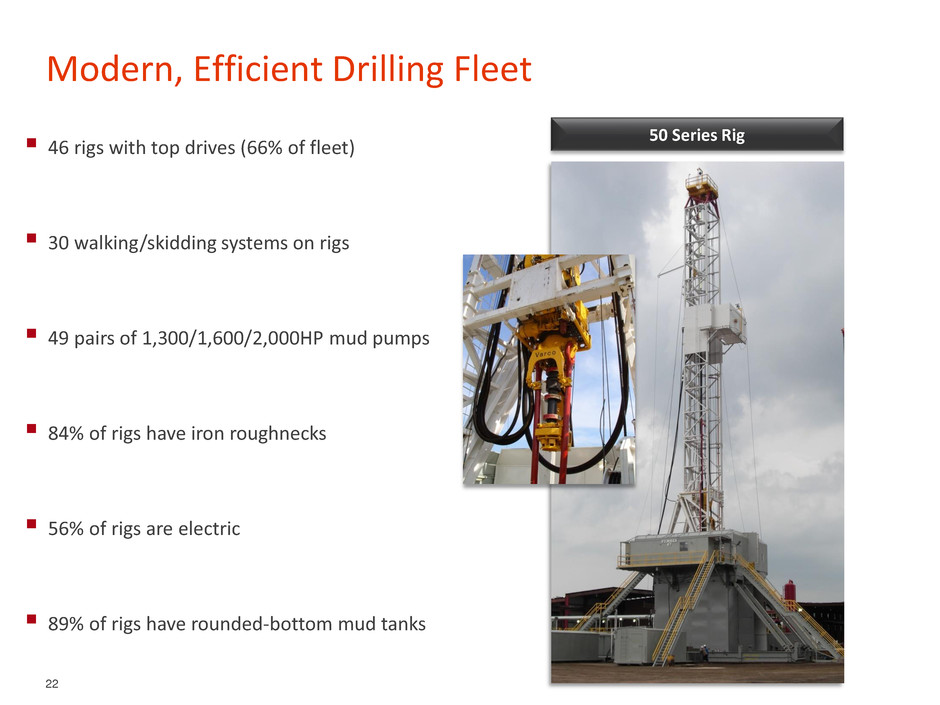

Modern, Efficient Drilling Fleet 46 rigs with top drives (66% of fleet) 30 walking/skidding systems on rigs 49 pairs of 1,300/1,600/2,000HP mud pumps 84% of rigs have iron roughnecks 56% of rigs are electric 89% of rigs have rounded-bottom mud tanks 50 Series Rig 22

New-Build Features 23 State-of-the-art 550K and 750K sub & mast AC new-builds Integrated 500 ton top drives in mast section for faster rig up and rig down Crane free rig up / rig down design 30 loads on base rig for fast moves BOP handling systems Automatic catwalk 1,600 HP and 2,000 HP mud pumps Ability to drill multi-well single-row pads and walk easily between wells with above ground heads

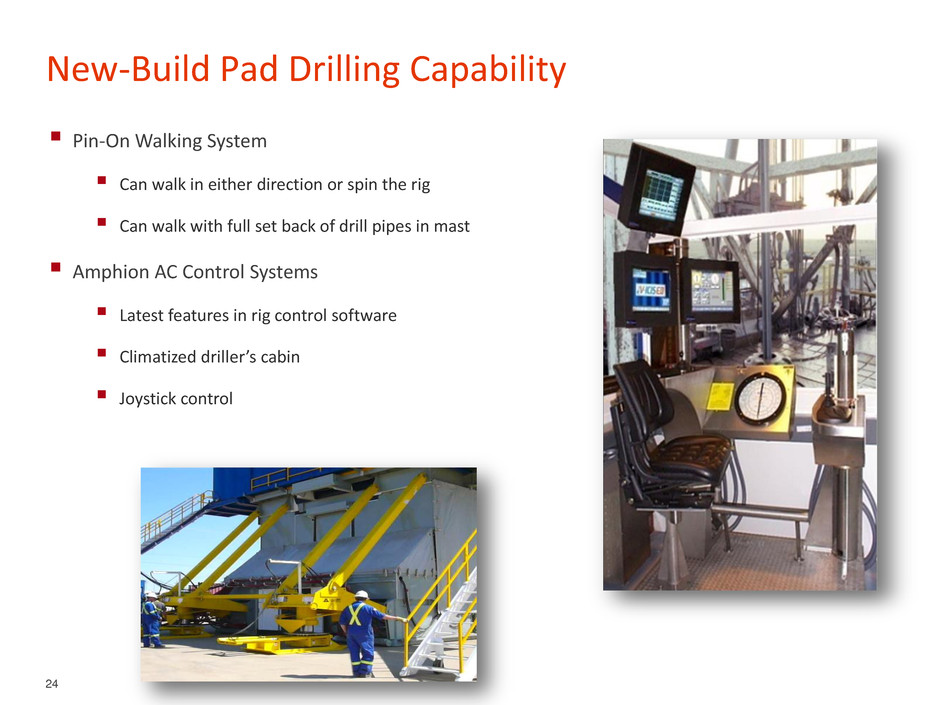

New-Build Pad Drilling Capability 24 Pin-On Walking System Can walk in either direction or spin the rig Can walk with full set back of drill pipes in mast Amphion AC Control Systems Latest features in rig control software Climatized driller’s cabin Joystick control

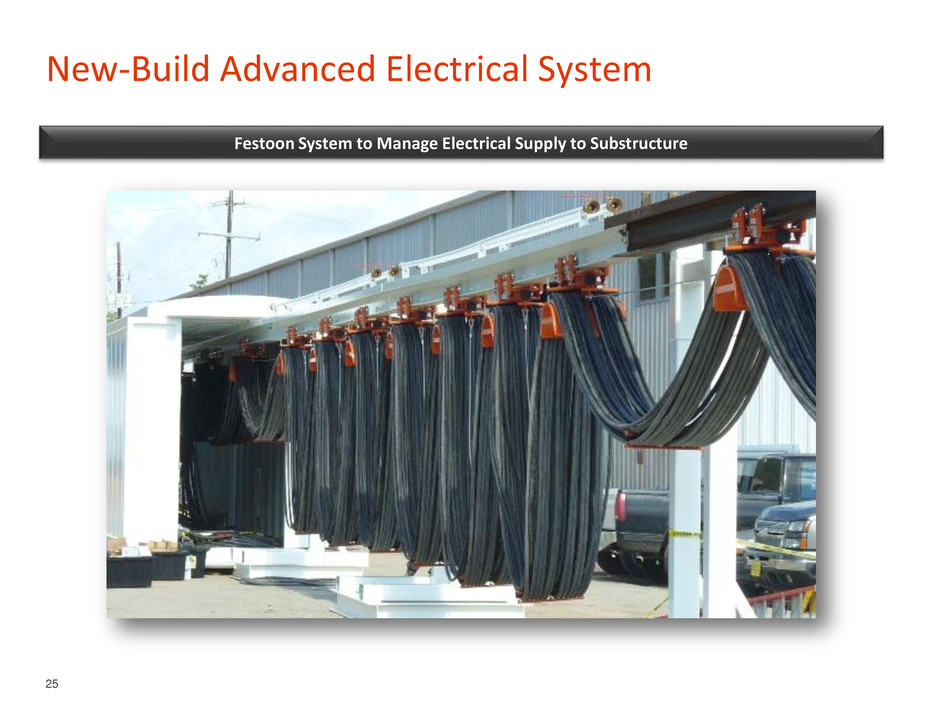

New-Build Advanced Electrical System 25 Festoon System to Manage Electrical Supply to Substructure

Financials 26

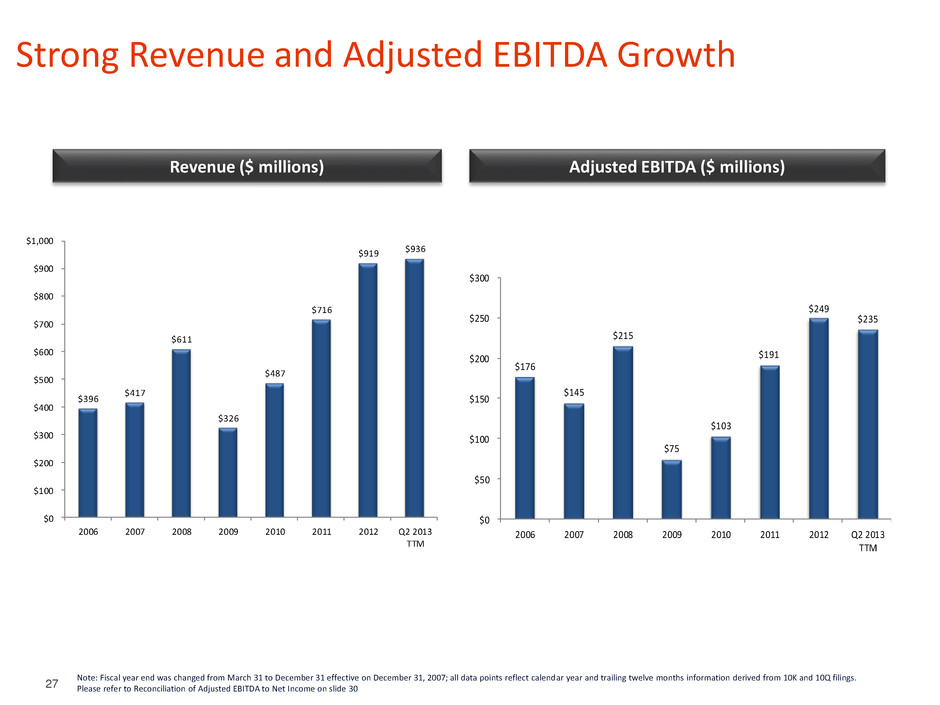

$176 $145 $215 $75 $103 $191 $249 $235 $0 $50 $100 $150 $200 $250 $300 2006 2007 2008 2009 2010 2011 2012 Q2 2013 TTM Strong Revenue and Adjusted EBITDA Growth Revenue ($ millions) Adjusted EBITDA ($ millions) $396 $417 $611 $326 $487 $716 $919 $936 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2006 2 07 2008 2009 2010 2011 2012 Q2 2013 TTM Note: Fiscal year end was changed from March 31 to December 31 effective on December 31, 2007; all data points reflect calendar year and trailing twelve months information derived from 10K and 10Q filings. Please refer to Reconciliation of Adjusted EBITDA to Net Income on slide 30 27

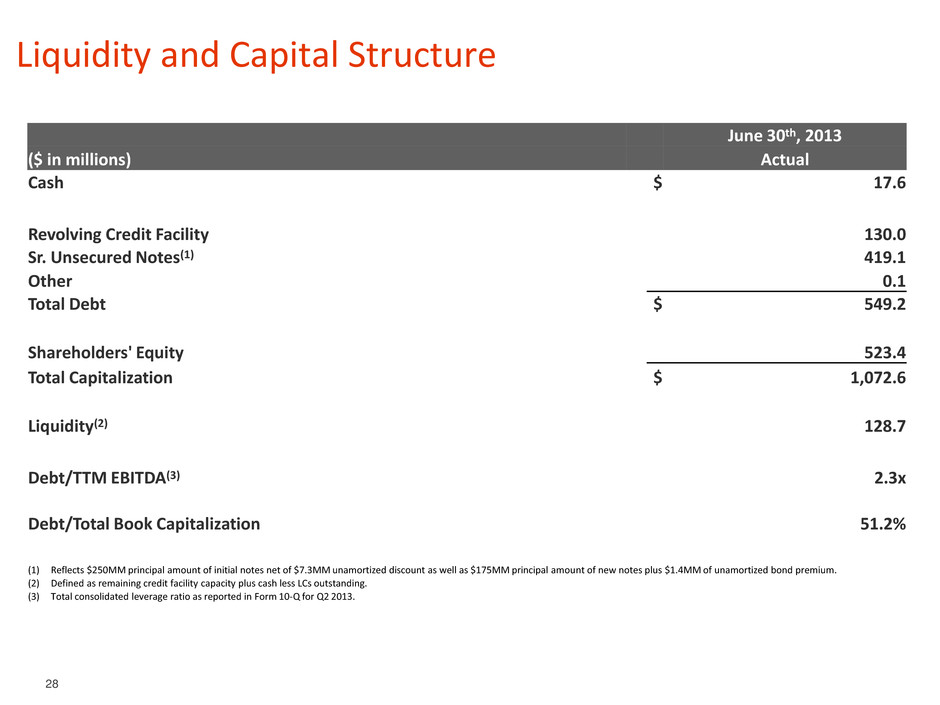

Liquidity and Capital Structure June 30th, 2013 ($ in millions) Actual Cash $ 17.6 Revolving Credit Facility 130.0 Sr. Unsecured Notes(1) 419.1 Other 0.1 Total Debt $ 549.2 Shareholders' Equity 523.4 Total Capitalization $ 1,072.6 Liquidity(2) 128.7 Debt/TTM EBITDA(3) 2.3x Debt/Total Book Capitalization 51.2% (1) Reflects $250MM principal amount of initial notes net of $7.3MM unamortized discount as well as $175MM principal amount of new notes plus $1.4MM of unamortized bond premium. (2) Defined as remaining credit facility capacity plus cash less LCs outstanding. (3) Total consolidated leverage ratio as reported in Form 10-Q for Q2 2013. 28

Appendix 29

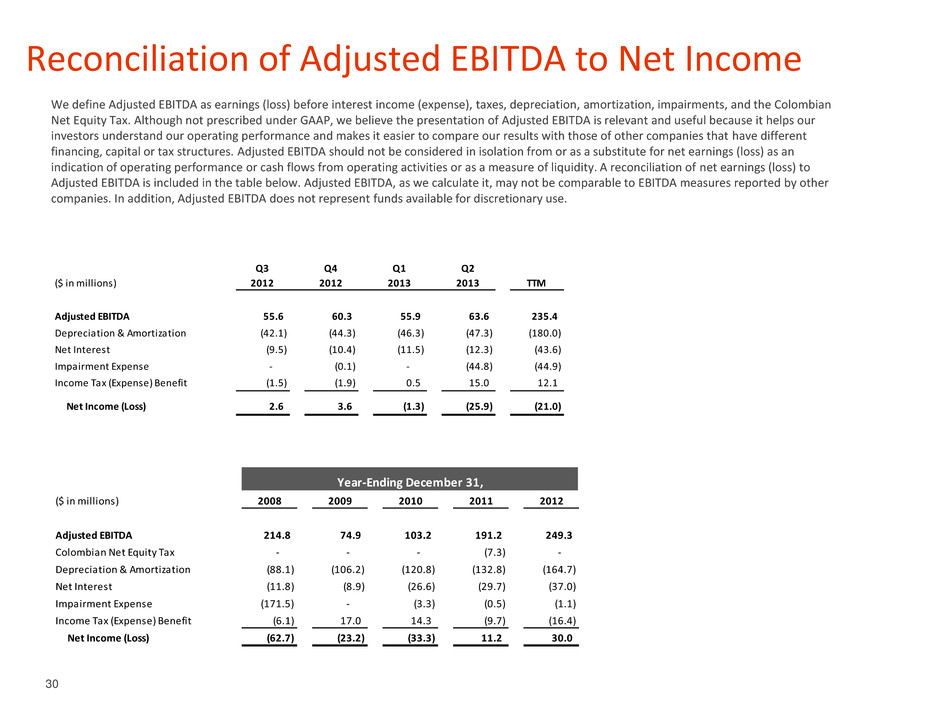

Reconciliation of Adjusted EBITDA to Net Income We define Adjusted EBITDA as earnings (loss) before interest income (expense), taxes, depreciation, amortization, impairments, and the Colombian Net Equity Tax. Although not prescribed under GAAP, we believe the presentation of Adjusted EBITDA is relevant and useful because it helps our investors understand our operating performance and makes it easier to compare our results with those of other companies that have different financing, capital or tax structures. Adjusted EBITDA should not be considered in isolation from or as a substitute for net earnings (loss) as an indication of operating performance or cash flows from operating activities or as a measure of liquidity. A reconciliation of net earnings (loss) to Adjusted EBITDA is included in the table below. Adjusted EBITDA, as we calculate it, may not be comparable to EBITDA measures reported by other companies. In addition, Adjusted EBITDA does not represent funds available for discretionary use. ($ in millions) 2008 2009 2010 2011 2012 Adjusted EBITDA 214.8 74.9 103.2 191.2 249.3 Colombian Net Equity Tax - - - (7.3) - Depreciation & Amortization (88.1) (106.2) (120.8) (132.8) (164.7) Net Interest (11.8) (8.9) (26.6) (29.7) (37.0) Impairment Expense (171.5) - (3.3) (0.5) (1.1) Income Tax (Expense) Benefit (6.1) 17.0 14.3 (9.7) (16.4) Net Income (Loss) (62.7) (23.2) (33.3) 11.2 30.0 Year-Ending December 31, ($ in millio ) Q3 2012 Q4 2012 Q1 2013 Q2 2013 TTM Adjust d EBITDA 55.6 60.3 55.9 63.6 235.4 D preciatio & Amortization (42.1) (44.3) (46.3) (47.3) (180.0) Net Interest (9.5) (10.4) (11.5) (12.3) (43.6) Impairment Expense - (0.1) - (44.8) (44.9) Income Tax (Expense) Benefit (1.5) (1.9) 0.5 15.0 12.1 Net Income (Loss) 2.6 3.6 (1.3) (25.9) (21.0) 30