Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Education Realty Trust, Inc. | edr-form8xkforinvestorpres.htm |

INVESTOR PRESENTATION September 2013 Grand Opening August 16, 2013 Central Hall I & III University of Kentucky

Leading Student Housing Company Strong and Consistent Fall 2013 Preleasing Positive Supply and Demand Dynamics Strong Company Growth Profile High Quality Owned Portfolio Significant Competitive Advantages Substantial External Growth Opportunities Balance Sheet Positioned for Growth Investment Highlights The Oaks on the Square – Storrs Center University of Connecticut 2

EdR is Second-Largest Company in the Industry $1.7 billion Total Enterprise Value 47 wholly owned communities with over 26,800 beds 23 managed communities with nearly 12,000 beds (1) 5 developments for $192 million opened August 2013 9 active development projects (2): 2014 deliveries - $258 million 2015 deliveries - $101 million Creating Value Through Growth Opportunities ONE PlanSM on-campus developments University of Kentucky Other high quality universities Off-campus developments Extensive pipeline for acquisitions Excellent Capital Structure Strong and Consistent Core FFO per Share Growth 9% increase in 2012 12% to 21% increase in 2013, based on guidance range (1) Includes 1 joint venture community also managed by the Company. (2) Project development costs represent the Company’s portion of the project costs for joint ventures and includes only company-owned projects that have been announced. Roosevelt Point, Arizona State University Downtown Phoenix Campus Leading Student Housing Company The Retreat at Oxford, University of Mississippi 3

Fall 2013 Preleasing Update 4 Projected Design Beds 2013 2012 Rate Increase Same-Communities - by Tier Prior Year Occupancy Below 95% (Tier 1) 12,234 91.5% 84.9% 0.3% Prior Year Occupancy 95% to 97.9% (Tier 2) 1,087 99.1% 95.9% 3.3% Prior Year Occupancy 98% and Above (Tier 3) 7,440 96.4% 99.7% 3.8% Total Same-Communities 20,761 93.6% 90.7% 2.0% Total New-Communities 6,058 94.0% Total 26,819 93.7% Same-Communities Recap Current Investor Presentation August '13 Q2 Earnings 7/24/13 NAREIT 6/2/13 Total Tier 1 & 3 2.9% 1.8% 1.2% 1.0% Ti r 2 3.2% 6.5% 13.2% 64.7% Total Same-Communities 2.9% 2.0% 1.8% 4.1% (1) Prior periods have been restated to eliminate the impact of College Grove as the asset was sold in June 2013. Preleasing as of September 4, Year Over Year Change - Recent Leasing Updates (1)

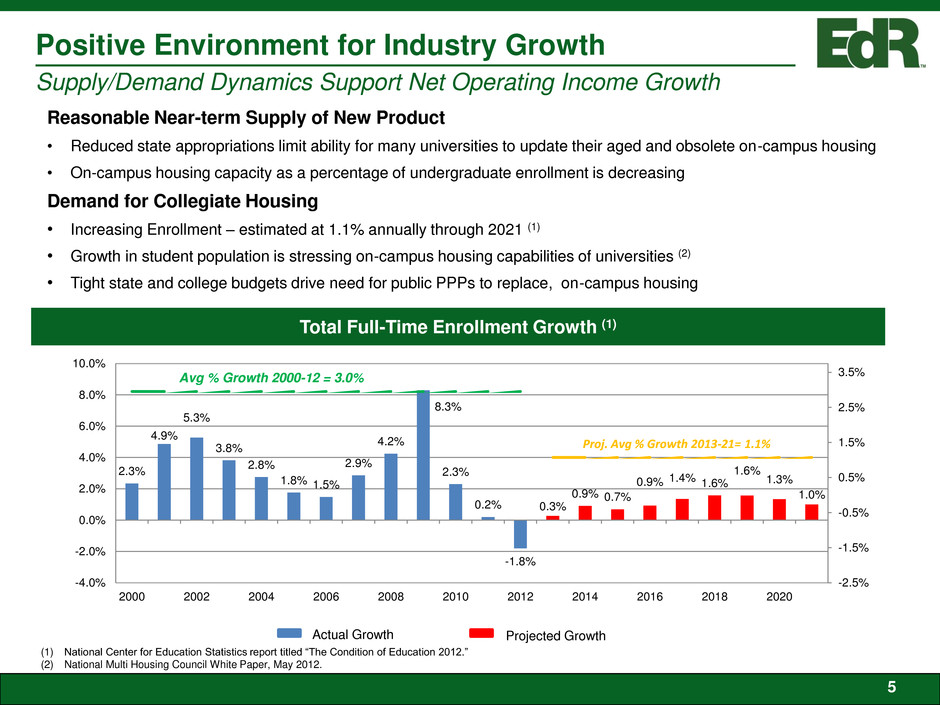

5 Reasonable Near-term Supply of New Product • Reduced state appropriations limit ability for many universities to update their aged and obsolete on-campus housing • On-campus housing capacity as a percentage of undergraduate enrollment is decreasing Demand for Collegiate Housing • Increasing Enrollment – estimated at 1.1% annually through 2021 (1) • Growth in student population is stressing on-campus housing capabilities of universities (2) • Tight state and college budgets drive need for public PPPs to replace, on-campus housing Positive Environment for Industry Growth Supply/Demand Dynamics Support Net Operating Income Growth (1) National Center for Education Statistics report titled “The Condition of Education 2012.” (2) National Multi Housing Council White Paper, May 2012. Total Full-Time Enrollment Growth (1) 2.3% 4.9% 5.3% 3.8% 2.8% 1.8% 1.5% 2.9% 4.2% 8.3% 2.3% 0.2% -1.8% 0.3% 0.9% 0.7% 0.9% 1.4% 1.6% 1.6% 1.3% 1.0% -2.5% -1.5% -0.5% 0.5% 1.5% 2.5% 3.5% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 Avg % Growth 2000-12 = 3.0% Proj. Avg % Growth 2013-21= 1.1% Actual Growth Projected Growth

6 Percentage of High School Graduates Attending College (1) Demand for Collegiate Housing • 1.1% Average Annual Increasing in Enrollment Driven by − Echo Boom generation − Increasing percentage of high school graduates choosing to attend college − College students are taking longer to graduate Positive Environment for Industry Growth (Con’t) Supply/Demand Dynamics Support Net Operating Income Growth (1) National Center for Education Statistics report titled “The Condition of Education 2012.” 52.6% 46.7% 58.6% 58.0% 62.6% 59.9% 66.5% 62.8% 40.0% 45.0% 50.0% 55.0% 60.0% 65.0% 70.0% 1975 1980 1985 1990 1995 2000 2005 2010

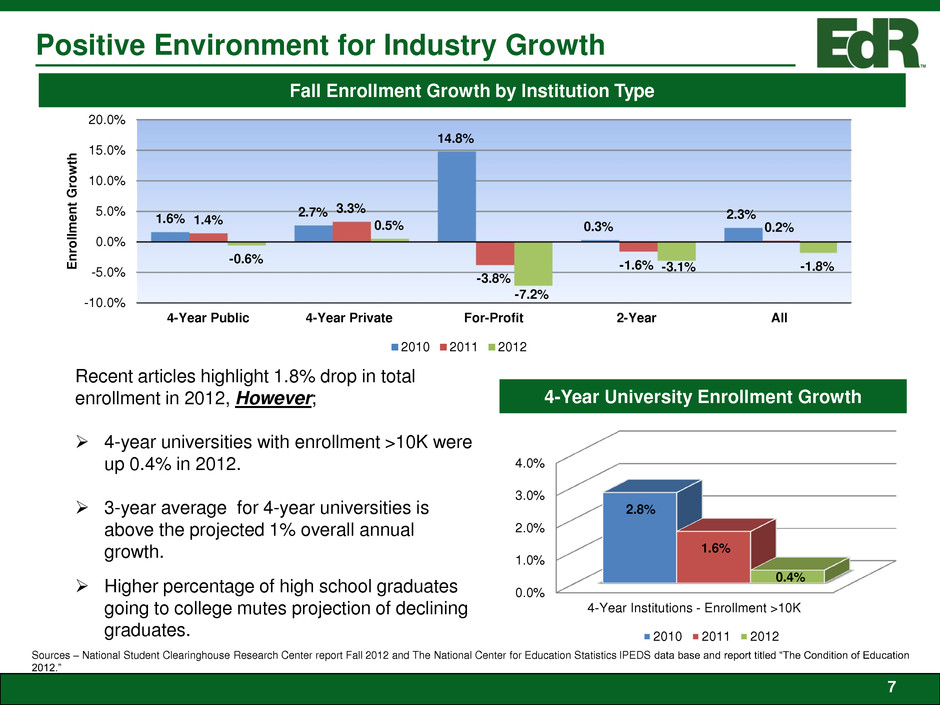

Recent articles highlight 1.8% drop in total enrollment in 2012, However; 4-year universities with enrollment >10K were up 0.4% in 2012. 3-year average for 4-year universities is above the projected 1% overall annual growth. Higher percentage of high school graduates going to college mutes projection of declining graduates. Positive Environment for Industry Growth 4-Year University Enrollment Growth Fall Enrollment Growth by Institution Type 7 Sources – National Student Clearinghouse Research Center report Fall 2012 and The National Center for Education Statistics IPEDS data base and report titled “The Condition of Education 2012.” 0.0% 1.0% 2.0% 3.0% 4.0% 4-Year Institutions - Enrollment >10K 2.8% 1.6% 0.4% 2010 2011 2012 -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 4-Year Public 4-Year Private For-Profit 2-Year All 1.6% 2.7% 14.8% 0.3% 2.3% 1.4% 3.3% -3.8% -1.6% 0.2% -0.6% 0.5% -7.2% -3.1% -1.8% E n ro llmen t G ro w th 2010 2011 2012

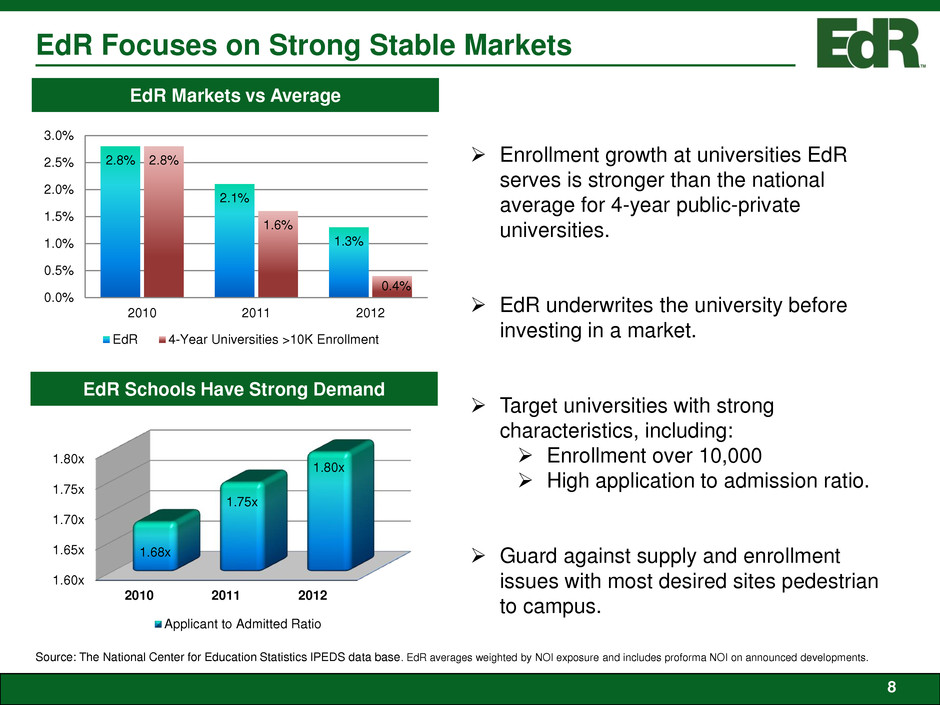

EdR Focuses on Strong Stable Markets EdR Schools Have Strong Demand EdR Markets vs Average 8 Enrollment growth at universities EdR serves is stronger than the national average for 4-year public-private universities. EdR underwrites the university before investing in a market. Target universities with strong characteristics, including: Enrollment over 10,000 High application to admission ratio. Guard against supply and enrollment issues with most desired sites pedestrian to campus. Source: The National Center for Education Statistics IPEDS data base. EdR averages weighted by NOI exposure and includes proforma NOI on announced developments. 2.8% 2.1% 1.3% 2.8% 1.6% 0.4% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 2010 2011 2012 EdR 4-Year Universities >10K Enrollment 1.60x 1.65x 1.70x 1.75x 1.80x 2010 2011 2012 1.68x 1.75x 1.80x Applicant to Admitted Ratio

High Quality Portfolio 2012 Average Enrollment Distance to Campus (1) 9 Median distance to campus 0.1 miles Average distance to campus 0.5 miles Average enrollment over 25,500 Average rental rate over $630 per bed Average age 7.4 years (2) (1) Based on community NOI, includes announced developments. (2) Age as of August 2014 in order to include developments delivering in 2014. On Campus 26% Pedestrian 38% 0.2 to 0.5 Miles 9% 0.6 to 1.0 Miles 1% 1.1 to 2.0 Miles 25% > 2.0 Miles 1% 25,943 20,139 - 5,000 10,000 15,000 20,000 25,000 30,000 EdR 4-Year Public- Private Graduate Undergraduate

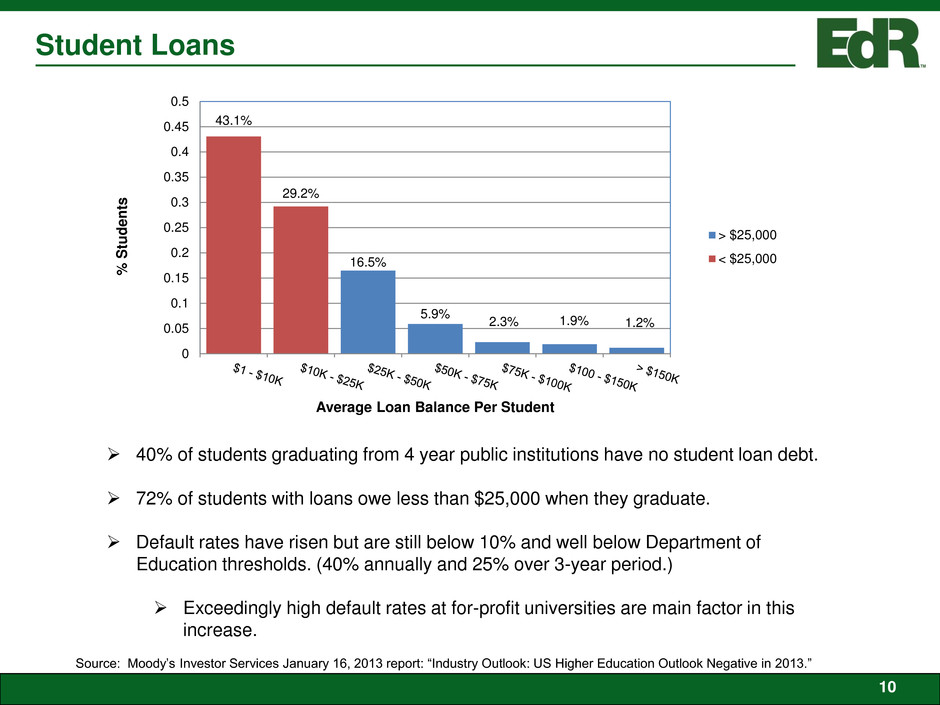

Student Loans 10 40% of students graduating from 4 year public institutions have no student loan debt. 72% of students with loans owe less than $25,000 when they graduate. Default rates have risen but are still below 10% and well below Department of Education thresholds. (40% annually and 25% over 3-year period.) Exceedingly high default rates at for-profit universities are main factor in this increase. Source: Moody’s Investor Services January 16, 2013 report: “Industry Outlook: US Higher Education Outlook Negative in 2013.” 16.5% 5.9% 2.3% 1.9% 1.2% 43.1% 29.2% 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 % S tu d e n ts Average Loan Balance Per Student > $25,000 < $25,000

Proven Growth Core FFO Growth Same Community Revenue Growth (1) 11 EdR has produced strong growth that is expected to continue. Industry leading same-community revenue growth three out four years. Significant increases in total revenue, NOI and gross assets. Strong growth in Core FFO per share. Annual dividend increases of at least 10% over the last two years. (1) Source: respective company’s disclosures. 2013 is midpoint of any disclosed range or last reported leasing progress for fall 2013. $0.47 $0.55 9.3% 17.0% $0.30 $0.40 $0.50 $0.60 $0.70 2012 2013 Mid-point P e r S h a re 4.3% 7.1% 0.9% 4.6% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 2010 2011 2012 2013 EdR ACC EdR CAGR = 4.2% ACC CAGR = 2.9%

Strong External Growth Profile External Growth Profile – Announced Deals 12 Significant growth comes from EdR’s development and acquisition pipeline. 32% of 2013 community NOI is expected to come from new communities. Currently announced deals will increase gross assets by over 38% by 2015. Actively working additional development opportunities for 2015. - 500 1,000 1,500 2,000 2,500 2012 2013 2014 2015 16% 17% 5% G ro s s A s s ets ( '000 ) 2015 Deliveries 2014 Deliveries 2013 Deliveries Current

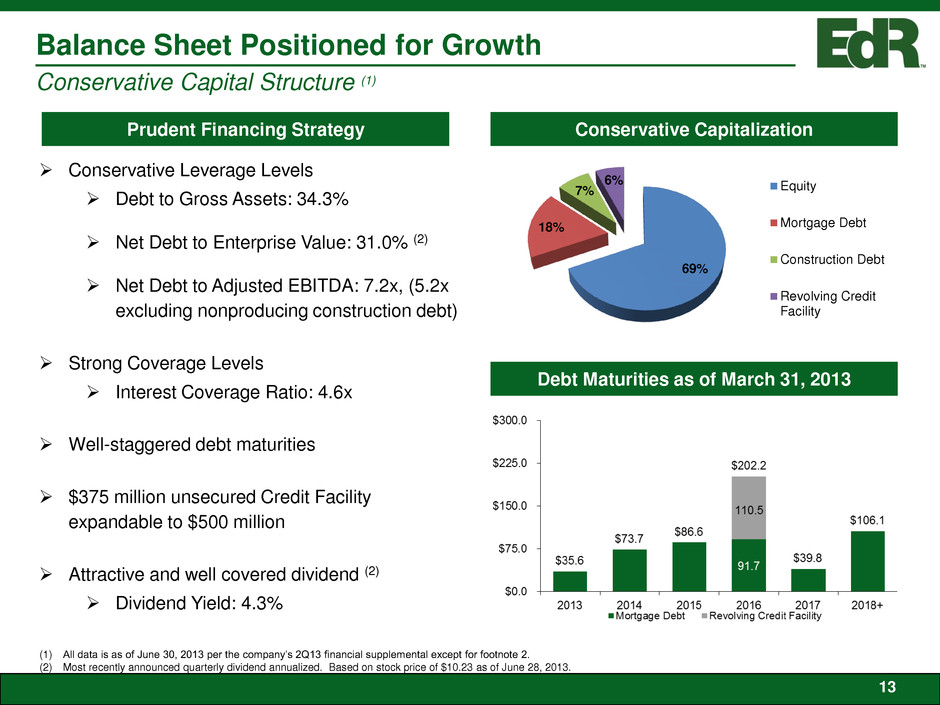

Balance Sheet Positioned for Growth Conservative Capital Structure (1) Debt Maturities as of March 31, 2013 Conservative Capitalization Prudent Financing Strategy (1) All data is as of June 30, 2013 per the company’s 2Q13 financial supplemental except for footnote 2. (2) Most recently announced quarterly dividend annualized. Based on stock price of $10.23 as of June 28, 2013. Conservative Leverage Levels Debt to Gross Assets: 34.3% Net Debt to Enterprise Value: 31.0% (2) Net Debt to Adjusted EBITDA: 7.2x, (5.2x excluding nonproducing construction debt) Strong Coverage Levels Interest Coverage Ratio: 4.6x Well-staggered debt maturities $375 million unsecured Credit Facility expandable to $500 million Attractive and well covered dividend (2) Dividend Yield: 4.3% 13 69% 18% 7% 6% Equity Mortgage Debt Construction Debt Revolving Credit Facility

Strengthened Balance Sheet Interest Coverage Debt to Gross Assets Source: Company disclosures. Unencumbered Assets (% of Gross Assets) Net Debt to Enterprise Value 14 41.5% 31.3% 31.7% 34.3% 20.0% 27.5% 35.0% 42.5% 50.0% 4Q10 4Q11 4Q12 2Q13 2.2x 2.7x 4.2x 4.6x 1.00x 2.00x 3.00x 4.00x 5.00x 4Q10 4Q11 4Q12 2Q13 43.9% 22.9% 27.4% 31.0% 10.0% 22.5% 35.0% 47.5% 60.0% 4Q10 4Q11 4Q12 2Q13 23.6% 43.6% 50.3% 49.4% 0.0% 15.0% 30.0% 45.0% 60.0% 4Q10 4Q11 4Q12 2Q13

Leading Student Housing Company Strong and Consistent Fall 2013 Preleasing Positive Supply and Demand Dynamics Strong Company Growth Profile High Quality Owned Portfolio Significant Competitive Advantages Substantial External Growth Opportunities Balance Sheet Positioned for Growth Investment Highlights 2400 Nueces, University of Texas at Austin 15

Forward Looking Statements This presentation includes certain statements, estimates and projections provided by EdR’s management with respect to the anticipated future performance of EdR, including “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements, estimates and projections reflect various assumptions by EdR’s management concerning anticipated results and have been included solely for illustrative purposes. Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “result,” and similar expressions. No representations are made as to the accuracy of such statements, estimates or projections, which necessarily involve known and unknown risks, uncertainties and other factors that, in some ways, are beyond management’s control. Such factors include the risk factors discussed in the Company’s registration statement on Form S-3, annual report on Form 10-K for the year ended December 31, 2012, and quarterly report on Form 10-Q for the period ended June 30, 2013, each as filed with the SEC. These risk factors include, but are not limited to risks and uncertainties inherent in the national economy, the real estate industry in general, and in our specific markets; legislative or regulatory changes including changes to laws governing REITS; our dependence on key personnel; rising insurance rates and real estate taxes; changes in GAAP; and our continued ability to successfully lease and operate our properties. Accordingly, actual results may vary materially from the projected results contained herein and you should not rely on any forward-looking statements made herein or made in connection with this presentation. The Company shall have no obligation or undertaking to update or revise any forward-looking statements to reflect any change in Company expectations or results, or any change in events. 16