Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VISTEON CORP | d581550d8k.htm |

Delivering Value

J.P. Morgan Conference –

August 2013

Exhibit 99.1

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses |

Page 2

Today We Will…

Provide Q2 2013 highlights

Update the status of the Company’s “Value Creation Plan”

first

presented on September 19, 2012

Review the YFV transaction

Outline the Visteon vision |

Q2

2013 Highlights J.P. Morgan Conference –

August 2013

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses |

Page 4

Second Quarter 2013 Recent Highlights

Strong Second-Quarter 2013 Performance

–

Sales of $1.9 billion vs. $1.7 billion in second-quarter 2012

–

Adjusted EBITDA of $187 million vs. $147 million in second-quarter 2012

–

Adjusted net income of $71 million

Adjusted EPS of $1.41

–

Strength in Climate and Electronics product groups

Year-over-year Adjusted EBITDA up 38% and 17%, respectively

Over $1 Billion of Liquidity at June 30, 2013, Despite $175 Million Share Buyback

and $50 Million Bond Repurchase During Last 12 Months

–

Cash of $1,008 million (up $306 million Y/Y); $114 million of U.S. ABL

availability –

Debt of $799 million; 1.2x Debt / Adjusted EBITDA

Increasing 2013 Financial Guidance

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

Prior

Revised

Sales

$7.3 -

$7.5 billion

$7.3 -

$7.5 billion

Adjusted EBITDA

$620 -

$660 million

$660 -

$690 million

Adjusted FCF

$100 -

$150 million

$135 -

$170 million

Adjusted EPS

$4.04 -

$5.52

$4.83 -

$6.11 |

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Status of “Value Creation”

Plan

J.P. Morgan Conference –

August 2013 |

Page 6

Decision Cornerstones

Base

strategic

decisions

on

“industrial

logic”

and

a

realistic

assessment

of

strengths and weaknesses

–

No smaller than #3 in relevant market presence

–

Core

strengths

must

include

technology

or

“know-how”

leverage

Provide customers with well financed, international-capable businesses with

exciting products

–

Financial performance must support R&D and capex investment

–

Must have presence where customers want to be

–

Capable of weathering economic challenges

Shareholder performance is an outcome of optimal strategic decisions and robust

execution

–

Lean, fast, driven and global

–

Focused, minimal overhead with strong leadership

Focused on Continued Strategy of Optimizing

Visteon’s Business Portfolio to Maximize Shareholder Value

Please see appendix for important disclosures regarding “Forward Looking

Information“ |

Page 7

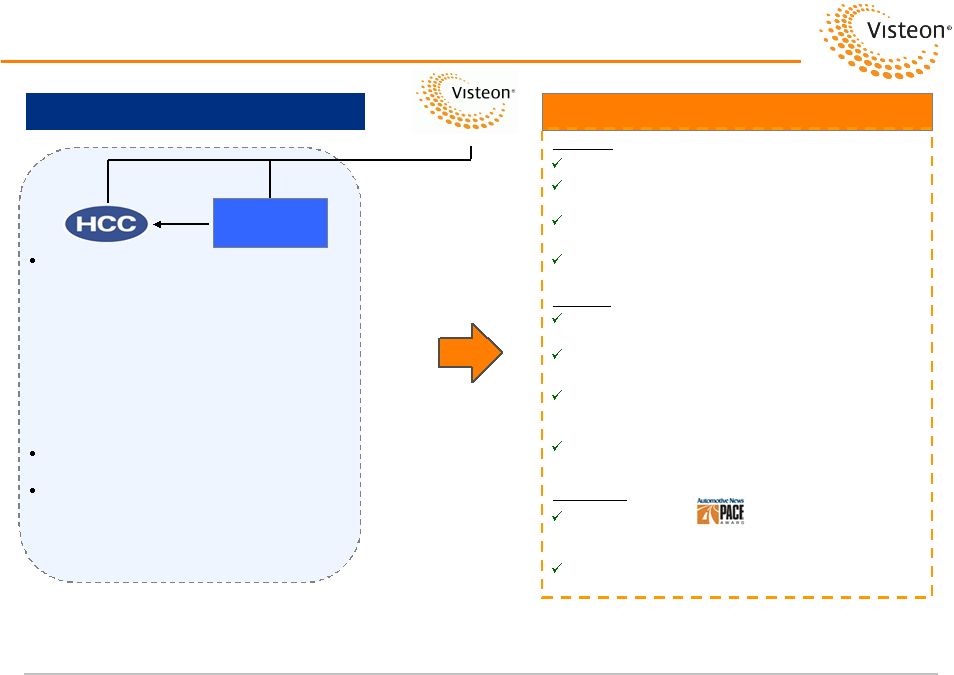

Visteon: The Plan (September 19, 2012)

Visteon

Climate

Yanfeng

Visteon

70%

100%

50%

100%

100%

Visteon

Interiors

Visteon

Electronics

Sell Visteon Climate to HCC for cash

Establishes “New Halla-Visteon Climate

Group”

(HVCG) as single consolidated

Climate presence with leadership of all global

Climate operations

Consolidation of these two operations into

one has been a major customer demand

Headquartered in Korea with global customer

presence and Korean leadership supported

by international management team

Visteon is equity holder (70%) in HVCG

Transfer limited SG&A and operating resources to

make business globally self-capable

Target transaction completion by Q1 2013

Remains non-core

Continue to pursue

options

Interiors will be

exited at a time

when value

objectives are met

Electronics

#5 global market

position

Significant integration

and technology

synergies with YFVE

Focused on

optimizing global

scale and ownership

YFV

Electronics

60%

40%

Yanfeng Visteon

YFV and affiliated

Visteon Electronics

represent a dynamic

marriage of global

presence with Asian-

centric power, low-cost

operations and

technological prowess

Core YFV business is

Interiors, which

Visteon is exiting

Need to monetize at

right value at right time

Rothschild and Goldman Sachs Were Engaged by Visteon to Pursue

Strategic Options to Enhance Customer, Partner and Shareholder Value

Please see appendix for important disclosures regarding “Forward Looking

Information“ Corporate Rightsizing

Minimal footprint

Staff businesses with lean and only “necessary”

support |

Page 8

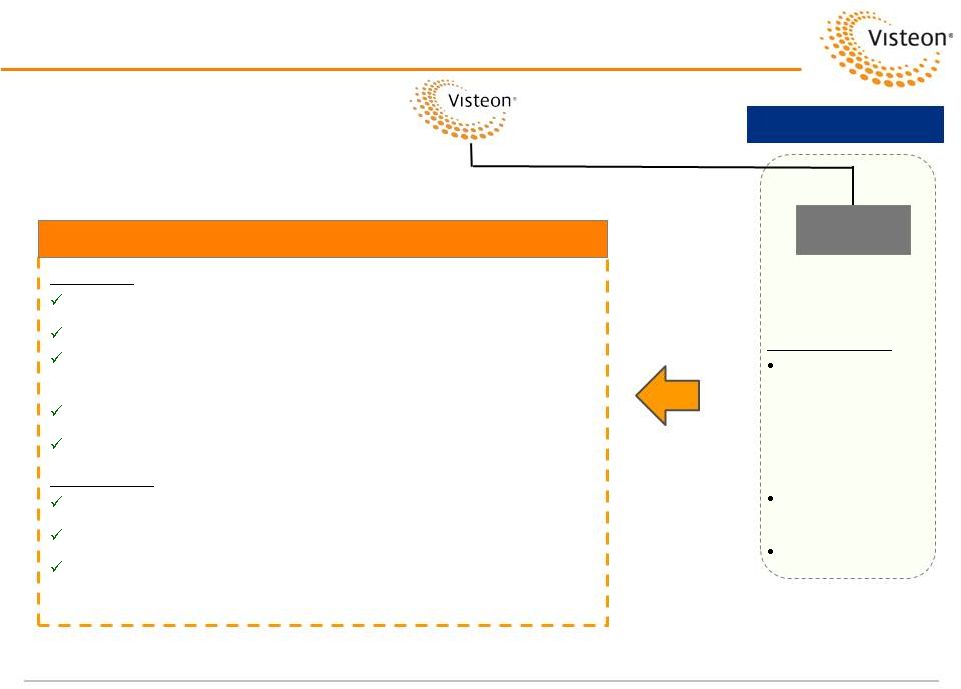

Visteon: The Status (August 13, 2013)

Visteon Status

The Plan

Visteon

Climate

70%

100%

Sell Visteon Climate to HCC for cash

–

Establishes “New Halla-Visteon Climate

Group”

(HVCG) as single consolidated

Climate presence with leadership of all global

Climate operations

–

Consolidation of these two operations into

one has been a major customer demand

–

Headquartered in Korea with global customer

presence and Korean leadership supported

by international management team

–

Visteon is equity holder (70%) in HVCG

Transfer limited SG&A and operating resources to

make business globally self-capable

Target transaction completion by Q1 2013

Overview

Completed Q1 2013

HVCC now #2 largest global auto climate business in

the world

Significant synergies already achieved, further

opportunities in process

HVCC stock price up over 30% YTD, up over 60%

since 52-week low

Financial

Order book supports 7%+ global sales CAGR through

2015

Project +$1 billion of new business wins in 2013

–

70% rewins / 30% incremental

2013 YTD performance

–

Revenue up $387 million (19%)

–

Adjusted EBITDA up $62 million (36%)

Significant margin enhancement opportunities;

increase

margins

100-150

bps

between

2012

-

2016

Technology

Awarded

prestigious award for technical

breakthrough on environmentally sensitive issue of

system fluid sealing integrity

Key supplier to new BMW i3 with innovative battery

cooling technology

Please see appendix for important disclosures regarding “Forward Looking Information“ and

“Use of Non-GAAP Financial Information” |

Page 9

Yanfeng

Visteon

50%

Yanfeng Visteon

YFV and affiliated

Visteon Electronics

represent a dynamic

marriage of global

presence with Asian-

centric power, low-cost

operations and

technological prowess

Core YFV business is

Interiors, which

Visteon is exiting

Need to monetize at

right value at right time

Visteon: The Status (August 13, 2013)

The Plan

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

Overview

Definitive agreement to sell YFV (ex. YFVE) signed August 12, 2013

Overall transaction valued at $1.5 billion

Visteon will sell non-Electronics position for $1.2 billion in cash

(tax exposure ~10%)

Visteon

will

retain

and

increase

direct

ownership

in

majority

of

YFVE

Most transactions expected to close Q4 2013 / Q1 2014

Key Benefits

Simplifies Visteon corporate structure

Improves integration of global Electronics business

Visteon will consolidate a majority of the existing YFVE operations,

and a JV will be established with HASCO, focused on specific

Chinese market opportunities

Visteon Status |

Page 10

100%

Visteon

Electronics

Electronics

#5 global market

position (pre YFVE

consolidation)

Significant integration

and technology

synergies with YFVE

Focused on

optimizing global

scale and ownership

YFV

Electronics

40%

Visteon: The Status (August 13, 2013)

Overview

Solidifies #3 global position in driver information and controls

Visteon Electronics will consolidate majority of YFVE’s former operations,

creating:

–

~$1.7 billion in 2013E sales ($350 to $400 million from YFVE)

–

$150+ million in 2013E Adjusted EBITDA ($40 to $45 million from YFVE)

Financial

Order book supports 12%+ sales CAGR in Cockpit Electronics through 2016

Project +$600 million of new business wins in 2013

–

33% rewins / 67% incremental

The Plan

Visteon Status

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

2013 YTD performance

–

Revenue up $86 million (14%)

–

Adjusted EBITDA up $7 million (12%)

Significant potential for margin enhancement/synergies

Operations and Technology

Market leader for worldwide delivery with complete global footprint

–

11,000 people at 31 sites in 15 countries; technical centers in every region

Recognized internationally for technical innovation

–

eBee vehicle receives major customer endorsements |

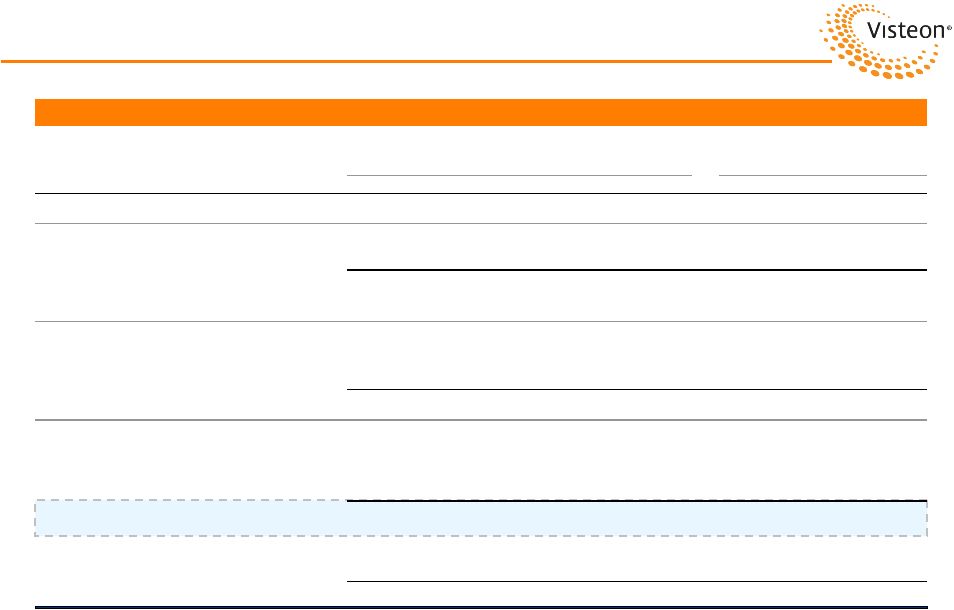

Page 11

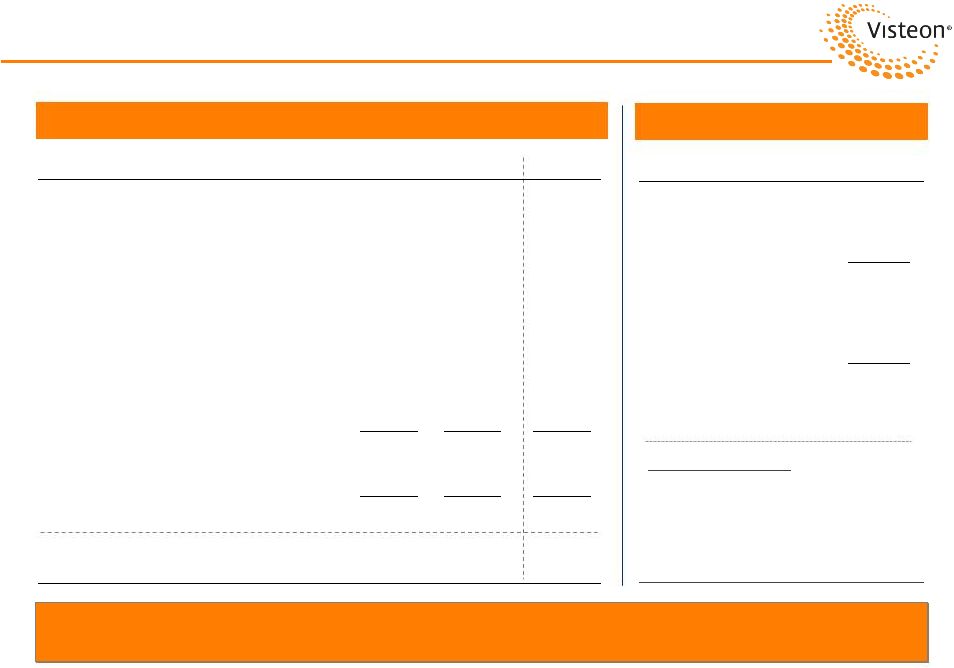

Corporate Rightsizing

Minimal footprint

Staff businesses with lean and only “necessary”

support

Visteon: The Status (August 13, 2013)

Overview

“Corporate centric”

business model being

replaced with “stand-alone”

capable business

units

Opportunity to relocate and/or charge shared

service centers to better match profitable

locations, improve tax efficiency

–

Today Visteon generates profits in certain

regions (namely Asia), incurs losses in other

regions (includes restructuring and

transformation expenses, and net interest

expense)

–

Losses partially funded with

dividends….creates significant tax leakage and

inefficiencies in our structure

Significant opportunity to minimize losses and

increase the efficiency of structure going forward

The Plan

Fixed Costs and SG&A Spend

(Originally Presented at DB Conference in Jan 2013 /

Updated for 2012 Actual and 2013 Latest Outlook)

(Dollars in Millions)

$340-$380

2012 Full-Year Tax Provision and Cash Taxes

(Presented During Q4 2012 Earnings Call)

Visteon Status

(1)

(2)

Please see appendix for important disclosures regarding “Forward Looking Information“

(1) U.S. GAAP basis equity in net income of non-consolidated affiliates.

(2) Pro forma effective tax rate not in conformity with U.S. GAAP.

(3) Including Non-U.S. withholding taxes related to consolidated dividends, royalties, and other

distributions. U.S. GAAP

U.S. GAAP

Implied

Cash

(Dollars in Millions)

PBT

Tax Expense

Tax Rate

Taxes

Halla Climate Control Corp and Affiliates

$257

$60

23%

$75

Visteon and Affiliates (Profitable)

127

32

25%

35

Visteon and Affiliates (Non-Profitable)

(319)

3

(1%)

4

Visteon Non-U.S. Withholding Tax on Non-Consol

226

21

9%

9

Other

(3)

-

5

N/M

10

Total

$291

$121

$133

$485

$437

$412

2011

2012

2013E

Goal

42% |

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

The YFV Transaction

J.P. Morgan Conference –

August 2013 |

Page 13

YFV Transaction: Overview

Transaction

Visteon is selling its 50% stake in YFV as well as direct stakes

in certain

Yanfeng-related affiliates (i.e. Halol, Jinqiao, Tooling, Toppower)

Visteon is increasing ownership stake in YFVE

–

Purchasing 11% of YFVE to bring Visteon’s stake to 51%

–

Purchasing

50%

of

a

New

HoldCo

which

will

own

49%

of

Toppower

as

well

as

own

stakes in the other YFV electronics-related entities

$1,183 million net cash proceeds

–

$1,053

million

gross

proceeds

for

YFV

and

other

direct

stakes

sold

(1)

–

($68) million net investment for increased stake in YFVE and

electronics-related entities

(2)

–

Cash

Consideration

Most transactions expected to close during late 2013 / early 2014

Timing subject to customary government and regulatory approvals

Timing

(1)

Excludes proceeds from sale of Toppower.

(2)

Includes proceeds from sale of Toppower.

(3)

Actual distribution could vary between $184 million and $211 million due to the

proration of certain distributions which depend on the closing date of the transaction..

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

$198 million distribution from existing cash

(3) |

Page 14

YFV Transaction: YFVE Structure

YFVE Simplified Structure

Future YFVE Structure

Proposed YFVE Structure Will Contribute $350 to $400 Million of Consolidated Sales

and $40 to $45 Million of EBITDA (Including Equity Income) to the Electronics

Product Group Post the transaction, Visteon will

own:

–

51% stake in YFVE and its main

fully owned operations in

Songjiang, China

–

50% of a New HoldCo which will

own 49% of Toppower as well

as own stakes in the other YFV

electronics-related entities

Steps

Increase stake in YFVE to 51%

through capital increase

Capitalize New HoldCo

–

New HoldCo to acquire 49%

stake in Toppower as well as

stakes in other YFV

electronics-related entities from

YFVE

Future

Consolidated

by Visteon

21%

7%

72%

% of Total

YFVE Sales

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

YF

Visteon

New HoldCo

YFVE

Other

entities

Toppower

50%

50%

49%

51%

51%

49%

100%

YFV

Visteon

Sky Captain

Songjiang

Other

entities

YFVE

Toppower

60%

40%

29.1%

12.5%

58.4%

Songjiang

Current |

Page 15

YFV Transaction: Proceeds

(Dollars in Millions)

Transaction Proceeds

Total Transaction Value of Approximately $1.5 Billion

YFVE Valuation

YFVE EBITDA

(3)

$43

Eliminate YFV Support Costs

7

Total EBITDA

$50

Multiple Based on Comps

6.0x

Valuation

$300

(2)

Amount

Paid

Value of YFV 50% Stake

$928

At Close

Direct Stakes in Other Interiors JVs

96

June 2015

(1)

Dividends from Other Interiors JVs

28

June 2014 / June 2015

Gross Proceeds

$1,053

Cash Distribution

198

At or Near Close

Gross Proceeds w/ Distribution

$1,251

Payment to Gain YFVE Consolidation

(68)

At Close

Net Cash Proceeds

$1,183

YFVE Valuation

300

Total Transaction Value

$1,483

Please see appendix for important disclosures regarding “Forward Looking Information“ and

“Use of Non-GAAP Financial Information” (1) Substantially all the funds will be received by June 2015.

(2) Actual distribution could vary between $184 million and $211 million due

to the proration of certain distributions which depend on the closing date of the transaction.

(3) Represents YFVE 2013 YTD EBITDA annualized. |

Visteon Electronics Business

Page 16

Transaction Solidifies #3 Global Position in Driver Information and Controls

Sales

Adjusted

EBITDA

$1,274

$126

Remove YFVE Equity Income

–

(14)

VC Electronics (ex. YFVE)

$1,274

$112

New YFVE

457

40

Elims

(137)

–

Adjusted

$1,594

$152

Visteon Electronics –

2012

(Dollars in Millions)

Visteon Cockpit Electronics Business

Pre-YFVE Transaction

Post-YFVE Transaction

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

Note: Consistent with Visteon’s reporting practices, Adjusted EBITDA includes

equity in affiliates and deduction for non-controlling interests. EU

38%

NA

37%

AP

21%

SA

4%

AP

37%

EU

30%

NA

29%

SA

4%

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2010

2011

2012

2013E

2014E

2015E

2016E

Historical Visteon Consolidated Electronics

Consolidated YFVE Sales

Other Non-Consolidated Sales (China, Indonesia)

Visteon Electronics – Base

|

Page 17

YFV Transaction: Impacts to Visteon

(Dollars in Millions)

2009

$35

2010

$12

2011

$42

2012

$70

YFV + Visteon

Direct Stakes

(1)

Est. YFVE

Est. YFV

Non-

YFVE

YFVE

EBITDA

Post Deal

Support

Costs

Net Impact

2012

($126)

($23)

$40

$5-10

($99)-(104)

2013 YTD

($69)

($13)

$21

$3-7

($54)-(58)

R

YFV Dividend History (ex. Electronics)

Impact to Visteon Reported Adjusted EBITDA

(Visteon EBITDA Includes YFV Equity Income)

Visteon Will Recognize Approximately $100 Million Less in Adjusted EBITDA

and Will Gain Approximately $1.1 Billion in After-Tax Cash Proceeds

Please see appendix for important disclosures regarding “Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

(1) Represents equity income from Yanfeng and related entities that is included in

Visteon’s Adjusted EBITDA. Note: Visteon will also consolidate YFVE cash

post the transaction. YFVE cash balance was $40 million at 6/30/2013. |

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses

Post YFV

J.P. Morgan Conference –

August 2013 |

Page 19

Visteon: Post YFV

#2 in the world in high-growth

climate market

7%+ Revenue CAGR

Powerful technology

Strong balance sheet

Generates cash

Please see appendix for important disclosures regarding “Forward Looking

Information“ Electronics

#3 in the world in driver

information and controls

12%+ Revenue CAGR

Powerful technology

Strong balance sheet

Generates cash

Interiors

World-class IP technology

Managing through Europe

downturn

Restructuring business

for future growth while

exploring divestment

opportunities

Visteon Consolidating Around Two World-class Core Businesses

70%

100%

100% |

Climate Segment Undergoing Revolution in Product

Compressors

Powertrain

Cooling

EV &

Hybrid

Battery

Cooling

Fluid

Transport

HVAC

Page 20

Please see appendix for important disclosures regarding “Forward Looking

Information“ HVCC: One of Only Two Climate Companies With A Complete

Product Line |

Page 21

Visteon: HVCC Driving Climate Technology

Please see appendix for important disclosures regarding “Forward Looking

Information“ Redefining the Climate Portfolio, Generating Content Growth

and Margin Expansion Cathode Oxygen

Depletion Heater

Brushless DC

Cooling Module

High-Voltage Positive

Temperature Coefficient

(PTC) Heater

Turbo Blower

Fuel Cell Vehicle

Technologies

Hybrid and Electric Vehicle

Technologies

Battery Chiller and

Contact Heat Exchanger

Precise battery temperature control

Electric Compressor

Lightweight, High-Performance

(5.6 kW cooling capacity)

HVAC with High-Efficiency

Blower Scroll

Significant reduction in power

consumption and noise

Integrated Climate

System Module

Revolutionizes cockpit

design by relocating

HVAC in engine

compartment |

Visteon: HVCC Innovative Technologies and Strong IP

Page 22

Please see appendix for important disclosures regarding “Forward Looking

Information“ Intellectual Property

Innovative Technologies

TF* Coolant Heater for Electric Vehicle

World First

Rapid Cabin Heating

& Compact Structure

More Innovation To Come

* Thin Film.

Heat Pump System for Electric Vehicle

Metal Seal Fitting for

Reducing Refrigerant Leakage

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

2012

0

100

200

300

400

2011

Publication Year

# of Released Patents

Competitor D

Competitor C

Competitor B

HVCC

Competitor A

Source: Boston Consulting Group.

2013

PACE Award

2012

New Excellent

Technology (NET)

Certificate

IP

Application

Registration

2,279

7,538

HVCC |

Automotive Converges with Consumer Electronics

Page 23

Please see appendix for important disclosures regarding “Forward Looking

Information“ Note: Logos above are trademarks and copyrights of the respective companies. Next

Generation

User Interface

Open Source

Software

Environment

Cloud

Content &

Services

Always

Connected

“Pipeline” |

Page 24

Visteon: Driving Electronics Technology

Advanced Instrument Clusters

•

Third generation reconfigurable clusters

•

Leading 3-D graphics

•

Superior display resolution

Next

Generation

Display

Technologies

•

Consumer electronics-driven user interaction

•

OEM styling freedom

•

Optimized viewability

Open Architecture Infotainment

•

Contextual, intuitive HMI

•

Car-to-Cloud connectivity

•

“SmartScreen”

smartphone integration

Redefining the Electronics Portfolio, Generating Content Growth and Margin

Expansion |

Page 25

Visteon: Driving Technology

Please see appendix for important disclosures regarding “Forward Looking

Information“ Generating Growth, Generating Value

|

Page 26

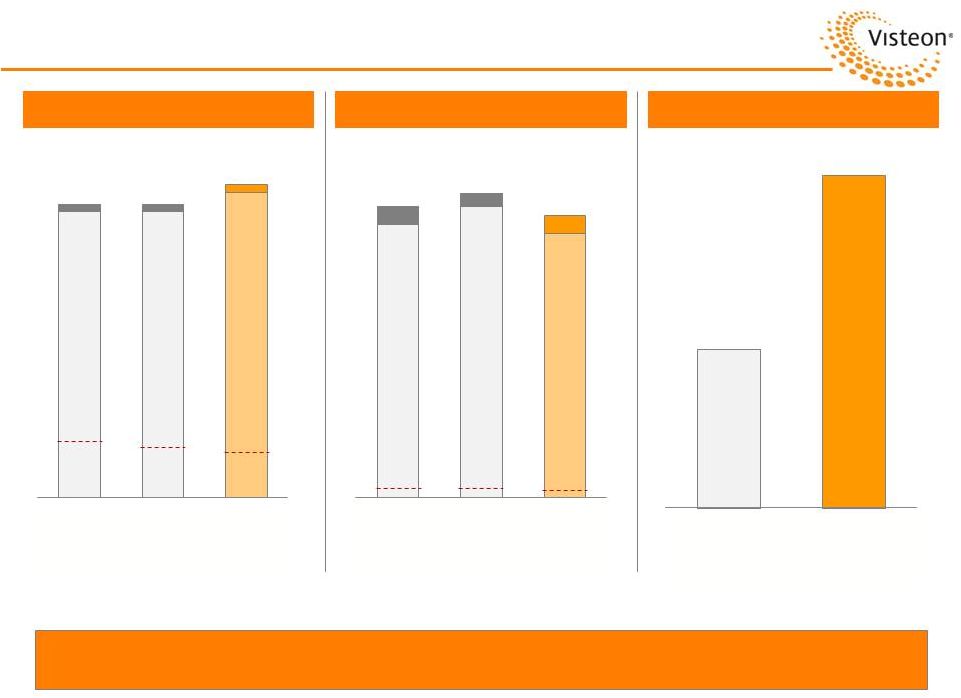

Visteon: Post YFV (Financial Outlook)

Revenue

Adjusted EBITDA

Cash

$7.3 -

$7.5B

$7.8 -

$8.0B

$660 -

$690M

$600 -

$640M

$1.0B

$2.1B

$7.3 -

$7.5B

$620 -

$660M

KRW

(1)

1,094

1,120

1,110

Euro

$1.30

$1.30

$1.30

Interiors

(ex. YFV)

Visteon 2014 Adjusted EBITDA Post YFV Transaction is 3% Below Our Original 2013

Guidance and We Have $1.1 Billion of Additional After-tax Cash

Proceeds Note: Consistent with Visteon’s reporting practices, Adjusted

EBITDA includes equity in affiliates and deduction for non-controlling interests.

(1) Effective rate with hedges.

Please

see

appendix

for

important

disclosures

regarding

“Forward

Looking

Information“

and

“Use

of

Non-GAAP

Financial

Information”

6/30/2013

6/30/2013 PF for

YFV Transaction

2013

Original

Guidance

2013

Revised

Guidance

2014 Post

YFV

2013

Original

Guidance

2013

Revised

Guidance

2014 Post

YFV |

Page 27

Going Forward

Visteon Focusing on Core Value Creating Assets

–

Both core businesses among industry leaders

–

Both exhibit higher than segment growth

–

Bottom line being enhanced by Corporate fixed cost & SG&A reductions

YFV Transaction Affords Significant Balance Sheet Optimization…

The Plan: $1 Billion Share Buyback

–

Board

authorized

an

upsize

of

remaining

share

repurchase

program

to

$1

billion

though December 2015

Visteon Well Positioned to Continue Value Creation

–

Balance sheet optimization

–

Above industry growth in core operations with expanding margins

Visteon Focused on Continuing to Drive Shareholder Value

Please see appendix for important disclosures regarding “Forward Looking

Information“ |

Appendix

J.P. Morgan

Conference

–

August

2013

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses |

Page 29

Forward-Looking Information

This presentation contains "forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of

future results and conditions but rather are subject to various factors, risks and

uncertainties that could cause our actual results to differ materially from those expressed in these forward-

looking statements, including, but not limited to,

conditions within the automotive industry, including (i) the automotive vehicle production volumes and

schedules of our customers, and in particular Ford's and Hyundai-Kia’s vehicle

production volumes, (ii) the financial condition of our customers and the effects of any

restructuring or reorganization plans that may be undertaken by our customers, including work

stoppages at our customers, and (iii) possible disruptions in the supply of commodities to us or our

customers due to financial distress, work stoppages, natural disasters or civil unrest; our ability to satisfy future capital and liquidity requirements; including our ability to access the

credit and capital markets at the times and in the amounts needed and on terms acceptable to

us; our ability to comply with financial and other covenants in our credit agreements; and the

continuation of acceptable supplier payment terms;

our ability to execute on our transformational plans and cost-reduction initiatives in the amounts

and on the timing contemplated;

our ability to satisfy pension and other post-employment benefit obligations; our ability to access funds generated by foreign subsidiaries and joint ventures on a timely and cost

effective basis; general economic conditions, including changes in interest rates and fuel prices; the timing and

expenses related to internal restructurings, employee reductions, acquisitions or dispositions

and the effect of pension and other post- employment benefit obligations; increases in raw material and energy costs and our ability to offset or recover these costs, increases

in our warranty, product liability and recall costs or the outcome of legal or regulatory

proceedings to which we are or may become a party; and those factors identified in our filings with the SEC (including our Annual Report on Form 10-K for

the fiscal year ended December 31, 2012). Caution should be taken not to

place undue reliance on our forward-looking statements, which represent our view only as of

the date of this presentation, and which we assume no obligation to update. New business wins and

re-wins do not represent firm orders or firm commitments from customers, but are based on

various assumptions, including the timing and duration of product launches, vehicle productions

levels, customer price reductions and currency exchange rates. |

Page 30

Because not all companies use identical calculations, Adjusted Gross Margin,

Adjusted SG&A, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS, Free

Cash Flow and Adjusted Free Cash Flow used throughout this presentation may

not be comparable to other similarly titled measures of other companies.

In order to provide the forward-looking non-GAAP financial measures

for full-year 2013, the Company is providing reconciliations to the most

directly comparable GAAP financial measures on the subsequent slides.

The provision of these comparable GAAP financial measures is not intended to

indicate that the Company is explicitly or implicitly providing

projections

on

those

GAAP

financial

measures,

and

actual

results

for

such

measures

are

likely

to

vary

from

those

presented.

The

reconciliations

include

all

information

reasonably

available to the Company at the date of this presentation and the adjustments that

management can reasonably predict.

Use of Non-GAAP Financial Information |

Page 31

Reconciliation of Non-GAAP Financial Information

Sales

The Company defines

Adjusted Gross Margin as

gross margin, adjusted to

eliminate the impacts of

employee severance,

pension settlements, other

non-operating costs and

stock-based compensation

expense.

Adjusted Gross Margin

The Company defines

Adjusted SG&A as SG&A,

adjusted to eliminate the

impacts of employee

severance, pension

settlements, other non-

operating costs and stock-

based compensation

expense.

Adjusted SG&A

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

$1,856

$1,819

$1,656

$1,823

$7,154

$1,856

$1,892

Less: Discontinued operations

139

126

32

-

297

-

-

Net sales, products

$1,717

$1,693

$1,624

$1,823

$6,857

$1,856

$1,892

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

Gross margin (incl. discontinued operations)

$150

$141

$133

$198

$622

$154

$185

Less: Discontinued operations

16

13

4

-

33

-

-

Gross margin

$134

$128

$129

$198

$589

$154

$185

Less:

Employee severance, pension settlements and other

(4)

(2)

-

(11)

(17)

-

-

Subtotal

($4)

($2)

$0

($11)

($17)

$0

$0

Adjusted gross margin

$138

$130

$129

$209

$606

$154

$185

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

SG&A (incl. discontinued operations)

$94

$90

$90

$102

$376

$86

$91

Less: Discontinued operations

3

3

1

0

7

0

0

SG&A

$91

$87

$89

$102

$369

$86

$91

Less:

Employee severance, pension settlements and other

1

-

4

5

10

-

-

Stock-based compensation expense

7

6

6

5

24

6

4

Subtotal

$8

$6

$10

$10

$34

$6

$4

Adjusted SG&A

$83

$81

$79

$92

$335

$80

$87

Net sales, products (incl. discontinued operations)

|

Page 32

Reconciliation of Non-GAAP Financial Information

(cont’d)

Adjusted EBITDA

Free Cash Flow and Adjusted Free Cash Flow

2012

2013

2013 FY Guidance

2014 FY Guidance

(Dollars in Millions)

Full Year

1st Qtr

2nd Qtr

Low-end

High-end

Low-end

High-end

Adjusted EBITDA

$626

$170

$187

$660

$690

$600

$640

Interest expense, net

35

10

9

40

40

55

45

Provision for income taxes

121

(18)

39

90

55

165

125

Depreciation and amortization

258

67

65

265

265

265

265

Restructuring expense

79

20

3

100

75

50

25

Equity investment gain

(63)

-

-

-

-

-

-

Other income and expense

41

16

(1)

40

30

-

-

Other non-operating costs, net

27

-

3

10

10

-

-

Stock-based compensation expense

25

6

4

20

20

15

15

Discontinued operations net loss/(income)

3

-

-

-

-

-

-

Net Income (loss) attributable to Visteon

$100

$69

$65

$95

$195

$50

$165

2012

2013

2013 FY Guidance

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

Low-end

High-end

Cash from (used by) operating activities

$19

($12)

$156

$76

$239

$122

$36

$225

$300

Less: Capital expenditures

53

49

44

83

229

63

51

250

250

Free cash flow

($34)

($61)

$112

($7)

$10

$59

($15)

($25)

$50

Reconciliations to Adjusted Free Cash Flow (ex. Restructuring and

Transaction-Related Cash) Free cash flow

($34)

($61)

$112

($7)

$10

$59

($15)

($25)

$50

Exclude: Restructuring cash payments

38

3

2

3

46

15

11

100

75

Exclude: Transaction-related cash

22

7

6

11

46

21

6

60

45

Adjusted free cash flow

$26

($51)

$120

$7

$102

$95

$2

$135

$170 |

Page 33

Reconciliations of Adjusted Net Income, Earnings per Share

and Adjusted Earnings per Share

2012

2013

2013 FY Guidance

(Dollars and Shares in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

Low-end

High-end

Net income (loss) attributable to Visteon

($29)

$75

$15

$39

$100

$69

$65

$95

$195

Average shares outstanding, diluted

51.9

53.7

53.8

53.0

53.3

51.9

50.5

50.7

50.7

Earnings per share

($0.56)

$1.40

$0.28

$0.74

$1.88

$1.33

$1.29

$1.87

$3.85

Memo: Items Included in Net income (loss) attributable to Visteon

Restructuring expense

(41)

(1)

(2)

(35)

(79)

(20)

(3)

(100)

(75)

Equity investment gain

-

63

-

-

63

-

-

-

-

Other income and expense

(22)

(10)

9

(18)

(41)

(16)

1

(40)

(30)

Other non-operating costs, net

(5)

(2)

(5)

(15)

(27)

-

(4)

(10)

(10)

Taxes related to equity investment gain

-

(6)

-

-

(6)

-

-

-

-

Lighting net income / (loss)

3

(1)

(5)

-

(3)

-

-

-

-

Total

($65)

$43

($3)

($68)

($93)

($36)

($6)

($150)

($115)

Memo: Adjusted EPS

Net income (loss) attributable to Visteon

($29)

$75

$15

$39

$100

$69

$65

$95

$195

Items in net income (loss) attributable to Visteon

(65)

43

(3)

(68)

(93)

(36)

(6)

(150)

(115)

Adjusted net income (loss)

$36

$32

$18

$107

$193

$105

$71

$245

$310

Average shares outstanding, diluted

51.9

53.7

53.8

53.0

53.3

51.9

50.5

50.7

50.7

Adjusted earnings per share

$0.69

$0.60

$0.33

$2.02

$3.62

$2.02

$1.41

$4.83

$6.11 |

Page 34

Reconciliation of Climate Financial Information

Climate

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

YTD

Product Sales

$1,023

$1,065

$1,024

$1,174

$4,286

$1,228

$1,247

$2,475

Gross Margin

$89

$81

$89

$119

$378

$112

$121

$233

Employee Charges / Corp Severance

-

(1)

-

(8)

(9)

-

-

-

Adjusted Gross Margin

$89

$82

$89

$127

$387

$112

$121

$233

% of Sales

8.7%

7.7%

8.7%

10.8%

9.0%

9.1%

9.7%

9.4%

SG&A

Product Line Specific and Allocated SG&A

(35)

(37)

(35)

(38)

(145)

(36)

(35)

(71)

Employee Charges / Corp Severance

-

-

-

-

-

-

-

-

Adjusted SG&A

($35)

($37)

($35)

($38)

($145)

($36)

($35)

($71)

Adjusted EBITDA

Adjusted Gross Margin

$89

$82

$89

$127

$387

$112

$121

$233

Adjusted SG&A

(35)

(37)

(35)

(38)

(145)

(36)

(35)

(71)

Exclude D&A

45

49

46

46

186

49

50

99

Adjusted EBITDA (excl. Equity in Affil., NCI)

$99

$94

$100

$135

$428

$125

$136

$261

% of Sales

9.7%

8.8%

9.8%

11.5%

10.0%

10.2%

10.9%

10.5%

Equity in Affiliates

1

1

-

3

5

2

3

5

Noncontrolling Interests

(16)

(9)

(18)

(20)

(63)

(14)

(20)

(34)

Adjusted EBITDA

$84

$86

$82

$118

$370

$113

$119

$232 |

Page 35

Reconciliation of Electronics Financial Information

Electronics

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

YTD

Product Sales

$329

$304

$304

$337

$1,274

$365

$354

$719

Gross Margin

$29

$33

$23

$53

$138

$37

$41

$78

Employee Charges / Corp Severance

-

-

-

(2)

(2)

-

-

-

Cadiz Non-Operating Costs

(4)

-

-

3

(1)

-

-

-

Adjusted Gross Margin

$33

$33

$23

$52

$141

$37

$41

$78

% of Sales

10.0%

10.9%

7.6%

15.4%

11.1%

10.1%

11.6%

10.8%

SG&A

Product Line Specific and Allocated SG&A

(16)

(15)

(15)

(17)

(63)

(18)

(18)

(36)

Employee Charges / Corp Severance

-

-

-

-

-

-

-

-

Adjusted SG&A

($16)

($15)

($15)

($17)

($63)

($18)

($18)

($36)

Adjusted EBITDA

Adjusted Gross Margin

$33

$33

$23

$52

$141

$37

$41

$78

Adjusted SG&A

(16)

(15)

(15)

(17)

(63)

(18)

(18)

(36)

Exclude D&A

8

8

8

7

31

7

7

14

Adjusted EBITDA (excl. Equity in Affil., NCI)

$25

$26

$16

$42

$109

$26

$30

$56

% of Sales

7.6%

8.6%

5.3%

12.5%

8.6%

7.1%

8.5%

7.8%

Equity in Affiliates

3

4

5

6

18

4

5

9

Noncontrolling Interests

-

-

(1)

-

(1)

-

-

-

Adjusted EBITDA

$28

$30

$20

$48

$126

$30

$35

$65 |

Page 36

Reconciliation of Interiors Financial Information

Interiors

2012

2013

(Dollars in Millions)

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

YTD

Product Sales

$393

$352

$307

$336

$1,388

$317

$334

$651

Gross Margin

$16

$14

$17

$27

$74

$5

$23

$28

Employee Charges / Corp Severance

-

(1)

-

(3)

(4)

-

-

0

Adjusted Gross Margin

$16

$15

$17

$30

$78

$5

$23

$28

% of Sales

4.1%

4.3%

5.5%

8.9%

5.6%

1.6%

6.9%

4.3%

SG&A

Product Line Specific and Allocated SG&A

(19)

(18)

(15)

(17)

(69)

(17)

(19)

(36)

Employee Charges / Corp Severance

-

-

-

-

-

-

-

-

Adjusted SG&A

($19)

($18)

($15)

($17)

($69)

($17)

($19)

($36)

D&A

8

7

8

8

31

8

7

15

Adjusted D&A

$8

$7

$8

$8

$31

$8

$7

$15

Adjusted EBITDA

Adjusted Gross Margin

$16

$15

$17

$30

$78

$5

$23

$28

Adjusted SG&A

(19)

(18)

(15)

(17)

(69)

(17)

(19)

(36)

Adjusted D&A

8

7

8

8

31

8

7

15

Adjusted EBITDA (excl. Equity in Affil., NCI)

$5

$4

$10

$21

$40

($4)

$11

$7

% of Sales

1.3%

1.1%

3.3%

6.3%

2.9%

(1.3%)

3.3%

1.1%

Equity in Affiliates, excluding YFJC gain

38

35

34

34

141

38

37

75

Noncontrolling Interests

(2)

-

-

(1)

(3)

(1)

(1)

(2)

Adjusted EBITDA

$41

$39

$44

$54

$178

$33

$47

$80 |

Page 37

Reconciliation of YFVE Adjusted EBITDA

YFVE –

Pro Forma Adjusted EBITDA Impact to Visteon Post Transaction

Note: Estimates only, not purported to be U.S. GAAP.

2012 Actual

2013 Full-Year Estimate

2013 Actual

(Dollars in Millions)

Full Year

Low-end

High-end

1st Half

Adjusted EBITDA

$40

$40

$45

$21

Interest expense, net

2

2

2

1

Provision for income taxes

5

5

5

3

Depreciation and amortization

7

9

9

4

Net income

$26

$24

$29

$13 |

Second-Quarter

Q2 2013

2012

2013

B/(W) 2012

Sales

$1,693

$1,892

Adjusted Gross Margin

$130

$185

Adjusted SG&A

$81

$87

Adjusted EBITDA

$147

$187

Adjusted EPS

$0.60

$1.41

Free Cash Flow

($61)

($15)

Adjusted Free Cash Flow

($51)

$2

Page 38

Second-Quarter 2013 Key Financials

(Dollars in Millions)

7.7%

4.8%

8.7%

9.8%

4.6%

9.9%

$199

$0.81

$46

$53

210 bps

20 bps

120 bps |

Page 39

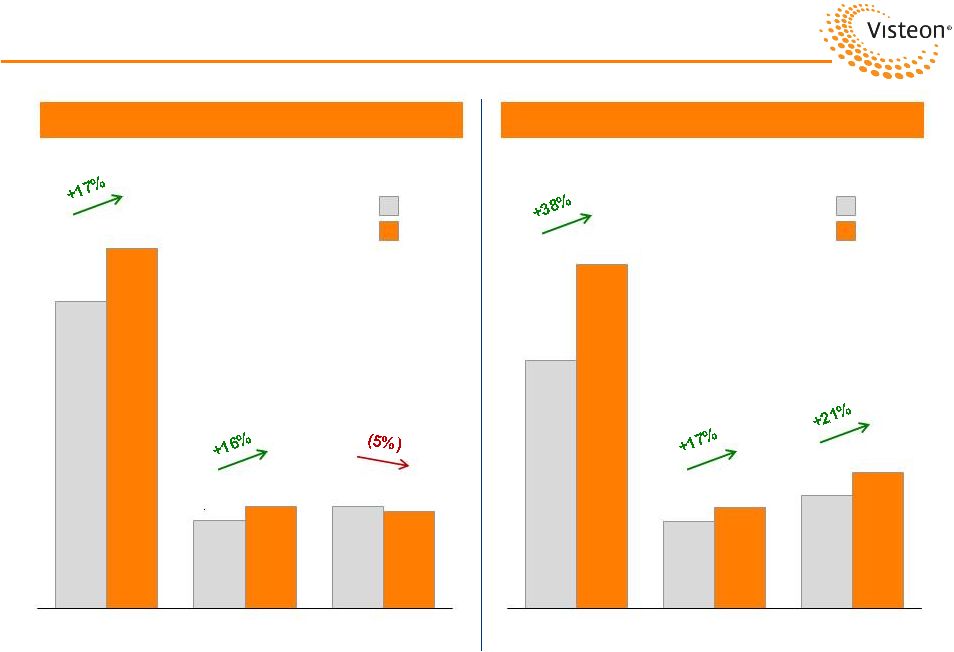

Sales and Adjusted EBITDA

Y/Y Performance

Q2

Volume / Mix

$214

Currency

5

Other Changes

(20)

Total

$199

Sales

(Dollars in Millions)

Adjusted EBITDA

Y/Y Performance

Q2

Volume / Mix

$45

Currency

2

Product Development

(2)

Business Equation

2

Equity Income

5

Non-Controlling Interest

(12)

Total

$40

8.7%

9.9%

$1,693

$1,892

Q2 2012

Q2 2013

$147

$187

Q2 2012

Q2 2013 |

Page 40

Second-Quarter 2013 Segment Financials

(Dollars in Millions)

Q2 2012

Q2 2013

(Includes Equity in Affiliates

and Non-Controlling Interests)

Q2 2012

Q2 2013

Note: Excludes $8 million and $14 million of corporate cost expense in Q2 2012 and

Q2 2013, respectively. $1,065

$304

$352

$1,247

$354

$334

Climate

Electronics

Interiors

$86

$30

$39

$119

$35

$47

Climate

Electronics

Interiors

Sales

Adjusted EBITDA |

Page 41

Cash Flow / Cash / Debt

(Dollars in Millions)

Adjusted Free Cash Flow Positive in Second Quarter 2013

(1) Excludes non-cash equity investment amortization (excluded from Adjusted

EBITDA). Q1 2013

Q2 2013

YTD

Adjusted EBITDA

$170

$187

$357

Trade Working Capital

97

(44)

53

Equity

Earnings,

Net

of

Dividends

(1)

(41)

(44)

(85)

Cash Taxes

(29)

(50)

(79)

Interest Payments

(3)

(18)

(21)

Restructuring / Transaction Payments

(36)

(17)

(53)

Non-Controlling Interests

15

21

36

Other Changes

(51)

1

(50)

Cash from Operations

$122

$36

$158

Capital Expenditures

(63)

(51)

(114)

Free Cash Flow

$59

($15)

$44

Memo: Adjusted FCF

(ex. Restructuring / Transaction Payments)

$95

$2

$97

6/30/13

Cash ex. HVCC

$675

HVCC Cash

333

Total Cash

$1,008

Debt ex. HVCC

474

HVCC Debt

325

Total Debt

$799

Net Cash

$209

Visteon Leverage

LTM Adjusted EBITDA

$693

Debt / Adj. EBITDA

1.2x

Net Debt / Adj. EBITDA

N/M

Free Cash Flow

Visteon Cash and Debt |

Page 42

2013 Guidance

Prior

Revised

Product Sales

$7.3 B -

$7.5 B

$7.3 B -

$7.5 B

Adjusted EBITDA

$620 M -

$660 M

$660 M -

$690 M

Free Cash Flow

Free Cash Flow

(1)

($75) M -

$25 M

($25) M -

$50 M

Adjusted Free Cash Flow

(ex. Restructuring and Transaction-Related)

$100 M -

$150 M

$135 M -

$170 M

Adjusted EPS

$4.04 -

$5.52

$4.83 -

$6.11

Other Selected Items:

Prior

Revised

Depreciation and Amortization

$270 M

$265 M

Interest Payments

$50 M

$45 M

Cash Taxes

Operating

$120 M -

$140 M

$135 M -

$160 M

Climate Transaction

$20 M -

$40 M

$15 M -

$20 M

Restructuring Payments

$75 M -

$125 M

$75 M -

$100 M

Capital Spending

$250 M

$250 M

(1)

Free cash flow equal to cash from operating activities, less capital expenditures.

Includes $75-$100 million of restructuring and $50-$60 million in

taxes and fees, primarily related to Halla Visteon Climate Control transaction. |

Visteon is Well Positioned with Global Vehicle Production

Page 43

Visteon: Post YFV (Sales by Region)

AP

43%

EU

31%

NA

20%

SA

6%

21.3 Million Units

Asia

N. America

S. America

Source: IHS Automotive.

14%

U.S.

Current

Post YFV Transaction

6%

20%

24%

50%

Global Industry Production

AP

47%

EU

29%

NA

19%

SA

SA

5%

Q2 2013 Global Production

Visteon Consolidated Sales by Region

Europe |

www.visteon.com |