Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VISTEON CORP | d561427d8k.htm |

Yanfeng 3-09 Financial Statements

June 28, 2013

Exhibit 99.1

Yanfeng Visteon

Electronics

Interiors

Our Family

of Businesses |

Page 2

Overview

Rule 3-09 requires separate financial statements be filed for significant

subsidiaries that meet certain conditions as set forth by the SEC

YFV meets these conditions and Visteon filed separate YFV financial statements for

historical periods on June 28, 2013 on a Form 10-K/A (amended 2012

annual filing) IFRS basis; initial adoption January 1, 2011

Presented full-year 2011 and 2012

The

separate

financial

statements

include

the

following

items

in

RMB

under

IFRS:

Statement of Income, including revenue, gross profit and net profit

Statement of Financial Position with typical balance sheet categories

Statement of Shareholders’

Equity

Statement of Cash Flows

Notes to Financial Statements

YFV Rule 3-09 Separate Statements

YFV Financial Statements Required on Annual Basis Only

|

Page 3

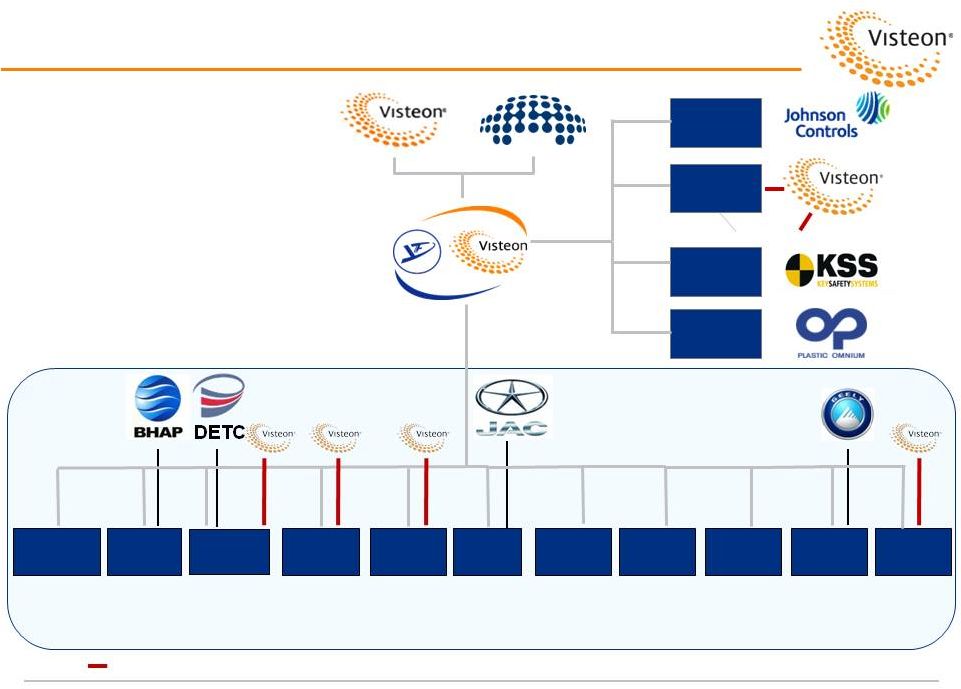

YFV Structure

•

The financials in the 3-09

financial statements relate to

the 50% / 50% JV between

Visteon and HASCO (SAIC)

•

The 3-09 financial statements

exclude Visteon’s direct

interests in Yanfeng affiliates

(i.e. Dongfeng, Halol India,

Jinqiao, Tooling, Toppower

YFV Electronics)

50%

50%

YFV

Beijing

2002

75%

YFV

Tooling

2006

50%

Dongfeng

Visteon

(1)

2003

40%

YFV

Jinqiao

2004

75%

60%

2002

50.1%

2004

YF Key

Safety

50.05%

2007

YFV

Hefei

2007

80%

YFV

Jiqiang

2008

51%

YFV

Nanjing

2010

80%

YFV

NJ FEM

2010

51%

YFV

Zhejiang

2011

60%

50.01%

YFJCI

Seating

1997

YFV

Chongqing

2001

99%

YFV

Halol India

2011

50%

20%

12.5%

25%

50%

Toppower

58.44%

YFV

Electronics

(1) Visteon interest sold in June 2013.

40%

Represent Visteon direct interests in YFV affiliates (these direct interests are

not included in YFV consolidated results) YFPO

Exterior

Interiors Operations

29.092% |

Page 4

YFV 3-09 Financial Highlights (2011-2012)

Under IFRS, YFV Generated 39.8 Billion in Sales in 2012 and

1.6 Billion in Profit

Note: See Visteon Corporation’s amended Annual Report on Form 10-K/A for

additional information. |

Page 5

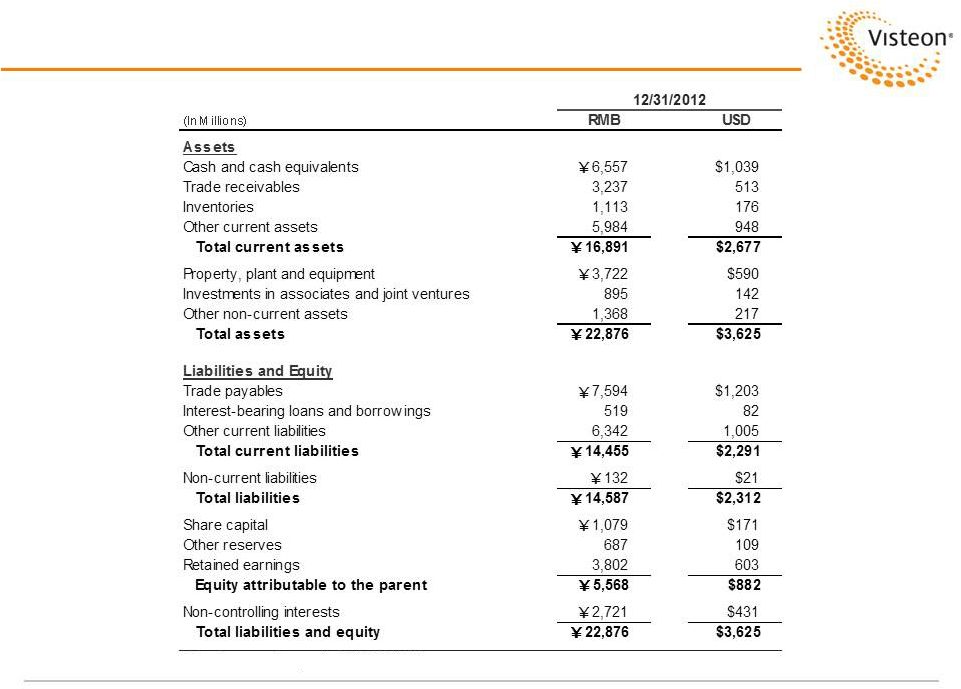

YFV Balance Sheet (December 31, 2012)

Note: Assumes exchange rate of 6.31 RMB / USD.

Note: See Visteon Corporation’s amended Annual Report on Form 10-K/A for

additional information. |

Page 6

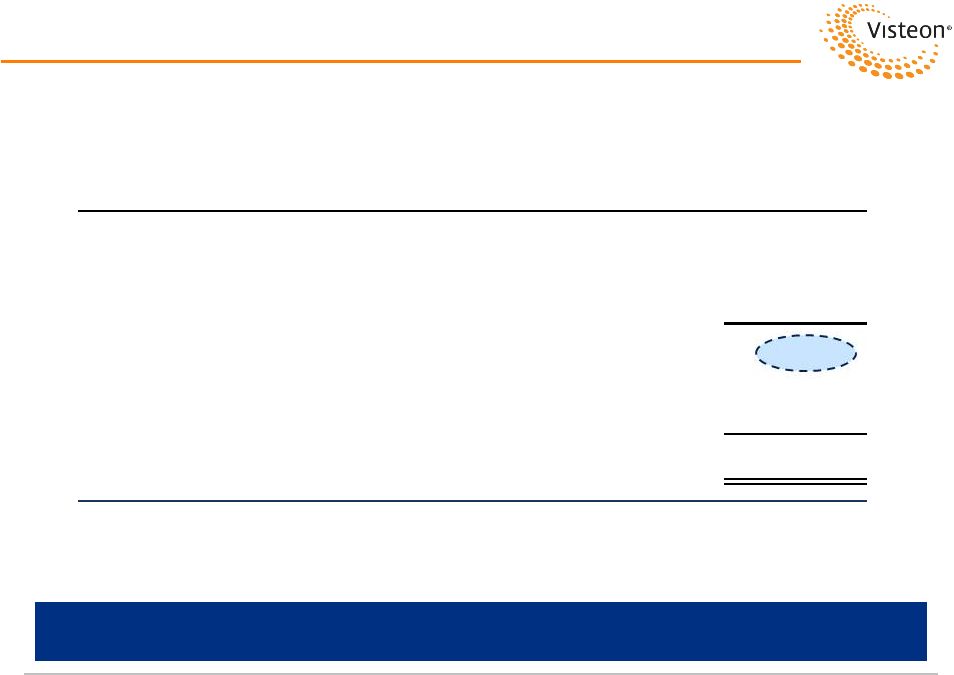

Walk to Visteon Reported 10-K Financials (FY 2012)

As Reported in Visteon’s 2012 Financial Statements,

YFV Earned $369 Million in Net Income Including $126 Million Non-Cash Gain

Gross

Net

Currency

Revenue

Margin

Income

IFRS

RMB

39,772

6,242

2,602

Less: Non-controlling interests

(1,049)

Equity holders of the parent

1,553

Exchange rate assumption

6.31

6.31

6.31

Translation

USD

$6,303

$989

$246

Reconciling Differences:

Classification

USD

(14)

(13)

-

Affiliate

Consolidation

(b)

USD

(1,119)

(192)

126

Timing / Other

USD

1

(2)

(3)

Visteon 2012 10-K Financial Statements

$5,171

$782

$369

(In Millions)

(a)

a)

Classification differences between U.S. GAAP and IFRS.

b)

Affiliate Consolidation for U.S. GAAP purposes effective June 2012, resulting in non-cash gain of

$126 million. |

Page 7

Reconciliation to Visteon Reported Equity Income (FY 2012)

Visteon

Recognized

$211

Million

in

2012

Equity

Income

Related

to

YFV

and

Affiliates

Visteon Equity

(USD in millions)

Net Income

Income

Total Yanfeng Visteon

$369

$181

Visteon Direct Interests in Yanfeng Affiliates

30

Total Yanfeng and Affiliates

$211

Other Visteon Non-Consolidated Affiliates

15

Total Equity Income to Visteon

$226 |

Page 8

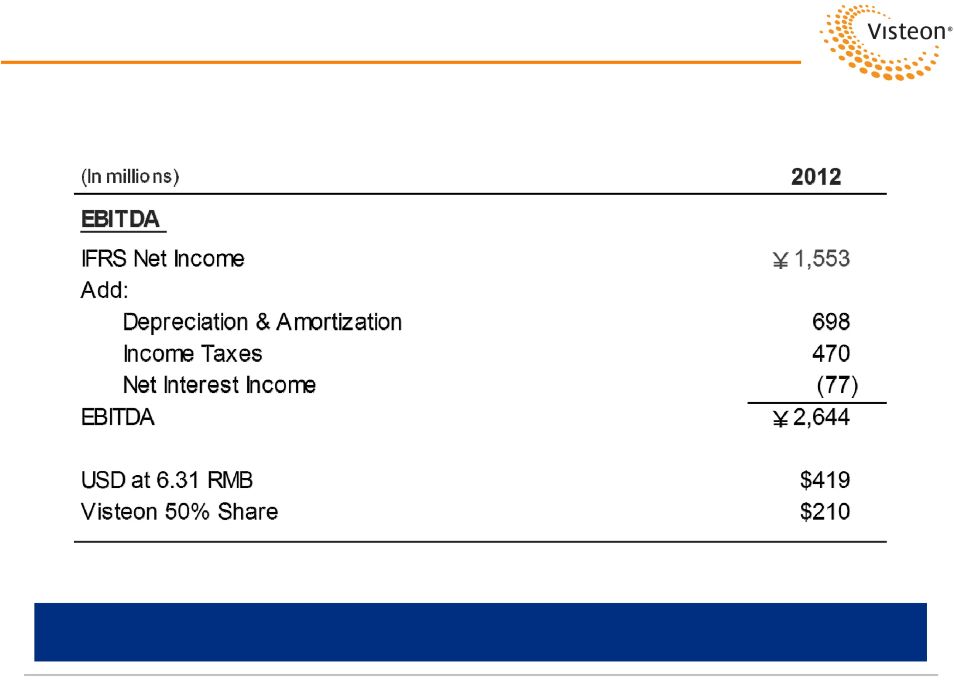

YFV 2012 EBITDA

Visteon’s 50% Share of YFV’s 2012 EBITDA Translates Into $210

Million Note:

All financial information included in the 3-09 financial statements relates to

YFV Consolidated only. Visteon’s direct stakes in Yanfeng

affiliates are not considered for this reporting. |