Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - First Choice Healthcare Solutions, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - First Choice Healthcare Solutions, Inc. | v343973_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - First Choice Healthcare Solutions, Inc. | v343973_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - First Choice Healthcare Solutions, Inc. | v343973_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - First Choice Healthcare Solutions, Inc. | v343973_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2013

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 000-53012

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact Name of small business issuer as specified in its charter)

| Delaware | 90-0687379 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901

(Address of principal executive offices) (Zip Code)

Issuer’s telephone Number: (321) 725-0090

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 14, 2013, the issuer had 12,845,962 shares of Common Stock outstanding.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Financial Statements | F-1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 11 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 18 |

| Item 4. | Controls and Procedures | 18 |

| PART II | ||

| Item 1. | Legal Proceedings | 18 |

| Item 1A. | Risk Factors | 18 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 18 |

| Item 3. | Defaults Upon Senior Securities | 18 |

| Item 4. | Mine Safety Disclosures | 18 |

| Item 5. | Other Information | 19 |

| Item 6. | Exhibits | 19 |

| ii |

PART I

ITEM 1. FINANCIAL STATEMENTS.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2013 | 2012 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 113,009 | $ | 67,045 | ||||

| Cash-restricted | 276,986 | 221,148 | ||||||

| Accounts receivable | 659,448 | 527,867 | ||||||

| Prepaid and other current assets | 56,904 | 69,970 | ||||||

| Capitalized financing costs, current portion | 57,348 | 57,348 | ||||||

| Total current assets | 1,163,695 | 943,378 | ||||||

| Property, plant and equipment, net of accumulated depreciation of $1,592,949 and $1,465,939 | 8,631,723 | 8,756,631 | ||||||

| Other assets | ||||||||

| Capitalized financing costs, long term portion | 138,574 | 152,911 | ||||||

| Patient list, net of accumulated amortization of $20,000 and $24,391 | 280,000 | 275,609 | ||||||

| Deposits | 2,719 | 2,719 | ||||||

| Total other assets | 421,293 | 431,239 | ||||||

| Total assets | $ | 10,216,711 | $ | 10,131,248 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 651,537 | $ | 576,209 | ||||

| Notes payable, current portion | 712,840 | 690,586 | ||||||

| Note payable, related party | 300,000 | 300,000 | ||||||

| Convertible note payable, net of unamortized debt discount of $188,567 and $160,543, respectively | 173,846 | 43,537 | ||||||

| Unearned revenue | 39,357 | 39,438 | ||||||

| Total current liabilities | 1,877,580 | 1,649,770 | ||||||

| Long term debt: | ||||||||

| Deposits held | 47,399 | 47,399 | ||||||

| Revolving line of credit, related party | 189,536 | 153,330 | ||||||

| Notes payable, long term portion | 9,288,586 | 9,410,296 | ||||||

| Derivative liability | 310,213 | 171,987 | ||||||

| Total long term debt | 9,835,734 | 9,783,012 | ||||||

| Total liabilities | 11,713,314 | 11,432,782 | ||||||

| Stockholders' deficit | ||||||||

| Preferred stock, $0.01 par value; 1,000,000 shares authorized, nil issued and outstanding | - | - | ||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized, 12,833,461 and 12,706,795 shares issued and outstanding as of March 31, 2013 and December 31, 2012, respectively | 12,833 | 12,707 | ||||||

| Additional paid in capital | 7,404,867 | 7,244,993 | ||||||

| Common stock subscriptions | - | 100,000 | ||||||

| Accumulated deficit | (8,914,303 | ) | (8,659,234 | ) | ||||

| Total stockholders' deficit | (1,496,603 | ) | (1,301,534 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 10,216,711 | $ | 10,131,248 | ||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| F-1 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| Three months ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| Revenues: | ||||||||

| Net patient service revenue | $ | 1,135,012 | $ | - | ||||

| Rental revenue | 266,669 | 330,216 | ||||||

| Total Revenue | 1,401,681 | 330,216 | ||||||

| Operating expenses: | ||||||||

| Salaries and benefits | 622,759 | 67,596 | ||||||

| Other operating expenses | 304,475 | 97,298 | ||||||

| General and administrative | 253,019 | 224,147 | ||||||

| Depreciation and amortization | 122,620 | 40,365 | ||||||

| Total operating expenses | 1,302,873 | 429,406 | ||||||

| Net income (loss) from operations | 98,808 | (99,190 | ) | |||||

| Other income (expense): | ||||||||

| Miscellaneous income | 750 | 750 | ||||||

| Loss on change in fair value of derivative liability | (40,649 | ) | - | |||||

| Amortization financing costs | (14,337 | ) | (14,337 | ) | ||||

| Interest expense, net | (299,641 | ) | (114,735 | ) | ||||

| Total other income (expense) | (353,877 | ) | (128,322 | ) | ||||

| Net loss before provision for income taxes | (255,069 | ) | (227,512 | ) | ||||

| Income taxes (benefit) | - | (23,103 | ) | |||||

| NET LOSS | $ | (255,069 | ) | $ | (204,409 | ) | ||

| Net loss per common share, basic and diluted | $ | (0.02 | ) | $ | (0.02 | ) | ||

| Weighted average number of common shares outstanding, basic and diluted | 12,751,906 | 12,462,750 | ||||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| F-2 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' DEFICIT

Three Months Ended March 31, 2013

(unaudited)

| Additional | Common | |||||||||||||||||||||||||||||||

| Preferred stock | Common stock | Paid in | Stock | Accumulated | ||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Subscriptions | Deficit | Total | |||||||||||||||||||||||||

| Balance, December 31, 2012 | - | $ | - | 12,706,795 | $ | 12,707 | $ | 7,244,993 | $ | 100,000 | $ | (8,659,234 | ) | $ | (1,301,534 | ) | ||||||||||||||||

| Common stock issued for services rendered | - | - | 60,000 | 60 | 59,940 | - | - | 60,000 | ||||||||||||||||||||||||

| Common stock issued for subscription | - | - | 66,666 | 66 | 99,934 | (100,000 | ) | - | - | |||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (255,069 | ) | (255,069 | ) | ||||||||||||||||||||||

| Balance, March 31, 2013 | - | $ | - | 12,833,461 | $ | 12,833 | $ | 7,404,867 | $ | - | $ | (8,914,303 | ) | $ | (1,496,603 | ) | ||||||||||||||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| F-3 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| Three months ended March 31, | ||||||||

| 2013 | 2012 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net Loss | $ | (255,069 | ) | $ | (204,409 | ) | ||

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | ||||||||

| Depreciation | 122,620 | 40,365 | ||||||

| Amortization of financing costs | 14,337 | 14,337 | ||||||

| Amortization of debt discount in connection with convertible note | 69,553 | - | ||||||

| Stock based compensation | 60,000 | - | ||||||

| Loss on change in fair value of debt derivative | 40,649 | - | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (131,581 | ) | - | |||||

| Prepaid expenses and other | 13,066 | (6,682 | ) | |||||

| Restricted funds | (55,838 | ) | (59,913 | ) | ||||

| Accounts payable and accrued expenses | 130,161 | 1,367 | ||||||

| Unearned income | (81 | ) | 13,321 | |||||

| Deferred income taxes | - | (23,103 | ) | |||||

| Net cash provided by (used in) operating activities | 7,817 | (224,717 | ) | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Payments on acquisition deposits | - | (355,301 | ) | |||||

| Purchase of equipment | (2,103 | ) | (6,750 | ) | ||||

| Interest earned on long term deposits | - | (13 | ) | |||||

| Net cash used in investing activities | (2,103 | ) | (362,064 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from related party line of credit | 36,206 | 110,000 | ||||||

| Proceeds from convertible note payable | 103,500 | - | ||||||

| Net payments on notes payable | (99,456 | ) | (20,017 | ) | ||||

| Net cash provided by financing activities | 40,250 | 89,983 | ||||||

| Net increase (decrease) in cash and cash equivalents | 45,964 | (496,798 | ) | |||||

| Cash and cash equivalents, beginning of period | 67,045 | 528,303 | ||||||

| Cash and cash equivalents, end of period | $ | 113,009 | $ | 31,505 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid during the period for interest | $ | 175,297 | $ | 114,762 | ||||

| Cash paid during the period for taxes | $ | - | $ | - | ||||

| Supplemental Disclosure on non-cash investing and financing activities: | $ | - | $ | - | ||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| F-4 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2013

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the presentation of the accompanying unaudited condensed consolidated financial statements follows:

General

The following (a) condensed consolidated balance sheet as of December 31, 2012, which has been derived from audited financial statements, and (b) the unaudited condensed consolidated interim financial statements of the First Choice Healthcare Solutions, Inc. (“FCHS” and including, where appropriate, its consolidated subsidiaries, the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2013, are not necessarily indicative of results that may be expected for the year ending December 31, 2013. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2012 included in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on April 1, 2013.

Basis of presentation

The Company caused a certificate of merger (the “Certificate of Merger”) of Medical Billing Assistance, Inc., a Colorado corporation incorporated on May 30, 2007 (“Medical Billing”), to be filed whereby Medical Billing was merged with and into the Company. The effective date for the Certificate of Merger was April 4, 2012. The effect of the merger was that Medical Billing reincorporated from Colorado to Delaware (the “Reincorporation”). The Company is deemed to be the successor issuer of Medical Billing under Rule 12g-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As a result of the Reincorporation, the Company changed its name to First Choice Healthcare Solutions, Inc. and its shares underwent an effective four-for-one reverse split. Other than the foregoing, the Reincorporation did not result in any change in the business, management, fiscal year, accounting, and location of the principal executive offices, assets or liabilities of the Company, formerly known as Medical Billing Assistance, Inc.

On April 2, 2012, the Company completed its acquisition of First Choice Medical Group of Brevard, LLC (“First Choice – Brevard”), pursuant to the Membership Interest Purchase Closing Agreement (the “Purchase Agreement”), dated the same date. The Company has been managing the practice of First Choice – Brevard since November 1, 2011, pursuant to a Management Services Agreement (the “Management Agreement”).

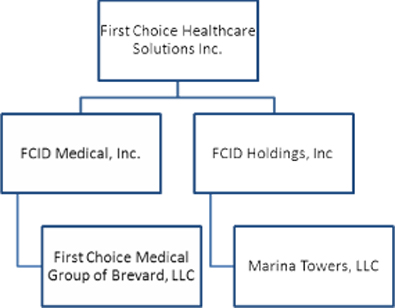

The unaudited condensed consolidated financial statements include the accounts of the Company, and its direct and indirect wholly owned subsidiaries FCID Holdings, Inc., Marina Towers, LLC, FCID Medical Inc. and First Choice - Brevard, LLC. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Property and Equipment

Property and equipment are stated at cost. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. For financial statement purposes, property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives of 20 to 39 years.

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed or determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing 605-25 on the Company's financial position and results of operations was not significant.

Segment Information

Accounting Standards Codification subtopic Segment Reporting 280-10 (“ASC 280-10”) establishes standards for reporting information regarding operating segments in annual financial statements and requires selected information for those segments to be presented in interim financial reports issued to stockholders. ASC 280-10 also establishes standards for related disclosures about products and services and geographic areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision-making group, in making decisions how to allocate resources and assess performance. The information disclosed herein represents all of the material financial information related to the Company’s two principal operating segments (see Note 12).

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Patient list

Patient list is comprised of acquired patients in connection with the acquisition of First Choice - Brevard, LLC and is amortized ratably over the estimated useful life of 15 years. Amortization for the three months ended March 31, 2013 and 2012 was $5,000 and $nil, respectively. Accumulated amortization of patient list costs were $20,000 and $24,391 at March 31, 2013 and December 31, 2012, respectively.

Cash and Cash Equivalents

The Company considers cash and cash equivalents to consist of cash on hand and investments having an original maturity of 90 days or less that are readily convertible into cash. As of March 31, 2013, the Company had $113, 009 in cash.

Capitalized financing costs

Capitalized financing costs represent costs incurred in connection with obtaining the debt financing. These costs are amortized ratably and charged to financing expenses over the term of the related debt. The amortization for the three months ended March 31, 2013 and 2012 was $14,337 and $14,337, respectively. Accumulated amortization of deferred financing costs was $90,801 and $76,464 at March 31, 2013 and December 31, 2012, respectively.

Concentrations of credit risk

The Company’s financial instruments that are exposed to a concentration of credit risk are cash and accounts receivable. Generally, the Company’s cash and cash equivalents in interest-bearing accounts may exceed FDIC insurance limits. The financial stability of these institutions is periodically reviewed by senior management.

| - 2 - |

Accounts Receivable

Trade receivables are carried at their estimated collectible amounts net of doubtful accounts. Trade credit is generally extended on a short-term basis; thus trade receivables do not bear interest. Trade accounts receivable are periodically evaluated for collectability based on a rolling average of cash received as a percentage of gross billing.

Income Taxes

The Company follows Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse and are considered immaterial.

Net loss per share

The Company accounts for net loss per share in accordance with Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS.

Basic net loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of potentially issuable common shares such as those related to our issued convertible debt, warrants and stock options. Diluted net loss per share for three months ended March 31, 2013 and 2012 does not reflect the effects of 335,519 and 100,000 shares, respectively, potentially issuable upon the conversion of our convertible note payable or the exercise of the Company's stock options and warrants (calculated using the treasury stock method) as of March 31, 2013 and 2012 as including such shares would be anti-dilutive.

Stock based compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete. As of March 31, 2013, the Company had no non-employee options outstanding to purchase shares of common stock.

Derivative financial instruments

Accounting Standards Codification subtopic 815-40, Derivatives and Hedging, Contracts in Entity’s own Equity (“ASC 815-40”) became effective for the Company on October 1, 2009. The Company’s convertible debt has conversion provisions based on a discount the market price of the Company’s common stock.

Fair Value of Financial Instruments

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of March 31, 2013 and December 31, 2012. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

| - 3 - |

Recent Accounting Pronouncements

There were various updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company's condensed consolidated financial position, results of operations or cash flows.

NOTE 2 — LIQUIDITY

The Company incurred various non-recurring expenses in 2012 in connection with operating startup costs relating to the acquisition of a medical practice. Management believes the positive year-end earnings before interest, taxes, depreciation and amortization and the continuing trend of positive growth before interest, taxes, depreciation and amortization through March 2013 will support improved liquidity. The Marina Towers building is fully occupied. The Company believes that ongoing operations of Marina Towers, LLC, the current positive cash balance along with the successful completion of its business development plan will allow the Company to continue to improve its working capital and that it will have sufficient capital resources to meet projected cash flow requirements through the date that is one year plus a day from the filing date of this report. Liquidity may also be supported with the $500,000 line of credit through CCR of Melbourne which as of March 31, 2013 has only used $189,536 of the available line. However, there can be no assurance that the Company will be successful in completing its business development plan.

NOTE 3 - CASH - RESTRICTED

Cash-restricted is comprised of funds deposited to and held by the mortgage lender for payments of property taxes, insurance, replacements and major repairs of the Company's commercial building. The majority of the restricted funds are reserved for tenant improvements.

NOTE 4 - PROPERTY, PLANT, AND EQUIPMENT

Property, plant and equipment at March 31, 2013 and December 31, 2012 are as follows:

|

March 31, 2013 |

December 31, 2012 |

|||||||

| Land | $ | 1,000,000 | $ | 1,000,000 | ||||

| Building | 3,055,168 | 3,055,168 | ||||||

| Building improvements | 1,691,625 | 1,691,625 | ||||||

| Medical office improvement | 1,410,028 | 1,410,028 | ||||||

| Automobiles | 29,849 | 29,849 | ||||||

| Computer equipment | 188,451 | 186,549 | ||||||

| Medical equipment | 2,039,593 | 2,039,393 | ||||||

| MRI center | 705,118 | 705,118 | ||||||

| Office equipment | 104,840 | 104,840 | ||||||

| 10,224,672 | 10,222,570 | |||||||

| Less: accumulated depreciation | (1,592,949 | ) | (1,465,939 | ) | ||||

| $ | 8,631,723 | $ | 8,756,631 | |||||

During the three months ended March 31, 2013 and 2012, depreciation expense charged to operations was $117,620 and $40,365, respectively.

NOTE 5 – LINE OF CREDIT, RELATED PARTY

On February 1, 2012, the Company opened a $500,000 unsecured, revolving line of credit loan with CCR of Melbourne, Inc., an entity owned and controlled by the Company's Chief Executive Officer. The revolving line of credit loan matures on October 1, 2015 with interest at a per annum rate of 8.5% beginning March 1, 2012. As of March 31, 2013, $189,536 was outstanding. The Company paid $3,206 and $345 as related party interest for the three months ended March 31, 2013 and 2012, respectively.

| - 4 - |

NOTE 6 – NOTE PAYABLE, RELATED PARTY

The Company entered into an unsecured loan agreement with HS Real Company, LLC (“HSR”) on May 17, 2012 for $100,000 at an interest rate of 12% per annum (the "HSR Note"). On August 5, 2012, HSR increased the principal amount to $250,000, and subsequently HSR advanced an additional $50,000 to the Company, bringing the aggregate principal amount of the HSR Note to $300,000, all of which was due and payable to HSR on December 31, 2012. The HSR Note is in default, and the Company will endeavor to reach satisfactory terms with HSR to repay its obligation. Interest expense on HSR Note for period ending March 31, 2013 and 2012 is $9,083 and $0, respectively.

NOTE 7 – CONVERTIBLE NOTES PAYABLE

Convertible notes payable at March 31, 2013 and December 31, 2012 are as follows:

|

March 31, 2013 |

December 31, 2012 |

|||||||

| Note payable, 8% per annum due September 18, 2013, net of unamortized debt discount of $105,183 and $160,543, respectively, including accrued interest | $ | 146,116 | $ | 43,537 | ||||

| Note payable, 8% per annum due November 21, 2013, net of unamortized debt discount of $83,384, including accrued interest | 27,730 | - | ||||||

| 173,846 | 43,537 | |||||||

| Less: current portion | (173,846 | ) | (43,537 | ) | ||||

| $ | - | $ | - | |||||

On February 19, 2013, the Company entered into a Securities Purchase Agreement with an accredited investor (the “Lender”), in reliance upon the exemption from registration under Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), for the sale of an 8% convertible note in the original principal amount of $103,500 (the “Note”). The total net proceeds the Company received from this offering were $100,000.

The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on November 21, 2013. The Note is pre-payable (with a premium) during the 180-day period after issuance. Beginning 180 days after issuance, the Note is convertible into common stock, at Lender’s option, at a 39% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion. In the event the Company prepays the Note in full, the Company is required to pay off all principal, interest and any other amounts owing multiplied by (i) 115% if prepaid during the period commencing on the closing date through 30 days thereafter, (ii) 120% if prepaid 31 days following the closing through 60 days following the closing, (iii) 123% if prepaid 61 days following the closing through 90 days following the closing and (iv) 135% if prepaid 91 days following the closing through 180 days following the closing. After the expiration of 180 days following the date of the Note, the Company has no right of prepayment.

The Lender has agreed to restrict its ability to convert the Notes and receive shares of common stock such that the number of shares of common stock held by it in the aggregate and its affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

The Company has identified the embedded derivatives related to the above described Note. These embedded derivatives included certain conversion features and reset provisions. The accounting treatment of derivative financial instruments requires that the Company record fair value of the derivatives as of the inception date of the Note and to fair value as of each subsequent reporting date.

At the inception of the Note, the Company determined the aggregate fair value of $97,577 of embedded derivatives. The fair value of the embedded derivatives was determined using the Binomial Lattice Option Pricing Model based on the following assumptions: (1) dividend yield of 0%; (2) expected volatility of 98.67%, (3) weighted average risk-free interest rate of 0.17 % (4) expected life of 0.75 years, and (5) estimated fair value of the Company’s common stock of $1.94 per share.

| - 5 - |

The determined fair value of the debt derivative of $97,577 was charged as a debt discount to the Note.

At March 31, 2013, the Company marked to market the fair value of the debt derivatives contained in the Company’s convertible notes and determined the aggregate fair value of $310,213. The Company recorded a loss from change in fair value of debt derivatives of $40,649 for the three months ended March 31, 2013. The fair value of the embedded derivatives was determined using Binomial Lattice Option Pricing Model based on the following assumptions: (1) dividend yield of 0%, (2) expected volatility of 100.30%, (3) weighted average risk-free interest rate of 0.11%, (4) expected life of 0.47 to .64 years, and (5) estimated fair value of the Company’s common stock of $1.75 per share.

The charge of the amortization of debt discount and costs for the year ended three months ended March 31, 2013 was $69,553.

NOTE 8 - NOTES PAYABLE

Notes payable as of March 31, 2013 and December 31, 2012 are comprised of the following:

|

March 31, 2013 |

December 31, 2012 |

|||||||

| Mortgage payable | $ | 7,420,754 | $ | 7,444,580 | ||||

| Note payable, GE Capital (construction), MRI | 424,995 | 450,604 | ||||||

| Note payable, GE Capital (construction), 2 | 140,487 | 153,340 | ||||||

| Note Payable, GE Capital (MRI) | 1,779,222 | 1,806,932 | ||||||

| Note Payable, GE Capital (X-ray) | 209,976 | 213,126 | ||||||

| Note payable, Auto | 25,992 | 27,300 | ||||||

| Note payable, Dr. Richard Newman | - | 5,000 | ||||||

| 10,001,426 | 10,300,882 | |||||||

| Less: current portion | (712,840 | ) | (690,586 | ) | ||||

| $ | 9,288,586 | $ | 9,410,296 | |||||

Mortgage payable

On August 12, 2011, the Company refinanced its existing mortgage note payable as described below providing additional working capital funds. The aggregate amount of the note of $7,550,000 bears 6.10% interest per annum with monthly payments of $45,752.61 beginning in October 2011 based on a 30 year amortization schedule with all remaining principal and interest due in full on September 16, 2016. The note is secured by land and the building along with first priority assignment of leases and rents. In addition, the Company's Chief Executive Officer provided a limited personal guaranty.

In connection with the refinancing of the mortgage note payable, the Company incurred financing costs of $286,723. The capitalized financing costs are amortized ratably over the term of the mortgage note payable.

Note payable, equipment financing

On May 21, 2012, the Company completed a financing with GE Healthcare Financial Services (“GE Capital”) for approximately $2.4 million.

As of March 31, 2013, the Company drew down $450,000 against the first construction loan. This construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made in the amount of $450,000.

| - 6 - |

On September 24, 2012, the Company drew down $150,000 against the second construction loan. This construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made in the amount of $150,000.

The Company entered into an aggregate of $2,288,679 equipment finance leases subject to delivery and acceptance. All notes and finance leases have been personally guaranteed by the Company's Chief Executive Officer.

On August 22, 2012, the Company accepted the delivery of x-ray equipment under the equipment finance leases discussed above. As such, the component piece accepted of $212,389 is due over 60 months at $-0- the first three months; $4,300 for the remaining 57 months including interest at 7.9375% per annum. On March 8, 2013, the Company amended the finance lease to interest only payments of $1,384 for three months; $4,575 for the remaining 56 monthly payments.

On September 27, 2012, the Company accepted the delivery of MRI equipment under the equipment finance leases discussed above. As such, the component piece accepted of $1,771,390 is due over 60 months at $-0- the first three months; $38,152 for the remaining 57 months including interest at 7.9375% per annum. On March 8, 2013, the Company amended the finance lease to interest only payments of $11,779 for three months; $38,152 for the remaining 56 monthly payments.

Note payable, Auto

On May 21, 2012, the Company issued a note payable, in the amount of $29,850, due in monthly installments of $593 including interest of 6.99%, due to mature in June 2017, secured by related equipment.

Note payable, Newman

In connection with the acquisition of First Choice – Brevard as described in Note 1 above, the Company assumed a $45,000 non-interest bearing, unsecured note payable to Dr. Richard Newman at $5,000 per month, maturing on January 1, 2013 and is paid in full.

Aggregate maturities of long-term debt as of March 31, 2013 are as follows:

| Amount | ||||

| Nine months ended December 31, 2013 | $ | 591,130 | ||

| Year ended December 31, 2014 | 732,570 | |||

| Year ended December 31, 2015 | 710,269 | |||

| Year ended December 31, 2016 and after | $ | 7,967,457 | ||

| Total | S | 10,001,426 | ||

NOTE 9 - RELATED PARTY TRANSACTIONS

As more fully described in Note 5 above, CCR of Melbourne, Inc., an entity owned and controlled by the Company’s Chief Executive Officer, provides a $500,000 unsecured, revolving line of credit to the Company. As of March 31, 2013, $189,536 was outstanding. The Company paid $3,206 and $345 as related party interest for the three months ended March 31, 2013 and 2012, respectively.

As more fully described in Note 6 above, the Company entered into an unsecured loan agreement with HS Real Company, LLC (“HSR”) on May 17, 2012 for $100,000 at an interest rate of 12% per annum (the "HSR Note"). On August 5, 2012, HSR increased the principal amount to $250,000, and subsequently HSR advanced an additional $50,000 to the Company, bringing the aggregate principal amount of the HSR Note to $300,000, all of which was due and payable to HSR on December 31, 2012. The HSR Note is in default, and the Company will endeavor to reach satisfactory terms with HSR to repay its obligation. Interest expense on HSR Note for period ending March 31, 2013 and 2012 is $9,083 and $0, respectively.

| - 7 - |

NOTE 10 - CAPITAL STOCK

In February 2013, the Company issued 60,000 shares of its common stock for services rendered. The shares of common stock were valued at $60,000, which was estimated to be approximate the fair value of the Company’s common shares during the period covered by the service provided.

NOTE 11 - STOCK OPTIONS AND WARRANTS

Warrants

The following table summarizes the warrants outstanding and the related prices for the shares of the Company's common stock issued at March 31, 2013:

| Warrants Outstanding | Warrants Exercisable | |||||||||||||||||||||

| Weighted Average | Weighted | Weighted | ||||||||||||||||||||

| Prices | Outstanding | (Years) | Price | Exercisable | Price | |||||||||||||||||

| $ | 3.60 | 1,875,000 | 5.75 | $ | 3.60 | 1,875,000 | $ | 3.60 | ||||||||||||||

Transactions involving stock warrants issued to non-employees are summarized as follows:

| Number of Shares |

Weighted Average Price Per Share |

|||||||

| Outstanding at December 31, 2011: | 1,875,000 | $ | 3.60 | |||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at December 31, 2012: | 1,875,000 | 3.60 | ||||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at March 31, 2013: | 1,875,000 | $ | 3.60 | |||||

As of March 31, 2013, the Company had no outstanding options.

NOTE 12 - SEGMENT REPORTING

The Company reports segment information based on the “management” approach. The management approach designates the internal reporting used by management for making decisions and assessing performance as the source of the Company’s reportable segments. The Company has two reportable segments: Marina Towers, LLC and FCID Medical, Inc.

The Marina Towers, LLC segment derives revenue from the operating leases of its owned building, whereas FCID Medical segment derives revenue for medical procedures performed.

Information concerning the operations of the Company's reportable segments is as follows:

| - 8 - |

Summary Statement of Operations for the three months ended March 31, 2013:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Net Patient Service Revenue | $ | - | $ | 1,135,012 | $ | - | $ | - | $ | 1,135,012 | ||||||||||

| Rental revenue | 371,664 | - | - | (104,995 | ) | 266,669 | ||||||||||||||

| Total Revenue | 371,664 | 1,135,012 | - | (104,995 | ) | 1,401,681 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries & benefits | 3,000 | 473,646 | 146,113 | - | 622,759 | |||||||||||||||

| Other operating expenses | 100,936 | 314,833 | - | (111,294 | ) | 304,475 | ||||||||||||||

| General and administrative | 19,228 | 132,217 | 101,574 | - | 253,019 | |||||||||||||||

| Depreciation and amortization | 40,731 | 81,889 | - | - | 122,620 | |||||||||||||||

| Total operating expenses | 163,895 | 1,002,585 | 247,687 | (111,294 | ) | 1,302,873 | ||||||||||||||

| Net income (loss) from operations: | 207,769 | 132,427 | (247,687 | ) | 6,299 | 98,808 | ||||||||||||||

| Interest expense | (113,390 | ) | (57,998 | ) | (128,253 | ) | - | (299,641 | ) | |||||||||||

| Amortization of financing costs | (14,337 | ) | - | - | - | (14,337 | ) | |||||||||||||

| Loss on change in derivative liability | - | - | (40,649 | ) | - | (40,649 | ) | |||||||||||||

| Other income (expense) | 750 | - | - | - | 750 | |||||||||||||||

| Net Income (loss): | 80,792 | 74,429 | (416,589 | ) | 6,299 | (255,069 | ) | |||||||||||||

| Income taxes | - | - | - | - | - | |||||||||||||||

| Net income (loss) | $ | 80,792 | $ | 74,429 | $ | (416,589 | ) | $ | 6,299 | $ | (255,069 | ) | ||||||||

Summary Statement of Operations for the three months ended March 31, 2012:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Rental Revenue | $ | 360,187 | $ | - | $ | - | $ | (29,971 | ) | $ | 330,216 | |||||||||

| Total Revenue | 360,187 | - | - | (29,971 | ) | 330,216 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Salaries and benefits | 3,000 | 64,596 | 67,596 | |||||||||||||||||

| Other operating expenses | 97,298 | 97,298 | ||||||||||||||||||

| General and administrative | 15,793 | - | 238,325 | (29,971 | ) | 224,147 | ||||||||||||||

| Depreciation and amortization | 40,365 | - | - | - | 40,365 | |||||||||||||||

| Total operating expenses | 156,456 | - | 302,921 | (29,971 | ) | 429,406 | ||||||||||||||

| Net income (loss) from operations: | 203,731 | - | (302,921 | ) | - | (99,190 | ) | |||||||||||||

| Interest expense | (114,735 | ) | - | - | (114,735 | ) | ||||||||||||||

| Amortization of finance costs | (14,337 | ) | - | - | - | (14,337 | ) | |||||||||||||

| Other income (expense) | 750 | - | - | - | 750 | |||||||||||||||

| Net Income (loss): | 75,409 | - | (302,921 | ) | - | (227,512 | ) | |||||||||||||

| Income taxes | (4,605 | ) | - | 27,708 | - | 23,103 | ||||||||||||||

| Net income (loss) | $ | 70,804 | $ | - | $ | (275,213 | ) | $ | - | $ | (204,409 | ) | ||||||||

| - 9 - |

Assets:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Assets: | ||||||||||||||||||||

| At March 31, 2013: | $ | 5,033,063 | $ | 5,134,681 | $ | 48,967 | $ | - | $ | 10,216,711 | ||||||||||

| At December 31, 2012: | $ | 4,938,954 | $ | 5,183,592 | $ | 8,702 | $ | - | $ | 10,131,248 | ||||||||||

| Assets acquired | ||||||||||||||||||||

| Three months ended March 31, 2013 | $ | - | $ | 2,103 | $ | - | $ | - | $ | 2,103 | ||||||||||

| Three months ended March 31, 2012 | $ | - | $ | - | $ | 6,750 | $ | - | $ | 6,750 | ||||||||||

NOTE 13 – SUBSEQUENT EVENTS

On May 6, 2013, the Company entered into an agreement with DCConsulting Inc., to provide business advisory services, shareholder information services, and public relations services. DCConsulting will also provide strategy on marketing of the Company’s business strategies and increase market awareness.

On May 1, 2013, the company entered into an agreement with MTI Capital, LLC. for a line of credit that could advance up to $2 million at the lender’s discretion. The terms include a 12% annual rate of interest and at the Lender’s option the Lender has the right to convert any unpaid principal and interest balance at a fixed price that has been determined to be the closing price of the stock as of May 1, 2013.

| - 10 - |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD LOOKING STATEMENTS

From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by us with the SEC. Words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project or projected,” or similar expressions are intended to identify “forward-looking statements”. Such statements are qualified in their entirety by reference to and are accompanied by the above discussion of certain important factors that could cause actual results to differ materially from such forward-looking statements.

Management is currently unaware of any trends or conditions other than those mentioned elsewhere in this management's discussion and analysis that could have a material adverse effect on the Company's consolidated financial position, future results of operations, or liquidity. However, investors should also be aware of factors that could have a negative impact on the Company's prospects and the consistency of progress in the areas of revenue generation, liquidity, and generation of capital resources. These include, but are not limited to: (i) variations in revenue, (ii) possible inability to attract investors for its equity or other securities or otherwise raise adequate funds from any source should the Company seek to do so, (iii) increased governmental regulation, (iv) increased competition, (v) unfavorable outcomes to litigation involving the Company or to which the Company may become a party in the future, and (vi) a very competitive and rapidly changing operating environment. The risks identified here are not exhaustive. New risks emerge from time to time and it is not possible for management to predict all of such risks, nor can it assess the impact of all such risks on the Company's business or the extent to which any risk or combination of risks may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. Except as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the information, including any risk factors, set forth herein and in other reports and documents that we file from time to time with the SEC, particularly the Annual Reports on Form 10-K, Quarterly reports on Form 10-Q and any Current Reports on Form 8-K.

The financial information set forth in the following discussion should be read in conjunction with the consolidated financial statements of the Company included elsewhere herein.

OVERVIEW AND HISTORY

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, we issued 2,429,000 common shares to Mr. Michael West in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which was then a wholly-owned inactive subsidiary of the Company. The consideration for the disposition was the net liability assumption by the purchaser.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings”), which is at times referred to herein with FCID Medical as “FCID,” and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 10,000,000 common shares of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

| - 11 - |

In connection with the Share Exchange Agreement, in addition to the foregoing and effective on the closing date, Michael West resigned as President, Treasurer and a director of the Company. Mr. Steve West resigned as an officer of the Company but retained a directorship with the Company and subsequently resigned as such in 2011. After such resignations, Christian Charles Romandetti was appointed President, Chief Executive Officer and a director of the Company, and Donald Bittar was appointed Chief Financial Officer, Treasurer and Secretary of the Company. Currently, Mr. Bittar also is a director.

Merger, Reincorporation and Change in Name

On or about February 13, 2012, we obtained stockholder consent for (i) the approval of an agreement and plan of merger (the “Merger Agreement”) with FCHS, a Delaware corporation formed exclusively for the purpose of merging with the Company, pursuant to which (a) the Company’s state of incorporation changed from Colorado to Delaware (the “Reincorporation”) and (b) every four shares of Company’s common stock was exchanged for one share of FCHS common stock (effectively resulting in a four-to-one reverse split of the Company’s common stock) (the “Reverse Split”), and (ii) the approval of the Medical Billing Assistance, Inc. 2011 Incentive Stock Plan. As a result of the Reincorporation, the Company presently operates under the name First Choice Healthcare Solutions, Inc. The effective date for the Reincorporation and the Reverse Split was April 4, 2012. The Company changed its name to be more closely aligned with its target market.

All operations are conducted through our direct and indirect wholly-owned subsidiaries: FCID Medical and FCID Holdings. First Choice - Brevard, the wholly-owned subsidiary operating the multi-specialty medical clinic, is wholly owned by FCID Medical. We have real estate holdings through FCID Holdings, Inc., of which Marina Towers, LLC is wholly-owned subsidiary. A diagram of our corporate structure is set forth below:

Our Business

The cornerstone of our business plan is developing, via acquisition or restructuring, multi-specialty clinics, into a synergistic, state-of-the-art, efficient medical centers of excellence. The Company has carved a new niche in the multi-billion dollar health care industry by offering a paradigm to the way physicians practice medicine. Our centers of excellence include an optimal mix of synergistic multi-specialty physicians combined with an array of diagnostic capabilities.

Business Strategy

We are dedicated to providing the excellent quality and cost effective healthcare services to the communities and patients we serve. Our steadfast goal is to create an environment of excellent patient care, proactive attitudes and the enthusiastic spirit in every member of our team. We strive to be an unsurpassed provider of orthopedic, neurological and interventional pain medicine services supported by an array of the latest technological and medical ancillary diagnostic tools located within each facility.

| - 12 - |

Our operational strategy for our medical facilities is devoted to the excellent care of our patients. Our driven willingness to address our patients’ needs, ranging from their physical health to their emotional well-being, has helped direct the operating improvements in our business.

Our strategic focus is to expand our healthcare business by making selective employment of physicians and or acquisition of physician practices in other select markets. Our expansion program plans to provide:

| · | Additional revenues; |

| · | More rapid growth; |

| · | Economies of scale in billing, collection, purchasing, advertising and compliance; and |

| · | Increased exposure to our brand. |

First Medical Center of Excellence

On October 5, 2011, FCID Medical, Inc., a wholly owned subsidiary of the Company, entered into a management agreement to manage the medical practice of First Choice - Brevard. On April 2, 2012, we completed the acquisition of the practice and acquired all of the issued and outstanding membership interests of First Choice - Brevard. Since acquiring First Choice - Brevard:

| · | Monthly patient visits have increased; |

| · | Accounts receivable turnaround time has improved; and |

| · | The number of physicians and healthcare professionals has increased |

New MRI and X-ray Facility

Following the acquisition of First Choice - Brevard, on May 21, 2012, the Company completed a $2.4 million financing with GE Healthcare Financial Services for a state-of-the-art, technologically advanced GE X-ray machine and MRI system. Both the X-ray and MRI systems were installed and fully operational within First Choice - Brevard’s Center of Excellence on August 22, 2012, and September 27, 2012 respectively.

We are proud to have installed the newest and among the most technologically advanced MRI system in our target market area. The GE MRI Gem Suite system has been certified by the American College of Radiology. The MRI facility was positioned and installed to capitalize on the river views, which is intended to promote patient relaxation and comfort. This is intended to produce a better study which in turn contributes to a better patient experience. The MRI system is housed in a newly constructed expansion space within First Choice - Brevard’s Center of Excellence. The Center’s expansion space, specifically designed for the MRI system, is located within the Company’s headquarters building. Billing and patient volume for MRI and X-ray services continues to track on plan.

The Diagnostic Equipment and Facilities Expansion initiative was successful with all of the equipment, systems and the facility fully operational and revenue productive.

Customer service for our medical patients continues to significantly improve.

A new paradigm medical Center of Excellence

Some retail business models have been successful with broad customer demographics, easy service provider substitution, intense competition and continuing lower profit margins. We view medical centers as a retail-oriented business delivering excellent medical services direct to patients, who are the consumers. Unlike transportation, fast food, electronics and other retailers, medical centers, generally, have not been quick to adapt themselves to operating successfully with lower profit margins and growing competition. The successful retail businesses recognized the importance of embracing information technology, telecommunication and functional economies of scale to allow high service levels to continue, while retaining acceptable profit margins. Their corporate cultures include a commitment to ensuring the best possible customer experience through consistent, predictable and superior service levels in every aspect of their business. They have learned to become profitable in the face of greater pressure on margins and increasing competition. We believe that one of the keys to our success is our new paradigm of our multi-specialty medical centers of excellence. While adopting the leading edge retail service practices, the Company remains committed to excellent patient service levels intended to achieve predictable and acceptable profit margins.

| - 13 - |

Excellent medical service levels with a human touch

Our business model is intended to bring the best retail practices to operating a multi-specialty medical center successfully with a “human touch.” Patients want their pain, fear and concerns acknowledged and considered. They want to be treated with dignity and respect. From the patient’s first interaction with us, making an appointment to see a doctor, our strategic and tactical goals are to provide the best possible patient healthcare experience through consistent, predictable and superior service levels in every aspect of our clinics. Timely appointments, accurate and current patient information, attention to detail and careful patient follow up are part of our commitment to an excellent patient experience. Management actively monitors the daily service level objectives of every aspect of the patient experience from the initial appointment through the end of treatment. Clinic staff is encouraged and rewarded for exceeding their service level objectives.

Medical service mix

Like other successful business models for professional medical services, ours is designed to offer the most synergistic and profitable medical service mix. By their nature, some combinations of medical specialties can be more revenue positive than others. Physicians need access to diagnostic equipment, like X-Ray, MRI and physical therapy. Patients expect their physicians to have access to the best diagnostic and service delivery equipment. Without diagnostic services many medical practices will find it difficult to maintain their current margins of profitability. We combine medical specialties and diagnostic services at our locations to maintain or increase the capability for profit. While one specialty may have high reimbursements for their professional service but insufficient volume to profitably support the necessary diagnostic equipment, another medical specialty may have a lower professional service reimbursement but high volume diagnostic equipment use. Operating independently, each specialty group would face retreating profit margins and a significant challenge to maintain high service levels with adequate equipment and current technologies. However, operating together, they create the optimal mix of professional service fee income and diagnostic equipment procedure income. Since the combination is more profitable than either of its components, there is a favorable opportunity to sustain profit margins that will allow the facility to maintain high service levels with leading edge equipment and state of the art technologies.

In recruiting, selecting and hiring physicians, we employ physicians with the highest patient care reviews always making superior quality of service our number one priority. Our expansion plan is to employee physicians in multiple multi-specialty medical centers located in other geographic markets. In future facilities, we expect to work to maintain the optimal combination of medical specialties we believe will support the most profitable mix of professional service fees. This business model, in turn, is most likely to provide our physicians with the best diagnostic equipment available, our patients with the best possible medical experience and the Company with the potential when combining physicians and diagnostic equipment to maintain attractive profit margins.

The model is also designed to allow physicians to concentrate exclusively on delivering excellent patient care. The requirements for running the business functions of a successful medical clinic are the sole responsibility of the business management team and not the physicians.

Scalable back office and economies of scale

Fixed cost legacy administrative functions have subjected many established medical centers to a downward spiral of diminishing profit margins and losses. In legacy medical centers, administrative management, billing, compliance, accounting, marketing, advertising, scheduling, customer service, record keeping functions represent fixed overhead for the practice. The fixed administrative overhead of a practice has the effect of reducing profit margins as the practice experiences declining revenues as a result of lower patient volumes from increasing competition, lower pricing, lower reimbursements or patient migration to competitors.

A key to our success is our ability to employ a highly experienced team of business managers supported by an array of professional, experienced and compliant subcontractors. Using the best project management practices, our business managers contract services for billing, compliance, accounting, marketing, advertising, legal, information technology and record keeping functions. The cost of our ‘back office operation’ scales quickly in direct relation to our volume, allowing us to sustain profit margins with a cost effective and scalable back office. As the number of physicians increases so do the economies of scale for our back office. The economies of scale support selecting the best and not the lowest cost subcontractors, while allowing our multi-specialty medical centers to operate cost effectively with higher service levels.

| - 14 - |

Developing and operating additional multi-specialty medical centers of excellence in other geographic areas will take advantage of the economies of scale for our administrative back office functions. Our plan calls for opening up multiple centers in multiple states and cities at a pace that will allow us to maintain the same levels of quality and acceptable profitability from each location. We believe that the scalable structure of our administrative back office functions will efficiently support our expansion plans.

High technology infrastructure supporting excellent human touch patient experiences

Successful retail models in other industries already effectively use telecommunications, remote computing, mobile computing, cloud computing, virtual networks and other leading-edge technologies to manage geographically diverse operating units. These technologies create the infrastructure to allow a central management team to monitor, direct and control geographically dispersed operating units and subcontractors, including national operations.

We believe that the FCHS business model incorporates the best of these technologies. A central management team monitors, directs and controls our multi-specialty medical centers of excellence and all the necessary support subcontractors. We operate a secure paperless system with electronic patient medical records. Test results, X-ray and MRI images, diagnoses, patient notes, visit reports, billing information, insurance coverage, and patient identification information are all contained within the electronic medical record, allowing physicians and staff instant access to every aspect of a patient’s medical information from anywhere, in any clinic. The patient billing, accounts receivable and collection functions also are paperless. A majority of our third party payors remit by EFT and wire transfers. Accordingly, every aspect of the business is positioned to achieve high productivity and lower administrative headcounts and per capita expenses.

We intend to grow by replicating our multi-specialty medical centers of excellence, supported by our standardized policies, procedures and clinic setup guidelines. The administrative functions can be quickly scaled to handle multiple additional clinics. As we roll out our business model, we expect our administrative core and clinic retail model to transform the economics within each of our multi-specialty medical centers of excellence.

Our headquarters

Our corporate headquarters is located on the shore of the Indian River, at 709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901 in Marina Towers, which is owned by Marina Towers, LLC, a wholly owned subsidiary of FCID Holdings, Inc.

FCID Holdings manages our real estate. Marina Towers, LLC operates Marina Towers, a 75,267 square foot Class A six-story office building. The building has operated with a 95% average tenant occupancy and a rent roll that is supported by approximately 75% non-affiliate, high quality, commercial tenants. The building generates revenue and income for the Company that is intended to be available to fund the expansion of our operating businesses.

Results of Operations

The following discussion involves our results of operations for the three months ended March 31, 2013 compared to the three months ended March 31, 2012.

Revenues

Comparing our operations, we had revenues of $1,401,681 for the three months ended March 31, 2013, compared to revenues of $330,216 for the three months ended March 31, 2012. The increase in revenue of $1,071,465, or 324%, is primarily attributable to the acquisition of First Choice - Brevard, completed in April 2012, which added $1,135,012 in medical revenue for the quarter ended March 31, 2013 compared to nil for the same period last year. We had a decrease of $63,547 in rental income from the three months ended March 31, 2012 to the three months ended March 31, 2013. The decrease is attributable to the fact our medical segment currently leases their facility from our Marina Towers segment compared to the same period last year where Marina Towers leased to an independent group.

| - 15 - |

Operating expenses

Salaries and benefits

Salaries and benefits increased to $622,759 for the three months ended March 31, 2013 from $67,596 for the three months ended March 31, 2012, which is primarily attributable to the acquisition of First Choice - Brevard, completed in April 2012, which added $473,646 in salary and benefits expenses for the quarter ended March 31, 2013 compared to nil for the same period last year. In addition, corporate salaries and benefits increased by $81,517 from $64,596 for the three months ended March 31, 2012 to $146,113 for the current period, primarily from non-cash stock based compensation of $60,000 paid to our board of directors for services in the current period as compared to nil for same period last year.

Other operating expenses

Other operating expenses increased to $304,475 for the three months ended March 31, 2013 from $97,298 for the three months ended March 31, 2012, which is primarily attributable to the acquisition of First Choice - Brevard, completed in April 2012, which added $203,539 in other operating expenses for the quarter ended March 31, 2013 compared to nil for the same period last year.

General and administrative

General and administrative expenses increased to $253,019 for the three months ended March 31, 2013 from $224,147 for the same period, last year; a net increase of $28,872 or 13%. The increase is primarily attributable to the added expenses associated with our acquisition of First Choice - Brevard in April 2012.

We believe that the general and administrative expenses in current operations have scaled as our revenues increased. Each additional sale or service and corresponding gross profit of such sale or service has minimal incremental offsetting operating expenses. Thus, additional sales could contribute to profit at a higher rate of return on sales as a result of not needing to expand operating expenses at the same pace as sales.

Depreciation and amortization

Depreciation and amortization increased from $40,365 for the three months ended March 31, 2012 to $122,620 for the three months ended March 31, 2013. The increase is a direct result of the added property and equipment with our April acquisition.

Other income (expense):

During 2013 and 2012, we issued convertible promissory notes with an embedded derivative, all requiring us to establish the fair value of the derivatives for each reporting period and mark it to market as a non-cash adjustment to our current period operations. This resulted in a net loss from change in fair value of derivative liability of $40,649 for the three months ended March 31, 2013 as compared to nil for the three months ended March 31, 2012.

Interest expense was $299,641 and $114,735 for the three months ended March 31, 2013 and 2012, respectively. The increase in our interest expense was due in part to the added construction and equipment financing we incurred in connection with our April 2012 acquired medical practice. In addition, we incurred a non-cash interest cost of $69,553 for the three month period ended March 31, 2013 relating to the amortization of debt discounts associated to our convertible debt as compared to nil for same period, last year.

Net Loss

We had a net loss of $255,069 for the three months ended March 31, 2013 compared to a net loss of $204,409 for the same period last year. The increase in net loss is mainly attributable to the increase in expenses related to the acquisition of First Choice - Brevard, LLC.

Liquidity and Capital Resources

As of March 31, 2013, we had cash or cash equivalents of $113,009.

Net cash provided by operating activities was $7,817 for the three months ended March 31, 2013, compared to cash used in operating activities of $(224,717) for the same period last year. We anticipate that overhead costs in current operations will remain fairly constant as revenues develop.

Net cash flows used in investing activities was $(2,103) for the three months ended March 31, 2013, compared to $(362,064) for the three months ended March 31, 2012.

Cash flows provided by financing activities was $40,250 for the three months ended March 31, 2013, compared to net cash provided by financing activities of $89,983 for the three months ended March 31, 2012.

| - 16 - |

On February 19, 2013, the Company entered into a Securities Purchase Agreement with an accredited investor (the “Lender”), in reliance upon the exemption from registration under Section 4(2) of the Securities Act, for the sale of an 8% convertible note in the original principal amount of $103,500 (the “Note”). The total net proceeds the Company received from this offering were $100,000. The Note bears interest at the rate of 8% per annum. All interest and principal must be repaid on November 21, 2013. The Note is prepayable (with a premium) during the 180-day period after issuance. Beginning 180 days after issuance, the Note is convertible into common stock, at Lender’s option, at a 39% discount to the average of the three lowest closing bid prices of the common stock during the 10 trading day period prior to conversion.

Over the next twelve months we expect to incur significant capital costs to further develop and expand operations. We plan to add another medical Center of Excellence and purchase additional diagnostic equipment for our operations. We expect to need additional capital of approximately $2-3 million to fund the development and expansion of our operations in 2013.

There can be no assurance that our cash flow will increase in the near future from anticipated new business activities, or that revenues generated from our existing operations will be sufficient to allow us to continue to pursue new customer programs or profitable ventures.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance sheet arrangements.

INFLATION

It is our opinion that inflation has not had, and is not likely to have, a material effect on our operations.

CRITICAL ACCOUNTING POLICIES

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Derivative financial instruments

Accounting Standards Codification subtopic 815-40, Derivatives and Hedging, Contracts in Entity’s own Equity (“ASC 815-40”) became effective for the Company on October 1, 2009. The Company’s convertible debt has conversion provisions based on a discount the market price of the Company’s common stock.

| - 17 - |

Share-Based Compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures as of the end of the period covered by this report were effective such that the information required to be disclosed by us in reports filed under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) accumulated and communicated to our management to allow timely decisions regarding disclosure. A controls system cannot provide absolute assurance, however, that the objectives of the controls system are met, and no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within a company have been detected.

Changes in Internal Control over Financial Reporting. During the most recent quarter ended March 31, 2013, there has been no change in our internal control over financial reporting (as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act) that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II

ITEM 1. LEGAL PROCEEDINGS.

We are not a party to any pending legal proceeding, nor is our property the subject of a pending legal proceeding, that is not in the ordinary course of business or otherwise material to the financial condition of our business. None of our directors, officers or affiliates is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 1A. RISK FACTORS.

Not applicable.