Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - First Choice Healthcare Solutions, Inc. | v404949_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - First Choice Healthcare Solutions, Inc. | v404949_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - First Choice Healthcare Solutions, Inc. | v404949_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - First Choice Healthcare Solutions, Inc. | v404949_ex32-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - First Choice Healthcare Solutions, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ________

Commission file number: 000-53012

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 90-0687379 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 709 S. Harbor City Blvd., Suite 250, Melbourne, FL | 32901 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code (321) 725-0090

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| N/A | N/A |

Securities registered pursuant to Section

12(g) of the Act:

Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant's most recently completed second fiscal quarter was $18,312,622.

As of April 10, 2015, there were 18,432,055 shares of common stock, par value $0.001 per share, outstanding.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

TABLE OF CONTENTS

| 2 |

This report may contain forward-looking statements within the meaning of Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking state to all comments are based on our management's beliefs and assumptions and on information currently available to our management and involve risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment, from time to time of our competitive position, the industry environment, potential growth opportunities and the effects of regulation. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We discuss many of these risks in greater detail in “Risk Factors.” Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management's beliefs and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report and have filed as exhibits to the report completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Overview

First Choice Healthcare Solutions, Inc. (“FCHS,” “the Company,” “we,” “our” or “us”) is engaged in the creation of state-of the-art, multi-specialty “Medical Centers of Excellence” in select markets primarily in the southeastern United States. We intend to own, operate and manage these “Medical Centers of Excellence” under the FCHS brand.

We believe by integrating the synergistic mix of orthopaedic, neurology and interventional pain specialties with related diagnostic and ancillary services and state-of-the-art equipment and technologies all in one location or “Medical Center of Excellence,” we are able to:

| · | provide patients with convenient access to musculoskeletal and rehabilitative care via orthopaedic, neurology and interventional pain medicine treatment, diagnostics and ancillary care services, including, but not limited to, magnetic resonance imaging (“MRI”), x-ray (“X-ray”), durable medical equipment (“DME”) and physical therapy (“PT”); |

| · | empower physicians to collaborate as a unified care team, optimizing care coordination and improving outcomes; |

| · | advance the quality and cost effectiveness of our patients’ healthcare; and |

| · | achieve strong, sustainable financial performance that serves to create long-term value for our stockholders. |

We currently own and operate First Choice Medical Group of Brevard, LLC (“FCMG”), our model multi-specialty Medical Center of Excellence. FCMG will serve as the model for replicating our “Medical Center of Excellence” strategy in our target expansion markets. Located in Melbourne, Florida, FCMG specializes in the delivery of musculoskeletal medicine, via our strategically aligned subspecialties in orthopaedic, neurology and interventional services, including MRI, X-ray, DME and rehabilitative care with multiple quality-focused goals centered on enriching our patients’ care experiences.

| 3 |

Our Real Estate Business

FCID Holdings, Inc. (“FCID Holdings”) is our wholly owned subsidiary which operates our real estate interests. Currently, FCID Holdings has one real estate holding, Marina Towers, LLC, a 78,000 square feet, Class A, six story building located on Indian River in Melbourne, Florida. In addition to housing our corporate headquarters and FCMG, the building which averages 95% annual occupancy, also leases approximately 48,698 square feet of commercial office space to third party tenants.

History

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, 2,429,000 common shares were issued to Mr. Michael West and other IVS shareholders in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which, at the time, was an inactive, wholly-owned subsidiary of the Company. The consideration for the disposition was the net liability assumption by the purchaser.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings)”, which together will be referred to herein with FCID Medical as “FCID”, and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 10,000,000 common shares of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

On or about February 13, 2012, we obtained stockholder consent for (i) the approval of an agreement and plan of merger (the “Merger Agreement”) with First Choice Healthcare Solutions, Inc., (“FCHS Delaware”), a Delaware corporation formed exclusively for the purpose of merging with the Company, pursuant to which (a) the Company's state of incorporation changed from Colorado to Delaware (the “Reincorporation”) (b) the Company's name changed from Medical Billing Assistance, Inc. to First Choice Healthcare Solutions, Inc. (the “Name Change”), (c) every four shares of Company's common stock was exchanged for one share of FCHS Delaware common stock (effectively resulting in a four-to-one reverse split of the Company's common stock) (the “Reverse Split”), and (d) FCHS Delaware inherited the rights and property of the Company and assumed the liabilities of the Company and (ii) the approval of the Medical Billing Assistance, Inc. 2011 Incentive Stock Plan. The effective date for the Reincorporation and the Reverse Split was April 4, 2012. The Company changed its name to be more closely aligned with its target market.

Our address is 709 S. Harbor City Blvd., Suite 250, Melbourne, Florida, 32901 and our phone number is (321) 725-0090. Our website address is www.myfchs.com. Information contained in our website is not incorporated by reference herein.

Operating Segments

We operate in two segments, healthcare services and real estate through five wholly-owned subsidiaries:

| · | FCID Medical, Inc. (“FCID Medical”), which is the subsidiary under which all of our Medical Centers of Excellence are and will be owned and operated. First Choice Medical Group of Brevard, LLC is our Medical Center of Excellence and is located in Melbourne, Florida. First Choice Medical Group is our model multi-specialty Medical Center of Excellence and is wholly-owned and operated by FCID Medical. |

| · | FCID Holdings, Inc. (“FCID Holdings”) operates Marina Towers, a 78,000 square foot, Class A, six-story building located on the Indian River in Melbourne, Florida. Marina Towers is owned by Marina Towers, LLC, a subsidiary owned by FCID Holdings (99%) and MTMC of Melbourne, Inc. (1%). |

Our goal is to build a network of non-physician and physician owned and operated Medical Centers of Excellence in diverse locations, primarily throughout the Southeastern United States. By centralizing current and future centers’ business management functions, including call center operations, scheduling, billing, compliance, accounting, marketing, advertising, legal, information technology and record-keeping at our corporate headquarters, we will maintain efficiencies and economies of scale. We believe our structure will enable our staff physicians to focus on the practice of medicine and the delivery of quality care to the patients we serve, as opposed to having their time and attention focused on business administration responsibilities.

| 4 |

Our Healthcare Services Business

We own and operate First Choice Medical Group of Brevard, LLC (“FCMG”), a multi-specialty medical center in Melbourne, Florida. FCMG is our model multi-specialty Medical Center of Excellence and specializes in the delivery of musculoskeletal medicine, diagnostic services and rehabilitative care.

Using FCMG as a model, we plan to create world-class, state-of-the-art Medical Centers of Excellence committed to delivering patient-centric care in select U.S. markets.

FCID Medical, Inc.

FCID Medical is our wholly-owned subsidiary under which all of our Medical Centers of Excellence will be owned and operated. FCID Medical independently managed FCMG from November 2011 until April 2012 when we acquired FCMG as a subsidiary. Since acquiring FCMG, we have succeeded in increasing monthly patient visits, improving management of account payables/receivables, and expanding the number of physicians and care specialists on staff.

First Choice Medical Group of Brevard, LLC

Based in Melbourne, Florida, FCMG is our model multi-specialty Medical Center of Excellence. The Center specializes in the delivery of musculoskeletal medicine, diagnostic services and rehabilitative care with multiple quality-focused goals centered on enriching patient care experiences. Our physicians and care specialists are recruited and retained with an emphasis on best practices and attitude: being committed to meeting and exceeding the needs of patients and their families. Moreover, all employees of FCMG, from the receptionists to the doctors, are considered caregivers who put the patient first. All caregivers cooperate with one another with a common focus on the best interests and personal goals of each patient. Unique to FCMG, we also consider families and friends of patients to be vital components of the care team.

Care is focused on each patient’s full continuum of care, which requires a more personalized approach to treatment. It is the mission of our team to customize care to ensure that each patient’s needs, values and choices are always considered, which squarely aligns with our purpose of “transforming healthcare delivery, one patient at a time.”

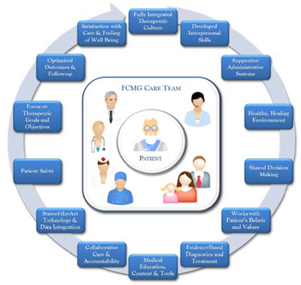

FIRST CHOICE MEDICAL GROUP’S PATIENT-CENTRIC CARE DELIVERY MODEL

Our caregivers listen to and honor the perspectives and choices of patients and their families. Moreover, our caregivers communicate and share complete and unbiased information with patients and families in ways that are affirming and useful in decision-making processes. Our care delivery practices exemplify the very definition of patient-centric care, explicitly recognizing the importance of human interaction in terms of personalized care, kindness and being `present' with patients.

| 5 |

FCMG's patient-centric culture strives to include providing an inviting, easily accessible, peaceful, healing environment that is aesthetically pleasing and designed specifically to allay patient fear, anxiety and discomfort. The design and decor of FCMG's lobby and diagnostic and treatment areas are intended to define and reinforce a strong and relevant brand image of quality, patient-centered care.

FCMG also engages the most advanced diagnostic technologies coupled with the latest in individualized care, including trigger point injections and pharmacological, physical, neurological, orthopedic, chiropractic and massage therapy treatments. Our care facilities house both a digital GE X-Ray system and a GE 450 MRI Gem Suite system, which is physically positioned to capitalize on the expansive waterfront view of the Indian River, promoting patient relaxation and soothing fear and anxiety.

Our physicians currently have hospital and surgical privileges at several hospitals serving Brevard County, Florida, including Health First, Inc., Melbourne Same-Day Surgery Center and SCA Surgery Center. Patients at FCMG are seen by physicians and care specialists who are our employees, not contractors; and patient clinical care and approach to treatment is well coordinated across a patient's full care continuum.

Our Definition of a “Medical Center of Excellence”

As there are numerous definitions of a “Medical Center of Excellence,” we have strictly defined what we believe is qualified as a “Medical Center of Excellence” to ensure that our high standards for patient care and attention can be fostered and preserved. More specifically, each of our Medical Centers of Excellence will:

| · | be approximately eight to ten specialty physicians —all of whom are subject to our rigorous qualification and hiring process; |

| · | provide for the combination of synergistic medical disciplines in orthopaedics, neurology and interventional pain medicine, while supported by related in-house diagnostic and ancillary services, including, but not limited to MRI, X-ray, DME and PT using advanced technologies; |

| · | be capable of generating estimated annual revenue of $20 to $30 million when operating at full capacity, based on current reimbursement rates; |

| · | be housed in a commercial building, in close geographic proximity to a primary hospital(s); and |

| · | allow for 16,000-20,000 square feet of usable space for build-out consideration. |

Because we believe in ideals relating to optimal patient experience of care, we continually reinforce the importance of hiring, training, evaluating, compensating and supporting a workforce committed to patient-centered care. Just as vital, we engage our employees in all aspects of process design and treat them with the same dignity and respect that they are expected to show patients and family members. Central to our long term growth strategy is attracting and recruiting top tier physicians and care specialists that rank in the top percentile of performance in the local markets we serve; and creating a work environment and corporate culture that serves to engage, motivate and retain them.

Due to sweeping healthcare reform, increased regulatory and reimbursement mandates and the financial challenges each of these impose, remaining in private practice is quickly losing its appeal for many physicians. In fact, according to a nationwide survey published in 2013 by recruiting firm Jackson Healthcare, one-third of U.S. physicians plan to leave private medical practice within the next ten years in favor of employment by hospitals and multi-specialty medical groups. Thus, the opportunity for our Company to attract key medical talent has never been more robust.

Our systems of operation unburden our physicians from business administration responsibilities associated with operating a medical practice or clinic. More specifically, we believe that physicians will choose employment with us because we can offer advantages and benefits such as being able to focus exclusively on delivering excellent patient care; higher income potential; freedom from day-to-day practice administration, including marketing and generating new patient leads; access to state-of-the-art technology, diagnostics and services; and camaraderie and collaboration with a cadre of first-rate caregivers dedicated to common, patient-centered goals and objectives. The requirements for running the day-to-day business functions of the Centers are the sole responsibility of our management team —and not the physicians. Simply put, doctors get to be doctors.

| 6 |

Currently, we are actively engaged in identifying and pursuing discussions with prospective physicians in our key target markets —with those being primarily in the Southeastern United States. We anticipate investing $4-5 million to create one or more Medical Centers of Excellence during the next 12 months; and each Center may require up to 6-12 months to achieve optimal economic capacity, depending on the number of physicians and physician assistants to be employed, the medical service mix and the type of diagnostic and ancillary services to be offered. However, there can be no assurance that we will be able to negotiate acceptable terms for, or find suitable candidates for, such positions.

Our Strategy

We aim to distinguish our Medical Centers of Excellence from our competition by designing our Centers as premier destinations for clinically superior, patient-centric care that is coordinated across a patient’s entire care continuum. By doing so, we expect to deliver more meaningful and collaborative doctor-patient experiences, more accurate diagnoses due to the care coordination, effective treatment plans, faster recoveries and materially reduced costs. Our strategic focus is to grow primarily in select southeastern and western U.S. markets by hiring additional physicians to create FCHS-branded Medical Centers of Excellence that fit our defined criteria. Our criteria includes the following:

| · | opportunities for us to introduce additional revenue channels (i.e., synergistic musculoskeletal medical disciplines; on-site MRI, X-ray, DME and PT; related health and wellness products, etc.) that will support and promote enhanced, well-coordinated, patient-centric care while supporting and promoting profitable business operations; |

| · | opportunities that support economies of scale in billing, collections, purchasing, advertising and compliance which can be fully leveraged to reduce expenses and fuel income growth; and |

| · | opportunities to increase awareness of our brand by aligning with patients, referring physicians, medical institutions, insurers, employers and other healthcare stakeholders in local markets that share our values of patient care. |

Our business model is to employ all of our multi-specialty physicians, thereby permitting us to optimize revenue generation from both physician and ancillary services, while also providing our employed care providers with the ability to refer patients to our on-site diagnostic services. Physician-owned practices, on the other hand, may be subject to prevailing federal regulations (e.g., The Ethics in Patient Referral Act of 1989, as amended), which may limit their ability to refer patients for certain healthcare services provided by entities in which a physician-owner(s) has a financial interest.

Our centralized system of back office operations will allow us to achieve measurable cost and productivity efficiencies as we expand the number of Centers we own and operate. We have specifically designed our centralized system to alleviate our staff physicians from business administration responsibilities associated with operating a medical practice or clinic, enabling them to focus on caring for the patients we serve. Physicians who own and manage their own private practices or clinics typically have to devote valuable time and resources to addressing business concerns, time and resources that might otherwise be spent on treating their patients.

Medical Service Mix

Like other business models for professional medical services, our Medical Center of Excellence model is designed to offer the most synergistic and profitable medical service mix. By their nature, some combinations of medical specialties can generate more revenue than others. Physicians need access to diagnostic equipment and ancillary services, such as MRI, X-ray, DME and PT. Moreover, patients expect their physicians to have access to the best diagnostic and service delivery equipment. Without diagnostic services, many medical practices will find it difficult to maintain their current margins of profitability.

We integrate both medical specialties and diagnostic services in our Centers to maintain or enhance our profits. While one specialty may have high reimbursements for their professional services but insufficient volume to profitably support the necessary diagnostic equipment, another medical specialty may have a lower professional service reimbursements but high volume of diagnostic equipment use. Operating independently, each specialty group would face retreating profit margins and confront significant challenges to maintaining high service levels with adequate equipment and advanced technologies. However, operating together, they create the optimal mix of professional service fee income and diagnostic equipment procedure income. Since the combination is more profitable than either of its components, there is a favorable opportunity to sustain profit margins that will allow each Center to maintain high service levels with state-of-the-art equipment.

| 7 |

Scalable Back Office and Economies of Scale

Fixed cost legacy administrative functions have subjected many established medical centers to a downward spiral of diminishing profit margins and losses. In legacy medical centers, administrative management, billing, compliance, accounting, marketing, advertising, scheduling, customer service and record keeping functions represent fixed overhead for the practice. The fixed administrative overhead of a practice has the effect of reducing profit margins if the practice experiences declining revenues as a result of lower patient volumes from increasing competition, lower pricing, lower reimbursements or patient migration to competitors.

A key to our success will be our ability to continue to employ a highly experienced team of business managers supported by an array of professional, experienced and compliant subcontractors. Using project management best practices, our corporate team managers all billing, compliance, accounting, marketing, advertising, legal, information technology and record keeping functions on behalf of FCMG. It is our plan that the cost of our “back office operations” will not increase in direct relation to the growth of our Medical Centers of Excellence, which will allow us to sustain profit margins across our entire business operations with a cost effective and scalable back office. As the number of employed physicians and operated Medical Centers of Excellence increases, the economies of scale for our back office operations will also increase. The economies of scale support selecting the best and not the lowest cost subcontractors, while allowing FCMG and our other future Medical Centers of Excellence to operate cost effectively with higher service levels.

Specifically, we currently provide all of the administrative services necessary to support the practice of medicine by our physicians and improve operating efficiencies of FCMG and our future Medical Centers of Excellence:

| • | Recruiting and Credentialing. We have proven experience in locating, qualifying, recruiting and retaining experienced physicians. In addition to the verification of credentials, licenses and references of all prospective physician candidates, each caregiver undergoes Level Two Background Checks. We maintain a national database of practicing physicians. In addition to our database of physicians, we recruit locally through trade advertising, the American Academy of Orthopaedic Surgeons and referrals from our physicians. |

| • | Billing, Collection and Reimbursement. We assume responsibility for contracting with third-party payors for all of our physicians; and we are responsible for billing, collection and reimbursement for services rendered by our physicians. In all instances, however, we do not assume responsibility for charges relating to services provided by hospitals or other referring physicians with whom we collaborate. Such charges are billed and collected separately by the hospitals or other physicians. The majority of our third party payors remit by EFT and wire transfers. Accordingly, every aspect of the business is positioned to achieve high productivity and lower administrative headcounts and per capita expense. We provide our physicians with a training curriculum that emphasizes detailed documentation of and proper coding protocol for all procedures performed and services provided, and we provide comprehensive internal auditing processes, all of which are designed to achieve appropriate coding, billing and collection of revenue for physician services. All of our billing and collection operations are controlled and will continue to be controlled from our business offices located at our corporate headquarters in Melbourne, Florida. |

| • | Risk Management and Other Services. We maintain a risk management program focused on reducing risk, including the identification and communication of potential risk areas to our medical staff. We maintain professional liability coverage for our group of healthcare professionals. Through our risk management staff, we conduct risk management programs for loss prevention and early intervention in order to prevent or minimize professional liability claims. In addition, we provide a multi-faceted compliance program that is designed to assist our multi-specialty Medical Centers of Excellence in complying with increasingly complex laws and regulations. We also manage all information technology, facilities management, legal support, marketing support, regulatory compliance and other services. |

Developing and operating additional multi-specialty Medical Centers of Excellence in other geographic areas will take advantage of the economies of scale for our administrative back office functions. Our business development plan calls for opening up multiple Centers in multiple states and cities at a pace that will allow us to maintain the same levels of quality and acceptable profitability from each location. We believe that the scalable structure of our administrative back office functions will efficiently support our expansion plans.

| 8 |

High Technology Infrastructure Supporting High Touch Patient Experiences

Successful retail models in other industries already effectively use telecommunications, remote computing, mobile computing, cloud computing, virtual networks and other leading-edge technologies to manage geographically diverse operating units. These technologies create the infrastructure to allow a central management team to monitor, direct and control geographically dispersed operating units and subcontractors, including national operations.

We believe that our business model incorporates the best of these technologies. A central management team monitors, directs and controls FCMG, and will control our future multi-specialty Medical Centers of Excellence as well as the necessary support subcontractors required by the operations. Our administrative operations are centered on a secure paperless practice management platform. We utilize a state-of-the-art, cloud-based electronic medical record (“EMR”) management system, which provides ready access to each patient’s test results from anywhere in the world where there is internet connectivity, including X-ray and MRI images, diagnosis, patient and doctor notes, visit reports, billing information, insurance coverage, patient identification and personalized care delivery requirements. Our EMR system fully complies with Meaningful Use standards defined by the Centers for Medicare & Medicaid Services Incentive Programs. These programs govern the use of electronic health records and allow us to earn incentive payments from the U.S. government, pursuant to the Health Information Technology for Economic and Clinical Health (HITECH) Act, which was enacted as part of the American Recovery and Reinvestment Act of 2009.

We intend to grow by replicating our model, currently in place at FCMG, in other geographic markets, and by hiring and managing additional physicians to serve patients in our current and future Medical Centers of Excellence - all of which will be supported by our standardized policies, procedures and clinic setup guidelines. We believe our administrative functions can be quickly scaled to handle multiple additional Centers and/or physicians. As we rollout our business model, we expect our administrative core and clinic retail model will assist us in maintaining economies of scale for all of our multi-specialty Medical Centers of Excellence.

Referral and Partnering Relationships,

Our business model is influenced by the direct contact and daily interaction that our physicians have with their patients, and emphasizes a patient-centric, shared clinical approach that also serves to address the needs of our various “partners,” including hospitals, third-party payors, referring physicians, our physicians and, most importantly, our patients. Our relationships with our partners are important to our continued success.

Hospitals

Our relationships with our hospital partners are critical to our operations. We work with our hospital partners to market our services to referring physicians, an important source of hospital admissions, within the communities served by those hospitals. In addition, a majority of our physicians maintain regular hospital privileges, to ensure best in class is available to our patients and the community. Under our contracts with hospitals, we are responsible for billing patients and third-party payors for services rendered by our physicians separately from other related charges billed by the hospital or other physicians within the hospital to the same payors.

Third-Party Payors

Our relationships with government-sponsored plans, including Medicare and TRICARE, managed care organizations and commercial health insurance payors are vital to our business. We seek to maintain professional working relationships with our third-party payors, streamline the administrative process of billing and collection, and assist our patients and their families in understanding their health insurance coverage and any balances due for co-payments, co-insurance, deductibles or out-of-network benefit limitations. In addition, through our quality initiatives and continuing research and education efforts, we have sought to enhance clinical care provided to patients, which we believe benefits third-party payors by contributing to improved patient outcomes and reduced long-term health system costs.

We receive compensation for professional services provided by our physicians to patients based upon rates for specific services provided, principally from third-party payors. Our billed charges are substantially the same for all parties in a particular geographic area, regardless of the party responsible for paying the bill for our services. Approximately one-third of our net patient service revenue is received from government-sponsored plans, principally Medicare and TRICARE programs.

| 9 |

Medicare is a health insurance program primarily for individuals 65 years of age and older, certain younger people with disabilities and people with end-stage renal disease. The program is provided without regard to income or assets and offers beneficiaries different ways to obtain their medical benefits. The most common option selected today by Medicare beneficiaries is the traditional fee-for-service payment system. The other options include managed care, preferred provider organizations, private fee-for-service and specialty plans. TRICARE is the healthcare program for U.S. military service members (active, Guard/Reserve and retired) and their families around the world. TRICARE is managed by the Defense Health Agency under leadership of the Assistant Secretary of Defense. Both Medicare and TRICARE compensation rates are generally lower in comparison to commercial health plans. In order to participate in government programs, our Medical Centers of Excellence must comply with stringent and often complex enrollment and reimbursement requirements.

We also receive compensation pursuant to contracts with commercial payors that offer a wide variety of health insurance products, such as health maintenance organizations, preferred provider organizations and exclusive provider organizations that are subject to various state laws and regulations, as well as self-insured organizations subject to federal Employee Retirement Income Security Act (“ERISA”) requirements. We seek to secure mutually agreeable contracts with payors that enable our physicians to be listed as in-network participants within the payors' provider networks

We charge our standard rates to all patients and adjust our collections based on our contractual agreements with the insurance payors. If payment is less than billed charges, we bill the balance to the patient, subject to state and federal laws regulating such billing. Although we maintain standard billing and collections procedures, we also provide discounts and/or payment option plans in certain hardship situations where patients and their families do not have financial resources necessary to pay the amount due at the time services are rendered. Any amounts written-off related to private-pay patients are based on the specific facts and circumstances related to each individual patient account.

Referring Physicians and Practice Groups

Our relationships with our referring physicians and referring practice groups are critical to our success. Our physicians seek to establish and maintain long-term professional relationships with referring physicians in the communities where we practice. We believe that our community presence, through our hospital coverage and FCMG, assists referring physicians with further enhancing their practices by providing well-coordinated and highly responsive care to their patients who require our musculoskeletal services, diagnostic services and rehabilitative care.

Government Regulation

The healthcare industry is governed by a framework of federal and state laws, rules and regulations that are extensive and complex and for which, in many cases, the industry has the benefit of only limited judicial and regulatory interpretation. If one of our physicians or physician practices is found to have violated these laws, rules or regulations, our business, financial condition and results of operations could be materially adversely affected. Moreover, the Affordable Care Act signed into law in March 2010 contains numerous provisions that are reshaping the United States healthcare delivery system, and healthcare reform continues to attract significant legislative interest, regulatory activity, new approaches, legal challenges and public attention that create uncertainty and the potential for additional changes. Healthcare reform implementation, additional legislation or regulations, and other changes in government policy or regulation may affect our reimbursement, restrict our existing operations, limit the expansion of our business or impose additional compliance requirements and costs, any of which could have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of our common stock.

Fraud and Abuse Provisions

Existing federal laws governing Medicare, TRICARE and other federal healthcare programs (the “FHC Programs”), as well as similar state laws, impose a variety of fraud and abuse prohibitions on healthcare companies like us. These laws are interpreted broadly and enforced aggressively by multiple government agencies, including the Office of Inspector General of the Department of Health and Human Services, the Department of Justice (the “DOJ”) and various state authorities.

The fraud and abuse laws include extensive federal and state regulations applicable to our financial relationships with hospitals, referring physicians and other healthcare entities. In particular, the federal anti-kickback statute prohibits the offer, payment, solicitation or receipt of any remuneration in return for either referring Medicare, TRICARE or other FHC Program business, or purchasing, leasing, ordering or arranging for or recommending any service or item for which payment may be made by an FHC Program. In addition, federal physician self-referral legislation, commonly known as the “Stark Law,” prohibits a physician from ordering certain designated health services reimbursable by Medicare from an entity with which the physician has a prohibited financial relationship. These laws are broadly worded and, in the case of the anti-kickback statute, have been broadly interpreted by federal courts, and potentially subject many healthcare business arrangements to government investigation and prosecution, which can be costly and time consuming.

| 10 |

There are a variety of other types of federal and state fraud and abuse laws, including laws authorizing the imposition of criminal, civil and administrative penalties for filing false or fraudulent claims for reimbursement with government healthcare programs. These laws include the civil False Claims Act (“FCA”), which prohibits the submitting of or causing to be submitted false claims to the federal government or federal government programs, including Medicare, the TRICARE program for military dependents and retirees, and the Federal Employees Health Benefits Program. The FCA also applies to the improper retention of known overpayments and includes “whistleblower” provisions that permit private citizens to sue a claimant on behalf of the government and thereby share in the amounts recovered under the law and to receive additional remedies.

In addition, federal and state agencies that administer healthcare programs have at their disposal statutes, commonly known as “civil money penalty laws,” that authorize substantial administrative fines and exclusion from government programs in cases where an individual or company that filed a false claim, or caused a false claim to be filed, knew or should have known that the claim was false or fraudulent. As under the FCA, it often is not necessary for the agency to show that the claimant had actual knowledge that the claim was false or fraudulent in order to impose these penalties.

If we were excluded from any government-sponsored healthcare programs, not only would we be prohibited from submitting claims for reimbursement under such programs, but we also would be unable to contract with other healthcare providers, such as hospitals, to provide services to them. It could also adversely affect our ability to contract with, or to obtain payment from, non-governmental payors.

Government Reimbursement Requirements

In order to participate in the Medicare program, we must comply with stringent and often complex enrollment and reimbursement requirements. These programs generally provide for reimbursement on a fee-schedule basis rather than on a charge-related basis, we generally cannot increase our revenue by increasing the amount we charge for our services. To the extent our costs increase, we may not be able to recover our increased costs from these programs, and cost containment measures and market changes in non-governmental insurance plans have generally restricted our ability to recover, or shift to non-governmental payors, these increased costs. In attempts to limit federal and state spending, there have been, and we expect that there will continue to be, a number of proposals to limit or reduce Medicare reimbursement for various services. Our business may be significantly and adversely affected by any such changes in reimbursement policies and other legislative initiatives aimed at reducing healthcare costs associated with Medicare, TRICARE and other government healthcare programs.

Our business also could be adversely affected by reductions in or limitations of reimbursement amounts or rates under these government programs, reductions in funding of these programs or elimination of coverage for certain individuals or treatments under these programs.

Antitrust

The healthcare industry is subject to close antitrust scrutiny. In recent years, the Federal Trade Commission (the “FTC”), the Department of Justice (“DOJ”) and state Attorney General have increasingly taken steps to review and, in some cases, taken enforcement action against business conduct and acquisitions in the healthcare industry. Violations of antitrust laws may be punishable by substantial penalties, including significant monetary fines, civil penalties, criminal sanctions, consent decrees and injunctions prohibiting certain activities or requiring divestiture or discontinuance of business operations. Any of these penalties could have a material adverse effect on our business, financial condition and results of operations. We consider the antitrust laws in connection with the acquisition of physician practices and the operation of our business, and we believe our operations are in compliance with applicable laws.

| 11 |

HIPAA and Other Privacy Laws

Numerous federal and state laws, rules and regulations govern the collection, dissemination, use and confidentiality of protected health information, including the federal Health Insurance Portability and Accountability Act of 1996, as amended (“HIPAA”), and its implementing regulations, violations of which are punishable by monetary fines, civil penalties and, in some cases, criminal sanctions. As part of our medical record keeping, third-party billing, research and other services, we and our affiliated practices collect and maintain protected health information on the patients that we serve.

HHS's Security Standards require healthcare providers to implement administrative, physical and technical safeguards to protect the integrity, confidentiality and availability of individually identifiable health information that is electronically received, maintained or transmitted (including between us and our affiliated practices). We have implemented security policies, procedures and systems designed to facilitate compliance with the HIPAA Security Standards.

In February 2009, Congress enacted the Health Information Technology for Economic and Clinical Health Act (“HITECH”) as part of the American Recovery and Reinvestment Act (“ARRA”). Among other changes to the law governing protected health information, HITECH strengthens and expands HIPAA, increases penalties for violations, gives patients new rights to restrict uses and disclosures of their health information, and imposes a number of privacy and security requirements directly on our “Business Associates,” which are third-parties that perform functions or services for us or on our behalf.

In addition to the federal HIPAA and HITECH requirements, numerous other state and certain other federal laws protect the confidentiality of patient information, including state medical privacy laws, state social security number protection laws, human subjects research laws and federal and state consumer protection laws. In some cases, state laws are more stringent than HIPAA and therefore, are not preempted by HIPAA.

Environmental Regulations

Our healthcare operations generate medical waste that must be disposed of in compliance with federal, state and local environmental laws, rules and regulations. Our office-based operations are subject to compliance with various other environmental laws, rules and regulations. Such compliance does not, and we anticipate that such compliance will not, materially affect our capital expenditures, financial position or results of operations.

Compliance Program

We maintain a compliance program that reflects our commitment to complying with all laws, rules and regulations applicable to our business and that meets our ethical obligations in conducting our business (the “Compliance Program”). We believe our Compliance Program provides a solid framework to meet this commitment and our obligations as a provider of health care services, including:

| • | a Compliance Committee consisting of our senior executives; |

| • | our Code of Ethics, which is applicable to our employees, officers and directors; |

| • | a disclosure program that includes a mechanism to enable individuals to disclose on a confidential or anonymous basis to our Chief Executive Officer, or any person who is not in the disclosing individual's chain of command, issues or questions believed by the individual to be a potential violation of criminal, civil, or administrative laws; |

| • | an organizational structure designed to integrate our compliance objectives into our corporate offices and Medical Centers of Excellence; and |

| • | education, monitoring and corrective action programs, including a disclosure policy designed to establish methods to promote the understanding of our Compliance Program and adherence to its requirements. |

The foundation of our Compliance Program is our Code of Ethics which is intended to be a comprehensive statement of the ethical and legal standards governing the daily activities of our employees, affiliated professionals, independent contractors, officers and directors. All our personnel are required to abide by, and are given thorough education regarding, our Code of Ethics. In addition, all employees are expected to report incidents that they believe in good faith may be in violation of our Code of Ethics.

| 12 |

Government Investigations

We expect that audits, inquiries and investigations from government authorities, agencies, contractors and payors will occur in the ordinary course of business. Such audits, inquiries and investigations and their ultimate resolutions, individually or in the aggregate, could have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of our common stock. To the best of our knowledge, as of this time, our health care business is not the subject of any pending audit, inquiry or investigation by any governmental authority.

Legal Proceedings

From time to time, we may become involved in lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. Our contracts with hospitals generally requires us to indemnify them and their affiliates for losses resulting from the negligence of our physicians.

Although we currently maintain liability insurance coverage intended to cover professional liability and certain other claims, we cannot assure that our insurance coverage will be adequate to cover liabilities arising out of claims asserted against us in the future where the outcomes of such claims are unfavorable to us. Liabilities in excess of our insurance coverage, including coverage for professional liability and certain other claims, could have a material adverse effect on our business, financial condition and results of operations.

On or about July 25, 2104, MedTRX Health Care Solutions, LLC and MedTRX Collection Services, LLC (“MedTRX”) filed a demand for arbitration with the American Arbitration Association (“AAA”) against FCID Medical, Inc. and First Choice Medical Group of Brevard, LLC (collectively, “First Choice”). MedTRX claims that First Choice breached an exclusive five year billing and collection agreement dated as of December 9, 2011 (“Billing Agreement”) by engaging another billing service on or about June 1, 2014. MedTRX also claims that First Choice failed to pay for services that MedTRX had performed prior to June 1, 2014 leaving a balance due of $93,280.84. MedTRX claims total damages of “not less than $3 million. On or about September 15, 2014, First Choice served its Answering Statement and Counterclaims (“Answering Statement”). In the Answering Statement, First Choice denies all liability to MedTRX due to MedTRX’s numerous material breaches of the Billing Agreement and asserted two counterclaims for fraudulent inducement and negligence against MedTRX. First Choice seeks damages of not less than $2 Million against MedTRX.

However, no assurance can be given that any amounts ultimately due by the Company will not have a material impact on the Company's financial condition. Colin Halpern, a former member of our Board of Directors, is the Managing Member of MedTRX Provider Network, LLC, which is an affiliate of MedTRX.

Professional and General Liability Coverage

We maintain professional and general liability insurance policies with third-party insurers on a claims-made basis, subject to deductibles, self-insured retention limits, policy aggregates, exclusions, and other restrictions, in accordance with standard industry practice. We believe that our insurance coverage is appropriate based upon our claims experience and the nature and risks of our business. However, we cannot assure that any pending or future claim will not be successful or if successful will not exceed the limits of available insurance coverage.

Our Real Estate Business

FCID Holdings, Inc.

Our wholly-owned subsidiary, FCID Holdings, Inc. (“FCID Holdings”) operates our Company’s real estate interests. Currently, FCID Holding has one real estate holding, Marina Towers, a Class A 78,000 square foot, six-story building located on the Indian River in Melbourne, Florida. The address is 709 South Harbor City Boulevard, Melbourne, Florida 32901. In addition to housing our corporate headquarters and First Choice Medical Group, the building, which averages 95% annual occupancy, also leases commercial office space to tenants. Our corporate headquarters currently utilizes approximately 5,609 square feet on the second floor of Marina Towers; and FCMG, including its MRI center, currently occupies approximately 19,000 square feet on the first floor and ground floor.

| 13 |

Marina Towers is owned by Marina Towers, LLC, a subsidiary owned by FCID Holdings (99%) and MTMC of Melbourne, Inc. (1%).

Our Headquarters

Our corporate headquarters is located on the shore of the Indian River at 709 S. Harbor City Boulevard, Suite 250, Melbourne, Florida 32901 in Marina Towers, which is owned by Marina Towers, LLC, a subsidiary owned by FCID Holdings, Inc. and MTMC of Melbourne, Inc., both wholly owned subsidiaries of the Company.

Employees

As of December 31, 2014, FCHS and its subsidiaries, in aggregate, employed approximately 53 employees, which included 6 physicians and 2 physician assistants.

Where You Can Find Additional Information

The Company is subject to the reporting requirements under the Exchange Act. The Company files with, or furnishes to, the SEC quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports and will furnish its proxy statement. These filings are available free of charge on the Company's website, www.myfchs.com, shortly after they are filed with, or furnished to, the SEC. The SEC maintains an Internet website, www.sec.gov, which contains reports and information statements and other information regarding issuers.

The risk factors discussed below could cause our actual results to differ materially from those expressed in any forward-looking statements. Although we have attempted to list comprehensively these important factors, we caution you that other factors may in the future prove to be important in affecting our results of operations. New factors emerge from time to time and it is not possible for us to predict all of these factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

The risks described below set forth what we believe to be the most material risks associated with the purchase of our common stock. Before you invest in our common stock, you should carefully consider these risk factors, as well as the other information contained in this prospectus.

GENERAL RISKS REGARDING OUR HEALTHCARE SERVICES BUSINESS

We have a limited operating history that impedes our ability to evaluate our potential future performance and strategy.

We have only owned and operated our model Medical Center of Excellence, FCMG, since 2012 and have experienced net losses to date. Using FCMG as our model “Medical Center of Excellence,” we plan to hire additional physicians to create state-of-the-art Medical Centers of Excellence committed to delivering patient-centric care in select markets in the United States. Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on estimates of our future performance. To address these risks and uncertainties, we must do the following:

| · | Successfully execute our business strategy to establish and extend the “First Choice Healthcare Solutions” brand and reputation as a profitable, well-managed enterprise committed to delivering quality and cost-effective health care primarily in parts of the southeastern and western United States and then pursue select other U.S. markets; |

| · | Respond to competitive developments; |

| 14 |

| · | Effectively and efficiently integrate new Medical Centers of Excellence; and |

| · | Attract, integrate, retain and motivate qualified personnel. |

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition and results of operations may be materially and adversely affected.

We are implementing a strategy to grow our business by hiring additional physicians to create FCHS-branded Medical Centers of Excellence in select U.S. markets, which requires significant additional capital and may not generate income.

We intend to grow our business by hiring and managing additional physicians to create FCHS-branded Medical Centers of Excellence in select U.S. markets. We estimate the investment to create each additional Medical Center of Excellence to be approximately $4-5 million. Although we are taking steps to raise funds through equity offerings to implement our growth strategy, these funds may not be adequate to offset all of the expenses we incur in expanding our business. We will need to generate revenues to offset expenses associated with our growth, and we may be unsuccessful in achieving sufficient revenues, despite our attempts to grow our business. If our growth strategies do not result in sufficient revenues and income, we may have to abandon our plans for further growth and/or cease operations, which could have a material and adverse effect on our business, prospects and financial condition.

In order to pursue our business strategy, we will need to raise additional capital. If we are unable to raise additional capital, our business may fail.

We will need to raise additional capital to pursue our business plan, which includes hiring additional physicians in order to expand our business operations and develop our FCHS brand of Medical Centers of Excellence. We believe that we have access to capital resources through possible public or private equity offerings, debt financings, corporate collaborations or other means. If the economic climate in the United States does not improve or further deteriorates, our ability to raise additional capital could be negatively impacted. If we are unable to secure additional capital, we may be required to curtail our initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations.

We may not be able to achieve the expected benefits from opening new Medical Centers of Excellence, which would adversely affect our financial condition and results.

We plan to rely on hiring additional physicians to create FCHS-branded Medical Center of Excellence as a method of expanding our business. If we do not successfully integrate such new Medical Centers of Excellence, we may not realize anticipated operating advantages and cost savings. The integration of these new Medical Centers of Excellence into our business operations involves a number of risks, including:

| · | Demands on management related to the increase in our Company’s size with the establishment of each new Medical Center of Excellence, which is crucial to our business plan; |

| · | The diversion of management’s attention from the management of daily operations to the integration of operations of the new Medical Centers of Excellence; |

| · | Difficulties in the assimilation and retention of employees; |

| · | Potential adverse effects on operating results; and |

| · | Challenges in retaining patients from the new physicians. |

Further, the successful integration of the new physicians will depend upon our ability to manage the new physicians and to eliminate redundant and excess costs. Difficulties in integrating new physicians may not be able to achieve the cost savings and other size-related benefits that we hoped to achieve, which would harm our financial condition and operating results.

| 15 |

If we are unable to attract and retain qualified medical professionals, our ability to maintain operations at our existing Medical Center of Excellence, attract patients or open new multi-specialty Medical Centers of Excellence could be negatively affected.

We generate our revenues through physicians and medical professionals who work for us or we manage, to perform medical services and procedures. The retention of those physicians and medical professionals is a critical factor in the success of our medical multi-specialty Centers, and the hiring of qualified physicians and medical professionals is a critical factor in our ability to launch new multi-specialty Medical Centers of Excellence successfully. However, at times it may be difficult for us to retain or hire qualified physicians and medical professionals. If we are unable consistently to hire and retain qualified physicians and medical professionals, our ability to open new Centers, maintain operations at existing medical multi-specialty Centers, and attract patients could be materially and adversely affected.

We may have difficulties managing our Company’s growth, which could lead to higher operating losses, or we may not grow at all.

Rapid growth could strain our human and capital resources, potentially leading to higher operating losses. Our ability to manage operations and control growth will be dependent upon our ability to raise and spend capital to successfully attract, train, motivate, retain and manage new employees and continue to update and improve our management and operational systems, infrastructure and other resources, financial and management controls, and reporting systems and procedures. Should we be unsuccessful in accomplishing any of these essential aspects of our growth in an efficient and timely manner, then management may receive inadequate information necessary to manage our operations, possibly causing additional expenditures and inefficient use of existing human and capital resources or we otherwise may be forced to grow at a slower pace that could slow or eliminate our ability to achieve and sustain profitability. Such slower than expected growth may require us to restrict or cease our operations and go out of business.

Since a significant percentage of our operating expenses are fixed, a relatively small decrease in revenues could have a significant negative impact on our financial results.

A significant percentage of our expenses are currently fixed, meaning they do not vary significantly with our increase or decrease in revenues. Such expenses include, but will not be limited to, debt service and capital lease payments, rent and operating lease payments, salaries, maintenance and insurance. As a result, a small reduction in the prices we charge for our services or procedure volume could have a disproportionately negative effect on our financial results.

Loss of key executives, limited experience in operating a public company and failure to attract qualified managers and sales persons could limit our growth and negatively impact our operations.

We depend upon our management team to a substantial extent. In particular, we depend upon Christian C. Romandetti, our President and Chief Executive Officer, for his skills, experience and knowledge of our Company and industry contacts. The loss of Mr. Romandetti or other members of our management team could have a material adverse effect on our business, results of operations or financial condition.

Our limited experience in dealing with the increasingly complex laws pertaining to public companies could be a significant disadvantage to us in that it is likely that an increasing amount of management’s time will be devoted to these activities which will result in less time being devoted to the management and growth of our Company. It is possible that we will be required to expand our employee base and hire additional employees to support our operations as a public company which will increase our operating costs in future periods.

We require medical clinic managers, medical professionals and marketing persons with experience in our industry to operate and market our medical clinic services. It is impossible to predict the availability of qualified persons or the compensation levels that will be required to hire them. The loss of the services of any member of our senior management or our inability to hire qualified persons at economically reasonable compensation levels could adversely affect our ability to operate and grow our business.

| 16 |

We may be subject to medical professional liability risks, which could be costly and could negatively impact our business and financial results.

We may be subject to professional liability claims. Although there currently are no known hazards associated with any of our procedures or technologies when performed or used properly, hazards may be discovered in the future. For example, there is a risk of harm to a patient during an MRI if the patient has certain types of metal implants or cardiac pacemakers within his or her body. Although patients are screened to safeguard against this risk, screening may nevertheless fail to identify the hazard. There also is potential risk to patients treated with therapy equipment secondary to inadvertent or excessive over- or under- exposure to radiation. We maintain professional liability insurance with coverage that we believe is consistent with industry practice and appropriate in light of the risks attendant to our business. However, any claim made against us could be costly to defend against, resulting in a substantial damage award against us and divert the attention of our management team from our operations, which could have an adverse effect on our financial performance.

The healthcare regulatory and political framework is uncertain and evolving.

Healthcare laws and regulations may change significantly in the future which could adversely affect our financial condition and results of operations. We continuously monitor these developments and modify our operations from time to time as the legislative and regulatory environment changes.

In March 2010, President Barack Obama signed a health care reform measure, which provides healthcare insurance for approximately 30 million more Americans. The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act (collectively, the “PPACA”), which includes a variety of healthcare reform provisions and requirements that will become effective at varying times through 2018, substantially changes the way health care is financed by both governmental and private insurers, including several payment reforms that establish payments to hospitals and physicians based in part on quality measures, and may significantly impact our industry. The PPACA requires, among other things, payment rates for services using imaging equipment that costs over $1 million to be calculated using revised equipment usage assumptions and reduced payment rates for imaging services paid under the Medicare Part B fee schedule. Many of the provisions of the PPACA will phase in over the course of the next several years, and we are unable to predict what effect the PPACA or other healthcare reform measures that may be adopted in the future will have on our business.

The healthcare industry is highly regulated, and government authorities may determine that we have failed to comply with applicable laws or regulations.

The healthcare industry and physicians’ medical practices, including the healthcare and other services that we and our affiliated physicians provide, are subject to extensive and complex federal, state and local laws and regulations, compliance with which imposes substantial costs on us. Of particular importance are the provisions summarized as follows:

| · | federal laws (including the federal False Claims Act) that prohibit entities and individuals from knowingly or recklessly making claims to Medicare and other government programs that contain false or fraudulent information or from improperly retaining known overpayments; |

| · | a provision of the Social Security Act, commonly referred to as the “anti-kickback” law, that prohibits the knowing and willful offer, payment, solicitation or receipt of any bribe, kickback, rebate or other remuneration, in cash or in kind, in return for the referral or recommendation of patients for items and services covered, in whole or in part, by federal healthcare programs, such as Medicare; |

| · | a provision of the Social Security Act, commonly referred to as the Stark Law, that, subject to limited exceptions, prohibits physicians from referring Medicare patients to an entity for the provision of certain “designated health services” if the physician or a member of such physician’s immediate family has a direct or indirect financial relationship (including a compensation arrangement) with the entity; |

| · | similar state law provisions pertaining to anti-kickback, fee splitting, self-referral and false claims issues, which typically are not limited to relationships involving federal payors; |

| · | provisions of HIPAA that prohibit knowingly and willfully executing a scheme or artifice to defraud a healthcare benefit program or falsifying, concealing or covering up a material fact or making any material false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services; |

| · | state laws that prohibit general business corporations from practicing medicine, controlling physicians’ medical decisions or engaging in certain practices, such as splitting fees with physicians; |

| 17 |

| · | federal and state laws that prohibit providers from billing and receiving payment from Medicare and TRICARE for services unless the services are medically necessary, adequately and accurately documented and billed using codes that accurately reflect the type and level of services rendered; |

| · | federal and state laws pertaining to the provision of services by non-physician practitioners, such as advanced nurse practitioners, physician assistants and other clinical professionals, physician supervision of such services and reimbursement requirements that may be dependent on the manner in which the services are provided and documented; and |

| · | federal laws that impose civil administrative sanctions for, among other violations, inappropriate billing of services to federally funded healthcare programs, inappropriately reducing hospital care lengths of stay for such patients, or employing individuals who are excluded from participation in federally funded healthcare programs. |

In addition, we believe that our business will continue to be subject to increasing regulation, the scope and effect of which we cannot predict.

We may in the future become the subject of regulatory or other investigations or proceedings, and our interpretations of applicable laws, rules and regulations may be challenged.

Regulatory authorities or other parties may assert that our arrangements with our affiliated professional contractors constitute fee splitting or the corporate practice of medicine and seek to invalidate these arrangements. Such parties also could assert that our relationships, including fee arrangements, among our affiliated professional contractors, hospital clients or referring physicians violate the anti-kickback, fee splitting or self-referral laws and regulations or that we have submitted false claims or otherwise failed to comply with government program reimbursement requirements.

Such investigations, proceedings and challenges could result in substantial defense costs to us and a diversion of management’s time and attention. In addition, violations of these laws are punishable by monetary fines, civil and criminal penalties, exclusion from participation in government-sponsored healthcare programs, and forfeiture of amounts collected in violation of such laws and regulations, any of which could have a material adverse effect on our business, financial condition, results of operations, cash flows and the trading price of our common stock.

Federal and state laws that protect the privacy and security of protected health information may increase our costs and limit our ability to collect and use that information and subject us to penalties if we are unable to fully comply with such laws.

Numerous federal and state laws and regulations govern the collection, dissemination, use, security and confidentiality of individually identifiable health information. These laws include:

| · | Provisions of HIPAA that limit how healthcare providers may use and disclose individually identifiable health information, provide certain rights to individuals with respect to that information and impose certain security requirements; |

| · | HITECH, which strengthens and expands the HIPAA Privacy Standards and Security Standards; |

| · | Other federal and state laws restricting the use and protecting the privacy and security of protected information, many of which are not preempted by HIPAA; |

| · | Federal and state consumer protection laws; and |

| · | Federal and state laws regulating the conduct of research with human subjects. |

As part of our medical record keeping, third-party billing, research and other services, we collect and maintain protected health information in electronic format. New protected health information standards, whether implemented pursuant to HIPAA, HITECH, congressional action or otherwise, could have a significant effect on the manner in which we handle healthcare-related data and communicate with payors, and compliance with these standards could impose significant costs on us or limit our ability to offer services, thereby negatively impacting the business opportunities available to us.

| 18 |

If we do not comply with existing or new laws and regulations related to protected health information we could be subject to remedies that include monetary fines, civil or administrative penalties or criminal sanctions.

Changes in the rates or methods of third-party reimbursements for medical services could result in reduced demand for our services or create downward pricing pressure, which would result in a decline in our revenues and harm to our financial position.

Third-party payors such as Medicare, TRICARE and commercial health insurance companies, may change the rates or methods of reimbursement for the services we currently provide or plan to provide and such changes could have a significant negative impact on those revenues. At this time, we cannot predict the impact that rate reductions will have on our future revenues or business. Moreover, patients on whom we currently depend, and expect to continue to depend on, for the majority of our medical clinic revenues generally rely on reimbursement from third-party payors for the payment of medical services. If our patients begin to receive decreased reimbursement from third-party payors for their medical services and as such are forced to pay for the remainder of their medical services out of pocket, then a reduced demand for our services or downward pricing pressures could result, which could have a material impact on our financial position.

Future requirements limiting access to or payment for medical services may negatively impact our future revenues or business. If legislation substantially changes the way healthcare is reimbursed by both governmental and commercial insurance carriers, it may negatively impact payment rates for certain medical services. We cannot predict at this time whether or the extent to which other proposed changes will be adopted, if any, or how these or future changes will affect the demand for our services.

Managed care organizations may prevent their members from using our services which would cause us to lose current and prospective patients.

Healthcare providers participating as providers under managed care plans may be required to refer medical services to specific medical clinics depending on the plan in which each covered patient is enrolled. These requirements may inhibit their members from using our medical services in some cases. The proliferation of managed care may prevent an increasing number of their members from using our services in the future which would cause our revenues to decline.

We may need to restructure our services and practices if our methods are determined not to comply with the Stark Law.