Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - First Choice Healthcare Solutions, Inc. | v326903_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - First Choice Healthcare Solutions, Inc. | v326903_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - First Choice Healthcare Solutions, Inc. | v326903_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - First Choice Healthcare Solutions, Inc. | v326903_ex31-2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - First Choice Healthcare Solutions, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2012

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 000-53012

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(Exact Name of small business issuer as specified in its charter)

| Delaware | 90-0687379 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

709 S. Harbor City Blvd., Suite 250, Melbourne, FL 32901

(Address of principal executive offices) (Zip Code)

Issuer’s telephone Number: (321) 725-0090

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x | |

|

(Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 1, 2012, the issuer had 12,706,795 outstanding shares of Common Stock.

Explanatory Note: Registrant is filing this report on Form 10-Q after November 14, 2012, in reliance upon Release No. 68224 of the Securities and Exchange Commission, by reason of Registrant’s inability to meet the November 14, 2012 filing deadline for this report due to Hurricane Sandy and its aftermath and, specifically, the flooding conditions and loss of electricity caused by Hurricane Sandy which required personnel of RBSM LLP, the Registrant’s independent registered public accounting firm (“RBSM”) responsible for reviewing Registrant’s financial statements in this report, to suspend work for several days, which directly resulted in delay in the completion of RBSM’s review and delay in the completion of the Edgar proof and XBRL tagging required for this filing.

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| Item 1. | Financial Statements | 3 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | 25 |

| Item 4. | Controls and Procedures | 26 |

| PART II | ||

| Item 1. | Legal Proceedings | 26 |

| Item 1A. | Risk Factors | 26 |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 26 |

| Item 3. | Defaults Upon Senior Securities | 26 |

| Item 4. | Mine Safety Disclosures | 26 |

| Item 5. | Other Information | 27 |

| Item 6. | Exhibits | 28 |

| 2 |

PART I

ITEM 1. FINANCIAL STATEMENTS.

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, | December 31, | |||||||

| 2012 | 2011 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash | $ | 197,026 | $ | 528,303 | ||||

| Cash-restricted | 216,009 | 89,939 | ||||||

| Accounts receivable | 658,857 | - | ||||||

| Employee loans | 15,000 | - | ||||||

| Prepaid and other current assets | 87,678 | 29,705 | ||||||

| Deposits-acquisitions | - | 998,032 | ||||||

| Accounts receivable, other | - | 303,000 | ||||||

| Capitalized financing costs, current portion | 57,348 | 57,348 | ||||||

| Total current assets | 1,231,918 | 2,006,327 | ||||||

| Property, plant and equipment, net of accumulated depreciation of $1,357,851 and $1,180,431 | 8,571,947 | 4,537,099 | ||||||

| Other assets | ||||||||

| Capitalized financing costs, long term portion | 167,248 | 210,259 | ||||||

| Customer list, net of accumulated amortization of $10,000 | 290,000 | - | ||||||

| Deposits | 18,838 | 18,515 | ||||||

| Total other assets | 476,086 | 228,774 | ||||||

| Total assets | $ | 10,279,951 | $ | 6,772,200 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 464,006 | $ | 175,699 | ||||

| Notes payable, current portion | 827,917 | 92,392 | ||||||

| Unearned revenue | 27,858 | 24,084 | ||||||

| Deferred income taxes | - | 23,103 | ||||||

| Total current liabilities | 1,319,781 | 315,278 | ||||||

| Long term debt: | ||||||||

| Deposits held | 47,399 | 47,399 | ||||||

| Revolving line of credit, related party | 53,069 | - | ||||||

| Notes payable, long term portion | 9,676,464 | 7,435,419 | ||||||

| Total long term debt | 9,776,932 | 7,482,818 | ||||||

| Total liabilities | 11,096,713 | 7,798,096 | ||||||

| Stockholders' deficit | ||||||||

| Preferred stock, $0.01 par value; 1,000,000 shares authorized, Nil issued and outstanding | - | - | ||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized, 12,706,795 and 12,462,750 shares issued and outstanding as of September 30, 2012 and December 31, 2011, respectively | 12,707 | 12,463 | ||||||

| Additional paid in capital | 7,450,117 | 6,747,512 | ||||||

| Common stock subscriptions | 100,000 | - | ||||||

| Accumulated deficit | (8,379,586 | ) | (7,785,871 | ) | ||||

| Total stockholders' deficit | (816,762 | ) | (1,025,896 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 10,279,951 | $ | 6,772,200 | ||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| 3 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

(formerly known as Medical Billing Assistance, Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| Three months ended September 30, | Nine months ended September 30, | |||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| Revenues: | ||||||||||||||||

| Net Patient Service Revenue | $ | 798,077 | $ | - | $ | 1,707,694 | $ | - | ||||||||

| Rental Revenue | 270,547 | 322,905 | 883,179 | 979,485 | ||||||||||||

| Total Revenue | 1,068,624 | 322,905 | 2,590,873 | 979,485 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Practice salaries & benefits | 406,055 | - | 795,375 | - | ||||||||||||

| Practice supplies and other operating expenses | 171,364 | - | 299,505 | - | ||||||||||||

| General & administrative | 551,871 | 242,393 | 1,512,115 | 669,410 | ||||||||||||

| Depreciation and amortization | 73,518 | 40,365 | 187,420 | 121,095 | ||||||||||||

| Total operating expenses | 1,202,808 | 282,758 | 2,794,415 | 790,505 | ||||||||||||

| Net income (loss) from operations | (134,184 | ) | 40,147 | (203,542 | ) | 188,980 | ||||||||||

| Other income (expense): | ||||||||||||||||

| Miscellaneous income | 750 | - | 2,250 | 41,012 | ||||||||||||

| Gain on settlement of debt | - | - | - | 67,365 | ||||||||||||

| Amortization financing costs | (14,337 | ) | (4,779 | ) | (43,011 | ) | (4,779 | ) | ||||||||

| Interest expense, net | (135,652 | ) | (83,283 | ) | (372,515 | ) | (235,613 | ) | ||||||||

| Total other income (expense) | (149,239 | ) | (88,062 | ) | (413,276 | ) | (132,015 | ) | ||||||||

| Net (loss) income before provision for income taxes | (283,423 | ) | (47,915 | ) | (616,818 | ) | 56,965 | |||||||||

| Income taxes (benefit) | - | (9,600 | ) | (23,103 | ) | 11,400 | ||||||||||

| NET (LOSS) INCOME | $ | (283,423 | ) | $ | (38,315 | ) | $ | (593,715 | ) | $ | 45,565 | |||||

| Net (loss) income per common share, basic | $ | (0.02 | ) | $ | (0.00 | ) | $ | (0.05 | ) | $ | 0.00 | |||||

| Net (loss) income per common share-fully diluted | $ | (0.02 | ) | $ | (0.00 | ) | $ | (0.05 | ) | $ | 0.00 | |||||

| Weighted average number of common shares outstanding, basic | 12,706,795 | 12,429,000 | 12,623,962 | 12,429,000 | ||||||||||||

| Weighted average number of common shares outstanding, fully diluted | 12,706,795 | 12,429,000 | 12,623,962 | 12,529,000 | ||||||||||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| 4 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC

(formerly known as Medical Billing Assistance, Inc.)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| Nine months ended September 30, | ||||||||

| 2012 | 2011 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net (Loss) Income | $ | (593,715 | ) | $ | 45,565 | |||

| Adjustments to reconcile net (loss) income to cash provided by operating activities: | ||||||||

| Depreciation | 187,420 | 121,095 | ||||||

| Amortization of financing costs | 43,011 | 4,779 | ||||||

| Gain on settlement of debt | - | (67,365 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (166,447 | ) | (4,082 | ) | ||||

| Accounts receivable-other | (205,000 | ) | - | |||||

| Employee loans | (15,000 | ) | - | |||||

| Prepaid expenses and other | (57,973 | ) | (39,717 | ) | ||||

| Cash-restricted | (126,070 | ) | 13,198 | |||||

| Accounts payable and accrued expenses | 231,497 | 25,374 | ||||||

| Unearned income | 3,774 | 43,703 | ||||||

| Deferred income taxes | (23,103 | ) | 11,400 | |||||

| Net cash (used in) provided by operating activities | (721,606 | ) | 153,950 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Cash received from acquisition | 48,761 | - | ||||||

| Cash payments for acquisition | (143,366 | ) | (117,100 | ) | ||||

| Purchase of equipment | (2,473,799 | ) | - | |||||

| Interest earned on long term deposits | (323 | ) | - | |||||

| Net cash used in investing activities | (2,568,727 | ) | (117,100 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from related party line of credit | 190,000 | - | ||||||

| Proceeds from issuance of notes payable, net of financing costs | 2,871,058 | 1,634,172 | ||||||

| - | ||||||||

| Proceeds from common stock subscription | 100,000 | - | ||||||

| Net payments on notes payable | (202,002 | ) | (70,276 | ) | ||||

| Net payments on related party advances | - | (70,931 | ) | |||||

| Net cash provided by financing activities | 2,959,056 | 1,492,965 | ||||||

| Net (decrease) increase in cash and cash equivalents | (331,277 | ) | 1,529,815 | |||||

| Cash and cash equivalents, beginning of period | 528,303 | 3,318 | ||||||

| Cash and cash equivalents, end of period | $ | 197,026 | $ | 1,533,133 | ||||

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | ||||||||

| Cash paid during the period for interest | $ | 348,302 | $ | 221,387 | ||||

| Cash paid during the period for taxes | $ | - | $ | - | ||||

| Supplemental Disclosure on non-cash investing and financing activities: | ||||||||

| Common stock issued in connection with acquisition of First Choice Medical Group, Inc. | $ | 702,849 | $ | - | ||||

See the accompanying notes to these unaudited condensed consolidated financial statements

| 5 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

NOTE 1 – SIGNIFICANT ACCOUNTING POLICIES

A summary of the significant accounting policies applied in the presentation of the accompanying unaudited condensed consolidated financial statements follows:

General

The following (a) condensed consolidated balance sheet as of December 31, 2011, which has been derived from audited financial statements, and (b) the unaudited condensed consolidated interim financial statements of the First Choice Healthcare Solutions, Inc. (the "Company") have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2012 are not necessarily indicative of results that may be expected for the year ending December 31, 2012. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2011 included in the Company’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 30, 2012.

Basis of presentation

First Choice Healthcare Solutions, Inc., a Delaware corporation (the “Company" or "FCHS”) filed a certificate of merger (the “Certificate of Merger”) of Medical Billing Assistance, Inc., a Colorado corporation incorporated on May 30, 2007 (“Medical Billing”), into the Company. The effective date for the Certificate of Merger was April 4, 2012. Pursuant to the Certificate of Merger, Medical Billing was merged with and into the Company. The effect of the merger was that Medical Billing reincorporated from Colorado to Delaware (the “Reincorporation”). The Company is deemed to be the successor issuer of Medical Billing under Rule 12g-3 of the Securities Exchange Act of 1934, as amended.

Contemporaneously with the Reincorporation, the Company changed its name to First Choice Healthcare Solutions, Inc. Otherwise, the reincorporation does not result in any change in the business, management, fiscal year, accounting, and location of the principal executive offices, assets or liabilities of the Company, formerly known as Medical Billing Assistance, Inc.

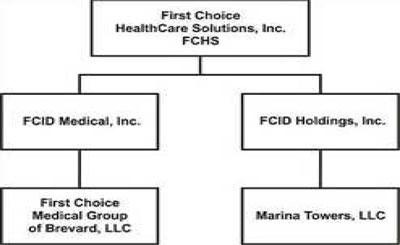

The unaudited condensed consolidated financial statements include the accounts of the Company, including FCID Holdings, Inc. Marina Towers LLC, FCID Medical Inc. and First Choice Medical Group of Brevard LLC, which are all wholly-owned subsidiaries of FCHS. All significant intercompany balances and transactions have been eliminated in consolidation.

Acquisition

On April 2, 2012, the Company completed its acquisition of First Choice Medical Group of Brevard, LLC (“First Choice – Brevard”), pursuant to the Membership Interest Purchase Closing Agreement (the “Purchase Agreement”), dated the same date. The Company has been managing the practice of First Choice – Brevard since November 1, 2011, pursuant to a Management Services Agreement (the “Management Agreement”).

The purchase price for the acquisition was $2,524,000, of which approximately $1.15 million was paid in cash, note payable for $88,794 and the balance, net of closing adjustments including invoiced service fees, was paid by issuing to the members of First Choice – Brevard 244,045 shares of the Company’s restricted common stock.

| 6 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

First Choice - Brevard is a multi-specialty medical group including orthopedics (both operative and non-operative), sports medicine, pain management and neurology. The practice is located in Marina Towers, a Class A office building owned by the Company.

A preliminary estimate of the fair values of the assets acquired and liabilities assumed at the date of acquisition are as follows:

| Assets acquired: | ||||

| Current assets: | ||||

| Cash | $ | 48,761 | ||

| Accounts receivable | 492,410 | |||

| Total current assets | 541,171 | |||

| Property and equipment | 1,731,590 | |||

| Other assets: | ||||

| Customer list | 300,000 | |||

| Total acquired assets | 2,572,761 | |||

| Liabilities assumed: | ||||

| Accounts payable | 48,761 | |||

| Net assets acquired | $ | 2,524,000 |

Use of Estimates

The preparation of the financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria (3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing 605-25 on the Company's financial position and results of operations was not significant.

Property and Equipment

Property and equipment are stated at cost. When retired or otherwise disposed, the related carrying value and accumulated depreciation are removed from the respective accounts and the net difference less any amount realized from disposition, is reflected in earnings. For financial statement purposes, property and equipment are recorded at cost and depreciated using the straight-line method over their estimated useful lives of 20 to 39 years.

| 7 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Segment Information

Accounting Standards Codification subtopic Segment Reporting 280-10 (“ASC 280-10”) establishes standards for reporting information regarding operating segments in annual financial statements and requires selected information for those segments to be presented in interim financial reports issued to stockholders. ASC 280-10 also establishes standards for related disclosures about products and services and geographic areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker, or decision-making group, in making decisions how to allocate resources and assess performance. The information disclosed herein materially represents all of the financial information related to the Company’s principal two operating segments (see Note 12).

Long-Lived Assets

The Company follows Accounting Standards Codification subtopic 360-10, Property, plant and equipment (“ASC 360-10”). The Statement requires that long-lived assets and certain identifiable intangibles held and used by the Company be reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Events relating to recoverability may include significant unfavorable changes in business conditions, recurring losses, or a forecasted inability to achieve break-even operating results over an extended period. The Company evaluates the recoverability of long-lived assets based upon forecasted undiscounted cash flows. Should impairment in value be indicated, the carrying value of intangible assets will be adjusted, based on estimates of future discounted cash flows resulting from the use and ultimate disposition of the asset. ASC 360-10 also requires assets to be disposed of be reported at the lower of the carrying amount or the fair value less costs to sell.

Customer list

Customer list is comprised of acquired customers in connection with the acquisition of First Choice Medical Group of Brevard, LLC and is amortized ratably over the estimated useful life of 15 years. Amortization for the three and nine months ended September 30, 2012 was $5,000 and $10,000 respectively. Accumulated amortization of customer list costs were $10,000 and $Nil at September 30, 2012 and December 31, 2011, respectively

Cash and Cash Equivalents

The Company considers cash to consist of cash on hand and investments having an original maturity of 90 days or less that are readily convertible into cash. As of September 30, 2012, the Company had $197,026 in cash.

Concentrations of credit risk

The Company’s financial instruments that are exposed to a concentration of credit risk are cash and accounts receivable. Effective December 31, 2010 and extending through December 31, 2012, all non-interest-bearing transaction accounts are fully insured by the Federal Deposit Insurance Corporation (FDIC), regardless of the balance of the account. Generally, the Company’s cash and cash equivalents in interest-bearing accounts may exceed FDIC insurance limits. The financial stability of these institutions is periodically reviewed by senior management.

Accounts Receivable

Trade receivables are carried at their estimated collectible amounts. Trade credit is generally extended on a short-term basis; thus trade receivables do not bear interest. Trade accounts receivable are periodically evaluated for collectability based on past credit history with customers and their current financial condition.

| 8 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Income Taxes

The Company follows Accounting Standards Codification subtopic 740-10, Income Taxes (“ASC 740-10”) for recording the provision for income taxes. Deferred tax assets and liabilities are computed based upon the difference between the financial statement and income tax basis of assets and liabilities using the enacted marginal tax rate applicable when the related asset or liability is expected to be realized or settled. Deferred income tax expenses or benefits are based on the changes in the asset or liability during each period. If available evidence suggests that it is more likely than not that some portion or all of the deferred tax assets will not be realized, a valuation allowance is required to reduce the deferred tax assets to the amount that is more likely than not to be realized. Future changes in such valuation allowance are included in the provision for deferred income taxes in the period of change. Deferred income taxes may arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse and are considered immaterial.

Net income (loss) per share

The Company accounts for net income (loss) per share in accordance with Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS.

Basic net income (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during each period. It excludes the dilutive effects of potentially issuable common shares such as those related to our stock options. Diluted net income (loss) share is calculated by including potentially dilutive share issuances in the denominator. Diluted net income (loss) per share for three and nine month periods ended September 30, 2012 does not reflect the effects of 100,000 shares and 1,875,000 shares, respectively, potentially issuable upon the exercise of the Company's stock options (calculated using the treasury stock method) and warrants as of September 30, 2012 as including the options and warrants would be anti-dilutive.

Fair Value of Financial Instruments

Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”) requires disclosure of the fair value of certain financial instruments. The carrying value of cash and cash equivalents, accounts payable and accrued liabilities, and short-term borrowings, as reflected in the balance sheets, approximate fair value because of the short-term maturity of these instruments. All other significant financial assets, financial liabilities and equity instruments of the Company are either recognized or disclosed in the financial statements together with other information relevant for making a reasonable assessment of future cash flows, interest rate risk and credit risk. Where practicable the fair values of financial assets and financial liabilities have been determined and disclosed; otherwise only available information pertinent to fair value has been disclosed. There were no items required to be measured at fair value on a recurring basis in the financial statement as of September 30, 2012.

The company follows Accounting Standards Codification subtopic 820-10, Fair Value Measurements and Disclosures (“ASC 820-10”) and Accounting Standards Codification subtopic 825-10, Financial Instruments (“ASC 825-10”), which permits entities to choose to measure many financial instruments and certain other items at fair value. Neither of these statements had an impact on the Company’s financial position, results of operations nor cash flows.

| 9 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Share-Based Compensation

Share-based compensation issued to employees is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. The Company measures the fair value of the share-based compensation issued to non-employees using the stock price observed in the arms-length private placement transaction nearest the measurement date (for stock transactions) or the fair value of the award (for non-stock transactions), which were considered to be more reliably determinable measures of fair value than the value of the services being rendered. The measurement date is the earlier of (1) the date at which commitment for performance by the counterparty to earn the equity instruments is reached, or (2) the date at which the counterparty’s performance is complete.

Capitalized financing costs

Capitalized financing costs represent costs incurred in connection with obtaining the debt financing. These costs are amortized ratably and charged to financing expenses over the term of the related debt. The amortization for the three and nine months ended September 30, 2012 was $14,337 and $43,011, respectively, and for the three and nine months ended September 30, 2011 was $4,779. Accumulated amortization of deferred financing costs was $62,127 and $19,116 at September 30, 2012 and December 31, 2011, respectively.

Reclassification

Certain reclassifications have been made to prior periods’ data to conform to the current year’s presentation. More specifically, the Company reclassified its common stock par value to additional paid-in capital to reflect the reverse stock split as retroactively restated and reclassified its accounts receivable-other to deposits and other-acquisitions. These reclassifications had no effect on reported income or losses.

Recent Accounting Pronouncements

There were various updates recently issued, most of which represented technical corrections to the accounting literature or application to specific industries and are not expected to a have a material impact on the Company’s consolidated financial position, results of operations or cash flows.

NOTE 2 — LIQUIDITY

The Company incurred various non-recurring expenses in 2012 in connection with operating startup costs relating to the acquisition of a medical practice (See above). Management believes that ongoing profitable operations of Marina Towers, LLC., the current positive cash balance resulted from the recent refinancing of the mortgage along with successful completion of its business development plan will allow the Company to continue to improve its working capital and will have sufficient capital resources to meet projected cash flow requirements through one year plus a day from the filing date of this report. However, there can be no assurance that the Company will be successful completing its business development plan.

NOTE 3 — ACCOUNTS RECEIVABLE-OTHER

Accounts receivable-other as of December 31, 2011 was comprised of management services provided for the management of an operating group medical practice through which physician services and medical direction are rendered.

The management services invoiced represented costs incurred to assist the invoiced medical practice. As such, the invoicing was applied towards recovery of such costs, and not as a revenue item on the Statement of Operations. The balance has been paid in full as of September 30, 2012.

| 10 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

NOTE 4 - DEPOSITS - ACQUISITIONS

On October 5, 2011, FCID Medical, Inc., a wholly owned subsidiary of the Company, entered into a Membership Interest Purchase Agreement ("Agreement") to acquire all of the issued and outstanding membership interests of First Choice Medical Group of Brevard, LLC, a Delaware limited liability company authorized to do business in Florida. As of December 31, 2011, the Company had paid $998,032 toward the purchase price, which had been classified as deposits and other-acquisitions in the accompanying unaudited condensed consolidated balance sheets.

As described in Note 1 above, on April 2, 2012, the Company acquired First Choice Medical Group of Brevard LLC for a total acquisition price of $2,524,000 comprised of deposits (included $1,141,398 of deposits-acquisitions and $508,000 of accounts receivable-other reclassified and applied to deposits and other-acquisitions at close) as described above, a note payable for $88,794 and 244,045 shares of the Company's common stock.

NOTE 5 - CASH - RESTRICTED

Cash-restricted is comprised of funds deposited to and held by the mortgage lender for payments of property taxes, insurance, replacements and major repairs of the Company's commercial building.

NOTE 6 - PROPERTY, PLANT, AND EQUIPMENT

Property, plant and equipment at September 30, 2012 and December 31, 2011 are as follows:

| September 30, 2012 (unaudited) | December 31. 2011 | |||||||

| Land | $ | 1,000,000 | $ | 1,000,000 | ||||

| Building | 3,055,168 | 3,055,168 | ||||||

| Building improvements | 1,662,362 | 1,662,362 | ||||||

| Medical office improvement | 1,410,028 | - | ||||||

| Automobiles | 29,849 | - | ||||||

| Computer equipment | 186,549 | - | ||||||

| Medical equipment | 56,214 | - | ||||||

| MRI center | 2,222,200 | - | ||||||

| X-ray Center | 202,588 | - | ||||||

| Office equipment | 104,840 | - | ||||||

| 9,929,798 | 5,717,530 | |||||||

| Less: accumulated depreciation | (1,357,851 | ) | (1,180,431 | ) | ||||

| $ | 8,571,947 | $ | 4,537,099 | |||||

During the three and nine months ended September 30, 2012, depreciation expense charged to operations was $73,518 and $187,420, respectively and during the three and nine months ended September 30, 2011, depreciation expense charged to operations was $40,365 and $121,095, respectively.

| 11 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

NOTE 7 - NOTES PAYABLE

Notes payable as of September 30, 2012 and December 31, 2011 are comprised of the following:

| September 30, 2012 (unaudited) | December 31. 2011 | |||||||

| Mortgage payable | $ | 7,466,818 | $ | 7,527,811 | ||||

| Note payable, GE Capital (construction), MRI | 456,749 | - | ||||||

| Note payable, GE Capital (construction), 2 | 150,092 | - | ||||||

| Note Payable, GE Capital (MRI) | 1,771,390 | |||||||

| Note Payable, GE Capital (X-ray) | 200,989 | |||||||

| Note payable, Auto | 28,586 | - | ||||||

| Note payable, HS Real, LLC. | 300,000 | - | ||||||

| Note payable, Dr. Anthony J. Lombardo | 109,757 | |||||||

| Note payable, Dr. Richard Newman | 20,000 | - | ||||||

| 10,504,381 | 7,527,811 | |||||||

| Less: current portion | (827,917 | ) | (92,392 | ) | ||||

| $ | 9,676,464 | $ | 7,435,419 | |||||

Mortgage payable

On August 12, 2011, the Company refinanced its existing mortgage note payable as described below providing additional working capital funds. The aggregate amount of the note of $7,550,000 bears 6.10% interest per annum with monthly payments of $45,752.61 beginning in October 2011 based on a 30 year amortization schedule with all remaining principal and interest due in full on September 16, 2016. The note is secured by land and the building along with first priority assignment of leases and rents. In addition, the Company's Chief Executive Officer provided a limited personal guarantee.

In connection with the refinancing of the mortgage note payable, the Company incurred financing costs of $286,723. The capitalized financing costs are amortized ratably over the term of the mortgage note payable.

Note payable, equipment financing

On May 21, 2012, the Company completed a financing with GE Healthcare Financial Services (“GE Capital”) for approximately $2.4 million.

The financing consists of a master lease for equipment having a total value of approximately $1,990,000 and $600,000 of construction loans.

As of September 30, 2012, the Company drew down $450,000 against the construction loan. The construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made ($450,000). Interest of $6,749 has accrued in addition to the principal balance.

On September 24, 2012, the Company drew down $150,000 against a second construction loan. The construction loan is payable in 35 monthly payments (first three payments are $nil) including interest at 7.38%, beginning the earlier of a) December 2012 or b) total advances have been made in the amount of $150,000. Interest of $92 has accrued in addition to the principal balance.

The Company entered into an aggregate of $2,288,679 equipment finance leases subject to delivery and acceptance. All notes and finance leases have been personally guaranteed by the Company's Chief Executive Officer.

| 12 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

On August 22, 2012, the Company accepted the delivery of x-ray equipment under the equipment finance leases discussed above. As such, the component piece accepted of $199,668 is due over 60 months at $-0- the first three months; $4,300 for the remaining 57 months including interest at 7.9375% per annum.

On September 27, 2012, the Company accepted the delivery of MRI equipment under the equipment finance leases discussed above. As such, the component piece accepted of $1,771,390 is due over 60 months at $-0- the first three months; $38,152 for the remaining 57 months including interest at 7.9375% per annum.

Note payable, Auto

On May 21, 2012, the Company issued a note payable, due in monthly installments of $593 including interest of 6.99%, due to mature in June 2017, secured by related equipment.

Promissory note dated May 17, 2012

On May 17, 2012, subsequently amended on August 17, 2012, the Company issued a promissory note to HS Real LLC for an aggregate of $300,000 due December 31, 2012 with interest paid monthly beginning September 2012, at a rate of 12% per annum, unsecured.

Note payable, Newman

In connection with the acquisition as described in Note 1 above, the Company assumed a $45,000 non interest bearing, unsecured note payable to Dr. Richard Newman at $5,000 per month, and maturing on January 1, 2013.

Note payable Lombardo

On April 2, 2012, the company issued a note payable in the amount of $88,794 to Dr. Anthony Lombardo in connection with the acquisition of the First Choice Medical Group of Brevard LLC. The note matures on April 2, 2015 at an annual interest rate of 3.54% beginning April 2, 2012. Subject to the terms of the acquisition agreement the principal amount would be adjusted for post-closing entries. As of September 30, 2012 the principal balance of this note has been adjusted for $20,963 of a post-closing entry.

The minimum future cash flow for the note payable at September 30, 2012 is as follows:

| Amount | ||||

| Three months ending December 31, 2012 | $ | 321,543 | ||

| Year ended December 31, 2013 | 681,615 | |||

| Year ended December 31, 2014 | 729,093 | |||

| Year ended December 31, 2015 | 804,670 | |||

| Year ended December 31, 2016 and thereafter | 7,967,460 | |||

| Total | $ | 10,504,381 | ||

NOTE 8 - RELATED PARTY TRANSACTIONS

On February 1, 2012, the Company opened a $500,000 unsecured, revolving line of credit loan with CCR of Melbourne, Inc., an entity owned and controlled by the Company's Chief Executive Officer. The revolving line of credit loan matures on October 1, 2013 with interest at a per annum rate of 8.5% beginning March 1, 2012. As of September 30, 2012, $53,069 was outstanding. The Company paid $1,391 and $3,331 as related party interest for the 3 and 9 months ended September 30, 2012, respectively.

NOTE 9 - STOCKHOLDERS EQUITY

On April 4, 2012, the Company affected a four-to-one (4 to 1) reverse stock split of its issued and outstanding shares of common stock, $0.001 par value (whereby every four shares of Company’s common stock will be exchanged for one share of FCHS common stock). All references in the unaudited condensed consolidated financial statements and the notes to consolidated financial statements, number of shares, and share amounts have been retroactively restated to reflect the reverse split. The Company has restated from 49,851,000 to 12,462,750 shares of common stock issued and outstanding as of December 31, 2011 to reflect the reverse split.

In April 2012, the Company issued an aggregate of 244,045 shares of its common stock in connection with the acquisition of First Choice Medical Group of Brevard, LLC.

| 13 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

NOTE 10 - STOCK OPTIONS AND WARRANTS

Non Employee Stock Options

The following table summarizes the stock options outstanding and the related prices for the shares of the Company's common stock issued to non employees at September 30, 2012:

| Options Outstanding | Options Exercisable | |||||||||||||||||||||

| Weighted Average | Weighted | Weighted | ||||||||||||||||||||

| Remaining | Average | Average | ||||||||||||||||||||

| Exercise | Number | Contractual Life | Exercise | Number | Exercise | |||||||||||||||||

| Prices | Outstanding | (Years) | Price | Exercisable | Price | |||||||||||||||||

| $ | 3.00 | 100,000 | 0.25 | $ | 3.00 | 100,000 | $ | 3.00 | ||||||||||||||

Transactions involving stock options issued to non-employees are summarized as follows:

| Number of Shares | Weighted Average Price Per Share | |||||||

| Outstanding at December 31, 2010: | 100,000 | $ | 3.00 | |||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at December 31, 2011: | 100,000 | 3.00 | ||||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at September 30, 2012: | 100,000 | $ | 3.00 | |||||

Warrants

The following table summarizes the warrants outstanding and the related prices for the shares of the Company's common stock issued at September 30, 2012:

| Warrants Outstanding | Warrants Exercisable | |||||||||||||||||||||

| Weighted Average | Weighted | Weighted | ||||||||||||||||||||

| Prices | Outstanding | (Years) | Price | Exercisable | Price | |||||||||||||||||

| $ | 3.60 | 1,875,000 | 6.25 | $ | 3.60 | 1,875,000 | $ | 3.60 | ||||||||||||||

| 14 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Transactions involving stock warrants issued to non employees are summarized as follows:

| Number of Shares | Weighted Average Price Per Share | |||||||

| Outstanding at December 31, 2010: | - | - | ||||||

| Granted | 1,875,000 | 3.60 | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at December 31, 2011: | 1,875,000 | 3.60 | ||||||

| Granted | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Outstanding at September 30, 2012: | 1,875,000 | $ | 3.60 | |||||

NOTE 11 - SEGMENT REPORTING

The Company reports segment information based on the “management” approach. The management approach designates the internal reporting used by management for making decisions and assessing performance as the source of the Company’s reportable segments. The Company has two reportable segments: Marina Towers, LLC and FCID Medical, Inc.

The Marina Towers, LLC segment derives revenue from the operating leases of its owned building, whereas FCID Medical segment derives revenue for medical procedures performed.

Information concerning the operations of the Company's reportable segments is as follows:

Summary Statement of Operations for the nine months ended September 30, 2012:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Net Patient Service Revenue | $ | - | $ | 1,707,694 | $ | - | $ | - | $ | 1,707,694 | ||||||||||

| Rental revenue | 1,094,466 | - | - | (211,287 | ) | 883,179 | ||||||||||||||

| Total Revenue | 1,094,466 | 1,707,694 | - | (211,287 | ) | 2,590,873 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Practice salaries & benefits | - | 795,375 | - | - | 795,375 | |||||||||||||||

| Practice supplies and other operating expenses | - | 510,792 | - | (211,287 | ) | 299,505 | ||||||||||||||

| General and administrative | 351,920 | 408,162 | 752,033 | - | 1,512,115 | |||||||||||||||

| Depreciation and amortization | 121,095 | 66,325 | - | - | 187,420 | |||||||||||||||

| Total operating expenses | 473,015 | 1,780,654 | 752,033 | (211,287 | ) | 2,794,415 | ||||||||||||||

| Net income (loss) from operations: | 621,451 | (72,960 | ) | (752,033 | ) | - | (203,542 | ) | ||||||||||||

| Interest expense | (348,227 | ) | (18,858 | ) | (5,430 | ) | - | (372,515 | ) | |||||||||||

| Amortization of financing costs | (43,011 | ) | - | - | - | (43,011 | ) | |||||||||||||

| Other income (expense) | 2,250 | - | - | - | 2,250 | |||||||||||||||

| Net Income (loss): | 232,463 | (91,818 | ) | (757,463 | ) | - | (616,818 | ) | ||||||||||||

| Income taxes | (8,707 | ) | 3,439 | 28,371 | - | 23,103 | ||||||||||||||

| Net income (loss) | $ | 223,756 | $ | (88,379 | ) | $ | (729,092 | ) | $ | - | $ | (593,715 | ) | |||||||

| 15 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Summary Statement of Operations for the three months ended September 30, 2012:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Net Patient Service Revenue | $ | - | $ | 798,077 | $ | - | $ | - | $ | 798,077 | ||||||||||

| Rental revenue | 364,081 | - | - | (93,534 | ) | 270,547 | ||||||||||||||

| Total Revenue | 364,081 | 798,077 | - | (93,534 | ) | 1,068,624 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Practice salaries & benefits | - | 406,055 | - | - | 406,055 | |||||||||||||||

| Practice supplies and other operating expenses | - | 319,039 | - | (147,675 | ) | 171,364 | ||||||||||||||

| General and administrative | 124,468 | 173,525 | 199,737 | 54,141 | 551,871 | |||||||||||||||

| Depreciation and amortization | 40,365 | 33,153 | - | - | 73,518 | |||||||||||||||

| Total operating expenses | 164,833 | 931,772 | 199,737 | (93,534 | ) | 1,202,808 | ||||||||||||||

| Net income (loss) from operations: | 199,248 | (133,695 | ) | (199,737 | ) | - | (134,184 | ) | ||||||||||||

| Interest expense | (116,576 | ) | (16,989 | ) | (2,087 | ) | - | (135,652 | ) | |||||||||||

| Amortization of financing costs | (14,337 | ) | - | - | - | (14,337 | ) | |||||||||||||

| Other income (expense) | 750 | - | - | - | 750 | |||||||||||||||

| Net Income (loss): | 69,085 | (150,684 | ) | (201,824 | ) | - | (283,423 | ) | ||||||||||||

| Income taxes | - | - | - | - | - | |||||||||||||||

| Net income (loss) | $ | 69,085 | $ | (150,684 | ) | $ | (201,824 | ) | $ | - | $ | (283,423 | ) | |||||||

Summary Statement of Operations for the nine months ended September 30, 2011:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Rental Revenue | $ | 1,008,576 | $ | - | $ | - | $ | (29,091 | ) | $ | 979,485 | |||||||||

| Total Revenue | 1,008,576 | - | - | (29,091 | ) | 979,485 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| General and administrative | 312,415 | - | 386,086 | (29,091 | ) | 669,410 | ||||||||||||||

| Depreciation and amortization | 121,095 | - | - | - | 121,095 | |||||||||||||||

| Total operating expenses | 433,510 | - | 386,086 | (29,091 | ) | 790,505 | ||||||||||||||

| Net income (loss) from operations: | 575,066 | - | (386,086 | ) | - | 188,980 | ||||||||||||||

| Interest expense | (221,387 | ) | - | (14,226 | ) | - | (235,613 | ) | ||||||||||||

| Amortization of finance costs | (4,779 | ) | - | - | - | (4,779 | ) | |||||||||||||

| Other income (expense) | 41,012 | - | 67,365 | - | 108,377 | |||||||||||||||

| Net Income (loss): | 389,912 | - | (332,947 | ) | - | 56,965 | ||||||||||||||

| Income taxes | (78,030 | ) | - | 66,630 | - | (11,400 | ) | |||||||||||||

| Net income (loss) | $ | 311,882 | $ | - | $ | (266,317 | ) | $ | - | $ | 45,565 | |||||||||

| 16 |

FIRST CHOICE HEALTHCARE SOLUTIONS, INC.

(formerly known as Medical Billing Assistance, Inc.)

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2012

Summary Statement of Operations for the three months ended September 30, 2011:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Revenue: | ||||||||||||||||||||

| Rental Revenue | $ | 351,996 | $ | - | $ | - | $ | (29,091 | ) | $ | 322,905 | |||||||||

| Total Revenue | 351,996 | - | - | (29,091 | ) | 322,905 | ||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| General and administrative | 100,470 | - | 171,014 | (29,091 | ) | 242,393 | ||||||||||||||

| Depreciation and amortization | 40,365 | - | - | - | 40,365 | |||||||||||||||

| Total operating expenses | 140,835 | - | 171,014 | (29,091 | ) | 282,758 | ||||||||||||||

| Net income (loss) from operations: | 211,161 | - | (171,014 | ) | - | 40,147 | ||||||||||||||

| Interest expense | (72,507 | ) | - | (10,776 | ) | - | (83,283 | ) | ||||||||||||

| Amortization of financing costs | (4,779 | ) | - | - | - | (4,779 | ) | |||||||||||||

| Other income (expense) | - | - | - | - | - | |||||||||||||||

| Net Income (loss): | 133,875 | - | (181,790 | ) | - | (47,915 | ) | |||||||||||||

| Income taxes | (26,823 | ) | - | 36,423 | - | 9,600 | ||||||||||||||

| Net income (loss) | $ | 107,052 | $ | - | $ | (145,367 | ) | $ | - | $ | (38,315 | ) | ||||||||

Assets:

| Marina | FCID | Intercompany | ||||||||||||||||||

| Towers | Medical | Corporate | Eliminations | Total | ||||||||||||||||

| Assets: | ||||||||||||||||||||

| At September 30, 2012: | $ | 4,923,496 | $ | 5,347,160 | $ | 9,295 | $ | - | $ | 10,279,951 | ||||||||||

| At December 31, 2011: | $ | 4,956,962 | $ | - | $ | 1,815,238 | $ | - | $ | 6,772,200 | ||||||||||

NOTE 12 - SUBSEQUENT EVENTS

In October 2012, the Board of Directors approved the appointment of two new directors and resolved that, in consideration of their agreement to serve as directors of the Company, each would receive 30,000 shares of the Company’s restricted common stock, with an issue date of October 2, 2012.

| 17 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

FORWARD LOOKING STATEMENTS

From time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Such forward-looking statements may be included in, but not limited to, press releases, oral statements made with the approval of an authorized executive officer or in various filings made by us with the Securities and Exchange Commission. Words or phrases "will likely result", "are expected to", "will continue", "is anticipated", "estimate", "project or projected", or similar expressions are intended to identify "forward-looking statements". Such statements are qualified in their entirety by reference to and are accompanied by the above discussion of certain important factors that could cause actual results to differ materially from such forward-looking statements.

Management is currently unaware of any trends or conditions other than those mentioned elsewhere in this management's discussion and analysis that could have a material adverse effect on the Company's consolidated financial position, future results of operations, or liquidity. However, investors should also be aware of factors that could have a negative impact on the Company's prospects and the consistency of progress in the areas of revenue generation, liquidity, and generation of capital resources. These include: (i) variations in revenue, (ii) possible inability to attract investors for its equity securities or otherwise raise adequate funds from any source should the Company seek to do so, (iii) increased governmental regulation, (iv) increased competition, (v) unfavorable outcomes to litigation involving the Company or to which the Company may become a party in the future and, (vi) a very competitive and rapidly changing operating environment. The risks identified here are not all inclusive. New risk factors emerge from time to time and it is not possible for management to predict all of such risk factors, nor can it assess the impact of all such risk factors on the Company's business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the risk factors set forth herein and in other reports and documents that we file from time to time with the Securities and Exchange Commission, particularly the Annual Reports on Form 10-K, Quarterly reports on Form 10-Q and any Current Reports on Form 8-K.

The financial information set forth in the following discussion should be read in conjunction with the consolidated financial statements of First Choice Healthcare Solutions, Inc. included elsewhere herein.

OVERVIEW AND HISTORY

We were incorporated in the State of Colorado on May 30, 2007 to act as a holding corporation for I.V. Services Ltd., Inc. (“IVS”), a Florida corporation engaged in providing billing services to providers of medical services. IVS was incorporated in the State of Florida on September 28, 1987, and on June 30, 2007, we issued 2,000,000 common shares to Mr. Michael West in exchange for 100% of the capital stock of IVS. In the second quarter of 2011, we disposed of IVS, which, at the time, was a wholly-owned subsidiary of the Company that was inactive. The consideration for the disposition was the net liability assumption by the purchaser.

On December 29, 2010, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with FCID Medical, Inc., a Florida corporation (“FCID Medical”) and FCID Holdings, Inc., a Florida corporation (“FCID Holdings)”, which together will be referred to herein with FCID Medical as “FCID”, and the shareholders of FCID (the “FCID Shareholders”). Pursuant to the terms of the Share Exchange Agreement, the FCID Shareholders exchanged 100% of the outstanding common stock of FCID for a total of 10,000,000 common shares) of the Company, resulting in FCID Medical and FCID Holdings being 100% owned subsidiaries of the Company (the “Share Exchange”).

| 18 |

In connection with the Share Exchange Agreement, in addition to the foregoing and effective on the closing date, Michael West resigned as President, Treasurer and director of the Company. Mr. Steve West resigned as officer of the Company but retained a directorship with the Company and subsequently resigned in 2011. After such resignations, Christian Charles Romandetti was appointed President, Chief Executive Officer and a director of the Company, and Donald Bittar was appointed Chief Financial Officer, Treasurer and Secretary. Currently, Mr. Bittar also is a director.

Merger, Re-Incorporation and Name Change

On or about February 13, 2012, we obtained stockholder consent for (i) the approval of an agreement and plan of merger (the “Merger Agreement”) with First Choice Healthcare Solutions, Inc., (“FCHS Delaware”), a Delaware corporation formed exclusively for the purpose of merging with the Company, pursuant to which (a) the Company’s state of incorporation changed from Colorado to Delaware (the “Reincorporation”) (b) the Company’s name changed from Medical Billing Assistance, Inc. to First Choice Healthcare Solutions, Inc. (the “Name Change”), and (c) every four shares of Company’s common stock was exchanged for one share of FCHS Delaware common stock (effectively resulting in a four-to-one reverse split of the Company’s common stock) (the “Reverse Split”), and (ii) the approval of the Medical Billing Assistance, Inc. 2011 Incentive Stock Plan. The effective date for the Reincorporation and the Reverse Split was April 4, 2012.

All operations are conducted through our wholly-owned subsidiaries: FCID Medical and FCID Holdings. The wholly-owned subsidiary operating the multi-specialty medical clinic is owned by FCID Medical. We have real estate holdings through FCID Holdings, Inc., under which Marina Towers, LLC is wholly-owned subsidiary. A diagram of our corporate structure is set forth below:

Our Business

The cornerstone of the FCID Medical business plan is to develop and acquire efficient, specialized healthcare clinical units. The Company is carving a new niche in the multi-billion dollar medical clinical service industry with this new paradigm, professional multi-specialty medical centers. These multi-specialty medical centers include an optimal mix of synergistic multi-specialty physicians combined with an array of diagnostic capabilities.

First Medical Clinic Acquisition

On October 5, 2011, FCID Medical, Inc., a wholly owned subsidiary of the Company, entered into a management agreement to manage the medical practice of First Choice Medical Group of Brevard, LLC. On April 2, 2012, we completed the acquisition of the practice and acquired all of the issued and outstanding membership interests of First Choice Medical Group of Brevard, LLC.

| 19 |

A new paradigm medical clinic

Some retail business models have been successful with broad customer demographics, easy service provider substitution, intense competition and continuing lower profit margins. We view medical centers as a retail-oriented business delivering medical services direct to consumers. Unlike transportation, fast food, electronics and other retailers, medical centers, generally, have not been quick to adapt themselves to operating successfully with lower profit margins and growing competition. The successful retail businesses recognized the importance of embracing information technology, telecommunication and functional economies of scale to allow high service levels to continue, while retaining acceptable profit margins. Their corporate cultures include a commitment to insuring the best possible customer experience through consistent, predictable and superior service levels in every aspect of their business. They have learned to become profitable in the face of lower margins and increasing competition.

The key to our success is our new paradigm multi-specialty medical centers. While adopting the leading edge retail service practices, the Company remains committed to high patient service levels intended to achieve predictable and acceptable profit margins.

Excellent medical service levels with a human touch

Our business model is intended to bring the best retail practices to operating a multi-specialty medical center successfully with a ‘human touch’. Patients want their pain, fear and concerns acknowledged and considered. They want to be treated with dignity and respect. From the patient’s first interaction with us, making an appointment to see a doctor, our strategic and tactical goals are to provide the best possible patient healthcare experience through consistent, predictable and superior service levels in every aspect of our clinics. On time appointments, accurate and current patient information, attention to detail and careful patient follow up are part of our commitment to an excellent patient experience. Management actively monitors the daily service level objectives for every aspect of the patient experience from the initial appointment through the end of treatment. Clinic staff is encouraged and rewarded for exceeding their service level objectives.

Medical service mix

Like other successful business models for professional medical services, ours is designed to offer the most synergistic and profitable medical service mix. By their nature, some combinations of medical specialties can be more revenue positive than others. Physicians need access to diagnostic equipment like, X-Ray, MRI and physical therapy. Patients expect their physicians to have access to the best diagnostic and service delivery equipment. Without diagnostic services many medical practices will find it difficult to maintain their current margins of profitability. We combine medical specialties and diagnostic services at our locations to maintain or increase the capability for profit. While one specialty may have high reimbursements for their professional service but insufficient volume to profitably support the necessary diagnostic equipment, another medical specialty may have a lower professional service reimbursement but high volume diagnostic equipment use. Operating independently, each specialty group would face retreating profit margins and a significant challenge to maintain high service levels with adequate equipment and current technologies. However, operating together, they create the optimal mix of professional service fee income and diagnostic equipment procedure income. Since the combination is more profitable than either of its components, there is a most favorable opportunity to sustain profit margins that will allow the facility to maintain high service levels with leading edge equipment and state of the art technologies.

In recruiting, selecting and hiring physicians, we employ physicians with the highest patient care reviews always making superior quality of service our number one priority. Our expansion plan is to employee physicians in multiple multi-specialty medical centers located in other geographic markets. In future facilities, we will work to maintain the optimal combination of medical specialties we believe will support the most profitable mix of professional service fees. This business model, in turn, is most likely to provide our physicians with the best diagnostic equipment available, our patients with the best possible medical experience and our Company with the potential when combining physicians and diagnostic equipment to maintain attractive profit margins.

| 20 |

The model is also designed to allow physicians to concentrate exclusively on delivering excellent patient care. The requirements for running the business functions of a successful medical clinic are the sole responsibility of the business management team and not the physicians.

Expansion of Diagnostic Equipment and Facilities

Following the acquisition of First Choice Medical Group of Brevard, the Company initiated a $2.4 million diagnostic equipment and facilities expansion initiative. On May 21, 2012, the Company completed the financing for a state of the art diagnostic facility to house a leading edge X-ray machine, CAT Scanner and MRI system.

The company completed the equipment expansion initiative on time.

Our leading edge X-ray machine was operational on August 22, 2012.

On September 27, 2012, our new state of the art MRI system was accepted and fully operational. The MRI system is housed in the newly constructed space, specifically designed for the MRI system, on the ground floor of the Marina Towers Building.

The Diagnostic Equipment and Facilities Expansion initiative is a success with all of the equipment, systems and facility fully operational and revenue productive ahead of schedule.

Customer service for our medical patients continues to significantly improve. Patients are currently using our new MRI and X-ray systems. The Company is presently billing patients for MRI and X-ray services.

Scalable back office and economies of scale

Fixed cost legacy administrative functions have subjected many established medical centers to a downward spiral of diminishing profit margins and losses. In legacy medical centers, administrative management, billing, compliance, accounting, marketing, advertising, scheduling, customer service, record keeping functions represent fixed overhead for the practice. The fixed administrative overhead of a practice has the effect of reducing profit margins as the practice experiences declining revenues as a result of lower patient volumes from increasing competition, lower pricing, lower reimbursements or patient migration to competitors.

We intend to achieve and sustain profitability, in part, first by introducing economies of scale to our nonclinical administrative functions and second to scale these economies, with similar profit margins, to higher operating volumes from future multi-specialty medical centers. Nonclinical administrative functions operating with economies of scale are intended to improve the profit margin for our medical clinic retail model. More significantly, our administrative functions are readily scalable to allow profit margins at relatively low clinic volume and also with larger numbers of physicians and locations.

A key to our success is our ability to employ a highly experienced team of business managers supported by an array of professional, experienced and compliant subcontractors. Using the best project management practices, our business managers contract services for the billing, compliance, accounting, marketing, advertising, legal, information technology and record keeping functions. The cost of our ‘back office operation’ scales quickly in direct relation to our volume, allowing us to sustain profit margins with a cost effective and scalable back office. As the number of physicians increases so do the economies of scale for our back office. The economies of scale support selecting the best and not the lowest cost subcontractors, while allowing our multi-specialty medical centers to operate cost effectively with higher service levels.

Developing and operating additional multi-specialty medical centers in other geographic areas will take advantage of the economies of scale for our administrative back office functions. Our plan calls for opening up multiple clinics in multiple states and cities at a pace that will allow us to maintain the same levels of quality and acceptable profitability from each location. We believe that the scalable structure of our administrative back office functions will efficiently support our expansion plans.

High technology infrastructure supporting excellent human touch patient experiences

Successful retail models in other industries already effectively use telecommunications, remote computing, mobile computing, cloud computing, virtual networks and other leading-edge technologies to manage geographically diverse operating units. These technologies create the infrastructure to allow a central management team to monitor, direct and control geographically disbursed operating units and subcontractors, including national operations.

| 21 |

The FCHS business model is designed to incorporate the best of these technologies. Each day, a central management team monitors, directs and controls our multi-specialty medical centers and all the necessary support subcontractors. We operate a paperless system with electronic patient medical records. Test results, X-ray images, MRI, diagnosis, patient notes, visit reports, billing information, insurance coverage, and patient identification information are all contained an electronic medical record. This will allow physicians and staff instant access to every aspect of a patient’s medical information from anywhere, in any clinic, and remotely with mobile computing devices. The patient billing, accounts receivable and collection functions also are paperless. A majority of our third party payors remit by EDI and wire transfers. Accordingly, every aspect of the business is positioned to achieve high productivity and lower administrative headcounts and per capita expenses.

We intend to grow by replicating our multi-specialty medical centers, supported by our standardized policies, procedures and clinic setup guidelines. The administrative functions can be quickly scaled to handle multiple additional clinics. As we roll out our business model, we expect our administrative core and clinic retail model to transform the economics of multi-specialty medical centers.

Results of Operations

Three months ended September 30, 2012 compared to three months ended September 30, 2011:

The following discussion involves our results of operations for the three months ended September 30, 2012 compared to the three months ended September 30, 2011.

Comparing our operations, we had revenues of $1,068,624 for the three months ended September 30, 2012, compared to revenues of $322,905 for the three months ended September 30, 2011. The increase in revenue of $745,719 or 231%, is primarily attributable to the acquisition of First Choice Medical Group of Brevard, LLC, completed in April 2012, which added $798,077 in medical revenue for the quarter ended September 30, 2012 compared to Nil for the same period last year. We had a decrease of $52,358 in rental income from the three months ended September 30, 2011 to the three months ended September 30, 2012. The decrease is attributable to the fact our medical segment currently leases their facility from our Marina Towers segment compared to the same period last year where Marina Towers leased to independent group.

Operating expenses include practice salaries & benefits of $406,055 and practice supplies and other operating costs of $171,364 for the three months ended September 30, 2012, attributable to our April 2, 2012 acquisition, as compared to $0 for the same period last year. In addition, operating expenses include general and administrative expenses for the three months ended September 30, 2012 of $551,871 compared to $242,393 for the three months ended September 30, 2011. The increase of $309,478, or approximately 128%, is mainly attributable $173,525 of additional general and administrative costs added as a result of our April 2, 2012 acquisition as discussed above. Depreciation and amortization increased from $40,365 for the three months ended September 30, 2011 to $73,518 for the three months ended September 30, 2012. The increase is a direct result of the added property and equipment with our April acquisition.

The major components of operating expenses include practice salaries and benefits, practice supplies and other operating costs, depreciation and general and administrative which includes legal, accounting and professional fees associated with maintaining a public entity.

We believe that the general and administrative expenses in current operations have scaled as our revenues increased. Each additional sale or service and corresponding gross profit of such sale or service has minimal incremental offsetting operating expenses. Thus, additional sales could contribute to profit at a higher rate of return on sales as a result of not needing to expand operating expenses at the same pace as sales.

Interest expense, primarily composed of our mortgage interest on our building was $135,652 and $83,283 for the three months ended September 30, 2012 and 2011, respectively. The increase in our interest expense was due to the higher mortgage loan on our Marina Towers property we put in place in the later part of 2011 along with added borrowings in 2012.

| 22 |

We had a net loss of $283,423 for the three months ended September 30, 2012 compared to $38,315 for the three months ended September 30, 2011. This increase in net loss of $245,108 is mainly attributable to reasons as described above.

Nine months ended September 30, 2012 compared to nine months ended September 30, 2011:

The following discussion involves our results of operations for the nine months ended September 30, 2012 compared to the nine months ended September 30, 2011.

Comparing our operations, we had revenues of $2,590,873 for the nine months ended September 30, 2012, compared to revenues of $979,485 for the nine months ended September 30, 2011. The increase in revenue of $1,611,388 or 165%, is primarily attributable to the acquisition of First Choice Medical Group of Brevard, LLC, completed in April 2012, which added $1,707,694 in medical revenue for the nine months ended September 30, 2012 compared to Nil for the same period last year. We had a decrease of $96,306 in rental income from the nine months ended September 30, 2011 to the nine months ended September 30, 2012. The decrease is attributable to the fact our medical segment currently leases their facility from our Marina Towers segment compared to the same period last year whereby Marina Towers leased to an independent group.

Operating expenses include practice salaries & benefits of $795,375 and practice supplies and other operating costs of $299,505 for the nine months ended September 30, 2012, attributable to our April 2, 2012 acquisition as compared to $0 for the same period last year. In addition, operating expenses include general and administrative expenses for the nine months ended September 30, 2012 of $1,512,115 compared to $669,410 for the nine months ended September 30, 2011. The increase of $842,705, or approximately 126%, is mainly attributable $408,162 of additional general and administrative costs added as a result of our April 2, 2012 acquisition as discussed above along with higher consulting and payroll costs. Depreciation and amortization increased from $121,095 for the nine months ended September 30, 2011 to $187,420 for the nine months ended September 30, 2012. The increase is a direct result of the added property and equipment with our April acquisition.

The major components of operating expenses include practice salaries and benefits, practice supplies and other operating costs, depreciation and general and administrative which includes legal, accounting and professional fees associated maintaining with a public entity.

We believe that the general and administrative expenses in current operations has scaled as our revenues increased. Each additional sale or service and corresponding gross profit of such sale or service has minimal incremental offsetting operating expenses. Thus, additional sales could contribute to profit at a higher rate of return on sales as a result of not needing to expand operating expenses at the same pace as sales.

Interest expense, primarily composed of our mortgage interest on our building was $372,515 and $235,613 for the nine months ended September 30, 2012 and 2011, respectively. The increase in our interest expense was due to the higher mortgage loan on our Marina Towers property we put in place in the later part of 2011 along with added borrowings in 2012.

We had a net loss of $593,715 for the nine months ended September 30, 2012 compared to net income of $45,565 for the nine months ended September 30, 2011. This decrease in net income of $639,280 is mainly attributable to reasons as described above.

Liquidity and Capital Resources

As of September 30, 2012, we had cash or cash equivalents of $197,026.

Net cash used in operating activities was ($721,606) for the nine months ended September 30, 2012, compared to cash provided by operating activities of $153,950 for the same period last year. We anticipate that overhead costs in current operations will remain fairly constant as revenues develop.

| 23 |

Net cash flows used in investing activities was $(2,568,727 for the nine months ended September 30, 2012, compared to $117,100 for the nine months ended September 30, 2011.

Cash flows provided by financing activities was $2,959,058 for the nine months ended September 30, 2012, compared to net cash provided in financing activities of $1,492,965 for the nine months ended September 30, 2011.

On February 1, 2012, the Company opened a $500,000 unsecured, revolving line of credit loan with CCR of Melbourne, Inc., an entity owned and controlled by the Company's Chief Executive Officer. The revolving line of credit loan matures on October 1, 2013 with interest and is paid monthly at a per annum rate of 8.5% beginning March 1, 2012. As of September 30, 2012, $53,069 was outstanding.

On May 17, 2012, subsequently amended on August 17, 2012, the Company issued a promissory note to HS Real LLC for $300,000 due December 31, 2012 with interest paid monthly beginning September 2012 at a rate of 12% per annum, unsecured.

On May 21, 2012, the Company completed a financing with GE Healthcare Financial Services (“GE Capital”) for approximately $2.4 million. The financing consists of a master lease for equipment having a total value of approximately $1,990,000 and with $450,000 and $150,000 construction loans.

On May 21, 2012, the Company issued a note payable, due in monthly installments of $593 including interest of 6.99%, due to mature in June 2017, secured by related equipment.