Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - U S PHYSICAL THERAPY INC /NV | d517322d8k.htm |

Exhibit 99.1

Dear U.S. Physical Therapy Shareholder:

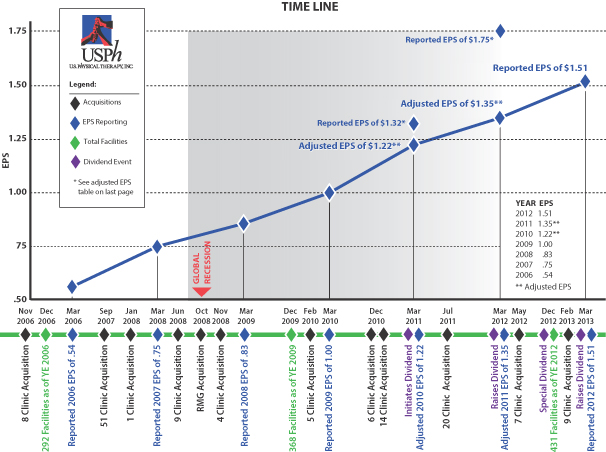

Your Company had another solid year of growth in earnings, EBITDA, and share price appreciation. In fact, 2012 represented the sixth consecutive year of record earnings from operations. Some highlights include:

| • | We enjoyed strong stock appreciation in 2012 with an increase for the year of 40%. |

| • | We continued to grow the Company organically as well as through acquisitions. In 2012, we completed a seven-facility deal and seven “tuck-in” single-clinic acquisitions. We also produced another year of solid de novo clinic growth with 18 new clinics added organically. Thus far in 2013, we have already completed the acquisition of a 9 clinic group. |

| • | In terms of capital deployment, in addition to our acquisitions, while we did not repurchase stock in 2012, we did return additional capital to our shareholders through a 12.5% quarterly dividend increase coupled with a sizeable special dividend at year end. |

| • | FIT2WRK, our workers comp initiative, continues to be a brand on the move with further expansion across the country, including household names like Chrysler, Utz Chips, William Sonoma, Dow Chemical and Lennox International, just to name a few of our growing list of client companies we are now serving through this terrific industrial program. |

| • | In 2012, we achieved additional efficiencies at the home office reducing our corporate overhead as a percent of revenue to below 10% for the first time in the Company’s history. |

| • | We began working on new programs to further support our growth in 2013 and beyond, including further expansion of our sales organization and an orthopedic “home care” initiative, which will be discussed in more detail below. |

Toward the end of 2012 we received what looked like a solid outlook from Medicare for 2013, that being a proposed modest increase in pricing for the coming year. That rosy outlook quickly went away in early January with a new law, which effectively reduced our Medicare pricing approximately 8-10% starting in April. Further, as a result of the “budget sequester”, we will receive an additional 2% reduction. In our year-end 2012 press release, we discussed these reimbursement headwinds, which we estimate will have a negative impact on our Company of approximately $.22 in earnings per share in 2013. That’s a tough hill to climb, but climb we will!

Our Action:

First, let me say that I think this particular reimbursement action is unwise. The government, with this move, is hurting an industry where dollars spent on outpatient physical therapy help to restore function while saving significant costs down-the-road, as well as helping to prevent other expensive complications. That said, we are not going to spend our time wringing our hands, but rather we will put our heads and hands to work to overcome this challenge. This entails rolling out new programs, as well as working to continue to broaden, expand and improve our existing service offerings. This year we have expanded our sales and marketing program so as to enable us to cover an even greater percentage of our facilities utilizing existing members of our team who have been pre-qualified to uniquely fit into an adapted

sales model, generally on a part-time basis. This initiative will allow us to cover an even greater number of facilities with a trained “sales force” without having to hire additional staff.

In 2013, we are working with our partners to deliver what we are calling an “orthopedic home therapy program” which is very different than traditional “home health” services. In short, through our partners many physician relationships, we can now offer their patients excellent orthopedic rehabilitation under some specific and limited parameters in the home on a temporary basis until the patient is ready to engage in a full “in-clinic” traditional treatment program. This program will be rolled out selectively across the country depending on licensing issues at the state level.

For 2013 we have decided to shift additional resources to our acquisition program. This initiative has brought the Company some of our largest partnerships and has helped to fuel our organic satellite growth as well. Given the changes, challenges and the increasing complexity within the current operating environment for all outpatient physical therapy providers, we believe this resource shift will enable us to attract an even greater number of dynamic partner groups to our Company. That will also afford us an opportunity to further focus our internal recruiting efforts on our existing de novo and acquired partnerships as they work to further expand their existing facility footprint in established markets.

We think these resource shifts, coupled with new and existing programs like FIT2WRK, will allow us to navigate these choppy reimbursement waters and set the Company up for a strong 2014. Additionally, our partners understand that with these reimbursement changes we must become more efficient while remaining just as effective in the treatment of our patients. While these aren’t easy changes to make, we understand the importance of adapting with, or ahead, of the evolution of the healthcare environment. The good news is that we are well-resourced and have a capable team and we believe that we can continue to attract talented clinician owners due to the nature of our relationship-centric partnership model.

This will be a busy and challenging year. Rest assured that everyone at U.S. Physical Therapy remains committed to delivering superior results to our patients, medical referral sources, colleagues and shareholders alike.

On behalf of the Company’s more than 2,600 employees across 43 states we thank you for your continued belief and support.

Sincerely,

Chris Reading, PT

President and CEO

*&** The following table reconciles Adjusted Net Income Attributable to Common Shareholders (“Adjusted Net Income”) to comparable generally accepted accounting principles (“GAAP”) measurements. Adjusted Net Income equals net income attributable to common shareholders (“Net Income”) less the after-tax effect of the 2011 gain on purchase price settlement, the 2010 gain on sale of a five clinic joint venture and the 2010 positive adjustment to the income tax provision, all of which are described in the Company’s Form 10K filed with the SEC on March 12, 2013.

Adjusted Net Income is not a measure of financial performance under GAAP. Items excluded from this measure are significant components in understanding and assessing financial performance. This measure should not be considered in isolation or as an alternative to, or substitute for, Net Income or net income including noncontrolling interests data presented in the consolidated financial statements as indicators of financial performance. Because this measure is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, this measurement may not be comparable to other similarly titled measures of other companies.

| ADJUSTED NET INCOME ATTRIBUTABLE TO |

|

Year Ended December 31, |

|

|||||||||

| 2012 | 2011 | 2010 | ||||||||||

| (In thousands, except per share data) | ||||||||||||

| Net income attributable to common shareholders |

$ | 17,933 | $ | 20,974 | $ | 15,645 | ||||||

| Gain on purchase price settlement of $5,434 less tax effect of $629 |

- | (4,805 | ) | - | ||||||||

| Positive adjustment in income tax provision |

- | - | (814 | ) | ||||||||

| Gain on the sale of a five clinic joint venture of $578 less tax effect of $227 |

- | - | (351 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted net income attributable to common shareholders |

$ | 17,933 | $ | 16,169 | $ | 14,480 | ||||||

|

|

|

|

|

|

|

|||||||

| Diluted shares used in computation |

11,904 | 11,977 | 11,870 | |||||||||

| Adjusted net income attributable to common shareholders per diluted share |

$ | 1.51 | $ | 1.35 | $ | 1.22 | ||||||